false

0000061004

0000061004

2024-11-13

2024-11-13

0000061004

lgl:CommonStockParValue001CustomMember

2024-11-13

2024-11-13

0000061004

lgl:WarrantsToPurchaseCommonStockParValue001CustomMember

2024-11-13

2024-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 13, 2024

|

THE LGL GROUP, INC.

|

|

(Exact Name of Registrant as Specified in Charter)

|

| |

|

|

|

Delaware

|

001-00106

|

38-1799862

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

|

2525 Shader Road, Orlando, FL

|

32804

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (407) 298-2000

| |

|

(Former Name or Former Address, If Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01

|

|

LGL

|

|

NYSE American

|

|

Warrants to Purchase Common Stock, par value $0.01

|

|

LGL WS

|

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition |

The information contained in Item 7.01 is incorporated by reference into this Item 2.02.

|

Item 7.01.

|

Regulation FD Disclosure |

On November 13, 2024, The LGL Group, Inc. (the "Company") issued a press release (the "Press Release") announcing its financial results for the third quarter ended September 30, 2024. A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information furnished pursuant to this Item 7.01 of this Current Report on Form 8-K, including the exhibits hereto, shall not be considered "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any future filings by the Company under the Securities Act of 1933, as amended, or under the Exchange Act, unless the Company expressly sets forth in such future filing that such information is to be considered "filed" or incorporated by reference therein.

|

Item 9.01.

|

Financial Statements and Exhibits

|

|

Exhibit No.

|

Description

|

| |

|

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

THE LGL GROUP, INC.

|

| |

(Registrant) |

| |

|

| Date: November 13, 2024 |

By:

|

/s/ Christopher L. Nossokoff

|

| |

|

Name:

|

Christopher L. Nossokoff

|

| |

|

Title:

|

Vice President - Finance

|

Exhibit 99.1

THE LGL GROUP, INC. REPORTS Third QUARTER 2024 RESULTS

ORLANDO, FL. – November 13, 2024 – The LGL Group, Inc. (NYSE American: LGL) ("LGL," "LGL Group," or the "Company") announced today its financial results for the third quarter ended September 30, 2024.

Third Quarter 2024

Fiscal Year to Date 2024

"Although our yields in U.S. Treasuries have seen a modest decline, the portfolio's overall performance has been resilient despite the Federal Reserve's September rate cut," said Tim Foufas, Co-Chief Executive Officer. "We are also thrilled to welcome Cameron Pforr to our team, whose expertise will help drive our strategy forward as we continue to actively pursue investment opportunities."

Consolidated Results

Third Quarter 2024 net income available to LGL Group common stockholders was $72,000, or $0.01 per diluted share, compared with $108,000, or $0.02 per diluted share, in the third quarter of 2023. The decrease was primarily due to:

| |

•

|

higher Manufacturing cost of sales reflecting sales of higher-cost products; and

|

| |

•

|

higher Engineering, selling and administrative driven by changes in headcount and higher wages and benefits. |

The decrease was partially offset by higher Net sales driven by higher product shipments in Q3 2024.

Gross Margin

Gross margin decreased to 43.4% for the three months ended September 30, 2024 compared to 55.5% for the three months ended September 30, 2023. The decrease was primarily due to sales of lower margin products.

Fiscal year to date 2024 net income available to LGL Group common stockholders was $230,000, or $0.04 per diluted share, compared with $135,000, or $0.03 per diluted share, in 2023. The increase was primarily due to:

| |

•

|

higher Net sales driven by higher product shipments; and

|

| |

•

|

higher Net investment income on investments in U.S. Treasury money market funds due to the repositioning of the portfolio into U.S. Treasury money market funds that occurred during 2023.

|

The increase was partially offset by:

| |

•

|

lower Net gains (losses) driven by lower mark-to-market movements and sales of Marketable securities;

|

| |

•

|

higher Manufacturing cost of sales consistent with the overall growth in Net sales and sales of higher-cost products during Q3 2024; and

|

| |

•

|

higher Engineering, selling and administrative driven by changes in headcount and higher wages and benefits.

|

Gross Margin

Gross margin decreased to 50.0% for the nine months ended September 30, 2024 compared to 53.6% for the nine months ended September 30, 2023 reflecting sales of lower margin products.

Backlog

As of September 30, 2024, our order backlog was $505,000, an increase of $362,000 from $143,000 as of December 31, 2023 and an increase of $192,000 from $313,000 as of September 30, 2023. The backlog of unfilled orders includes amounts based on signed contracts, which we have determined are firm orders likely to be fulfilled primarily in the next 12 months but most of the backlog will ship in the next 90 days.

Liquidity

Our working capital metrics were as follows:

|

(in thousands)

|

|

September 30, 2024

|

|

December 31, 2023

|

|

Current assets

|

|

$ |

42,274 |

|

|

$ |

41,566 |

|

|

Less: Current liabilities

|

|

|

739 |

|

|

|

474 |

|

|

Working capital

|

|

$ |

41,535 |

|

|

$ |

41,092 |

|

As of September 30, 2024, LGL Group had investments (classified within Cash and cash equivalents and Marketable securities) with a fair value of $41.2 million, of which $24.3 million was held within the Merchant Investment business.

About The LGL Group, Inc.

The LGL Group, Inc. ("LGL," "LGL Group," or the "Company") is a holding company engaged in services, merchant investment and manufacturing business activities. Precise Time and Frequency, LLC ("PTF") is a globally positioned producer of industrial Electronic Instruments and commercial products and services. Founded in 2002, PTF operates from our design and manufacturing facility in Wakefield, Massachusetts. Lynch Capital International LLC is focused on the development of value through investments.

LGL Group was incorporated in 1928 under the laws of the State of Indiana, and in 2007, the Company was reincorporated under the laws of the State of Delaware as The LGL Group, Inc. We maintain our executive offices at 2525 Shader Road, Orlando, Florida 32804. Our telephone number is (407) 298-2000. Our Internet address is www.lglgroup.com. LGL common stock and warrants are traded on the NYSE American under the symbols "LGL" and "LGL WS," respectively.

LGL Group's business strategy is primarily focused on growth through expanding new and existing operations across diversified industries. The Company's engineering and design origins date back to the early 1900s. In 1917, Lynch Glass Machinery Company ("Lynch Glass"), the predecessor of LGL Group, was formed and emerged in the late 1920s as a successful manufacturer of glass-forming machinery. Lynch Glass was then renamed Lynch Corporation ("Lynch") and was incorporated in 1928 under the laws of the State of Indiana. In 1946, Lynch was listed on the "New York Curb Exchange," the predecessor to the NYSE American. The Company has a had a long history of owning and operating various business in the precision engineering, manufacturing, and services sectors.

Cautionary Note Concerning Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, such as those pertaining to the Company’s financial condition, results of operations, business strategy and financial needs. All statements other than statements of current or historical fact contained in this press release are forward-looking statements. The words "believe," "expect," "anticipate," "should," "plan," "will," "may," "could," "intend," "estimate," "predict," "potential," "continue" or the negative of these terms and similar expressions, as they relate to LGL Group, are intended to identify forward-looking statements.

These forward-looking statements are largely based on current expectations and projections about future events and financial trends that may affect the financial condition, results of operations, business strategy and financial needs of the Company. They can be affected by inaccurate assumptions, including the risks, uncertainties and assumptions described in the filings made by LGL Group with the Securities and Exchange Commission ("SEC"), including those risks set forth under the heading "Risk Factors" in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 as filed with the SEC on April 1, 2024. In light of these risks, uncertainties and assumptions, the forward-looking statements in this press release may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. When you consider these forward-looking statements, you should keep in mind these risk factors and other cautionary statements in this press release.

These forward-looking statements speak only as of the date of this press release. LGL Group undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

###

Contact:

The LGL Group, Inc.

Christopher Nossokoff

(407) 298-2000

info@lglgroup.com

The LGL Group, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| |

|

Three Months Ended September 30,

|

|

Nine Months Ended September 30,

|

|

(in thousands, except share data)

|

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

650 |

|

|

$ |

438 |

|

|

$ |

1,573 |

|

|

$ |

1,282 |

|

|

Net investment income

|

|

|

531 |

|

|

|

544 |

|

|

|

1,568 |

|

|

|

1,017 |

|

|

Net (losses) gains

|

|

|

(2 |

) |

|

|

(4 |

) |

|

|

(6 |

) |

|

|

384 |

|

|

Total revenues

|

|

|

1,179 |

|

|

|

978 |

|

|

|

3,135 |

|

|

|

2,683 |

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing cost of sales

|

|

|

368 |

|

|

|

195 |

|

|

|

786 |

|

|

|

595 |

|

|

Engineering, selling and administrative

|

|

|

673 |

|

|

|

584 |

|

|

|

1,895 |

|

|

|

1,771 |

|

|

Total expenses

|

|

|

1,041 |

|

|

|

779 |

|

|

|

2,681 |

|

|

|

2,366 |

|

|

Income from continuing operations before income taxes

|

|

|

138 |

|

|

|

199 |

|

|

|

454 |

|

|

|

317 |

|

|

Income tax expense

|

|

|

48 |

|

|

|

69 |

|

|

|

160 |

|

|

|

132 |

|

|

Net income from continuing operations

|

|

|

90 |

|

|

|

130 |

|

|

|

294 |

|

|

|

185 |

|

|

Income (loss) from discontinued operations, net of tax

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(28 |

) |

|

Net income

|

|

|

90 |

|

|

|

130 |

|

|

|

294 |

|

|

|

157 |

|

|

Less: Net income attributable to non-controlling interests

|

|

|

18 |

|

|

|

22 |

|

|

|

64 |

|

|

|

22 |

|

|

Net income attributable to LGL Group common stockholders

|

|

$ |

72 |

|

|

$ |

108 |

|

|

$ |

230 |

|

|

$ |

135 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) per common share attributable to LGL Group common stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic (a):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

0.04 |

|

|

$ |

0.03 |

|

|

Income (loss) from discontinued operations

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

|

Net income attributable to LGL Group common stockholders

|

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

0.04 |

|

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted (a):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

0.04 |

|

|

$ |

0.03 |

|

|

Income (loss) from discontinued operations

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

|

Net income attributable to LGL Group common stockholders

|

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

0.04 |

|

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

5,352,937 |

|

|

|

5,352,937 |

|

|

|

5,352,937 |

|

|

|

5,352,937 |

|

|

Diluted

|

|

|

5,531,969 |

|

|

|

5,355,006 |

|

|

|

5,543,795 |

|

|

|

5,352,937 |

|

|

(a)

|

Basic and diluted earnings per share are calculated using actual, unrounded amounts. Therefore, the components of earnings per share may not sum to its corresponding total.

|

The LGL Group, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

|

(in thousands)

|

|

September 30, 2024

|

|

December 31, 2023

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

41,602 |

|

|

$ |

40,711 |

|

|

Marketable securities

|

|

|

16 |

|

|

|

22 |

|

|

Accounts receivable, net of reserves of $52 and $58, respectively

|

|

|

133 |

|

|

|

356 |

|

|

Inventories, net

|

|

|

338 |

|

|

|

204 |

|

|

Prepaid expenses and other current assets

|

|

|

185 |

|

|

|

273 |

|

|

Total current assets

|

|

|

42,274 |

|

|

|

41,566 |

|

|

Right-of-use lease assets

|

|

|

21 |

|

|

|

75 |

|

|

Intangible assets, net

|

|

|

41 |

|

|

|

57 |

|

|

Deferred income tax assets

|

|

|

149 |

|

|

|

152 |

|

|

Total assets

|

|

$ |

42,485 |

|

|

$ |

41,850 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

739 |

|

|

|

474 |

|

|

Non-current liabilities

|

|

|

743 |

|

|

|

694 |

|

|

Total liabilities

|

|

|

1,482 |

|

|

|

1,168 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

Total LGL Group stockholders' equity

|

|

|

39,019 |

|

|

|

38,762 |

|

|

Non-controlling interests

|

|

|

1,984 |

|

|

|

1,920 |

|

|

Total stockholders' equity

|

|

|

41,003 |

|

|

|

40,682 |

|

|

Total liabilities and stockholders' equity

|

|

$ |

42,485 |

|

|

$ |

41,850 |

|

The LGL Group, Inc.

Segment Results

(Unaudited)

| |

|

Three Months Ended September 30,

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

|

2024

|

|

2023

|

|

$ Change

|

|

% Change

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Instruments

|

|

$ |

650 |

|

|

$ |

438 |

|

|

$ |

212 |

|

|

|

48.4 |

% |

|

Merchant Investment

|

|

|

318 |

|

|

|

287 |

|

|

|

31 |

|

|

|

10.8 |

% |

|

Corporate

|

|

|

211 |

|

|

|

253 |

|

|

|

(42 |

) |

|

|

-16.6 |

% |

|

Total revenues

|

|

|

1,179 |

|

|

|

978 |

|

|

|

201 |

|

|

|

20.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Instruments

|

|

|

606 |

|

|

|

368 |

|

|

|

238 |

|

|

|

64.7 |

% |

|

Merchant Investment

|

|

|

90 |

|

|

|

64 |

|

|

|

26 |

|

|

|

40.6 |

% |

|

Corporate

|

|

|

345 |

|

|

|

347 |

|

|

|

(2 |

) |

|

|

-0.6 |

% |

|

Total expenses

|

|

|

1,041 |

|

|

|

779 |

|

|

|

262 |

|

|

|

33.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from continuing operations before income taxes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Instruments

|

|

|

44 |

|

|

|

70 |

|

|

|

(26 |

) |

|

|

-37.1 |

% |

|

Merchant Investment

|

|

|

228 |

|

|

|

223 |

|

|

|

5 |

|

|

|

2.2 |

% |

|

Corporate

|

|

|

(134 |

) |

|

|

(94 |

) |

|

|

(40 |

) |

|

|

42.6 |

% |

|

Income from continuing operations before income taxes

|

|

|

138 |

|

|

|

199 |

|

|

|

(61 |

) |

|

|

-30.7 |

% |

|

Income tax expense (benefit)

|

|

|

48 |

|

|

|

69 |

|

|

|

(21 |

) |

|

|

-30.4 |

% |

|

Net income from continuing operations

|

|

|

90 |

|

|

|

130 |

|

|

|

(40 |

) |

|

|

-30.8 |

% |

|

Income from discontinued operations, net of tax

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

n/m

|

|

|

Net income

|

|

|

90 |

|

|

|

130 |

|

|

|

(40 |

) |

|

|

-30.8 |

% |

|

Less: Net income attributable to non-controlling interests

|

|

|

18 |

|

|

|

22 |

|

|

|

(4 |

) |

|

|

-18.2 |

% |

|

Net income attributable to LGL Group common stockholders

|

|

$ |

72 |

|

|

$ |

108 |

|

|

$ |

(36 |

) |

|

|

-33.3 |

% |

The LGL Group, Inc.

Segment Results

(Unaudited)

| |

|

Nine Months Ended September 30,

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

|

2024

|

|

2023

|

|

$ Change

|

|

% Change

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Instruments

|

|

$ |

1,573 |

|

|

$ |

1,282 |

|

|

$ |

291 |

|

|

|

22.7 |

% |

|

Merchant Investment

|

|

|

922 |

|

|

|

542 |

|

|

|

380 |

|

|

|

70.1 |

% |

|

Corporate

|

|

|

640 |

|

|

|

859 |

|

|

|

(219 |

) |

|

|

-25.5 |

% |

|

Total revenues

|

|

|

3,135 |

|

|

|

2,683 |

|

|

|

452 |

|

|

|

16.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Instruments

|

|

|

1,453 |

|

|

|

1,118 |

|

|

|

335 |

|

|

|

30.0 |

% |

|

Merchant Investment

|

|

|

217 |

|

|

|

152 |

|

|

|

65 |

|

|

|

42.8 |

% |

|

Corporate

|

|

|

1,011 |

|

|

|

1,096 |

|

|

|

(85 |

) |

|

|

-7.8 |

% |

|

Total expenses

|

|

|

2,681 |

|

|

|

2,366 |

|

|

|

315 |

|

|

|

13.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from continuing operations before income taxes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Instruments

|

|

|

120 |

|

|

|

164 |

|

|

|

(44 |

) |

|

|

-26.8 |

% |

|

Merchant Investment

|

|

|

705 |

|

|

|

390 |

|

|

|

315 |

|

|

|

80.8 |

% |

|

Corporate

|

|

|

(371 |

) |

|

|

(237 |

) |

|

|

(134 |

) |

|

|

56.5 |

% |

|

Income from continuing operations before income taxes

|

|

|

454 |

|

|

|

317 |

|

|

|

137 |

|

|

|

43.2 |

% |

|

Income tax expense

|

|

|

160 |

|

|

|

132 |

|

|

|

28 |

|

|

|

21.2 |

% |

|

Net income from continuing operations

|

|

|

294 |

|

|

|

185 |

|

|

|

109 |

|

|

|

58.9 |

% |

|

Income (loss) from discontinued operations, net of tax

|

|

|

— |

|

|

|

(28 |

) |

|

|

28 |

|

|

|

-100.0 |

% |

|

Net income

|

|

|

294 |

|

|

|

157 |

|

|

|

137 |

|

|

|

87.3 |

% |

|

Less: Net income attributable to non-controlling interests

|

|

|

64 |

|

|

|

22 |

|

|

|

42 |

|

|

|

190.9 |

% |

|

Net income attributable to LGL Group common stockholders

|

|

$ |

230 |

|

|

$ |

135 |

|

|

$ |

95 |

|

|

|

70.4 |

% |

v3.24.3

Document And Entity Information

|

Nov. 13, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

THE LGL GROUP, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 13, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-00106

|

| Entity, Tax Identification Number |

38-1799862

|

| Entity, Address, Address Line One |

2525 Shader Road

|

| Entity, Address, City or Town |

Orlando

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

32804

|

| City Area Code |

407

|

| Local Phone Number |

298-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000061004

|

| CommonStockParValue001 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01

|

| Trading Symbol |

LGL

|

| Security Exchange Name |

NYSE

|

| WarrantsToPurchaseCommonStockParValue001 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to Purchase Common Stock, par value $0.01

|

| Trading Symbol |

LGL WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lgl_CommonStockParValue001CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lgl_WarrantsToPurchaseCommonStockParValue001CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

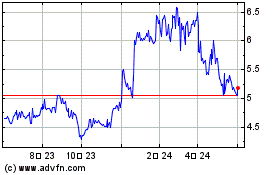

LGL (AMEX:LGL)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

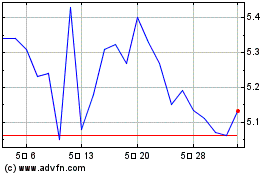

LGL (AMEX:LGL)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025