Form SD - Specialized disclosure report

31 5월 2024 - 3:17AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

THE LGL GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-00106

|

38-1799862

|

|

(State or Other Jurisdiction of Incorporation

|

(Commission File Number

|

(IRS Employer Identification No.)

|

|

2525 Shader Road, Orlando, FL

|

32804

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

Christopher L. Nossokoff

|

| Vice President - Finance |

| (407) 298-2000 |

| (Name and telephone number, including area code, of the person to contact in connection with this report.) |

Check the appropriate box to indicate the rule pursuant to which this form is being filed:

|

☒

|

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023.

|

|

☐

|

Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended _____________.

|

| Section 1. |

Conflict Minerals Disclosure |

| Item 1.01 |

Conflict Minerals Disclosure and Report |

A Conflict Minerals Report for the calendar year ended December 31, 2023, is filed herewith as Exhibit 1.01 and is publicly available at www.lglgroup.com/investor-relations, under the "Corporate Governance" section.

The reference to our website is provided for convenience only, and its contents are not incorporated by reference into this Form SD and the Conflict Minerals Report nor deemed filed with the U.S. Securities and Exchange Commission.

A copy of the Conflict Minerals Report is filed herewith as Exhibit 1.01.

| Section 2. |

Resource Extraction Issuer Disclosure |

| Item 2.01 |

Resource Extraction Issuer Disclosure and Report |

Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

|

THE LGL GROUP, INC.

|

|

|

|

| |

|

|

|

|

By:

|

/s/ Christopher L. Nossokoff |

|

May 30, 2024 |

|

| |

Christopher L. Nossokoff

|

|

DATE |

|

| |

Vice President - Finance

|

|

|

|

| |

|

|

|

|

Exhibit 1.01

The LGL Group, Inc.

Conflict Minerals Report

For the Year Ended December 31, 2023

This Conflict Minerals Report (the "Report") for the year ended December 31, 2023 was prepared by The LGL Group, Inc. (hereinafter referred to as "LGL," "LGL Group," the "Company," "we," "us," or "our") pursuant to Rule 13p-1 under the Securities Exchange Act of 1934, as amended ("Rule 13p-1").

The term "Conflict Minerals" is defined in Rule 13p-1 and refers to gold and cassiterite, columbite-tantalite, gold, wolframite, or their derivatives, which are limited to tin, tantalum, and tungsten (collectively, the "Conflict Minerals" or "3TGs"). Rule 13p-1 requires disclosure of certain information when a company manufactures or contracts to manufacture products containing Conflict Minerals that are necessary to the functionality or production of those products. These requirements apply to registrants whatever the geographic origin of the conflict minerals and whether or not they fund armed conflict.

In accordance with the instructions to Form SD, this Report outlines the diligence measures undertaken by the Company and its wholly owned subsidiary, Precise Time and Frequency, LLC ("PTF"), to assess the source and chain of custody of necessary conflict minerals in its supply chain. In accordance with the instructions to Form SD, this Report has not been audited by an independent private sector auditor.

Company and Product Overview

The Company’s PTF subsidiary is a globally positioned producer of industrial and commercial products and services focused on the design and manufacture of high-performance frequency and time reference standards that form the basis for timing and synchronization in various applications.

Covered Products

We conducted an analysis of our products and determined that certain Conflict Minerals, specifically gold, tantalum, tin, and tungsten, are necessary to the functionality or production of substantially all our products. Those products include frequency and time references, amplifiers, auto switches and network time servers (collectively, the "Covered Products").

Supply Chain Description

Our business depends on a network of suppliers to provide the materials and parts required to make our products. As a downstream company, there are multiple tiers of suppliers between us and the ultimate raw materials sources of Conflict Minerals that enter the manufacturing process. To complicate matters further, Conflict Minerals are included in parts that we purchase from our suppliers rather than being purchased by us in raw form. Therefore, we must rely on our suppliers to further work with their suppliers to provide us with accurate information about the origin of the 3TGs in the materials and parts that we purchase.

Reasonable Country of Origin ("RCOI")

The Company has actively engaged with our customers and suppliers for several years with respect to the use of conflict minerals. We utilize the Responsible Minerals Initiative’s ("RMI") Conflict Minerals Reporting Template ("CMRT") version 5.12 to conduct surveys of our suppliers to determine whether necessary 3TGs in our products originated in the Democratic Republic of Congo (the "DRC") and surrounding countries (collectively, the "Covered Countries"),

Due Diligence Program

Our due diligence measures have been designed to conform to the five-step framework in the Organisation for Economic Co-operation and Development ("OECD") Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas: Third Edition (the "OECD Guidance") and the related supplements for gold and for tin, tantalum and tungsten.

The Company’s due diligence measures included:

| |

1.

|

Establish strong company management systems

|

| |

•

|

Adopted a Conflict Minerals Policy Statement, communicated it to relevant suppliers, and posted it at www.ptf-llc.com/wp-content/uploads/2019/09/PTF-Conflict-Minerals-Policy-Statement.pdf.

|

| |

•

|

Structured internal management to support supply chain due diligence.

|

| |

•

|

Engaged with our suppliers through our RCOI and due diligence activities aimed at ensuring that they do not contribute to human rights abuses or conflict.

|

| |

2.

|

Identify and assess risk in the supply chain

|

| |

|

|

| |

|

In accordance with OECD Guidelines, it is important to identify and assess risks associated with conflict minerals in the supply chain. Risks were identified by assessing the due diligence practices of smelters and refiners identified in the supply chain by upstream suppliers that listed mineral processing facilities on their CMRT declarations.

We do not typically have a direct relationship with 3TGs smelters and refiners and do not perform or direct audits of these entities within our supply chain. In cases where the smelter’s due diligence practices have not been audited against the RMI Responsible Minerals Assurance Program ("RMAP") standard, a potential supply chain risk exists.

We are working to validate the smelter/refiner entries from the submitted CMRTs. Due to the provision of primarily supplier-level CMRTs, we cannot determine their connection to the Covered Products.

|

| |

3.

|

Design and implement a strategy to respond to identified risks

|

| |

|

|

| |

|

We engage each of our suppliers that we have reason to believe are supplying us with 3TGs from sources that may support conflict in the Covered Countries to establish an alternative source of 3TGs that does not support such conflict, as provided in the OECD Guidance. |

| |

4.

|

Carry out independent third-party audit of smelter/refinery due diligence practices

|

| |

|

|

| |

|

As a downstream manufacturer, the Company does not have a direct relationship with 3TGs smelters and refiners and does not perform or direct audits of these entities within its supply chain. We rely on industry efforts, such as RMI, to influence smelters and refiners to be audited and certified through RMI’s RMAP. |

| |

5.

|

Report annually on supply chain due diligence

|

| |

|

|

| |

|

The Company submitted our annual 2023 Conflict Minerals Report to the SEC, the public and our shareholders on May 30, 2024. This report and the associated Form SD for 2023 are publicly available on the Company’s website at www.lglgroup.com/investor-relations under the "Corporate Governance" section towards the bottom of the page. |

Due Diligence Results

As an indirect purchaser of 3TGs minerals several levels removed from the actual mining or smelting of the minerals, our position in the supply chain is remote. As a result, our due diligence efforts cannot provide absolute assurance regarding the source and chain of custody of the 3TGs ultimately included in our products.

Continuous Improvement Efforts to Mitigate Risk

The Company will endeavor to continuously improve upon its supply chain due diligence efforts. The Company will continue to engage its suppliers, support internal education and training, and seek to integrate expectations regarding its Conflict Minerals Program into new supplier contracts and those coming up for renewal.

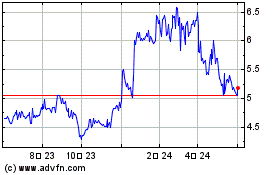

LGL (AMEX:LGL)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

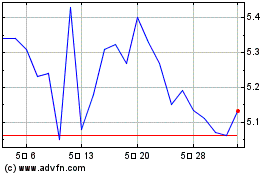

LGL (AMEX:LGL)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025