Form 8-K - Current report

08 5월 2024 - 6:11AM

Edgar (US Regulatory)

falseU S PHYSICAL THERAPY INC /NV000088597800008859782024-05-072024-05-07

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2024

U.S. PHYSICAL THERAPY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

001-11151

|

|

76-0364866

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

1300 WEST SAM HOUSTON PARKWAY,

SUITE 300,

HOUSTON, Texas

|

|

77043

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (713) 297-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions ( see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

USPH

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

◻

|

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL RESULTS.

On May 7, 2024 – U.S. Physical Therapy, Inc. (“USPH” or the “Company”) (NYSE: USPH),

a national operator of outpatient physical therapy clinics and provider of industrial injury prevention services, reported results for the first quarter ended March 31, 2024.

A copy of the

press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K, including the exhibits, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the

Exchange Act, except as shall be expressly set forth by specific reference in such filing.

The Company’s Board of Directors declared a quarterly dividend of $0.44 per share payable on June 14, 2024, to shareholders of record on May 23, 2024.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

| |

|

|

|

Exhibits

|

|

Description of Exhibits

|

| |

|

|

|

|

Registrant's Press Release dated May 7, 2024

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

|

|

|

|

|

|

|

| |

|

|

|

U.S. PHYSICAL THERAPY, INC.

|

|

| |

|

|

|

|

|

Dated: May 7, 2024

|

|

|

|

By:

|

|

/s/ CAREY HENDRICKSON

|

|

| |

|

|

|

|

|

Carey Hendrickson

|

|

| |

|

|

|

|

|

Chief Financial Officer

|

|

| |

|

|

|

|

|

(duly authorized officer and principal financial and accounting officer)

|

|

CONTACT:

U.S. Physical Therapy, Inc.

Carey Hendrickson, Chief Financial Officer

Email: Chendrickson@usph.com

Chris Reading, Chief Executive Officer

(713) 297-7000

Three Part Advisors

Joe Noyons

(817) 778-8424

U.S. Physical Therapy Reports

First Quarter 2024 Results

Management Raises Full Year 2024 Guidance

Houston, TX, May 7, 2024 – U.S. Physical Therapy,

Inc. (“USPH” or the “Company”) (NYSE: USPH), a national operator of outpatient physical therapy clinics and provider of industrial injury prevention services, today reported results for the first quarter ended March 31, 2024.

FINANCIAL HIGHLIGHTS

|

•

|

Adjusted EBITDA (1), a non-Generally Accepted Accounting Principles (“GAAP”) measure, was $16.7 million for the first quarter

ended March 31, 2024 (“2024 First Quarter”) compared to $18.5 million in the first quarter ended March 31, 2023 (“2023 First Quarter”), with the variance due to the Medicare rate reductions that took effect at the beginning of 2024 and the

impact of significant adverse weather events in January 2024. The Medicare rate reductions decreased Adjusted EBITDA by approximately $1.7 million while the adverse weather resulted in a decrease in Adjusted EBITDA of approximately $1.3

million.

|

|

•

|

Operating Results (1), a non-GAAP measure, was $7.7 million in each of the 2024 First Quarter and 2023 First Quarter. On a

per share basis, Operating Results was $0.51 in the 2024 First Quarter compared to $0.59 in the 2023 First Quarter, with the decrease attributable to the increase in shares outstanding associated with the Company’s secondary offering

completed in May 2023. The impact of the Medicare rate reduction and weather on 2024 First Quarter Operating Results was approximately $2.2 million, or $0.15 per share.

|

|

•

|

Net income attributable to USPH’s shareholders (“USPH net income”), a GAAP measure, was $8.0 million for the 2024 First Quarter compared

to $7.4 million for the 2023 First Quarter. In accordance with GAAP, the revaluation of redeemable non-controlling interest, net of taxes, is not included in net income but is charged directly to retained earnings; however, this change is

included in the computation of earnings per share. Earnings per share for the 2024 First Quarter was $0.46 compared to $0.58 for the 2023 First Quarter.

|

|

•

|

Total revenue from physical therapy operations for the 2024 First Quarter increased $5.3 million, or 4.1%, to $134.4 million.

|

|

•

|

Net rate per patient visit for the 2024 First Quarter increased to $103.37 from $103.12 for the 2023 First Quarter despite the 3.5%

Medicare rate reduction in effect for most of the 2024 First Quarter. The increase in net rate per patient visit reflects the Company’s strategic priority of increasing reimbursement rates through contract negotiations with commercial and

other payors as well as growth in workers compensation as percent of the Company’s overall mix of business.

|

|

•

|

Average daily visits per clinic was 29.5 for the 2024 First Quarter compared to 29.8 in the comparable prior year quarter. Total patient

visits were 1,268,002 in the 2024 First Quarter, a 3.3% increase from 2023 First Quarter. Average daily visits per clinic in January 2024 of 27.4 were lower than the prior year of 28.9, while average daily visits per clinic in February and

March of 2024 were higher than the prior year, the highest volumes for those two months in the Company’s history.

|

|

•

|

Industrial injury prevention (“IIP”) services revenue was $21.3 million for the 2024 First Quarter, an increase of 9.8% as compared to

the 2023 First Quarter, with an increase in gross profit of 15.1%.

|

|

•

|

During the 2024 First Quarter, the Company added 14 new clinics, including the acquisition described below, and closed six clinics

bringing its total clinic count to 679 as of March 31, 2024, as compared to 647 clinics as of March 31, 2023.

|

|

•

|

On March 29, 2024, the Company acquired a 50% equity interest in a nine-clinic practice for a purchase price of $16.4 million, with the

original practice owners retaining a 50% equity interest. The acquired business currently generates approximately $11.4 million in annual revenues and approximately 65,000 annual visits.

|

|

•

|

On April 30, 2024, one of the Company’s primary IIP businesses, Briotix Health Limited Partnership, acquired 100% of an IIP services

business for a purchase price of $24.0 million. The acquired business currently generates approximately $11.0 million in annual revenues.

|

|

•

|

The Company’s Board of Directors declared a quarterly dividend of $0.44 per share payable on June 14, 2024, to shareholders of record on

May 23, 2024.

|

|

•

|

Management increased full-year guidance and now expects Adjusted EBITDA for 2024 to be in the range of $82.5 million to $87.5 million.

See “Management Updates 2024 Guidance” below for more information.

|

|

(1)

|

See pages 11 and 12 of this release for the definition and reconciliation of non-GAAP measures,

Adjusted EBITDA and Operating Results, to the most directly comparable GAAP measure.

|

|

U.S. Physical Therapy Press Release

|

Page 2

|

|

May 7, 2024

|

|

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

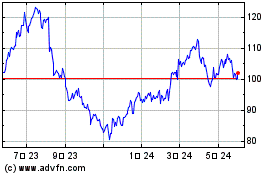

US Physical Therapy (NYSE:USPH)

과거 데이터 주식 차트

부터 4월(4) 2024 으로 5월(5) 2024

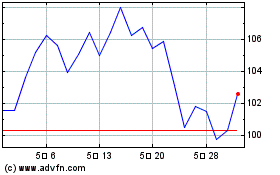

US Physical Therapy (NYSE:USPH)

과거 데이터 주식 차트

부터 5월(5) 2023 으로 5월(5) 2024