0001835256FALSE00018352562023-09-272023-09-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

September 27, 2023

Date of Report (Date of earliest event reported)

The Duckhorn Portfolio, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40240 | 81-3866305 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| |

| | |

| |

1201 Dowdell Lane

Saint Helena, CA 94574

(Address of principal executive offices) (Zip Code)

(707) 302-2658

(Registrant's telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | NAPA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On September 27, 2023, The Duckhorn Portfolio, Inc. (the “Company”) issued a press release announcing its financial results for its fourth quarter and year ended July 31, 2023. On September 27, 2023, the Company also made a presentation to investors, which includes supplemental information relating to the Company’s financial results for its fourth quarter and year ended July 31, 2023. Copies of the press release and presentation are being furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report on Form 8-K and are incorporated by reference into this Item 2.02.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | |

| The Duckhorn Portfolio, Inc. |

| | |

Date: September 27, 2023 | By: | /s/ S.B.A. Sullivan |

| | Sean Sullivan |

| | Executive Vice President, Chief Strategy and Legal Officer |

The Duckhorn Portfolio Announces Fourth Quarter and Fiscal Year 2023 Financial Results

Fourth Quarter Net Sales of $100.1 million, an Increase of 28%

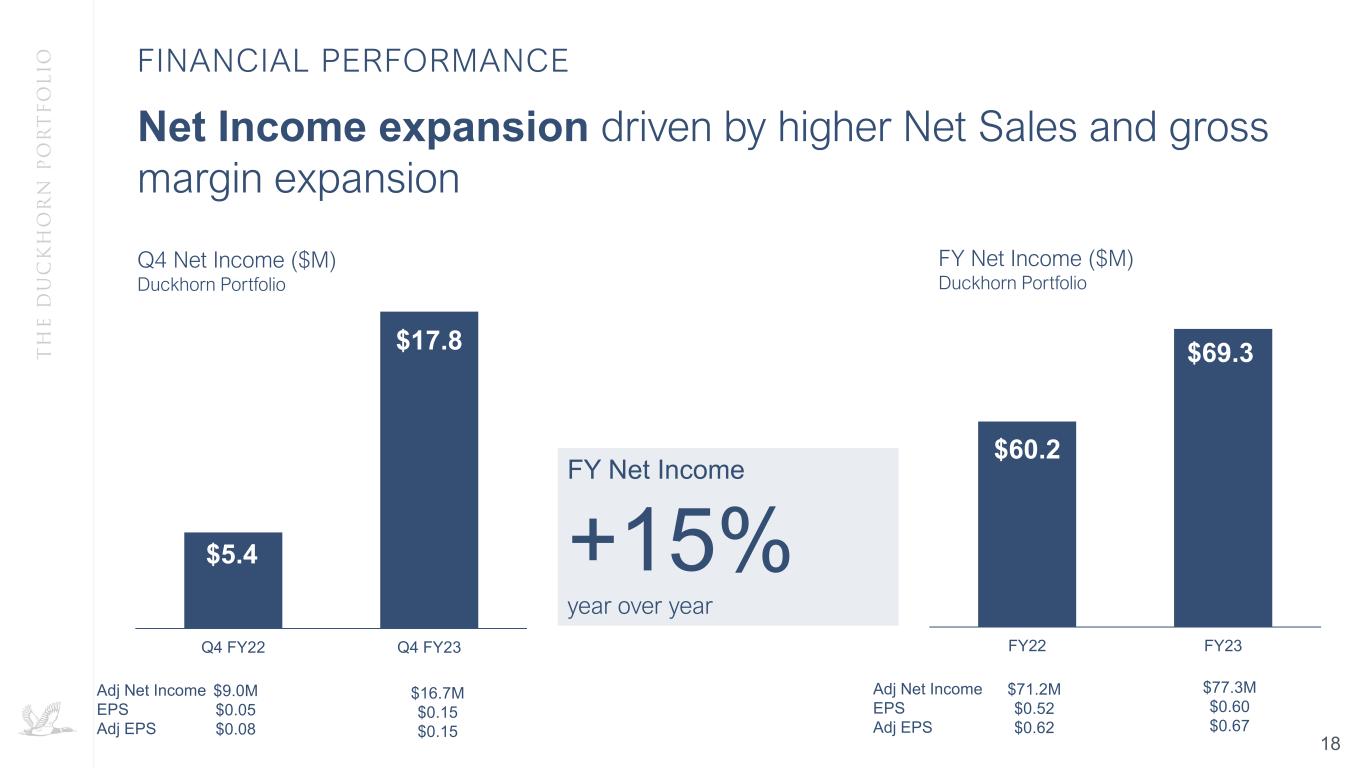

Fourth Quarter Net Income of $17.8 million; Adjusted Net Income of $16.7 million

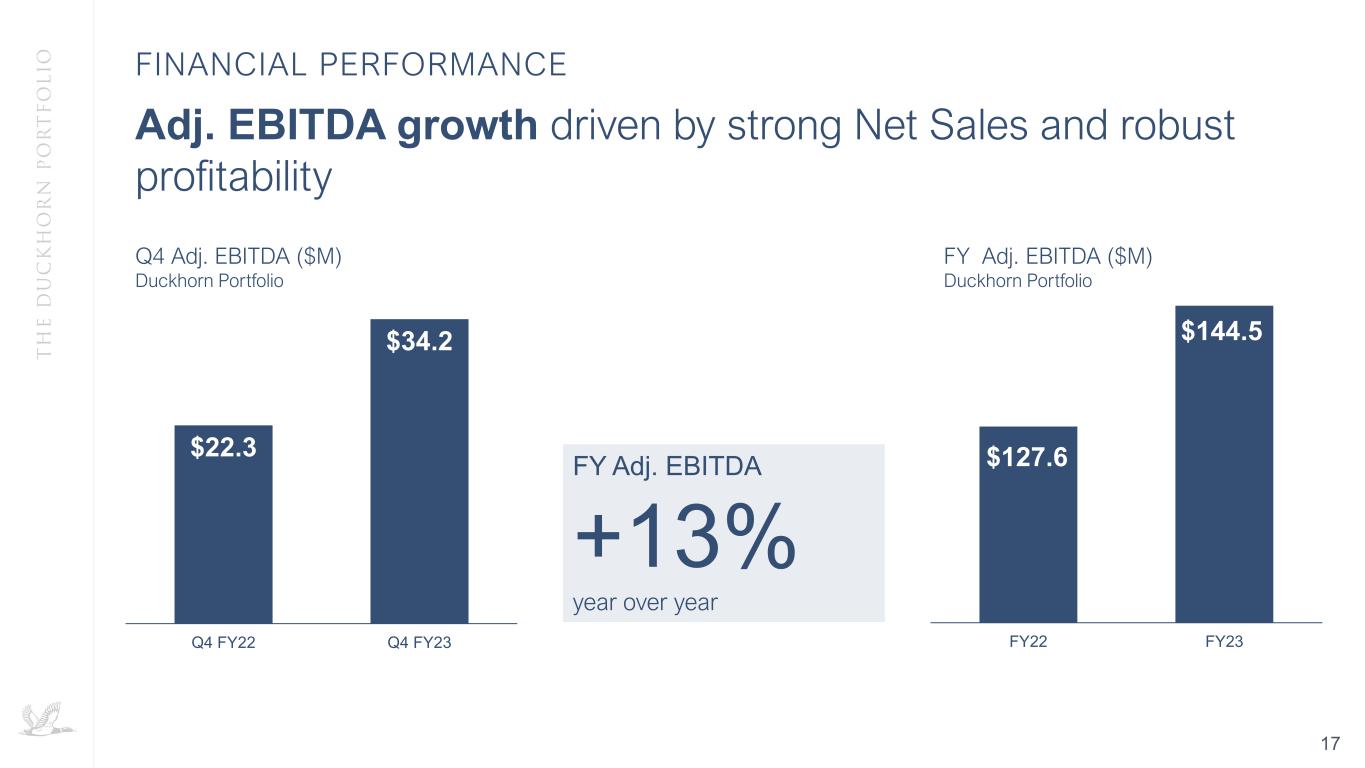

Fourth Quarter Adjusted EBITDA of $34.2 million, an Increase of 54%

Introduces Fiscal Year 2024 Guidance

ST. HELENA, CA, September 27, 2023 – (BUSINESS WIRE) – The Duckhorn Portfolio, Inc. (NYSE: NAPA) (the “Company”) today reported its financial results for the three months and fiscal year ended July 31, 2023.

Fourth Quarter 2023 Highlights

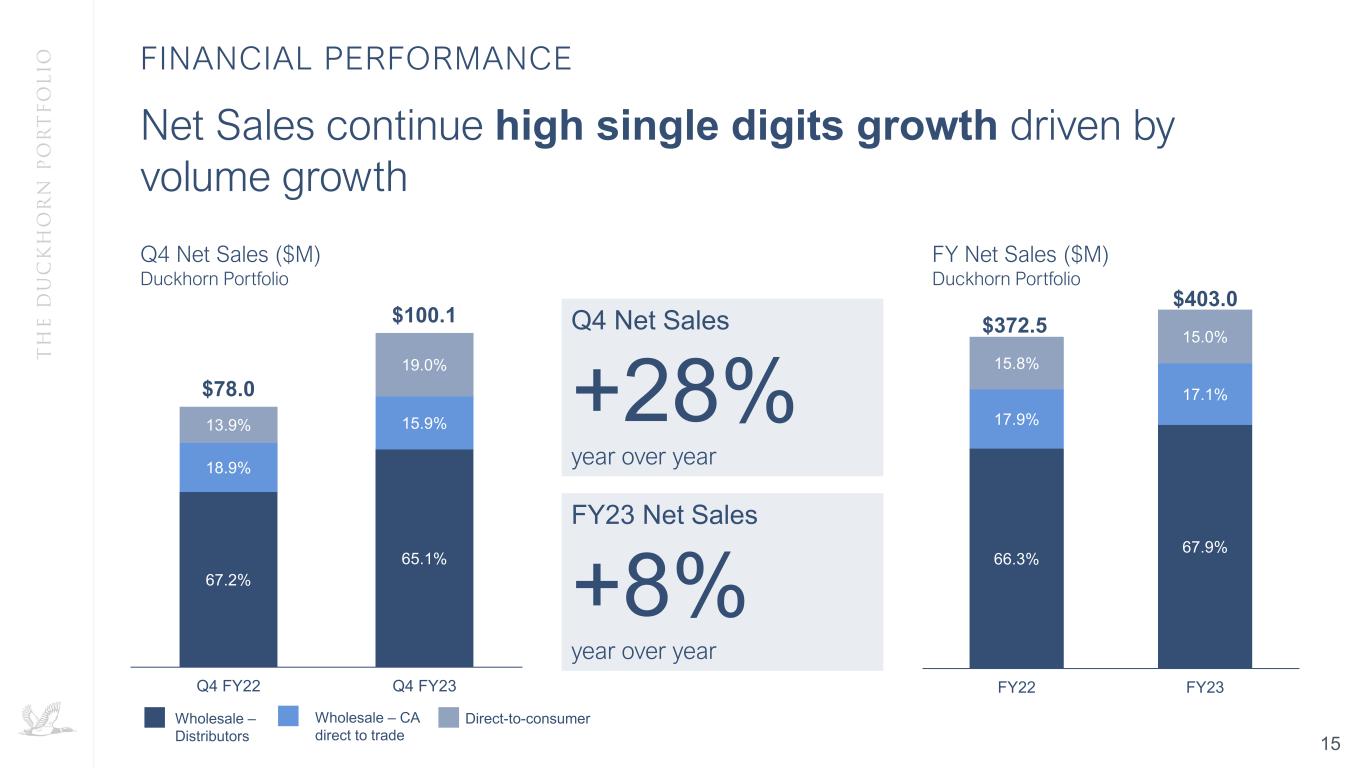

▪Net sales were $100.1 million, an increase of $22.1 million, or 28.3%, versus the prior year period.

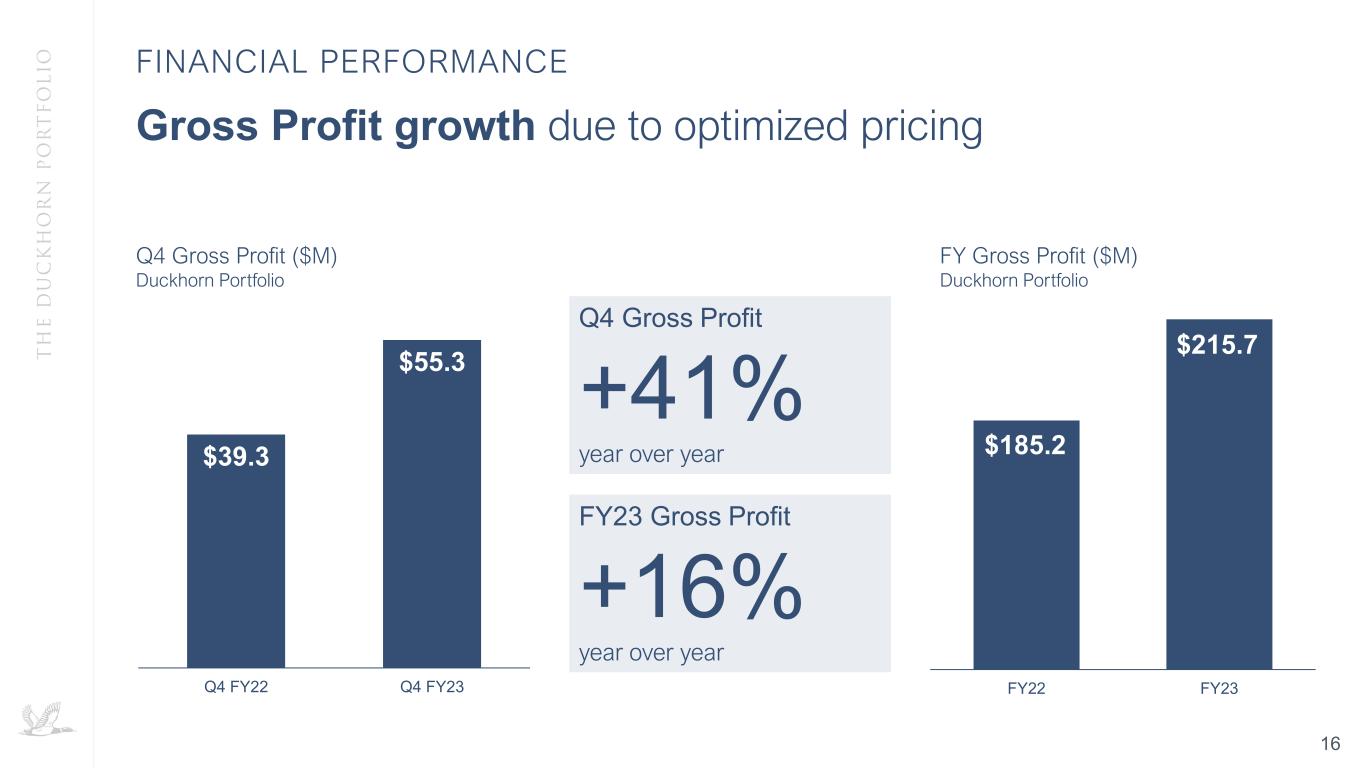

▪Gross profit was $55.3 million, an increase of $16.0 million, or 40.6%, versus the prior year period. Gross profit margin was 55.2%, up 480 basis points versus 50.4% in the prior year period.

▪Net income was $17.8 million, or $0.15 per diluted share, versus $5.4 million, or $0.05 per diluted share, in the prior year period. Adjusted net income was $16.7 million, or $0.15 per diluted share, versus $9.0 million, or $0.08 per diluted share, in the prior year period.

▪Adjusted EBITDA was $34.2 million, an increase of $11.9 million, or 53.5%, and Adjusted EBITDA margin improved 560 basis points versus the prior year period.

▪Cash was $6.4 million as of July 31, 2023. The Company’s leverage ratio was 1.6x net debt (net of deferred financing costs), to trailing twelve months adjusted EBITDA.

Fiscal Year 2023 Highlights

▪Net sales were $403.0 million, an increase of $30.5 million, or 8.2%, versus the prior year.

▪Gross profit was $215.7 million, an increase of $30.5 million, or 16.5%, versus the prior year. Gross profit margin was 53.5%, up 380 basis points versus 49.7% for the prior year period.

▪Net income was $69.3 million, or $0.60 per diluted share, versus $60.2 million, or $0.52 per diluted share, for the prior year. Adjusted net income was $77.3 million, or $0.67 per diluted share, increasing by $6.1 million, or 8.6%, versus $71.2 million, or $0.62 per diluted share, for the prior year.

▪Adjusted EBITDA was $144.5 million, an increase of $17.0 million, or 13.3%, versus the prior year. Adjusted EBITDA margin expanded by approximately 170 basis points, reaching a margin of 35.9%.

Fourth Quarter and Fiscal Year 2023 Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended July 31, | | Fiscal year ended July 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net sales growth | 28.3 | % | | 10.0 | % | | 8.2 | % | | 10.7 | % |

| Volume contribution | 10.6 | % | | 7.1 | % | | 5.6 | % | | 9.4 | % |

| Price / mix contribution | 17.7 | % | | 2.9 | % | | 2.6 | % | | 1.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended July 31, | | Fiscal year ended July 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Wholesale – Distributors | 65.1 | % | | 67.2 | % | | 67.9 | % | | 66.3 | % |

| Wholesale – California direct to trade | 15.9 | | | 18.9 | | | 17.1 | | | 17.9 | |

| DTC | 19.0 | | | 13.9 | | | 15.0 | | | 15.8 | |

| Net sales | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

Fourth Quarter 2023 Financial Information

Net sales were $100.1 million, an increase of $22.1 million, or 28.3%, versus $78.0 million for the prior year period. The increase in net sales was driven by 10.6% volume growth, which lapped a robust 7.1% growth rate for the prior year period, supported by positive price/mix contribution of 17.7%. The positive price/mix contribution was primarily attributable to favorable DTC channel sales mix, which included a higher concentration of Kosta Browne sales, as well as positive impacts from wholesale channel discounts due to pricing initiatives.

Gross profit was $55.3 million, an increase of $16.0 million, or 40.6%, versus the prior year period. Gross profit margin was 55.2%, improving 480 basis points versus the prior year period as a result of improved performance across our wholesale channels, successful execution of planned price increases and lower discounting.

Total selling, general and administrative expenses were $30.4 million, an increase of $2.7 million, or 9.8%, versus $27.7 million in the prior year period. The increase was primarily attributed to higher compensation costs due to investments in our workforce to support our long-term growth strategy, as well as increases in other direct selling costs.

Net income was $17.8 million, or $0.15 per diluted share, versus $5.4 million, or $0.05 per diluted share, in the prior year period. Adjusted net income was $16.7 million, or $0.15 per diluted share, versus $9.0 million, or $0.08 per diluted share, in the prior year period. The increases were driven by higher net sales and profitability, and partially offset by higher operating expenses, interest expense and income taxes compared to the prior year period.

Adjusted EBITDA was $34.2 million, an increase of $11.9 million, or 53.5%, versus $22.3 million in the prior year period. Adjusted EBITDA margin improved 560 basis points versus the prior year period. The increase was driven by higher net sales and profitability, partially offset by higher operating expenses.

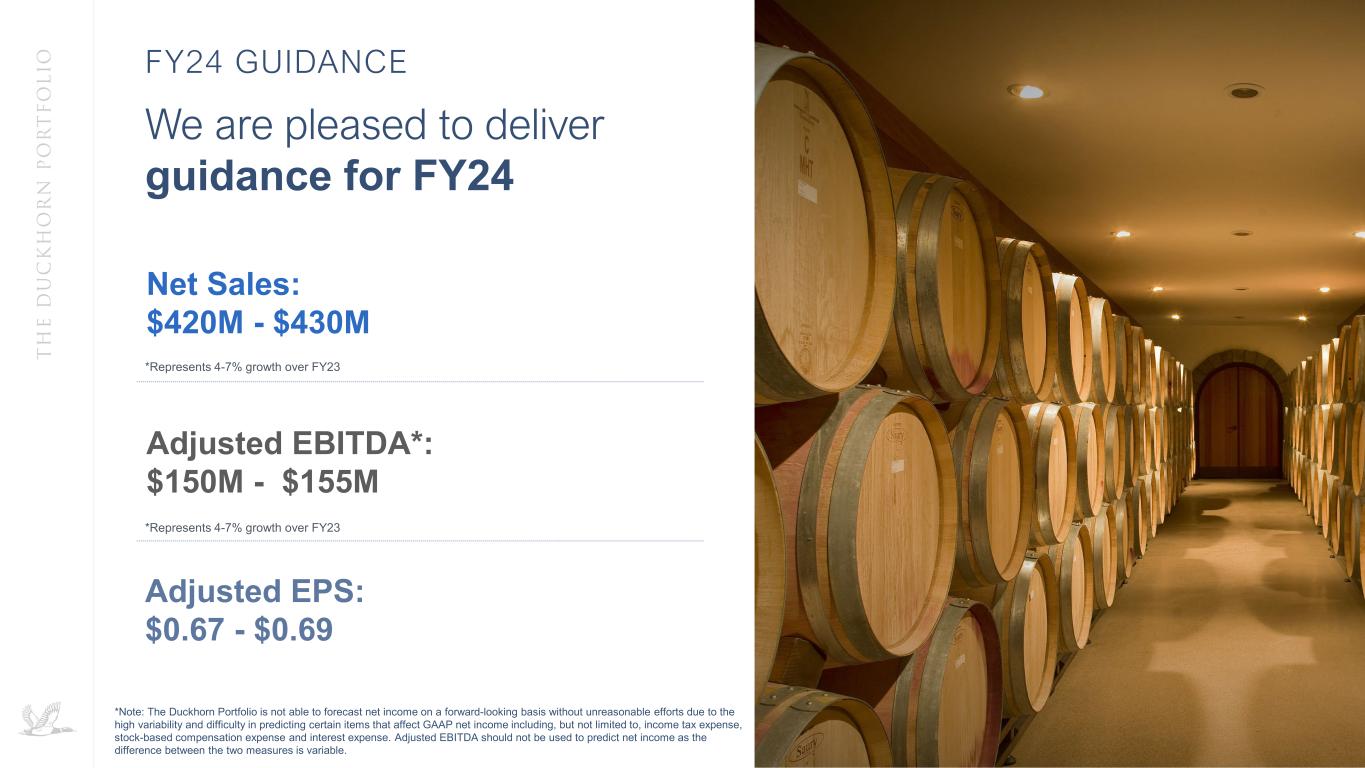

Fiscal Year 2024 Guidance

The Company is providing the following guidance ranges below for Fiscal Year 2024:

| | | | | | | | | | | |

(amounts in millions, except per share data and percentages) | Fiscal year ended July 31, 2024 |

| Net sales | $420 | - | $430 |

| Adjusted EBITDA | $150 | - | $155 |

| Adjusted EPS | $0.67 | - | $0.69 |

| Diluted share count | 115 | - | 116 |

| Effective tax rate | 25% | - | 27% |

Conference Call and Webcast

The Company will host a conference call and webcast today with an accompanying presentation to discuss these results at 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time). Investors interested in participating in the live call can dial 833-470-1428 from the U.S. and 404-975-4839 internationally, and enter confirmation code 879708. A telephone replay will be available approximately two hours after the call concludes through Wednesday, October 11, 2023 by dialing 929-458-6194 from the U.S., or +44 204-525-0658 from international locations, and entering confirmation code 809496.

There will also be a simultaneous, live webcast available on the Company’s investor relations website at https://ir.duckhorn.com/events-and-presentations. The webcast will be archived for 30 days.

About The Duckhorn Portfolio, Inc.

The Duckhorn Portfolio is North America’s premier luxury wine company, with ten wineries, nine state-of-the-art winemaking facilities, seven tasting rooms and over 1,100 coveted acres of vineyards spanning 32 Estate properties. Established in 1976, when vintners Dan and Margaret Duckhorn founded Napa Valley’s Duckhorn Vineyards, today, our portfolio features some of North America’s most revered wineries, including Duckhorn Vineyards, Decoy, Paraduxx, Goldeneye, Migration, Canvasback, Calera, Kosta Browne, Greenwing and Postmark. Sourcing grapes from our own Estate properties and fine growers in Napa Valley, Sonoma County, Anderson Valley, California’s North and Central coasts, Oregon and Washington State, we offer a curated and comprehensive portfolio of acclaimed luxury wines with price points ranging from $20 to $200 across more than 15 varieties and 39 appellations. Our wines are available throughout the United States, on five continents, and in more than 50 countries around the world. To learn more, visit us at: https://www.duckhornportfolio.com/. Investors can access information on our investor relations website at: https://ir.duckhorn.com.

Use of Non-GAAP Financial Information

In addition to the Company’s results, which are determined in accordance with generally accepted accounting principles in the United States (“GAAP”), the Company believes the following non-GAAP measures presented in this press release and discussed on the related teleconference call are useful in evaluating its operating performance: adjusted gross profit, adjusted EBITDA, adjusted net income and adjusted EPS. Certain of these non-GAAP measures exclude depreciation and amortization, non-cash equity-based compensation expense, purchase accounting adjustments, casualty losses or gains, impairment losses, inventory write-downs, changes in the fair value of derivatives, and certain other items, net of the tax effects of all such adjustments, which are not related to the Company’s core operating performance. The Company believes that these non-GAAP financial measures are provided to enhance the reader’s understanding of our past financial performance and our

prospects for the future. The Company’s management team uses these non-GAAP financial measures to evaluate business performance in comparison to budgets, forecasts and prior period financial results. The non-GAAP financial information is presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly titled non-GAAP measures used by other companies. A reconciliation is provided herein for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. Readers are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

Forward-Looking Statements

This press release includes forward-looking statements. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and other words of similar meaning. These forward-looking statements address various matters including statements regarding the timing or nature of future operating or financial performance or other events. For example, all statements The Duckhorn Portfolio makes relating to its estimated and projected financial results or its plans and objectives for future operations, growth initiatives or strategies are forward-looking statements. Each forward-looking statement contained in this press release is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others, the Company’s ability to manage the growth of its business; the Company’s reliance on its brand name, reputation and product quality; the effectiveness of the Company’s marketing and advertising programs, including the consumer reception of the launch and expansion of our product offerings; general competitive conditions, including actions the Company’s competitors may take to grow their businesses; overall decline in the health of the economy and the impact of inflation on consumer discretionary spending and consumer demand for wine; the occurrence of severe weather events (including fires, floods and earthquakes), catastrophic health events, natural or man-made disasters, social and political conditions, war or civil unrest; risks associated with disruptions in the Company’s supply chain for grapes and raw and processed materials, including corks, glass bottles, barrels, winemaking additives and agents, water and other supplies; risks associated with the disruption of the delivery of the Company’s wine to customers; the impact of COVID-19 and its variants on the Company’s customers, suppliers, business operations and financial results; disrupted or delayed service by the distributors and government agencies the Company relies on for the distribution of its wines outside of California; the Company’s ability to successfully execute its growth strategy; decreases in the Company’s wine score ratings by wine rating organizations; quarterly and seasonal fluctuations in the Company’s operating results; the Company’s success in retaining or recruiting, or changes required in, its officers, key employees or directors; the Company’s ability to protect its trademarks and other intellectual property rights, including its brand and reputation; the Company’s ability to comply with laws and regulations affecting its business, including those relating to the manufacture, sale and distribution of wine; the risks associated with the legislative, judicial, accounting, regulatory, political and economic risks and conditions specific to both domestic and to international markets; claims, demands and lawsuits to which the Company is, and may in the future, be subject and the risk that its insurance or indemnities coverage may not be sufficient; the Company’s ability to operate, update or implement its IT systems; the Company’s ability to successfully pursue strategic acquisitions and integrate acquired businesses; the Company’s potential ability to obtain additional financing when and if needed; the Company’s substantial indebtedness and its ability to maintain compliance with restrictive covenants in the documents governing such indebtedness; the Company’s sponsor’s significant influence over the Company, and the Company’s status as a “controlled company” under the rules of the New York Stock Exchange; the potential liquidity and trading of the Company’s securities; the future trading prices of the Company’s common stock and the impact of securities analysts’ reports on these prices; and the risks identified in the Company’s other filings with the SEC. The Company cautions investors not to place considerable reliance on the forward-looking statements contained in this press release. You are encouraged to read the Company’s filings with the

SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of this document, and the Company undertakes no obligation to update or revise any of these statements. The Company’s business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

Contacts

Investor Contact

ICR, Inc.

ir@duckhorn.com

707-302-2635

Media Contact

Jessica Liddell, ICR

DuckhornPR@icrinc.com

203-682-8200

THE DUCKHORN PORTFOLIO, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited, amounts in thousands, except shares and per share data)

| | | | | | | | | | | |

| July 31, 2023 | | July 31, 2022 |

| ASSETS |

| Current assets: | | | |

| Cash | $ | 6,353 | | | $ | 3,167 | |

| Accounts receivable trade, net | 48,706 | | | 37,026 | |

| Inventories | 322,227 | | | 285,430 | |

| | | |

| Prepaid expenses and other current assets | 10,244 | | | 13,898 | |

| Total current assets | 387,530 | | | 339,521 | |

| | | |

| Property and equipment, net | 323,530 | | | 269,659 | |

| Operating lease right-of-use assets | 20,376 | | | 23,375 | |

| Intangible assets, net | 184,227 | | | 191,786 | |

| Goodwill | 425,209 | | | 425,209 | |

| Other assets | 6,810 | | | 1,963 | |

| | | |

| Total assets | $ | 1,347,682 | | | $ | 1,251,513 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | |

| Accounts payable | $ | 4,829 | | | $ | 3,382 | |

| Accrued expenses | 38,246 | | | 29,475 | |

| Accrued compensation | 16,460 | | | 12,893 | |

| | | |

| | | |

| Current operating lease liabilities | 3,787 | | | 3,498 | |

| | | |

| Current maturities of long-term debt | 9,721 | | | 9,810 | |

| Other current liabilities | 1,417 | | | 944 | |

| Total current liabilities | 74,460 | | | 60,002 | |

| | | |

| | | |

| Long-term debt, net of current maturities and debt issuance costs | 223,619 | | | 213,748 | |

| | | |

| Operating lease liabilities | 16,534 | | | 19,732 | |

| | | |

| Deferred income taxes | 90,216 | | | 90,483 | |

| Other liabilities | 445 | | | 387 | |

| | | |

| Total liabilities | 405,274 | | | 384,352 | |

| Stockholders’ equity: |

| Common stock, $0.01 par value; 500,000,000 shares authorized; 115,316,308 and 115,184,161 issued and outstanding at July 31, 2023, and July 31, 2022, respectively | 1,153 | | | 1,152 | |

| Additional paid-in capital | 737,557 | | | 731,597 | |

| Retained earnings | 203,122 | | | 133,824 | |

| Total The Duckhorn Portfolio, Inc. stockholders’ equity | 941,832 | | | 866,573 | |

| Non-controlling interest | 576 | | | 588 | |

| Total stockholders’ equity | 942,408 | | | 867,161 | |

| Total liabilities and stockholders’ equity | $ | 1,347,682 | | | $ | 1,251,513 | |

THE DUCKHORN PORTFOLIO, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, amounts in thousands, except shares and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended July 31, | | Fiscal year ended July 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net sales (net of excise taxes of $1,267, $1,059, $5,446 and $5,115, respectively) | $ | 100,095 | | | $ | 78,009 | | | $ | 402,996 | | | $ | 372,510 | |

| Cost of sales | 44,813 | | | 38,678 | | | 187,307 | | | 187,330 | |

| Gross profit | 55,282 | | | 39,331 | | | 215,689 | | | 185,180 | |

| | | | | | | |

| Selling, general and administrative expenses | 30,404 | | | 27,688 | | | 109,711 | | | 97,743 | |

| | | | | | | |

| Casualty gain, net | — | | | — | | | — | | | 123 | |

| Income from operations | 24,878 | | | 11,643 | | | 105,978 | | | 87,314 | |

| | | | | | | |

| Interest expense | 3,882 | | | 1,917 | | | 11,721 | | | 6,777 | |

| Other income, net | (3,597) | | | 263 | | | (212) | | | (2,214) | |

| Total other expenses, net | 285 | | | 2,180 | | | 11,509 | | | 4,563 | |

| Income before income taxes | 24,593 | | | 9,463 | | | 94,469 | | | 82,751 | |

| Income tax expense | 6,825 | | | 4,041 | | | 25,183 | | | 22,524 | |

| Net income | 17,768 | | | 5,422 | | | 69,286 | | | 60,227 | |

| Less: Net loss (income) attributable to non-controlling interest | 1 | | | (2) | | | 12 | | | (37) | |

| Net income attributable to The Duckhorn Portfolio, Inc. | $ | 17,769 | | | $ | 5,420 | | | $ | 69,298 | | | $ | 60,190 | |

| | | | | | | |

| Earnings per share of common stock: | | | | | | | |

| Basic | $0.15 | | $0.05 | | $0.60 | | $0.52 |

| Diluted | $0.15 | | $0.05 | | $0.60 | | $0.52 |

| | | | | | | |

| Weighted average shares of common stock outstanding: | | | | | | | |

| Basic | 115,302,619 | | 115,173,211 | | 115,233,324 | | 115,096,152 |

| Diluted | 115,355,026 | | 115,376,739 | | 115,407,624 | | 115,363,578 |

THE DUCKHORN PORTFOLIO, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, amounts in thousands) | | | | | | | | | | | |

| Fiscal year ended July 31, |

| 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net income | $ | 69,286 | | | $ | 60,227 | |

| Adjustments to reconcile net income to net cash from operating activities: | | | |

| Deferred income taxes | (267) | | | 3,817 | |

| Depreciation and amortization | 27,768 | | | 23,427 | |

| Loss (gain) on disposal of assets | 157 | | | (528) | |

| Change in fair value of derivatives | 34 | | | (1,695) | |

| Amortization of debt issuance costs | 975 | | | 1,608 | |

| | | |

| | | |

| Equity-based compensation | 6,290 | | | 5,523 | |

| Inventory reserve adjustments | 722 | | | 4,363 | |

| Change in operating assets and liabilities: | | | |

| Accounts receivable trade, net | (11,679) | | | (3,773) | |

| Inventories | (33,894) | | | (18,818) | |

| | | |

| Prepaid expenses and other assets | 2,281 | | | (3,293) | |

| Other assets | (917) | | | 1,258 | |

| Accounts payable | 1,549 | | | (262) | |

| Accrued expenses | 7,002 | | | 7,681 | |

| Accrued compensation | 3,567 | | | (3,953) | |

| | | |

| Deferred revenue | (6) | | | (2,830) | |

| Other current and non-current liabilities | (2,776) | | | (3,920) | |

| Net cash provided by operating activities | 70,092 | | | 68,832 | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (72,843) | | | (44,644) | |

| Proceeds from sales of property and equipment | 271 | | | 910 | |

| Net cash used in investing activities | (72,572) | | | (43,734) | |

| Cash flows from financing activities | | | |

| | | |

| | | |

| Payments of deferred offering costs | — | | | (270) | |

| Payments under line of credit | (121,000) | | | (98,000) | |

| Borrowings under line of credit | 24,000 | | | 84,000 | |

| | | |

| Issuance of long-term debt | 225,833 | | | — | |

| Payments of long-term debt | (120,166) | | | (11,347) | |

| | | |

| Proceeds from employee stock purchase plan | 350 | | | 287 | |

| Taxes paid related to net share settlement of equity awards | (680) | | | (845) | |

| Debt issuance costs | (2,671) | | | — | |

| Net cash provided by (used in) financing activities | 5,666 | | | (26,175) | |

| Net increase (decrease) in cash | 3,186 | | | (1,077) | |

| Cash - Beginning of year | 3,167 | | | 4,244 | |

| Cash - End of year | $ | 6,353 | | | $ | 3,167 | |

| Supplemental cash flow information | | | |

| Cash paid during the year | | | |

| Interest paid, net of amount capitalized | $ | 10,393 | | | $ | 5,179 | |

| Income taxes paid | $ | 11,562 | | | $ | 17,674 | |

| Non-cash investing activities | | | |

| Property and equipment additions in accounts payable and accrued expenses | $ | 3,360 | | | $ | 1,694 | |

THE DUCKHORN PORTFOLIO, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Adjusted gross profit, adjusted net income, adjusted EBITDA and adjusted EPS, collectively referred to as “Non-GAAP Financial Measures,” are commonly used in the Company’s industry and should not be construed as an alternative to net income or earnings per share as indicators of operating performance (as determined in accordance with GAAP). These Non-GAAP Financial Measures may not be comparable to similarly titled measures reported by other companies. The Company has included these Non-GAAP Financial Measures because it believes the measures provide management and investors with additional information to evaluate business performance in comparison to budgets, forecasts and prior year financial results.

Non-GAAP Financial Measures are adjusted to exclude certain items that affect comparability. The adjustments are itemized in the tables below. You are encouraged to evaluate these adjustments and the reason the Company considers them appropriate for supplemental analysis. In evaluating adjustments, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments set forth below. The presentation of Non-GAAP Financial Measures should not be construed as an inference that future results will be unaffected by unusual or recurring items.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure that the Company calculates as net income before interest, taxes, depreciation and amortization, non-cash equity-based compensation expense, purchase accounting adjustments, casualty losses or gains, changes in the fair value of derivatives and certain other items which are not related to our core operating performance. Adjusted EBITDA is a key performance measure the Company uses in evaluating its operational results. The Company believes adjusted EBITDA is a helpful measure to provide investors an understanding of how management regularly monitors the Company’s core operating performance, as well as how management makes operational and strategic decisions in allocating resources. The Company believes adjusted EBITDA also provides management and investors consistency and comparability with the Company’s past financial performance and facilitates period to period comparisons of operations, as it eliminates the effects of certain variations unrelated to its overall performance.

Adjusted EBITDA has certain limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. Some of these limitations include:

•although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

•adjusted EBITDA does not reflect changes in, or cash requirements for, the Company’s working capital needs;

•adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on the Company’s debt;

•adjusted EBITDA does not reflect income tax payments that may represent a reduction in cash available to the Company; and

•other companies, including companies in the Company’s industry, may calculate adjusted EBITDA differently, which reduce their usefulness as comparative measures.

Because of these limitations, you should consider adjusted EBITDA alongside other financial performance measures, including net income and the Company’s other GAAP results. In evaluating adjusted EBITDA, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments in this presentation. The Company’s presentation of adjusted EBITDA should not be construed as an inference that the Company’s future results will be unaffected by the types of items excluded from the calculation of adjusted EBITDA.

Adjusted Gross Profit

Adjusted gross profit is a non-GAAP financial measure that the Company calculates as gross profit excluding the impact of purchase accounting adjustments (including depreciation and amortization related to purchase accounting), non-cash equity-based compensation expense, and certain inventory charges. We believe adjusted gross profit is a useful measure to us and our investors to assist in evaluating our operating performance because it provides consistency and direct comparability with our past financial performance between fiscal periods, as the metric eliminates the effects of non-cash or other expenses unrelated to our core operating performance that would result in fluctuations in a given metric for reasons unrelated to overall continuing operating performance. Adjusted gross profit should not be considered a substitute for gross profit or any other measure of financial performance reported in accordance with GAAP.

Adjusted Net Income

Adjusted net income is a non-GAAP financial measure that the Company calculates as net income excluding the impact of non-cash equity-based compensation expense, purchase accounting adjustments, casualty losses or gains, impairment losses (including certain inventory charges), changes in the fair value of derivatives and certain other items unrelated to core operating performance, as well as the estimated income tax impacts of all such adjustments included in this non-GAAP performance measure. We believe adjusted net income assists us and our investors in evaluating our performance period-over-period. In calculating adjusted net income, we also calculate the following non-GAAP financial measures which adjust each GAAP-based financial measure for the relevant portion of each adjustment to reach adjusted net income:

•Adjusted SG&A – calculated as selling, general, and administrative expenses excluding the impacts of purchase accounting, transaction expenses, equity-based compensation; and

•Adjusted income tax – calculated as the tax effect of all adjustments to reach adjusted net income based on the applicable blended statutory tax rate for the period.

Adjusted net income should not be considered a substitute for net income or any other measure of financial performance reported in accordance with GAAP.

Adjusted EPS

Adjusted EPS is a non-GAAP financial measure that the Company calculates as adjusted net income divided by diluted share count for the applicable period. We believe adjusted EPS is useful to us and our investors because it improves the comparability of results of operations from period to period. Adjusted EPS should not be considered a substitute for net income per share or any other measure of financial performance reported in accordance with GAAP.

THE DUCKHORN PORTFOLIO, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

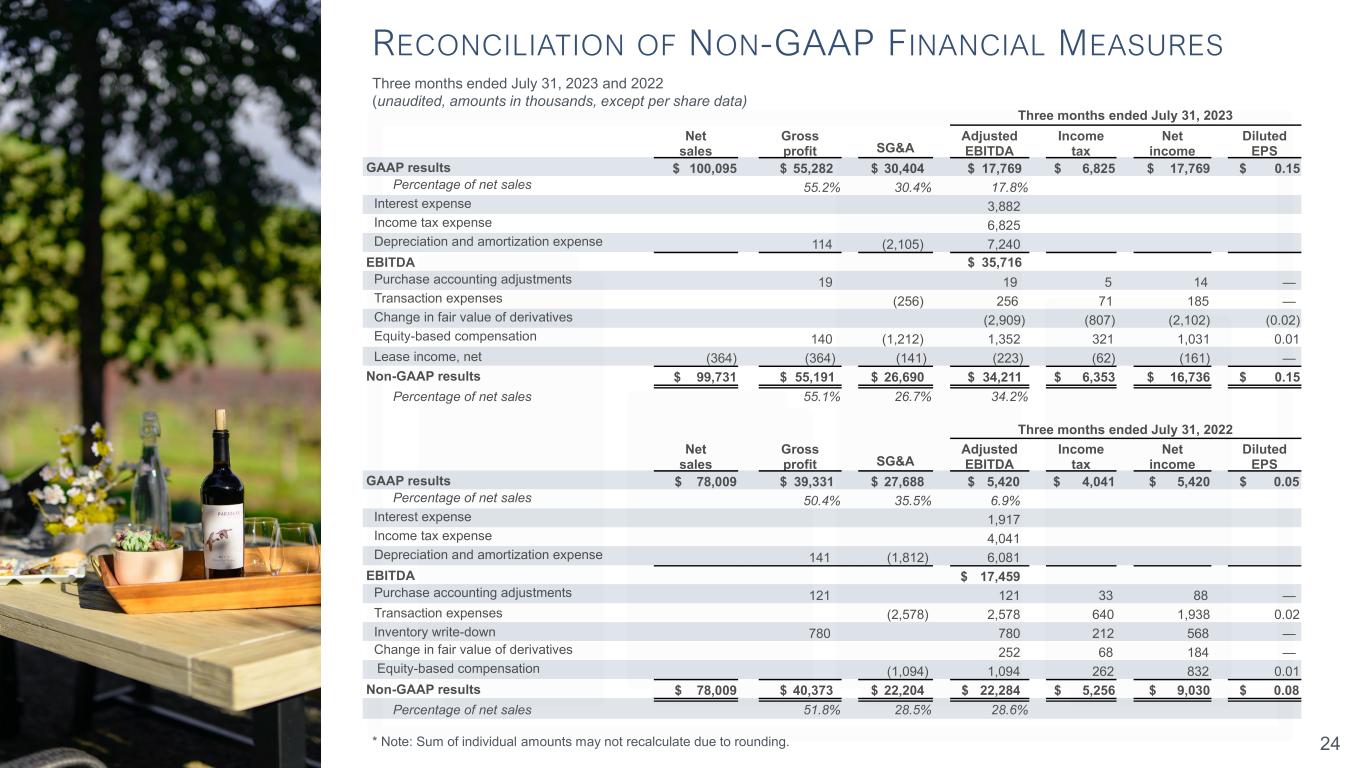

Three months ended July 31, 2023 and 2022

(Unaudited, amounts in thousands, except per share data) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Three months ended July 31, 2023 |

| Net

sales | | Gross

profit | | SG&A | | Adjusted EBITDA | | Income

tax | | Net

income | | Diluted

EPS |

| GAAP results | $ | 100,095 | | | $ | 55,282 | | | $ | 30,404 | | | $ | 17,769 | | | $ | 6,825 | | | $ | 17,769 | | | $ | 0.15 | |

Percentage of net sales | | | 55.2 | % | | 30.4 | % | | 17.8 | % | | | | | | |

Interest expense | |

| | | |

| 3,882 | | | | | | | |

Income tax expense | |

| | | |

| 6,825 | | | | | | | |

Depreciation and amortization expense | |

| 114 | | (2,105) |

| 7,240 | | | | | | | |

| EBITDA | | | | | | | $ | 35,716 | | | | | | | |

Purchase accounting adjustments | |

| 19 | | |

| 19 | | | 5 | | | 14 | | | — | |

Transaction expenses | |

| | | (256) |

| 256 | | | 71 | | | 185 | | | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Change in fair value of derivatives | |

| | | |

| (2,909) | | | (807) | | | (2,102) | | | (0.02) | |

Equity-based compensation | |

| 140 | | (1,212) |

| 1,352 | | | 321 | | | 1,031 | | | 0.01 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Lease income, net | (364) | | | (364) | | | (141) | | | (223) | | | (62) | | | (161) | | | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-GAAP results | $ | 99,731 | | | $ | 55,191 | | | $ | 26,690 | | | $ | 34,211 | | | $ | 6,353 | | | $ | 16,736 | | | $ | 0.15 | |

Percentage of net sales | | | 55.1 | % | | 26.7 | % | | 34.2 | % | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | Three months ended July 31, 2022 |

| Net

sales | | Gross

profit | | SG&A | | Adjusted EBITDA | | Income

tax | | Net

income | | Diluted

EPS |

| GAAP results | $ | 78,009 | | | $ | 39,331 | | | $ | 27,688 | | | $ | 5,420 | | | $ | 4,041 | | | $ | 5,420 | | | $ | 0.05 | |

Percentage of net sales | | | 50.4 | % | | 35.5 | % | | 6.9% | | | | | | |

Interest expense | |

| | | |

| 1,917 | | | | | | |

Income tax expense | |

| | | |

| 4,041 | | | | | | |

Depreciation and amortization expense | |

| 141 | | | (1,812) | |

| 6,081 | | | | | | |

| EBITDA | | | | | | | $ | 17,459 | | | | | | |

Purchase accounting adjustments | |

| 121 | | | |

| 121 | | 33 | | | 88 | | | — | |

| Transaction expenses | | | | | (2,578) | | | 2,578 | | 640 | | | 1,938 | | | 0.02 | |

| | | | | | | | | | | | | |

| Inventory write-down | | | 780 | | | | | 780 | | 212 | | | 568 | | | — | |

Change in fair value of derivatives | |

| | | |

| 252 | | 68 | | | 184 | | | — | |

Equity-based compensation | |

| | | (1,094) | |

| 1,094 | | 262 | | | 832 | | | 0.01 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-GAAP results | $ | 78,009 | | | $ | 40,373 | | | $ | 22,204 | | | $ | 22,284 | | $ | 5,256 | | | $ | 9,030 | | | $ | 0.08 | |

Percentage of net sales | | | 51.8 | % | | 28.5 | % | | 28.6 | % | | | | | | |

Note: Sum of individual amounts may not recalculate due to rounding.

THE DUCKHORN PORTFOLIO, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

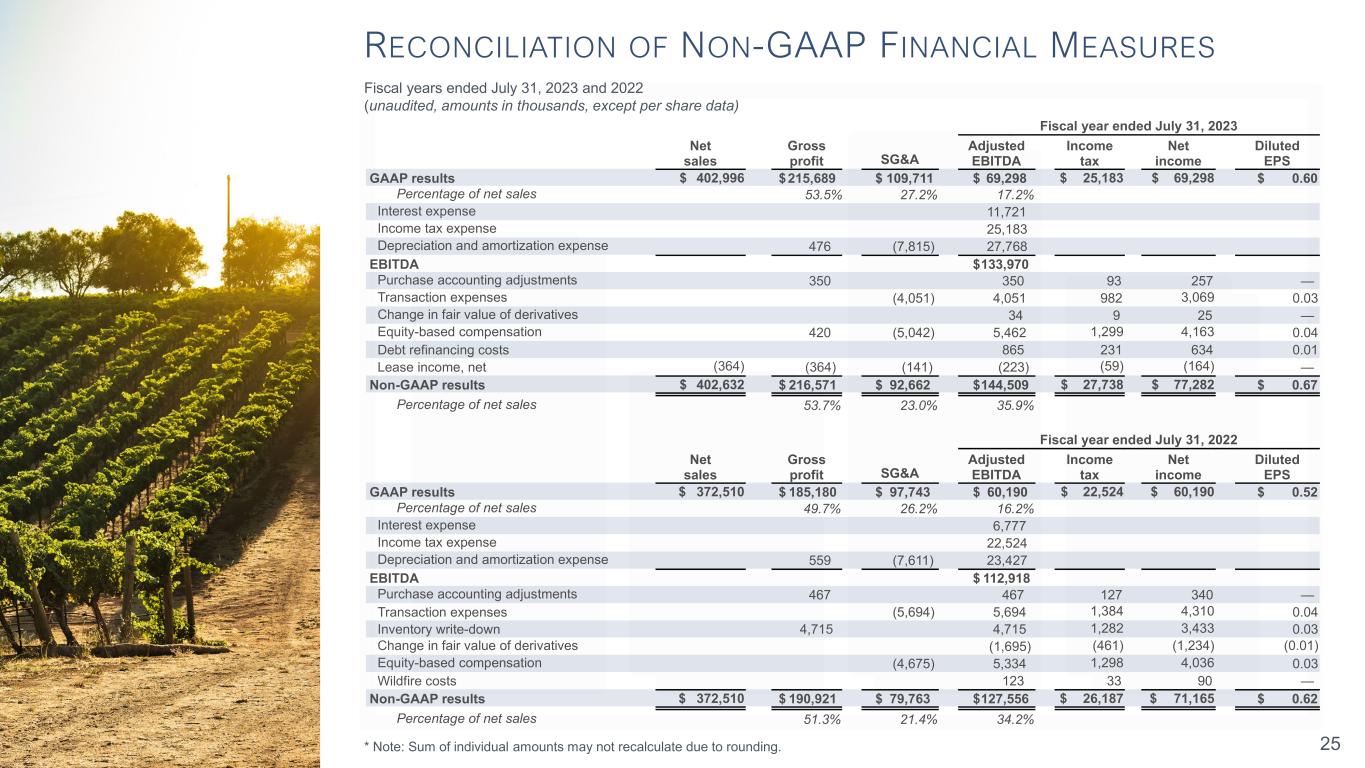

Fiscal years ended July 31, 2023 and 2022

(Unaudited, amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Fiscal year ended July 31, 2023 |

| Net

sales | | Gross

profit | | SG&A | | Adjusted EBITDA | | Income

tax | | Net

income | | Diluted

EPS |

| GAAP results | $ | 402,996 | | | $ | 215,689 | | | $ | 109,711 | | | $ | 69,298 | | | $ | 25,183 | | | $ | 69,298 | | | $ | 0.60 | |

Percentage of net sales | | | 53.5 | % | | 27.2 | % | | 17.2 | % | | | | | | |

Interest expense | | | | | | | 11,721 | | | | | | | |

Income tax expense | | | | | | | 25,183 | | | | | | | |

Depreciation and amortization expense | | | 476 | | | (7,815) | | | 27,768 | | | | | | | |

| EBITDA | | | | | | | $ | 133,970 | | | | | | | |

Purchase accounting adjustments | | | 350 | | | | | 350 | | | 93 | | | 257 | | | — | |

Transaction expenses | | | | | (4,051) | | | 4,051 | | | 982 | | | 3,069 | | | 0.03 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Change in fair value of derivatives | | | | | | | 34 | | | 9 | | | 25 | | | — | |

Equity-based compensation | | | 420 | | | (5,042) | | | 5,462 | | | 1,299 | | | 4,163 | | | 0.04 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Debt refinancing costs | | | | | | | 865 | | | 231 | | | 634 | | | 0.01 | |

| Lease income, net | (364) | | | (364) | | | (141) | | | (223) | | | (59) | | | (164) | | | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-GAAP results | $ | 402,632 | | | $ | 216,571 | | | $ | 92,662 | | | $ | 144,509 | | | $ | 27,738 | | | $ | 77,282 | | | $ | 0.67 | |

Percentage of net sales | | | 53.7 | % | | 23.0 | % | | 35.9 | % | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | Fiscal year ended July 31, 2022 |

| Net

sales | | Gross

profit | | SG&A | | Adjusted EBITDA | | Income

tax | | Net

income | | Diluted

EPS |

| GAAP results | $ | 372,510 | | | $ | 185,180 | | | $ | 97,743 | | | $ | 60,190 | | | $ | 22,524 | | | $ | 60,190 | | | $ | 0.52 | |

Percentage of net sales | | | 49.7 | % | | 26.2 | % | | 16.2 | % | | | | | | |

Interest expense | | | | | | | 6,777 | | | | | | | |

Income tax expense | | | | | | | 22,524 | | | | | | | |

Depreciation and amortization expense | | | 559 | | | (7,611) | | | 23,427 | | | | | | | |

| EBITDA | | | | | | | $ | 112,918 | | | | | | | |

Purchase accounting adjustments | | | 467 | | | | | 467 | | | 127 | | | 340 | | | — | |

| Transaction expenses | | | | | (5,694) | | | 5,694 | | | 1,384 | | | 4,310 | | | 0.04 | |

| | | | | | | | | | | | | |

| Inventory write-down | | | 4,715 | | | | | 4,715 | | | 1,282 | | | 3,433 | | | 0.03 | |

Change in fair value of derivatives | | | |

| |

| (1,695) | | | (461) | | | (1,234) | | | (0.01) | |

Equity-based compensation | | | |

| (4,675) | |

| 5,334 | | | 1,298 | | | 4,036 | | | 0.03 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Wildfire costs | | | | | | | 123 | | | 33 | | | 90 | | | — | |

| | | | | | | | | | | | | |

| Non-GAAP results | $ | 372,510 | | | $ | 190,921 | | | $ | 79,763 | | | $ | 127,556 | | | $ | 26,187 | | | $ | 71,165 | | | $ | 0.62 | |

Percentage of net sales | | | 51.3 | % | | 21.4 | % | | 34.2 | % | | | | | | |

Note: Sum of individual amounts may not recalculate due to rounding.

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . Fourth Quarter and Fiscal Year 2023 Financial Results September 27, 2023

LEGAL DISCLAIMER This presentation of The Duckhorn Portfolio, Inc. (the “Company”) and the accompanying conference call contain forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and other words of similar meaning. These forward-looking statements address various matters including statements regarding the timing or nature of future operating or financial performance or other events. Each forward-looking statement contained in this presentation is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others, the Company’s ability to manage the growth of its business; the Company’s reliance on its brand name, reputation and product quality; the effectiveness of the Company’s marketing and advertising programs; general competitive conditions, including actions the Company’s competitors may take to grow their businesses; overall decline in the health of the economy and the impact of inflation on consumer discretionary spending; the occurrence of severe weather events (including fires, floods and earthquakes), catastrophic health events, natural or man-made disasters, social and political conditions, war or civil unrest; risks associated with disruptions in the Company’s supply chain for grapes and raw and processed materials, including corks, glass bottles, barrels, winemaking additives and agents, water and other supplies; risks associated with the disruption of the delivery of the Company’s wine to customers; the impact of COVID-19 and its variants on the Company’s customers, suppliers, business operations and financial results; disrupted or delayed service by the distributors and government agencies the Company relies on for the distribution of its wines outside of California; the Company’s ability to successfully execute its growth strategy; decreases in the Company’s wine score ratings by wine rating organizations; quarterly and seasonal fluctuations in the Company’s operating results; the Company’s success in retaining or recruiting, or changes required in, its officers, key employees or directors; the Company’s ability to protect its trademarks and other intellectual property rights, including its brand and reputation; the Company’s ability to comply with laws and regulations affecting its business, including those relating to the manufacture, sale and distribution of wine; the risks associated with the legislative, judicial, accounting, regulatory, political and economic risks and conditions specific to both domestic and to international markets; claims, demands and lawsuits to which the Company is, and may in the future, be subject and the risk that its insurance or indemnities coverage may not be sufficient; the Company’s ability to operate, update or implement its IT systems; the Company’s ability to successfully pursue strategic acquisitions and integrate acquired businesses; the Company’s potential ability to obtain additional financing when and if needed; the Company’s substantial indebtedness and its ability to maintain compliance with restrictive covenants in the documents governing such indebtedness; the Company’s sponsor’s significant influence over the Company, and the Company’s status as a “controlled company” under the rules of the New York Stock Exchange; the potential liquidity and trading of the Company’s securities; the future trading prices of the Company’s common stock and the impact of securities analysts’ reports on these prices; and the risks identified in the Company’s other filings with the Securities and Exchange Commission (“SEC”). The Company cautions investors not to place considerable reliance on the forward-looking statements contained in this presentation. You are encouraged to read the Company’s filings with the SEC, available at www.sec.gov, including its most recent Annual Report on Form 10-K, as amended, for a discussion of these and other risks and uncertainties. The forward-looking statements in this presentation speak only as of the date of this document, and the Company undertakes no obligation to update or revise any of these statements. The Company’s business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties. This presentation also includes certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, and not as a substitute for or superior to, measures of financial performance prepared in accordance with generally accepted accounting principles (“GAAP”). Certain of these non-GAAP measures exclude depreciation and amortization, non-cash equity-based compensation expense, purchase accounting adjustments, casualty losses or gains, impairment losses, inventory write-downs, changes in the fair value of derivatives, and certain other items, net of the tax effects of all such adjustments, which are not related to the Company’s core operating performance. The Company believes that these non-GAAP financial measures enhance the reader’s understanding of our past financial performance and our prospects for the future. The Company’s management team uses these non-GAAP financial measures to evaluate business performance in comparison to budgets, forecasts and prior period financial results. The non-GAAP financial information is presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with GAAP and may be different from similarly titled non-GAAP measures used by other companies. A reconciliation is provided herein for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. Readers are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. For further information with respect to the Company, we refer you to our most recent Annual Report on Form 10-K, as amended, filed with the SEC. In addition, we are subject to the information and reporting requirements of the Securities Exchange Act of 1934 and, accordingly, we file periodic reports, current reports, proxy statements and other information with the SEC. These periodic reports, current reports, proxy statements and other information are available for review at the SEC’s website at http://www.sec.gov. 2

The Duckhorn Portfolio sets the standard for American fine wine Over nearly half a century of producing iconic luxury wines, we’ve curated a cohesive portfolio of critically acclaimed winery brands that are beloved by wine consumers and trusted by our trade partners. Our ability to leverage the brand strength of our entire portfolio makes us a category leader, poised to continue to scale and take market share.

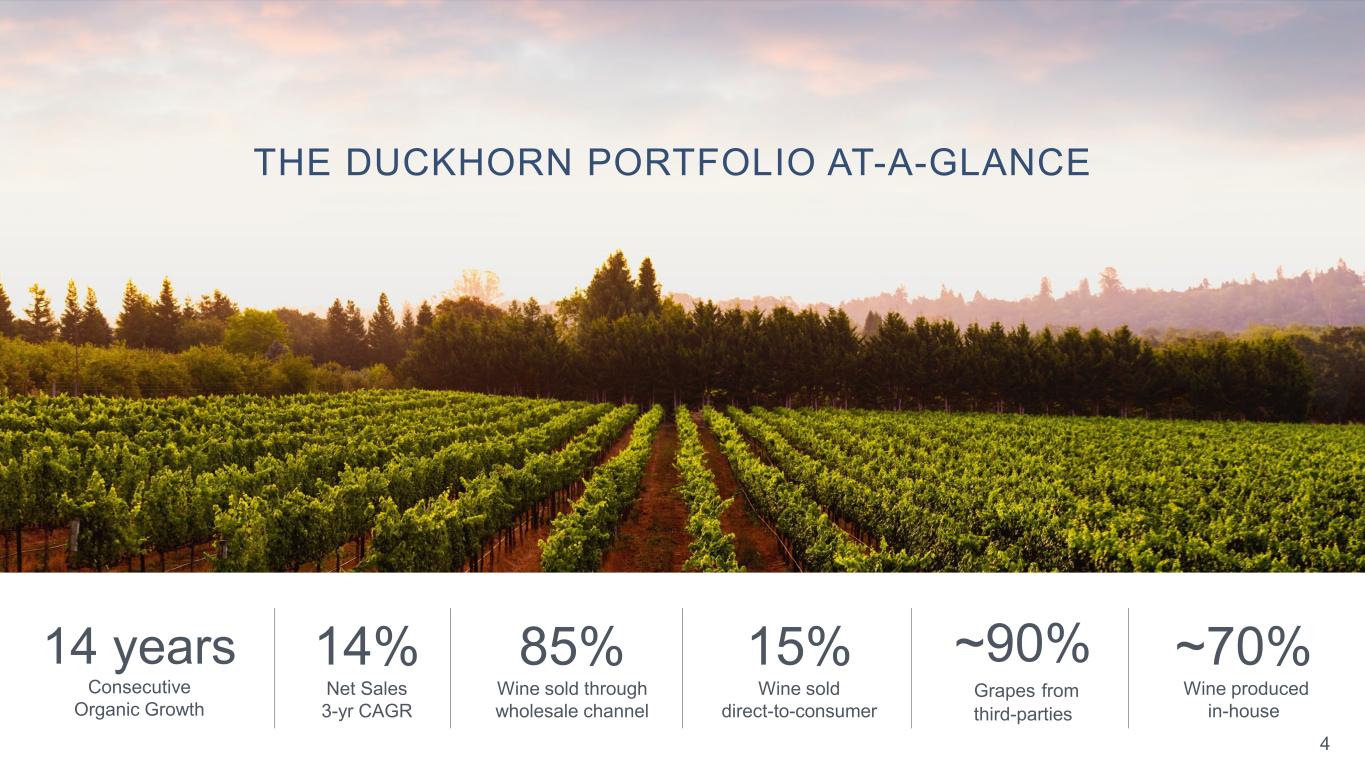

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . 14 years Consecutive Organic Growth 14% Net Sales 3-yr CAGR ~90% Grapes from third-parties ~70% Wine produced in-house 85% Wine sold through wholesale channel 15% Wine sold direct-to-consumer THE DUCKHORN PORTFOLIO AT-A-GLANCE 4

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . 7 beautiful tasting rooms 10 highly-acclaimed winery brands, each with their own winemaking team 1,100+ coveted acres of vineyard spanning 32 Estate properties 9 state-of-the-art winemaking facilities Three Palms Vineyard Duckhorn Vineyards Barrel Chai Goldeneye Winemaking Team Duckhorn Vineyards Tasting Room

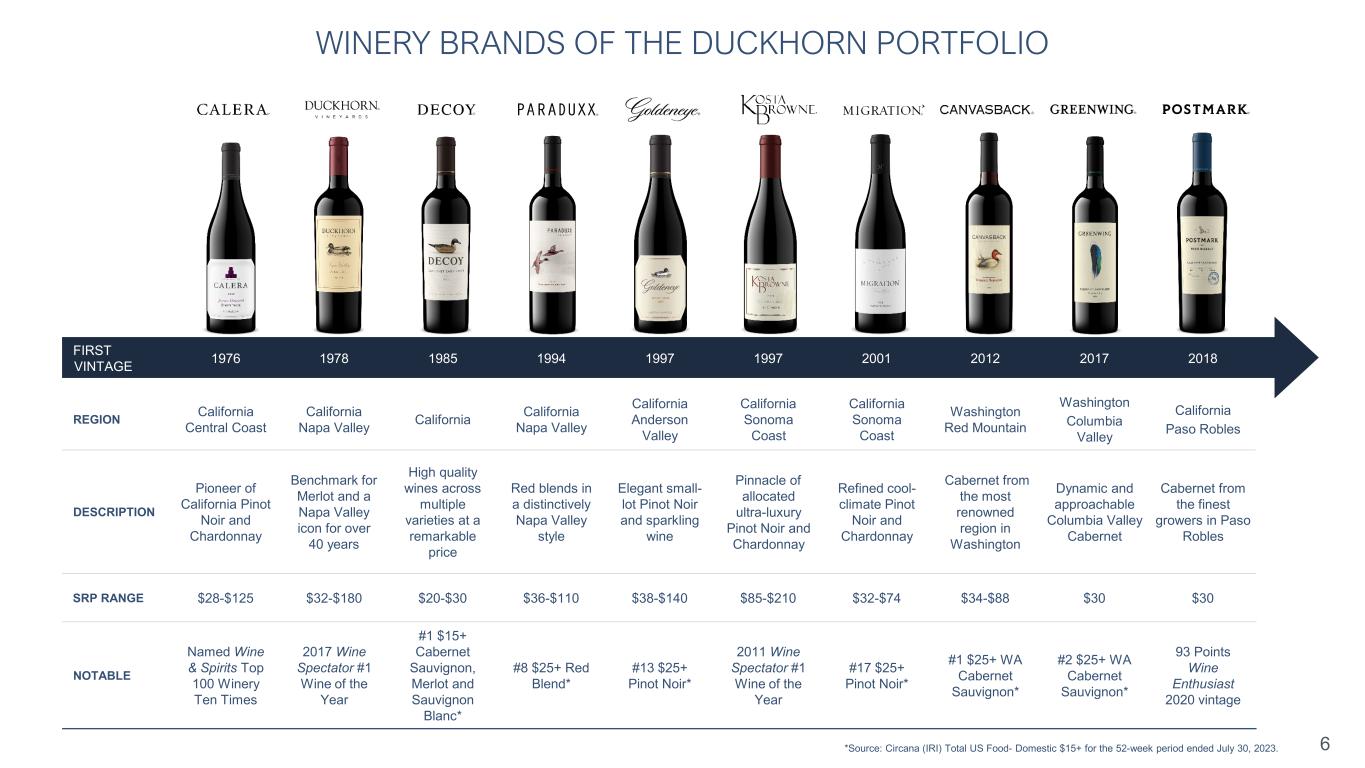

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . WINERY BRANDS OF THE DUCKHORN PORTFOLIO FIRST VINTAGE 1976 1978 1985 1994 1997 1997 2001 2012 2017 2018 REGION California Central Coast California Napa Valley California California Napa Valley California Anderson Valley California Sonoma Coast California Sonoma Coast Washington Red Mountain Washington Columbia Valley California Paso Robles DESCRIPTION Pioneer of California Pinot Noir and Chardonnay Benchmark for Merlot and a Napa Valley icon for over 40 years High quality wines across multiple varieties at a remarkable price Red blends in a distinctively Napa Valley style Elegant small- lot Pinot Noir and sparkling wine Pinnacle of allocated ultra-luxury Pinot Noir and Chardonnay Refined cool- climate Pinot Noir and Chardonnay Cabernet from the most renowned region in Washington Dynamic and approachable Columbia Valley Cabernet Cabernet from the finest growers in Paso Robles SRP RANGE $28-$125 $32-$180 $20-$30 $36-$110 $38-$140 $85-$210 $32-$74 $34-$88 $30 $30 NOTABLE Named Wine & Spirits Top 100 Winery Ten Times 2017 Wine Spectator #1 Wine of the Year #1 $15+ Cabernet Sauvignon, Merlot and Sauvignon Blanc* #8 $25+ Red Blend* #13 $25+ Pinot Noir* 2011 Wine Spectator #1 Wine of the Year #17 $25+ Pinot Noir* #1 $25+ WA Cabernet Sauvignon* #2 $25+ WA Cabernet Sauvignon* 93 Points Wine Enthusiast 2020 vintage *Source: Circana (IRI) Total US Food- Domestic $15+ for the 52-week period ended July 30, 2023. 6

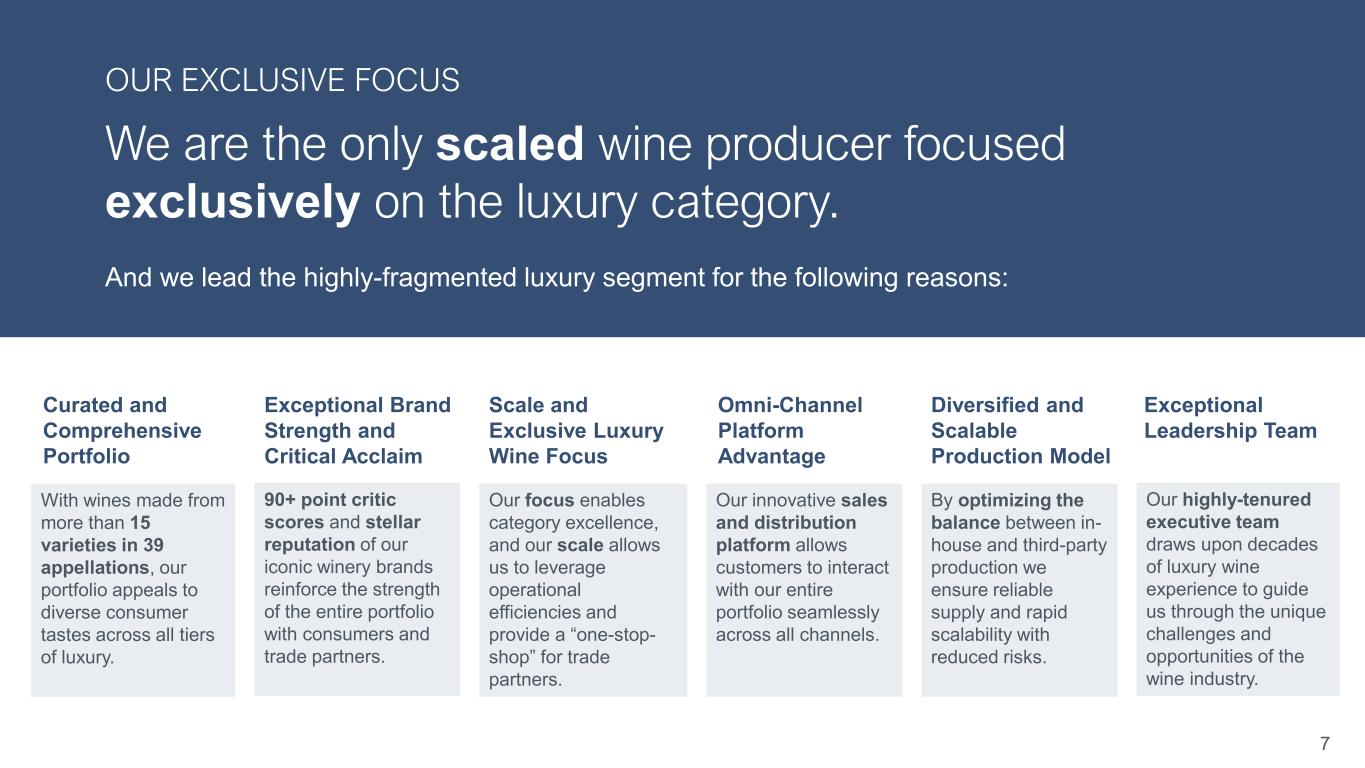

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . Curated and Comprehensive Portfolio We are the only scaled wine producer focused exclusively on the luxury category. And we lead the highly-fragmented luxury segment for the following reasons: Exceptional Brand Strength and Critical Acclaim Scale and Exclusive Luxury Wine Focus Omni-Channel Platform Advantage Diversified and Scalable Production Model Exceptional Leadership Team With wines made from more than 15 varieties in 39 appellations, our portfolio appeals to diverse consumer tastes across all tiers of luxury. 90+ point critic scores and stellar reputation of our iconic winery brands reinforce the strength of the entire portfolio with consumers and trade partners. Our focus enables category excellence, and our scale allows us to leverage operational efficiencies and provide a “one-stop- shop” for trade partners. Our innovative sales and distribution platform allows customers to interact with our entire portfolio seamlessly across all channels. By optimizing the balance between in- house and third-party production we ensure reliable supply and rapid scalability with reduced risks. Our highly-tenured executive team draws upon decades of luxury wine experience to guide us through the unique challenges and opportunities of the wine industry. OUR EXCLUSIVE FOCUS 7

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . 28% Net Sales growth A strong Q4 caps off another year of industry leading performance 18% Price/Mix 11% Volume growth HIGHLIGHTS 54% Adj. EBITDA growth * Note: Sum of individual amounts may not recalculate due to rounding.

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . WINE INDUSTRY TRENDS Source: Circana (IRI) US Food data for the 52-week period ended July 30, 2023. The luxury segment continues to outpace broader industry growth. Dollar sales change by segment Last 52 weeks as of 07.30.23 (0.7%) 1.6% 9.1% Total Wine $15+ Luxury The Duckhorn Portfolio Dollar sales change by segment Last 12 weeks as of 07.30.23 2.3% 5.4% 7.5% Total Wine $15+ Luxury The Duckhorn… The Duckhorn Portfolio is outpacing our peers in the luxury segment on both a 52- and 12-week basis 9

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . Leverage portfolio brand strength Use portfolio strength to increase individual winery brand equity and engagement, cultivate purchase intent and drive conversion. Targeted portfolio evolution Launch winery brand extensions to proactively address changes in customer and market dynamics and penetrate white space. Expand and accelerate wholesale distribution Leverage our scale and strength in trade relationships to capture distribution growth opportunities. Continue to enhance our DTC experience Drive consumer engagement across our luxury portfolio through our elevated tasting rooms, wine clubs and eCommerce website. Disciplined strategic acquisitions Strategically evaluate and acquire winery brands, production wineries and acclaimed vineyards to drive stockholder value. O R G AN IC AD D IT IV E STRATEGIES FOR GROWTH

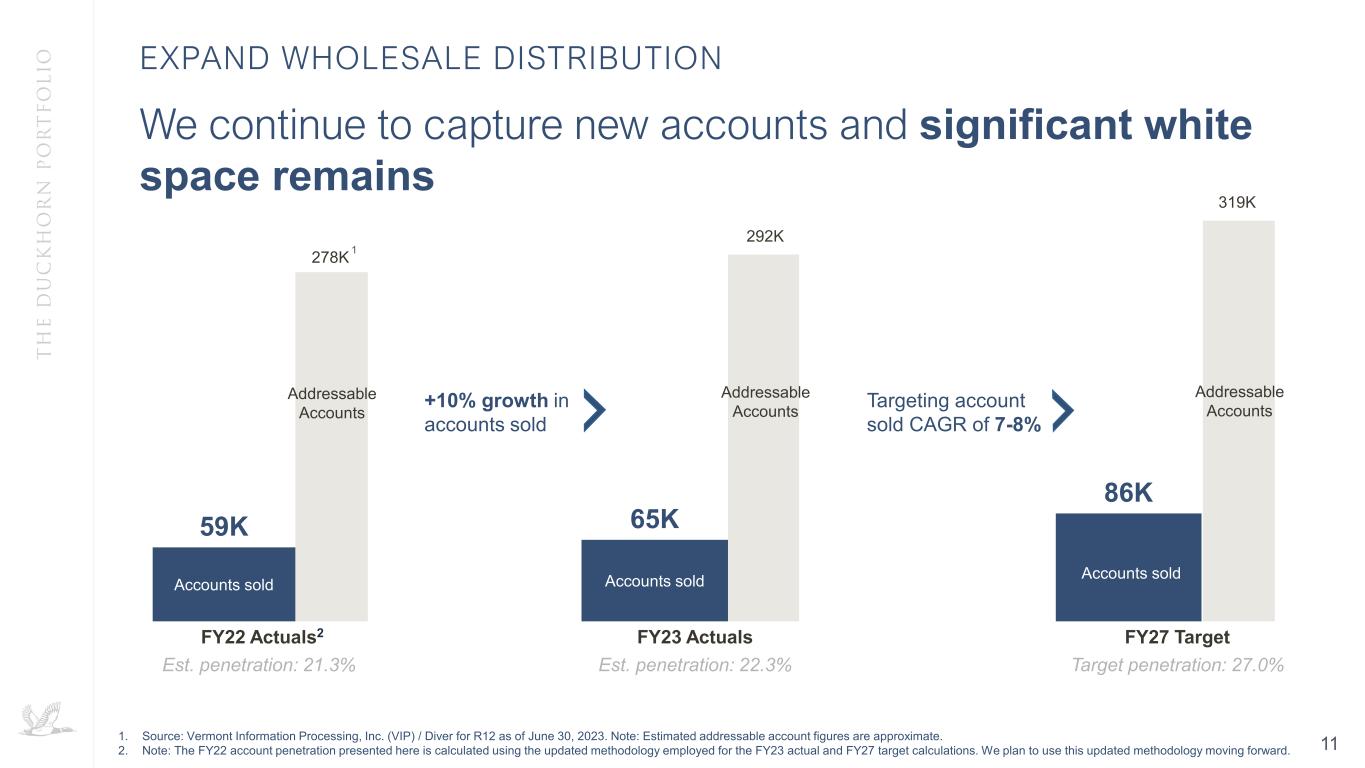

Accounts sold 86K 319K Addressable Accounts Accounts sold 65K 292K Addressable Accounts Target penetration: 27.0% FY27 Target Accounts sold 59K 278K Est. penetration: 21.3% FY22 Actuals Est. penetration: 22.3% FY23 Actuals Targeting account sold CAGR of 7-8% +10% growth in accounts sold Addressable Accounts EXPAND WHOLESALE DISTRIBUTION We continue to capture new accounts and significant white space remains 1. Source: Vermont Information Processing, Inc. (VIP) / Diver for R12 as of June 30, 2023. Note: Estimated addressable account figures are approximate. 2. Note: The FY22 account penetration presented here is calculated using the updated methodology employed for the FY23 actual and FY27 target calculations. We plan to use this updated methodology moving forward. 1 2 11

• Demonstrated brand strength • Authenticity in the luxury wine segment • Opportunity for us to accelerate growth of the target • Positive trade and consumer reaction • Access to premium grapes, production resiliency and diversification • Accretive long-term financial profile KEY ACQUISITIONS CRITERIACOMPONENTS OF M&A PLATFORM • Robust Funnel of Targets • Industry Known Buyer of Choice • Portfolio Synergies • Disciplined Strategy • Experienced M&A Team • Proven Integration Experience We have a proven ability to integrate and drive growth through strategic acquisitions DISCIPLINED STRATEGIC ACQUISITIONS 12

• Provides runway for growth over the next decade • Enhances COGS stability • Materially decreases reliance on third-party custom crush • Will house a new high-speed centralized bottling line • Designed to reduce the environmental impact of the winemaking process DISCIPLINED STRATEGIC ACQUISITIONS Recent acquisition spotlight: Geyserville production winery

E S G E N V I R O N M E N TA L , S O C I A L , A N D G OV E R N A N C E ( E S G ) VA LU E S Enterprise Risk Management Board Diversity and Accountability Diversity, Equity & Inclusion Human Capital Management Community Involvement Sustainable Product Employee Health and Safety Climate and Emissions Sustainable Agriculture Supply Chain Circularity Data Stewardship • Examined prior ESG disclosure – deep dive into current program to determine pathway for future ESG initiatives. • Created an internal working group to develop water efficiency projects at production facilities. • Continued evaluation and development of our DEI programming with the People Team. • Implemented Workiva ESG module – a software that supports consistent, transparent ESG data disclosures. Completed Projects and Programs Certifications and Frameworks In-Progress Projects and Programs • Completing second annual Scope 1 and Scope 2 emissions calculations, which include our Washington State operations. • 2023 ESG Report Development – Workiva software creates confidence in externally-reported metrics. • We look forward to continued ESG-focused investor outreach. We continue to advance our commitment to ESG across our organization 14

Net Sales continue high single digits growth driven by volume growth 67.2% 65.1% 18.9% 15.9%13.9% 19.0% $78.0 $100.1 Q4 FY22 Q4 FY23 Q4 Net Sales ($M) Duckhorn Portfolio 66.3% 67.9% 17.9% 17.1% 15.8% 15.0%$372.5 $403.0 FY22 FY23 FY Net Sales ($M) Duckhorn Portfolio Wholesale – Distributors Wholesale – CA direct to trade Direct-to-consumer FY23 Net Sales +8% year over year Q4 Net Sales +28% year over year FINANCIAL PERFORMANCE 15

$185.2 $215.7 FY22 FY23 Gross Profit growth due to optimized pricing $39.3 $55.3 Q4 FY22 Q4 FY23 Q4 Gross Profit ($M) Duckhorn Portfolio FY Gross Profit ($M) Duckhorn Portfolio Q4 Gross Profit +41% year over year FY23 Gross Profit +16% year over year FINANCIAL PERFORMANCE 16

$127.6 $144.5 FY22 FY23 Adj. EBITDA growth driven by strong Net Sales and robust profitability $22.3 $34.2 Q4 FY22 Q4 FY23 Q4 Adj. EBITDA ($M) Duckhorn Portfolio FY Adj. EBITDA ($M) Duckhorn Portfolio FY Adj. EBITDA +13% year over year FINANCIAL PERFORMANCE 17

$60.2 $69.3 FY22 FY23 Net Income expansion driven by higher Net Sales and gross margin expansion $5.4 $17.8 Q4 FY22 Q4 FY23 Q4 Net Income ($M) Duckhorn Portfolio FY Net Income ($M) Duckhorn Portfolio Adj Net Income EPS Adj EPS $16.7M $0.15 $0.15 $9.0M $0.05 $0.08 $77.3M $0.60 $0.67 $71.2M $0.52 $0.62 Adj Net Income EPS Adj EPS FY Net Income +15% year over year FINANCIAL PERFORMANCE 18

Net Sales: $420M - $430M Adjusted EBITDA*: $150M - $155M We are pleased to deliver guidance for FY24 *Represents 4-7% growth over FY23 *Represents 4-7% growth over FY23 FY24 GUIDANCE *Note: The Duckhorn Portfolio is not able to forecast net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP net income including, but not limited to, income tax expense, stock-based compensation expense and interest expense. Adjusted EBITDA should not be used to predict net income as the difference between the two measures is variable. Adjusted EPS: $0.67 - $0.69

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . APPENDIX

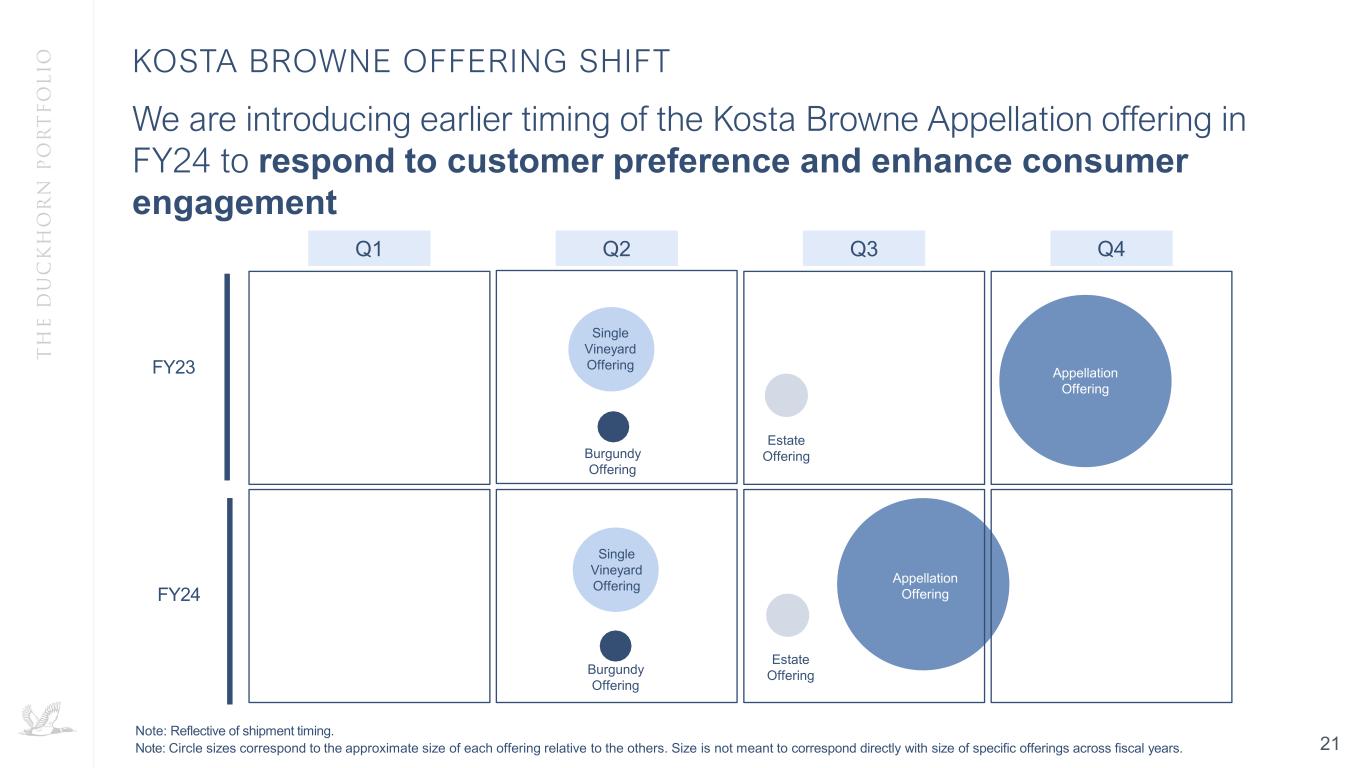

FY23 FY24 Note: Reflective of shipment timing. Note: Circle sizes correspond to the approximate size of each offering relative to the others. Size is not meant to correspond directly with size of specific offerings across fiscal years. We are introducing earlier timing of the Kosta Browne Appellation offering in FY24 to respond to customer preference and enhance consumer engagement Q1 Single Vineyard Offering Single Vineyard Offering Burgundy Offering Burgundy Offering Estate Offering Estate Offering Appellation Offering Appellation Offering KOSTA BROWNE OFFERING SHIFT Q2 Q3 Q4 21

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Adjusted gross profit, adjusted net income, adjusted EBITDA and adjusted EPS, collectively referred to as “Non-GAAP Financial Measures,” are commonly used in the Company’s industry and should not be construed as an alternative to net income or earnings per share as indicators of operating performance (as determined in accordance with GAAP). These Non-GAAP Financial Measures may not be comparable to similarly titled measures reported by other companies. The Company has included these Non-GAAP Financial Measures because it believes the measures provide management and investors with additional information to evaluate business performance in comparison to budgets, forecasts and prior year financial results. Non-GAAP Financial Measures are adjusted to exclude certain items that affect comparability. The adjustments are itemized in the tables below. You are encouraged to evaluate these adjustments and the reason the Company considers them appropriate for supplemental analysis. In evaluating adjustments, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments set forth below. The presentation of Non-GAAP Financial Measures should not be construed as an inference that future results will be unaffected by unusual or recurring items. ADJUSTED EBITDA Adjusted EBITDA is a non-GAAP financial measure that the Company calculates as net income before interest, taxes, depreciation and amortization, non-cash equity-based compensation expense, purchase accounting adjustments, casualty losses or gains, impairment losses (including certain inventory charges), changes in the fair value of derivatives and certain other items which are not related to our core operating performance. Adjusted EBITDA is a key performance measure the Company uses in evaluating its operational results. The Company believes adjusted EBITDA is a helpful measure to provide investors an understanding of how management regularly monitors the Company’s core operating performance, as well as how management makes operational and strategic decisions in allocating resources. The Company believes adjusted EBITDA also provides management and investors consistency and comparability with the Company’s past financial performance and facilitates period to period comparisons of operations, as it eliminates the effects of certain variations unrelated to its overall performance. Adjusted EBITDA has certain limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. Some of these limitations include: • although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; • adjusted EBITDA does not reflect changes in, or cash requirements for, the Company’s working capital needs; • adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on the Company’s debt; • adjusted EBITDA does not reflect income tax payments that may represent a reduction in cash available to the Company; and • other companies, including companies in the Company’s industry, may calculate adjusted EBITDA differently, which reduce their usefulness as comparative measures. Because of these limitations, you should consider adjusted EBITDA alongside other financial performance measures, including net income and the Company’s other GAAP results. In evaluating adjusted EBITDA, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments in this presentation. The Company’s presentation of adjusted EBITDA should not be construed as an inference that the Company’s future results will be unaffected by the types of items excluded from the calculation of adjusted EBITDA. 22

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES ADJUSTED GROSS PROFIT Adjusted gross profit is a non-GAAP financial measure that the Company calculates as gross profit excluding the impact of purchase accounting adjustments (including depreciation and amortization related to purchase accounting), bulk wine losses, and certain inventory charges. We believe adjusted gross profit is a useful measure to us and our investors to assist in evaluating our operating performance because it provides consistency and direct comparability with our past financial performance between fiscal periods, as the metric eliminates the effects of non-cash or other expenses unrelated to our core operating performance that would result in fluctuations in a given metric for reasons unrelated to overall continuing operating performance. Adjusted gross profit should not be considered a substitute for gross profit or any other measure of financial performance reported in accordance with GAAP. ADJUSTED NET INCOME Adjusted net income is a non-GAAP financial measure that the Company calculates as net income excluding the impact of non-cash equity-based compensation expense, purchase accounting adjustments, casualty losses or gains, impairment losses (including certain inventory charges), changes in the fair value of derivatives and certain other items unrelated to core operating performance, as well as the estimated income tax impacts of all such adjustments included in this non-GAAP performance measure. We believe adjusted net income assists us and our investors in evaluating our performance period-over-period. In calculating adjusted net income, we also calculate the following non-GAAP financial measures which adjust each GAAP-based financial measure for the relevant portion of each adjustment to reach adjusted net income: • Adjusted net sales – calculated as net sales excluding the impact of purchase accounting and bulk wine losses; • Adjusted SG&A – calculated as selling, general, and administrative expenses excluding the impacts of purchase accounting, transaction expenses, equity-based compensation, and COVID-19 costs; • Adjusted income tax – calculated as the tax effect of all adjustments to reach adjusted net income based on the applicable blended statutory tax rate for the period. Adjusted net income should not be considered a substitute for net income or any other measure of financial performance reported in accordance with GAAP. ADJUSTED EPS Adjusted EPS is a non-GAAP financial measure that the Company calculates as adjusted net income divided by diluted share count for the applicable period. We believe adjusted EPS is useful to us and our investors because it improves the comparability of results of operations from period to period. Adjusted EPS should not be considered a substitute for net income per share or any other measure of financial performance reported in accordance with GAAP. 23

Note: Source: RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Three months ended July 31, 2023 and 2022 (unaudited, amounts in thousands, except per share data) * Note: Sum of individual amounts may not recalculate due to rounding. Three months ended July 31, 2023 Net sales Gross profit SG&A Adjusted EBITDA Income tax Net income Diluted EPS GAAP results $ 100,095 $ 55,282 $ 30,404 $ 17,769 $ 6,825 $ 17,769 $ 0.15 Percentage of net sales 55.2% 30.4% 17.8% Interest expense 3,882 Income tax expense 6,825 Depreciation and amortization expense 114 (2,105) 7,240 EBITDA $ 35,716 Purchase accounting adjustments 19 19 5 14 — Transaction expenses (256) 256 71 185 — Change in fair value of derivatives (2,909) (807) (2,102) (0.02) Equity-based compensation 140 (1,212) 1,352 321 1,031 0.01 Lease income, net (364) (364) (141) (223) (62) (161) — Non-GAAP results $ 99,731 $ 55,191 $ 26,690 $ 34,211 $ 6,353 $ 16,736 $ 0.15 Percentage of net sales 55.1% 26.7% 34.2% Three months ended July 31, 2022 Net sales Gross profit SG&A Adjusted EBITDA Income tax Net income Diluted EPS GAAP results $ 78,009 $ 39,331 $ 27,688 $ 5,420 $ 4,041 $ 5,420 $ 0.05 Percentage of net sales 50.4% 35.5% 6.9% Interest expense 1,917 Income tax expense 4,041 Depreciation and amortization expense 141 (1,812) 6,081 EBITDA $ 17,459 Purchase accounting adjustments 121 121 33 88 — Transaction expenses (2,578) 2,578 640 1,938 0.02 Inventory write-down 780 780 212 568 — Change in fair value of derivatives 252 68 184 — Equity-based compensation (1,094) 1,094 262 832 0.01 Non-GAAP results $ 78,009 $ 40,373 $ 22,204 $ 22,284 $ 5,256 $ 9,030 $ 0.08 Percentage of net sales 51.8% 28.5% 28.6% 24

Note: Source: RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Fiscal years ended July 31, 2023 and 2022 (unaudited, amounts in thousands, except per share data) * Note: Sum of individual amounts may not recalculate due to rounding. Fiscal year ended July 31, 2023 Net sales Gross profit SG&A Adjusted EBITDA Income tax Net income Diluted EPS GAAP results $ 402,996 $ 215,689 $ 109,711 $ 69,298 $ 25,183 $ 69,298 $ 0.60 Percentage of net sales 53.5% 27.2% 17.2% Interest expense 11,721 Income tax expense 25,183 Depreciation and amortization expense 476 (7,815) 27,768 EBITDA $ 133,970 Purchase accounting adjustments 350 350 93 257 — Transaction expenses (4,051) 4,051 982 3,069 0.03 Change in fair value of derivatives 34 9 25 — Equity-based compensation 420 (5,042) 5,462 1,299 4,163 0.04 Debt refinancing costs 865 231 634 0.01 Lease income, net (364) (364) (141) (223) (59) (164) — Non-GAAP results $ 402,632 $ 216,571 $ 92,662 $ 144,509 $ 27,738 $ 77,282 $ 0.67 Percentage of net sales 53.7% 23.0% 35.9% Fiscal year ended July 31, 2022 Net sales Gross profit SG&A Adjusted EBITDA Income tax Net income Diluted EPS GAAP results $ 372,510 $ 185,180 $ 97,743 $ 60,190 $ 22,524 $ 60,190 $ 0.52 Percentage of net sales 49.7% 26.2% 16.2% Interest expense 6,777 Income tax expense 22,524 Depreciation and amortization expense 559 (7,611) 23,427 EBITDA $ 112,918 Purchase accounting adjustments 467 467 127 340 — Transaction expenses (5,694) 5,694 1,384 4,310 0.04 Inventory write-down 4,715 4,715 1,282 3,433 0.03 Change in fair value of derivatives (1,695) (461) (1,234) (0.01) Equity-based compensation (4,675) 5,334 1,298 4,036 0.03 Wildfire costs 123 33 90 — Non-GAAP results $ 372,510 $ 190,921 $ 79,763 $ 127,556 $ 26,187 $ 71,165 $ 0.62 Percentage of net sales 51.3% 21.4% 34.2% 25

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |