0000880406

false

N-2

N-CSR

0000880406

2022-07-01

2023-06-30

0000880406

herzfeld:DiscountFromNetAssetValueMember

2022-07-01

2023-06-30

0000880406

herzfeld:RisksOfInvestingInCaribbeanBasinCountriesMember

2022-07-01

2023-06-30

0000880406

herzfeld:GeographicConcentrationsRiskMember

2022-07-01

2023-06-30

0000880406

herzfeld:ForeignSecuritiesRiskMember

2022-07-01

2023-06-30

0000880406

herzfeld:ForeignEconomyRiskMember

2022-07-01

2023-06-30

0000880406

herzfeld:CurrencyRiskMember

2022-07-01

2023-06-30

0000880406

herzfeld:GovernmentalSupervisionAndRegulationAccountingStandardsMember

2022-07-01

2023-06-30

0000880406

herzfeld:CertainRisksOfHoldingFundAssetsOutsideTheUnitedStatesMember

2022-07-01

2023-06-30

0000880406

herzfeld:SettlementRiskMember

2022-07-01

2023-06-30

0000880406

herzfeld:StockDividendRiskMember

2022-07-01

2023-06-30

0000880406

herzfeld:EmergingMarketsRiskMember

2022-07-01

2023-06-30

0000880406

herzfeld:CommonStockRiskMember

2022-07-01

2023-06-30

0000880406

herzfeld:PreferredStockRisksMember

2022-07-01

2023-06-30

0000880406

herzfeld:ConvertibleSecuritiesRiskMember

2022-07-01

2023-06-30

0000880406

herzfeld:RisksOfOtherEquityLinkedSecuritiesMember

2022-07-01

2023-06-30

0000880406

herzfeld:CommonStocksMember

2023-04-01

2023-06-30

0000880406

herzfeld:CommonStocksMember

2023-01-01

2023-03-31

0000880406

herzfeld:CommonStocksMember

2022-10-01

2022-12-31

0000880406

herzfeld:CommonStocksMember

2022-07-01

2022-09-30

0000880406

herzfeld:CommonStocksMember

2022-04-01

2022-06-30

0000880406

herzfeld:CommonStocksMember

2022-01-01

2022-03-31

0000880406

herzfeld:CommonStocksMember

2021-10-01

2021-12-31

0000880406

herzfeld:CommonStocksMember

2021-07-01

2021-09-30

0000880406

herzfeld:CommonStocksMember

2023-06-30

0000880406

herzfeld:CommonStocksMember

2022-07-01

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment

Company Act file number 811-06445

The

Herzfeld Caribbean Basin Fund, Inc.

(Exact

name of registrant as specified in charter)

119

Washington Ave. Suite 504, Miami Beach, FL 33139

(Address

of principal executive offices) (Zip code)

Erik

M. Herzfeld

119

Washington Ave. Suite 504, Miami Beach, FL 33139

(Name

and address of agent for service)

Registrant’s

telephone number, including area code: 305-777-1660

Date

of fiscal year end: 6/30/2023

Date

of reporting period: 7/1/2022 – 6/30/2023

Form

N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission

to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of

1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection,

and policymaking roles.

A

registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant

is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office

of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection

burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington,

DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM

1. SHAREHOLDER REPORT

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in the Registration Statement

on Form N-2 (No. 333-255265) of The Herzfeld Caribbean Basin Fund, Inc. of our report dated August 25, 2023 relating to the financial

statements and financial highlights for the fiscal year ended June 30, 2023, which appear in this Form N-CSR.

/s/ TAIT, WELLER & BAKER

LLP

Philadelphia, Pennsylvania

September 6, 2023

(a)

The Herzfeld Caribbean

Basin Fund, Inc.

119 Washington Avenue, Suite 504

Miami Beach, FL 33139

(305) 777-1660

Investment Advisor

HERZFELD/CUBA

a division of Thomas J. Herzfeld Advisors, Inc.

119 Washington Avenue, Suite 504

Miami Beach, FL 33139

(305) 777-1660

Administrator, Transfer Agent

and Fund Accountant

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

Sub-Transfer Agent

Equiniti & Trust Company, LLC

6201 15th Avenue Brooklyn

New York, NY 11219

Custodian

Fifth Third Bank N.A.

Fifth Third Center

38 Fountain Square Plaza

Cincinnati, OH 45263

Counsel

Troutman Pepper Hamilton Sanders LLP

3000 Two Logan Square

18th and Arch Streets

Philadelphia, PA 19103

Independent Registered Public Accounting Firm

Tait, Weller & Baker LLP

50 South 16th Street, Suite 2900

Philadelphia, PA 19102

The Herzfeld Caribbean Basin Fund, Inc.’s investment objective is long-term capital appreciation. To achieve its objective, the Fund invests in issuers that are likely, in the Advisor’s view, to benefit from economic, political, structural and technological developments in the countries in the Caribbean Basin, which include, among others, Cuba, Jamaica, Trinidad and Tobago, the Bahamas, the Dominican Republic, Barbados, Aruba, Haiti, the Netherlands Antilles, the Commonwealth of Puerto Rico, Mexico, Honduras, Guatemala, Belize, Costa Rica, Panama, Colombia, the United States, Guyana and Venezuela (“Caribbean Basin Countries”). The Fund invests at least 80% of its total assets in equity and equity-linked securities of issuers, including U.S.-based companies which engage in substantial trade with, and derive substantial revenue from, operations in Caribbean Basin Countries.

Listed NASDAQ Capital Market

Symbol: CUBA

- 2 -

Letter to Stockholders (unaudited)

|

Dear Fellow Stockholders,

We are pleased to present our Annual Report for the period ended June 30, 2023. On that date, the net asset value (“NAV”) of The Herzfeld Caribbean Basin Fund, Inc. (CUBA) was $4.98 per share. For the fiscal year ended June 30, 2023, the total investment return, adjusted for dividends, was 23.37% based on NAV per share and 16.24% based on market value per share. Over the period, the discount to NAV widened from -13.39% to -20.68%.

The Fund seeks long-term capital appreciation through investment in companies that we believe are poised to benefit from economic, political, structural, and technological developments in the Caribbean Basin. Part of the investment strategy focuses on companies in the region that we believe would benefit from the resumption of U.S. trade with Cuba. Since it is impossible to predict when the U.S. embargo will be lifted, we have concentrated on investments that we believe can do well even if there is no political or economic change with respect to Cuba.

Caribbean Basin Update

As reported in our December 2022 letter to shareholders, during the 2022 calendar year the Caribbean Basin economies continued their recovery that started in 2021. The global pandemic caused significant economic pain to the tourist-centric Caribbean as Gross Domestic Product (GDP) dropped more than 10% in 2020 for almost all Caribbean countries. After starting their recovery later than most Group of Twenty (G20) nations, the countries of the Caribbean saw some of the quickest recoveries as tourism returned and commodity exports increased. Real GDP growth for the region was 5.1% in 2021 and accelerated to 12.4% for 2022. The International Monetary Fund (IMF) continues to project real GDP growth for the region in 2023, with the Caribbean estimated to come in at 9.9% for 20231.

Tourist arrivals to the region continued to trend in the right direction for the first three to five months of calendar year 2023 (depending upon country data available). When compared to the same period in 2022, “stop-over visits” increased in 2023 in every country for which data is available except for the U.S. Virgin Islands (-3.3%). Percentage increases year-over-year range from 16.4% (Dominican Republic; January through May) to 197.2% (Cayman Islands; January through March). Notable also are visits to Cuba which were up 119.7% for the January through April period2.

Thomas J. Herzfeld

Chairman and

Portfolio Manager

|

1

|

See https://www.imf.org/external/datamapper/profile/CBQ.

|

|

2

|

See https://tourismanalytics.com/caribbean.html

|

- 3 -

Letter to Stockholders (unaudited) (continued)

|

Erik M. Herzfeld

President and

Portfolio Manager

While we believe there are generally positive indicators in the region, global monetary tightening by the world’s central banks could yet constrict economic performance in the Caribbean region by negatively affecting demand for commodity exports and reducing discretionary spending available for use in the Caribbean. While higher interest rates have not significantly slowed the recovery in the region to date, we are cognizant of the experience of Caribbean economies during the last two recessions (the Great Recession of 2008 and the COVID-19 recession), which saw significant pullbacks. Despite global central banks tightening monetary policy and general caution regarding the impacts of ongoing inflation and uncertainty over the war in Ukraine, we do not project an immediate meaningful economic downturn and anticipate an above trend growth period for the Caribbean region.

In addition to our generally positive views towards macro-economic conditions in the Caribbean Basin, we have identified potential investment opportunities in two specific countries in the region: Guyana and Cuba.

Guyana is a country of just 791,000 people but is projected to become the world’s fourth largest offshore oil producer, placing it ahead of Qatar, the U.S., Mexico and Norway3. The IMF projects 37.2% local economic growth for 2023, with the potential for 45.3% GDP growth in 2024.4 Guyana is reported to have launched a number of infrastructure projects in anticipation of that growth, including construction of 12 hospitals, seven hotels, scores of schools, two main highways and its first deep-water port. A $1.9 billion gas-to-energy project is also reportedly underway. In our view, the projected economic growth in Guyana is likely to create investment opportunities in the Caribbean region generally and with companies doing business in Guyana specifically.

Although currently subject to the U.S. trade embargo, Cuba is the second country in which we believe there may be attractive investment opportunities. Throughout the Fund’s history, the Fund’s portfolio has been positioned to take advantage of opportunities in Cuba in the event of a thawing of U.S.-Cuba relations and the opening of investment opportunities in that country. While over that history the expectations for an opening of business opportunities with Cuba have ebbed and flowed, we believe the conditions are becoming ripe for the Biden Administration to make an announcement regarding the opening of relations with Cuba for a number of reasons:

| |

●

|

We point to a series of events over the past year where Cuba first opened up its doors to foreign investment in 2022, and the Biden administration subsequently loosened restrictions on travel to and from Cuba.

|

| |

●

|

We take note particularly of President Biden’s aside to Senator Bob Menendez, caught on video after the President’s State of the Union Address in February, 2023, in which he was heard saying that he wanted to discuss Cuba with the

|

|

3

|

See https://apnews.com/article/guyana-oil-discovery-money-14c23a72c6d7c13675493ede42ed1000

|

|

4

|

See https://guyanachronicle.com/2023/04/12/imf-projects-37-2-local-economic-growth-for-this-year/

|

- 4 -

Letter to Stockholders (unaudited) (continued)

|

| |

|

Senator, who has been a long-time advocate for Cuban expatriates here in the United States. |

| |

|

|

| |

●

|

We also note a May 16, 2023 social media post by Ambassador Brian A. Nichols, Assistant Secretary for Western Hemisphere Affairs, U.S. Department of State, who commented: “One year ago, the U.S. announced several policy measures to empower the Cuban people. We delivered on our commitment to reunify Cuban-American families, expand travel, & restart remittances. We’ve also increased support to independent Cuban businesses, with more to announce soon.”

|

| |

●

|

We have had discussions with private citizens doing business with Cuba who have indicated that they have been informed by certain U.S. government contacts with whom they regularly engage that a shift in U.S. policy is coming soon.

|

| |

●

|

With recent announcements that China and Russia continue to make inroads in Cuba, our view is that it would make political and economic sense for the U.S. to reengage with the island nation both politically and economically instead of surrendering influence to China and Russia.

|

We cannot predict with certainty when the opening of investment opportunities in Cuba will happen, or if such opening will occur. However, the potential for the opening of investment in Cuba and the opportunities to be created by projected GDP growth in Guyana are certainly factors that we are watching closely.

Portfolio

Our overweight positioning in travel related stocks was the major driver of the 23.37% gain in NAV in the portfolio over the fiscal year. Travel companies are continuing to see revenue growth in the Caribbean region and recent economic data showing declining inflation while maintaining solid economic growth in the U.S. could be a continuing tailwind for the sector. On the opposite end of the spectrum, energy stocks went from leaders to laggards and the banking crisis that enveloped small and regional U.S. banks in March caused our holdings in Puerto Rican banks to see sizable drops between -19% and -21% in that month. Banks have regained their footing after the unprecedented support from the Federal Reserve (Fed), Federal Deposit Insurance Corporation, other government agencies and investments by larger banks. We added to our bank holdings during the swoon as Puerto Rican banks did not have the same crypto, technology, and commercial real estate exposures that we believe were leading to bank runs and deposit flights.

Royal Caribbean Cruises Ltd. (RCL) was the best performer in the portfolio over the fiscal year gaining 197.16% as the cruise industry continues to rebound after near collapse during the pre-vaccine stage of the pandemic. Norwegian Cruise Line Holdings (NCLH) was the second best performer in the portfolio, gaining 95.77% in the period. Despite the

Ryan M. Paylor

Portfolio Manager

- 5 -

Letter to Stockholders (unaudited) (continued)

|

massive rallies in our cruise line holdings, we still believe there is more upside as ongoing strong consumer sentiment continues to provide cruise operators with necessary booking revenues to restructure or retire their expensive debt incurred during the pandemic. On a forward-looking basis, we would argue cruise lines remain cheap and that their strong gains achieved over the past fiscal year can continue.

The worst performer over the fiscal year was New Fortress Energy (NFE) which declined 25.91%. Despite the weak performance over the period, we remain bullish on NFE’s future growth prospects. The company has received export authorization for their Altamira Fast LNG project in Mexico, won an energy contract to supply 150 megawatts of power to Puerto Rico, and is nearing completion of their terminals in Brazil. Additionally, they have estimated demand from their existing terminals to increase more than four-fold over the next two years from 40 trillion British thermal units (BTUs) to 175 trillion BTUs. Future contracted demand also provides capital to grow the company as opposed to debt sales and equity issuance. NFE also is focused on returning cash to shareholders as it has returned $3.40 to shareholders along with buying back shares over the last year.

Lennar Corp. (LEN) was another strong performer over the fiscal year gaining 80.59%. The homebuilder dipped at the start of 2022 as investors surmised rising rates would affect homebuilders negatively. This makes sense in theory as the purchasing power of new homeowners would be expected to decline in a rising mortgage rate environment. What many investors failed to foresee is many homeowners purchased a home in the last few years when rates were low or refinanced their mortgages while the Fed was at the emergency rate. The rapid rise in mortgage rates resulted in current homeowners becoming reticent to sell their homes and trade in their low-rate mortgages for new homes at higher rates. As a consequence, the supply of existing homes for sale is at a low level last seen during the Great Financial Crisis even though the consumer is in a much better place. This means less demand for existing homes sales and increasing demand for new construction for homebuilders like LEN which are still operating in an environment where demand for homes continues to outstrip supply. With mortgage rates around 7% for a 30-year fixed mortgage, we do not foresee a rebound in existing homes sales for years which should provide a tailwind for LEN until mortgage rates decline and the supply of existing homes for sale increases.

Popular, Inc. (BPOP) was our weakest performer in the banking sector declining 18.45%. Since bottoming in March 2023 during the banking crisis that saw three U.S. banks collapse, BPOP has rallied 20.16%. BPOP does not have the same concentration of industry, sector, or client type that was the downfall of Signature Bank, Silvergate Bank, and Silicon Valley Bank nor the same losses on its fixed income investments classified as held-to-maturity. BPOP is also benefitting from robust growth in Puerto Rico as the territory’s GDP grew 6.9% in 2022 versus 1.9% for the mainland U.S. We believe the same growth tailwinds the Caribbean Basin region is experiencing will continue into 2023 which should benefit banks like BPOP. BPOP closed the quarter at a price-to-earnings ratio (P/E) of 4.23 while the KBW Regional Banking Index was at a P/E of 8.08. The banks in the regional banking index are operating in areas that do not have the same economic growth back drop as the Caribbean which we believe will support the cheaper valuation of BPOP and cause it to eventually trade more in line with its more expensive peers.

- 6 -

Letter to Stockholders (unaudited) (continued)

|

Copa Holdings (CPA) was a major beneficiary from the resumption of travel in Latin America but also saw demand increase due to the bankruptcies of regional carriers over the last few years that once competed for business. CPA gained 77.48% over the last year. The airline posted record revenues of $2.97 billion in 2022, a significant milestone after revenues declined 70% in 2020. CPA is on track for revenues of $3.42 billion in 2023 while earnings per share (EPS) is projected to ramp up to $14.80 per share. Jet fuel costs have declined significantly since peaking in 2022 which also directly benefits the bottom line of CPA. We believe travel demand will remain elevated over the next year as consumers continue to spend on travel and related experiences over goods.

Margo Caribe (MRGO) struggled over the last year declining 13.47%. The lawn and garden product purveyor saw its business spike during the early stages of the pandemic as demand for landscaping upgrades was driven by homeowners working from home. The company is not listed on a major stock exchange and stopped filing quarterly reports in 2006. MRGO restarted filing quarterly reports in 2021 as the increased revenues during the pandemic and return to profitability brought new life to the company. The company has used its revenues to diversify its product offerings by expanding into the pottery segment by leveraging newly secured production commitments from South American and European suppliers. The company has recently pivoted from growing and distributing tropical foliage and flowering plants to landscaping rocks and mulch while also adding new product lines like fire glass. It remains to be seen whether the new product offerings will be profitable. We do not expect the same spike in sales experienced during the pandemic but MRGO earned $1.10 per share in 2022 and earned $0.50 per share in the first quarter of 2023. At the end of June, the closing price equates to a relatively cheap trailing 12-month P/E of 3.77. If the company continues to deliver profitable quarters, it may register on a major exchange or there is the potential for it to be taken private at a premium to the current market price.

Outlook

With global central banks near the end of their rate hiking cycles and positive economic data coming out of the U.S. that was unexpected by many economists and investors, we believe the Caribbean Basin is poised to benefit from this dynamic and continue its above-trend growth. Our positions in travel and leisure stocks remain attractive in our view even after the strong performance over the fiscal year. The banking crisis that caused significant turmoil in the banking markets appears to be contained and less of a risk for our bank holdings in the Caribbean going forward. It is possible there could be a catch-up trade for our bank holdings as their valuations are as discounted as they were during the Great Financial Crisis.

The Caribbean Basin is experiencing the highest GDP growth of any region in the world at the moment and we feel the Fund is well positioned to capitalize on the growth tailwinds. The one year forward P/E for the Fund’s portfolio companies on average is 11.85 versus 20.63 for the S&P 500 Index®. Typically, we would expect higher growth to coincide with a higher multiple but the Fund is currently at an almost 50% discount to the lower growth S&P 500®. We are also seeing new opportunities for direct investment in the region that could provide diversification and opportunity for higher rates of return.

- 7 -

Letter to Stockholders (unaudited) (continued)

|

Finally, the potential for the opening of investment in Cuba, the opportunities to be created by projected GDP growth in Guyana, and the overall economic conditions observed in the Caribbean Basin, lead to a generally positive view of the future.

Largest Allocations

The following tables present our largest investment and geographic allocations5 as of June 30, 2023.

Geographic Allocation |

% of Net Assets |

| |

|

USA |

41.10% |

Mexico |

18.57% |

Puerto Rico |

13.92% |

Liberia |

7.25% |

Bermuda |

7.13% |

Panama |

6.73% |

Netherlands |

2.26% |

Cayman Islands |

1.21% |

Cuba |

0.00% |

Money Market |

1.76% |

Other assets in excess of liabilities |

0.07% |

| |

100.00% |

Largest Portfolio Positions |

% of Net Assets |

| |

|

MasTec, Inc. |

7.82% |

Royal Caribbean Cruises Ltd. |

7.25% |

Norwegian Cruise Line Holdings Ltd. |

7.13% |

New Fortress Energy, Inc. |

5.54% |

First BanCorp. |

5.52% |

Martin Marietta Materials, Inc. |

5.19% |

Popular, Inc. |

5.05% |

NextEra Energy, Inc. |

4.14% |

Copa Holdings, S.A. |

4.12% |

Fomento Económico Mexicano, S.A.B. de C.V. ADR |

4.08%

|

Rights Offering

On August 4, 2023, the Board of Directors (the “Board”) authorized the Fund to conduct a non-transferable rights offering to permit existing Fund stockholders to subscribe for additional shares of the Fund’s common stock (the “Rights Offer”). Commencement of the Rights Offer will be announced via press release and the definitive terms of the Rights Offer, including important dates and the subscription price, will be included in the Fund’s Rights Offer prospectus upon being declared effective by the U.S. Securities and Exchange Commission (“SEC”). Discussion regarding the Rights Offer herein is not an offer to sell these securities and the Fund is not soliciting an offer to buy these securities in any state where the offer or sale is permitted. The Rights Offer will be made only be means of a prospectus and only after the registration statement has been declared effective by the SEC.

Quarterly Distribution in Stock and Cash

As part of the Fund’s Managed Distribution Plan, the Fund has been making quarterly distributions to stockholders paid in cash or shares of our common stock at the election of

|

5

|

Geographic allocation is determined by the isser’s legal domicile.

|

- 8 -

Letter to Stockholders (unaudited) (continued)

|

stockholders. The last distribution was made on June 30, 2023. On August 10, 2023, the Board indefinitely suspended the Managed Distribution Plan until further notice.

Tender Offer

On August 10, 2023, the Board also modified the Fund’s Self-Tender Policy. Under the terms of the Self-Tender Policy, the Fund has undertaken to commence a tender offer for its shares of common stock by October 31, 2023. Because of the uncertainty regarding the timing of the Rights Offer, the Board modified the Self-Tender Policy to allow for the Fund to commence the tender offer within a reasonable amount of time following the conclusion of the Rights Offering, which is estimated to conclude in November 2023.

Daily net asset values and press releases by the Fund are available on our website at www.herzfeld.com/cuba.

Sincerely,

|

|

|

Thomas J. Herzfeld

Chairman of the Board

and Portfolio Manager |

Erik M. Herzfeld

President and

Portfolio Manager |

Ryan M. Paylor

Portfolio Manager |

The above commentary is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The commentary is intended to assist stockholders in understanding our performance during the fiscal year ended June 30, 2023. The views and opinions in this letter were current as of August 16, 2023. Statements other than those of historical facts included herein may constitute forward-looking statements regarding management’s future expectations, beliefs, intentions, goals, strategies, plans or prospects, including statements relating to management’s beliefs that the cash and stock distribution will allow the Fund to strengthen its balance sheet and to be in a position to capitalize on potential future investment opportunities, when there can be no assurance either will occur, and other factors may contain forward looking statements within the meaning of the Private Securities Litigation Reform Act, with respect to the Fund’s future financial or business performance, strategies or expectations. Nothing herein should be relied upon as a representation as to the future performance or portfolio holdings of the Fund. We undertake no duty to update any forward-looking statement made herein. The specific securities identified and described do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable. Portfolio composition is subject to change.

- 9 -

Investment Results (unaudited)

|

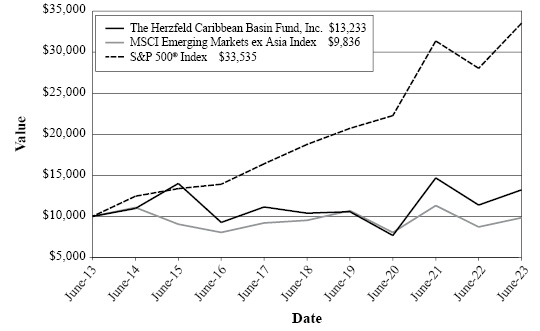

Average Annual Total Returns*

(For the periods ended June 30, 2023)

| |

One Year |

Five Year |

Ten Year |

The Herzfeld Caribbean Basin Fund |

|

|

|

Net asset value per share |

23.37% |

3.14% |

2.67% |

Market value per share |

16.24% |

4.95% |

2.84% |

| |

|

|

|

S&P 500® Index** |

19.59% |

12.31% |

12.86% |

MSCI Emerging Markets ex Asia Index *** |

12.83% |

0.65% |

-0.16% |

Total annual operating expenses, as disclosed in the Herzfeld Caribbean Basin Fund (the “Fund”) N-2 dated April 15, 2021, and amended June 29, 2021, were 3.20% of average daily net assets. During the fiscal year ended June 30, 2023, the Advisor voluntarily waived its management fee by 10 basis points (from 1.45% to 1.35%) in support of the Fund’s initiative to attempt to reduce the stock price discount to net asset value. Additional information pertaining to the Fund’s expense ratios as of June 30, 2023 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (305) 777-1660.

|

*

|

Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower.

|

|

**

|

The S&P 500® Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

|

|

***

|

The MSCI Emerging Markets ex Asia Index (the “Index”) captures large and mid cap representation across 15 Emerging Markets countries (Brazil, Chile, Colombia, Czech Republic, Egypt, Greece, Hungary, Mexico, Peru, Poland, Qatar, Saudi Arabia, South Africa, Turkey and United Arab Emirates). With 248 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country excluding Asia. The index is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

|

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

- 10 -

Investment Results (unaudited) (continued)

|

Comparison of the Growth of a $10,000 Investment in the

Herzfeld Caribbean Basin Fund (at Market Value), the S&P 500® Index

and the MSCI Emerging Markets ex Asia Index

The chart above assumes an initial investment of $10,000 made on June 30, 2013 and held through June 30, 2023. The S&P 500® Index and the MSCI Emerging Markets ex Asia Index are widely recognized unmanaged indexes of equity securities and each is representative of a broader equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 800-TJH-FUND (800-854-3863). You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

- 11 -

Schedule of Investments as of June 30, 2023

|

| |

Shares or

Principal

Amount |

|

Description |

|

Fair Value |

|

Common Stocks — 98.17% of net assets |

|

|

|

|

| |

|

|

|

|

|

|

|

|

Aerospace and Defense — 3.69% |

|

|

|

|

| |

|

89,206 |

|

Aersale Corp.* |

|

$ |

1,311,328 |

|

| |

|

|

|

|

|

|

|

|

Airlines — 4.12% |

|

|

|

|

| |

|

13,250 |

|

Copa Holdings, S.A. |

|

|

1,465,185 |

|

| |

|

|

|

|

|

|

|

|

Banking and finance — 15.78% |

|

|

|

|

| |

|

42,089 |

|

Banco Latinoamericano de Comercio Exterior, S.A. |

|

|

928,483 |

|

| |

|

16,956 |

|

Evertec, Inc. |

|

|

624,489 |

|

| |

|

160,604 |

|

First BanCorp. (Puerto Rico) |

|

|

1,962,581 |

|

| |

|

11,541 |

|

OFG Bancorp |

|

|

300,989 |

|

| |

|

29,702 |

|

Popular, Inc. |

|

|

1,797,565 |

|

| |

|

|

|

|

|

|

|

|

Communications — 1.63% |

|

|

|

|

| |

|

10,698 |

|

América Móvil, S.A.B. de C.V. Class B ADR |

|

|

231,505 |

|

| |

|

209,144 |

|

América Móvil, S.A.B. de C.V. |

|

|

226,987 |

|

| |

|

479,175 |

|

Fuego Enterprises, Inc.*1 |

|

|

20,652 |

|

| |

|

207,034 |

|

Grupo Radio Centro S.A.B. de C.V.* |

|

|

39,666 |

|

| |

|

2 |

|

Sitios LatinoAmerica S.A.B. de C.V. |

|

|

1 |

|

| |

|

31,172 |

|

Spanish Broadcasting System, Inc.* |

|

|

31,172 |

|

| |

|

33,226 |

|

Operadora de Sites Mexicanos, S.A. de C.V. |

|

|

31,480 |

|

| |

|

|

|

|

|

|

|

Construction and related — 23.21% |

|

|

|

|

| |

|

155,645 |

|

Cemex, S.A.B. de C.V. ADR* |

|

|

1,101,967 |

|

| |

|

20 |

|

Ceramica Carabobo Class A ADR*1 |

|

|

— |

|

| |

|

4,000 |

|

Martin Marietta Materials, Inc. |

|

|

1,846,760 |

|

| |

|

23,568 |

|

MasTec, Inc.* |

|

|

2,780,317 |

|

| |

|

48,117 |

|

PGT Innovations, Inc.* |

|

|

1,402,610 |

|

| |

|

5,000 |

|

Vulcan Materials Company |

|

|

1,127,200 |

|

| |

|

|

|

|

|

|

|

|

Food, beverages and tobacco — 7.38% |

|

|

|

|

| |

|

393,164 |

|

Becle, S.A.B. de C.V. |

|

|

963,188 |

|

| |

|

18,900 |

|

Fomento Económico Mexicano, S.A.B. de C.V. Series UBD |

|

|

209,109 |

|

| |

|

13,110 |

|

Fomento Económico Mexicano, S.A.B. de C.V. ADR |

|

|

1,453,112 |

|

See accompanying notes to the financial statements.

- 12 -

Schedule of Investments as of June 30, 2023

|

| |

Shares or

Principal

Amount |

|

Description |

|

Fair Value |

|

Housing — 3.70% |

|

|

|

|

| |

|

10,500 |

|

Lennar Corporation |

|

$ |

1,315,755 |

|

| |

|

|

|

|

|

|

|

|

Investment companies — 0.07% |

|

|

|

|

| |

|

70,000 |

|

Waterloo Investment Holdings Ltd.*1 |

|

|

24,500 |

|

| |

|

|

|

|

|

|

|

|

Leisure — 18.97% |

|

|

|

|

| |

|

6,745 |

|

Marriott Vacations Worldwide Corporation |

|

|

827,746 |

|

| |

|

116,578 |

|

Norwegian Cruse Line Holdings Ltd.* |

|

|

2,537,903 |

|

| |

|

98,605 |

|

Playa Hotels and Resorts N.V.* |

|

|

802,645 |

|

| |

|

24,863 |

|

Royal Caribbean Cruises Ltd.* |

|

|

2,579,288 |

|

| |

|

|

|

|

|

|

|

|

Machinery — 0.71% |

|

|

|

|

| |

|

170,625 |

|

Grupo Rotoplas S.A.B. de C.V. |

|

|

252,756 |

|

| |

|

|

|

|

|

|

|

|

Mining — 0.05% |

|

|

|

|

| |

|

3,872 |

|

Grupo México, S.A.B. de C.V. Series B |

|

|

18,614 |

|

| |

|

|

|

|

|

|

|

|

Retail — 2.58% |

|

|

|

|

| |

|

1,270 |

|

Grupo Elektra, S.A.B. de C.V. Series CPO |

|

|

85,119 |

|

| |

|

210,222 |

|

Wal-Mart de México, S.A.B. de C.V. Series V |

|

|

833,668 |

|

| |

|

|

|

|

|

|

|

|

Transportation infrastructure — 3.26% |

|

|

|

|

| |

|

4,175 |

|

Grupo Aeroportuario ADR |

|

|

1,159,356 |

|

| |

|

|

|

|

|

|

|

|

Trucking and marine freight — 1.37% |

|

|

|

|

| |

|

137 |

|

Seaboard Corporation |

|

|

487,819 |

|

| |

|

|

|

|

|

|

|

|

Utilities — 10.90% |

|

|

|

|

| |

|

23,200 |

|

Caribbean Utilies Ltd. Class A |

|

|

284,200 |

|

| |

|

6,092 |

|

Consolidated Water Company Ltd. |

|

|

147,609 |

|

| |

|

700 |

|

Cuban Electric Company*1 |

|

|

— |

|

| |

|

19,854 |

|

NextEra Energy, Inc. |

|

|

1,473,167 |

|

| |

|

73,602 |

|

New Fortress Energy, Inc., Class A |

|

|

1,971,062 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

See accompanying notes to the financial statements.

- 13 -

Schedule of Investments as of June 30, 2023

|

| |

Shares or

Principal

Amount |

|

Description |

|

Fair Value |

|

Other — 0.75% |

|

|

|

|

| |

|

55,921 |

|

Margo Caribe, Inc.* |

|

$ |

268,421 |

|

| |

|

79 |

|

Siderurgica Venezolana Sivensa, S.A. Series B*1 |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

Total common stocks (cost $21,091,483) |

|

|

34,925,974 |

|

| |

|

|

|

|

|

|

|

Bonds — 0.00% of net assets |

|

|

|

|

| |

$ |

165,000 |

|

Republic of Cuba — 4.5%, 1977 - in default*1 |

|

|

— |

|

| |

|

|

|

|

|

|

|

Total bonds (cost $63,038) |

|

|

— |

|

| |

|

|

|

|

|

|

|

Money Market Funds — 1.76% |

|

|

|

|

| |

|

624,397 |

|

Federated Hermes Government Obligations Fund, Institutional Class, 4.92%2 |

|

|

624,397 |

|

| |

|

|

|

|

|

|

|

|

Total money market funds (cost $624,397) |

|

|

624,397 |

|

| |

|

|

|

|

|

|

|

|

Total investments (cost $21,778,918) — 99.93% of net assets |

|

|

35,550,371 |

|

| |

|

|

|

|

|

|

|

|

Assets in excess of other liabilities — 0.07% of net assets |

|

|

25,221 |

|

| |

|

|

|

|

|

|

|

|

Net assets — 100% |

|

$ |

35,575,592 |

|

The investments are concentrated in the following geographic regions3 (as percentages of net assets)(unaudited):

United States of America |

41.10% |

Mexico |

18.57% |

Puerto Rico |

13.92% |

Liberia |

7.25% |

Bermuda |

7.13% |

Panama |

6.73% |

Other, individually under 5%** |

5.30% |

| |

100.00% |

|

1

|

Securities have been fair valued in good faith, by the Advisor, as “valuation designee”, using fair value methodology approved by the Board of Directors. Fair valued securities comprised 0.13% of net assets.

|

|

2

|

Rate disclosed is the seven day effective yield as of June 30, 2023.

|

|

3

|

Geographic allocation is determined by the isser’s legal domicile.

|

|

**

|

Amount includes other assets in excess of liabilities of 0.07%.

|

See accompanying notes to the financial statements.

- 14 -

Statement of Assets and Liabilities as of

June 30, 2023 |

ASSETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Investments in securities, at fair value (cost $21,778,918) (Notes 2 and 3) |

|

|

|

|

|

$ |

35,550,371 |

|

Dividends receivable |

|

|

|

|

|

|

21,263 |

|

Deferred offering costs (shelf) (Note 7) |

|

|

|

|

|

|

67,342 |

|

Other assets |

|

|

|

|

|

|

44,311 |

|

| |

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

|

|

|

|

|

35,683,287 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Accrued investment advisor fee (Note 4) |

|

$ |

37,293 |

|

|

|

|

|

Accrued Administrator fees |

|

|

5,417 |

|

|

|

|

|

Accrued professional fees |

|

|

49,244 |

|

|

|

|

|

Accrued other expenses |

|

|

15,741 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

|

|

|

|

|

107,695 |

|

| |

|

|

|

|

|

|

|

|

NET ASSETS (Equivalent to $4.98 per share based on 7,150,673 shares outstanding) |

|

|

|

|

|

$ |

35,575,592 |

|

| |

|

|

|

|

|

|

|

|

Net assets consist of the following: |

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 100,000,000 shares authorized; 7,150,673 shares issued and outstanding |

|

|

|

|

|

|

|

|

Paid-in capital |

|

|

|

|

|

|

22,056,685 |

|

Accumulated earnings |

|

|

|

|

|

|

13,518,907 |

|

| |

|

|

|

|

|

|

|

|

NET ASSETS |

|

|

|

|

|

$ |

35,575,592 |

|

See accompanying notes to the financial statements.

- 15 -

Statement of Operations

For the Year Ended June 30, 2023 |

INVESTMENT INCOME |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Dividends (net of foreign withholding tax of $25,855) |

|

|

|

|

|

$ |

661,751 |

|

Total investment income |

|

|

|

|

|

|

661,751 |

|

| |

|

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Investment advisor fees (Note 4) |

|

$ |

468,025 |

|

|

|

|

|

Director fees |

|

|

127,535 |

|

|

|

|

|

Legal fees |

|

|

108,155 |

|

|

|

|

|

Administration fees (Note 4) |

|

|

65,000 |

|

|

|

|

|

Compliance and operational support services fees (Note 4) |

|

|

60,000 |

|

|

|

|

|

Tender offer fees |

|

|

58,717 |

|

|

|

|

|

Audit fees |

|

|

41,321 |

|

|

|

|

|

Listing fees |

|

|

33,663 |

|

|

|

|

|

Printing and postage fees |

|

|

30,644 |

|

|

|

|

|

Transfer agent fees |

|

|

28,800 |

|

|

|

|

|

Insurance fees |

|

|

25,616 |

|

|

|

|

|

Quarterly distribution fees |

|

|

12,730 |

|

|

|

|

|

Proxy mailing and filing fees |

|

|

12,305 |

|

|

|

|

|

Custodian fees |

|

|

5,746 |

|

|

|

|

|

Other fees |

|

|

35,037 |

|

|

|

|

|

Total expenses |

|

|

|

|

|

|

1,113,294 |

|

Fees voluntarily waived by investment advisor |

|

|

|

|

|

|

(32,277 |

) |

Net operating expenses |

|

|

|

|

|

|

1,081,017 |

|

| |

|

|

|

|

|

|

|

|

NET INVESTMENT LOSS |

|

|

|

|

|

|

(419,266 |

) |

| |

|

|

|

|

|

|

|

|

NET REALIZED AND CHANGE IN UNREALIZED GAIN/LOSS ON INVESTMENTS |

|

|

|

|

|

|

|

|

Net realized gain on investments and foreign currency |

|

|

725,551 |

|

|

|

|

|

Change in unrealized appreciation/depreciation on investments and foreign currency |

|

|

7,533,181 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY |

|

|

|

|

|

|

8,258,732 |

|

| |

|

|

|

|

|

|

|

|

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

|

|

|

|

|

$ |

7,839,466 |

|

See accompanying notes to the financial statements.

- 16 -

Statements of Changes in Net Assets

|

| |

|

For the

Year Ended

June 30,

2023 |

|

|

For the

Year Ended

June 30,

2022 |

|

INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS |

|

|

|

|

|

|

|

|

Net investment loss |

|

$ |

(419,266 |

) |

|

$ |

(808,643 |

) |

Net realized gain on investments and foreign currency |

|

|

725,551 |

|

|

|

2,250,124 |

|

Change in unrealized appreciation/depreciation on investments and foreign currency |

|

|

7,533,181 |

|

|

|

(8,891,696 |

) |

| |

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS |

|

|

7,839,466 |

|

|

|

(7,450,215 |

) |

| |

|

|

|

|

|

|

|

|

DISTRIBUTIONS TO STOCKHOLDERS |

|

|

|

|

|

|

|

|

From earnings |

|

|

(714,706 |

) |

|

|

(1,343,479 |

) |

Return of capital |

|

|

(3,893,734 |

) |

|

|

(4,951,954 |

) |

| |

|

|

|

|

|

|

|

|

TOTAL DISTRIBUTIONS |

|

|

(4,608,440 |

) |

|

|

(6,295,433 |

) |

| |

|

|

|

|

|

|

|

|

CAPITAL TRANSACTIONS |

|

|

|

|

|

|

|

|

Reinvestment of distributions, 935,753 and 1,028,536 shares issued, respectively |

|

|

3,686,258 |

|

|

|

5,052,306 |

|

Payments for 338,382 and 302,216 shares repurchased, respectively |

|

|

(1,685,921 |

) |

|

|

(2,109,770 |

) |

NET INCREASE IN NET ASSETS FROM COMMON STOCK TRANSACTIONS |

|

|

2,000,337 |

|

|

|

2,942,536 |

|

| |

|

|

|

|

|

|

|

|

TOTAL INCREASE (DECREASE) IN NET ASSETS |

|

|

5,231,363 |

|

|

|

(10,803,112 |

) |

| |

|

|

|

|

|

|

|

|

NET ASSETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Beginning of year |

|

|

30,344,229 |

|

|

|

41,147,341 |

|

| |

|

|

|

|

|

|

|

|

End of year |

|

$ |

35,575,592 |

|

|

$ |

30,344,229 |

|

See accompanying notes to the financial statements.

- 17 -

| |

|

Year Ended June 30 |

|

| |

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

2019 |

|

Selected Per Share Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, beginning of year |

|

$ |

4.63 |

|

|

$ |

7.06 |

|

|

$ |

4.76 |

|

|

$ |

7.59 |

|

|

$ |

8.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment loss1 |

|

|

(0.06 |

) |

|

|

(0.14 |

) |

|

|

(0.13 |

) |

|

|

(0.10 |

) |

|

|

(0.08 |

) |

Net realized and unrealized gain (loss) on investment |

|

|

1.19 |

|

|

|

(1.07 |

) |

|

|

3.04 |

|

|

|

(1.72 |

) |

|

|

(0.02 |

) |

Total from investment operations |

|

|

1.13 |

|

|

|

(1.21 |

) |

|

|

2.91 |

|

|

|

(1.82 |

) |

|

|

(0.10 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less distributions to shareholders from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net realized gains |

|

|

(0.10 |

) |

|

|

(0.23 |

) |

|

|

— |

|

|

|

(0.11 |

) |

|

|

(0.31 |

) |

Return of capital |

|

|

(0.59 |

) |

|

|

(0.83 |

) |

|

|

(0.62 |

) |

|

|

(0.90 |

) |

|

|

— |

|

Total distributions |

|

|

(0.69 |

) |

|

|

(1.06 |

) |

|

|

(0.62 |

) |

|

|

(1.01 |

) |

|

|

(0.31 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anti-dilutive effect due to common stock repurchases |

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

Dilutive effect due to dividend reinvestment |

|

|

(0.10 |

) |

|

|

(0.17 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end of year |

|

$ |

4.98 |

|

|

$ |

4.63 |

|

|

$ |

7.06 |

|

|

$ |

4.76 |

|

|

$ |

7.59 |

|

Per share market value, end of year |

|

$ |

3.95 |

|

|

$ |

4.01 |

|

|

$ |

6.27 |

|

|

$ |

3.70 |

|

|

$ |

6.36 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investment return based on market value per share2 |

|

|

16.24 |

% |

|

|

(22.50 |

)% |

|

|

91.31 |

% |

|

|

(27.37 |

)% |

|

|

2.16 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios and Supplemental Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of year (000 omitted) |

|

$ |

35,576 |

|

|

$ |

30,344 |

|

|

$ |

41,147 |

|

|

$ |

29,196 |

|

|

$ |

46,542 |

|

Ratio of expenses to average net assets after waiver |

|

|

3.35 |

% |

|

|

3.47 |

% |

|

|

3.15 |

%3 |

|

|

3.10 |

% |

|

|

2.79 |

% |

Ratio of expenses to average net assets before waiver |

|

|

3.45 |

% |

|

|

3.57 |

% |

|

|

3.25 |

%3 |

|

|

3.20 |

% |

|

|

2.79 |

% |

Ratio of net investment loss to average net assets after waiver |

|

|

(1.30 |

)% |

|

|

(2.17 |

)% |

|

|

(2.14 |

)%3 |

|

|

(1.51 |

)% |

|

|

(1.06 |

)% |

Portfolio turnover rate |

|

|

7 |

% |

|

|

9 |

% |

|

|

12 |

% |

|

|

8 |

% |

|

|

6 |

% |

|

1

|

Computed by dividing the respective period’s amounts from the Statement of Operations by the average outstanding shares for each period presented.

|

|

2

|

Total investment return is calculated assuming a purchase of common stock at the current market price on the first day and a sale at the current market price on the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at actual prices pursuant to the Fund’s Dividend Reinvestment Plan.

|

|

3

|

This figure includes expenses incurred as a result of the expiration of the Fund’s shelf registration. The overall impact on the Fund’s ratios is an increase of 0.06% (Note 7).

|

See accompanying notes to the financial statements.

- 18 -

Notes to Financial Statements

|

NOTE 1. ORGANIZATION AND RELATED MATTERS

The Herzfeld Caribbean Basin Fund, Inc. (the “Fund”) is a non-diversified, closed-end management investment company incorporated under the laws of the State of Maryland on March 10, 1992, and registered under the Investment Company Act of 1940, as amended, and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services - Investment Companies”. The Fund commenced investing activities in January 1994. The Fund is listed on the NASDAQ Capital Market and trades under the symbol “CUBA.”

The Fund’s investment objective is to obtain long-term capital appreciation. The Fund pursues its objective by investing primarily in equity and equity-linked securities of public and private companies, including U.S.-based companies, (i) whose securities are traded principally on a stock exchange in a Caribbean Basin Country or (ii) that have at least 50% of the value of their assets in a Caribbean Basin Country or (iii) that derive at least 50% of their total revenue from operations in a Caribbean Basin Country (collectively, “Caribbean Basin Companies”). Under normal conditions, the Fund invests at least 80% of its total assets in equity and equity-linked securities of Caribbean Basin Countries. This 80% policy may be changed without stockholder approval upon sixty days written notice to stockholders. The Fund’s investment objective is fundamental and may not be changed without the approval of a majority of the Fund’s outstanding voting securities.

Under the Fund’s organizational documents, its Officers and Directors and certain key management persons are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve any future potential claims that may be made against the Fund. However, based on experience, management expects the risk of loss to be remote.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Security Valuation

In accordance with accounting principles generally accepted in the United States of America (“GAAP”), fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants at the measurement date.

In determining fair value, the Fund uses various valuation approaches. In accordance with GAAP, a fair value hierarchy for inputs is used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that observable inputs be used when available.

Observable inputs are those that market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s assumptions about the inputs market participants would use in pricing the asset or liability developed based on the best information

- 19 -

Notes to Financial Statements (continued)

|

available in the circumstances. The fair value hierarchy is categorized into three levels based on the inputs as follows:

|

Level 1:

|

Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

|

|

Level 2:

|

Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an active market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

|

|

Level 3:

|

Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available.

|

The availability of valuation techniques and observable inputs can vary from security to security and is affected by a wide variety of factors including, the type of security, whether the security is new and not yet established in the marketplace, and other characteristics particular to the transaction. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Those estimated values do not necessarily represent the amounts that may be ultimately realized due to the occurrence of future circumstances that cannot be reasonably determined. Because of the inherent uncertainty of valuation, those estimated values may be materially higher or lower than the values that would have been used had a ready market for the securities existed. Accordingly, the degree of judgment exercised by the Fund in determining fair value is greatest for securities categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement in its entirety falls, is determined based on the lowest level input that is significant to the fair value measurement.

Fair value is a market-based measure considered from the perspective of a market participant rather than an entity-specific measure. Therefore, even when market assumptions are not readily available, the Fund’s own assumptions are set to reflect those that market participants would use in pricing the asset or liability at the measurement date. The Fund uses prices and inputs that are current as of the measurement date, including periods of market dislocation. In periods of market dislocation, the observability of prices and inputs may be reduced for many securities. This condition could cause a security to be reclassified to a lower level within the fair value hierarchy.

Investments in securities traded on a national securities exchange (or reported on the NASDAQ National Market or Capital Market) are stated at the last reported sales price on the day of valuation (or at the NASDAQ official closing price); other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are stated at the last quoted bid price. Restricted securities and other securities for which quotations are not readily available are valued at fair value as determined, in

- 20 -

Notes to Financial Statements (continued)

|

good faith by the Advisor, as “valuation designee”, under the oversight of the Board of Directors.

The following table summarizes the classification of the Fund’s investments by the above fair value hierarchy levels as of June 30, 2023:

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Assets (at fair value) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USA |

|

$ |

14,574,936 |

|

|

$ |

— |

|

|

$ |

45,152 |

|

|

$ |

14,620,088 |

|

Mexico |

|

|

6,606,528 |

|

|

|

— |

|

|

|

— |

|

|

|

6,606,528 |

|

Puerto Rico |

|

|

4,685,624 |

|

|

|

268,421 |

|

|

|

— |

|

|

|

4,954,045 |

|

Panama |

|

|

2,393,668 |

|

|

|

— |

|

|

|

— |

|

|

|

2,393,668 |

|

Liberia |

|

|

2,579,288 |

|

|

|

— |

|

|

|

— |

|

|

|

2,579,288 |

|

Bermuda |

|

|

2,537,903 |

|

|

|

— |

|

|

|

— |

|

|

|

2,537,903 |

|

Netherlands |

|

|

802,645 |

|

|

|

— |

|

|

|

— |

|

|

|

802,645 |

|

Cayman |

|

|

431,809 |

|

|

|

— |

|

|

|

— |

|

|

|

431,809 |

|

Bonds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cuba |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Money Market Funds |

|

|

624,397 |

|

|

|

— |

|

|

|

— |

|

|

|

624,397 |

|

Total Investments in securities |

|

$ |

35,236,798 |

|

|

$ |

268,421 |

|

|

$ |

45,152 |

|

|

$ |

35,550,371 |

|

The fair valued securities (Level 3) held in the Fund consisted of Cuban Electric Company, Ceramica Carabobo, Fuego Enterprises, Inc., Siderurgica Venezolana Sivensa S.A., Waterloo Investment Holdings Ltd. and Republic of Cuba 4.5% bond.

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used to determine fair value as of June 30, 2023:

|

|

Level 3 |

|

Balance as of 6/30/22 |

|

$ |

— |

|

Sales |

|

|

— |

|

Realized gain/(loss) |

|

|

— |

|

Change in unrealized gain/(loss) |

|

|

24,500 |

|

Transfer into Level 3 |

|

|

20,652 |

|

Transfer out of Level 3 |

|

|

— |

|

Balance as of 6/30/23 |

|

$ |

45,152 |

|

Under procedures approved by the Board of Directors, the Advisor provides administration and oversight of the Fund’s valuation policies and procedures, which are reviewed at least annually by the Directors. Among other things, these procedures allow the Fund to utilize

- 21 -

Notes to Financial Statements (continued)

|

independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

The Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not readily available. Under these procedures, the Advisor convenes on a regular and ad hoc basis to review such securities and considers a number of factors, including valuation methodologies and significant unobservable valuation inputs, when determining a fair value. The Advisor may employ a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discount may be applied due to the nature or duration of any restrictions on the disposition of investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The Advisor employs various methods for calibrating these valuation approaches including a regular view of valuation methodologies, key inputs and assumptions, transactional back-testing or disposition analysis and reviews of any related market activity.

The Fund adopted policies to comply with the SEC’s Rule 2a-5 under the 1940 Act, which establishes a regulatory framework for registered investment company fair valuation practices. The Fund’s fair value policies and procedures and valuation practices were updated prior to the rule’s required compliance date of September 8, 2022. Under Rule 2a-5, the Fund’s Board of Directors designated the Advisor as the Fund’s “Valuation Designee” to make fair value determinations.

Income Recognition

Security transactions are recorded on the trade date. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recognized on the ex- dividend date or in the case of certain foreign securities, as soon as the Fund is notified, and interest income is recognized on an accrual basis. Discounts and premiums on debt securities purchased are amortized over the life of the respective securities. It is the Fund’s practice to include the portion of realized and unrealized gains and losses on investments denominated in foreign currencies as components of realized and unrealized gains and losses on investments and foreign currency. Withholding on foreign taxes have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Foreign Currency

The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts and investments denominated in a foreign currency, if any, are translated into U.S. dollar amounts at current exchange rates on the valuation date. Purchases and sales of investments denominated in foreign currencies are translated into U.S. dollar amounts at the exchange rate on the respective dates of such transactions.

- 22 -

Notes to Financial Statements (continued)

|

Deposits with Financial Institutions

The Fund may, during the course of its operations, maintain account balances with financial institutions in excess of federally insured limits.

Counterparty Brokers

In the normal course of business, substantially all of the Fund’s money balances and security positions are custodied with the Fund’s custodian, Fifth Third Bank N.A. The Fund also transacts with other brokers. The Fund is subject to credit risk to the extent any broker with which it conducts business is unable to fulfill contractual obligations on its behalf. The Fund’s management monitors the financial condition of such brokers and does not anticipate any losses from these counterparties.

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Income Taxes

The Fund’s policy is to continue to comply with the provisions of the Internal Revenue Code of 1986, as amended, that are applicable to regulated investment companies and to distribute substantially all of its taxable income to its stockholders. Under these provisions, the Fund is not subject to federal income tax on its taxable income and no federal income or excise tax provision is required.

The Fund has adopted a June 30 year-end for federal income tax purposes.

Distributions to Stockholders