false

0001506928

0001506928

2024-12-11

2024-12-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 11, 2024

Avinger, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-36817

|

20-8873453

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

400 Chesapeake Drive

Redwood City, California 94063

(Address of principal executive offices, including zip code)

(650) 241-7900

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

AVGR

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.04. Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

On December 11, 2024, Avinger, Inc. (the “Company”) filed with the Securities Exchange Commission (“SEC”) a preliminary proxy statement in connection with its special meeting of stockholders scheduled for January 17, 2025 (the “Special Meeting”). The preliminary proxy statement contains a proposal to approve an assignment for the benefit of creditors followed by a voluntary dissolution and liquidation if the Company’s board of directors deems such actions to be in the best interests of the Company and its stockholders. Such proposal may be deemed to be an event of default under Section 11.01(i) of that certain term loan agreement dated September 22, 2015 (as amended, modified or supplemented from time to time) by and between the Company and CRG Partners III L.P. and certain of its affiliated funds (collectively “CRG”) (the “CRG Agreement”).

Additionally, on December 11, 2024, the Company notified CRG, pursuant to Section 8.02 of the CRG Agreement, that it was not in compliance with the $3,500,000 minimum liquidity covenant required by Section 10.01 of the CRG Agreement. Failure to remain in compliance with such liquidity covenant is an immediate event of default under Section 11.01(d) of the CRG Agreement.

Under the terms of the CRG Agreement, upon the occurrence of an event of default under Section 11.01(i), the principal, accrued interest, fees and other obligations become immediately due and payable without further action or notice from CRG.

Under the terms of the CRG Agreement, upon the occurrence of an event of default under Section 11.01(d), the Majority Lenders (as defined in the CRG Agreement) may, at their discretion and upon notice to the Company, accelerate the outstanding balance under the CRG Agreement, making the principal, accrued interest, fees and other obligations, immediately due and payable.

As of December 11, 2024, a total of approximately $2.8 million in principal and interest was outstanding under the CRG Agreement.

Item 8.01. Other Matters.

On December 11, 2024, the Company filed with the SEC a preliminary proxy statement in connection with the Special Meeting. The preliminary proxy statement contains a proposal (the “Assignment and Dissolution Proposal”) to approve an assignment for the benefit of creditors (the “Assignment”) followed by a voluntary dissolution and liquidation (the “Dissolution”) pursuant to a plan of dissolution.

The Assignment is a state-governed insolvency procedure in which the Company would transfer all of its right, title, interest in, and custody and control of, its property to an assignee (the “Assignee”). The Assignee will then liquidate the property and distribute the proceeds to the Company’s creditors to satisfy its obligations. From the effective date of the Assignment, the Assignee, as a fiduciary, will have sole control over the Company’s assets and the Company will no longer control its operations, the liquidation or distribution of assets or the resolution of claims. Because the Company does not know the final amount which the Assignee will recover from a liquidation of the Company’s assets or how the Assignee will resolve the Company’s outstanding obligations, the Company does not know whether any amounts will be available for distribution to holders of its common stock; however, based upon the Company’s current outstanding liabilities it is unlikely that holders of its common stock will receive any distribution.

The Company expects that, in connection with the proposed Assignment and Dissolution, if effected, the Company’s common stock would be delisted from Nasdaq.

Additional Information

The Company intends to file a definitive proxy statement on Schedule 14A, an accompanying proxy card and other relevant documents with the SEC in connection with the solicitation of proxies from the Company’s stockholders for the Special Meeting. STOCKHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ THE COMPANY’S DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain a copy of the definitive proxy statement, an accompanying proxy card, any amendments or supplements to the definitive proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge in the “SEC Filings” section of the Company’s website at https://investors.avinger.com/financials, as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

Participants in the Solicitation

The Company, its directors, and certain of its executive officers are participants in the solicitation of proxies from the Company’s stockholders in connection with matters to be considered at the Special Meeting. Information regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers is included in the Company’s Proxy Statement on Schedule 14A for its 2024 annual meeting of stockholders, filed with the SEC on November 5. 2024, the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 20, 2024, and in the Company’s Current Reports on Form 8-K filed with the SEC from time to time. Changes to the direct or indirect interests of the Company’s directors and executive officers are set forth in SEC filings on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4. These documents are available free of charge as described above.

Forward-Looking Statements

This Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve substantial risks and uncertainties and are based on the Company’s current expectations, estimates, and projections about its business, financial condition, and other future events. Forward-looking statements include, but are not limited to, statements regarding: the company’s plans and intentions to pursue an assignment for the benefit of creditors and dissolution, including the anticipated timing, process, and outcome of such assignment and dissolution; the anticipated timing, process, and outcome of the process to obtain stockholder approval of the assignment and dissolution at the Special Meeting; the company’s discussions with its creditors and other stakeholders in connection with its financial condition and potential breach of its loan agreement; and any other statements regarding the company's future financial condition, operations, or prospects.

These forward-looking statements are subject to numerous risks, uncertainties, and assumptions that could cause actual results to differ materially from those expressed or implied in these statements. Important factors that could cause actual results to differ materially include, but are not limited to: risks associated with the assignment for the benefit of creditors, including the risk that the process may not achieve the intended results or may result in lower-than-expected recoveries for creditors or stakeholders; the impact of the potential breach of the Company’s loan agreement on its financial position, including potential enforcement actions by lenders; the Company’s ability to obtain stockholder approval of the assignment and dissolution; and other risks detailed in the Company’s filings with the SEC including its most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

The Company cautions investors not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update or revise any forward-looking statements to reflect events or circumstances after the date of this Form 8-K, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

AVINGER, INC.

|

| |

|

|

|

|

| |

|

|

|

|

| |

Date: December 11, 2024

|

By:

|

/s/ Jeffrey M. Soinski

|

|

| |

|

|

Jeffrey M. Soinski

Chief Executive Officer

|

v3.24.3

Document And Entity Information

|

Dec. 11, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Avinger, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 11, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36817

|

| Entity, Tax Identification Number |

20-8873453

|

| Entity, Address, Address Line One |

400 Chesapeake Drive

|

| Entity, Address, City or Town |

Redwood City

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94063

|

| City Area Code |

650

|

| Local Phone Number |

241-7900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AVGR

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001506928

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Avinger (NASDAQ:AVGR)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

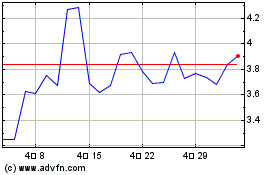

Avinger (NASDAQ:AVGR)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025