0001973239ARM HOLDINGS PLC /UK03-312024FY5/8/2024false00019732392024-05-082024-05-0800019732392023-04-012024-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

| | |

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934 |

For the month of May, 2024

Commission file number 001-41800

Arm Holdings plc

| | |

|

110 Fulbourn Road Cambridge CB1 9NJ United Kingdom |

(Address of principal executive office) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

| | | | | |

| Exhibit Number | Description |

| 99.1 | |

| 99.2 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| ARM HOLDINGS PLC |

| | |

Date: May 8, 2024 | By: | /s/ Laura Bartels |

| Name: | Laura Bartels |

| Title: | Chief Accounting Officer (Principal Accounting Officer) |

Arm Holdings plc Reports Results for the Fourth Quarter of the Financial Year Ended 2024

Cambridge, England, May 8, 2024: Arm Holdings plc (NASDAQ: ARM), the company that is building the future of computing, has today published a letter to its shareholders containing the company’s results for its fiscal fourth quarter and three months ended March 31, 2024. The letter is available on its investor relations website (https://investors.arm.com/financials/quarterly-annual-results).

Arm will host an audio webcast to discuss its results with analysts at 14:00 PT / 17:00 ET / 22:00 BST today, May 8. The live webcast will be available at https://edge.media-server.com/mmc/p/gkayf4zp/ and a replay will be available for four weeks at https://investors.arm.com.

About Arm:

Arm technology is building the future of computing. Our energy-efficient processor designs and software platforms have enabled advanced computing in more than 280 billion chips and our technologies securely power products from the sensor to the smartphone and the supercomputer. Together with 1,000+ technology partners, we are enabling artificial intelligence to work everywhere, and in cybersecurity, we are delivering the foundation for trust in the digital world – from chip to cloud. The future is being built on Arm.

All information is provided “as is” and without warranty or representation. This document may be shared freely, attributed and unmodified. Arm is a registered trademark of Arm Limited (or its subsidiaries or affiliates). All brands or product names are the property of their respective holders. © 1995-2024 Arm Limited.

Contacts:

Media

Arm External Communications

Global-PRteam@arm.com

Investors

Arm Investor Relations

Investor.Relations@arm.com

Exhibit 99.2

| | |

Arm will be hosting a conference call via an audio webcast to discuss earnings at 14:00 Pacific Time (17:00 Eastern Time, 22:00 BST) on Wednesday, May 8, 2024. A replay of and a transcript of the call will be available the following day. |

| The webcast and replay can be accessed at: https://edge.media-server.com/mmc/p/gkayf4zp/ |

Dear Shareholder,

Arm’s third quarter as a public company has produced our third set of record results as we continue to build upon the world's most popular compute platform. In Q4, we delivered record revenues and exceeded the high-end of our guidance ranges for both revenue and non-GAAP EPS. This growth was driven by record royalty revenue as Armv9 adoption continues, especially in smartphones, server, and automotive markets. Revenue from licensing was also very strong, driven by multiple high-value agreements and the increased demand for Arm’s power-efficient technology for AI from data centers to edge computing.

We believe these fundamental trends will continue and we expect next quarter to also deliver strong year-over-year growth in revenue and profits.

Arm’s long-term strategy promotes multiple growth drivers.

Growth will be driven by royalty revenue. We expect the demand for Arm-based compute to continue across all market segments, especially as AI is deployed in virtually all applications, from the most advanced data centers to the smallest edge devices. All this extra compute requires increased performance with less power consumption, which is driving the need for Arm’s most advanced technology, such as Armv9, into smartphones, servers, smart IoT, and networking devices. Chips based on Armv9 technology now contribute around 20% of royalty revenue, up from around 15% last quarter1.

Growth will be driven by the need for more energy-efficient compute and AI capability from the data center to edge computers. As the amount of compute to run these complex AI workloads is increasing exponentially, the amount of energy required will increase too. According to a 2023 report from Boston Consulting Group, US data centers already consume around 126TWh per year, and this is expected to rise three-fold by 2030. Arm’s data center customers are reporting substantial performance-per-watt savings compared with legacy architectures and this contributes to why Arm’s energy-efficient technology is being chosen to help run these workloads. Google recently announced its first custom Arm-based Axion product, which provides 50% better performance and up to 60% better energy-efficiency compared to legacy architectures, and will be used to run AI training and inference. Ten of the world’s largest hyperscalers are deploying Arm-based chips for their data centers, including Amazon Web Services, Microsoft, and Oracle Cloud. NVIDIA also recently announced their Grace Blackwell Superchip that combines NVIDIA’s Blackwell GPU architecture with an Arm-based Grace CPU. This provides significant power savings compared to running a GPU alongside a legacy server chip. Arm technology provides similar power-efficiency for chips in PCs, smartphones, automotive applications, and networking equipment, and as AI goes everywhere, we believe it will be enabled by our technology.

During the quarter, Arm also announced its next generation family of processors for automotive, including the world’s most power efficient and high performance server-class CPU with safety-critical automotive enhanced (AE) features, Arm Neoverse V3AE. This new family of automotive processors is already being adopted by leading players, including Marvell, MediaTek, NVIDIA, NXP, Renesas, Telechips, Texas Instruments, and others.

In addition, during the quarter Arm announced Ethos-U85 which adds transformer network support to Arm Ethos products, bringing Generative AI to deeply embedded devices, such as factory automation and smart cameras. Importantly, it provides support for some of the most commonly used AI frameworks such as TensorFlow Lite and PyTorch.

Growth will be driven by Compute Subsystems. Complex chips and chiplets are more difficult to develop and take longer to design, increasing the cost of the chip and increasing the risk the chip will miss the product launch window. Our solution to this is Arm Compute Subsystems ("CSS"), which are integrated and verified configurations of Arm technology platforms targeting specific end markets and use cases. By providing more of the solution, Arm is accelerating customers’ time-to-market and reducing development cost and can therefore command a higher royalty fee per chip. Arm is continuing to increase investment in CSS platforms. During the quarter, Arm announced two new infrastructure platforms, the Neoverse CSS V3 and Neoverse CSS N3 and the development of our first CSS platform for the automotive market. In addition, we continue to add key partners to the Arm Total Design ecosystem to accelerate the development of custom chips, most recently Nokia, who is defining next generation system-on-chips ("SoCs") based on Neoverse CSS for the wireless market.

1 For the quarter, we estimate that Armv9 provided around 20% of royalty revenues, Armv8 around 50%, and older architectures around 30%.

Growth will be driven by Arm’s unique ecosystem of software and design partners.

Arm has the world’s largest compute ecosystem with more than 18 million software developers and we continue to increase investment across all market segments to accelerate software development on Arm.

With our software optimizations, we are expanding support of generative AI to make models, such as Llama, now accessible to all devices using Arm’s platform. We recently announced a partnership with Meta to incorporate one of the most widely used AI frameworks, PyTorch/ExecuTorch, with Arm’s software, enabling on-device inference capabilities to run efficiently on mobile and edge devices.

As cloud service providers continue to shift to Arm-based chips, many of the largest enterprise computing applications are following with Oracle databases, SAP Hana, Microsoft Teams, Google’s YouTube Ad platform, among others now running on Arm with better price-performance and power efficiency than legacy architectures.

During the quarter, we also announced an automotive partner program to deliver virtual prototyping platforms which will enable software to be developed in parallel with the physical silicon, accelerating the total development cycle of an automotive solution by up to two years – providing significant savings. Siemens is among the first providers delivering a pre-silicon Arm-based environment for their partners, including Tata Technologies for software-defined vehicle application testing.

In addition, Arm and Intel Foundry Services announced a multigenerational collaboration to enable chip designers to develop advanced Arm-based SoCs to be manufactured at Intel Foundry, initially for mobile and data centers and potentially for IoT and automotive applications. This builds on the announcement last quarter relating to Intel Foundry, TSMC and Samsung participating in the Arm Total Design ecosystem.

All combined, we expect Arm’s long-term strategy to provide sustainable growth for years to come.

| | |

"We finished our financial year achieving over $3 billion in revenue for the first time, and with strong tailwinds heading into FYE25 as AI is driving increased demand for Arm-based technology across all end markets," said Rene Haas, CEO. "From cloud to edge, all AI software models, from GPT to Llama, rely and run on the Arm compute platform. As these models become larger and smarter, their requirements for more compute with greater power efficiency can only be realized through Arm."

|

Sincerely,

| | | | | |

Rene Haas, Chief Executive Officer | Jason Child, Chief Financial Officer |

| |

Investor Contact Ian Thornton Investor.Relations@arm.com | Media Contact Phil Hughes Global-PRteam@arm.com |

Fourth Quarter Highlights

•Revenues of $928 million, up 47% year-over-year, with record royalty revenue and strong growth in license revenue.

•Royalty revenue of $514 million, up 37% year-over-year was driven by the rapidly increasing penetration of Armv9-based chips which typically command a higher royalty rate, and the recovery in the semiconductor industry.

•License revenue of $414 million, up 60% year-over-year, was due to multiple high-value license agreements being signed as companies increase investment in Arm-based technology for AI across all end markets.

•Strong non-GAAP operating profit growth to $391 million resulting in a 42.1% non-GAAP operating margin.

Full Year Highlights

•Revenues of $3,233 million, up 21% year-over-year, with record royalty and license revenue.

•Royalty revenue of $1,802 million, up 8% year-over-year, was driven by the semiconductor industry recovery in the second half of the fiscal year, especially related to smartphones, increasing penetration of Armv9-based chips, and on-going share gains in automotive and at cloud hyperscalers.

•Strong license revenue of $1,431 million, up 43% year-over-year, was due to leading technology companies aligning their future roadmaps with Arm's product portfolio, many signing long-term, high-value Arm Total Access agreements. This demand has been accelerated by the need for energy-efficient AI capability across a wide range of end-markets, from servers to smartphones to sensors, which only Arm's technology can provide.

•Full year non-GAAP operating profit of $1,408 million, up 80% year-over-year, delivered a 43.6% non-GAAP operating margin.

Guidance and Results

| | | | | | | | | | | |

| Quarterly Guidance & Results | Q4 FYE24 Guidance(2) | Q4 FYE24 Results(2) | Q1 FYE25 Guidance |

| Revenue | $850m - $900m | $928m | $875m - $925m |

Non-GAAP operating expense (1)(2) | ~$490m | $511m | ~$475m |

Non-GAAP fully diluted earnings per share (1)(2) | $0.28 - $0.32 | $0.36 | $0.32 - $0.36 |

| Annual Guidance | FYE24 Guidance(2) | FYE24 Results(2) | FYE25 Guidance |

| Revenue | $3,155m - $3,205m | $3,233m | $3,800m - $4,100m |

Non-GAAP operating expense (1)(2) | ~$1,700m | $1,723m | ~$2,050m |

Non-GAAP fully diluted earnings per share (1)(2) | $1.20 - $1.24 | $1.27 | $1.45 - $1.65 |

(1) For more information and definitions of the non-GAAP measures see the “Key Financial and Operating Metrics” section below. A reconciliation of each of the projected non-GAAP operating expense and non-GAAP fully diluted earnings per share, which are forward-looking non-GAAP financial measures, to the most directly comparable GAAP financial measure, is not provided because Arm is unable to provide such reconciliation without unreasonable effort. The inability to provide each reconciliation is due to the unpredictability of the amounts and timing of events affecting the items we exclude from the non-GAAP measure.

(2) Q4 FYE24 and FYE24 results, unaudited, are presented consistent with how guidance was set on February 7, 2024. FYE24 non-GAAP operating expense results of $1,723 million are net of non-GAAP adjustment of $181 million for employer taxes related to share-based compensation ("SBC") equity-classified awards, net of the research and development ("R&D") tax incentive associated with these taxes. These amounts are dependent on our stock price at the time of vesting and as a result, these taxes may vary in any particular period independent of the financial and operating performance of our business. To improve comparability of our results, this net expense has been recast across historical periods for trend purposes.

Results for Q4 fiscal year ending 2024

Financial Metrics (1) (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| $ million, unless stated | GAAP | Non-GAAP (1) |

Q4 FYE24 | Q4 FYE23 | Y/Y % | Q4 FYE24 | Q4 FYE23 | Y/Y % |

| Total revenue | 928 | 633 | 47% | 928 | 633 | 47% |

| License and other revenue | 414 | 259 | 60% | 414 | 259 | 60% |

| Royalty revenue | 514 | 374 | 37% | 514 | 374 | 37% |

| Cost of sales | (41) | (27) | 52% | (26) | (25) | 4% |

| Gross profit | 887 | 606 | 46% | 902 | 608 | 48% |

| Gross margin (%) | 95.6% | 95.7% | | 97.2% | 96.1% | |

| Operating expenses | (865) | (656) | 32% | (511) | (609) | (16)% |

| Operating profit | 22 | (50) | nm | 391 | (1) | nm |

| Operating margin (%) | 2.4% | (7.9)% | | 42.1% | (0.2)% | |

| Net income | 224 | 3 | nm | 376 | 18 | nm |

| Diluted earnings per share ($) | 0.21 | 0.00 | nm | 0.36 | 0.02 | nm |

| Free cash flow | | | | 637 | 454 | 40% |

| Free cash flow trailing twelve months ("TTM") | | | | 907 | 606 | 50% |

| Remaining performance obligations ("RPO") | 2,484 | 1,712 | 45% | | | |

(1) For more information, definitions, and reconciliations of Non-GAAP measures see the “Key Financial and Operating Metrics” section below. Percentage changes that are considered not meaningful are presented as "nm."

Non-Financial Metrics (1) (Unaudited)

| | | | | | | | | | | |

| Q4 FYE24 | Q4 FYE23 | Y/Y % |

| Annualized contract value ("ACV") | $1,182 million | $1,030 million | 15% |

| Arm Total Access licenses | 31 | 18 | |

| Arm Flexible Access licenses | 222 | 203 | |

Chips reported as shipped (2) | 7.0 billion | 7.8 billion | (10)% |

| Total number of employees | 7,096 | 5,963 | 19% |

Engineers as a percentage of total employees (3) | 83% | 80% | |

(1) For more information and definitions of Non-Financial Metrics see the “Key Financial and Operating Metrics” section below.

(2) Chips reported as shipped reflect actual chip shipments from the prior quarter and are based off customers' reports received in the quarter presented.

(3) In Q4 FYE24, 180 application engineers were reclassified from Non-Engineering to Engineering.

Financial Overview

(US GAAP unless otherwise stated)

Total revenue

Total revenue in Q4 FYE24 was a record $928 million, an increase of 47% year-over-year. This was driven by record royalty revenue and better than expected license and other revenue.

Royalty revenue

Royalty revenue was $514 million, up 37% year-over-year, reflecting increasing penetration of Armv9 in multiple markets, recovery in semiconductor industry growth, and strong year-over-year growth in smartphones, custom Arm-based chips by cloud hyperscalers, and advanced chips for automotive.

In cloud servers we continue to see the early benefits from the adoption of Armv9-based chips and market share gains as more cloud companies start to deploy Arm-based server chips. Royalty revenue from smartphones grew strongly year-over-year as AI-enabled Armv9 based handsets, which have a higher royalty rate, continued to gain share. In the automotive market, more cars are deploying ADAS and digital cockpits creating more opportunity for Arm-based chips, leading to strong year-over-year royalty revenue growth. Royalty revenue from the IoT/embedded market was down slightly due to semiconductor industry weakness, with industrial and general purpose microcontrollers being more impacted than consumer electronics.

Chips reported as shipped

We record and report actual chip shipments in the subsequent quarter. During the current quarter, Arm’s customers reported that they had shipped 7.0 billion Arm-based chips for the December quarter shipping period. This takes the cumulative number of Arm-based chips reported as shipped since inception to 287.4 billion.

License and other revenue

License and other revenue for Q4 FYE24 was $414 million, up 60% year-over-year. This better-than-expected result was driven by multiple high-value, long-term license agreements signed in the quarter with leading technology companies, the delivery of Arm's latest technologies generating revenue under agreements signed in prior quarters, and by more companies choosing Arm's latest and most advanced CPUs to run AI, which typically command a higher license fee.

Annualized contract value

ACV at the end of Q4 FYE24 was $1,182 million, up 15% year-over-year and up 2% compared with Q3 FYE24. Sequential growth was primarily driven by the high-value Arm Total Access license agreements signed during the quarter.

Remaining performance obligations

As of the end of Q4 FYE24, RPO was $2,484 million, up 45% year-on-year and up slightly compared with Q3 FYE24, driven by multiple high-value license agreements. We expect to recognize approximately 28% of RPO as revenue over the next 12 months, 14% over the subsequent 13-to-24-month period, and the remainder thereafter.

Licenses signed

During the quarter, Arm signed four additional Arm Total Access agreements, taking the total number of extant licenses to 31, which now includes more than half of our top 30 customers. The new Arm Total Access agreements were signed with semiconductor companies developing chips for a wide range of end markets, including AI-enabled smartphones, servers and embedded computing.

The Arm Flexible Access program enables early-stage companies to take advantage of the benefits of the broad Arm ecosystem. The program now has 222 customers developing products for a wide range of applications including multiple AI accelerators, automotive applications, consumer electronics, robotics and smart sensors.

Gross profit and margin

Cost of sales in Q4 FYE24 was $41 million, including $6 million of share-based compensation (SBC) cost (equity-settled) and $7 million of employer taxes related to SBC net of R&D tax incentives, resulting in a Gross Profit of $887 million and a 95.6% Gross Margin. Non-GAAP cost of sales was $26 million, resulting in a non-GAAP Gross Profit of $902 million and a 97.2% non-GAAP Gross Margin.

Operating expense and margin

Total operating expense in Q4 FYE24 was $865 million, including $180 million of SBC cost (equity-settled), $156 million of employer taxes related to SBC net of R&D tax incentives, and a one-time employee benefit related to the settlement of the Arm Limited All Employee Plan 2019 (“2019 AEP”) of $18 million. Total non-GAAP operating expense of $511 million was down 16% year-over-year. Headcount increased 19% year-over-year, but this was more than offset by the change in mix of SBC cost from liability-settled to equity-settled and a favorable year-over-year comparison in legal and bonus costs. For more detail on SBC cost see table in "GAAP to Non-GAAP Reconciliation" below.

Research and development ("R&D") expense in Q4 FYE24 was $584 million, representing 62.9% of revenue. Non-GAAP R&D expense was $326 million, representing 35.1% of revenue, and down 9% year-over-year. Engineering headcount increased 24% year-over-year, but this was more than offset by the shift in SBC costs from liability-settled to equity-settled.

Selling, general and administrative ("SG&A") expense in Q4 FYE24 was $281 million, representing 30.3% of revenue. Non-GAAP SG&A expense was $185 million, representing 19.9% of revenue, down 26% year-over-year. The decline was due to the shift from liability-settled to equity-settled SBC costs and the favorable year-over-year comparison in legal costs previously mentioned.

In Q4 FYE24, GAAP operating profit of $22 million was an improvement from the $50 million loss from same period a year ago. The increase was driven by higher revenue, partially offset by higher SBC cost and employer taxes related to SBC net of R&D tax incentives. Non-GAAP operating profit was $391 million, much improved from the $1 million loss a year ago, and represents a 42.1% non-GAAP operating margin, compared with (0.2)% for the same period last year. The primary difference between GAAP and non-GAAP operating profit was SBC cost (equity-settled) and employer taxes related to SBC net of R&D tax incentives.

In Q4 FYE24, total SBC cost (equity-settled) was $186 million with $6 million included in cost of sales, $127 million included in R&D and $53 million included in SG&A. Total employer taxes related to SBC net of R&D tax incentives were $163 million with $7 million included in cost of sales, $118 million included in R&D and $38 million included in SG&A.

Income before income taxes, effective tax rate, net income, earnings per share, and share count

Income before income taxes in Q4 FYE24 was $58 million, up more than 10-fold when compared with the same period one year ago. We recorded a tax benefit of $166 million for the quarter due to a windfall tax benefit associated with SBC cost. As a result, net income was $224 million, much improved from the $3 million from a year ago.

Non-GAAP Income before income taxes was $434 million, much improved from $15 million a year ago. The non-GAAP effective tax rate was 13.4%, and we expect it to remain in the mid-teens on a go-forward basis. Non-GAAP net income was $376 million, much improved from the $18 million from a year ago.

Q4 FYE24 fully diluted earnings per share were $0.21 (non-GAAP: $0.36 per share) compared with Q4 FYE23 fully diluted earnings per share of $0.00 (non-GAAP: $0.02 per share).

In Q4 FYE24, on a GAAP and a non-GAAP basis, our basic weighted average share count was 1,032,360,816 and our fully diluted weighted average share count was 1,057,533,533.

Free cash flow

Non-GAAP free cash flow was $637 million for the quarter, with non-GAAP free cash flow for the trailing twelve months totaling $907 million, up 50% year-over-year. Q4 FYE24 non-GAAP free cash flow includes a $573 million change in working capital benefit that is primarily related to cash held for payroll taxes expected to be paid in Q1 FYE25. At the end of FYE24, Arm’s cash and cash equivalents, and short-term investments, totaled $2,923 million, up 22% from $2,401 million in the prior quarter and 32% year-over-year.

Arm Holdings plc

Condensed Consolidated Income Statements

(in millions, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Fiscal Year Ended March 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| Revenue from external customers | $ | 754 | | | $ | 499 | | | $ | 2,509 | | | $ | 2,025 | |

| Revenue from related parties | 174 | | | 134 | | | 724 | | | 654 | |

| Total revenue | 928 | | | 633 | | | 3,233 | | | 2,679 | |

| Cost of sales | (41) | | | (27) | | | (154) | | | (106) | |

| Gross profit | 887 | | | 606 | | | 3,079 | | | 2,573 | |

| Operating expenses: | | | | | | | |

| Research and development | (584) | | | (381) | | | (1,979) | | | (1,133) | |

| Selling, general and administrative | (281) | | | (274) | | | (983) | | | (762) | |

| | | | | | | |

| Disposal, restructuring and other operating expenses, net | — | | | (1) | | | (6) | | | (7) | |

| Total operating expense | (865) | | | (656) | | | (2,968) | | | (1,902) | |

| Operating income (loss) | 22 | | | (50) | | | 111 | | | 671 | |

| Income (loss) from equity investments, net | (7) | | | 35 | | | (20) | | | (45) | |

| Interest income, net | 30 | | | 21 | | | 110 | | | 42 | |

| Other non-operating income (loss), net | 13 | | | (1) | | | 11 | | | 3 | |

| Income (loss) before income taxes | 58 | | | 5 | | | 212 | | | 671 | |

| Income tax benefit (expense) | 166 | | | (2) | | | 94 | | | (147) | |

| Net income (loss) from continuing operations | $ | 224 | | | $ | 3 | | | $ | 306 | | | $ | 524 | |

| | | | | | | |

| Net income (loss) per share attributable to ordinary shareholders | | | | | | | |

| Basic | $ | 0.22 | | | $ | 0.00 | | | $ | 0.30 | | | $ | 0.51 | |

| Diluted | $ | 0.21 | | | $ | 0.00 | | | $ | 0.29 | | | $ | 0.51 | |

| | | | | | | |

| Weighted average ordinary shares outstanding | | | | | | | |

| Basic | 1,032,360,816 | | 1,025,234,000 | | 1,027,443,122 | | 1,025,234,000 |

| Diluted | 1,057,533,533 | | 1,029,150,740 | | 1,044,497,032 | | 1,027,505,008 |

Arm Holdings plc

Condensed Consolidated Balance Sheets

(in millions, except par value and share amounts)

(Unaudited)

| | | | | | | | | | | |

| As of March 31, |

| 2024 | | 2023 |

| Assets: | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,923 | | | $ | 1,554 | |

| Short-term investments | 1,000 | | | 661 | |

Accounts receivable, net (including receivables from related parties of $296 and $402 as of March 31, 2024 and 2023, respectively) | 781 | | | 999 | |

| Contract assets (including contract assets from related parties of $22 and $9 as of March 31, 2024 and 2023, respectively) | 336 | | | 154 | |

| Prepaid expenses and other current assets | 157 | | | 169 | |

| | | |

| Total current assets | 4,197 | | | 3,537 | |

| Non-current assets: | | | |

| Property and equipment, net | 215 | | | 185 | |

| Operating lease right-of-use assets | 205 | | | 206 | |

Equity investments (including investments held at fair value of $573 and $592 as of March 31, 2024 and 2023, respectively) | 741 | | | 723 | |

| Goodwill | 1,625 | | | 1,620 | |

| Intangible assets, net | 152 | | | 138 | |

| Deferred tax assets | 282 | | | 139 | |

| Non-current portion of contract assets | 240 | | | 116 | |

| Other non-current assets | 270 | | | 202 | |

| | | |

| Total non-current assets | 3,730 | | | 3,329 | |

| Total assets | $ | 7,927 | | | $ | 6,866 | |

| Liabilities: | | | |

| Current liabilities: | | | |

| Accrued compensation and benefits and share-based compensation | $ | 298 | | | $ | 589 | |

| Tax liabilities | 147 | | | 162 | |

Contract liabilities (including contract liabilities from related parties of $107 and $135 as of March 31, 2024 and 2023, respectively) | 198 | | | 293 | |

| Operating lease liabilities | 27 | | | 26 | |

Other current liabilities (including payables to related parties of $7 and $17 as of March 31, 2024 and 2023, respectively) | 835 | | | 293 | |

| | | |

| Total current liabilities | 1,505 | | | 1,363 | |

| Non-current liabilities: | | | |

| Non-current portion of accrued compensation and share-based compensation | 20 | | | 152 | |

| Deferred tax liabilities | 135 | | | 262 | |

| Non-current portion of contract liabilities | 717 | | | 807 | |

| Non-current portion of operating lease liabilities | 194 | | | 193 | |

| Other non-current liabilities | 61 | | | 38 | |

| | | |

| Total non-current liabilities | 1,127 | | | 1,452 | |

| Total liabilities | 2,632 | | | 2,815 | |

Arm Holdings plc

Condensed Consolidated Balance Sheets

(in millions, except par value and share amounts)

(Unaudited)

| | | | | | | | | | | |

| As of |

| March 31, 2024 | | March 31, 2023 |

| Shareholders’ equity: | | | |

Ordinary shares, $0.001 par value; 1,088,334,144 shares authorized and 1,040,330,497 shares issued and outstanding as of March 31, 2024; and 1,025,234,000 shares authorized, issued and outstanding as of March 31, 2023 | 2 | | | 2 | |

| Additional paid-in capital | 2,171 | | | 1,216 | |

| Accumulated other comprehensive income | 371 | | | 376 | |

| Retained earnings | 2,751 | | | 2,457 | |

| Total shareholders’ equity | 5,295 | | | 4,051 | |

| Total liabilities and shareholders’ equity | $ | 7,927 | | | $ | 6,866 | |

Arm Holdings plc

Condensed Consolidated Statements of Cash Flows

(in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Fiscal Year Ended March 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows provided by (used for) operating activities: | | | | | | | |

| Net income (loss) | $ | 224 | | | $ | 3 | | | $ | 306 | | | $ | 524 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used for) operating activities: | | | | | | | |

| Depreciation and amortization | 38 | | | 40 | | | 162 | | | 170 | |

| Deferred income taxes | (247) | | | (8) | | | (273) | | | (34) | |

| (Income) loss from equity investments, net | 7 | | | (35) | | | 20 | | | 45 | |

| | | | | | | |

| Share-based compensation cost | 185 | | | 51 | | | 1,037 | | | 79 | |

| Operating lease expense | 9 | | | 8 | | | 35 | | | 34 | |

| Other non-cash operating activities, net | — | | | — | | | (2) | | | (6) | |

| Changes in assets and liabilities: | | | | | | | |

| Accounts receivable, net (including receivables from related parties) | 18 | | | 277 | | | 218 | | | 125 | |

| Contract assets, net (including contract assets from related parties) | (153) | | | (9) | | | (307) | | | (2) | |

| Prepaid expenses and other assets | (42) | | | (30) | | | (61) | | | (1) | |

| Accrued compensation and benefits and share-based compensation | 91 | | | 203 | | | (292) | | | (138) | |

| Contract liabilities (including contract liabilities from related parties) | (42) | | | (27) | | | (190) | | | (37) | |

| Tax liabilities | 16 | | | (52) | | | (30) | | | 35 | |

| Operating lease liabilities | (10) | | | (5) | | | (28) | | | (58) | |

| Other liabilities (including payables to related parties) | 573 | | | 67 | | | 495 | | | 3 | |

| Net cash provided by (used for) operating activities | $ | 667 | | | $ | 483 | | | $ | 1,090 | | | $ | 739 | |

| | | | | | | |

| Cash flows provided by (used for) investing activities | | | | | | | |

| Purchase of short-term investments | (225) | | | (126) | | | (765) | | | (1,111) | |

| Proceeds from maturity of short-term investments | 74 | | | 136 | | | 425 | | | 1,081 | |

| Purchases of equity investments | — | | | (11) | | | (32) | | | (15) | |

| Purchases of intangible assets | (8) | | | (4) | | | (51) | | | (29) | |

| Purchases of property and equipment | (11) | | | (16) | | | (92) | | | (64) | |

| Other investing activities, net, including investments in convertible loans | — | | | — | | | (1) | | | — | |

| Net cash provided by (used for) investing activities | $ | (170) | | | $ | (21) | | | $ | (516) | | | $ | (138) | |

| | | | | | | |

| Cash flows provided by (used for) financing activities | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Payment of intangible asset obligations | (11) | | | (9) | | | (40) | | | (40) | |

| Other financing activities, net | — | | | (1) | | | (10) | | | (2) | |

| Payment of withholding tax on vested shares | (110) | | | — | | | (158) | | | — | |

| Net cash provided by (used for) financing activities | $ | (121) | | | $ | (10) | | | $ | (208) | | | $ | (42) | |

| | | | | | | |

| Effect of foreign exchange rate changes on cash and cash equivalents | (4) | | | 1 | | | 3 | | | (9) | |

| Net increase (decrease) in cash and cash equivalents | 372 | | | 453 | | | 369 | | | 550 | |

| Cash and cash equivalents at the beginning of the period | 1,551 | | | 1,101 | | | 1,554 | | | 1,004 | |

| Cash and cash equivalents at the end of the period | $ | 1,923 | | | $ | 1,554 | | | $ | 1,923 | | | $ | 1,554 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Key Financial and Operating Metrics

We use the following key performance indicators and non-GAAP financial measures to analyze our business performance and financial forecasts and to develop strategic plans, which we believe provide useful information to the market to aid in understanding and evaluating our results of operations in the same manner as our management team. Certain judgments and estimates are inherent in our processes to calculate these metrics. These key performance indicators and non-GAAP financial measures are presented for supplemental informational purposes only, should not be considered a substitute for financial information presented in accordance with GAAP, and may differ from similarly titled metrics or measures presented by other companies.

The following table sets forth a summary of the key financial and operating metrics:

| | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except for Number of Arm-based Chips, Number of extant Arm Total Access and Arm Flexible Access licenses, and Total number of employees and engineers) | Three Months Ended March 31, | | Fiscal Year Ended March 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Total revenue | $ | 928 | | | $ | 633 | | | $ | 3,233 | | | $ | 2,679 | |

License and other revenue | 414 | | 259 | | 1,431 | | 1,004 |

| Royalty revenue | 514 | | 374 | | 1,802 | | 1,675 |

| Operating income (loss) | 22 | | (50) | | 111 | | 671 |

| Non-GAAP operating income (loss) (1) | 391 | | (1) | | 1,408 | | 783 |

| Net income from continuing operations | 224 | | 3 | | 306 | | 524 |

| Non-GAAP net income (1) | 376 | | 18 | | 1,324 | | 657 |

| Net cash provided by operating activities | 667 | | 483 | | 1,090 | | 739 |

| Non-GAAP free cash flow (1) | 637 | | 454 | | 907 | | 606 |

| Non-GAAP free cash flow TTM (1) | 907 | | 606 | | | | |

| | | | | | | |

| Operating metrics: | | | | | | | |

| Number of Arm-based chips reported as shipped (billions) | 7.0 | | 7.8 | | 28.6 | | 30.6 |

| | | | | | | |

| | | | | As of March 31, |

| Operating metrics: | | | | | 2024 | | 2023 |

| Cumulative number of Arm-based chips reported as shipped (billions) | | | | | 287.4 | | 258.5 |

| Number of extant Arm Total Access licenses (2) | | | | | 31 | | 18 |

| Number of extant Arm Flexible Access licenses (2) | | | | | 222 | | 203 |

| Annualized contract value | | | | | $ | 1,182 | | | $ | 1,030 | |

| Remaining performance obligation | | | | | $ | 2,484 | | | $ | 1,712 | |

| Total number of employees (at end of period) | | | | | 7,096 | | 5,963 |

| Total number of engineers | | | | | 5,887 | | 4,753 |

| Total number of non-engineers | | | | | 1,209 | | 1,210 |

(1) Non-GAAP operating income (loss), Non-GAAP net income from continuing operations, Non-GAAP free cash flow, and Non-GAAP free cash flow TTM are non-GAAP financial measures. For more information regarding our use of these measures and a reconciliation of these measures to the most directly comparable GAAP financial measures, see “—GAAP to Non-GAAP Reconciliation” below.

(2) As of the last day of the applicable period.

Total revenue

Our major product offerings consist of the following:

License and other revenue

•Intellectual property license — We generally license IP under non-exclusive license agreements that provide usage rights for specific applications for a finite or perpetual term. These licenses are made available electronically to address the customer-specific business requirements. These arrangements generally have distinct performance obligations that consist of transferring the licensed IPs, version extensions of architecture IP or releases of IPs, and support services. Support services consist of a stand-ready obligation to provide technical support, patches, and bug fixes over the support term. Revenue allocated to the IP license is recognized at a point in time upon the delivery or beginning of license term, whichever is later. Revenue allocated to distinct version extensions of architecture IP or releases of IP, excluding when-and-if-available minor updates over the support term, are recognized at a point in time upon the delivery or beginning of license term, whichever is later.

Certain license agreements provide customers with the right to access a library of current and future IPs on an unlimited basis over the contractual period depending on the terms of the applicable contract. These licensing arrangements represent stand-ready obligations in that the timing of the delivery of the underlying IPs is within the control of the customer and the extent of use in any given period does not diminish the remaining performance obligation. The contract consideration related to these arrangements is recognized ratably over the term of the contract in line with when the control of the performance obligations is transferred.

•Software sales, including development systems — Sales of software, including development systems, which are not specifically designed for a given license (such as off-the-shelf software), are recognized upon delivery when control has been transferred and customer can begin to use and benefit from the license.

•Professional services — Services (such as training and professional and design services) that we provide, which are not essential to the functionality of the IP, are separately stated and priced in the contract and accounted for separately. Training revenue is recognized as services are performed. Revenue from professional and design services are recognized over time using the input method based on engineering labor hours expended to date relative to the estimated total effort required. For such professional and design services, we have an enforceable right to payment for performance completed to date, which includes a reasonable profit margin and the performance of such services do not create an asset with an alternative use.

•Support and maintenance — Support and maintenance is a stand-ready obligation to the customer that is both provided and consumed simultaneously. Revenue is recognized on a straight-line basis over the period for which support and maintenance is contractually agreed pursuant to the license.

Royalty revenue

For certain IP license agreements, royalties are collected on products that incorporate our IP. Royalties are recognized on an accrual basis in the quarter in which the customer ships their products, based on our technology that it contains. This estimation process for the royalty revenue accrual is based on a combination of methodologies, including the use of historical sales trends and macroeconomic factors for predictive analysis, the analysis of customer royalty reports and their sales trends and forecasts, as well as data and forecasts from third-party industry research providers. Data considered includes revenue, unit shipments, average selling price, product mix, market share and market penetration. Adjustments to revenue are required in subsequent periods to reflect changes in estimates as new information becomes available, primarily resulting from actual amounts subsequently reported by the licensees.

Royalty technology mix

Royalty mix by architecture such as Armv9 is estimated at the system-on-a-chip (SoC) level based on the architecture of the primary CPU or an approximation of the IP mix and is subject to change based on the availability of additional product detail.

Number of Arm-based chips reported as shipped - for the period and cumulative

Each quarter, most of our customers, and those contracted through Arm China, furnish us (directly or via Arm China) with royalty reports setting forth the actual number of Arm-powered chips they shipped in the immediately preceding quarter. Royalty reports received in the 12-month period from April 1 to March 31 of each year relate to chip shipments made in the period from January 1 to December 31 of each year. We also perform various procedures to assess customer data related to royalties for reasonableness, and our license agreements generally include rights for us to audit the books and records of our customers to verify certain types of customer data.

We consider the number of chips reported as shipped by our customers as a key performance indicator because it represents the acceptance of our products by companies who use chips in their products (e.g., our customers’ customers). The number of chips shipped also provides insight into chip pricing and volumes in different end markets, which helps inform our pricing models and competitive positioning.

The cumulative number of Arm-based chips reported as shipped are from inception to date. This figure includes our customers' adjustments on the number of Arm-based chips reported as shipped in prior periods. We consider the cumulative number of Arm-based chips reported as shipped by our customers as a key performance indicator because it represents the scale of expansion of Arm-based products.

Number of extant Arm Total Access and Arm Flexible Access licenses

Each quarter, we track the number of extant Arm Total Access and Arm Flexible Access licenses with our customers, and those contracted through Arm China. We believe that, over time, many of our customers will transition to either an Arm Total Access or Arm Flexible Access license to access our products. This transition enables us and our customers to focus less on contract negotiations and more on how our products can be deployed in our customers’ future chips.

We consider the number of extant Arm Total Access and Arm Flexible Access licenses as key performance indicators as they represent the increasing collaboration between us and our customers, which could be a leading indicator to more chips being designed with our products and, accordingly, more recurring royalty revenue in the future, improving our long-term market share.

Annualized contract value ("ACV")

Each quarter, we track the ACV relating to licensing agreements signed with our customers and those contracted through Arm China per the aggregate license fee as shared under the IPLA. We define ACV as the total annualized committed fees, excluding any potential future royalty revenue, for all signed agreements deemed to be active through the last day of each applicable reporting period. Arm Total Access agreements and ALAs are deemed to be active for, and annualized over, the number of years in the contract. Any other license agreements, including single use and limited use licenses issued under an Arm Flexible Access agreement or TLA, are deemed to be active for, and annualized over, three years based on the historical licensing patterns of our customers. The aggregate license fee shared by Arm China is also deemed to be active for, and annualized over, three years.

ACV is an operational metric based on committed fees, excluding royalties, not recognized revenue, and therefore is not reconcilable to, nor a substitute for, revenue reported under GAAP. However, we consider ACV to be a key operational metric that we use to track existing licensing commitments with our customers. Bookings of new licenses and recognized revenue may fluctuate materially from quarter to quarter due to customer buying patterns, timing of subscription renewals and as a function of contract duration. As a result, we believe ACV provides an additional understanding of our business performance and long-term trends.

Remaining performance obligations ("RPO")

RPO represents the transaction price allocated to performance obligations that are unsatisfied, or partially unsatisfied, which includes unearned revenue and amounts that will be invoiced and recognized as revenue in future periods.

Arm has elected to exclude potential future royalty receipts from the disclosure of RPO. Revenue recognition occurs upon delivery or beginning of license term, whichever is later.

Non-GAAP financial measures

In addition to our results determined in accordance with GAAP, we utilize and present financial measures that are not calculated and presented in accordance with GAAP. Our non-GAAP financial measures include non-GAAP cost of sales, non-GAAP gross profit, non-GAAP gross profit margin, non-GAAP research and development operating expenses, non-GAAP selling, general and administrative operating expenses, non-GAAP impairment of long-lived assets operating expenses, non-GAAP disposal, restructuring and other operating expense, net, non-GAAP operating expense, non-GAAP operating income (loss), non-GAAP operating profit margin, non-GAAP income (loss) from equity investments, net, non-GAAP interest income, net, non-GAAP other non-operating income (loss), net, non-GAAP income before income taxes, net, non-GAAP net income (loss), non-GAAP basic and diluted net income per share attributable to ordinary shareholders, free cash flow, and free cash flow TTM. We believe these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating our results of operations, as well as provide a useful measure for period-to-period comparisons of our business performance. Moreover, we have included these non-GAAP financial measures because they are key measurements used by our management internally to make operating decisions, including those related to analyzing operating expenses, evaluating performance, and performing strategic planning and annual budgeting. We believe that the presentation of our non-GAAP financial measures, when viewed holistically, is helpful to investors in assessing the consistency and comparability of our performance in relation to prior periods and facilitates comparisons of our financial performance relative to our competitors, particularly with respect to competitors that present similar non-GAAP financial measures in addition to their GAAP results.

Non-GAAP financial measures are presented for supplemental information purposes only, should not be considered a substitute for financial information presented in accordance with GAAP, and may not align with similar financial measures presented by our competitors, which may limit the ability of investors to assess our performance relative to certain peer companies.

Non-GAAP financial measures presented herein exclude acquisition-related intangible asset amortization, share-based compensation ("SBC") cost associated with equity-classified awards where our intent is to issue equity upon vesting (in lieu of cash settlement), employer taxes related to SBC equity-classified awards, net of the research and development ("R&D") tax incentives associated with these taxes, one-time employee benefit related to the Arm Limited All Employee Plan 2019 (“2019 AEP”), costs associated with disposal activities, impairment of long-lived assets, restructuring and related costs, public company readiness costs, other operating income (expenses), net, (income) loss from equity method investments, gain on disposal of business, and income tax effect on non-GAAP adjustments. We exclude these items from our non-GAAP financial measures because they are non-cash or non-recurring in nature, or because the amount and timing of these items is unpredictable and not driven by core results of operations, which renders comparisons with prior periods and competitors less meaningful.

Investors should consider non-GAAP financial measures alongside other financial performance measures, including operating income, net income and our other GAAP results. For more information regarding our use of these measures and a reconciliation to the most directly comparable GAAP financial measure, see “—GAAP to Non-GAAP Reconciliation.”

Arm Holdings plc

GAAP to Non-GAAP Reconciliation

(Unaudited)

The following is a reconciliation of GAAP to Non-GAAP results:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2024 |

| (in millions, except share and per share amounts) | | GAAP Results | Acquisition-related intangible asset amortization | Share-based compensation cost (equity settled) (1)(2)(3) | Employer taxes related to SBC, net of R&D tax incentives (4) | One-time employee benefit (5) | | | | | | | (Income) loss from equity method investments, net | Income tax effect on non-GAAP adjustments | Non-GAAP Results |

| Total revenue | | $ | 928 | | $ | — | | $ | — | | $ | — | | $ | — | | | | | | | | $ | — | | $ | — | | $ | 928 | |

| Cost of sales | | (41) | | 1 | | 6 | | 7 | | 1 | | | | | | | | — | | — | | (26) | |

| Gross profit | | 887 | | 1 | | 6 | | 7 | | 1 | | | | | | | | — | | — | | 902 | |

| Gross profit margin | | 95.6 | % | | | | | | | | | | | | | 97.2 | % |

| Operating expenses: | | | | | | | | | | | | | | | |

| Research and development | | (584) | | — | | 127 | | 118 | | 13 | | | | | | | | — | | — | | (326) | |

| Selling, general and administrative | | (281) | | — | | 53 | | 38 | | 5 | | | | | | | | — | | — | | (185) | |

| | | | | | | | | | | | | | | |

| Disposal, restructuring and other operating expenses, net | | — | | — | | — | | — | | — | | | | | | | | — | | — | | — | |

| Total operating expense | | (865) | | — | | 180 | | 156 | | 18 | | | | | | | | — | | — | | (511) | |

| Operating income (loss) | | 22 | | 1 | | 186 | | 163 | | 19 | | | | | | | | — | | — | | 391 | |

| Operating profit margin | | 2.4 | % | | | | | | | | | | | | | 42.1 | % |

| Income (loss) from equity investments, net | | (7) | | — | | — | | — | | — | | | | | | | | 7 | | — | | — | |

| Interest income, net | | 30 | | — | | — | | — | | — | | | | | | | | — | | — | | 30 | |

| Other non-operating income (loss), net | | 13 | | — | | — | | — | | — | | | | | | | | — | | — | | 13 | |

| Income (loss) before income taxes | | 58 | | 1 | | 186 | | 163 | | 19 | | | | | | | | 7 | | — | | 434 | |

| Income tax benefit (expense) | | 166 | | — | | — | | — | | — | | | | | | | | — | | (224) | | (58) | |

| Net income (loss) from continuing operations | | $ | 224 | | $ | 1 | | $ | 186 | | $ | 163 | | $ | 19 | | | | | | | | $ | 7 | | $ | (224) | | $ | 376 | |

| Net income (loss) per share attributable to ordinary shareholders | | | | | | | | | | | | | | | |

| Basic | | $ | 0.22 | | | | | | | | | | | | | | $ | 0.36 | |

| Diluted | | $ | 0.21 | | | | | | | | | | | | | | $ | 0.36 | |

| Weighted average ordinary shares outstanding | | | | | | | | | | | | | | | |

| Basic | | 1,032,360,816 | | | | | | | | | | | | | 1,032,360,816 |

| Diluted | | 1,057,533,533 | | | | | | | | | | | | | 1,057,533,533 |

(1) Total share-based compensation cost, including both cash and equity settled awards, was $195 million for the three months ended March 31, 2024.

(2) Refer to page 20 for a summary of share-based compensation cost recognized in the Condensed Consolidated Income Statements. (3) Refer to page 20 for a summary of share-based compensation liability-classified cost recognized in the Condensed Consolidated Income Statements. (4) Represents employer taxes related to share-based compensation (“SBC”) for equity-classified awards, net of the research and development ("R&D") tax incentives associated with these taxes.

(5) Represents one-time employee benefit related to the Arm Limited All Employee Plan 2019 (“2019 AEP”).

Arm Holdings plc

GAAP to Non-GAAP Reconciliation (continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2023 |

| (in millions, except share and per share amounts) | | GAAP Results | Acquisition-related intangible asset amortization | Share-based compensation cost (equity settled) (1)(2)(3) | | | Public company readiness costs | | Costs associated with disposal activities | | | Gain on disposal of business | (Income) loss from equity method investments, net | Income tax effect on non-GAAP adjustments | Non-GAAP Results |

| Total revenue | | $ | 633 | | $ | — | | $ | — | | | | $ | — | | | $ | — | | | | $ | — | | $ | — | | $ | — | | $ | 633 | |

| Cost of sales | | (27) | | 1 | | 1 | | | | — | | | — | | | | — | | — | | — | | (25) | |

| Gross profit | | 606 | | 1 | | 1 | | | | — | | | — | | | | — | | — | | — | | 608 | |

| Gross profit margin | | 95.7 | % | | | | | | | | | | | | | 96.1 | % |

| Operating expenses: | | | | | | | | | | | | | | | |

| Research and development | | (381) | | — | | 23 | | | | — | | | — | | | | — | | — | | — | | (358) | |

| Selling, general and administrative | | (274) | | — | | 14 | | | | 9 | | | — | | | | — | | — | | — | | (251) | |

| | | | | | | | | | | | | | | |

| Disposal, restructuring and other operating expenses, net | | (1) | | — | | — | | | | — | | | 1 | | | | — | | — | | — | | — | |

| Total operating expense | | (656) | | — | | 37 | | | | 9 | | | 1 | | | | — | | — | | — | | (609) | |

| Operating income (loss) | | (50) | | 1 | | 38 | | | | 9 | | | 1 | | | | — | | — | | — | | (1) | |

| Operating profit margin | | (7.9) | % | | | | | | | | | | | | | (0.2) | % |

| Income (loss) from equity investments, net | | 35 | | — | | — | | | | — | | | — | | | | — | | (35) | | — | | — | |

| Interest income, net | | 21 | | — | | — | | | | — | | | — | | | | — | | — | | — | | 21 | |

| Other non-operating income (loss), net | | (1) | | — | | — | | | | — | | | — | | | | (4) | | — | | — | | (5) | |

| Income (loss) before income taxes | | 5 | | 1 | | 38 | | | | 9 | | | 1 | | | | (4) | | (35) | | — | | 15 | |

| Income tax (expense) benefit | | (2) | | — | | — | | | | — | | | — | | | | — | | — | | 5 | | 3 | |

| Net income (loss) | | $ | 3 | | $ | 1 | | $ | 38 | | | | $ | 9 | | | $ | 1 | | | | $ | (4) | | $ | (35) | | $ | 5 | | $ | 18 | |

| Net income (loss) per share attributable to ordinary shareholders | | | | | | | | | | | | | | | |

| Basic | | $ | 0.00 | | | | | | | | | | | | | | $ | 0.02 | |

| Diluted | | $ | 0.00 | | | | | | | | | | | | | | $ | 0.02 | |

| Weighted average ordinary shares outstanding | | | | | | | | | | | | | | | |

| Basic | | 1,025,234,000 | | | | | | | | | | | | | 1,025,234,000 |

| Diluted | | 1,029,150,740 | | | | | | | | | | | | | 1,029,150,740 |

(1) Total share-based compensation cost, including both cash and equity settled awards, was $164 million for the three months ended March 31, 2023. For non-GAAP purposes, we adjust for those awards that are liability-classified pre-IPO but will be equity settled after IPO. Liability-classified awards are remeasured at the end of each reporting period through the date of settlement to ensure that the expense recognized for each award is equivalent to the amount to be paid in cash or equity settled after the initial public offering.

(2) Refer to page 20 for a summary of share-based compensation cost recognized in the Condensed Consolidated Income Statements. (3) Refer to page 20 for a summary of share-based compensation liability-classified cost recognized in the Condensed Consolidated Income Statements.

Arm Holdings plc

GAAP to Non-GAAP Reconciliation (continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended March 31, 2024 |

| (in millions, except share and per share amounts) | | GAAP Results | Acquisition-related intangible asset amortization | Share-based compensation cost (equity settled) (1)(2)(3) | Employer taxes related to SBC, net of R&D tax incentives (4) | One-time employee benefit (5) | Public company readiness costs | Other operating income (expenses), net | | | | | (Income) loss from equity method investments, net | Income tax effect on non-GAAP adjustments | Non-GAAP Results |

| Total revenue | | $ | 3,233 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | | | | | $ | — | | $ | — | | $ | 3,233 | |

| Cost of sales | | (154) | | 4 | | 39 | | 8 | | 1 | | — | | — | | | | | | — | | — | | (102) | |

| Gross profit | | 3,079 | | 4 | | 39 | | 8 | | 1 | | — | | — | | | | | | — | | — | | 3,131 | |

| Gross profit margin | | 95.2 | % | | | | | | | | | | | | | 96.8 | % |

| Operating expenses: | | | | | | | | | | | | | | | |

| Research and development | | (1,979) | | — | | 705 | | 133 | | 13 | | — | | — | | | | | | — | | — | | (1,128) | |

| Selling, general and administrative | | (983) | | — | | 293 | | 48 | | 5 | | 42 | | — | | | | | | — | | — | | (595) | |

| | | | | | | | | | | | | | | |

| Disposal, restructuring and other operating expenses, net | | (6) | | — | | — | | — | | — | | — | | 6 | | | | | | — | | — | | — | |

| Total operating expense | | (2,968) | | — | | 998 | | 181 | | 18 | | 42 | | 6 | | | | | | — | | — | | (1,723) | |

| Operating income (loss) | | 111 | | 4 | | 1,037 | | 189 | | 19 | | 42 | | 6 | | | | | | — | | — | | 1,408 | |

| Operating profit margin | | 3.4 | % | | | | | | | | | | | | | 43.6 | % |

| Income (loss) from equity investments, net | | (20) | | — | | — | | — | | — | | — | | — | | | | | | 20 | | — | | — | |

| Interest income, net | | 110 | | — | | — | | — | | — | | — | | — | | | | | | — | | — | | 110 | |

| Other non-operating income (loss), net | | 11 | | — | | — | | — | | — | | — | | — | | | | | | — | | — | | 11 | |

| Income (loss) before income taxes | | 212 | | 4 | | 1,037 | | 189 | | 19 | | 42 | | 6 | | | | | | 20 | | — | | 1,529 | |

| Income tax benefit (expense) | | 94 | | — | | — | | — | | — | | — | | — | | | | | | — | | (299) | | (205) | |

| Net income (loss) from continuing operations (6) | | $ | 306 | | $ | 4 | | $ | 1,037 | | $ | 189 | | $ | 19 | | $ | 42 | | $ | 6 | | | | | | $ | 20 | | $ | (299) | | $ | 1,324 | |

| Net income (loss) per share attributable to ordinary shareholders | | | | | | | | | | | | | | | |

| Basic | | $ | 0.30 | | | | | | | | | | | | | | $ | 1.29 | |

| Diluted | | $ | 0.29 | | | | | | | | | | | | | | $ | 1.27 | |

| Weighted average ordinary shares outstanding | | | | | | | | | | | | | | | |

| Basic | | 1,027,443,122 | | | | | | | | | | | | | 1,027,443,122 |

| Diluted | | 1,044,497,032 | | | | | | | | | | | | | 1,044,497,032 |

(1) Total share-based compensation cost, including both cash and equity settled awards, was $1,070 million for the fiscal year ended March 31, 2024. For non-GAAP purposes, we adjust for those awards that are liability-classified pre-IPO but will be equity settled after IPO. Liability-classified awards are remeasured at the end of each reporting period through the date of settlement to ensure that the expense recognized for each award is equivalent to the amount to be paid in cash or equity settled after the initial public offering.

(2) Refer to page 20 for a summary of share-based compensation cost recognized in the Condensed Consolidated Income Statements. (3) Refer to page 20 for a summary of share-based compensation liability-classified cost recognized in the Condensed Consolidated Income Statements. (4) Represents employer taxes related to share-based compensation for equity-classified awards, net of the research and development tax incentives associated with these taxes.

(5) Represents one-time employee benefit related to the Arm Limited All Employee Plan 2019 (“2019 AEP”).

(6) Non-GAAP net income from continuing operations includes $26 million of employer taxes related to SBC, net of the R&D tax incentives and the associated $9 million of income tax effect on non-GAAP adjustments which has been recast across historical periods for trend purposes.

Arm Holdings plc

GAAP to Non-GAAP Reconciliation (continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended March 31, 2023 |

| (in millions, except share and per share amounts) | | GAAP Results | Acquisition-related intangible asset amortization | Share-based compensation cost (equity settled) (1)(2)(3) | | | Public company readiness costs | | Costs associated with disposal activities | | Restructuring and related costs | Gain on disposal of business | (Income) loss from equity method investments, net | Income tax effect on non-GAAP adjustments | Non-GAAP Results |

| Total revenue | | $ | 2,679 | | $ | — | | $ | — | | | | $ | — | | | $ | — | | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 2,679 | |

| Cost of sales | | (106) | | 5 | | 2 | | | | — | | | — | | | — | | — | | — | | — | | (99) | |

| Gross profit | | 2,573 | | 5 | | 2 | | | | — | | | — | | | — | | — | | — | | — | | 2,580 | |

| Gross profit margin | | 96.0 | % | | | | | | | | | | | | | 96.3 | % |

| Operating expenses: | | | | | | | | | | | | | | | |

| Research and development | | (1,133) | | — | | 38 | | | | — | | | — | | | — | | — | | — | | — | | (1,095) | |

| Selling, general and administrative | | (762) | | — | | 20 | | | | 42 | | | — | | | — | | — | | — | | — | | (700) | |

| | | | | | | | | | | | | | | |

| Disposal, restructuring and other operating expenses, net | | (7) | | — | | — | | | | — | | | 4 | | | 1 | | — | | — | | — | | (2) | |

| Total operating expense | | (1,902) | | — | | 58 | | | | 42 | | | 4 | | | 1 | | — | | — | | — | | (1,797) | |

| Operating income (loss) | | 671 | | 5 | | 60 | | | | 42 | | | 4 | | | 1 | | — | | — | | — | | 783 | |

| Operating profit margin | | 25.0 | % | | | | | | | | | | | | | 29.2 | % |

| Income (loss) from equity investments, net | | (45) | | — | | — | | | | — | | | — | | | — | | — | | 45 | | — | | — | |

| Interest income, net | | 42 | | — | | — | | | | — | | | — | | | — | | — | | — | | — | | 42 | |

| Other non-operating income (loss), net | | 3 | | — | | — | | | | — | | | — | | | — | | (4) | | — | | — | | (1) | |

| Income (loss) before income taxes | | 671 | | 5 | | 60 | | | | 42 | | | 4 | | | 1 | | (4) | | 45 | | — | | 824 | |

| Income tax (expense) benefit | | (147) | | — | | — | | | | — | | | — | | | — | | — | | — | | (20) | | (167) | |

| Net income (loss) | | $ | 524 | | $ | 5 | | $ | 60 | | | | $ | 42 | | | $ | 4 | | | $ | 1 | | $ | (4) | | $ | 45 | | $ | (20) | | $ | 657 | |

| Net income (loss) per share attributable to ordinary shareholders | | | | | | | | | | | | | | | |

| Basic | | $ | 0.51 | | | | | | | | | | | | | | $ | 0.64 | |

| Diluted | | $ | 0.51 | | | | | | | | | | | | | | $ | 0.64 | |

| Weighted average ordinary shares outstanding | | | | | | | | | | | | | | | |

| Basic | | 1,025,234,000 | | | | | | | | | | | | | 1,025,234,000 |

| Diluted | | 1,027,505,008 | | | | | | | | | | | | | 1,027,505,008 |

(1) Total share-based compensation cost, including both cash and equity settled awards, was $326 million for the fiscal year ended March 31, 2023. For non-GAAP purposes, we adjust for those awards that are liability-classified pre-IPO but will be equity settled after IPO. Liability-classified awards are remeasured at the end of each reporting period through the date of settlement to ensure that the expense recognized for each award is equivalent to the amount to be paid in cash or equity settled after the initial public offering.

(2) Refer to page 20 for a summary of share-based compensation cost recognized in the Condensed Consolidated Income Statements. (3) Refer to page 20 for a summary of share-based compensation liability-classified cost recognized in the Condensed Consolidated Income Statements.

Arm Holdings plc

GAAP to Non-GAAP Reconciliation (continued)

(Unaudited)

(2) A summary of share-based compensation cost recognized in the Condensed Consolidated Income Statements is as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | Fiscal Year Ended March 31, |

| (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of sales | | $ | 7 | | | $ | 5 | | | $ | 41 | | | $ | 12 | |

| Research and development | | 134 | | | 109 | | | 728 | | | 212 | |

| Selling, general and administrative | | 54 | | | 50 | | | 301 | | | 102 | |

| Total | | $ | 195 | | | $ | 164 | | | $ | 1,070 | | | $ | 326 | |

(3) A summary of share-based compensation liability-classified cost recognized in the Condensed Consolidated Income Statements is as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | Fiscal Year Ended March 31, |

| (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of sales | | $ | — | | | $ | 4 | | | $ | 1 | | | $ | 10 | |

| Research and development | | 8 | | | 86 | | | 24 | | | 174 | |

| Selling, general and administrative | | 1 | | | 36 | | | 8 | | | 82 | |

| Total | | $ | 9 | | | $ | 126 | | | $ | 33 | | | $ | 266 | |

The following is a reconciliation of Non-GAAP free cash flow to Net cash provided by operating activities, the most directly comparable GAAP cash flow measure:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | Fiscal Year Ended March 31, |

| (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | | $ | 667 | | | $ | 483 | | | $ | 1,090 | | | $ | 739 | |

| Adjusted for: | | | | | | | | |

| Purchases of property and equipment | | (11) | | | (16) | | | (92) | | | (64) | |

| Purchases of intangible assets | | (8) | | | (4) | | | (51) | | | (29) | |

| Payment of intangible asset obligations | | (11) | | | (9) | | | (40) | | | (40) | |

| Non-GAAP free cash flow | | $ | 637 | | | $ | 454 | | | $ | 907 | | | $ | 606 | |

Forward-Looking Statements

This shareholder letter contains forward-looking statements that reflect our plans, beliefs, expectations and current views with respect to, among other things, future events and financial performance. Our actual results could differ materially from the forward-looking statements included herein. Statements regarding our future and projections relating to revenue, cost of sales expenses, costs, income (loss), and potential growth opportunities are typical of such statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in “Risk Factors” in our IPO Prospectus.

The following contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, relating to our operations, results of operations and other matters that are based on our current expectations, estimates, assumptions and projections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “is/are likely to,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “target,” “continue” and “ongoing,” or the negative of these terms or other comparable terminology intended to identify statements about the future. The forward-looking statements and opinions are based upon current expectations and, while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. We caution that you should not place undue reliance on any of our forward-looking statements. We undertake no obligation to update forward-looking statements to reflect developments or information obtained after the date hereof and disclaim any obligation to do so except as required by applicable laws.

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

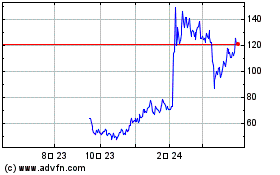

ARM (NASDAQ:ARM)

과거 데이터 주식 차트

부터 4월(4) 2024 으로 5월(5) 2024

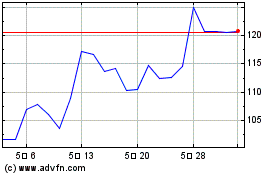

ARM (NASDAQ:ARM)

과거 데이터 주식 차트

부터 5월(5) 2023 으로 5월(5) 2024