TORONTO, Feb. 21,

2024 /PRNewswire/ - Allied Gold Corporation

(TSX: AAUC) ("Allied" or the "Company") herein provides its

preliminary operating results for 2023, alongside the Company's

2024 operating guidance and medium term outlook, including updates

on Mineral Reserves and Mineral Resources. This announcement

underscores the significant potential and inherent upside within

Allied's asset portfolio, supported by growth and robust, expanding

geological endowments across both established and emerging premier

gold mining jurisdictions.

Production for the fourth quarter totaled 94,755 ounces of gold,

with full year 2023 production reaching 343,817 ounces, slightly

below the previously disclosed 2023 production range of

approximately 350,000 ounces. The All-in Sustaining Costs

("AISC")(1) for the year are estimated at less than

$1,585 per ounce, which is in line

with the normal cost tolerances used by Allied, which are two

percent above and below Allied's guided AISC(1), which,

in this case, was $1,550 per ounce

for 2023.

The Company's producing mines are expected to sustainably

produce at least 375,000 ounces per year, as evidenced by the run

rate delivered in the fourth quarter. Building on this foundation,

Allied has executed several strategic project advancements and

exploration efforts throughout 2023, laying the groundwork for

future growth and enhanced cash flow.

The advancement of the Kurmuk project into the execution phase,

with its confirmed design for a 6Mt/y capacity operation,

represents a significant milestone. This phase involves the

establishment of Allied's project management framework, the

appointment of an EPCM contractor, the initiation of detailed

engineering and early works, and the procurement of critical

project services and infrastructure along with strengthening

relationships and engaging with local stakeholders. Additionally,

the Company has established a phased expansion plan at Sadiola,

designed to significantly reduce capital expenditures in the short

term, while boosting production at lower costs.

On the exploration front, Allied expanded its Mineral Reserves

and Resources, replacing depletion by 190% in 2023. The Company

remains focused on extending the mine lives at Agbaou, Bonikro, and

Kurmuk, and on increasing the oxide mineral inventory at Sadiola,

facilitating a smoother transition for the phased expansion and

providing additional processing flexibility. Moreover, Allied

advanced its regional exploration programs aimed at uncovering

significant potential across its portfolio, realizing exploration

success at highly prospective locations such as Oume, located north

of Bonikro mill, and Tsenge, located south to the project mill at

Kurmuk.

Optimizations in mine contractor management and enhancements in

processing plant controls, including increased security and

metallurgical oversight at the gravity circuit, are key components

of Allied's strategy to solidify a sustainable production base.

These measures underscore the Company's commitment to continuous

improvement, setting the stage for ongoing success and growth.

In 2024, Allied anticipates producing 375,000 to 405,000 ounces

of gold. Achieving the higher end of this guided range primarily

hinges on the successful completion of mine contractor transition

at Agbaou, where efforts to enhance efficiencies and maximize

long-term value are underway, notwithstanding the short-term

impacts on production.

|

(000's

ounces)

|

2023

Actual

|

2024

Guidance

|

|

Sadiola

|

171,007

|

195,000 –

205,000

|

|

Bonikro

|

99,409

|

95,000 –

105,000

|

|

Agbaou

|

73,401

|

85,000 –

95,000

|

|

Total Gold

Production

|

343,817

|

375,000 –

405,000

|

Regarding costs, the projected mine-site level

AISC(1) for 2024 is expected to be $1,400 per ounce marking a significant reduction

compared to the preliminary AISC(1) for 2023. Allied

offers this cost guidance within a range of +/- 2%, with the guided

figure representing the range's midpoint.

|

(US$/oz

Sold)

|

|

2024 Cash

Costs(1)

|

2024 Mine-Site

AISC(1)

|

|

Sadiola

|

|

1,075

|

1,150

|

|

Bonikro

|

|

1,275

|

1,650

|

|

Agbaou

|

|

1,595

|

1,675

|

|

Total

|

|

1,250

|

1,400

|

Anticipated cost savings in 2024, amounting to nearly

$200 per ounce compared to 2023, are

set to reflect the benefits of increased production and continued

optimization efforts.

Corporate items are expected to add approximately $100 per ounce sold to arrive at the

corporate-level AISC(1), with this impact decreasing in

future periods as costs decline and production rises.

The following table presents expansionary capital, sustaining

capital and exploration spend expectations by mine and

company-level for 2024:

|

(US$

millions)

|

Expansionary

Capital

|

Sustaining

Capital

|

Total

Exploration

|

|

Sadiola

|

35.0

|

12.5

|

8.0

|

|

Bonikro

|

1.0

|

5.5

|

10.5

|

|

Agbaou

|

0.5

|

7.5

|

6.0

|

|

Kurmuk

|

155.0

|

-

|

7.5

|

|

Corporate

|

7.0

|

4.0

|

-

|

|

Total

|

198.5

|

29.5

|

32.0

|

Approximately 70% of the Company's expected exploration spend is

capital in nature.

The following table presents other expenditure expectations for

2024:

|

(US$

millions)

|

2024

Guidance

|

|

Total

DD&A

|

55

|

|

Cash based

G&A

|

38

|

|

Cash income taxes paid

(assumes $2,000/oz Au)

|

60

|

Allied's key focus for 2024 is the sustainable reduction of

costs across its asset portfolio. Alongside this, the Company is

dedicated to delivering near-term oxide ores at Sadiola and

advancing construction activities at Kurmuk, while also continuing

its exploration success to extend mine life, particularly in Côte

d'Ivoire. Based on ongoing efforts to optimize assets, Allied will

release a three-year production and cost forecast in due

course.

While not currently reflected in Allied's official one-year

guidance, the operating trends clearly support the Company's vision

of achieving significant growth at substantially lower costs and

underpin the outlook for 2025 and 2026.

At Sadiola, gold production is anticipated to increase

sequentially each year during the outlook period, with a goal of

achieving 230,000 ounces per year. The improvement is expected to

be driven by the inclusion of additional oxide ore from Diba and

targets such as Sekekoto West, FE4, and S12, alongside the Phase 1

expansion. These developments are anticipated to offer further

opportunities for production increases. For 2025, the

AISC(1) is expected to remain within the range of

$1,150 to $1,250 per ounce. Although AISC(1) may

see a slight increase in 2026, it is projected to stay below

$1,350 per ounce. This anticipated

rise in costs is partly attributed to the preparations for the

mine's second phase expansion later in that year, which will follow

the commencement of production at Kurmuk. During this period, costs

are expected to continue benefiting from increased production and

optimizations. With the availability of oxide ore from Diba and

other targets, Phase 1 execution is now targeted to start in late

2024, with production commencing in early 2026.

In the near term, Bonikro is expected to achieve modest yearly

increases in gold production during the outlook period, with a goal

of exceeding 110,000 ounces annually. This projection does not

account for the potential additional benefits from Oume. This

improvement is due to the stripping phase planned for 2024 that

will expose higher-grade materials in 2025 and 2026, significantly

reducing the mine-site AISC(1) to below $1,050 per ounce by the end of the outlook

period. At Oume, there is potential for further gains, including

advanced resource drilling at Oume West and North, as well as at

the Akissi-So target south of Bonikro mill.

For Agbaou, gold production is expected to remain consistent

each year throughout the outlook period, not falling below 90,000

ounces annually. The improvements are attributed to the

identification of additional Mineral Reserves in Agbalé, as well as

mining and plant optimizations. These enhancements enable the mill

to handle relatively harder rock blends more effectively, while

also offering the opportunity to increase oxide feed from Agbalé

and other targets.

Kurmuk is expected to start production by mid-2026, contributing

more than 175,000 ounces of gold to the latter half of the 2026

forecast. Significant exploration potential at near-mine locations

around Dish Mountain and Ashashire, and the Tsenge prospect,

supports a strategic mine life of at least 15 years at a mine-site

AISC(1) below $950 per

ounce. This expected performance is driven by increased throughput

and unit costs savings, access to low-cost renewable energy supply

and high grade ore near surface among others.

Overall, these developments across Allied's portfolio, from

enhanced production and cost efficiencies at Sadiola and Bonikro to

the promising exploration and operational optimizations at Agbaou

and Kurmuk, collectively reinforce a positive outlook, positioning

the Company to deliver >600,000 ounces of gold at an

AISC(1) below $1,225 per

ounce in 2026.

ALLIED'S OUTLOOK UNDERPINNED BY

EXPANDING MINERAL RESERVES AND MINERAL RESOURCES

Allied's near-term guidance and longer-term outlook is supported

by growing Mineral Reserves and Mineral Resources which underpin

the longevity of the Company's sustainable production platform and

the optionality to increase near term production and cash flows

from near mine high-yield targets. As at December 31, 2023, Proven and Probable Mineral

Reserves were reported at 11.2 million ounces of gold contained

within 238 million tonnes at a grade of 1.46 g/t, an increase of

over 300,000 ounces versus the previous year. This increase

reflects meaningful growth at Sadiola, Agbaou and Kurmuk, with

partial replacement of mining depletion at Bonikro. Similarly,

total Measured and Indicated Mineral Resources grew to over 16.0

million ounces of gold contained within 330 million tonnes at a

grade of 1.51 g/t, up from 15.2 million ounces in the previous

year, partly due to the conversion of Inferred Mineral Resources,

which ended the year at 1.8 million ounces contained within 43

million tonnes at a grade of 1.29 g/t. Highlights of the expanding

mineral inventory, and the strategic initiatives leveraging their

growth, include:

- Optimizing oxide mineral inventory at Sadiola: Allied is

focused on optimizing the oxide mineral inventory at Sadiola,

aiming to enhance the mine's value by leveraging ongoing

exploration successes. This strategy is designed to optimize

near-term cash flow and refine the capital expenditure profile. The

start of production from Diba, anticipated in the first half of

2024, will introduce near-surface high-grade oxide ore into the

processing mix, complementing the increased rates of fresh ore

feed. As of December 31, 2023, Allied

has identified Proven and Probable Mineral Reserves at Diba,

totaling 280,000 ounces of gold contained within 6.1 million tonnes

at a grade of 1.43 g/t. Additionally, the total Measured and

Indicated Resource at Diba, inclusive of Mineral Reserves, is now

estimated at 377,000 ounces of gold contained within 8.8 million

tonnes at a grade of 1.33 g/t. To further grow near-term oxide

inventories and maximize near-term free cash flow and operational

flexibility, Allied has approved an $8

million 2024 exploration budget at Sadiola, in part, to

support a 12,000-meter drilling program aimed at extending these

Mineral Resources. Significant work programs are also being pursued

at Sekekoto West, FE4 and S12 where results to date show the

potential to add additional near-term high-grade oxide ore to the

mine plans. Sadiola maintains a world-class mineral inventory with

nearly 7.4 million ounces of gold in Mineral Reserves, contained in

156 million tonnes at a grade of 1.48 g/t. With the addition of

Diba helping to drive a 187% replacement of depletion during 2023,

and additional near mine high-grade oxide targets, the Company has

increased flexibility for the execution of the phased expansion, in

particular allowing for an optimized allocation of capital and

execution of phase 1, which is now expected to be in production in

early 2026.

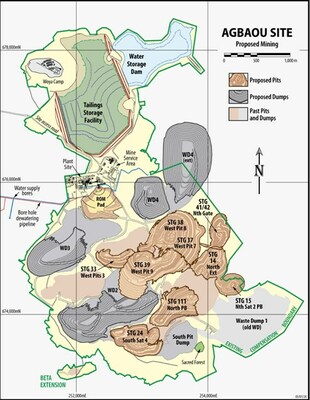

- Extending mine life at Agbaou: The Company is focused on

extending the life of its mines in Côte d'Ivoire through strategic

exploration and resource management, with new life-of-mine planning

at Agbaou supporting total gold production of over 465,000 ounces

through 2028 at a mine-site AISC(1) below $1,450 per ounce versus the most recent

life-of-mine estimate which saw mining cease in mid-2026. The

proposed pit stages for the improved life-of-mine are shown in

Figure 1. This outlook is supported by updated Proven and Probable

Mineral Reserves of approximately 0.5 million ounces of gold

contained within 7.9 million tonnes at a grade of

1.84 g/t. This represents a 25% increase

compared to the previous year and equates to a 229% replenishment

of the year's depletion. Notably, Measured and Indicated Resources,

inclusive of Mineral Reserves, also increased during the year to

nearly 0.9 million ounces of gold contained in 13.3 million tonnes

at a grade of 1.99 g/t, up from 0.6

million ounces. The Company is actively optimizing operations,

focusing on cost reduction while extending mine life and pursuing

growth through the newly defined Agbalé deposit. This

deposit is planned for processing at Agbaou, as

detailed in the following section. The company has allocated

$6 million to further advance

exploration initiatives at Agbaou in 2024.

- Exploration upside at Bonikro: At Bonikro, ongoing

drilling successes at Agbalé and Oume (formerly known as Dougbafla)

have led to a 28% increase in Measured and Indicated Mineral

Resources, now totaling 1.4 million ounces of gold in 32.8 million

tonnes at a grade of 1.32 g/t. Despite a decrease in Mineral

Reserves by 74,000 ounces to 0.6 million ounces contained in 13.7

million tonnes at a grade of 1.30 g/t, the Company managed to

partially offset depletion given 2023 production of 99,409 ounces.

This reflects the exploration strategy to increase total Mineral

Resources at Oume first to better define the orebody before

stepping up infill-drilling. Exploration drilling continues at

Oume, including advanced resource drilling at Oume West and North.

Additionally, Allied is conducting resource drilling at Akissi-So

and scout drilling at Agbalé in the Hire area to expand the mineral

inventory. As noted above, Agbalé ore is planned to be transported

to Agbaou due to its metallurgy and short haulage distances. These

efforts are part of a broader strategy to extend the strategic mine

life in Côte d'Ivoire to over 10 years, aiming for annual

production of 180-200,000 gold ounces at reduced costs. To support

this aim, $10.5 million is allocated

for total exploration spending at Bonikro in 2024.

- Definition Drilling and Upside Potential at Kurmuk:

Definition drilling at Kurmuk has resulted in a 5% increase in

Proven and Probable Mineral Reserves to 2.7 million gold ounces

contained in 60.5 million tonnes at a grade of 1.41 g/t. Similarly,

total Measured and Indicated Mineral Resources increased to over

3.1 million ounces contained in 57.9 million tonnes at a grade of

1.68 g/t. These advancements, however, do not yet reflect the

outcomes of in-pit Inferred Mineral Resource conversion drilling

and ongoing regional exploration efforts, which has continued to

meet with success and supports the broader strategy to extend the

strategic mine life to at least 15 years. Drilling efforts, as part

of the $7.5 million 2024 exploration

budget at Kurmuk, are concentrated on near-mine targets around Dish

Mountain and Ashashire, which are the initial open pits housing all

current Mineral Reserves. Additionally, drilling activities

continue with several diamond drill rigs at the Tsenge Prospect,

defined by a 9km gold in soil and rock anomaly. Initial holes at

Tsenge have returned economic widths and grades of gold in drill

core, indicating significant upside potential which could

potentially contribute to extend mine life and optimize short term

production.

FINANCIAL FLEXIBILITY

Allied is actively executing a select number of non-dilutive

alternatives to enhance the company's financial flexibility as it

progresses with its growth initiatives, which include streams on

producing assets and a gold prepay facility. This strategic

direction is prompted by the current capital markets not fully

capturing the inherent value of the Company's assets, leading

Allied to seek alternative sources of capital that offer low-cost

options with the added benefit of more accurately reflecting true

value to market participants. Among these initiatives, Allied is in

advanced discussions to implement a stream for approximately

$50 million on non-core assets, with

the competitive tension in the market supporting the potential to

raise proceeds of about $75-100

million from a small 0.75-1.00% stream on Sadiola. Additionally,

the company aims to secure at least $100

million in proceeds by late 2024 or early 2025 through a

gold prepay facility, which not only brings forward revenue but

also includes a built-in gold price collar amidst favorable market

rates, acting as a hedge against gold price depreciation during the

construction of Kurmuk. Furthermore, Allied has completed

negotiations and entered into a Revolving Credit Facility, which it

does not expect to draw upon, reinforcing its financial strategy to

support growth while mitigating downside price risks.

The Company will release its fourth quarter and year-end 2023

operational and financial results after the market closes on

Tuesday, March 26, 2024, Eastern Daylight

Time ("EDT"). The Company will then host a conference call

and webcast to review the results on Wednesday, March 27, 2024, at 9:00 a.m. EDT.

|

Fourth Quarter 2023

Conference Call

|

|

|

|

Toll-free dial-in

number (Canada/US):

|

1-800-898-3989

|

|

Local dial-in

number:

|

416-406-0743

|

|

Toll Free

(UK):

|

00-80042228835

|

|

Participant

passcode:

|

5324345#

|

|

Webcast:

|

https://alliedgold.com/investors/presentations

|

|

Conference Call

Replay

|

|

Toll-free dial-in

number (Canada/US):

|

1-800-408-3053

|

|

Local dial-in

number:

|

905-694-9451

|

|

Passcode:

|

6354190#

|

The conference call replay will be available from

12:00 p.m. EDT on March 26,

2024, until 11:59 p.m. EDT on

April 26, 2024.

Mineral Reserves at 31 December

2023

|

Mineral

Property

|

Proven Mineral

Reserves

|

Probable Mineral

Reserves

|

Total Mineral

Reserves

|

|

Tonnes

(kt)

|

Grade

(g/t)

|

Content

(koz)

|

Tonnes

(kt)

|

Grade

(g/t)

|

Content

(koz)

|

Tonnes

(kt)

|

Grade

(g/t)

|

Content

(koz)

|

|

Sadiola Mine

|

18,612

|

0.82

|

492

|

137,174

|

1.57

|

6,907

|

155,786

|

1.48

|

7,399

|

|

Kurmuk

Project

|

21,864

|

1.51

|

1,063

|

38,670

|

1.35

|

1,678

|

60,534

|

1.41

|

2,742

|

|

Bonikro Mine

|

4,771

|

0.71

|

108

|

8,900

|

1.62

|

462

|

13,671

|

1.30

|

571

|

|

Agbaou Mine

|

1,815

|

2.01

|

117

|

6,092

|

1.79

|

351

|

7,907

|

1.84

|

469

|

|

Total Mineral

Reserves

|

47,061

|

1.18

|

1,782

|

190,836

|

1.53

|

9,399

|

237,897

|

1.46

|

11,180

|

Notes:

- Mineral Reserves are stated effective as at December 31, 2023 and estimated in accordance

with CIM Standards and NI 43-101.

- Shown on a 100% basis.

- Reflects that portion of the Mineral Resource which can be

economically extracted by open pit methods.

- Considers the modifying factors and other parameters, including

but not limited to the mining, metallurgical, social,

environmental, statutory and financial aspects of the project.

Sadiola Mine:

- Includes an allowance for mining dilution at 8% and ore loss at

3%

- A base gold price of US$1,500/oz

was used for the pit optimization, with the selected pit shells

using values of US$1,320/oz (revenue

factor 0.88) for Sadiola Main and US$1,500/oz (revenue factor 1.00) for FE3, FE4,

Diba, Tambali and Sekekoto.

- The cut-off grades used for Mineral Reserves reporting were

informed by a US$1,500/oz gold price

and vary from 0.31 g/t to 0.73 g/t for different ore types due to

differences in recoveries, costs for ore processing and ore

haulage.

Kurmuk Project:

- Includes an allowance for mining dilution at 18% and ore loss

at 2%

- A base gold price of US$1,500/oz

was used for the pit optimization, with the selected pit shells

using values of US$1,320/oz (revenue

factor 0.88) for Ashashire and US$1,440/oz (revenue factor 0.96) for Dish

Mountain.

- The cut-off grades used for Mineral Reserves reporting were

informed by a US$1,500/oz gold price

and vary from 0.30 g/t to 0.45 g/t for different ore types due to

differences in recoveries, costs for ore processing and ore

haulage.

Bonikro Mine:

- Includes an allowance for mining dilution at 8% and ore loss at

5%

- A base gold price of $1,500/oz

was used for the Mineral Reserves for the Bonikro pit:

- With the selected pit shell using a value of $1,388/oz (revenue factor 0.925).

- Cut-off grades vary from 0.68 to 0.74 g/t Au for different

ore types due to differences in recoveries, costs for ore

processing and ore haulage.

- A base gold price of $1,800/oz

was used for the Mineral Reserves for the Agbalé pit:

- With the selected pit shell using a value of US$1,800/oz (revenue factor 1.00).

- Cut-off grades vary from 0.58 to 1.00 g/t Au for different

ore types to the Agbaou processing plant due to differences in

recoveries, costs for ore processing and ore haulage

Agbaou Mine:

- Includes an allowance for mining dilution at 26% and ore loss

at 1%

- A base gold price of $1,500/oz

was used for the Mineral Reserves for the:

- Pit designs (revenue factor 1.00) apart from North Gate (Stage

41) and South Sat (Stage 215) pit designs which used a higher short

term gold price of $1,800/oz and

account for 49 koz or 10% of the Mineral Reserves.

- Cut-off grades which range from 0.49 to 0.74 g/t for

different ore types due to differences in recoveries, costs for ore

processing and ore haulage.

Mineral Resources at 31 December

2023

|

Mineral

Property

|

Measured Mineral

Resources

|

Indicated

Mineral

Resources

|

Total Measured

and

Indicated Mineral Resources

|

|

Tonnes

(kt)

|

Grade

(g/t)

|

Content

(koz)

|

Tonnes

(kt)

|

Grade

(g/t)

|

Content

(koz)

|

Tonnes

(kt)

|

Grade

(g/t)

|

Content

(koz)

|

|

Sadiola Mine

|

20,079

|

0.86

|

557

|

205,952

|

1.53

|

10,101

|

226,031

|

1.47

|

10,659

|

|

Kurmuk

Project

|

20,472

|

1.74

|

1,148

|

37,439

|

1.64

|

1,972

|

57,912

|

1.68

|

3,120

|

|

Bonikro Mine

|

7,033

|

0.98

|

222

|

25,793

|

1.41

|

1,171

|

32,826

|

1.32

|

1,393

|

|

Agbaou Mine

|

2,219

|

2.15

|

154

|

11,130

|

1.96

|

701

|

13,349

|

1.99

|

855

|

|

Total Mineral

Resources

|

49,804

|

1.30

|

2,081

|

280,315

|

1.55

|

13,945

|

330,118

|

1.51

|

16,027

|

Inferred Mineral Resources at 31

December 2023

|

Mineral

Property

|

Inferred Mineral

Resources

|

|

Tonnes

(kt)

|

Grade

(g/t)

|

Content

(koz)

|

|

Sadiola Mine

|

16,177

|

1.12

|

581

|

|

Kurmuk

Project

|

5,980

|

1.62

|

311

|

|

Bonikro Mine

|

19,588

|

1.30

|

816

|

|

Agbaou Mine

|

959

|

1.84

|

57

|

|

Total Mineral

Resources

|

42,704

|

1.29

|

1,765

|

Notes:

- Mineral Resources are estimated in accordance with CIM

Standards and NI 43-101.

- Shown on a 100% basis.

- Are inclusive of Mineral Reserves. Mineral Resources that are

not Mineral Reserves do not have demonstrated economic

viability.

- Are listed at 0.5 g/t Au cut-off grade, constrained within an

US$1,800/oz pit shell and depleted to

31 December 2023.

- Rounding of numbers may lead to discrepancies when summing

columns.

Qualified Persons

Except as otherwise disclosed, all scientific and technical

information contained in this press release has been reviewed and

approved by Sébastien Bernier, P.Geo (Vice President, Technical

Performance and Compliance). Mr. Bernier is an employee of Allied

and a "Qualified Person" as defined by Canadian Securities

Administrators' National Instrument 43-101 - Standards of

Disclosure for Mineral Projects ("NI 43-101").

About Allied Gold

Corporation

Allied Gold is a Canadian-based gold producer with a significant

growth profile and mineral endowment which operates a portfolio of

three producing assets and development projects located in Côte

d'Ivoire, Mali, and Ethiopia. Led by a team of mining executives

with operational and development experience and proven success in

creating value, Allied Gold aspires to become a mid-tier next

generation gold producer in Africa

and ultimately a leading senior global gold producer.

|

END

NOTES

|

|

|

|

(1)

|

This is a non-GAAP

financial performance measure. Refer to the Non-GAAP Financial

Performance Measures section at the end of this news

release.

|

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION AND STATEMENTS

This press release contains "forward-looking information"

including "future oriented financial information" under applicable

Canadian securities legislation. Except for statements of

historical fact relating to the Company, information contained

herein constitutes forward-looking information, including, but not

limited to, any information as to the Company's strategy,

objectives, plans or future financial or operating performance.

Forward-looking statements are characterized by words such as

"plan", "expect", "budget", "target", "project", "intend",

"believe", "anticipate", "estimate" and other similar words or

negative versions thereof, or statements that certain events or

conditions "may", "will", "should", "would" or "could" occur. In

particular, forward-looking information included in this press

release includes, without limitation, statements with respect

to:

- the Company's expectations in connection with the production

and exploration, development and expansion plans at the Company's

projects discussed herein being met;

- the Company's plans to continue building on its base of

significant gold production, development-stage properties,

exploration properties and land positions in Mali, Côte d'Ivoire and Ethiopia through optimization initiatives at

existing operating mines, development of new mines, the advancement

of its exploration properties and, at times, by targeting other

consolidation opportunities with a primary focus in Africa;

- the Company's expectations relating to the performance of its

mineral properties;

- the estimation of Mineral Reserves and Mineral Resources;

- the timing and amount of estimated future production;

- the estimation of the life of mine of the Company's

projects;

- the timing and amount of estimated future capital and operating

costs;

- the costs and timing of exploration and development

activities;

- the Company's expectations regarding the timing of feasibility

or pre-feasibility studies, conceptual studies or environmental

impact assessments;

- the effect of government regulations (or changes thereto) with

respect to restrictions on production, export controls, income

taxes, expropriation of property, repatriation of profits,

environmental legislation, land use, water use, land claims of

local people, mine safety and receipt of necessary permits;

- the Company's community relations in the locations where it

operates and the further development of the Company's social

responsibility programs;

- the Company's expectations regarding the payment of any future

dividends; and

- the Company's aspirations to become a mid-tier next generation

gold producer in Africa and

ultimately a leading senior global gold producer.

Forward-looking information is based on the opinions,

assumptions and estimates of management considered reasonable at

the date the statements are made, and is inherently subject to a

variety of risks and uncertainties and other known and unknown

factors that could cause actual events or results to differ

materially from those projected in the forward-looking information.

These factors include the Company's dependence on products produced

from its key mining assets; fluctuating price of gold; risks

relating to the exploration, development and operation of mineral

properties, including but not limited to adverse environmental and

climatic conditions, unusual and unexpected geologic conditions and

equipment failures; risks relating to operating in emerging

markets, particularly Africa,

including risk of government expropriation or nationalization of

mining operations; health, safety and environmental risks and

hazards to which the Company's operations are subject; the

Company's ability to maintain or increase present level of gold

production; nature and climatic condition risks; counterparty,

credit, liquidity and interest rate risks and access to financing;

cost and availability of commodities; increases in costs of

production, such as fuel, steel, power, labour and other

consumables; risks associated with infectious diseases; uncertainty

in the estimation of Mineral Reserves and Mineral Resources; the

Company's ability to replace and expand Mineral Resources and

Mineral Reserves, as applicable, at its mines; factors that may

affect the Company's future production estimates, including but not

limited to the quality of ore, production costs, infrastructure and

availability of workforce and equipment; risks relating to partial

ownerships and/or joint ventures at the Company's operations;

reliance on the Company's existing infrastructure and supply chains

at the Company's operating mines; risks relating to the

acquisition, holding and renewal of title to mining rights and

permits, and changes to the mining legislative and regulatory

regimes in the Company's operating jurisdictions; limitations on

insurance coverage; risks relating to illegal and artisanal mining;

the Company's compliance with anti-corruption laws; risks relating

to the development, construction and start-up of new mines,

including but not limited to the availability and performance of

contractors and suppliers, the receipt of required governmental

approvals and permits, and cost overruns; risks relating to

acquisitions and divestures; title disputes or claims; risks

relating to the termination of mining rights; risks relating to

security and human rights; risks associated with processing and

metallurgical recoveries; risks related to enforcing legal rights

in foreign jurisdictions; competition in the precious metals mining

industry; risks related to the Company's ability to service its

debt obligations; fluctuating currency exchange rates (including

the US Dollar, Euro, West African CFA Franc and Ethiopian Birr

exchange rates); the values of assets and liabilities based on

projected future conditions and potential impairment charges; risks

related to shareholder activism; timing and possible outcome of

pending and outstanding litigation and labour disputes; risks

related to the Company's investments and use of derivatives;

taxation risks; scrutiny from non-governmental organizations;

labour and employment relations; risks related to third-party

contractor arrangements; repatriation of funds from foreign

subsidiaries; community relations; risks related to relying on

local advisors and consultants in foreign jurisdictions; the impact

of global financial, economic and political conditions, global

liquidity, interest rates, inflation and other factors on the

Company's results of operations and market price of common shares;

risks associated with financial projections; force majeure events;

the Company's plans with respect to dividend payment; transactions

that may result in dilution to common shares; future sales of

common shares by existing shareholders; the Company's dependence on

key management personnel and executives; possible conflicts of

interest of directors and officers of the Company; the reliability

of the Company's disclosure and internal controls; compliance with

international ESG disclosure standards and best practices;

vulnerability of information systems including cyber attacks; as

well as those risk factors discussed or referred to herein.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking information,

there may be other factors that could cause actions, events or

results to not be as anticipated, estimated or intended. There can

be no assurance that forward-looking information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. The Company

undertakes no obligation to update forward-looking information if

circumstances or management's estimates, assumptions or opinions

should change, except as required by applicable law. The reader is

cautioned not to place undue reliance on forward-looking

information. The forward-looking information contained herein is

presented for the purpose of assisting investors in understanding

the Company's expected financial and operational performance and

results as at and for the periods ended on the dates presented in

the Company's plans and objectives and may not be appropriate for

other purposes.

CAUTIONARY NOTES TO INVESTORS –

MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

Mineral Resources are stated effective as at December 31, 2023, reported at a 0.5 g/t cut-off

grade, constrained within an $1,800/oz pit shell and estimated in accordance

with the 2014 Canadian Institute of Mining, Metallurgy and

Petroleum Definition Standards for Mineral Resources and Mineral

Reserves ("CIM Standards") and 43-101. Where Mineral Resources are

stated alongside Mineral Reserves, those Mineral Resources are

inclusive of, and not in addition to, the stated Mineral Reserves.

Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability.

Mineral Reserves are stated effective as at December 31, 2023 and estimated in accordance

with CIM Standards and NI 43-101. The Mineral Reserves:

- are inclusive of the Mineral Resources which were converted in

line with the material classifications based on the level of

confidence within the Mineral Resource estimate;

- reflect that portion of the Mineral Resources which can be

economically extracted by open pit methods;

- consider the modifying factors and other parameters, including

but not limited to the mining, metallurgical, social,

environmental, statutory and financial aspects of the project;

- include an allowance for mining dilution and ore loss; and

- were reported using cut-off grades that vary by ore type due to

variations in recoveries and operating costs. The majority (99.3%

of contained gold) of the cut-off grades and pit shells were based

on a $1,500/oz gold price with three

short term pits (Agbale, North Gate and South Sat 3 cutback) were

based on a $1,800/oz gold price.

Mineral Reserve and Mineral Resource estimates are shown on a

100% basis. Designated government entities and national minority

shareholders hold the following interests in each of the mines: 20%

of Sadiola, 10% of Bonikro and 15% of Agbaou. Only a portion of the

government interests are carried. The Government of Ethiopia is entitled to a 7% equity

participation in Kurmuk once the mine enters into commercial

production.

The Mineral Resource and Mineral Reserve estimates for each of

the Company's mineral properties have been approved by the

qualified persons, within the meaning of NI 43-101, as set forth

below:

- Mineral Resources: John Cooke of

Allied Gold Corporation

- Mineral Reserves: Steve Craig of

Orelogy Consulting Pty Ltd.

Except as otherwise disclosed, all scientific and technical

information contained in this press release has been reviewed and

approved by Sébastien Bernier, P.Geo (Vice President, Technical

Performance and Compliance). Mr. Bernier is an employee of Allied

and a "Qualified Person" as defined by Canadian Securities

Administrators' NI 43-101.

Readers should also refer to the technical reports in respect of

the Sadiola Mine, the Kurmuk Project, the Bonikro Mine and the

Agbaou Mine, as well as the Annual Information Form of the Company

for the year ended December 31, 2022

dated September 7, 2023, each

available on SEDAR at www.sedarplus.ca for further information on

Mineral Reserves and Mineral Resources, which is subject to the

qualifications and notes set forth therein.a

CAUTIONARY NOTE TO U.S. INVESTORS

REGARDING ESTIMATES OF MEASURED, INDICATED AND INFERRED

RESOURCES

This press release uses the terms "Measured", "Indicated" and

"Inferred" Mineral Resources as defined in accordance with NI

43-101. United States readers are

advised that while such terms are recognized and required by

Canadian securities laws, the United States Securities and Exchange

Commission does not recognize them. Under United States standards, mineralization may

not be classified as a "reserve" unless the determination has been

made that the mineralization could be economically and legally

produced or extracted at the time the reserve calculation is made.

United States readers are

cautioned not to assume that all or any part of the mineral

deposits in these categories will ever be converted into reserves.

In addition, "Inferred Resources" have a great amount of

uncertainty as to their existence, and as to their economic and

legal feasibility. It cannot be assumed that all or any part of an

Inferred Resource will ever be upgraded to a higher category.

United States readers are also

cautioned not to assume that all or any part of an Inferred Mineral

Resource exists or is economically or legally mineable.

CAUTIONARY STATEMENT REGARDING

NON-GAAP MEASURES

The Company has included certain non-GAAP financial performance

measures to supplement its Consolidated Financial Statements, which

are presented in accordance with IFRS, including the following:

- Cash costs per gold ounce sold;

- AISC per gold ounce sold; and

The Company believes that these measures, together with measures

determined in accordance with IFRS, provide investors with an

improved ability to evaluate the underlying performance of the

Company.

Non-GAAP financial performance measures do not have any

standardized meaning prescribed under IFRS, and therefore may not

be comparable to similar measures employed by other companies.

Non-GAAP financial performance measures are intended to provide

additional information, and should not be considered in isolation

or as a substitute for measures of performance prepared in

accordance with IFRS and are not necessarily indicative of

operating costs, operating earnings or cash flows presented under

IFRS.

Management's determination of the components of non-GAAP

financial performance measures and other financial measures are

evaluated on a periodic basis, influenced by new items and

transactions, a review of investor uses and new regulations as

applicable. Any changes to the measures are duly noted and

retrospectively applied, as applicable. Subtotals and per unit

measures may not calculate based on amounts presented in the

following tables due to rounding.

The measures of cash costs and AISC, along with revenue from

sales, are considered to be key indicators of a company's ability

to generate operating earnings and cash flows from its mining

operations.

CASH COSTS PER GOLD OUNCE

SOLD

Cash costs include mine site operating costs such as mining,

processing, administration, production taxes and royalties which

are not based on sales or taxable income calculations. Cash costs

exclude DA, exploration costs, accretion and amortization of

reclamation and remediation, and capital, development and

exploration spend. Cash costs include only items directly related

to each mine site, and do not include any cost associated with the

general corporate overhead structure.

The Company discloses cash costs because it understands that

certain investors use this information to determine the Company's

ability to generate earnings and cash flows for use in investing

and other activities. The Company believes that conventional

measures of performance prepared in accordance with IFRS do not

fully illustrate the ability of its operating mines to generate

cash flows. The most directly comparable IFRS measure is cost of

sales, excluding DA. As aforementioned, this non-GAAP measure does

not have any standardized meaning prescribed under IFRS, and

therefore may not be comparable to similar measures employed by

other companies, should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS, and is not necessarily indicative of operating costs,

operating earnings or cash flows presented under IFRS.

Cash costs are computed on a weighted average basis, with the

aforementioned costs, net of by-product revenue credits from sales

of silver, being the numerator in the calculation, divided by gold

ounces sold.

AISC PER GOLD OUNCE SOLD

AISC figures are calculated generally in accordance with a

standard developed by the World Gold Council ("WGC"), a

non-regulatory, market development organization for the gold

industry. Adoption of the standard is voluntary, and the standard

is an attempt to create uniformity and a standard amongst the

industry and those that adopt it. Nonetheless, the cost measures

presented herein may not be comparable to other similarly titled

measures of other companies. The Company is not a member of the WGC

at this time.

AISC include cash costs (as defined above), mine sustaining

capital expenditures (including stripping), sustaining mine-site

exploration and evaluation expensed and capitalized, and accretion

and amortization of reclamation and remediation. AISC exclude

capital expenditures attributable to projects or mine expansions,

exploration and evaluation costs attributable to growth projects,

DA, income tax payments, borrowing costs and dividend payments.

AISC include only items directly related to each mine site, and do

not include any cost associated with the general corporate overhead

structure. As a result, Total AISC represent the weighted average

of the three operating mines, and not a consolidated total for the

Company. Consequently, this measure is not representative of all of

the Company's cash expenditures.

Sustaining capital expenditures are expenditures that do not

increase annual gold ounce production at a mine site and exclude

all expenditures at the Company's development projects as well as

certain expenditures at the Company's operating sites that are

deemed expansionary in nature, such as the Sadiola Phased

Expansion, the construction and development of Kurmuk and the PB5

pushback at Bonikro. Exploration capital expenditures

represent exploration spend that has met criteria for

capitalization under IFRS.

The Company discloses AISC as it believes that the measure

provides useful information and assists investors in understanding

total sustaining expenditures of producing and selling gold from

current operations, and evaluating the Company's operating

performance and its ability to generate cash flow. The most

directly comparable IFRS measure is cost of sales, excluding DA. As

aforementioned, this non-GAAP measure does not have any

standardized meaning prescribed under IFRS, and therefore may not

be comparable to similar measures employed by other companies,

should not be considered in isolation as a substitute for measures

of performance prepared in accordance with IFRS, and is not

necessarily indicative of operating costs, operating earnings or

cash flows presented under IFRS.

AISC are computed on a weighted average basis, with the

aforementioned costs, net of by-product revenue credits from sales

of silver, being the numerator in the calculation, divided by gold

ounces sold.

View original content to download

multimedia:https://www.prnewswire.com/news-releases/allied-gold-announces-preliminary-2023-operating-results-2024-guidance-and-medium-term-outlook-highlighting-upside-to-its-sustainable-production-base-with-improved-costs-and-growing-mineral-inventory-302066824.html

View original content to download

multimedia:https://www.prnewswire.com/news-releases/allied-gold-announces-preliminary-2023-operating-results-2024-guidance-and-medium-term-outlook-highlighting-upside-to-its-sustainable-production-base-with-improved-costs-and-growing-mineral-inventory-302066824.html

SOURCE Allied Gold Corporation