0001616707false00016167072025-03-072025-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 7, 2025

WAYFAIR INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-36666 | 36-4791999 |

(State or other jurisdiction of

incorporation or organization) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| 4 Copley Place | Boston | MA | 02116 |

| (Address of principal executive offices) | | | (Zip Code) |

(617) 532-6100

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.001 par value per share | W | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05. Costs Associated with Exit or Disposal Activities.

On March 7, 2025, Wayfair Inc. (“Wayfair” or the “Company”) announced a workforce reduction involving approximately 340 members of its Technology team. These changes reflect efforts to reshape, streamline and refocus the Company’s Technology organization after completing significant modernization and replatforming milestones.

As a result of this reorganization, the Company expects to incur aggregate charges of approximately $33 million to $38 million, consisting primarily of cash employee-related costs, including severance, benefits and transition costs (excluding non-cash charges associated with equity-based compensation). The majority of the cash payments are expected to be made over the next 12 months.

In the near term, the Company expects elevated transition costs will largely offset structural cost savings from the Technology reorganization. However, the Company expects to incrementally realize savings from the reorganization starting in the second half of 2025, and building into the beginning of 2026.

These estimates, and the timing thereof, are subject to a number of assumptions, and actual charges and results may differ materially from estimates. The Company may also incur charges and expenditures not currently contemplated due to unanticipated events that may occur in connection with the reorganization.

Item 7.01. Regulation FD Disclosure.

On March 7, 2025, Wayfair issued a blog post relating to the Technology reorganization. A copy of the blog post is furnished as Exhibit 99.1 and incorporated herein by reference.

The information furnished in this Item 7.01 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly provided by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | | |

| 104 | | | Cover Page Interactive Data File (embedded within Inline XBRL document) |

This Current Report on Form 8-K contains forward-looking statements within the meaning of federal and state securities laws. All statements other than statements of historical fact contained herein including, but not limited to, statements regarding the estimated costs resulting from the workforce reduction, as well as when the Company expects any such charges, costs or savings will occur are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “continues,” “could,” “intends,” “goals,” “target,” “projects,” “contemplates,” “returning,” “believes,” “estimates,” “predicts” or “potential” or the negative of these terms or other similar expressions.

Forward-looking statements are based on current expectations of future events. The Company cannot guarantee that any forward-looking statement will be accurate, although it believes it has been reasonable in its expectations and assumptions. Investors should realize that if underlying assumptions prove inaccurate or that known or unknown risks or uncertainties materialize, actual results could vary materially from the Company’s expectations and projections. Investors are therefore cautioned not to place undue reliance on any forward-looking statements. These forward-looking statements speak only as of the date hereof and, except as required by applicable law, the Company undertakes no obligation to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | WAYFAIR INC. |

| | |

| | |

Date: March 7, 2025 | | /s/ ANDREW OLIVER |

| | Andrew Oliver |

| | | Deputy General Counsel and Assistant Secretary |

Evolving Our Technology Organization for the Future

Over the past five years, we have embarked on a major transformation to modernize our technology stack, including a comprehensive replatforming and migration to the cloud. This journey required significant investment, dedication, and the collective effort of our talented technology teams. We now operate on a modern, scalable, and high-performance infrastructure designed to adapt to the evolving needs of our customers and business.

With the foundation of this transformation now in place, our technology needs have shifted. To best support Wayfair’s next phase of growth, we must refocus our resources, streamline our operations, and ensure our teams are structured for long-term success. As part of this effort, we are making the difficult but necessary decision to reshape our Technology organization, which includes the departure of approximately 340 valued colleagues and friends.

Additionally, we decided to streamline our Technology Development Center (TDC) footprint to enhance collaboration and efficiency, making the tough choice to close our Austin TDC. Austin was a valuable hub for us, and we sincerely thank our team there for their many contributions. Moving forward, our TDCs in Seattle, Mountain View, Toronto, Boston, and Bengaluru will be our key centers of innovation.

This decision was made after extensive analysis on how to best position our Technology organization for future success. We deeply appreciate the contributions of those affected. These colleagues have played a key role in helping us build the robust technology foundation we have today, and we are grateful for their hard work and dedication. We are committed to supporting those impacted with a comprehensive support package as they navigate their next steps.

Looking Ahead

As we enter this next phase, our commitment to technological excellence is unwavering. We will continue to invest in cutting-edge solutions that improve our platform, enhance the shopping experience, and drive business growth. With a strong market position and ongoing innovation, we are delivering greater value to our customers while reinforcing our leadership in retail.

Wayfair will continue to invest aggressively in technology, with our team of over 2,500 technologists helping us advance retail innovation. By investing in technology to drive our strategic priorities, we are positioning Wayfair for continued success in an ever-evolving retail landscape.

We are harnessing technology to inspire and guide our customers, especially those who are unsure of what they’re looking for and eager to explore different styles. We're also significantly advancing personalization and simplifying navigation by tailoring our assortment precisely to each customer’s unique needs. These are just some of the innovations underway. Additionally, we are leveraging generative AI to boost productivity across our organization, ensuring efficiency and innovation at every level. Together, these advancements empower us to fulfill our brand promise—making it easy for our customers to create a home that is just right for them.

To all of our Wayfair team members—thank you for your dedication, resilience, and contributions to our journey. Your commitment fuels our innovation and strengthens our ability to shape the future of retail.

Forward Looking Statements

This blog post contains forward-looking statements within the meaning of federal and state securities laws. All statements other than statements of historical fact contained in this post, including, but not limited to, statements regarding our technology investment plans and anticipated returns on those investments, our future customer growth, our future results of operations and financial position, business strategy and plans, and the financial impact and expected savings of our restructuring plan, as well as when we expect any such charges, costs or savings will occur — are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these terms or other similar expressions. We cannot guarantee that any forward-looking statement will be accurate, although we believe we have been reasonable in our expectations and assumptions. If underlying assumptions prove inaccurate or that known or unknown risks or uncertainties materialize, actual results could vary materially from expectations and projections. You are therefore cautioned not to rely on any forward-looking statements. For important information about the risks and uncertainties that could cause actual results to vary materially from the assumptions, expectations, and projections expressed in any forward-looking statements, please review our most recent Annual Report on Form 10-K and our other filings and reports with the Securities and Exchange Commission. Our forward-looking statements speak only as of the date hereof and, except as required by applicable law, we undertake no obligation to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events or otherwise.

###

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

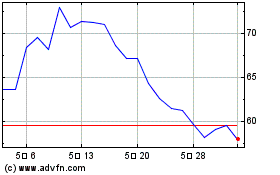

Wayfair (NYSE:W)

과거 데이터 주식 차트

부터 2월(2) 2025 으로 3월(3) 2025

Wayfair (NYSE:W)

과거 데이터 주식 차트

부터 3월(3) 2024 으로 3월(3) 2025