0000720005DEF 14Afalse00007200052022-10-012023-09-30iso4217:USD00007200052021-10-012022-09-3000007200052020-10-012021-09-300000720005ecd:PeoMemberrjf:StockAwardsAdjustmentsMember2022-10-012023-09-300000720005ecd:PeoMemberrjf:StockAwardsAdjustmentsMember2021-10-012022-09-300000720005ecd:PeoMemberrjf:StockAwardsAdjustmentsMember2020-10-012021-09-300000720005rjf:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2022-10-012023-09-300000720005rjf:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2021-10-012022-09-300000720005rjf:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2020-10-012021-09-300000720005ecd:PeoMemberrjf:EquityAwardsGrantedInPriorYearsUnvestedMember2022-10-012023-09-300000720005ecd:PeoMemberrjf:EquityAwardsGrantedInPriorYearsUnvestedMember2021-10-012022-09-300000720005ecd:PeoMemberrjf:EquityAwardsGrantedInPriorYearsUnvestedMember2020-10-012021-09-300000720005ecd:PeoMemberrjf:EquityAwardsGrantedDuringTheYearVestedMember2022-10-012023-09-300000720005ecd:PeoMemberrjf:EquityAwardsGrantedDuringTheYearVestedMember2021-10-012022-09-300000720005ecd:PeoMemberrjf:EquityAwardsGrantedDuringTheYearVestedMember2020-10-012021-09-300000720005rjf:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-10-012023-09-300000720005rjf:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-10-012022-09-300000720005rjf:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-10-012021-09-300000720005ecd:PeoMemberrjf:EquityAwardsThatFailedToMeetVestingConditionsMember2022-10-012023-09-300000720005ecd:PeoMemberrjf:EquityAwardsThatFailedToMeetVestingConditionsMember2021-10-012022-09-300000720005ecd:PeoMemberrjf:EquityAwardsThatFailedToMeetVestingConditionsMember2020-10-012021-09-300000720005ecd:PeoMemberrjf:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2022-10-012023-09-300000720005ecd:PeoMemberrjf:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2021-10-012022-09-300000720005ecd:PeoMemberrjf:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2020-10-012021-09-300000720005ecd:NonPeoNeoMemberrjf:StockAwardsAdjustmentsMember2022-10-012023-09-300000720005ecd:NonPeoNeoMemberrjf:StockAwardsAdjustmentsMember2021-10-012022-09-300000720005ecd:NonPeoNeoMemberrjf:StockAwardsAdjustmentsMember2020-10-012021-09-300000720005rjf:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-10-012023-09-300000720005rjf:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-10-012022-09-300000720005rjf:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-10-012021-09-300000720005rjf:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-10-012023-09-300000720005rjf:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-10-012022-09-300000720005rjf:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-10-012021-09-300000720005rjf:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-10-012023-09-300000720005rjf:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-10-012022-09-300000720005rjf:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2020-10-012021-09-300000720005rjf:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-10-012023-09-300000720005rjf:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-10-012022-09-300000720005rjf:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-10-012021-09-300000720005rjf:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2022-10-012023-09-300000720005rjf:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2021-10-012022-09-300000720005rjf:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2020-10-012021-09-300000720005rjf:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2022-10-012023-09-300000720005rjf:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2021-10-012022-09-300000720005rjf:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2020-10-012021-09-30000072000512022-10-012023-09-30000072000522022-10-012023-09-30000072000532022-10-012023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. __ )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material under §240.14a-12 |

Raymond James Financial, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| x | | No fee required |

| o | | Fee paid previously with preliminary materials |

| o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Who We Are

| | | | | |

OUR VISION Our vision is to be a financial services firm as unique as the people we serve, transforming lives, businesses and communities through the power of personal relationships and professional advice. | OUR MISSION Our business is people and their financial well-being. We are committed to helping individuals, corporations and institutions achieve their unique goals, while also developing and supporting successful professionals, and helping our communities prosper. |

| |

OUR VALUES

| | | | | | | | | | | |

| | | |

We put clients first. If we do what’s right for our clients, the firm will do well and we’ll all benefit. | We act with integrity. We put others above self, and what’s right above what’s easy. We believe doing well and doing good aren’t mutually exclusive. | We value independence. We respect autonomy, celebrate individuality and welcome diverse perspectives, while encouraging collaboration and innovation. | We think long term. We act responsibly, taking a conservative approach that translates into a strong, stable firm for clients, advisors, associates and shareholders. |

Letters from Leadership

January 8, 2024

Dear Fellow Shareholder,

I am pleased to invite you to our 2024 Annual Meeting of Shareholders, which will be held virtually, via webcast, on February 22, 2024, at 4:30 p.m. Eastern Standard Time (EST).

Despite the challenging environment this fiscal year, which included a regional banking crisis, heightened volatility, geopolitical turmoil and rapidly rising interest rates, Raymond James achieved record financial results, with annual net revenues of $11.6 billion and net income available to common shareholders of $1.7 billion. This strong performance, driven by record net revenues in the Private Client Group (PCG) and Bank segments, and record pre-tax income in PCG, highlights the resilience of our business model and reinforces the value of our diverse and complementary businesses.

As we previously reported, after 48 years as a director (including 40 as CEO), Tom James shared with us in December his decision to retire from the Board at the end of the annual meeting. I know that I speak for the whole firm when I say how deeply grateful we are for Tom’s tenure and the client-first culture he so thoughtfully and deliberately established. We are thankful that, even after his retirement, he will remain Chairman Emeritus and an active and visible presence in our offices.

We are once again delivering proxy materials to certain shareholders over the Internet. The Notice of Internet Availability of Proxy Materials (“Notice”) contains instructions on how to access our Proxy Statement, Annual Report and other soliciting materials, and on how to vote. The Notice also contains instructions on how to request paper copies of these materials if you so desire.

During the meeting, we will consider the proposals described in this Proxy Statement, and I will provide updates on our performance and progress on strategic initiatives. Your vote is very important to us. Whether or not you plan to participate in the virtual-only meeting directly, we ask that your shares be represented and voted.

On behalf of the Board of Directors and the management of Raymond James, I extend our appreciation for your continued support.

Yours sincerely,

| | | | | |

| Paul C. Reilly Chair and Chief

Executive Officer |

January 8, 2024

Dear Fellow Shareholder,

On behalf of the Board of Raymond James, I would like to join Chief Executive Officer Paul Reilly in inviting you to our company’s Annual Meeting of Shareholders.

Fiscal 2023 has been a year of significant challenges, both in the U.S. and globally. While inflation has eased to some extent, it remains high relative to central bank targets, and the progress achieved has come at the cost of aggressive interest rate hikes by the Federal Reserve. Nonetheless, economic growth has defied most expectations by remaining strong through the fiscal fourth quarter ended September 2023. In the world of finance that Raymond James inhabits, we have seen several high-profile failures, from the implosion of cryptocurrency giant FTX early in fiscal 2023, to the collapse of Silicon Valley Bank and Signature Bank in March and the rescue of First Republic Bank in May.

Against this difficult backdrop, your company’s record performance is even more impressive — record revenue and earnings per share on both a GAAP and adjusted basis, driven primarily by record results in the Private Client Group. Such strong results speak to the quality not only of our senior management team, so ably led by Paul Reilly (now in his 14th year as CEO), but also of all our advisors and associates. It speaks to the soundness of our strategy and our core principles of client focus, conservatism and integrity. It speaks to our position in the market and the recognition among a growing number of high-quality professionals that Raymond James is the preferred employer and partner in our industry.

I have had the honor to serve as a director since 2014, but this has been my first year as your Lead Independent Director. Fortunately, I serve with nine other highly-talented independent directors and alongside Paul Reilly and Chairman Emeritus Tom James. Together we work diligently to position the company to continue to perform well in a wide variety of market and economic conditions.

Thank you for your investment in Raymond James and your continued confidence in us. I wish you all health and prosperity in the year ahead.

Yours sincerely,

| | | | | |

| Jeffrey N. Edwards Lead Independent Director |

Notice of 2024 Annual Meeting of Shareholders

| | | | | | | | | | | |

Date and Time Thursday, February 22, 2024, 4:30 p.m. (EST) Place The meeting will be a virtual-only meeting, conducted exclusively via webcast at www.virtualshareholdermeeting.com/RJF2024. There will not be a physical location for the meeting, so you will not be able to attend the meeting in person. Shareholders will be able to attend, vote, and submit questions (both before, and during a portion of, the meeting) virtually. Record Date December 20, 2023 (“Record Date”) | | Agenda The following proposals will be voted upon: | |

| Proposal 1: To elect the eleven (11) director nominees

named in the Proxy Statement | |

| Proposal 2: To hold an advisory vote on our

executive compensation | |

| Proposal 3: To ratify our independent registered public

accounting firm for fiscal 2024 | |

| Other: To act on any other business that may

properly come before the meeting | |

| | | | | | | | |

| | |

Who Can Vote Shareholders of record

on the Record Date | Who Can Attend All shareholders are invited to attend the Annual Meeting. To attend the meeting at www.virtualshareholdermeeting.com/RJF2024, you must enter the control number on your Notice of Internet Availability of Proxy Materials (“Notice”), proxy card or voting instruction form. The virtual meeting room will open at 4:15 p.m. (EST). | Date of Mailing A Notice or the Proxy Statement, a 2023 Annual Report to Shareholders, and a form of proxy are first being sent to shareholders and participants in our Employee Stock Ownership Plan on or about January 8, 2024. |

| | |

|

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on February 22, 2024: The Proxy Statement, the 2023 Annual Report to Shareholders and the form of proxy card are available online at www.raymondjames.com/investor-relations/news-and-events/shareholders-meeting. |

|

Whether or not you are able to attend the virtual Annual Meeting, please complete, sign and return your proxy card by mail, or vote via the Internet or the toll-free telephone number.

By Order of the Board of Directors,

Jonathan N. Santelli,

General Counsel and Secretary

January 8, 2024

Table of Contents

Company Highlights

About Raymond James

We are a different kind of financial services firm. At a time when the business of investment advice was about telling, Raymond James started with asking. We asked clients about their needs, their concerns and their long-term goals. And more importantly, we listened, providing truly personalized guidance rooted in people-first service. Over 60 years after our founding, we are a publicly traded, global company with distinct business units that serve clients in all 50 states, Canada, the United Kingdom and continental Europe. Throughout that growth, we’ve remained true to the core values that made it possible – long-term planning, independence, integrity and client-first service.

Our mission is to help individuals, corporations and institutions achieve their unique goals, while also developing and supporting successful professionals, and helping our communities prosper.

Our vision is to be a financial services firm as unique as the people we serve, transforming lives, businesses and communities through the power of personal relationships and professional advice.

Among the keys to our success, our emphasis on putting the client first is at the core of our corporate values. We also believe in maintaining a conservative, long-term approach in our decision making. We believe this disciplined approach has helped us build a strong, stable financial services firm for clients, advisors, associates and shareholders.

| | | | | | | | | | | | | | | | | |

| | | | | |

| By the numbers* | | | | |

| | | | | |

$1.26 trillion in total

client assets | Approximately 8,700 financial advisors | More than 2x required total

capital ratio | 143 consecutive

quarters of

profitability | S&P 500 and

Fortune 400 company | Strong issuer and senior long term debt credit ratings: A-/Stable Outlook (Fitch), A3/Stable Outlook (Moody’s), A-/Stable Outlook (S&P) |

| | | | | |

Diverse and Complementary Businesses**

Total net revenues of $11.6 billion for fiscal year ended

September 30, 2023

FY 2023

* As of September 30, 2023.

** Chart is intended to show relative contribution of each of the firm’s four core business segments. Amounts do not add up to total net revenues due to “Other” segment and intersegment eliminations not being depicted. “Other” includes the firm’s interest income on certain corporate cash balances, private equity investments and certain other corporate investing activity, and certain corporate overhead costs of RJF that are not allocated to other segments.

Growth Initiatives

| | | | | | | | | | | | | | |

| | | | |

| | | | |

Drive organic growth

across core businesses | | Expand investments

in technology | | Maintain disciplined focus on

strategic M&A and effective integration |

2023 Performance Highlights

| | | | | | | | | | | |

| in millions, except per share amounts | 2023 | 2022 | % Change |

| Net Revenues | $11,619 | | $11,003 | | 6 | % |

| Net Income Available to Common Shareholders | $1,733 | | $1,505 | | 15 | % |

| Earnings per Common Share (Diluted) | $7.97 | | $6.98 | | 14 | % |

| Common Shareholders’ Equity Attributable to RJF | $10,135 | | $9,338 | | 9 | % |

Common Shares Outstanding(1) | 208.8 | | 215.1 | | (3) | % |

| Book Value per Share | $48.54 | | $43.41 | | 12 | % |

(1)Excludes non-vested Restricted Stock Units (“RSUs”)

All Data as of Fiscal Year Ended September 30, 2023

•Record annual net revenues of $11.62 billion for the fiscal year ended September 30, 2023 (“fiscal 2023”), an increase of 6% over fiscal 2022

•Record net revenues in Private Client Group and Bank segments and record pre-tax income in the Private Client Group highlight the resilience of our business model and reinforce the value of our diverse and complementary businesses

•Record net income available to common shareholders of $1.73 billion, or $7.97 per diluted share; Record adjusted net income available to common shareholders of $1.81 billion(1), or $8.30 per diluted share(1)

•Return on common equity (“ROE”) of 17.7% and adjusted return on common equity ("Adjusted ROE") of 18.4%(1), both strong results, particularly given our robust capital position throughout fiscal 2023

•Returned $1.1 billion to shareholders through common stock dividends and common stock repurchases under the Board's common stock repurchase authorization

•Maintained strong capital position with a total capital ratio, or total regulatory capital to risk-weighted assets, of 22.8%, well above regulatory requirements

(1)Adjusted net income available to common shareholders, adjusted earnings per common share (diluted), and Adjusted ROE are each non-GAAP financial measures. Please refer to Appendix A for reconciliations of these measures to the most directly comparable GAAP measures and other important disclosures.

ESG Highlights

Through fiscal year 2023, we maintained focus on our people, sustainability, community and governance as we sought to build a more sustainable future for clients, associates, advisors and the communities we serve.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PEOPLE | | | | SUSTAINABILITY | | |

| | | | | | | | | | |

Defined our employee value proposition: Raymond James is a place “where good people grow.” | | | | $15 billion+ in equity raised by Raymond James Affordable Housing Investments since inception in 1986 for housing finance authorities and housing developers, including nearly $1.7 billion in equity raised in fiscal year 2023 |

| DIVERSITY METRICS* | | |

Percentage of our US-based associates who self-identify as people of color | | Percentage of our global associates who self-identify as woman | | |

| | | | | | |

| | | | | | |

| | | Approximately 78% of Raymond James financial advisors utilize at least one sustainable investment fund with their clients | |

| | | | | | |

| | | | | | |

| | | Nearly 14,000 trees planted in recognition of Private Client Group clients who chose to receive paperless correspondence |

*As of September 30, 2023 | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMUNITY | | | | GOVERNANCE | | |

| | | | | | | | | | |

| RAYMOND JAMES CARES MONTH | | | BOARD OF DIRECTORS** |

| | | | | | | | | | |

9,600+ volunteer hours | | 250+ charitable organizations supported | | | |

DISASTER AND HUMANITARIAN RELIEF | | |

| | | | | | | | | | |

$1.05M+ | | CA$210k+ | | | | Developed and published a Human Rights Policy |

Raised for disaster relief organizations | | |

| | | | | | | | | | |

| | | | | | | | | | |

| $7.4 million raised in December 2022 through United Way | | | **This information pertains to our non-executive director nominees. |

| | | | | | | | | | |

| | | | | | | | | | |

Proxy Summary

To help you review the proposals to be voted upon at our 2024 Annual Meeting, we have summarized important information in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should carefully read the entire Proxy Statement and our other proxy materials before voting.

| | | | | | | | | | | |

| | | |

| Proposal 1 | | |

| | | |

| Election of Directors | | |

| | | |

| | | |

| The Board recommends a vote FOR each director nominee. | | |

| | | |

Director Nominees

The following provides summary information about each director nominee.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Director

Since | Committee Membership |

| Name and Primary Occupation | Independent | Age | AC | RC | CG&ESG | C&T | CPC |

| Marlene Debel

Executive Vice President, Chief Risk Officer and Head of MetLife Insurance Investments, MetLife, Inc. | | 57 | 2020 | | | | | |

| Robert M. Dutkowsky

Retired, Former Executive Chairman and Chief Executive Officer,

Tech Data Corporation | | 69 | 2018 | | | | | |

| Jeffrey N. Edwards

Chief Operating Officer, New Vernon Advisers, LP | | 62 | 2014 | | | | | |

| Benjamin C. Esty

Professor of Business Administration, Harvard University Graduate School of Business Administration | | 61 | 2014 | | | | | |

| Art A. Garcia

Retired, Former Chief Financial Officer, Ryder System, Inc. | | 62 | 2023 | | | | | |

| Anne Gates

Retired, Former President, MGA Entertainment, Inc. | | 64 | 2018 | | | | | |

| Gordon L. Johnson

President, Highway Safety Devices, Inc. | | 66 | 2010 | | | | | |

| Raymond W. McDaniel, Jr.

Retired, Former Chairman, Moody's Corporation | | 66 | 2023 | | | | | |

| Roderick C. McGeary

Retired, Former Chairman, Co-President and Co-Chief Executive Officer, Tegile Systems, Inc. | | 73 | 2015 | | | | | |

| Paul C. Reilly

Chair and Chief Executive Officer, Raymond James Financial | | 69 | 2006 | | | | | |

| Raj Seshadri

President, Data and Services, Mastercard Incorporated | | 58 | 2019 | | | | | |

| | | | | |

| AC | Audit Committee |

| RC | Risk Committee |

| CG&ESG | Corporate Governance and

ESG Committee |

| | | | | |

| C&T | Compensation and Talent

Committee |

| CPC | Capital Planning

Committee |

Non-Executive Board Nominees Snapshot

Our non-executive (i.e. non-employee) director nominees have a diversity of experience and a variety of complementary skills, education, qualification and viewpoints that strengthen the Board’s ability to carry out its oversight role.

<5 years

5-10 years

>10 years | | | | | |

| 5.6 average years of service |

Non-Executive Board Nominees Skills Matrix

The information below summarizes the range of selected qualifications and experiences that each non-executive director nominee brings to our Board.

| | | | | | | | | | | | | | | | | | | | |

| Non-Executive Director Nominee | | | | | | |

Financial

Industry

Experience | Public Company Chair and/or CEO

Experience | Financial

Reporting | Corporate

Governance | Risk

Management | Information Technology |

| Marlene Debel | | | | | | |

| Robert M. Dutkowsky | | | | | | |

| Jeffrey N. Edwards | | | | | | |

| Benjamin C. Esty | | | | | | |

| Art A. Garcia | | | | | | |

| Anne Gates | | | | | | |

| Gordon L. Johnson | | | | | | |

| Raymond W. McDaniel, Jr. | | | | | | |

| Roderick C. McGeary | | | | | | |

| Raj Seshadri | | | | | | |

Governance Highlights

| | | | | |

| Board Independence and Qualifications | •Ten of our current 12 directors, and ten of our 11 director nominees, are non-executive directors who have been deemed independent under Securities and Exchange Commission (“SEC”) and New York Stock Exchange (“NYSE”) rules •All of our Board committees other than the CPC are composed exclusively of independent directors •Nominees to our Board may not serve on more than three (3) other public company boards |

| Board Diversity and Refreshment | •40% of our non-executive director nominees are people of color •30% of our non-executive director nominees are women •Non-executive directors are normally expected to serve for no more than 12 years |

| Accountability | •Directors are elected for one-year terms •Directors must receive a majority vote of our shareholders to be re-elected •Special meetings of shareholders may be called by holders of 10% or more of our common shares •Our shareholders may act by written consent in lieu of a meeting •We do not maintain a shareholder rights plan, or “poison pill” •We maintain a Director Code of Conduct applicable to the Board •We maintain a robust compensation recoupment (“clawback”) policy applicable to executive officers, with triggers including materially imprudent judgment causing financial or reputational harm, along with a separate Dodd-Frank Clawback Policy in line with NYSE requirements |

| Lead Independent Director | •A lead independent director, selected by our non-executive directors, operates pursuant to a separate written charter •Duties include presiding over executive sessions, recommending agenda topics, facilitating annual self-evaluation of the Board and its committees, assisting in the performance evaluation of our CEO, and CEO succession planning |

| Board Oversight of Risk Management | •Our Board exercises oversight of management’s responsibilities to assess and manage our key risks, including cybersecurity risks •The Board has delegated aspects of its oversight responsibility to its principal committees •The Board recently split certain of its committees in order to further enhance subject matter oversight in certain focus areas |

Board Practices | •Our Board and committees annually review their effectiveness with a questionnaire and confidential one-on-one interviews coordinated by a third-party facilitator or the lead independent director, who reports on results in person to the Board •Evaluation includes review of individual director contributions to the Board by each other director •The Board continually adjusts its nomination criteria, with the goal that the Board continues to reflect an appropriate mix of skills and experience |

Executive Sessions | •Non-executive directors hold executive sessions without management present at least four times per year •The lead independent director presides over these executive sessions •Each major Board committee generally holds executive sessions at regularly scheduled meetings |

Share Ownership Requirements and Trading Limitations | •Robust stock ownership policy requires directors and executive officers to maintain meaningful ownership levels in our stock •Policy restricts trading by directors and executive officers and prohibits certain types of transactions, including use of options, short sales, hedging and pledging of our stock |

| | | | | | | | | | | |

| | |

| Proposal 2 Advisory Vote on Executive Compensation | |

| The Board recommends a vote FOR this proposal. | | |

| | | |

Overview

We are asking our shareholders to vote to approve, on an advisory (nonbinding) basis, the compensation of our named executive officers (“NEOs”) as disclosed in this Proxy Statement in accordance with the SEC’s rules. This proposal, commonly known as a “say-on-pay” proposal, gives our shareholders the opportunity to express their views on our NEOs’ compensation.

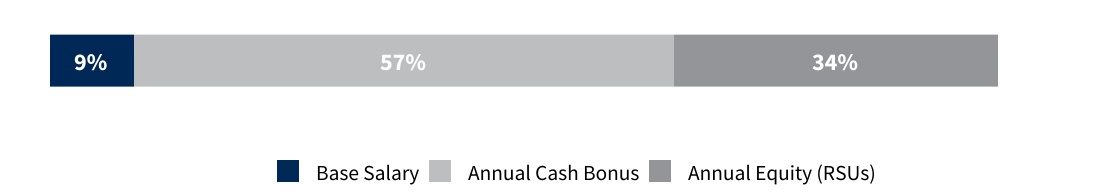

The following charts present the mix of compensation elements actually received for 2023 performance by our chief executive officer ("CEO") and our other NEOs (average, excluding retirement plan contributions):

Components of Total Direct Compensation — 2023 Actual

Response to Say-on-Pay Vote

We hold an annual advisory vote by our shareholders on executive compensation. At the 2023 annual shareholders meeting, 92% of the votes cast were in favor of the “Say-on-Pay” proposal. We believe that the 2023 vote approving the Say-on-Pay proposal once again conveyed our shareholders’ strong support of the Compensation and Talent Committee’s decisions and our existing executive compensation programs. Based on this feedback, the committee determined to continue our current compensation practices as described herein.

% of votes in favor of

Say-on-Pay Proposal in 2023

| | | | | | | | | | | |

| Type | Pay Element | Purpose | Link to Strategy |

| Base Salary | •Provides base level of pay | •Competitive salaries attract and retain key talent |

| Annual Bonus - Cash | •Provides competitive incentive opportunity | •Rewards executives who achieve strategic and financial goals that are important for creating shareholder value •Attracts and retains key talent |

Annual Bonus - Equity (RSUs) | •Aligns executives with shareholder interests •Time-vesting awards encourage retention by vesting at end of 3-year period (if not otherwise retirement eligible) •Performance vesting awards depend on company’s achievement of Adjusted ROE(1) and relative total shareholder return (“rTSR”) thresholds, thus further aligning executives with long-term shareholder interests | •Time-vesting awards serve as a long-term retention tool •Performance-vesting awards encourage executives to focus on key financial metrics where final payout is dependent on company performance and stock price growth |

| Retention Awards - RSUs | •Aligns executives with shareholder interests •Encourages retention by longer vesting period, generally over a five-year period (if not otherwise retirement eligible) | •Serves as a long-term retention tool and further aligns our executives with our shareholders |

| Retirement Plan Contributions | •Profit Sharing, Employee Stock Ownership Plan (“ESOP”) and Long-Term Incentive Plan (“LTIP”) align executives with shareholder interests since contributions are based on company financial results. 401(k) Plan facilitates retirement savings. | •Provide competitive benefits package and further align executives with our shareholders |

(1)Adjusted ROE is a non-GAAP financial measure. Please refer to Appendix A for a reconciliation of this measure to the most directly comparable GAAP measure and other important disclosures.

Our Compensation Practices

| | | | | | | | | | | |

| | |

| Proposal 3 Ratify Appointment of Independent Registered Public Accounting Firm | |

| The Board recommends a vote FOR this proposal. | | |

| | |

The Audit Committee has appointed KPMG LLP as the independent registered public accounting firm to audit the company’s consolidated financial statements for the fiscal year ending September 30, 2024, and to audit the company’s internal control over financial reporting as of September 30, 2024. We are asking our shareholders to ratify this decision by the Audit Committee.

Proposal 1 – Election of Directors

| | | | | |

|

What is being voted on: Election to our Board of 11 director nominees. | Board recommendation: After a review of the individual qualifications and experience of each of our director nominees and his or her contributions to our Board, our Board determined unanimously to recommend that shareholders vote “FOR” all of our director nominees. |

|

Our Directors

The Board currently consists of twelve (12) directors. As previously disclosed, Mr. James informed the company that he would not be standing for re-election to the Board at the Annual Meeting, and the Board has approved resolutions to reduce the number of directors to eleven (11) upon Mr. James’ retirement. The Board has nominated the eleven (11) directors identified below as candidates for election at the Annual Meeting. All nominees are current directors of the company and were unanimously recommended for re-election by the Corporate Governance and ESG Committee (the “CG&ESG Committee”). The Board continually monitors evolving board refreshment best practices, including those with respect to the average tenure of directors and the mix of both non-executive and executive directors.

Board Non-Executive Nominees - Composition and Skills

Our non-executive director nominees have a diversity of experience and a variety of complementary skills, education, qualification and viewpoints that strengthen the Board’s ability to carry out its oversight role. The Board does not consider individual directors to be responsible for particular areas of the Board’s focus or specific categories of issues that may come before it. Rather, the Board seeks to assemble a group of directors that, as a whole, represents a mix of experiences and skills that allows appropriate deliberation on all issues that the Board might be likely to consider. The following information pertains to our non-executive director nominees:

<5 years

5-10 years

>10 years | | | | | |

| 5.6 average years of service |

Proposal 1 – Election of Directors

Director Qualifications

The Board believes there are certain minimum qualifications that each director nominee must satisfy in order to be suitable for a position on the Board, including that such nominee:

•demonstrates high standards of integrity and character

•may not be on the boards of more than three (3) other public companies

•offers important perspectives on some aspect of the company’s business, based on experience

•may not be subject to certain convictions or judgments of courts or regulatory authorities

The table below summarizes the range of selected qualifications and experiences that each non-executive director nominee brings to our Board. The skills included in this table are evaluated against our strategy so that the table can serve as an up-to-date tool for identifying non-executive director nominees who collectively have the complementary experience and skills to guide the company. This summary is not intended to be a complete description of all of the skills and attributes possessed by each director nominee.

Additional information about each Board member’s background, business experience and other matters, as well as a description of how each individual’s experience qualifies him or her to serve as a director, is provided below under the heading “Director Biographies”.

| | | | | | | | | | | | | | | | | | | | |

| Non-Executive Director Nominee | | | | | | |

Financial

Industry

Experience | Public Company Chair and/or CEO

Experience | Financial

Reporting | Corporate

Governance | Risk

Management | Information Technology |

| Marlene Debel | | | | | | |

| Robert M. Dutkowsky | | | | | | |

| Jeffrey N. Edwards | | | | | | |

| Benjamin C. Esty | | | | | | |

| Art A. Garcia | | | | | | |

| Anne Gates | | | | | | |

| Gordon L. Johnson | | | | | | |

| Raymond W. McDaniel, Jr. | | | | | | |

| Roderick C. McGeary | | | | | | |

| Raj Seshadri | | | | | | |

Proposal 1 – Election of Directors

Director Biographies

| | | | | | | | |

| |

| Marlene Debel, 57

Non-Executive Director |

|

Director Since: 2020 RJF Committees •Risk (Chair since 2023) •Audit •Capital Planning Committee | Other Public Directorships •Current: None •Former (past 5 years): None |

| | | | | |

Career Highlights •MetLife, Inc., a leading global provider of insurance, annuities, employee benefits and asset management services ▷Executive Vice President, Chief Risk Officer and Head of MetLife Insurance Investments (2023 – present) ▷Executive Vice President and Chief Risk Officer (2019 – 2023) ▷Executive Vice President and Head of Retirement & Income Solutions (2018 – 2019) ▷Executive Vice President and Chief Financial Officer, U.S. Business (2016 – 2018) ▷Executive Vice President and Treasurer (2011 – 2016) •Global Head of Liquidity Risk Management and Rating Agency Relations, Bank of America (2009 – 2011) •Assistant Treasurer, Merrill Lynch & Co., Inc. (2007 – 2008) | Other Professional Experience and Community Involvement •Foundation Board Member, LaGuardia Community College •Former Board Member, Women’s Forum of New York |

|

Key Experience and Qualifications •Finance and risk management experience: Deep knowledge of finance and more than three decades of experience in financial, strategic and risk management •Financial services management and leadership: Proven business leader who has helped guide organizations through periods of significant growth and change |

|

| | | | | | | | |

| |

| Robert M. Dutkowsky, 69

Non-Executive Director |

| |

Director Since: 2018 RJF Committees •Compensation and Talent (Chair since 2023) •Corporate Governance and ESG | Other Public Directorships •Current: U.S. Foods Holding Corp. (non-executive chair since January 5, 2023); The Hershey Company •Former (past 5 years): Pitney Bowes (2018 - 2023); Tech Data Corporation (2006 – 2020) |

| | | | | |

Career Highlights •Tech Data Corporation, a multinational IT products and services distribution company ▷Executive Chairman (2017 – 2020) ▷Chief Executive Officer (2006 – 2018) •President, Chief Executive Officer, and Chairman, Egenera, Inc., a multinational cloud manager and data center infrastructure automation company (2004 – 2006) •President, Chief Executive Officer and Chairman, J.D. Edwards & Co., Inc., an enterprise resource planning (ERP) software company (2002 – 2004) •President, Chief Executive Officer and Chairman, GenRad, Inc., a manufacturer of electronic automatic test equipment and related software (2000 – 2002) | Other Professional Experience and Community Involvement •Board of Directors, First Tee of Tampa Bay •Board of Directors, Moffitt Research Committee •Advisory Board, University of South Florida Business School •Board of Trustees, University of Tampa |

| |

Key Experience and Qualifications •Technology and technology risks: More than 40 years of experience in the information technology industry, including senior executive positions in sales, marketing and channel distribution with leading manufacturers and software publishers •Corporate governance and leadership: Valuable governance perspectives from substantial senior executive leadership roles and experience as a board member and chair of several public and private companies |

| |

Proposal 1 – Election of Directors

| | | | | | | | |

| | |

| Jeffrey N. Edwards, 62

Non-Executive Director |

| |

Director Since: 2014 RJF Committees •Corporate Governance and ESG •Compensation and Talent •Capital Planning Committee | Other Public Directorships •Current: American Water Works Company, Inc. •Former (past 5 years): None |

| | | | | |

Career Highlights •Chief Operating Officer, New Vernon Advisers, LP, a registered investment advisor (2009 – present) •Merrill Lynch & Co., Inc., a global financial services company ▷Vice Chairman (2007 – 2009) ▷Chief Financial Officer (2005 – 2007) ▷Head of Investment Banking for the Americas (2004 – 2005) ▷Head of Global Capital Markets and Financing (2003 – 2005) ▷Co-head of Global Equities (2001 – 2003) | Other Professional Experience and Community Involvement •Director, The NASDAQ Stock Market (2004 – 2006) •Director, Medusind, Inc., a medical billing company (2012 – 2019) |

| |

Key Experience and Qualifications •Financial services industry: More than two decades of capital markets and corporate finance experience at a global financial services firm •Review and preparation of financial statements: Experience as CFO of large financial services company provides valuable insights to our Board |

| |

| | | | | | | | |

| |

| Benjamin C. Esty, 61

Non-Executive Director |

| |

Director Since: 2014 RJF Committees •Risk •Compensation and Talent | Other Public Directorships •Current: None •Former (past 5 years): None |

| | | | | |

Career Highlights •Harvard University Graduate School of Business Administration ▷Professor of Business Administration teaching corporate finance, corporate strategy and leadership (1993 – present) ▷Roy and Elizabeth Simmons Professor of Business Administration (with tenure, 2005 – present) ▷Head of the Finance Department (2009 – 2014) ▷Founding faculty Chairman, General Management Program (GMP), a comprehensive leadership program for senior executives | Other Professional Experience and Community Involvement •Director and Chair of Audit and Risk Committee, Harvard Business Publishing Group, a not-for-profit education company (2018 - 2023) •Eaton Vance family of mutual funds ▷Independent Trustee (2005 – 2013) ▷Chairman, Portfolio Management Committee (2008 – 2013) •Director, Harvard University Employees Credit Union (1995 – 2001) ▷Member, Finance Committee •Finance and Investment Committee, Deaconess Abundant Life Communities, a not-for-profit continuing care retirement community (2017 – present) •Member of the Advisory Board, The GEM Group (2021 – present), a private seller of promotional products |

|

Key Experience and Qualifications •Finance, investment and risk management: Extensive knowledge of finance and deep experience in the mutual fund / investment management business, including evaluation of fund performance, investment strategies, acquisition analysis, valuation analysis, trading, and risk management •Financial services industry: Provides valuable insight to the company’s investment banking, commercial banking, and asset management businesses, as well as its own financing activities •Executive leadership development: Experience in leadership development assists Board in oversight of management succession |

|

Proposal 1 – Election of Directors

| | | | | | | | |

| |

| Art A. Garcia, 62 Non-Executive Director |

|

Director Since: 2023 RJF Committees •Risk | Other Public Directorships •Current: ABM Industries Incorporated; American Electric Power Company, Inc.; Elanco Animal Health Incorporated •Former (past 5 years): None |

| | | | | |

Career Highlights •Ryder System, Inc., a commercial fleet and supply chain management solutions company ▷Executive Vice President and Chief Financial Officer (2010 – 2019) ▷Senior Vice President, Controller and Chief Accounting Officer (2002 – 2010) ▷Group Director of Accounting Services (2000 – 2002) •Coopers & Lybrand LLP (1984 - 1997) ▷Senior Manager of Business Assurance | Other Professional Experience and Community Involvement •Certified Public Accountant

|

|

Key Experience and Qualifications •Review and preparation of financial statements: Extensive business, financial, and investor relations experience culminating in the role of chief financial officer •Finance management experience: Accomplished background in corporate finance, accounting, financial management, mergers and acquisitions and supply chain management •Risk management experience: Relevant expertise in risk management, highly regulated industries, corporate safety and strategic development |

|

| | | | | | | | |

| |

| Anne Gates, 64 Non-Executive Director |

|

Director Since: 2018 RJF Committees •Corporate Governance and ESG (Chair since 2022) •Audit | Other Public Directorships •Current: The Kroger Company; Tapestry, Inc. (Chair) •Former (past 5 years): None |

| | | | | |

Career Highlights •President, MGA Entertainment, Inc., a developer, manufacturer and marketer of toy and entertainment products for children (2014 – 2017) •The Walt Disney Company, a diversified multinational mass media and entertainment conglomerate (1991 – 2012) ▷Executive Vice President, Chief Financial Officer—Disney Consumer Products (2000 – 2007, 2009 – 2012) ▷Managing Director—Disney Consumer Products Europe and Emerging Markets (2007 – 2009) ▷Senior Vice President of Operations, Planning and Analysis (1998 – 2000) | Other Professional Experience and Community Involvement •Board of Directors, Cynosure (2020 – present) •Board of Trustees, University of California, Berkeley Foundation (2016 – present) •Board of Directors, Salzburg Global Seminar (2018 – present) •Board of Trustees, PBS SoCal (2014 – present) •Board of Trustees, Packard Foundation (2020 – present) •Board of Visitors, Columbia University Engineering School (2021 – present) •Board of Trustees, Save the Children (2023 – present) |

|

Key Experience and Qualifications •Retail and consumer products insight: Over 25 years’ experience in retail and consumer products industry •International business and growth markets: Broad business background in finance, marketing, strategy and business development, including growing international businesses |

|

Proposal 1 – Election of Directors

| | | | | | | | |

| |

| Gordon L. Johnson, 66 Non-Executive Director |

|

Director Since: 2010 RJF Committees •Risk •Compensation and Talent | Other Public Directorships •Current: None •Former (past 5 years): None |

| | | | | |

Career Highlights •President, Highway Safety Devices, Inc., a full-service specialty contractor (2004 – present) •Bank of America Corporation, a multinational investment bank and financial services company ▷Various managerial and executive positions ▷(1992 – 2002) | Other Professional Experience and Community Involvement •Director of TriState Capital Bank (2022 - present) •Director of Raymond James Bank (2007 - present) •Director, Florida Transportation Builders Association (2007 – 2016) •Director, Santa Fe Healthcare (2008 – 2014) |

|

Key Experience and Qualifications •Banking and financial services: Over 24 years of experience with unaffiliated banks •Raymond James Bank insights: Sixteen years as a director of Raymond James Bank, a significant part of our business •Entrepreneurial experience: Perspective of an entrepreneur and consumer of business-related financial services |

| |

| | | | | | | | |

| |

| Raymond W. McDaniel, Jr., 66 Non-Executive Director |

|

Director Since: 2023 RJF Committees •Audit •Risk | Other Public Directorships •Current: John Wiley & Sons, Inc. •Former (past 5 years): Moody’s Corporation |

| | | | | |

Career Highlights •Moody’s Corporation, a global integrated risk assessment firm ▷Non-executive Chairman (2021 – 2023) ▷Director (2003 – 2023) ▷President and Chief Executive Officer (2012 – 2020) ▷Chairman and Chief Executive Officer (2005 – 2012) ▷Chief Operating Officer (2004 – 2005) ▷Chief Executive Officer, Moody’s Investors Service (2007 – 2020) | Other Professional Experience and Community Involvement •Member, Board of Trustees of Muhlenberg College (2015 - present) •Member, Board of Directors of the Council for Economic Education (2003 - 2005) •Member, State Bar of New York, 1984 |

| |

Key Experience and Qualifications •Finance management experience: Substantial executive leadership, risk management and business operations experience, including 15 years as a chief executive officer •Financial services industry: Proven professional track record navigating worldwide markets, product strategy initiatives and corporate financial performance •Risk management experience: Pertinent expertise in risk management, regulated industries, corporate governance and strategy |

| |

Proposal 1 – Election of Directors

| | | | | | | | |

| |

| Roderick C. McGeary, 73 Non-Executive Director |

|

Director Since: 2015 RJF Committees •Audit (Chair since 2023) •Risk •Corporate Governance and ESG | Other Public Directorships •Current: Cisco Systems, Inc.; PACCAR Inc. •Former (past 5 years): None |

| | | | | |

Career Highlights •Chairman, Tegile Systems, Inc., a manufacturer of flash storage arrays (2010 – 2012) •BearingPoint, Inc., a multinational management and technology consulting firm ▷Chairman (2004 – 2009) ▷Interim Chief Executive Officer (2004 – 2005) ▷Co-President and Co-Chief Executive Officer (1999 – 2000) •Chief Executive Officer, Brience, Inc., a provider of software that enables companies to personalize customer experiences through broadband or wireless devices (2000 – 2002) •Managing Director, KPMG Consulting LLC, a management consulting firm (April – June 2000) •KPMG LLP, the U.S. member of a global network of professional firms providing audit, tax and advisory services ▷Co-Vice Chairman of Consulting (1997 – 1999) ▷Audit Partner for various technology clients (1980 – 1988) | Other Professional Experience and Community Involvement •Certified Public Accountant |

| |

Key Experience and Qualifications •Review and preparation of financial statements: Deep accounting and auditing knowledge acquired through many years with a large public accounting firm •Leadership and governance: Decades of board and leadership experience involving multiple industries •Technology and technology risks: Leadership experience with global technology companies |

| |

| | | | | | | | |

| |

| Paul C. Reilly, 69 Chair and Chief Executive Officer |

|

Director Since: 2006 RJF Committees •Capital Planning Committee | Other Public Directorships •Current: Willis Towers Watson Public Limited Company •Former (past 5 years): None |

| | | | | |

Career Highlights •Raymond James Financial, Inc. ▷Chair (2017 – present) ▷Chief Executive Officer (2010 – present) ▷President (2009 – 2010) ▷Non-executive Director (2006 – 2009) ▷Chair, Audit Committee (2008 – 2009) •Korn Ferry International, a global organizational consulting firm ▷Executive Chairman (2007 – 2009) ▷Chairman and Chief Executive Officer (2001 – 2007) •Chief Executive Officer, KPMG International, a global network of professional firms providing audit, tax and advisory services (1998 – 2001) •National Managing Partner, Financial Services, KPMG LLP (1995 – 1998) | Other Professional Experience and Community Involvement •Member, Board at Large, Securities Industry and Financial Markets Association (SIFMA) •Member, Board of Directors, American Securities Association •Member, Board of Directors, National Leadership Roundtable •Former Member, The Florida Council of 100 •Former Member, Financial Services Roundtable •Former Director, United Way Suncoast •Cabinet Member and former Chairman, Tampa Heart Walk and Heart Ball for the American Heart Association •Member, The University of Notre Dame Business Advisory Council •Trustee, House of Prayer Foundation |

| |

Key Experience and Qualifications •Strong leader, with prior public company CEO experience: Prior experience as chief executive officer of two complex, global organizations (one of which was a public company) brings a perspective to the Board beyond the financial services industry •Auditing and strategic consulting perspective: Background as a certified public accountant and financial services consultant •Leadership continuity: Previous service on our Board provides continuity with prior senior management |

| |

Proposal 1 – Election of Directors

| | | | | | | | |

| |

| Raj Seshadri, 58

Non-Executive Director |

|

Director Since: 2019 RJF Committees •Risk •Compensation and Talent | Other Public Directorships •Current: None •Former (past 5 years): None |

| | | | | |

Career Highlights •Mastercard Incorporated, a global payments and technology company ▷President, Data and Services (2020 - present) ▷President, US Issuers (2016 – 2020) •BlackRock, Inc., a global asset manager ▷Managing Director, Head of iShares Wealth Advisory

(2014 – 2015) ▷Managing Director, Global Chief Marketing Officer for iShares (2012 – 2013) •Citigroup, Inc., a global financial institution ▷Managing Director, Head of CitiBusiness for Citibank (2010 – 2012) ▷Managing Director, Global Head of Strategy (2008 – 2009) | Other Professional Experience and Community Involvement •Trustee, Mount Holyoke College (2017 – present) •Member, Global Board, American India Foundation (2019 – present) •Member, Innovation Advisory Council of the Federal Reserve Bank of New York (2021 - 2022) •Member, Management Board, Stanford Graduate School of Business (2017 – 2020) •Adjunct Professor, Columbia University Graduate School of Business (2012 – 2017) •David Rockefeller Fellow (2017 – 2018) |

| |

Key Experience and Qualifications •Financial services and technology leadership: Brings a rare combination of experience from her roles at global brands in marketing, sales, business strategy, asset management, wealth management, payments, software services and business-to-business partnerships |

| |

Proposal 1 – Election of Directors

Election of Directors

Each director is elected by shareholders at our annual meeting for a term of one (1) year (subject to extension until a successor is duly elected and qualified and subject to such director’s earlier resignation or removal). Under our By-laws, unless the election is contested, each director nominee must receive a majority vote to be elected. A “majority vote” means that the number of votes cast in favor of a nominee exceeds the number of votes cast against the nominee. In a contested election, directors are elected by a plurality of the votes cast. A “plurality" vote means that the nominee who receives more votes than any other nominee is elected.

In addition, each director nominee must tender an irrevocable conditional resignation to the company, to be effective only upon (i) the director’s failure to receive the required shareholder vote in an uncontested election, and (ii) Board acceptance of such resignation. If any nominee fails to receive the required vote, the CG&ESG Committee will recommend that the Board accept the resignation unless it determines that the best interests of the company and its shareholders would not be served by doing so. Absent such determination, the Board will accept the resignation no later than 120 days from the certification of the shareholder vote, subject to maintaining compliance with NYSE or SEC rules. The Board will promptly disclose publicly its decision to accept or reject such resignation and the reasons therefor.

Director Independence

For a director to be considered independent under NYSE rules, the Board must affirmatively determine that the director does not have any “material relationship” with the company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the company. A material relationship can include commercial, industrial, banking, consulting, legal, accounting, charitable and family relationships.

The Board has affirmatively determined that the following ten director candidates are independent under NYSE and SEC rules: Marlene Debel, Robert M. Dutkowsky, Jeffrey N. Edwards, Benjamin C. Esty, Art A. Garcia, Anne Gates, Gordon L. Johnson, Raymond W. McDaniel, Jr., Roderick C. McGeary and Raj Seshadri.

Each candidate has indicated that he or she would serve if elected. We do not anticipate that any nominee would be unable to stand for election, but if that were to happen, the Board may reduce the size of the Board, designate a substitute nominee or leave a vacancy unfilled. If a substitute is designated, proxies voting on the original director candidate will be cast for the substituted candidate.

Director Tenure

We believe that non-executive directors (those directors who are not officers or employees of the company) who have longer-term experience with the company have gained a level of familiarity with its operations that enables them to make valuable contributions to Board deliberations. Nevertheless, our Corporate Governance Principles contemplate that directors are normally expected to serve no more than 12 years on the Board. The Board reserves the right, in extraordinary circumstances, to waive this limitation to allow a director—if elected by the shareholders—to serve up to three additional one-year terms. In this connection, the Board has determined that the need for continuity of service of the director who also serves on the boards of Raymond James Bank and TriState Capital Bank, Gordon L. Johnson, constitutes a sufficient basis for waiving the above tenure limitation to permit him to serve a further one-year term.

Proposal 1 – Election of Directors

Nominating Process and Succession Planning

The CG&ESG Committee reviews the experience and qualifications of all potential nominees to the Board. In considering director candidates, the CG&ESG Committee gathers all information regarding a candidate’s background and qualifications, evaluates his or her mix of skills and qualifications, and determines the contributions that the candidate could be expected to make to the overall functioning of the Board, giving due consideration to the Board’s balance and diversity of perspectives, backgrounds and experiences. The CG&ESG Committee routinely considers diversity as a part of its deliberations, but does not have a formal policy regarding diversity. With respect to current directors, the CG&ESG Committee annually evaluates the individual’s past participation in, and contributions to, the activities of the Board. The CG&ESG Committee recommends director nominees to the Board based on its assessment of overall suitability to serve.

Illustrated below is an overview of the process used by the CG&ESG Committee to identify the desired skills and experience of candidates as well as to evaluate potential candidates for the Board.

| | | | | | | | | | | | | | |

| | | | |

| 1 | | Candidate Recommendations |

| | | | |

| | | •From search firms, current and former directors, management and shareholders |

| | | | |

| | | | |

| 2 | | Corporate Governance and ESG Committee |

| | | | |

| | | •Considers skills and the current and future needs of the Board •Screens qualifications and considers diversity •Reviews independence and potential conflicts | •Interviews potential directors •Recommends nominees to the Board |

| | | | |

| | | | |

| 3 | | Board of Directors |

| | | | |

| | | •Evaluates candidates, analyzes independence and other issues, interviews potential directors and selects nominees |

| | | | |

| | | | |

| 4 | | Shareholders | |

| | | | |

| | | •Vote on nominees at Annual Meeting | |

| | | | | | | | | | | |

| | | |

6 | New Directors Added in the past five years, bringing fresh perspectives to the Board | •Art A. Garcia •Anne Gates •Robert M. Dutkowsky | •Raymond W. McDaniel, Jr. •Raj Seshadri •Marlene Debel |

Nominations by Shareholders

The CG&ESG Committee will consider candidates recommended for nomination to the Board by shareholders under Florida law and our By-laws. Our By-laws contain advance notice and a number of other requirements applicable to any shareholder nomination, including a description of the information that must be included with any such proposal. The manner in which the committee evaluates candidates recommended by shareholders would be generally the same as for any other candidate. However, the CG&ESG Committee would also consider information concerning any relationship between a shareholder recommending a candidate and the candidate to determine if the candidate can represent the interests of all shareholders. The committee would not evaluate a candidate recommended by a shareholder unless, among the other requirements of our By-laws, the shareholder’s proposal contained all of the information necessary to conduct an evaluation. For information regarding shareholder proposal deadlines, please see below under “Additional Information — Shareholder Proposals for the 2025 Annual Meeting.”

Corporate Governance

Role of the Board

Raymond James’ business and affairs are managed under the direction of the Board of Directors. The role of the Board is to oversee management of the company in its efforts to enhance shareholder value and conduct the company’s business in accordance with its mission statement. In this vein, the Board’s duties include assisting management with assessing long-range strategies for the company and evaluating management performance.

Corporate Governance Principles

The Board has adopted Corporate Governance Principles, which are available in the Investor Relations section of the company’s website at www.raymondjames.com (the “company’s website”). This document describes the principles the Board follows with respect to, among other matters, the Board’s:

| | | | | | | | | | | | | | |

| | | | |

| Board Composition | | Best Practices | | Board Effectiveness |

•committees •size and composition | | •confidentiality •director compensation •communications with shareholders | | •leadership structure •role and duties •annual performance evaluation •director responsibilities •access to officers, employees

and advisors |

Code of Ethics and Directors’ Code

As part of our ethics and compliance program, our Board has approved:

•Code of Ethics for Senior Financial Officers (the “Code of Ethics”) which applies to our principal executive officer, principal financial officer, principal accounting officer, controller and persons performing similar functions, and

•Code of Business Conduct and Ethics for Members of the Board of Directors (“Directors’ Code”) that applies to all members of the Board.

Both the Code of Ethics and the Directors’ Code are posted on our company’s website. We intend to satisfy the disclosure requirement regarding any amendment to, or waiver of, the Code of Ethics or the Directors’ Code by posting such information on our website. The company also maintains a reporting hotline (888-686-8351), where employees and individuals outside the company can anonymously submit a complaint or concern regarding compliance with applicable laws, rules or regulations, the Code of Ethics, as well as accounting, auditing, ethical or other concerns.

Board Leadership Structure

| | | | | |

Paul C. Reilly Chair of the Board | |

The Board believes it is in the company’s best interests to periodically evaluate its leadership structure and make a determination regarding whether to separate or combine the roles of chair and chief executive officer based on circumstances at the time of its evaluation. By retaining flexibility to adjust the company’s leadership structure, the Board believes that it is best able to provide for appropriate management and leadership of the company and address any circumstances the company may face. Since 2017, our CEO, Mr. Paul Reilly, has also served as Chair of the Board. The Board believes that a combined chair / chief executive officer structure provides the company with a single leader who communicates the firm’s business and strategy to our shareholders, clients, employees, regulators and the public, promoting accountability for the company’s performance. For these reasons, the Board believes that our existing Board leadership structure continues to be the most appropriate one for the company. Nevertheless, the Board may reassess the appropriateness of this structure at any time, including following future changes in Board composition, in management, or in the character of the company’s business and operations. |

| | | | | |

Jeffrey N. Edwards Lead Independent Director | |

The Board also believes that independent leadership is important, and it has appointed an independent director, Jeffrey N. Edwards, who succeeded retired director Susan Story as lead director (“Lead Director”) in February 2023. The Board has structured the role of our Lead Director to strike an appropriate balance to the combined Chair and CEO role and to fulfill the important requirements of independent leadership of the Board. The Board has approved a charter for the Lead Director, which provides that the Lead Director is elected by the independent directors for a renewable term of three years. The charter also sets forth the Lead Director’s specific responsibilities, including to: •preside at Board meetings in the absence of the Chair, subject to the By-laws •review and approve Board meeting agendas and schedules •advise on information submitted to the Board •serve as liaison for communication between non-executive directors and shareholders •communicate individual performance feedback from Board peer evaluations in private meetings with each director •preside over executive sessions of non-executive directors •recommend topics for Board consideration •serve as a liaison between non-executive directors and the Chair •with the CG&ESG Committee, facilitate the Board’s annual evaluation process •assist the CG&ESG Committee in conducting its performance evaluation of the CEO, and in CEO succession planning The Charter of the Lead Director, which is available on the company’s website, provides a more detailed description of the role and responsibilities, qualifications, and the procedures for appointment of, the Lead Director. |

Board Committees

The Board has delegated authority to committees to assist in overseeing the management of the company. The members and chair of each committee are appointed and removed by the Board. The committee chairs review and approve agendas for all meetings of their respective committees. The responsibilities of the Audit Committee, the Risk Committee, the CG&ESG Committee and the Compensation and Talent Committee (the “C&T Committee”) are defined in their respective charters, which incorporate the applicable requirements of the SEC and NYSE and are available on the company’s website at www.raymondjames.com/investor-relations/corporate-governance/charters.

Reorganization of the Audit and Risk Committee

In order to maintain corporate governance best practices and respond to new regulatory requirements, the Board reviews its corporate governance practices and the charters for its standing committees at least annually. In April of 2023, the Board determined to restructure its Audit and Risk Committee to better address the evolving needs of the company and the evolving regulatory governance landscape. Effective April 10, 2023, the Board split the Audit and Risk Committee into two committees: the Audit Committee and the Risk Committee.

The Board adopted new charters for each of the new committees that set forth a detailed statement of the respective committee’s roles and responsibilities. The Board determined that the new Audit Committee should retain all of the audit-related responsibilities previously exercised by the Audit and Risk Committee, and that the new Risk Committee should retain all of the risk oversight responsibilities previously exercised by the Audit and Risk Committee. Each new committee is comprised solely of directors who have been determined to meet the definition of an “independent director” in accordance with NYSE listing standards.

The Board believes that having separate committees to oversee these areas of focus provides the proper support and resources for these crucial and evolving activities.

The following table identifies the Board’s committees and their respective members, and provides information about meetings during fiscal 2023.

| | | | | | | | | | | | | | | | | |

| Director | Audit Committee | Risk Committee | Corporate Governance and ESG Committee | Compensation and Talent Committee | Capital Planning Committee |

Marlene Debel | M | C | — | — | M |

| Robert M. Dutkowsky | — | — | M | C | — |

| Jeffrey N. Edwards | — | — | M | M | M |

| Benjamin C. Esty | — | M | — | M | — |

| Art A. Garcia | — | M | — | — | — |

| Anne Gates | M | — | C | — | — |

| Gordon L. Johnson | — | M | — | M | — |

Raymond W. McDaniel, Jr. | M | M | — | — | — |

| Roderick C. McGeary | C | M | M | — | — |

| Raj Seshadri | — | M | — | M | — |

Thomas A. James (1) | — | — | — | — | M |

| Paul C. Reilly | — | — | — | — | M |

Total Committee Meetings (2) | 9 | 7 | 4 | 6 | 4 |

(1)Mr. James is not standing for re-election at the Annual Meeting.

(2) The total number of committee meetings for each of the two committees formed in April of 2023, the Audit Committee and the Risk Committee, includes meetings of their respective predecessor committee: the Audit and Risk Committee.

M = Member, C = Chair

| | | | | | | | |

| Audit Committee The Board has affirmatively determined that each member of the Audit Committee is “independent” under NYSE and SEC rules. The Board has further determined that each member of the Audit Committee is “financially literate” and that each of Ms. Debel, Ms. Gates, Mr. McDaniel and Mr. McGeary qualifies as an “audit committee financial expert” and has “accounting or related financial management expertise” under applicable NYSE or SEC rules. |

| |

| |

Chair: Roderick C. McGeary Members: Marlene Debel Anne Gates Raymond W. McDaniel, Jr. Number of meetings in fiscal 2023: 9 | The Audit Committee’s responsibilities include: •oversight of the independent auditor, including annually reviewing the independent auditor’s report and evaluating its qualifications, performance and independence •reviewing and discussing with management and the independent auditor (i) the audited financial statements and related disclosures, (ii) earnings press releases, (iii) critical accounting policies, (iv) internal controls over financial reporting and disclosure controls and procedures, (v) use of non-GAAP financial measures, and (vi) any audit issues •oversight of the company’s internal audit function; and •reviewing reports from the chief compliance officer and general counsel The Audit Committee charter provides a more detailed description of the role and responsibilities of the committee. |

| | | | | | | | |

| Risk Committee The Board has affirmatively determined that each member of the Risk Committee is “independent” under NYSE and SEC rules. |

| |

| |

Chair: Marlene Debel Members: Benjamin C. Esty Art A. Garcia Gordon L. Johnson Raymond W. McDaniel, Jr. Roderick C. McGeary Raj Seshadri Number of meetings in fiscal 2023: 7 | The Risk Committee’s responsibilities include: •oversight of management’s responsibilities to manage key risks, including the company’s enterprise risk management program •oversight of the company’s risk governance structure, including approval of enterprise-wide risk policies; and •reviewing quarterly reports of the chief risk officer, and oversight of the performance of the chief risk officer and the chief compliance officer The Risk Committee charter provides a more detailed description of the role and responsibilities of the committee. |

| | | | | | | | |

| Corporate Governance and ESG Committee The Board has affirmatively determined that each member of the CG&ESG Committee is “independent” under NYSE and SEC rules. |

| |

| |

Chair: Anne Gates Members: Robert M. Dutkowsky Jeffery N. Edwards Roderick C. McGeary Number of meetings in fiscal 2023: 4 | The CG&ESG Committee’s responsibilities include: •reviewing the qualifications and experience of potential director nominees and recommending them to the Board •reviewing succession planning for the CEO and other senior management positions •developing and monitoring compliance with corporate governance policies •leading the Board and its committees in annual reviews of their performance •periodically reviewing and assessing our codes of ethics and recommending changes to the Board •reviewing and approving policies and procedures with respect to related person transactions, and reviewing, approving or disapproving, and ratifying such transactions •recommending reasonable director compensation to the Board •exercising sole authority to retain director candidate search firms, including determining their compensation and terms of engagement •reviewing and overseeing the Company’s strategies, policies and programs with respect to environmental matters and stakeholder engagement efforts •coordinating the ESG oversight activities of the Board and other Board committees, and •reviewing and discussing with senior management the content of the Company’s annual corporate responsibility report and other significant disclosures regarding ESG matters. The CG&ESG Committee charter provides a more detailed description of the role and responsibilities of this committee. |

| | | | | | | | |

| Compensation and Talent Committee The Board has affirmatively determined that each member of the C&T Committee is “independent” under NYSE and SEC rules. |

| |

| |

Chair: Robert M. Dutkowsky Members: Jeffrey N. Edwards Benjamin C. Esty Gordon L. Johnson Raj Seshadri Number of meetings in fiscal 2023: 6 | The C&T Committee’s responsibilities for compensation and talent matters include: •annually approving senior management compensation structure •annually setting criteria for compensating the CEO, evaluating his or her performance and determining the amount of his or her compensation •approving and overseeing the administration of equity-based and other incentive compensation plans •annually recommending to the Board the amounts of company contributions to employee benefit plans •overseeing administration of other employee benefit plans •reviewing and discussing with the CEO the development and succession plans for the CEO, other executive officers, and other senior management positions •reviewing and discussing with management the company’ strategies and policies related to human capital management and related public disclosures, and •reviewing and discussing with management trends in certain employee conduct matters. The Compensation and Talent Committee charter provides a more detailed description of the role and responsibilities of the committee. |

| | | | | |

| Capital Planning Committee The Capital Planning Committee does not have a separate written charter. |

| | | | | |

| |

Members: Marlene Debel Jeffrey N. Edwards Thomas A. James (1) Paul C. Reilly Number of meetings in fiscal 2023: 4 | The Capital Planning Committee provides oversight of the firm’s capital and liquidity planning process and decision-making. The committee reviews metrics and tolerances for managing capital and liquidity, oversees capital and liquidity projections and stress tests, and approves (or recommends approval to the full Board, as applicable) certain capital and liquidity actions, such as dividends, share repurchase authorizations, and issuances of debt or equity securities. |

(1)Mr. James is not standing for re-election at the Annual Meeting.

Compensation Committee Interlocks and Insider Participation

During fiscal 2023, the following directors served as members of the Compensation and Talent Committee: Gordon L. Johnson (Chair through February 2023), Jeffrey N. Edwards, Benjamin C. Esty (since April 2023), Robert M. Dutkowsky (Chair since February 2023) and Ms. Raj Seshadri. No member of the Compensation and Talent Committee was an officer or employee of the company or any of its subsidiaries during fiscal 2023, and no member of the Compensation and Talent Committee was formerly an officer of the company or any of its subsidiaries or was a party to any disclosable related person transaction involving the company. During fiscal 2023, none of the executive officers of the company has served on the board of directors or on the compensation committee of any other entity that has or had executive officers serving as a member of the Board of Directors or Compensation and Talent Committee of the company.

Meetings and Attendance

| | | | | |

During fiscal 2023, the Board held four meetings (not including committee meetings). Each director nominated for re-election at the Annual Meeting attended at least 92% of the aggregate of the total number of meetings held by the Board and the total number of meetings held by all committees of the Board on which he or she served during fiscal 2023. The company’s Executive Committee also attends each regularly-scheduled Board meeting, as the Board believes that this direct exposure facilitates the deepest understanding and alignment of the firm’s strategy and also permits the Board to directly evaluate the performance of each Executive Committee member. It is the policy of the Board that all directors attend the annual meeting of shareholders. All of our directors then in office attended the February 2023 annual meeting of shareholders. | 92% All director nominees attended at least 92% of meetings held by the Board and its committees |

Executive Sessions

The non-executive directors meet in executive session without management at least four times per year during regularly-scheduled Board meetings. Mr. Jeffrey N. Edwards, our Lead Director, presided at the regular executive sessions of the non-executive directors. In addition, the non-executive directors in each of the Audit Committee, the Risk Committee, the CG&ESG Committee and the C&T Committee generally meet in executive session in conjunction with the regularly scheduled meetings of such committees.

Director Education and Orientation

We believe that ongoing education is important for the ability of our directors to fulfill their duties, and the company supports our Board members in continuing education throughout their service with us. We encourage directors to participate in a variety of external director education programs, and we reimburse directors for the expenses of their attendance. Internal and external specialists also regularly provide the Board with educational sessions on particular topics during our regular Board meetings. These presentations have included sessions covering recent developments in anti-money laundering (AML), anti-bribery/anti-corruption (ABAC), the evolving regulation of bank holding companies (BHC), cybersecurity developments and risks (presented each quarter), and emerging ESG topics.