0001585364false00015853642025-02-262025-02-260001585364prgo:OrdinaryShares0001ParValueMember2025-02-262025-02-260001585364prgo:A4.900SeniorNotesDueJune152030Member2025-02-262025-02-260001585364prgo:A6.125SeniorNotesDue2032Member2025-02-262025-02-260001585364prgo:A5.375SeniorNotesDue2032Member2025-02-262025-02-260001585364prgo:A5.30UnsecuredSeniorNotesDueNovember152043Member2025-02-262025-02-260001585364prgo:A49SeniorLoanDue2024Member2025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________

FORM 8-K

______________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 26, 2025

______________________________________________

Perrigo Company plc

(Exact name of registrant as specified in its charter)

_______________________________________________

Commission file number 001-36353

| | | | | | | | |

| Ireland | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

The Sharp Building, Hogan Place, Dublin 2, Ireland D02 TY74

+353 1 7094000

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Not Applicable

(Former name or former address, if changed since last report)

________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Securities Registered pursuant to section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

| Ordinary shares, €0.001 par value | PRGO | New York Stock Exchange |

| | |

4.900% Notes due 2030 | PRGO30 | New York Stock Exchange |

6.125% Notes due 2032 | PRGO32A | New York Stock Exchange |

5.375% Notes due 2032 | PRGO32B | New York Stock Exchange |

| 5.300% Notes due 2043 | PRGO43 | New York Stock Exchange |

| 4.900% Notes due 2044 | PRGO44 | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of

Certain Officers; Compensatory Arrangements of Certain Officers.

On February 26, 2025, Perrigo Company plc (“Perrigo” or the “Company”) announced it reached agreement with Patrick Lockwood-Taylor to extend his tenure as CEO and President and member of the Board, and the Company, through its US subsidiary Perrigo Company, a Michigan corporation, entered into an amended and restated employment agreement with Mr. Lockwood-Taylor to be effective on February 26, 2025, (the “Employment Agreement”). The Employment Agreement has an initial term of three years ending on June 30, 2028, which is subject to automatic renewal thereafter for one-year periods unless either party provides 90 days’ prior notice of non-renewal. The Agreement provides that Mr. Lockwood-Taylor will be entitled to an annual base salary of $1,240,000 and a target annual bonus opportunity of not less than 125% of his annual base salary (the “Target Annual Bonus”), with the actual amount of the annual bonus ranging from 0% to 200% of the Target Annual Bonus; provided that Mr. Lockwood-Taylor will receive at least 50% of the Target Annual Bonus if the minimum applicable performance metrics are achieved for the applicable fiscal year. He will also be eligible to continue to participate in the Company’s 2019 Long-Term Incentive Plan; provided that annual grants made to Mr. Lockwood-Taylor shall have a grant date fair value of not less than $6,600,000. Mr. Lockwood-Taylor will continue to participate in employee benefit plans in effect from time to time. In addition, the Employment Agreement continues to entitle Mr. Lockwood-Taylor to indemnification to the fullest extent permitted by applicable law and directors’ and officers’ insurance coverage, in each case, to the same extent as other officers and directors of Perrigo.

If Mr. Lockwood-Taylor’s employment is terminated involuntarily by the Company without cause or by Mr. Lockwood-Taylor for good reason (except in the case of his primary place of work being changed to Dublin, Ireland), in either case, other than upon, or within 24 months following, a change in control, he will be entitled to a prorated annual bonus for the year of termination (based on actual performance), cash severance equal to 1.5 times the sum of his annual base salary and target annual bonus opportunity, and payment of the cost of health care continuation coverage for up to 18 months following termination, plus payment of the amount of such costs for up to an additional six months, provided that any payment of health care continuation costs shall cease if Mr. Lockwood-Taylor becomes eligible to receive health care benefits under another employer-provided plan). Mr. Lockwood-Taylor will also be entitled to the continued vesting of any then-outstanding equity incentive awards for 36 months following his termination, with any performance-based awards vesting, if at all, based on actual performance.

If Mr. Lockwood-Taylor’s employment were terminated involuntarily by the Company without cause or by Mr. Lockwood-Taylor for good reason, in either case, upon, or within 24 months following, a change in control, he would be entitled to a prorated annual bonus for the year of termination based on target annual bonus activity, cash severance equal to 2.0 times the sum of his annual base salary and target annual bonus opportunity, paid health care continuation coverage for up to 18 months as described above, and an additional lump sum cash payment equal to the cost of an additional six months of healthcare continuation coverage. Mr. Lockwood-Taylor will also be entitled to the full vesting of any then-outstanding equity incentive awards, with any then-outstanding performance-based equity incentive awards vesting based on “target” levels of achievement of the applicable performance thresholds.

The foregoing severance benefits are subject to Mr. Lockwood-Taylor’s execution of a release of claims in favor of Perrigo. In addition, Mr. Lockwood-Taylor has agreed to comply with (i) a post-termination noncompete covenant and a post-termination nonsolicitation of customers and employees covenant, each of which will endure for 24 months following any termination of employment, (ii) a perpetual confidentiality covenant, and (iii) a perpetual mutual nondisparagement covenant.

The foregoing summary of the Amended and Restated Employment Agreement is qualified in its entirety by the full text thereof, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

ITEM 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit Number | Description |

| 10.1 | |

| 104 | Cover Page Interactive Data file (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | (Registrant)

|

| | | PERRIGO COMPANY PLC

|

| | | | |

| | | By: | /s/ Charles Atkinson |

| Dated: | February 26, 2025 | | | Charles Atkinson |

| | | | Executive Vice President, General Counsel and Secretary |

| | | | |

| | | | |

Cover Page

|

Feb. 26, 2025 |

| Entity Listings [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 26, 2025

|

| Entity Registrant Name |

Perrigo Company plc

|

| Entity File Number |

001-36353

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity Address, Address Line One |

The Sharp Building,

|

| Entity Address, Address Line Two |

Hogan Place,

|

| Entity Address, City or Town |

Dublin 2,

|

| Entity Address, Country |

IE

|

| Entity Address, Postal Zip Code |

D02 TY74

|

| Country Region |

353

|

| City Area Code |

1

|

| Local Phone Number |

7094000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001585364

|

| Amendment Flag |

false

|

| Ordinary shares, €0.001 par value |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Ordinary shares, €0.001 par value

|

| Trading Symbol |

PRGO

|

| Security Exchange Name |

NYSE

|

| 4.900% Notes due 2030 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

4.900% Notes due 2030

|

| Trading Symbol |

PRGO30

|

| Security Exchange Name |

NYSE

|

| 5.375% Notes due 2032 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

5.375% Notes due 2032

|

| Trading Symbol |

PRGO32B

|

| Security Exchange Name |

NYSE

|

| 6.125% Notes due 2032 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

6.125% Notes due 2032

|

| Trading Symbol |

PRGO32A

|

| Security Exchange Name |

NYSE

|

| 5.300% Notes due 2043 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

5.300% Notes due 2043

|

| Trading Symbol |

PRGO43

|

| Security Exchange Name |

NYSE

|

| 4.900% Notes due 2044 |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

4.900% Notes due 2044

|

| Trading Symbol |

PRGO44

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=prgo_OrdinaryShares0001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=prgo_A4.900SeniorNotesDueJune152030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=prgo_A5.375SeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=prgo_A6.125SeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=prgo_A5.30UnsecuredSeniorNotesDueNovember152043Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=prgo_A49SeniorLoanDue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

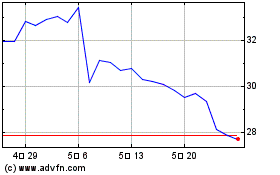

Perrigo Company Plc Irel... (NYSE:PRGO)

과거 데이터 주식 차트

부터 2월(2) 2025 으로 3월(3) 2025

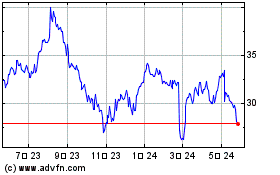

Perrigo Company Plc Irel... (NYSE:PRGO)

과거 데이터 주식 차트

부터 3월(3) 2024 으로 3월(3) 2025