Juniper Networks (NYSE: JNPR), a leader in secure, AI-Native

networks, today reported preliminary financial results for the

three months and fiscal year ended December 31, 2024.

Proposed Merger with Hewlett Packard Enterprise

As announced on January 9, 2024, Hewlett Packard Enterprise

Company (“HPE”) plans to acquire Juniper Networks in an all-cash

transaction for $40.00 per share, representing an equity value of

approximately $14 billion. On January 30, 2025, the U.S. Department

of Justice filed a complaint seeking to block the closing of the

transaction. Juniper Networks and HPE will vigorously defend the

transaction and remain fully committed to completing it.

Fourth Quarter 2024 Financial Performance

Net revenues were $1,404.1 million, an increase of 3%

year-over-year, and an increase of 5% sequentially.

GAAP operating margin was 11.9%, an increase from 9.2% in the

fourth quarter of 2023, and an increase from 7.1% in the third

quarter of 2024.

Non-GAAP operating margin was 19.2%, an increase from 18.3% in

the fourth quarter of 2023, and an increase from 15.0% in the third

quarter of 2024.

GAAP net income was $162.0 million, an increase of 30%

year-over-year, and an increase of 75% sequentially, resulting in

diluted earnings per share of $0.48.

Non-GAAP net income was $216.6 million, an increase of 10%

year-over-year, and an increase of 36% sequentially, resulting in

non-GAAP diluted earnings per share of $0.64.

Full-Year 2024 Financial Performance

Net revenues were $5,073.6 million, a decrease of 9%

year-over-year.

GAAP operating margin was 5.8%, a decrease from 8.4% in fiscal

year 2023.

Non-GAAP operating margin was 14.2%, a decrease from 16.9% in

fiscal year 2023.

GAAP net income was $287.9 million, a decrease of 7%

year-over-year, resulting in diluted earnings per share of $0.86, a

decrease of 9% year-over-year. The year-over-year decrease was

primarily due to lower revenue, which was partially offset by

higher other income and expenses and higher gross margin.

Non-GAAP net income was $574.5 million, a decrease of 22%

year-over-year, resulting in diluted earnings per share of $1.72, a

decrease of 24% year-over-year.

The reconciliation between GAAP and non-GAAP financial measures

is provided in a table immediately following the Preliminary Net

Revenues by Geographic Region table below.

“We saw another quarter of strong demand during the fourth

quarter, with total product orders growing double-digits

sequentially and more than 40% year-over-year,” said Juniper’s CEO,

Rami Rahim. “I am particularly pleased by the breadth of the

momentum we are seeing, as we saw double-digit order growth in our

enterprise and service provider verticals complement another

quarter of triple-digit year-over-year growth in our cloud

vertical, where we continue to benefit from these customers’ AI

networking initiatives. I believe these results reflect the strong

execution of our teams and the strength of our AI-native networking

solutions, which continue to win across customer verticals and set

us up well to deliver sustainable growth on a go forward

basis.”

“We delivered strong Q4 financial results that saw revenue and

non-GAAP earnings per share return to growth on a year-over-year

basis,” said Juniper’s CFO, Ken Miller. “Non-GAAP gross and

operating margin also improved during Q4, and we grew backlog

approximately 30% year-over-year. We maintain strong momentum

entering the March quarter and remain optimistic regarding our

financial prospects.”

Balance Sheet and Other Financial Results

Total cash, cash equivalents, and investments as of December 31,

2024 were $1,770.0 million, compared to $1,324.3 million as of

December 31, 2023, and $1,562.9 million as of September 30,

2024.

Net cash flows provided by operations for the fourth quarter of

2024 was $279.8 million, compared to $9.1 million in the fourth

quarter of 2023, and $192.2 million in the third quarter of

2024.

Days sales outstanding in accounts receivable was 75 days in the

fourth quarter of 2024, compared to 69 days in the fourth quarter

of 2023, and 65 days in the third quarter of 2024.

Capital expenditures were $27.2 million, and depreciation and

amortization expense was $38.4 million during the fourth quarter of

2024.

Capital Return

Our Board of Directors has declared a cash dividend of $0.22 per

share to be paid on March 24, 2025 to stockholders of record as of

the close of business on March 3, 2025. We remain committed to

paying our dividend; however, we have agreed to suspend repurchases

of our shares in accordance with the terms of the merger agreement

with HPE.

Fourth Quarter and Fiscal Year 2024 Financial Commentary

Available Online

A CFO Commentary reviewing Juniper Networks’ fourth quarter 2024

and fiscal year 2024 financial results will be published on Juniper

Networks’ website at http://investor.juniper.net.

In light of the proposed transaction with HPE, and as is

customary during the pendency of an acquisition, Juniper Networks

will not be providing financial guidance.

About Juniper Networks

Juniper Networks believes that connectivity is not the same as

experiencing a great connection. Juniper's AI-Native Networking

Platform is built from the ground up to leverage AI to deliver

exceptional, highly secure and sustainable user experiences from

the edge to the data center and cloud. Additional information can

be found at Juniper Networks (www.juniper.net) or connect with

Juniper on X (formerly Twitter), LinkedIn and Facebook.

Investors and others should note that Juniper Networks announces

material financial and operational information to its investors

using its Investor Relations website, press releases, SEC filings

and public conference calls and webcasts. Juniper Networks also

intends to use the X (formerly Twitter) account @JuniperNetworks

and Juniper Networks’ blogs as a means of disclosing information

about Juniper Networks and for complying with its disclosure

obligations under Regulation FD. The social media channels that

Juniper Networks intends to use as a means of disclosing

information described above may be updated from time to time as

listed on Juniper Networks’ Investor Relations website.

Juniper Networks, the Juniper Networks logo, Juniper, Junos, and

other trademarks are registered trademarks of Juniper Networks,

Inc. and/or its affiliates in the United States and other

countries. Other names may be trademarks of their respective

owners.

Safe Harbor; Forward-Looking Statements

Statements in this release concerning Juniper Networks’

business, economic and market outlook, our expectations regarding

our liquidity and capital return program; deal, customer and

product mix; costs and supply constraints; backlog; customer

demand; the completion of the proposed transaction with HPE on

anticipated terms and timing or at all, including obtaining

regulatory approvals and other conditions to the completion of the

transaction and the outcome of the legal action taken by the U.S.

Department of Justice (“DOJ”) regarding the proposed transaction;

and our overall future prospects are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

that involve a number of uncertainties and risks. Actual results or

events could differ materially from those anticipated in those

forward-looking statements as a result of several factors,

including: the completion of the proposed transaction with HPE on

anticipated terms and timing or at all, including obtaining

regulatory approvals and other conditions to the completion of the

transaction and the outcome of the legal action taken by the DOJ

regarding the proposed transaction; the fact that if the proposed

transaction is completed, Juniper stockholders will forego the

opportunity to realize the potential long-term value of the

successful execution of Juniper’s current strategy as an

independent company, which will also be affected by the ability of

HPE to integrate and implement its plans, forecasts and other

expectations with respect to Juniper’s business after the

completion of the proposed transaction and realize additional

opportunities for growth and innovation; the occurrence of any

event, change or other circumstance or condition that could give

rise to the termination of the merger agreement; Juniper’s ability

to implement its business strategies; potential significant

transaction costs associated with the proposed transaction;

potential litigation or regulatory actions relating to the proposed

transaction; the risk that disruptions from the proposed

transaction will harm Juniper’s business, including current plans

and operations, and risks related to diverting management’s

attention from Juniper’s ongoing business operations and

relationships; the ability of Juniper to retain and hire personnel;

potential adverse business uncertainty resulting from the

announcement, pendency or completion of the proposed transaction,

including restrictions during the pendency of the proposed

transaction that may impact Juniper’s ability to pursue certain

business opportunities or strategic transactions; legal,

regulatory, tax and economic developments affecting Juniper’s

business; the unpredictability and severity of catastrophic events,

including, but not limited to, acts of terrorism, outbreak of war

or hostilities or current or future pandemics or epidemics, as well

as Juniper’s response to any of the aforementioned factors; general

economic and political conditions globally or regionally, including

the impact of a U.S. federal government shutdown or sovereign debt

default and adverse changes in China-Taiwan relations and any

impact due to armed conflicts (such as the continuing conflict

between Russia and Ukraine and the escalation of Middle East

conflicts and wars, as well as governmental sanctions imposed in

response); rising interest rates; inflationary pressures; monetary

policy shifts; business and economic conditions in the networking

industry; changes in overall technology spending by our customers;

the network capacity and security requirements of our customers;

contractual terms that may result in the deferral of revenue; the

timing of orders and their fulfillment; continuing manufacturing

and supply chain challenges and logistics costs, constraints,

changes or disruptions; availability and pricing of key product

components, such as semiconductors; delays in scheduled product

availability; order cancellations; adoption of or changes to laws,

regulations, standards or policies affecting our operations,

products, services or the networking industry; product defects,

returns or vulnerabilities; significant effects of tax legislation

and judicial or administrative interpretation of new tax

regulations, including the potential for corporate tax increases

and changes to global tax laws; legal settlements and resolutions,

including with respect to enforcing our proprietary rights; the

potential impact of activities related to the execution of capital

return, restructurings and product rationalization; the impact of

import tariffs and changes thereto; currency exchange rates; and

other factors listed in Juniper Networks’ most recent report on

Form 10-Q or 10-K filed with the Securities and Exchange

Commission. Note that our estimates as to the tax rate on our

business are based on current tax law and regulations, including

current interpretations thereof, and could be materially affected

by changing interpretations as well as additional legislation and

guidance. All statements made in this release are made only as of

the date set forth at the beginning of this release. Juniper

Networks undertakes no obligation to update the information made in

this release in the event facts or circumstances subsequently

change after the date of this release. We have not filed our Form

10-K for the year ended December 31, 2024. As a result, all

financial results described in this earnings release should be

considered preliminary, and are subject to change to reflect any

necessary adjustments or changes in accounting estimates, that are

identified prior to the time we file our Form 10-K.

Use of Non-GAAP Financial Information

Juniper Networks believes that the presentation of non-GAAP

financial information provides important supplemental information

to management and investors regarding financial and business trends

relating to Juniper Networks’ financial condition and results of

operations. For further information regarding why Juniper Networks

believes that these non-GAAP measures provide useful information to

investors, the specific manner in which management uses these

measures, and some of the limitations associated with the use of

these measures, please refer to the "Discussion of Non-GAAP

Financial Measures" section of this press release. The following

tables and reconciliations can also be found on our Investor

Relations website at http://investor.juniper.net.

Juniper Networks, Inc.

Preliminary Condensed

Consolidated Statements of Operations

(in millions, except per share

amounts)

(unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Net revenues:

Product

$

870.2

$

858.6

$

3,020.0

$

3,632.5

Service

533.9

506.2

2,053.6

1,932.0

Total net revenues

1,404.1

1,364.8

5,073.6

5,564.5

Cost of revenues:

Product

420.1

410.4

1,509.5

1,781.6

Service

145.3

147.2

582.6

581.0

Total cost of revenues

565.4

557.6

2,092.1

2,362.6

Gross margin

838.7

807.2

2,981.5

3,201.9

Operating expenses:

Research and development

288.7

289.1

1,150.5

1,144.4

Sales and marketing

310.4

310.9

1,221.4

1,233.9

General and administrative (1)

62.2

60.4

245.8

253.9

Restructuring (benefits) charges

(0.4

)

19.5

10.1

98.0

Merger-related charges (1) (2)

10.9

1.6

61.9

1.6

Total operating expenses

671.8

681.5

2,689.7

2,731.8

Operating income

166.9

125.7

291.8

470.1

Gain (loss) on privately-held investments,

net (3)

13.8

(5.3

)

0.7

(97.3

)

Other (expense) income, net

(0.2

)

(2.8

)

5.5

(23.8

)

Income before income taxes and loss from

equity method investment

180.5

117.6

298.0

349.0

Income tax provision (benefit)

15.3

(10.4

)

0.5

29.2

Loss from equity method investment, net of

tax

3.2

3.7

9.6

9.6

Net income

$

162.0

$

124.3

$

287.9

$

310.2

Net income per share:

Basic

$

0.49

$

0.39

$

0.88

$

0.97

Diluted

$

0.48

$

0.38

$

0.86

$

0.95

Weighted-average shares used in computing

net income per share:

Basic

331.6

319.2

327.2

320.0

Diluted

338.1

324.6

334.6

325.9

_________________

(1)

The prior period amounts have been

reclassified to conform to the current period presentation.

(2)

Represents charges incurred directly in

connection with the pending merger with HPE.

(3)

Privately-held investments represent

investments in privately-held debt and redeemable preferred stock

securities and equity investments without readily determinable fair

value.

Juniper Networks, Inc.

Preliminary Net Revenues by

Customer Solution

(in millions)

(unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Customer Solutions:

Wide Area Networking

$

420.1

$

454.1

$

1,474.5

$

1,839.3

Data Center

234.3

180.8

810.7

744.7

Campus and Branch

332.8

321.2

1,172.5

1,391.8

Hardware Maintenance and Professional

Services

416.9

408.7

1,615.9

1,588.7

Total

$

1,404.1

$

1,364.8

$

5,073.6

$

5,564.5

Juniper Networks, Inc.

Preliminary Net Revenues by

Vertical

(in millions)

(unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Cloud

$

368.1

$

317.3

$

1,235.6

$

1,162.8

Service Provider

363.1

400.2

1,501.1

1,842.5

Enterprise

672.9

647.3

2,336.9

2,559.2

Total

$

1,404.1

$

1,364.8

$

5,073.6

$

5,564.5

Juniper Networks, Inc.

Preliminary Net Revenues by

Geographic Region

(in millions)

(unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Americas

$

888.9

$

849.7

$

3,112.5

$

3,333.3

Europe, Middle East, and Africa

322.4

335.8

1,232.0

1,405.7

Asia Pacific

192.8

179.3

729.1

825.5

Total

$

1,404.1

$

1,364.8

$

5,073.6

$

5,564.5

Juniper Networks, Inc.

Preliminary Reconciliations

between GAAP and non-GAAP Financial Measures

(in millions, except percentages

and per share amounts)

(unaudited)

Three Months Ended

Twelve Months Ended

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

December 31, 2023

GAAP operating income

$

166.9

$

94.1

$

125.7

$

291.8

$

470.1

GAAP operating margin

11.9

%

7.1

%

9.2

%

5.8

%

8.4

%

Share-based compensation expense

C

79.4

70.2

81.8

290.8

279.4

Share-based payroll tax expense

C

0.8

4.5

0.9

9.1

6.7

Amortization of purchased intangible

assets

A

10.5

10.7

17.2

49.0

68.6

Restructuring (benefits) charges

B

(0.4

)

4.8

19.5

10.1

98.0

Merger-related charges (1)

B

10.9

13.6

1.6

61.9

1.6

Acquisition and integration-related

(benefits) charges

A

—

—

(0.1

)

(0.1

)

0.7

Gain on non-qualified deferred

compensation plan ("NQDC")

B

0.8

2.0

3.5

7.1

6.7

Others (1)

B

—

0.1

0.1

0.2

8.3

Non-GAAP operating income

$

268.9

$

200.0

$

250.2

$

719.9

$

940.1

Non-GAAP operating margin

19.2

%

15.0

%

18.3

%

14.2

%

16.9

%

GAAP net income

$

162.0

$

92.6

$

124.3

$

287.9

$

310.2

Share-based compensation expense

C

79.4

70.2

81.8

290.8

279.4

Share-based payroll tax expense

C

0.8

4.5

0.9

9.1

6.7

Amortization of purchased intangible

assets

A

10.5

10.7

17.2

49.0

68.6

Restructuring (benefits) charges

B

(0.4

)

4.8

19.5

10.1

98.0

Merger-related charges (1)

B

10.9

13.6

1.6

61.9

1.6

Acquisition and integration-related

(benefits) charges

A

—

—

(0.1

)

(0.1

)

0.7

Loss (gain) on privately-held investments

(1)

B

(13.8

)

(0.5

)

5.3

(0.7

)

97.3

Gain on equity investments

B

(0.4

)

(3.1

)

(0.8

)

(7.4

)

(0.5

)

Loss from equity method investment

B

3.2

2.2

3.7

9.6

9.6

Income tax effect of tax legislation

B

—

—

—

—

(7.8

)

One-time tax benefit (2)

B

—

—

(15.5

)

(19.0

)

(15.5

)

Income tax effect of non-GAAP

exclusions

B

(35.6

)

(35.4

)

(41.1

)

(116.9

)

(120.2

)

Others (1)

B

—

0.1

0.1

0.2

8.3

Non-GAAP net income

$

216.6

$

159.7

$

196.9

$

574.5

$

736.4

GAAP diluted net income per share

$

0.48

$

0.28

$

0.38

$

0.86

$

0.95

Non-GAAP diluted net income per share

D

$

0.64

$

0.48

$

0.61

$

1.72

$

2.26

Shares used in computing diluted net

income per share

338.1

335.9

324.6

334.6

325.9

__________________

(1)

The prior period amounts have been

reclassified to conform to the current period presentation.

(2)

Benefits related to one-time changes in

the geographic mix of taxable earnings.

Discussion of Non-GAAP Financial Measures

Juniper Networks believes that the presentation of non-GAAP

financial information provides important supplemental information

to management and investors regarding financial and business trends

relating to the company’s financial condition and results of

operations.

This press release, including the tables above, includes the

following non-GAAP financial measures derived from our Preliminary

Consolidated Statements of Operations: operating income; operating

margin; net income; and diluted net income per share. These

measures are not presented in accordance with, nor are they a

substitute for GAAP. In addition, these measures may be different

from non-GAAP measures used by other companies, limiting their

usefulness for comparison purposes. The non-GAAP financial measures

used in the table above should not be considered in isolation from

measures of financial performance prepared in accordance with GAAP.

Investors are cautioned that there are material limitations

associated with the use of non-GAAP financial measures as an

analytical tool. Certain of the adjustments to our GAAP financial

measures reflect the exclusion of items that are recurring and will

be reflected in our financial results for the foreseeable

future.

We utilize a number of different financial measures, both GAAP

and non-GAAP, in analyzing and assessing the overall performance of

our business, in making operating decisions, forecasting and

planning for future periods, and determining payments under

compensation programs. We consider the use of the non-GAAP measures

presented above to be helpful in assessing the performance of the

continuing operation of our business. By continuing operation, we

mean the ongoing revenue and expenses of the business, excluding

certain items that render comparisons with prior periods or

analysis of on-going operating trends more difficult, such as

expenses not directly related to the actual cash costs of

development, sale, delivery or support of our products and

services, or expenses that are reflected in periods unrelated to

when the actual amounts were incurred or paid. Consistent with this

approach, we believe that disclosing non-GAAP financial measures to

the readers of our financial statements provides such readers with

useful supplemental data that, while not a substitute for financial

measures prepared in accordance with GAAP, allows for greater

transparency in the review of our financial and operational

performance. In addition, we have historically reported non-GAAP

results to the investment community and believe that continuing to

provide non-GAAP measures provides investors with a tool for

comparing results over time. In assessing the overall health of our

business for the periods covered by the table above and, in

particular, in evaluating the financial line items presented in the

table above, we have excluded items in the following three general

categories, each of which are described below: Acquisition Related

Charges, Other Items, and Share-Based Compensation Related Items.

We also provide additional detail below regarding the shares used

to calculate our non-GAAP net income per share. Notes identified

for line items in the table above correspond to the appropriate

note description below.

The above tables and reconciliations can also be found on our

Investor Relations website at http://investor.juniper.net.

Note A: Acquisition Related

Charges. We exclude certain expense items resulting from

acquisitions including amortization of purchased intangible assets

associated with our acquisitions. The amortization of purchased

intangible assets associated with acquisitions results in recording

expenses in our GAAP financial statements that were already

expensed by the acquired company before the acquisition and for

which we have not expended cash. Moreover, had we internally

developed the products acquired, the amortization of intangible

assets, and the expenses of uncompleted research and development

would have been expensed in prior periods. Accordingly, we analyze

the performance of our operations in each period without regard to

such expenses. In addition, acquisitions result in non-continuing

operating expenses, which would not otherwise have been incurred by

us in the normal course of our business operations. We believe that

providing non-GAAP information for acquisition-related expense

items in addition to the corresponding GAAP information allows the

users of our financial statements to better review and understand

the historic and current results of our continuing operations, and

also facilitates comparisons to less acquisitive peer

companies.

Note B: Other Items. We exclude

certain other items that are the result of either unique,

infrequent or unplanned events, including the following, when

applicable: (i) strategic investment-related gain or loss,

including gain or loss from our equity method investment and our

privately-held investments; (ii) legal reserve and settlement

charges or benefits; (iii) gain or loss on significant isolated

events or transactions, including divestitures and the

Russia-Ukraine conflict, which are directly related to the events,

objectively quantifiable, and not expected to occur regularly in

the future that are not indicative of our core operating results;

(iv) merger-related charges, including professional services,

financial advisory fees, and certain retention costs, in connection

with the pending merger with HPE; (v) significant effects of tax

legislation and judicial or administrative interpretation of tax

regulations, including the impact of income tax reform; (vi)

recognition of previously unrecognized tax benefits that are

non-recurring in nature; and (vii) the income tax effect on our

financial statements of excluding items related to our non-GAAP

financial measures. Additionally, the non-GAAP results exclude the

effects of NQDC-related investments. It is difficult to estimate

the amount or timing of these items in advance. Although these

events are reflected in our GAAP financial statements, these

transactions may limit the comparability of our on-going operations

with prior and future periods.

In addition, we exclude restructuring benefits or charges as

these result from events that arise from unforeseen circumstances,

which often occur outside of the ordinary course of continuing

operations. As such, we believe these expenses do not accurately

reflect the underlying performance of our continuing business

operations for the period in which they are incurred or comparisons

to past operating results. We also exclude gains or losses related

to strategic investments as well as significant isolated events as

they are directly related to an event that is distinct and does not

reflect current ongoing business operations. In the case of legal

reserves and settlements, these gains or losses are recorded in the

period in which the matter is concluded or resolved even though the

subject matter of the underlying dispute may relate to multiple or

different periods. As such, we believe that these expenses do not

accurately reflect the underlying performance of our continuing

operations for the period in which they are incurred. Additionally,

we exclude previously unrecognized tax benefits that are

non-recurring in nature which are recorded in the period in which

applicable statutes of limitation lapse or upon the completion of

tax review cycles as the tax matter may relate to multiple or

different periods. Further, certain items related to global tax

reform may continue to impact the business and are generally

unrelated to the current level of business activity. We believe

these tax events limit the comparability with prior periods and

that these expenses or benefits do not accurately reflect the

underlying performance of our continuing business operations for

the period in which they are incurred. We also believe providing

financial information with and without the income tax effect of

excluding items related to our non-GAAP financial measures provide

our management and users of the financial statements with better

clarity regarding the on-going performance and future liquidity of

our business. Because of these factors, we assess our operating

performance with these amounts both included and excluded, and by

providing this information, we believe the users of our financial

statements are better able to understand the financial results of

what we consider our continuing operations.

Note C: Share-Based Compensation Related

Items. We provide non-GAAP information relative to our

expense for share-based compensation and related payroll tax. Due

to the varying available valuation methodologies, subjective

assumptions and the variety of award types, which affect the

calculations of share-based compensation, we believe that the

exclusion of share-based compensation and related payroll tax

allows for more accurate comparisons of our operating results to

our peer companies and is useful to investors to understand the

impact of share-based compensation on our results of operations.

Further, expense associated with granting share-based awards does

not reflect any cash expenditures by the company as no cash is

expended.

Note D: Non-GAAP Net Income Per Share

Items. We provide diluted non-GAAP net income per share. The

diluted non-GAAP net income per share includes additional dilution

from potential issuance of common stock, except when such issuances

would be anti-dilutive.

Juniper Networks, Inc.

Preliminary Condensed

Consolidated Balance Sheets

(in millions)

(unaudited)

December 31,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,224.3

$

1,068.1

Short-term investments

160.3

139.4

Accounts receivable, net of allowances

1,163.3

1,044.1

Inventory

830.1

952.4

Prepaid expenses and other current

assets

467.6

591.5

Total current assets

3,845.6

3,795.5

Property and equipment, net

680.2

689.9

Operating lease assets

160.2

111.4

Long-term investments

385.4

116.8

Purchased intangible assets, net

42.6

91.8

Goodwill

3,734.3

3,734.4

Other long-term assets

1,159.7

978.7

Total assets

$

10,008.0

$

9,518.5

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

256.5

$

295.1

Accrued compensation

357.8

292.2

Deferred revenue

1,228.4

1,130.0

Short-term portion of long-term debt

399.4

—

Other accrued liabilities

399.9

386.7

Total current liabilities

2,642.0

2,104.0

Long-term debt

1,215.7

1,616.8

Long-term deferred revenue

1,013.6

894.9

Long-term income taxes payable

83.5

204.5

Long-term operating lease liabilities

135.5

82.9

Other long-term liabilities

133.5

122.7

Total liabilities

5,223.8

5,025.8

Total stockholders' equity

4,784.2

4,492.7

Total liabilities and stockholders'

equity

$

10,008.0

$

9,518.5

Juniper Networks, Inc.

Preliminary Condensed

Consolidated Statements of Cash Flows

(in millions)

(unaudited)

Twelve Months Ended December

31,

2024

2023

Cash flows from operating

activities:

Net income

$

287.9

$

310.2

Adjustments to reconcile net income to net

cash provided by operating activities:

Share-based compensation expense

290.8

279.4

Depreciation, amortization, and

accretion

156.9

194.7

Deferred income taxes

(213.3

)

(262.1

)

Provision for inventory excess and

obsolescence

33.3

109.8

Operating lease assets expense

43.1

40.7

Loss (gain) on privately-held investments,

net

(0.7

)

97.3

Loss from equity method investment

9.7

9.6

Impairment of assets

5.5

28.0

Loss (gain) on NQDC and other

(7.5

)

(4.8

)

Changes in operating assets and

liabilities, net of acquisitions:

Accounts receivable, net

(119.9

)

183.4

Inventory

82.8

(484.4

)

Prepaid expenses and other assets

94.0

182.2

Accounts payable

(31.6

)

(51.9

)

Accrued compensation

70.3

(13.2

)

Income taxes payable

(67.2

)

(99.6

)

Other accrued liabilities

(64.1

)

(7.5

)

Deferred revenue

218.1

361.0

Net cash provided by operating

activities

788.1

872.8

Cash flows from investing

activities:

Purchases of property and equipment

(115.5

)

(159.4

)

Purchases of available-for-sale debt

securities

(600.0

)

(155.0

)

Proceeds from sales of available-for-sale

debt securities

59.0

31.9

Proceeds from maturities and redemptions

of available-for-sale debt securities

239.2

217.3

Purchases of equity securities

(9.2

)

(11.6

)

Proceeds from sales of equity

securities

6.2

15.7

Proceeds from sale of equity method

investment

30.0

—

Subsequent payments related to

acquisitions in prior years

—

(0.7

)

Funding of loan receivable and other

—

(5.8

)

Net cash used in investing activities

(390.3

)

(67.6

)

Cash flows from financing

activities:

Repurchase and retirement of common stock

(1)

—

(385.0

)

Shares repurchased and retired for tax

withholding on vesting of restricted stock (1)

(17.9

)

(12.6

)

Proceeds from issuance of common stock

73.4

61.9

Payment of dividends

(288.6

)

(280.8

)

Payment of debt issuance costs and

other

0.4

(2.3

)

Net cash used in financing activities

(232.7

)

(618.8

)

Effect of foreign currency exchange rates

on cash, cash equivalents, and restricted cash

(13.6

)

0.2

Net increase in cash, cash equivalents,

and restricted cash

151.5

186.6

Cash, cash equivalents, and restricted

cash at beginning of period

1,084.3

897.7

Cash, cash equivalents, and restricted

cash at end of period

$

1,235.8

$

1,084.3

__________________

(1)

The prior period amounts have been

reclassified to conform to the current period presentation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204808656/en/

Investor Relations: Jess Lubert Juniper Networks (408)

936-3734 jlubert@juniper.net

Media Relations: Penny Still Juniper Networks

+441372385692 pstill@juniper.net

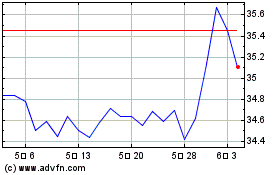

Juniper Networks (NYSE:JNPR)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

Juniper Networks (NYSE:JNPR)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025