As filed with the Securities and Exchange Commission

on December 26, 2024

Registration No. 333-282664

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT

OF 1933

THE CHILDREN’S

PLACE, INC.

(Exact Name of Registrant

as Specified in Its Charter)

| Delaware |

31-1241495 |

(State

or Other Jurisdiction of

Incorporation or Organization) |

(I.R.S.

Employer

Identification Number) |

500 Plaza Drive

Secaucus, New Jersey

07094

(201) 558-2400

(Address, Including

Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Jared E. Shure

Chief Administrative

Officer, General Counsel and Corporate Secretary

The Children's Place, Inc.

500 Plaza Drive

Secaucus, New Jersey 07094

(201) 558-2400

(Name, Address, Including

Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Cadwalader, Wickersham &

Taft LLP

200 Liberty Street

New York, NY 10281

212-504-6000

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended

(the “Securities Act”), check the following box. x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

check the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “accelerated filer,” “large accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer |

|

¨ |

Accelerated filer |

x |

|

| |

Non-accelerated filer |

|

¨ |

Smaller reporting company |

¨ |

|

| |

|

|

|

Emerging growth company |

¨ |

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. These securities may not be distributed until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy

these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY

Prospectus Dated december 26, 2024

THE CHILDREN’S PLACE, INC.

Non-Transferable

Subscription Rights to Purchase Up to $90,000,000 in

Shares of Common Stock, representing 9,230,769 Shares of Common Stock in the Aggregate

The Children’s Place, Inc.

(“The Children’s Place”, the “Company”, “we”, “us”

or “our”) is distributing at no charge to the holders of our common stock, par value $0.10 per share (the “Common

Stock”), on a pro rata basis, non-transferable subscription rights to purchase up to an aggregate of 9,230,769 shares

of our Common Stock at a subscription price of $9.75 per whole share, payable by each rights holder (i) in cash, (ii) by delivery

in lieu of cash of an equivalent amount of any indebtedness for borrowed money (principal and/or accrued and unpaid interest) owed by

the Company to such rights holder, or (iii) by delivery of a combination of cash and such indebtedness. We refer to this offering

as the “Rights Offering”. We are offering to each of our stockholders one non-transferable subscription right for

each full share of Common Stock owned by that stockholder as of the close of business on December 13, 2024, the record date (the

“Record Date”). Each subscription right will entitle its holder to purchase 0.7220 shares of our Common Stock. Additionally,

rights holders who fully exercise their basic subscription rights will be entitled to subscribe for additional shares of our Common Stock

that remain unsubscribed as a result of any unexercised basic subscription rights (the “over-subscription privilege”).

The over-subscription privilege allows a rights holder to subscribe for additional shares of our Common Stock at the subscription price

of $9.75 per whole share. We refer to the basic subscription rights and over-subscription privilege as “rights” or “subscription

rights”.

The

total subscription price of shares of Common Stock offered in this Rights Offering will be $90.0 million, assuming all rights are exercised.

To the extent you properly exercise your over-subscription privilege for an amount of shares of Common Stock that exceeds the number

of the unsubscribed shares of Common Stock available to you, the subscription agent for this Rights Offering, Equiniti Trust Company,

LLC (the “Subscription Agent”), will return to you any excess subscription payments, in the manner and form in which

such payments were made, without interest or penalty, as soon as practicable following the Expiration Date and Time (as defined below),

and after all necessary calculations, pro rata allocations and adjustments

have been completed. We are not requiring a minimum individual or overall subscription to complete the Rights Offering. The Subscription

Agent will hold all funds received from subscribing stockholders in a segregated account (or, with respect to any evidence of indebtedness

for borrowed money received from subscribing stockholders, in escrow) until we issue your shares of our Common Stock to you upon consummation

of the Rights Offering or the withdrawal or termination of the Rights Offering. Subscription rights may only be exercised in aggregate

for whole numbers of our Common Stock; fractional shares of Common Stock or cash in lieu of fractional shares of Common Stock will

not be issued in the Rights Offering. Any fractional shares of Common Stock resulting from the exercise of the basic subscription rights

will be eliminated by rounding down to the nearest whole share of Common Stock.

The subscription rights

may be exercised at any time during the Rights Offering subscription period (the “Subscription Period”), which will

commence on December 31, 2024, and will expire at 5:00 p.m., New York City time, on January 31, 2025 (the “Expiration

Date and Time”). We may, in our sole discretion, extend the Subscription Period. We will extend the duration of the Rights

Offering as required by applicable law, and we may choose to extend it if we decide that changes in the market price of our Common Stock

warrant an extension or if we decide to give you more time to exercise your subscription rights in this Rights Offering. Once you have

exercised your subscription right, your exercise may not be revoked. The rights are non-transferable. The subscription rights that are

not exercised by the Expiration Date and Time will expire and will have no value. You should carefully consider whether or not to exercise

your subscription rights before the Expiration Date and Time. If you are a beneficial owner of shares of Common Stock registered in the

name of a broker, dealer, custodian bank, or other nominee, your nominee may establish an earlier deadline before the Expiration

Date and Time by which time you must provide the nominee with your instructions and deliver all documents and payments to exercise your

subscription rights.

See “The Rights

Offering” for additional information.

The

Rights Offering is being made in connection with the Letter Agreement between the Company and Mithaq Capital SPC, a Cayman segregated

portfolio company (“Mithaq”) entered into on February 29, 2024 (the “Letter Agreement”).

Our largest stockholder,

Mithaq, has indicated that it currently intends, but undertakes no obligation, to exercise all of the subscription rights distributed

to it and its subsidiary, Snowball Compounding Ltd. (“Snowball”), by the Company in the Rights Offering, as well as

the over-subscription privilege, and that it currently intends, but undertakes no obligation, to pay some or all of the subscription

price payable upon the exercise of any such subscription rights directly held by Mithaq with indebtedness for borrowed money owed by

the Company to Mithaq (including any indebtedness then-outstanding pursuant to Mithaq Term Loans (as defined below)). Our directors and

executive officers who own shares of Common Stock are permitted, but not required, to participate in the Rights Offering on the same

terms and conditions applicable to all holders of subscription rights. See “The Rights Offering – Participation of Our

Directors, Executive Officers and Significant Stockholders” and “Risk Factors – Risks Related to Our Stock and

Stock Price – We have a controlling stockholder who, following the Rights Offering, may continue owning a majority of our outstanding

shares of Common Stock, and as a result controls all matters requiring shareholder approval.”

Our Common Stock is listed

on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “PLCE”. On December 24, 2024, the

closing price of our Common Stock as reported by Nasdaq was $9.90 per share.

The subscription rights are

non-transferable, except that they will be transferable by operation of law. The subscription rights will not be listed for trading on

Nasdaq or any other stock exchange or market.

| | |

Per Share

of

Common

Stock | | |

Aggregate | |

| Subscription Price | |

$ | 9.75 | | |

$ | 90,000,000 | |

| Proceeds to The Children’s Place, before expenses | |

$ | 9.75 | | |

$ | 90,000,000 | (1) |

(1) Assumes

that the Rights Offering is fully subscribed and that the subscription price for all shares of Common Stock subscribed for is paid in

cash. To the extent that the subscription price for any shares of Common Stock subscribed for is paid for by the delivery of indebtedness

for borrowed money, such delivery would have the result of reducing the Company’s outstanding indebtedness for borrowed money but

would not result in cash proceeds to the Company.

Exercising

the subscription rights and investing in our Common Stock involves significant

risks. We urge you to read carefully the entirety of this prospectus, including the section titled “Risk Factors”

beginning on page 11 of this prospectus, the section titled “Risk Factors” of the Company’s Annual

Report on Form 10-K filed on May 6, 2024 (the “Form 10-K”) and in our Quarterly Reports on

Form 10-Q for the fiscal quarters ended May 4,

2024, August 3,

2024 and November 2,

2024, and all other information included or incorporated by reference in this prospectus before you decide whether to exercise your

rights.

Neither the Securities

and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities

or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Equiniti Trust Company, LLC

will serve as the Subscription Agent and transfer agent (the “Transfer Agent”) for the Rights Offering, and D.F. King &

Co., Inc. will serve as the information agent (the “Information Agent”) for the Rights Offering.

Neither we nor our board

of directors (the “Board of Directors”) make any recommendation to holders regarding whether they should exercise

their subscription rights. As a result of the terms of this Rights Offering, stockholders who do not fully exercise their subscription

rights will own, upon completion of this Rights Offering, a smaller proportional interest in our Common Stock than otherwise would be

the case had they fully exercised their rights, including as compared to any stockholders that exercise a greater proportion of their

rights. See “Risk Factors” beginning on page 11 of this registration statement for more information.

If you have any questions

or need further information about this Rights Offering, please call D.F. King & Co., Inc., our Information Agent for this

Rights Offering, at (888) 567-1626. It is anticipated that delivery of the Common Stock purchased in this Rights Offering will be made

on or about February 7, 2025 (assuming all necessary calculations, pro rata allocations

and adjustments have been completed by such date).

The

date of this prospectus is [•], 2024.

TABLE OF CONTENTS

ABOUT

THIS PROSPECTUS

This prospectus is part of

a registration statement that we have filed with the SEC. The exhibits to the registration statement contain the full text of certain

contracts and other important documents we have summarized in this prospectus. Since these summaries may not contain all the information

that you may find important in deciding whether to purchase our Common Stock, you should review the full text of these documents. The

registration statement and the exhibits can be obtained from the SEC as indicated under the section entitled “Where You Can

Find More Information”.

We have not authorized

anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf

of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other

information that others may give you. You should assume that the information appearing in this prospectus is accurate only as of the

date on its cover page. Our business, financial condition, results of operations and prospects may have changed since those dates.

QUESTIONS

AND ANSWERS ABOUT THE RIGHTS OFFERING

The following are examples

of what we anticipate will be common questions about the Rights Offering. The answers are based on selected information included elsewhere

in this prospectus. The following questions and answers do not contain all of the information that may be important to you and may not

address all of the questions that you may have about the Rights Offering. You should carefully read this prospectus and the documents

incorporated by reference in this prospectus as they contain more detailed descriptions of the terms and conditions of the Rights Offering

and provide additional information about us and our business, including potential risks related to the Rights Offering. We urge you to

read this entire prospectus, our financial statements and related notes and the other information incorporated by reference herein as

described under the section entitled “Incorporation of Certain Information by Reference”.

| Q: | What

is the Rights Offering? |

| A: | The

Rights Offering is a pro rata distribution at no charge to holders of our Common Stock

of non-transferable subscription rights to purchase up to an aggregate of 9,230,769

shares of our Common Stock at a subscription price of $9.75 per whole share. We are offering

to each of our stockholders, either as a holder of record or, in the case of shares held

of record by brokers, dealers, custodian banks or other nominees on your behalf, as a beneficial

owner of those shares, one non-transferable subscription right for each full share of Common

Stock owned by that stockholder as of the close of business on the Record Date. Each subscription

right will entitle its holder to purchase 0.7220 shares of our Common Stock. Each subscription

right contains the basic subscription right and an over-subscription privilege, as described

below. This registration statement is registering both the subscription rights and the shares

of Common Stock that may be issued pursuant to the exercise of subscription rights. |

| Q: | What

is the basic subscription right? |

| A: | The

basic subscription right gives our stockholders the opportunity to purchase 0.7220

shares of Common Stock at a subscription price of $9.75 per whole share. We have granted

to you, as a stockholder of record on the Record Date, one non-transferable subscription

right for every share of our Common Stock you owned at that time. |

We determined the ratio of rights required

to purchase one share of Common Stock by dividing $90.0 million by the subscription price of $9.75 to determine the number of shares

of Common Stock to be issued in the Rights Offering and then dividing the number of shares of Common Stock to be issued in the Rights

Offering by 12,784,972, which was the number of shares of our Common Stock outstanding on the Record Date. Accordingly, each subscription

right allows the holder thereof to subscribe for 0.7220 shares of Common Stock at a subscription price of $9.75 per whole share. As an

example, if you owned 1,000 shares of our Common Stock on the Record Date, you would receive 1,000 subscription rights pursuant to your

basic subscription right that would entitle you to purchase up to 722 shares of Common Stock at a subscription price of $9.75 per whole

share.

You may exercise all or a portion of

your basic subscription right or you may choose not to exercise any subscription rights at all. However, if you exercise less than your

full basic subscription right, you will not be entitled to purchase shares of Common Stock under your over-subscription privilege.

If

you hold your shares in street name through a broker, dealer, custodian bank, or other nominee who uses the services of The Depository

Trust Company (“DTC”), then DTC will issue one non-transferable subscription right to your nominee for every share

of our Common Stock you own on the Record Date. Each subscription right can then be used to purchase 0.7220 shares of Common Stock for

$9.75 per whole share of Common Stock. See “The Rights Offering – Procedures for DTC Participants”. As in the

example above, if you owned 1,000 shares of our Common Stock on the Record Date, your nominee would receive 1,000 subscription rights

and you would have the right to purchase up to 722 shares of Common Stock for $9.75 per whole share.

No fractional shares of Common Stock

will be issued upon the exercise of subscription rights in the Rights Offering. Any fractional shares of Common Stock created by the

exercise of subscription rights will be rounded down to the nearest whole share.

| Q: | What

is the over-subscription privilege? |

| A: | The

over-subscription privilege of each subscription right entitles you, if you fully exercise

your basic subscription right and subject to certain limitations, to subscribe for additional

shares of our Common Stock at the same subscription price per share if any shares are not

purchased by other holders of subscription rights under their basic subscription rights as

of the Expiration Date and Time. No fractional shares will be issued. |

| Q: | What

if there are an insufficient number of shares of Common Stock to satisfy the over-subscription

requests? |

If

there are an insufficient number of shares of our Common Stock available to fully satisfy the over-subscription requests of rights holders,

whether due to all holders exercising their basic subscription rights in full, or due to over-subscription requests exceeding the number

of shares not purchased by other holders of subscription rights under their basic subscription rights, subscription rights holders who

exercised their over-subscription privilege will receive the available shares of Common Stock pro rata based on the number of

shares of Common Stock each subscription rights holder subscribed for under the basic subscription right. “Pro rata”

means in proportion to the number of shares of our Common Stock that you and the other subscription rights holders have purchased by

exercising your basic subscription rights on your Common Stock holdings. Any excess subscription payments will be returned in the manner

and form in which such payments were made, without interest or penalty, as soon as practicable following the Expiration Date and Time,

and after all necessary calculations, pro rata allocations and adjustments

have been completed.

| Q: | Will

fractional shares be issued upon exercise of the subscription rights? |

| A: | No. We

will not issue fractional shares of Common Stock in this Rights Offering. Any fractional

shares of Common Stock created by the exercise of subscription rights will be rounded down

to the nearest whole share. Any excess subscription payments received by the Subscription

Agent will be returned in the manner and form in which such payments were made, without interest

or deduction, as soon as practicable following the Expiration Date and Time, and after

all necessary calculations, pro rata allocations

and adjustments have been completed. |

| Q: | Why

are you engaging in the Rights Offering? |

| A: | On

February 28, 2024, the then-Board of Directors of the Company, none of the members of

which were associated with Mithaq, approved the Letter Agreement, which requires, among other

things, that the Company use reasonable best efforts to prepare, file, and cause to be effective

a registration statement, prospectus and other materials required under applicable law to

permit, and to then commence and complete, a rights offering, as has been previously disclosed

by the Company. In furtherance of the Company’s efforts to comply with such pre-existing

contractual obligation, and following the determination of the disinterested directors on

the Company’s current Board of Directors (the “Disinterested Directors”)

that the Rights Offering is in the best interests of the Company and its stockholders and

would, among other things, provide the Company with an opportunity to raise capital and deleverage

and more generally strengthen its balance sheet, the Disinterested Directors unanimously

approved the Rights Offering. See “Summary – Recent Developments”,

“Use of Proceeds” and “The Rights Offering – Reasons for

the Rights Offering” for additional information. |

| Q: | When

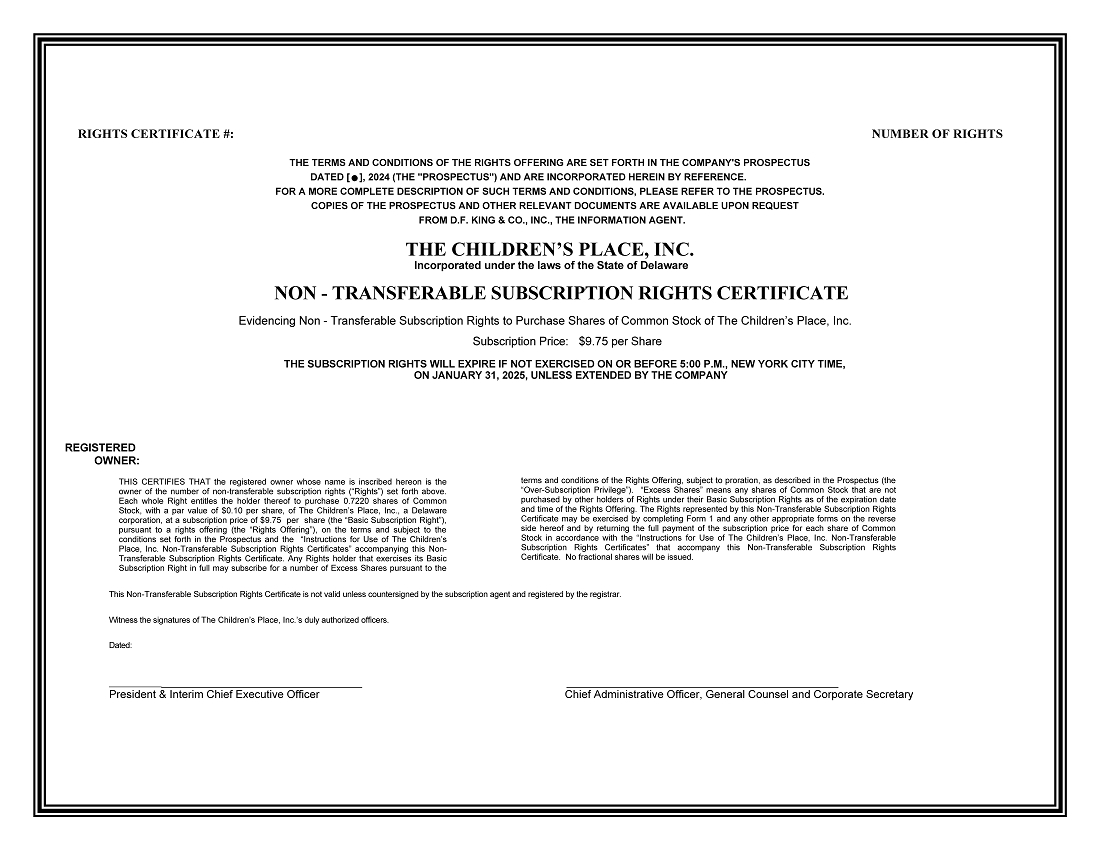

will I receive my rights certificate? |

| A: | Promptly

after the date of this prospectus, the Subscription Agent will send a rights certificate

to each registered holder of our Common Stock as of 5:00 p.m., New York City time, on the

Record Date, based on our stockholder registry maintained at the Transfer Agent for our Common

Stock. If you hold your shares of Common Stock in “street name” through a brokerage

account, dealer, custodian bank, or other nominee, you will not receive a physical rights

certificate. Instead, as described in this prospectus, you must instruct your broker, dealer,

custodian bank, or other nominee whether or not to exercise subscription rights on your behalf.

If you wish to obtain a separate rights certificate, you should promptly contact your broker,

dealer, custodian bank, or other nominee and request a separate rights certificate. It is

not necessary to have a physical rights certificate to elect to exercise your subscription

rights if your shares are held by a broker, dealer, custodian bank, or other nominee. |

| Q: | What

happens if I choose not to exercise my subscription rights? |

| A: | You

will retain your current number of shares of our Common Stock even if you do not exercise

your basic subscription rights. However, if you do not exercise your basic subscription rights,

the percentage of our Common Stock that you own may decrease, and your voting and other rights

may be diluted. |

| Q: | Can

the Board of Directors amend, withdraw or terminate the Rights Offering? |

| A: | Yes.

Our Board of Directors reserves the right to amend, withdraw or terminate the Rights Offering

at any time prior to the expiration of the Rights Offering for any reason. If the Rights

Offering is terminated, any subscription payments received by the Subscription Agent will

be returned in the manner and form in which such payments were made, without interest or

penalty, as soon as practicable following the termination of the Rights Offering. To the

extent that our Board of Directors amends material terms of, withdraws or terminates the

Rights Offering, we will notify our stockholders in a manner reasonably calculated to inform

them about such action. |

| Q: | When

will the Rights Offering expire? |

| A: | The

subscription rights will expire, if not exercised, at the Expiration Date and Time, unless

we decide to extend the Rights Offering until some later time. See “The Rights Offering

– Expiration of the Rights Offering and Extensions, Amendments and Termination”.

The Subscription Agent must actually receive all required documents and payments before that

time and date in order for you to properly exercise your subscription rights. Although we

will make reasonable attempts to provide this prospectus to our stockholders, the Rights

Offering and all subscription rights will expire on the Expiration Date and Time, whether

or not we have been able to locate each person entitled to subscription rights. If you cannot

deliver your documents and payment before the Expiration Date and Time, you may follow the

guaranteed delivery procedures described under “The Rights Offering – Guaranteed

Delivery Procedures”. |

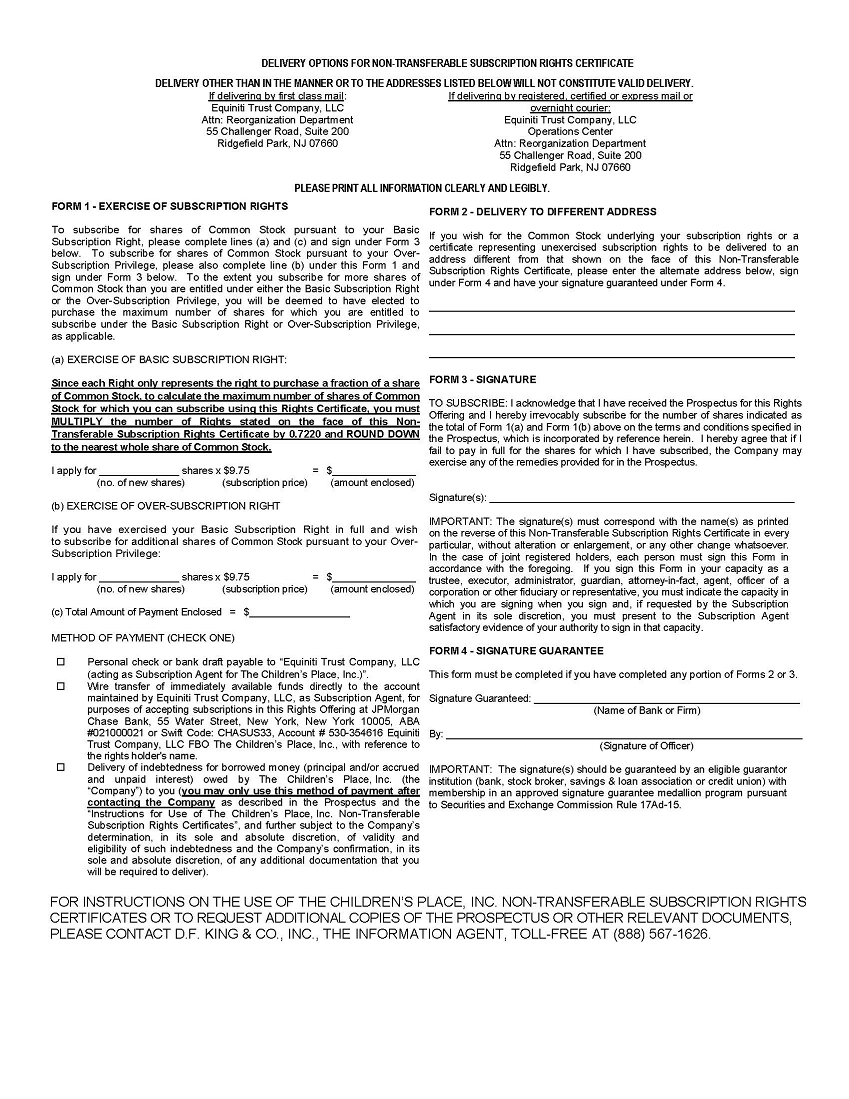

| Q: | How

do I exercise my subscription rights? |

| A: | You

may exercise your subscription rights by properly completing and signing your subscription

rights certificate if you are a record holder of our Common Stock, or by properly completing

the subscription documents received from your bank or broker-dealer if your shares of Common

Stock are held in street name. Your subscription rights certificate, or properly completed

subscription documents, as the case may be, together with full payment of the subscription

price, must be received by the Subscription Agent by the Expiration Date and Time, unless

delivery of the subscription rights certificate is effected pursuant to the guaranteed delivery

procedures described below. You must exercise your over-subscription privilege at the same

time you exercise your basic subscription right in full. In exercising the over-subscription

privilege, you must pay the full subscription price for all the shares you are electing to

purchase. All subscription payments received by the Subscription Agent from the exercise

of subscription rights that are not fulfilled will be returned to investors in the manner

and form in which such payments were made, without interest or penalty, as soon as practicable

after the Rights Offering has expired and all prorating calculations and reductions contemplated

by the terms of the Rights Offering have been effected. |

If you use mail, we recommend that

you use insured, traceable or overnight mail, return receipt requested. We will not be obligated to honor your exercise of subscription

rights if the Subscription Agent receives the documents relating to your exercise after the Expiration Date and Time, regardless of when

you transmitted the documents.

| Q: | May I

transfer, sell or assign my subscription rights? |

| A: | No.

You may not transfer, sell or assign any of your subscription rights, except that the

subscription rights will be transferable by operation of law. The subscription rights are

non-transferable and will not be listed on any securities exchange or included in any automated

quotation system. Therefore, there will be no market for the subscription rights. |

| Q: | What

should I do if I want to participate in the Rights Offering but my shares of Common Stock

are held in the name of my broker, dealer, custodian bank, or other nominee? |

| A: | If

you hold shares of our Common Stock through a broker, dealer, custodian bank, or other nominee,

we will ask your broker, dealer, custodian bank, or other nominee to notify you of the Rights

Offering. If you wish to exercise your subscription rights, you will need to have your broker,

dealer, custodian bank, or other nominee act for you. To indicate your decision, you should

complete and return to your broker, dealer, custodian bank, or other nominee the form entitled

“Beneficial Owner Election Form”. You should receive this form from your broker,

dealer, custodian bank, or other nominee with the other rights offering materials. You should

contact your broker, dealer, custodian bank, or other nominee if you do not receive this

form, but you believe you are entitled to participate in the Rights Offering. Your

nominee may establish an earlier deadline before the Expiration Date and Time by

which time you must provide the nominee with your instructions and deliver all documents

and payments to exercise your subscription rights. |

| Q: | Will

I be charged a sales commission or a fee if I exercise my subscription rights? |

| A: | We

will not charge a brokerage commission or a fee to subscription rights holders for exercising

their subscription rights. However, if you exercise your subscription rights through a broker,

dealer, custodian bank, or other nominee, you will be responsible for any fees charged by

your broker, dealer, custodian bank, or other nominee. |

| Q: | Are

there any conditions to my right to exercise my subscription rights? |

| A: | Yes.

The Rights Offering is subject to certain limited conditions. See “The Rights Offering

– Conditions, Amendment, Withdrawal and Termination”. |

| Q: | May I

participate in this Rights Offering if I sell my Common Stock after the Record Date? |

| A: | The

Record Date for this Rights Offering is December 13, 2024. If you owned Common Stock

as of the Record Date, you will receive subscription rights and may participate in the Rights

Offering even if you subsequently sell your Common Stock. |

| Q: | Will

the Company’s executive officers and directors exercise their subscription rights? |

Messrs. Turki Saleh A. AlRajhi

and Muhammad Asif Seemab, members of the Board of Directors, are also Managing Directors of Mithaq,

and may be deemed to beneficially own all of the shares of Common Stock currently beneficially owned by Mithaq and its subsidiary, Snowball,

and any shares of Common Stock which would be acquired by Mithaq and Snowball upon exercise of their subscription rights in the

Rights Offering. Mithaq has indicated that it currently intends, but undertakes no obligation, to exercise all of the subscription rights

distributed to it and Snowball by the Company in the Rights Offering, as well as the over-subscription privilege.

More generally, our directors and executive

officers who own shares of Common Stock are permitted, but not required, to participate in the Rights Offering on the same terms and

conditions applicable to all holders of subscription rights.

| Q: | What

is the recommendation of the Board of Directors regarding the Rights Offering? |

| A: | Although

the Rights Offering has been approved by the Disinterested Directors, neither the Company

nor the Board of Directors is making any recommendation regarding your exercise of subscription

rights in the Rights Offering or the sale or transfer of the underlying shares of Common

Stock. You are urged to make your decision based on your own assessment of your best interests

and of our business and financial condition, our prospects for the future, the terms of the

Rights Offering and the information contained in, or incorporated by reference in, this prospectus,

as it may be supplemented from time to time. |

| Q: | How

was the subscription price of $9.75 per whole share of Common Stock established? |

| A: | The

Disinterested Directors determined the subscription price prior to the registration statement

of which this prospectus forms a part becoming effective, after

consultation with our financial advisor, Roth Capital Partners, LLC (“Roth”),

and taking into consideration, among other things, the following factors: |

| · | the

current and historical trading prices of Common Stock on Nasdaq; |

| · | the

Disinterested Directors’ assessment of the price at which stockholders might be willing

to participate in the Rights Offering; |

| · | the

Company’s need for additional capital and liquidity and to deleverage; |

| · | the

Company’s business prospects and general conditions of the securities markets; |

| · | the

cost of capital from other sources; |

| · | comparable

precedent transactions, including the percentage of shares offered, the terms of the rights

being offered, the subscription price and the discount that the subscription price represents

to recent closing prices for those offerings; and |

| · | the

Company’s contractual obligations pursuant to the Letter Agreement. |

In conjunction with the review of these

factors, the Disinterested Directors considered our history and prospects, including our past and present earnings and cash requirements,

our prospects for the future, the outlook for our industry and our current financial condition. The Disinterested Directors believe that

the subscription price should be designed to provide an incentive to our current stockholders to participate in the Rights Offering and

exercise their basic subscription rights and their over-subscription privilege.

The subscription price does not necessarily

bear any relationship to the book value of our assets or our past operations, cash flows, losses, financial condition, net worth or any

other established criteria used to value securities. No valuation consultant or investment banker has opined or is expected to opine

upon the fairness or adequacy of the subscription price. You should not consider the subscription price to necessarily be an indication

of the fair value of the Common Stock to be offered in this Rights Offering. You should not assume or expect that, after the Rights Offering,

our Common Stock will trade at or above the subscription price in any given time period. The market price of our Common Stock may decline

after the Rights Offering. We cannot assure you that you will be able to sell the shares of our Common Stock purchased during the Rights

Offering at a price equal to or greater than the subscription price. You should obtain a current price quote for our Common Stock before

exercising your subscription sights and make your own assessment of our business and financial condition, our prospects for the future,

and the terms of the Rights Offering. Once made, all exercises of subscription rights are irrevocable. For a discussion of recent trading

prices of our Common Stock on Nasdaq, see “Public Market for Our Common Stock”.

We retained

Roth to render certain financial advisory services in connection with the Rights Offering. We have agreed to pay Roth a $200,000

fee for rendering these services. See “Plan of Distribution”.

| Q: | Is

it risky to exercise my subscription rights? |

| A: | The

exercise of your subscription rights involves risks. Exercising your subscription rights

means buying additional shares of our Common Stock and should be considered as carefully

as you would consider any other equity investment. You should carefully consider the information

under the heading “Risk Factors” and all other information included herein

before deciding to exercise your subscription rights. |

| Q: | Am

I required to subscribe in the Rights Offering? |

| A: | No.

You may exercise any number of your subscription rights or you may choose not to exercise

any subscription rights. If you do not exercise any subscription rights, the number of shares

of our Common Stock you own will not change. However, if you choose not to exercise your

subscription rights in full, your ownership interest in our capital stock may be diluted

by other stockholder purchases. In addition, if you do not exercise your basic subscription

right in full, you will not be entitled to participate in the over-subscription privilege.

See “Risk Factors - Risks Related to the Rights Offering - Stockholders who do not

fully exercise their rights may have their interests diluted”. |

| Q: | How

do I exercise my subscription rights if I live outside the United States? |

| A: | Subscription

rights certificates will only be mailed to holders as of the Record Date whose addresses

are within the United States (other than an APO or FPO address). Holders as of the Record

Date whose addresses are outside the United States or who have an APO or FPO address and

who wish to subscribe to the Rights Offering either in part or in full should contact the

Subscription Agent in writing no later than five business days prior to the Expiration Date

and Time. See “The Rights Offering—Foreign Restrictions”. |

| Q: | After

I exercise my subscription rights, can I change my mind and cancel my purchase? |

| A: | No. Once

you send in your subscription rights certificate and payment, you cannot revoke the exercise

of your subscription rights, even if the market price of our Common Stock is below the subscription

price of $9.75 per whole share of Common Stock. You should not exercise your subscription

rights unless you are certain that you wish to purchase additional shares of our Common Stock

at a price of $9.75 per whole share of Common Stock. Subscription rights not exercised prior

to the expiration of the Rights Offering will expire and will have no value. |

| Q: | What

are the U.S. federal income tax consequences of receiving or exercising my subscription rights? |

| A: | Although

the authorities governing transactions such as the Rights Offering are complex and unclear

in certain respects (including with respect to the effects of the over-subscription privilege),

we believe and intend to take the position that a holder’s receipt or exercise of rights

should generally be non-taxable for U.S. federal income tax purposes. This position regarding

the non-taxable treatment of the Rights Offering is, however, not binding on the U.S. Internal

Revenue Service (the “IRS”) or the courts. You should consult your tax

advisor as to the particular tax consequences to you of the receipt of rights in the Rights

Offering and the exercise or lapse of the rights, including the applicability of any state,

local or non-U.S. tax laws in light of your particular circumstances. For a more detailed

discussion, see “Material U.S. Federal Income Tax Consequences”. |

| Q: | If

the Rights Offering is not completed, will my subscription payment be returned to me? |

| A: | Yes.

The Subscription Agent will hold all funds received from subscribing stockholders

in a segregated account (or, with respect to any evidence of indebtedness for borrowed money

received from subscribing stockholders, in escrow) until we issue your shares of our Common

Stock to you upon consummation of the Rights Offering or the withdrawal or termination of

the Rights Offering. If the Rights Offering is not completed, all subscription payments

that the Subscription Agent receives will be returned in the manner and form in which such

payments were made, without interest or deduction, as soon as practicable after the Expiration

Date and Time, and after all necessary calculations,

pro rata allocations and adjustments have been completed. If you own shares

in “street name”, it may take longer for you to receive payment because the Subscription

Agent will return payments to the record holder of your shares of Common Stock. |

| Q: | How

many shares of Common Stock will be outstanding after the Rights Offering? |

| A: | We

expect approximately 22,015,741 shares of our Common Stock will be outstanding immediately

after the completion of the Rights Offering, assuming full exercise of each holder’s

basic subscription rights and no other changes in our shares outstanding. |

| Q: | Will

Mithaq exercise the subscription rights? |

| A: | Mithaq

has indicated that it currently intends, but undertakes no obligation, to exercise all of

the subscription rights distributed to it and its subsidiary, Snowball, by the Company in

the Rights Offering, as well as the over-subscription privilege, and that it currently intends,

but undertakes no obligation, to pay some or all of the subscription price payable upon the

exercise of any such subscription rights directly held by Mithaq with indebtedness for borrowed

money owed by the Company to Mithaq (including any indebtedness then-outstanding pursuant

to Mithaq Term Loans). We expect the total subscription price payable upon the exercise of

all of such rights by Mithaq and Snowball, excluding any additional subscription price that

might be payable in connection with any exercise by Mithaq and Snowball of the over-subscription

privilege, to be approximately $49,289,077.50. See “The Rights Offering—Participation

of Our Directors, Executive Officers and Significant Stockholders” and “Risk

Factors – Risks Related to Our Stock and Stock Price – We have a controlling

stockholder who, following the Rights Offering, may continue owning a majority of our outstanding

shares of Common Stock, and as a result controls all matters requiring shareholder approval.” |

| Q: | If

I exercise my subscription rights, when will I receive shares of Common Stock purchased in

the Rights Offering? |

|

A: |

We

will deliver to the record holders who purchase shares of our Common Stock in the Rights Offering DRS statements representing

the shares of Common Stock purchased in the Rights Offering as soon as practicable after the Expiration Date and Time, or such

later date as to which the Rights Offering may be extended, and after all necessary

calculations, pro rata allocations and adjustments have been completed.

If

you hold your shares of Common Stock in street name through a broker, dealer, custodian bank, or other nominee and you purchase shares

of Common Stock in the Rights Offering, your account with your nominee will be credited with the shares you purchased in the Rights

Offering as soon as practicable after the Expiration Date and Time, or such later date as to which the Rights Offering may be extended,

and after all necessary calculations, pro rata allocations and adjustments have

been completed. |

| Q: | Will

the subscription rights be listed on a stock exchange or national market? |

| A: | No. The

subscription rights are non-transferable and will not be listed on any securities exchange

or included in any automated quotation system. Therefore, there will be no market for the

subscription rights. |

| Q: | To

whom should I send my forms and payment? |

| A: | The

Subscription Agent for this Rights Offering is Equiniti Trust Company, LLC. If your

shares of Common Stock are held in the name of a broker, dealer, custodian bank, or other

nominee, then you should send your applicable subscription documents to your broker, dealer,

custodian bank, or other nominee. If you are a record holder, then you should send your applicable

subscription documents, by first class mail, registered, certified or express mail, or overnight

courier, to: |

Equiniti Trust Company, LLC

55 Challenger Road

Suite # 200

Ridgefield Park, New Jersey 07660

Attn: Reorganization Department

Delivery of your subscription documents

to an address other than set forth above does not constitute a valid delivery.

We will pay the fees and expenses of

the Subscription Agent and have agreed to indemnify the Subscription Agent with respect to certain liabilities that it may incur in connection

with the Rights Offering.

You are solely responsible for timely

completing the delivery to the Subscription Agent of your subscription documents, subscription rights certificate and payment. We urge

you to allow sufficient time for delivery of your subscription materials.

| Q: | I

am a stockholder and also a creditor of the Company with respect to indebtedness

for borrowed money. I would like to pay some or all of the subscription price

for my shares of Common Stock by delivery, in lieu of cash, of an equivalent amount of indebtedness

for borrowed money owed to me by the Company. How can I do so? |

|

A: |

If

you would like to pay some or all of the subscription price for your shares of Common Stock

by delivery, in lieu of cash, of an equivalent amount of indebtedness for borrowed money owed to

you by the Company, you must contact the Company at:

500 Plaza Drive

Secaucus, New Jersey

07094

Attention:

Jared E. Shure, Chief Administrative Officer, General Counsel & Secretary

Telephone:

(201) 453-7049

as soon as practicable after the date of

this prospectus (and in any event prior to exercising your subscription rights and delivering any indebtedness for borrowed money

in payment therefor) so that the Company can in its sole and absolute discretion, (i) determine whether it considers such indebtedness

for borrowed money to be valid and eligible for delivery in payment of some or all of the subscription price and (ii) confirm

the documentation that you will be required to deliver to the Subscription Agent in order to validly deliver such indebtedness for

borrowed money as payment for some or all of the subscription price. As it may take some time for the Company to evaluate and respond

to requests to deliver indebtedness for borrowed money in full or partial payment of the subscription price and for you, thereafter,

to complete and provide the necessary documentation to the Subscription Agent, the Company strongly recommends that you start this

process as soon as possible and not wait until the final days of the Subscription Period. Your delay in commencing this process may

result in your being unable to timely deliver your indebtedness for borrowed money as full or partial payment of the subscription

price, which in turn would result in your purported exercise of Rights to be paid for with such indebtedness for borrowed money being

rejected.

Following

the Company’s determination, in its sole and absolute discretion, that it considers such indebtedness for borrowed money to

be valid and eligible for delivery in payment of some or all of the subscription price and confirmation, in its sole and absolute

discretion, of the documentation that you will be required to deliver to the Subscription Agent in order to validly deliver such

indebtedness for borrowed money as payment for some or all of the subscription price, you must deliver to the Subscription Agent

prior to the Expiration Date and Time, at the Subscription Agent’s address set forth above, the original evidence of such indebtedness

for borrowed money (principal and/or accrued and unpaid interest) owed to you by the Company in the amount equivalent to the

amount of the subscription price (in accordance with the Instructions for Use of Non-Transferable Subscription Rights Certificates

that accompanied this prospectus), together with a properly completed and executed subscription rights certificate and any other

documentation confirmed to you by the Company.

You should contact the Company directly at

the address or phone number stated above for further details regarding the appropriate documentation to submit in order to validly

deliver evidence of such indebtedness for borrowed money. |

| Q: | What

should I do if I have other questions? |

| A: | If

you have questions or need assistance, please contact D.F. King & Co., Inc.,

the Information Agent for the Rights Offering, at (888) 567-1626. |

Key Dates for the Rights Offering

| Record date |

5:00 p.m., New York City time, on December 13, 2024 |

| Launch of Rights Offering and distribution of rights |

December 31, 2024 |

| Expiration Date and Time |

5:00 p.m., New York City time, on January 31, 2025 |

| Notice of guaranteed delivery due |

5:00 p.m., New York City time, on January 31, 2025 |

SUMMARY

This summary highlights

information included elsewhere in this registration statement and does not contain all of the information that may be important to you.

You should read this entire registration statement carefully, including the information contained in the sections titled “Risk

Factors” and “Cautionary Statement Regarding Forward-Looking Statements”.

Overview

The Children’s Place

and its subsidiaries operate an omni-channel children’s specialty portfolio of brands with an industry-leading digital-first operating

model. Our global retail and wholesale network includes two digital storefronts, more than 500 stores in North America, wholesale marketplaces

and distribution in 15 countries through six international franchise partners. We design, contract to manufacture, and sell fashionable,

high-quality apparel, accessories and footwear predominantly at value prices, primarily under our proprietary brands: “The Children’s

Place”, “Gymboree”, “Sugar & Jade”, and “PJ Place”. Our physical stores offer a friendly

and convenient shopping environment, segmented into departments that serve the wardrobe needs of girls and boys (sizes 4-18), toddler

girls and boys (sizes 6 months-5T), and baby (sizes 0-24 months). Our merchandise is also available online at www.childrensplace.com

and www.gymboree.com. Our customers are able to shop online for the same merchandise available in our physical stores, in

addition to certain merchandise which is exclusive to our e-commerce sites.

The Children’s Place

was founded in 1969 and became publicly traded on Nasdaq in 1997. As of February 3, 2024, we operated 523 stores throughout North

America, as well as our online stores. On November 19, 2024, we opened our first Gymboree store at the Garden State Plaza in Paramus,

New Jersey.

Recent Developments

Mithaq

Investment

As of February 12, 2024,

Mithaq had acquired more than 50% of our outstanding shares of the Common Stock (the “Mithaq Investment”). As of October 15,

2024, Mithaq beneficially owned 7,001,787 shares of Common Stock, or approximately 55.1% of the shares of our Common Stock outstanding

as of September 5, 2024, based on disclosures made by Mithaq in its most recent amendment to its Beneficial Ownership Report on

Schedule 13D in respect of the Company.

Mithaq’s acquisition

of our Common Stock resulted in a change of control of the Company, thereby triggering an event of default under the Amended and Restated

Credit Agreement, dated as of May 9, 2019, with the lenders party thereto (collectively, the “Credit Agreement Lenders”,

and such Amended and Restated Credit Agreement, as amended from time to time, the “Credit Agreement”). On April 16,

2024, the Company and certain of its subsidiaries entered into a seventh amendment to the Credit Agreement (the “Seventh Amendment”)

with the Credit Agreement Lenders that, among other things, provided a permanent waiver of such change of control event of default.

Governance

On February 29, 2024,

we and Mithaq entered into the Letter Agreement for purposes of, among other things, ensuring an orderly transition of the governance

of the Company following the change of control. As of May 3, 2024, the size of our Board of Directors was reduced from ten to six,

and other than our then-Chief Executive Officer, all other then-members of the Board of Directors resigned and, where applicable, were

replaced. On May 20, 2024, Jane T. Elfers departed as President and Chief Executive

Officer of the Company and as a member of the Board of Directors, and Muhammad Umair was appointed

as President and Interim Chief Executive Officer of the Company.

On October 3, 2024,

we announced that Jared E. Shure, who was previously the Company’s Senior Vice President, General Counsel and Corporate Secretary,

was named Chief Administrative Officer, General Counsel and Corporate Secretary, effective September 10, 2024.

On December 12, 2024,

we announced that, as previously disclosed, Sheamus Toal would be leaving his positions as Chief

Operating Officer and Chief Financial Officer (and as the Company’s principal financial officer and principal accounting officer),

effective December 14, 2024. Also on December 12, 2024, we announced that Laura

Lentini, the Company’s Chief Accounting Officer, has been appointed as Interim Chief Financial Officer as well as the Company’s

principal financial officer and principal accounting officer, effective December 15, 2024.

Indebtedness

We and certain of our subsidiaries

maintain the $433.0 million asset-based revolving credit facility (the “ABL Credit

Facility”) under our Credit Agreement. The ABL Credit Facility will mature in November 2026. Any payments in respect of

the shares of our Common Stock issuable upon exercise of the subscription rights will be subordinated to our obligations under the Credit

Agreement.

On February 29, 2024,

we and certain of our subsidiaries entered into an interest-free unsecured subordinated promissory note with Mithaq, providing for up

to $78.6 million in term loans (the “Initial Mithaq Term Loan”). We received $30 million on February 29, 2024

and $48.6 million on March 8, 2024. The Initial Mithaq Term Loan matures on February 15, 2027.

On April 16, 2024, we

and certain of our subsidiaries entered into a new financing agreement with Mithaq for an unsecured and subordinated $90.0 million term

loan (the “New Mithaq Term Loan”, and collectively with the Initial Mithaq Term Loan, the “Mithaq Term Loans”).

The New Mithaq Term Loan matures on April 16, 2027, and requires monthly payments equivalent to interest charged at the Secured

Overnight Financing Rate (“SOFR”) plus 4.000% per annum, with such monthly payments to Mithaq deferred until

April 30, 2025. We received the funds from the New Mithaq Term Loan on April 18, 2024.

The proceeds from these financings

were used to pay down the Company’s $50.0 million term loan that existed as of February 3, 2024, and the remaining proceeds

were used to support the general operations of the Company’s business, including working capital.

Also on April 16, 2024,

we and certain of our subsidiaries entered into the Seventh Amendment that, among other things, reduced the ABL Credit Facility from

$445.0 million to $433.0 million. The Seventh Amendment also modified certain existing requirements to restrict certain payments, including

the repurchase of shares and the payment of dividends.

On May 2, 2024, we entered

into a commitment letter with Mithaq for a $40.0 million senior unsecured credit facility (the “Mithaq Credit Facility”).

Under the Mithaq Credit Facility, we may request for advances at any time up to July 1, 2026. If any debt is incurred under the

Mithaq Credit Facility, it shall require monthly payments equivalent to interest charged at the SOFR plus 5.000% per annum. Additionally,

such debt shall require no mandatory prepayments and shall mature no earlier than July 1, 2026.

Rights

Offering

Pursuant

to the Letter Agreement, the Company agreed to, among other things, use reasonable best efforts to prepare, file, and cause to

be effective a registration statement, prospectus and other materials required under applicable law to permit, and to then commence and

complete, a rights offering in order to raise up to approximately $90.0

million in additional capital. In light of this obligation, and following the Disinterested

Directors’ determination that the Rights Offering is in the best interests of the Company and its stockholders and would, among

other things, provide the Company with an opportunity to raise capital and deleverage and more generally strengthen its balance sheet,

the Disinterested Directors unanimously approved the Rights Offering. See “The Rights Offering – Reasons for the Rights

Offering”.

Mithaq has indicated that

it currently intends, but undertakes no obligation, to exercise all of the subscription rights distributed to it and its subsidiary,

Snowball, by the Company in the Rights Offering, as well as the over-subscription privilege, and that it currently intends, but undertakes

no obligation, to pay some or all of the subscription price payable upon the exercise of any such subscription rights directly held by

Mithaq with indebtedness for borrowed money owed by the Company to Mithaq (including any indebtedness for borrowed money then-outstanding

pursuant to Mithaq Term Loans). Messrs. Turki Saleh A. AlRajhi and Muhammad Asif Seemab, members of the Board of Directors, are

also Managing Directors of Mithaq, and may be deemed to beneficially own all of the shares of Common

Stock currently owned by Mithaq and Snowball and any shares of Common Stock which would be acquired by Mithaq and Snowball upon exercise

of their subscription rights in the Rights Offering. We expect the total subscription price payable upon the exercise of all of such

rights by Mithaq and Snowball, excluding any additional subscription price that might be payable in connection with any exercise by Mithaq

and Snowball of the over-subscription privilege, to be approximately $49,289,077.50. See “The Rights Offering – Participation

of Our Directors, Executive Officers and Significant Stockholders” and “Risk Factors – Risks Related to Our

Stock and Stock Price – We have a controlling stockholder who, following the Rights Offering, may continue owning a majority of

our outstanding shares of Common Stock, and as a result controls all matters requiring shareholder approval.”

Risk Factors Summary

An investment in shares of

our Common Stock is subject to a number of risks, including risks relating to the separation, the successful implementation of our strategy

and the ability to grow our business. The following list of risk factors is not exhaustive. See “Risk Factors” for

a more thorough description of these and other risks.

Risks Related to Business

Strategies and Global Operations

| |

· |

We depend

on generating sufficient cash flows, together with our existing cash balances and availability under our credit facility, to fund

our ongoing operations, capital expenditures, debt service requirements, and any future share repurchases or payment of dividends. |

| |

· |

We may

not be able to successfully execute our business strategies. |

| |

· |

A wide

variety of factors can cause a decline in consumer confidence and spending. |

| |

· |

Fluctuations

in the prices of raw materials, labor, energy, and services could result in increased product and/or delivery costs. |

| |

· |

Damage

to, or a prolonged interruption of activities at, any facility that we use in our business operations could have a material adverse

effect on our business. |

| |

· |

We depend

on our relationships with unaffiliated manufacturers, suppliers, and transportation companies, both domestically and internationally. |

| |

· |

We may

experience disruptions at ports used to export our products from Asia, Africa, and other regions, or along the various shipping routes,

or used as ports of entry in the United States and Canada. |

| |

· |

Because

certain of our subsidiaries operate outside of the United States, some of our revenues, product costs, and other expenses are subject

to foreign economic and currency risks. |

| |

· |

Acts of

terrorism, effects of war, pandemics or other health issues, natural disasters, other catastrophes, or political unrest could have

a material adverse effect on our business. |

| |

· |

Our success

depends upon the service and capabilities of our management team. |

| |

· |

Any disruption

in, or changes to, our consumer credit arrangements, including our private label credit card agreement, may adversely affect the

ability of our customers to obtain consumer credit. |

| |

· |

We are

subject to customer payment-related risks that could increase our operating costs, expose us to fraud or theft, subject us to potential

liability and potentially disrupt our business. |

Risks Related to the Retail

and Apparel Industries

| |

· |

We may

suffer material adverse business consequences if we are unable to anticipate, identify, and respond to merchandise trends, marketing

and promotional trends, changes in technology, or customer shopping patterns. Profitability and our reputation could be materially

negatively impacted if we do not adequately forecast the demand for our products and, as a result, create significant levels of excess

inventory or insufficient levels of inventory. |

| |

· |

Product

liability costs, related claims, and the cost of compliance with consumer product safety laws in the U.S. and in Canada or our inability

to comply with such laws could have a material adverse effect on our business and reputation. |

| |

· |

We face

significant competition in the retail and apparel industries, which could negatively impact our business. |

| |

· |

If our

landlords should suffer financial difficulty or if we are unable to successfully negotiate acceptable lease terms, it could have

a material adverse effect on our business. |

Risks Related to Our Stock

and Stock Price

| |

· |

Changes

in our sales, comparable retail sales, margins, operating income, earnings per share, cash flows, and/or other results of operations

could have a material adverse effect on the market price of our Common Stock, which subsequently could lead to litigation. |

| |

· |

We have a controlling

stockholder who, following the Rights Offering, may continue owning a majority of our outstanding

shares of Common Stock, and as a result controls all matters requiring shareholder approval. |

| |

· |

Our share

price may be volatile. |

| |

· |

We have

no current plans to pay regular cash dividends on our Common Stock for the foreseeable future. |

| |

· |

Our actual

operating results may not meet or exceed our guidance and investor expectations, which would likely cause our stock price to decline. |

| |

· |

An active,

liquid trading market for our Common Stock may not be sustained. |

| |

· |

If securities

or industry analysts do not publish research or reports about our business, our stock price and trading volume could decline. |

Risks Related to Cybersecurity,

Data Privacy, Information Technology and E-Commerce

| |

· |

A privacy

breach, through a cybersecurity incident or otherwise, or failure to comply with privacy laws could have a material adverse effect

on our business. |

| |

· |

Our failure

to successfully manage our e-commerce business could have a material adverse effect on our business. |

| |

· |

A material

disruption in, failure of, inability to upgrade, or inability to properly implement disaster recovery plans for, our information

technology or other business systems could have a material adverse effect on our business. |

Risks Related to Legal

and Regulatory Matters

| |

· |

We have

exercised our option for the “controlled company” exemption under Nasdaq rules. |

| |

· |

We may

be unable to protect our trademarks and other intellectual property rights. |

| |

· |

Federal

tax and other legislation have had and will continue to have a material effect on our business. |

| |

· |

Our failure

to comply with federal, state or local law, and litigation involving such laws, or changes in such laws, could materially increase

our expenses and expose us to legal risks and liability. |

| |

· |

Legal

and regulatory actions are inherent in our business and could have a material adverse effect on our business, reputation, financial

position, results of operations, and cash flows. |

| |

· |

Legislative

actions and new accounting pronouncements could result in us having to increase our administrative expenses to remain compliant and

could have other material adverse effects. |

| |

· |

We have

in the past experienced a material weakness in our internal controls over financial reporting. |

Risks Related to the Rights

Offering

| |

· |

In the

event that the Rights Offering does not close, or results in less proceeds than expected, we will have less liquidity than expected. |

| |

· |

The subscription

price determined for this Rights Offering is not necessarily an indication of the fair value of our Common Stock. No valuation consultant

or investment banker has opined or is expected to opine upon the fairness or adequacy of the subscription price. |

| |

· |

Stockholders

who do not fully exercise their rights may have their interests diluted. |

| |

· |

You may

not revoke your subscription exercise and could be committed to buying shares of Common Stock above the prevailing market price. |

| |

· |

We may

terminate the Rights Offering at any time prior to the expiration of the Subscription Period, and neither we nor the Subscription

Agent will have any obligation to you except to return your exercise payments. |

| |

· |

The rights

are not transferable, and there is no market for the rights. |

| |

· |

You must

act promptly and follow instructions carefully if you want to exercise your rights. |

| |

· |

Significant

sales of our Common Stock, or the perception that significant sales may occur in the future, could adversely affect the market price

for our Common Stock. |

| |

· |

You will

not be able to sell the shares of Common Stock you buy in the Rights Offering until you receive your DRS statements or your account

is credited with the Common Stock. |

| |

· |

Because

our management will have broad discretion over the use of the net cash proceeds from the Rights Offering, you may not agree with

how we use the proceeds, and we may not invest the proceeds successfully. |

| |

· |

If you

use a personal check to pay for the shares of Common Stock, it may not clear in time. |

| |

· |

If you

seek to pay some or all of the subscription price by delivering indebtedness for borrowed money and fail to contact the Company with

such request promptly following the commencement of this Rights Offering, such delay may result in your being unable to timely deliver

your indebtedness for borrowed money as full or partial payment of the subscription price, which in turn would result in your purported

exercise of Rights to be paid for with such indebtedness for borrowed money being rejected. |

| |

· |

Because

no minimum subscription is required and because we do not have formal commitments from our stockholders for the entire amount we

seek to raise pursuant to the Rights Offering, we cannot assure you of the amount of proceeds that we will receive from the Rights

Offering. |

Controlled Company Status

As a

result of the Mithaq Investment, we are a “controlled company” within the meaning of Rule 5615(c)(1) of the Nasdaq

Listing Rules, and our Board of Directors has chosen to rely on the controlled company exceptions under the Nasdaq Listing Rules that

would otherwise require us to have a majority independent board and fully independent Human Capital and Compensation Committee and Corporate

Responsibility, Sustainability and Governance Committee. See “Risk Factors – Risks Related to Legal and

Regulatory Matters – We have exercised our option for the “controlled company” exemption under Nasdaq rules”.

Corporate Information

The Children’s Place

is a Delaware corporation founded in 1969. The address of our principal executive offices is 500 Plaza Drive, Secaucus, New Jersey 07094,

and our telephone number is (201) 558-2400. We maintain an internet website at www.childrensplace.com. Our website, and the information

contained on or accessible through our website, is not incorporated by reference in this registration statement.

THE

RIGHTS OFFERING SUMMARY

The following summary

describes the principal terms of the Rights Offering, but it is not intended to be a complete description of the Rights Offering. See

the information under the heading “The Rights Offering” in this prospectus for a more detailed description of the terms and

conditions of the Rights Offering.

| Subscription

Rights |

We

will distribute to each stockholder of record as of close of business on the Record Date, either as a holder of record or, in the

case of shares held of record by brokers, dealers, custodians or other nominees on your behalf, as a beneficial owner of those shares,

at no charge, one non-transferable subscription right for each share of our Common Stock then owned. Each subscription right will

entitle its holder to purchase 0.7220 shares of our Common Stock. The subscription rights will be evidenced by a non-transferable

subscription rights certificate. This registration statement is registering both the subscription rights and the shares of Common

Stock that may be issued pursuant to the exercise of subscription rights. |

| |

|

| Basic

Subscription Right |

Each subscription

right will entitle the holder to purchase 0.7220 shares of our Common Stock at a subscription price of $9.75 per whole share. |

| |

|

| Over-subscription

Privilege |

Each rights

holder who elects to exercise its basic subscription right in full may also subscribe for additional shares of our Common Stock at

the same subscription price per share. If an insufficient number of shares of our Common Stock is available to fully satisfy the

over-subscription privilege requests, the available shares of Common Stock will be distributed proportionately among rights holders

who exercised their over-subscription privilege based on the number of shares of Common Stock each rights holder subscribed for under

the basic subscription right, subject to certain limitations. You must exercise your over-subscription privilege at the same time

you exercise your basic subscription right in full. In exercising the over-subscription privilege, you must pay the full subscription

price for all the shares you are electing to purchase. If you exercised your over-subscription privilege and are allocated less than

all of the shares of our Common Stock for which you wished to subscribe, your excess payment for shares that were not allocated to

you will be returned in the manner and form in which such payment was made, without interest or deduction, as soon as practicable

following the Expiration Date and Time, and after all necessary calculations, pro

rata allocations and adjustments have been completed. |

| Subscription

Price |

The

subscription price is $9.75 per whole share of Common Stock, payable (i) in cash, (ii) by delivery in lieu of cash

of an equivalent amount of any indebtedness for borrowed money (principal and/or accrued and unpaid interest) owed by the Company

to the applicable rights holder, or (iii) by delivery of a combination of cash and such indebtedness. To be effective, any payment

related to the exercise of a subscription right must be received by the Subscription Agent and must clear before the Expiration Date

and Time. The subscription price does not necessarily bear any relationship to the book value of our assets or our past operations,

cash flows, losses, financial condition, net worth or any other established criteria used to value securities. |

| |

|

| No

Fractional Shares |

No fractional

shares of Common Stock will be issued upon the exercise of subscription rights in this Rights Offering. Any fractional shares of

Common Stock created by the exercise of subscription rights will be rounded down to the nearest whole share. |

| |

|

| Record

Date |

5:00 p.m., New

York City time, on December 13, 2024 (close of business). |

| |

|

| Expiration

Date and Time |

5:00

p.m., New York City time, on January 31, 2025, unless we extend the Subscription Period. Rights not exercised before

the Expiration Date and Time will be void and of no value and will cease to be exercisable for our Common Stock. We will not be obligated

to honor your exercise of rights if the Subscription Agent receives the documents and payment of the subscription price relating

to your exercise after the Expiration Date and Time, regardless of when you transmitted the documents, provided that if you

wish to exercise rights, but you do not have sufficient time to deliver the rights certificate evidencing your rights to the Subscription

Agent before the Expiration Date and Time, you may exercise your rights by guaranteed delivery procedures described under “The

Rights Offering –Guaranteed Delivery Procedures”. All payments in respect of the Subscription Price, whether

in cash or by delivery of indebtedness for borrowed money owed to you by the Company, must be received by the Subscription Agent

prior to the Expiration Date and Time, even if you intend to deliver the rights certificate evidencing your rights by Notice of Guaranteed

Delivery. |

| |

|

| Listing

and Trading |

Our Common

Stock is listed on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “PLCE”. The rights

will be non-transferable. |

| Procedure for Exercising Rights |

To exercise your subscription rights, you

must take the following steps: |

| |

|

|

| |

· |

If you are

a registered holder of our Common Stock, the Subscription Agent must receive your payment for each share of Common stock subscribed