0001498710false00014987102024-05-062024-05-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 6, 2024

SPIRIT AIRLINES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-35186 | 38-1747023 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

| | | |

| 1731 Radiant Drive | Dania Beach, | Florida | 33004 |

| (Address of Principal Executive) | (Zip Code) |

(954) 447-7920

(Registrant's telephone number, including area code)

2800 Executive Way, Miramar, Florida, 33025

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | SAVE | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 6, 2024, Spirit Airlines, Inc. (the “Company” or “Spirit”) issued a press release announcing its unaudited financial results for the first quarter of 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference (the "Earnings Press Release").

Non-GAAP financial measures that reflect adjustments from historical financial data prepared under GAAP, including adjustments for special items, are included in the Earnings Press Release as supplemental disclosures because the Company believes they are useful indicators of the Company's operating performance for comparative purposes. These non-GAAP financial measures are well recognized performance measurements in the airline industry that are frequently used by investors, securities analysts and other interested parties in comparing the operating performance of companies in the airline industry. The non-GAAP financial measures provided have limitations as an analytical tool. Because of these limitations, non-GAAP financial measures should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. The Company has also provided in the Earnings Press Release reconciliations of these non-GAAP financial measures to the appropriate GAAP financial measures.

Item 7.01. Regulation FD Disclosure.

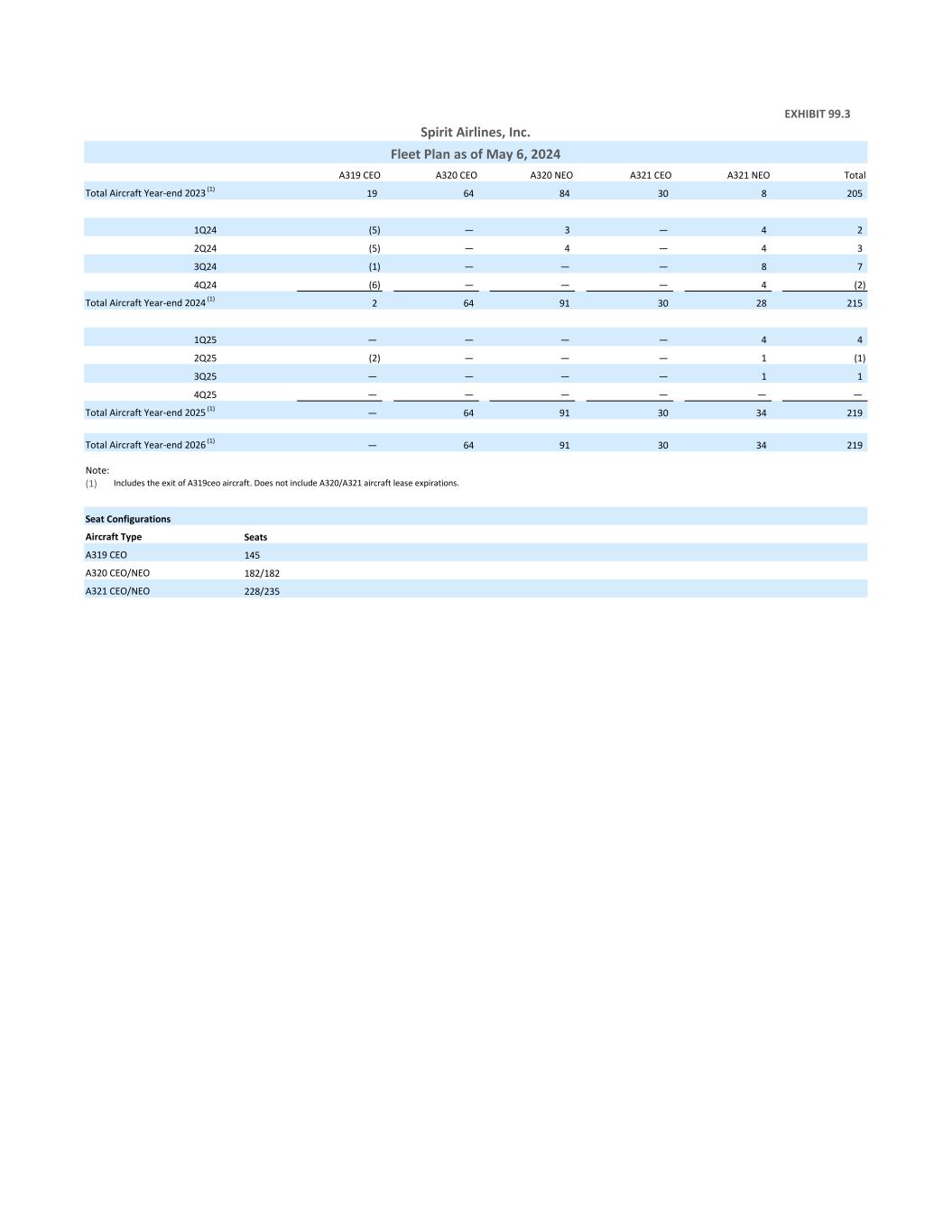

On May 6, 2024, the Company posted a copy of an investor update (the "Investor Update") providing second quarter and full year 2024 guidance as well a Fleet Plan on its investor relations website at https://ir.spirit.com. A copy of the Investor Update and a copy of the Fleet Plan are furnished pursuant to this Item 7.01 as Exhibit 99.2 and Exhibit 99.3, respectively, to this Current Report on Form 8-K and incorporated by reference herein in its entirety. Investors are encouraged to read the Investor Update and the Fleet Plan in conjunction with the Earnings Press Release. The Company reserves the right to discontinue availability of the Investor Update from its website at any time.

Pursuant to General Instruction B.2. to Form 8-K, the information set forth in this Current Report on Form 8-K, including Exhibits 99.1, 99.2 and 99.3 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities thereof, nor shall it be incorporated by reference into future filings by the Company under the Exchange Act or under the Securities Act of 1933, as amended, except to the extent specifically provided in any such filing. Additionally, the submission of the information set forth in this Item 7.01 is not deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely by Regulation FD.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following is furnished as an exhibit to this report and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act:

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Date: May 6, 2024 | SPIRIT AIRLINES, INC. |

| |

| By: /s/ Thomas Canfield |

| Name: Thomas Canfield |

| Title: Senior Vice President and General Counsel |

| |

| |

| |

| |

| |

EXHIBIT 99.1

Spirit Airlines Reports First Quarter 2024 Results

Strategic and tactical changes benefiting unit revenue

Expect cost saving initiatives to benefit 2024 by over $75 million;

annualized run-rate savings estimated at over $100 million

DANIA BEACH, Fla., May 6, 2024 - Spirit Airlines, Inc. ("Spirit" or the "Company") (NYSE: SAVE) today reported first quarter 2024 financial results.

First Quarter 2024 Financial Results

Quarterly results were in line with expectations despite a 230 basis point1 headwind from deferred recognition in earnings of a significant portion of the credits from Pratt & Whitney related to aircraft unavailable for service.

| | | | | | | | | | | | | | | |

| First Quarter 2024 |

| (unaudited) |

| As Reported | | | | | | Adjusted1 |

| | | | | | | |

| | |

| | | | | | | |

| Total operating revenues | $1,265.5 million | | | | | | $1,265.5 million |

| Operating income (loss) | $(207.3) million | | | | | | $(175.6) million |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating margin | (16.4)% | | | | | | (13.9)% |

| Adj. Operating income (loss), for AOG credits | — | | | | | | $(146.6) million |

| Adj. Operating margin adj. for AOG credits | — | | | | | | (11.6)% |

| Net income (loss) | $(142.6) million | | | | | | $(160.2) million |

| Diluted earnings (loss) per share | $(1.30) | | | | | | $(1.46) |

| | | | | | | |

| | | | | | | |

"While we reported a loss in the first quarter 2024, we are making progress towards our financial goals. I thank the entire Spirit team for their continued focus on running a reliable operation and delivering value to our Guests as we implement our go-forward standalone plan. There are numerous steps to rollout the plan in a successful, orderly fashion, but we are on track and we are excited to unveil the milestones to you over the coming months," said Ted Christie, Spirit’s President and Chief Executive Officer.

“The competitive environment remains challenging due to elevated capacity in many of the markets we serve. Nevertheless, we are confident that the strategic changes we are implementing, together with our cost saving initiatives, will allow Spirit to compete effectively in today's marketplace and drive continuous improvement in the years ahead.”

First Quarter 2024 Operations

Adverse weather and air traffic control related delays, particularly along the Eastern seaboard and in Florida, as well as continued civil unrest in Cap-Haitien and Port-au-Prince, Haiti negatively impacted the Company's operational performance for the quarter.

•System completion factor of 98.7 percent

•System controllable completion factor2 of 99.9 percent

•Capacity increase of 2.1 percent year over year

•Load factor of 80.7 percent, a decrease 0.1 pts year over year

•Aircraft utilization of 10.4 hours, down 7.1 percent compared to the first quarter last year of 11.2 hours, primarily due to aircraft unavailable for operational service due to PW1100G-JM geared turbo fan engine availability issues (“AOG”)

First Quarter 2024 Revenues

Spirit's total revenue per available seat mile ("TRASM") improved significantly from the fourth quarter 2023 to the first quarter 2024, increasing 4.9 percent sequentially. Sequential improvement in domestic TRASM was partially offset by continued pressures in the Company's international markets, driven by elevated capacity increases by U.S. and non-U.S. based carriers to/from the U.S. and Latin America.

•Total operating revenues of $1,265.5 million, a decrease of 6.2 percent year over year

•Total revenue per ASM ("TRASM") of 9.38 cents, a decrease of 8.2 percent year over year on 2.1 percent more capacity

•Total revenue per passenger flight segment ("segment") was $117.03, a decrease of 8.1 percent year over year

•Fare revenue per segment was $48.08, a decrease of 16.3 percent year over year

•Non-ticket revenue per segment was $68.95,1 a decrease of 1.4 percent year over year

First Quarter 2024 Cost Performance

•Total operating expense of $1,472.9 million and adjusted operating expenses of $1,441.1 million1

•Adjusted non-fuel cost of $1,034.7 million1

•Average economic fuel price per gallon of $2.90

•Total non-operating income of $50.3 million and adjusted total other expense of $31.4 million1

First Quarter 2024 Liquidity and Capital Deployment

•Ended the quarter with unrestricted cash and cash equivalents, short-term investment securities and liquidity available under the Company's revolving credit facility of $1.2 billion

•Completed sale-leaseback transactions of five previously owned and operated aircraft resulting in net cash proceeds of approximately $99.0 million

•Received a $69.0 million payment from JetBlue related to the termination of the merger agreement

•Total capital expenditures of $33.9 million

“Over the last several months, our team has been engaged working on the first phase of our new standalone business plan. While we were hopeful for a successful merger with JetBlue, over the last year we have been working in the background to prepare for the possibility that the merger would not be allowed to proceed. The first phase of our standalone plan involved finalizing our AOG compensation agreement with Pratt & Whitney, reducing near term capacity to improve working capital, rightsizing the resources in the business to our expected lower level of capacity and additional liquidity improvements. We believe the combination of AOG compensation, aircraft deferrals and cost savings will improve our cash levels by $450-$550 million in 2024. All of this was done to prepare us for phase two of our go-forward evolution, which we plan to start rolling out over the coming months. The pending merger and engine AOGs have made the last year disruptive for our team, but we are on the cusp of making changes which we believe will position us on the road back to sustained profitability," said Scott Haralson, Spirit's Chief Financial Officer.

"Also, Spirit’s advisors have started discussions with our loyalty bondholders and convert holders that come due in September 2025 and May 2026, respectively, and expect a resolution at some point this summer.”

First Quarter 2024 Fleet and NEO Engine Update

•Took delivery of seven new aircraft (three A320neos and four A321neos)

•Retired five A319ceo aircraft

•Ended the quarter with a fleet of 207 aircraft

•Reached an agreement with Pratt & Whitney regarding compensation for AOG aircraft through the end of 2024

•AOG credits to be issued by Pratt & Whitney based on AOG days during the quarter were $30.6 million, of which $1.6 million was recorded as a credit within maintenance, materials and repairs on the Company's condensed consolidated statement of operations, $16.2 million recorded as a reduction in the cost of assets on the Company's consolidated balance sheet with the remainder to be recognized as future reductions in the cost basis of goods and services purchased from Pratt & Whitney

•Estimates that it will average about 25 AOG aircraft throughout the full year 2024

•Estimates AOG credits to be issued by Pratt & Whitney for AOG aircraft in 2024 will be between $150 million and $200 million

•Spirit intends to discuss appropriate arrangements with Pratt & Whitney in due course for any Spirit AOG aircraft after December 31, 2024

On April 8, 2024, Spirit announced that it reached an agreement with Airbus to defer all aircraft on order that are scheduled to be delivered in the second quarter of 2025 through the end of 2026 to 2030-2031. These deferrals do not include the direct-lease aircraft scheduled for delivery in that period, one in each of the second and third quarters of 2025. There were no changes to the aircraft on order with Airbus that are scheduled to be delivered in 2027-2029. Spirit estimates the deferral of these aircraft will enhance its 2024 liquidity position by approximately $230 million.

Conference Call/Webcast Detail

Spirit will conduct a conference call to discuss these results today at 10:00 a.m. Eastern U.S. Time. A live audio webcast of the conference call will be available to the public on a listen-only basis at

https://ir.spirit.com. An archive of the webcast will be available under "Events & Presentations" for 60 days.

About Spirit Airlines

Spirit Airlines (NYSE: SAVE) is committed to delivering the best value in the sky. We are the leader in providing customizable travel options starting with an unbundled fare. This allows our Guests to pay only for the options they choose — like bags, seat assignments, refreshments and Wi-Fi — something we call À La Smarte®. Our Fit Fleet® is one of the youngest and most fuel-efficient in the United States. We serve destinations throughout the U.S., Latin America and the Caribbean, making it possible for our Guests to venture further and discover more than ever before. We are committed to inspiring positive change in the communities where we live and work through the Spirit Charitable Foundation. Come save with us at spirit.com.

Investor inquiries:

Spirit Investor Relations

investorrelations@spirit.com

Media inquiries:

Spirit Media Relations

Media_Relations@spirit.com

Forward Looking Guidance

The forward-looking guidance items provided in this release are based on the Company's current estimates and are not a guarantee of future performance. There could be significant risks and uncertainties that could cause actual results to differ materially, including the risk factors discussed in the Company's reports on file with the Securities and Exchange Commission. Spirit undertakes no duty to update any forward-looking statements or estimates.

Investors are encouraged to read this press release in conjunction with the company's Investor Update which provides additional information about the company's forward-looking estimates for certain financial metrics and is included along with this press release in the Current Report on Form 8-K furnished to the U.S. Securities and Exchange Commission. The Investor Update is also available at https://ir.spirit.com. Management will also discuss certain business outlook items during the quarterly earnings conference call.

Investors are also encouraged to read the Company's periodic and current reports filed with or furnished to the Securities and Exchange Commission, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, for additional information regarding the Company.

End Notes

(1) See "Reconciliation of Reported Amounts to Adjusted (Non-GAAP) Items" tables below for more details.

(2) Excludes the following events, which are outside of the Company's control, from the calculation of completion factor: weather, air traffic and uncontrolled airport/runway closures, which may include acts of nature, disabled aircraft incidents on the runway, political/civil unrest and disturbances preventing normal operations within airline control, among others, and any city/state closures as declared by local authorities and asserted by our Security department.

Cautionary Statement Regarding Forward Looking Statements

Forward-Looking Statements in this release and certain oral statements made from time to time by representatives of the Company contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify forward-looking statements. Forward-looking statements include, without limitation, guidance for 2024 and statements regarding the Company's intentions and expectations regarding revenues, cash levels, capacity and passenger demand, additional financing, capital spending, operating costs and expenses, pre-tax income, pre-tax margin, taxes, hiring and furloughs, aircraft deliveries, stakeholders, negotiations and settlement with Pratt & Whitney regarding neo engine availability issues, resolving outstanding indebtedness, vendors and government support. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors include, among others, results of operations and financial condition, the competitive environment in our industry, our ability to keep costs low and the impact of worldwide economic conditions, including the impact of economic cycles or downturns on customer travel behavior and other factors, as described in the Company’s filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as supplemented in the Company's Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024. Furthermore, such forward-looking statements speak only as of the date of this release. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently

deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results. Additional information concerning certain factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

SPIRIT AIRLINES, INC.

Condensed Consolidated Statement of Operations

(unaudited, in thousands, except per-share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | | | | | | |

| March 31, | Percent | | | | | | | | |

| 2024 | | 2023 | | Change | | | | | | | | | | | | |

| Operating revenues: | | | | | | | | | | | | | | | | | |

| Passenger | $ | 1,239,310 | | | $ | 1,327,473 | | | (6.6) | | | | | | | | | | | | | |

| Other | 26,227 | | | 22,301 | | | 17.6 | | | | | | | | | | | | | |

| Total operating revenues | 1,265,537 | | | 1,349,774 | | | (6.2) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | |

| Aircraft fuel | 406,351 | | | 487,711 | | | (16.7) | | | | | | | | | | | | | |

Salaries, wages and benefits

| 431,483 | | | 389,185 | | | 10.9 | | | | | | | | | | | | | |

| Landing fees and other rents | 106,718 | | | 97,345 | | | 9.6 | | | | | | | | | | | | | |

| Aircraft rent | 115,206 | | | 85,267 | | | 35.1 | | | | | | | | | | | | | |

| Depreciation and amortization | 81,346 | | | 77,991 | | | 4.3 | | | | | | | | | | | | | |

| Maintenance, materials and repairs | 54,915 | | | 54,414 | | | 0.9 | | | | | | | | | | | | | |

| Distribution | 45,176 | | | 48,017 | | | (5.9) | | | | | | | | | | | | | |

| Special charges (credits) | 36,258 | | | 13,983 | | | 159.3 | | | | | | | | | | | | | |

| Loss (gain) on disposal of assets | (3,029) | | | 7,100 | | | (142.7) | | | | | | | | | | | | | |

| Other operating | 198,450 | | | 201,156 | | | (1.3) | | | | | | | | | | | | | |

| Total operating expenses | 1,472,874 | | | 1,462,169 | | | 0.7 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating income (loss) | (207,337) | | | (112,395) | | | 84.5 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Other (income) expense: | | | | | | | | | | | | | | | | | |

| Interest expense | 54,809 | | | 51,793 | | | 5.8 | | | | | | | | | | | | | |

| Loss (gain) on extinguishment of debt | (14,996) | | | — | | | NM | | | | | | | | | | | | |

| Capitalized interest | (10,003) | | | (7,648) | | | 30.8 | | | | | | | | | | | | | |

| Interest income | (13,590) | | | (15,434) | | | (11.9) | | | | | | | | | | | | | |

| Other (income) expense | (66,490) | | | 542 | | | NM | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total other (income) expense | (50,270) | | | 29,253 | | | (271.8) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Income (loss) before income taxes | (157,067) | | | (141,648) | | | 10.9 | | | | | | | | | | | | | |

| Provision (benefit) for income taxes | (14,432) | | | (37,737) | | | (61.8) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) | $ | (142,635) | | | $ | (103,911) | | | 37.3 | | | | | | | | | | | | | |

| Basic earnings (loss) per share | $ | (1.30) | | | $ | (0.95) | | | 36.8 | | | | | | | | | | | | | |

| Diluted earnings (loss) per share | $ | (1.30) | | | $ | (0.95) | | | 36.8 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Weighted-average shares, basic | 109,430 | | | 109,110 | | | 0.3 | | | | | | | | | | | | | |

| Weighted-average shares, diluted | 109,430 | | | 109,110 | | | 0.3 | | | | | | | | | | | | | |

NM: "Not Meaningful"

SPIRIT AIRLINES, INC.

Selected Operating Statistics

(unaudited)

| | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | Change |

| Operating Statistics | 2024 | | 2023 | |

| Available seat miles (ASMs) (thousands) | 13,489,019 | | | 13,209,136 | | | 2.1 | % |

| Revenue passenger miles (RPMs) (thousands) | 10,882,616 | | | 10,674,879 | | | 1.9 | % |

| Load factor (%) | 80.7 | | | 80.8 | | | (0.1) | pts |

| Passenger flight segments (thousands) | 10,814 | | | 10,598 | | | 2.0 | % |

| | | | | |

| Departures | 71,921 | | | 72,749 | | | (1.1) | % |

| Total operating revenue per ASM (TRASM) (cents) | 9.38 | | | 10.22 | | | (8.2) | % |

| Average yield (cents) | 11.63 | | | 12.64 | | | (8.0) | % |

| Fare revenue per passenger flight segment ($) | 48.08 | | | 57.45 | | | (16.3) | % |

| Non-ticket revenue per passenger flight segment ($) | 68.95 | | | 69.91 | | | (1.4) | % |

| Total revenue per passenger flight segment ($) | 117.03 | | | 127.36 | | | (8.1) | % |

| CASM (cents) | 10.92 | | | 11.07 | | | (1.4) | % |

| Adjusted CASM (cents) (1) | 10.68 | | | 10.91 | | | (2.1) | % |

| Adjusted CASM ex-fuel (cents) (1)(2) | 7.67 | | | 7.22 | | | 6.2 | % |

| Fuel gallons consumed (thousands) | 140,139 | | | 142,343 | | | (1.5) | % |

| Average fuel cost per gallon ($) | 2.90 | | | 3.43 | | | (15.5) | % |

| Aircraft at end of period | 207 | | | 195 | | | 6.2 | % |

| Average daily aircraft utilization (hours) | 10.4 | | | 11.2 | | | (7.1) | % |

| Average stage length (miles) | 995 | | | 991 | | | 0.4 | % |

| | | | | |

(1)Excludes operating special items.

(2)Excludes fuel expense and operating special items.

Non-GAAP Financial Measures

The Company evaluates its financial performance utilizing various accounting principles generally accepted in the United States of America (“GAAP”) and non-GAAP financial measures, including Adjusted operating expenses, Adjusted operating income (loss), Adjusted operating margin, Adjusted pre-tax income (loss),

Adjusted pre-tax margin, Adjusted net income (loss), Adjusted provision (benefit) for income taxes, Adjusted diluted earnings (loss) per share, Adjusted CASM and Adjusted CASM ex-fuel. These non-GAAP financial measures are provided as supplemental information to the financial information presented in this press release that is calculated and presented in accordance with GAAP and these non-GAAP financial measures are presented because management believes that they supplement or enhance management’s, analysts’ and investors’ overall understanding of the Company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods.

Because the non-GAAP financial measures are not calculated in accordance with GAAP, they should not be considered superior to and are not intended to be considered in isolation or as a substitute for the related GAAP financial measures presented in the press release and may not be the same as or comparable to similarly titled measures presented by other companies due to possible differences in the method of calculation and in the items being adjusted. We encourage investors to review our financial statements and other filings with the Securities and Exchange Commission in their entirety and not to rely on any single financial measure.

The information below provides an explanation of certain adjustments reflected in the non-GAAP financial measures and shows a reconciliation of non-GAAP financial measures reported in this press release (other than forward-looking non-GAAP financial measures) to the most directly comparable GAAP financial measures. Within the financial tables presented, certain columns and rows may not add due to the use of rounded numbers. Per unit amounts presented are calculated from the underlying amounts.

The Company believes that adjusting for a litigation loss contingency (recorded within other operating expenses within the Company's Condensed Consolidated Statement of Operations), loss on disposal of assets, special charges, and loss (gain) on extinguishment of debt is useful to investors because these items are not indicative of the Company’s ongoing performance and the adjustments are similar to those made by our peers and allow for enhanced comparability to other airlines.

Operating expenses per available seat mile (“CASM”) is a common metric used in the airline industry to measure an airline’s cost structure and efficiency. We exclude aircraft fuel and related taxes and special items from operating expenses to determine Adjusted CASM ex-fuel. We also believe that excluding fuel costs from certain measures is useful to investors because it provides an additional measure of management’s performance excluding the effects of a significant cost item over which management has limited influence and increases comparability with other airlines that also provide a similar metric.

| | | | | | | | | | | | | | | |

| Reconciliation of Reported Amounts to Adjusted (Non-GAAP) Items | | | | | | |

| (See Note Regarding Use of Non-GAAP Financial Measures) | | | |

| Within the tables presented, certain amounts may not add due to the use of rounded numbers |

| (in thousands, except per share or per unit amounts) (unaudited) | | | |

| | | | | | | |

| Three Months Ended | | |

| March 31, | | |

| 2024 | | 2023 | | | | |

| Operating revenues | | | | | | | |

| Fare | $ | 519,942 | | | $ | 608,861 | | | | | |

| Non-fare | 719,368 | | | 718,612 | | | | | |

| Total passenger revenues | 1,239,310 | | | 1,327,473 | | | | | |

| Other revenues | 26,227 | | | 22,301 | | | | | |

| Total operating revenues | $ | 1,265,537 | | | $ | 1,349,774 | | | | | |

| | | | | | | |

| Non-ticket revenues (1) | $ | 745,595 | | | $ | 740,913 | | | | | |

| | | | | | | |

| Passenger segments | 10,814 | | | 10,598 | | | | | |

| | | | | | | |

| Non-ticket revenue per passenger flight segment ($) | $ | 68.95 | | | $ | 69.91 | | | | | |

| | | | | | | |

| Special Items (2) | | | | | | | |

| Operating special items include the following: | | | | | | | |

| Litigation loss contingency (3) | $ | (1,448) | | | $ | — | | | | | |

| Loss (gain) on disposal of assets (4) | (3,029) | | | 7,100 | | | | | |

| Operating special charges (5) | 36,258 | | | 13,983 | | | | | |

| Total operating special items | $ | 31,781 | | | $ | 21,083 | | | | | |

| | | | | | | |

| Non-operating special items include the following: | | | | | | | |

| Loss (gain) on extinguishment of debt (6) | $ | (14,996) | | | $ | — | | | | | |

| Other (income) expense (7) | (66,720) | | | — | | | | | |

| Total non-operating special items | $ | (81,716) | | | $ | — | | | | | |

| | | | | | | |

| Total special items (2) | $ | (49,935) | | | $ | 21,083 | | | | | |

| | | | | | | |

| Total operating expenses, as reported | $ | 1,472,874 | | | $ | 1,462,169 | | | | | |

| Less: Operating special items | 31,781 | | | 21,083 | | | | | |

| Adj. Operating expenses, non-GAAP (8) | $ | 1,441,093 | | | $ | 1,441,086 | | | | | |

| Less: Aircraft fuel expense | 406,351 | | | 487,711 | | | | | |

| Adj. Operating expenses excluding fuel, non-GAAP (9) | $ | 1,034,742 | | | $ | 953,375 | | | | | |

| | | | | | | |

| Available seat miles | 13,489,019 | | | 13,209,136 | | | | | |

| | | | | | | |

| CASM (cents) | 10.92 | | | 11.07 | | | | | |

| Adj. CASM (cents) (8) | 10.68 | | | 10.91 | | | | | |

| Adj. CASM ex-fuel (cents) (9) | 7.67 | | | 7.22 | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | |

| Reconciliation of Reported Amounts to Adjusted (Non-GAAP) Items | | | | | | |

| (See Note Regarding Use of Non-GAAP Financial Measures) | | | |

| Within the tables presented, certain amounts may not add due to the use of rounded numbers |

| (in thousands, except per share or per unit amounts) (unaudited) | | | |

| | | | | | | |

| Three Months Ended | | |

| March 31, | | |

| 2024 | | 2023 | | | | |

| Operating income (loss), as reported | $ | (207,337) | | | $ | (112,395) | | | | | |

| Operating margin | (16.4) | % | | (8.3) | % | | | | |

| Add: Operating special items expense | 31,781 | | | 21,083 | | | | | |

| Adj. Operating income (loss), non-GAAP (8) | $ | (175,556) | | | $ | (91,312) | | | | | |

| Adj. Operating margin, non-GAAP (8) | (13.9)% | | (6.8) | % | | | | |

| | | | | | | |

| Add: Adj. for AOG credit | $ | 28,991 | | | $ | — | | | | | |

| Adj. Operating income (loss), non-GAAP (10) | $ | (146,565) | | | $ | — | | | | | |

| Adj. Operating margin adj. for AOG credits (10) | (11.6)% | | — | % | | | | |

| | | | | | | |

| Total other (income) expense, as reported | $ | (50,270) | | | $ | 29,253 | | | | | |

| Less: Total non-operating special items | (81,716) | | | — | | | | | |

| Adj. Total other (income) expense, non-GAAP (11) | $ | 31,446 | | | $ | 29,253 | | | | | |

| | | | | | | |

| Income (loss) before income taxes, as reported | $ | (157,067) | | | $ | (141,648) | | | | | |

| Pre-tax margin | (12.4)% | | (10.5) | % | | | | |

| Less: Operating special items expense | 31,781 | | | 21,083 | | | | | |

| Less: Total non-operating special items | (81,716) | | | — | | | | | |

| Adj. Income (loss) before income taxes, non-GAAP (12) | $ | (207,002) | | | $ | (120,565) | | | | | |

| Adj. Pre-tax margin, non-GAAP (12) | (16.4)% | | (8.9)% | | | | |

| | | | | | | |

| Provision (benefit) for income taxes, as reported | $ | (14,432) | | | $ | (37,737) | | | | | |

| Less: Net income (loss) tax impact of special items | 32,350 | | | (6,543) | | | | | |

| Adj. Provision (benefit) for income taxes, non-GAAP (13) | $ | (46,782) | | | $ | (31,194) | | | | | |

| | | | | | | |

| Net income (loss), as reported | $ | (142,635) | | | $ | (103,911) | | | | | |

| Less: Operating special items expense | 31,781 | | | 21,083 | | | | | |

| Less: Total non-operating special items | (81,716) | | | — | | | | | |

| Less: Net income (loss) tax impact of special items | 32,350 | | | (6,543) | | | | | |

| Adj. Net income (loss), non-GAAP (12) | $ | (160,220) | | | $ | (89,371) | | | | | |

| | | | | | | |

| | | | | | | |

| Net income (loss) per share, diluted, as reported | $ | (1.30) | | | $ | (0.95) | | | | | |

| Add: Impact of special items | (0.46) | | | 0.19 | | | | | |

| Add: Tax impact of special items (14) | 0.30 | | | (0.06) | | | | | |

| Adj. Net income (loss) per share, diluted, non-GAAP (2) | $ | (1.46) | | | $ | (0.82) | | | | | |

| | | | | | | |

| | | | | | | |

(1)Non-ticket revenues equal the sum of non-fare passenger revenues and other revenues.

(2)Refer to the section "Non-GAAP Financial Measures" for additional information.

(3)2024 includes an adjustment to the estimated probable loss booked in 2023.

(4)2024 includes gains on aircraft sale-leaseback transactions related to 3 new aircraft deliveries, partially offset by losses related to the sale of 5 A319 airframes and 15 A319 engines and losses related to 2 aircraft sale-lease back transactions. 2023 includes amounts related to the loss on 2 aircraft sale-leaseback transactions net of gains related to the sale of 4 A319 aircraft.

(5)2024 and 2023 include legal, advisory, retention award program and other fees related to the Agreement and Plan of Merger with JetBlue and Sundown Acquisition Corp. (the "JetBlue Merger Agreement").

(6)2024 includes gains recognized due to the early extinguishment of certain of our outstanding fixed-rate term loans, partially offset by the write-off of unamortized debt issuance costs.

(7)2024 includes a $69 million payment related to the fee paid to Spirit by JetBlue related to the termination of the JetBlue Merger Agreement, net of $2.3 million applied to a prepayment receivable.

(8)Excludes operating special items. Refer to the section "Non-GAAP Financial Measures" for additional information.

(9)Excludes operating special items and aircraft fuel expense. Refer to the section "Non-GAAP Financial Measures" for additional information.

(10)Excludes special items and adjusts for the difference between the AOG credits to be received related to the AOG aircraft in the first quarter 2024 and the AOG credits recognized in the Company’s operating statement for the first quarter 2024.

(11)Excludes non-operating special items. Refer to the section "Non-GAAP Financial Measures" for additional information.

(12)Excludes total special items. Refer to the section "Non-GAAP Financial Measures" for additional information.

(13)The Company determined the Adjusted Provision (benefit) for income taxes using its statutory tax rate.

(14)Reflects the difference between the Company's GAAP Provision (benefit) for income taxes and Adjusted Provision (benefit) for income taxes as presented on a per share basis.

EXHIBIT 99.2

EXHIBIT 99.2

Investor Update as of May 6, 2024

The second quarter and full year 2024 estimates provided below are based on the current estimates of Spirit Airlines, Inc. ("Spirit" or the "Company") and are not a guarantee of future performance. There could be significant risks and uncertainties that could cause actual results to differ materially, including the risk factors discussed in the Company's reports on file with the Securities and Exchange Commission. Spirit undertakes no duty to update any forward-looking statements or estimates.

The Company estimates its total revenue for the second quarter will be between $1,320 million and $1,340 million.

While the domestic environment is improving, to date it has improved at a slower rate than the Company had anticipated. The Company anticipates continued improvement through the summer with the peaks still performing well. The off-peak periods will need to see more improvement for this forecast to materialize, but that is anticipated to be the case. In the meantime, the Company is making material modifications starting in June that will have a positive impact to the brand, the guest experience, and ultimately to unit revenues.

Based on the estimated number of cumulative days aircraft will be unavailable for operational service due to PW100G-JM geared turbo fan engine availability issues (“AOG”) during the second quarter 2024, the Company estimates it will earn credits of approximately $42 million and recognize approximately $7 million in its consolidated statement of operations for the second quarter 2024. Second quarter Adjusted Operating margin is estimated to range between negative 11.0 percent and negative 9.0 percent,or between negative 8.5 percent to negative 6.5 percent when adjusted for the difference between AOG credits estimated to be earned and the estimated AOG credit to be recognized through earnings.

| | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| 2Q24E | | | | | | | |

| Total revenues ($millions) | $1,320 to $1,340 | | | | | | | |

| | | | | | | | |

Adjusted Operating income (loss), non-GAAP ($millions)(1) | $(145) to $(121) | | | | | | | |

Adjusted Operating margin (%)(1) | (11.0)% - (9.0)% | | | | | | | |

| Add: Adj. for AOG credit ($millions) | $35 | | | | | | | |

Adj. Operating income (loss) adj. for AOG credits, non-GAAP ($millions)(2) | $(110) to $(86) | | | | | | | |

Adj. Operating margin adj. for AOG credits(2) | (8.5)% - (6.5)% | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Fuel cost per gallon ($)(3) | $2.80 | | | | | | | |

| Fuel gallons (millions) | 147 | | | | | | | |

Total other (income) expense ($millions)(4) | $35 | | | | | | | |

Tax rate for adjusted income(5) | 22.6% | | | | | | | |

| Weighted average diluted share count (millions) | 109.5 | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Capital expenditures ($millions) | Full Year 2024E |

| Pre-delivery deposits (refunds), net | $ | (175) | | |

| Purchase of property and equipment | 145 | | |

Total capital expenditures ($millions)(6) | $ | (30) | | |

| | | | | | | | | | | | | | | | |

| | | 2Q24E | | FY24E | |

| Available seat miles % change vs. 2023 | | | ~2% | | flat to up low-single digits | |

|

Footnotes(1)Excludes special items, which may include loss on disposal of assets, special charges and credits and other items which are not estimable at this time.

(2)Excludes special items and adjusts for the difference between the AOG credits estimated to be received related to the AOG aircraft in the second quarter 2024 and the AOG credits estimated to be recognized in the Company’s operating statement for the second quarter 2024.

(3)Includes fuel taxes and into-plane fuel cost.

(4)Includes interest expense, capitalized interest, interest income and other income and expense.

(5)Based on the Company’s statutory tax rate.

(6)Total capital expenditures assumes all new aircraft deliveries are either delivered under direct leases or financed through sale-leaseback transactions.

Forward Looking Statements

Forward-Looking Statements in this investor update and certain oral statements made from time to time by representatives of the Company contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify forward-looking statements. Forward-looking statements include, without limitation, guidance for 2024 and statements regarding the Company's intentions and expectations regarding revenues, cash levels, capacity and passenger demand, additional financing, capital spending, operating costs and expenses, pre-tax income, pre-tax margin, taxes, hiring and furloughs, aircraft deliveries and stakeholders, negotiations and settlement with Pratt & Whitney regarding neo engine availability issues, resolving outstanding indebtedness, vendors and government support. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors include, among others, results of operations and financial condition, the competitive environment in our industry, our ability to keep costs low and the impact of worldwide economic conditions, including the impact of economic cycles or downturns on customer travel behavior and other factors, as described in the Company’s filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as supplemented in the Company's Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024. Furthermore, such forward-looking statements speak only as of the date of this investor update. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results. Additional information concerning certain factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

Non-GAAP Financial Measures

The Company evaluates its financial performance utilizing various accounting principles generally accepted in the United States of America (“GAAP”) and non-GAAP financial measures, including Adjusted operating income (loss) and Adjusted operating margin. These non-GAAP financial measures are provided as supplemental information to the financial information presented in this investor update that is calculated and presented in accordance with GAAP and these non-GAAP financial measures are presented because management believes that they supplement or enhance management’s, analysts’ and investors’ overall understanding of the Company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods.

Adjusted operating expenses and adjusted operating margin are non-GAAP financial measures, which are provided on a forward-looking basis. The Company does not provide a reconciliation of non-GAAP measures on a forward-looking basis where the Company believes such reconciliation would imply a degree of precision and certainty that could be confusing to investors and is unable to reasonably predict certain items included in/excluded from the GAAP financial measures without unreasonable efforts. This is due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred and are out of the Company’s control or cannot be reasonably predicted. For the same reasons, the Company is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. Investors are encouraged to read this investor update in conjunction with the Company's Earnings Release which provides additional information about the Company's non-GAAP financial measures and is included along with this investor update in the Current Report on Form 8-K furnished to the U.S. Securities and Exchange Commission. The Earnings Release is also available at https://ir.spirit.com.

EXHIBIT 99.3 A319 CEO A320 CEO A320 NEO A321 CEO A321 NEO Total 19 64 84 30 8 205 1Q24 (5) — 3 — 4 2 2Q24 (5) — 4 — 4 3 3Q24 (1) — — — 8 7 4Q24 (6) — — — 4 (2) 2 64 91 30 28 215 1Q25 — — — — 4 4 2Q25 (2) — — — 1 (1) 3Q25 — — — — 1 1 4Q25 — — — — — — — 64 91 30 34 219 — 64 91 30 34 219 Note: (1) Seat Configurations Seats 145 182/182 228/235 Spirit Airlines, Inc. Fleet Plan as of May 6, 2024 A321 CEO/NEO Total Aircraft Year-end 2023 (1) Total Aircraft Year-end 2024 (1) Aircraft Type A319 CEO Total Aircraft Year-end 2025 (1) A320 CEO/NEO Includes the exit of A319ceo aircraft. Does not include A320/A321 aircraft lease expirations. Total Aircraft Year-end 2026 (1)

v3.24.1.u1

Cover Page

|

May 06, 2024 |

| Cover page. [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 06, 2024

|

| Entity Registrant Name |

SPIRIT AIRLINES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35186

|

| Entity Tax Identification Number |

38-1747023

|

| Entity Address, Address Line One |

1731 Radiant Drive

|

| Entity Address, City or Town |

Dania Beach,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33004

|

| City Area Code |

954

|

| Local Phone Number |

447-7920

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

SAVE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001498710

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

save_Coverpage.Abstract |

| Namespace Prefix: |

save_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Spirit Airlines (NYSE:SAVE)

과거 데이터 주식 차트

부터 5월(5) 2024 으로 6월(6) 2024

Spirit Airlines (NYSE:SAVE)

과거 데이터 주식 차트

부터 6월(6) 2023 으로 6월(6) 2024