SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C.

20549

Form 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

January 2025

Commission

File Number 1-15182

DR.

REDDY’S LABORATORIES LIMITED

(Translation of registrant’s name into English)

8-2-337, Road No. 3, Banjara Hills

Hyderabad, Telangana 500 034, India

+91-40-49002900

______________

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ______

Yes ¨

No x

Note: Regulation S-T Rule 101(b)(1) only permits the submission

in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ______

Yes ¨

No x

Note: Regulation S-T Rule 101(b)(7) only permits the submission

in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and

make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s

“home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as

long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s

security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing

on EDGAR.

Indicate by check mark whether by furnishing the information contained

in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ¨

No x

If “Yes” is marked, indicate below the file number assigned

to registrant in connection with Rule 12g3-2(b): 82-________.

DISCLOSURE OF RESULTS OF OPERATIONS AND FINANCIAL

CONDITION

We hereby furnish the United States Securities

and Exchange Commission with copies of the following information about our public disclosures regarding our results of operations and

financial condition for the quarter and nine months ended December 31, 2024.

On January 23, 2025, we announced our results

of operations for the quarter and nine months ended December 31, 2024. We issued a press release announcing our results under International

Financial Reporting Standards (“IFRS”), IFRS Unaudited Consolidated Financial Results, Ind AS Unaudited Consolidated Financial

Results with Limited Review report and Ind AS Unaudited Standalone Financial Results with Limited Review report for the quarter and nine

months ended December 31, 2024, a copy of which is attached to this Form 6-K as Exhibit 99.1 , 99.2 , 99.3 and 99.4 respectively.

We have also made available to the public on our

web site, www.drreddys.com, the following: IFRS Unaudited Consolidated Financial Results, Ind AS Unaudited Consolidated Financial Results

and Ind AS Unaudited Standalone Financial Results for the quarter and nine months ended December 31, 2024.

EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

DR.

REDDY’S LABORATORIES LIMITED

(Registrant) |

| |

|

|

|

Date:

January 23, 2025 |

By: |

/s/

K Randhir Singh |

| |

|

Name: |

K Randhir Singh |

| |

|

Title: |

Company

Secretary & Compliance Officer |

Exhibit 99.1

|

Dr. Reddy’s Laboratories Ltd.

8-2-337, Road No. 3, Banjara Hills,

Hyderabad - 500 034, Telangana,

India.

CIN : L85195TG1984PLC004507

Tel : +91 40 4900 2900

Fax : +91 40 4900 2999

Email : mail@drreddys.com

www.drreddys.com |

January 23, 2025

National Stock Exchange of India Ltd. (Scrip Code: DRREDDY)

BSE Limited (Scrip Code: 500124)

New York Stock Exchange Inc. (Stock Code: RDY)

NSE IFSC Ltd. (Stock Code: DRREDDY)

Dear Sir/Madam,

Sub: Disclosure under Regulation 30 of the SEBI

(Listing Obligations and Disclosure Requirements) Regulations, 2015 (“SEBI Listing Regulations”) – Board meeting outcome

In furtherance to our letter dated December 23, 2024,

we would like to inform you that the Board of Directors of the Company, at its meeting held on January 23, 2025, has inter alia approved

the Unaudited Financial Results of the Company for the quarter and nine months ended December 31, 2024.

In terms of the above, we are enclosing herewith the

following:

| |

a. |

Unaudited Consolidated Financial Results of the Company and its subsidiaries for the quarter ended December 31, 2024, prepared in compliance with International Financial Reporting Standards (IFRS) as issued by International Accounting Standards Board (IASB). |

| |

|

|

| |

b. |

Press Release on Unaudited Financial Results of the Company for the above period. |

| |

|

|

| |

c. |

Unaudited Consolidated Financial Results of the Company and its subsidiaries for the quarter ended December 31, 2024, as per Indian Accounting Standards. |

| |

|

|

| |

d. |

Unaudited Standalone Financial Results of the Company for the quarter ended December 31, 2024, as per Indian Accounting Standards. |

Pursuant to Regulation 33 of the SEBI Listing Regulations,

the Limited Review Reports of the Statutory Auditors on the Unaudited Consolidated and Standalone Financial Results as mentioned at serial

nos. (c) & (d) are also enclosed.

The Board Meeting commenced at 2:21 p.m. IST and concluded

at 4:11 p.m. IST.

This is for your information and record.

Thanking you.

Yours faithfully,

For Dr. Reddy’s Laboratories Limited

K Randhir Singh

Company Secretary, Compliance Officer &

Head-CSR

Encl: as above

| |

CONTACT |

| DR. REDDY'S LABORATORIES LTD. |

Investor relationS |

Media relationS |

8-2-337, Road No. 3, Banjara Hills,

Hyderabad - 500034. Telangana, India. |

Richa Periwal

AISHWARYA SITHARAM |

richaperiwal@drreddys.com

aishwaryasitharam@drreddys.com |

USHA IYER

ushaiyer@drreddys.com |

Dr.

Reddy’s Q3 & 9MFY25 Financial Results

Hyderabad, India, January 23, 2025: Dr. Reddy’s

Laboratories Ltd. (BSE: 500124 | NSE: DRREDDY | NYSE: RDY | NSEIFSC: DRREDDY) today announced its consolidated financial results for the

quarter and nine months ended December 31, 2024. The information mentioned in this release is based on consolidated financial statements

under International Financial Reporting Standards (IFRS).

| |

Q3FY25 |

9MFY25 |

| |

|

|

| Revenues |

₹ 83,586 Mn

[Up: 16% YoY^; 4% QoQ] |

₹ 240,475 Mn

[Up: 15% YoY^] |

| |

|

|

| Gross Margin |

58.7%

[Q3FY24: 58.5%; Q2FY25: 59.6%] |

59.5%

[9MFY24: 58.6%] |

| |

|

|

| SG&A Expenses |

₹ 24,117 Mn

[Up: 19% YoY; 5% QoQ] |

₹ 69,815 Mn

[Up: 23% YoY] |

| |

|

|

| R&D Expenses |

₹ 6,658 Mn

[8.0% of Revenues] |

₹ 20,122 Mn

[8.4% of Revenues] |

| |

|

|

| EBITDA |

₹ 22,982 Mn

[27.5% of Revenues] |

₹ 67,384 Mn

[28.0% of Revenues] |

| |

|

|

| Profit before Tax |

₹ 18,742* Mn

[Up: 3% YoY; Down: 2% QoQ] |

₹ 56,730 Mn

[Up: 2% YoY] |

| |

|

|

Profit after Tax

attributable

to Equity Holders |

₹ 14,133 Mn

[Up: 2% YoY; 13% QoQ] |

₹ 40,606 Mn

[Down: 5% YoY] |

^Includes Revenues of ₹6,049 Mn

from the recently acquired NRT business. Underlying YoY growth excluding NRT is 7.5% for Q3FY25 and 12.5% for 9MFY25.

* Includes Profit before Tax of ₹1,240

Mn from the recently acquired NRT business.

Commenting on

the results, Co-Chairman & MD, G V Prasad said: “We delivered double digit growth aided by our newly acquired

NRT business, new launches and improved operational efficiencies. We remain committed to addressing patient needs by advancing healthcare

through access, affordability and innovation.”

| All amounts in millions, except EPS |

All US dollar amounts based on convenience translation rate of 1 USD = ₹85.55 |

Dr. Reddy’s Laboratories Limited

& Subsidiaries

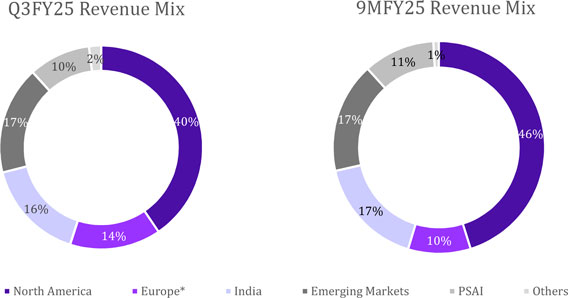

Revenue Mix by Segment for the quarter

| Particulars | |

Q3FY25 | | |

Q3FY24 | | |

YoY | | |

Q2FY25 | | |

QoQ | |

| |

(₹) | | |

(₹) | | |

Gr % | | |

(₹) | | |

Gr% | |

| Global Generics | |

| 73,753 | | |

| 63,095 | | |

| 17 | | |

| 71,576 | | |

| 3 | |

| North America | |

| 33,834 | | |

| 33,492 | | |

| 1 | | |

| 37,281 | | |

| (9 | ) |

| Europe* | |

| 12,096 | | |

| 4,970 | | |

| 143 | | |

| 5,770 | | |

| 110 | |

| India | |

| 13,464 | | |

| 11,800 | | |

| 14 | | |

| 13,971 | | |

| (4 | ) |

| Emerging Markets | |

| 14,358 | | |

| 12,833 | | |

| 12 | | |

| 14,554 | | |

| (1 | ) |

| Pharmaceutical Services and Active Ingredients (PSAI) | |

| 8,219 | | |

| 7,839 | | |

| 5 | | |

| 8,407 | | |

| (2 | ) |

| Others | |

| 1,614 | | |

| 1,214 | | |

| 33 | | |

| 179 | | |

| 802 | |

| Total | |

| 83,586 | | |

| 72,148 | | |

| 16 | | |

| 80,162 | | |

| 4 | |

Revenue Mix by Segment for nine months

| Particulars | |

9MFY25 | | |

9MFY24 | | |

YoY | |

| | |

(₹) | | |

(₹) | | |

Gr% | |

| Global Generics | |

| 214,187 | | |

| 184,262 | | |

| 16 | |

| North America | |

| 109,578 | | |

| 97,269 | | |

| 13 | |

| Europe* | |

| 23,132 | | |

| 15,303 | | |

| 51 | |

| India | |

| 40,687 | | |

| 35,141 | | |

| 16 | |

| Emerging Markets | |

| 40,790 | | |

| 36,549 | | |

| 12 | |

| PSAI | |

| 24,283 | | |

| 21,582 | | |

| 13 | |

| Others | |

| 2,005 | | |

| 2,490 | | |

| (19 | ) |

| Total | |

| 240,475 | | |

| 208,334 | | |

| 15 | |

*Includes Revenues of ₹6,049 Mn from the

recently acquired NRT business. Underlying growth for Europe excluding NRT is 22% YoY and 5% QoQ.

Consolidated Income Statement for the quarter

| Particulars | |

Q3FY25 | | |

Q3FY24 | | |

YoY | | |

Q2FY25 | | |

QoQ | |

| |

($) | | |

(₹) | | |

($) | | |

(₹) | | |

Gr % | | |

($) | | |

(₹) | | |

Gr% | |

| Revenues* | |

| 977 | | |

| 83,586 | | |

| 843 | | |

| 72,148 | | |

| 16 | | |

| 937 | | |

| 80,162 | | |

| 4 | |

| Cost of Revenues | |

| 404 | | |

| 34,534 | | |

| 350 | | |

| 29,945 | | |

| 15 | | |

| 379 | | |

| 32,393 | | |

| 7 | |

| Gross Profit | |

| 573 | | |

| 49,052 | | |

| 493 | | |

| 42,203 | | |

| 16 | | |

| 558 | | |

| 47,769 | | |

| 3 | |

| % of Revenues | |

| | | |

| 58.7 | % | |

| | | |

| 58.5 | % | |

| | | |

| | | |

| 59.6 | % | |

| | |

| Selling, General & Administrative Expenses | |

| 282 | | |

| 24,117 | | |

| 236 | | |

| 20,228 | | |

| 19 | | |

| 269 | | |

| 23,007 | | |

| 5 | |

| % of Revenues | |

| | | |

| 28.9 | % | |

| | | |

| 28.0 | % | |

| | | |

| | | |

| 28.7 | % | |

| | |

| Research & Development Expenses | |

| 78 | | |

| 6,658 | | |

| 65 | | |

| 5,565 | | |

| 20 | | |

| 85 | | |

| 7,271 | | |

| (8 | ) |

| % of Revenues | |

| | | |

| 8.0 | % | |

| | | |

| 7.7 | % | |

| | | |

| | | |

| 9.1 | % | |

| | |

| Impairment of Non-Current Assets, net | |

| (0 | ) | |

| (4 | ) | |

| 1 | | |

| 110 | | |

| (104 | ) | |

| 11 | | |

| 924 | | |

| (100 | ) |

| Other (Income)/Expense, net | |

| (5 | ) | |

| (439 | ) | |

| (11 | ) | |

| (967 | ) | |

| (55 | ) | |

| (12 | ) | |

| (984 | ) | |

| (55 | ) |

| Results from Operating Activities | |

| 219 | | |

| 18,720 | | |

| 202 | | |

| 17,267 | | |

| 8 | | |

| 205 | | |

| 17,551 | | |

| 7 | |

| Finance (Income)/Expense, net | |

| 0 | | |

| 20 | | |

| (11 | ) | |

| (963 | ) | |

| (102 | ) | |

| (18 | ) | |

| (1555 | ) | |

| (101 | ) |

| Share of Profit of Equity Accounted Investees, net of tax | |

| (0 | ) | |

| (42 | ) | |

| (0 | ) | |

| (27 | ) | |

| 56 | | |

| (1 | ) | |

| (61 | ) | |

| (31 | ) |

| Profit before Income Tax | |

| 219 | | |

| 18,742 | # | |

| 213 | | |

| 18,257 | | |

| 3 | | |

| 224 | | |

| 19,167 | | |

| (2 | ) |

| % of Revenues | |

| | | |

| 22.4 | % | |

| | | |

| 25.3 | % | |

| | | |

| | | |

| 23.9 | % | |

| | |

| Income Tax Expense | |

| 55 | | |

| 4,704 | | |

| 52 | | |

| 4,468 | | |

| 5 | | |

| 67 | | |

| 5,752 | | |

| (18 | ) |

| Profit for the Period | |

| 164 | | |

| 14,038 | | |

| 161 | | |

| 13,789 | | |

| 2 | | |

| 157 | | |

| 13,415 | | |

| 5 | |

| % of Revenues | |

| | | |

| 16.8 | % | |

| | | |

| 19.1 | % | |

| | | |

| | | |

| 16.7 | % | |

| | |

| Attributable to Equity holders of the parent company | |

| 165 | | |

| 14,133 | | |

| 161 | | |

| 13,789 | | |

| 2 | | |

| 147 | | |

| 12,553 | | |

| 13 | |

| Attributable to Non-controlling interests | |

| (1 | ) | |

| (95 | ) | |

| | | |

| - | | |

| - | | |

| 10 | | |

| 862 | | |

| - | |

| Diluted Earnings per Share (EPS) | |

| 0.20 | | |

| 16.94 | | |

| 0.19 | | |

| 16.54 | ^ | |

| 2 | | |

| 0.18 | | |

| 15.05 | | |

| 13 | |

*Includes Revenues of ₹6,049 Mn from the recently acquired NRT

business. Underlying YoY growth excluding NRT is 7.5% for Q3FY25.

^Historical numbers re-casted basis the increased number of shares post

share split.

#Includes Profit before Tax of ₹1,240 Mn from the recently

acquired NRT business.

EBITDA Computation for the quarter

| Particulars | |

Q3FY25 | | |

Q3FY24 | | |

Q2FY25 | |

| |

($) | | |

(₹) | | |

($) | | |

(₹) | | |

($) | | |

(₹) | |

| Profit before Income Tax | |

| 219 | | |

| 18,742 | | |

| 213 | | |

| 18,257 | | |

| 224 | | |

| 19,167 | |

| Interest (Income) / Expense, net* | |

| (6 | ) | |

| (475 | ) | |

| (12 | ) | |

| (1,030 | ) | |

| (15 | ) | |

| (1,262 | ) |

| Depreciation | |

| 32 | | |

| 2,733 | | |

| 28 | | |

| 2,437 | | |

| 31 | | |

| 2,629 | |

| Amortization | |

| 23 | | |

| 1,986 | | |

| 16 | | |

| 1,333 | | |

| 16 | | |

| 1,346 | |

| Impairment | |

| (0 | ) | |

| (4 | ) | |

| 1 | | |

| 110 | | |

| 11 | | |

| 924 | |

| EBITDA | |

| 269 | | |

| 22,982 | | |

| 247 | | |

| 21,107 | | |

| 267 | | |

| 22,803 | |

| % of Revenues | |

| | | |

| 27.5 | % | |

| | | |

| 29.3 | % | |

| | | |

| 28.4 | % |

*Includes income from Investment

Consolidated Income Statement for nine months

| Particulars | |

9MFY25 | | |

9MFY24 | | |

YoY | |

| |

($) | | |

(₹) | | |

($) | | |

(₹) | | |

Gr % | |

| Revenues* | |

| 2,811 | | |

| 240,475 | | |

| 2,435 | | |

| 208,334 | | |

| 15 | |

| Cost of Revenues | |

| 1,137 | | |

| 97,310 | | |

| 1,008 | | |

| 86,210 | | |

| 13 | |

| Gross Profit | |

| 1,673 | | |

| 143,165 | | |

| 1,428 | | |

| 122,124 | | |

| 17 | |

| % of Revenues | |

| | | |

| 59.5 | % | |

| | | |

| 58.6 | % | |

| | |

| Selling, General & Administrative Expenses | |

| 816 | | |

| 69,815 | | |

| 663 | | |

| 56,725 | | |

| 23 | |

| % of Revenues | |

| | | |

| 29.0 | % | |

| | | |

| 27.2 | % | |

| | |

| Research & Development Expenses | |

| 235 | | |

| 20,122 | | |

| 187 | | |

| 15,996 | | |

| 26 | |

| % of Revenues | |

| | | |

| 8.4 | % | |

| | | |

| 7.7 | % | |

| | |

| Impairment of Non-Current Assets, net | |

| 11 | | |

| 925 | | |

| 2 | | |

| 176 | | |

| 426 | |

| Other (Income)/Expense, net | |

| (22 | ) | |

| (1,893 | ) | |

| (41 | ) | |

| (3,543 | ) | |

| (47 | ) |

| Results from Operating Activities | |

| 634 | | |

| 54,196 | | |

| 617 | | |

| 52,770 | | |

| 3 | |

| Finance (Income)/Expense, net | |

| (28 | ) | |

| (2,372 | ) | |

| (35 | ) | |

| (2,972 | ) | |

| (20 | ) |

| Share of Profit of Equity Accounted Investees, net of tax | |

| (2 | ) | |

| (162 | ) | |

| (1 | ) | |

| (112 | ) | |

| 45 | |

| Profit before Income Tax | |

| 663 | | |

| 56,730 | | |

| 653 | | |

| 55,854 | | |

| 2 | |

| % of Revenues | |

| | | |

| 23.6 | % | |

| | | |

| 26.8 | % | |

| | |

| Income Tax Expense | |

| 180 | | |

| 15,357 | | |

| 155 | | |

| 13,240 | | |

| 16 | |

| Profit for the Period | |

| 484 | | |

| 41,373 | | |

| 498 | | |

| 42,614 | | |

| (3 | ) |

| % of Revenues | |

| | | |

| 17.2 | % | |

| | | |

| 20.5 | % | |

| | |

| Attributable to Equity holders of the parent company | |

| 475 | | |

| 40,606 | | |

| 498 | | |

| 42,614 | | |

| (5 | ) |

| Attributable to Non-controlling interests | |

| 9 | | |

| 767 | | |

| | | |

| - | | |

| | |

| Diluted Earnings per Share (EPS) | |

| 0.57 | | |

| 48.68 | | |

| 0.60 | | |

| 51.14 | ^ | |

| (5 | ) |

*Includes Revenues of ₹6,049 Mn from the recently acquired NRT

business. Underlying YoY growth excluding NRT is 12.5% for 9MFY25.

^Historical numbers re-casted basis the increased number of shares post

share split.

| EBITDA Computation for nine months |

*Includes income from Investment |

| Particulars | |

9MFY25 | | |

9MFY24 | |

| |

($) | | |

(₹) | | |

($) | | |

(₹) | |

| Profit before Income Tax | |

| 663 | | |

| 56,730 | | |

| 653 | | |

| 55,854 | |

| Interest (Income) / Expense, net* | |

| (32 | ) | |

| (2,775 | ) | |

| (34 | ) | |

| (2,881 | ) |

| Depreciation | |

| 92 | | |

| 7,870 | | |

| 84 | | |

| 7,155 | |

| Amortization | |

| 54 | | |

| 4,634 | | |

| 47 | | |

| 3,989 | |

| Impairment | |

| 11 | | |

| 925 | | |

| 2 | | |

| 176 | |

| EBITDA | |

| 788 | | |

| 67,384 | | |

| 752 | | |

| 64,293 | |

| % of Revenues | |

| | | |

| 28.0 | % | |

| | | |

| 30.9 | % |

Key Balance Sheet Items

| Particulars | |

As on 31st Dec 2024 | | |

As on 30th Sep 2024 | | |

As on 31st Dec 2023 | |

| |

($) | | |

(₹) | | |

($) | | |

(₹) | | |

($) | | |

(₹) | |

| Cash and Cash Equivalents and Other Investments | |

| 750 | | |

| 64,198 | | |

| 751 | | |

| 64,274 | | |

| 896 | | |

| 76,665 | |

| Trade Receivables | |

| 1,078 | | |

| 92,212 | | |

| 987 | | |

| 84,398 | | |

| 917 | | |

| 78,417 | |

| Inventories | |

| 837 | | |

| 71,630 | | |

| 842 | | |

| 72,039 | | |

| 711 | | |

| 60,796 | |

| Property, Plant, and Equipment | |

| 1,088 | | |

| 93,053 | | |

| 1,013 | | |

| 86,693 | | |

| 851 | | |

| 72,795 | |

| Goodwill and Other Intangible Assets | |

| 1,225 | | |

| 104,780 | | |

| 1,214 | | |

| 103,892 | | |

| 481 | | |

| 41,192 | |

| Loans and Borrowings (Current & Non-Current) | |

| 597 | | |

| 51,085 | | |

| 567 | | |

| 48,540 | | |

| 232 | | |

| 19,851 | |

| Trade Payables | |

| 421 | | |

| 36,022 | | |

| 418 | | |

| 35,776 | | |

| 364 | | |

| 31,113 | |

| Equity | |

| 3,759 | | |

| 321,565 | | |

| 3,615 | | |

| 309,283 | | |

| 3,131 | | |

| 267,850 | |

Key Business Highlights

[for Q3FY25]

| · | Consolidated Nicotine Replacement Therapy (‘NRT’) financials in this quarter. Integration

of the NRT business progressing as per plan. |

| | | |

| · | Entered into a voluntary licensing agreement with Gilead Sciences to manufacture and commercialise

HIV treatment drug, Lenacapavir, in 120+ countries. |

| | | |

| · | Promising results of Phase 1 study for India’s first trial for novel autologous CAR-T

cell therapy for multiple myeloma announced by our subsidiary, Aurigene Oncology Limited. |

| | | |

| · | Denosumab biosimilar filing completed for the US and Europe by our partner, Alvotech. |

| | | |

| · | Launched Toripalimab, the first and only immuno-oncology drug approved for the treatment of nasopharyngeal

carcinoma in India. |

| | | |

| · | Launched Elobixibat, a first-in-class drug to treat chronic constipation, under the brand name

BixiBat®, in India. |

ESG Highlights [for

Q3FY25]

| · | MSCI ESG rating upgraded to ‘A’ in December 2024. |

| | | |

| · | Placed 5th globally amongst pharma companies assessed in the 2024 S&P Global’s Corporate

Sustainability Assessment, with an ESG score of 79/100. |

| | | |

| · | Continue to be members of the DJSI World Index for the 2nd year in a row, along with

the DJSI Emerging Markets Index for the 9th year in a row. |

| | | |

| · | Continue to feature amongst NIFTY 100 ESG Sector Leaders. |

| | | |

| · | Named in TIME & Statista's global list of ‘World's Best Companies - Sustainable Growth’ |

| | | |

| · | Named in Science Magazine’s ‘Top 20 global pharma and biotech employers’ for

the 3rd consecutive year. |

Other Updates [for

Q3FY25]

| · | Good Manufacturing Practice (GMP) inspection completed by the USFDA at our API facility,

CTO-2, in Bollaram, Hyderabad in November, 2024 and issued a Form 483 with seven observations. The response to the observations

were submitted within stipulated timelines. |

| | | |

| · | Completed alteration in share capital of the Company by sub-division/ split of existing

equity shares of face value of ₹5 each, fully paid up, into 5 equity shares of ₹1 each, fully paid-up. Further, each American

Depositary Share (ADS) continues to represent one underlying equity share and, therefore, the number of ADSs held by an American Depositary

Receipt (ADR) holder has increased proportionately. |

Revenue Analysis

| · | Q3FY25 consolidated revenues at ₹83.6 billion, YoY growth of 16% and sequential growth of

4%. Underlying YoY growth excluding NRT is 7.5% and a decline of 3% QoQ. |

9MFY25 consolidated revenues at ₹240.5

billion, YoY growth of 15%. Underlying YoY growth excluding NRT is 12.5%.

The growth was largely driven by revenues

from the recently acquired Nicotine Replacement Therapy (NRT) portfolio, revenues from India and Emerging Markets.

Global Generics

(GG)

| · | Q3FY25 revenues at ₹73.8 billion, YoY growth of 17% and QoQ growth of 3%. Underlying growth

excluding NRT is 7% YoY and a decline of 5% QoQ. |

9MFY25 revenues at ₹214.2 billion,

a YoY growth of 16%. Underlying YoY growth excluding NRT is 13% for 9MFY25.

Growth was largely driven by revenues from

the acquired NRT portfolio, higher volumes and new product launches.

North America

| · | Q3FY25 revenues at ₹33.8 billion, YoY growth of 1% and QoQ decline of 9%. Volume growth coupled

with new product launches and favourable forex was offset by price erosion on a YoY basis. The sequential decline was largely on account

of lower sales of certain products including Lenalidomide. |

9MFY25 revenues at ₹109.6 billion,

YoY growth of 13%. The YoY growth was largely on account of increase in demand for our product portfolio, contribution from new product

launches, partially offset by price erosion in few key products.

| · | During the quarter, we launched four new products in the U.S. A total of 11 products were launched during

the nine months ended December 31, 2024. |

| · | We filed three new Abbreviated New Drug Applications (ANDAs) with the USFDA during the nine months ended

December 31, 2024. As of December 31, 2024, 79 generic filings were pending approval from the USFDA. These comprise of 75 ANDAs and four

New Drug Applications (NDAs) filed under Section 505(b)(2) route of the US Federal Food, Drug, and Cosmetic Act. Of the 75 ANDAs, 44 are

Paragraph IV applications, and we believe that 20 of these have the ‘First to File’ status. |

Europe

| · | Q3FY25 revenues at ₹12.1 billion, YoY growth of 143% and QoQ

growth of 110%. Q3FY25 revenues includes revenues from the recently acquired NRT portfolio. Underlying growth excluding NRT is 22% YoY

and 5% QoQ. |

| | | |

| o | Germany at ₹3.3 billion, YoY growth of 24% and QoQ growth

of 3% |

| | | |

| o | UK at ₹1.9 billion, YoY growth of 39% and QoQ growth of 16%. |

| | | |

| o | Rest of Europe at ₹0.8 billion, YoY decline of 10% and QoQ decline of 8% |

| | | |

| · | 9MFY25 revenues at ₹23.1 billion, YoY growth of 51%. Underlying

YoY growth excluding NRT is 12%. |

| | | |

| o | Germany at ₹9.3 billion, YoY growth of 20%. |

| | | |

| o | UK at ₹5.1 billion, YoY growth of 6%. |

| | | |

| o | Rest of Europe at ₹2.6 billion, YoY decline of 2% |

| · | The growth was primarily on account of revenues from the acquired NRT Portfolio, new product launches

and momentum in the base business, partly offset by price erosion. |

| · | During the quarter, we launched nine new products in the region, taking the year-to-date total to 29. |

India

| · | Q3FY25 revenues at ₹13.5 billion, YoY growth of 14% and QoQ decline of 4%. |

| · | 9MFY25 revenues at ₹40.7 billion, YoY growth of 16%. |

Growth was led by revenues from the in-licensed

vaccine portfolio, new product launches as well as price increases, partially offset by lower volume pick-up in certain brands in Cardiac

and Gastro-intestinal therapy areas.

| · | As per IQVIA, our IPM rank was maintained at 10. During the quarter, we launched six new brands in the

country, taking the year-to-date total to 22. |

Emerging Markets

| · | Q3FY25 revenues at ₹14.4 billion, YoY growth of 12% and flat QoQ. YoY growth is attributable

to market share expansion as well as new product launches. |

| - | Revenues from Russia at ₹7.0 billion, YoY growth of 19% and QoQ growth of 2%. YoY growth

was due to higher volumes, price increase and new product launches, partially offset by adverse forex movement. |

| - | Revenues from other Commonwealth of Independent States (CIS) countries and Romania at ₹2.4

billion, YoY growth of 4% and QoQ growth of 13%. YoY growth was due to higher prices and contribution from new product launches, partially

offset by adverse forex movement. QoQ growth was primarily on account of higher base business volumes. |

| - | Revenues from Rest of World (RoW) territories at ₹4.9 billion, YoY growth of 7% YoY and QoQ

decline of 11%. YoY growth was primarily due to contribution from new product launches, partially offset by adverse forex movement. QoQ

decline was largely due to decrease in base business volumes. |

| · | 9MFY25 revenues at ₹40.8 billion, YoY growth of 12%. The growth is attributable to market

share expansion and new product launches, partly offset by unfavorable forex. |

| | | |

| - | Revenues from Russia at ₹19.4 billion, YoY growth of 12%. The growth was largely on account

of price increases in certain brands and improved volumes, partially offset by adverse forex. |

| | | |

| - | Revenues from other CIS countries and Romania at ₹6.5 billion, flat YoY. |

| | | |

| - | Revenues from RoW territories at ₹14.9 billion, YoY growth of 17%. The growth is largely

due to higher base business volumes and new product launches, partially offset by price erosion. |

During Q3FY25, we launched 20 new products

across countries, with the year-to-date total to 59.

Pharmaceutical Services and Active Ingredients

(PSAI)

| · | Q3FY25 revenues at ₹8.2 billion, YoY growth of 5% and QoQ decline of 2%. YoY Growth in PSAI

business was due to increase in volumes, new launches and favourable forex, partially offset by adverse price variance. QoQ decline was

primarily due to moderation in the growth of the services business. |

| · | 9MFY25 revenues at ₹24.3 billion, with a growth of 13% YoY. The growth was mainly driven

by market share expansion, growth in services business and revenues from new products. |

During the quarter, we filed 23 Drug Master Files

(DMFs) globally, taking the year-to-date count to 59.

Income Statement

Highlights:

Gross Margin

| · | Q3FY25 at 58.7% (GG: 61.3%, PSAI: 28.6%), a YoY increase of 20 basis points (bps) and a QoQ decline

of 91 bps. The YoY increase was primarily on account of favourable product mix, manufacturing overhead leverage, partly offset by price

erosion. On a sequential basis, the decline was primarily on account of unfavorable product mix. |

9MFY25 at 59.5% (GG: 63.0%, PSAI:

27.3%), a YoY increase by 91 bps YoY. The expansion in margin was on account of favourable product mix, cost optimisation, partially offset

by price erosion.

Selling, General & Administrative (SG&A)

Expenses

| · | Q3FY25 at ₹24.1 billion, YoY increase of 19% and QoQ increase of 5%. |

9MFY25 at ₹69.8 billion, YoY

increase of 23%.

The increase is largely on account of costs

associated with the NRT business, higher investments in sales & marketing activities to strengthen our existing brands, new business

initiatives, including scaling up of consumer health businesses and higher freight costs.

Research & Development (R&D) Expenses

| · | Q3FY25 at ₹6.7 billion. As % to Revenues – Q3FY25: 8.0% | Q3FY24: 7.7% | Q2FY25: 9.1%. |

9MFY25 at ₹20.1 billion. As % to Revenues

– 9MFY25: 8.4% | 9MFY24: 7.7%.

R&D investments are related to our ongoing development

efforts across complex generics, peptides, biosimilars, as well as our novel oncology assets.

Net Finance Income

| · | Q3FY25 at ₹(0.02) billion compared to ₹1.0 billion in Q3FY24. |

The decrease was on account of higher foreign currency

exchange loss as well as interest expense in comparison to interest income in the corresponding quarter of the previous year.

9MFY25 at ₹2.4 billion as compared to

₹3.0 billion in 9MFY24.

Income Tax

| · | Q3FY25 at ₹4.7 billion. As % to PBT – Q3FY25: 25.1% | Q3FY24: 24.5% | Q2FY25: 30%. |

9MFY25: The ETR was 27.1% as compared to 23.7% in 9MFY24.

The higher tax for the nine months ended

December 31, 2024 is primarily on account of:

| - | the reversal of a previously recognized deferred tax asset on indexation of land; |

| | | |

| - | change in the mix of tax jurisdictions; and |

| | | |

| - | the recognition of a previously unrecognized deferred tax asset on operating tax losses, primarily pertaining

to Dr. Reddy’s Laboratories SA, Switzerland, during the nine months ended December 31, 2023. |

Profit before tax

| · | Q3FY25 at ₹18.7 billion, a YoY growth of 3% and a QoQ decline of 2%. |

As % to Revenues – Q3FY25: 22.4% | Q3FY24: 25.3% | Q2FY25:

23.9%.

Profit before tax includes ₹1,240

Mn from the recently acquired NRT business.

9MFY25 at ₹56.7 billion, a

YoY growth of 2%.

Profit attributable to Equity Holders of Parent

Company

| · | Q3FY25 at ₹14.1 billion, a YoY growth of 2% and a QoQ growth of 13%. |

As % to Revenues – Q3FY25: 16.9% |

Q3FY24: 19.1% | Q2FY25: 15.7%.

9MFY25 at ₹40.6 billion, a

YoY decline of 5%. As % to Revenues – 9MFY25: 16.9% | 9MFY24: 20.5%.

Diluted Earnings per Share (EPS)

| · | Q3FY25 is ₹16.94. 9MFY25 is ₹48.68. |

The Earnings per share has been arrived

at on the increased number of shares pursuant to the stock split of one fully paid-up equity share of Rupees five each into five fully

paid-up equity share of Rupee one each.

Other Highlights:

Earnings before Interest, Tax, Depreciation

and Amortization (EBITDA)

| · | Q3FY25 at ₹23.0 billion, YoY growth of 9% and flat QoQ. |

As % to Revenues – Q3FY25: 27.5% |

Q3FY24: 29.3% | Q2FY25: 28.4%.

| · | 9MFY25 at ₹67.4 billion, a YoY growth of 5%. As % to Revenues – 9MFY25: 28.0% | 9MFY24:

30.9%. |

Others:

| · | Operating Working Capital : As on 31st December 2024 at ₹127.8 billion. |

| · | Capital Expenditure: Q3FY25 at ₹7.1 billion. |

| · | Cash Flow: Q3FY25 at ₹(2.1) billion. |

| · | Net Cash Surplus: As on 31st December 2024 at ₹16.0 billion |

| · | Net Debt to Equity: As on 31st December 2024 is (0.05) |

| · | ROCE: Q3FY25 at 27.8% (Annualized) |

About key metrics and non-GAAP Financial

Measures

This press release contains non-GAAP financial measures

within the meaning of Regulation G and Item 10(e) of Regulation S-K. Such non-GAAP financial measures are measures of our historical performance,

financial position or cash flows that are adjusted to exclude or include amounts from the most directly comparable financial measure calculated

and presented in accordance with IFRS.

The presentation of this financial information is

not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in

accordance with IFRS. Our non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles. These

measures may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes.

We believe these non-GAAP financial measures provide

investors with useful supplemental information about the financial performance of our business, enable comparison of financial results

between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key

metrics used by management in operating our business.

For more information on our non-GAAP financial measures

and a reconciliation of GAAP to non-GAAP measures, please refer to "Reconciliation of GAAP to Non-GAAP Results" table

in this press release.

All amounts in millions, except EPS

Reconciliation of GAAP Measures to Non-GAAP

Measures

Operating Working Capital

| Particulars | |

As on 31st Dec 2024 | |

| |

(₹) | |

| Inventories | |

| 71,630 | |

| Trade Receivables | |

| 92,212 | |

| Less: | |

| | |

| Trade Payables | |

| (36,022 | ) |

| Operating Working Capital | |

| 127,820 | |

Cash Flow

| Particulars | |

Three months ended

31st Dec 2024 | |

| |

(₹) | |

| Net cash generated from operating activities | |

| 13,277 | |

| Less: | |

| | |

| Taxes | |

| (6,656 | ) |

| Investments in Property, Plant & Equipment and intangibles | |

| (8,708 | ) |

| Cash Flow | |

| (2,087 | ) |

Net Cash Surplus and Debt to Equity

| Particulars | |

As on 31st Dec 2024 | |

| |

(₹) | |

| Cash and Cash Equivalents | |

| 13,032 | |

| Investments | |

| 51,166 | |

| Short-term Borrowings | |

| (42,400 | ) |

| Long-term Borrowings, Non-Current | |

| (7,579 | ) |

| Less: | |

| | |

| Restricted Cash Balance – Unclaimed Dividend and others | |

| 615 | |

| Lease liabilities (included in Long-term Borrowings, Non-Current) | |

| (3,779 | ) |

| Equity Investments (Included in Investments) | |

| 1,356 | |

| Net Cash Surplus | |

| 16,027 | |

| Equity | |

| 321,565 | |

| Net Debt/Equity | |

| (0.05 | ) |

Computation of Return on Capital Employed

| Particulars | |

As on 31st Dec 2024 | |

| |

(₹) | |

| Profit before Tax | |

| 18,742 | |

| Less: | |

| | |

| Interest and Investment Income (Excluding forex gain/loss) | |

| (475 | ) |

| Earnings Before Interest and taxes [A] | |

| 18,267 | |

| | |

| | |

| Average Capital Employed [B] | |

| 258,829 | |

| |

| | |

| Annualized Return on Capital Employed (A/B) (Ratio) | |

| 27.8 | % |

Computation of Capital Employed:

| Particulars | |

As on | |

| |

Dec 31,

2024 | | |

Mar 31,

2024 | |

| Property Plant and Equipment | |

| 93,053 | | |

| 76,886 | |

| Intangibles | |

| 92,925 | | |

| 36,951 | |

| Goodwill | |

| 11,855 | | |

| 4,253 | |

| Investment in Equity Accounted Associates | |

| 4,742 | | |

| 4,196 | |

| Other Current Assets | |

| 28,750 | | |

| 22,560 | |

| Other Investments | |

| 4,276 | | |

| 1,059 | |

| Other Non-Current Assets | |

| 1,360 | | |

| 1,632 | |

| Inventories | |

| 71,630 | | |

| 63,552 | |

| Trade Receivables | |

| 92,214 | | |

| 80,298 | |

| Derivative Financial Instruments | |

| (1,319 | ) | |

| (299 | ) |

| Less: | |

| | | |

| | |

| Other Liabilities | |

| 47,940 | | |

| 46,866 | |

| Provisions | |

| 5,725 | | |

| 5,444 | |

| Trade payables | |

| 36,022 | | |

| 30,919 | |

| Operating Capital Employed | |

| 309,799 | | |

| 207,859 | |

| Average Capital Employed | |

| 258,829 | |

Computation of EBITDA

Refer page no. 3 & 4.

Earnings Call Details

The management of the Company will host an Earnings call to discuss the

Company’s financial performance and answer any questions from the participants.

Date: January 23, 2025

Time: 19:30 pm IST | 09:00 am ET

| Conference Joining Information |

| Option 1: Pre-register with the below link and join without waiting for the operator |

| https://services.choruscall.in/DiamondPassRegistration/register?confirmationNumber=4085539&linkSecurityString=1bdc5f535b |

| Option 2: Join through below Dial-In Numbers |

|

Universal Access Number:

|

+91 22 6280 1219

+91 22 7115 8120 |

| International Toll-Free Number: |

USA: 1 866 746 2133

UK: 0 808 101 1573

Singapore: 800 101 2045

Hong Kong: 800 964 448 |

No password/pin number is necessary to dial in to any of the above numbers.

The operator will provide instructions on asking questions before and during the call.

Play Back: The play back will be available after the earnings call,

till January 30th, 2025. For play back dial in phone No: +91 22 7194 5757, and Playback Code is 40359#.

Transcript: Transcript of the Earnings call will be available on

the Company’s website: www.drreddys.com

About Dr. Reddy’s: Dr. Reddy’s

Laboratories Ltd. (BSE: 500124, NSE: DRREDDY, NYSE: RDY, NSEIFSC: DRREDDY) is a global pharmaceutical company headquartered in Hyderabad,

India. Established in 1984, we are committed to providing access to affordable and innovative medicines. Driven by our purpose of ‘Good

Health Can’t Wait’, we offer a portfolio of products and services including APIs, generics, branded generics, biosimilars

and OTC. Our major therapeutic areas of focus are gastrointestinal, cardiovascular, diabetology, oncology, pain management and dermatology.

Our major markets include – USA, India, Russia & CIS countries, China, Brazil, and Europe. As a company with a history of deep

science that has led to several industry firsts, we continue to plan and invest in businesses of the future. As an early adopter of sustainability

and ESG actions, we released our first Sustainability Report in 2004. Our current ESG goals aim to set the bar high in environmental stewardship;

access and affordability for patients; diversity; and governance.

For more information, log on to: www.drreddys.com.

Disclaimer: This press release may include

statements of future expectations and other forward-looking statements that are based on the management’s current views and assumptions

and involve known or unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from

those expressed or implied in such statements. In addition to statements which are forward-looking by reason of context, the words "may",

"will", "should", "expects", "plans", "intends", "anticipates", "believes",

"estimates", "predicts", "potential", or "continue" and similar expressions identify forward-looking

statements. Actual results, performance or events may differ materially from those in such statements due to without limitation, (i) general

economic conditions such as performance of financial markets, credit defaults , currency exchange rates , interest rates, persistency

levels and frequency / severity of insured loss events (ii) mortality and morbidity levels and trends, (iii) changing levels of competition

and general competitive factors, (iv) changes in laws and regulations and in the policies of central banks and/or governments, (v) the

impact of acquisitions or reorganization , including related integration issues, and (vi) the susceptibility of our industry and the markets

addressed by our, and our customers’, products and services to economic downturns as a result of natural disasters, epidemics, pandemics

or other widespread illness, including coronavirus (or COVID-19), and (vii) other risks and uncertainties identified in our public filings

with the Securities and Exchange Commission, including those listed under the "Risk Factors" and "Forward-Looking Statements"

sections of our Annual Report on Form 20-F for the year ended March 31, 2024 and quarterly financial statements filed in Form 6-K with

the US SEC for the quarter ended June 30, 2024, September 30, 2024 and our other filings with US SEC. The company assumes no obligation

to update any information contained herein.

Exhibit 99.2

|

Dr. Reddy’s Laboratories Ltd.

8-2-337, Road No. 3, Banjara Hills,

Hyderabad - 500 034, Telangana,

India.

CIN : L85195TG1984PLC004507

Tel : +91 40 4900 2900

Fax : +91 40 4900 2999

Email : mail@drreddys.com

www.drreddys.com |

DR. REDDY’S LABORATORIES LIMITED

Unaudited consolidated financial results of Dr. Reddy’s Laboratories

Limited and its subsidiaries for the quarter and nine months ended 31 December 2024 prepared in accordance with International Financial

Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB)

All amounts in Indian Rupees millions

| | |

| |

Quarter ended | | |

Nine months ended | | |

Year ended | |

| Sl. No. | |

Particulars | |

31.12.2024 | | |

30.09.2024 | | |

31.12.2023 | | |

31.12.2024 | | |

31.12.2023 | | |

31.03.2024 | |

| | |

| |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Audited) | |

| 1 | |

Revenues | |

| 83,586 | | |

| 80,162 | | |

| 72,148 | | |

| 240,475 | | |

| 208,334 | | |

| 279,164 | |

| 2 | |

Cost of revenues | |

| 34,534 | | |

| 32,393 | | |

| 29,945 | | |

| 97,310 | | |

| 86,210 | | |

| 115,557 | |

| 3 | |

Gross profit (1 - 2) | |

| 49,052 | | |

| 47,769 | | |

| 42,203 | | |

| 143,165 | | |

| 122,124 | | |

| 163,607 | |

| 4 | |

Selling, general and administrative expenses | |

| 24,117 | | |

| 23,007 | | |

| 20,228 | | |

| 69,815 | | |

| 56,725 | | |

| 77,201 | |

| 5 | |

Research and development expenses | |

| 6,658 | | |

| 7,271 | | |

| 5,565 | | |

| 20,122 | | |

| 15,996 | | |

| 22,873 | |

| 6 | |

Impairment of non-current assets, net | |

| (4 | ) | |

| 924 | | |

| 110 | | |

| 925 | | |

| 176 | | |

| 3 | |

| 7 | |

Other income,net | |

| (439 | ) | |

| (984 | ) | |

| (967 | ) | |

| (1,893 | ) | |

| (3,543 | ) | |

| (4,199 | ) |

| | |

Total operating expenses | |

| 30,332 | | |

| 30,218 | | |

| 24,936 | | |

| 88,969 | | |

| 69,354 | | |

| 95,878 | |

| 8 | |

Results from operating activities [(3) - (4 + 5 + 6 + 7)] | |

| 18,720 | | |

| 17,551 | | |

| 17,267 | | |

| 54,196 | | |

| 52,770 | | |

| 67,729 | |

| | |

Finance income | |

| 798 | | |

| 2,312 | | |

| 1,357 | | |

| 4,545 | | |

| 4,090 | | |

| 5,705 | |

| | |

Finance expense | |

| (818 | ) | |

| (757 | ) | |

| (394 | ) | |

| (2,173 | ) | |

| (1,118 | ) | |

| (1,711 | ) |

| 9 | |

Finance (expense)/income,net | |

| (20 | ) | |

| 1,555 | | |

| 963 | | |

| 2,372 | | |

| 2,972 | | |

| 3,994 | |

| 10 | |

Share of profit of equity accounted investees, net of tax | |

| 42 | | |

| 61 | | |

| 27 | | |

| 162 | | |

| 112 | | |

| 147 | |

| 11 | |

Profit before tax (8 + 9 + 10) | |

| 18,742 | | |

| 19,167 | | |

| 18,257 | | |

| 56,730 | | |

| 55,854 | | |

| 71,870 | |

| 12 | |

Tax expense,net | |

| 4,704 | | |

| 5,752 | | |

| 4,468 | | |

| 15,357 | | |

| 13,240 | | |

| 16,186 | |

| 13 | |

Profit for the period/year (11 -12) | |

| 14,038 | | |

| 13,415 | | |

| 13,789 | | |

| 41,373 | | |

| 42,614 | | |

| 55,684 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Attributable to: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Equity holders of the parent company | |

| 14,133 | | |

| 12,553 | | |

| 13,789 | | |

| 40,606 | | |

| 42,614 | | |

| 55,684 | |

| | |

Non-controlling interests | |

| (95 | ) | |

| 862 | | |

| - | | |

| 767 | | |

| - | | |

| - | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| 14 | |

Earnings per equity share attributable to equity shareholders of parent | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Basic earnings per share of Re.1/- each | |

| 16.96 | | |

| 15.07 | | |

| 16.56 | | |

| 48.75 | | |

| 51.23 | | |

| 66.93 | |

| | |

Diluted earnings per share of Re.1/- each | |

| 16.94 | | |

| 15.05 | | |

| 16.54 | | |

| 48.68 | | |

| 51.14 | | |

| 66.81 | |

| | |

| |

| (Not annualised) | | |

| (Not annualised) | | |

| (Not annualised) | | |

| (Not annualised) | | |

| (Not annualised) | | |

| | |

| Segment information |

All amounts in Indian Rupees millions |

| | |

| |

Quarter ended | | |

Nine months ended | | |

Year ended | |

| Sl. No. | |

Particulars | |

31.12.2024 | | |

30.09.2024 | | |

31.12.2023 | | |

31.12.2024 | | |

31.12.2023 | | |

31.03.2024 | |

| | |

| |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Audited) | |

| | |

Segment wise revenue and results: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| 1 | |

Segment revenue: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

a) Pharmaceutical Services and Active Ingredients | |

| 10,221 | | |

| 11,030 | | |

| 10,390 | | |

| 31,560 | | |

| 29,054 | | |

| 40,580 | |

| | |

b) Global Generics | |

| 73,753 | | |

| 71,576 | | |

| 63,095 | | |

| 214,187 | | |

| 184,262 | | |

| 245,453 | |

| | |

c) Others | |

| 1,614 | | |

| 179 | | |

| 1,214 | | |

| 2,005 | | |

| 2,490 | | |

| 3,910 | |

| | |

Total | |

| 85,588 | | |

| 82,785 | | |

| 74,699 | | |

| 247,752 | | |

| 215,806 | | |

| 289,943 | |

| | |

Less: Inter-segment revenues | |

| 2,002 | | |

| 2,623 | | |

| 2,551 | | |

| 7,277 | | |

| 7,472 | | |

| 10,779 | |

| | |

Net revenues | |

| 83,586 | | |

| 80,162 | | |

| 72,148 | | |

| 240,475 | | |

| 208,334 | | |

| 279,164 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| 2 | |

Segment results: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Gross profit from each segment | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

a) Pharmaceutical Services and Active Ingredients | |

| 2,353 | | |

| 2,518 | | |

| 2,306 | | |

| 6,639 | | |

| 4,569 | | |

| 6,919 | |

| | |

b) Global Generics | |

| 45,219 | | |

| 45,162 | | |

| 39,075 | | |

| 134,899 | | |

| 116,335 | | |

| 154,268 | |

| | |

c) Others | |

| 1,480 | | |

| 89 | | |

| 822 | | |

| 1,627 | | |

| 1,220 | | |

| 2,420 | |

| | |

Total | |

| 49,052 | | |

| 47,769 | | |

| 42,203 | | |

| 143,165 | | |

| 122,124 | | |

| 163,607 | |

| | |

Less: Selling and other un-allocable expenditure, net of other income | |

| 30,310 | | |

| 28,602 | | |

| 23,946 | | |

| 86,435 | | |

| 66,270 | | |

| 91,737 | |

| | |

Total profit before tax | |

| 18,742 | | |

| 19,167 | | |

| 18,257 | | |

| 56,730 | | |

| 55,854 | | |

| 71,870 | |

Global Generics segment includes operations of Biologics

business. Inter-segment revenues represent sale from Pharmaceutical Services and Active Ingredients to Global Generics and Others at cost.

Segmental capital employed

As certain assets of the Company including manufacturing

facilities, development facilities, treasury assets and liabilities are often deployed interchangeably across segments, it is impractical

to allocate these assets and liabilities to each segment. Hence, the details for capital employed have not been disclosed in the above

table.

Notes:

| 1 |

The above statement of unaudited consolidated financial results of Dr.Reddy’s Laboratories Limited (“the Company”), which have been prepared in accordance with recognition and measurement principles of IAS 34 as issued by the International Accounting Standards Board (IASB) and were reviewed and recommended by Audit Committee and approved by the Board of Directors at their meetings held on 23 January 2025. The Auditors have carried out a limited review on the unaudited consolidated financial results and issued an unmodified report thereon. |

| |

|

| 2 |

“Revenues” for the quarter and nine months ended 31 December 2024 includes an amount of Rs.1,266 million received as a milestone payment upon U.S.FDA approval of DFD 29, in accordance with the license and collaboration agreement dated 29 June 2021 with Journey Medical Corporation. This transaction pertains to the Company’s Others segment. |

| |

|

| 3 |

During the quarter and nine months ended 31 December 2024, an amount of Rs.841 million and Rs.2,556 million, respectively, and during the quarter and nine months ended 31 December 2023, an amount of Rs.1,148 million and Rs.3,422 million, respectively, representing government grants has been accounted as a reduction from cost of revenues. |

| |

|

| 4 |

“Impairment of non-current assets, net” recorded during the nine months ended 31 December 2024 includes an amount of Rs.907 million pertaining to Haloette® (a generic equivalent to Nuvaring®), a product-related intangible, due to constraints on procurement of the underlying product from its contract manufacturer, resulting in a lower recoverable value compared to the carrying value. This impairment charge pertains to the Company’s Global Generics segment. |

| |

|

| 5 |

“Other income, net” for the year ended

31 March 2024 includes:

a. Rs.540 million recognised, in April 2023, pursuant

to settlement agreement with Janssen Group in settlement of the claim brought in the Federal Court of Canada by the Company and its affiliates

for damages under section 8 of the Canadian Patented Medicines (Notice of Compliance) Regulations in regard to the Company’s ANDS

for a generic version of Zytiga®(Abiraterone).

b. Rs.984 million recognised in September 2023 pursuant

to settlement of product related litigation by the Company and its affiliates in the United Kingdom.

These transactions pertains to the Company’s Global

Generics segment. |

| |

|

| 6 |

Pursuant to the amendment in The Finance Act 2024, resulting in withdrawal of indexation benefit on long-term capital gain, the Company has written off Deferred Tax Asset amounting to Rs.482 million, created in earlier periods on land, during the nine months ended 31 December 2024. |

| |

|

| 7 |

On 25 April 2024, the Company entered into an agreement

with Nestlé India Limited (“Nestlé India”) for the manufacturing, development, promotion, marketing, sale, distribution,

and commercialization of nutraceutical products and supplements in India, as well as other mutually agreed geographies. These operations

will be carried out by Dr. Reddy’s Nutraceuticals Limited, established on 14 March 2024. The entity was later renamed as Dr. Reddy’s and

Nestlé Health Science Limited (the “Nutraceuticals subsidiary”) on 13 June 2024.

Upon completion of the closing conditions, the transaction

concluded on 01 August 2024. Consequently, the Company has made an additional investment of Rs.7,340 million in its Nutraceuticals subsidiary,

with corresponding infusion from Nestlé India amounting to Rs.7,056 million resulting in a revised shareholding pattern of 51:49

between the Company and Nestlé India. Subsequently, Nutraceuticals subsidiary had purchased the portfolio of nutraceutical products

and supplements from Nestlé India for a consideration of Rs.2,231 million. The acquired portfolio consists of Product licenses,

sales and marketing teams, contract manufacturers and employees.

Based on fair valuation, the company had allocated

purchase consideration and recognized Product licenses and other intangibles of Rs.1,982 million, property, plant and equipment and current

assets of Rs.43 million and Goodwill of Rs.207 million.

Upon Closing, the Company had also transferred its

nutraceuticals and supplements portfolio to the Nutraceuticals subsidiary as a common control transfer of business. This acquisition pertains

to the Company’s Global Generics segment.

Profit after tax attributable to Non-controlling interest

for nine months ended 31 December 2024, has arisen primarily on recognition of deferred tax asset on account of transfer of business from

parent company to Nutraceuticals subsidiary. As at 31 December 2024, share of 49% held by Nestlé India is recorded under Non-controlling

interest of Rs.3,844 million. |

| 8 |

Business purchase agreement with Haleon:

On 26 June 2024, the Company entered into definitive

agreement with Haleon UK Enterprises Limited (“Haleon”) to acquire Haleon’s global portfolio outside of the United States

of consumer healthcare brands in the Nicotine Replacement Therapy category (“NRT Business”).

The definitive agreement for the acquisition of this

NRT Business from Haleon includes the transfer of intellectual property, employees, agreements with commercial manufacturing organization,

marketing authorizations and other assets relating to the commercialization of four brands - i.e., Nicotinell, Nicabate, Thrive, and Habitrol.

The acquisition is inclusive of all formats such as lozenge, patch, spray and/or gum in all applicable global markets outside of the United

States.

The closing conditions were met, and the transaction

was completed on 30 September 2024. |

| |

|

| |

Upon Completion, the company acquired the shares of

Northstar Switzerland SARL from Haleon for an upfront cash payment of Rs.51,407 million (GBP 458 million). An additional consideration

of up to Rs.4,714 million (GBP 42 million) is payable which is contingent upon achieving agreed-upon sales targets in Calender years 2024

and 2025, bringing the total potential consideration to Rs.56,121 million (GBP 500 million).

The Company completed the provisional allocation of

purchase price. The fair value of consideration transferred is Rs.55,897 million (GBP 498 million). Based on fair valuation, the Company

recognised Intangibles (Brands) of Rs.54,920 million (GBP 488.80 million), Deferred tax liabilities of Rs.8,469 million (GBP 75.45 million)

and Goodwill of Rs.7,249 million (GBP 64.58 million). This acquisition pertains to the Company’s Global Generics segment.

Further, The company executed a forward exchange contract

to hedge its exposure to the payment made in GBP. Upon maturity, hedge gain of Rs. 2,197 million (GBP 20 million) was reclassified from

the cash flow hedge reserves and has been adjusted in consideration paid upon closing of the transaction.

Acquisition related costs amounting to Rs.1,017 and

Rs.280 were recognised as expenses under “Selling, general and administrative expenses” during the nine months ended 31 December

2024 and the year ended 31 March 2024, respectively.

This marketing authorisation will transition gradually

into the Company in a phased approach between April 2025 and February 2026. During transition period, Haleon group will provide distribution

and related services in the markets, facilitating successful integration of the business across various geographies into the Company.

The amount of revenue and profit before tax (derived

after amortisation of NRT brands and integration expense) pertaining to the business acquired from Haleon since the acquisition date (i.e.,

September 30, 2024) was Rs.6,049 (GBP 56.3 million) and Rs.1,240 ( GBP 11.3 million) respectively, during the three months ended December

31, 2024. |

| |

|

| 9 |

The Company received an anonymous complaint in September

2020, alleging that healthcare professionals in Ukraine and potentially in other countries were provided with improper payments by or

on behalf of the Company in violation of U.S. anti-corruption laws, specifically the U.S. Foreign Corrupt Practices Act. The Company disclosed

the matter to the U.S. Department of Justice (“DOJ”), Securities and Exchange Commission (“SEC”) and Securities

Exchange Board of India. The Company engaged a U.S. law firm to conduct the investigation at the instruction of a committee of the Company’s

Board of Directors. On 6 July 2021, the Company received a subpoena from the SEC for the production of related documents, which were provided

to the SEC.

The Company has continued to engage with the SEC and

DOJ, including through submissions and presentations regarding the initial complaint and additional complaints relating to other markets,

and in relation to its Global Compliance Framework, which includes enhancement initiatives undertaken by the Company, and the Company

is complying with its listing obligations as it relates to updating the regulatory agencies. While the findings from the aforesaid investigations

could result in government or regulatory enforcement actions against the Company in the United States and/or foreign jurisdictions and

can also lead to civil and criminal sanctions under relevant laws, the outcomes, including liabilities, are not reasonably ascertainable

at this time. |

| |

|

| 10 |

The Company considered the uncertainties relating to the escalation of conflict in the middle east, and duration of military conflict between Russia and Ukraine, in assessing the recoverability of receivables, goodwill, intangible assets, investments and other assets. For this purpose, the Company considered internal and external sources of information up to the date of approval of these financial results. Based on its judgments, estimates and assumptions, the Company expects to fully recover the carrying amount of receivables, goodwill, intangible assets, investments and other assets. The Company will continue to closely monitor any material changes to future economic conditions. |

| |

|

| 11 |

The Board of Directors of the Company at their meeting

held on 27 July 2024 have approved the sub-division/ split of each equity share having a face value of Rupees five each, fully paid-up,

into five equity shares having a face value of Rupee One each, fully paid-up (the “stock split”), by alteration of the capital

clause of the Memorandum of Association of the Company. Further, each American Depositary Share (ADS) of the Company will continue to

represent one underlying equity share as at present and, therefore, the number of ADSs held by an American Depositary Receipt(ADR) holder

would consequently increase in proportion to the increase in number of equity shares.

On 12 September 2024, the approval of the shareholders

of the Company was obtained through a postal ballot process with a requisite majority.

Consequently w.e.f. record date of 28 October 2024,

the authorized share capital, the paid up share capital and the treasury shares were sub-divided into five equity shares having a face

value of Rupee One each. As on 31 December 2024, the closing number of shares fully paid up and treasury shares were 834,424,050 and 1,302,980

respectively.

Post stock split, the number of each stock option

vested and unvested and not exercised as on the record date were sub-divided into five options and the exercise price was proportionately

adjusted.

The effect of stock split was considered in the computation

of basic and diluted EPS for the quarter and nine months ended 31 December 2024 and prior periods have been restated considering face

value of Rupee One each in accordance with IAS 33- “Earnings per Share” and rounded off to the nearest decimals. |

By order of the Board

For Dr. Reddy’s Laboratories Limited

| |

|

| Place: Hyderabad |

G V Prasad |

| Date: 23 January 2025 |

Co-Chairman & Managing Director |

Exhibit 99.3

|

THE SKYVIEW 10

18th Floor, “NORTH LOBBY”

Survey No. 83/1, Raidurgam

Hyderabad - 500 032, India

Tel : +91 40 6141 6000 |

Independent Auditor’s Review Report on

the Quarterly and Year to Date Unaudited Consolidated Financial Results of the Company Pursuant to the Regulation 33 of the SEBI (Listing

Obligations and Disclosure Requirements) Regulations, 2015, as amended

Review Report to

The Board of Directors

Dr Reddy’s Laboratories Limited

| 1. | We have reviewed the accompanying ’Statement of Unaudited Consolidated Financial Results for the

quarter and nine months ended 31 December 2024’ (the “Statement”) of Dr. Reddy’s Laboratories Limited (the “Holding

Company”) and its subsidiaries (the Holding Company and its subsidiaries together referred to as “the Group”), its associates

and joint ventures attached herewith, being submitted by the Holding Company pursuant to the requirements of Regulation 33 of the SEBI

(Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended (the “Listing Regulations”). |

| 2. | The Holding Company’s Management is responsible for the preparation of the Statement in accordance

with the recognition and measurement principles laid down in Indian Accounting Standard 34, (Ind AS 34) “Interim Financial Reporting”

prescribed under Section 133 of the Companies Act, 2013 as amended, read with relevant rules issued thereunder and other accounting principles

generally accepted in India and in compliance with Regulation 33 of the Listing Regulations. The Statement has been approved by the Holding

Company’s Board of Directors . Our responsibility is to express a conclusion on the Statement based on our review. |

| 3. | We conducted our review of the Statement in accordance with the Standard

on Review Engagements (SRE) 2410, “Review of Interim Financial Information Performed by the Independent Auditor of the Entity”

issued by the Institute of Chartered Accountants of India. This standard requires that we plan and perform the review to obtain moderate

assurance as to whether the Statement is free of material misstatement. A review of interim financial information consists of making inquiries,

primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is

substantially less in scope than an audit conducted in accordance with Standards on Auditing and consequently does not enable us to obtain

assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an

audit opinion. |

We also performed procedures in accordance

with the Master Circular issued by the Securities and Exchange Board of India under Regulation 33(8) of the Listing Regulations, to the

extent applicable.

| 4. | The Statement includes the results of the following entities: |

Holding Company:

Dr. Reddy’s Laboratories Limited

Subsidiaries

| 1. | Aurigene Discovery Technologies (Malaysia) Sdn. Bhd. |

| 2. | Aurigene Oncology Limited (Formerly, Aurigene Discovery Technologies Limited) |

| 3. | Aurigene Pharmaceutical Services Limited |

| 4. | beta Institut gemeinnützige GmbH |

| 5. | betapharm Arzneimittel GmbH |

| 6. | Cheminor Investments Limited |

| 7. | Chirotech Technology Limited (dissolved w.e.f. September 18, 2024) |

| 8. | Dr. Reddy’s Farmaceutica Do Brasil Ltda. |

| 9. | Dr. Reddy’s Laboratories (EU) Limited |

| 10. | Dr. Reddy’s Laboratories (Proprietary) Limited |

| 11. | Dr. Reddy’s Laboratories (UK) Limited |

| 12. | Dr. Reddy’s Laboratories Canada, Inc. |

S.R. Batliboi & Associates LLP, a Limited Liability Partnership with LLP Identity No. AAB-4295

Regd. Office : 22, Camac Street, Block

‘B’, 3rd Floor, Kolkata-700 016

| 13. | Dr. Reddy’s Laboratories Chile SPA. |

| 14. | Dr. Reddy’s Laboratories Inc. |

| 15. | Dr. Reddy’s Laboratories Japan KK |

| 16. | Dr. Reddy’s Laboratories Kazakhstan LLP |

| 17. | Dr. Reddy’s Laboratories Louisiana LLC |

| 18. | Dr. Reddy’s Laboratories Malaysia Sdn. Bhd. |

| 19. | Dr. Reddy’s Laboratories New York, LLC |

| 20. | Dr. Reddy’s Laboratories Philippines Inc. |

| 21. | Dr. Reddy’s Laboratories Romania Srl |

| 22. | Dr. Reddy’s Laboratories SA |

| 23. | Dr. Reddy’s Laboratories Taiwan Limited |

| 24. | Dr. Reddy’s Laboratories (Thailand) Limited |

| 25. | Dr. Reddy’s Laboratories LLC, Ukraine |

| 26. | Dr. Reddy’s New Zealand Limited |

| 28. | Dr. Reddy’s Bio-Sciences Limited |

| 29. | Dr. Reddy’s Laboratories (Australia) Pty. Limited |

| 30. | Dr. Reddy’s Laboratories SAS |

| 31. | Dr. Reddy’s Netherlands B.V. (Formerly Dr. Reddy’s Research and Development B.V.) |

| 32. | Dr. Reddy’s Venezuela, C.A. (till April 17, 2024) |

| 33. | Dr. Reddy’s (Beijing) Pharmaceutical Co. Limited |

| 35. | Dr. Reddy’s Formulations Limited |

| 36. | Idea2Enterprises (India) Pvt. Limited |

| 37. | Imperial Owners and Land Possessions Private Limited (Formerly, Imperial Credit Private Limited) (Under liquidation) |

| 38. | Industrias Quimicas Falcon de Mexico, S.A. de CV |

| 39. | Lacock Holdings Limited |

| 40. | Dr. Reddy’s Laboratories LLC, Russia |

| 43. | Reddy Netherlands B.V. |

| 44. | Reddy Pharma Iberia SAU |

| 45. | Reddy Pharma Italia S.R.L. |

| 47. | Svaas Wellness Limited |

| 49. | Dr. Reddy’s Laboratories Jamaica Limited |

| 50. | Dr. Reddy’s and Nestle Health Science Limited (Formerly, Dr. Reddy’s Nutraceuticals Limited) |

| 51. | Northstar Switzerland SARL (from September 30, 2024) |

| 52. | North Star OpCo Limited (from September 30, 2024) |

| 53. | North Star Sweden AB (from September 30, 2024) |

| 54. | Dr. Reddy’s Denmark ApS (from October 04, 2024) |

| 55. | Dr. Reddy’s Finland Oy (from December 20, 2024) |

Associates

| 1. | O2 Renewable Energy IX Private Limited |

| 2. | Clean Renewable Energy KK 2A Private Limited (from 30 May 2024) |

Joint Venture

| 1. | DRES Energy Private Limited |

| 2. | Kunshan Rotam Reddy Pharmaceutical Co. Limited |

Other Consolidating Entities

| 1. | Dr. Reddy’s Employees ESOS Trust |

| 2. | Cheminor Employees Welfare Trust |

| 3. | Dr. Reddy’s Research Foundation |

| 5. | Based on our review conducted and procedures performed as stated in paragraph 3 above, nothing has come

to our attention that causes us to believe that the accompanying Statement, prepared in accordance with recognition and measurement principles

laid down in the aforesaid Indian Accounting Standards (‘Ind AS’) specified under Section 133 of the Companies Act, 2013,

as amended, read with relevant rules issued thereunder and other accounting principles generally accepted in India, has not disclosed

the information required to be disclosed in terms of the Listing Regulations, including the manner in which it is to be disclosed, or

that it contains any material misstatement. |

For S.R. Batliboi & Associates LLP

Chartered Accountants

ICAI Firm registration number:

101049W/E300004

| per Shankar Srinivasan |

|

| Partner |

| Membership No.: 213271 |

| |

| UDIN: 25213271BMISKZ7444 |

| |

| Place: Hyderabad |

| Date: January 23, 2025 |

|

Dr. Reddy’s Laboratories Ltd.

8-2-337, Road No. 3, Banjara Hills,

Hyderabad - 500 034, Telangana,

India.

CIN : L85195TG1984PLC004507

Tel : +91 40 4900 2900

Fax : +91 40 4900 2999

Email : mail@drreddys.com

www.drreddys.com |

DR. REDDY’S LABORATORIES LIMITED

STATEMENT OF UNAUDITED CONSOLIDATED FINANCIAL

RESULTS FOR THE QUARTER AND NINE MONTHS ENDED 31 DECEMBER 2024

| | | |

| |

All amounts in Indian Rupees millions | |

| | |

| |

Quarter ended | | |

Nine months ended | | |

Year ended | |

| Sl.

No. | | |

Particulars | |

31.12.2024 | | |

30.09.2024 | | |

31.12.2023 | | |

31.12.2024 | | |

31.12.2023 | | |

31.03.2024 | |

| | | |

| |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Audited) | |

| | 1 | | |

Revenue from operations | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | | |

a) Sales | |

| 79,960 | | |

| 78,859 | | |

| 69,647 | | |

| 234,215 | | |

| 203,138 | | |

| 271,396 | |

| | | | |

b) License fees and service income | |

| 3,626 | | |

| 1,302 | | |

| 2,501 | | |

| 6,259 | | |

| 5,196 | | |

| 7,768 | |

| | | | |

c) Other operating income | |

| 226 | | |

| 221 | | |

| 220 | | |

| 681 | | |

| 639 | | |

| 947 | |

| | | | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | | |

Total revenue from operations | |

| 83,812 | | |

| 80,382 | | |

| 72,368 | | |

| 241,155 | | |

| 208,973 | | |

| 280,111 | |

| | | | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | 2 | | |

Other income | |

| 1,502 | | |

| 3,075 | | |

| 2,162 | | |

| 6,156 | | |

| 6,984 | | |

| 8,943 | |

| | | | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | 3 | | |

Total income (1 + 2) | |

| 85,314 | | |

| 83,457 | | |

| 74,530 | | |

| 247,311 | | |

| 215,957 | | |

| 289,054 | |

| | | | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | 4 | | |

Expenses | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | | |

a) Cost of materials consumed | |

| 14,526 | | |

| 12,872 | | |

| 11,412 | | |

| 39,670 | | |

| 33,939 | | |

| 44,901 | |

| | | | |

b) Purchase of stock-in-trade | |

| 10,507 | | |

| 12,828 | | |

| 12,083 | | |

| 37,136 | | |

| 32,232 | | |

| 43,991 | |

| | | | |

c) Changes in inventories of finished goods, work-in-progress and stock-in-trade | |

| 782 | | |

| (2,033 | ) | |

| (1,735 | ) | |

| (5,507 | ) | |

| (5,005 | ) | |

| (6,805 | ) |

| | | | |

d) Employee benefits expense | |