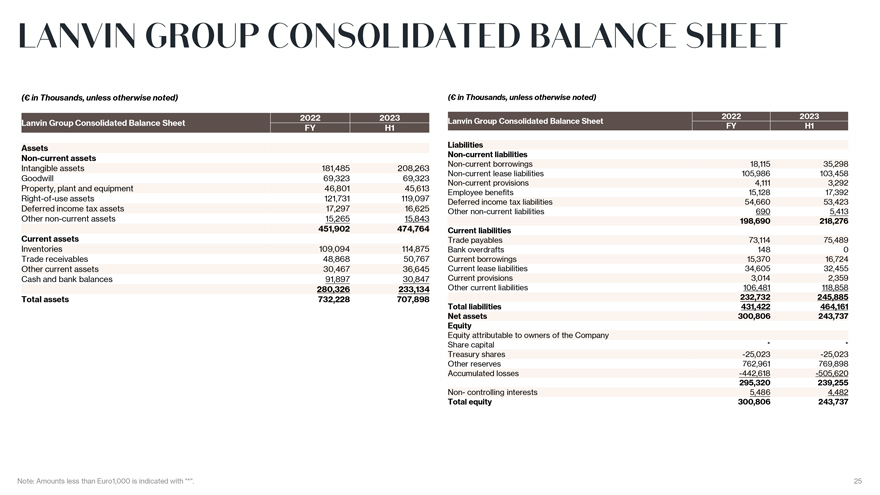

LANVIN GROUP CONSOLIDATED BALANCE SHEET (C in Thousands, unless otherwise noted) (Cin Thousands, unless

otherwise noted) 2022 2023 Lanvin Group Consolidated Balance Sheet Lanvin Group Consolidated Balance Sheet Liabilities Assets ities Non-current liabil Non-current assets

Non-current borrowings 18,115 35,298 Intangible assets 181,485 208,263 Non-current lease liabilities 105,986 103,458 Goodwill 69,323 69,323 Non-current provisions 4,111 3,292 Property, plant and equipment 46,801 45,613 benefits Right-of-use assets 121,731 119,097 Employee

15,128 17,392 Deferred income tax liabilities 54,660 53,423 Deferred income tax assets 17,297 16,625 Other non-current liabilities 690 5,413 Other non-current assets

15,265 15,843 198,690 218,276 451,902 474,764 Current liabilities Current assets Trade payables 73,114 75,489 Inventories 109,094 114,875 Bank overdrafts 148 0 Trade receivables 48,868 50,767 Current borrowings 15,370 16,724 Other current assets

30,467 36,645 Current lease liabilities 34,605 32,455 Cash and bank balances 91,897 30,847 Current provisions 3,014 2,359 280,326 233,134 Other current liabilities 106,481 118.858 Total assets 732,228 707,898 232,732 245,885 Total liabilities

431,422 464,161 Net assets 300,806 243,737 Equity Equity attributable to owners of the Company Share capital * * Treasury shares -25,023 -25,023 Other reserves 762,961

769,898 Accumulated losses -442,618 -505,620 295,320 239,255 Non- controlling interests 5,486 4.482 Total equity 300,806 243,737

Note: Amounts less than Euro1,000 is indicated with “*”. 25