H&R Block, Inc. (NYSE: HRB) (the "Company") today released

financial results1 for its fiscal 2025 second quarter ended

December 31, 2024.

"I am pleased with our performance in the first half of the

year," said Jeff Jones, president and chief executive officer. "We

are reaffirming our fiscal 2025 outlook, and are well prepared to

deliver this tax season and in the second half of the fiscal

year."

Fiscal 2025 Second Quarter Results and

Key Financial Metrics"We are on track for the year and we

are well positioned to deliver strong results," said Tiffany Mason,

chief financial officer. "During the second quarter, we repurchased

3.2 million shares for $190 million, reflecting our confidence in

the long-term value of our stock and our commitment to delivering

shareholder returns."

For the second quarter, the Company delivered total revenue of

$179.1 million, which was flat to the prior year. Increases in

revenue from Wave and international tax preparation were offset by

lower interest and fee income on Emerald Advance® due to a decrease

in loan originations.

Total operating expenses of $472.4 million increased by $25.8

million as expected, primarily due to higher tax professional and

corporate wages, increased healthcare costs, an increase in

occupancy costs and the timing of marketing expenses versus the

prior year.

Pretax loss increased by $29.4 million to $312.3 million.

Loss per share from continuing operations2 increased to $(1.79)

from $(1.33) and adjusted loss per share from continuing

operations2 increased to $(1.73) from $(1.27), due to a higher net

loss and fewer shares outstanding as a result of share repurchases,

which are accretive to earnings per share on a full-year basis.

Capital Allocation

The Company reported the following related to its capital

structure:

- Repurchased and retired 3.2 million shares at an aggregate

price of $190.5 million, or $58.65 per share in the second

quarter.

- The Company has approximately $1.1 billion remaining on its

$1.5 billion share repurchase program.

Since 2016, the Company has returned more than $4.4 billion to

shareholders in the form of dividends and share repurchases, buying

back over 43% of its shares outstanding3.

Fiscal Year 2025 Outlook Reaffirmed

The Company continues to expect:

- Revenue to be in the range of $3.69 to $3.75 billion.

- EBITDA4 to be in the range of $975 million to $1.02

billion.

- Effective tax rate to be approximately 13%, resulting in a

one-time benefit to EPS of approximately 50 cents.

- Adjusted Diluted Earnings Per Share4 to be in the range of

$5.15 to $5.35.

Conference Call

The Company will host a conference call for analysts and

investors to discuss second quarter 2025 results at 4:30 p.m. ET on

Tuesday, February 4, 2025. To join live, participants must register

at

https://register.vevent.com/register/BI06a7e8ddc07544a6853995c1fe75ea2c.

Once registered, the participant will receive a dial-in number and

unique PIN to access the call. Please join approximately 5 minutes

prior to the scheduled start time.

The call, along with a presentation for viewing, will also be

webcast in a listen-only format for the media and general public.

The webcast can be accessed directly at

https://edge.media-server.com/mmc/p/qdeqpgfd and will be available

for replay 2 hours after the call is concluded and continuing for

90 days.

About H&R Block

H&R Block, Inc. (NYSE: HRB) provides help and inspires

confidence in its clients and communities everywhere through global

tax preparation services, financial products, and small-business

solutions. The company blends digital innovation with human

expertise and care as it helps people get the best outcome at tax

time, and be better with money using its mobile banking app,

Spruce. Through Block Advisors and Wave, the company helps

small-business owners thrive with year-round bookkeeping, payroll,

advisory, and payment processing solutions. For more information,

visit H&R Block News.

About Non-GAAP Financial Information

This press release and the accompanying tables include non-GAAP

financial information. For a description of these non-GAAP

financial measures, including the reasons management uses each

measure, and reconciliations of these non-GAAP financial measures

to the most directly comparable financial measures prepared in

accordance with generally accepted accounting principles, please

see the section of the accompanying tables titled "Non-GAAP

Financial Information."

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the securities laws. Forward-looking statements can

be identified by the fact that they do not relate strictly to

historical or current facts. They often include words or variation

of words such as "expects," "anticipates," "intends," "plans,"

"believes," "commits," "seeks," "estimates," "projects,"

"forecasts," "targets," "would," "will," "should," "goal," "could"

or "may" or other similar expressions. Forward-looking statements

provide management's current expectations or predictions of future

conditions, events or results. All statements that address

operating performance, events or developments that we expect or

anticipate will occur in the future are forward-looking statements.

They may include estimates of revenues, client trajectory, income,

effective tax rate, earnings per share, cost savings, capital

expenditures, dividends, share repurchases, liquidity, capital

structure, market share, industry volumes or other financial items,

descriptions of management’s plans or objectives for future

operations, products or services, or descriptions of assumptions

underlying any of the above. They may also include the expected

impact of external events beyond the Company’s control, such as

outbreaks of infectious disease, severe weather events, natural or

manmade disasters, or changes in the regulatory environment in

which we operate. All forward-looking statements speak only as of

the date they are made and reflect the Company's good faith

beliefs, assumptions and expectations, but they are not guarantees

of future performance or events. Furthermore, the Company disclaims

any obligation to publicly update or revise any forward-looking

statement to reflect changes in underlying assumptions, factors, or

expectations, new information, data or methods, future events or

other changes, except as required by law. By their nature,

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from those

suggested by the forward-looking statements. Factors that might

cause such differences include, but are not limited to a variety of

economic, competitive and regulatory factors, many of which are

beyond the Company's control, that are described in our Annual

Report on Form 10-K for the most recently completed fiscal year in

the section entitled "Risk Factors" and additional factors we may

describe from time to time in other filings with the Securities and

Exchange Commission. You may get such filings for free at our

website at https://investors.hrblock.com. In addition, factors that

may cause the Company’s actual estimated effective tax rate to

differ from estimates include the Company’s actual results from

operations compared to current estimates, future discrete items,

changes in interpretations and assumptions the Company has made,

future actions of the Company, or increases in applicable tax rates

in jurisdictions where the Company operates. You should understand

that it is not possible to predict or identify all such factors

and, consequently, you should not consider any such list to be a

complete set of all potential risks or uncertainties.

1 All amounts in this release are unaudited. Unless otherwise

noted, all comparisons refer to the current period compared to the

corresponding prior year period.2 All per share amounts are based

on fully diluted shares at the end of the corresponding period. The

Company reports non-GAAP financial measures of performance,

including adjusted earnings per share (EPS), earnings before

interest, tax, depreciation, and amortization (EBITDA) from

continuing operations, free cash flow, and free cash flow yield,

which it considers to be useful metrics for management and

investors to evaluate and compare the ongoing operating performance

of the Company. See "About Non-GAAP Financial Information" below

for more information regarding financial measures not prepared in

accordance with generally accepted accounting principles (GAAP).3

Shares outstanding calculated as of April 30, 2016.4 Adjusted

Diluted EPS and EBITDA from continuing operations are non-GAAP

financial measures. Future period non-GAAP outlook includes

adjustments for items not indicative of our core operations, which

may include, without limitation, items described in the below

section titled “Non-GAAP Financial Information” and in the

accompanying tables. Such adjustments may be affected by changes in

ongoing assumptions and judgments, as well as nonrecurring,

unusual, or unanticipated charges, expenses or gains, or other

items that may not directly correlate to the underlying performance

of our business operations. The exact amounts of these adjustments

are not currently determinable but may be significant. It is

therefore not practicable to provide the comparable GAAP measures

or reconcile this non-GAAP outlook to the most comparable GAAP

measures.

| For

Further Information |

| |

|

|

| Investor Relations: |

|

Colby Brown, (816) 854-4559,

colby.brown@hrblock.com |

| |

|

Jordyn Eskijian, (816)

854-5674, jordyn.eskijian@hrblock.com |

| Media Relations: |

|

Teri Daley, (816) 854-3787,

teri.daley@hrblock.com |

| |

|

Media Desk,

mediadesk@hrblock.com |

| |

|

|

|

FINANCIAL RESULTS |

|

(unaudited, in 000s - except per share amounts) |

| |

|

Three months ended December 31, |

|

Six months ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

REVENUES: |

|

|

|

|

|

|

|

|

|

U.S. tax preparation and related services: |

|

|

|

|

|

|

|

|

|

Assisted tax preparation |

|

$ |

48,380 |

|

|

$ |

48,342 |

|

|

$ |

91,343 |

|

|

$ |

87,605 |

|

|

Royalties |

|

|

3,499 |

|

|

|

5,454 |

|

|

|

9,351 |

|

|

|

11,155 |

|

|

DIY tax preparation |

|

|

13,744 |

|

|

|

13,111 |

|

|

|

16,980 |

|

|

|

16,959 |

|

|

Refund Transfers |

|

|

637 |

|

|

|

813 |

|

|

|

1,497 |

|

|

|

1,955 |

|

|

Peace of Mind® Extended Service Plan |

|

|

16,145 |

|

|

|

17,440 |

|

|

|

39,242 |

|

|

|

42,287 |

|

|

Tax Identity Shield® |

|

|

4,013 |

|

|

|

4,694 |

|

|

|

7,922 |

|

|

|

9,274 |

|

|

Other |

|

|

11,824 |

|

|

|

9,592 |

|

|

|

25,633 |

|

|

|

20,572 |

|

|

Total U.S. tax preparation and related services |

|

|

98,242 |

|

|

|

99,446 |

|

|

|

191,968 |

|

|

|

189,807 |

|

|

Financial services: |

|

|

|

|

|

|

|

|

|

Emerald Card® and SpruceSM |

|

|

10,148 |

|

|

|

11,700 |

|

|

|

18,974 |

|

|

|

20,333 |

|

|

Interest and fee income on Emerald Advance® |

|

|

12,308 |

|

|

|

15,235 |

|

|

|

12,308 |

|

|

|

15,533 |

|

|

Total financial services |

|

|

22,456 |

|

|

|

26,935 |

|

|

|

31,282 |

|

|

|

35,866 |

|

|

International |

|

|

31,811 |

|

|

|

29,569 |

|

|

|

96,666 |

|

|

|

90,134 |

|

|

Wave |

|

|

26,561 |

|

|

|

23,133 |

|

|

|

52,964 |

|

|

|

47,076 |

|

|

Total revenues |

|

$ |

179,070 |

|

|

$ |

179,083 |

|

|

$ |

372,880 |

|

|

$ |

362,883 |

|

| Compensation and

benefits: |

|

|

|

|

|

|

|

|

|

Field wages |

|

|

81,565 |

|

|

|

77,795 |

|

|

|

149,659 |

|

|

|

140,230 |

|

|

Other wages |

|

|

78,731 |

|

|

|

74,671 |

|

|

|

156,066 |

|

|

|

146,769 |

|

|

Benefits and other compensation |

|

|

38,402 |

|

|

|

36,063 |

|

|

|

77,156 |

|

|

|

71,311 |

|

| |

|

|

198,698 |

|

|

|

188,529 |

|

|

|

382,881 |

|

|

|

358,310 |

|

| Occupancy |

|

|

104,999 |

|

|

|

101,194 |

|

|

|

206,317 |

|

|

|

200,479 |

|

| Marketing and advertising |

|

|

14,863 |

|

|

|

11,305 |

|

|

|

24,835 |

|

|

|

16,786 |

|

| Depreciation and

amortization |

|

|

29,195 |

|

|

|

30,107 |

|

|

|

58,026 |

|

|

|

60,332 |

|

| Bad debt |

|

|

19,416 |

|

|

|

21,754 |

|

|

|

22,146 |

|

|

|

26,552 |

|

| Other |

|

|

105,190 |

|

|

|

93,626 |

|

|

|

200,297 |

|

|

|

174,182 |

|

|

Total operating expenses |

|

|

472,361 |

|

|

|

446,515 |

|

|

|

894,502 |

|

|

|

836,641 |

|

| Other income (expense),

net |

|

|

2,744 |

|

|

|

5,922 |

|

|

|

14,661 |

|

|

|

15,758 |

|

| Interest expense on

borrowings |

|

|

(21,752 |

) |

|

|

(21,364 |

) |

|

|

(37,599 |

) |

|

|

(37,234 |

) |

| Pretax loss |

|

|

(312,299 |

) |

|

|

(282,874 |

) |

|

|

(544,560 |

) |

|

|

(495,234 |

) |

| Income tax benefit |

|

|

(69,833 |

) |

|

|

(93,758 |

) |

|

|

(130,673 |

) |

|

|

(143,245 |

) |

| Net loss from continuing

operations |

|

|

(242,466 |

) |

|

|

(189,116 |

) |

|

|

(413,887 |

) |

|

|

(351,989 |

) |

| Net loss from discontinued

operations |

|

|

(954 |

) |

|

|

(639 |

) |

|

|

(2,109 |

) |

|

|

(1,248 |

) |

| Net loss |

|

$ |

(243,420 |

) |

|

$ |

(189,755 |

) |

|

$ |

(415,996 |

) |

|

$ |

(353,237 |

) |

| BASIC AND DILUTED LOSS

PER SHARE: |

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

(1.79 |

) |

|

$ |

(1.33 |

) |

|

$ |

(3.02 |

) |

|

$ |

(2.44 |

) |

|

Discontinued operations |

|

|

(0.01 |

) |

|

|

— |

|

|

|

(0.01 |

) |

|

|

(0.01 |

) |

|

Consolidated |

|

$ |

(1.80 |

) |

|

$ |

(1.33 |

) |

|

$ |

(3.03 |

) |

|

$ |

(2.45 |

) |

| WEIGHTED AVERAGE

DILUTED SHARES |

|

|

135,563 |

|

|

|

142,340 |

|

|

|

137,359 |

|

|

|

144,307 |

|

| Adjusted diluted EPS (1) |

|

$ |

(1.73 |

) |

|

$ |

(1.27 |

) |

|

$ |

(2.89 |

) |

|

$ |

(2.31 |

) |

| EBITDA (1) |

|

$ |

(261,352 |

) |

|

$ |

(231,403 |

) |

|

$ |

(448,935 |

) |

|

$ |

(397,668 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) All non-GAAP measures are results from

continuing operations. See "Non-GAAP Financial Information" for a

reconciliation of non-GAAP measures.

|

CONSOLIDATED BALANCE SHEETS |

|

(unaudited, in 000s - except per share data) |

|

As of |

|

December 31, 2024 |

|

June 30, 2024 |

| |

|

|

|

|

|

ASSETS |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

320,051 |

|

|

$ |

1,053,326 |

|

|

Cash and cash equivalents - restricted |

|

|

21,473 |

|

|

|

21,867 |

|

|

Receivables, net |

|

|

321,171 |

|

|

|

69,075 |

|

|

Prepaid expenses and other current assets |

|

|

114,658 |

|

|

|

95,208 |

|

|

Total current assets |

|

|

777,353 |

|

|

|

1,239,476 |

|

|

Property and equipment, net |

|

|

143,833 |

|

|

|

131,319 |

|

|

Operating lease right of use assets |

|

|

389,629 |

|

|

|

461,986 |

|

|

Intangible assets, net |

|

|

270,601 |

|

|

|

264,102 |

|

|

Goodwill |

|

|

783,286 |

|

|

|

785,226 |

|

|

Deferred tax assets and income taxes receivable |

|

|

281,694 |

|

|

|

271,658 |

|

|

Other noncurrent assets |

|

|

65,924 |

|

|

|

65,043 |

|

|

Total assets |

|

$ |

2,712,320 |

|

|

$ |

3,218,810 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

LIABILITIES: |

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

136,893 |

|

|

$ |

155,830 |

|

|

Accrued salaries, wages and payroll taxes |

|

|

64,993 |

|

|

|

105,548 |

|

|

Accrued income taxes and reserves for uncertain tax positions |

|

|

149,255 |

|

|

|

318,830 |

|

|

Current portion of long-term debt |

|

|

349,611 |

|

|

|

— |

|

|

Operating lease liabilities |

|

|

170,726 |

|

|

|

206,070 |

|

|

Deferred revenue and other current liabilities |

|

|

187,885 |

|

|

|

191,050 |

|

|

Total current liabilities |

|

|

1,059,363 |

|

|

|

977,328 |

|

|

Long-term debt and line of credit borrowings |

|

|

1,932,545 |

|

|

|

1,491,095 |

|

|

Deferred tax liabilities and reserves for uncertain tax

positions |

|

|

292,643 |

|

|

|

291,063 |

|

|

Operating lease liabilities |

|

|

228,041 |

|

|

|

265,373 |

|

|

Deferred revenue and other noncurrent liabilities |

|

|

72,188 |

|

|

|

103,357 |

|

|

Total liabilities |

|

|

3,584,780 |

|

|

|

3,128,216 |

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

| STOCKHOLDERS’

EQUITY: |

|

|

|

|

|

Common stock, no par, stated value $.01 per share |

|

|

1,644 |

|

|

|

1,709 |

|

|

Additional paid-in capital |

|

|

752,093 |

|

|

|

762,583 |

|

|

Accumulated other comprehensive loss |

|

|

(71,762 |

) |

|

|

(48,845 |

) |

|

Retained earnings (deficit) |

|

|

(908,785 |

) |

|

|

12,654 |

|

|

Less treasury shares, at cost |

|

|

(645,650 |

) |

|

|

(637,507 |

) |

|

Total stockholders' equity (deficiency) |

|

|

(872,460 |

) |

|

|

90,594 |

|

|

Total liabilities and stockholders' equity |

|

$ |

2,712,320 |

|

|

$ |

3,218,810 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(unaudited, in 000s) |

|

Six months ended December 31, |

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

|

Net loss |

|

$ |

(415,996 |

) |

|

$ |

(353,237 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

Depreciation and amortization |

|

|

58,026 |

|

|

|

60,331 |

|

|

Provision for credit losses |

|

|

20,727 |

|

|

|

21,536 |

|

|

Deferred taxes |

|

|

(1,531 |

) |

|

|

(35,525 |

) |

|

Stock-based compensation |

|

|

17,945 |

|

|

|

17,525 |

|

|

Changes in assets and liabilities, net of acquisitions: |

|

|

|

|

|

Receivables |

|

|

(262,348 |

) |

|

|

(348,833 |

) |

|

Prepaid expenses, other current and noncurrent assets |

|

|

2,588 |

|

|

|

(7,395 |

) |

|

Accounts payable, accrued expenses, salaries, wages and payroll

taxes |

|

|

(76,806 |

) |

|

|

(58,543 |

) |

|

Deferred revenue, other current and noncurrent liabilities |

|

|

(45,170 |

) |

|

|

(58,520 |

) |

|

Income tax receivables, accrued income taxes and income tax

reserves |

|

|

(192,340 |

) |

|

|

(180,706 |

) |

|

Other, net |

|

|

(733 |

) |

|

|

1,201 |

|

|

Net cash used in operating activities |

|

|

(895,638 |

) |

|

|

(942,166 |

) |

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

Capital expenditures |

|

|

(49,115 |

) |

|

|

(32,708 |

) |

|

Payments made for business acquisitions, net of cash acquired |

|

|

(28,017 |

) |

|

|

(27,158 |

) |

|

Franchise loans funded |

|

|

(17,442 |

) |

|

|

(15,491 |

) |

|

Payments from franchisees |

|

|

971 |

|

|

|

2,747 |

|

|

Other, net |

|

|

6,110 |

|

|

|

1,565 |

|

|

Net cash used in investing activities |

|

|

(87,493 |

) |

|

|

(71,045 |

) |

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

Repayments of line of credit borrowings |

|

|

(100,000 |

) |

|

|

(25,000 |

) |

|

Proceeds from line of credit borrowings |

|

|

890,000 |

|

|

|

825,000 |

|

|

Dividends paid |

|

|

(96,960 |

) |

|

|

(89,854 |

) |

|

Repurchase of common stock, including shares surrendered |

|

|

(436,233 |

) |

|

|

(378,709 |

) |

|

Other, net |

|

|

1,791 |

|

|

|

4,011 |

|

|

Net cash provided by financing activities |

|

|

258,598 |

|

|

|

335,448 |

|

| Effects of exchange rate

changes on cash |

|

|

(9,136 |

) |

|

|

671 |

|

| Net decrease in cash and cash

equivalents, including restricted balances |

|

|

(733,669 |

) |

|

|

(677,092 |

) |

| Cash, cash equivalents and

restricted cash, beginning of period |

|

|

1,075,193 |

|

|

|

1,015,316 |

|

| Cash, cash equivalents and

restricted cash, end of period |

|

$ |

341,524 |

|

|

$ |

338,224 |

|

| SUPPLEMENTARY CASH

FLOW DATA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes paid, net (includes payments for purchased investment

tax credits) |

|

$ |

62,290 |

|

|

$ |

72,160 |

|

|

Interest paid on borrowings |

|

|

33,412 |

|

|

|

35,496 |

|

|

Accrued additions to property and equipment |

|

|

3,798 |

|

|

|

4,036 |

|

|

New operating right of use assets and related lease

liabilities |

|

|

47,135 |

|

|

|

70,532 |

|

|

Accrued dividends payable to common shareholders |

|

|

50,176 |

|

|

|

45,273 |

|

| |

|

|

|

|

|

(in 000s) |

|

|

|

Three months ended December 31, |

|

Six months ended December 31, |

|

NON-GAAP FINANCIAL MEASURE - EBITDA |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

| Net loss - as reported |

|

$ |

(243,420 |

) |

|

$ |

(189,755 |

) |

|

$ |

(415,996 |

) |

|

$ |

(353,237 |

) |

| Discontinued operations,

net |

|

|

954 |

|

|

|

639 |

|

|

|

2,109 |

|

|

|

1,248 |

|

| Net loss from continuing

operations - as reported |

|

|

(242,466 |

) |

|

|

(189,116 |

) |

|

|

(413,887 |

) |

|

|

(351,989 |

) |

| Add back: |

|

|

|

|

|

|

|

|

|

Income tax benefit |

|

|

(69,833 |

) |

|

|

(93,758 |

) |

|

|

(130,673 |

) |

|

|

(143,245 |

) |

|

Interest expense |

|

|

21,752 |

|

|

|

21,364 |

|

|

|

37,599 |

|

|

|

37,234 |

|

|

Depreciation and amortization |

|

|

29,195 |

|

|

|

30,107 |

|

|

|

58,026 |

|

|

|

60,332 |

|

| |

|

|

(18,886 |

) |

|

|

(42,287 |

) |

|

|

(35,048 |

) |

|

|

(45,679 |

) |

| EBITDA from continuing

operations |

|

$ |

(261,352 |

) |

|

$ |

(231,403 |

) |

|

$ |

(448,935 |

) |

|

$ |

(397,668 |

) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

(in 000s, except per share amounts) |

|

|

|

Three months ended December 31, |

|

Six months ended December 31, |

|

NON-GAAP FINANCIAL MEASURE - ADJUSTED EPS |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

| Net loss from continuing

operations - as reported |

|

$ |

(242,466 |

) |

|

$ |

(189,116 |

) |

|

$ |

(413,887 |

) |

|

$ |

(351,989 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

Amortization of intangibles related to acquisitions (pretax) |

|

|

10,910 |

|

|

|

12,269 |

|

|

|

22,038 |

|

|

|

24,824 |

|

|

Tax effect of adjustments (1) |

|

|

(2,539 |

) |

|

|

(3,087 |

) |

|

|

(5,184 |

) |

|

|

(6,022 |

) |

| Adjusted net loss from

continuing operations |

|

$ |

(234,095 |

) |

|

$ |

(179,934 |

) |

|

$ |

(397,033 |

) |

|

$ |

(333,187 |

) |

| Diluted loss per share from

continuing operations - as reported |

|

$ |

(1.79 |

) |

|

$ |

(1.33 |

) |

|

$ |

(3.02 |

) |

|

$ |

(2.44 |

) |

| Adjustments, net of tax |

|

|

0.06 |

|

|

|

0.06 |

|

|

|

0.13 |

|

|

|

0.13 |

|

| Adjusted diluted loss per

share from continuing operations |

|

$ |

(1.73 |

) |

|

$ |

(1.27 |

) |

|

$ |

(2.89 |

) |

|

$ |

(2.31 |

) |

|

|

|

|

|

|

|

|

|

|

(1)Tax effect of adjustments is the difference

between the tax provision calculated on a GAAP basis and on an

adjusted non-GAAP basis.

Non-GAAP Financial Information

Non-GAAP financial measures should not be considered as a

substitute for, or superior to, measures of financial performance

prepared in accordance with GAAP. Because these measures are not

measures of financial performance under GAAP and are susceptible to

varying calculations, they may not be comparable to similarly

titled measures for other companies.

We consider our non-GAAP financial measures to be performance

measures and a useful metric for management and investors to

evaluate and compare the ongoing operating performance of our

business. We make adjustments for certain non-GAAP financial

measures related to amortization of intangibles from acquisitions

and goodwill impairments. We may consider whether other significant

items that arise in the future should be excluded from our non-GAAP

financial measures.

We measure the performance of our business using a variety of

metrics, including earnings before interest, taxes, depreciation

and amortization (EBITDA) from continuing operations, adjusted

EBITDA from continuing operations, adjusted diluted earnings per

share from continuing operations, free cash flow, and free cash

flow yield. We also use EBITDA from continuing operations and

pretax income from continuing operations, each subject to permitted

adjustments, as performance metrics in incentive compensation

calculations for our employees.

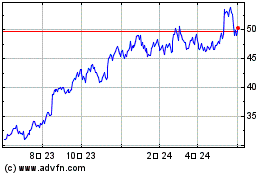

H and R Block (NYSE:HRB)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

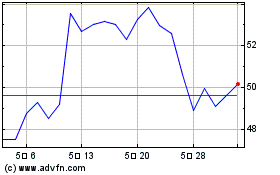

H and R Block (NYSE:HRB)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025