Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

29 12월 2023 - 8:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of December, 2023

Commission File Number 001-15216

HDFC BANK LIMITED

(Translation of registrant’s name into English)

HDFC Bank House, Senapati Bapat Marg,

Lower Parel, Mumbai. 400 013, India

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HDFC BANK LIMITED |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: December 28, 2023 |

|

|

|

By: |

|

/s/ Santosh Haldankar |

|

|

|

|

Name: Santosh Haldankar |

|

|

|

|

Title: Company Secretary |

EXHIBIT INDEX

The following documents (bearing the exhibit number listed below) are furnished herewith and are made a part of this report pursuant to the General

Instructions for Form 6-K.

Exhibit No. 99

Description

Update on Settlement Application made by HDFC

Bank Limited (“Bank”) dated August 18, 2023 in respect of a show cause notice dated June 19, 2023 received from SEBI on June 20, 2023 and the settlement has been recommended upon payment of Rs. 9,18,750 by the Bank to

SEBI, within 30 calendar days.

Exhibit 99

December 28, 2023

New York Stock Exchange

11, Wall Street,

New York,

NY 10005

USA

Dear Sir/ Madam,

Sub: Intimation under Regulation 30 of

SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“SEBI LODR Regulations”)

Pursuant to Regulation 30 of SEBI

(Listing Obligations and Disclosure Requirements) Regulations, 2015, we wish to inform you that the Securities and Exchange Board of India (“SEBI”) vide its email dated December 27, 2023 has considered the Settlement Application made

by HDFC Bank Limited (“Bank”) dated August 18, 2023 in respect of a show cause notice dated June 19, 2023 received from SEBI on June 20, 2023 and the settlement has been recommended upon payment of Rs. 9,18,750 by the

Bank to SEBI, within 30 calendar days.

The details as required to be provided as per sub-para 20 of Para A of Part A of Schedule III of SEBI LODR

Regulations is as follows:

|

|

|

|

|

| Sr. No |

|

Particulars |

|

Details |

|

1. |

|

Name of the authority |

|

Securities and Exchange Board of India |

|

2. |

|

Nature and details of the action(s) taken, initiated or order(s) passed |

|

The Bank had filed a settlement application dated August 18, 2023 (“Settlement Application”) in respect of a show cause

notice dated June 19, 2023 received from SEBI on June 20, 2023 (“SCN”). SEBI’s committees have considered the Bank’s Settlement Application and the settlement has been recommended upon payment of INR 9,18,750 (Nine

Lakh Eighteen Thousand Seven Hundred Fifty Rupees) by the Bank. Accordingly, SEBI has communicated to the Bank, vide its email dated December 27, 2023, that it has been agreed in principle to accept the terms of the settlement recommended by

its committees, subject to Regulations 28 and 31 of the SEBI (Settlement Proceedings) Regulations, 2018 (“Settlement Regulations”). Accordingly, the Bank has been advised to comply with the non-monetary terms, if any, and pay

INR 9,18,750 (Nine Lakh Eighteen Thousand Seven Hundred Fifty Rupees) to SEBI, within 30 calendar days (in terms of Regulation 14(3) of the Settlement Regulations). |

|

3. |

|

Date of receipt of direction or order, including any ad-interim or interim orders, or any other communication from the authority- |

|

December 27, 2023 |

|

4. |

|

Details of the violation(s)/contravention(s) committed or alleged to be committed;- |

|

The SCN issued to the Bank alleged that the Bank permitted a foreign portfolio investor to transact in the Indian securities market,

despite being ineligible in terms of the SEBI (Foreign Portfolio Investors) Regulations, 2019 (“FPI Regulations”), thereby violating provisions of Regulation 4(f) of the FPI Regulations. |

|

5. |

|

Impact on financial, operation or other activities of the listed entity, quantifiable in monetary terms to the extent possible |

|

Nil (Except to the extent of payment of the settlement amount of INR 9,18,750/-). |

This is for your information and appropriate dissemination.

Yours faithfully,

For HDFC Bank Limited

Sd/-

Santosh Haldankar

Company Secretary

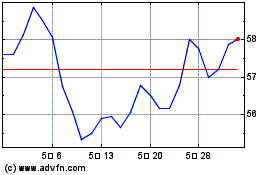

HDFC Bank (NYSE:HDB)

과거 데이터 주식 차트

부터 4월(4) 2024 으로 5월(5) 2024

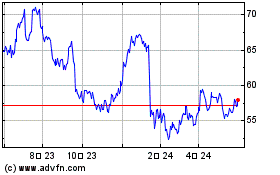

HDFC Bank (NYSE:HDB)

과거 데이터 주식 차트

부터 5월(5) 2023 으로 5월(5) 2024