0001562528FALSE00015625282025-02-132025-02-130001562528us-gaap:CommonStockMember2025-02-132025-02-130001562528us-gaap:SeriesEPreferredStockMember2025-02-132025-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 13, 2025

Franklin BSP Realty Trust, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Maryland | 001-40923 | 46-1406086 |

| (State or other jurisdiction | (Commission File Number) | (I.R.S. Employer |

| of incorporation) | | Identification No.) |

1 Madison Ave,

New York, New York 10010

(Address of principal executive offices, including zip code)

| | | | | | | | |

| 1345 Avenue of the Americas, Suite 32A |

| New York, New York 10105 |

| (Former name, former address and former fiscal year, if changed since last report) |

Registrant’s telephone number, including area code: (212) 588-6770

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | FBRT | New York Stock Exchange |

| 7.50% Series E Cumulative Redeemable Preferred Stock, par value $0.01 per share | FBRT PRE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On February 13, 2025, Franklin BSP Realty Trust, Inc. (the “Company”) issued a press release and supplemental slide presentation reporting the Company’s financial results for the quarter and year ended December 31, 2024. Copies of the press release and supplemental slide presentation are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

The information in this Item 2.02 (including Exhibits 99.1 and 99.2) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| | | EXHIBIT INDEX |

Exhibit

No. | | Description |

| | Press Release dated February 13, 2025 announcing the Company’s financial results for the quarter and year ended December 31, 2024 |

| | |

| | Supplemental Presentation for the quarter ended December 31, 2024 |

| | |

| 104.1 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | FRANKLIN BSP REALTY TRUST, INC. |

| | | |

| | | |

| | By: | /s/ Jerome S. Baglien |

| | Name: | Jerome S. Baglien |

| | Title: | Chief Financial Officer and Chief Operating Officer |

Date: February 13, 2025

| | |

Investor Relations Contact: Lindsey Crabbe l.crabbe@benefitstreetpartners.com

(214) 874-2339 |

Franklin BSP Realty Trust, Inc. Announces Fourth Quarter and Full Year 2024 Results

New York City, NY – February 13, 2025 – Franklin BSP Realty Trust, Inc. (NYSE: FBRT) (“FBRT” or the “Company”) today announced financial results for the quarter and full year ended December 31, 2024.

Reported GAAP net income of $30.2 million and $92.4 million for the three and twelve months ended December 31, 2024, respectively, compared to $30.0 million and $144.5 million for the three and twelve months ended December 31, 2023, respectively. Reported diluted earnings per share ("EPS") to common stockholders of $0.29 and $0.82 for the three and twelve months ended December 31, 2024, respectively, compared to $0.28 and $1.42 for the three and twelve months ended December 31, 2023, respectively.

Reported Distributable Earnings (a non-GAAP financial measure) of $31.2 million and $100.7 million, or $0.30 and $0.92 per diluted common share on a fully converted basis(1), for the three and twelve months ended December 31, 2024, respectively, compared to $39.3 million and $189.5 million, or $0.39 and $1.92 per diluted common share on a fully converted basis(1), for the three and twelve months ended December 31, 2023, respectively.

Fourth Quarter 2024 Summary

•Core portfolio principal balance as of December 31, 2024 of $5.0 billion:

◦Portfolio consisted of 155 loans with an average loan size of $32 million

◦99% of the Company's portfolio is in senior mortgage loans and approximately 93% is floating rate

◦71% of the portfolio is collateralized by multifamily properties and only 3.7% is collateralized by office properties

•Closed $441 million of new loan commitments at a weighted average spread of 344 basis points

•Funded $476 million of principal balance including future funding on existing loans and received loan repayments of $641 million

•Total liquidity of $535 million, which includes $184 million in cash and cash equivalents

•Produced a fourth quarter GAAP and Distributable Earnings ROE (a non-GAAP financial measure) of 7.6% and 7.8%, respectively

•Declared a fourth quarter common stock cash dividend of $0.355, representing an annualized 9.3% yield on book value

•Book value of $15.19 per diluted common share on a fully converted basis(1)

Full Year 2024 Summary

•Closed $2.0 billion of new loan commitments at a weighted average spread of 385 basis points

•Funded $1.9 billion of principal balance including future funding on existing loans and received loan repayments of $1.6 billion

•Produced a full year GAAP and Distributable Earnings ROE (a non-GAAP financial measure) of 5.6% and 5.9%, respectively

•GAAP and Distributable Earnings dividend coverage of 61% and 65%, respectively

•Closed BSPRT 2024-FL11 ("FL11 CRE CLO"), a $1.024 billion managed Commercial Real Estate Collateralized Loan Obligation ("CLO"), resulting in financing of $886.2 million, with a 36 month re-investment period, advance rate of 86.5% and a weighted average interest rate of 1M Term SOFR+199 before accounting for discount and transaction costs

•Repurchased 391,863 shares of common stock at an average price of $12.42 per share for an aggregate of $4.9 million, which represents a $0.02 per share increase to book value

1 Fully converted per share information in this press release assumes applicable conversion of our series of outstanding convertible preferred stock into common stock and the vesting of our outstanding equity compensation awards.

Richard Byrne, Chairman and Chief Executive Officer of FBRT, said, “FBRT originated $2.0 billion in new loan commitments in 2024. We're pleased with the significant progress we made in turning over our legacy portfolio. Including January 2025 originations, 52% of our book was originated post the Fed’s interest rate hikes."

Further commenting on the Company's results, Michael Comparato, President of FBRT, added, “We continue to actively manage our legacy loan portfolio. In 2024, we received over $1.6 billion in loan payoffs, extended loans where borrowers improved our debt position, and sold $159.5 million in REO assets. We are confident that our proactive approach to legacy loan resolutions will lead to enhanced earnings power for FBRT."

Portfolio and Investment Activity

Core portfolio: For the quarter ended December 31, 2024, the Company closed $441 million of new loan commitments, funded $476 million of principal balance on new and existing loans, and received loan repayments of $641 million. As of December 31, 2024, the Company had four loans on its watch list, three of which are risk rated a five and one risk rated a four.

Conduit: For the quarter ended December 31, 2024, the Company originated $87.3 million of fixed rate conduit loans that will be sold through FBRT's conduit program.

Real estate owned: During the fourth quarter, the Company sold one retail property and three multifamily properties. In addition, the Company foreclosed on one multifamily property during the quarter.

Allowance for credit losses: During the quarter, the Company recognized an incremental provision for credit losses of $0.9 million, comprised of a $2.5 million asset-specific provision and a $(1.6) million general allowance benefit.

Book Value

As of December 31, 2024, book value was $15.19 per diluted common share on a fully converted basis(1).

Share Repurchase Program

As of February 10, 2025, $31.1 million remains available under the $65 million share repurchase program, which extends through December 31, 2025.

Subsequent Events

Investment Activity: We obtained, through foreclosure, two multifamily properties, both located in Texas. One of these two properties was subsequently sold on February 12, 2025 for a purchase price of $63.8 million, above our debt basis, and was financed with a loan originated by the Company.

We also sold a previously foreclosed multifamily property, located in North Carolina, for a purchase price of $12.9 million.

Conduit Activity: We sold two of our commercial mortgage loans, held for sale into the CMBS securitization market. The loans had a fair value of $82.3 million as of December 31, 2024.

Distributable Earnings and Distributable Earnings to Common

Distributable Earnings is a non-GAAP measure, which the Company defines as GAAP net income (loss), adjusted for (i) non-cash CLO amortization acceleration and amortization over the expected useful life of the Company's CLOs, (ii) unrealized gains and losses on loans and derivatives, including CECL reserves and impairments, net of realized gains and losses, as described further below, (iii) non-cash equity compensation expense, (iv) depreciation and amortization, (v) subordinated performance fee accruals/(reversal), (vi) realized gains and losses on debt extinguishment and CLO calls, and (vii) certain other non-cash items. Further, Distributable Earnings to Common, a non-GAAP measure, presents Distributable Earnings net of (i) perpetual preferred stock dividend payments and (ii) non-controlling interests in joint ventures.

As noted above, we exclude unrealized gains and losses on loans and other investments, including CECL reserves and impairments, from our calculation of Distributable Earnings and include realized gains and losses. The nature of these adjustments is described more fully in the footnotes to our reconciliation tables. GAAP loan loss reserves and any property impairment losses have been excluded from Distributable Earnings consistent with other unrealized losses pursuant to our existing definition of Distributable Earnings. We expect to only recognize such potential credit or property impairment losses in Distributable Earnings if and when such amounts are deemed nonrecoverable upon a realization event. This is generally at the time a loan is repaid, or in the case of a foreclosure or other property, when the underlying asset is sold. Amounts may also be deemed non-recoverable if, in our determination, it is nearly certain the carrying amounts will not be collected or realized. The realized loss amount reflected in Distributable Earnings will generally equal the difference between the cash received and the

1 Fully converted per share information in this press release assumes applicable conversion of our series of outstanding convertible preferred stock into common stock and the vesting of our outstanding equity compensation awards.

Distributable Earnings basis of the asset. The timing of any such loss realization in our Distributable Earnings may differ materially from the timing of the corresponding loss reserves, charge-offs or impairments in our consolidated financial statements prepared in accordance with GAAP.

The Company believes that Distributable Earnings and Distributable Earnings to Common provide meaningful information to consider in addition to the disclosed GAAP results. The Company believes Distributable Earnings and Distributable Earnings to Common are useful financial metrics for existing and potential future holders of its common stock as historically, over time, Distributable Earnings to Common has been an indicator of common dividends per share. As a REIT, the Company generally must distribute annually at least 90% of its taxable income, subject to certain adjustments, and therefore believes dividends are one of the principal reasons stockholders may invest in its common stock. Further, Distributable Earnings to Common helps investors evaluate performance excluding the effects of certain transactions and GAAP adjustments that the Company does not believe are necessarily indicative of current loan portfolio performance and the Company's operations and is one of the performance metrics the Company's board of directors considers when dividends are declared.

Distributable Earnings and Distributable Earnings to Common do not represent net income (loss) and should not be considered as an alternative to GAAP net income (loss). The methodology for calculating Distributable Earnings and Distributable Earnings to Common may differ from the methodologies employed by other companies and thus may not be comparable to the Distributable Earnings reported by other companies.

Please refer to the financial statements and reconciliation of GAAP Net Income to Distributable Earnings and Distributable Earnings to Common included at the end of this release for further information.

1 Fully converted per share information in this press release assumes applicable conversion of our series of outstanding convertible preferred stock into common stock and the vesting of our outstanding equity compensation awards.

Supplemental Information

The Company published a supplemental earnings presentation for the quarter ended December 31, 2024 on its website to provide additional disclosure and financial information. These materials can be found on the Company’s website at http://www.fbrtreit.com under the Presentations tab.

Conference Call and Webcast

The Company will host a conference call and live audio webcast to discuss its financial results on Friday, February 14, 2025 at 9:00 a.m. ET. Participants are encouraged to pre-register for the call and webcast at https://dpregister.com/sreg/10195037/fe18cf47ce. If you are unable to pre-register, the conference call may be accessed by dialing (844) 701-1166 (Domestic) or (412) 317-5795 (International). Ask to join the Franklin BSP Realty Trust conference call. Participants should call in at least five minutes prior to the start of the call.

The call will also be accessible via live webcast at https://ccmediaframe.com/?id=Q2f3DmSE. Please allow extra time prior to the call to download and install audio software, if needed. A slide presentation containing supplemental information may also be accessed through the Company’s website in advance of the call.

An audio replay of the live broadcast will be available approximately one hour after the end of the conference call on FBRT’s website. The replay will be available for 90 days on the Company’s website.

About Franklin BSP Realty Trust, Inc.

Franklin BSP Realty Trust, Inc. (NYSE: FBRT) is a real estate investment trust that originates, acquires and manages a diversified portfolio of commercial real estate debt secured by properties located in the United States. As of December 31, 2024, FBRT had approximately $6.0 billion of assets. FBRT is externally managed by Benefit Street Partners L.L.C., a wholly owned subsidiary of Franklin Resources, Inc. For further information, please visit www.fbrtreit.com.

Forward-Looking Statements

Certain statements included in this press release are forward-looking statements. Those statements include statements regarding the intent, belief or current expectations of the Company and members of our management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as "may," "will," "seeks," "anticipates," "believes," "estimates," "expects," "plans," "intends," "should" or similar expressions. Actual results may differ materially from those contemplated by such forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law.

The Company's forward-looking statements are subject to various risks and uncertainties. Factors that could cause actual outcomes to differ materially from our forward-looking statements include macroeconomic factors in the United States including inflation, changing interest rates and economic contraction, the extent of any recoveries on delinquent loans, the financial stability of our borrowers and the other, risks and important factors contained and identified in the Company’s filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and its subsequent filings with the SEC, any of which could cause actual results to differ materially from the forward-looking statements. The forward-looking statements included in this communication are made only as of the date hereof.

FRANKLIN BSP REALTY TRUST, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data) | | | | | | | | | | | | | | |

| | December 31, 2024 | | December 31, 2023 |

| ASSETS | | | | |

| Cash and cash equivalents | | $ | 184,443 | | | $ | 337,595 | |

| Restricted cash | | 12,421 | | | 6,092 | |

Commercial mortgage loans, held for investment, net of allowance for credit losses of $78,083 and $47,175 as of December 31, 2024 and 2023, respectively(1) | | 4,908,667 | | | 4,989,767 | |

Commercial mortgage loans, held for sale, measured at fair value(2) | | 87,270 | | | — | |

| | | | |

Real estate securities, available for sale, measured at fair value, amortized cost of $202,894 and $243,272 as of December 31, 2024 and 2023, respectively(3) | | 202,973 | | | 242,569 | |

| | | | |

| | | | |

Receivable for loan repayment(4) | | 157,582 | | | 55,174 | |

| Accrued interest receivable | | 42,225 | | | 42,490 | |

| Prepaid expenses and other assets | | 17,526 | | | 19,213 | |

| Intangible lease asset, net of amortization | | 39,834 | | | 42,793 | |

| Real estate owned, net of depreciation | | 113,160 | | | 115,830 | |

| Real estate owned, held for sale | | 222,890 | | | 103,657 | |

| Equity method investment in real estate | | 13,395 | | | — | |

| | | | |

| Total assets | | $ | 6,002,386 | | | $ | 5,955,180 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | |

| Collateralized loan obligations | | $ | 3,628,270 | | | $ | 3,567,166 | |

| Repurchase agreements and revolving credit facilities - commercial mortgage loans | | 329,811 | | | 299,707 | |

| Repurchase agreements - real estate securities | | 236,608 | | | 174,055 | |

| Mortgage note payable | | 23,998 | | | 23,998 | |

| Other financings | | 12,865 | | | 36,534 | |

| Unsecured debt | | 81,395 | | | 81,295 | |

| Derivative instruments, measured at fair value | | 713 | | | — | |

| Interest payable | | 12,844 | | | 15,383 | |

| Distributions payable | | 36,237 | | | 36,133 | |

| Accounts payable and accrued expenses | | 14,443 | | | 13,339 | |

| Due to affiliates | | 14,106 | | | 19,316 | |

| Intangible lease liability, held for sale | | 1,291 | | | 12,297 | |

| | | | |

| Total liabilities | | $ | 4,392,581 | | | $ | 4,279,223 | |

| Commitments and Contingencies | | | | |

| Redeemable convertible preferred stock: | | | | |

Redeemable convertible preferred stock Series H, $0.01 par value, 20,000 authorized and 17,950 issued and outstanding as of December 31, 2024 and 2023, respectively | | $ | 89,748 | | | $ | 89,748 | |

| | | | |

| Total redeemable convertible preferred stock | | $ | 89,748 | | | $ | 89,748 | |

| Equity: | | | | |

Preferred stock, $0.01 par value; 100,000,000 shares authorized, 7.5% Cumulative Redeemable Preferred Stock, Series E, 10,329,039 shares issued and outstanding as of December 31, 2024 and 2023 | | $ | 258,742 | | | $ | 258,742 | |

Common stock, $0.01 par value, 900,000,000 shares authorized, 83,066,789 and 82,751,913 issued and outstanding as of December 31, 2024 and 2023, respectively | | 818 | | | 820 | |

| Additional paid-in capital | | 1,600,997 | | | 1,599,197 | |

| Accumulated other comprehensive income (loss) | | 79 | | | (703) | |

| Accumulated deficit | | (348,074) | | | (298,942) | |

| Total stockholders' equity | | $ | 1,512,562 | | | $ | 1,559,114 | |

| Non-controlling interest | | 7,495 | | | 27,095 | |

| Total equity | | $ | 1,520,057 | | | $ | 1,586,209 | |

| Total liabilities, redeemable convertible preferred stock and equity | | $ | 6,002,386 | | | $ | 5,955,180 | |

______________________________________________________________________

(1) Includes pledged assets of $268.7 million and $299.7 million as of December 31, 2024 and 2023, respectively.

(2) Includes pledged assets of $61.1 million and zero as of December 31, 2024 and 2023, respectively.

(3) Includes pledged assets of $180.7 million and $167.9 million as of December 31, 2024 and 2023, respectively.

(4) Includes $157.0 million and $55.1 million of cash held by the servicer related to the CLOs as of December 31, 2024 and 2023, respectively.

FRANKLIN BSP REALTY TRUST, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2024 | | 2023 | | 2022 |

| Income | | | | | |

| Interest income | $ | 526,076 | | | $ | 552,506 | | | $ | 357,705 | |

| Less: Interest expense | 338,471 | | | 305,577 | | | 160,526 | |

| Net interest income | 187,605 | | | 246,929 | | | 197,179 | |

| Revenue from real estate owned | 22,849 | | | 17,021 | | | 9,655 | |

| Total income | $ | 210,454 | | | $ | 263,950 | | | $ | 206,834 | |

| Expenses | | | | | |

| Asset management and subordinated performance fee | $ | 25,958 | | | $ | 33,847 | | | $ | 26,157 | |

| Acquisition expenses | 996 | | | 1,241 | | | 1,360 | |

| Administrative services expenses | 9,707 | | | 14,440 | | | 12,928 | |

| | | | | |

| Professional fees | 14,508 | | | 15,270 | | | 22,566 | |

| Share-based compensation | 8,173 | | | 4,761 | | | 2,519 | |

| | | | | |

| Depreciation and amortization | 5,630 | | | 7,128 | | | 5,408 | |

| Other expenses | 21,472 | | | 11,135 | | | 6,572 | |

| Total expenses | $ | 86,444 | | | $ | 87,822 | | | $ | 77,510 | |

| Other income/(loss) | | | | | |

| (Provision)/benefit for credit losses | $ | (35,699) | | | $ | (33,738) | | | $ | (36,115) | |

| | | | | |

| Realized gain/(loss) on extinguishment of debt | — | | | 2,201 | | | (5,167) | |

| Realized gain/(loss) on real estate securities, available for sale | 143 | | | 80 | | | — | |

| Realized gain/(loss) on sale of commercial mortgage loans, held for sale | — | | | — | | | (354) | |

| Realized gain/(loss) on sale of commercial mortgage loans, held for investment | 138 | | | — | | | — | |

| Realized gain/(loss) on sale of commercial mortgage loans, held for sale, measured at fair value | 13,125 | | | 3,873 | | | 2,358 | |

| Gain/(loss) on other real estate investments | (7,983) | | | (7,089) | | | (692) | |

| Unrealized gain/(loss) on commercial mortgage loans, held for sale, measured at fair value | — | | | 44 | | | (511) | |

| | | | | |

| Trading gain/(loss) | — | | | (605) | | | (119,220) | |

| Unrealized gain/(loss) on derivatives | 1,050 | | | (140) | | | (15,840) | |

| Realized gain/(loss) on derivatives | (1,261) | | | 998 | | | 60,033 | |

| Total other income/(loss) | $ | (30,487) | | | $ | (34,376) | | | $ | (115,508) | |

| Income/(loss) before taxes | 93,523 | | | 141,752 | | | 13,816 | |

| (Provision)/benefit for income tax | (1,120) | | | 2,757 | | | 399 | |

| Net income/(loss) | $ | 92,403 | | | $ | 144,509 | | | $ | 14,215 | |

| Net (income)/loss attributable to non-controlling interest | 3,475 | | | 706 | | | 216 | |

| Net income/(loss) attributable to Franklin BSP Realty Trust, Inc. | $ | 95,878 | | | $ | 145,215 | | | $ | 14,431 | |

| Less: Preferred stock dividends | 26,993 | | | 26,993 | | | 41,741 | |

| | | | | |

| Net income/(loss) attributable to common stock | $ | 68,885 | | | $ | 118,222 | | | $ | (27,310) | |

| | | | | |

| Basic earnings per share | $ | 0.82 | | | $ | 1.42 | | | $ | (0.38) | |

| Diluted earnings per share | $ | 0.82 | | | $ | 1.42 | | | $ | (0.38) | |

| Basic weighted average shares outstanding | 81,846,170 | | | 82,307,970 | | | 71,628,365 | |

| Diluted weighted average shares outstanding | 81,846,170 | | | 82,307,970 | | | 71,628,365 | |

FRANKLIN BSP REALTY TRUST, INC.

RECONCILIATION OF GAAP NET INCOME TO DISTRIBUTABLE EARNINGS

(In thousands, except share and per share data)

(Unaudited)

The following table provides a reconciliation of GAAP net income to Distributable Earnings and Distributable Earnings to Common for the years ended December 31, 2024, 2023 and 2022 (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 | | 2022 |

| GAAP net income (loss) | | $ | 92,403 | | $ | 144,509 | | $ | 14,215 |

| Adjustments: | | | | | | |

CLO amortization acceleration(1) | | — | | (5,521) | | (438) |

Unrealized (gain)/loss on financial instruments(2) | | 6,933 | | 7,185 | | 17,010 |

| Unrealized (gain)/loss - ARMs | | — | | 415 | | 43,557 |

| (Reversal of)/provision for credit losses | | 35,699 | | 33,738 | | 36,115 |

| Non-cash compensation expense | | 8,173 | | 4,762 | | 3,485 |

| Depreciation and amortization | | 5,630 | | 7,128 | | 5,408 |

Subordinated performance fee(3) | | (7,551) | | 6,171 | | (8,380) |

| Realized (gain)/loss on debt extinguishment / CLO call | | — | | (2,201) | | — |

Realized gain/(loss) adjustment on loans and REO(4) | | (40,605) | | (1,571) | | — |

Loan workout charges/(loan workout recoveries)(5) | | — | | (5,105) | | 5,104 |

| Distributable Earnings | | $ | 100,682 | | $ | 189,510 | | $ | 116,076 |

| 7.5% series E cumulative redeemable preferred stock dividend | | (19,367) | | (19,367) | | (19,367) |

| Non-controlling interests in joint ventures net (income) / loss | | 3,475 | | (602) | | | 216 |

| Non-controlling interests in joint ventures adjusted net (income) / loss DE Adjustments | | (3,717) | | (31) | | (1,415) |

| Distributable Earnings to Common | | $ | 81,073 | | $ | 169,510 | | $ | 95,510 |

Average common stock & common stock equivalents(6) | | 1,363,621 | | 1,403,558 | | 1,456,871 |

| GAAP net income/(loss) ROE | | 5.6 | % | | 8.9 | % | | (0.3) | % |

| Distributable earnings ROE | | 5.9 | % | | 12.1 | % | | 6.6 | % |

| GAAP net income/(loss) per share, diluted | | $ | 0.82 | | $ | 1.42 | | $ | (0.38) |

GAAP net income/(loss) per share, fully converted(7) | | $ | 0.87 | | $ | 1.42 | | $ | (0.06) |

Distributable earnings per share, fully converted(7) | | $ | 0.92 | | $ | 1.92 | | $ | 1.07 |

________________________

(1) Before Q1 2024, we adjusted GAAP income for non-cash CLO amortization acceleration to effectively amortize the issuance costs of our CLOs over the expected lifetime of the CLOs. We assume our CLOs will be outstanding for approximately four years and amortized the financing costs over approximately four years in our distributable earnings as compared to effective yield methodology in our GAAP earnings. Starting in Q1 2024, we amortized the issuance costs incurred on our CLOs over the expected lifetime of the CLOs in our GAAP presentation, making our previous adjustment no longer necessary.

(2) Represents unrealized gains and losses on (i) commercial mortgage loans, held for sale, measured at fair value, (ii) other real estate investments, measured at fair value and (iii) derivatives.

(3) Represents accrued and unpaid subordinated performance fee. In addition, reversal of subordinated performance fee represents cash payment obligations during the period.

(4) Represents amounts deemed nonrecoverable upon a realization event, which is generally at the time a loan is repaid, or in the case of a foreclosure or other property, when the underlying asset is sold. Amounts may also be deemed non-recoverable if, in our determination, it is nearly certain the carrying amounts will not be collected or realized upon sale. Amount may be different than the GAAP basis. As of December 31, 2024, the Company has $11.9 million of GAAP loss adjustments that would run through distributable earnings if and when cash losses are realized.

(5) Represents loan workout charges the Company incurred, which the Company deemed likely to be recovered. Reversal of loan workout charges represent recoveries received. During the second quarter of 2023, the Company recovered $5.1 million of loan workout charges, in aggregate, related to the loan workout charges incurred in 2022.

(6) Represents the average of all classes of equity except the Series E Preferred Stock.

(7) Fully Converted assumes conversion of our series of convertible preferred stock and full vesting of our outstanding equity compensation awards.

Franklin BSP Realty Trust Fourth Quarter 2024 Supplemental Information

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 2 Important Information The information herein relates to the Company’s business and financial information as of December 31, 2024 and does not reflect subsequent developments. Risk Factors Investing in and owning our common stock involves a high degree of risk. See the section entitled “Risk Factors” in our Annual Report on Form 10-K filed with the SEC on February 26, 2024, and the risk disclosures in our subsequent periodic reports filed with the SEC for a discussion of these risks. Forward-Looking Statements Certain statements included in this presentation are forward-looking statements. Those statements include statements regarding the intent, belief or current expectations of Franklin BSP Realty Trust, Inc. (“FBRT” or the “Company”) and may include the assumptions on which such statements are based, and generally are identified by the use of words such as "may," "will," "seeks," "anticipates," "believes," "estimates," "expects," "plans," "intends," "should" or similar expressions. Actual results may differ materially from those contemplated by such forward-looking statements. Factors that could cause actual outcomes to differ materially from our forward-looking statements include macroeconomic factors in the United States including inflation, changing interest rates and economic contraction, impairments in the value of real estate property securing our loans or that we own, the extent of any recoveries on delinquent loans, and the financial stability of our borrowers, and the other factors set forth in the risk factors section of our most recent Form 10-K and Form 10-Q. The extent to which these factors impact us and our borrowers will depend on future developments, which are highly uncertain and cannot be predicted with confidence. Further, forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by law. Additional Important Information The summary information provided in this presentation does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of the Company. This summary is not an offer to sell securities and is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted. This summary is not advice, a recommendation or an offer to enter into any transaction with us or any of our affiliated funds. There is no guarantee that any of the goals, targets or objectives described in this summary will be achieved. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal, ERISA or tax advice or investment recommendations. Investors should also seek advice from their own independent tax, accounting, financial, ERISA, investment and legal advisors to properly assess the merits and risks associated with their investment in light of their own financial condition and other circumstances. The information contained herein is qualified in its entirety by reference to our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. You may obtain a copy of the most recent Annual Report or Quarterly Report by calling (844) 785-4393 and/or visiting www.fbrtreit.com. This presentation contains information regarding FBRT’s financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), including Distributable Earnings. Please refer to the appendix for the reconciliation of the applicable GAAP financial measures to non-GAAP financial measures. PAST PERFORMANCE IS NOT A GUARANTEE OR INDICATIVE OF FUTURE RESULTS. INVESTMENTS INVOLVE SIGNIFICANT RISKS, INCLUDING LOSS OF THE ENTIRE INVESTMENT. There is no guarantee that any of the estimates, targets or projections illustrated in this summary will be achieved. Any references herein to any of the Company’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objective of the Company will be achieved. Any investment entails a risk of loss. An investor could lose all or substantially all of his or her investment. Please refer to our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q for a more complete list of risk factors. The following slides contain summaries of certain financial information about the Company. The information contained in this presentation is summary information that is intended to be considered in the context of our filings with the Securities and Exchange Commission and other public announcements that we may make, by press release or otherwise, from time to time.

FBRT 4Q 2024 Financial Update

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 4 Highlights 1. Fully converted per share information assumes applicable conversion of our outstanding series of convertible preferred stock into common stock and the full vesting of our outstanding equity compensation awards. 2. Please see appendix for GAAP net income to Distributable Earnings calculation. 3. Adjusted for accumulated depreciation and amortization of real property of $13.8 million and $12.6 million at 12/31/24 and 9/30/24, respectively. 4. Cash excludes restricted cash. Total liquidity amount includes the cash available we can invest at a market advance rate utilizing our available capacity on financing lines. 5. As of December 31, 2024, the Company’s foreclosure real estate owned assets include eleven multifamily properties that previously collateralized eight commercial mortgage loans. FBRT 4Q 2024 Financial Update • Book value per share, fully converted is $15.19 vs. $15.24 in Q3 2024 (1). Undepreciated book value per share, fully converted is $15.35 vs. $15.38 in Q3 2024 (1) (3) • Net debt to equity is 2.6x; recourse net debt to equity is 0.3x • 89% of financing sources are non-mark-to-market on our core book • $535 million of liquidity of which $184 million is cash and $12 million is CLO reinvest/ramp available (4) • Core Portfolio: In the quarter, principal balance decreased by $165 million. Closed $441 million of new loan commitments and funded $476 million of principal balance including future funding on existing loans. Received loan repayments of $641 million • Core Portfolio: In 2024, originated $2.0 billion of new loan commitments and funded $1.7 billion of principal balance on new loans. Received loan repayments of $1.6 billion • Core Portfolio of 155 CRE loans and $5.0 billion of principal balance, average size of $32 million and 71% multifamily. During the quarter, one asset was removed from the watch list. Four assets remain on the watch list, three of which are risk rated a five and one of which is risk rated a four • Eleven foreclosure real estate owned positions, totaling $250 million (5), one investment real estate owned position of $123 million, and one equity investment position of $13 million Capitalization Investments Portfolio Earnings • GAAP Net Income of $30.2 million and $0.29 per diluted common share and $0.29 per fully converted share (1) • Distributable Earnings (2) of $31.2 million and $0.30 per fully converted share (1) • Declared a cash dividend of $0.355 per share, representing an annualized yield of 9.3% on book value per share, fully converted (1). GAAP and Distributable Earnings (2) dividend coverage of 82% and 84%, respectively

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 5 Income Statement Balance Sheet - Assets (End of Quarter) Net interest income $47.3 Total core portfolio $4,908.7 Operating expenses (1) (17.8) Total real estate securities 203.0 Provision for credit loss (0.9) Cash and restricted cash 196.9 Other income/(loss) 1.6 CLO reinvestment available 12.2 GAAP net income (loss) $30.2 Other assets 681.6 Adjustments to GAAP net income (loss) (2) 1.0 Total assets $6,002.4 Distributable Earnings (2) $31.2 Balance Sheet - Debt & Equity GAAP net income (loss) per share, fully converted (3) $0.29 Collateralized loan obligations $3,628.3 GAAP return on common equity 7.6% Warehouse 329.8 GAAP dividend coverage, fully converted (2), (3) 81.8% Repo - securities 236.6 Asset specific financings 36.9 Distributable Earnings per share, fully converted (2), (3) $0.30 Unsecured debt 81.4 Distributable Earnings return on common equity (2) 7.8% Total debt $4,313.0 Distributable Earnings dividend coverage, fully converted (2), (3) 84.1% Preferred equity (4) 348.5 Common stock/retained earnings (5) 1,261.3 Dividend per share $0.355 Total equity (4), (5) $1,609.8 Dividend per share yield on book value 9.3% Book value per share, fully converted (3) $15.19 Net debt/total equity 2.56x Recourse net debt/total equity 0.30x Financial Highlights Note: All numbers in millions except per share and share data. 1. Does not include real estate owned operating income which is reported under Other income / (loss). 2. Please see appendix for the detail on the adjustments from GAAP net income to Distributable Earnings. 3. Fully converted per share information assumes applicable conversion of our outstanding series of convertible preferred stock into common stock and the full vesting of our outstanding equity compensation awards. 4. Includes $90 million of preferred equity that converts to common equity on 1/21/26, subject to the holder's right to accelerate the conversion. These amounts are reflected as temporary equity on the consolidated balance sheets. The remaining $259 million of preferred equity represents the Series E preferred, which is not convertible into common equity. 5. Includes non-controlling interest. FBRT 4Q 2024 Financial Update

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 6 $41.0 $32.4 -$4.0 $31.2 1Q'24 2Q'24 3Q'24 4Q'24 Earnings & Distributions Note: All numbers in millions except per share data. 1. Please see appendix for the detail on the adjustments from GAAP net income to Distributable Earnings. 2. Fully converted per share information assumes applicable conversion of our outstanding series of convertible preferred stock into common stock and the full vesting of our outstanding equity compensation awards. FBRT 4Q 2024 Financial Update Distributable Earnings ($M) (1) GAAP Net Income (Loss) ($M) $35.8 -$3.8 $30.2 $30.2 1Q'24 2Q'24 3Q'24 4Q'24 1Q'24 2Q'24 3Q'24 4Q'24 $0.355 $0.355 $0.355 $0.355 Dividend per share $0.41 $0.31 ($0.10) $0.30 Distributable earnings per share, fully converted (1), (2) 115% 87% (28%) 84% Distributable dividend coverage, fully converted (1), (2)

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 7 Note: All numbers in millions. 1. Includes full paydowns, dispositions, partial paydowns, non-REO related charge-offs and amortization 2. Includes REO related charge-offs Core Net Fundings FBRT 4Q 2024 Financial Update 4Q 2024 ($M) FY 2024 ($M) $5,165 $415 $62 ($641) ($1) $5,000 3Q24 Loans Outstanding Fundings on New Loans Fundings on Existing Loans Repayments REO/ Foreclosures 4Q24 Loans Outstanding $5,045 $1,704 $205 ($1,642) ($312) $5,000 4Q23 Loans Outstanding Fundings on New Loans Fundings on Existing Loans Repayments REO/ Foreclosures 4Q24 Loans Outstanding (1 ) (1 ) (2 ) (2 ) Total Commitment of $441M Total Commitment of $2,034M

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 8 Capitalization Overview 1. On our core book (excluding repo-securities), 89% of financings are non-mark-to-market 2. Net leverage represents (i) total outstanding borrowings under secured financing arrangements, including collateralized loan obligations, repurchase agreements - commercial mortgage loans, repurchase agreements - real estate securities, asset-specific financing arrangements, and unsecured debt, less cash and cash equivalents, to (ii) total equity and total redeemable convertible preferred stock, at period end. Recourse net leverage excludes collateralized loan obligations. FBRT 4Q 2024 Financial Update Financing Sources (1) Net Leverage (2) Average debt cost including financing was 7.4% in 4Q24 vs. 7.9% in 3Q24 Collateralized Loan Obligations 84% Warehouse 8% Repo - Securities 5% Asset Specific Financings 1% Unsecured Debt 2% 0.30x 2.56x 0.00x 0.50x 1.00x 1.50x 2.00x 2.50x 3.00x Recourse Net Leverage Total Net Leverage

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 9 Financing Detail 1. Outstanding balance as of December 31, 2024 and net of tranches held by FBRT 2. Cost of debt is shown before discount and transaction costs 3. Commitment for loans. Excludes bond repurchase agreements FBRT 4Q 2024 Financial Update CLOs Warehouse/Revolver/Other CLO Name Debt Amount(1) Reinvest End Date Cost of Debt(2) BSPRT 2021-FL6 $344 million Ended S + 1.64% BSPRT 2021-FL7 $393 million Ended S + 1.90% BSPRT 2022-FL8 $797 million Ended S + 1.77% BSPRT 2022-FL9 $520 million Ended S + 2.94% BSPRT 2023-FL10 $717 million 4/8/25 S + 2.59% BSPRT 2024-FL11 $886 million 10/8/27 S + 1.99% Total $3,657 million CLO reinvestment available $12 million Repo – Securities (outstanding) $237 million Name Commitment (3) Barclays (Warehouse) $500 million Wells Fargo $400 million JP Morgan $500 million Atlas SP Partners $350 million Churchill $225 million Barclays (Secured Revolver) $100 million Total $2,075 million

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 10 Liquidity 1. Represents cash available at 12/31/2024 that we can invest at a market advance rate utilizing our available capacity on financing lines FBRT 4Q 2024 Financial Update Liquidity ($M) $12 $339 $535 $184 Unrestricted Cash CLO Reinvestment Available Financing Available & In Progress Total Liquidity ( 1 )

Portfolio

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 12 Core Loan Portfolio Composition 1. Weighted average loan-to-value percentage (WA LTV) represents the weighted average ratio of the loan amount to the appraised value of the property at the time of origination 2. Unpaid principal balance (UPB) represents the portion of the loan that has not yet been remitted to the lender 3. All three risk rated 5 Portfolio Collateral by Region Rate TypePortfolio Summary Collateral by StateCollateral Summary • $5.0B total portfolio; 62.9% WA LTV (1) • 145 senior loans; average UPB (2) of $34M • 10 mezzanine loans; average UPB (2) of $4M • 3 non-performing loans (3) Portfolio Overview Floating 93% Fixed 7% Multifamily 71% Hospitality 15% Industrial 7% Office 4% Retail 1% Other 2% Senior 99% Mezzanine 1% Texas 34% Florida 12% North Carolina 12% Various 6% Georgia 5% South Carolina 5% Arizona 4% New York 4% All Other 18% Southeast 39% Southwest 38% Mideast 6% New England 4% Far West 3% Great Lakes 2% Rocky Mountain 2% Various 6%

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 13 Multifamily 68% Other 16% Industrial 9% Hospitality 7% By State By Collateral By Region Core Originations in the Quarter Note: Charts shown above are based on the initial funding/unpaid principal balance of the newly originated loans. 1. All-in coupon based on 12/31/24 SOFR indices. Portfolio • 18 loans; $441 million total commitment ($415 million of initial funding / $26 million of future funding) • 3.44% weighted average spread; 7.79% all-in coupon (1) • 0.9% and 0.5% weighted average origination and exit fees, respectively Overview Southeast 56% Mideast 30% Southwest 14% New York 30% Georgia 20% North Carolina 16% Texas 14% Florida 11% South Carolina 6% Tennessee 3%

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 14 Core Portfolio - Watch List Loans (Risk Rating 4&5) Note: Watchlist loans are loans with a risk rating of 4 or 5 Portfolio Investment Suburban Office Park CBD Office Building 376-Unit Apartment Community 307-Unit Student Housing Community Loan Type Floating Rate Senior Loan Floating Rate Senior Loan Floating Rate Senior Loan Floating Rate Senior Loan Investment Date Q4 2019 Q1 2021 Q4 2021 Q2 2022 Default Date None None Q4 2024 None Non-Performing Yes Yes Yes No Collateral Office Office Multifamily Multifamily Loan Purpose Acquisition Refinance Acquisition Acquisition Location Alpharetta, Georgia Denver, Colorado Dallas, Texas Norfolk, VA Loan Risk Rating 5 5 5 4

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 15 Foreclosure Real Estate Owned (“REO”) Portfolio Investment Single Tenant Retail Portfolio CBD Office Complex 16-Building Apartment Complex 144-Unit Apartment Community 471-Unit Apartment Community 426-Unit Apartment Community 224-Unit Apartment Community 397-Unit Apartment Community 76-Unit Apartment Community 122-Unit Apartment Community 50-Unit Apartment Community Loan Investment Date Q2 2022 Q1 2020 Q1 2021 Q2 2022 Q2 2022 Q2 2018 Q3 2021 Q2 2022 Q2 2022 Q2 2022 Q2 2022 Foreclosure / Deed-In-Lieu Date Q4 2022 - Q2 2023 - Q3 2023 Q4 2023 Q2 2024 Q2 2024 Q2 2024 Q3 2024 Q3 2024 Q3 2024 Q3 2024 Q4 2024 Collateral Type Retail Office Multifamily Multifamily Multifamily Multifamily Multifamily Multifamily Multifamily Multifamily Multifamily Collateral Detail 4 Freestanding Retail Properties 124k Square Foot Office Complex 236-Unit Apartment Complex with 16 Buildings 144-Unit, Garden-Style Apartment Communities 471-Unit, Garden Style Apartment Community 426-Unit, High Rise Apartment Community 224-Unit, Garden Style Apartment Community 397-Unit, Garden Style Apartment Community 76-Unit, Garden Style Apartment Community 122-Unit, Garden Style Apartment Community 50-Unit, Mid- Rise Apartment Community Location Various Portland, Oregon Lubbock, Texas Chapel Hill, North Carolina Raleigh, North Carolina Cleveland, Ohio San Antonio, Texas Oklahoma City, Oklahoma Charlotte, North Carolina Statesville, North Carolina Rock Hill, South Carolina Multi Property Loan

Appendix

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 17 Core Portfolio – FBRT Portfolio Details – Top 15 Loans Note: All numbers in millions. 1. Effective Yield defined as: (1) current spread of the loan plus (2) the greater of any applicable index or index floor 2. As-is loan to value percentage is from metrics at origination. Predevelopment construction loans at origination will not have an LTV and therefore is nil. Appendix Loan Loan Type Origination Date Par Value Amortized Cost Spread Effective Yield (1) Fully Extended Maturity State Collateral Type As-is LTV (2) Loan 1 Senior Loan 5/10/24 117 116 + 2.50% 6.83% 5/9/29 Connecticut Multifamily 50.7% Loan 2 Senior Loan 4/5/24 112 112 + 3.15% 7.48% 4/9/28 Various Industrial 63.8% Loan 3 Senior Loan 2/9/23 111 111 + 4.90% 9.23% 2/9/28 Various Hospitality 53.6% Loan 4 Senior Loan 2/24/22 86 86 + 3.15% 7.48% 3/9/27 North Carolina Multifamily 69.6% Loan 5 Senior Loan 2/10/22 82 82 + 3.20% 7.53% 2/9/27 Florida Multifamily 74.5% Loan 6 Senior Loan 12/15/21 81 81 + 2.00% 6.33% 8/9/26 North Carolina Multifamily 76.1% Loan 7 Senior Loan 2/16/24 80 79 + 3.65% 7.98% 3/9/29 Texas Multifamily 53.3% Loan 8 Senior Loan 8/1/23 79 79 + 3.20% 7.53% 8/9/28 Texas Multifamily 58.7% Loan 9 Senior Loan 12/21/21 79 78 + 3.45% 7.78% 1/9/27 Florida Multifamily 78.8% Loan 10 Senior Loan 3/7/24 75 75 + 2.70% 7.03% 3/9/29 North Carolina Industrial 58.6% Loan 11 Senior Loan 3/31/21 75 75 + 2.95% 7.40% 4/9/26 Texas Multifamily 72.6% Loan 12 Senior Loan 9/6/24 71 71 + 2.75% 7.08% 9/9/28 Florida Multifamily 72.7% Loan 13 Senior Loan 11/30/21 69 69 + 2.88% 7.33% 1/9/27 Texas Multifamily 74.8% Loan 14 Senior Loan 9/20/21 68 68 + 3.25% 7.70% 10/9/26 South Carolina Multifamily 77.1% Loan 15 Senior Loan 10/29/21 67 67 + 2.85% 7.30% 11/9/26 Texas Multifamily 70.6% Loans 16 - 155 Senior & Mezz Loans Various 3,748 3,738 + 3.78% 8.13% Various Various Various 61.8% Total/Wtd. avg. $5,000 $4,987 + 3.63% 7.97% 2.6 years 62.9% Average Loan Size $32 $32

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 18 Risk Rating Principal Balance - 3,804 1,004 57 135 Loan Count, 3Q24 - 127 27 1 2 (+) Addition - 18 4 1 1 (-) Reduction - (21) (4) (1) - Loan Count, 4Q24 - 124 27 1 3 Change QoQ - (3) - - 1 Non-Performing - - - - 3 Watch List - - - 1 3 0.0% 76.1% 20.1% 1.1% 2.7% 1 2 3 4 5 Core Portfolio – Risk Ratings Note: Principal balance in millions. Watchlist loans are loans with a risk rating of 4 or 5 Appendix Risk Ratings Average risk rating was 2.3 for the quarter vs. 2.2 in 3Q24

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 19 $0.07 $0.01 ($0.01) $0.00 $0.01 -1.50% -1.00% -0.50% 12/31/2024 +0.25% Change in Floating Base Rate Indices Earnings Sensitivity Note: Reflects earnings impact of an increase or decrease in the floating-rate indices referenced by our portfolio, assuming no change in credit spreads, portfolio composition or asset performance Appendix EPS Sensitivity on Index Rates Positive earnings correlation to falling rates due to rate floor activations As of 1/22/25: 1M SOFR: 4.30% As of 12/31/24: 1M SOFR: 4.33%

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 20 $413 $1,259 $1,574 $894 $843 $17 2025 2026 2027 2028 2029 2030 Core Portfolio – Fully Extended Maturities Note: All numbers in millions. Excludes loans on non-accrual and loans in maturity default at 12/31/2024 Appendix Fully Extended Maturity by Year

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 21 Multifamily 47% Office 36% Hospitality 12% All Other 5% Core Portfolio – Allowance For Loan Loss Note: All numbers in millions. Allowance for loan loss above includes future funding. Appendix Total Allowance for Credit Loss by Collateral Type 3Q24 Change 4Q24 UPB As % of Total UPB General CECL Provision $49.6 ($1.6) $48.0 $4,865 1.0% Specific CECL Provision 28.7 2.5 31.2 $135 0.6% Total Allowance for Credit Losses $78.3 $0.9 $79.2 $5,000 1.6%

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 22 GAAP Net Income to Distributable Earnings Reconciliation Note: All numbers in millions except share and per share data. 1. Represents unrealized gains and losses on (i) commercial mortgage loans, held for sale, measured at fair value, (ii) other real estate investments, measured at fair value and (iii) derivatives. 2. Represents accrued and unpaid subordinated performance fee. In addition, reversal of subordinated performance fee represents cash payment obligations in the quarter. 3. Represents amounts deemed nonrecoverable upon a realization event, which is generally at the time a loan is repaid, or in the case of a foreclosure or other property, when the underlying asset is sold. Amounts may also be deemed non-recoverable if, in our determination, it is nearly certain the carrying amounts will not be collected or realized upon sale. Amount may be different than the GAAP basis. As of December 31, 2024, the Company has $11.9 million of GAAP loss adjustments that would run through distributable earnings if and when cash losses are realized. 4. Represents the average of all classes of equity except the Series E Preferred Stock. 5. Fully Converted assumes conversion of our series of convertible preferred stock and full vesting of our outstanding equity compensation awards. Appendix 4Q'24 3Q'24 2Q'24 1Q'24 GAAP Net Income (Loss) 30.2 30.2 (3.8) 35.8 Adjustments: Unrealized (Gain) / Loss (1) (1.5) 2.5 6.3 (0.3) Subordinated Performance Fee (2) (1.4) (3.4) (2.2) (0.6) Non-Cash Compensation Expense 2.2 2.1 2.1 1.8 Depreciation & Amortization 1.4 1.4 1.4 1.4 (Reversal of) / Provision for Credit Loss 0.9 (0.3) 32.2 2.9 Realized Gain / (Loss) Adjustment on Loans and REO (3) (0.5) (36.4) (3.7) - Distributable Earnings 31.2 (4.0) 32.4 41.0 7.5% Series E Cumulative Reedemable Preferred Stock Dividend (4.8) (4.8) (4.8) (4.8) Noncontrolling Interests in Joint Ventures Net (Income) / Loss 0.4 1.4 1.6 0.1 Noncontrolling Interests in Joint Ventures Net (Income) / Loss DE Adjustments (0.4) (1.4) (1.7) (0.3) Distributable Earnings to Common 26.4 (8.8) 27.4 36.0 Average Common Stock & Common Stock Equivalents (4) 1,346.2 1,349.1 1,370.7 1,389.9 GAAP Net Income / (Loss) ROE 7.6% 7.9% (2.0%) 8.9% Distributable Earnings ROE 7.8% (2.6%) 8.0% 10.4% GAAP Net Income / (Loss) Earnings Per Share, Diluted $0.29 $0.30 ($0.11) $0.35 Fully Converted Weighted Average Shares Outstanding (5) 88,437,287 88,432,401 88,452,224 88,470,537 GAAP Net Income / (Loss) Earnings Per Share, Fully Converted (5) $0.29 $0.30 ($0.08) $0.35 Distributable Earnings Per Share, Fully Converted (5) $0.30 ($0.10) $0.31 $0.41

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 23 December 31, 2024 December 31, 2023 Stockholders' equity applicable to convertible common stock $ 1,343,568 $ 1,390,120 Shares: Common stock 81,788,091 81,942,656 Restricted stock and restricted stock units 1,278,698 809,257 Series H convertible preferred stock 5,370,498 5,370,498 Total outstanding shares 88,437,287 88,122,411 Fully-converted book value per share(1)(2) $ 15.19 $ 15.77 Book Value Per Share & Shares Outstanding Note: All numbers in thousands except per share and share data. Preferred stock values expressed in common stock equivalents. 1. Fully-converted book value per share reflects full conversion of our outstanding series of convertible preferred stock and vesting of our outstanding equity compensation awards. 2. Excluding the amounts for accumulated depreciation and amortization of real property of $13.8 million and $9.4 million as of December 31, 2024 and December 31, 2023, respectively, would result in a fully-converted book value per share of $15.35 and $15.88 as of December 31, 2024 and December 31, 2023, respectively. Appendix

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 24 Year Ended December 31, 2024 2023 2022 Income Interest income $ 526,076 $ 552,506 $ 357,705 Less: Interest expense 338,471 305,577 160,526 Net interest income 187,605 246,929 197,179 Revenue from real estate owned 22,849 17,021 9,655 Total income $ 210,454 $ 263,950 $ 206,834 Expenses Asset management and subordinated performance fee $ 25,958 $ 33,847 $ 26,157 Acquisition expenses 996 1,241 1,360 Administrative services expenses 9,707 14,440 12,928 Professional fees 14,508 15,270 22,566 Share-based compensation 8,173 4,761 2,519 Depreciation and amortization 5,630 7,128 5,408 Other expenses 21,472 11,135 6,572 Total expenses $ 86,444 $ 87,822 $ 77,510 Other income/(loss) (Provision)/benefit for credit losses $ (35,699) $ (33,738) $ (36,115) Realized gain/(loss) on extinguishment of debt — 2,201 (5,167) Realized gain/(loss) on real estate securities, available for sale 143 80 — Realized gain/(loss) on sale of commercial mortgage loans, held for sale 138 — (354) Realized gain/(loss) on sale of commercial mortgage loans, held for sale, measured at fair value 13,125 3,873 2,358 Gain/(loss) on other real estate investments (7,983) (7,089) (692) Unrealized gain/(loss) on commercial mortgage loans, held for sale, measured at fair value — 44 (511) Trading gain/(loss) — (605) (119,220) Unrealized gain/(loss) on derivatives 1,050 (140) (15,840) Realized gain/(loss) on derivatives (1,261) 998 60,033 Total other income/(loss) $ (30,487) $ (34,376) $ (115,508) Income/(loss) before taxes 93,523 141,752 13,816 (Provision)/benefit for income tax (1,120) 2,757 399 Net income/(loss) $ 92,403 $ 144,509 $ 14,215 Net (income)/loss attributable to non-controlling interest 3,475 706 216 Net income/(loss) attributable to Franklin BSP Realty Trust, Inc. $ 95,878 $ 145,215 $ 14,431 Less: Preferred stock dividends 26,993 26,993 41,741 Net income/(loss) attributable to common stock $ 68,885 $ 118,222 $ (27,310) Basic earnings per share $ 0.82 $ 1.42 $ (0.38) Diluted earnings per share $ 0.82 $ 1.42 $ (0.38) Basic weighted average shares outstanding 81,846,170 82,307,970 71,628,365 Diluted weighted average shares outstanding 81,846,170 82,307,970 71,628,365 FBRT Income Statement Appendix

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 25 December 31, 2024 December 31, 2023 ASSETS Cash and cash equivalents $ 184,443 $ 337,595 Restricted cash 12,421 6,092 Commercial mortgage loans, held for investment, net of allowance for credit losses of $78,083 and $47,175 as of December 31, 2024 and 2023, respectively 4,908,667 4,989,767 Commercial mortgage loans, held for sale, measured at fair value 87,270 — Real estate securities, available for sale, measured at fair value, amortized cost of $202,894 and $243,272 as of December 31, 2024 and 2023, respectively (includes pledged assets of $180,701 and $167,948 as of December 31, 2024 and 2023, respectively) 202,973 242,569 Receivable for loan repayment(1) 157,582 55,174 Accrued interest receivable 42,225 42,490 Prepaid expenses and other assets 17,526 19,213 Intangible lease asset, net of amortization 39,834 42,793 Real estate owned, net of depreciation 113,160 115,830 Real estate owned, held for sale 222,890 103,657 Equity method investment in real estate 13,395 — Total assets $ 6,002,386 $ 5,955,180 LIABILITIES AND STOCKHOLDERS' EQUITY Collateralized loan obligations $ 3,628,270 $ 3,567,166 Repurchase agreements and revolving credit facilities - commercial mortgage loans 329,811 299,707 Repurchase agreements - real estate securities 236,608 174,055 Mortgage note payable 23,998 23,998 Other financings 12,865 36,534 Unsecured debt 81,395 81,295 Derivative instruments, measured at fair value 713 — Interest payable 12,844 15,383 Distributions payable 36,237 36,133 Accounts payable and accrued expenses 14,443 13,339 Due to affiliates 14,106 19,316 Intangible lease liability, held for sale 1,291 12,297 Total liabilities $ 4,392,581 $ 4,279,223 Commitments and Contingencies Redeemable convertible preferred stock: Redeemable convertible preferred stock Series H, $0.01 par value, 20,000 authorized and 17,950 issued and outstanding as of December 31, 2024 and 2023, respectively $ 89,748 $ 89,748 Total redeemable convertible preferred stock $ 89,748 $ 89,748 Equity: Preferred stock, $0.01 par value; 100,000,000 shares authorized, 7.5% Cumulative Redeemable Preferred Stock, Series E, 10,329,039 shares issued and outstanding as of December 31, 2024 and 2023, respectively $ 258,742 $ 258,742 Common stock, $0.01 par value, 900,000,000 shares authorized, 83,066,789 and 82,751,913 issued and outstanding as of December 31, 2024 and 2023, respectively 818 820 Additional paid-in capital 1,600,997 1,599,197 Accumulated other comprehensive income (loss) 79 (703) Accumulated deficit (348,074) (298,942) Total stockholders' equity $ 1,512,562 $ 1,559,114 Non-controlling interest 7,495 27,095 Total equity $ 1,520,057 $ 1,586,209 Total liabilities, redeemable convertible preferred stock and equity $ 6,002,386 $ 5,955,180 FBRT Balance Sheet Appendix

B E N E F I T S T R E E T P A R T N E R S | A L C E N T R A 26 Definitions Distributable Earnings and Distributable Earnings to Common Distributable Earnings is a non-GAAP measure, which the Company defines as GAAP net income (loss), adjusted for (i) non-cash CLO amortization acceleration and amortization over the expected useful life of the Company's CLOs, (ii) unrealized gains and losses on loans and derivatives, including CECL reserves and impairments, net of realized gains and losses, as described further below, (iii) non-cash equity compensation expense, (iv) depreciation and amortization, (v) subordinated performance fee accruals/(reversal), (vi) realized gains and losses on debt extinguishment and CLO calls, and (vii) certain other non-cash items. Further, Distributable Earnings to Common, a non-GAAP measure, presents Distributable Earnings net of (i) perpetual preferred stock dividend payments and (ii) non-controlling interests in joint ventures. As noted above, we exclude unrealized gains and losses on loans and other investments, including CECL reserves and impairments, from our calculation of Distributable Earnings and include realized gains and losses. The nature of these adjustments is described more fully in the footnotes to our reconciliation tables. GAAP loan loss reserves and any property impairment losses have been excluded from Distributable Earnings consistent with other unrealized losses pursuant to our existing definition of Distributable Earnings. We expect to only recognize such potential credit or property impairment losses in Distributable Earnings if and when such amounts are deemed nonrecoverable upon a realization event. This is generally at the time a loan is repaid, or in the case of a foreclosure or other property, when the underlying asset is sold. Amounts may also be deemed non-recoverable if, in our determination, it is nearly certain the carrying amounts will not be collected or realized. The realized loss amount reflected in Distributable Earnings will generally equal the difference between the cash received and the Distributable Earnings basis of the asset. The timing of any such loss realization in our Distributable Earnings may differ materially from the timing of the corresponding loss reserves, charge-offs or impairments in our consolidated financial statements prepared in accordance with GAAP. The Company believes that Distributable Earnings and Distributable Earnings to Common provide meaningful information to consider in addition to the disclosed GAAP results. The Company believes Distributable Earnings and Distributable Earnings to Common are useful financial metrics for existing and potential future holders of its common stock as historically, over time, Distributable Earnings to Common has been an indicator of common dividends per share. As a REIT, the Company generally must distribute annually at least 90% of its taxable income, subject to certain adjustments, and therefore believes dividends are one of the principal reasons stockholders may invest in its common stock. Further, Distributable Earnings to Common helps investors evaluate performance excluding the effects of certain transactions and GAAP adjustments that the Company does not believe are necessarily indicative of current loan portfolio performance and the Company's operations and is one of the performance metrics the Company's board of directors considers when dividends are declared. Distributable Earnings and Distributable Earnings to Common do not represent net income (loss) and should not be considered as an alternative to GAAP net income (loss). The methodology for calculating Distributable Earnings and Distributable Earnings to Common may differ from the methodologies employed by other companies and thus may not be comparable to the Distributable Earnings reported by other companies.

www.benefitstreetpartners.com www.alcentra.com London Cannon Place 78 Cannon Street London EC4N 6HL UK West Palm Beach 360 South Rosemary Avenue Suite 1510 West Palm Beach FL 33401 USA Boston 100 Federal Street 22nd Floor Boston MA 02110 USA New York One Madison Avenue Suite 1600 New York NY 10010 USA

v3.25.0.1

Cover

|

Feb. 13, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 13, 2025

|

| Entity Registrant Name |

Franklin BSP Realty Trust, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-40923

|

| Entity Tax Identification Number |

46-1406086

|

| Entity Address, Address Line One |

1 Madison Ave

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10010

|

| City Area Code |

212

|

| Local Phone Number |

588-6770

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001562528

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

FBRT

|

| Security Exchange Name |

NYSE

|

| Series E Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.50% Series E Cumulative Redeemable Preferred Stock, par value $0.01 per share

|

| Trading Symbol |

FBRT PRE

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesEPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

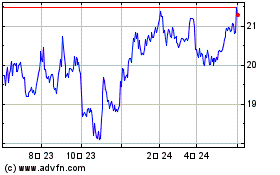

Franklin BSP Realty (NYSE:FBRT-E)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

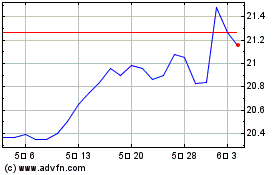

Franklin BSP Realty (NYSE:FBRT-E)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025