0001042893false00010428932023-07-312023-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): July 31, 2023

DRIL-QUIP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-13439 |

|

74-2162088 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

2050 West Sam Houston Parkway S., Suite 1100 Houston, Texas |

|

77042 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (713) 939-7711

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $.01 par value per share |

|

DRQ |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

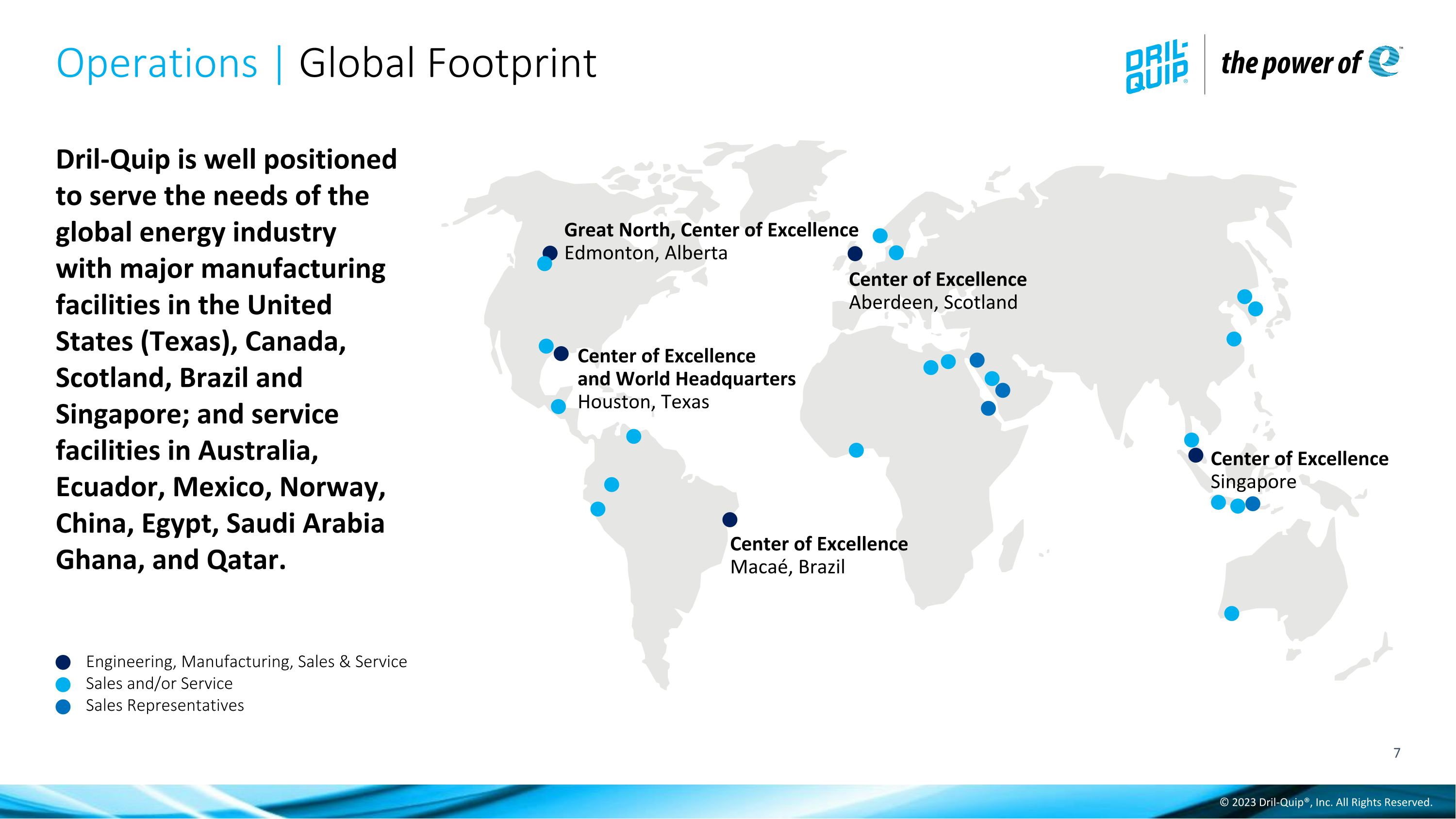

On July 31, 2023, TIW Canada ULC (“Purchaser”), an unlimited liability company governed by the Laws of Alberta and wholly-owned subsidiary of Dril-Quip, Inc. (“Dril-Quip”), acquired all of the issued and outstanding shares in the capital of 1185641 B.C. Ltd. (d/b/a Great North Wellhead and Frac), a corporation governed by the laws of the province of British Columbia (the “Company”), pursuant to a definitive agreement (the “Share Purchase Agreement”), dated as of July 31, 2023, among each of the shareholders of the Company (collectively, “Sellers”), Industrial Growth Partners V AIV L.P., in its capacity as agent to Sellers thereunder, Purchaser and, solely in its capacity as guarantor for the obligations of Purchaser thereunder, Dril-Quip for a cash purchase price of $105 million CAD. The purchase price is subject to customary purchase price adjustments and includes potential earnout payments of up to $30 million CAD to be paid over the course of 2024 and 2025 if the Company and its subsidiaries meet specific revenue growth targets.

The parties have made customary representations and warranties to each other. The Share Purchase Agreement also contains customary covenants.

* * *

The foregoing summary of the Share Purchase Agreement and the transaction contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Share Purchase Agreement, a copy of which is filed as Exhibit 2.1 hereto.

Investors are cautioned that the representations, warranties and covenants included in the Share Purchase Agreement were made by Dril-Quip, Purchaser and Sellers to each other. These representations, warranties and covenants were made as of specific dates and only for purposes of the Share Purchase Agreement and are subject to important exceptions and limitations, including a contractual standard of materiality different from that generally relevant to investors, and are qualified by information in disclosure schedules that Sellers delivered to Purchaser in connection with the execution of the Share Purchase Agreement, which disclosures are not necessarily reflected in the Share Purchase Agreement. In addition, the representations and warranties may have been included in the Share Purchase Agreement for the purpose of allocating risk between Purchaser and Sellers, rather than to establish matters as facts.

The Share Purchase Agreement is described in this Current Report on Form 8-K and attached as Exhibit 2.1 hereto only to provide you with information regarding certain material terms and conditions, and, except for its status as a contractual document that establishes and governs the legal relationship among the parties thereto with respect to the transaction, not to provide any other factual information regarding Dril-Quip, Purchaser, Sellers, the Company or their respective businesses. Investors are not third-party beneficiaries under the Share Purchase Agreement and should not rely on the representations and warranties in the Share Purchase Agreement as characterizations of the actual state of facts about Dril-Quip, Purchaser, Sellers, the Company or any other person referenced therein.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.01.

Item 2.02 Results of Operations and Financial Condition.

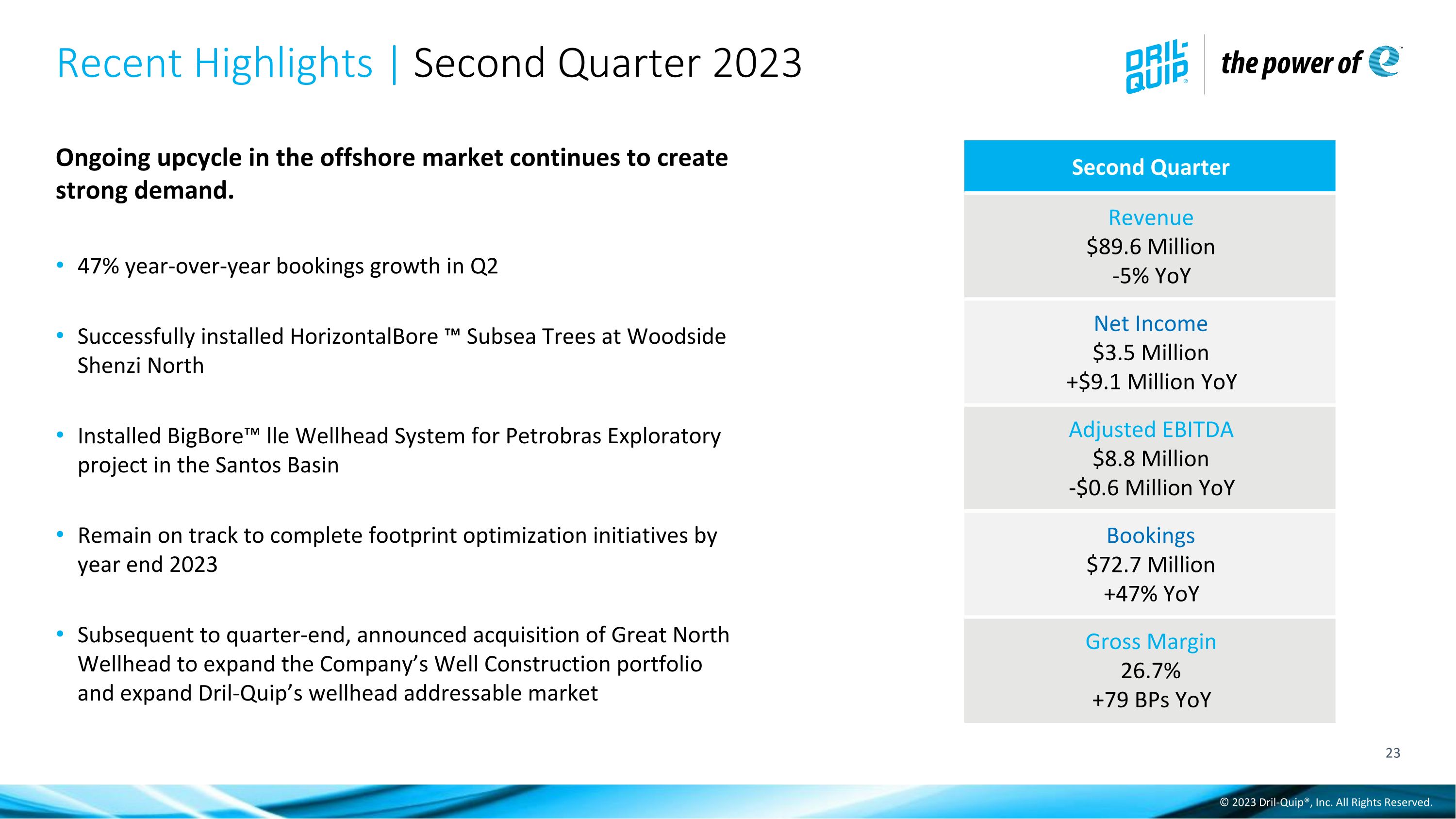

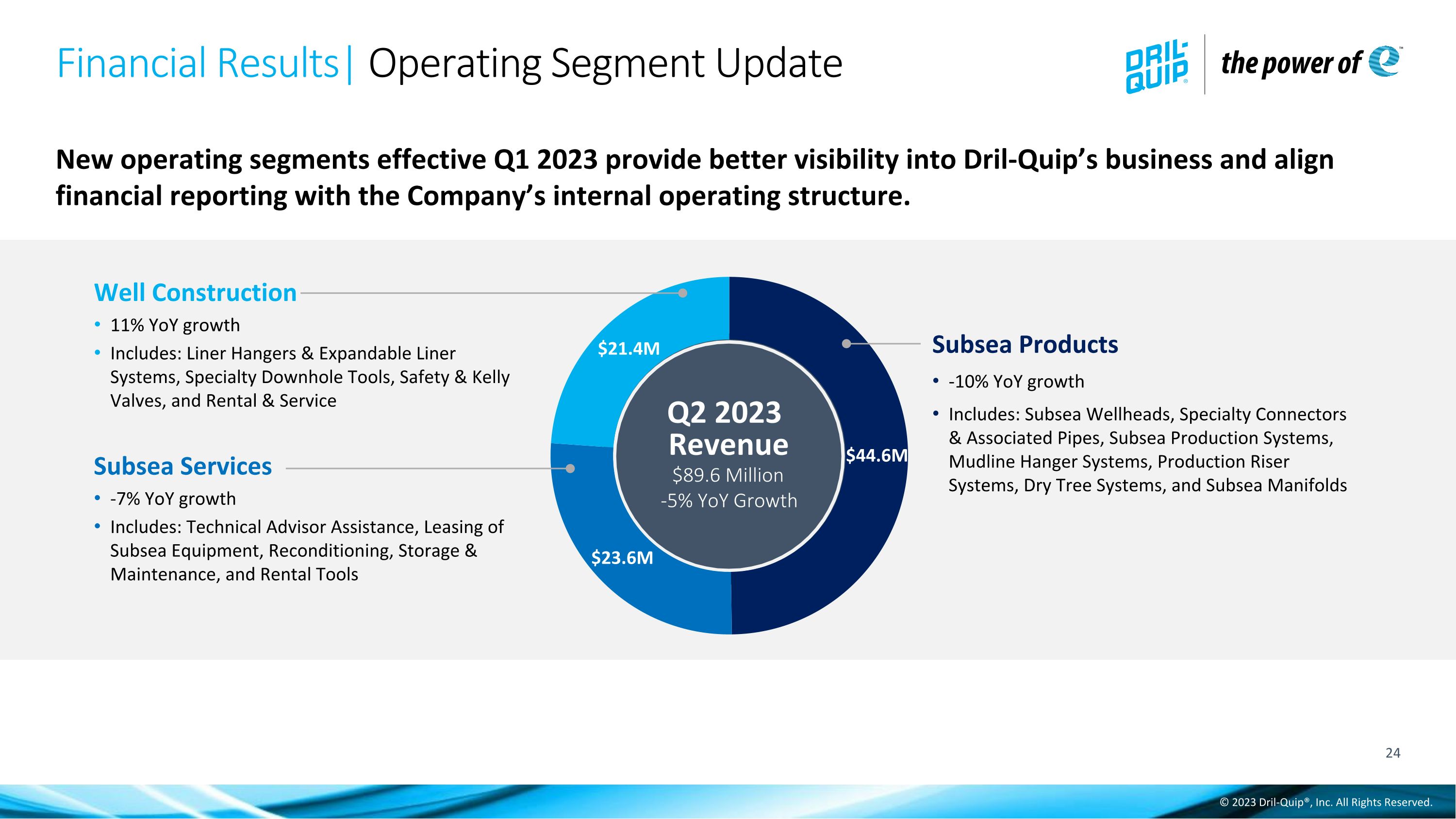

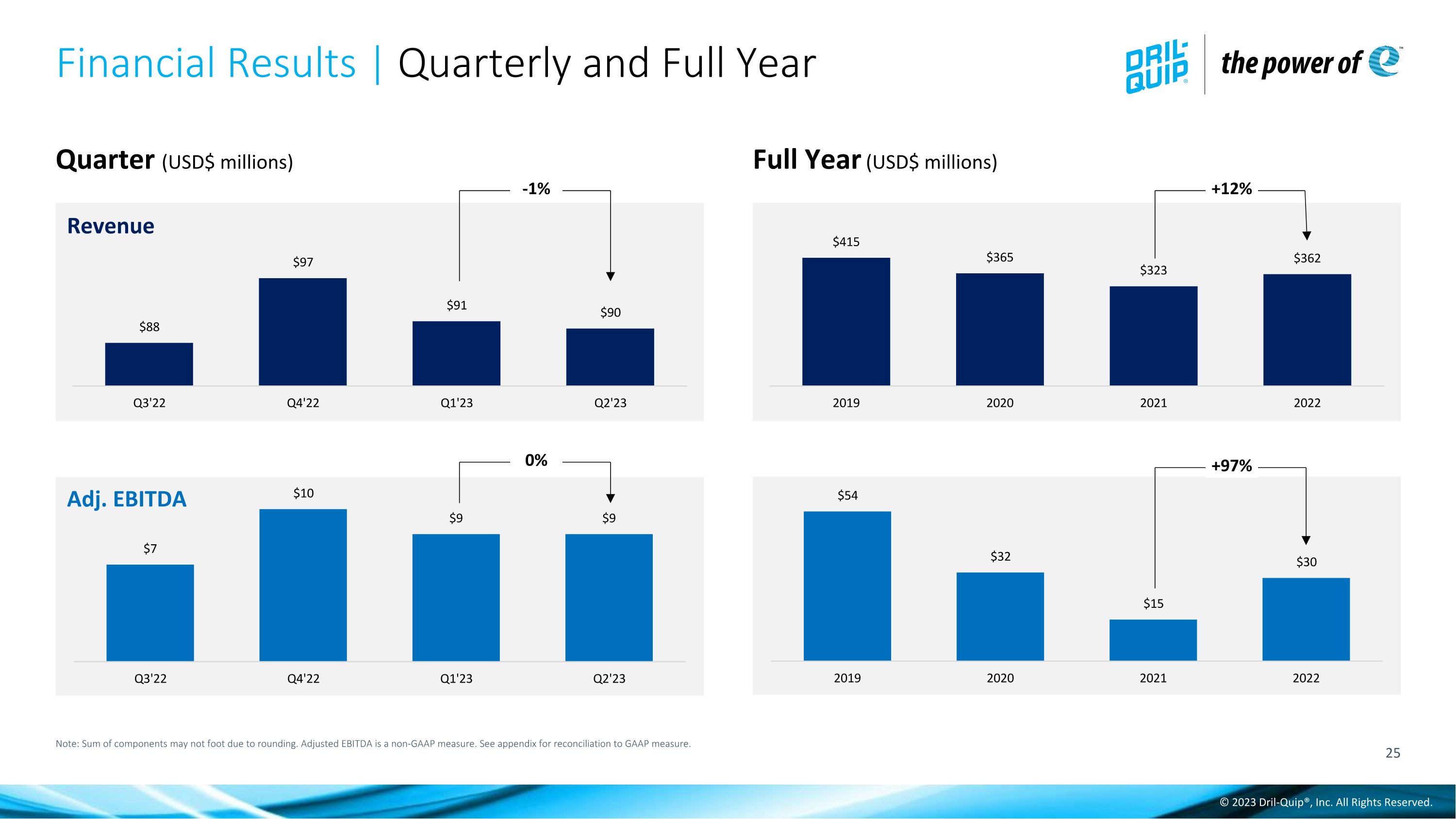

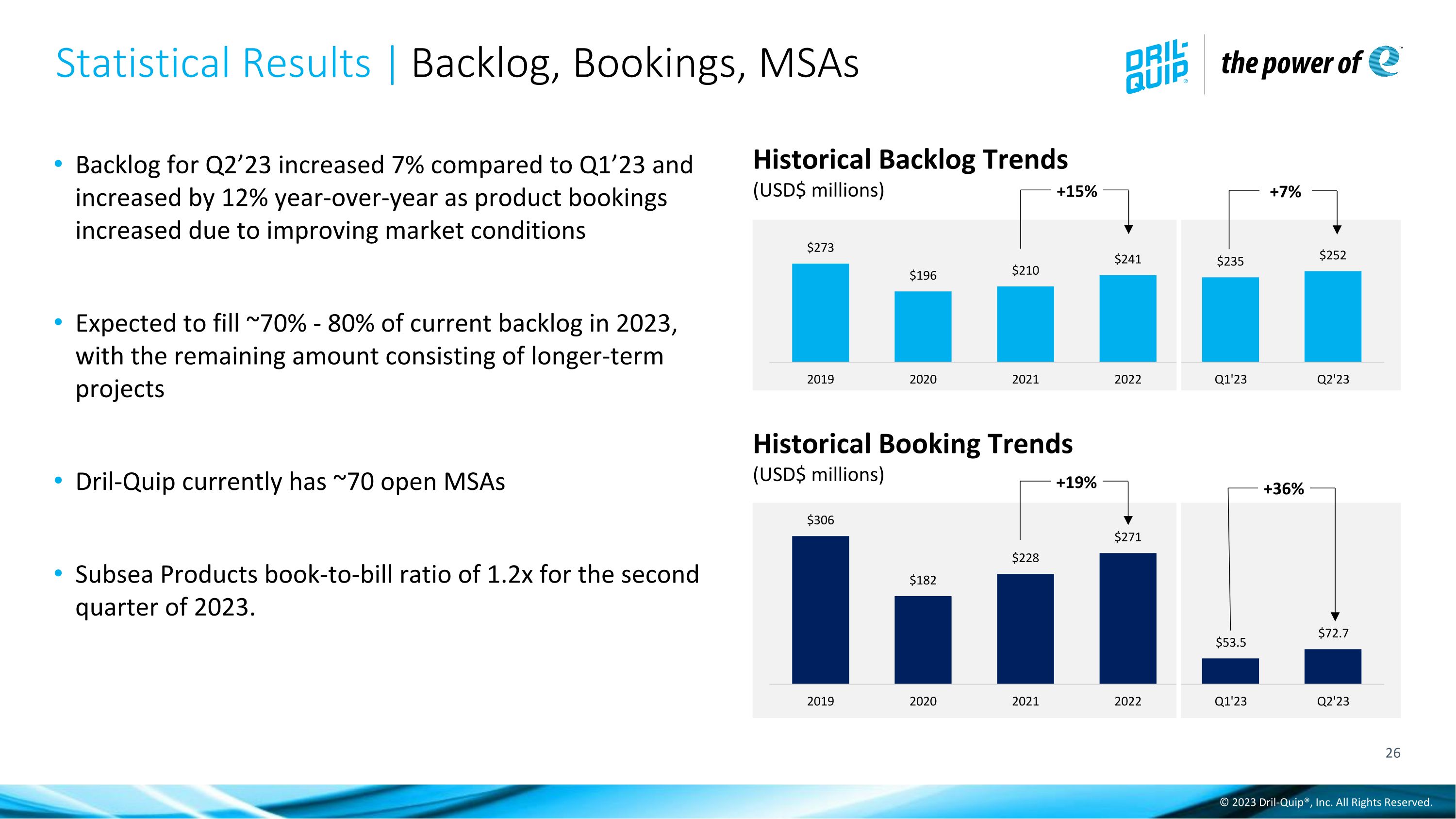

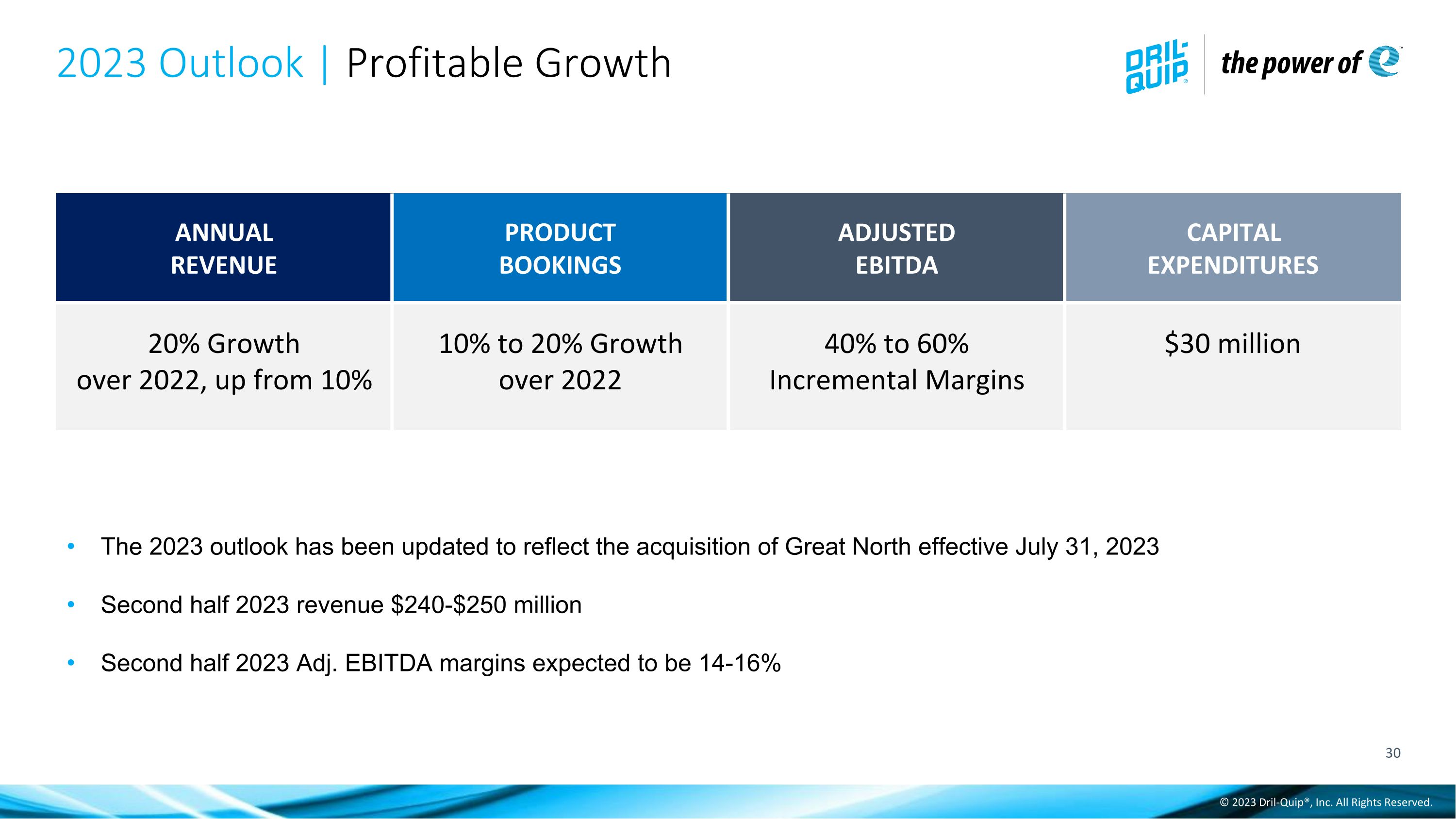

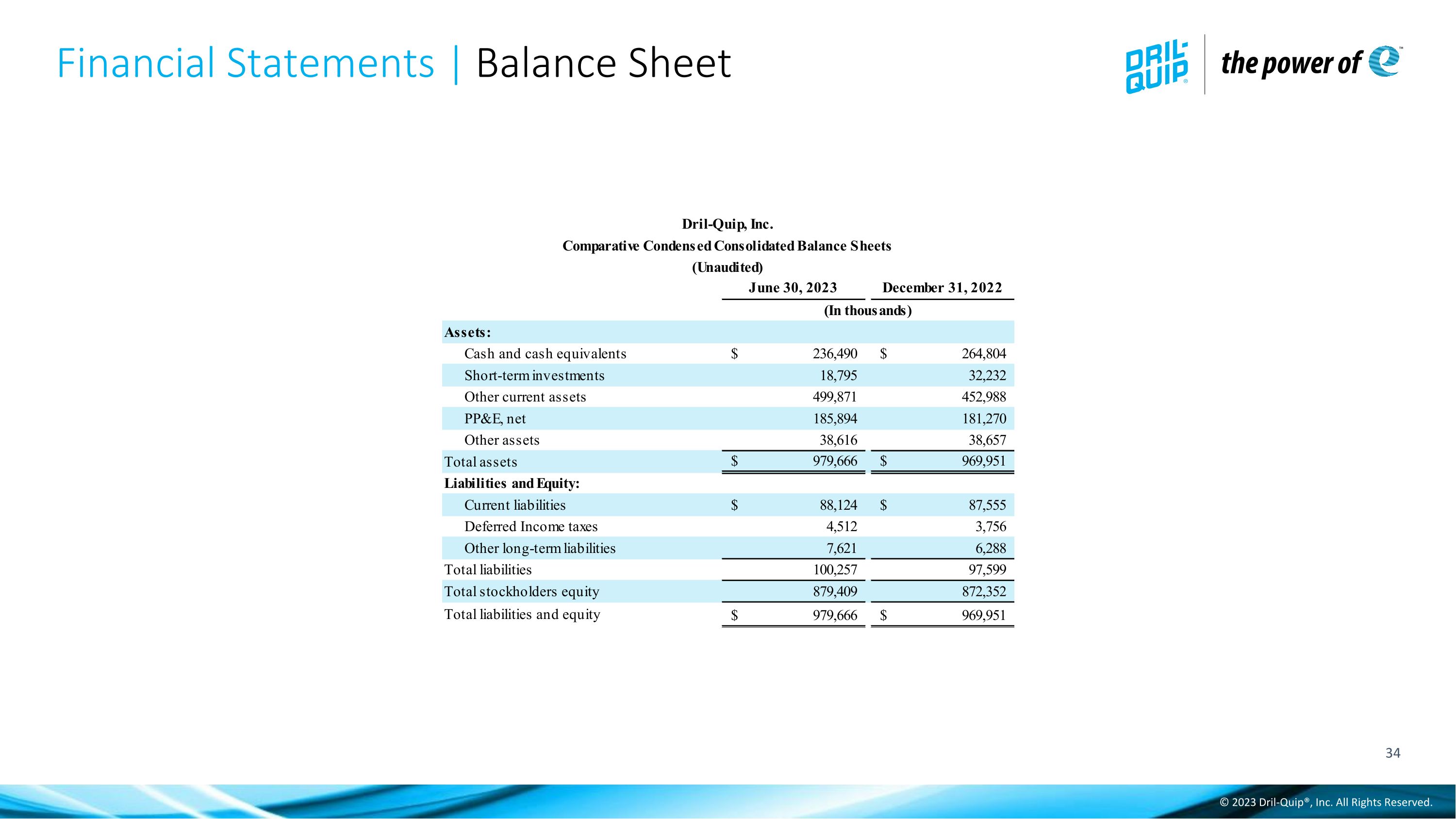

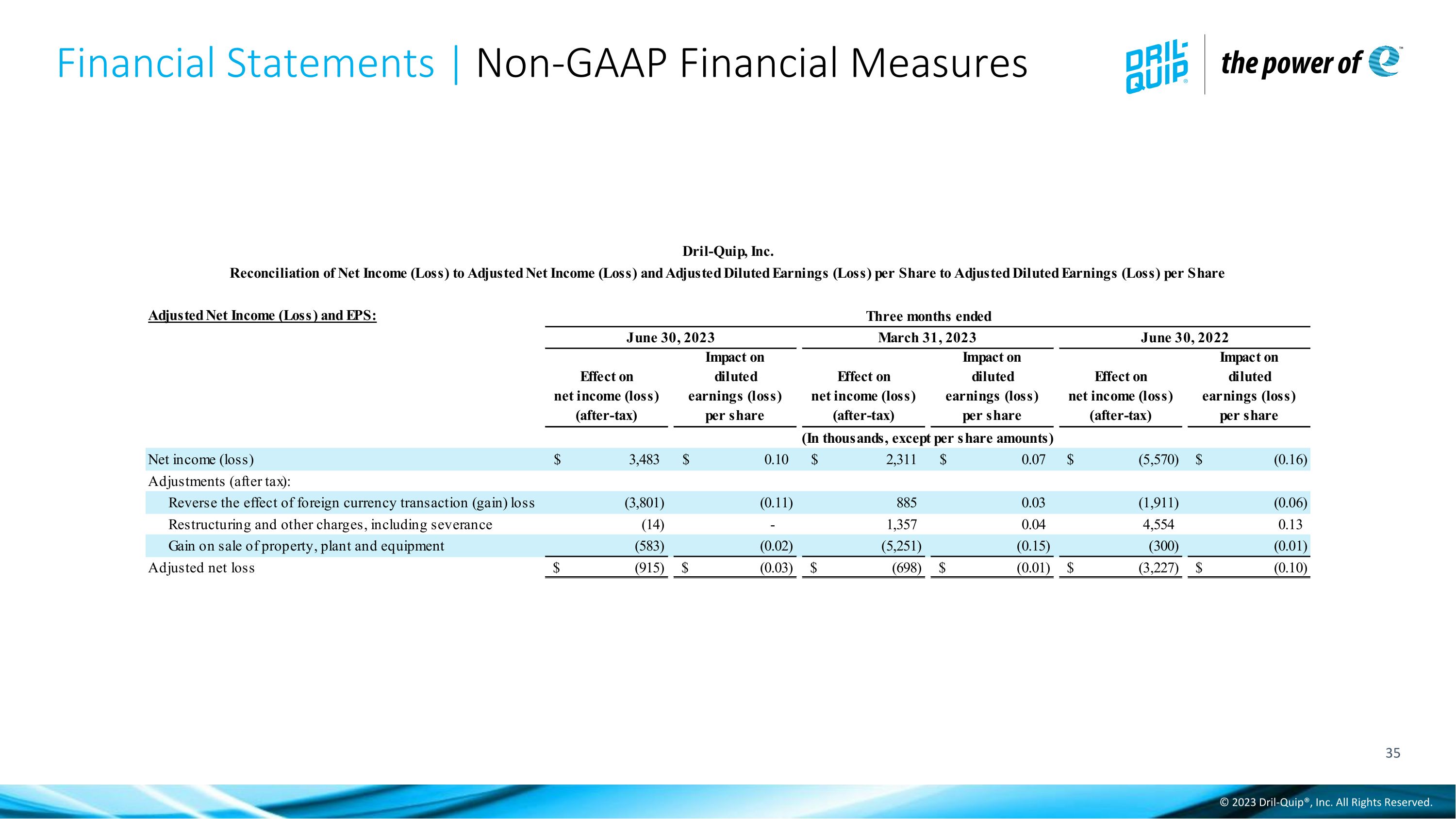

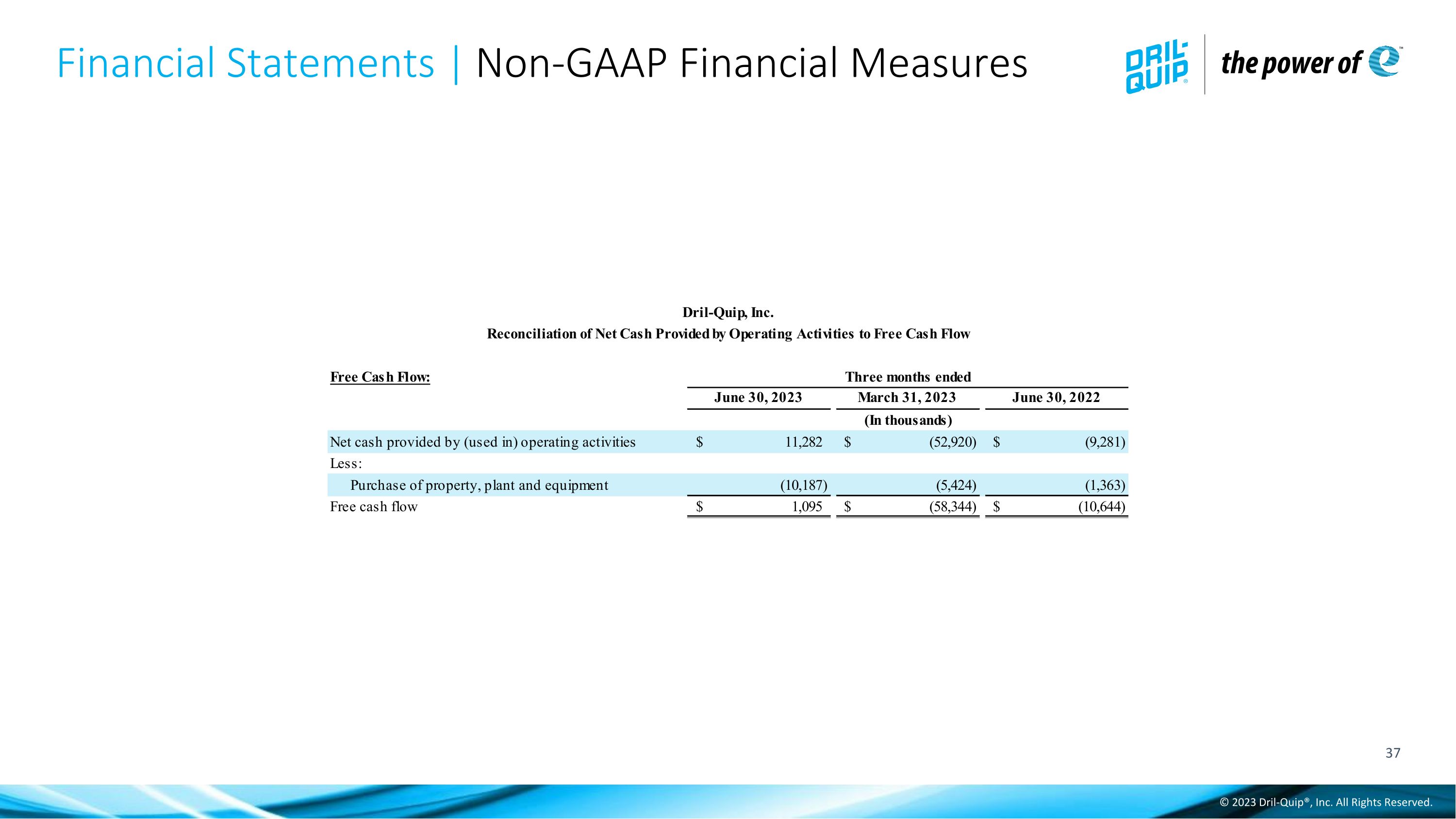

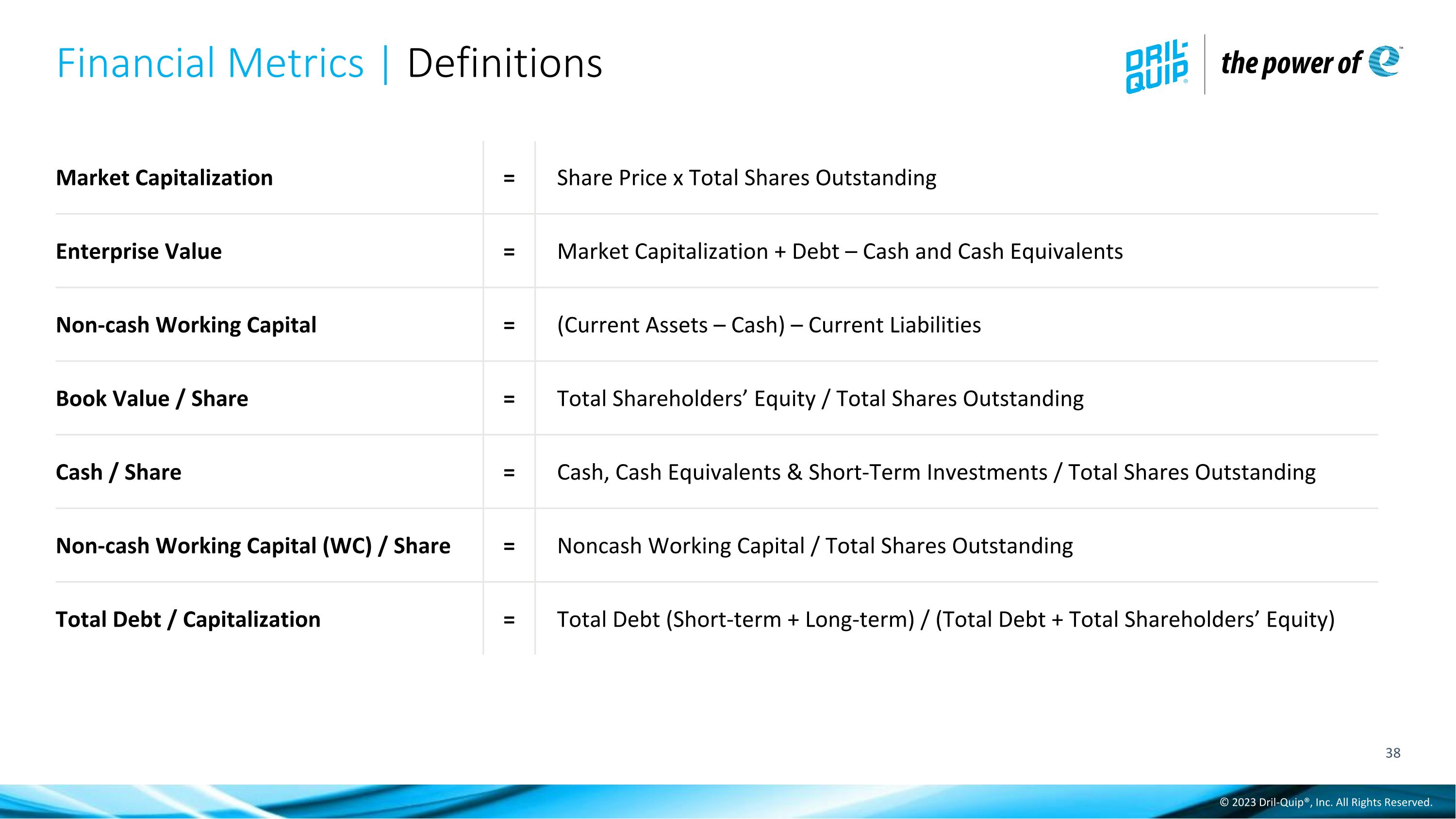

On July 31, 2023, Dril-Quip, Inc. (“Dril-Quip”) reported second quarter 2023 earnings. For additional information regarding Dril-Quip’s second quarter 2023 earnings, please refer to Dril-Quip’s press release attached to this report as Exhibit 99.1 (the “Press Release”), which Press Release is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On July 31, 2023, Dril-Quip posted the second quarter 2023 Supplemental Earnings Information presentation (the “Presentation”) to its website at www.dril-quip.com. The Presentation is attached hereto as Exhibit 99.2.

The information in the Press Release and the Presentation is being furnished, not filed, pursuant to Items 2.02 and 7.01. Accordingly, the information in the Press Release and the Presentation will not be incorporated by reference into any registration statement filed by Dril-Quip under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The exhibits listed below are being furnished pursuant to Items 1.01, 2.02 and 7.01 of this Form 8-K:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

DRIL-QUIP, INC. |

|

|

By: |

|

/s/ Kyle F. McClure |

|

|

Kyle F. McClure |

|

|

Vice President and Chief Financial Officer |

Date: July 31, 2023

Execution Version

EXHIBIT 2.1

THE PERSONS LISTED ON EXHIBIT A HERETO

collectively, as Sellers

AND

INDUSTRIAL GROWTH PARTNERS V AIV L.P.

as Agent

AND

solely for the purposes of Sections 2.9, 2.10(e) and 2.11

1185641 B.C. LTD.

AND

TIW CANADA ULC

as Purchaser

AND

solely for the purposes of the Guarantor Provisions

DRIL-QUIP, INC.

as Guarantor

SHARE PURCHASE AGREEMENT

Dated as of July 31, 2023

TABLE OF CONTENTS

|

|

|

Article 1 INTERPRETATION |

1 |

1.1 |

Defined Terms. |

1 |

1.2 |

Other Defined Terms. |

13 |

1.3 |

Headings, etc. |

14 |

1.4 |

Currency and Payment Obligations. |

14 |

1.5 |

Time Reference. |

14 |

1.6 |

Certain Expressions, etc. |

14 |

1.7 |

Knowledge. |

14 |

1.8 |

Accounting Terms. |

15 |

1.9 |

Statutory and Agreement References. |

15 |

1.10 |

Computation of Time Periods. |

15 |

1.11 |

Legal Representation; No Presumption Against Party that Stipulated the Obligation. |

15 |

1.12 |

Incorporation of Exhibits and Schedules. |

15 |

Article 2 CLOSING; PURCHASED SHARES AND PURCHASE PRICE |

16 |

2.1 |

Date, Time and Place of Closing. |

16 |

2.2 |

Purchase and Sale. |

16 |

2.3 |

Deliveries to Purchaser. |

16 |

2.4 |

Deliveries to Sellers. |

17 |

2.5 |

Purchase Price. |

18 |

2.6 |

Payments at Closing. |

18 |

2.7 |

Adjustment of Purchase Price. |

18 |

2.8 |

Repayment of Indebtedness and Sellers' Transaction Expenses. |

22 |

2.9 |

Treatment of Options. |

22 |

2.10 |

Earn-Out Amount. |

23 |

2.11 |

Termination of Shareholders' Agreement. |

26 |

2.12 |

Tax Withholding. |

26 |

Article 3 REPRESENTATIONS AND WARRANTIES OF SELLERS |

26 |

3.1 |

Representations and Warranties of Sellers as to Sellers. |

26 |

3.2 |

Representations and Warranties of Sellers as to the Acquired Companies. |

28 |

3.3 |

Disclaimer of Sellers. |

45 |

3.4 |

Disclosure Letter. |

45 |

Article 4 REPRESENTATIONS AND WARRANTIES OF PURCHASER |

45 |

4.1 |

Representations and Warranties of Purchaser. |

45 |

Article 5 COVENANTS |

47 |

5.1 |

Books and Records. |

47 |

5.2 |

Further Assurances. |

47 |

5.3 |

Representation and Warranty Insurance. |

47 |

5.4 |

Tax Matters. |

48 |

5.5 |

Director and Officer Indemnification. |

49 |

5.6 |

Transferred Personal Information. |

50 |

5.7 |

Termination of Related Party Agreements. |

51 |

5.8 |

Confidentiality. |

51 |

Article 6 SURVIVAL; INDEMNIFICATION |

51 |

6.1 |

Survival and Limitation of Representations and Warranties. |

51 |

6.2 |

Indemnities of Sellers. |

52 |

i

#110828415

|

|

|

6.3 |

Indemnification Procedures. |

52 |

6.4 |

Indemnification Payments. |

54 |

Article 7 MISCELLANEOUS |

55 |

7.1 |

Conflicts and Privilege. |

55 |

7.2 |

Notices. |

55 |

7.3 |

Specific Performance. |

56 |

7.4 |

Time of the Essence. |

56 |

7.5 |

Announcements. |

56 |

7.6 |

Third Party Beneficiaries. |

57 |

7.7 |

Expenses. |

57 |

7.8 |

Appointment of Agent. |

57 |

7.9 |

Amendments. |

58 |

7.10 |

Waiver. |

59 |

7.11 |

Non-Merger. |

59 |

7.12 |

Entire Agreement. |

59 |

7.13 |

Successors and Assigns. |

59 |

7.14 |

Assignment. |

59 |

7.15 |

Inconsistency. |

59 |

7.16 |

Severability. |

60 |

7.17 |

Governing Law. |

60 |

7.18 |

Waiver of Jury Trial. |

60 |

7.19 |

Counterparts. |

60 |

7.20 |

No Recourse. |

60 |

7.21 |

Guarantee. |

60 |

ii

#110828415

SHARE PURCHASE AGREEMENT

Share Purchase Agreement dated July 31, 2023 among the Persons listed on Exhibit A hereto, (collectively, "Sellers"), Industrial Growth Partners V AIV L.P., in its capacity as Agent (as hereinafter defined), solely for the purposes of Sections 2.9, 2.10(e) and 2.11, 1185641 B.C. Ltd., a British Columbia corporation (“Corporation”), TIW Canada ULC, an unlimited liability company governed by the Laws of Alberta ("Purchaser"), and, solely for the purposes of the Guarantor Provisions (as hereinafter defined), Dril‑Quip, Inc., a Delaware corporation (“Guarantor”).

WHEREAS, Sellers are the registered and beneficial owners of the Class A common shares, Class B common shares and Class C earn-out shares in the capital of Corporation (the "Purchased Shares") as set out in Schedule 3.1(f)(ii) of the Disclosure Letter;

WHEREAS, Sellers wish to sell to Purchaser, and Purchaser wishes to purchase from Sellers, the Purchased Shares upon the terms and subject to the conditions set forth herein;

WHEREAS, the transactions contemplated by this Agreement (as defined below) shall be consummated on the same date as the execution of this Agreement; and

WHEREAS, concurrently with the execution and delivery of this Agreement, as a condition and inducement to Purchaser's willingness to enter into this Agreement, each of the Key Employees and Corporation have executed and delivered to Agent, and Agent has delivered to Purchaser an Employment Agreement (each an "Employment Agreement"), each of which shall be effective as of Closing.

NOW, THEREFORE, in consideration of the premises and the mutual agreements and covenants hereinafter set forth, Sellers and Purchaser hereby agree as follows:

Article 1

INTERPRETATION

1.1 Defined Terms.

As used in this Agreement, the following terms have the following meanings:

(a) "2024 Earn-Out Period" means the 12-month period ending on May 31, 2024.

(b) "2025 Earn-Out Period" means the 12-month period ending on May 31, 2025.

(c) "Accounting Principles" means (i) methodologies, practices, estimation techniques, assumptions and principles applied on a consistent basis as set forth in Exhibit C hereto with the sample calculation of Working Capital, (ii) to the extent consistent with the preceding clause (i), the accounting principles, practices, definitions, methods, judgements, asset recognition bases, classifications, categorizations and estimation techniques (including in respect of management judgement) as actually applied in the preparation of the Financial Statements as of the Balance Sheet Date, and (iii) to the extent consistent with the preceding clauses (i) and (ii), ASPE as applicable as at the date of this Agreement. For the avoidance of doubt, clause (i) shall take precedence over clauses (ii) and (iii), and clause (ii) shall take precedence over clause (iii).

(d) "Acquired Companies" means, collectively, Corporation and each of the Subsidiaries.

(e) "Acquired Companies' Transaction Expenses" means all Transaction Expenses other than Sellers' Transaction Expenses.

1

#110828415

(f) "Acquired Company Revenue" means the aggregate gross revenue of the Acquired Companies, determined in accordance with the Earn-Out Principles as set forth on Part A of Exhibit D.

(g) "Adjustment Escrow Account" means an escrow account which shall be established pursuant to the Escrow Agreement.

(h) "Adjustment Escrow Amount" means $3,050,000, which such amount shall be held and released from the Adjustment Escrow Account by the Escrow Agent pursuant to Section 2.7(g) hereof and the terms and conditions of the Escrow Agreement.

(i) "Affiliate" means with respect to any Person, any other Person who directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such Person. The term "control" means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by Contract or otherwise, and the terms "controlled" and "controlling" have meanings correlative thereto.

(j) "Agreement" means this Share Purchase Agreement and all exhibits, schedules and instruments in amendment or confirmation of it.

(k) "Allocable Portion" means, (i) in respect of all amounts paid by a Seller, and the amounts paid to a Seller (other than an Earn-Out Amount), the percentage set forth beside such Seller's name listed in Exhibit A hereto, (ii) and in respect of the payment to a Seller of an Earn-Out Amount, the amount determined in accordance with Part 27 of the articles of the Corporation, as applicable.

(l) "Ancillary Agreement" means the Escrow Agreement.

(m) "ASPE" means Canadian accounting standards for private enterprises defined in the CPA Canada Handbook – Accounting PART II, as applicable from time to time.

(n) "Authorization" means, with respect to any Person, any order, permit, approval, notification, waiver, license or similar authorization of any Governmental Entity having jurisdiction over such Person.

(o) "Balance Sheet Date" means February 28, 2023.

(p) "Books and Records" means all files, records, information, data, statements, budgets, books of account, Tax and financial records, sales and purchase records, corporate records and customer and supplier lists relating to each of the Acquired Companies, whether in writing or electronic form and in the possession or reasonable control of each of the Acquired Companies or Sellers, as applicable.

(q) "Business" means the business of designing, manufacturing and providing custom made wellheads, wellhead products, fracking solutions and well completions systems.

(r) "Business Day" means any day other than a Saturday, Sunday or other day on which the principal commercial banks in Edmonton, Alberta, or San Francisco, California, are not open for business during normal business hours.

(s) "Cash" means with respect to the Acquired Companies, on a consolidated basis, all (a) cash (net of any negative account balances) and (b) cash equivalents (for purposes of this clause (b), to the extent readily convertible into cash within 30 days following Closing) determined in accordance with the Accounting Principles, plus, without duplication, (i) deposits in transit and cash resulting from the

2

#110828415

clearance of cheques deposited prior to the Closing Date to the extent there has been a reduction of accounts receivable used in determining Working Capital on account thereof, (ii) the portion of the aggregate receivables in respect of the Option Loans representing the aggregate amount of the exercise price for the Vested Options, and, for greater certainty, excluding the portion of the Option Loans representing the aggregate amount of any applicable withholding Taxes on the exercise of the Vested Options, (iii) petty cash, minus any cash in reserve accounts, restricted cash accounts and an amount of cash equal to any bank overdrafts, outstanding or uncleared cheques and other wire transfers at such time that have not yet cleared only to the extent there has been a reduction of accounts payable used in determining Working Capital on account thereof, and (iv) all cash required to collateralize the credit cards issued by National Bank of Canada pursuant to the Payoff Letter.

(t) “Credit Agreement” means that certain credit agreement dated December 13, 2018 between 2153125 Alberta Ltd., as borrower, National Bank of Canada, as a lender and agent for the lenders and the swap lenders and the other banks and financial institutions from time to time party thereto, as lenders.

(u) "Closing" means the completion, on the Closing Date at the Effective Time, of the transactions of purchase and sale contemplated in this Agreement.

(v) "Code" means the United States Internal Revenue Code of 1986, as amended.

(w) "Company Representations" means those representations and warranties of the Acquired Companies set forth in Section 3.2.

(x) "Company Intellectual Property" means all Intellectual Property owned or purported to be owned by any of the Acquired Companies.

(y) "Contracts" means all written or legally binding oral contracts, agreements, indentures, notes, bonds, loans, licenses, deeds, mortgages, sublicenses, leases or subleases of real or personal property (including the Lease Documents), joint ventures, purchase and sale orders or other legally binding commitment to which any Person is a party, including the Material Contracts.

(z) "COVID-19" means SARS-CoV-2 or COVID-19, and any evolutions or mutations thereof or related or associated epidemics, pandemic or disease outbreaks.

(aa) "COVID-19 Measures" means any of the Acquired Companies' compliance with any quarantine, "shelter in place", "stay at home", work force reduction, social distancing, shut down, closure, sequester, safety or similar Law, policies, guidelines or recommendations promulgated by any Governmental Entity in connection with, related to, or in response to COVID-19.

(bb) "COVID-19 Response" means any reasonable action or inaction, including the establishment of any policy, procedure or protocol, by any Acquired Company that such Acquired Company determines in its reasonable discretion is necessary, advisable or prudent in connection with (i) mitigating the adverse effects of COVID-19 or applicable COVID-19 Measures, (ii) ensuring compliance by the Acquired Companies with COVID-19 Measures applicable to any of them, and/or (iii) in respect of COVID-19, protecting the health and safety of employees or other persons with whom the Acquired Companies and/or any of their respective personnel come into contact with during the course of business operations.

(cc) "Crown" means the Government of the Province of Alberta.

3

#110828415

(dd) “Data Security Requirements” means, collectively, all of the following to the extent applicable to the processing of Personal Information by the Acquired Companies: (i) applicable Law, and (ii) Contracts to which any Acquired Company is a party or by which it is otherwise bound.

(ee) "Disclosure Letter" means the letter of disclosure dated the date hereof and signed by Agent (for and on behalf of Sellers) and delivered to Purchaser.

(ff) "Earn-Out Amount" means, collectively, the 2024 Earn-Out Amount and the 2025 Earn-Out Amount.

(gg) "Earn-Out Periods" means, collectively, the 2024 Earn-Out Period and the 2025 Earn-Out Period.

(hh) "Earn-Out Principles" means the principles set forth on Part A of Exhibit D.

(ii) "Effective Time" means 12:01 a.m. prevailing Mountain Time on the Closing Date or such other time as the Parties may agree to in writing.

(jj) "Employee Contingent Bonus Amount" means an amount not to exceed $1,000,000, for the 2024 Earn-Out Period, and an amount not to exceed $1,000,000, for the 2025 Earn-Out Period, each of which are the maximum aggregate payments to employees of the Acquired Companies pursuant to the Employee Contingent Bonus Obligations, plus the employer portion of any payroll Taxes thereon.

(kk) "Employee Contingent Bonus Obligations" means obligations owed, subject to Section 2.10(e), by the Acquired Companies to certain employees of the Acquired Companies in respect of the Employee Contingent Bonus Amount, to be distributed at the discretion of Stephen Forberg and Agent.

(ll) "Environmental Laws" means all applicable Laws and agreements with Governmental Entities and all other statutory or regulatory requirements relating to health and safety (to the extent related to exposure to Hazardous Materials), the protection of the environment and all Authorizations issued pursuant to such Laws, agreements or statutory or regulatory requirements.

(mm) "Escrow Agent" means Laurel Hill Advisory Group, or such other Person as may be appointed in replacement thereof pursuant to the terms of the Escrow Agreement.

(nn) "Escrow Agreement" means the escrow agreement dated as of the date hereof among Purchaser, Agent, and the Escrow Agent.

(oo) "Financial Statements" means with respect to the Acquired Companies, the consolidated (i) audited financial statements thereof for the years ending on May 31, 2021 and May 31, 2022 and (ii) unaudited balance sheet and income statement as of the Balance Sheet Date, copies of which are provided in Schedule 1.1(oo) of the Disclosure Letter.

(pp) "Fraud" means, with respect to any Person, such Person's actual, knowing (without reference to Section 1.7) and intentional representation of a material fact, which is false or inaccurate, with respect to the representations and warranties set forth in this Agreement and to be relied upon by any Person or Persons in entering into this Agreement. For the avoidance of doubt, the definition of "Fraud" in this Agreement is limited to actual, knowing and intentional fraud and does not include, and no claim may be made by any Person in relation to this Agreement (i) for constructive fraud or other claims based on constructive knowledge, (ii) for negligent misrepresentation, equitable fraud or any other fraud based claim or theory that is other than actual, knowing and intentional fraud, or (iii) against any Person other than the Party to this Agreement that committed Fraud.

4

#110828415

(qq) "Governmental Entity" means any domestic or foreign (i) federal or central, state, regional, provincial, territorial, municipal, local or other governmental or public department, central bank, court, commission, commissioner, board, bureau, agency, regulatory authority, tribunal, instrumentality or any judicial, administrative or (public or private) arbitral body or arbitrator, (ii) quasi-governmental authority exercising any regulatory, expropriation or taxing authority that has the force of law under or for the account of any of the above, or (iii) any applicable stock or securities exchange.

(rr) "GST/HST" means all goods and services tax and harmonized sales tax imposed under the Excise Tax Act (Canada), and any other similar value added or sales tax imposed under the Laws of any jurisdiction.

(ss) “Guarantor Provisions” means Section 7.21 and such terms, conditions and provisions of this Agreement that are otherwise necessary to give full effect to such terms, conditions and provisions.

(tt) "Hazardous Materials" means any substance or material that is prohibited, listed, defined, designated or classified as, or otherwise determined to be, dangerous, hazardous, radioactive, explosive or toxic or a pollutant or a contaminant under or pursuant to any applicable Environmental Laws, including any mixture or solution thereof, and including but not limited to petroleum and petroleum products, polychlorinated biphenyls, per-and polyfluoroalkyl substances, radioactive materials and friable asbestos.

(uu) "Hedge Contract" means any forward, futures, swap, collar, put, call, floor, cap, option or other similar Contract to which any Acquired Company is a party or otherwise relating to (and for which any Acquired Company has liability for) or binding on the assets of any Acquired Company that is intended to benefit from, relate to, or reduce or eliminate the risk of fluctuations in the price of commodities, currencies, interests rates and indices, and any financial transmission rights and auction revenue rights, including the Hedge Contracts described in Schedule 1.1(uu) of the Disclosure Letter.

(vv) "Indebtedness" means, collectively (and without duplication) with respect to the Acquired Companies, on a consolidated basis, the sum of:

(i) indebtedness for borrowed money, including the Credit Agreement and any related prepayment fees, penalties or expenses related to the Credit Agreement or otherwise (including overdraft facilities) (whether short term or long term);

(ii) indebtedness for the deferred purchase price of property or services and all deferred purchase price liabilities related to past acquisitions, whether contingent or otherwise (including any "earn-out" or similar payment or obligations at the maximum amount payable in respect thereof);

(iii) indebtedness evidenced by notes, bonds, debentures, mortgages or other similar instruments;

(iv) fair market value of indebtedness arising under any Hedge Contract, which, for greater certainty, shall mean the net value of any out-of-the-money Hedge Contract;

(v) indebtedness under loans due to any related party (within the meaning of the Tax Act), including any shareholder net of any related party loans receivable;

(vi) any declared dividend not paid by any Acquired Company other than any dividend payable to any Acquired Company;

5

#110828415

(vii) Acquired Companies' Transaction Expenses;

(viii) any liabilities under or in connection with any letter of credit (to the extent drawn and excluding instruments supporting or guaranteeing any obligations of any Acquired Company) or bankers' acceptances or similar items;

(ix) all liabilities in respect of accrued but unpaid bonuses for the fiscal year ended May 31, 2023 and the employer portion of any payroll Taxes thereon;

(x) all liabilities in respect of severance or other termination benefits arising in connection with terminations of employment occurring before the Closing and the employer portion of any payroll Taxes thereon;

(xi) any accrued interest, fees, related expenses, prepayment obligations, make-whole payments, commitment or breakage fees, premiums or penalties relating to any of the indebtedness referred to in paragraphs (i) through (x);

(xii) all indebtedness of others referred to in paragraphs (i) through (xi) above guaranteed by, or secured by any Lien upon any property or asset owned by any Acquired Company;

(xiii) all accrued income Tax liabilities (net of any accrued income Tax credits, overpayments or refunds for a period ending on or prior to the Closing Date but solely to the extent such items reduce cash income Taxes) of the Acquired Companies accruing up to the Closing, which amount may not be negative either in total or for any jurisdiction (provided, accrued income Taxes shall be calculated without regard to the effects of any election by Purchaser or any of its Affiliates under Section 338 or 336(e) of the Code (or any similar election under state or local Tax Law) in connection with any transactions provided for herein); and

(xiv) all liabilities under capitalized leases set forth on Schedule 1.1(vv)(xiv) of the Disclosure Letter,

reduced by the sum of all assets or benefits arising under any interest rate or currency swap or other interest rate or currency protection agreement or other similar interest rate or currency agreement, on a consolidated basis, in each case, determined in accordance with the Accounting Principles; provided, however, that (A) "Indebtedness" excludes any indebtedness incurred by or at the direction of Purchaser, (B) "Indebtedness" excludes any operating leases, and (C) any liability included in Working Capital for purposes of this Agreement shall be excluded from the calculation of Indebtedness for purposes of this Agreement.

(ww) "Indemnify" means indemnify, defend (including the requirement to pay reasonable, documented costs of litigation, dispute resolution and other legal costs and court fees (including reasonable and documented out-of-pocket attorneys' fees) and hold harmless.

(xx) "Intellectual Property" means all of the following in any jurisdiction throughout the world: (i) patents, patent applications, utility models and applications for utility models, inventor's certificates and applications for inventor's certificates, and invention disclosure statements, together with all reissuances, continuations, continuations-in-part, divisionals, revisions, extensions, and reexaminations thereof, (ii) trademarks, service marks, trade names, logos, slogans, trade dress and other source indicators and registrations and applications to register any of the foregoing, including

6

#110828415

intent-to-use registrations or similar pending reservations of marks (as well as all goodwill associated with each of the foregoing), (iii) works of authorship and copyrights (whether registered or unregistered), applications for copyright registration, and all translations, adaptations, derivations and combinations of the foregoing, (iv) Internet Web Sites, Internet domain names, URLs, and social media identifiers and handles, (v) software (including object code, source code, or other form), data, data sets, databases and collections of data, (vi) trade secrets, confidential information, know-how, ideas, methods, formulae, methodologies, processes, technology, customer lists and inventions, (vii) moral rights (and waivers or agreements not to enforce moral rights), publicity rights and any other proprietary or intellectual property rights of any kind or nature.

(yy) "Internet Web Sites" means all of the Acquired Companies' web sites used in the conduct of the Business that are accessible by the public over the internet.

(zz) "Investment Canada Act" means the Investment Canada Act (Canada) R.S.C., 1985, c. 28 (1st Supp.), as amended, together with all regulations promulgated thereunder.

(aaa) “Key Employees” means Stephen Forberg, David Wootton, Greg Dowell and Caren Steele.

(bbb) "Laws" means all current (i) constitutions, treaties, laws, statutes, codes, ordinances, orders, decrees, orders-in-council, rules, regulations, general principles of common and civil law, (ii) directives, notices, judgments and orders of any Governmental Entity and (iii) policies, practices and guidelines of any Governmental Entity having the force or effect of law.

(ccc) "Lien" means with respect to any property or asset, any mortgage, charge, pledge, hypothec, option, prior claim, power of sale, security interest, security under sections 426 or 427 of the Bank Act (Canada), security agreement, debenture, trust, trust deed or deemed trust, conditional sales contract, license, assignment, lien (statutory or otherwise), easement, equity, right of pre-emption, covenant, condition, restriction, right of first refusal, right of first offer, restriction on transfer, title retention agreement or lease in the nature thereof, non-disposal undertaking, title retention agreement or arrangement, encroachment, or other encumbrance of any nature or any other arrangement or condition, whether registered or unregistered, which, in substance, secures payment, performance of an obligation or claim against a proprietary right or an agreement to create any of the foregoing.

(ddd) "Losses" means all losses, costs, liabilities, obligations, Taxes, expenses, fines, penalties, interest, claims, awards, settlements, judgments, damages, reasonable and documented out-of-pocket attorneys' fees and reasonable out-of-pocket expenses of investigating, defending and prosecuting litigation, which, for greater certainty, shall exclude any punitive, incidental, consequential, exemplary or special or indirect damages.

(eee) "Material Adverse Effect" means a fact, circumstance, change, event, occurrence or condition (each an "Event", and collectively, "Events") that, individually or in the aggregate, (a) has had or would reasonably be expected to have a material adverse effect on the Business, operations, assets, liabilities or financial condition of the Acquired Companies, taken as a whole or (b) materially and adversely affect the ability of the applicable Party to consummate the transactions contemplated under this Agreement or would reasonably be expected to do so; provided, however, that, with respect to clause (a) above, no Event (by itself or when aggregated or taken together with any and all other Events) directly or indirectly resulting from, attributable to or arising out of any of the following shall be deemed to be or constitute a "Material Adverse Effect", and no Event (by itself or when aggregated or taken together with any and all other such Events) directly or indirectly resulting from, attributable to or arising out of any of the following shall be taken into account when determining whether a "Material Adverse Effect" has occurred: (i) worldwide, national, provincial or local conditions or circumstances, whether they are economic, political, regulatory (including any change in Law or ASPE) or otherwise, including war, armed hostilities, acts of terrorism, emergencies, and crises, (ii) natural disasters or

7

#110828415

pandemics (including the effects of COVID-19 or any COVID-19 Measures or any change in such COVID-19 Measures or the effects of any COVID-19 Response), (iii) changes in the markets or industry in which the Acquired Companies operate, (iv) the announcement of this Agreement and the Ancillary Agreement, including the loss of any customer, supplier or distributor following the announcement of this Agreement and the Ancillary Agreement as a result of such announcement or communication, (v) any act or omission of Purchaser or its Affiliates, (vi) any act or omission of the Acquired Companies, as the case may be, prior to the Closing Date taken or omitted to be taken with the prior consent or at the request of Purchaser, and (vii) the failure of any of the Acquired Companies to meet any internal, published or public projections, forecasts, guidance or estimates, including, of production, revenues, earnings or cash flows (it being understood that the causes underlying such failure may be taken into account in determining whether a Material Adverse Effect has occurred); except, in the case of clauses (i) through (iii), such Events may be taken into account if (and then only to the extent) they adversely affect the Acquired Companies, taken as whole, in a materially disproportionate manner relative to other similarly situated participants in the industry and geographic regions in which the Acquired Companies operate.

(fff) "Net Indebtedness" means an amount equal to the amount of Indebtedness minus the amount of Cash, in each case, as of immediately prior to the Effective Time, and each determined in accordance with the Accounting Principles (which may result in either a positive or a negative amount). An illustrative calculation of the Net Indebtedness as at July 31, 2023 is attached as Exhibit C.

(ggg) "Option Holder" means a Person who exercised Options in accordance with Section 2.9.

(hhh) "Option Plan" means the Stock Option Plan of Corporation dated December 17, 2018.

(iii) "Options" means each option to purchase one or more shares in the capital of Corporation granted on or prior to the date hereof to any current or former employee, officer or director of the Acquired Companies pursuant to the Option Plan.

(jjj) "Ordinary Course" means, with respect to an action taken by a Person, that such action is consistent with the past practices of the Person and is taken in the ordinary course of the normal day-to-day operations of the Person, including, with respect to the Acquired Companies, such changes made by any Acquired Company that are (i) required by Law, (ii) in compliance with and as a result of COVID-19 Measures, or (iii) pursuant to a COVID-19 Response.

(kkk) "Parties" means Sellers and Purchaser.

(lll) "Payoff Letter" means with respect to any Indebtedness owed by the Acquired Companies set forth on Part A of Schedule 2.8 of the Disclosure Letter required to be repaid in connection with the Closing, a customary letter, in form and substance satisfactory to Purchaser, acting reasonably, provided by the lenders, investors or creditors (or, in each case, their duly authorized agent or representative) to whom or which such Indebtedness is owed setting forth the total outstanding amount of such Indebtedness, including principal, interest, fees and expenses as at the Closing Date (together with a customary per diem for each day thereafter) and the instructions for the payment of such Indebtedness to release and terminate such obligations, which letter also shall state that, upon receipt of payment of such amount (together with the per diem, to the extent applicable) in cash in immediately available funds: (A) all liabilities under the such Indebtedness (other than (x) those liabilities that expressly survive the termination thereof and (y) any letters of credit issued and outstanding thereunder that are not terminated at Closing for which alternative arrangements have been agreed) shall be satisfied and all commitments under the applicable credit documents shall be terminated and (B) all Liens on the capital stock, property and assets of the Acquired Companies securing such Indebtedness shall be discharged (other than any cash collateral or other arrangements to backstop any letters of credit issued and outstanding under such Indebtedness that are not terminated at

8

#110828415

Closing) and that the Acquired Companies or Purchaser or any of its Affiliates or relevant agents are authorized to file such documents and instruments as are necessary to evidence such release and discharge; provided that, in lieu of such authorization to release, such letter may be accompanied by such lien termination and release documentation and instruments as are reasonably acceptable to Purchaser.

(mmm) “Permitted Equity Lien” means the Liens under clause (xix) of the definition of Permitted Lien.

(nnn) "Permitted Lien" means the following Liens:

(i) minor encroachment by the Acquired Company Real Property over neighbouring lands and any fences or concrete curbs, (1) for which such Acquired Company has not received notice in writing by a neighbouring landowner or Governmental Entity to remove or rectify such encroachment, and (2) which individually and/or in the aggregate (A) do not materially affect the occupation, use or enjoyment of any of the Acquired Company Real Property and (B) do not materially affect the value or the marketability of any of the Acquired Company Real Property;

(ii) any subsisting restrictions, exceptions, reservations, limitations, provisions and conditions (including royalties, reservation of mines, mineral rights (including coal, oil and natural gas) and timber rights, access to navigable waters and similar rights) expressed in any original grants from the Crown, under applicable Laws or from any predecessor in title;

(iii) zoning, land use and building restrictions, by-laws, regulations and ordinances of any Governmental Entity, including municipal by-laws and regulations, airport zoning regulations, other land use limitations, pre-emption rights regulations and rights to repurchase in favour of or imposed or reserved by any Governmental Entity;

(iv) all immovable property leases, whether registered or not, but only to the extent that true, correct and complete copies of which have been made available to Purchaser and are expressly identified in Schedule 3.2(v) of the Disclosure Letter;

(v) any minor defect or irregularities in title, variation and other restrictions or encumbrances (whether or not registered) (other than with respect to Intellectual Property) and which individually and/or in the aggregate (A) do not materially affect the occupation, use or enjoyment of any of the Acquired Company Real Property and (B) do not materially affect the value or the marketability of any of the Acquired Company Real Property;

(vi) Liens for Taxes not yet due and payable or, if due and payable then being contested in good faith by appropriate proceedings and for which adequate reserves are maintained in accordance with ASPE (applied on a basis consistent with the Financial Statements);

(vii) Liens arising by operation of Law or securing, carriers', warehousemen's, mechanics', workers', suppliers', contractors', builders', architects', engineers', materialmen's and other such similar liens incurred in the Ordinary Course which have not at such time been filed pursuant to Law or which relate to

9

#110828415

obligations not due and payable or, if overdue, are being contested in good faith by appropriate proceedings and in respect of which adequate reserves are maintained in accordance with ASPE (applied on a basis consistent with the Financial Statements) and are not material to the Business, operations or financial condition of the Acquired Companies;

(viii) deposits to secure the performance of obligations in respect of Liens contemplated in paragraphs (vi) and (vii) above;

(ix) Liens or deposits in connection with bids, tenders and contracts or to secure workers' compensation, unemployment insurance or other similar statutory assessments, or to secure costs of litigation when required by Law, and surety or appeal bonds;

(x) any immaterial disagreement between the title deeds, the cadastre, the plan of renovation and/or the measurements and which, individually and/or in the aggregate (A) do not materially affect the occupation, use or enjoyment of any of the Acquired Company Real Property and (B) do not materially affect the value or the marketability of any of the Acquired Company Real Property;

(xi) the right reserved to or vested in or security given to any Governmental Entity by statute or common law;

(xii) subdivision agreements, site plan control agreements, servicing agreements and other similar agreements with municipalities and restrictions, easements, restrictive covenants, licenses, servitudes, watercourse, rights-of-way, right of access or user or other similar rights in land (including rights of way and servitudes for railways, sewers, drains, gas and oil pipelines, gas and water mains, electric light and power and telephone or telegraph or cable television conduits, poles, wires and cables) granted to or reserved by other Persons to the extent they are in good standing and which, either individually or in the aggregate, do not materially affect the value or the marketability, use in the Ordinary Course, occupation or enjoyment of any of the Acquired Company Real Property;

(xiii) non-exclusive licenses to Company Intellectual Property granted to customers in the Ordinary Course;

(xiv) any Lien incurred or deposits made securing performance by any party of tenders, bids, statutory or regulatory obligations, surety and appeal bonds government contracts and other obligations owing to Governmental Entities, performance and return-of-money bonds and other obligations of like nature incurred in the Ordinary Course;

(xv) Liens arising solely by operation of Law over any credit balance or cash held in an account with a financial institution;

(xvi) Liens which will continue to encumber the assets following the Closing as set out in Schedule 1.1(nnn) of the Disclosure Letter;

(xvii) Liens which are being discharged prior to or concurrently with Closing as set out in Schedule 1.1(nnn) of the Disclosure Letter;

10

#110828415

(xviii) Liens securing the obligations of the Acquired Companies under any Indebtedness; and

(xix) Liens related to the transferability of securities under applicable securities Laws.

(ooo) "Person" means a natural person, partnership, corporation, joint stock company, limited liability company, trust, unincorporated association, joint venture or other entity or Governmental Entity, and pronouns have a similarly extended meaning.

(ppp) “Personal Information” means information about an identifiable individual other than their business contact information when used or disclosed for the purpose of contacting such individual in that individual's capacity as an employee or an official of an organization and for no other purpose or as otherwise defined by applicable Laws.

(qqq) "Purchaser Indemnified Parties" means Purchaser, its Affiliates and all of its and their respective equityholders, partners, members, directors, officers, managers, employees, attorneys, agents and representatives.

(rrr) "Release" means any release, spill, emission, leaking, pumping, pouring, injection, escaping, deposit, disposal, discharge, dispersal, dumping, leaching or migration into or through the environment.

(sss) "Representation and Warranty Policy" means the buyer side representation and warranty insurance policy obtained and paid for by Purchaser and effective the date hereof, a copy of which has been delivered to Sellers.

(ttt) "Representation and Warranty Policy Limit" means $11,000,000, being the maximum coverage under the Representation and Warranty Policy on the date hereof.

(uuu) "Seller Representations" means those representations and warranties of each Seller set forth in Section 3.1.

(vvv) "Sellers' Transaction Expenses" means any Transaction Expenses incurred by or for the benefit of Sellers, including such fees, costs and expenses incurred in connection with the negotiation, execution and delivery of this Agreement, and the investigation, pursuit and consummation of the transactions contemplated by this Agreement or under the other transaction documents, including any amounts payable to any brokers, financial advisory, investment bankers, legal counsel, accountants, consultants, other advisors, and other professional or transaction related costs, fees and expense, and shall include (i) the Expenses Amount and (ii) one half of the escrow fee payable to the Escrow Agent.

(www) "Subsidiaries" means 2153125 Alberta Ltd., a corporation governed by the Laws of the province of Alberta, Redco Equipment Sales Ltd., a corporation governed by the Laws of the province of Alberta, and Great North Equipment Inc., a corporation governed by the Laws of the province of Alberta.

(xxx) "Subsidiaries' Shares" means the shares set out in Schedule 1.1(xxx) of the Disclosure Letter.

(yyy) "Systems" means all of the following that are owned by, used, or relied on by the Acquired Companies: software, software engines, computer hardware (whether general or special purpose), Internet Web Sites, web site content and links and equipment used to process, store, maintain and operate data, database operating systems and electronic data processing, record keeping, and

11

#110828415

communications, telecommunications systems, networks interfaces, platforms, servers, peripherals, computer systems, and other information technology infrastructure, including any outsourced systems and processes, and information and functions owned, used or provided by the Acquired Companies.

(zzz) "Target Working Capital" means $25,932,343.

(aaaa) "Tax" or, collectively, "Taxes" means any and all federal or central, state, regional, provincial, municipal, local and foreign taxes, assessments, reassessment and other governmental charges, duties, impositions and liabilities, including Canada Pension Plan and provincial pension plan contributions and unemployment insurance contributions or premiums and employment insurance contributions or premiums and including taxes based upon or measured by gross receipts, income, profits, sales, capital use and occupation, good and services, harmonized sales, value added, ad valorem, transfer, land transfer, franchise, withholding, customs duties, payroll, employment, unemployment, excise and property taxes, including estimated taxes, together with all interest, penalties, fines and additions imposed with respect to such amounts.

(bbbb) "Tax Act" means the Income Tax Act (Canada), as amended.

(cccc) "Tax Return" or, collectively "Tax Returns" means all returns, declarations, reports, statements, schedules, notices, elections, designations, forms or other documents or information filed or required to be filed in respect of the determination, assessment, collection or payment of any Tax or in connection with the administration, implementation or enforcement of any legal requirement relating to any Tax.

(dddd) "Transaction Expenses" means collectively (and without duplication) all fees, costs, and expenses payable by any of the Acquired Companies or Sellers to any Person solely in connection with the negotiation, execution and delivery of this Agreement and the consummation of the transactions contemplated by this Agreement, including (i) any amounts payable to any brokers, financial advisory, investment bankers, legal counsel, accountants, consultants, other advisors, and other professional or transaction related costs, fees and expenses, (ii) any amounts payable to any current or former directors, employees or consultants of the Acquired Companies or any other Persons with respect to any change of control, transaction bonus, commission or other similar payments payable solely as a result of or in connection with the transactions contemplated by this Agreement and the employer portion of payroll Taxes thereon and (iii) all fees or other payments payable to any shareholder of the Corporation or any Affiliate of any such Person as a result of, or in connection with, the transactions contemplated by this Agreement.

(eeee) "Transferred Information" means the Personal Information to be disclosed or conveyed to one Party or any of its representatives or agents (a "Recipient") by or on behalf of another Party (a "Disclosing Party") as a result of or in conjunction with the transactions contemplated under this Agreement, and includes all such Personal Information disclosed to the Recipient prior to the execution of this Agreement.

(ffff) "Unvested Options" means each Option which did not vest in connection with the completion of the transactions contemplated herein pursuant to the Option Plan.

(gggg) "Vested Options" means each Option which vested in connection with the completion of the transactions contemplated herein pursuant to the Option Plan.

(hhhh) "Working Capital" means the current assets minus current liabilities, in each case, that are specifically listed in the sample calculation set forth in Exhibit C in respect of the Acquired Companies, on a consolidated basis, as of immediately prior to the Effective Time, each determined in accordance with the Accounting Principles.

12

#110828415

1.2 Other Defined Terms.

In addition to the defined terms in Section 1.1, each of the following capitalized terms shall have the meaning ascribed thereto in the corresponding Sections:

|

|

Term |

Section |

2024 Earn-Out Amount |

2.10(a)(ii)(A) |

2025 Earn-Out Amount |

2.10(a)(ii)(B) |

Acquired Company Real Property |

3.2(v) |

Agent |

7.8 |

Benefit Plan |

3.2(k)(iv) |

Claim Notice |

6.3(a) |

Closing Date |

2.1 |

Closing Net Working Capital Adjustment |

2.7(a) |

Confidentiality Agreement |

5.8 |

Contracting Parties |

7.20 |

Corporation |

Recitals |

Disclosing Party |

1.1(eeee) |

Draft Statement |

2.7(b) |

Earn-Out Statement |

2.10(a) |

Employment Agreement |

Recitals |

Event or Events |

1.1(eee) |

Exercise Price |

2.9(a) |

Expenses Amount |

7.8(j) |

Final Statements |

2.7(f) |

Guarantor |

Preamble |

Lease Documents |

3.2(v) |

Leased Real Properties |

3.2(v) |

Material Contracts |

3.2(t)(i) |

Net Downward Adjustment |

2.7(g)(v) |

Net Upward Adjustment |

2.7(g)(iv) |

Non-Recourse Parties |

7.20 |

Notice of Objection |

2.7(d) |

Obligations |

7.21(a) |

Option Loan |

2.9(a) |

Owned Real Property |

3.2(u) |

Preliminary Closing Date Net Indebtedness |

2.7(a) |

Preliminary Closing Date Net Working Capital Amount |

2.7(a) |

Preliminary Statement |

2.7(a) |

Purchase Price |

2.5 |

Purchased Shares |

Recitals |

Purchaser |

Preamble |

Recipient |

1.1(eeee) |

Registered IP |

3.2(p)(i) |

Related Party Agreement |

3.2(dd) |

SE |

7.1 |

Sellers |

Preamble |

Shareholders' Agreement |

2.11 |

Third Party Auditors |

2.7(e) |

Third Party Claim |

6.3(a) |

Top Customers |

3.2(aa) |

Top Suppliers |

3.2(aa) |

Withholding Taxes |

2.9(a) |

13

#110828415

1.3 Headings, etc.

The provision of a Table of Contents, the division of this Agreement into Articles and Sections and the insertion of headings are for convenient reference only and are not to affect its interpretation.

1.4 Currency and Payment Obligations.

(a) All references in this Agreement to dollars, unless otherwise specifically indicated, are expressed in Canadian currency.

(b) Any payment to or by Sellers contemplated by this Agreement shall be made to or by Sellers in accordance with each Seller's Allocable Portion.

1.5 Time Reference.

All references in this Agreement to times of the day are to local time in the relevant jurisdiction, unless otherwise indicated.

1.6 Certain Expressions, etc.

In this Agreement, (a) the words "includes", "including" and similar expressions mean "includes (or including) without limitation", (b) the phrases the "aggregate of", the "total of", the "sum of" and similar expressions mean the "aggregate (or total or sum), without duplication, of", (c) the phrase "made available", when used in reference to a document, means that the document was (i) delivered or provided to Purchaser (with confirmation of receipt by Purchaser), or (ii) made available for viewing in the "Project Ellis" electronic data room hosted by Firmex, in a folder accessible by Purchaser and its authorized representatives on or prior to the Business Day immediately prior to the date of this Agreement, (d) pronouns in one gender include any other gender, unless the context clearly indicates otherwise, (e) definitions in the singular include the plural, and vice versa, and (f) the words "hereof", "herein", "hereunder", "hereto" and similar expressions refer to this Agreement as a whole and the words "Article", "Section", "Exhibit" or "Schedule" refer to an Article of, Section of, Exhibit to or Schedule to, this Agreement, unless specified otherwise.

1.7 Knowledge.

(a) Where any representation or warranty contained in this Agreement is qualified by reference to the knowledge of Sellers or any similar expression with regard to the knowledge or awareness of, or receipt of notice by, the Acquired Companies, it shall be deemed to refer to the actual knowledge, as of the date of this Agreement, of each of Stephen Forberg, David Wootton and Greg Dowell, in each case, after reasonable inquiry, and without personal liability on the part of them.

(b) Where any representation or warranty contained in Section 3.1 is qualified by reference to the knowledge of Sellers or any similar expression with regard to the knowledge or awareness of, or receipt of notice by, such Seller, it shall be deemed to refer to the actual knowledge, as of the date of this Agreement, of such Seller, in the case of a non-corporate Seller, and of such Seller's directors and officers, in the case of a Corporate Seller, after reasonable inquiry.

14

#110828415

1.8 Accounting Terms.

All accounting terms not specifically defined in this Agreement shall be interpreted in accordance with ASPE (applied on a basis consistent with the Financial Statements), unless otherwise provided.

1.9 Statutory and Agreement References.

Except as otherwise provided in this Agreement, (a) any reference in this Agreement to a statute refers to such statute and all rules and regulations made under it as they may have been or may from time to time be amended, re-enacted or replaced; and (b) any reference in this Agreement to an agreement or a contract shall mean such agreement or contract, as the same may be amended, renewed, supplemented, extended and/or restated from time to time as of the date of this Agreement.

1.10 Computation of Time Periods.

(a) If any action may be taken within, or any right or obligation is to expire at the end of, a period of days under this Agreement, then the first day of the period is not counted, but the day of its expiry is counted.

(b) Whenever an action is to be taken on or not later than a day which is not a Business Day, such action shall be taken on or not later than the next succeeding Business Day.

(c) All references to times of the day are to the times of the day in Edmonton, Alberta.

1.11 Legal Representation; No Presumption Against Party that Stipulated the Obligation.

Each Party acknowledges that such Party has been represented by counsel in connection with the negotiation and execution of this Agreement and related matters, and that the terms of this Agreement and related matters have been negotiated by it. Any rule of law or any legal decision that would require interpretation of any claimed ambiguities in this Agreement against the Party that stipulated the obligation has no application and any such right is expressly waived by the Parties.

1.12 Incorporation of Exhibits and Schedules.

The exhibits and schedules to the Disclosure Letter attached to this Agreement shall, for all purposes of this Agreement, form an integral part of it.

The following are the exhibits to this Agreement:

|

|

Exhibit |

Description |

Exhibit A |

Allocable Portion |

Exhibit B |

Preliminary Statement |

Exhibit C |

Illustrative Calculation of the Acquired Companies' Net Indebtedness and Working Capital |

Exhibit D |

Earn-Out Principles |

15

#110828415

Article 2

CLOSING; PURCHASED SHARES AND PURCHASE PRICE

2.1 Date, Time and Place of Closing.

The Sellers and Purchaser agree that the Closing shall be deemed to have occurred concurrently with the execution and delivery by the parties of this Agreement and to be effective as of the Effective Time (the "Closing Date"). The completion of the transactions contemplated by this Agreement shall take place virtually at the Effective Time on the Closing Date or at such other place, on such other date and at such other time as may be agreed upon in writing between Agent, for on behalf of Sellers, and Purchaser. Notwithstanding the previous sentence, the Closing can take place virtually by exchange of executed documents by electronic mail, other electronic means or courier and payment by wire transfer of immediately available funds.

2.2 Purchase and Sale.

Subject to the terms and conditions of this Agreement, at the Closing, each Seller shall sell, assign and transfer ownership to Purchaser, and Purchaser shall purchase from each Seller, all (but not less than all) of the Purchased Shares held thereby, free and clear of all Liens, except Permitted Equity Liens. The Purchased Shares will constitute at Closing, in the aggregate, all (but not less than all) of the issued and outstanding shares in the capital of Corporation. Each Seller irrevocably constitutes and appoints any officer of the Corporation as attorney to transfer the Purchased Shares held by such Seller on the books of the Corporation, and for that purpose to make and execute all necessary acts of assignment and transfer thereof, with full power of substitution in the premises.

2.3 Deliveries to Purchaser.

At or prior to Closing, Agent, for and on behalf of Sellers, shall deliver or cause to be delivered to Purchaser the following in form and substance satisfactory to Purchaser, acting reasonably:

(a) a copy of the Escrow Agreement duly executed by Agent, for and on behalf of Sellers, and Escrow Agent;

(b) share certificates representing the Purchased Shares, together with irrevocable stock transfer powers with respect to the Purchased Shares duly executed in blank by the holders of record;

(c) an officer's certificate of the Corporation, dated as of the Closing Date: (A) attaching the current constating documents of the Acquired Companies, including any amendments thereto; (B) attaching all required resolutions of the board of directors and shareholders of the Corporation approving the transfer of the Purchased Shares to Purchaser, and (C) attesting to the incumbency and signatures of the officers of the Corporation;

(d) an officer's certificate from each corporate Seller, dated as of the Closing Date: (A) attaching all required resolutions of the board of directors and shareholders of such Seller authorizing the execution, delivery and performance of this Agreement and the Ancillary Agreement and the consummation of the transactions contemplated hereby and thereby (including the transfer of the Purchased Shares to Purchaser), and (B) attesting to the incumbency and signatures of the officers of such Seller;

(e) a certificate of status, compliance, good standing or like certificate with respect to corporate Sellers and the Acquired Companies issued by appropriate government officials of their respective jurisdictions of incorporation, if available in such jurisdiction;

16

#110828415

(f) executed Payoff Letters with respect to any Indebtedness set forth on Part A of Schedule 2.8 of the Disclosure Letter;

(g) if requested by Purchaser, resignations and releases effective as of Closing by those directors and officers of the Acquired Companies identified by Purchaser, duly executed by such directors and officers;

(h) mutual releases of Agent, for and on behalf of Sellers and their Affiliates, and Purchaser and its Affiliates (including the Acquired Companies), duly executed by Agent;

(i) evidence of the termination of all Hedge Contracts;

(j) evidence of the termination of any Related Party Agreements in accordance with Section 5.7;

(k) a copy of a statement setting forth the Transaction Expenses;

(l) a copy of the Preliminary Statement; and

(m) copies of the Employment Agreements, duly executed by each of the Key Employees and the Corporation.

2.4 Deliveries to Sellers.

At or prior to Closing, Purchaser shall deliver or cause to be delivered to Agent (for and on behalf of Sellers) the following in form and substance satisfactory to Agent, acting reasonably:

(a) a copy of the Escrow Agreement duly executed by Purchaser;

(b) a copy of the Representation and Warranty Policy;

(c) an officer's certificate of Purchaser, dated as of the Closing Date: (A) attaching all required resolutions of the board of directors of Purchaser authorizing the execution, delivery and performance of this Agreement and the Ancillary Agreement and the consummation of the transactions contemplated hereby and thereby, and (B) attesting to the incumbency and signatures of the officers of the Purchaser;

(d) an officer's certificate of Guarantor, dated as of the Closing Date: (A) attaching all required resolutions of the board of directors of Guarantor authorizing the execution, delivery and performance of this Agreement and the Ancillary Agreement and the consummation of the transactions contemplated hereby and thereby, and (B) attesting to the incumbency and signatures of the officers of the Guarantor;

(e) a certificate of status, compliance, good standing or like certificate with respect to the Purchaser issued by the government officials of its jurisdictions of incorporation, if available in such jurisdiction;

(f) a certificate of status, compliance, good standing or like certificate with respect to the Guarantor issued by the government officials of its jurisdictions of incorporation, if available in such jurisdiction;

(g) the Purchase Price in the manner set forth in Section 2.6; and

(h) mutual releases referred to in Section 2.3(h), duly executed by Purchaser.

17

#110828415

2.5 Purchase Price.

Subject to adjustment, if any, in accordance with Section 2.7(g), the aggregate purchase price payable by Purchaser for the Purchased Shares shall be an amount equal to (a) $105,000,000, plus, if a negative amount, or minus, if a positive amount, as the case may be, (b) the Preliminary Closing Date Net Indebtedness, plus or minus, as the case may be, (c) the amount of the Closing Net Working Capital Adjustment, and plus (d) the Earn-Out Amount, if any, payable in accordance with Section 2.10 (the "Purchase Price").

2.6 Payments at Closing.

(a) At Closing, Purchaser shall pay the Purchase Price (excluding the Earn-Out Amount) by paying:

(i) to Sellers, subject to Section 2.9(c), an amount equal to the Purchase Price (excluding the Earn-Out Amount) minus the Adjustment Escrow Amount minus the Sellers' Transaction Expenses by way of wire transfer of immediately available funds to an account designated in writing by Agent; provided that any amounts to be paid in U.S. Dollars pursuant to Agent’s instructions shall be paid in U.S. Dollars based on the conversion rate as published in The Wall Street Journal in effect on July 28, 2023 at 5:00 p.m. Eastern Time;

(ii) the Sellers' Transaction Expenses, in accordance with Section 2.8(b); and

(iii) the Adjustment Escrow Amount to the Adjustment Escrow Account.

(b) At Closing, Purchaser shall pay to the Corporation, the portion of the Option Loans attributable to the aggregate Withholding Taxes in accordance with Section 2.9(c)(i).

(c) At Closing, Purchaser shall pay on behalf of the applicable Acquired Company, Indebtedness set forth on Part A of Schedule 2.8 of the Disclosure Letter in accordance with Section 2.8(a).

2.7 Adjustment of Purchase Price.

(a) Preliminary Statements. The Parties have agreed to the statement attached hereto as Exhibit B (the "Preliminary Statement"), together with supporting calculations in reasonable detail and based upon the Books and Records, setting forth the Corporation's good faith estimate of (A) the Working Capital (the "Preliminary Closing Date Net Working Capital Amount"), and (B) the Net Indebtedness (the "Preliminary Closing Date Net Indebtedness"), in each case, as of immediately prior to the Effective Time and determined in accordance with the Accounting Principles. If the Preliminary Closing Date Net Working Capital Amount is greater than the Target Working Capital, the Purchase Price will be increased dollar-for-dollar by the amount of such excess, and if the Preliminary Closing Date Net Working Capital Amount is less than the Target Working Capital, the Purchase Price will be decreased dollar-for-dollar by the amount of such shortfall (in each case, the "Closing Net Working Capital Adjustment"). In order to facilitate the payment of the Sellers' Transaction Expenses, Sellers shall have delivered to Purchaser a written statement with respect to such Sellers' Transaction Expenses (which statement shall include reasonable supporting documentation evidencing any third party Sellers' Transaction Expenses) that are to be paid by Purchaser on behalf of Sellers pursuant to Section 2.8(b).

(b) Draft Statement. Within 45 days following the Closing Date, Purchaser shall prepare and shall deliver to Agent a statement setting forth the determination of the Working Capital and the Net Indebtedness, in each case, as of immediately prior to the Effective Time and determined in

18

#110828415

accordance with the Accounting Principles, and reasonable supporting detail of the calculation of the Working Capital and Net Indebtedness contained therein (the "Draft Statement").

(c) Cooperation. Upon reasonable request, at any time after the delivery of the Draft Statement, Purchaser shall reasonably cooperate with Agent and its advisors and provide access to all work papers of Purchaser's auditors, accounting books and records and supporting schedules as they relate to the Draft Statement relating to the Acquired Companies and the appropriate personnel to verify the accuracy, presentation and other matters relating to the preparation of the Draft Statement; provided that (A) none of Purchaser, the Acquired Companies, employees and accountants shall be required to disclose to Agent or any of its accountants or other representatives any information if doing so would contravene any fiduciary duty or applicable Law to which any such Person or any of their respective Affiliates is a party or otherwise bound or is subject, or which it reasonably determines upon the advice of counsel could result in the loss of the ability to successfully assert the attorney-client, work product or any other legal privilege, and (B) none of the auditors or accountants of Purchaser or the Acquired Companies shall be obligated to make any work papers available to any Person unless and until such Person has executed a customary agreement relating to such access to work papers in form and substance reasonably acceptable to such auditors and accountants.

(d) Objection Period. Within 45 days following delivery of the Draft Statement, Agent (for and on behalf of Sellers) shall notify Purchaser in writing if it has any objections to the Draft Statement. The notice of objection (the "Notice of Objection") must state in reasonable detail the basis of each objection and the approximate amounts in dispute. Any component of the Draft Statement that is not disputed in a Notice of Objection will be final and binding upon the Parties and will not be subject to appeal, absent manifest error.

(e) Settlement of Dispute. If Agent (for and on behalf of Sellers) disputes the Draft Statement in accordance with Section 2.7(d), then Purchaser and Agent (for and on behalf of Sellers) will work expeditiously and in good faith in an attempt to resolve such dispute within a further period of 30 days after the date of the Notice of Objection. Any such disputed items that are resolved and documented by mutual agreement of Purchaser and Agent (for and on behalf of Sellers) during such 30‑day period will be final and binding upon Sellers and Purchaser and will not be subject to appeal. If Purchaser and Agent (for and on behalf of Sellers) do not resolve all such disputed items by the end of such 30‑day period, the items remaining in dispute with respect to the Notice of Objection may be submitted by Agent (for and on behalf of Sellers) or Purchaser for final determination to BDO Canada LLP (Calgary), or if such firm is unwilling or unable to act, or conflicted at the time of such submission, Grant Thornton LLP (in any such case, the "Third Party Auditors"). Purchaser and Agent shall use commercially reasonable efforts to cause the Third Party Auditors to complete their work within 30 days of their engagement. While the Third Party Auditors are performing their engagement, neither Agent nor Purchaser shall communicate with the Third Party Auditors on the subject matter of their work relating to this Agreement, except by conference call that includes both Agent and Purchaser, by meeting that includes both Agent and Purchaser or by letter with a copy simultaneously delivered to the other. The Third Party Auditors will allow each of Purchaser and Agent (for and on behalf of Sellers) to present their respective positions regarding the Notice of Objection, and each of Purchaser and Agent (for and on behalf of Sellers) shall have the right to present additional documents, materials and other information to the Third Party Auditors regarding the items in dispute. The Third Party Auditors will consider such additional documents, materials, other information. Any such other documents, materials or other information will be copied to each of Purchaser and Agent and each of which will be entitled to reply thereto. Agent and Purchaser shall instruct the Third Party Auditors to (i) act as an expert and not an arbitrator, (ii) make all calculations in accordance with the definitions, terms and provisions of this Agreement and the Accounting Principles, (iii) consider only those items and amounts that are identified in the Notice of Objection as being items that Purchaser and Agent are unable to resolve, and (iv) not assign a dollar value to any disputed item greater than the highest amount or less than the lowest amount claimed by Purchaser or Agent, as applicable. The

19

#110828415

determination of the Third Party Auditors will be final and binding upon Sellers and Purchaser and will not be subject to appeal, absent manifest error. Agent (for and on behalf of Sellers) and Purchaser agree that the procedure set forth in this Section 2.7(e) for resolving disputes with respect to the Draft Statement is the sole and exclusive method of resolving such disputes.

(f) Final Determination. Promptly following the 45‑day period referred to in Section 2.7(d) during which no Notice of Objection was given or the resolution of any dispute in accordance with Section 2.7(e), as the case may be, Purchaser shall deliver to Agent (for and on behalf of Sellers) the final closing date balance sheet, a statement setting forth the Working Capital and the Net Indebtedness (the "Final Statements"). The Final Statements shall reflect the resolution of any dispute in accordance with Section 2.7(e) or, if Corporation's auditors are unable or unwilling to reflect such resolution, then the Final Statements shall be deemed to be amended to reflect such resolution. The Final Statements shall be final and binding upon the Parties upon delivery thereof and shall not be subject to appeal, absent manifest error.

(g) Adjustment to Purchase Price.

(i) If (A) the Working Capital set forth in the Final Statements is equal to the Preliminary Closing Date Net Working Capital Amount set forth in the Preliminary Statement, and (B) the Net Indebtedness set forth in the Final Statements is equal to the Preliminary Closing Date Net Indebtedness set forth in the Preliminary Statement, then no further adjustment will be made to the Purchase Price, and Purchaser and Agent shall deliver joint written instructions to the Escrow Agent instructing the Escrow Agent to release the Adjustment Escrow Amount from the Adjustment Escrow Account to Agent.

(ii) If the Working Capital set forth in the Final Statements is greater than the Preliminary Closing Date Net Working Capital Amount set forth in the Preliminary Statement, then Purchaser shall owe an amount equal to such excess to Sellers. If the Working Capital set forth in the Final Statements is less than the Preliminary Closing Date Net Working Capital Amount set forth in the Preliminary Statement, then Sellers shall owe an amount equal to such shortfall to Purchaser.