false000001604000000160402024-12-042024-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 4, 2024

Cabot Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

1-5667 |

04-2271897 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

2 Seaport Lane, Suite 1400, Boston, MA |

|

02210-2019 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (617) 345-0100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

☐ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $1 par value per share |

CBT |

New York Stock Exchange |

Item 7.01. Regulation FD Disclosure

Cabot Corporation (the “Company”) will host its 2024 Investor Day on Wednesday, December 4, 2024. At the event, Sean Keohane, President and Chief Executive Officer, and other members of the Company’s executive team will meet with investors and investment professionals and make a presentation regarding the Company. A live video webcast of the conference, including the slide presentation will be accessible via the Company’s website at cabotcorp.com/investors. A copy of the press release issued by the Company announcing this conference is attached as Exhibit 99.1 and is incorporated herein by reference, and a copy of the presentation is attached as Exhibit 99.2 and is incorporated herein by reference.

The information contained in this report, including Exhibit 99.1 and Exhibit 99.2 attached hereto, is being furnished and shall not be deemed “filed” for any purpose, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, regardless of any general incorporation language in any such filing.

Item 9.01 Financial Statements and Exhibits.

* Filed herewith.

** Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

CABOT CORPORATION

By: /s/ Sean D. Keohane

Name: Sean D. Keohane

Title: President and Chief Executive Officer

Date: December 4, 2024

Investor Contact: Steve Delahunt

(617) 342-6255

Cabot Corporation Highlights Growth Strategy and 3-Year Financial Targets at Investor Day

BOSTON (December 4, 2024)-- Cabot Corporation (NYSE: CBT) today hosts its 2024 Investor Day in Boston, MA. Sean Keohane, President and Chief Executive Officer, and other members of Cabot’s executive management team, will provide an in-depth review of the Company’s strategic vision and financial targets for the next three years. The live event will begin at 9:30 AM EST and will be webcast live.

Creating for Tomorrow Strategy

Cabot’s “Creating for Tomorrow” strategy, originally introduced at the Company’s 2021 Investor Day, is underpinned by its purpose to create materials that improve daily life and enable a more sustainable future. The strategy focuses on three key pillars;

Grow: Focus on strategic investments to achieve advantaged growth

Innovate: Developing innovative products and processes that enable a better future

Optimize: Driving continuous improvement in everything we do

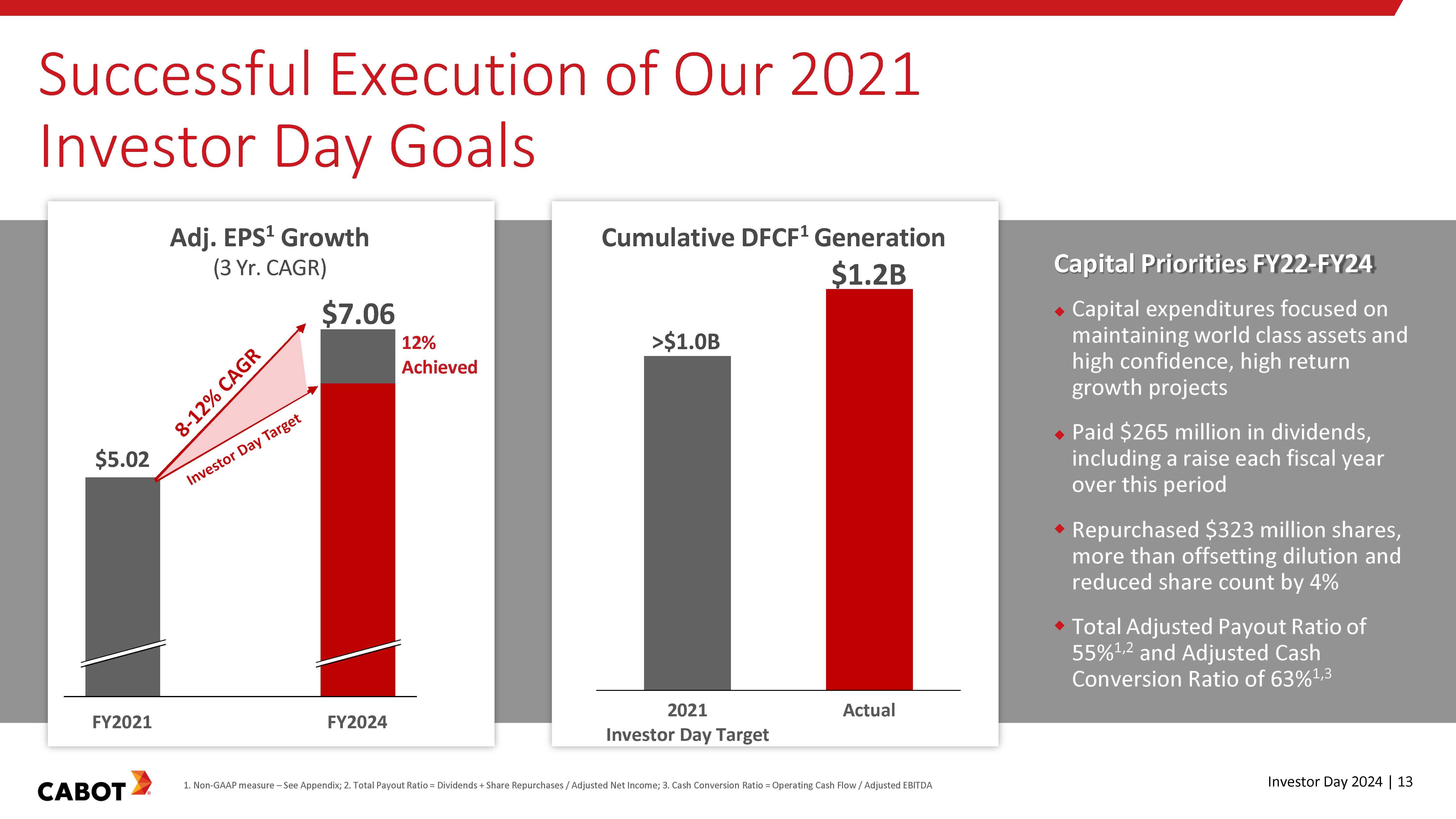

Over the past three years, Cabot has delivered significant results by leveraging its market leadership, performance capabilities, and commitment to sustainability. The Company achieved its 3-year corporate targets, delivering the top end of its Adjusted EPS CAGR target range of 8-12%, and exceeding its 3-year cumulative Discretionary Free Cash Flow Generation (DFCF) target of over $1 billion, with $1.2 billion of DFCF over the 3-year period.

Key Themes for 2024 Investor Day

Building on our proven track record of delivering on our financial commitments

Continuing the execution of our Creating for Tomorrow strategy

Investing in high-growth vectors, such as battery materials with new capacity to meet growth in customer demand

Elevating performance in our industry leading businesses through commercial and operational excellence, innovation and advantaged growth investments

Winning the sustainability transition

Maintaining a strong balance sheet and investment-grade credit rating to support our capital allocation framework

3-Year Financial Targets

Cabot is introducing the following 3-year financial targets:

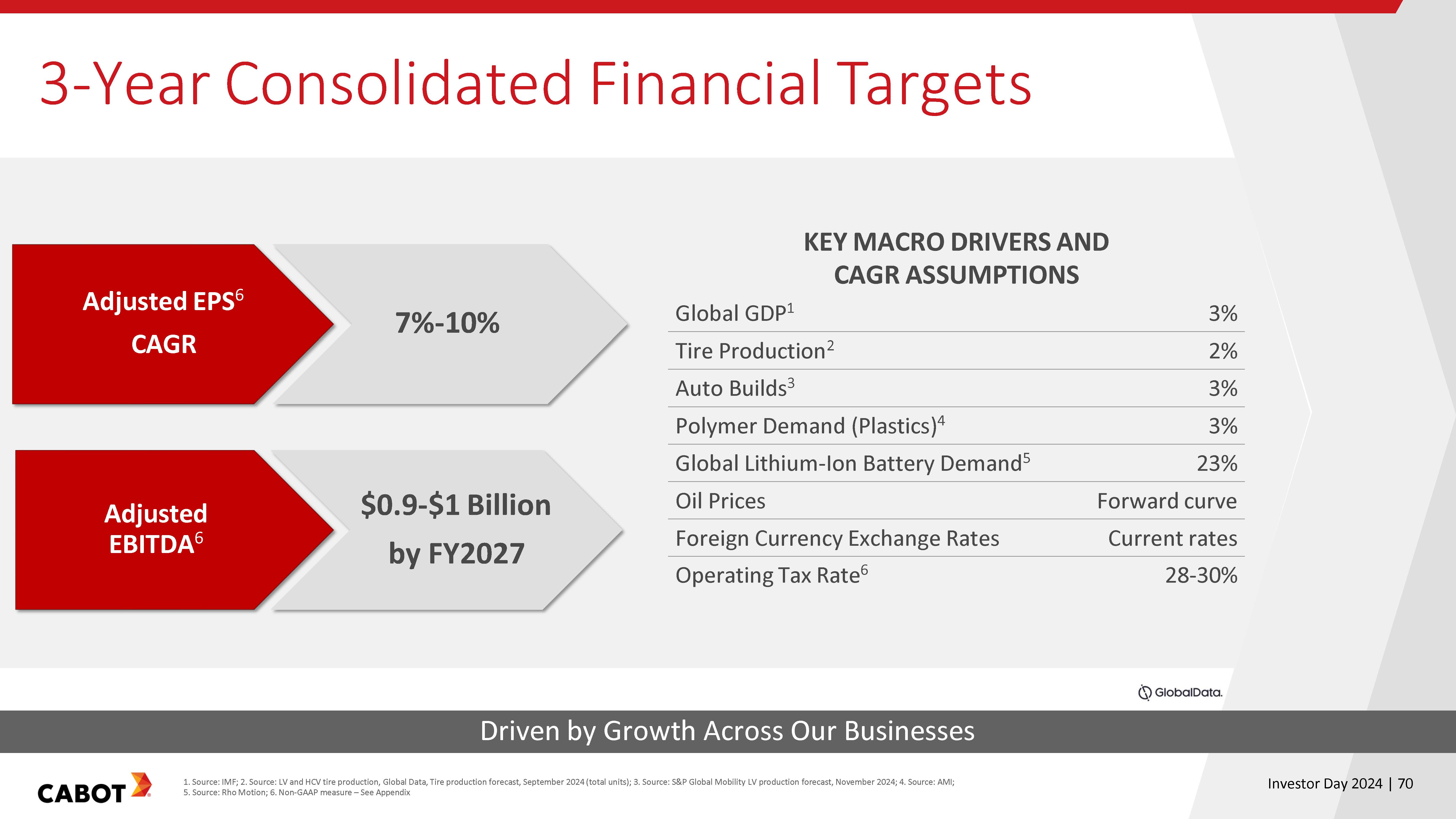

Adjusted EPS CAGR of 7-10% from fiscal 2024 through fiscal 2027

Adjusted EBITDA of $0.9-$1.0 billion by fiscal year 2027

“As we build on this momentum, Cabot remains committed to creating long-term value for our shareholders through earnings growth, robust cash flow generation, and disciplined capital allocation. With our global scale, operational and commercial excellence, and commitment to sustainability, we are confident in our ability to achieve our next set of strategic objectives, including an Adjusted EPS CAGR of 7-10% over the next 3 years and Adjusted EBITDA of $0.9-$1 billion by fiscal 2027. In addition, we remain committed to maintaining an investment-grade credit rating, executing on our growth priorities and returning robust levels of cash to shareholders through disciplined capital allocation,” said Sean Keohane, President and Chief Executive Officer.

Join the Webcast

To listen to the live webcast, visit the Cabot Corporation 2024 Investor Day site at investorday.cabotcorp.com. Following the event, a replay will be available on the Company’s investor relations website cabotcorp.com/investors.

About Cabot Corporation

Cabot Corporation (NYSE: CBT) is a global specialty chemicals and performance materials company headquartered in Boston, Massachusetts. The company is a leading provider of reinforcing carbons, specialty carbons, battery materials, engineered elastomer composites, inkjet colorants, masterbatches and conductive compounds, fumed metal oxides and aerogel. For more information on Cabot, please visit the company’s website at cabotcorp.com. The Company regularly posts important information on its website and encourages investors and potential investors to consult the Cabot website regularly.

# # #

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: Certain statements and information in the press release, particularly statements and information regarding future financial performance, and expectations and objectives of management constitute forward-looking statements. Our forward-looking statements are subject to risks and uncertainties, which may cause actual results to differ materially from those projected or implied by the forward-looking statement. Forward-looking statements are based on current expectations and assumptions and currently available data and are neither predictions or guarantees of future events or performance. We do not undertake to update or revise any forward-looking statements after they are made, whether as a result of new information, future events, or otherwise, except as required by applicable law. For a discussion of some of the important factors that could cause actual results to differ from those contained in the forward -looking statements, please consult the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K.

Non-GAAP Measures:

This press release contains certain non-GAAP measures which are provided to assist in an understanding of Cabot’s business and its performance. These measures should always be considered in conjunction with the appropriate GAAP measures. Please consult the slides that accompany this press release for information about these measures.

CABOT INVESTOR DAY December 4, 2024

Safe Harbor Statement This presentation contains forward-looking statements based on management’s current expectations, estimates and projections. All statements that address expectations or projections about the future, including statements about the Company’s strategy for growth, the future growth rates of our businesses including expected adjusted EBITDA and adjusted earnings per share growth over the next three years, and for our Battery Materials, Inkjet and E2C® solutions product offerings, how we expect to achieve our growth targets, the benefits we expect from macroeconomic trends, the expected Reinforcement Materials capacity available from operational excellence and debottlenecking projects and when we expect additional capacity to be available, our product and application development activities, market position, when we expect capacity expansions to be completed, the timing of planned capital expenditures, whether we are able to negotiate favorable terms with the U.S. Department of Energy related to certain grants, our strategy for achieving net zero carbon emissions by 2050, our expected financial performance and results and total shareholder return, our expected cash flows, including DFCF and uses of cash for, among other uses, share repurchases, our capital expenditures, key growth projects and their costs over our fiscal years period of 2025-2027, and our operating tax rate, are forward-looking statements. Forward-looking statements are based on our current expectations, assumptions, estimates and projections about Cabot's businesses and strategies, market trends and conditions, economic conditions and other factors. These statements are not guarantees of future performance and are subject to risks, uncertainties, potentially inaccurate assumptions, and other factors, some of which are beyond our control and difficult to predict. If known or unknown risks materialize, or should underlying assumptions prove inaccurate, our actual results could differ materially from past results and from those expressed in the forward-looking statement. Important factors that could cause our results to differ materially from those expressed in the forward-looking statements include, but are not limited to industry capacity utilization and competition from other specialty chemical companies; safety, health and environmental requirements and related constraints imposed on our business; regulatory and financial risks related to climate change developments; volatility in the price and availability of energy and raw materials, including with respect to the Russian invasion of Ukraine and the U.S.-China trade relationship; a significant adverse change in a customer relationship or the failure of a customer to perform its obligations under agreements with us; failure to achieve growth expectations from new products, applications and technology developments; failure to realize benefits from acquisitions, alliances, or joint ventures or achieve our portfolio management objectives; unanticipated delays in, or increased cost of site development projects; negative or uncertain worldwide or regional economic conditions and market opportunities, including from trade relations, global health matters or geo-political conflicts; litigation or legal proceedings; interest rates, tax rates, currency exchange controls and fluctuations in foreign currency rates such as the recent currency movements in Argentina; and the accuracy of the assumptions we used in establishing reserves for our share of liability for respirator claims. These factors are discussed more fully in the reports we file with the Securities and Exchange Commission (“SEC”), particularly under the heading “Risk Factors” in our annual report on Form 10-K for our fiscal year ended September 30, 2024, which are filed with the SEC at www.sec.gov. We assume no obligation to provide revisions to any forward-looking statements should circumstances change, except as otherwise required by securities and other applicable laws. Non-GAAP Financial Measures and Explanations of Terms Used This presentation includes references to the following non-GAAP financial measures: adjusted EPS (earnings per share), adjusted EBITDA (earnings before interest, taxes, depreciation and amortization), adjusted EBIT (earnings before interest, taxes), adjusted EBITDA margin, total segment EBITDA, total segment EBIT, EBITDA margins, adjusted ROIC (return on invested capital), DFCF (discretionary free cash flow), adjusted payout ratio, adjusted EBITDA conversion and operating tax rate. The definitions of these non-GAAP financial measures, reconciliations to the most comparable GAAP financial measures, and explanations of other terms used are provided in the Appendix to this presentation. Investor Day 2024 | 2

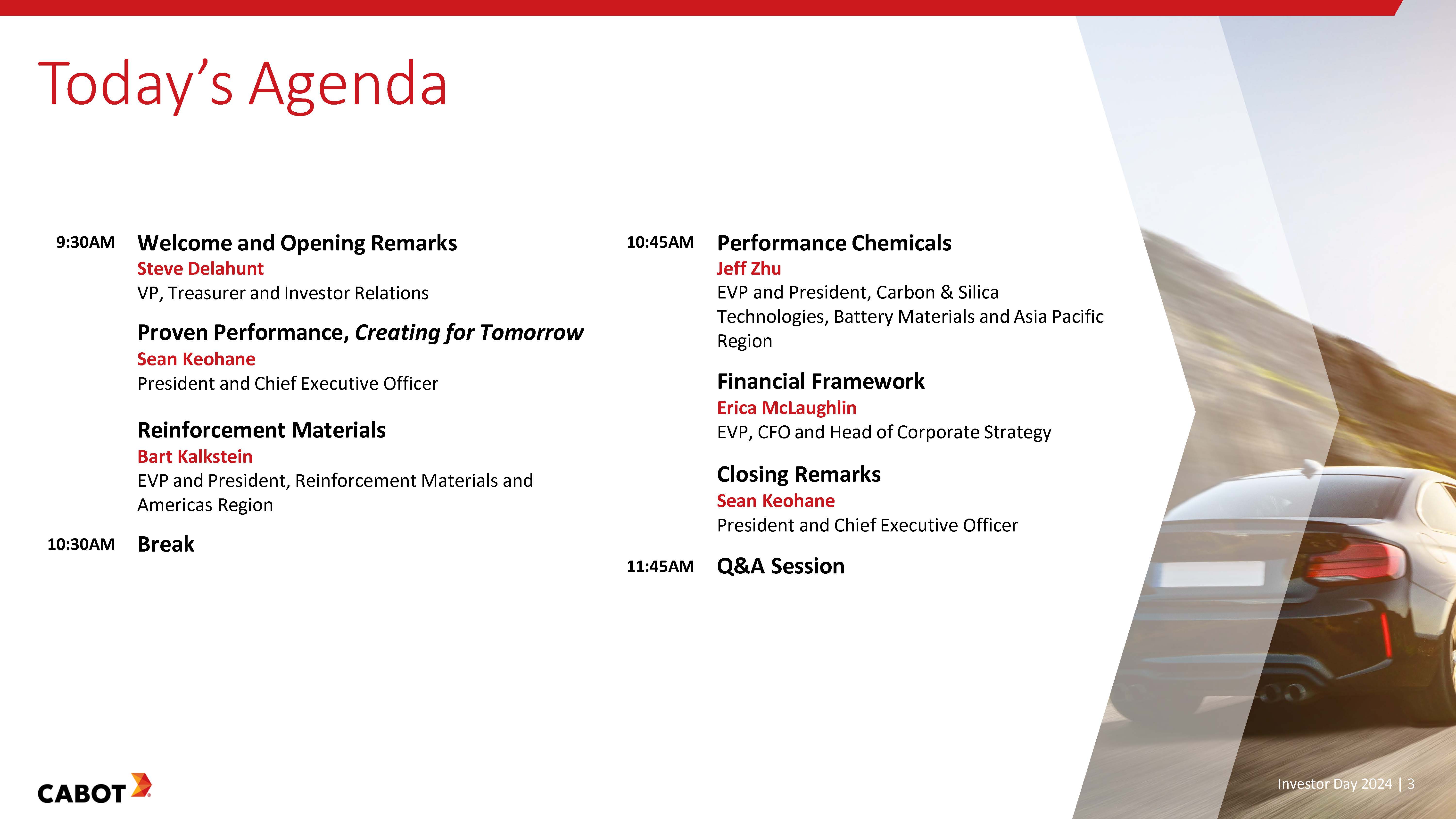

Today’s Agenda 9:30AM Welcome and Opening Remarks Steve Delahunt VP, Treasurer and Investor Relations Proven Performance, Creating for Tomorrow Sean Keohane President and Chief Executive Officer Reinforcement Materials Bart Kalkstein EVP and President, Reinforcement Materials and Americas Region 10:45AM Performance Chemicals Jeff Zhu EVP and President, Carbon & Silica Technologies, Battery Materials and Asia Pacific Region Financial Framework Erica McLaughlin EVP, CFO and Head of Corporate Strategy Closing Remarks Sean Keohane President and Chief Executive Officer 10:30AM Break 11:45AM Q&A Session Investor Day 2024 | 3

Our Purpose Creating materials that improve daily life and enable a more sustainable future. Investor Day 2024 | 4

Proven Performance, Creating for Tomorrow Sean Keohane President and Chief Executive Officer

Key Messages Market Leader with Size and Scale Strong Track Record of Execution Broad global footprint, diverse product portfolio and strong customer relationships serving attractive markets Demonstrated consistent delivery of above market financial results through challenging global markets Proven Ability to Deliver Customer Value Deep industry expertise and commitment to innovation, operational and commercial excellence Well-Positioned to Win the Sustainability Transition Unique offering provides opportunity to create value for Cabot and customers Clear Strategy to Achieve Targets Focused strategy to deliver growth, achieve profitability targets, deploy capital, and compound shareholder value 1 2 3 4 5 Investor Day 2024 | 6

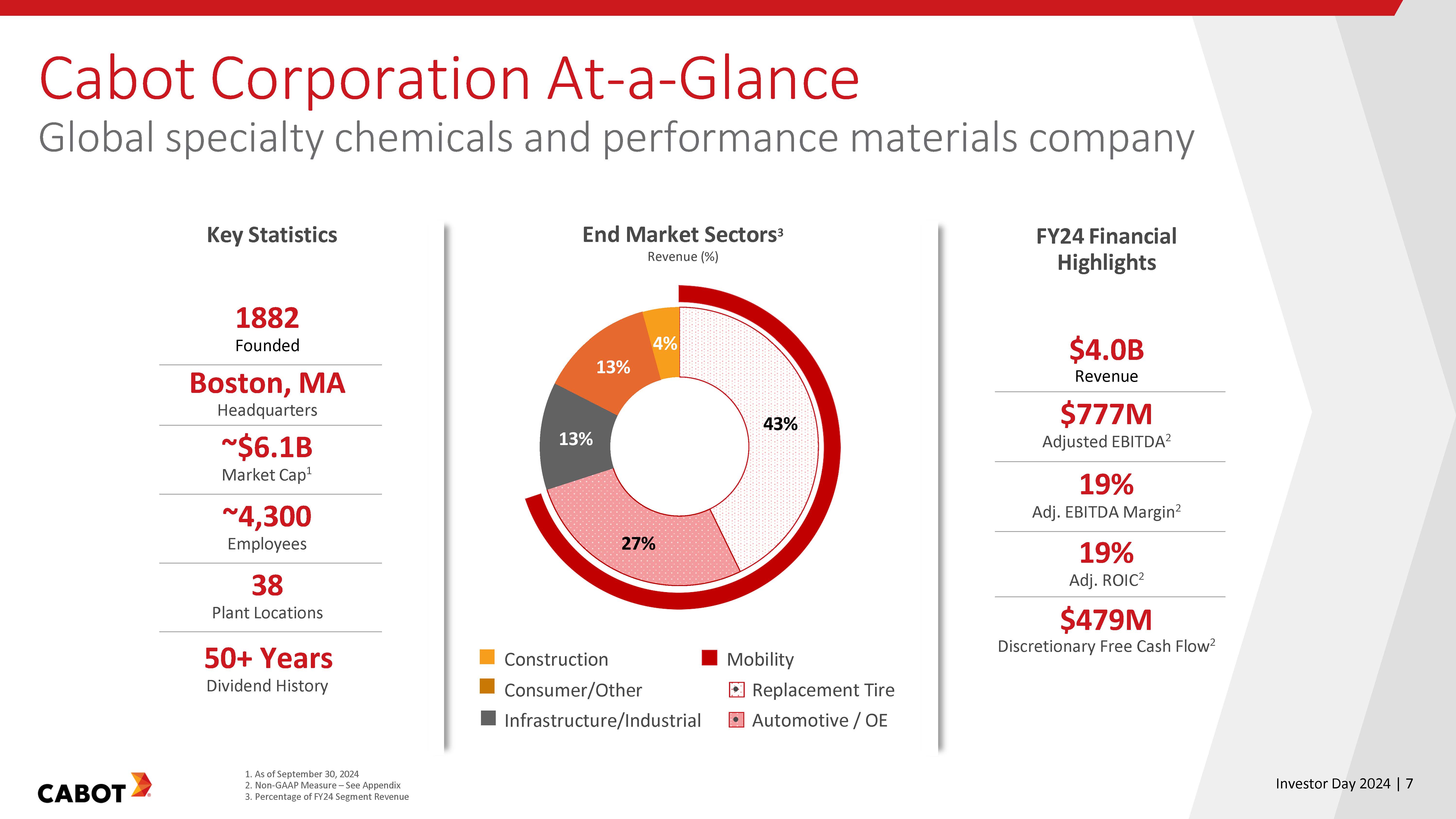

Cabot Corporation At-a-Glance Global specialty chemicals and performance materials company Key Statistics End Market Sectors3 Revenue (%) FY24 Financial Highlights 1882 Founded Boston, MA Headquarters ~$6.1B Market Cap1 ~4,300 Employees 38 Plant Locations 50+ Years Dividend History $4.0B Revenue $777M Adjusted EBITDA2 19% Adj. EBITDA Margin2 19% Adj. ROIC2 $479M Discretionary Free Cash Flow2 Construction Consumer/Other Infrastructure/Industrial Mobility Replacement Tire Automotive / OE 1. As of September 30, 2024 2. Non-GAAP Measure – See Appendix 3. Percentage of FY24 Segment Revenue Investor Day 2024 | 7

Segment Overview Broad range of products used in a wide variety of applications REINFORCEMENT MATERIALS Global leader with durable, growing earnings, and robust cash generation PERFORMANCE CHEMICALS Portfolio of leading high-growth, high-margin product lines, aligned with favorable macrotrends Reinforcing Carbons Engineered Elastomer Composites (E2C®) Specialty Carbons Specialty Compounds Fumed Metal Oxides Battery Material Aerogel Inkjet Colorants Investor Day 2024 | 8

Driving Growth Through Purpose, Strategy, and Values OUR PURPOSE Creating materials that improve daily life and enable a more sustainable future. OUR STRATEGY Creating for Tomorrow We will leverage our strengths to lead in performance and sustainability — today and into the future. OUR VALUES Integrity Respect Excellence Responsibility Investor Day 2024 | 9

Experienced Management Team Track record of success Year Joined Sean Keohane President & Chief Executive Officer Erica McLaughlin EVP, Chief Financial Officer & Head of Corporate Strategy Bart Kalkstein EVP & President, Reinforcement Materials, & Americas Region Jeff Zhu EVP & President, Carbon & Silica Technologies, Battery Materials & Asia Pacific Region Karen Kalita SVP & General Counsel 2002 2002 2005 2012 2008 Aaron Johnson SVP, Global Business Services, Global Engineering & Inkjet Jennifer Chittick SVP, Safety, Health & Environment & Chief Sustainability Officer Patricia Hubbard SVP & Chief Technology Officer Art Wood SVP & Chief Human Resources Officer Jaume Campaña SVP & President, EMEA Region & EMEA Regional Business Director, Reinforcement Materials Segment 2005 2012 2018 2017 1997 Seasoned Leadership Team with Strong Track Record of Execution Investor Day 2024 | 10

Experienced Board to Support Company Strategy Diverse Set of Expertise Accounting/ Finance Chemical Industry Corporate Governance Cybersecurity/ Information Systems International Markets/ Business Manufacturing P&L Responsibility Public Co CEO R&D/ Technology Related Value Chain Risk Management Strategic Planning Sustainability 2017 CHAIR 2016 2016 2018 2012 2018 2020 2022 2014 2005 2024 2019 Michael Morrow Chairman Former Partner, PwC Sean Keohane President and CEO, Cabot Corporation Dr. Michelle Williams Former Global Group President, Altuglas International (subsidiary of Arkema) Dr. Cynthia Arnold Former CTO, Valspar William Kirby Professor, Harvard Business School & Harvard University Frank Wilson Former CFO, PerkinElmer Douglas Del Grosso Former President and CEO, Adient Raffiq Nathoo Managing Partner, TX3 Sage Rock; Former Managing Director, Blackstone Dr. Matthias Wolfgruber Former CEO, Altana Juan Enriquez CEO, Biotechonomy Ventures; Managing Director, Excel Venture Management Thierry Vanlancker Managing Director, Aliaxis; Former CEO & Director of AkzoNobel NV Christine Yan Former President of Asia & VP of Integration, Stanley Black & Decker Strong Governance ~7yrs 25% 42% Average Tenure Female Diversity Independent committee dedicated to safety, health, environment and sustainability matters Investor Day 2024 | 11

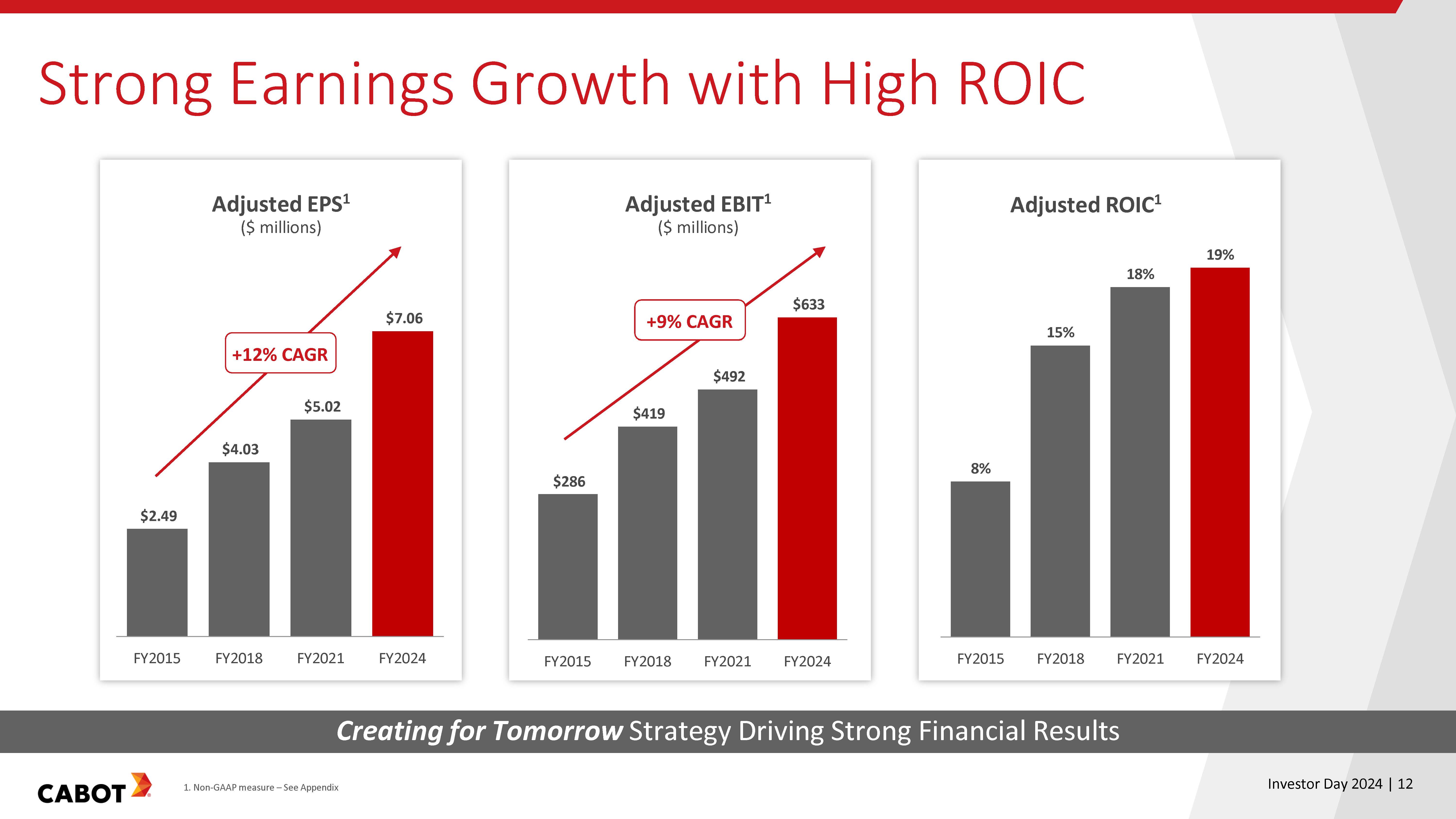

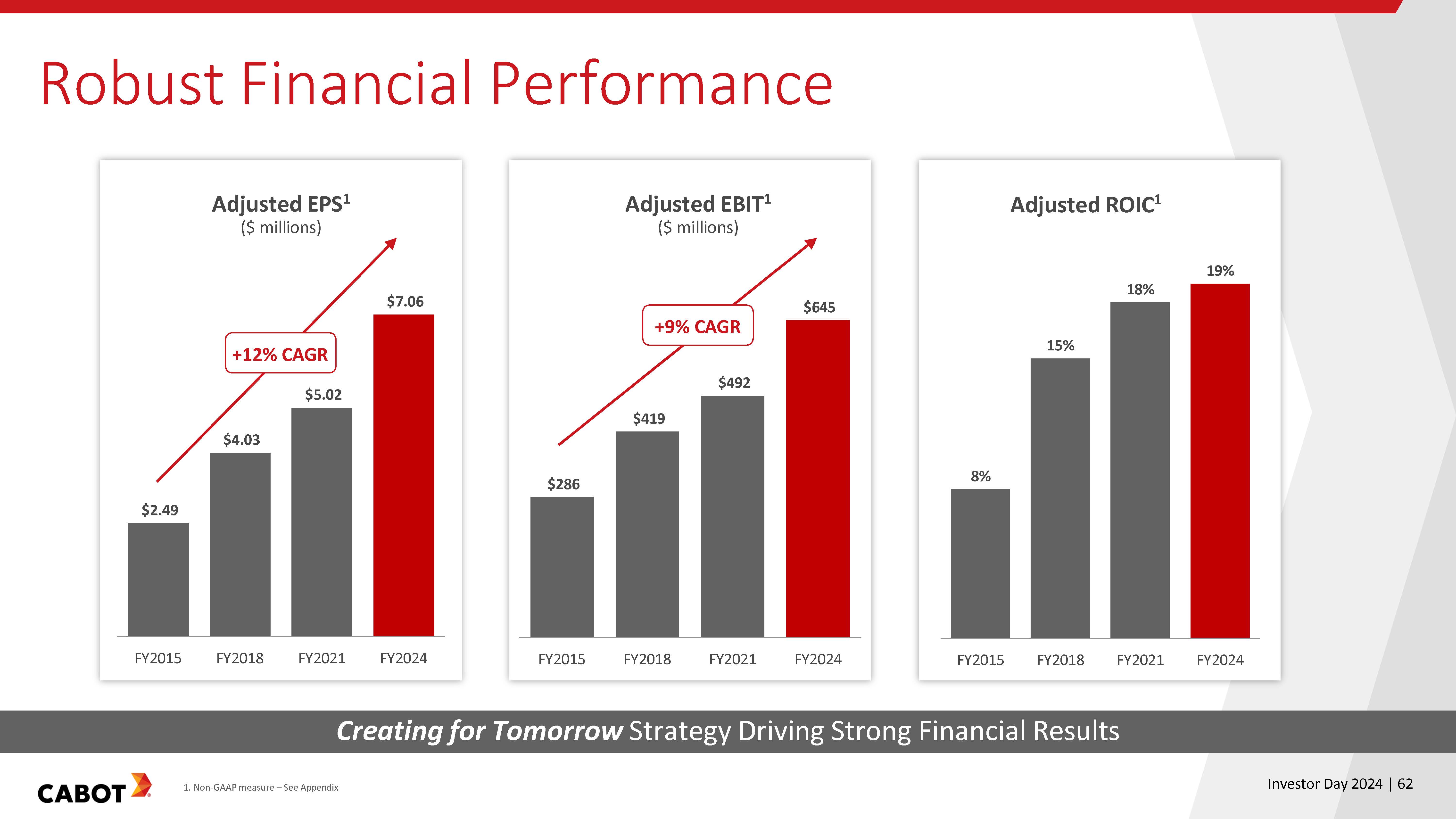

Strong Earnings Growth with High ROIC Adjusted EPS1 ($ millions) Adjusted EBIT1 ($ millions) Adjusted ROIC1 +12% CAGR +9% CAGR FY2015 FY2018 FY2021 FY2024 $2.49 $4.03 $5.02 $7.06 $286 $419 $492 $633 8% 15% 18% 19% Creating for Tomorrow Strategy Driving Strong Financial Results Investor Day 2024 | 12

Successful Execution of Our 2021 Investor Day Goals Adj. EPS1 Growth (3 Yr. CAGR)$7.06 $5.02 12% Achieved FY2021 FY2024 Cumulative DFCF1 Generation $1.2B >$1.0B 2021 Investor Day Target Actual Capital Priorities FY22-FY24 Capital expenditures focused on maintaining world class assets and high confidence, high return growth projects Paid $265 million in dividends, including a raise each fiscal year over this period Repurchased $323 million shares, more than offsetting dilution and reduced share count by 4% Total Adjusted Payout Ratio of 55%1,2 and Adjusted Cash Conversion Ratio of 63%1,3 1. Non-GAAP measure – See Appendix; 2. Total Payout Ratio = Dividends + Share Repurchases / Adjusted Net Income; 3. Cash Conversion Ratio = Operating Cash Flow / Adjusted EBITDA Investor Day 2024 | 13

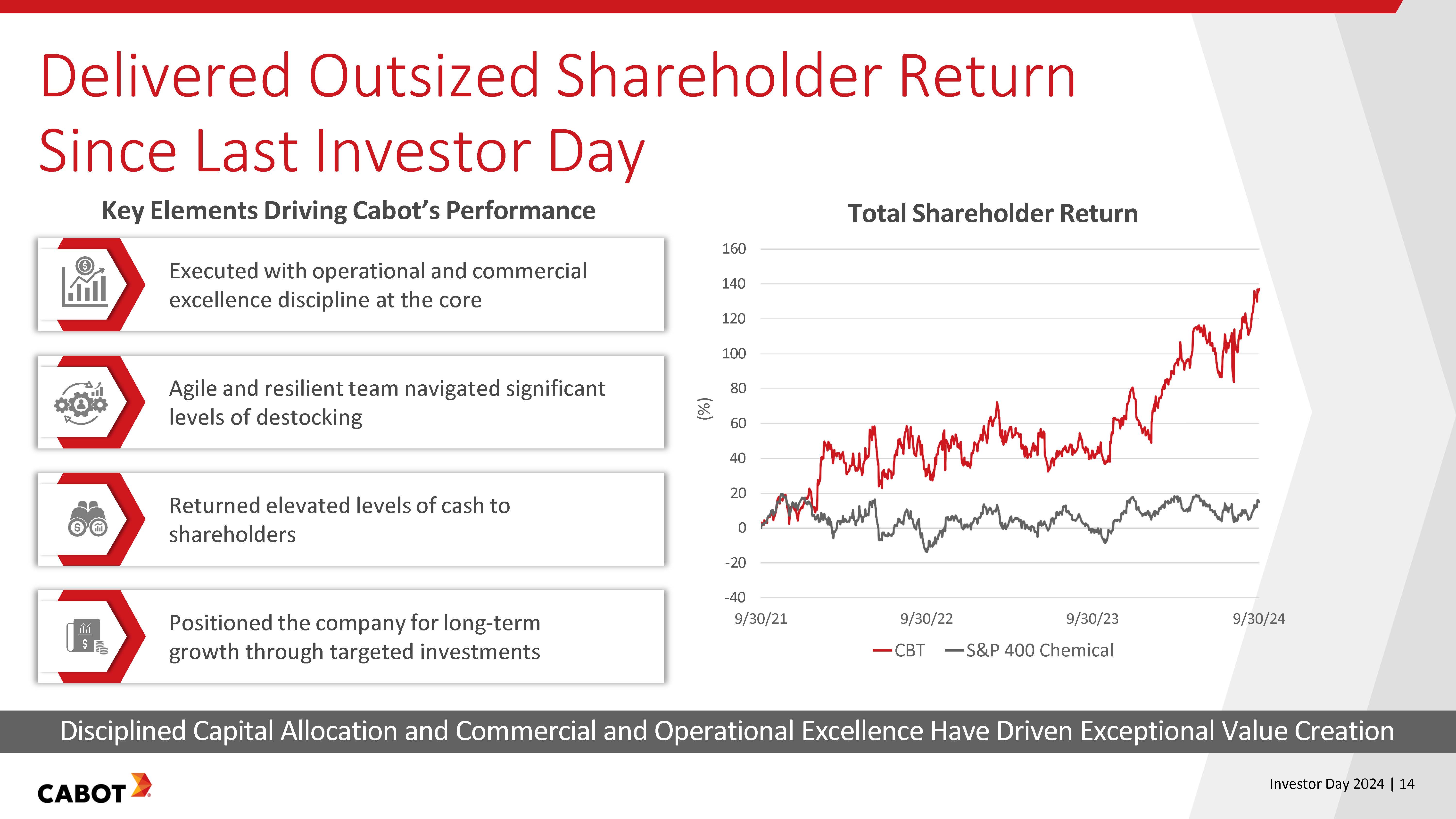

Delivered Outsized Shareholder Return Since Last Investor Day Key Elements Driving Cabot’s Performance Total Shareholder Return Executed with operational and commercial excellence discipline at the core Agile and resilient team navigated significant levels of destocking Returned elevated levels of cash to shareholders Positioned the company for long-term growth through targeted investments 9/30/21 9/30/22 9/30/23 9/30/24 Disciplined Capital Allocation and Commercial and Operational Excellence Have Driven Exceptional Value Creation Investor Day 2024 | 14

Our Competitive Advantages Unparalleled Global Footprint Exceptional talent: global perspective with local leaders Leading assets: flexibility through global manufacturing network Ability to support customers with local supply Innovative Technology Leadership Strong innovation heritage Deep application knowledge to meet complex customer requirements Complementary upstream and downstream value chain positions Extensive Product Portfolio Aligned to Key Macrotrends Positioned for growth in changing mobility landscape Capitalizing on global infrastructure buildout and alternative energy growth Driving sustainability with circular innovations and energy-efficient solutions Leadership in Sustainability Partner with customers to develop innovative, sustainable solutions Commitment to circularity in our operations and product offerings Creating value through sustainability investments Investor Day 2024 | 15

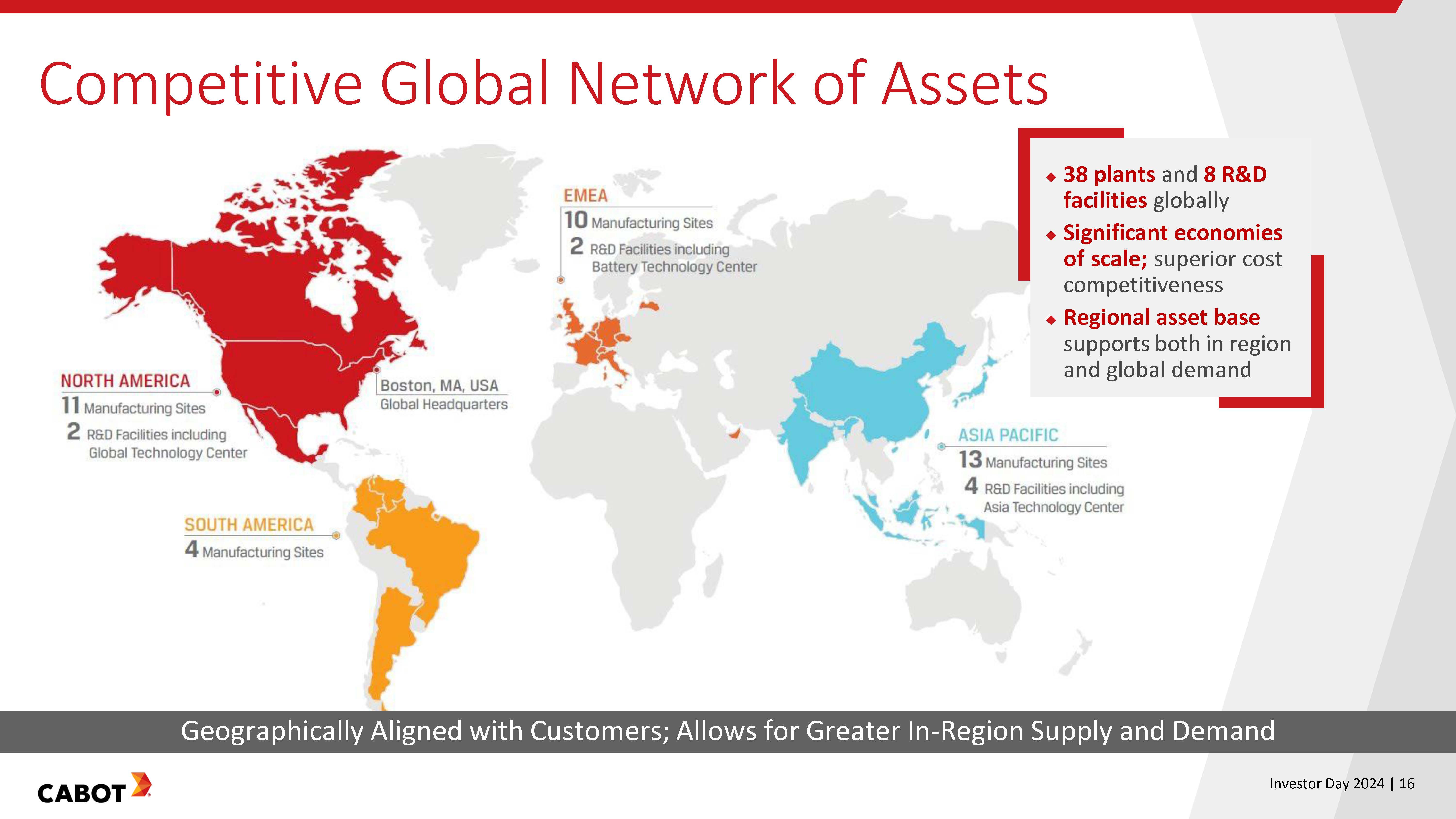

Competitive GlobalNetwork of Assets North America 11 manufacturing sites 2 R&d favilities including global technology center boston, ma,usa global headquarters south America manufacturing sites Emea 10 manufacturing sites 2 R&d facilities including battery technology center asia pacific 13 manufacturing sites 4 R&d facility including aisa technology center 38 plants and 8 R&D facilities globally Significant economies of scale; superior cost competitiveness Regional asset base supports both in region and global demand Geographically Alignedwith Customers; Allowsfor Greater In-Region Supply and Demand Investor Day 2024 | 16 Logo

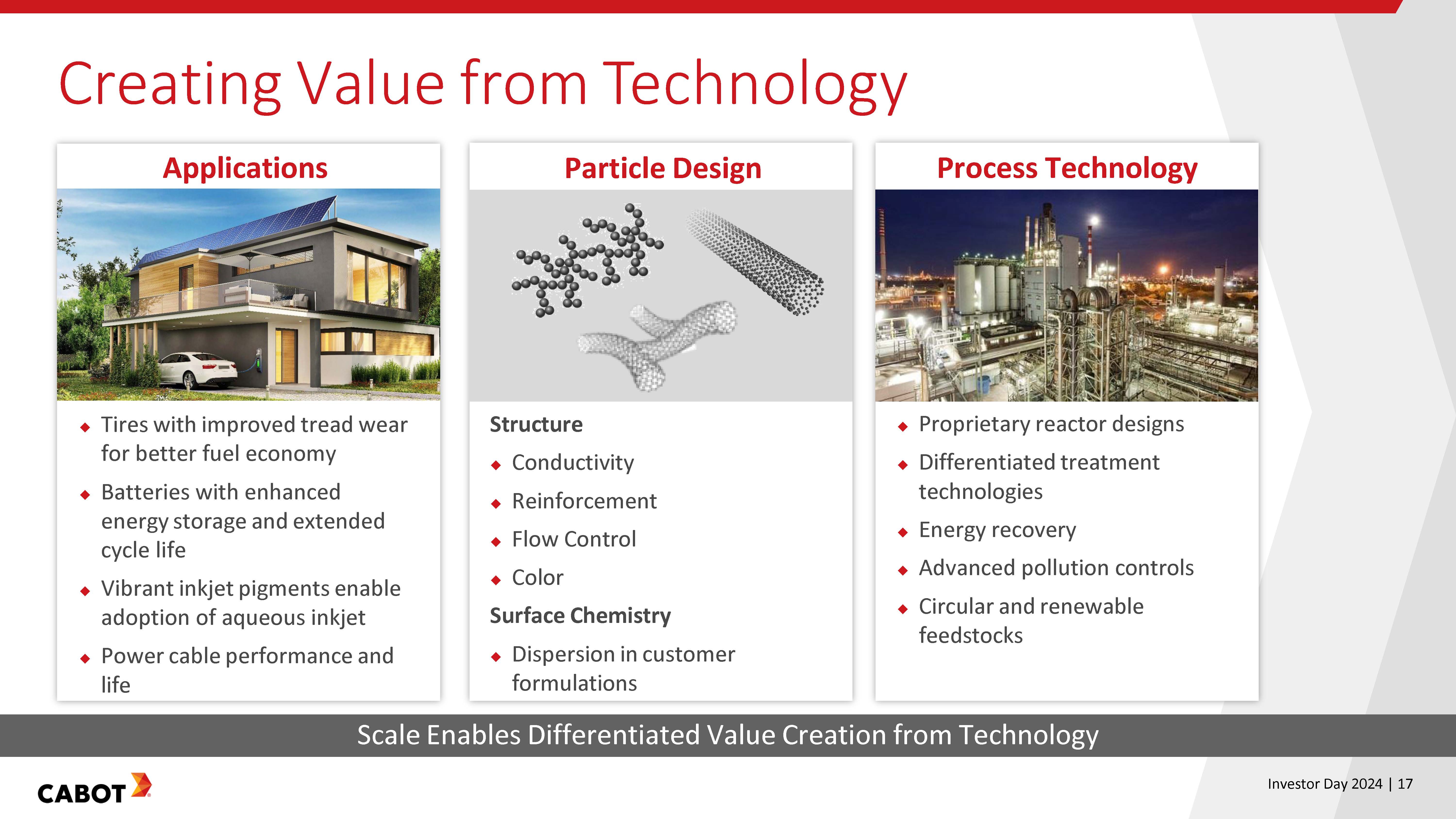

Creating Value from Technology Applications Particle DesignProcess Technology Tires with improved treadwear for better fuel economy Batteries with enhanced energy storageand extended cycle life Vibrant inkjetpigments enable adoption of aqueous inkjet Power cable performance and life Structure Conductivity Reinforcement Flow Control Color Surface Chemistry Dispersion in customerformulations Proprietary reactordesigns Differentiated treatment technologiesEnergy recovery Advanced pollution controlsCircular and renewable feedstocks Scale EnablesDifferentiated Value Creationfrom Technology Investor Day 2024 | 17 Logo

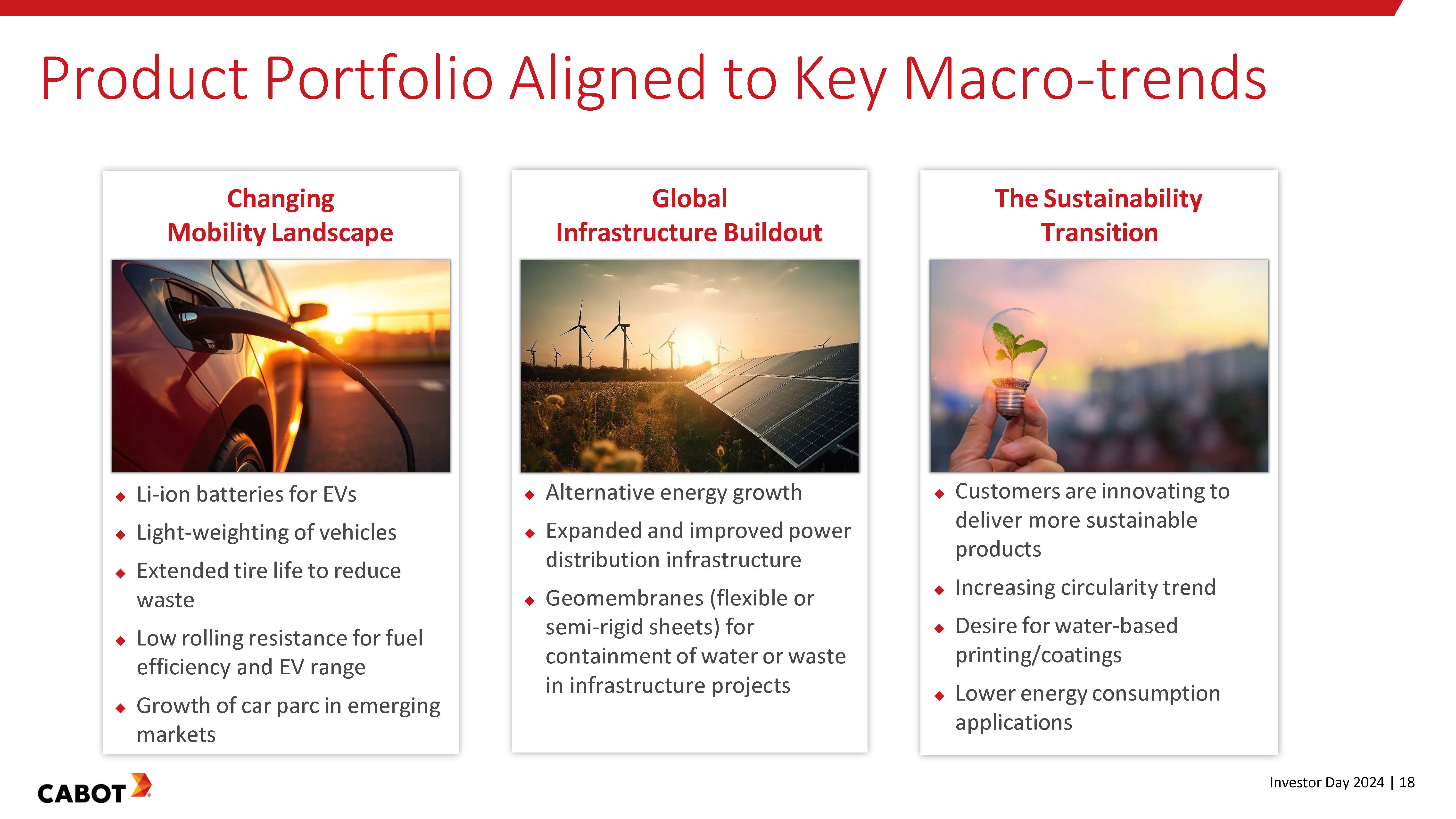

Product Portfolio Alignedto Key Macro-trends Changing Mobility Landscape Li-ion batteries for EVsLight-weighting of vehiclesExtended tire life to reduce wasteLow rolling resistance for fuel efficiency and EV range Growth of car parc in emerging markets Global Infrastructure BuildoutAlternative energy growth Expanded and improved power distribution infrastructure Geomembranes (flexible or semi-rigid sheets) for containment of water or waste in infrastructure projects The Sustainability Transition Customers are innovating to deliver more sustainable products Increasing circularity trend Desire for water-based printing/coatings Lower energy consumption applications Investor Day 2024 | 18 Logo

A Leader in Performance and Sustainability Innovative Solutions Responsible Operations Industry Recognition Battery Materials ENERMAX® CNS PROPEL® E Series Carbon Blacks E2C® Solutions EVOLVE® Sustainable Solutions Better Plants U.s Department of energy American chemistry council ic ba responsible care driving safety & sustainability America most responsible companies 2024 Newsweek statitsa platinum ecovadis ERJ Top 10 elastomers for sustainability Investor Day 2024 | 19 Logo

Our Strategy | Creating for Tomorrow Leverage our strengths to lead in performance and sustainability — today and into the future. GROW Investing for advantaged growth INNOVATE Developing innovative products and processes that enable a better future OPTIMIZE Driving continuous improvement in everything we do Investor Day 2024 | 20 Logo

Grow: Investments Create Foundation for Earnings Growth Specialty Compounds Capacity Addition Conductive Additives Dispersion Capacity Addition Specialty Carbons Capacity Addition Completed Projects Cilegon, Indonesia Zhuhai, China Xuzhou, China In-Process Projects Cilegon, Indonesia Port Dickson, Malaysia USA, Europe & China Reinforcing Carbons CapacityAddition E2C® Solutions Capacity Addition Carbon Nanotube & Dispersions Capacity Additions Investor Day 2024 | 21 Logo

Grow: Growth Vector Update Investments expected to drive long-term earnings growth Battery Materials Leading manufacturer with broad suite of conductive additives, fumed metal oxides and aerogel for lithium-ion batteries Selected for award negotiation on a $50M grant from the U.S. Department of Energy to establish the first U.S. production facility for battery-grade CNTs and conductive additive dispersions, with final terms expected by January 2025 Inkjet Transition from analog to digital printing underway, specifically in packaging and other industrial print segments, accelerating demand for Cabot aqueous inkjet colorants Leveraging our capabilities and breadth of technology to win in the packaging market E2C® Solutions Lifecycle assessment shows that E2C can significantly reduce vehicle emissions and environmental impact Continued growth expected driven by large off- the-road tires, Malaysia site capacity addition Truck, bus and radial (TBR) next growth segment; multiple customer road tests underway to confirm E2C value proposition Building Positions in Attractive Markets Where We Have a "Right to Win" Investor Day 2024 | 22 Logo

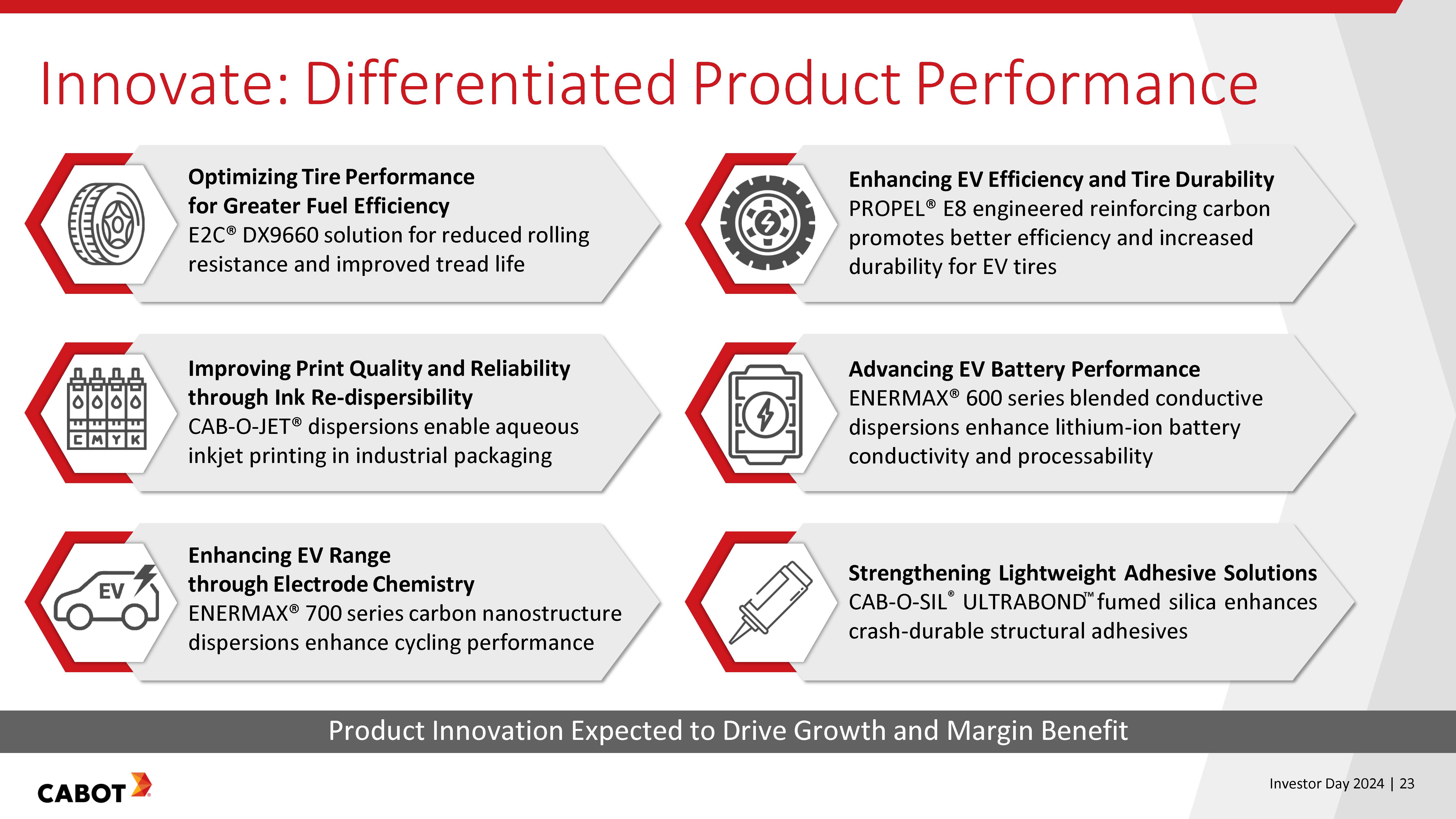

Innovate: Differentiated ProductPerformance Optimizing TirePerformance for Greater Fuel Efficiency E2C® DX9660 solution for reduced rolling resistance and improved tread life Enhancing EV Efficiency and Tire Durability PROPEL® E8 engineered reinforcing carbon promotes better efficiency and increased durability for EV tires Improving Print Qualityand Reliability through Ink Re-dispersibility CAB-O-JET® dispersions enable aqueous inkjet printing in industrial packaging Advancing EV Battery Performance ENERMAX® 600 series blendedconductive dispersions enhance lithium-ion battery conductivity and processability Enhancing EV Range through Electrode Chemistry ENERMAX® 700 series carbon nanostructure dispersions enhance cycling performance Strengthening Lightweight Adhesive Solutions CAB-O-SIL® ULTRABOND fumed silica enhances crash-durable structural adhesives Product Innovation Expected to Drive Growth and Margin Benefit Day 2024 | 23 Logo

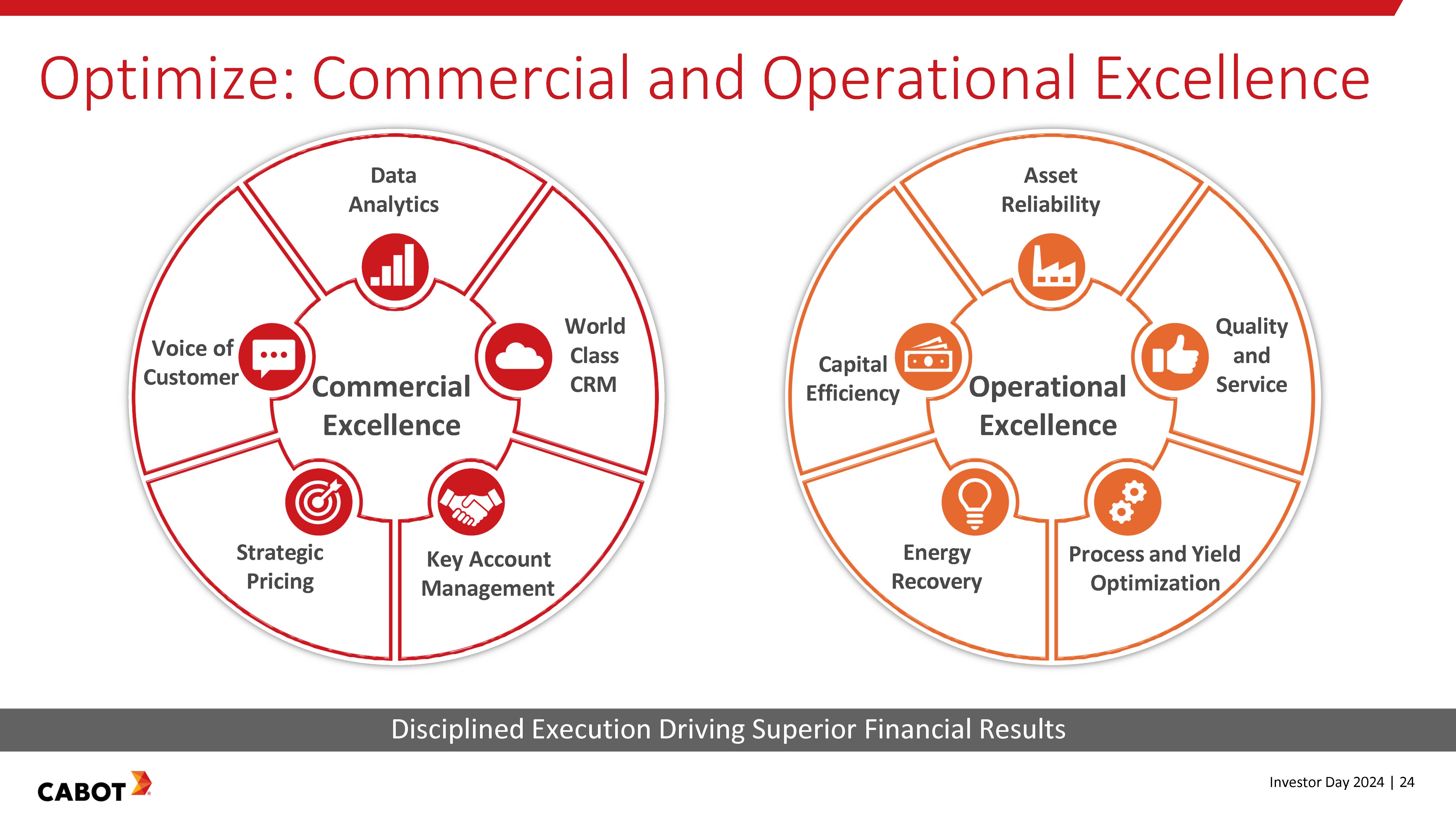

Optimize: Commercial and Operational Excellence Data AnalyticsVoice of Customer Commercial Excellence World Class CRM Strategic Pricing Key Account Management Asset Reliability CapitalEfficiency Operational Excellence Process and Yield Optimization Energy Recovery Disciplined Execution Driving Superior Financial Results Investor Day 2024 | 24 Logo

Our PathForward 2025-2027 Strong Growth Trajectory Growth underpinned by macro-trends in Changing Mobility Landscape, Global Infrastructure Buildout, and the Sustainability Transition Maintain attractive RONA Continued Strong Cash Generation Disciplined approach to working capital execution to support robust cash flow levels Expect to deliver a new higher level of discretionary free cash flow1 Fund advantaged growth investments in markets with strong "Right to Win" Commitment to Capital Return Committed to a growing and industry competitive dividend Continued share repurchases expected as a use for strong cash flow Recent board authorization for a 10 million share repurchase program (>$1 billion)2 Winning the Sustainability Transition Strengthening global battery supply chain to enable EV transition Expanding commercial success of E2C® solutions and Inkjet for packaging EVOLVE® Sustainable Solutions portfolio designed to deliver lower carbon, circular materials without compromising performance Non-GAAP measure– See Appendix. 2. >$1Billion of Share Repurchase authorization is based on 10 millionauthorization shares x Cabot’s 9/30/24 ending share price Investor Day 2024 | 25

2025-2027 Corporate Targets Positioned to deliver continued strong financial performance Expect Adjusted EPS1 CAGR of 7-10% $0.9-$1 billion of Adjusted EBITDA1 expected by FY2027 Non-GAAP measure– See Appendix Investor Day 2024 | 25 Logo

Key Takeaways Market Leader with Size and Scale Strong Track Record of Execution Proven Ability to Deliver Customer Value Well-Positioned to Win the Sustainability Transition Clear Strategy to Achieve Targets Investor Day 2024 | 27 Logo

Reinforcement Materials Bart Kalkstein EVP & President, Reinforcement Materials & Americas Region Logo

Reinforcement Materials | Key Messages Global Leader with Robust Cash Generation Strong Operator with Track Record of Execution Targeted Capacity Growth in Advantaged Geographies Sustainable Solutions for the Mobility Evolution Global footprint serving leading tire and industrial rubber products customers while generating strong EBITDA margins and cash flows Continuous improvement in commercial and operational excellence drives differentiated performance Organic and potential inorganic investments in capacity expansions to drive further growth Engineered Elastomer Composite (E2C®) and EVOLVE® sustainable solutions drive better tire performance and enable incorporation of sustainable materials for today’s tires and the growing electric vehicle (EV) fleet Investor Day 2024 | 29 Logo

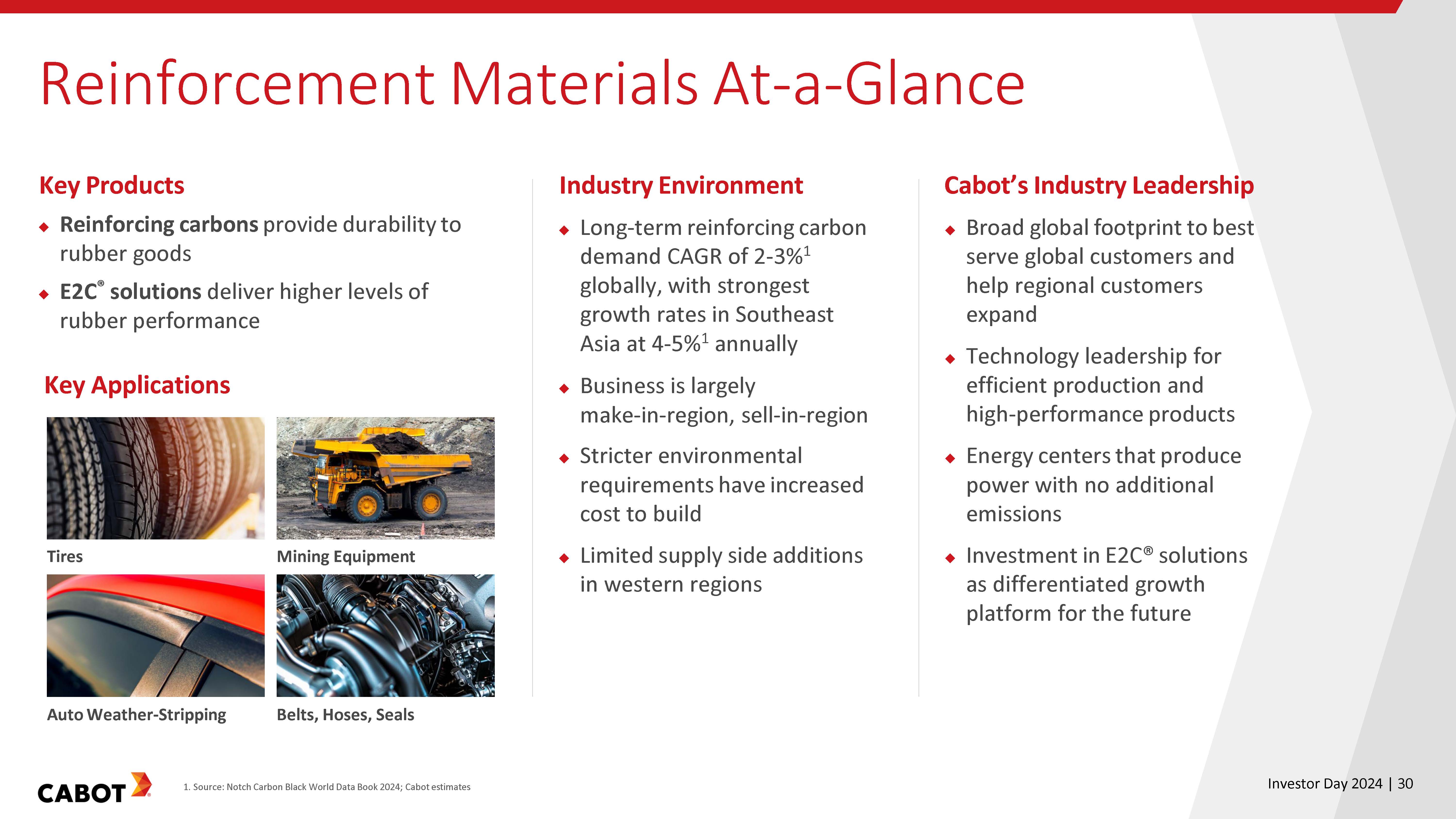

Reinforcement Materials At-a-Glance Key Products Reinforcing carbons provide durability to rubber goods E2C® solutions deliver higher levels of rubber performance Key Applications Industry Environment Long-term reinforcing carbon demand CAGR of 2-3%1 globally, with strongest growth rates in Southeast Asia at 4-5%1 annually Business is largely make-in-region, sell-in-region Stricter environmental requirements have increased cost to build Limited supply side additions in western regions Cabot’s Industry Leadership Broad global footprint to best serve global customers and help regional customers expand Technology leadership for efficient production and high-performance products Energy centers that produce power with no additional emissions Investment in E2C® solutions as differentiated growth platform for the future Auto Weather-Stripping Belts, Hoses,Seals Source: Notch Carbon Black World Data Book 2024; Cabot estimatesInvestor Day 2024 | 30

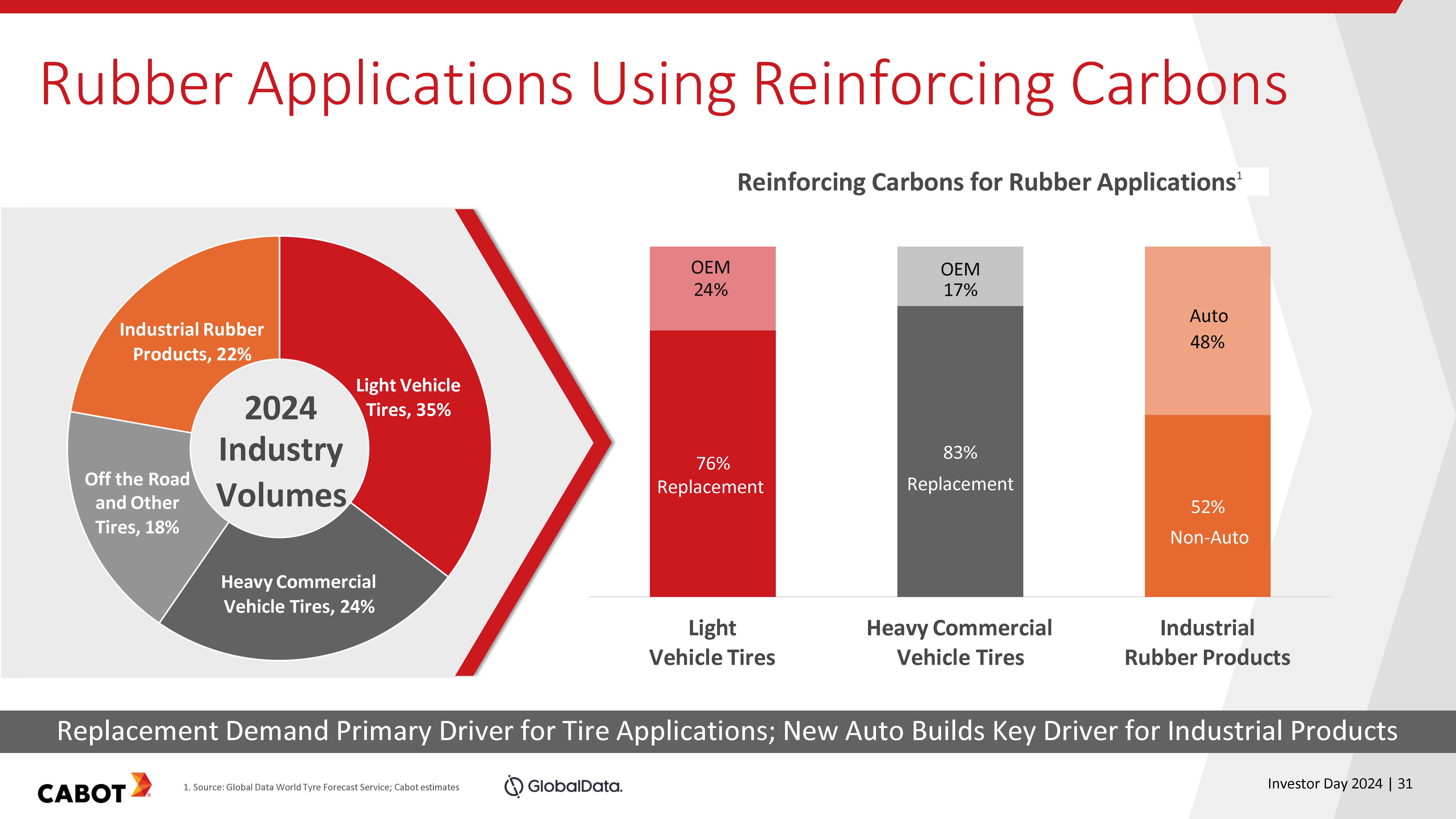

Rubber Applications Using Reinforcing Carbons Industrial Rubber Products, 22% Light Vehicle Tires, 35% Off the Road and Other Tires, 18% 2024 Industry Volumes Heavy Commercial Vehicle Tires, 24% Reinforcing Carbons for Rubber Applications 1 OEM 24% 76% Replacement OEM 17% 83% Replacement Auto 48% 52% Non-Auto Light Vehicle Tires Heavy Commercial Vehicle Tires Industrial Rubber Products Replacement Demand Primary Driver for Tire Applications; New Auto Builds Key Driver for Industrial Products cabot 1. Source: Global Data World Tyre Forecast Service; Cabot estimates Globaldata Investor Day 2024 | 31

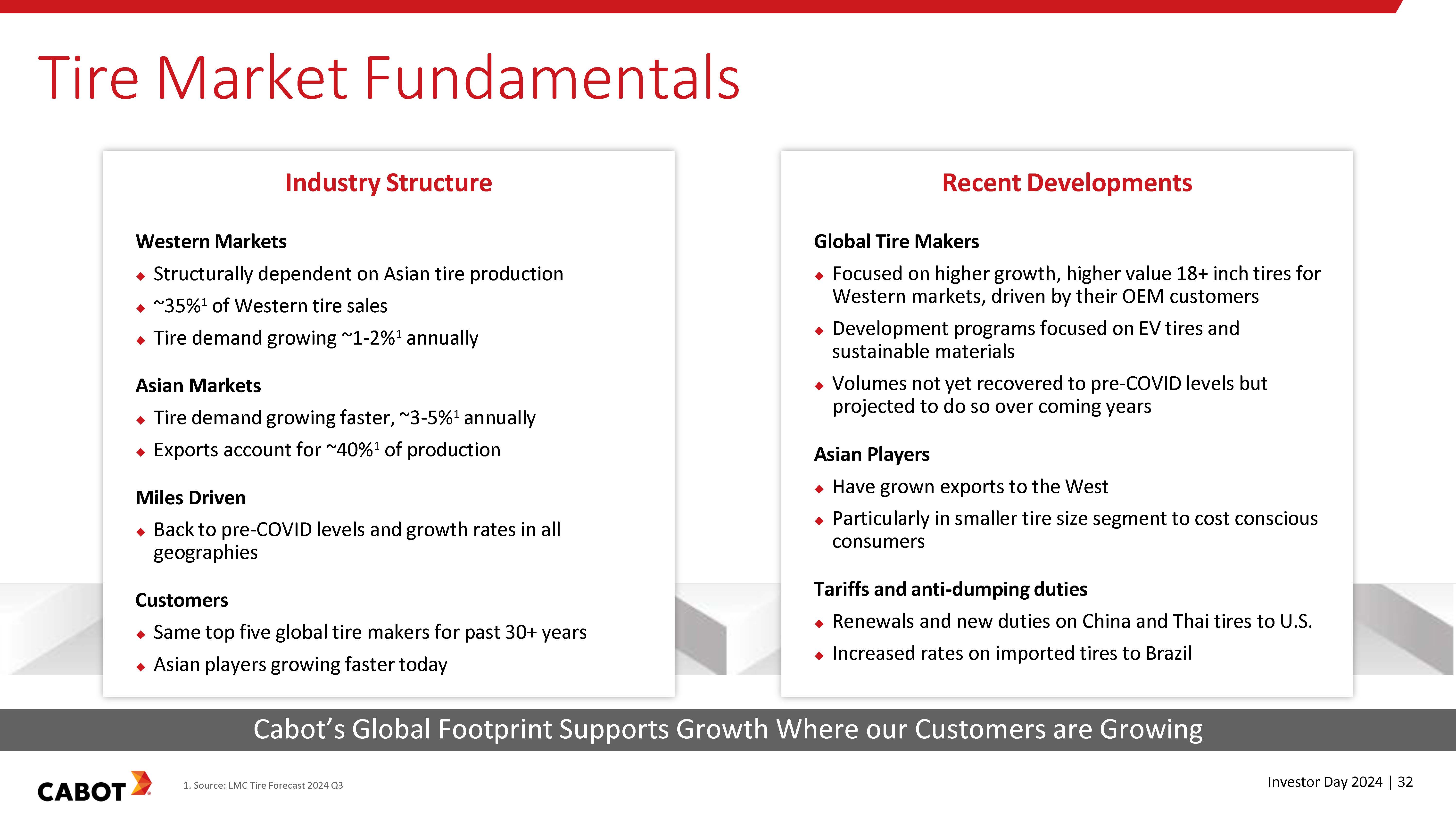

Tire Market Fundamentals Industry Structure Western Markets Structurally dependent on Asian tire production ~35%1 of Western tire sales Tire demand growing ~1-2%1 annually Asian Markets Tire demand growing faster, ~3-5%1 annually Exports account for ~40%1 of production Miles Driven Back to pre-COVID levels and growth rates in all geographies Customers Same top five global tire makers for past 30+ years Asian players growing faster today Recent Developments Global Tire Makers Focused on higher growth, higher value 18+ inch tires for Western markets, driven by their OEM customers Development programs focused on EV tires and sustainable materials Volumes not yet recovered to pre-COVID levels but projected to do so over coming years Asian Players Have grown exports to the West Particularly in smaller tire size segment to cost conscious consumers Tariffs and anti-dumping duties Renewals and new duties on China and Thai tires to U.S.Increased rates on imported tires to Brazil Cabot’s Global Footprint Supports Growth Where our Customers are Growing CABOT 1. Source: LMC Tire Forecast 2024 Q3 Investor Day 2024 | 32

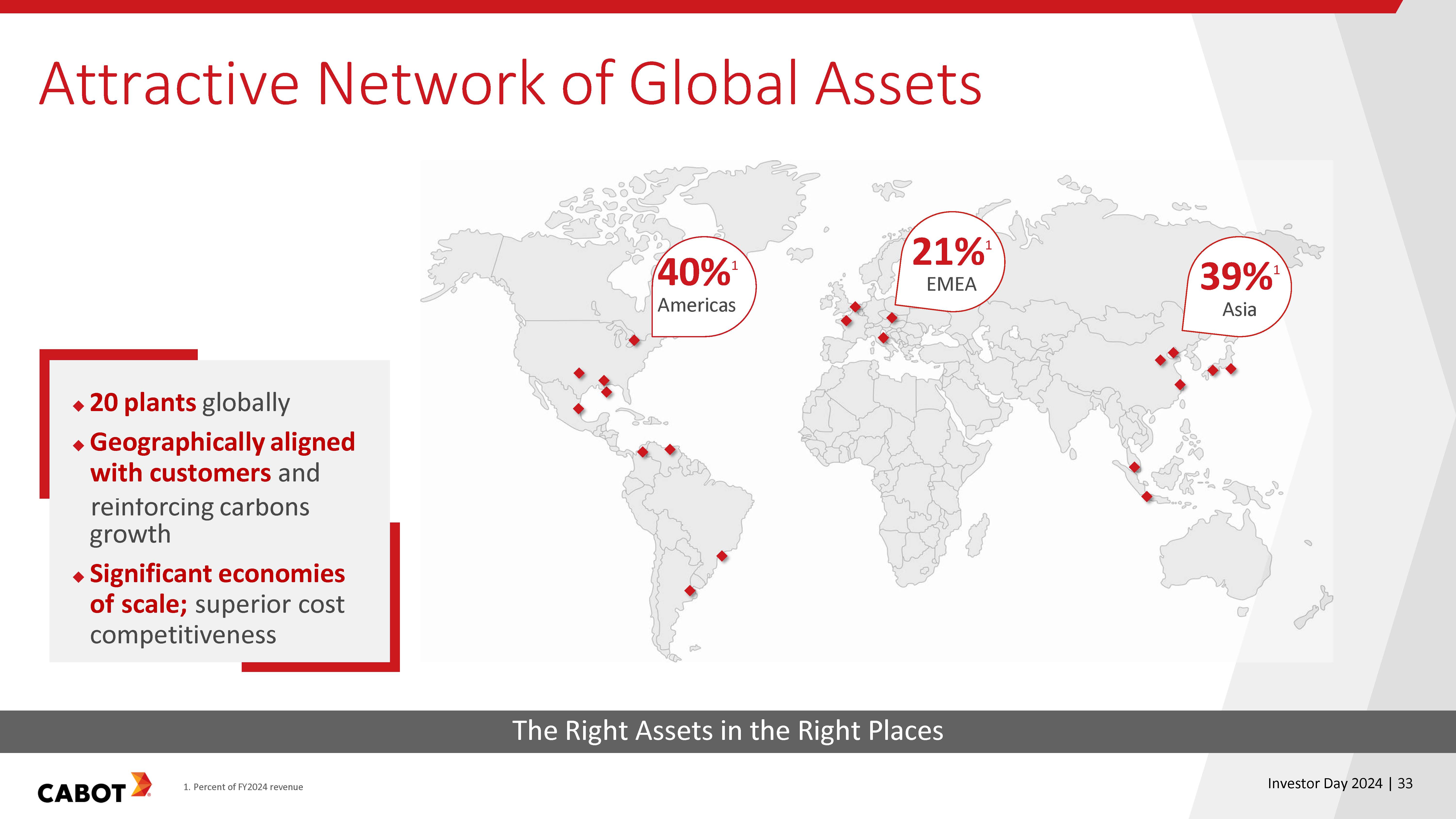

Attractive Network of Global Assets 20 plants globally Geographically aligned with customers and reinforcing carbons growth Significant economies of scale; superior cost competitiveness The Right Assets in the Right Places 40% 1 americas 21% 1 EMEA 39% ASIA CABOT 1. Percent of FY2024 revenue Investor Day 2024 | 33

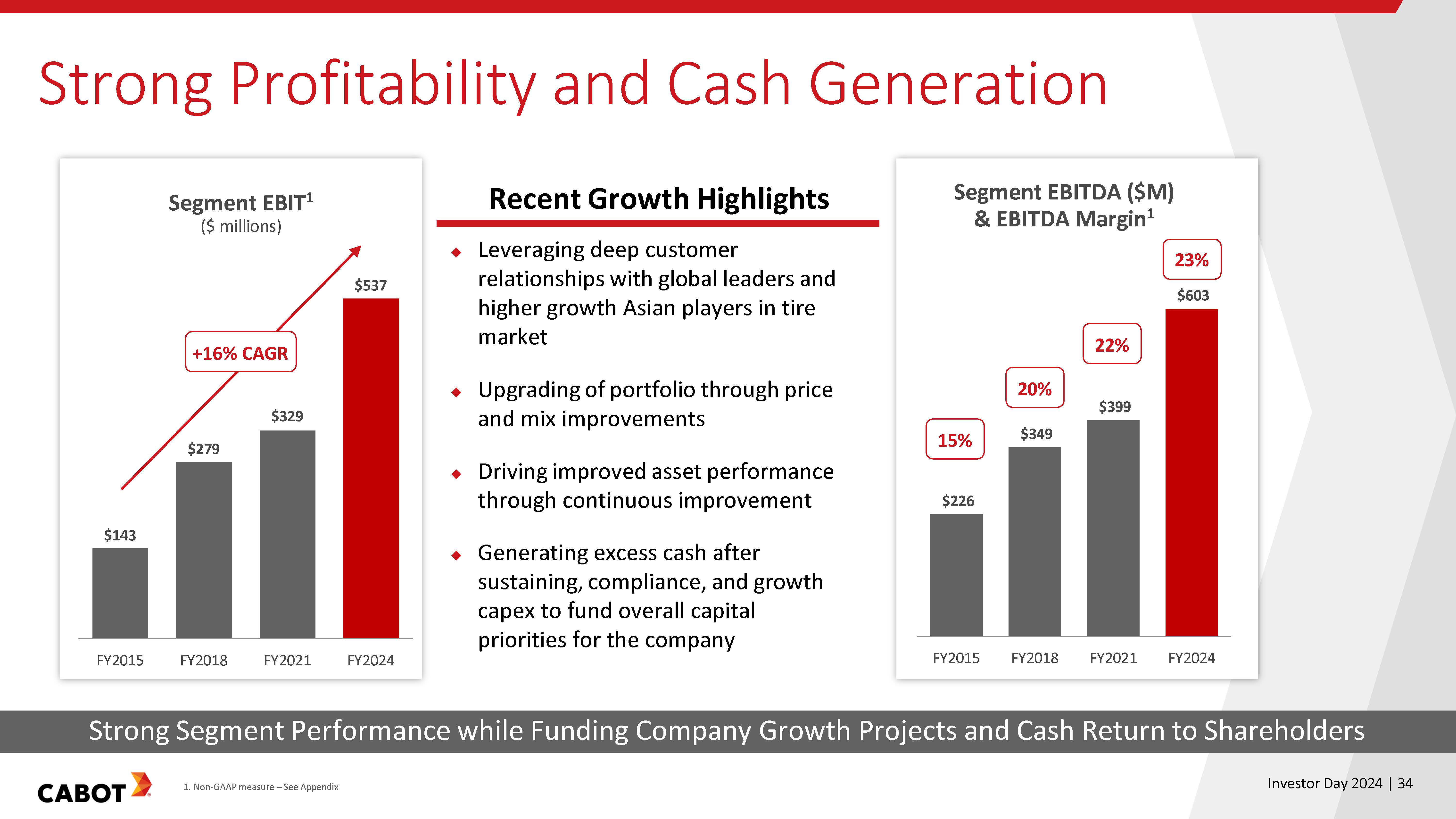

Strong Profitability and Cash Generation Recent Growth Highlights Leveraging deep customer relationships with global leaders and higher growth Asian players in tire market Upgrading of portfolio through price and mix improvements Driving improved asset performance through continuous improvement Generating excess cash after sustaining, compliance, and growth capex to fund overall capital priorities for the company SEGMENT EBIT 1 ($ MILLIONS) +16%CAGR $143 $279 $329 $537 FY2015 FY2018 FY2021 FY2024 Segment EBITDA ($M) & EBITDA Margin1 15% 20% 22% 23% $226 $349 $399 $603 FY2015 FY2018 FY2021 FY2024 Strong Segment Performance while Funding Company Growth Projects and Cash Return to Shareholders 1. Non-GAAP measure – See Appendix CABOT Investor Day 2024 | 34

Key Growth Levers for Reinforcement Materials Continued Margin Improvement through Commercial and Operational Excellence Winning the Sustainability Transition Investing in Targeted Capacity Additions Capitalizing on the Changing Mobility Landscape for Future Volume Growth Levers Expected to Drive Margin and Volume Growth cabot Investor Day 2024 | 35

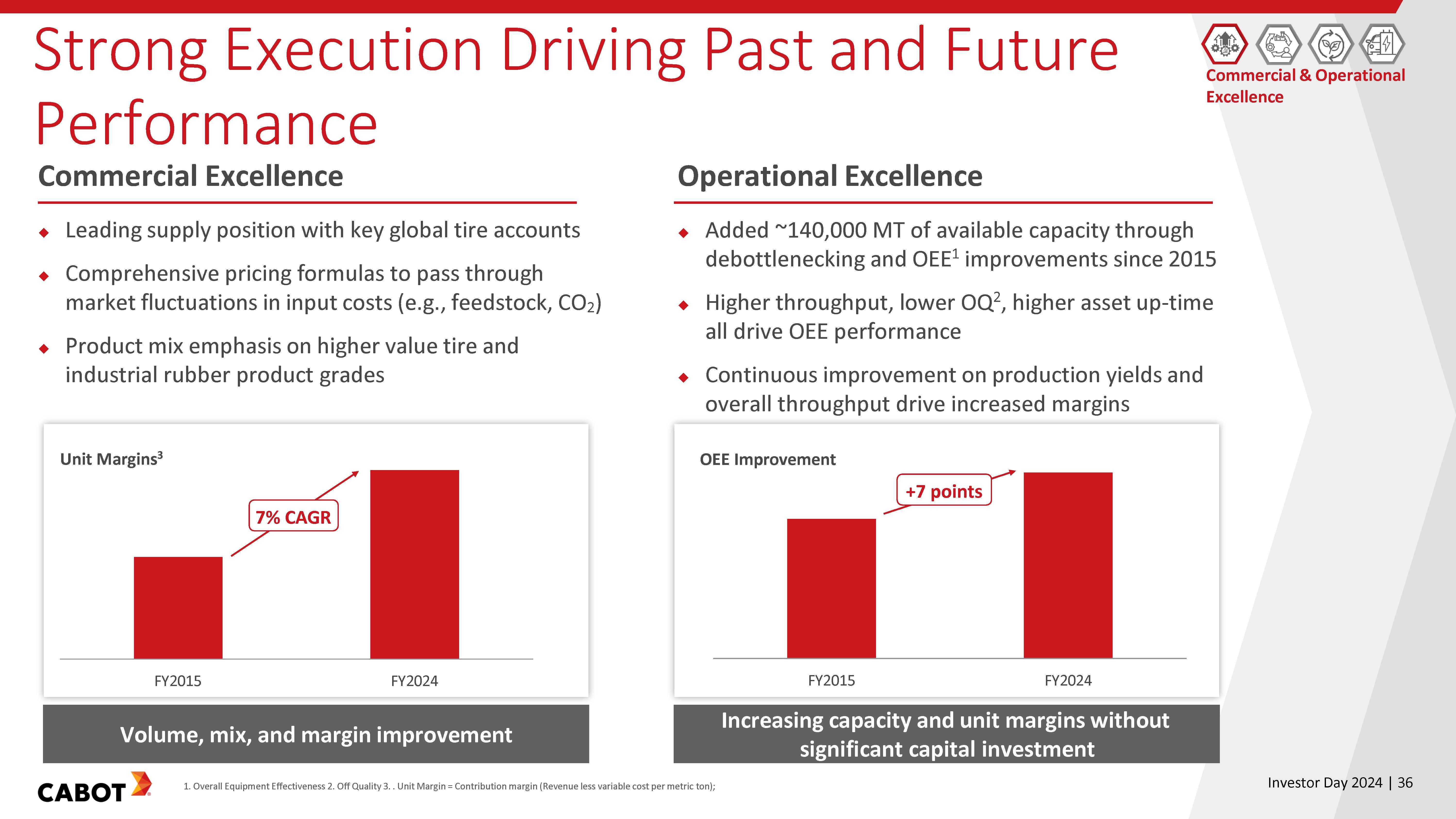

Strong Execution Driving Past and Future Performance Commercial Excellence Leading supply position with key global tire accounts Comprehensive pricing formulas to pass through market fluctuations in input costs (e.g., feedstock, CO2) Product mix emphasis on higher value tire and industrial rubber product grades Unit Margins3 7% CAGR FY2015 FY2024 Volume, mix, and margin improvement Operational Excellence Added ~140,000 MT of available capacity through debottlenecking and OEE1 improvements since 2015 Higher throughput, lower OQ2, higher asset up-time all drive OEE performance Continuous improvement on production yields and overall throughput drive increased margins OEE Improvement +7 points FY2015 FY2024 Increasing capacity and unit margins without significant capital investment Commercial & Operational Excellence 1. Overall Equipment Effectiveness 2. Off Quality 3. . Unit Margin = Contribution margin (Revenue less variable cost per metric ton); cabot Investor Day 2024 | 36

Indonesia Capacity Expansion Capacity Additions Expansion project to support growth of local reinforcing carbons market Cabot is the only reinforcing carbons producer in Indonesia Southeast Asia is the fastest growing region in the world Region is short of capacity, relies on imports Expansion expected to nearly double plant capacity Local supply means shorter lead times, lower inventory levels for customers Expansion expected to be commissioned in mid-2025 Continuing to Explore Targeted Opportunities in Advantaged Geographies cabot Investor Day 2024 | 37

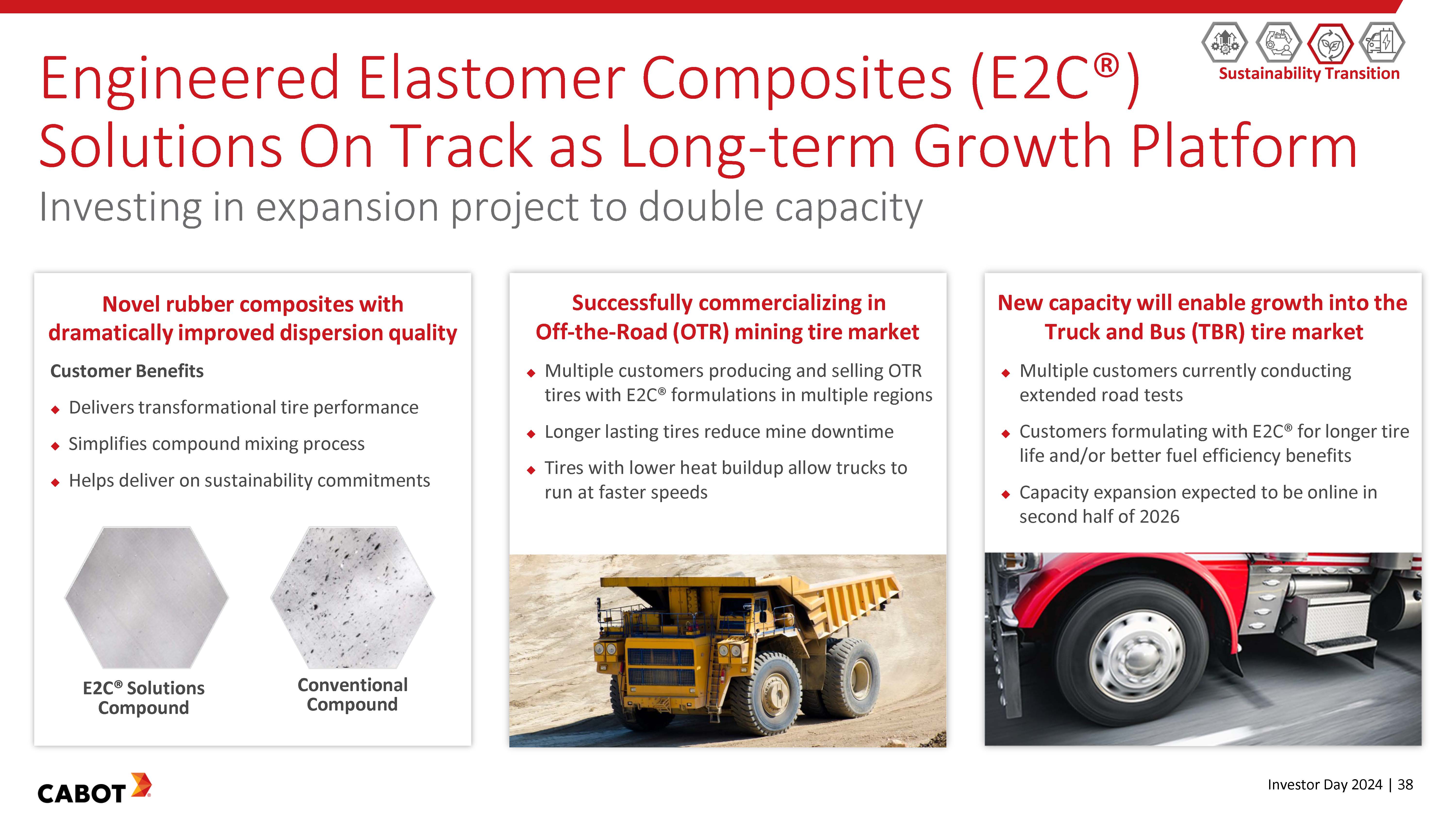

Engineered Elastomer Composites (E2C®) Sustainability Transition Solutions On Track as Long-term Growth Platform Investing in expansion project to double capacity Novel rubber composites with dramatically improved dispersion quality Customer Benefits Delivers transformational tire performance Simplifies compound mixing process Helps deliver on sustainability commitments E2C® Solutions Compound Conventional Compound Successfully commercializing in Off-the-Road (OTR) mining tire market Multiple customers producing and selling OTR tires with E2C® formulations in multiple regions Longer lasting tires reduce mine downtime Tires with lower heat buildup allow trucks to run at faster speedsNew capacity will enable growth into the Truck and Bus (TBR) tire market Multiple customers currently conducting extended road tests Customers formulating with E2C® for longer tire life and/or better fuel efficiency benefits Capacity expansion expected to be online in second half of 2026 cabot Investor Day 2024 | 38

EVOLVE® Sustainable Solutions EVOLVE Sustainable Solutions is a technology platform for delivering more sustainable reinforcing carbons and other performance materials Products powered by EVOLVE Sustainable Solutions offer sustainable content with reliable performance at industrial scale Sustainability Transition RENEWABLE RECOVERED REDUCED Seven Cabot Sites Now ISCC+ Certified for EVOLVE Production cabot Investor Day 2024 | 39

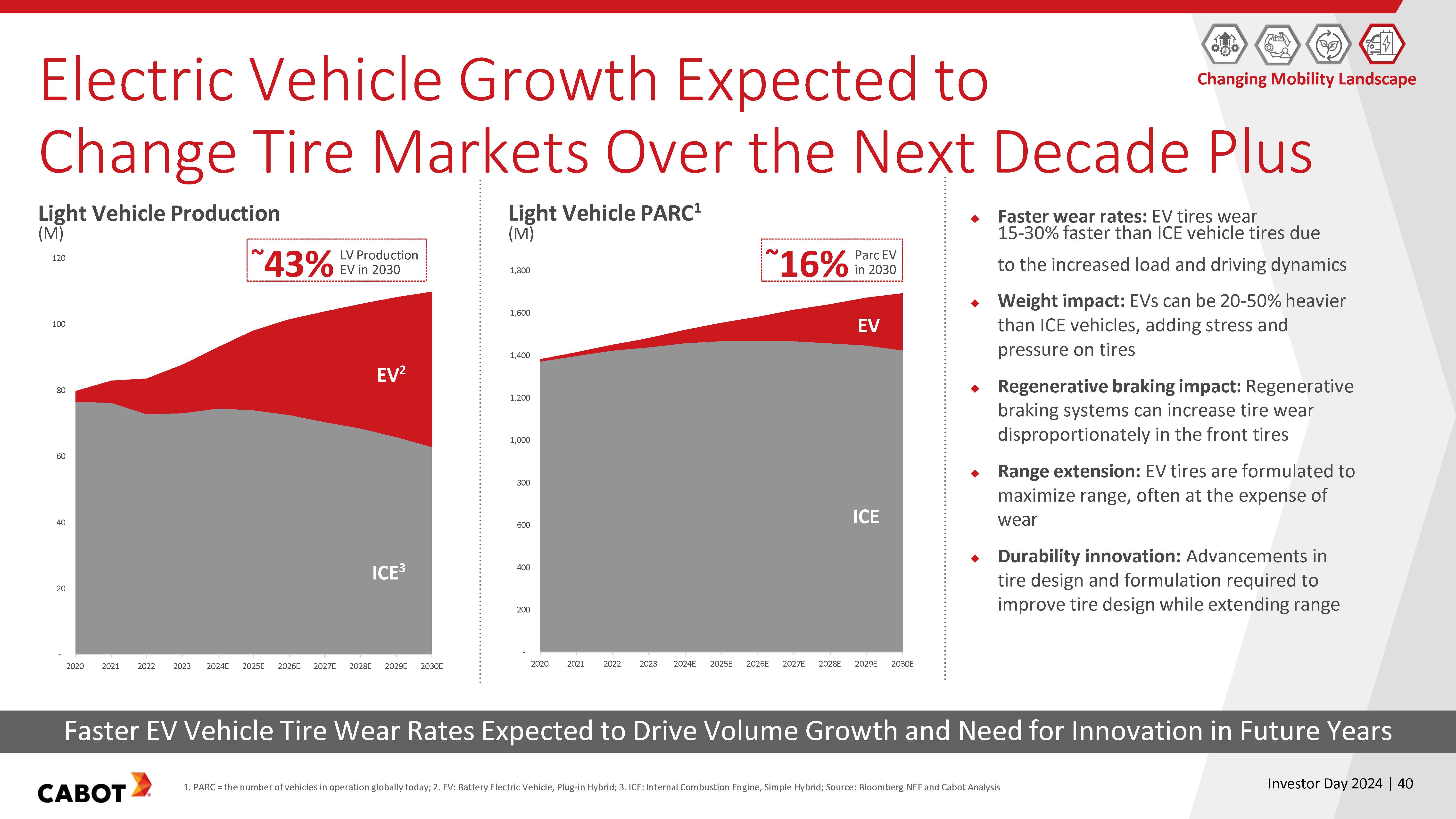

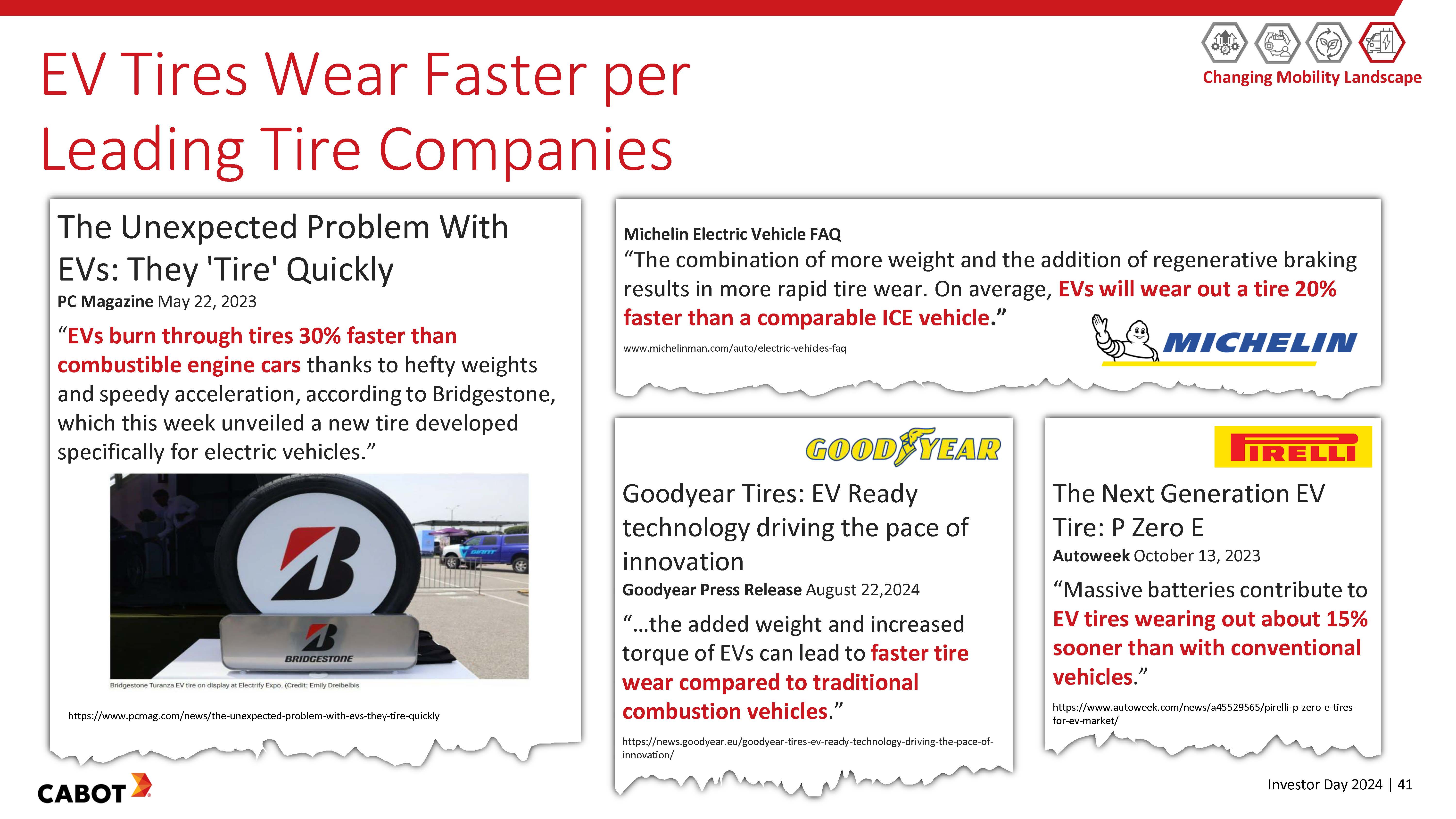

Electric Vehicle Growth Expected to Changing Mobility Landscape Change Tire Markets Over the Next Decade Plus Changing Mobility Landscape Light Vehicle Production (M) 120 100 80 60 40 20 ~43% LV Production EV in 2030 EV2 ICE3 2020 2021 2022 2023 2024E 2025E 2026E 2027E 2028E 2029E 2030E Light Vehicle PARC1 (M) ~16% Parc EV in 2030 1,800 1,600 1,400 1,200 1,000 800 600 400 200 ~16% Parc EV in 2030 2020 2021 2022 2023 2024E 2025E 2026E 2027E 2028E2029E 2030E Faster wear rates: EV tires wear 15-30% faster than ICE vehicle tires due to the increased load and driving dynamics Weight impact: EVs can be 20-50% heavier than ICE vehicles, adding stress and pressure on tires Regenerative braking impact: Regenerative braking systems can increase tire wear disproportionately in the front tires Range extension: EV tires are formulated to maximize range, often at the expense of wear Durability innovation: Advancements in tire design and formulation required to improve tire design while extending range Faster EV Vehicle Tire Wear Rates Expected to Drive Volume Growth and Need for Innovation in Future Years 1. PARC = the number of vehicles in operation globally today; 2. EV: Battery Electric Vehicle, Plug-in Hybrid; 3. ICE: Internal Combustion Engine, Simple Hybrid; Source: Bloomberg NEF and Cabot Analysis cabot Investor Day 2024 | 40

EV Tires Wear Faster per Leading Tire Companies The Unexpected Problem With EVs: They 'Tire' Quickly PC Magazine May 22, 2023 “EVs burn through tires 30% faster than combustible engine cars thanks to hefty weights and speedy acceleration, according to Bridgestone, which this week unveiled a new tire developed specifically for electric vehicles.” Michelin Electric Vehicle FAQ “The combination of more weight and the addition of regenerative braking results in more rapid tire wear. On average, EVs will wear out a tire 20% faster than a comparable ICE vehicle.” www.michelinman.com/auto/electric-vehicles-faq MICHELIN Goodyear Tires: EV Ready technology driving the pace of innovation Goodyear Press Release August 22,2024 “…the added weight and increased torque of EVs can lead to faster tire wear compared to traditional combustion vehicles.” https://news.goodyear.eu/goodyear-tires-ev-ready-technology-driving-the-pace-of- innovation/ The Next Generation EV Tire: P Zero E Autoweek October 13, 2023 “Massive batteries contribute to EV tires wearing out about 15% sooner than with conventional vehicles.” https://www.autoweek.com/news/a45529565/pirelli-p-zero-e-tires- for-ev-market/ Changing Mobility Landscape CABOT Investor Day 2024 | 41

Reinforcement Materials | Key Takeaways 1 Global Leader with Robust Cash Generation 2 Strong Operator with Track Record of Execution 3 Targeted Capacity Growth in Advantaged Geographies 4 Sustainable Solutions for the Mobility Evolution cabot Investor Day 2024 | 42

Break cabot

Performance Chemicals Jeff Zhu EVP & President, Carbon & Silica Technologies, Battery Materials & Asia Pacific Region cabot

Performance Chemicals | Key Messages 1 Diversified portfolio with industry leading scale Geographically dispersed asset base across several product lines Serving broad set of applications in attractive market segments 2 Recently expanded capacity to enhance earnings Expansions in Asia, plus development facility in Europe, poised for earnings growth 3 Disciplined execution to drive earnings growth Commercial and operational excellence embedded in all product lines 4 Significant growth opportunities Well positioned for growth in expanding Li-ion battery and Inkjet for packaging markets cabot Investor Day 2024 | 45

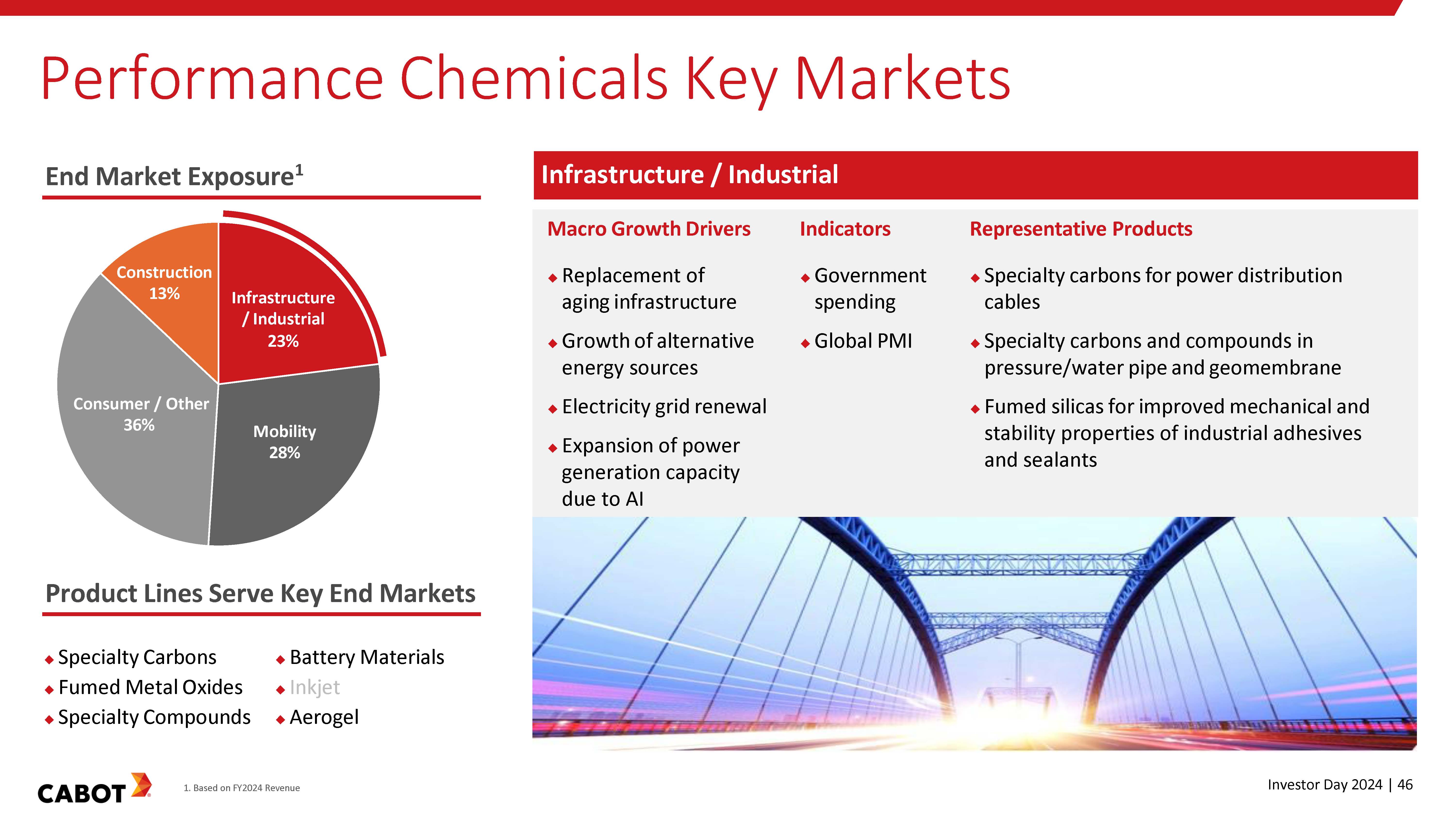

Performance Chemicals Key Markets End Market Exposure1 Construction 13% Consumer / Other 36% Infrastructure / Industrial 23% Mobility 28% Infrastructure / Industrial Macro Growth Drivers ◆ Replacement of aging infrastructure ◆ Growth of alternative energy sources ◆ Electricity grid renewal ◆ Expansion of power generation capacity due to Al Indicators ◆ Government spending Global PMI Representative Products • Specialty carbons for power distribution cables Specialty carbons and compounds in pressure/water pipe and geomembrane ◆ Fumed silicas for improved mechanical and stability properties of industrial adhesives and sealants Product Lines Serve Key End Markets Specialty Carbons ◆ Fumed Metal Oxides ◆Specialty Compounds ◆ Battery Materials Inkjet Aerogel CABOT 1. Based on FY2024 Revenue ww Investor Day 2024 | 46

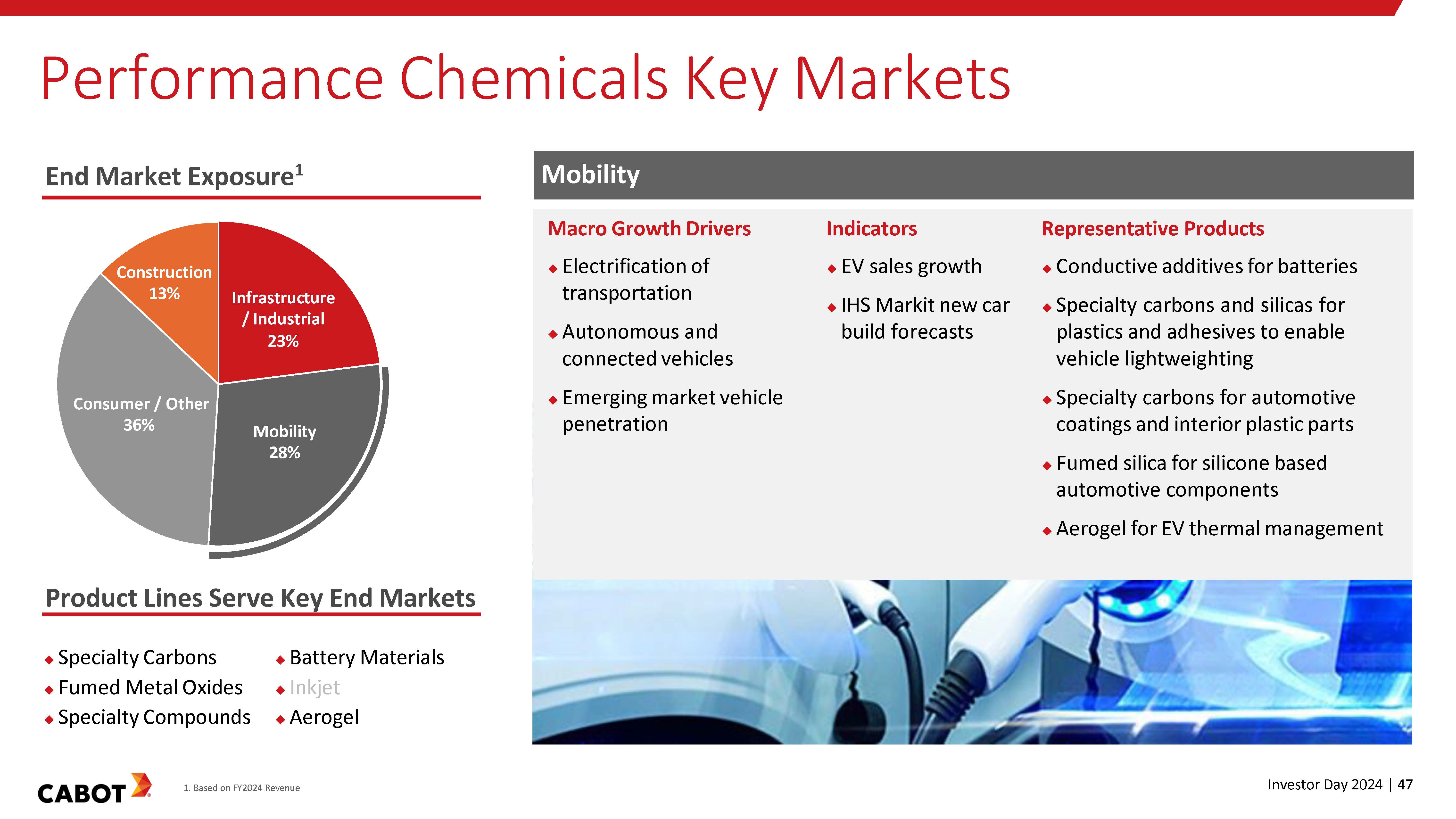

Performance Chemicals Key Markets End Market Exposure1 Construction 13% Infrastructure / Industrial 23% Consumer / Other 36% Mobility 28% Mobility Macro Growth Drivers Electrification of transportation ◆ Autonomous and connected vehicles ◆ Emerging market vehicle penetration Indicators ◆ EV sales growth IHS Markit new car build forecasts Representative Products ◆ Conductive additives for batteries Specialty carbons and silicas for plastics and adhesives to enable vehicle lightweighting ◆Specialty carbons for automotive coatings and interior plastic parts ◆ Fumed silica for silicone based automotive components ◆ Aerogel for EV thermal management Product Lines Serve Key End Markets ◆ Specialty Carbons ◆ Fumed Metal Oxides ◆Specialty Compounds ◆ Battery Materials ♦ Inkjet Aerogel CABOT 1. Based on FY2024 Revenue Investor Day 2024 | 47

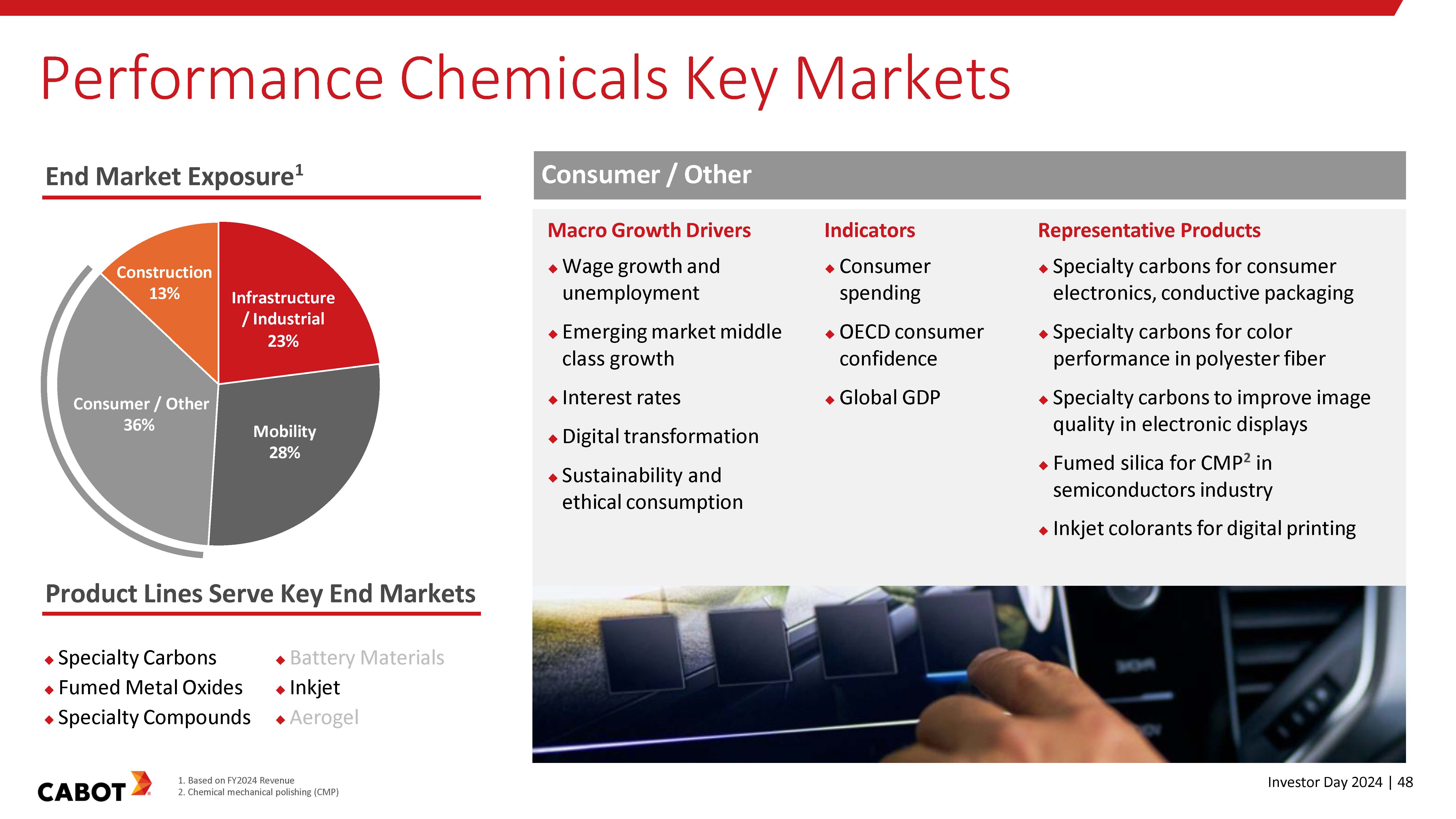

Performance Chemicals Key Markets End Market Exposure1 Construction 13% Infrastructure / Industrial 23% Consumer / Other Macro Growth Drivers ◆ Wage growth and unemployment ◆ Emerging market middle class growth ♦ Interest rates Indicators ◆ Consumer spending ◆ OECD consumer confidence Global GDP Consumer / Other 36% Mobility 28% ◆ Digital transformation Product Lines Serve Key End Markets ◆ Specialty Carbons Battery Materials ◆ Fumed Metal Oxides ♦ Inkjet ◆ Specialty Compounds ◆ Aerogel 1. Based on FY2024 Revenue CABOT 2. Chemical mechanical polishing (CMP) O ◆ Sustainability and ethical consumption Representative Products • Specialty carbons for consumer electronics, conductive packaging Specialty carbons for color performance in polyester fiber Specialty carbons to improve image quality in electronic displays ◆ Fumed silica for CMP2 in semiconductors industry Inkjet colorants for digital printing 304 Investor Day 2024 | 48

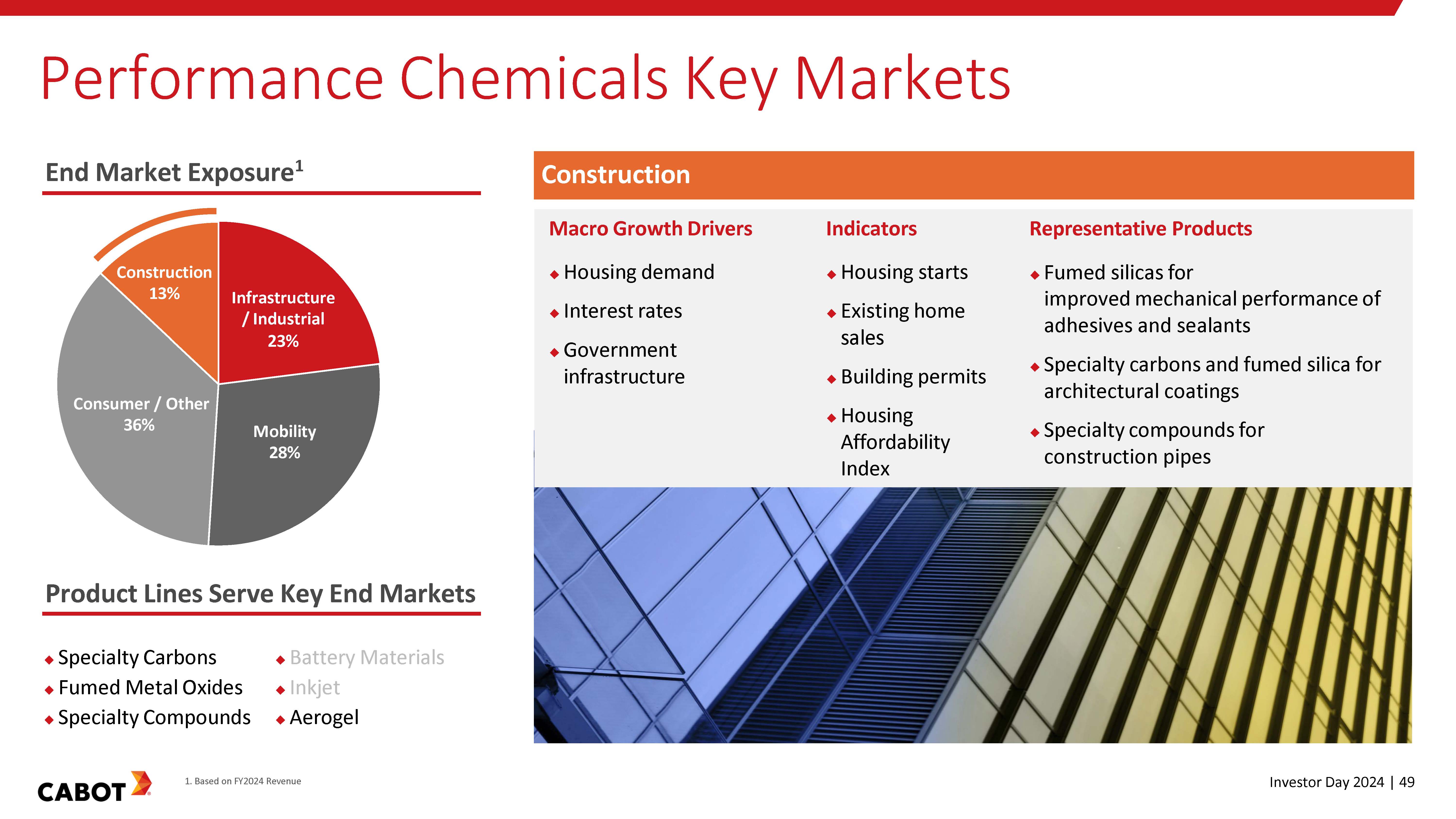

Performance Chemicals Key Markets End Market Exposure1 Construction 13% Consumer / Other 36% Infrastructure / Industrial 23% Mobility 28% Construction Macro Growth Drivers Housing demand Interest rates ◆ Government infrastructure Indicators ◆ Housing starts Existing home sales ◆ Building permits ◆ Housing Affordability Index Representative Products ◆ Fumed silicas for improved mechanical performance of adhesives and sealants Specialty carbons and fumed silica for architectural coatings ◆ Specialty compounds for construction pipes Product Lines Serve Key End Markets ◆ Specialty Carbons ◆ Fumed Metal Oxides ◆ Specialty Compounds Battery Materials Inkjet ◆ Aerogel 1. Based on FY2024 Revenue CABOT ® Investor Day 2024 | 49

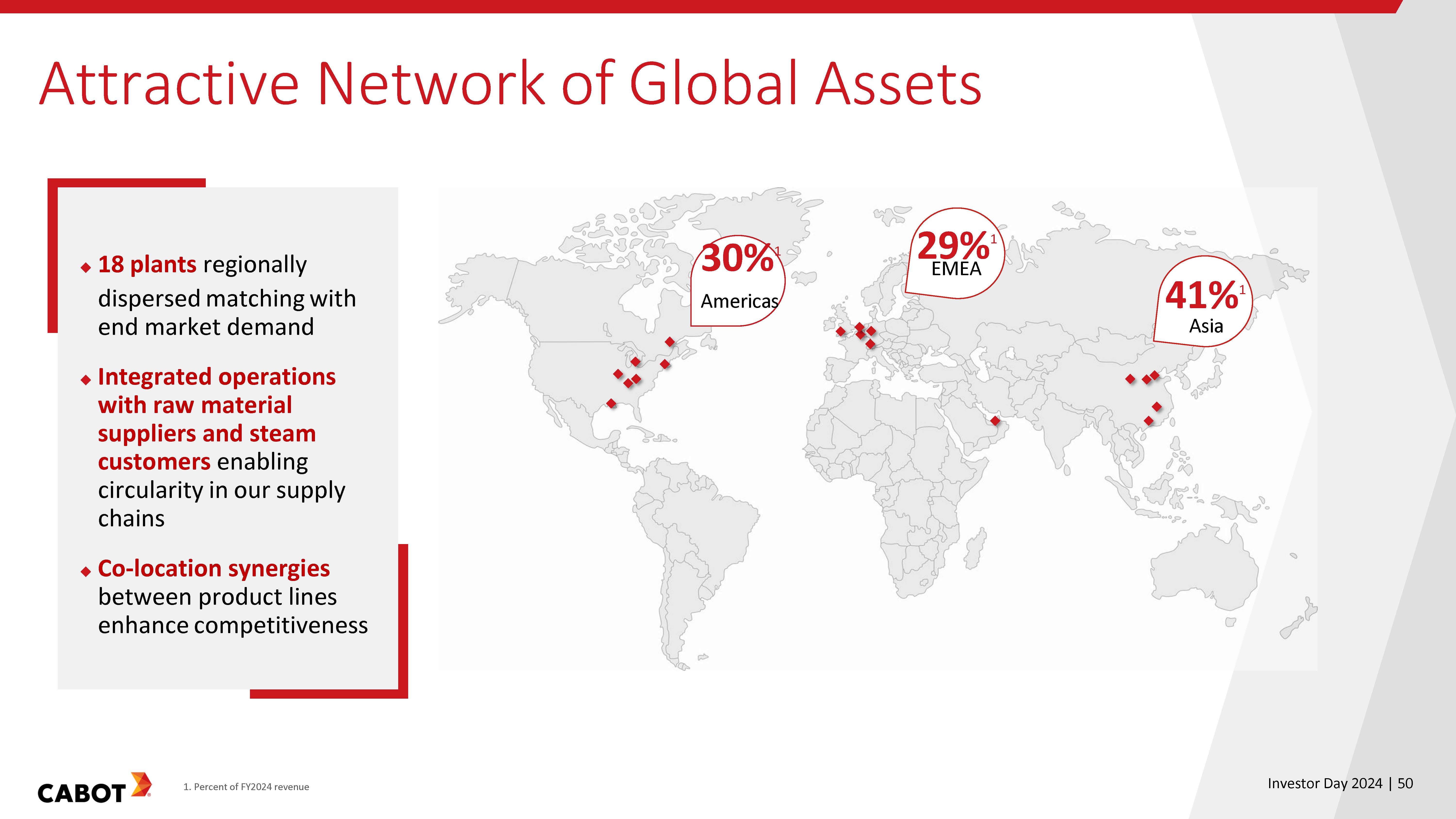

Attractive Network of Global Assets ◆ 18 plants regionally dispersed matching with end market demand ♦ Integrated operations with raw material suppliers and steam customers enabling circularity in our supply chains ◆ Co-location synergies between product lines enhance competitiveness CABOT 1. Percent of FY2024 revenue 30% 29% 1 9° EMEA Americas 41%1 Asia D Investor Day 2024 | 50

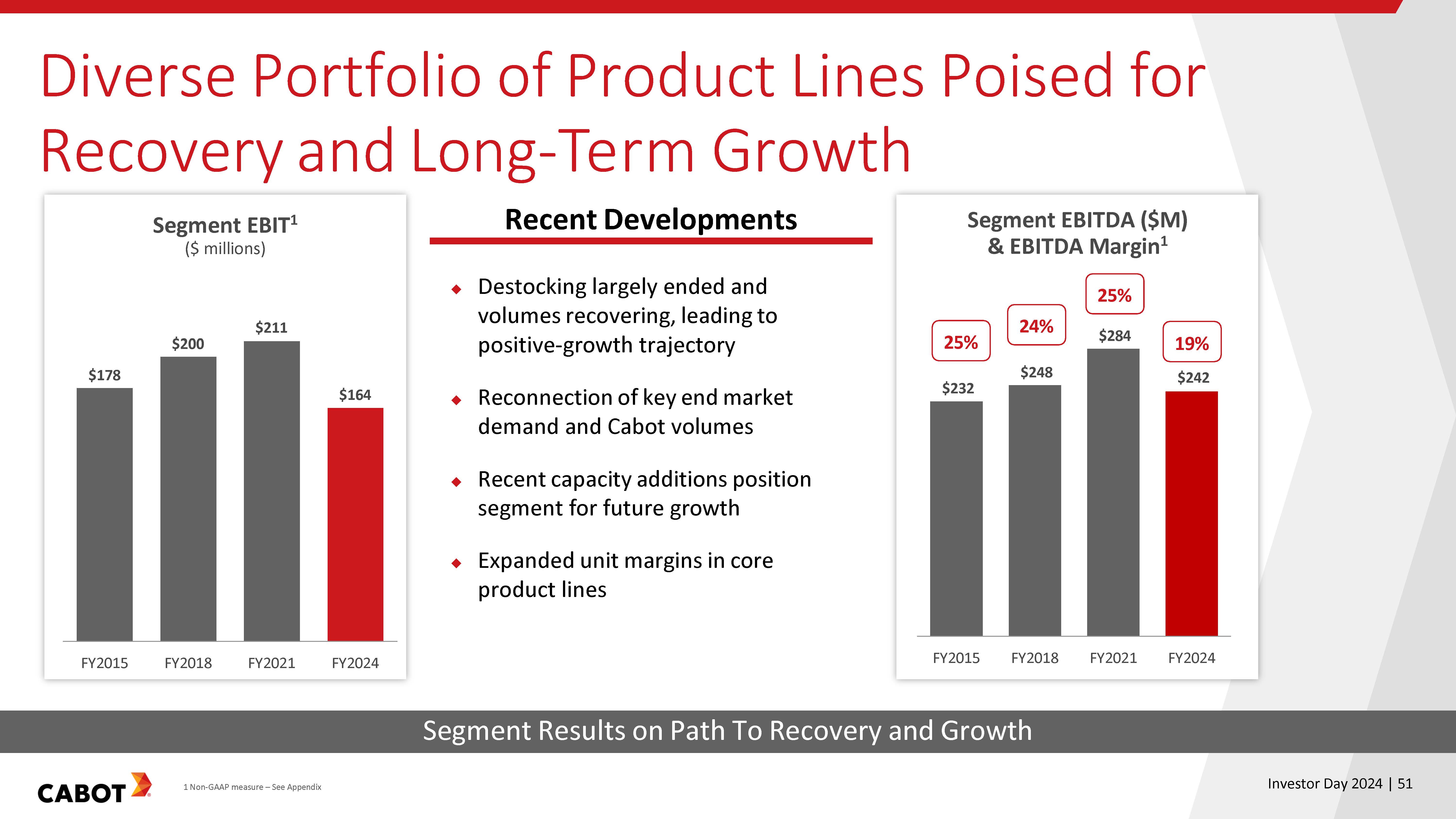

Diverse Portfolio of Product Lines Poised for Recovery and Long-Term Growth Segment EBIT1 ($ millions) Recent Developments Segment EBITDA ($M) & EBITDA Margin1 $178 $200 $211 • Destocking largely ended and volumes recovering, leading to positive-growth trajectory 25% 24% 25% $284 19% $248 $242 $232 $164 • Reconnection of key end market demand and Cabot volumes FY2015 FY2018 FY2021 FY2024 CABOT 1 Non-GAAP measure - See Appendix • Recent capacity additions position segment for future growth Expanded unit margins in core product lines FY2015 FY2018 FY2021 FY2024 Segment Results on Path To Recovery and Growth Investor Day 2024 | 51

Key Growth Levers for Performance Chemicals Continued Commercial and $ 剑 Operational Excellence Favorable Macro-trends in Legacy Product Lines X 000 Completed Growth Investments Adding Earnings Capacity Growth Vectors Positioned to Win; Spotlight on Battery Materials CABOT Levers Expected to Drive Margin and Volume Growth Investor Day 2024 | 52

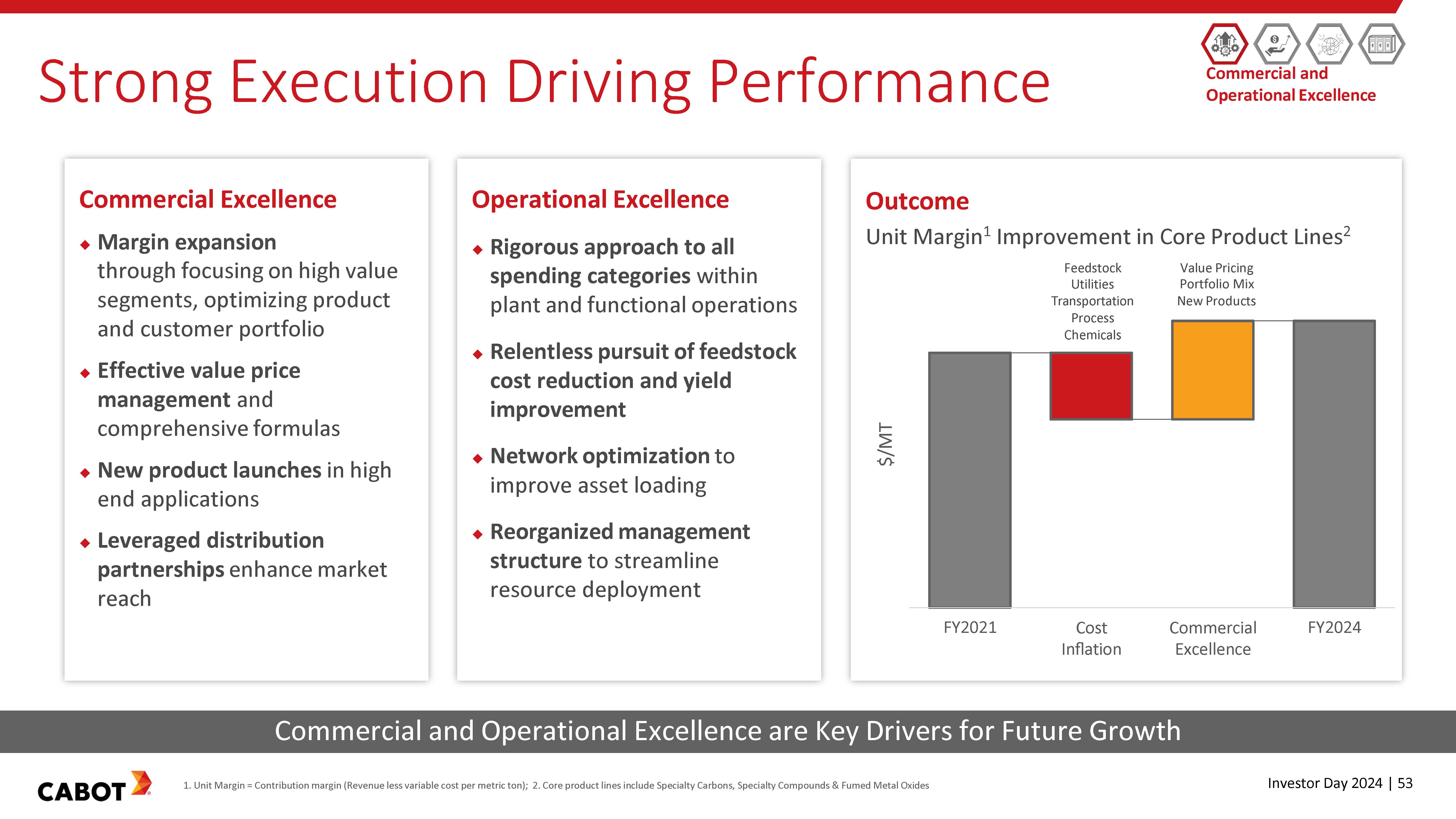

Strong Execution Driving Performance Commercial and Operational Excellence Commercial Excellence Margin expansion through focusing on high value segments, optimizing product and customer portfolio Effective value price management and comprehensive formulas ◆ New product launches in high end applications Leveraged distribution partnerships enhance market reach Operational Excellence Rigorous approach to all spending categories within plant and functional operations Relentless pursuit of feedstock cost reduction and yield improvement Network optimization to improve asset loading • Reorganized management structure to streamline resource deployment Outcome Unit Margin1 Improvement in Core Product Lines2 $/MT Feedstock Utilities Transportation Process Chemicals Value Pricing Portfolio Mix New Products FY2021 Cost Inflation Commercial Excellence FY2024 Commercial and Operational Excellence are Key Drivers for Future Growth CABOT 1. Unit Margin = Contribution margin (Revenue less variable cost per metric ton); 2. Core product lines include Specialty Carbons, Specialty Compounds & Fumed Metal Oxides Investor Day 2024 | 53

Investments Completed Since 2021 Fueling earnings growth in key end-markets Zhuhai, China • 10kmt expansion of dispersion capacity for conductive additives • Directly supports both Chinese and western battery makers ♦ IATF 16949 certified, qualified material and commercial sales with nine out of the top ten battery producers over the last three years Xuzhou, China State-of-the art battery materials research facility Investments • 40kmt specialty carbons capacity added Serving infrastructure, mobility, and consumer end-markets • Capital efficient acquisition and conversion to supply key specialty carbons • 20kmt Southeast Asia expansion of specialty compounds capacity Positioned close to market leaders and leading technical institutes Co-located with reinforcing carbons facility - driving competitive cost structure — Münster, Germany • Supports battery makers in adopting Cabot battery solutions in Europe and developing solutions for next-generation batteries Geographically positioned to serve fast growing market in plastics industry Cilegon, Indonesia CABOT ® Capacity and Capability Investments Poised to Meaningfully Contribute to Earnings Growth Investor Day 2024 | 54

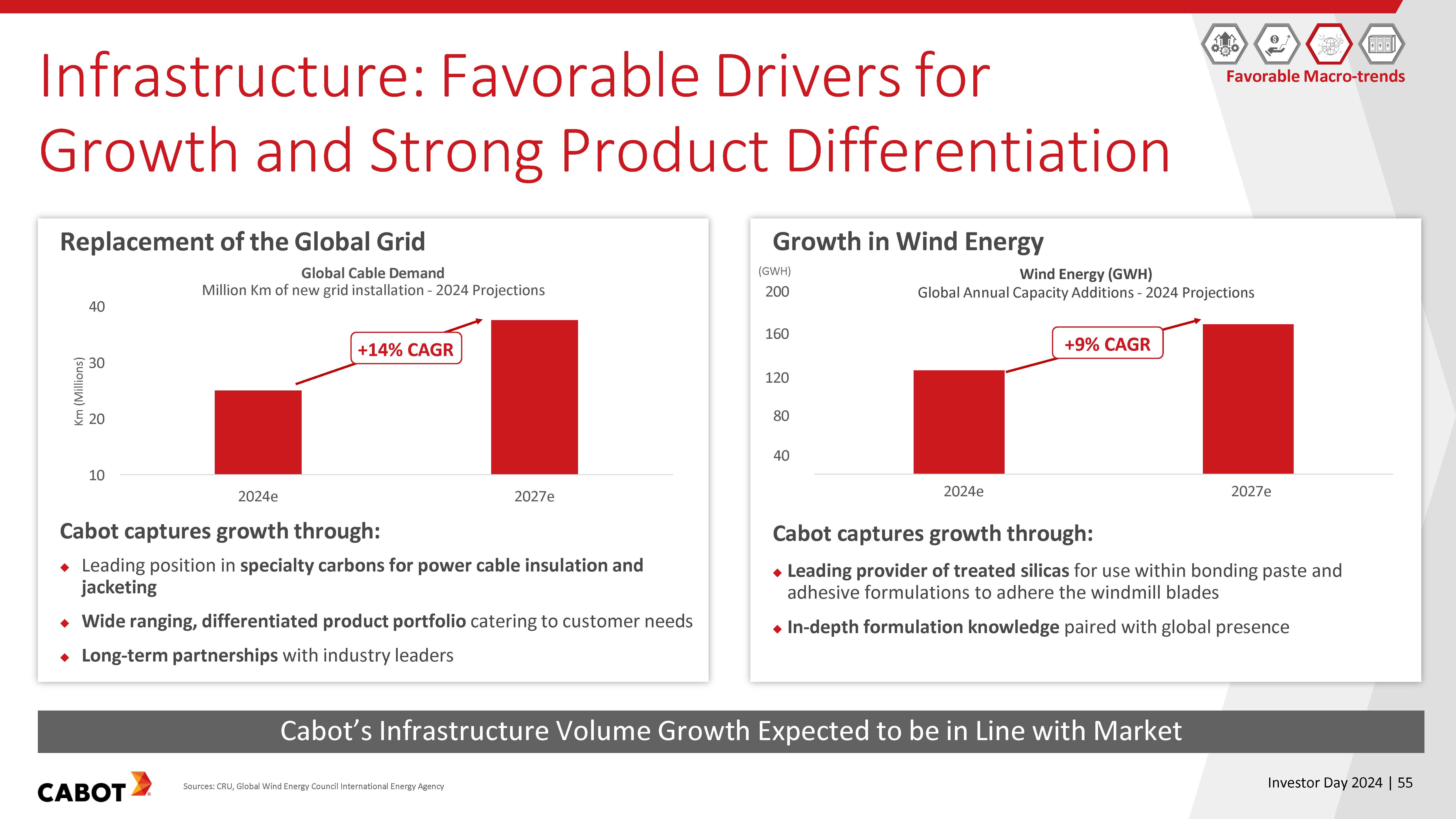

Favorable Macro-trends Infrastructure: Favorable Drivers for Growth and Strong Product Differentiation Replacement of the Global Grid Global Cable Demand Million Km of new grid installation - 2024 Projections Growth in Wind Energy (GWH) 200 Wind Energy (GWH) Global Annual Capacity Additions - 2024 Projections Km (Millions) 40 30 20 10 +14% CAGR 160 120 80 40 +9% CAGR 2024e Cabot captures growth through: 2027e • Leading position in specialty carbons for power cable insulation and jacketing ♦ Wide ranging, differentiated product portfolio catering to customer needs. ♦ Long-term partnerships with industry leaders 2024e Cabot captures growth through: 2027e ◆ Leading provider of treated silicas for use within bonding paste and adhesive formulations to adhere the windmill blades ♦ In-depth formulation knowledge paired with global presence Cabot's Infrastructure Volume Growth Expected to be in Line with Market CABOT Sources: CRU, Global Wind Energy Council International Energy Agency Investor Day 2024 | 55

Notable Progress in Battery Materials Over the last three years.... Cabot volumes grew at a 30% CAGR CABOT Sales to 9 out of the top 10 global battery producers $ Added footprint and significant customer wins • Awarded supply contract for new gigafactory in Europe in 2024 Awarded DOE grant to build CNT and dispersion plant in Michigan • All battery dedicated assets achieved IATF 16949 certification 24 new products launched including conductive additive blends Growth Vectors Investor Day 2024 | 56

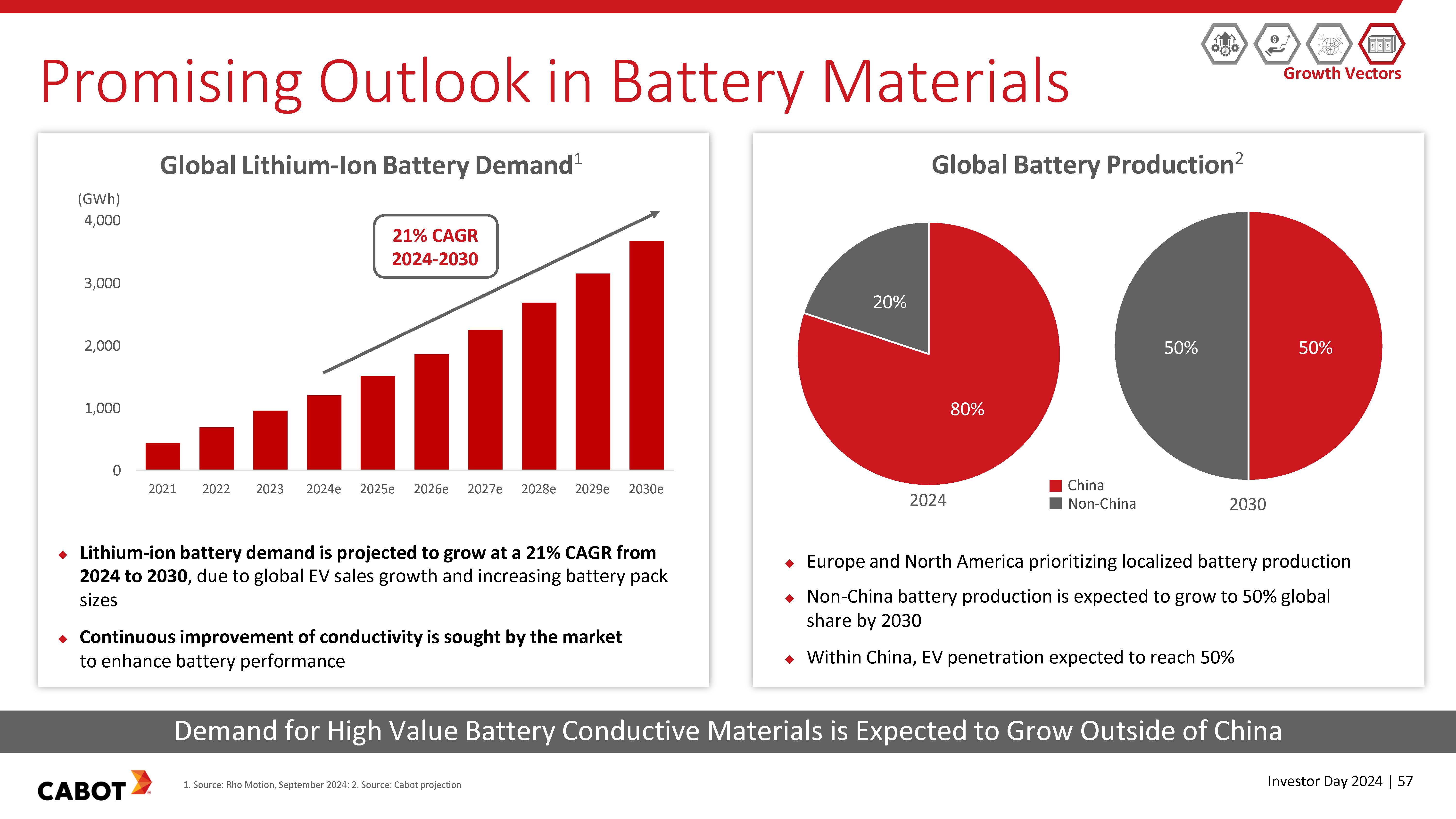

Promising Outlook in Battery Materials Global Lithium-Ion Battery Demand1 Global Battery Production2 (GWh) 4,000 3,000 2,000 1,000 0 21% CAGR 2024-2030 2021 2022 2023 2024e 2025e 2026e 2027e 2028e 2029e 2030e 20% 2024 80% China Non-China Growth Vectors 50% 50% 2030 Lithium-ion battery demand is projected to grow at a 21% CAGR from 2024 to 2030, due to global EV sales growth and increasing battery pack sizes Continuous improvement of conductivity is sought by the market to enhance battery performance • Europe and North America prioritizing localized battery production • Non-China battery production is expected to grow to 50% global share by 2030 ♦ Within China, EV penetration expected to reach 50% Demand for High Value Battery Conductive Materials is Expected to Grow Outside of China CABOT 1. Source: Rho Motion, September 2024: 2. Source: Cabot projection Investor Day 2024 | 57

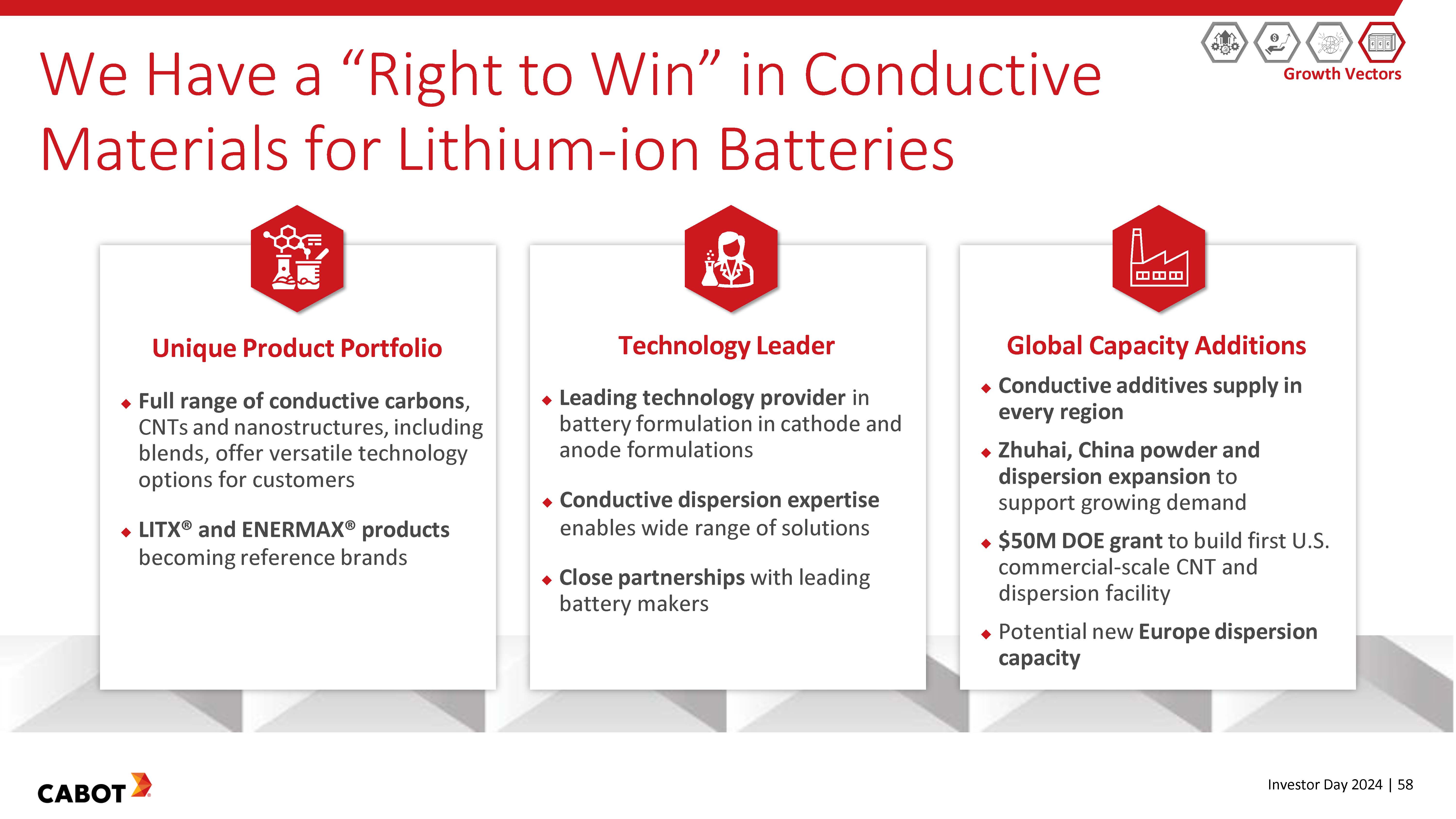

We Have a "Right to Win" in Conductive Materials for Lithium-ion Batteries Unique Product Portfolio ◆ Full range of conductive carbons, CNTs and nanostructures, including blends, offer versatile technology options for customers ◆ LITX® and ENERMAX® products becoming reference brands O Technology Leader Leading technology provider in battery formulation in cathode and anode formulations Conductive dispersion expertise enables wide range of solutions ◆ Close partnerships with leading battery makers Growth Vectors Global Capacity Additions ◆ Conductive additives supply in every region ◆ Zhuhai, China powder and dispersion expansion to support growing demand $50M DOE grant to build first U.S. commercial-scale CNT and dispersion facility ◆ Potential new Europe dispersion capacity CABOT Investor Day 2024 | 58

Performance Chemicals | Key Takeaways 1 Diversified portfolio with industry leading scale 22 Recently expanded capacity to enhance earnings 3 Disciplined execution to drive earnings growth 4 Significant growth opportunities CABOT 1207 こ Investor Day 2024 | 59

CABOT Financial Framework Erica McLaughlin EVP, Chief Financial Officer and Head of Corporate Strategy

Financial Framework| Key Messages 1 2 3 4 Strong Execution Track Record Met corporate financial commitments for Creating for Tomorrow strategy, overcoming significant global headwinds Robust Cash Generation Discretionary Free Cash Flow expected to fund capital allocation priorities and enable shareholder returns Capital Allocation Priorities Remain Balanced Focused on a balanced approach to capital deployment to accelerate growth and create shareholder value Confidence in Go Forward Growth Plan Enabled by strategy execution and disciplined balance sheet management cabot Investor Day 2024 | 61

Robust Financial Performance Adjusted EPS1 ($ millions) $7.06 +12% CAGR $5.02 $4.03 $2.49 FY2015 FY2018 FY2021 FY2024 FY2015 FY2018 FY2021 FY2024 FY2015 FY2018 FY2021 FY2024 Creating for Tomorrow Strategy Driving Strong Financial Results cabot 1. Non-GAAP measure – See Appendix Investor Day 2024 | 62 Adjusted EBIT1 ($ millions) +9% CAGR $645 $492 $419 $286 Adjusted ROIC1 19%18%15%8% Investor Day 2024 | 62

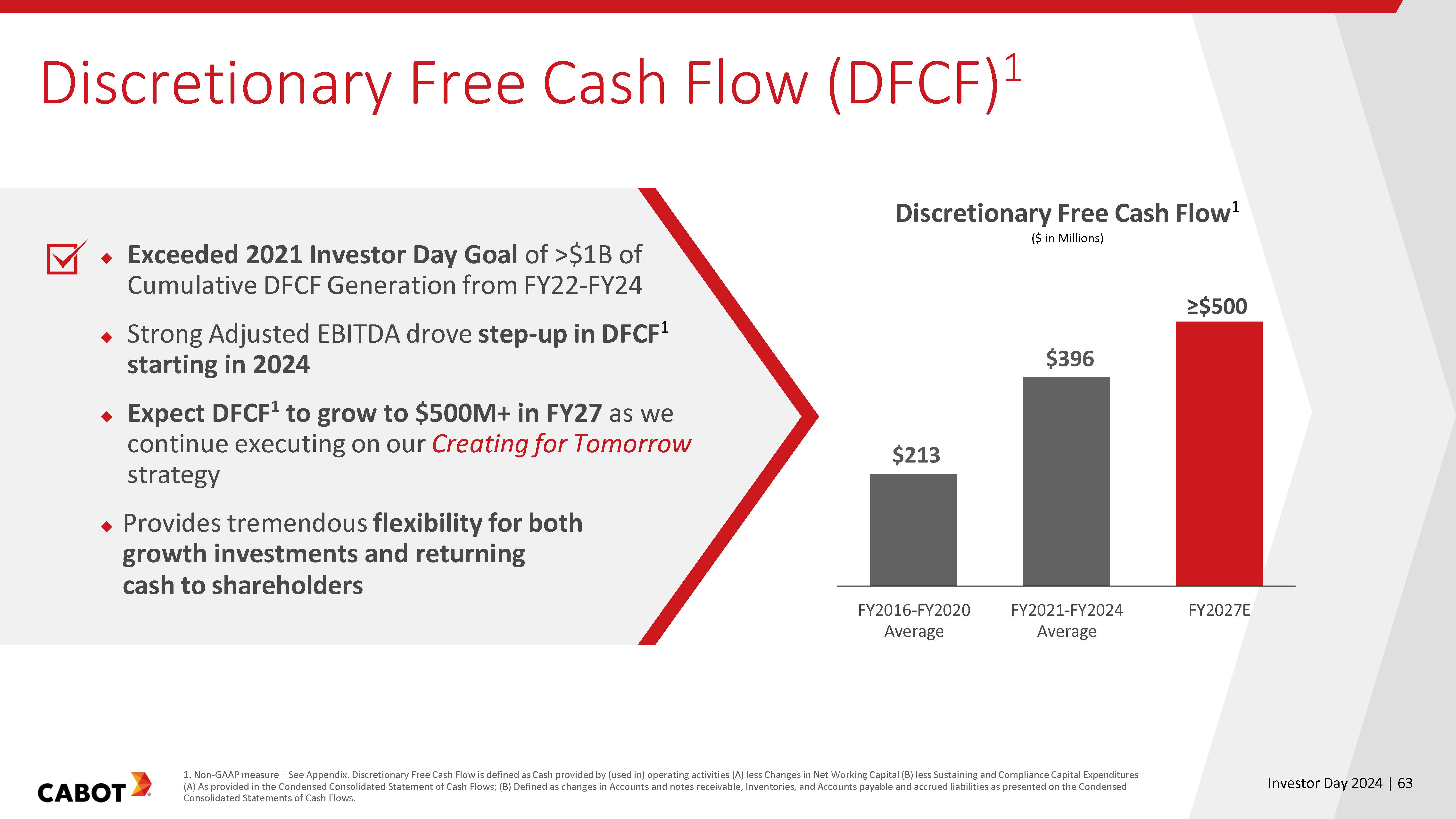

Discretionary Free Cash Flow (DFCF)1 Discretionary Free Cash Flow1($ in Millions)Exceeded 2021 Investor Day Goal of >$1B of Cumulative DFCFGeneration from FY22-FY24 Strong Adjusted EBITDA drovestep-up in DFCF1 starting in 2024 Expect DFCF1 to grow to $500M+ in FY27 as we continue executingon our Creating forTomorrow strategy Provides tremendous flexibility for both growth investments and returning cash to shareholders ≥$500 $396 $213 FY2016-FY2020 FY2016-FY2020 Average Average ≥$500 $396 $213 FY2016-FY2020 Average FY2021-FY2024 Average FY2027E cabot 1. Non-GAAP measure – See Appendix. Discretionary Free Cash Flow is defined as Cash provided by (used in) operating activities (A) less Changes in Net Working Capital (B) less Sustaining and Compliance Capital Expenditures (A) As provided in the Condensed Consolidated Statement of Cash Flows; (B) Defined as changes in Accounts and notes receivable, Inventories, and Accounts payable and accrued liabilities as presented on the Condensed Consolidated Statements of Cash Flows. Investor Day 2024 | 63

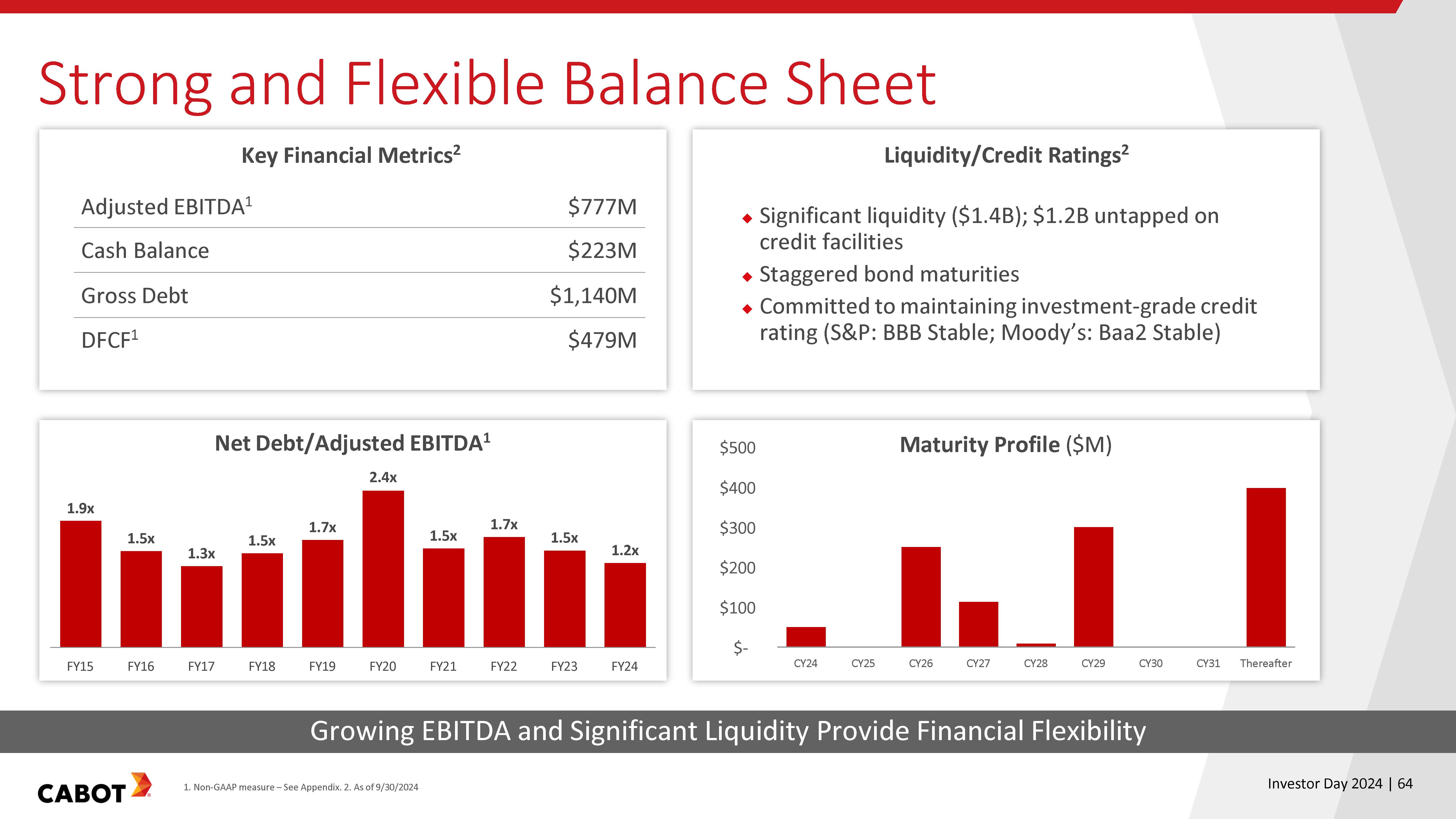

Strong and Flexible Balance Sheet Key Financial Metrics2 Adjusted EBITDA1 $777M Cash Balance $223M Gross Debt $1,140M DFCF1 $479M Liquidity/Credit Ratings2 Significant liquidity ($1.4B); $1.2B untapped on credit facilities Staggered bond maturities Committed to maintaining investment-grade credit rating (S&P: BBB Stable; Moody’s: Baa2 Stable) Net Debt/Adjusted EBITDA1 1.9x1.5x 1.3x 1.5x 1.7 x2.4x 1.5x1.7x1.5x1.2x FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY20 Maturity Profile ($M) $500 $400 $300 $200 $100 $ CY24 CY25 CY26 CY27 CY28 CY29 CY30 CY31 thereafter Growing EBITDA and Significant Liquidity Provide Financial Flexibility cabot1. . Non-GAAP measure – See Appendix. 2. As of 9/30/2024 Investor Day 2024 | 64

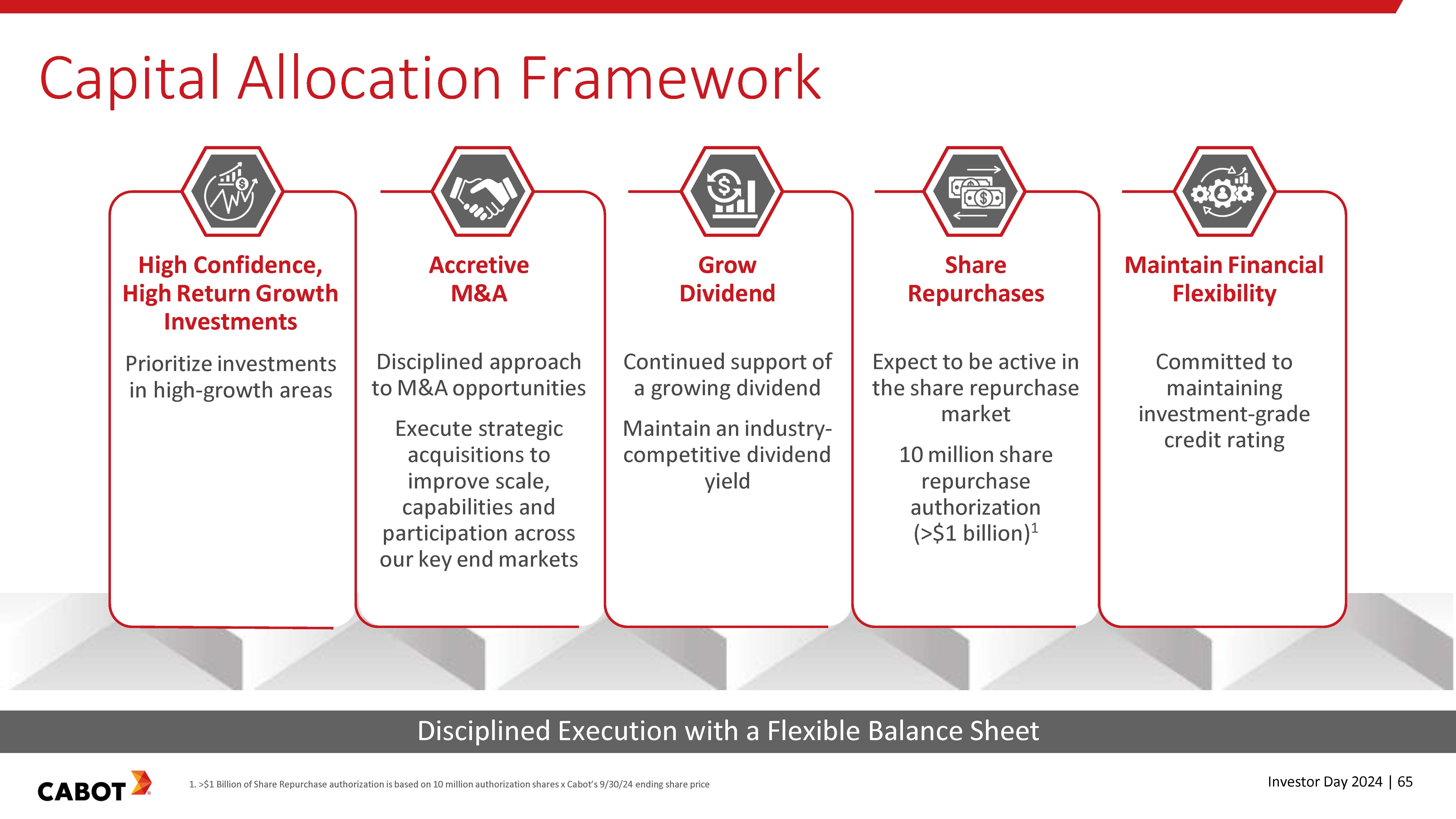

Capital Allocation Framework High Confidence, High Return Growth Investments Prioritize investments in high-growth areas Accretive M&A Disciplined approach to M&A opportunities Execute strategic acquisitions to improve scale, capabilities and participation across our key end markets Grow Dividend Continued support of a growing dividend Maintain an industry- competitive dividend yield Share Repurchases Expect to be active in the share repurchase market 10 million share repurchase authorization (>$1 billion)1 Maintain Financial Flexibility Committed to maintaining investment-grade credit rating Disciplined Execution with a Flexible Balance Sheet cabot 1. >$1 Billion of Share Repurchase authorization is based on 10 million authorization shares x Cabot’s 9/30/24 ending share price Investor Day 2024 | 65

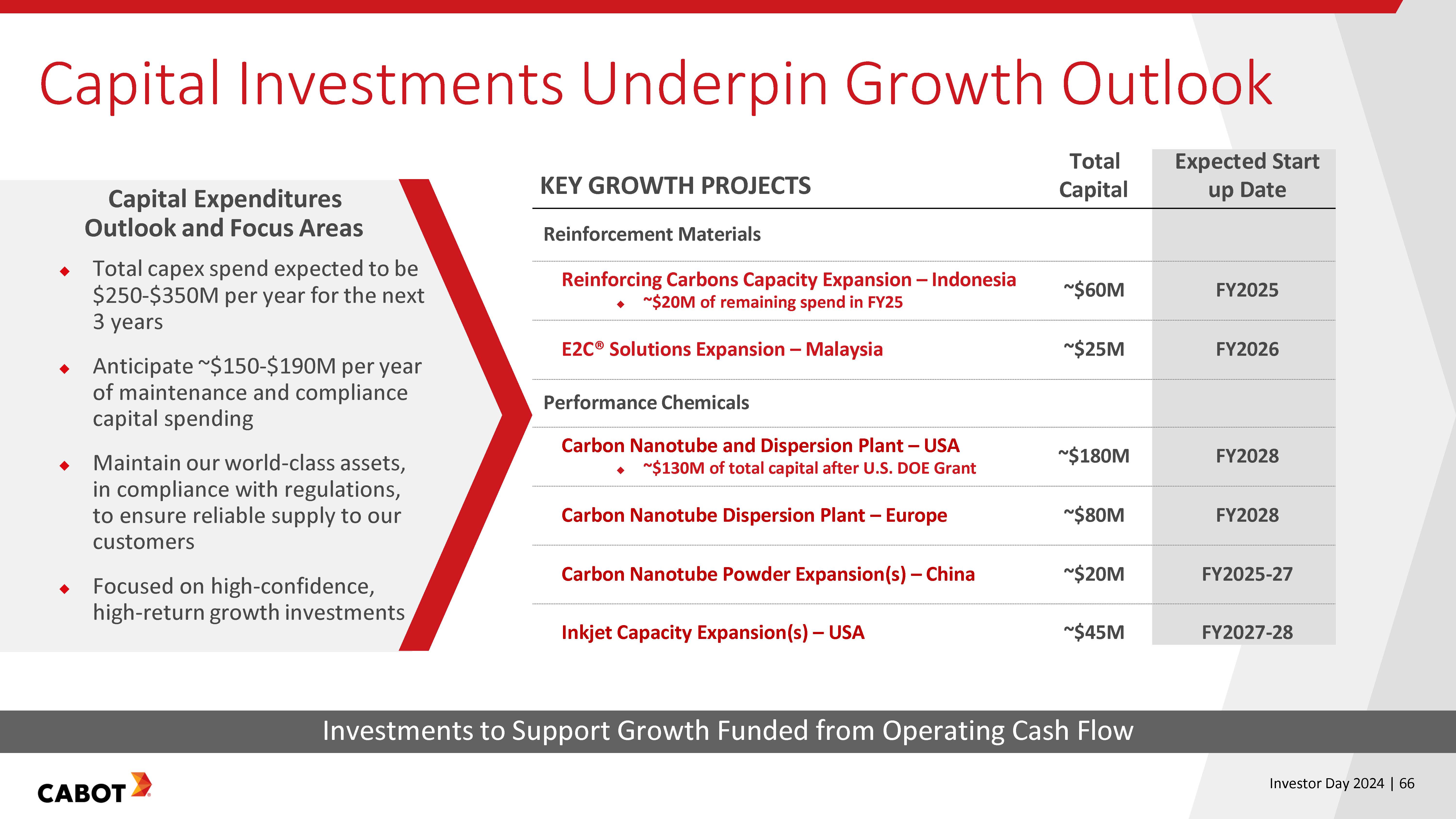

Capital Investments Underpin Growth Outlook Capital Expenditures Outlook and Focus Areas Total capex spend expected to be $250-$350M per year for the next 3 years Anticipate ~$150-$190M per year of maintenance and compliance capital spending Maintain our world-class assets, in compliance with regulations, to ensure reliable supply to our customers Focused on high-confidence, high-return growth investments KEY GROWTH PROJECTS Reinforcement Materials Reinforcing Carbons Capacity Expansion – Indonesia ~$20M of remaining spend in FY25 E2C® Solutions Expansion – Malaysia Performance Chemicals Carbon Nanotube and Dispersion Plant – USA ~$130M of total capital after U.S. DOE Grant Carbon Nanotube Dispersion Plant – Europe Carbon Nanotube Powder Expansion(s) – China Inkjet Capacity Expansion(s) – USA Total Capital Expected Start up Date ~$60M FY2025 ~$25M FY2026 ~$180M FY2028 ~$80M FY2028 ~$20M FY2025-27 ~$45M FY2027-28 Investments to Support Growth Funded from Operating Cash Flow cabot Investor Day 2024 | 66

M&A Priorities Strengthen Business Competitive Position Accretive to Earnings ROIC > Cost of Capital in 3-5 Years Growth and/or Margin Enhancing STRATEGIC FOCUS AREAS Accretive acquisitions to support strategy and drive incremental growth above targets Capability and capacity in high growth segments Battery Materials Inkjet Packaging Conductive Carbons Increase scale, geographic access and participation across carbon and silica franchises Access technologies related to Sustainable Materials, Batteries, and Conductive Materials cabot Investor Day 2024 | 67

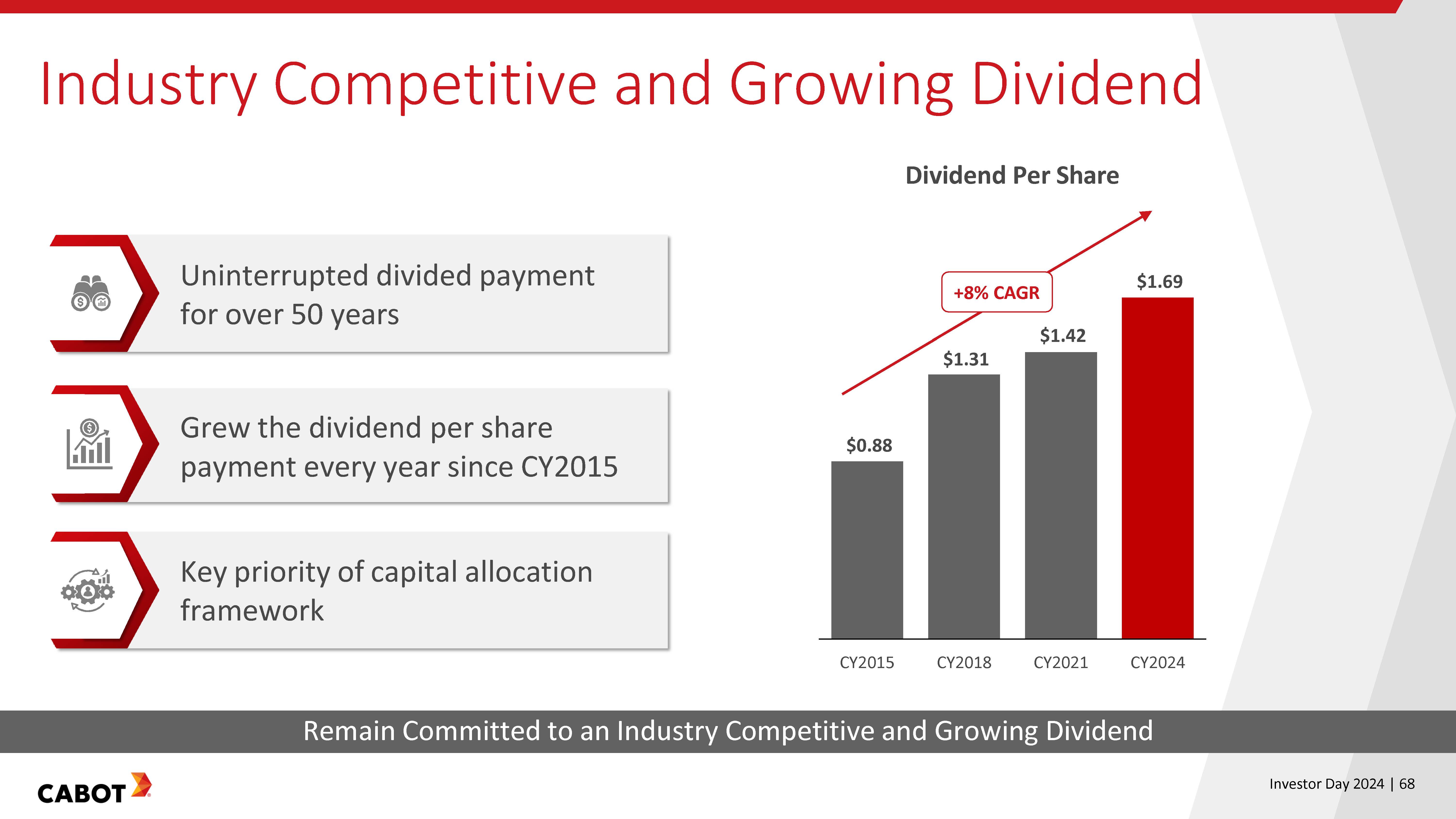

Industry Competitive and Growing Dividend Dividend Per Share Uninterrupted divided payment for over 50 years Grew the dividend per share payment every year since CY2015 Key priority of capital allocation framework +8% CAGR $1.69 $1.42 $1.31 $0.88 CY2015 CY2018 CY2021 CY2024 Remain Committed to an Industry Competitive and Growing Dividend cabot Investor Day 2024 | 68

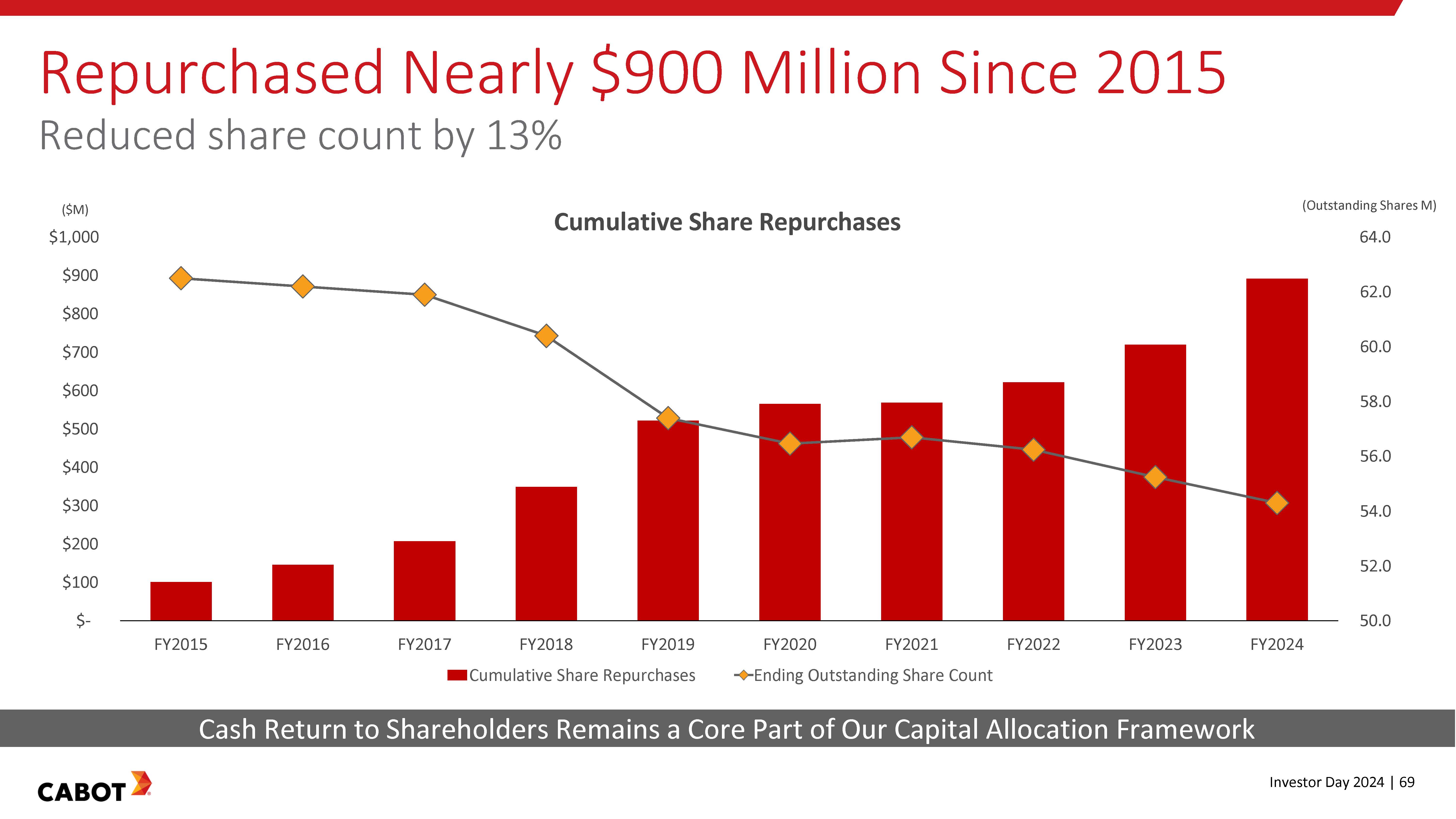

Repurchased Nearly $900 Million Since 2015 Reduced share count by 13% Cumulative Share Repurchases ($M) $1,000 $900 $800 $700 $600 $500 $400 $300 $200 $100 $- FY2015 FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 FY2022 FY2023 FY2024 (Outstanding Shares M) 64.0 62.0 60.0 58.0 56.0 54.0 52.0 50.0 Cumulative Share Repurchases Ending Outstanding Share Count Cash Return to Shareholders Remains a Core Part of Our Capital Allocation Framework cabot Investor Day 2024 | 69

3-Year Consolidated Financial Targets Adjusted EPS6 CAGR 7%-10% Adjusted EBITDA6 $0.9-$1 Billion by FY2027 KEY MACRO DRIVERS AND CAGR ASSUMPTIONS Global GDP1 3% Tire Production2 2% Auto Builds3 3% Polymer Demand (Plastics)4 3% Global Lithium-Ion Battery Demand5 23% Oil Prices Forward curve Foreign Currency Exchange Rates Current rates Operating Tax Rate6 28-30% Driven by Growth Across Our Businesses cabot globaldata 1. Source: IMF; 2. Source: LV and HCV tire production, Global Data, Tire production forecast, September 2024 (total units); 3. Source: S&P Global Mobility LV production forecast, November 2024; 4. Source: AMI; 5. Source: Rho Motion; 6. Non-GAAP measure – See Appendix Investor Day 2024 | 70

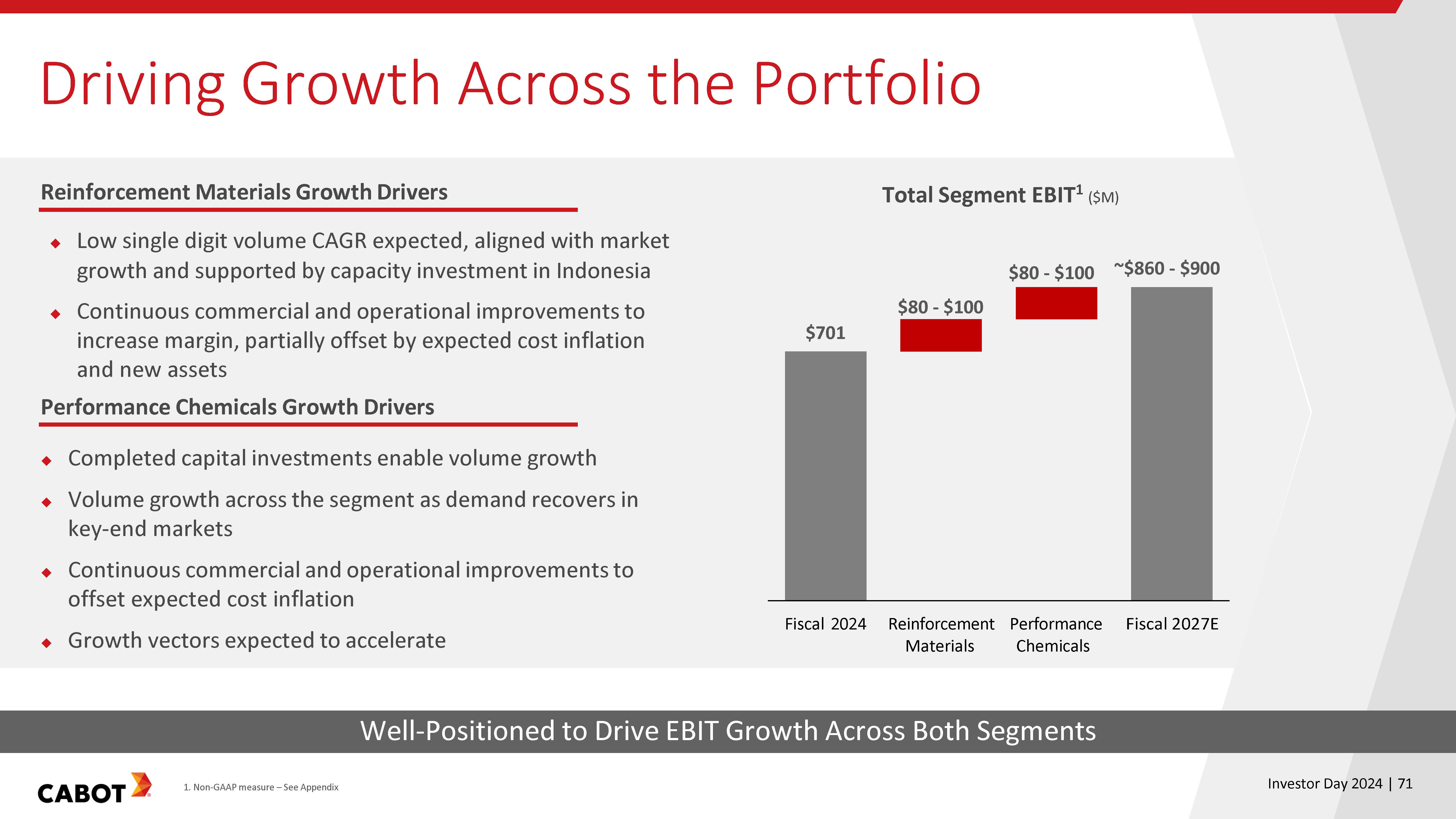

Driving Growth Across the Portfolio Reinforcement Materials Growth Drivers Low single digit volume CAGR expected, aligned with market growth and supported by capacity investment in Indonesia Continuous commercial and operational improvements to increase margin, partially offset by expected cost inflation and new assets Performance Chemicals Growth Drivers Completed capital investments enable volume growth Volume growth across the segment as demand recovers in key-end markets Continuous commercial and operational improvements to offset expected cost inflation Growth vectors expected to accelerate Total Segment EBIT1 Total Segment EBIT1 ($M) ($M) $701 $80 - $100 $80 - $100 ~$860 - $900 Fiscal 2024 Reinforcement Materials Performance Chemicals Fiscal 2027E Well-Positioned to Drive EBIT Growth Across Both Segments cabot 1. Non-GAAP measure – See Appendix Investor Day 2024 | 71

Compelling Path to Shareholder Value Creation Adjusted EBITDA1 Target of ~$0.9-$1 Billion Adjusted EPS1 Target CAGRof 7%-10% Competitive Dividend Yield Share Repurchase Authorization of >$1 Billion2 Driven by Creating for Tomorrow Strategy Top-Tier Total Shareholder Return Strong Execution Track Record and Strength of Businesses Give Us Confidence in our Outlook Cabot 1. Non-GAAP measure – See Appendix. 2 >$1 Billion of Share Repurchase authorization is based on 10 million authorization shares x Cabot’s 9/30/24 ending share price Investor Day 2024 | 72

Financial Framework| Key Takeaways 1 2 3 4 Strong Execution Track Record Robust Cash Generation Capital Allocation Priorities Remain Balanced Confidence in Go Forward Growth Plan cabot Investor Day 2024 | 73

Image Closing Remarks Sean Keohane President and Chief Executive Officer cabot

Cabot: A Compelling Investment Thesis Right Strategy "Creating for Tomorrow" Grow Innovate Optimize Technology Aligned with Key Macro-trends Changing Mobility Landscape Global Infrastructure Build-out The Sustainability Transition Growth Objectives Targeting 3-year Adj. EPS1 CAGR of 7-10% Growth driven by expectation of strong results in both segments Management team with a proven track record of execution Capital Allocation Strong cash flow generation 1.Balanced capital allocation focused on funding advantaged growth and returning capital to shareholders cabot 1. Non-GAAP measure – See Appendix Investor Day 2024 | 75

Q&A CABOT

Appendix CABOT

Use of Non-GAAP Financial Measures This presentation includes references to adjusted earnings per share (EPS), adjusted EBITDA, adjusted EBIT, adjusted EBITDA margin, total segment EBITDA, total segment EBIT, segment EBIT margins, adjusted return on invested capital (ROIC), discretionary free cash flow, adjusted payout ratio, adjusted EBITDA conversion, and operating tax rate. Reconciliations for these non-GAAP measures are included in the following slides. Cabot does not provide an expected GAAP EPS range or reconciliation of the Adjusted EPS range with an expected GAAP EPS range because, without unreasonable effort, we are unable to predict with reasonable certainty the matters we would allocate to “certain items,” including unusual gains and losses, costs associated with future restructurings, acquisition-related expenses and litigation outcomes. These items are uncertain, depend on various factors, and could have a material impact on GAAP EPS in future periods. This presentation also includes our forecast of the range we expect our “operating tax rate”, which represents the tax rate on our recurring operating results, to fall within. This rate excludes discrete tax items, which are included in the effective tax rate. Discrete tax items are comprised of (i) unusual or infrequent items, (ii) items related to uncertain tax positions, and (iii) other tax items, such as the impact from the timing of losses in certain jurisdictions and cumulative tax rate adjustments, the tax impact of legislative changes and tax accruals on historic earnings due to changes in indefinite reinvested assertions. The operating tax rate also excludes the impact of the items of expense and income we identify as certain items on both our operating income and the tax provision. Management believes that the operating tax rate is useful supplemental information because it helps our investors compare our tax rate year to year on a consistent basis and to understand what our tax rate on current operations would be without the impact of these items. Cabot does not provide a forward-looking reconciliation of the operating tax rate range with an effective tax rate range because, without unreasonable effort, we are unable to predict with reasonable certainty the matters we would allocate to “certain items,” including unusual gains and losses, costs associated with future restructurings, acquisition-related expenses and litigation outcomes. These items are uncertain, depend on various factors, and could have a material impact on the effective tax rate in future periods. To calculate “Discretionary Free Cash Flow” we deduct sustaining and compliance capital expenditures and changes in Net Working Capital from cash flow from operating activities. To calculate “Free Cash Flow” we deduct capital expenditures as disclosed in the consolidated statement of cash flows (as Additions to property, plant and equipment) from cash flow from operating activities. Explanation of Terms Used Product Mix: The term “product mix” refers to the mix of types and grade of products sold or the mix of geographic regions where products are sold, and the positive or negative impact this has on the revenue or profitability of the business or segment. Net Working Capital: The term “net working capital” includes accounts receivable, inventory and accounts payable and accrued liabilities. CABOT Investor Day 2024 | 78

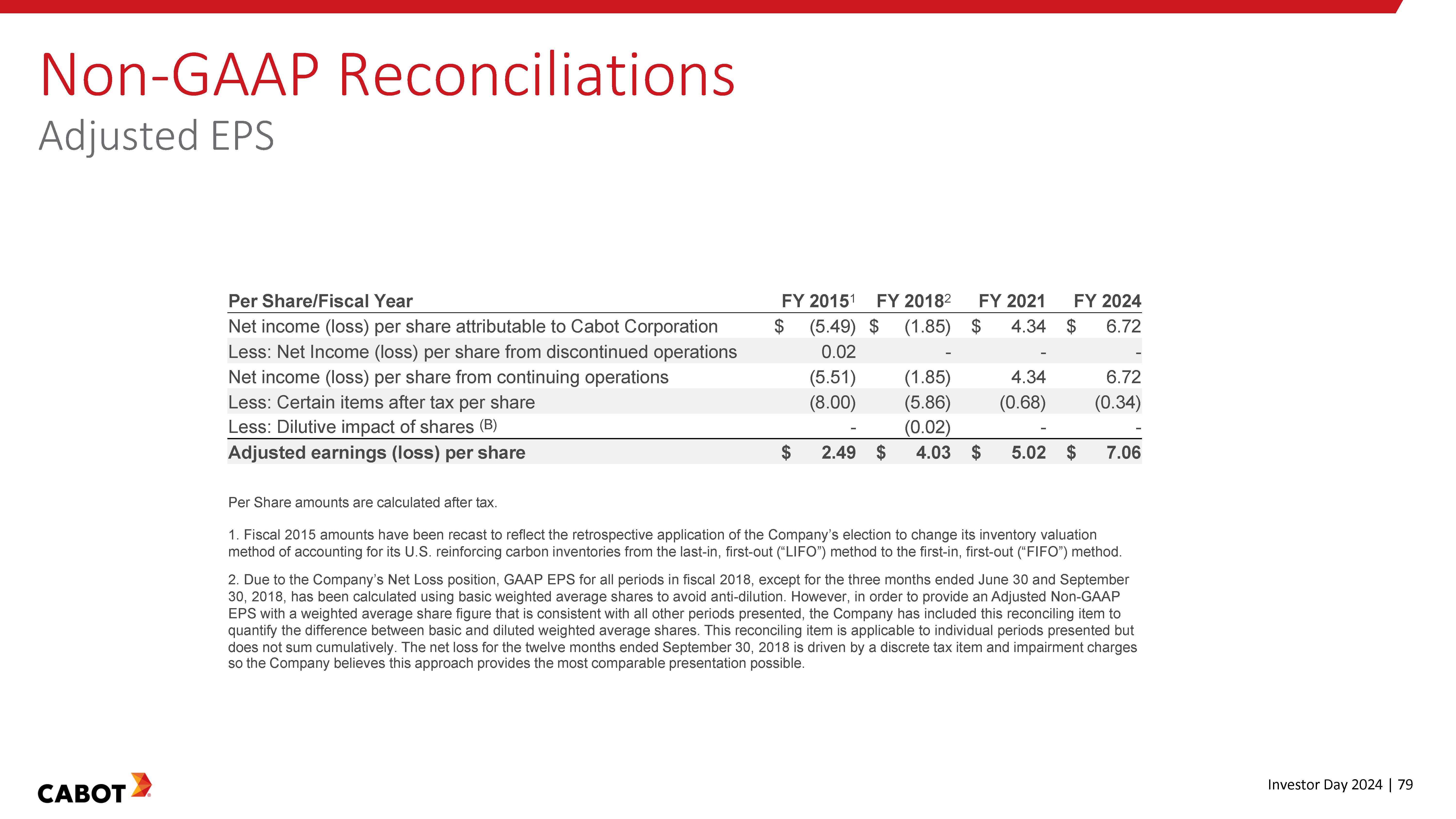

Non-GAAP Reconciliations Adjusted EPS Per Share/Fiscal Year FY 20151 FY 20182 FY 2021 FY 2024 Net income (loss) per share attributable to Cabot Corporation $ (5.49) $ (1.85) $ 4.34 $ 6.72 Less: Net Income (loss) per share from discontinued operations 0.02 - - - Net income (loss) per share from continuing operations (5.51) (1.85) 4.34 6.72 Less: Certain items after tax per share (8.00) (5.86) (0.68) (0.34) Less: Dilutive impact of shares (B) - (0.02) - - Adjusted earnings (loss) per share $ 2.49 $ 4.03 $ 5.02 $ 7.06 Per Share amounts are calculated after tax. 1. Fiscal 2015 amounts have been recast to reflect the retrospective application of the Company’s election to change its inventory valuation method of accounting for its U.S. reinforcing carbon inventories from the last-in, first-out (“LIFO”) method to the first-in, first-out (“FIFO”) method. 2. Due to the Company’s Net Loss position, GAAP EPS for all periods in fiscal 2018, except for the three months ended June 30 and September 30, 2018, has been calculated using basic weighted average shares to avoid anti-dilution. However, in order to provide an Adjusted Non-GAAP EPS with a weighted average share figure that is consistent with all other periods presented, the Company has included this reconciling item to quantify the difference between basic and diluted weighted average shares. This reconciling item is applicable to individual periods presented but does not sum cumulatively. The net loss for the twelve months ended September 30, 2018 is driven by a discrete tax item and impairment charges so the Company believes this approach provides the most comparable presentation possible. CABOT Investor Day 2024 | 79

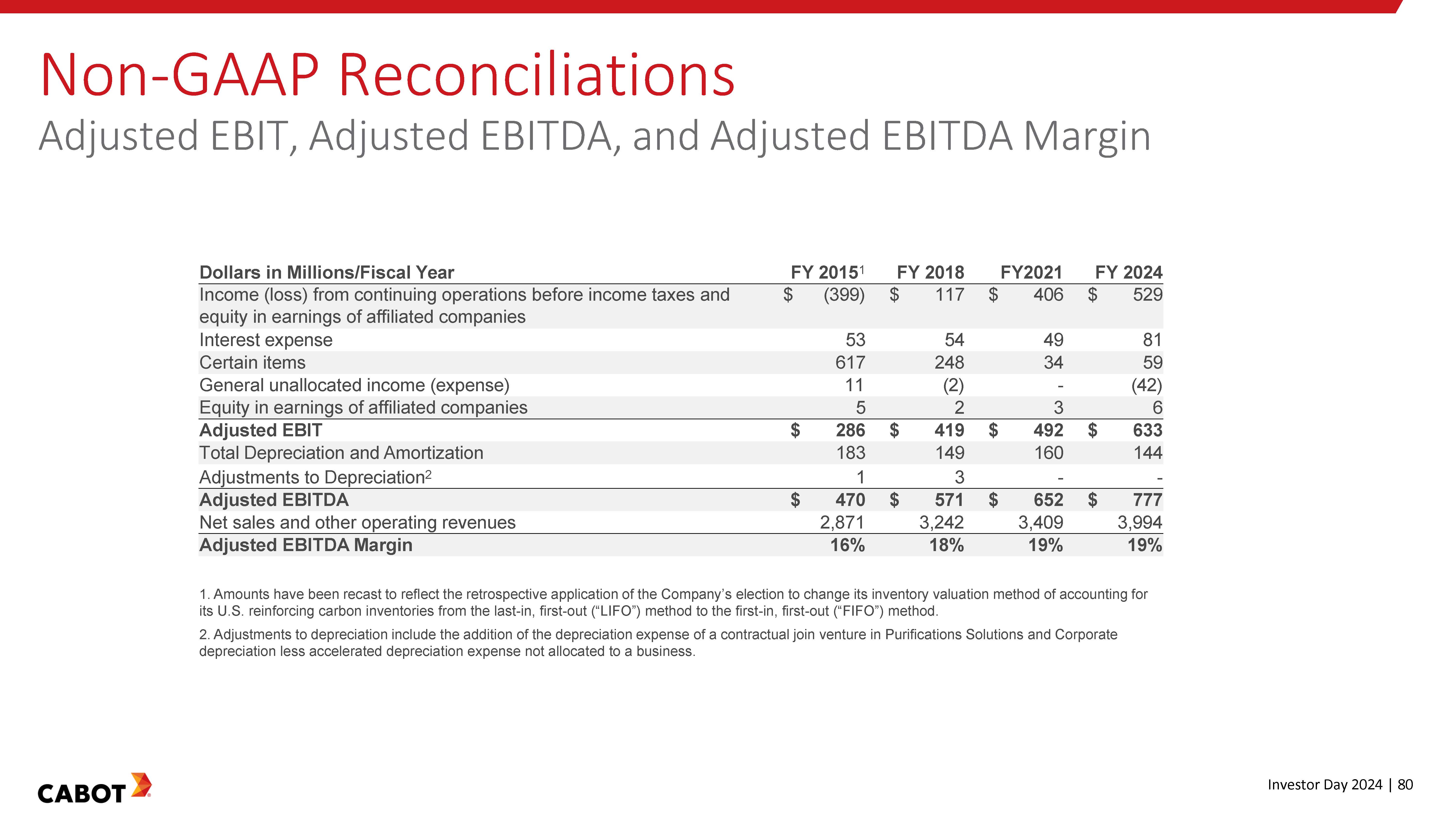

Non-GAAP Reconciliations Adjusted EBIT, Adjusted EBITDA, and Adjusted EBITDA Margin Dollars in Millions/Fiscal Year FY 20151 FY 2018 FY2021 FY 2024 Income (loss) from continuing operations before income taxes and equity in earnings of affiliated companies $ (399) $ 117 $ 406 $ 529 Interest expense 53 54 49 81 Certain items 617 248 34 59 General unallocated income (expense) 11 (2) - (42) Equity in earnings of affiliated companies 5 2 3 6 Adjusted EBIT $ 286 $ 419 $ 492 $ 633 Total Depreciation and Amortization 183 149 160 144 Adjustments to Depreciation2 1 3 - - Adjusted EBITDA $ 470 $ 571 $ 652 $ 777 Net sales and other operating revenues 2,871 3,242 3,409 3,994 Adjusted EBITDA Margin 16% 18% 19% 19% 1. Amounts have been recast to reflect the retrospective application of the Company’s election to change its inventory valuation method of accounting for its U.S. reinforcing carbon inventories from the last-in, first-out (“LIFO”) method to the first-in, first-out (“FIFO”) method. 2. Adjustments to depreciation include the addition of the depreciation expense of a contractual join venture in Purifications Solutions and Corporate depreciation less accelerated depreciation expense not allocated to a business. CABOT Investor Day 2024 | 80

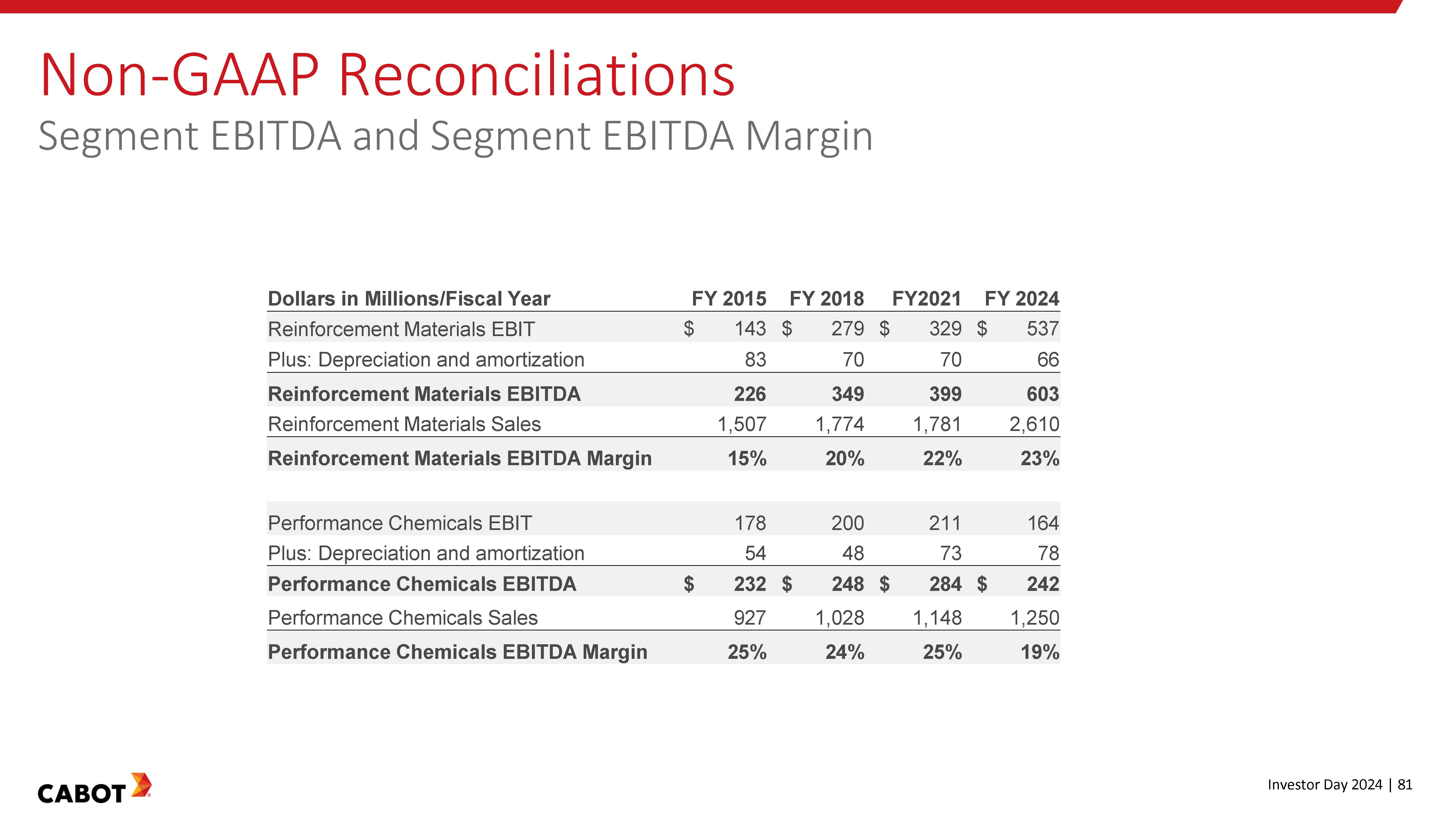

Non-GAAP Reconciliations Segment EBITDA and Segment EBITDA Margin Dollars in Millions/Fiscal Year FY 2015 FY 2018 FY2021 FY 2024 Reinforcement Materials EBIT $ 143 $ 279 $ 329 $ 537 Plus: Depreciation and amortization 83 70 70 66 Reinforcement Materials EBITDA 226 349 399 603 Reinforcement Materials Sales 1,507 1,774 1,781 2,610 Reinforcement Materials EBITDA Margin 15% 20% 22% 23% Performance Chemicals EBIT 178 200 211 164 Plus: Depreciation and amortization 54 48 73 78 Performance Chemicals EBITDA $ 232 $ 248 $ 284 $ 242 Performance Chemicals Sales 927 1,028 1,148 1,250 Performance Chemicals EBITDA Margin 25% 24% 25% 19% CABOT Investor Day 2024 | 81

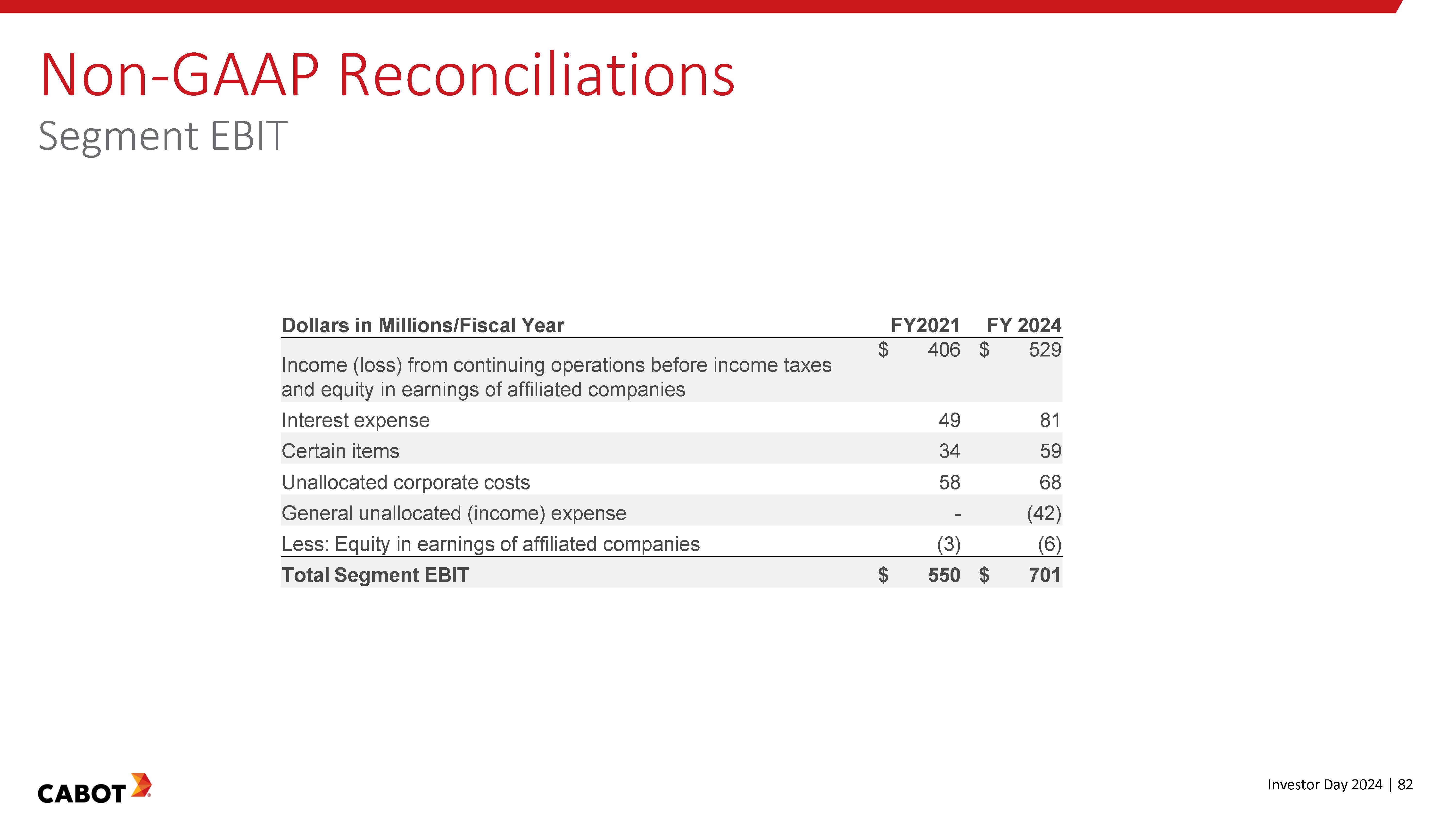

Non-GAAP Reconciliations Segment EBIT Dollars in Millions/Fiscal Year FY2021 FY 2024 Income (loss) from continuing operations before income taxes and equity in earnings of affiliated companies $ 406 $ 529 Interest expense 49 81 Certain items 34 59 Unallocated corporate costs 58 68 General unallocated (income) expense - (42) Less: Equity in earnings of affiliated companies (3) (6) Total Segment EBIT $ 550 $ 701 CABOT Investor Day 2024 | 82

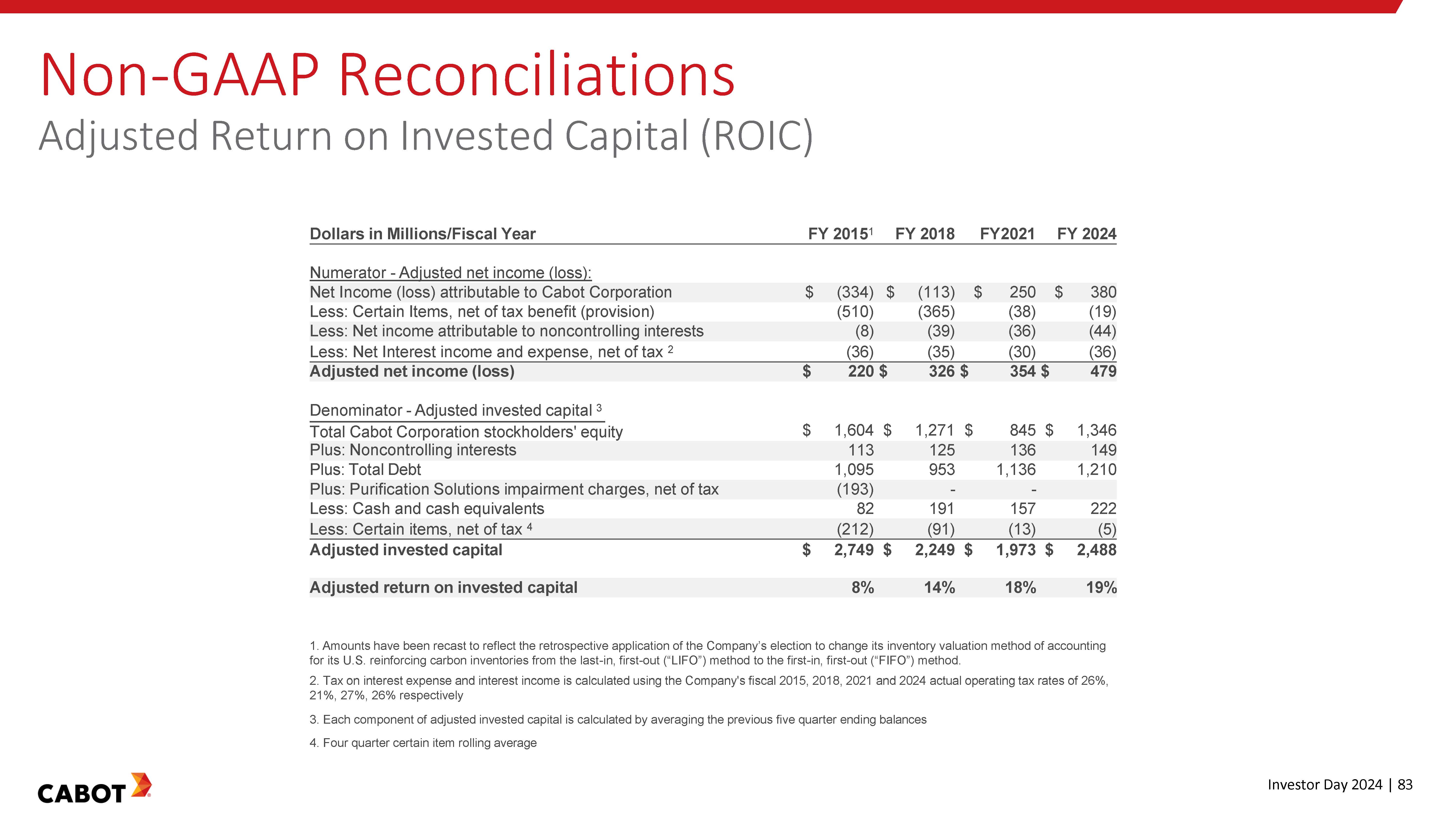

Non-GAAP Reconciliations Adjusted Return on Invested Capital (ROIC) Dollars in Millions/Fiscal Year FY 20151 FY 2018 FY2021 FY 2024 Numerator - Adjusted net income (loss): Net Income (loss) attributable to Cabot Corporation $ (334) $ (113) $ 250 $ 380 Less: Certain Items, net of tax benefit (provision) (510) (365) (38) (19) Less: Net income attributable to noncontrolling interests (8) (39) (36) (44) Less: Net Interest income and expense, net of tax 2 (36) (35) (30) (36) Adjusted net income (loss) $ 220 $ 326 $ 354 $ 479 Denominator - Adjusted invested capital 3 Total Cabot Corporation stockholders' equity $ 1,604 $ 1,271 $ 845 $ 1,346 Plus: Noncontrolling interests 113 125 136 149 Plus: Total Debt 1,095 953 1,136 1,210 Plus: Purification Solutions impairment charges, net of tax (193) - - Less: Cash and cash equivalents 82 191 157 222 Less: Certain items, net of tax 4 (212) (91) (13) (5) Adjusted invested capital $ 2,749 $ 2,249 $ 1,973 $ 2,488 Adjusted return on invested capital 8% 14% 18% 19% 1. Amounts have been recast to reflect the retrospective application of the Company’s election to change its inventory valuation method of accounting for its U.S. reinforcing carbon inventories from the last-in, first-out (“LIFO”) method to the first-in, first-out (“FIFO”) method. 2. Tax on interest expense and interest income is calculated using the Company's fiscal 2015, 2018, 2021 and 2024 actual operating tax rates of 26%, 21%, 27%, 26% respectively 3. Each component of adjusted invested capital is calculated by averaging the previous five quarter ending balances 4. Four quarter certain item rolling average CABOT Investor Day 2024 | 83

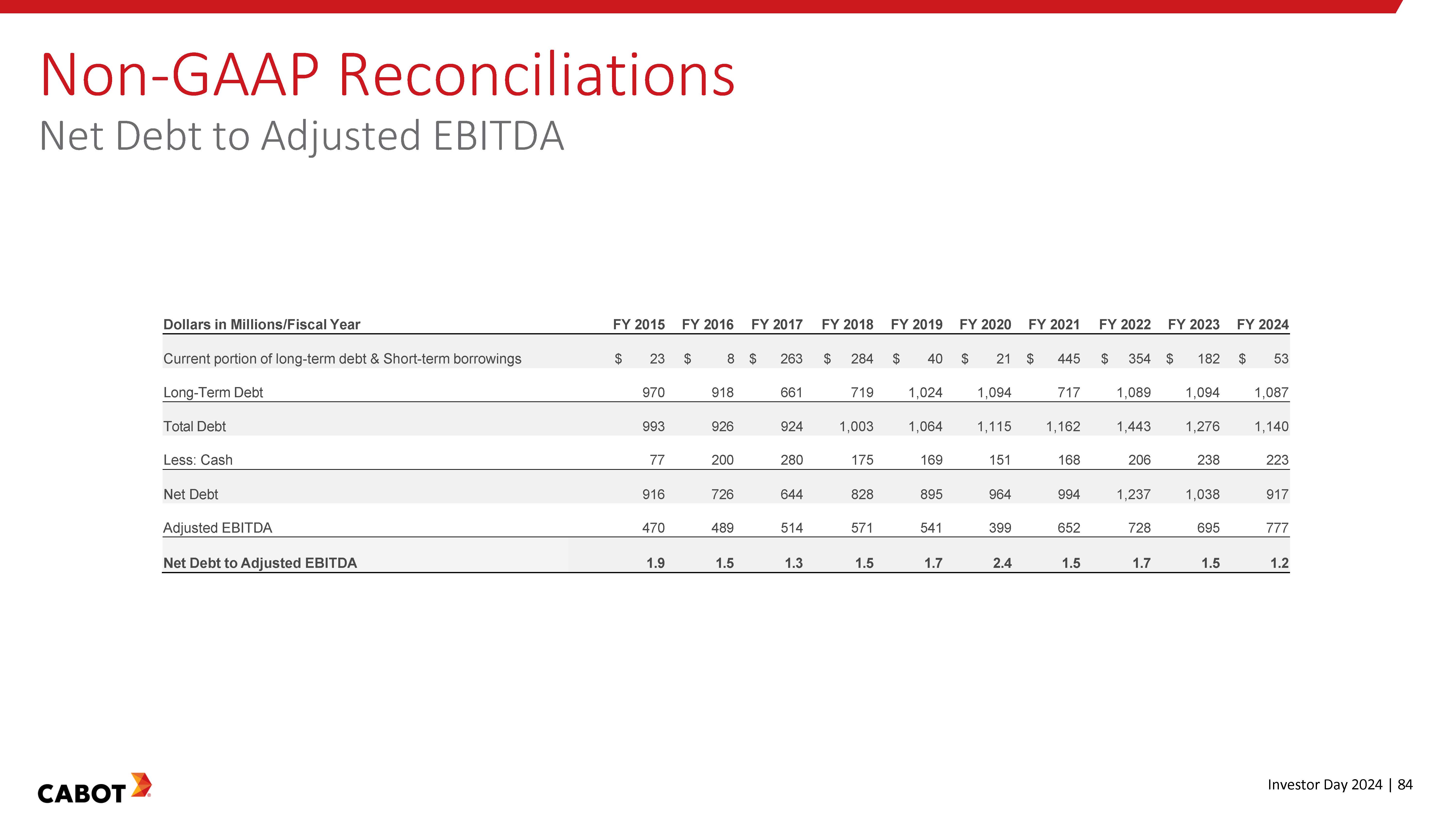

Non-GAAP Reconciliations Net Debt to Adjusted EBITDA Dollars in Millions/Fiscal Year FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 Current portion of long-term debt & Short-term borrowings $ 23 $ 8 $ 263 $ 284 $ 40 $ 21 $ 445 $ 354 $ 182 $ 53 Long-Term Debt 970 918 661 719 1,024 1,094 717 1,089 1,094 1,087 Total Debt 993 926 924 1,003 1,064 1,115 1,162 1,443 1,276 1,140 Less: Cash 77 200 280 175 169 151 168 206 238 223 Net Debt 916 726 644 828 895 964 994 1,237 1,038 917 Adjusted EBITDA 470 489 514 571 541 399 652 728 695 777 Net Debt to Adjusted EBITDA 1.9 1.5 1.3 1.5 1.7 2.4 1.5 1.7 1.5 1.2 CABOT Investor Day 2024 | 84

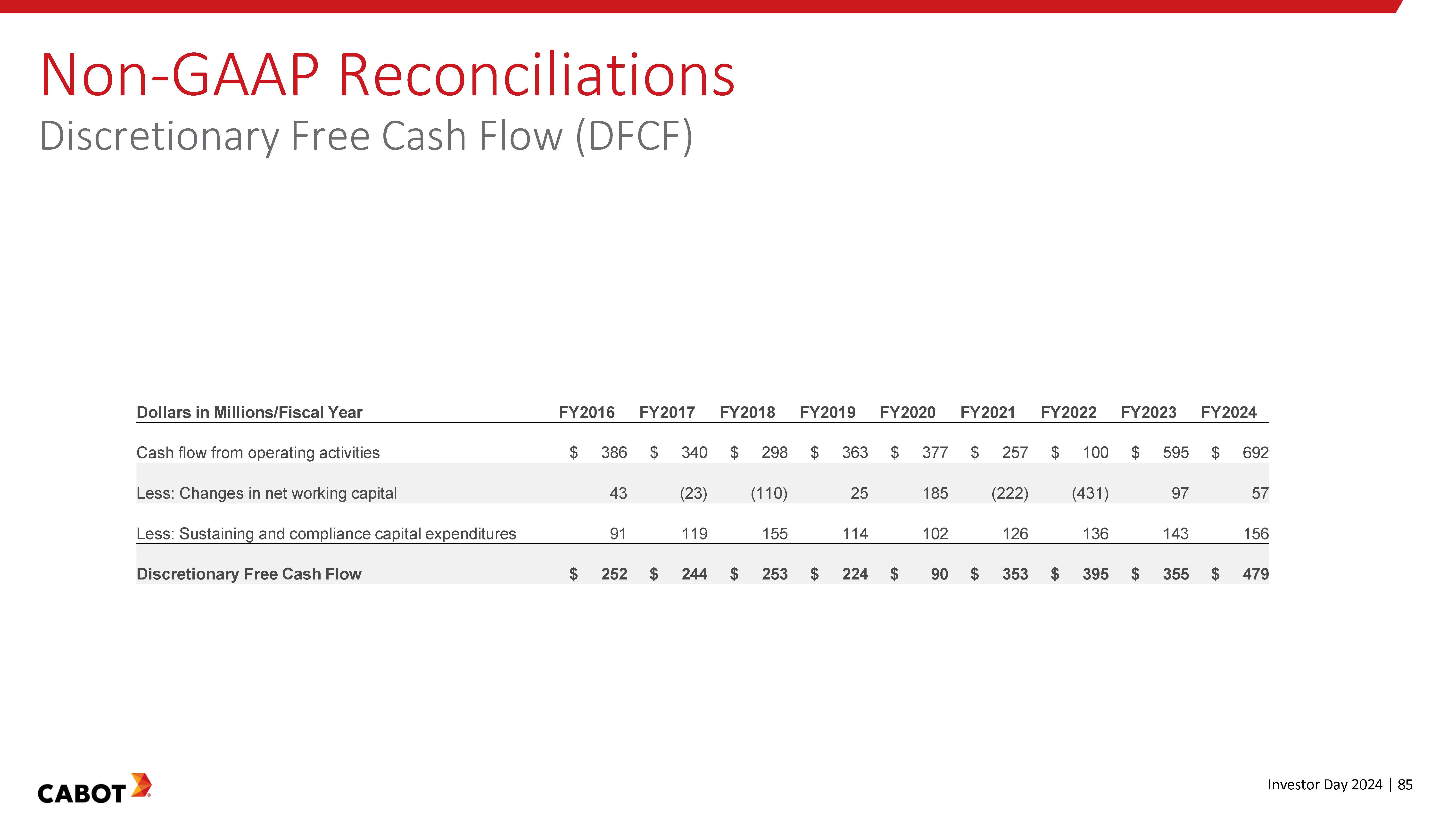

Non-GAAP Reconciliations Discretionary Free Cash Flow (DFCF) Dollars in Millions/Fiscal Year FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 FY2022 FY2023 FY2024 Cash flow from operating activities $ 386 $ 340 $ 298 $ 363 $ 377 $ 257 $ 100 $ 595 $ 692 Less: Changes in net working capital 43 (23) (110) 25 185 (222) (431) 97 57 Less: Sustaining and compliance capital expenditures 91 119 155 114 102 126 136 143 156 Discretionary Free Cash Flow $ 252 $ 244 $ 253 $ 224 $ 90 $ 353 $ 395 $ 355 $ 479 CABOT Investor Day 2024 | 85

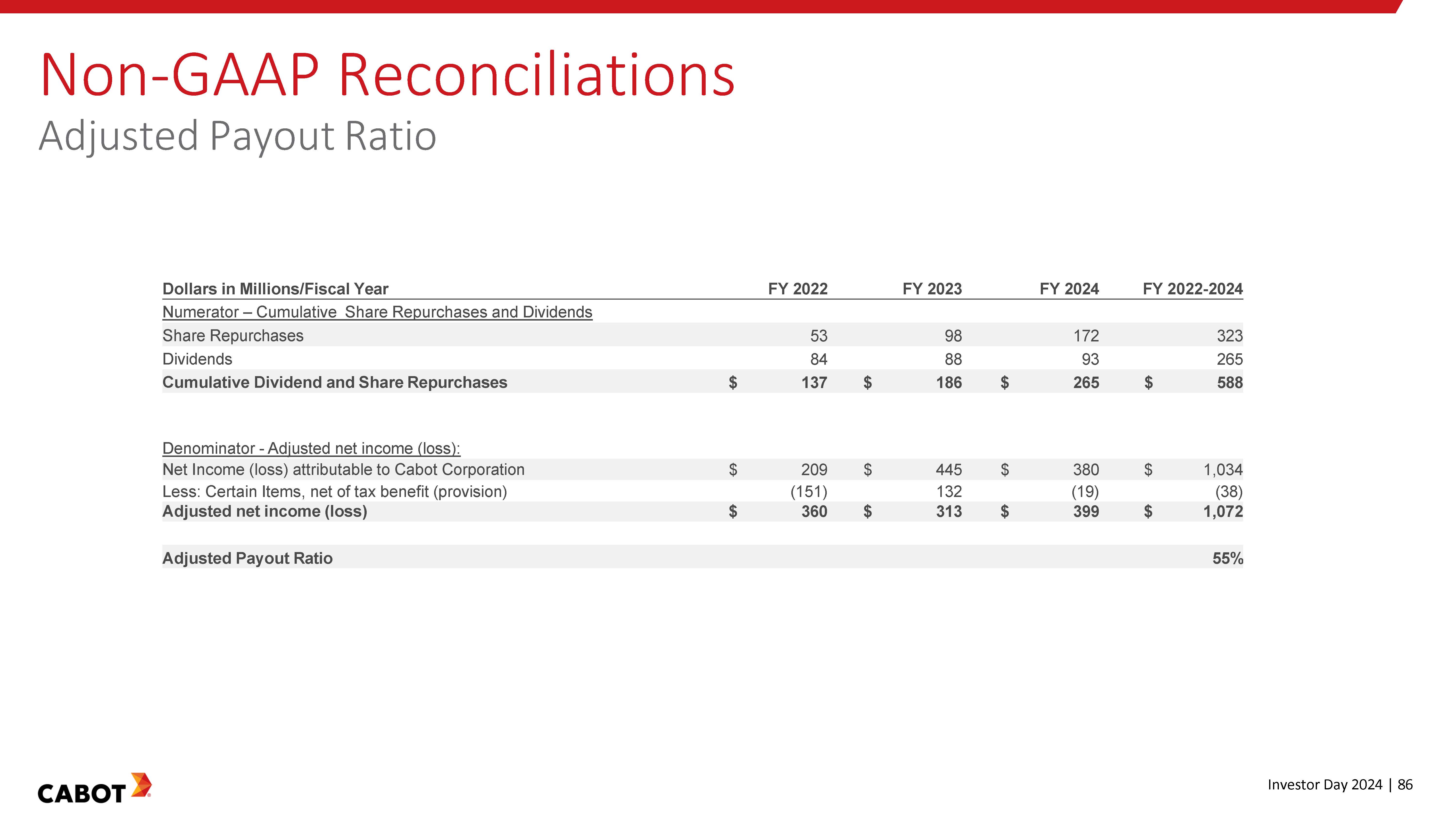

Non-GAAP Reconciliations Adjusted Payout Ratio Dollars in Millions/Fiscal Year FY 2022 FY 2023 FY 2024 FY 2022-2024 Numerator – Cumulative Share Repurchases and Dividends Share Repurchases 53 98 172 323 Dividends 84 88 93 265 Cumulative Dividend and Share Repurchases $ 137 $ 186 $ 265 $ 588 Denominator - Adjusted net income (loss): Net Income (loss) attributable to Cabot Corporation $ 209 $ 445 $ 380 $ 1,034 Less: Certain Items, net of tax benefit (provision) (151) 132 (19) (38) Adjusted net income (loss) $ 360 $ 313 $ 399 $ 1,072 Adjusted Payout Ratio 55% CABOT Investor Day 2024 | 86

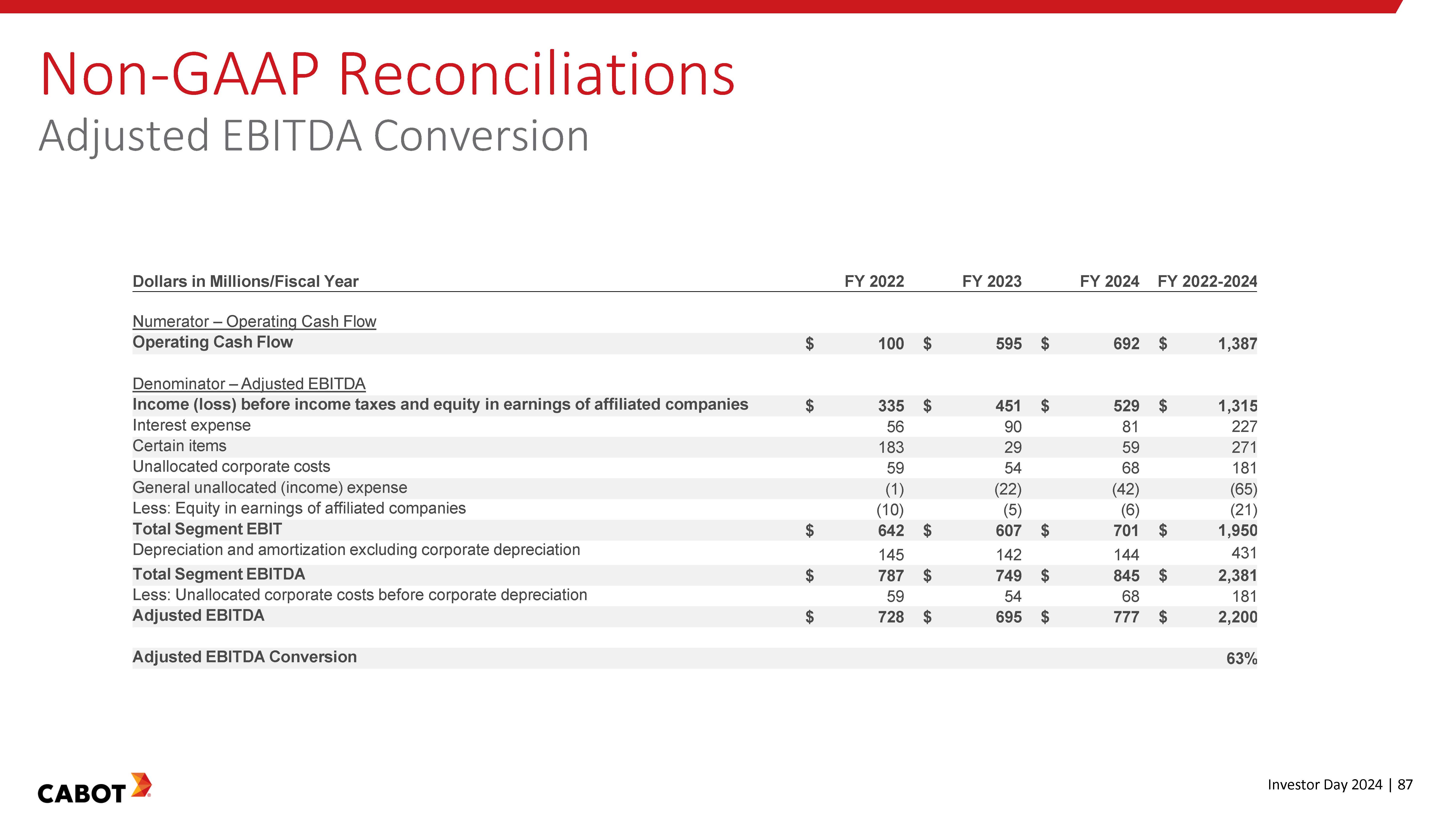

Non-GAAP Reconciliations Adjusted EBITDA Conversion Dollars in Millions/Fiscal Year FY 2022 FY 2023 FY 2024 FY 2022-2024 Numerator – Operating Cash Flow Operating Cash Flow $ 100 $ 595 $ 692 $ 1,387 Denominator – Adjusted EBITDA Income (loss) before income taxes and equity in earnings of affiliated companies $ 335 $ 451 $ 529 $ 1,315 Interest expense 56 90 81 227 Certain items 183 29 59 271 Unallocated corporate costs 59 54 68 181 General unallocated (income) expense (1) (22) (42) (65) Less: Equity in earnings of affiliated companies (10) (5) (6) (21) Total Segment EBIT $ 642 $ 607 $ 701 $ 1,950 Depreciation and amortization excluding corporate depreciation 145 142 144 431 Total Segment EBITDA $ 787 $ 749 $ 845 $ 2,381 Less: Unallocated corporate costs before corporate depreciation 59 54 68 181 Adjusted EBITDA $ 728 $ 695 $ 777 $ 2,200 Adjusted EBITDA Conversion 63% CABOT Investor Day 2024 | 87

Leadership Bios

Leadership bios CABOT

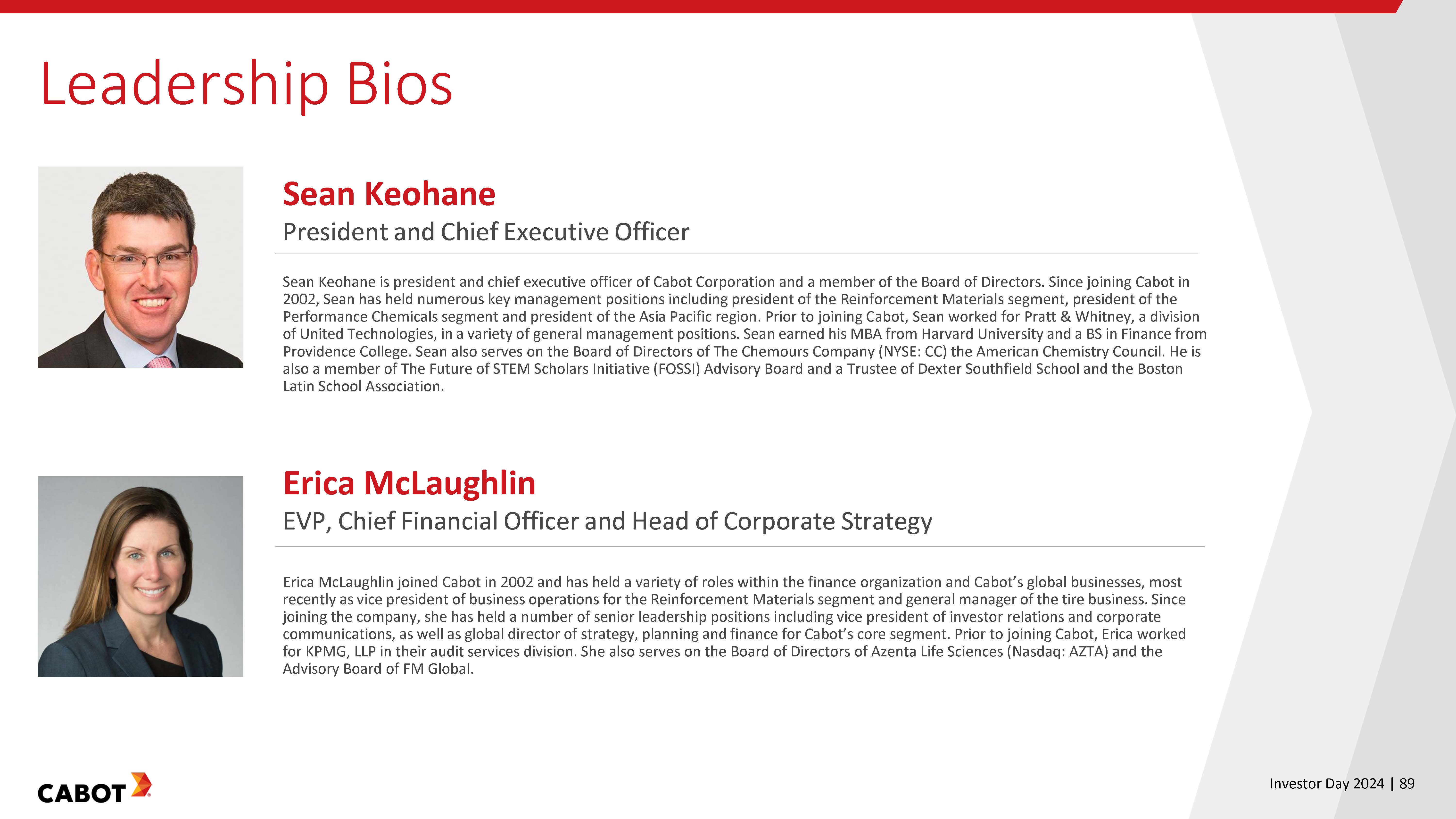

Leadership Bios Sean Keohane President and Chief Executive Officer Sean Keohane is president and chief executive officer of Cabot Corporation and a member of the Board of Directors. Since joining Cabot in 2002, Sean has held numerous key management positions including president of the Reinforcement Materials segment, president of the Performance Chemicals segment and president of the Asia Pacific region. Prior to joining Cabot, Sean worked for Pratt & Whitney, a division of United Technologies, in a variety of general management positions. Sean earned his MBA from Harvard University and a BS in Finance from Providence College. Sean also serves on the Board of Directors of The Chemours Company (NYSE: CC) the American Chemistry Council. He is also a member of The Future of STEM Scholars Initiative (FOSSI) Advisory Board and a Trustee of Dexter Southfield School and the Boston Latin School Association. Erica McLaughlin EVP, Chief Financial Officer and Head of Corporate Strategy Erica McLaughlin joined Cabot in 2002 and has held a variety of roles within the finance organization and Cabot’s global businesses, most recently as vice president of business operations for the Reinforcement Materials segment and general manager of the tire business. Since joining the company, she has held a number of senior leadership positions including vice president of investor relations and corporate communications, as well as global director of strategy, planning and finance for Cabot’s core segment. Prior to joining Cabot, Erica worked for KPMG, LLP in their audit services division. She also serves on the Board of Directors of Azenta Life Sciences (Nasdaq: AZTA) and the Advisory Board of FM Global. CABOT Investor Day 2024 | 89

Leadership Bios Bart Kalkstein EVP and President, Reinforcement Materials and Americas Region Bart Kalkstein joined Cabot in 2005. Since joining the company, Bart has held several key management positions within the company, most recently as vice president of corporate strategy and development. He was also vice president of global business operations and general manager of global emission control solutions for the former Purification Solutions segment, vice president of business operations and executive director of marketing and business strategy for the Performance Chemicals segment, and general manager of the aerogel business. Prior to joining Cabot, Bart worked for Boston Consulting Group. Bart earned his MBA from Harvard University and a BSE in Civil Engineering and Operations Research at Princeton University Jeff Zhu EVP and President, Carbon & Silica Technologies, Battery Materials and Asia Pacific Region Jeff Zhu is Executive Vice President and President, Carbon & Silica Technologies, Battery Materials and Asia Pacific Region. In his role, Jeff has executive oversight for the battery materials product line as well as Carbon & Silica Technologies, which includes the specialty carbons, specialty compounds, fumed metal oxides and aerogel product lines. Prior to joining Cabot, he spent 18 years with Rhodia (and its predecessor Rhone- Poulenc) where he served in a variety of regional and global business leadership roles, including Asia Pacific Regional Commercial Director, Regional Vice President and General Manager of Novecare, and Vice president and Global Director of electronics and catalysis. He served as the chairman and a Board Director of the Association of International Chemical Manufacturers (AICM). Jeff's most recent experience before joining Cabot was with Asia Pacific Resources International Holding Limited (APRIL), a multi-billion USD privately owned global paper and pulp company, where he served as head of global sales. Jeff earned his M.Sc in Chemistry from National University of Singapore and a distinction MBA from the University of Hull, UK. CABOT Investor Day 2024 | 90

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|