British American Tobacco Sees GBP25 Billion Impairment But Backs Guidance

06 12월 2023 - 4:50PM

Dow Jones News

By Joe Hoppe

British American Tobacco said it expects a one-off impairment of

around 25 billion pounds ($31.49 billion) in 2023, though it backed

its full-year guidance.

The FTSE 100 cigarette maker--which houses the Kent, Dunhill and

Lucky Strike brands among its portfolio--said Wednesday that it

expects 2023 revenue growth at the low end of its previously guided

3% to 5% range at constant currency.

It reported strong volume and revenue growth in new categories,

which it expects to be broadly breakeven.

The company said macroeconomic pressures were hitting its

combustibles performance in the U.S., and in conjunction with

investment in its noncombustibles business it will take an

accounting noncash adjusting impairment charge of around GBP25

billion.

It said the adjustment mainly relates to some of its acquired

U.S. combustibles brands, and will now assess their carrying value

and useful economic lives over an estimated period of 30 years.

BATs said it will commit to driving noncombustibles revenue up

to 50% of its revenue by 2035, and said it will drive investment

into 2024 to accelerate its transformation.

"We expect a progressive improvement to 3-5% revenue growth, and

mid-single digit adjusted profit from operations growth on an

organic basis at constant rates by 2026," the company said.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

December 06, 2023 02:35 ET (07:35 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

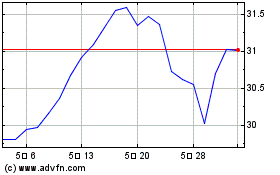

British American Tobacco (NYSE:BTI)

과거 데이터 주식 차트

부터 4월(4) 2024 으로 5월(5) 2024

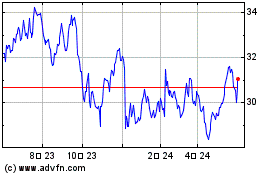

British American Tobacco (NYSE:BTI)

과거 데이터 주식 차트

부터 5월(5) 2023 으로 5월(5) 2024