U Power Limited Announces Receipt of Nasdaq Notification Regarding Minimum Bid Price Deficiency

24 1월 2024 - 6:05AM

U Power Limited (Nasdaq: UCAR) (the “Company” or “U Power”), a

vehicle sourcing services provider with a vision to becoming a

comprehensive EV battery power solution provider in China, today

announced the Company had received a notification letter (the

“Notification Letter”), dated January 19, 2024, from the Listing

Qualifications Department of The Nasdaq Stock Market LLC

("Nasdaq"), indicating that it is not in compliance with the

minimum bid price requirement set forth in the Nasdaq Listing Rules

for continued listing on the Nasdaq.

Nasdaq Listing Rule 5550(a)(2) requires listed

securities to maintain a minimum bid price of US$1.00 per share,

and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to

meet the minimum bid price requirement exists if such deficiency

continues for a period of 30 consecutive business days. Based on

the closing bid price of the Company's ordinary shares for the 30

consecutive business days from December 4, 2023, to January 18,

2024, the Company no longer meets the minimum bid price

requirement.

The Notification Letter does not impact the

Company's listing on the Nasdaq Capital Market at this time. In

accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has

been provided 180 calendar days, or until July 17, 2024 (the

“Compliance Period”), to regain compliance with Nasdaq Listing Rule

5550(a)(2). To regain compliance, the Company's ordinary shares

must have a closing bid price of at least US$1.00 for a minimum of

10 consecutive business days. If at any time during the Compliance

Period, the closing bid price per share of the Company's Ordinary

Shares is at least $1.00 for a minimum of 10 consecutive business

days, Nasdaq will provide the Company a written confirmation of

compliance and the matter will be closed.

In the event the Company does not regain

compliance by July 17, 2024, the Company may be eligible for

additional time to regain compliance. To qualify, the Company will

be required to meet the continued listing requirement for market

value of publicly held shares and all other initial listing

standards for the Nasdaq Capital Market, with the exception of the

bid price requirement, and will need to provide written notice to

Nasdaq of its intention to cure the deficiency.

The Company's operations are not affected by the

receipt of the Notification Letter. The Company intends to monitor

the closing bid price of its ordinary shares and may, if

appropriate, consider implementing available options, including,

but not limited to, implementing a reverse share split of its

outstanding ordinary shares, to regain compliance with the minimum

bid price requirement under the Nasdaq Listing Rules.

About U Power Limited

U Power Limited is a vehicle sourcing services

provider, with a vision to becoming an EV market player primarily

focused on its proprietary battery-swapping technology, or UOTTA

technology, which is an intelligent modular battery-swapping

technology designed to provide a comprehensive battery power

solution for EVs. Since its operation in 2013, the Company has

established a vehicle sourcing network in China's lower-tier

cities. The Company has developed two types of battery-swapping

stations for compatible EVs and is operating one manufacturing

factory in Zibo City, Shandong Province, China. For more

information, please visit the Company's website:

http://ir.upincar.com/.

Forward-Looking Statements

This press release contains “forward-looking

statements”. Forward-looking statements reflect our current view

about future events. These forward-looking statements involve known

and unknown risks and uncertainties and are based on the Company’s

current expectations and projections about future events that the

Company believes may affect its financial condition, results of

operations, business strategy and financial needs. Investors can

identify these forward-looking statements by words or phrases such

as “may,” “will,” “could,” “expect,” “anticipate,” “aim,”

“estimate,” “intend,” “plan,” “believe,” “is/are likely to,”

“propose,” “potential,” “continue” or similar expressions. The

Company undertakes no obligation to update or revise publicly any

forward-looking statements to reflect subsequent occurring events

or circumstances, or changes in its expectations, except as may be

required by law. Although the Company believes that the

expectations expressed in these forward-looking statements are

reasonable, it cannot assure you that such expectations will turn

out to be correct, and the Company cautions investors that actual

results may differ materially from the anticipated results and

encourages investors to review other factors that may affect its

future results in the Company's registration statement and other

filings with the U.S. Securities and Exchange Commission.

For investor and media inquiries, please

contact:

U Power LimitedInvestor

Relations DepartmentEmail: ir@upincar.com

Ascent Investor Relations

LLCTina XiaoPhone: +1-646-932-7242Email:

investors@ascent-ir.com

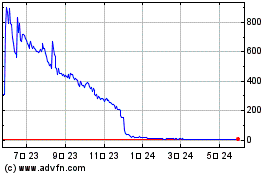

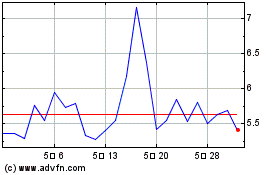

U Power (NASDAQ:UCAR)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

U Power (NASDAQ:UCAR)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024