UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 20)*

SunPower Corporation

(Name of Issuer)

Common

Stock, par value $0.001 per share

(Title of Class of Securities)

867652

406

(CUSIP Number)

Paul

Moss-Bowpitt

Legal Director, Corporate Transactions

TOTALENERGIES SE

2, place Jean Millier

La Défense 6

92400 Courbevoie

France

00-331-4135-2834

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

May 30, 2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §

240.13d-7 for other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be

filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which

would alter disclosures provided in a prior cover page. |

The information

required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of

the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 867652 406

| |

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

TotalEnergies SE |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a)

¨

(b) ¨ |

| 3 |

|

SEC

Use Only |

| 4 |

|

Source of Funds (See Instructions)

WC |

| 5 |

|

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or Place of Organization

France |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

162,970,512 (1)(2) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

162,970,512 (1)(2) |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

162,970,512 (1)(2) |

| 12 |

|

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares ¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

65.1% (3) |

| 14 |

|

Type of Reporting Person

CO |

CUSIP No. 867652 406

| |

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

TotalEnergies Gestion USA SARL |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC

Use Only |

| 4 |

|

Source of Funds (See Instructions)

WC |

| 5 |

|

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or Place of Organization

France |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

162,970,512

(1)(2) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

162,970,512 (1)(2) |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

162,970,512 (1)(2) |

| 12 |

|

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares ¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

65.1%

(3) |

| 14 |

|

Type of Reporting Person

CO |

CUSIP No. 867652 406

| |

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

TotalEnergies Holdings USA, Inc. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC

Use Only |

| 4 |

|

Source of Funds (See Instructions)

WC |

| 5 |

|

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or Place of Organization

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

162,970,512 (1)(2) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

162,970,512

(1)(2) |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

162,970,512

(1)(2) |

| 12 |

|

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares ¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

65.1%

(3) |

| 14 |

|

Type of Reporting Person

CO |

CUSIP No. 867652 406

| |

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

TotalEnergies Delaware, Inc. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC

Use Only |

| 4 |

|

Source of Funds (See Instructions)

WC |

| 5 |

|

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or Place of Organization

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

162,970,512 (1)(2) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

162,970,512 (1)(2) |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

162,970,512

(1)(2) |

| 12 |

|

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares ¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

65.1%

(3) |

| 14 |

|

Type of Reporting Person

CO |

CUSIP No. 867652 406

| |

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

TotalEnergies Renewables USA, LLC |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC

Use Only |

| 4 |

|

Source of Funds (See Instructions)

WC |

| 5 |

|

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or Place of Organization

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

162,970,512 (1)(2) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

162,970,512 (1)(2) |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

162,970,512 (1)(2) |

| 12 |

|

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares ¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

65.1% (3) |

| 14 |

|

Type of Reporting Person

OO |

CUSIP No. 867652 406

| |

|

|

|

|

|

|

| 1 |

|

Names of Reporting Persons

Sol Holding, LLC |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC

Use Only |

| 4 |

|

Source of Funds (See Instructions)

WC |

| 5 |

|

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or Place of Organization

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

162,970,512

(1)(2) |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

162,970,512

(1)(2) |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

162,970,512 (1)(2) |

| 12 |

|

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares ¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

65.1%

(3) |

| 14 |

|

Type of Reporting Person

OO |

| (1) | Includes

33,402,112 shares of common stock, par value $0.001 per share (“Common Stock”)

of SunPower Corp. (the “Issuer”) issuable upon the exercise of the Second Tranche

Warrant (as described in this filing) and 41,612,944 shares of the Issuer’s Common

Stock issued upon the net exercise of the First Tranche Warrant (as described in this filing).

The First Tranche Warrant exercise price was paid on a cashless basis pursuant to the terms

of the warrant on March 5, 2024 and May 1, 2024, resulting in the Issuer withholding

an aggregate of 139,696 shares of Common Stock to pay the exercise price and issuing an aggregate

of 41,612,944 shares of Common Stock. |

| (2) | The shares of Common Stock reported herein

are held directly by Sol Holding, LLC. TotalEnergies Holdings USA, Inc. is the sole

shareholder of TotalEnergies Delaware, Inc., which is the sole member of TotalEnergies

Renewables USA, LLC, which is one of two members of Sol Holding, LLC, a limited liability

company managed by a board of managers. TotalEnergies Gestion USA SARL, which is a direct

wholly owned subsidiary of TotalEnergies SE, is the sole shareholder of TotalEnergies Holdings

USA, Inc. As a result, each of the foregoing entities may be deemed to beneficially

own the shares of Common Stock reported herein. |

| (3) | Percentage calculated based on (i) 175,361,088

shares of Common Stock outstanding as of December 15, 2023 as reported by the Issuer

in its quarterly report on Form 10-Q filed with the Securities and Exchange Commission

on December 18, 2023 plus (ii) 41,612,944 shares of Common Stock issued to the

Reporting Person upon the cashless exercise of the First Tranche Warrant and (iii) 33,402,112

shares of Common Stock underlying the Second Tranche Warrant. In computing the number of

shares beneficially owned by a person or entity and the percentage ownership of that person

or entity, all shares subject to warrants held by such person or entity were deemed outstanding

if such warrants are currently exercisable or will become exercisable within 60 days of the

date of this filing. These shares were not deemed outstanding, however, for the purpose of

computing the percentage ownership of any other person or entity. |

Explanatory Note

This Amendment No. 20 (this “Amendment”)

amends and supplements the statement on Schedule 13D dated June 23, 2011, as amended on July 1, 2011, November 21, 2011,

December 23, 2011, February 2, 2012, March 1, 2012, June 6, 2013, June 18, 2014, December 9, 2015, December 10,

2015, November 25, 2019, January 21, 2020, February 4, 2020, February 19, 2020, March 20, 2020, April 15,

2020, May 25, 2022, August 18, 2022, September 12, 2022, and February 14, 2024 (the “Filing”), by the

Reporting Persons relating to the shares of common stock, par value $0.001 per share (“Common Stock”) of SunPower Corporation

(the “Issuer”). Information reported in the Filing remains in effect except to the extent that it is amended, restated or

superseded by information contained in this Amendment. Capitalized terms used but not defined in this Amendment have the respective meanings

set forth in the Filing.

The information set forth in response to each

separate Item below shall be deemed to be a response to all Items where such information is relevant. Information with respect to each

Reporting Person is given solely by such Reporting Person and no Reporting Person assumes responsibility for the accuracy or completeness

of the information furnished by another Reporting Person, except as otherwise provided in Rule 13d-1(k).

| Item

3. | Source

and Amount of Funds or Other Consideration. |

Item 3 of the Filing is amended and supplemented as follows:

Second Lien Credit Facility

As previously disclosed, on February 14,

2024, the Company entered into the Second Lien Credit Agreement, by and among the Company, certain of its subsidiaries as guarantors

party thereto, the lenders party thereto, GLAS USA LLC, as Administrative Agent, and GLAS Americas, LLC, as Collateral Agent (the “Second

Lien Credit Agreement”). Capitalized terms used but not defined in this section shall have

the meanings given to such terms in the Second Lien Credit Agreement.

The Second Lien Credit Agreement provides for

an approximately $175.5 million term loan facility comprised of: (i) an approximately $125.5 million tranche of second lien term

loans (“Tranche 1 Second Lien Loans”), which was borrowed on the closing date of the Second Lien Credit Agreement; and (ii) a

second tranche of $50 million of second lien term loans (“Tranche 2 Second Lien Loans”).

On May 30,

2024, the Company borrowed $50 million of Tranche 2 Second Lien Loans, which consisted of all Tranche 2 Term Loan Commitments.

The foregoing descriptions of the Tranche 2 Second

Lien Loans and the terms of the Second Lien Credit Agreement do not purport to be complete and are subject to, and qualified in their

entirety by, reference to the Second Lien Credit Agreement, which was filed as Exhibit 40

to this Filing as part of Amendment No. 19 dated February 14, 2024.

Warrants

As previously disclosed, in connection with the

Second Lien Credit Agreement, the Issuer agreed to issue to Sol Holding warrants to purchase shares of Common Stock in two tranches:

(i) the first tranche (“First Tranche Warrant”) consisting of a warrant exercisable for 41,752,640 shares of Common

Stock and (ii) the second tranche (“Second Tranche Warrant”) consisting of an additional warrant exercisable for 33,402,112

shares of Common Stock. As previously disclosed, on February 14, 2024, concurrent with the issuance of the Tranche 1 Loans, the

Issuer issued the First Tranche Warrant to Sol Holding. On March 5, 2024, Sol Holding elected to exercise the portion of the First

Tranche Warrant representing 35,077,905 of the 41,752,640 shares of Common Stock underlying the First Tranche Warrant, and paid the exercise

price on a cashless basis pursuant to the terms of the First Tranche Warrant, resulting in the Issuer withholding 107,907 shares of Common

Stock to pay the exercise price and issuing to Sol Holding an aggregate of 34,969,998 shares of Common Stock. On May 1, 2024, Sol

Holding elected to exercise the remaining 6,674,735 shares of Common Stock underlying the First Tranche Warrant, and paid the exercise

price on a cashless basis pursuant to the terms of the First Tranche Warrant, resulting in the Issuer withholding 31,789 shares of Common

Stock to pay the exercise price and issuing to Sol Holding an aggregate of 6,642,946 shares of Common Stock. The total number of shares

of Common Stock issued to Sol Holding upon the exercises of the First Tranche Warrants was 41,612,944 shares of Common Stock.

On May 30, 2024, concurrently with the issuance

of the Tranche 2 Loans, the Issuer issued the Second Tranche Warrant to Sol Holding.

The

Second Tranche Warrant is exercisable in whole or in part for shares of Common Stock at an exercise price of $0.01 per share and expires

on the tenth anniversary of issuance. Sol Holding may pay the exercise price in cash or elect to exercise the Second Tranche Warrant

on a “cashless” basis. Pursuant to the terms of the Second Tranche Warrant, the number of shares for which the Second

Tranche Warrant is exercisable and the exercise price for such shares may be adjusted in the event of certain dilutive issuances pursuant

to an anti-dilution formula set forth in the Second Tranche Warrant, and for stock splits, reclassifications, share combinations, dividends

or distributions made by the Issuer on the Common Stock. Further, in connection with an Event of Default (as defined in the Second

Lien Credit Agreement), the Issuer may be required, at the election of the warrantholder, to either (a) purchase the Second

Tranche Warrant for a cash amount equal to the Black-Scholes Value (as defined in the Second Tranche Warrant) of the unexercised portion

of the Second Tranche Warrant or (b) permit the exercise of the Second Tranche Warrant pursuant to a cashless default exercise for

a number of shares of Common Stock with a value equal to the Black-Scholes Value of the unexercised portion of the Second Tranche Warrant.

The foregoing description of the Second Tranche

Warrant does not purport to be complete and is qualified by the full text of the Warrant to Purchase, which is filed as Exhibit 46

to this Filing.

| Item 4. | Purpose

of Transaction. |

Item 4 of the Filing is amended and supplemented as follows:

The descriptions of the Tranche 2 Loans and Second

Tranche Warrant in Item 3 are hereby incorporated by reference into this Item 4.

| Item 5. | Interest

in Securities of the Issuer. |

Item 5 of the Filing is amended and restated in its entirety as follows.

The information set forth in the facing pages of

this Schedule 13D with respect to the shared beneficial ownership of Common Stock by the Reporting Persons is incorporated by reference

into this Item 5.

The information set forth in Items 2, 3 and 4 is hereby incorporated

by reference into this Item 5.

(a)-(b) The number and percentage of shares

of Common Stock to which this Filing relates is 162,970,512, constituting 65.1% of the Common Stock outstanding. The percentage of beneficial

ownership in this Filing is calculated in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended, and

is based on an aggregate of 175,361,088 shares of Common Stock outstanding as of December 15, 2023 as reported by the Issuer in

its quarterly report on Form 10-Q filed with the SEC on December 18, 2023, adjusted to reflect the 41,612,944 shares of Common

Stock issued to Sol Holding upon the cashless exercise of the First Tranche Warrant.

The shares of Common Stock reported herein are

held directly by Sol Holding. TotalEnergies Holdings is the sole shareholder of TotalEnergies Delaware, which is the sole member of TotalEnergies

Renewables, which is one of two members of Sol Holding, a limited liability company managed by a board of managers. TotalEnergies Gestion,

which is a direct wholly owned subsidiary of TotalEnergies SE, is the sole shareholder of TotalEnergies Holdings. As a result, each of

the foregoing entities may be deemed to beneficially own the shares of Common Stock reported herein.

(c) Other

than as disclosed in Item 4 of this Amendment, none of the Reporting Persons has effected any transactions in the Common Stock during

the past 60 days.

(d) None.

(e) Not

applicable.

| Item

7. | Materials

to be Filed as Exhibits |

Item 7 of the Filing is hereby amended and supplemented as follows:

| Exhibit Number | Description |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I

certify that the information set forth in this statement is true, complete and correct.

Date:

June 3, 2024

| |

TOTALENERGIES SE |

| |

|

|

| |

By: |

/s/

Marine Delaitre |

| |

Name: |

Marine Delaitre |

| |

Title: |

Authorized Signatory |

| |

|

|

| |

TOTALENERGIES GESTION USA SARL |

| |

|

|

| |

By: |

/s/

Eric Bozec |

| |

Name: |

Eric Bozec |

| |

Title: |

General Manager |

| |

|

|

| |

TOTALENERGIES HOLDINGS USA, INC. |

| |

|

|

| |

By: |

/s/

Richard Frazier |

| |

Name: |

Richard Frazier |

| |

Title: |

Assistant Secretary |

| |

|

|

| |

TOTALENERGIES DELAWARE, INC. |

| |

|

|

| |

By: |

/s/

Richard Frazier |

| |

Name: |

Richard Frazier |

| |

Title: |

Secretary |

| |

|

|

| |

TOTALENERGIES RENEWABLES USA, LLC |

| |

|

|

| |

By: |

/s/

Richard Frazier |

| |

Name: |

Richard Frazier |

| |

Title: |

Secretary |

| |

|

|

| |

SOL HOLDING, LLC |

| |

|

|

| |

By: |

/s/ Christopher Gillies |

| |

Name: |

Christopher Gillies |

| |

Title: |

President and Manager |

Schedule A

DIRECTORS AND EXECUTIVE OFFICERS OF THE REPORTING

PERSONS

Set forth below is the name

and current principal occupation or employment of each director and executive officer, as applicable, of TotalEnergies SE, TotalEnergies

Gestion USA SARL, TotalEnergies Holdings USA Inc., TotalEnergies Delaware Inc., TotalEnergies Renewables USA LLC and Sol Holding, LLC.

The business address of each of the directors and executive officers of TotalEnergies SE and TotalEnergies Gestion USA SARL is 2, place

Jean Millier, La Défense 6, 92400 Courbevoie, France. The business address of each of the other individuals listed below is 1201

Louisiana St. Suite 1800, Houston, TX 77002

TOTALENERGIES SE

Name |

Occupation |

Citizenship |

| Patrick

Pouyanné |

Chairman

and Chief Executive Officer |

French |

| Helle

Kristoffersen |

President,

Asia |

French

and Danish |

| Stéphane

Michel |

President,

Gas, Renewables & Power |

French |

| Thierry

Pflimlin |

President,

Marketing & Services |

French |

| Bernard

Pinatel |

President,

Refining & Chemicals |

French |

| Jean-Pierre

Sbraire |

Chief

Financial Officer |

French |

| Namita

Shah |

President,

OneTech |

French |

| Nicolas

Terraz |

President,

Exploration & Production |

French |

| Aurélien

Hamelle |

President

Strategy & Sustainability |

French |

| Jacques

Aschenbroich |

Director |

French |

| Anelise

Quintão Lara |

Director |

French |

| Marie-Christine

Coisne-Roquette |

Lead

Independent Director |

French |

| Lise

Croteau |

Director |

Canadian |

| Mark

Cutifani |

Director |

Australian |

| Emma

de Jonge |

Director

representing employee shareholders |

French |

| Romain

Garcia-Ivaldi |

Director

representing employees |

French |

| Maria

van der Hoeven |

Director |

Netherlands |

| Glenn

Hubbard |

Director |

American |

| Anne-Marie

Idrac |

Director |

French |

| Jean

Lemierre |

Director |

French |

| Dirk

Paskert |

Director |

German |

| Angel

Pobo |

Director

representing employees |

French |

TOTALENERGIES GESTION USA SARL

| Eric

Bozec |

General

Manager |

French |

TOTALENERGIES HOLDINGS USA INC.

| Mike

Naeve |

Director |

American |

| Christophe

Vuillez |

Director,

President & Chief Executive Officer |

French |

| Alexander

Adotevi |

Director

and Chief Financial Officer |

German |

| Dawn

Lannin |

Director,

General Counsel & Secretary |

American |

| Eric

Bozec |

Director |

French |

| Esmeralda

Fernandez |

Treasurer |

American |

| Rich

Frazier |

Assistant

Secretary |

American |

TOTALENERGIES DELAWARE INC.

| Christophe

Vuillez |

Director

and President |

French |

| Alexander

Adotevi |

Director

and Vice President |

German |

| Dawn

Lannin |

Director |

American |

| Esmeralda

Fernandez |

Treasurer |

American |

| Rich

Frazier |

Secretary |

American |

TOTALENERGIES RENEWABLES USA LLC

| Vincent

Stoquart |

Manager |

Belgian |

| Marc-Antoine

Pignon |

Manager

and Chief Executive Officer |

French |

| Olivier

Terneaud |

Manager |

French |

| Alexander

Adotevi |

Manager |

German |

| David

Foulon |

Manager |

American |

| Christopher

Gillies |

Chief

Financial Officer |

Australian |

| Ali

Mirza |

Vice

President, Structured Finance |

American |

| Jeff

Newcombe |

Vice

President, Technical |

American |

| Anais

Immas |

Vice

President, Business Development |

French |

| Eric

Potts |

Vice

President, Managing Director, Distributed Generation |

American |

| Greg

Nelson |

Vice

President, Managing Director – Core Solar |

American |

| Esmeralda

Fernandez |

Treasurer |

American |

| Rich

Frazier |

Secretary |

American |

| Simon

Hayes |

Assistant

Secretary |

British |

| Ha

C. Yi |

Assistant

Secretary |

American |

Sol Holding, LLC

| Vincent

Stoquart |

Manager |

Belgian |

| Jonathan

Bram |

Manager |

American |

| Christopher

Gillies |

President

and Manager |

Australian |

| Emmanuel

Barrois |

Manager |

French |

| Daniel

Barbosa |

Manager |

American |

| Rich

Frazier |

Secretary |

American |

| Wendy

Barberousse |

Assistant

Secretary |

American;

French |

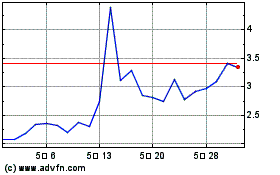

SunPower (NASDAQ:SPWR)

과거 데이터 주식 차트

부터 5월(5) 2024 으로 6월(6) 2024

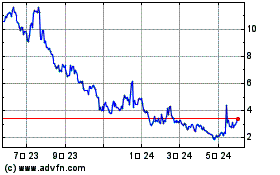

SunPower (NASDAQ:SPWR)

과거 데이터 주식 차트

부터 6월(6) 2023 으로 6월(6) 2024