false

0001300734

0001300734

2024-08-22

2024-08-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

AND EXCHANGE ACT OF 1934

Date

of report (date of earliest event reported): August 22, 2024

SHINECO,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-37776 |

|

52-2175898 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

T1,

South Tower, Jiazhaoye Square, Chaoyang

District,

Beijing, People’s

Republic of China 100022

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (+86) 10-87227366

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

SISI |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

August 22, 2024, Shineco, Inc. (the “Company”) entered into a securities purchase agreement (the “SPA”) with

22 purchasers, each an unrelated third party to the Company (collectively, the “Purchasers”). Pursuant to the SPA, the Purchasers

agree to purchase, and the Company agreed to issue and sell to the Purchasers, an aggregate of 14,985,000 shares of the Company’s

common stock, par value $0.001 per share (the “Shares”), at a purchase price of $0.55 per share, and for an aggregate purchase

price of $8,241,750 (the “Offering”). The Shares were offered under the Company’s registration statement on Form S-3

(File No. 333-261229), initially filed with the U.S. Securities and Exchange Commission on November 19, 2021, as amended on May 11, 2022,

and on June 3, 2022, and was declared effective on June 10, 2022 (the “Registration Statement”). A prospectus supplement

to the Registration Statement in connection with this Offering is expected to be filed with the U.S. Securities and Exchange Commission

on or about September 6, 2024. The SPA, the transactions contemplated thereby, and the issuance of the Shares have been approved by the

Company’s board of directors.

The

Company expects to receive gross proceeds, before

deducting the offering expenses payable by the Company, of approximately $8,241,750 from the issuance and sale of the

Shares and expects the settlement thereof to occur in accordance with the terms of the SPA. Subject to the satisfaction of the

closing conditions, the Offering is expected to close on or about September 10, 2024, in accordance with Rule 15c6-1 promulgated

under the Securities Exchange Act of 1934, as amended.

The

foregoing description of the SPA is qualified in its entirety by reference to the full text of the Form of Securities Purchase Agreement,

which is filed as Exhibit 10.1 to this Form 8-K and is incorporated herein by reference.

This

report shall not constitute an offer to sell or the solicitation to buy nor shall there be any sale of the securities in any state or

jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such state or jurisdiction.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Shineco

Inc. |

| |

|

|

| Date:

August 28, 2024 |

By: |

/s/

Jennifer Zhan |

| |

|

Jennifer

Zhan, Chief Executive Officer |

Exhibit

10.1

SECURITIES

PURCHASE AGREEMENT

This

SECURITIES PURCHASE AGREEMENT (the “Agreement”) is dated as of _______, 2024 by and among Shineco, Inc., a Delaware

company (the “Company”), and individuals listed in Exhibit A hereto and each affixes its signature on the signature

page of this Agreement (each, a “Purchaser”; collectively, the “Purchasers”).

RECITALS

WHEREAS,

the Company and the Purchasers are executing and delivering this Agreement in accordance with and pursuant to the Company’s effective

shelf registration statement on Form S-3 (Reg. No. 333-261229);

WHEREAS,

the Company is offering (the “Offering”) up to _______ shares of its common stock, par value $0.001 per share (the

“Common Stock”), at a price of $___ per share to the Purchasers listed in Exhibit A, each of whom severally but not

jointly enters into this Agreement and makes representations and warranties hereunder;

NOW,

THEREFORE, IN CONSIDERATION of the mutual covenants contained in this Agreement, and for other good and valuable consideration, the receipt

and adequacy of which are hereby acknowledged, the Company and the Purchaser hereby agree as follows:

ARTICLE

I

Purchase

and Sale of the Shares

Section

1.1 Purchase Price and Closing.

| |

(a) |

Subject

to the terms and conditions hereof, the Company agrees to issue and sell to the Purchasers and, in consideration of and in express

reliance upon the representations, warranties, covenants, terms and conditions of this Agreement, the Purchasers severally but not

jointly agree to purchase for $___ per share, such number of shares of Common Stock (each a “Share” and collectively

the “Shares”) set forth on the signature page hereto (the “Purchase Price”) executed by such

Purchaser. At the Closing, the Purchaser shall deliver to the accounts designated by the Company (See Exhibit B), via wire transfer

immediately available funds equal to the Purchaser’s Subscription Dollar Amount (Or the RMB amount converted from the Dollar

subscription amount based on the exchange rate of US $1=RMB 7.10) as set forth on the signature page hereto executed by the Purchaser,

as determined by multiplying the number of Shares being purchased by such Purchaser by the per share purchase price of $___ and the

Company shall deliver to the Purchaser such number of Shares of the Common Stock purchased, as set forth on the signature page executed

by such Purchaser. |

| |

|

|

| |

(b) |

Deliveries. |

| |

(A) |

The

Shares are being registered for sale pursuant to a currently effective shelf registration statement on Form S-3, as amended (Registration

No. 333-261229) (the “Registration Statement”). The Registration Statement was declared effective by the Securities

and Exchange Commission (the “Commission”) on June 10, 2022. A prospectus supplement (the “Prospectus

Supplement”) will be filed with the Commission and delivered to the Purchasers as required by law. The Shares are being

self-underwritten and offered by the Company on a “best efforts” basis, with a price equal to $___. The completion of

the purchase and sale of the Shares (the “Closing”) shall take place at a place and time (the “Closing

Date”) to be specified by the Company in accordance with Rule 15c6-1 promulgated under the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). Upon satisfaction or waiver of all the conditions to closing set forth in the

base prospectus contained in the Registration Statement, the Prospectus Supplement and Sections 1.1(b) hereof, the Closing shall

occur at the offices of the counsel to the Company or such other location as the parties shall mutually agree. |

| |

(B) |

On

or prior to the Closing the Company shall deliver or cause to be delivered to the Purchasers the following: |

| |

(i) |

This

Agreement duly executed by the Company; |

| |

|

|

| |

(ii) |

The

Registration Statement and the Prospectus Supplement; and |

| |

|

|

| |

(iii) |

The

Shares purchased by the Purchaser pursuant to this Agreement which may be delivered pursuant to a book entry statement set forth

on the records on the Company’s transfer agent and which may be delivered as soon as practicable after the Closing. |

| |

(C) |

On

or prior to the Closing, the Purchasers shall each deliver or cause to be delivered to the Company as applicable: |

| |

(i) |

This

Agreement duly executed by the Purchaser; and |

| |

|

|

| |

(ii) |

The

Purchaser’s Purchase Price by wire transfer to the account specified in writing by the Company. |

| |

(D) |

The

obligations of the Company hereunder in connection with the Closing are subject to the following conditions being met: |

| |

(i) |

The

accuracy in all material respects on the applicable Closing date of the representations and warranties of the Company contained herein; |

| |

|

|

| |

(ii) |

All

obligations, covenants and agreements of the Company required to be performed at or prior to the applicable closing shall have been

performed; |

| |

|

|

| |

(iii) |

The

delivery by the Company of the items set forth in Section 1.1(b)(B) to be delivered by the Company; and |

| |

|

|

| |

(iv) |

If

required by the Nasdaq Listing Rules, the Company shall have submitted a Listing of Additional Shares Notification Form to Nasdaq

and obtained the approval by Nasdaq of the transactions contemplated hereby. |

| |

(E) |

The

obligations of the Purchasers hereunder in connection with the Closing are subject to the following conditions being met: |

| |

(i) |

The

accuracy in all material respects when made on the applicable Closing date of the representations and warranties of the Purchasers

contained herein; |

| |

|

|

| |

(ii) |

All

obligations, covenants and agreements of the Purchasers required to be performed at or prior to the applicable closing shall have

been performed; and |

| |

|

|

| |

(iii) |

The

delivery by the Purchasers of the items set forth in Section 1.1(b)(C) to be delivered by the Purchasers. |

ARTICLE

II

Representations

and Warranties

Section

2.1 Representations and Warranties of the Company and its Subsidiaries. The Company hereby represents and warrants to the Purchaser

on behalf of itself, its Subsidiaries (the “Subsidiaries”), as of the date hereof as follows:

(a)

Organization, Good Standing and Power. The Company is a corporation duly incorporated or otherwise organized and is in good standing

under the laws of its jurisdiction of incorporation or organization (as applicable) as of the date of this Agreement.

(b)

Corporate Power; Authority and Enforcement. The Company has the requisite corporate power and authority to enter into and perform

its obligations under this Agreement and to issue and sell the Shares in accordance with the terms hereof. The execution, delivery and

performance of this Agreement by the Company and the consummation by it of the transactions contemplated hereby have been duly and validly

authorized by all necessary corporate action, and no further consent or authorization of the Company or stockholders is required. This

Agreement constitutes, or shall constitute when executed and delivered, a valid and binding obligation of the Company enforceable against

the Company in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization,

moratorium, liquidation, conservatorship, receivership or similar laws relating to, or affecting generally the enforcement of, creditor’s

rights and remedies or by other equitable principles of general application.

(c)

Issuance of Shares. The Shares to be issued at the Closing shall have been duly authorized by all necessary corporate action and

when paid for and issued in accordance with the terms hereof, shall be validly issued, fully paid and non-assessable.

(d)

Commission Documents. The Company has filed all reports, schedules, forms, statements and other documents required to be filed

by it with the Commission pursuant to the reporting requirements of the Exchange Act within the past twelve months, including filings

incorporated by reference therein (the “Commission Documents”). The Company has not provided to the Purchaser any

material non-public information or other information which, according to applicable law, rule or regulation, was required to have been

disclosed publicly by the Company but which has not been so disclosed, other than the transactions contemplated by this Agreement. At

the time of the respective filings, each Commission Documents complied in all material respects with the requirements of the Exchange

Act and the rules and regulations of the Commission promulgated thereunder and other federal, state and local laws, rules and regulations

applicable to such documents.

(e)

No Integration. Assuming the accuracy of the Purchasers’ representations and warranties set forth in Section 2.2, neither

the Company, nor any of its affiliates, nor any person acting on its or their behalf has, directly or indirectly, made any offers or

sales of any securities or solicited any offers to buy any securities, under circumstances that would cause this Offering of the Shares

to be integrated with prior offerings by the Company for purposes of (i) the Securities Act of 1933, as amended (the “Securities

Act”) which would require the registration of any such securities under the Securities Act, or (ii) any applicable shareholder

approval provisions of any trading market on which any of the securities of the Company are listed or designated.

Section

2.2 Representations and Warranties of the Purchaser. Each Purchaser, severally but not jointly, hereby makes the following representations

and warranties to the Company as of the date hereof:

(a)

No Conflicts. The execution, delivery and performance of this Agreement and the consummation by such Purchaser of the transactions

contemplated hereby and thereby or relating hereto do not and will not conflict with, or constitute a default (or an event which with

notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or

cancellation of any agreement, indenture or instrument or obligation to which such Purchaser is a party or by which its properties or

assets are bound, or result in a violation of any law, rule, or regulation, or any order, judgment or decree of any court or governmental

agency applicable to such Purchaser or its properties (except for such conflicts, defaults and violations as would not, individually

or in the aggregate, have a material adverse effect on such Purchaser). Such Purchaser is not required to obtain any consent, authorization

or order of, or make any filing or registration with, any court or governmental agency in order for it to execute, deliver or perform

any of its obligations under this Agreement, provided, that for purposes of the representation made in this sentence, such Purchaser

is assuming and relying upon the accuracy of the relevant representations and agreements of the Company herein.

(b)

Status of Purchaser. The Purchaser is not required to be registered as a broker-dealer under Section 15 of the Exchange Act and

such Purchaser is not a broker-dealer, nor an affiliate of a broker-dealer.

(c)

Reliance on Exemptions. The Purchaser understands that the Shares are being offered and sold to the Purchaser in reliance upon

specific exemptions from the registration requirements of United States federal and state securities laws and that the Company is relying

upon the truth and accuracy of, and the Purchaser’s compliance with, the representations, warranties, agreements, acknowledgments

and understandings of the Purchaser set forth herein in order to determine the availability of such exemptions and the eligibility of

the Purchaser to acquire the Shares.

(d)

No Governmental Review. The Purchaser understands that no United States federal or state agency or any other government or governmental

agency has passed on or made any recommendation or endorsement of the Shares or the fairness or suitability of the investment in the

Shares nor have such authorities passed upon or endorsed the merits of the Offering.

(e)

Experience of Such Purchaser. The Purchaser, either alone or together with its representatives, has such knowledge, sophistication

and experience in business and financial matters so as to be capable of evaluating the merits and risks of the prospective investment

in the Shares, and has so evaluated the merits and risks of such investment. Such Purchaser is able to bear the economic risk of an investment

in the Shares and, at the present time, is able to afford a complete loss of such investment.

(f)

General Solicitation. The Purchaser is not, to such Purchaser’s knowledge, purchasing the Shares as a result of any advertisement,

article, notice or other communication regarding the Shares published in any newspaper, magazine or similar media or broadcast over television

or radio or presented at any seminar or, to the knowledge of such Purchaser, any other general solicitation or general advertisement.

(g)

Access to Information. The Purchaser acknowledges that it has had the opportunity to review the transaction documents (including

this Agreement, all exhibits and schedules thereto) and has been afforded: (i) the opportunity to ask such questions as it has deemed

necessary of, and to receive answers from, representatives of the Company concerning the terms and conditions of the offering of the

Shares and the merits and risks of investing in the Shares; (ii) access to information about the Company and its financial condition,

results of operations, business, properties, management and prospects sufficient to enable it to evaluate its investment; and (iii) the

opportunity to obtain such additional information that the Company possesses or can acquire without unreasonable effort or expense that

is necessary to make an informed investment decision with respect to the investment.

(h)

Opportunity to Consult Counsel. The Purchaser acknowledges that such Purchaser has read and fully understands this Agreement and

that such Purchaser understands and acknowledges that the Company’s counsel does not represent the Purchaser and has no obligations

to the Purchasers under this Agreement or otherwise. The Purchaser acknowledges that such Purchaser has had sufficient opportunity to

consult independent legal counsel concerning the provisions of this Agreement and entered into this Agreement intending to be legally

bound. The Purchasers are relying solely upon the advice of their own independent counsel, if any.

(i)

No Current Intention to Sell or Distribute the Shares. The Purchaser is purchasing his or its Shares for its own account and not

with a present view towards the public sale or distribution thereof.

ARTICLE

III

Miscellaneous

Section

3.1 Fees and Expenses. Except as otherwise set forth in this Agreement, each party shall pay the fees and expenses of its advisors,

counsel, accountants and other experts, if any, and all other expenses incurred by such party incident to the negotiation, preparation,

execution, delivery and performance of this Agreement.

Section

3.2 Entire Agreement; Amendment. This Agreement contains the entire understanding and agreement of the parties with respect to

the matters covered hereby and, except as specifically set forth herein, neither the Company nor any of the Purchaser makes any representations,

warranty, covenant or undertaking with respect to such matters and they supersede all prior understandings and agreements with respect

to said subject matter, all of which are merged herein. No provision of this Agreement may be waived or amended other than by a written

instrument signed by the Company and the Purchaser, and no provision hereof may be waived other than by a written instrument signed by

the party against whom enforcement of any such waiver is sought.

Section

3.3 Notices. All notices, demands, consents, requests, instructions and other communications to be given or delivered or permitted

under or by reason of the provisions of this Agreement or in connection with the transactions contemplated hereby shall be in writing

and shall be deemed to be delivered and received by the intended recipient as follows: (i) if personally delivered, on the business day

of such delivery (as evidenced by the receipt of the personal delivery service), (ii) if mailed certified or registered mail return receipt

requested, two (2)business days after being mailed, (iii) if delivered by overnight courier (with all charges having been prepaid), on

the business day of such delivery (as evidenced by the receipt of the overnight courier service of recognized standing), or (iv) if delivered

by facsimile transmission, on the business day of such delivery if sent by 6:00 p.m. in the time zone of the recipient, or if sent after

that time, on the next succeeding business day (as evidenced by the printed confirmation of delivery generated by the sending party’s

telecopier machine). If any notice, demand, consent, request, instruction or other communication cannot be delivered because of a changed

address of which no notice was given or the refusal to accept same, the notice, demand, consent, request, instruction or other communication

shall be deemed received on the second business day the notice is sent (as evidenced by a sworn affidavit of the sender). All such notices,

demands, consents, requests, instructions and other communications will be sent to the following addresses or facsimile numbers as applicable:

If

to the Company:

Shineco,

Inc.

Address:

T1, South Tower, Jiazhaoye Square, Chaoyang District, Beijing, China, 100022.

Attention:

Secretary

Email:

secretary@shineco.tech

with

copies (which shall not constitute notice) to:

Hunter

Taubman Fischer & Li LLC

Address:

950 Third Avenue, 19th Floor New York, NY 10022

Attention:

Ying Li

Email:

yli@htflawyers.com

If

to Purchaser:

The

address listed on Exhibit B.

Any

party hereto may from time to time change its address for notices by giving at least ten (10) days written notice of such changed address

to the other party hereto.

Section

3.4 Waivers. No waiver by any party of any default with respect to any provision, condition or requirement of this Agreement shall

be deemed to be a continuing waiver in the future or a waiver of any other provisions, condition or requirement hereof, nor shall any

delay or omission of any party to exercise any right hereunder in any manner impair the exercise of any such right accruing to it thereafter.

Section

3.5 Successors and Assigns. This Agreement may not be assigned by a party hereto without the prior written consent of the Company

or the Purchaser, as applicable, provided, however, that, subject to federal and state securities laws, a Purchaser may assign its rights

and delegate its duties hereunder in whole or in part to an affiliate or to a third party acquiring all or substantially all of its Shares

in a private transaction without the prior written consent of the Company or the other Purchaser, after notice duly given by such Purchaser

to the Company provided, that no such assignment or obligation shall affect the obligations of such Purchaser hereunder and that such

assignee agrees in writing to be bound, with respect to the transferred securities, by the provisions hereof that apply to the Purchaser.

The provisions of this Agreement shall inure to the benefit of and be binding upon the respective permitted successors and assigns of

the parties. Nothing in this Agreement, express or implied, is intended to confer upon any party other than the parties hereto or their

respective successors and assigns any rights, remedies, obligations or liabilities under or by reason of this Agreement, except as expressly

provided in this Agreement.

Section

3.6 Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Agreement shall

be governed by and construed and enforced in accordance with the internal laws of the State of New York, without regard to the principles

of conflicts of law thereof. Each party agrees that all legal proceedings concerning the interpretations, enforcement and defense of

the transactions contemplated by this Agreement (whether brought against a party hereto or its respective affiliates, directors, officers,

shareholders, partners, members, employees or agents) shall be commenced exclusively in the state or federal courts sitting in the Borough

of Manhattan, New York, New York Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts

sitting in the Borough of Manhattan, New York, New York for the adjudication of any dispute hereunder or in connection herewith or with

any transaction contemplated hereby or discussed herein (including with respect to the enforcement of any this Agreement), and hereby

irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction

of any such court, that such suit, action or proceeding is improper or is an inconvenient venue for such proceeding. Each party hereby

irrevocably waives personal service of process and consents to process being served in any such suit, action or proceeding by mailing

a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect

for notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice

thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted by law.

Section

3.7 Survival. The representations and warranties of the Company and the Purchaser shall survive the execution and delivery hereof

and the Closing hereunder for a period of three (3) years following the Closing Date.

Section

3.8 Counterparts. This Agreement may be executed in any number of counterparts, each of which when so executed shall be deemed

to be an original and, all of which taken together shall constitute one and the same Agreement and shall become effective when counterparts

have been signed by each party and delivered to the other parties hereto, it being understood that all parties need not sign the same

counterpart. In the event that any signature is delivered by facsimile transmission, such signature shall create a valid binding obligation

of the party executing (or on whose behalf such signature is executed) the same with the same force and effect as if such facsimile signature

were the original thereof.

Section

3.9 Severability. The provisions of this Agreement are severable and, in the event that any court of competent jurisdiction shall

determine that any one or more of the provisions or part of the provisions contained in this Agreement shall, for any reason, be held

to be invalid, illegal or unenforceable in any respect, such invalidity, illegality or unenforceability shall not affect any other provision

or part of a provision of this Agreement and such provision shall be reformed and construed as if such invalid or illegal or unenforceable

provision, or part of such provision, had never been contained herein, so that such provisions would be valid, legal and enforceable

to the maximum extent possible.

Section

3.10 Individual Capacity. Each Purchaser enters into this Agreement on its own capacity, and not as a group with other Purchasers.

Each Purchaser, severally but not jointly, makes representations and warranties contained under this Agreement.

Section

3.11 Exchange Cap. The Company shall not issue Common Stock to the Purchaser pursuant to the terms of this Agreement in an amount

in excess of the aggregate number of shares of Common Stock which the Company may issue under the Agreement without breaching the Company’s

obligations under the rules or regulations of the Commission and the Nasdaq Capital Market.

Section

3.12 Termination. This Agreement may be terminated prior to Closing by mutual written agreement of the Purchaser and the Company.

[Remainder

of Page Intentionally Left Blank; Signature Pages Follow]

[Signature

Page of the Company]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed by their respective authorized officer as of the date

first above written.

The

Company:

SHINECO,

INC.

| By: |

|

|

| Name: |

Jennifer

Zhan |

|

| Title: |

CEO |

|

[Signature

Page of the Purchaser]

IN

WITNESS WHEREOF, the Purchaser has caused this Agreement to be duly executed individually or by its authorized officer or member as of

the date first above written.

The

Purchaser:

Number

of Shares for Purchase: _________________________

Total

Purchase Price (“Subscription Amount”): $ _________________________

Purchase

Price Per Share: $

Address

and Contacts of Purchaser:

EXHIBIT

A

LIST

OF PURCHASERS

| No. |

|

Shares |

|

Name |

|

Address |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Total: |

|

|

EXHIBIT

B

Shineco,Inc.

Wire Instructions (RMB)

Company

name:

Tax

identification number:

Address

and telephone:

Basic

Account Opening Bank Name:

Bank

Account No:

Opening

Bank Interbank No:

Shineco,Inc.

Wire Instructions (U.S. Dollar)

Beneficiary

Bank Name(收款行):

Bank

Code(银行行号):

Beneficiary

Bank Address(收款行地址):

SWIFT

Code(电文码):

Beneficiary

Account name(账户名称):

Beneficiary

Account Number(帐户号码):

v3.24.2.u1

Cover

|

Aug. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 22, 2024

|

| Entity File Number |

001-37776

|

| Entity Registrant Name |

SHINECO,

INC.

|

| Entity Central Index Key |

0001300734

|

| Entity Tax Identification Number |

52-2175898

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

T1,

South Tower

|

| Entity Address, Address Line Two |

Jiazhaoye Square

|

| Entity Address, Address Line Three |

Chaoyang

District

|

| Entity Address, City or Town |

Beijing

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

100022

|

| City Area Code |

+86

|

| Local Phone Number |

10-87227366

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock

|

| Trading Symbol |

SISI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Shineco (NASDAQ:SISI)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

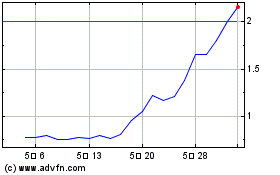

Shineco (NASDAQ:SISI)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024