Filed

Pursuant to Rule 424(b)(3) and Rule 424(c)

Registration

Statement No. 333-282540

November

13, 2024

PROSPECTUS

SUPPLEMENT NO. 1

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

12,134,375

Shares of Common Stock Underlying Warrants

9,350,846

Shares of Common Stock for Resale by Selling Securityholders

634,375 Warrants to Purchase Common Stock for Resale by Selling Securityholders

This

prospectus supplement amends the prospectus

dated October 18, 2024 (the “Prospectus”) of SBC Medical Group Holdings Incorporated, a Delaware corporation (the “Company”),

which forms a part of the Company’s Registration Statement on Form S-1 (No. 333-282540).

This prospectus supplement is being filed to update and supplement the information included or incorporated by reference in the Prospectus

with the information contained in our Quarterly Report on Form 10-Q and our Current Report on Form 8-K, each filed with the Securities

and Exchange Commission (the “SEC”) on November 13, 2024, as set forth below. This prospectus supplement should be

read in conjunction with the Prospectus, which is to be delivered with this prospectus supplement.

The

Company’s common stock and public warrants are currently quoted on the Nasdaq Global Market and the Nasdaq Capital Market, respectively,

under the symbols “SBC” and “SBCWW,” respectively. On November 8, 2024, the last reported sale price of our common

stock was $6.85 per share and the last reported sale price of our public warrants was $0.2502 per warrant. You are urged to obtain current

market quotations for our common stock and public warrants.

Investing

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 17 of the Prospectus and under similar

headings in any amendments or supplements to the Prospectus.

Neither

the SEC nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this

prospectus. Any representation to the contrary is a criminal offense.

The

date of this Prospectus Supplement No. 1 is November 13, 2024.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended September 30, 2024

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from __________ to __________

Commission

File Number: 001-41462

SBC

Medical Group Holdings Incorporated

(Exact

name of registrant as specified in its charter)

| Delaware |

|

88-1192288 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification Number) |

| |

|

|

200

Spectrum Center Dr. STE 300

Irvine, CA |

|

92618 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 949-593-0250

Pono

Capital Two, Inc.

643

Ilalo St. #102

Honolulu,

Hawaii 96813

(Former

name or former address, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on Which Registered |

| Common

Stock, $0.0001 par value per share |

|

SBC |

|

The

Nasdaq Stock Market LLC |

| Redeemable

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share |

|

SBCWW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Date File required to be submitted and pursuant to

Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

☒

As

of October 31, 2024, there were 103,020,816 shares of common stock, par value $0.0001 per share, issued and outstanding.

SBC

Medical Group Holdings Incorporated

FORM

10-Q FOR THE QUARTER ENDED

September

30, 2024

Table

of Contents

PART

I - FINANCIAL INFORMATION

ITEM

1. FINANCIAL STATEMENTS

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

INDEX

TO FINANCIAL STATEMENTS

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

UNAUDITED CONSOLIDATED BALANCE SHEETS

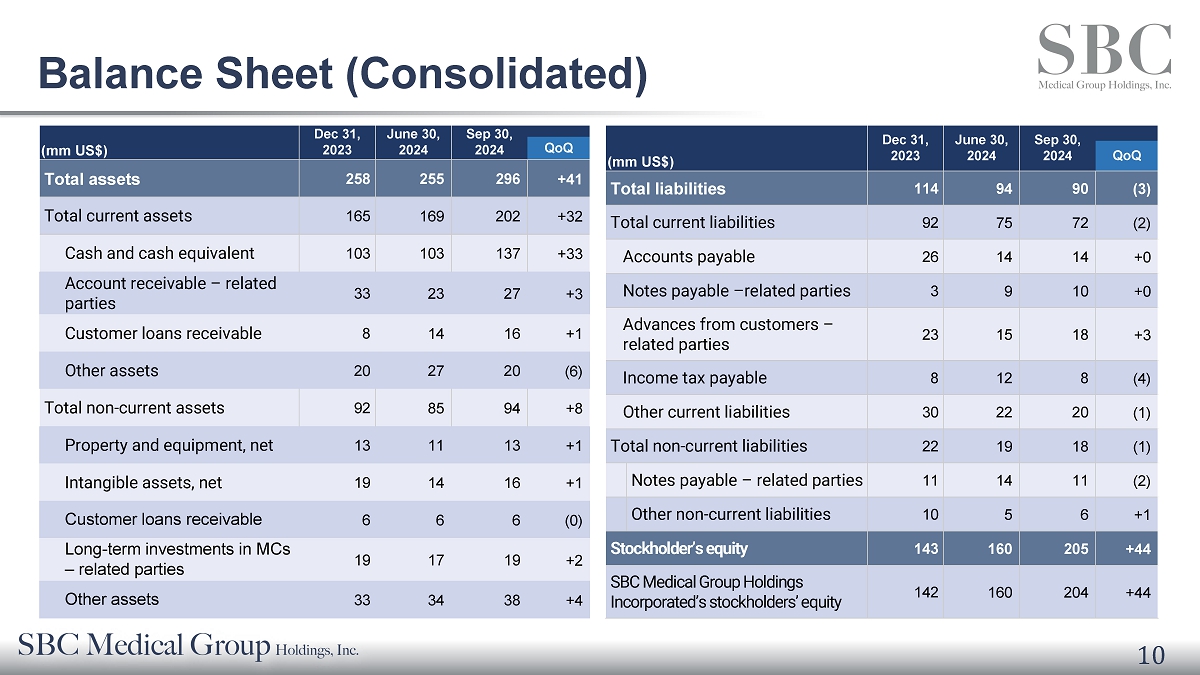

| | |

September 30,

2024 | | |

December 31,

2023 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 137,393,070 | | |

$ | 103,022,932 | |

| Accounts receivable | |

| 1,944,604 | | |

| 1,437,077 | |

| Accounts receivable – related parties | |

| 27,835,179 | | |

| 33,676,672 | |

Accounts receivable | |

| 27,835,179 | | |

| 33,676,672 | |

| Inventories | |

| 1,985,883 | | |

| 3,090,923 | |

| Finance lease receivables, current – related parties | |

| 8,443,338 | | |

| 6,143,564 | |

| Customer loans receivable, current | |

| 16,125,086 | | |

| 8,484,753 | |

| Prepaid expenses and other current assets | |

| 8,372,668 | | |

| 10,050,005 | |

| Total current assets | |

| 202,099,828 | | |

| 165,905,926 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Property and equipment, net | |

| 13,194,414 | | |

| 13,582,017 | |

| Intangible assets, net | |

| 16,218,233 | | |

| 19,739,276 | |

| Long-term investments | |

| 4,905,115 | | |

| 849,434 | |

| Goodwill, net | |

| 3,545,391 | | |

| 3,590,791 | |

| Finance lease receivables, non-current – related parties | |

| 4,629,047 | | |

| 3,420,489 | |

| Operating lease right-of-use assets | |

| 5,251,418 | | |

| 5,919,937 | |

| Deferred tax assets | |

| 624,564 | | |

| — | |

| Customer loans receivable, non-current | |

| 6,590,301 | | |

| 6,444,025 | |

| Long-term prepayments | |

| 4,308,810 | | |

| 4,099,763 | |

| Long-term investments in MCs – related parties | |

| 19,561,069 | | |

| 19,811,555 | |

| Other assets | |

| 15,550,402 | | |

| 15,442,058 | |

| Total non-current assets | |

| 94,378,764 | | |

| 92,899,345 | |

| Total assets | |

$ | 296,478,592 | | |

$ | 258,805,271 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 14,873,829 | | |

$ | 26,531,944 | |

| Current portion of long-term loans | |

| 136,683 | | |

| 156,217 | |

| Notes payable, current – related parties | |

| 10,202,360 | | |

| 3,369,203 | |

| Advances from customers | |

| 565,495 | | |

| 2,074,457 | |

| Advances from customers – related parties | |

| 18,994,015 | | |

| 23,058,175 | |

| Advances from customers | |

| 18,994,015 | | |

| 23,058,175 | |

| Income tax payable | |

| 8,000,808 | | |

| 8,782,930 | |

| Operating lease liabilities, current | |

| 4,060,844 | | |

| 3,885,812 | |

| Accrued liabilities and other current liabilities | |

| 12,054,047 | | |

| 21,009,009 | |

| Due to related party | |

| 3,532,453 | | |

| 3,583,523 | |

| Total current liabilities | |

| 72,420,534 | | |

| 92,451,270 | |

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

UNAUDITED CONSOLIDATED BALANCE SHEETS — (Continued)

| | |

September 30,

2024 | | |

December 31,

2023 | |

| Non-current liabilities: | |

| | | |

| | |

| Long-term loans | |

| 686,470 | | |

| 1,062,722 | |

| Notes payable, non-current – related parties | |

| 11,659,022 | | |

| 11,948,219 | |

| Deferred tax liabilities | |

| 3,515,825 | | |

| 6,013,565 | |

| Operating lease liabilities, non-current | |

| 1,528,972 | | |

| 2,444,316 | |

| Other liabilities | |

| 1,147,345 | | |

| 1,074,930 | |

| Total non-current liabilities | |

| 18,537,634 | | |

| 22,543,752 | |

| Total liabilities | |

| 90,958,168 | | |

| 114,995,022 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock ($0.0001

par value, 20,000,000 shares

authorized; no shares issued and

outstanding as of September 30, 2024 and December 31, 2023)** | |

| — | | |

| — | |

| Common stock ($0.0001

par value, 400,000,000 shares

authorized, 103,020,816 and 94,192,433

shares issued and outstanding as of September 30, 2024 and December 31, 2023)** | |

| 10,302 | | |

| 9,419 | |

| Additional paid-in capital** | |

| 60,825,115 | | |

| 36,879,281 | |

| Treasury stock receivable (270,000 shares of common stock) - related party | |

| (2,700,000 | ) | |

| — | |

| Retained earnings | |

| 182,923,786 | | |

| 142,848,732 | |

| Accumulated other comprehensive loss | |

| (36,078,149 | ) | |

| (37,578,255 | ) |

| Total SBC Medical Group Holdings Incorporated’s stockholders’ equity | |

| 204,981,054 | | |

| 142,159,177 | |

| Non-controlling interests | |

| 539,370 | | |

| 1,651,072 | |

| Total stockholders’ equity | |

| 205,520,424 | | |

| 143,810,249 | |

| Total liabilities and stockholders’ equity | |

$ | 296,478,592 | | |

$ | 258,805,271 | |

| ** |

Retrospectively

restated for effect of reverse recapitalization on September 17, 2024. |

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME

| | |

| | |

| | |

| | |

| |

| | |

For the Three Months Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues, net – related parties | |

$ | 51,209,243 | | |

$ | 45,119,709 | | |

$ | 152,718,488 | | |

$ | 125,336,653 | |

| Revenues, net | |

| 1,875,640 | | |

| 2,158,976 | | |

| 8,276,517 | | |

| 5,856,076 | |

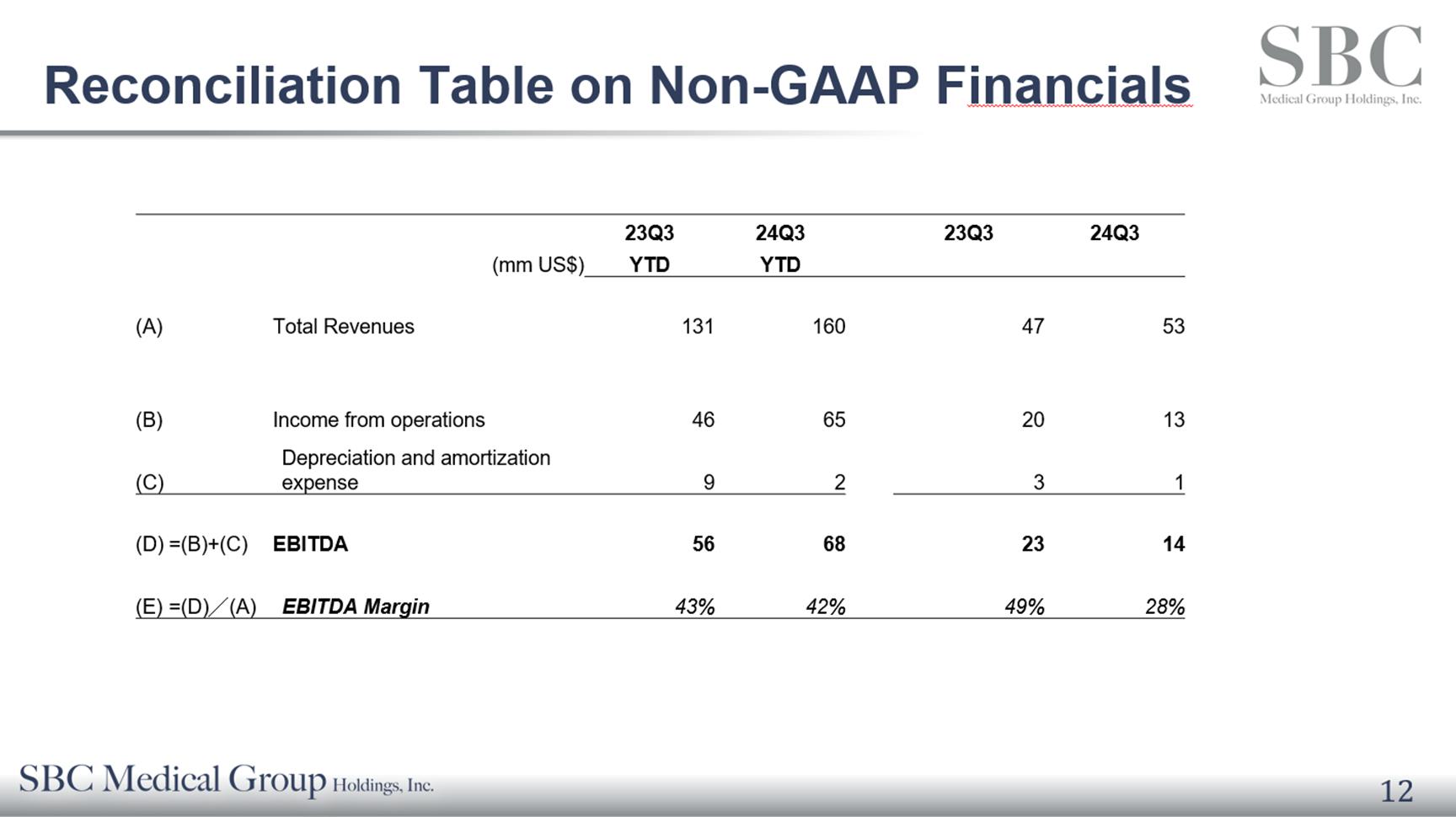

| Total revenues, net | |

| 53,084,883 | | |

| 47,278,685 | | |

| 160,995,005 | | |

| 131,192,729 | |

| Cost of revenues | |

| 9,845,793 | | |

| 13,780,309 | | |

| 38,816,865 | | |

| 37,256,066 | |

| Gross profit | |

| 43,239,090 | | |

| 33,498,376 | | |

| 122,178,140 | | |

| 93,936,663 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 16,597,032 | | |

| 13,446,618 | | |

| 43,784,637 | | |

| 46,885,138 | |

| Stock-based compensation | |

| 12,807,455 | | |

| — | | |

| 12,807,455 | | |

| — | |

| Misappropriation loss | |

| — | | |

| 28,516 | | |

| — | | |

| 380,766 | |

| Total operating expenses | |

| 29,404,487 | | |

| 13,475,134 | | |

| 56,592,092 | | |

| 47,265,904 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income from operations | |

| 13,834,603 | | |

| 20,023,242 | | |

| 65,586,048 | | |

| 46,670,759 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expenses): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 7,950 | | |

| 10,234 | | |

| 37,283 | | |

| 86,345 | |

| Interest expense | |

| (5,466 | ) | |

| (3,978 | ) | |

| (15,898 | ) | |

| (37,380 | ) |

| Other income | |

| 65,922 | | |

| 1,138,869 | | |

| 721,894 | | |

| 3,875,723 | |

| Other expenses | |

| (795,158 | ) | |

| (98,314 | ) | |

| (2,746,450 | ) | |

| (581,239 | ) |

| Gain on disposal of subsidiary | |

| — | | |

| — | | |

| 3,813,609 | | |

| — | |

| Total other income (expenses) | |

| (726,752 | ) | |

| 1,046,811 | | |

| 1,810,438 | | |

| 3,343,449 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 13,107,851 | | |

| 21,070,053 | | |

| 67,396,486 | | |

| 50,014,208 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| 10,273,384 | | |

| 13,012,262 | | |

| 27,254,478 | | |

| 25,683,244 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 2,834,467 | | |

| 8,057,791 | | |

| 40,142,008 | | |

| 24,330,964 | |

| Less: net income (loss) attributable to non-controlling interests | |

| 1,573 | | |

| (298,623 | ) | |

| 66,954 | | |

| (696,812 | ) |

| Net income attributable to SBC Medical Group Holdings Incorporated | |

$ | 2,832,894 | | |

$ | 8,356,414 | | |

$ | 40,075,054 | | |

$ | 25,027,776 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

$ | 20,783,646 | | |

$ | (974,249 | ) | |

$ | 1,543,245 | | |

$ | (19,825,222 | ) |

| Reclassification of unrealized gain on available-for-sale debt security to net income when realized, net of tax effect of nil and $(97,856) for the three months ended September 30, 2024 and 2023, respectively; nil and $(97,856) for the nine months ended September 30, 2024 and 2023, respectively | |

| — | | |

| (205,383 | ) | |

| — | | |

| (8,760 | ) |

| Total comprehensive income | |

| 23,618,113 | | |

| 6,878,159 | | |

| 41,685,253 | | |

| 4,496,982 | |

| Less: comprehensive income (loss) attributable to non-controlling interests | |

| 180,093 | | |

| (387,948 | ) | |

| 110,093 | | |

| (1,129,475 | ) |

| Comprehensive income attributable to SBC Medical Group Holdings Incorporated | |

$ | 23,438,020 | | |

$ | 7,266,107 | | |

$ | 41,575,160 | | |

$ | 5,626,457 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per share attributable to SBC Medical Group Holdings Incorporated** | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | 0.03 | | |

$ | 0.09 | | |

$ | 0.42 | | |

$ | 0.27 | |

| Weighted average shares outstanding** | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 95,095,144 | | |

| 94,192,433 | | |

| 94,495,533 | | |

| 94,192,433 | |

| ** |

Retrospectively

restated for effect of reverse recapitalization on September 17, 2024. |

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

UNAUDITED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Common Stock | | |

Additional

Paid-in | | |

Treasury

Stock | | |

Retained | | |

Accumulated

Other

Comprehensive | | |

Total

SBC Medical

Group

Holdings

Incorporated’s

Stockholders’ | | |

Non-

controlling | | |

Total

Stockholders’ | |

| | |

Number | | |

Amount | | |

Capital | | |

Receivable | | |

Earnings | | |

Loss | | |

Equity | | |

Interests | | |

Equity | |

| Balance as of December 31, 2023, previously reported | |

| 7,949,000 | | |

$ | 795 | | |

$ | 36,887,905 | | |

| — | | |

$ | 142,848,732 | | |

$ | (37,578,255 | ) | |

$ | 142,159,177 | | |

$ | 1,651,072 | | |

$ | 143,810,249 | |

| Effect of reverse recapitalization | |

| 86,243,433 | | |

| 8,624 | | |

| (8,624 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Balance as of December 31, 2023, restated | |

| 94,192,433 | | |

| 9,419 | | |

| 36,879,281 | | |

| — | | |

| 142,848,732 | | |

| (37,578,255 | ) | |

| 142,159,177 | | |

| 1,651,072 | | |

| 143,810,249 | |

| Disposal of subsidiary | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (1,221,795 | ) | |

| (1,221,795 | ) |

| Net income (loss) | |

| — | | |

| — | | |

| — | | |

| — | | |

| 18,757,752 | | |

| — | | |

| 18,757,752 | | |

| (7,536 | ) | |

| 18,750,216 | |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (10,109,388 | ) | |

| (10,109,388 | ) | |

| (84,464 | ) | |

| (10,193,852 | ) |

| Balance as of March 31, 2024, restated | |

| 94,192,433 | | |

| 9,419 | | |

| 36,879,281 | | |

| — | | |

| 161,606,484 | | |

| (47,687,643 | ) | |

| 150,807,541 | | |

| 337,277 | | |

| 151,144,818 | |

| Net income | |

| — | | |

| — | | |

| — | | |

| — | | |

| 18,484,408 | | |

| — | | |

| 18,484,408 | | |

| 72,917 | | |

| 18,557,325 | |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (8,995,632 | ) | |

| (8,995,632 | ) | |

| (50,917 | ) | |

| (9,046,549 | ) |

| Balance as of June 30, 2024, restated | |

| 94,192,433 | | |

| 9,419 | | |

| 36,879,281 | | |

| — | | |

| 180,090,892 | | |

| (56,683,275 | ) | |

| 160,296,317 | | |

| 359,277 | | |

| 160,655,594 | |

| Reverse recapitalization, net of transaction costs | |

| 5,080,820 | | |

| 508 | | |

| 8,407,380 | | |

| — | | |

| — | | |

| — | | |

| 8,407,888 | | |

| — | | |

| 8,407,888 | |

| Issuance of common stock to settle convertible note | |

| 270,000 | | |

| 27 | | |

| 2,699,973 | | |

| (2,700,000 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Issuance of common stock as incentive shares | |

| 339,565 | | |

| 34 | | |

| (34 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Stock-based compensation | |

| — | | |

| — | | |

| 12,807,455 | | |

| — | | |

| — | | |

| — | | |

| 12,807,455 | | |

| — | | |

| 12,807,455 | |

| Issuance of common stock from exercise of stock warrants | |

| 3,137,998 | | |

| 314 | | |

| 31,060 | | |

| — | | |

| — | | |

| — | | |

| 31,374 | | |

| — | | |

| 31,374 | |

| Net income | |

| — | | |

| — | | |

| — | | |

| — | | |

| 2,832,894 | | |

| — | | |

| 2,832,894 | | |

| 1,573 | | |

| 2,834,467 | |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 20,605,126 | | |

| 20,605,126 | | |

| 178,520 | | |

| 20,783,646 | |

| Balance as of September 30, 2024 | |

| 103,020,816 | | |

$ | 10,302 | | |

$ | 60,825,115 | | |

| (2,700,000 | ) | |

$ | 182,923,786 | | |

$ | (36,078,149 | ) | |

$ | 204,981,054 | | |

$ | 539,370 | | |

$ | 205,520,424 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Common Stock* | | |

Additional

Paid-in | | |

Retained | | |

Accumulated

Other

Comprehensive | | |

Total

SBC Medical

Group

Holdings

Incorporated’s

Stockholder’s | | |

Non-

controlling | | |

Total

Stockholder’s | |

| | |

Number | | |

Amount | | |

Capital* | | |

Earnings | | |

Loss | | |

Equity | | |

Interests | | |

Equity | |

| Balance as of December 31, 2022, previously reported | |

| 1 | | |

$ | — | | |

$ | 26,624,694 | | |

$ | 103,478,696 | | |

$ | (24,853,275 | ) | |

$ | 105,250,115 | | |

$ | 2,599,968 | | |

$ | 107,850,083 | |

| Effect of reverse recapitalization | |

| 11 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Balance as of December 31, 2022, restated | |

| 12 | | |

| — | | |

| 26,624,694 | | |

| 103,478,696 | | |

| (24,853,275 | ) | |

| 105,250,115 | | |

| 2,599,968 | | |

| 107,850,083 | |

| Issuance of common stock | |

| 11,850 | | |

| 1 | | |

| 9 | | |

| — | | |

| — | | |

| 10 | | |

| — | | |

| 10 | |

| Net income | |

| — | | |

| — | | |

| — | | |

| 6,002,440 | | |

| — | | |

| 6,002,440 | | |

| 415,451 | | |

| 6,417,891 | |

| Unrealized gain on available-for-sale debt security, net of tax effect of $15,575 | |

| — | | |

| — | | |

| — | | |

| — | | |

| 30,062 | | |

| 30,062 | | |

| — | | |

| 30,062 | |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| (10,945,737 | ) | |

| (10,945,737 | ) | |

| (26,603 | ) | |

| (10,972,340 | ) |

| Balance as of March 31, 2023, restated | |

| 11,862 | | |

| 1 | | |

| 26,624,703 | | |

| 109,481,136 | | |

| (35,768,950 | ) | |

| 100,336,890 | | |

| 2,988,816 | | |

| 103,325,706 | |

| Net income (loss) | |

| — | | |

| — | | |

| — | | |

| 10,668,922 | | |

| — | | |

| 10,668,922 | | |

| (813,640 | ) | |

| 9,855,282 | |

| Unrealized gain on available-for-sale debt security, net of tax effect of $86,150 | |

| — | | |

| — | | |

| — | | |

| — | | |

| 166,561 | | |

| 166,561 | | |

| — | | |

| 166,561 | |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| (7,561,898 | ) | |

| (7,561,898 | ) | |

| (316,735 | ) | |

| (7,878,633 | ) |

| Balance as of June 30, 2023, restated | |

| 11,862 | | |

| 1 | | |

| 26,624,703 | | |

| 120,150,058 | | |

| (43,164,287 | ) | |

| 103,610,475 | | |

| 1,858,441 | | |

| 105,468,916 | |

| Balance | |

| 11,862 | | |

| 1 | | |

| 26,624,703 | | |

| 120,150,058 | | |

| (43,164,287 | ) | |

| 103,610,475 | | |

| 1,858,441 | | |

| 105,468,916 | |

| Issuance of common stock | |

| 94,180,571 | | |

| 9,418 | | |

| (8,623 | ) | |

| — | | |

| — | | |

| 795 | | |

| — | | |

| 795 | |

| Net income (loss) | |

| — | | |

| — | | |

| — | | |

| 8,356,414 | | |

| — | | |

| 8,356,414 | | |

| (298,623 | ) | |

| 8,057,791 | |

| Reclassification of unrealized gain on available-for-sale debt security to net income when realized, net of tax effect of $(97,856) | |

| — | | |

| — | | |

| — | | |

| — | | |

| (205,383 | ) | |

| (205,383 | ) | |

| — | | |

| (205,383 | ) |

| Deemed contribution in connection with disposal of property and equipment | |

| — | | |

| — | | |

| 9,620,453 | | |

| — | | |

| — | | |

| 9,620,453 | | |

| — | | |

| 9,620,453 | |

| Deemed contribution in connection with reorganization | |

| — | | |

| — | | |

| 642,748 | | |

| — | | |

| — | | |

| 642,748 | | |

| — | | |

| 642,748 | |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| (884,924 | ) | |

| (884,924 | ) | |

| (89,325 | ) | |

| (974,249 | ) |

| Balance as of September 30, 2023, restated | |

| 94,192,433 | | |

$ | 9,419 | | |

$ | 36,879,281 | | |

$ | 128,506,472 | | |

$ | (44,254,594 | ) | |

$ | 121,140,578 | | |

$ | 1,470,493 | | |

$ | 122,611,071 | |

| Balance | |

| 94,192,433 | | |

$ | 9,419 | | |

$ | 36,879,281 | | |

$ | 128,506,472 | | |

$ | (44,254,594 | ) | |

$ | 121,140,578 | | |

$ | 1,470,493 | | |

$ | 122,611,071 | |

| * |

Retrospectively

restated for effect of share issuances on September 8, 2023. |

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

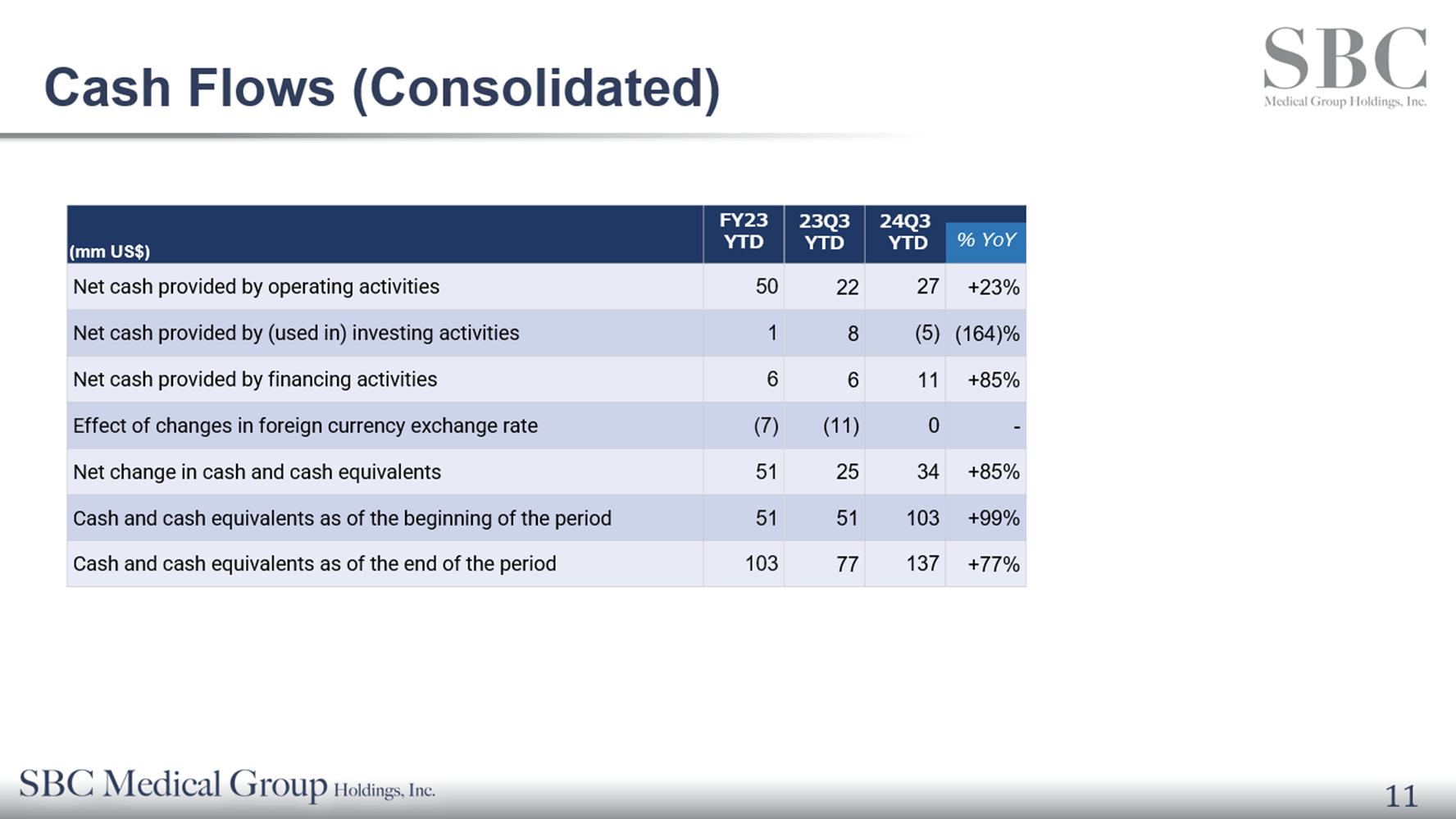

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | |

2024 | | |

2023 | |

| | |

For the Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net income | |

$ | 40,142,008 | | |

$ | 24,330,964 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization expense | |

| 2,867,781 | | |

| 9,688,640 | |

| Non-cash lease expense | |

| 2,908,990 | | |

| 2,424,220 | |

| Provision for (reversal of) credit losses | |

| (127,196 | ) | |

| 282,934 | |

| Stock-based compensation | |

| 12,807,455 | | |

| — | |

| Impairment loss on property and equipment | |

| — | | |

| 204,026 | |

| Realized gain on short-term investments | |

| — | | |

| (223,164 | ) |

| Fair value change of long-term investments | |

| 1,682,282 | | |

| — | |

| Gain on disposal of subsidiary | |

| (3,813,609 | ) | |

| — | |

| Loss (gain) on disposal of property and equipment and intangible assets | |

| 185,284 | | |

| (249,532 | ) |

| Deferred income taxes | |

| (2,154,837 | ) | |

| (1,379,922 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (804,000 | ) | |

| (924,061 | ) |

| Accounts receivable – related parties | |

| 4,971,911 | | |

| (19,979,099 | ) |

| Inventories | |

| 763,075 | | |

| (4,038,874 | ) |

| Finance lease receivables – related parties | |

| (3,430,267 | ) | |

| 17,241,740 | |

| Customer loans receivable | |

| 12,860,220 | | |

| — | |

| Prepaid expenses and other current assets | |

| 902,230 | | |

| 8,173,153 | |

| Long-term prepayments | |

| 432,380 | | |

| (1,991,626 | ) |

| Other assets | |

| (348,178 | ) | |

| (1,884,352 | ) |

| Accounts payable | |

| (10,511,619 | ) | |

| 6,712,977 | |

| Notes payable – related parties | |

| (14,030,092 | ) | |

| — | |

| Advances from customers | |

| (1,401,437 | ) | |

| (681,973 | ) |

| Advances from customers – related parties | |

| (3,565,778 | ) | |

| (7,430,332 | ) |

| Advances from customers | |

| (3,565,778 | ) | |

| (7,430,332 | ) |

| Income tax payable | |

| (549,446 | ) | |

| 16,518,062 | |

| Operating lease liabilities | |

| (2,971,946 | ) | |

| (2,335,113 | ) |

| Accrued liabilities and other current liabilities | |

| (9,010,270 | ) | |

| 298,743 | |

| Accrued retirement compensation expense – related party | |

| — | | |

| (22,082,643 | ) |

| Other liabilities | |

| 81,290 | | |

| 79,215 | |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | |

| 27,886,231 | | |

| 22,753,983 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Purchase of property and equipment | |

| (1,974,285 | ) | |

| (2,299,045 | ) |

| Purchase of intangible assets | |

| — | | |

| (1,683,030 | ) |

| Purchase of convertible note | |

| (1,700,000 | ) | |

| (1,000,000 | ) |

| Prepayments for property and equipment | |

| (843,740 | ) | |

| (417,353 | ) |

| Advances to related parties | |

| (617,804 | ) | |

| (1,017,292 | ) |

| Payments made on behalf of a related party | |

| (5,245,990 | ) | |

| — | |

| Purchase of short-term investments | |

| — | | |

| (2,106,720 | ) |

| Purchase of long-term investments | |

| (331,496 | ) | |

| — | |

| Long-term investments in MCs - related parties | |

| — | | |

| (26,780 | ) |

| Cash received for acquisition of subsidiary, net of cash received | |

| — | | |

| 722,551 | |

| Long-term loans to others | |

| (80,793 | ) | |

| (421,429 | ) |

| Repayments from related parties | |

| 5,990,990 | | |

| 734,358 | |

| Repayments from others | |

| 62,927 | | |

| 47,356 | |

| Proceeds from sales of short-term investments | |

| — | | |

| 4,125,813 | |

| Proceeds from surrender of life insurance policies | |

| — | | |

| 3,954,760 | |

| Disposal of subsidiary, net of cash disposed of | |

| (815,819 | ) | |

| — | |

| Proceeds from disposal of property and equipment | |

| 1,971 | | |

| 8,046,007 | |

| NET CASH PROVIDED BY (USD IN) INVESTING ACTIVITIES | |

| (5,554,039 | ) | |

| 8,659,196 | |

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

CONSOLIDATED STATEMENTS OF CASH FLOWS — (Continued)

| | |

For the Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Borrowings from related parties | |

| — | | |

| 12,310,106 | |

| Proceeds from reverse recapitalization, net of transaction costs | |

| 11,707,417 | | |

| — | |

| Proceeds from issuance of common stock | |

| — | | |

| 10 | |

| Proceeds from exercise of stock warrants | |

| 31,374 | | |

| — | |

| Repayments of long-term loans | |

| (89,448 | ) | |

| (8,691,462 | ) |

| Repayments to related parties | |

| (65,305 | ) | |

| (7,619,266 | ) |

| Deemed contribution in connection with disposal of property and equipment | |

| — | | |

| 9,620,453 | |

| Deemed contribution in connection with reorganization | |

| — | | |

| 642,748 | |

| NET CASH PROVIDED BY FINANCING ACTIVITIES | |

| 11,584,038 | | |

| 6,262,589 | |

| | |

| | | |

| | |

| Effect of changes in foreign currency exchange rate | |

| 453,908 | | |

| (11,982,793 | ) |

| | |

| | | |

| | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | |

| 34,370,138 | | |

| 25,692,975 | |

| CASH AND CASH EQUIVALENTS AS OF THE BEGINNING OF THE PERIOD | |

| 103,022,932 | | |

| 51,737,994 | |

| CASH AND CASH EQUIVALENTS AS OF THE END OF THE PERIOD | |

$ | 137,393,070 | | |

$ | 77,430,969 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | |

| | | |

| | |

| Cash paid for interest expense | |

$ | 15,898 | | |

$ | 37,380 | |

| Cash paid for income taxes | |

$ | 31,332,123 | | |

$ | 12,608,072 | |

| | |

| | | |

| | |

| NON-CASH INVESTING AND FINANCING ACTIVITIES | |

| | | |

| | |

| Property and equipment transferred from long-term prepayments | |

$ | 164,781 | | |

$ | 7,681,830 | |

| An intangible asset transferred from long-term prepayments | |

$ | — | | |

$ | 17,666,115 | |

| Settlement of loan payable to a related party in connection with disposal of property and equipment | |

$ | — | | |

$ | 4,163,604 | |

| Operating lease right-of-use assets obtained in exchange for operating lease liabilities | |

$ | — | | |

$ | 1,029,518 | |

| Remeasurement of operating lease liabilities and right-of-use assets due to lease modifications | |

$ | 2,408,752 | | |

$ | 2,110,079 | |

| Issuance of promissory notes to related parties in connection with loan services provided | |

$ | 20,398,301 | | |

$ | — | |

| Issuance of common stock to a related party to settle convertible note | |

$ | 2,700,000 | | |

$ | — | |

| Settlement of loan payable to a related party in connection with issuance of common stock | |

$ | — | | |

$ | 795 | |

| Non-cash purchase consideration for an asset acquisition | |

$ | — | | |

$ | 705,528 | |

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

1 — ORGANIZATION AND DESCRIPTION OF BUSINESS

Business

Overview

SBC

Medical Group Holdings Incorporated (“SBC Holding”) was originally incorporated under the laws of the state of

Delaware on March 11, 2022 as a special purpose acquisition corporation under the name Pono Two Capital, Inc. (“Pono”) for the purpose

of entering into a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with

one or more businesses.

SBC Medical Group, Inc. (formerly known as SBC Medical Group Holdings Incorporated, “SBC USA”, “Legacy

SBC”), through its consolidated subsidiaries and variable interest entity (“VIE”), is principally

engaged in medical industry to provide comprehensive management services to the medical corporations and their clinics, including

but not limited to licensure of the use of the trademark and brand name of “Shonan Beauty Clinic”, sales of medical

equipment, medical consumables procurement services, and management of customer’s loyalty program, etc.

Reverse Recapitalization

On

September 17, 2024, Pono consummated the merger transaction pursuant to the agreement by and among Pono, Pono Two Merger Sub, Inc., a Delaware corporation (“Merger Sub”) and a wholly-owned

subsidiary of Pono, and SBC USA (the “Merger Agreement”), whereby Merger Sub merged

with and into SBC USA, the separate corporation existence of Merger Sub ceased and SBC USA survived the merger as a wholly owned subsidiary

of Pono (“Pono Merger”). In connection with the consummation of Pono Merger, Pono changed its name to “SBC Medical

Group Holdings Incorporated” and SBC USA changed its name to “SBC Medical Group, Inc.” and, among other transactions

contemplated by the Merger Agreement, the existing equity holders of SBC USA exchanged their equity interests of SBC USA for equity interests

of Pono.

On

September 17, 2024, the Company received net cash of $11,707,417 from Pono Merger. The Company also assumed $416,799 in prepaid expenses

and other current assets, $1,108 in accounts payable, $14,431 in income tax payable, $2,700,000 in convertible note payable, which was subsequently converted to 270,000 shares upon the consummation of Pono Merger, $1,000,789

in accrued liabilities and other current liabilities, common stock of $508 and additional paid-in capital of $8,407,380.

The

total funds from Pono Merger of $11,707,417 were available to repay certain indebtedness, transaction costs and for general corporate

purposes, which primarily consisted of investment banking, legal, accounting, and other professional fees as follows:

SCHEDULE OF PROCEEDS FROM MERGER

| | |

| | |

| Cash—Pono working capital cash | |

$ | 766,735 | |

| Cash—Pono trust | |

| 16,731,409 | |

| Less: transaction costs and advisory fees | |

| 5,790,727 | |

| Net proceeds from Pono Merger | |

$ | 11,707,417 | |

Pono

Merger was accounted for as a reverse recapitalization under the accounting principles generally accepted in the United States of America

(“U.S. GAAP”). SBC USA was determined to be the accounting acquirer and Pono was treated as the acquired company for financial

reporting purposes. Accordingly, the financial statements of the combined company represent a continuation of the financial statements

of SBC USA.

Unless

the context indicates otherwise, any references herein to the “Company”, “we”, “us” and “our”

refer to 1) SBC USA and its consolidated subsidiaries and VIE prior to the consummation of Pono Merger and to 2) SBC Holding and its

consolidated subsidiaries and VIE following Pono Merger; and reference herein to “Pono” refers to SBC Holding prior to the

consummation of Pono Merger.

Reorganization

In June 2020 and April 2022, SBC

Inc., a company incorporated in Japan in June 2007, and Advice Innovation Co., Ltd., a company incorporated in Japan in December 2018,

were merged with and into SBC Medical Group Co., Ltd. (“SBC Japan”), respectively, with SBC Japan being the surviving entity

in such mergers. SBC Japan is a company incorporated in Japan in September 2017 and previously known as Aikawa Medical Management Co.,

Ltd.

In April 2023, SBC Japan

acquired 100% equity interest of L’Ange Cosmetique Co., Ltd. (“L’Ange Sub”), a company incorporated in Japan

in June 2003, and Shobikai Co., Ltd. (“Shobikai Sub”), a company incorporated in Japan in June 2014, through

share exchange. As a result, L’Ange Sub and Shobikai Sub become wholly owned subsidiaries of SBC Japan.

In August 2023, SBC Japan

and L’Ange Sub disposed of their entire equity interest in Ai Inc. and Lange Inc., respectively, both incorporated in the Federated

States of Micronesia in January 2022, for cash. As a result, Ai Inc. and Lange Inc. cease to be subsidiaries of the Company, with

the related investment in capital being treated as a deemed distribution and the disposal proceeds treated as a deemed contribution.

In September 2023, SBC USA

acquired 100% equity interest of SBC Japan through share exchange with one share of its common stock. As a result, SBC Japan becomes a

wholly owned subsidiary of SBC USA.

The above reorganization has been accounted for as

a recapitalization among entities under common control since the same controlling shareholder controlled these entities before and after

the reorganization. The consolidation of the Company has been accounted for at historical cost and prepared on the basis as if the transactions

had become effective as of the beginning of the earliest period presented in the accompanying consolidated financial statements.

Corporate

Structure

As

of September 30, 2024, the Company’s major subsidiaries and VIE are as follows:

SCHEDULE

OF MAJOR SUBSIDIARIES

| Name | |

Place of

Incorporation | |

Date of

Incorporation or

Acquisition | |

Percentage of

Ownership | | |

Principal Activities |

| SBC Medical Group, Inc. | |

United States | |

January 20, 2023 | |

| 100% | | |

Investment holding |

| SBC Medical Group Co., Ltd. | |

Japan | |

September 29, 2017 | |

| 100% | | |

Franchising, procurement and management services for the medical corporations |

| L’Ange Cosmetique Co., Ltd. | |

Japan | |

June 18, 2003 | |

| 100% | | |

Management and rental services for the medical corporations |

| Shobikai Co., Ltd. | |

Japan | |

June 4, 2014 | |

| 100% | | |

Procurement, management and rental services for the medical corporations |

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

1 — ORGANIZATION AND DESCRIPTION OF BUSINESS (cont.)

| Name | |

Place of

Incorporation | |

Date of

Incorporation or

Acquisition | |

Percentage of

Ownership | | |

Principal Activities |

| Liesta Co., Ltd. | |

Japan | |

December 15, 2020 | |

| 100% | | |

Real estate brokerage services |

| Skynet Academy Co., Ltd. | |

Japan | |

April 1, 2022 | |

| 78% | | |

Pilot training services |

| SBC Sealane Co., Ltd. | |

Japan | |

June 7, 2022 | |

| 100% | | |

Construction services |

| SBC Marketing Co., Ltd. | |

Japan | |

June 30, 2022 | |

| 100% | | |

Internet marketing services |

| Medical Payment Co., Ltd. | |

Japan | |

June 30, 2022 | |

| 75% | | |

Loan services |

| SBC Medical Consulting Co., Ltd. | |

Japan | |

August 2, 2022 | |

| 100% | | |

Human resource services |

| Shoubikai Medical Vietnam Co., Ltd. | |

Vietnam | |

August 29, 2013 | |

| 100% | | |

Cosmetic clinic |

| SBC Healthcare Inc. | |

United States | |

December 16, 2019 | |

| 100% | | |

Management services for cosmetic clinic in the United States |

| SBC Irvine, LLC* | |

United States | |

December 27, 2018 | |

| 100% | | |

Management services for cosmetic clinic in the United States |

| Kijimadairakanko Inc. | |

Japan | |

April 3, 2023 | |

| 100% | | |

Ski resorts and tourism services |

| Aikawa Medical Management, Inc. | |

United States | |

May 10, 2017 | |

| VIE | | |

Management services for cosmetic clinic in the United States |

| * |

A

subsidiary of SBC Healthcare Inc. |

NOTE

2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a)

Basis of Presentation and Principles of Consolidation

The

accompanying unaudited consolidated financial statements have been prepared in accordance with U.S. GAAP and pursuant to the rules and regulations of the Securities

and Exchange Commission (“SEC”). The unaudited consolidated financial statements do not include all of the information and disclosure required by U.S. GAAP for complete financial statements. Interim results are not necessarily indicative of results for a full year. In the opinion

of management, all adjustments consisting of a normal recurring nature considered necessary for a fair presentation of the financial

position and the results of operations and cash flows for the interim periods have been included. The unaudited consolidated financial

statements should be read in conjunction with the audited consolidated financial statements and related notes for the year ended December

31, 2023.

The

unaudited consolidated financial statements include the financial statements of the Company, its subsidiaries, and consolidated VIE for

which the Company is the primary beneficiary. The results of the subsidiaries are consolidated from the date on which the Company obtained

control and continue to be consolidated until the date that such control ceases. All significant transactions and balances among the

Company’s subsidiaries, including the VIE, have been eliminated upon consolidation.

Variable

Interest Entities

In

accordance with ASC Topic 810, “Consolidation”, the Company identifies its variable interests and analyzes to determine

if the entity in which the Company has a variable interest is a VIE. Determination if a variable interest is a VIE includes both quantitative

and qualitative consideration. For those entities determined to be VIEs within the scope of the VIE model, a further quantitative and

qualitative analysis is performed to determine if the Company is deemed the primary beneficiary. The primary beneficiary is the party

who has the power to direct the activities of a VIE that most significantly impact the entity’s economic performance and who has

an obligation to absorb losses of the entity or a right to receive benefits from the entity that could potentially be significant.

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

The

Company would consolidate those entities in which it is determined to be the primary beneficiary. The Company based its

qualitative analysis on its review of the design of the entity, its organizational structure including decision-making ability and

the relevant development, operating management and financial agreements.

The

Company evaluates its relationship with its VIE on an ongoing basis to determine whether it continues to be the primary beneficiary of

its consolidated VIE, or whether it has become the primary beneficiary of the VIE it does not consolidate.

Voting

Model

If

a legal entity fails to meet any of the three characteristics of a VIE, we then evaluate such entity under the voting model. Under the

voting model, we consolidate the entity if we determine that we, directly or indirectly, have greater than 50% of the voting rights and

that other equity holders do not have substantive participating rights.

Assessment

of Medical Corporations in Japan

SBC

Japan, L’Ange Sub and Shobikai Sub are each designated as a medical service corporation (the “MSC”) to provide services

to the Medical Corporations (the “MCs”) in Japan. To maintain and strengthen the business relationship and to secure

the source of revenues from the MCs, the Company acquired equity interests in the following MCs throughout the years.

SCHEDULE

OF ACQUIRED EQUITY INTERESTS

| Name of the MC | |

Percentage of

Equity Interest

Acquired | | |

Percentage of

Voting Interest

Held | |

| Medical Corporation Shobikai | |

| 100 | % | |

| 0 | % |

| Medical Corporation Kowakai | |

| 100 | % | |

| 0 | % |

| Medical Corporation Nasukai | |

| 100 | % | |

| 0 | % |

| Medical Corporation Aikeikai | |

| 100 | % | |

| 0 | % |

| Medical Corporation Jukeikai | |

| 100 | % | |

| 0 | % |

| Medical Corporation Ritz Cosmetic Surgery | |

| 100 | % | |

| 0 | % |

As

non-profit organizations, MCs are required to comply with the medical-related laws and regulations of the Japanese Medical Care Act (the

“Act”, “Medical Care Act”). In accordance with the Act, the highest authority of MCs is its general meeting of

members (the “Members”), with each Member having one voting right. The Company, through the MSCs, has no right to elect the

Members, no decision-making ability and no right to dividend or any profit distribution, but has the right to receive distribution of

the residual assets of the MCs.

Since

the not-for-profit entities scope exception to the variable interest model is applicable to the MCs, the Company evaluates its business

relationship, franchisor-franchisee agreements and/or services agreements with the MCs in Japan under the voting model. The Company has

concluded that consolidation of the MCs is not appropriate for the periods presented as it does not have a majority voting interest in

the Members of the MCs nor does it have a controlling financial interest in the MCs. The equity interests in the MCs held by the Company

are recorded as long-term investments in MCs — related parties on the unaudited consolidated balance sheets. The transactions between

the Company and the MCs are disclosed in Note 17 Related Party Transactions.

(b)

Foreign Currency

The

Company maintains its books and record in its local currency, Japanese YEN (“JPY” or “¥”), which is a functional

currency as being the primary currency of the economic environment in which its operation is conducted. Transactions denominated

in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the

dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated

into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded

in other income (expenses) in the unaudited statements of operations and comprehensive income.

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

The

reporting currency of the Company is the United States Dollars (“US$” or “$”), and the accompanying financial

statements have been expressed in US$. In accordance with ASC Topic 830-30, “Translations of Financial Statements”, assets

and liabilities of the Company whose functional currency is not US$ are translated into US$, using the exchange rate on the balance sheet

date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from the

translation of financial statements are recorded as a separate component of accumulated other comprehensive loss within the unaudited

statements of changes in stockholders’ equity.

Translation

of amounts from local currency of the Company into US$1 has been made at the following exchange rates:

SCHEDULE

OF LOCAL CURRENCY EXCHANGE RATES

| | |

September 30,

2024 | | |

September 30,

2023 | |

| Current JPY:US$1 exchange rate | |

| 142.8410 | | |

| 149.3680 | |

| Average JPY:US$1 exchange rate | |

| 151.1271 | | |

| 138.1015 | |

| Exchange rate | |

| 151.1271 | | |

| 138.1015 | |

(c)

Use of Estimates

In

preparing the unaudited consolidated financial statements in conformity U.S. GAAP, management is required to make certain estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at

the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. These estimates

are based on information available as of the date of the unaudited consolidated financial statements. Significant estimates required

to be made by management include, but are not limited to, useful lives and impairment of long-lived assets, impairment of goodwill,

impairment of long-term investments in MCs — related parties, valuation of stock-based compensation, valuation allowance of

deferred tax assets, uncertain income tax positions, the recognition and measurement of impairment of investments in securities,

allowance for credit losses and implicit interest rate of operating leases. Management bases its estimates on historical experience

and other assumptions it believes to be reasonable under the circumstances and evaluates these estimates on an on-going basis.

Actual results could differ from those estimates.

(d)

Customer Loans Receivable and Note Payables — Related Parties

In

February 2023, the Company started to provide loan services to certain customers of the related-party MCs (“End Customers”).

When a loan is granted to finance an End Customer’s purchase, the Company issues a promissory note to the MC to pay off the purchase

transaction on behalf of the End Customer, and the End Customer is required to repay the Company in monthly installments. The loans provided

to the End Customers are unsecured, interest-bearing, and due in three months to five years, depending on the End Customers’ choice

of the loan service term.

The

Company records the customer loans receivables at gross loan receivables less unamortized costs of issuance fees or discounts, which

are amortized over the life of the loan to interest income. During the nine months ended September 30, 2024 and 2023, the Company generated

interest income of $798,263 and $4,374, respectively, from the loan services, which were included in revenues.

Management

periodically evaluates individual End Customer’s financial condition, credit history and the current economic conditions to make

adjustments in the allowance when necessary. Customer loans receivable are charged off against the allowance after all means of collection

have been exhausted and the potential for recovery is considered remote. As of September 30, 2024 and December 31, 2023, the Company

determined no allowance for doubtful accounts was necessary for customer loans receivable.

The

Company repays each promissory note issued to the MCs when the End Customer fully repays the corresponding loan receivable or

at an earlier date agreed by the parties. The promissory notes are unsecured,

bear no interest, and are due in three months to five years, depending on the term of the loans provided to the corresponding End Customers.

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

(e)

Intangible Assets, Net

Intangible

assets with an indefinite life are not amortized and are tested for impairment annually or more frequently if events or changes in circumstances

indicate that they might be impaired.

Intangible

assets with finite lives are initially recorded at cost and amortized on a straight-line basis over the estimated economic useful lives

of the respective assets. Acquired intangible assets from business combinations are recognized and measured at fair value at the time

of acquisition. Those assets represent assets with finite lives are further amortized on a straight-line basis over the estimated economic

useful lives of the respective assets.

The

estimated useful lives of intangible assets are as follows:

SCHEDULE

OF ESTIMATED USEFUL LIVES OF INTANGIBLE ASSETS

| | |

Useful Life |

| Patent use right | |

16 years |

(f)

Goodwill, Net

Goodwill

represents the excess of the purchase price over the fair value of the identifiable assets and liabilities acquired in the business combination.

In accordance with FASB ASC Topic 350, “Intangibles-Goodwill and Others”, goodwill is subject to at least an annual assessment

for impairment or more frequently if events or changes in circumstances indicate that an impairment may exist, applying a fair-value

based test.

The

Company would recognize an impairment charge for the amount by which the carrying amount of a reporting unit exceeds its fair value up

to the amount of goodwill allocated to that reporting unit.

When

performing the annual impairment test, the Company has the option of performing a qualitative or quantitative assessment to determine

if an impairment has occurred. If a qualitative assessment indicates that it is more likely than not that the fair value of a reporting

unit is less than its carrying amount, the Company would be required to perform a quantitative impairment analysis for goodwill. The

quantitative analysis requires a comparison of the fair value of the reporting unit to its carrying value, including goodwill. If the

carrying value of the reporting unit exceeds its fair value, an impairment loss is recognized in an amount equal to that excess, limited

to the total amount of goodwill allocated to that reporting unit. The fair value is generally determined using the income approach with

the discounted cash flow valuation method, which requires management to make significant estimates and assumptions related to forecasted

revenues and cash flows and the discount rates.

(g)

Impairment of Long-lived Assets Other Than Goodwill

Long-lived

assets with finite lives, primarily property and equipment, intangible assets, and operating lease right-of-use assets are reviewed for

impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If the estimated

cash flows from the use of the asset and its eventual disposition are below the asset’s carrying value, then the asset is deemed

to be impaired and written down to its fair value.

(h)

Long-term Investments

Investments

in equity securities with readily determinable fair values

The

Company holds investments in equity securities of publicly listed companies, for which the Company does not have significant influence.

Investments in equity securities with readily determinable fair values are measured at fair value and any changes in fair value are recognized

in other income (expenses).

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Investments

in privately held companies and organizations that do not report Net Asset Value (the “NAV”) per share

The

Company’s long-term investments in privately held entities that do not report NAV per share are accounted for using a measurement

alternative, under which these investments are measured at cost, adjusted for observable price changes and impairments, with changes

recognized in other income (expenses).

The

Company recognizes both realized and unrealized gain and losses in its unaudited consolidated statements of operations and comprehensive

income, classified with other income (expenses). Unrealized gains and losses represent observable price changes for investments

in privately held entities that do not report NAV per share. Realized gains and losses represent the difference between proceeds received

upon disposition of investments and their historical or adjusted cost. Impairments are realized losses, which result in an adjusted cost,

and represent charges to reduce the carrying values of investments in privately held entities that do not report NAV per share, if impairments

are deemed other than temporary, to their estimated fair values.

(i)

Long-term Investments in MCs — Related Parties

Long-term

investments in MCs — related parties represent the payments to obtain equity interests of the MCs in Japan, made by the Company

through SBC Japan, a company designated as a MSC in Japan. In accordance with the Act and articles of incorporation of the MCs, which

are non-profit organizations, the equity interest holders of MCs are prohibited from receiving any profit distribution from MCs but have

the right to receive distribution of the residual assets of the MCs in proportion to the amount of their contribution. As of the balance

sheet dates, the investments represent probable future economic benefit to be realized at the time of dissolution of MCs or the equity

interests being sold.

The

investments in MCs — related parties are accounted for using a measurement alternative, under which these investments are measured

at cost, less impairment, and adjusted for observable price changes. The Company reviews the investments in MCs for impairment whenever

events or changes in circumstances indicate that the carrying amount may not be recoverable. The payments made for such investments are

classified as investing activities in the unaudited consolidated statements of cash flows. The MCs are considered related parties as

the relatives of the Chief Executive Officer (“CEO”) of the Company being the Members of the MCs. Also see Note 2(a) for

further details.

(j)

Lease

The

Company determines if an arrangement is or contains a lease at inception or modification of the arrangement. An arrangement is or contains

a lease if there are identified assets and the right to control the use of an identified asset is conveyed for a period in exchange for

consideration. Control over the use of the identified assets means the lessee has both the right to obtain substantially all of the economic

benefits from the use of the asset and the right to direct the use of the asset.

The

Company classifies its leases as either finance leases or operating leases if it is the lessee, or sales-type, direct financing, or operating

leases if it is the lessor. The following criteria is used to determine if a lease is a finance lease (as a lessee) or sales-type or

direct financing lease (as a lessor):

| |

(i) |

ownership is transferred from lessor to lessee by the end of

the lease term; |

| |

|

|

| |

(ii) |

an option to purchase is reasonably certain to be exercised; |

| |

|

|

| |

(iii) |

the lease term is for the major part of the underlying asset’s

remaining economic life; |

| |

|

|

| |

(iv) |

the present value of lease payments equals or exceeds substantially

all of the fair value of the underlying assets; or |

| |

|

|

| |

(v) |

the underlying asset is specialized and is expected to have

no alternative use at the end of the lease term. |

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

If

any of the above criteria is met, the Company accounts for the lease as a finance, a sales-type, or a direct financing lease. If none

of the criteria is met, the Company accounts for the lease as an operating lease.

Lessee

accounting

The

Company recognizes right-of-use assets and lease liabilities for all leases other than those with a term of twelve months or less as

the Company has elected to apply the short-term lease recognition exemption. Right-of-use assets represent the Company’s right

to use an underlying asset for the lease term. Lease liabilities represent the Company’s obligation to make lease payments arising

from the lease. Right-of-use assets and lease liabilities are classified and recognized at the commencement date of a lease. Lease liabilities

are measured based on the present value of fixed lease payments over the lease term. Right-of-use assets consist of (i) initial measurement

of the lease liability; (ii) lease payments made to the lessor at or before the commencement date less any lease incentives received;

and (iii) initial direct costs incurred by the Company.

As

the rates implicit on the Company’s leases for which it is the lessee are not readily determinable, the Company uses its incremental

borrowing rate based on information available at the commencement date in determining the present value of lease payments. When determining

the incremental borrowing rate, the Company assesses multiple variables such as lease term, collateral, economic conditions, and its

creditworthiness.

From

time to time, we may enter into sublease agreements with third parties. Our subleases generally do not relieve us of our primary obligations

under the corresponding head lease. As a result, we account for the head lease based on the original assessment at lease inception. We

determine if the sublease arrangement is either a sales-type, direct financing, or operating lease at inception of the sublease. If the

total remaining lease cost on the head lease for the term of the sublease is greater than the anticipated sublease income, the right-of-use

asset is assessed for impairment. Our subleases are generally operating leases and we recognize sublease income on a straight-line basis

over the sublease term.

Lessor

accounting — operating leases

The

Company accounts for the revenue from its lease contracts by utilizing the single component accounting policy. This policy requires the

Company to account for, by class of underlying asset, the lease component and nonlease component(s) associated with each lease as a single

component if two criteria are met.

| |

(i) |

the

timing and pattern of transfer of the lease component and the nonlease component(s) are the same; and |

| |

|

|

| |

(ii) |

the

lease component would be classified as an operating lease if it were accounted for separately. |

Lease

components consist primarily of fixed rental payments, which represent scheduled rental amounts due under our leases. Nonlease components

consist primarily of tenant recoveries representing reimbursements of rental operating expenses, including recoveries for utilities,

repairs and maintenance and common area expenses.

If

the lease component is the predominant component, we account for all revenues under such lease as a single component in accordance with

the lease accounting standard. Conversely, if the nonlease component is the predominant component, all revenues under such lease are

accounted for in accordance with the revenue recognition accounting standard. Our operating leases qualify for the single component accounting,

and the lease component in each of our leases is predominant. Therefore, we account for all revenues from our operating leases under

the lease accounting standard and classify these revenues as rental income.

The

Company commences recognition of rental income related to the operating leases at the date the property is ready for its intended use

by the tenant and the tenant takes possession or controls the physical use of the leased asset. Income from rentals related to fixed

rental payments under operating leases is recognized on a straight-line basis over the respective operating lease terms. Any amounts

received but will be recognized as revenue in future periods are classified in advances from customers in the Company’s unaudited

consolidated balance sheets.

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Lessor

accounting — sales-type leases

The

Company purchases medical equipment from vendors and leases it to its customers, who are required to pay installments throughout the

term of the leases. The lease agreements include lease payments that are fixed, do not contain residual value guarantees or variable

lease payments. The lease terms are based on the non-cancellable term of the lease and the buyer may have options to terminate the lease

in advance when meets certain conditions. The customers obtain control of the medical equipment when they physically possess the equipment.

The

Company recognizes sales from sales-type leases equal to the present value of the minimum lease payments discounted using the implicit

interest rate in the lease and cost of sales equal to carrying amount of the asset being leased and any initial direct costs incurred,

less the present value of the unguaranteed residual. Interest income from the leases is recognized over the lease terms and included

in revenues, net.

The

Company excludes from the measurement of its lease revenues any tax assessed by a governmental authority that is both imposed on and

concurrent with a specific revenue-producing transaction and collected from a customer.

(k)

Revenue Recognition

The

Company recognizes revenue from franchising services, procurement services, management services and other services or product sales under

ASC Topic 606, “Revenue from Contracts with Customers”.

To

determine revenue recognition for contracts with customers, the Company performs the following five steps: (i) identify the contract(s)

with the customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, including variable

consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocate the transaction price

to the respective performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies the performance

obligation. Revenue amount represents the invoiced value, net of consumption tax and applicable local government levies, if any. The

consumption tax on sales is calculated at 10% of gross sales. The Company does not have significant remaining unfulfilled performance

obligations or contract balances.

The

Company reports revenue on a gross or net basis based on management’s assessment of whether the Company acts as a principal or

agent in the transaction. The determination of whether the Company acts as a principal or an agent in a transaction is based

on the evaluation of whether (i) the Company is primarily responsible for fulfilling the promise to provide the specified goods or service,

(ii) the Company has inventory risk before the specified good or service has been transferred to a customer or after transfer of control

to the customer and (iii) the Company has discretion in establishing the price for the specified good or service. If the terms of a transaction

do not indicate the Company is acting as a principal in the transaction, then the Company is acting as an agent in the transaction and

the associated revenues are recognized on a net basis.

The

Company recognizes revenue from rental services under ASC Topic 842, “Leases”.

The

Company currently generates its revenue from the following main sources:

Franchising

Revenue

The

Company generates franchising revenue (royalty income) by licensing its intellectual properties, including but not limited to the Company’s

brand name (“Shonan Beauty Clinic”), trade name, patents, and trademarks, as a franchisor pursuant to franchise agreements

with the medical corporations (the “MCs”) in Japan. Prior to April 2023, royalty income was based on a percentage of sales

and recognized at the time when the related sales occurred; since April 2023, it is based on a fixed amount to each clinic of the MCs;

since September 2023, it is based on a fixed amount to each MC and a fixed amount to each clinic of the MCs and recognized over time

as services are rendered.

SBC

MEDICAL GROUP HOLDINGS INCORPORATED

NOTES

TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Procurement

Revenue

The

Company generates procurement services revenue by purchasing primarily advertising services and medical materials from qualified vendors

on behalf of MCs to maintain brand quality consistency. Procurement services revenue is recognized at the point in time upon the delivery

of products or over time as services are performed. Occasionally, the Company receives vendor discounts on certain large purchases. It

recognizes revenue based on actual payments and will return the over-collection resulting from such discounts to MCs.

Management

Services Revenue

The

Company provides loyalty program management services, labor supporting services, function supporting services, and management consulting

services to MCs.

Loyalty

program management services

The

Company awards loyalty points on behalf of MCs to MCs’ customers, who earn loyalty points from each qualified purchase made at

the loyalty program participating clinics of MCs, in exchange for a handling fee. The revenue is based on a percentage of the related

payment amount made by MCs’ customers and is recognized when the loyalty points are awarded.

At

the time loyalty points are awarded, a MC pays the Company cash in an amount equivalent to the awarded loyalty points, which is recorded

as advances from customers. When a MC’s customers redeem the loyalty points, the Company returns the cash back to the MC in an

amount equivalent to the redeemed loyalty points. The awarded loyalty points expire if a MC’s customer does not make any additional

qualified purchase at a participating clinic within a year. The Company accumulates and tracks the points on behalf of MCs until the

loyalty points expire at which time the Company recognizes an amount equivalent to the expired loyalty points as revenue, which is normally

not significant.

The

Company also awards certain points to MCs’ customers on behalf of MCs for free in order to increase the volume of MC’s sales,

from which the Company earns other types of revenues, such as royalty income. When a MC’s customers redeem such points, the Company

reimburses MC in an amount equivalent to the used free points and records it as a reduction of the revenue recognized.

The

Company is an agent in the management of loyalty programs, and as a result, revenues are recognized net of the cost of redemptions.

Labor

supporting services

The

Company generates revenue by dispatching staff to MCs to provide a range of services, primarily including clinic operation, IT, and administrative

services. The Company recognizes the revenue over the time when services are rendered.

Function

supporting services

The

revenue is derived from providing functional supporting services to MCs, such as accounting and human resources services. The Company

recognizes the revenue over the time when services are rendered.

Management

consulting services

The