UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the

Securities Exchange Act of 1934

January 17, 2024

Date of Report (Date of earliest event reported)

ROTH CH ACQUISITION

V CO.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-41105 |

|

86-1229207 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

|

888 San Clemente Drive, Suite 400

Newport Beach, CA

|

|

92660 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (949) 720-5700

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

ROCL |

|

The Nasdaq Stock Market LLC |

| Warrants |

|

ROCLW |

|

The Nasdaq Stock Market LLC |

| Units |

|

ROCLU |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected

not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

As previously reported, on January 3, 2024, Roth CH Acquisition V Co., a Delaware corporation (“ROCL” or “Acquiror”), entered into a Business Combination Agreement and Plan of Reorganization (as it

may be amended, supplemented or otherwise modified from time to time, the “Merger Agreement”), by and among Acquiror, Roth CH V Merger Sub Corp., a Delaware corporation and

a wholly-owned subsidiary of Acquiror (“Merger Sub”), and New Era Helium Corp., a Nevada corporation (“NEH” or the “Company”) with respect to a proposed business combination between ROCL and NEH.

Furnished as Exhibit 99.1 hereto and incorporated by reference herein is a press release issued in connection with the proposed business combination and related matters.

Furnished as Exhibit 99.2 hereto and incorporated by reference herein is the investor presentation that will

be used by ROCL and NEH in connection with the proposed business combination and related matters.

The information in this Item 7.01 and Exhibit 99.1 and Exhibit 99.2 attached hereto are being furnished and shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall they be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended

(the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such

filing.

Additional Information and Where to Find It

This Current Report on Form 8-K contains information with respect to a proposed business combination (the “Proposed Business Combination”) among NEH, ROCL and Merger Sub, a wholly-owned subsidiary of ROCL. In connection with the Proposed Business Combination, ROCL intends to file with the SEC a registration on Form S-4, which will include a proxy

statement to be sent to ROCL stockholders and a prospectus for the registration of ROCL securities (as amended from time to time, the “Registration Statement”). A full description of the terms of the Proposed Business Combination is expected

to be provided in the Registration Statement. ROCL urges investors, stockholders and other interested persons to read, when available,

the Registration Statement as well as other documents filed with the SEC because these

documents will contain important information about ROCL, NEH and the Proposed Business Combination. If and when the Registration Statement

is declared effective by the SEC, the definitive proxy statement/prospectus and other

relevant documents will be mailed to stockholders of ROCL as of a record date to be established for voting on the Proposed Business Combination.

Stockholders and other interested persons will also be able to obtain a copy of the

proxy statement, without charge, by directing a request to: Roth CH Acquisition V

Co., 888 San Clemente Drive, Suite 400, Newport Beach, CA 92660. The preliminary and

definitive proxy statement, once available, can also be obtained, without charge,

at the SEC’s website (www.sec.gov). The information contained on, or that may be accessed through,

the websites referenced in this press release is not incorporated by reference into,

and is not a part of, this press release.

Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995 including, but not limited to, ROCL’s and NEH’s expectations or predictions of future financial or business performance or conditions.

Forward-looking statements are inherently subject to risks, uncertainties and assumptions.

Generally, statements that are not historical facts, including statements concerning

possible or assumed future actions, business strategies, events or results of operations,

are forward-looking statements. These statements may be preceded by, followed by or

include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,”

“will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” “intends,” or similar

expressions. Such forward-looking statements involve risks and uncertainties that

may cause actual events, results or performance to differ materially from those indicated

by such statements. Certain of these risks are identified and discussed in ROCL’s final prospectus for its initial public offering, filed with the SEC on December 2, 2021, under the heading “Risk Factors.” These risk factors will be important to

consider in determining future results and should be reviewed in their entirety. These

forward-looking statements are expressed in good faith, and ROCL and NEH believe there is a reasonable basis for them. However, there can be no assurance

that the events, results or trends identified in these forward-looking statements

will occur or be achieved. Forward-looking statements speak only as of the date they

are made, and neither ROCL nor NEH is under any obligation, and expressly disclaim any obligation, to update,

alter or otherwise revise any forward-looking statement, whether as a result of new

information, future events or otherwise, except as required by law.

In addition to factors previously disclosed in ROCL’s reports filed with the SEC and those identified elsewhere in this Current Report on Form 8-K, the following factors, among others, could cause actual results to differ materially

from forward-looking statements or historical performance: (i) expectations regarding

NEH’s strategies and future financial performance, including its future business plans

or objectives, prospective performance and opportunities and competitors, revenues,

products and services, pricing, operating expenses, market trends, liquidity, cash

flows and uses of cash, capital expenditures, and NEH’s ability to invest in growth initiatives and pursue acquisition opportunities; (ii)

the occurrence of any event, change or other circumstances that could give rise to

the termination of the Merger Agreement; (iii) the outcome of any legal proceedings that may be instituted against ROCL or NEH following announcement of the Proposed Business Combination and the transactions

contemplated thereby; (iv) the inability to complete the Proposed Business Combination

due to, among other things, the failure to obtain ROCL stockholder approval on the expected terms and schedule, as well as the risk that

regulatory approvals required for the Proposed Business Combination are not obtained

or are obtained subject to conditions that are not anticipated; (v) the failure to

meet the minimum cash requirements of the Merger Agreement due to ROCL stockholder redemptions and the failure to obtain replacement financing; the inability to complete the concurrent

PIPE, (vi) the risk that the Proposed Business Combination or another business combination

may not be completed by ROCL’s business combination deadline and the potential failure to obtain an extension of

the business combination deadline; (vii) the risk that the announcement and consummation

of the Proposed Business Combination disrupts NEH’s current operations and future plans; (viii) the ability to recognize the anticipated

benefits of the Proposed Business Combination; (ix) unexpected costs related to the

Proposed Business Combination; (x) the amount of any redemptions by existing holders

of the ROCL Common Stock being greater than expected; (xi) limited liquidity and trading of ROCL’s securities; (xii) geopolitical risk and changes in applicable laws or regulations;

(xii) the possibility that ROCL and/or NEH may be adversely affected by other economic, business, and/or competitive

factors; (xiv) operational risk; (xv) risk that the COVID-19 pandemic, and local,

state, and federal responses to addressing the pandemic may have an adverse effect

on our business operations, as well as our financial condition and results of operations;

and (xvi) the risks that the consummation of the Proposed Business Combination is

substantially delayed or does not occur.

Any financial projections in this Current Report on Form 8-K are forward-looking statements that are based on assumptions that are inherently subject

to significant uncertainties and contingencies, many of which are beyond ROCL’s and NEH’s control. While all projections are necessarily speculative, ROCL and NEH believe that the preparation of prospective financial information involves

increasingly higher levels of uncertainty the further out the projection extends from

the date of preparation. The assumptions and estimates underlying the projected results

are inherently uncertain and are subject to a wide variety of significant business,

economic and competitive risks and uncertainties that could cause actual results to

differ materially from those contained in the projections. The inclusion of projections

in this Current Report on Form 8-K should not be regarded as an indication that ROCL and NEH, or their representatives, considered or consider the projections to be a

reliable prediction of future events.

Annualized, pro forma, projected and estimated numbers are used for illustrative purpose

only, are not forecasts and may not reflect actual results.

The foregoing list of factors is not intended to be all-inclusive or to contain all

the information that a person may desire in considering an investment in ROCL and is not intended to form the basis of an investment decision in ROCL. Readers should carefully review the foregoing factors and other risks and uncertainties

described in the “Risk Factors” section of the Registration Statement and the other

reports, which ROCL has filed or will file from time to time with the SEC. There may be additional risks

that neither ROCL nor NEH presently know, or that ROCL and NEH currently believe are immaterial, that could cause actual results to differ

from those contained in forward looking statements. For these reasons, among others,

investors and other interested persons are cautioned not to place undue reliance upon

any forward-looking statements in this Current Report on Form 8-K. All subsequent written and oral forward-looking statements concerning ROCL and NEH, the Proposed Business Combination or other matters and attributable to ROCL and NEH or any person acting on their behalf are expressly qualified in their entirety

by the cautionary statements above.

Participants in the Solicitation

ROCL, NEH and their respective directors and executive officers may be considered

participants in the solicitation of proxies with respect to the Proposed Business

Combination described herein under the rules of the SEC. Information about such persons

and a description of their interests will be contained in the Registration Statement

when it is filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This Current Report on Form 8-K does not constitute a proxy statement or solicitation of a proxy, consent, vote or

authorization with respect to any securities or in respect of the Proposed Business

Combination and shall not constitute an offer to sell or exchange, or a solicitation

of an offer to buy or exchange any securities, nor shall there be any sale, issuance

or transfer of any such securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: January 17, 2024

| ROTH CH ACQUISITION V CO. |

|

| |

|

|

| By: |

/s/ John Lipman |

|

| Name: |

John Lipman |

|

| Title: |

Co-Chief Executive Officer and Co-Chairman of the Board |

|

Exhibit 99.1

New Era Helium Corp. and Roth CH Acquisition V Co. announce the Filing of an Investor

Presentation for the Proposed Business Combination

MIDLAND, TX – January 17, 2024 – Roth CH Acquisition V Co. (NASDAQ: ROCL) (“Roth CH” or “Roth CH V”)), a special purpose acquisition company, and New Era Helium Corp. (“New Era”, “NEH”

or the “Company”), an exploration and production (“E&P”) company that sources helium

produced in association with the production of natural gas reserves in North America,

announced today that ROCL has filed an Investor Presentation on Form 8-K (the “Investor Presentation”) with the U.S. Securities and Exchange Commission (“SEC”) in connection

with the previously announced business combination with New Era. The Investor Presentation includes an overview of New Era, the helium market and the transaction.

Upon the closing of the transaction, subject to approval by ROCL’s stockholders and other customary closing conditions, the combined company will be

named “New Era Helium Corp.” and is expected to list on NASDAQ. Current NEH Chairman,

Joel Solis, and CEO, E. Will Gray II, will continue to lead the combined company,

and existing NEH shareholders will roll 100% of their equity into the combined company.

Completion of the business combination, which is expected to close in the first half

of 2024, is subject to regulatory and stockholder approvals and other customary closing

conditions.

Advisors

Roth Capital Partners, LLC and Craig-Hallum Capital Group LLC are acting as placement agents

for a PIPE transaction that is anticipated to close in connection with the closing of the business combination. Sichenzia Ross Ference Carmel LLP is acting as legal advisor to NEH and Loeb & Loeb

LLP is acting as legal advisor to ROCL.

About New Era Helium Corporation

NEH is an exploration and production company that sources helium produced in association with the production of natural gas reserves in North America. The company currently owns

and operates over 137,000 acres in Southeast New Mexico and has over 2 billion cubic feet of proved,

and probable helium reserves. More information can be found at www.newerahelium.com.

About Roth CH Acquisition V Co.

Roth CH Acquisition V Co. is a blank check company incorporated

for the for the purpose of entering into a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization

or other similar business combination with one or more businesses or entities. Roth CH V is jointly managed by affiliates of Roth Capital

Partners and Craig-Hallum Capital Group. Its initial public offering occurred on December 3, 2021. For more information, visit https://www.rothch.com/.

Additional Information and Where to Find It

This press release is provided for information purposes only and contains information

with respect to a proposed business combination (the “Proposed Business Combination”)

among NEH, Roth CH V and Roth CH V Merger Sub Corp., a wholly-owned subsidiary of Roth CH V. In connection with the Proposed Business

Combination, Roth CH V intends to file with the SEC a registration on Form S-4, which will include a proxy statement to be sent to Roth

CH V stockholders and a prospectus for the registration of Roth CH V securities (as

amended from time to time, the “Registration Statement”). A full description of the

terms of the Proposed Business Combination is expected to be provided in the Registration Statement. Roth CH V urges investors, stockholders and other interested persons to read, when

available, the Registration Statement as well as other documents filed with the SEC

because these documents will contain important information about Roth CH V, NEH and

the Proposed Business Combination. If and when the Registration Statement is declared

effective by the SEC, the definitive proxy statement/prospectus and other relevant

documents will be mailed to stockholders of Roth CH V as of a record date to be established

for voting on the Proposed Business Combination. Stockholders and other interested

persons will also be able to obtain a copy of the proxy statement, without charge,

by directing a request to: Roth CH Acquisition V Co., 888 San Clemente Drive, Suite

400, Newport Beach, CA 92660. The preliminary and definitive proxy statement, once

available, can also be obtained, without charge, at the SEC’s website (www.sec.gov). The information contained on, or that may be accessed through, the websites referenced

in this press release is not incorporated by reference into, and is not a part of,

this press release.

Forward Looking Statements

This communication contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 including, but not limited to, Roth CH V’s and NEH’s expectations or predictions of future financial or business performance or conditions.

Forward-looking statements are inherently subject to risks, uncertainties and assumptions.

Generally, statements that are not historical facts, including statements concerning

possible or assumed future actions, business strategies, events or results of operations,

are forward-looking statements. These statements may be preceded by, followed by or

include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,”

“will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” “intends,” or similar expressions. Such forward-looking statements involve risks and uncertainties

that may cause actual events, results or performance to differ materially from those

indicated by such statements. Certain of these risks are identified and discussed

in Roth CH V’s final prospectus for its initial public offering, filed with the SEC on December 2, 2021, under the heading “Risk Factors.” These risk factors will be important to consider

in determining future results and should be reviewed in their entirety. These forward-looking

statements are expressed in good faith, and Roth CH V and NEH believe there is a reasonable

basis for them. However, there can be no assurance that the events, results or trends identified in these forward-looking statements

will occur or be achieved. Forward-looking statements speak only as of the date they

are made, and neither Roth CH V nor NEH is under any obligation, and expressly disclaim

any obligation, to update, alter or otherwise revise any forward-looking statement,

whether as a result of new information, future events or otherwise, except as required

by law.

In addition to factors previously disclosed in Roth CH V’s reports filed with the SEC and those identified elsewhere in this communication,

the following factors, among others, could cause actual results to differ materially

from forward-looking statements or historical performance: (i) expectations regarding

NEH’s strategies and future financial performance, including its future business plans

or objectives, prospective performance and opportunities and competitors, revenues,

products and services, pricing, operating expenses, market trends, liquidity, cash

flows and uses of cash, capital expenditures, and NEH’s ability to invest in growth initiatives and pursue acquisition opportunities; (ii)

the occurrence of any event, change or other circumstances that could give rise to

the termination of the business combination agreement; (iii) the outcome of any legal

proceedings that may be instituted against Roth CH V or NEH following announcement

of the Proposed Business Combination and the transactions contemplated thereby; (iv)

the inability to complete the Proposed Business Combination due to, among other things, the failure to obtain Roth CH V stockholder approval on

the expected terms and schedule, as well as the risk that regulatory approvals required for the Proposed Business Combination are not obtained or are obtained subject to conditions that are not anticipated; (v) the failure to meet the minimum cash requirements of the business combination agreement

due to ROCL stockholder redemptions and the failure to obtain replacement financing;

the inability to complete the concurrent PIPE, (vi) the risk that the Proposed Business Combination or another business combination may not be completed by Roth CH V’s business combination deadline and the potential failure to obtain an extension of

the business combination deadline; (vii) the risk that the announcement and consummation of the Proposed Business Combination disrupts NEH’s current operations and future plans; (viii) the ability to recognize the anticipated benefits of the Proposed Business Combination; (ix) unexpected costs related to the Proposed Business Combination; (x) the amount of any redemptions by existing holders of the Roth CH V Common Stock

being greater than expected; (xi) limited liquidity and trading of Roth CH V’s securities; (xii) geopolitical risk and changes in applicable laws or regulations; (xii) the possibility that Roth CH V and/or NEH may be adversely affected by other economic,

business, and/or competitive factors; (xiv) operational risk; (xv) risk that the COVID-19 pandemic, and local, state, and federal responses to addressing

the pandemic may have an adverse effect on our business operations, as well as our

financial condition and results of operations; and (xvi) the risks that the consummation of the Proposed Business Combination is substantially delayed or does not occur.

Any financial projections in this communication are forward-looking statements that

are based on assumptions that are inherently subject to significant uncertainties

and contingencies, many of which are beyond Roth CH V’s and NEH’s control. While all projections are necessarily speculative, Roth CH V and NEH believe

that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from

the date of preparation. The assumptions and estimates underlying the projected results

are inherently uncertain and are subject to a wide variety of significant business,

economic and competitive risks and uncertainties that could cause actual results to

differ materially from those contained in the projections. The inclusion of projections

in this communication should not be regarded as an indication that Roth CH V and NEH,

or their representatives, considered or consider the projections to be a reliable

prediction of future events.

Annualized, pro forma, projected and estimated numbers are used for illustrative purpose

only, are not forecasts and may not reflect actual results.

The foregoing list of factors is not intended to be all-inclusive or to contain all

the information that a person may desire in considering an investment in Roth CH V

and is not intended to form the basis of an investment decision in Roth CH V. Readers

should carefully review the foregoing factors and other risks and uncertainties described

in the “Risk Factors” section of the Registration Statement and the other reports,

which Roth CH V has filed or will file from time to time with the SEC. There may be

additional risks that neither Roth CH V nor NEH presently know, or that Roth CH V

and NEH currently believe are immaterial, that could cause actual results to differ

from those contained in forward looking statements. For these reasons, among others,

investors and other interested persons are cautioned not to place undue reliance upon

any forward-looking statements in this press release. All subsequent written and oral

forward-looking statements concerning Roth CH V and NEH, the Proposed Business Combination

or other matters and attributable to Roth CH V and NEH or any person acting on their

behalf are expressly qualified in their entirety by the cautionary statements above.

Participants in the Solicitation

ROCL, NEH and their respective directors and executive officers may be considered participants

in the solicitation of proxies with respect to the Proposed Business Combination described

herein under the rules of the SEC. Information about such persons and a description

of their interests will be contained in the Registration Statement when it is filed

with the SEC. These documents can be obtained free of charge from the sources indicated

above.

No Offer or Solicitation

This communication does not constitute a proxy statement or solicitation of a proxy,

consent, vote or authorization with respect to any securities or in respect of the

Proposed Business Combination and shall not constitute an offer to sell or exchange,

or a solicitation of an offer to buy or exchange any securities, nor shall there be

any sale, issuance or transfer of any such securities in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such state or jurisdiction. No offer

of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Contact Information

Roth CH Acquisition V Co.

RothCH@roth.com

New Era Helium Corp.

E. Will Gray II

CEO, NEH

Will@NewEraHelium.com

Jonathan Paterson

Investor Relations

JonathanPaterson@harbor-access.com

Tel +1 475 477 9401

Exhibit 99.2

1 HELIUM CORP January 2024

Disclaimer This presentation (this “Presentation”) is provided solely for information purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, o r a recommendation to purchase any equity o r debt . It has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between New Era Helium Corp . , a Nevada corporation (“New Era”) and Roth CH Acquisition V Co . , a Delaware corporation (“ROCL” and related transactions (the “Proposed Business Combination”) and for no other purpose . On January 3 , 2024 , ROCL and New Era entered into a Business Combination Agreement and Plan of Reorganization (as it may be amended, supplemented o r otherwise modified from time to time, the “Merger Agreement”) . This Presentation is highly confidential and proprietary to New Era and may not be reproduced o r otherwise disseminated, in whole o r in part, without the prior written consent of New Era . The information contained herein does not purport to be all - inclusive . The data contained herein is derived from various internal and external sources . No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein . Any data on past performance or modeling contained herein is not an indication as to future performance . ROCL and New Era assume no obligation to update the information in this presentation, except as required by law . Furthermore, any and all trademarks and trade names referred to in this presentation are the property of their respective owners . No Representation or Warranties All information is provided “AS IS” and no representations o r warranties, of any kind, express o r implied are given in, o r in respect of, this Presentation . To the fullest extent permitted by law in no circumstances will ROCL, New Era o r any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers o r agents be responsible o r liable for any direct, indirect o r consequential loss o r loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, o r on opinions communicated in relation thereto o r otherwise arising in connection therewith . Industry and market data used in this Presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes . Neither ROCL nor New Era ha s independently verified the data obtained from these sources and cannot assure you of the data’s accuracy o r completeness . This data is subject to change . In addition, this Presentation does not purport to be all - inclusive o r to contain all of the information that may be required to make a full analysis of New Era o r the Proposed Business Combination . Viewers of this Presentation should each make their own evaluation of the company and of the relevance and adequacy of the information and should make such other investigations as they deem necessary . Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners . Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM © o r ® symbols, but New Era will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights . Use of Projections This Presentation contains projected financial information with respect to New Era . Such projected financial information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties . See “Forward - Looking Statements” above . Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved . 2

Disclaimer 3 Industry and Market Data In this Presentation, we rely on and refer to information and statistics regarding market participants in the sectors in which New Era competes and other industry data . We obtained this information and statistics from third - party sources, including reports by market research firms and company filings . Financial Information ; Non - GAAP Financial Measures The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X . Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement/prospectus or registration statement to be filed by ROCL with the SEC, and such differences may be material . In particular, all New Era projected financial information included herein is preliminary and subject to risks and uncertainties . Any variation between New Era’s actual results and the projected financial information included herein may be material . This presentation also contains non - GAAP financial measures and key metrics relating to the combined company’s projected future performance . A reconciliation of these non - GAAP financial measures to the corresponding GAAP measures on a forward - looking basis is not available because the various reconciling items are difficult to predict and subject to constant change . No Offer or Solicitation This Presentation does not constitute a proxy statement or solicitation of a proxy, consent, vote or authorization with respect to any securities or in respect of the Proposed Business Combination and shall not constitute an offer to sell or exchange, or a solicitation of an offer to buy or exchange any securities, nor shall there be any sale, issuance or transfer of any such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended, or an exemption therefrom . INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . Important Information About the Proposed Business Combination and Where to Find It In connection with the Proposed Business Combination, ROCL intends to file with the SEC a registration statement on Form S - 4 , which will include a proxy statement to be sent to ROCL stockholders and a prospectus for the registration of ROCL securities (as amended from time to time, the “Registration Statement”) . A full description of the terms of the Proposed Business Combination is expected to be provided in the Registration Statement . ROCL urges investors, stockholders and other interested persons to read, when available, the Registration Statement as well as other documents filed with the SEC because these documents will contain important information about ROCL, New Era and the Proposed Business Combination . If and when the Registration Statement is declared effective by the SEC, the definitive proxy statement/prospectus and other relevant documents will be mailed to stockholders of ROCL as of a record date to be established for voting on the Proposed Business Combination . Stockholders and other interested persons will also be able to obtain a copy of the proxy statement, without charge, by directing a request to : Roth CH Acquisition V Co . , 888 San Clemente Drive, Suite 400 , Newport Beach, CA 92660 . The preliminary and definitive proxy statement/prospectus, once available, can also be obtained, without charge, at the SEC’s website (www . sec . gov) . The information contained on, o r that may be accessed through, the websites referenced in this Presentation is not incorporated by reference into, and is not a part of, this Report . Participants in the Solicitation ROCL, New Era and their respective directors and executive officers may be considered participants in the solicitation of proxies with respect to the Proposed Business Combination described herein under the rules of the SEC . Information about such persons and a description of their interests will be contained in the Registration Statement when it is filed with the SEC . These documents can be obtained free of charge from the sources indicated above .

Forward Looking Statements This Presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, ROCL’s and New Era’s expectations or predictions of future financial or business performance or conditions . Forward - looking statements are inherently subject to risks, uncertainties and assumptions . Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward - looking statements . These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” “intends,” or similar expressions . Such forward - looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements . Certain of these risks are identified and discussed in ROCL’s final prospectus for its initial public offering, filed with the SEC on December 2 , 2021 , under the heading “Risk Factors . ” These risk factors will be important to consider in determining future results and should be reviewed in their entirety . These forward - looking statements are expressed in good faith, and ROCL and New Era believe there is a reasonable basis for them . However, there can be no assurance that the events, results or trends identified in these forward - looking statements will occur or be achieved . Forward - looking statements speak only as of the date they are made, and neither ROCL nor New Era is under any obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward - looking statement, whether as a result of new information, future events or otherwise, except as required by law . In addition to factors previously disclosed in ROCL’s reports filed with the SEC and those identified elsewhere in this Presentation, the following factors, among others, could cause actual results to differ materially from forward - looking statements or historical performance : (i) expectations regarding New Era’s strategies and future financial performance, including its future business plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and New Era’s ability to invest in growth initiatives and pursue acquisition opportunities ; (ii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement ; (iii) the outcome of any legal proceedings that may be instituted against ROCL or New Era following announcement of the Proposed Business Combination and the transactions contemplated thereby ; (iv) the inability to complete the Proposed Business Combination due to, among other things, the failure to obtain ROCL stockholder approval on the expected terms and schedule, as well as the risk that regulatory approvals required for the Proposed Business Combination are not obtained or are obtained subject to conditions that are not anticipated ; (v) the failure to meet the minimum cash requirements of the Merger Agreement due to ROCL stockholder redemptions and the failure to obtain replacement financing ; the inability to complete the concurrent PIPE ; (vi) the risk that the Proposed Business Combination or another business combination may not be completed by ROCL’s business combination deadline and the potential failure to obtain an extension of the business combination deadline ; (vii) the risk that the announcement and consummation of the Proposed Business Combination disrupts New Era’s current operations and future plans ; (viii) the ability to recognize the anticipated benefits of the Proposed Business Combination ; (ix) unexpected costs related to the Proposed Business Combination ; (x) the amount of any redemptions by existing holders of the ROCL common stock being greater than expected ; (xi) limited liquidity and trading of ROCL’s securities ; (xii) the inability to obtain or maintain the listing of the combined company’s common stock on Nasdaq following the Proposed Business Combination, including but not limited to the failure to meet Nasdaq’s initial listing standards in connection with the consummation of the Proposed Business Combination ; (xiii) geopolitical risk and changes in applicable laws or regulations ; (xiv) the possibility that ROCL and/or New Era may be adversely affected by other economic, business, and/or competitive factors ; (xv) operational risk ; (xvi) risk that the COVID - 19 pandemic, and local, state, and federal responses to addressing the pandemic may have an adverse effect on our business operations, as well as our financial condition and results of operations ; and (xvii) the risks that the consummation of the Proposed Business Combination is substantially delayed or does not occur . Any financial projections in this Presentation are forward - looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond ROCL’s and New Era’s control . While all projections are necessarily speculative, ROCL and New Era believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation . The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections . The inclusion of projections in this Presentation should not be regarded as an indication that ROCL and New Era, or their representatives, considered or consider the projections to be a reliable prediction of future events . Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results . The foregoing list of factors is not intended to be all - inclusive or to contain all the information that a person may desire in considering an investment in ROCL and is not intended to form the basis of an investment decision in ROCL . Readers should carefully review the foregoing factors and other risks and uncertainties described in the “Risk Factors” section of the Registration Statement and the other reports, which ROCL has filed or will file from time to time with the SEC . There may be additional risks that neither ROCL nor New Era presently know, or that ROCL and New Era currently believe are immaterial, that could cause actual results to differ from those contained in forward looking statements . For these reasons, among others, investors and other interested persons are cautioned not to place undue reliance upon any forward - looking statements in this Presentation. All subsequent written and oral forward - looking statements concerning ROCL and New Era, the Proposed Business 4 Combination or other matters and attributable to ROCL and New Era or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above.

Glossary of Abbreviations 5 BBL: Barrels (equal to 42 US gallons) BBL/D: Barrels per day BCF: Billions of cubic feet BCFE: Billions of cubic feet equivalent BOE: Barrels of oil equivalent (1 barrel of oil or 6,000 cubic feet of natural gas) CAGR: Compound annual growth rate G&A: General and administrative expenses LOE: Lease operating expense MBOE: Thousands of barrels of oil equivalent MCF: Thousands of cubic feet MCFE: Thousands of cubic feet of natural gas equivalent (6,000 cubic feet of natural gas or 1 barrel of oil) MCF/D: Thousands of cubic feet per day MMBOE: Millions of barrels of oil equivalent MM: Millions MMCF: Millions of cubic feet MMCF/D: Millions of cubic feet per day MMCFE: Millions of cubic feet equivalent MMCFE/D: Millions of cubic feet equivalent per day MMCF p.a.: Millions of cubic feet per annum MMSCF/yr: Millions of standard cubic feet per year MOL%: Mole percent NGL: Natural gas liquid SCF: Standard cubic feet SCF/D: Standard cubic feet per day SCF/yr: Standard cubic feet per year WI: Working interest

6 Overview of Roth CH Acquisition Co. • Roth CH Acquisition V Co. (“Roth CH” or “ROCL”) completed its IPO in December 2021 and currently has ~$27 million cash in trust • The Roth CH team is composed of proven operators and capital markets professionals who have long - standing relationships with leading institutional and private investors ROCL • The Roth CH team are serial SPAC sponsors and have successfully completed multiple prior SPAC business combinations with growth - stage companies • In addition to serving as SPAC sponsors, the Roth CH team has been active in all roles of the SPAC process — from formation, to capital raising, to aftermarket advisory services • Since 2020, the Roth CH team has completed four business combinations serving as sponsors, helped raise over $1 billion in SPAC financings, and advised on numerous others Unique Experience • The Roth CH team seeks to leverage the extensive history and successful track record of two leading growth investment banks (Roth Capital Partners and Craig - Hallum Capital Group) by utilizing its combined full - service investment banking platforms and its dedicated SPAC teams to bring a compelling growth company to the market • In its position, the team has a unique ability to drive value and support beyond a business combination with dedicated and industry specific aftermarket support The Roth CH Advantage ROCL Overview The Roth CH Team • The RothCH team is a highly experienced sponsor with extensive SPAC transaction experience • Byron Roth, Co - CEO and Co - Chairman • Mr. Roth has been the Chairman and Chief Executive Officer of Roth since 1998. Under his management the firm has helped raise over $75 billion for small - cap companies, as well as advising on many merger and acquisition transactions • John Lipman, Co - CEO and Co - Chairman • Mr. Lipman is a Partner and Managing Director of Investment Banking at Craig - Hallum. Mr. Lipman joined Craig - Hallum in 2012 and has more than 18 years of investment banking experience completing over 150 financings for growth companies Deep Management team comprised of individuals from Roth Capital Partners, LLC and Craig - Hallum Capital Group

7 What ROCL Likes About New Era Globally scarce industrial gas commodity, utilized in rapidly growing high tech markets US - Listed, North American helium platform positioned to consolidate a fragmented industry Experienced executive team and board, with expertise in both helium and conventional gas development Proved (not prospective) helium resource strategically located in Southeastern New Mexico in the Permian Basin Secured two (2) 10 - year take - or - pay offtake agreements with international helium buyers (estimated $113 million (1) helium revenue generation) Vertically integrated, scalable helium operation with a focus on producing Responsibly Sourced Gas (RSG) and Responsibly Sourced Helium (RSH ) (2) (1) Helium revenues are net of royalties, transportation and tolling services. Estimates are prepared by New Era Helium management (2) Responsibly Sourced Helium and RSH are trademarked by New Era Helium Helium, An Undersupplied Mission Critical Element A U.S. Platform for Growth & Consolidation Vertical Integration of the Helium Supply Chain Experienced Executive Team and Board Proved Reserves as a Differentiator Secured Long - Term Helium Offtake

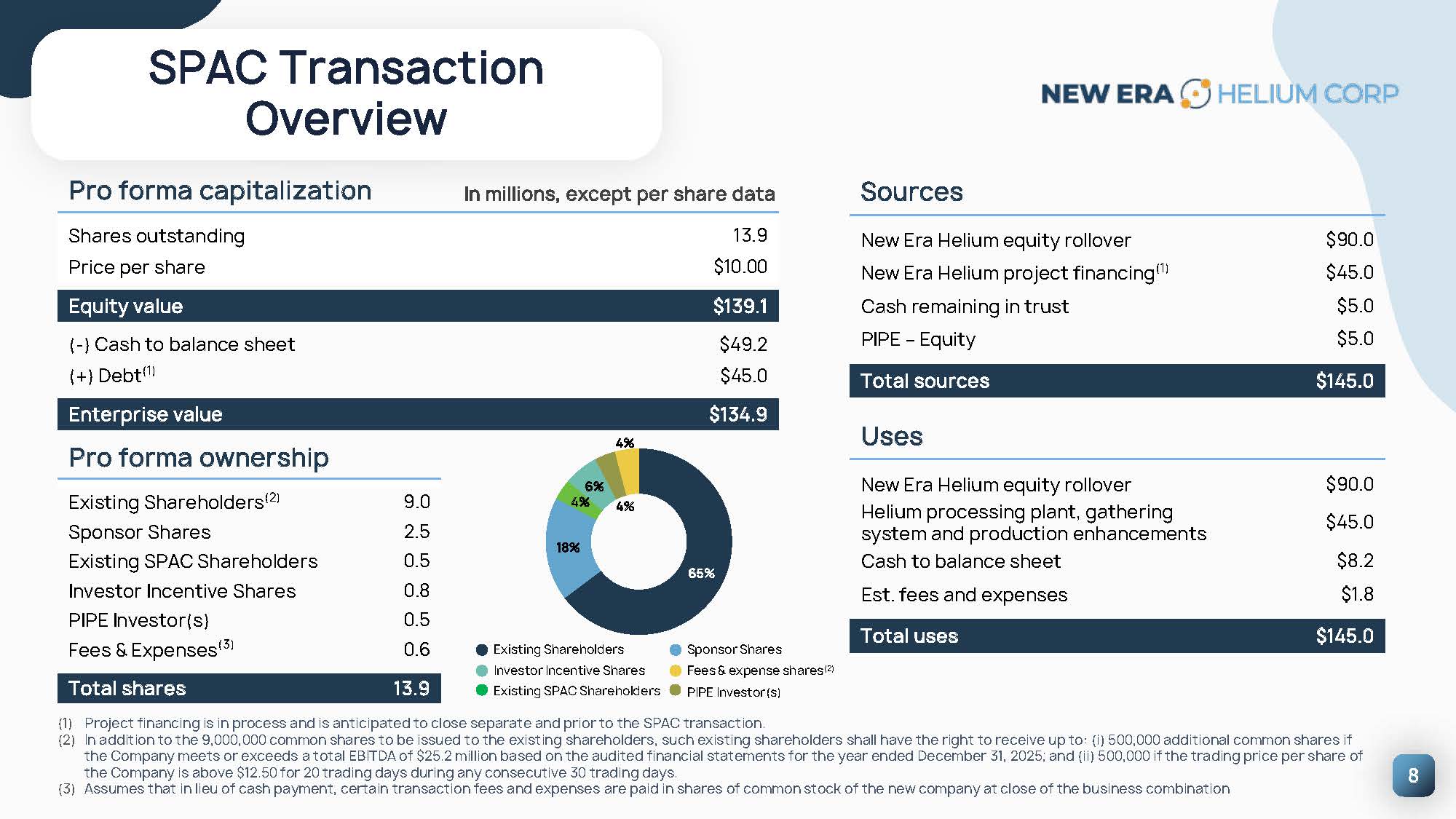

SPAC Transaction Overview 8 llions, except per share data Pro forma capitalization In mi 13.9 Shares outstanding $10.00 Price per share $139.1 Equity value $49.2 ( - ) Cash to balance sheet $45.0 (+) Debt (1) $134.9 Enterprise value Pro forma ownership 9.0 Existing Shareholders (2) 2.5 Sponsor Shares 0.5 Existing SPAC Shareholders 0.8 Investor Incentive Shares 0.5 PIPE Investor(s) 0.6 Fees & Expenses (3) 13.9 Total shares Sources $90.0 New Era Helium equity rollover $45.0 New Era Helium project financing (1) $5.0 Cash remaining in trust $5.0 PIPE – Equity $145.0 Total sources Uses $90.0 New Era Helium equity rollover $45.0 Helium processing plant, gathering system and production enhancements $8.2 Cash to balance sheet $1.8 Est. fees and expenses $145.0 Total uses (1) Project financing is in process and is anticipated to close separate and prior to the SPAC transaction. (2) In addition to the 9,000,000 common shares to be issued to the existing shareholders, such existing shareholders shall have the right to receive up to: (i) 500,000 additional common shares if the Company meets or exceeds a total EBITDA of $25.2 million based on the audited financial statements for the year ended December 31, 2025; and (ii) 500,000 if the trading price per share of the Company is above $12.50 for 20 trading days during any consecutive 30 trading days. (2) Assumes that in lieu of cash payment, certain transaction fees and expenses are paid in shares of common stock of the new company at close of the business combination 65% 18% 6% 4% 4% 4% Existing Shareholders Investor Incentive Shares Existing SPAC Shareholders Sponsor Shares Fees & expense shares (2) PIPE Investor(s)

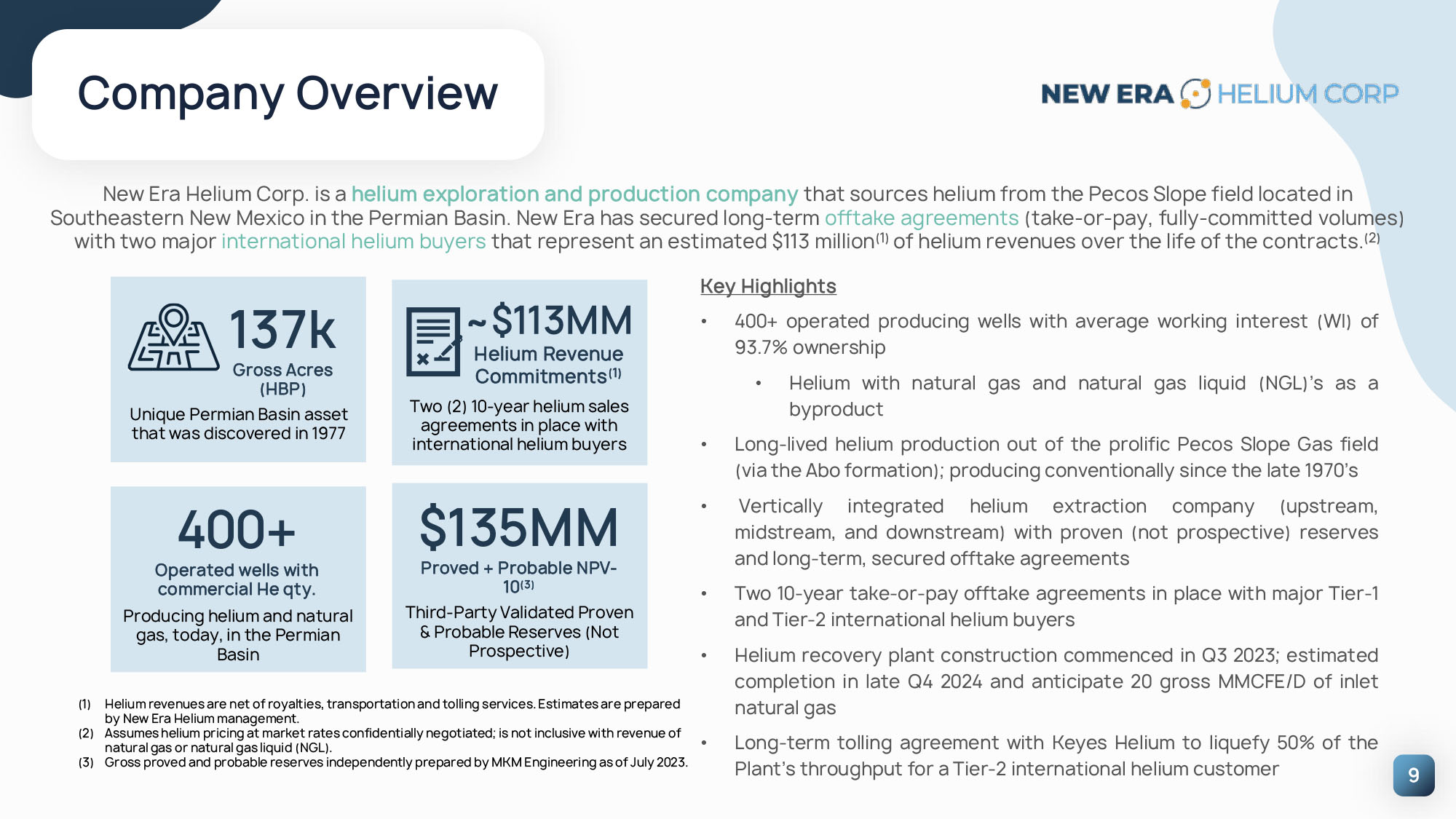

9 Company Overview New Era Helium Corp. is a helium exploration and production company that sources helium from the Pecos Slope field located in Southeastern New Mexico in the Permian Basin. New Era has secured long - term offtake agreements (take - or - pay, fully - committed volumes) with two major international helium buyers that represent an estimated $113 million (1) of helium revenues over the life of the contracts. (2) Key Highlights • 400+ operated producing wells with average working interest (WI) of 93.7% ownership • Helium with natural gas and natural gas liquid (NGL)’s as a byproduct • Long - lived helium production out of the prolific Pecos Slope Gas field (via the Abo formation); producing conventionally since the late 1970’s • Vertically integrated helium extraction company (upstream, midstream, and downstream) with proven (not prospective) reserves and long - term, secured offtake agreements • Two 10 - year take - or - pay offtake agreements in place with major Tier - 1 and Tier - 2 international helium buyers • Helium recovery plant construction commenced in Q 3 2023 ; estimated completion in late Q 4 2024 and anticipate 20 gross MMCFE/D of inlet natural gas • Long - term tolling agreement with Keyes Helium to liquefy 50 % of the Plant’s throughput for a Tier - 2 international helium customer ~$113MM Helium Revenue Commitments (1) Two (2) 10 - year helium sales agreements in place with international helium buyers 400+ Operated wells with commercial He qty. Producing helium and natural gas, today, in the Permian Basin $135MM Proved + Probable NPV - 10 (3) Third - Party Validated Proven & Probable Reserves (Not Prospective) 137k Gross Acres (HBP) Unique Permian Basin asset that was discovered in 1977 (1) Helium revenues are net of royalties, transportation and tolling services. Estimates are prepared by New Era Helium management. (2) Assumes helium pricing at market rates confidentially negotiated; is not inclusive with revenue of natural gas or natural gas liquid (NGL). (3) Gross proved and probable reserves independently prepared by MKM Engineering as of July 2023.

[picture] [picture] [picture] [picture] [picture] [picture] Key strategic partnerships New Era At a Glance 10 3 - stream (He, Nat Gas, Natural Gas Liquid) Revenue generation derived from three streams 2 BCF 2P Helium Reserves (2) Substantial reserve base with high - purity helium Permian Basin: Strategic location for helium production 32.0 MMCF p.a. Two (2) 10 - year helium sales agreements in place with major helium buyers 4.9 MMCF/D (1) Producing helium and natural gas in the Permian Basin (1) Includes gross daily production of natural gas and NGL; includes helium concentration that does not contribute to revenue. (2) Gross proved and probable reserves as prepared by MKM Engineering as of July 2023. (3) Kornbluth Helium Consulting, LLC. LATE 4Q24 First operations expected for Phase I ~1.6% Est. North American He Market Share (3) Plant capacity will represent ~2% of the North American helium market and growing

11 Leadership Joel G. Solis Co - Founder & Chairman Years of experience : 35 years Background : ▪ Founder of Solis Partners, LLC, which is a wholly - owned subsidiary of New Era Helium ▪ Mr . Solis is an oil and gas investor and oilfield services entrepreneur who has founded and built over 30 years within well services and fluid management in Odessa, Texas . E. Will Gray II Co - Founder, CEO & Director Years of experience: 19 years Background: ▪ Co - Founder of New Era Helium and partner at Solis Partners, LLC . ▪ Mr . Gray has oil and gas experience spanning 19 years, having directly operated over 950 wells located in New Mexico, Texas, and Oklahoma since 2005 . Mr . Gray has a specialization in conventional oil and gas assets Michael J Rugen Chief Financial Officer Years of experience: 40 years Background: ▪ CFO of New Era Helium. ▪ Mr . Rugen is a CPA with 40 years of experience in executive positions in finance primarily in E&P and oilfield services companies . Mr . Rugen was previously the CFO of Riley Exploration Permian, Inc . , a NYSE American listed Permian Basin oil and gas company and CFO/Interim CEO of Tengasco, Inc, its predecessor. Phil Kornbluth Pending Board Member Years of experience: 41 years Background: ▪ Pending Board Member of New Era Helium. ▪ President of Kornbluth Helium Consulting, LLC and developed supply agreements with ExxonMobil, Encana, Polish Oil & Gas Company, Rasgas, Gazprom & ConocoPhillips Prior Company Experience: Prior Company Experience: Prior Company Experience: Prior Company Experience:

12 Unique Properties of Helium ▪ Colorless, odorless, tasteless gas ▪ Chemically and Radiologically inert – Helium is non - reactive and does not become radioactive ▪ Second lightest element & second smallest molecule ▪ Lightest & smallest that does not burn ▪ Helium has the lowest condensation point of any element ▪ - 452.2 degrees F, - 269 degrees C, 4.2 degrees K ▪ Liquid Helium is the coldest substance on the planet ▪ Helium remains liquid even at absolute zero ▪ Gaseous Helium has a very high specific heat and thermal conductivity 2 He Helium

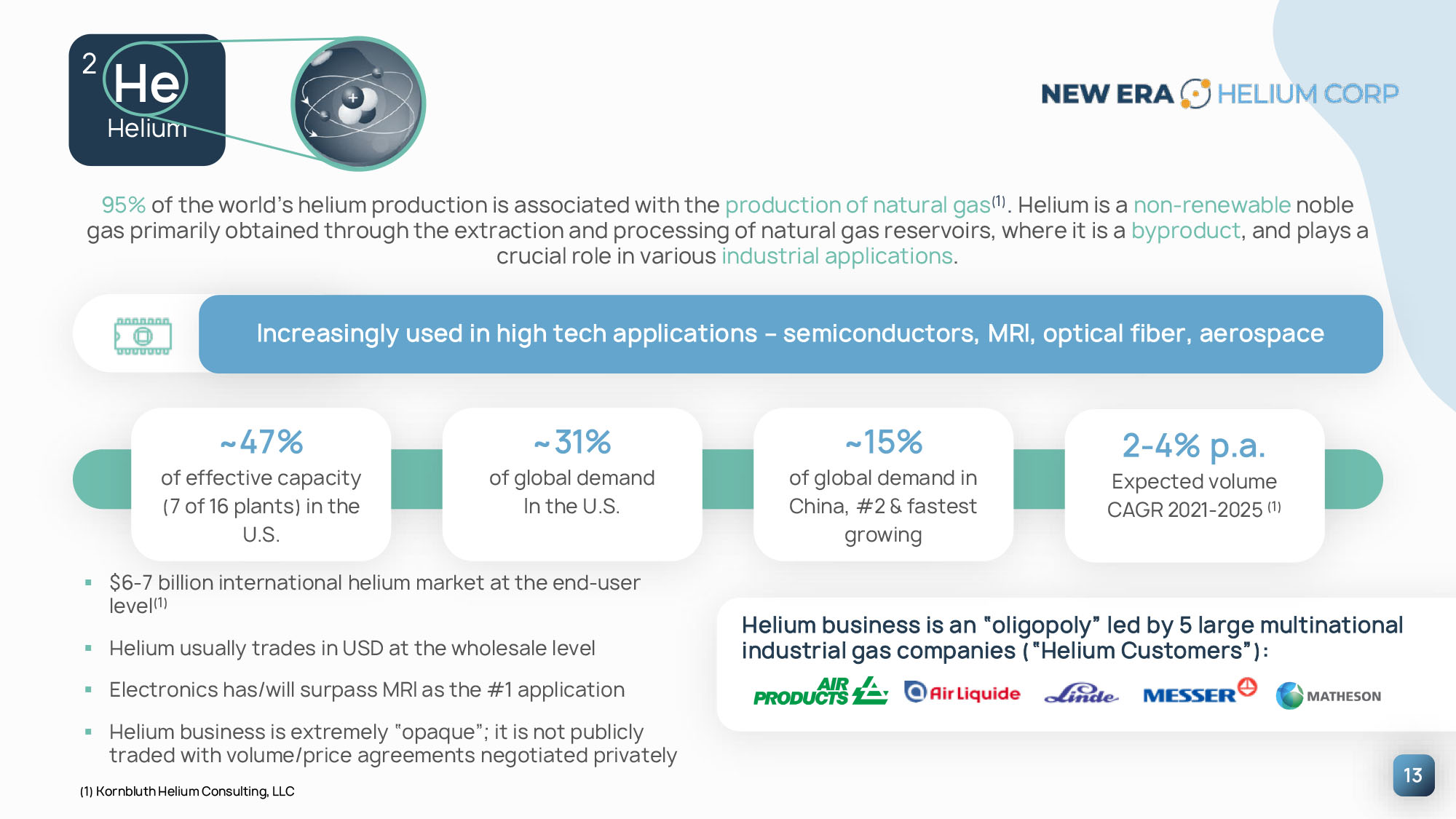

95% of the world’s helium production is associated with the production of natural gas (1) . Helium is a non - renewable noble gas primarily obtained through the extraction and processing of natural gas reservoirs, where it is a byproduct , and plays a crucial role in various industrial applications . 13 Increasingly used in high tech applications – semiconductors, MRI, optical fiber, aerospace Helium business is an “oligopoly” led by 5 large multinational industrial gas companies (“Helium Customers”): ~47% of effective capacity (7 of 16 plants) in the U.S. ~31% of global demand In the U.S. ~15% of global demand in China, #2 & fastest growing 2 - 4% p.a. Expected volume CAGR 2021 - 2025 (1) ▪ $6 - 7 billion international helium market at the end - user level (1) ▪ Helium usually trades in USD at the wholesale level ▪ Electronics has/will surpass MRI as the #1 application ▪ Helium business is extremely “opaque”; it is not publicly traded with volume/price agreements negotiated privately (1) Kornbluth Helium Consulting, LLC 2 He Helium

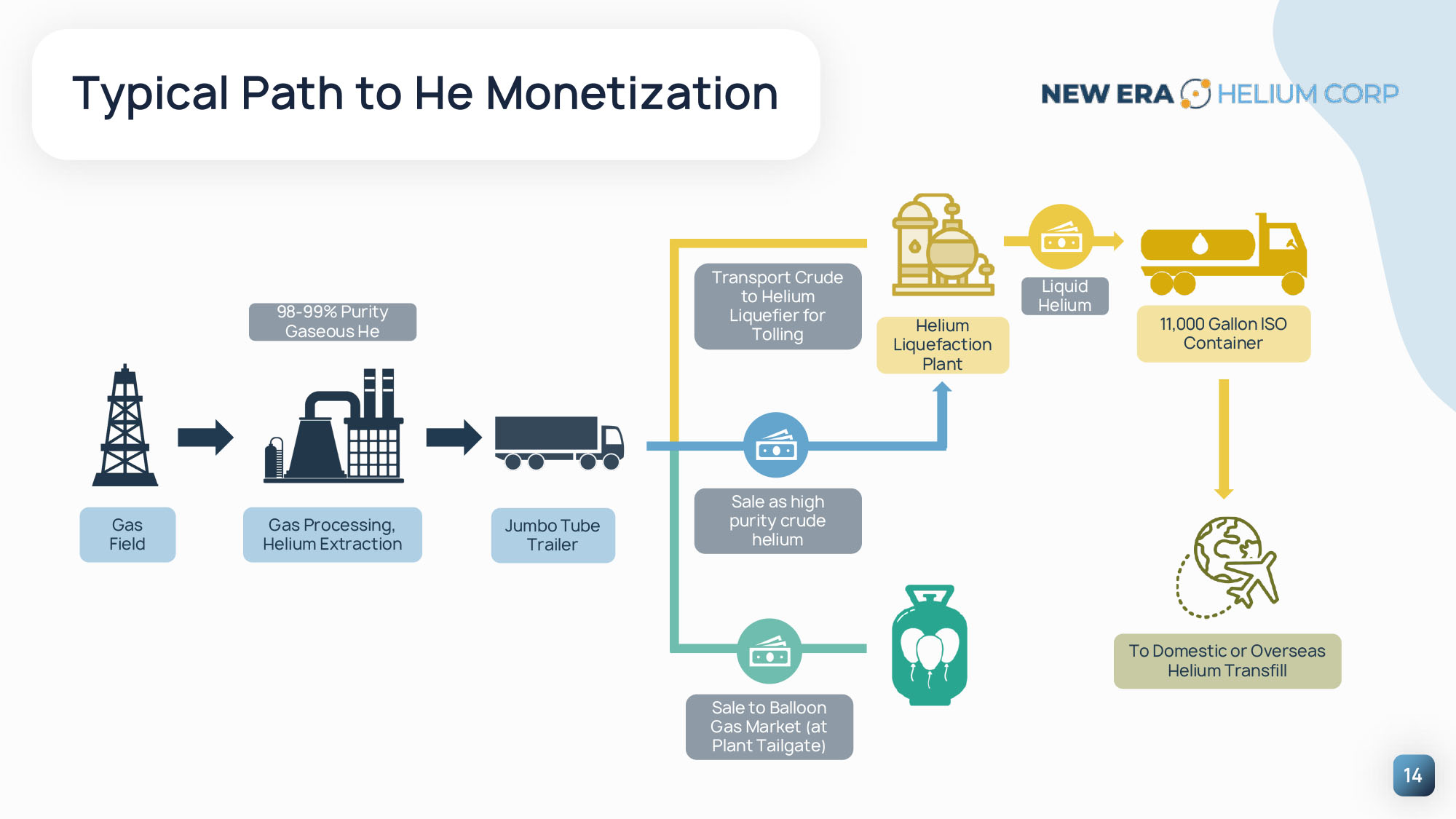

14 Typical Path to He Monetization Gas Field Gas Processing, Helium Extraction 98 - 99% Purity Gaseous He Jumbo Tube Trailer Helium Liquefaction Plant Sale to Balloon Gas Market (at Plant Tailgate) 11,000 Gallon ISO Container Liquid Helium To Domestic or Overseas Helium Transfill Transport Crude to Helium Liquefier for Tolling Sale as high purity crude helium

Helium Applications in High - Growth Sectors 15 Attractive Demand Growth Drivers ▪ Semiconductor Manufacturing: Helium is crucial in semiconductor manufacturing due to its unique properties as an inert gas and high thermal conductor and serves various functions throughout the manufacturing process, with limited substitutes. (1) ▪ Space and Defense : Helium is used in liquid fueled rockets and in critical processes during lift - off, including separation of hot gases and ultra - cold liquids. National defense applications include rocket engine testing, scientific balloons, surveillance crafts, air - to - air missile guidance systems, and more. (2) ▪ Life Sciences and Technology: 30% of helium is used in healthcare mainly magnetic resonance imaging (MRI), 17% in analytical and laboratory applications, and 6% in engineering and scientific applications. (3) ▪ Cryogenics: Liquid helium’s ability for extreme cooling allows them to act as a cryogenic agent for cooling various materials in many applications including precision welding applications, MRI machines, and lab use. (4)(5) Technology Manufacturing x Semiconductor manufacturing x LCD Panels x Fiber optics cables Healthcare & Life Sciences x MRI Scanners x Helium - ion microscopes x Laser eye surgery x Cryogenics Aerospace & Defense x Space Exploration x Fuel Purging Systems x Defense and Rocket Guidance Systems Industrial Uses x Wielding, shield masks x Gas leak detection x Nuclear reactor coolant x Crystal growth Mission Critical Applications (1) Semiconductor Industry Association (SIA) to the U.S. Geological Survey (USGS) on Helium Supply Risk. (2) U.S. Department of the Interior Bureau of Land Management. (3) The Institute for Energy Research (IER), Washington D.C. (4) Siemens Healthineers: The Liquid Gold of MRI. (5) NASA: NASA Awards Agency - wide Helium Contract.

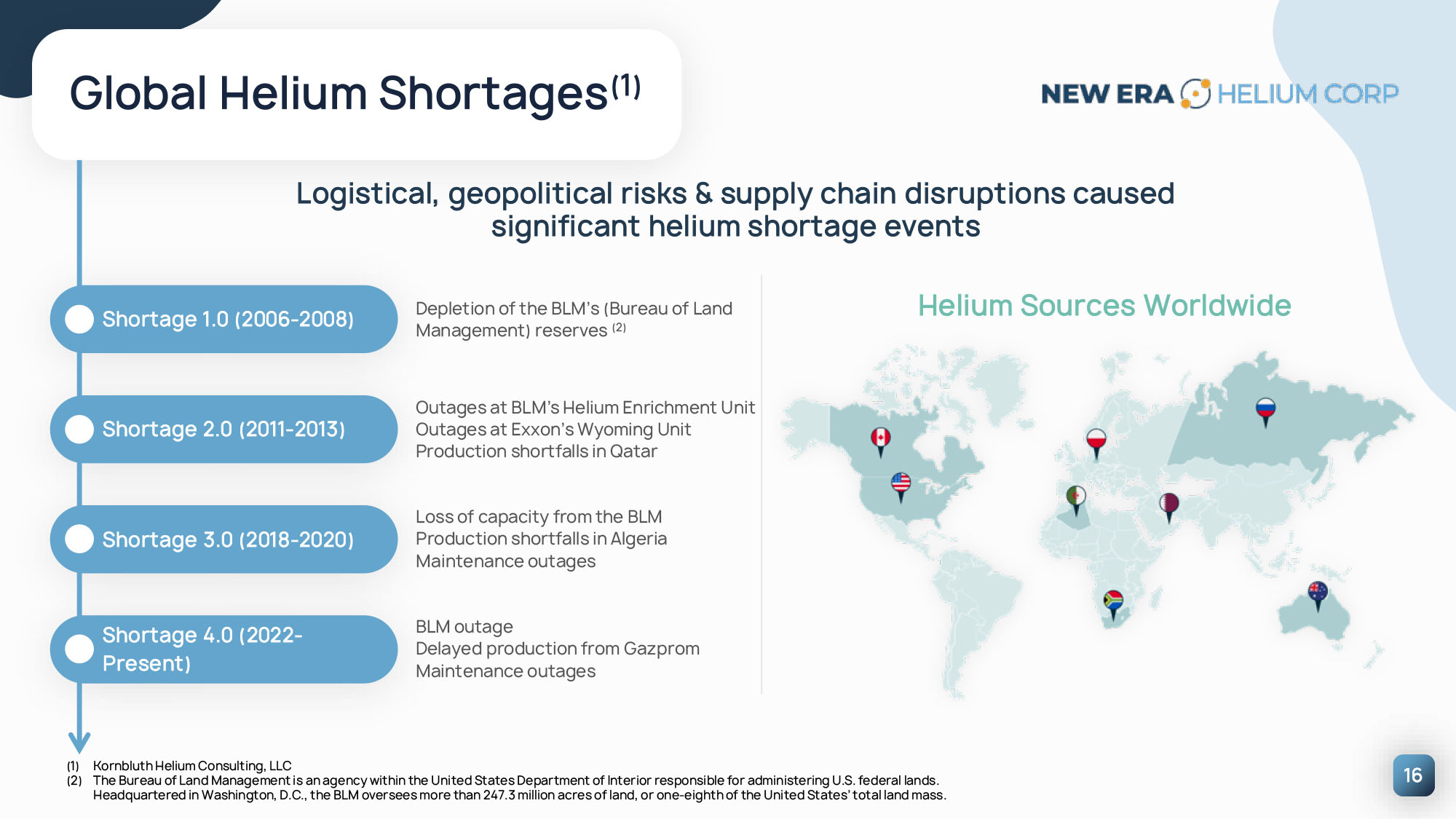

Shortage 1.0 (2006 - 2008) Shortage 2.0 (2011 - 2013) Shortage 3.0 (2018 - 2020) Shortage 4.0 (2022 - Present) Global Helium Shortages (1) Logistical, geopolitical risks & supply chain disruptions caused significant helium shortage events 16 Depletion of the BLM’s (Bureau of Land Management) reserves (2) Outages at BLM’s Helium Enrichment Unit Outages at Exxon’s Wyoming Unit Production shortfalls in Qatar Loss of capacity from the BLM Production shortfalls in Algeria Maintenance outages BLM outage Delayed production from Gazprom Maintenance outages Helium Sources Worldwide (1) Kornbluth Helium Consulting, LLC (2) The Bureau of Land Management is an agency within the United States Department of Interior responsible for administering U.S. federal lands. Headquartered in Washington, D.C., the BLM oversees more than 247.3 million acres of land, or one - eighth of the United States’ total land mass.

Helium Supply & Demand Outlook 17 MMCF/yr. 0% 20% 40% 60% 80% 100% 120% 140% 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 2022 2023 2024 2025 2026 2027 Supply Demand Capacity Utilization Source: Kornbluth Helium Consulting LLC New Era’s Existing long - term offtake agreements and contractual floor prices mitigate risk of future oversupply ▪ Helium Shortage 4 . 0 expected to wind down in 2024 as new supply from Russia enters the market ▪ Market remains tight through 2025 ▪ More plentiful supply expected by 2027 if Russian supply ramps up and new supply from Qatar enters the market

Historical Helium Pricing 18 Source: Kornbluth Helium Consulting LLC (1) Prices represented are the price for bulk liquid helium at the source sold in large quantities (>100MMscf/yr) under long term contracts (>=10 yrs.) Within the last two decades, helium prices have increased substantially – and in certain cases exceed current levels at the end - user level $69 $71 $73 $75 $77 $90 $95 $112 $121 $144 $142 $145 $160 $250 $230 $220 $375 $425 $50.00 $ - $100.00 $150.00 $200.00 $250.00 $350.00 $300.00 $400.00 $450.00 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2006 2007 2008 2009 2010 W.A. LHE Prices (1)

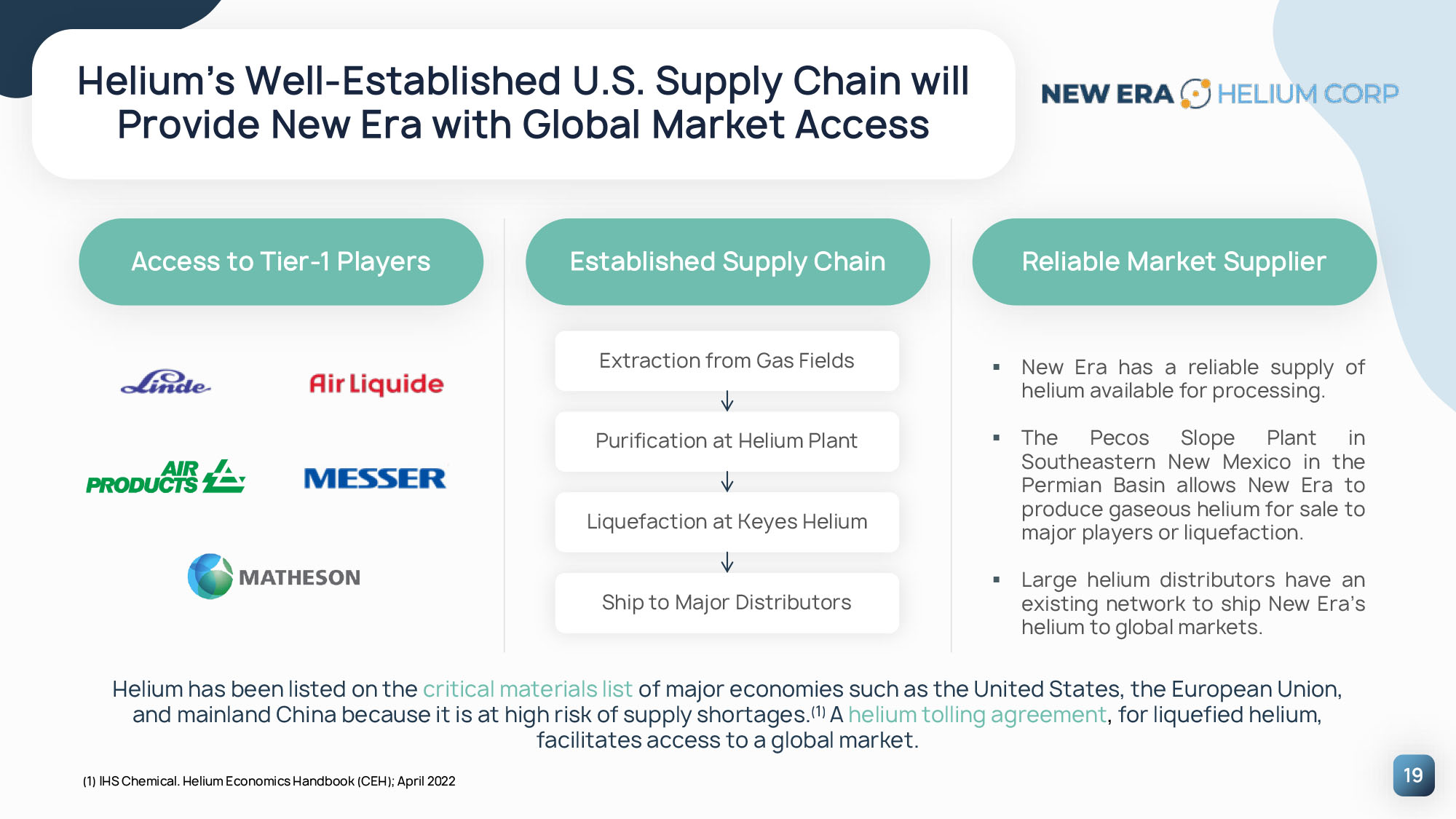

19 Helium’s Well - Established U.S. Supply Chain will Provide New Era with Global Market Access Established Supply Chain Reliable Market Supplier Access to Tier - 1 Players ▪ New Era has a reliable supply of helium available for processing. ▪ The Pecos Slope Plant in Southeastern New Mexico in the Permian Basin allows New Era to produce gaseous helium for sale to major players or liquefaction . ▪ Large helium distributors have an existing network to ship New Era’s helium to global markets . Extraction from Gas Fields Purification at Helium Plant Liquefaction at Keyes Helium Ship to Major Distributors Helium has been listed on the critical materials list of major economies such as the United States, the European Union, and mainland China because it is at high risk of supply shortages. (1) A helium tolling agreement , for liquefied helium, facilitates access to a global market. (1) IHS Chemical. Helium Economics Handbook (CEH); April 2022

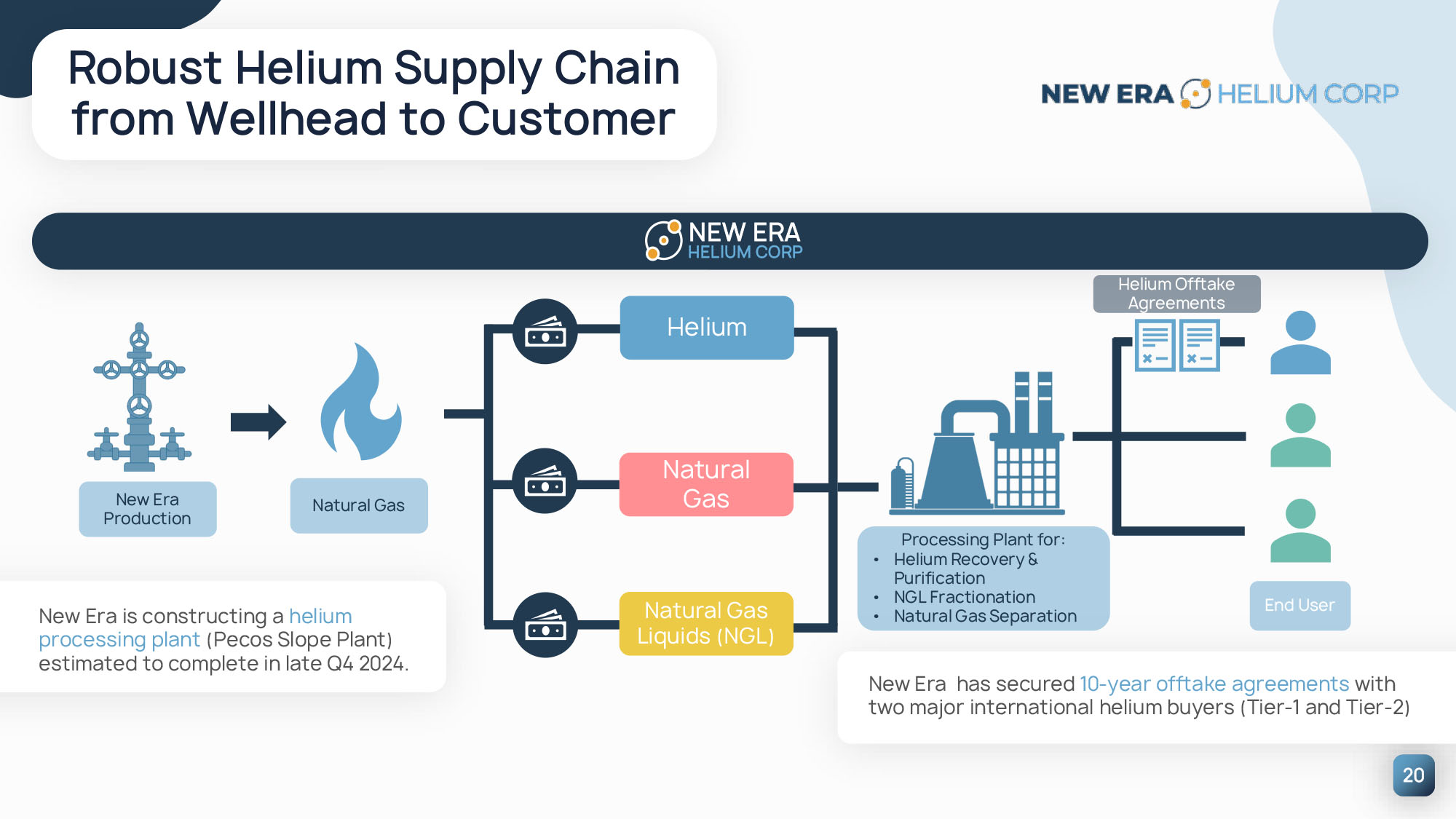

Robust Helium Supply Chain from Wellhead to Customer 20 NEW ERA HELIUM CORP Helium Offtake Agreements Helium Natural Gas Natural Gas Liquids (NGL) Processing Plant for: • Helium Recovery & Purification • NGL Fractionation • Natural Gas Separation Natural Gas New Era Production New Era is constructing a helium processing plant (Pecos Slope Plant) estimated to complete in late Q4 2024. New Era has secured 10 - year offtake agreements with two major international helium buyers (Tier - 1 and Tier - 2) End User

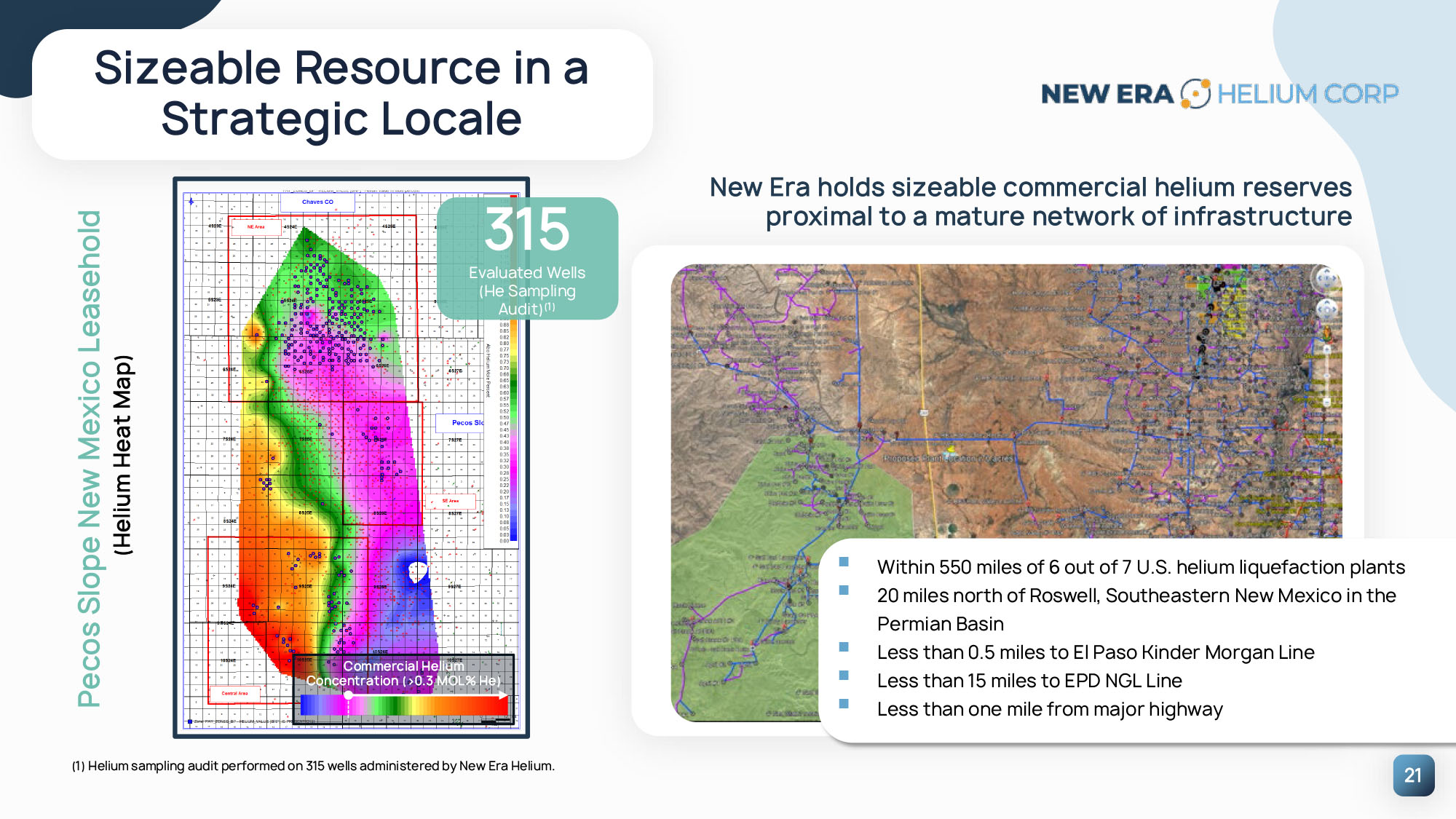

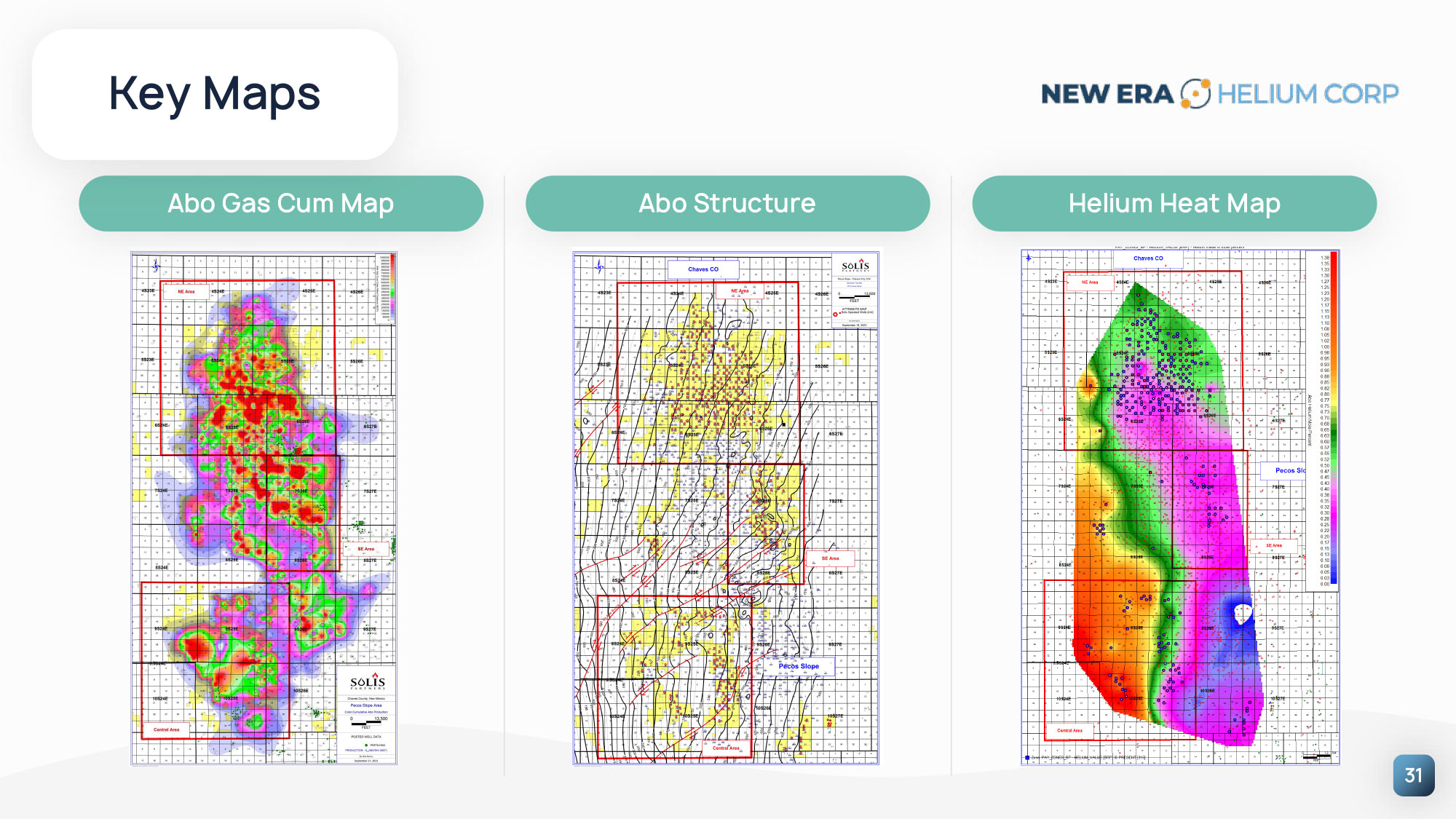

21 New Era holds sizeable commercial helium reserves proximal to a mature network of infrastructure Sizeable Resource in a Strategic Locale Pecos Slope New Mexico Leasehold (Helium Heat Map) ▪ Within 550 miles of 6 out of 7 U.S. helium liquefaction plants ▪ 20 miles north of Roswell, Southeastern New Mexico in the Permian Basin ▪ Less than 0.5 miles to El Paso Kinder Morgan Line ▪ Less than 15 miles to EPD NGL Line ▪ Less than one mile from major highway Commercial Helium Concentration (>0.3 MOL% He) 315 Evaluated Wells (He Sampling Audit) (1) (1) Helium sampling audit performed on 315 wells administered by New Era Helium.

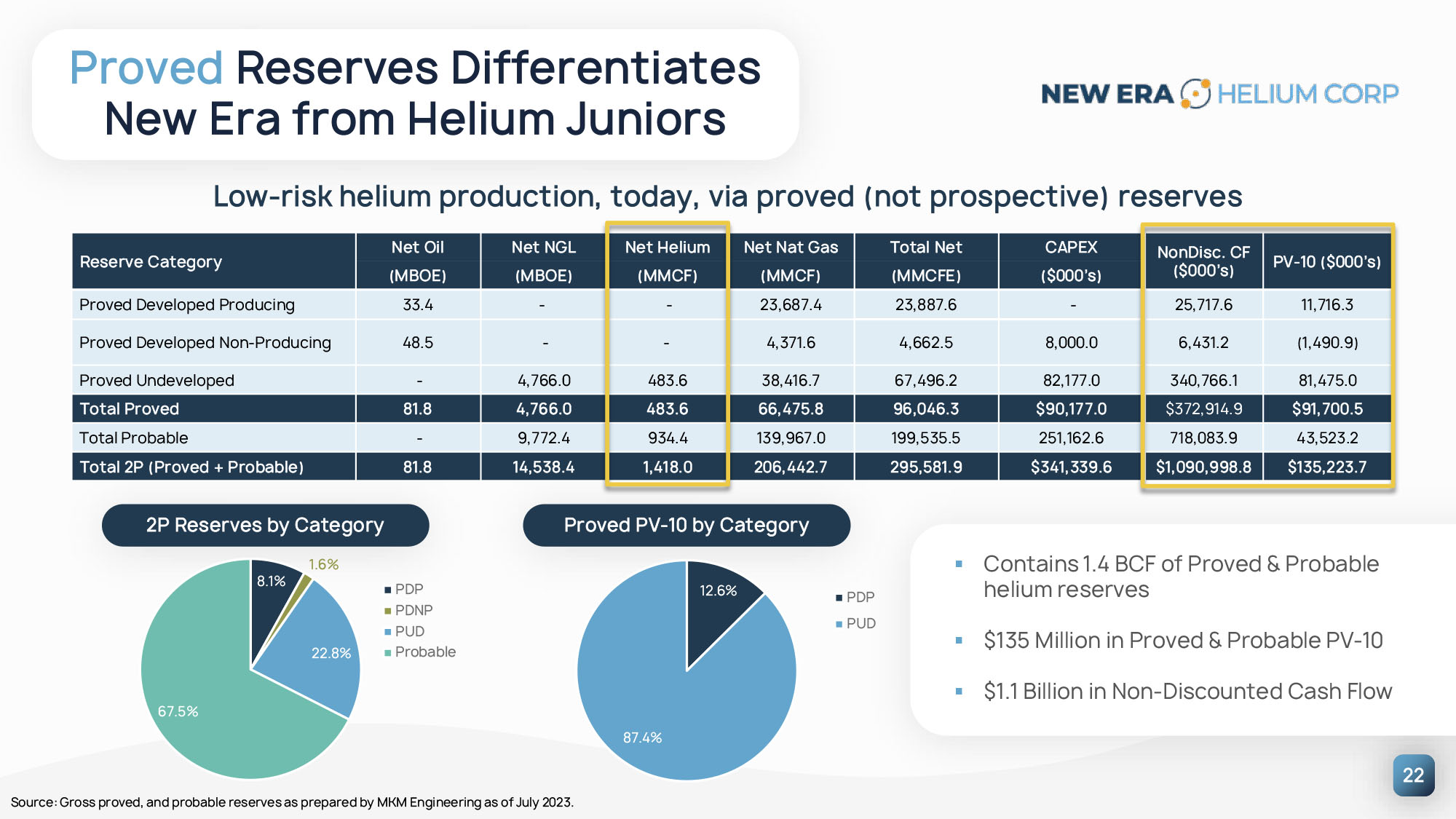

Proved Reserves Differentiates New Era from Helium Juniors 22 Low - risk helium production, today, via proved (not prospective) reserves Proved PV - 10 by Category 2P Reserves by Category 1.6% 8.1% 22.8% 67.5% PDP PDNP PUD Probable 12.6% 87.4% PDP PUD PV - 10 ($000’s) NonDisc. CF ($000’s) CAPEX Total Net Net Nat Gas Net Helium Net NGL Net Oil Reserve Category ($000’s) (MMCFE) (MMCF) (MMCF) (MBOE) (MBOE) 11,716.3 25,717.6 - 23,887.6 23,687.4 - - 33.4 Proved Developed Producing (1,490.9) 6,431.2 8,000.0 4,662.5 4,371.6 - - 48.5 Proved Developed Non - Producing 81,475.0 340,766.1 82,177.0 67,496.2 38,416.7 483.6 4,766.0 - Proved Undeveloped $91,700.5 $372,914.9 $90,177.0 96,046.3 66,475.8 483.6 4,766.0 81.8 Total Proved 43,523.2 718,083.9 251,162.6 199,535.5 139,967.0 934.4 9,772.4 - Total Probable $135,223.7 $1,090,998.8 $341,339.6 295,581.9 206,442.7 1,418.0 14,538.4 81.8 Total 2P (Proved + Probable) Source: Gross proved, and probable reserves as prepared by MKM Engineering as of July 2023. ▪ Contains 1.4 BCF of Proved & Probable helium reserves ▪ $135 Million in Proved & Probable PV - 10 ▪ $1.1 Billion in Non - Discounted Cash Flow

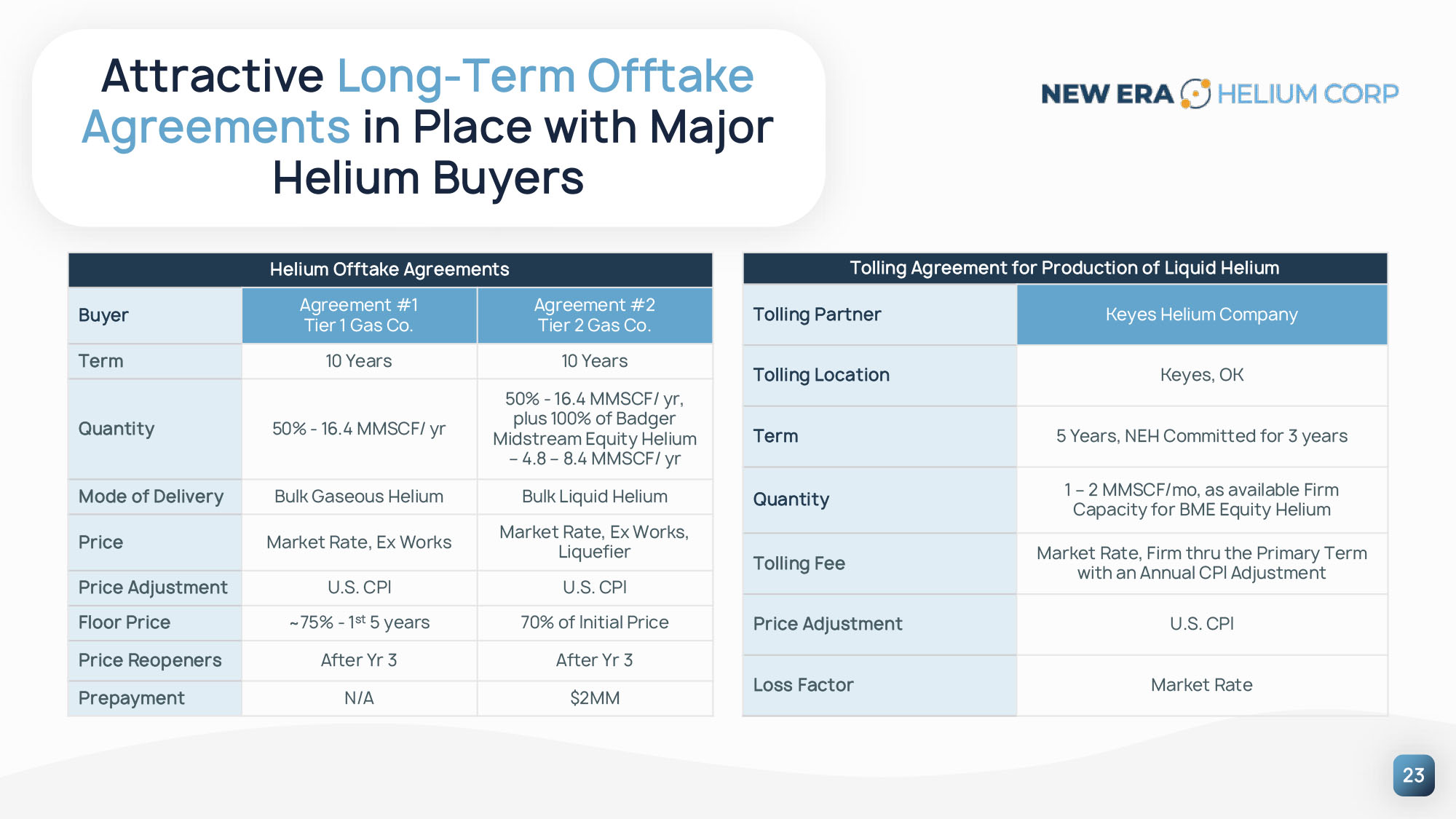

23 Attractive Long - Term Offtake Agreements in Place with Major Helium Buyers Helium Offtake Agreements Agreement #2 Tier 2 Gas Co. Agreement #1 Tier 1 Gas Co. Buyer 10 Years 10 Years Term 50% - 16.4 MMSCF/ yr, plus 100% of Badger Midstream Equity Helium – 4.8 – 8.4 MMSCF/ yr 50% - 16.4 MMSCF/ yr Quantity Bulk Liquid Helium Bulk Gaseous Helium Mode of Delivery Market Rate, Ex Works, Liquefier Market Rate, Ex Works Price U.S. CPI U.S. CPI Price Adjustment 70% of Initial Price ~75% - 1 st 5 years Floor Price After Yr 3 After Yr 3 Price Reopeners $2MM N/A Prepayment Tolling Agreement for Production of Liquid Helium Keyes Helium Company Tolling Partner Keyes, OK Tolling Location 5 Years, NEH Committed for 3 years Term 1 – 2 MMSCF/mo, as available Firm Capacity for BME Equity Helium Quantity Market Rate, Firm thru the Primary Term with an Annual CPI Adjustment Tolling Fee U.S. CPI Price Adjustment Market Rate Loss Factor

24 Vertical Integration Allows for Greater Monetization ▪ All natural gas volumes are currently gathered and processed by IACX Energy ▪ Completion of the Pecos Slope Plant in late Q4 2024 vertically integrates production, processing, and midstream takeaway – a complete helium platform operation ▪ Inlet gas volumes: 20 MMCF/D ▪ Helium (gaseous) sales volumes: 87.4 SCF/D ▪ Sales gas flow rate: 15.7 MMCF/D ▪ NGL flow rate: ~ 1,070 BBL/D ▪ Off spec fuel gas flow rate: ~ 2.6 MMCF/D ▪ Midstream gathering system (new build in mid Q1 2024) ▪ With a National Exchange Listing, the Company is positioned to aggregate additional assets within North America Illustrative 3D rendering of New Era Pecos Slope Plant currently under construction.

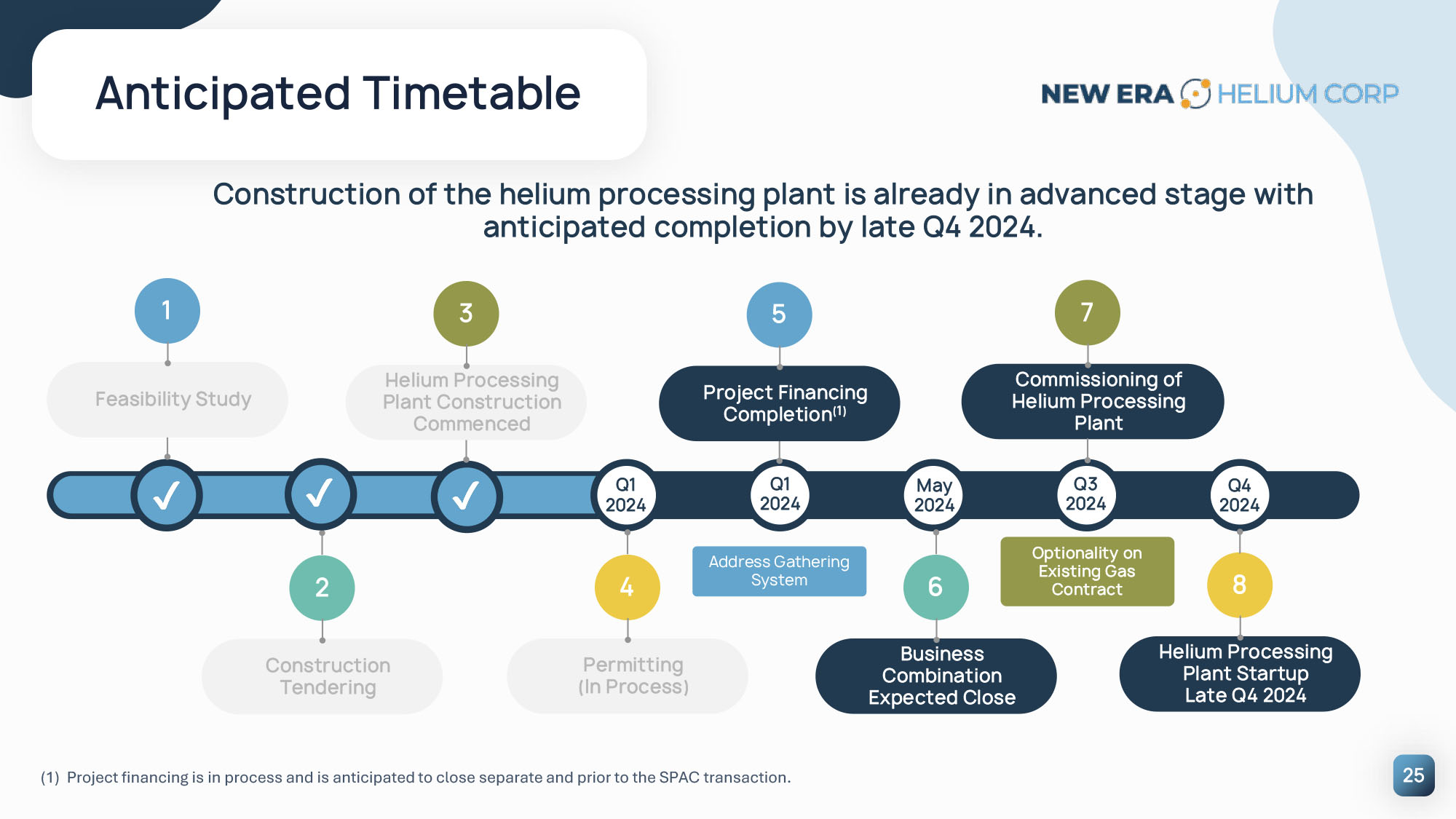

25 Anticipated Timetable Construction of the helium processing plant is already in advanced stage with anticipated completion by late Q4 2024. Optionality on Existing Gas Contract Project Financing Completion (1) 5 Q1 2024 Q3 2024 May 2024 Q4 2024 Address Gathering System Commissioning of Helium Processing Plant 7 Business Combination Expected Close 6 Helium Processing Plant Startup Late Q4 2024 8 Permitting (In Process) 4 Construction Tendering 2 Feasibility Study 1 Helium Processing Plant Construction Commenced 3 (1) Project financing is in process and is anticipated to close separate and prior to the SPAC transaction. Q1 2024

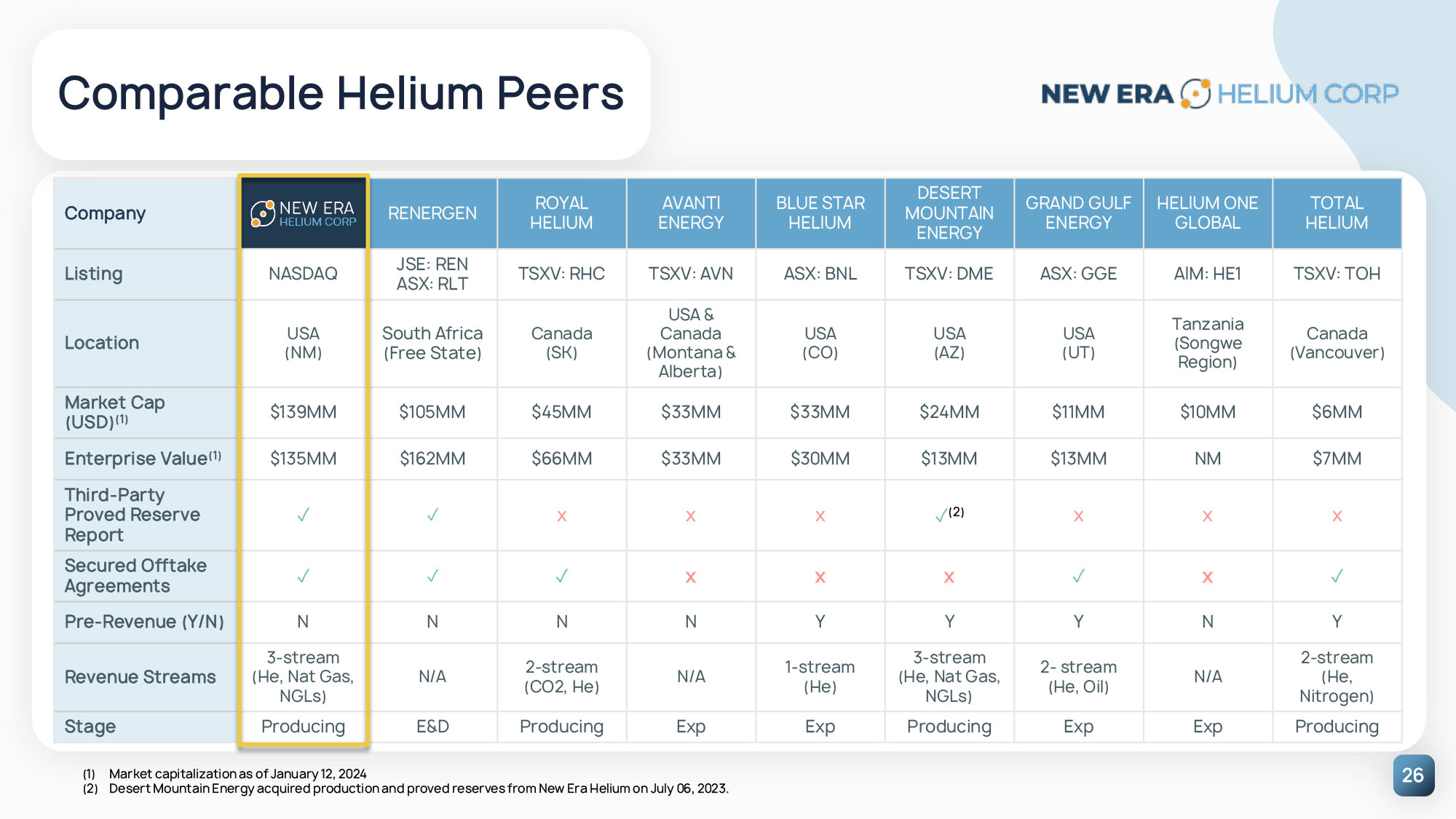

26 Comparable Helium Peers TOTAL HELIUM HELIUM ONE GLOBAL GRAND GULF ENERGY DESERT MOUNTAIN ENERGY BLUE STAR HELIUM AVANTI ENERGY ROYAL HELIUM RENERGEN Company TSXV: TOH AIM: HE1 ASX: GGE TSXV: DME ASX: BNL TSXV: AVN TSXV: RHC JSE: REN ASX: RLT NASDAQ Listing Canada (Vancouver) Tanzania (Songwe Region) USA (UT) USA (AZ) USA (CO) USA & Canada (Montana & Alberta) Canada (SK) South Africa (Free State) USA (NM) Location $6MM $10MM $11MM $24MM $33MM $33MM $45MM $105MM $139MM Market Cap (USD) (1) $7MM NM $13MM $13MM $30MM $33MM $66MM $162MM $135MM Enterprise Value (1) x x x ✓ (2) x x x ض ض Third - Party Proved Reserve Report ض x ض x x x ض ض ض Secured Offtake Agreements Y N Y Y Y N N N N Pre - Revenue (Y/N) 2 - stream (He, Nitrogen) N/A 2 - stream (He, Oil) 3 - stream (He, Nat Gas, NGLs) 1 - stream (He) N/A 2 - stream (CO2, He) N/A 3 - stream (He, Nat Gas, NGLs) Revenue Streams Producing Exp Exp Producing Exp Exp Producing E&D Producing Stage (1) Market capitalization as of January 12, 2024 (2) Desert Mountain Energy acquired production and proved reserves from New Era Helium on July 06, 2023.

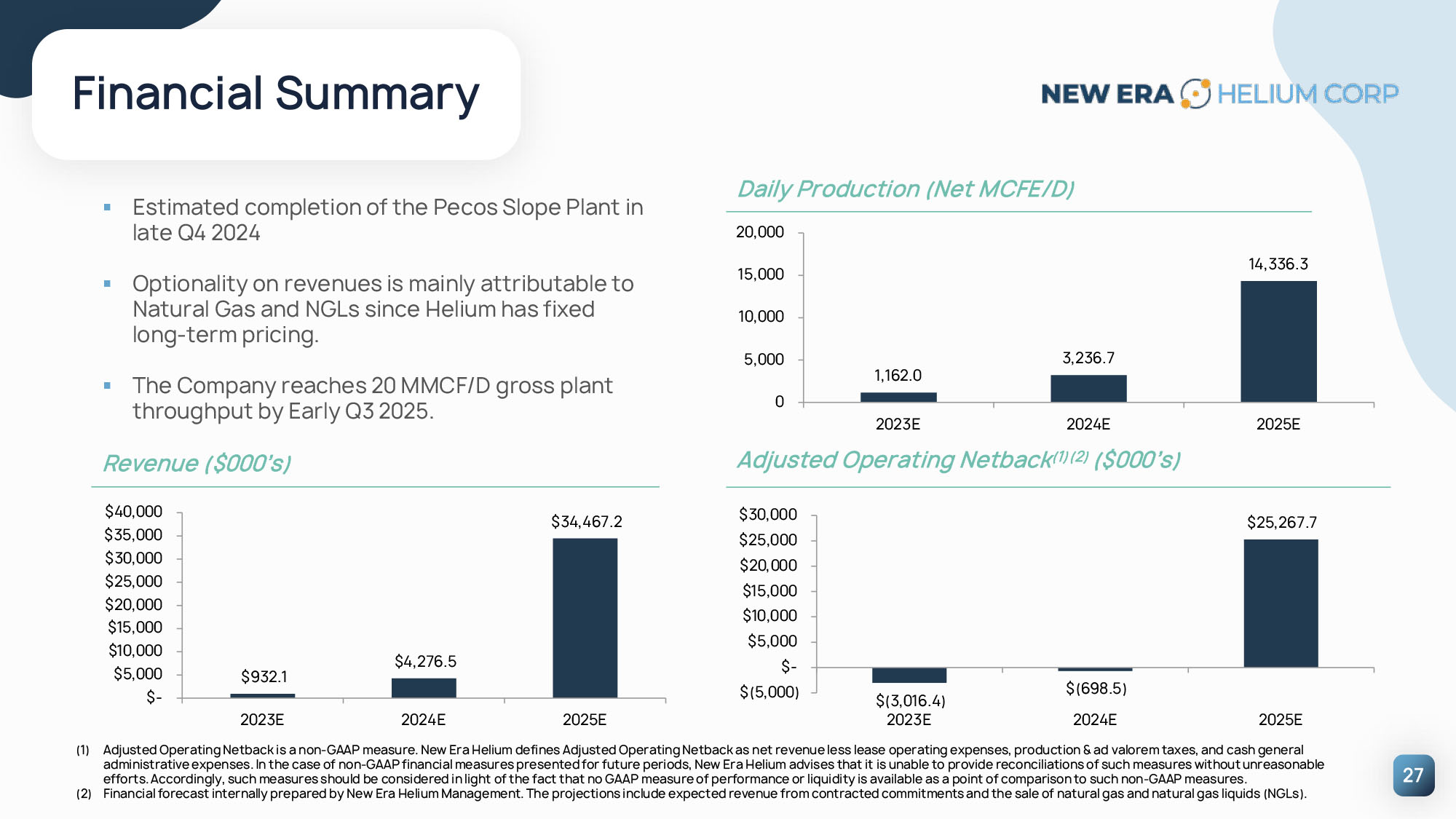

27 Financial Summary Revenue ($000’s) Daily Production (Net MCFE/D) ▪ Estimated completion of the Pecos Slope Plant in late Q4 2024 ▪ Optionality on revenues is mainly attributable to Natural Gas and NGLs since Helium has fixed long - term pricing. ▪ The Company reaches 20 MMCF/D gross plant throughput by Early Q3 2025. (1) Adjusted Operating Netback is a non - GAAP measure. New Era Helium defines Adjusted Operating Netback as net revenue less lease operating expenses, production & ad valorem taxes, and cash general administrative expenses. In the case of non - GAAP financial measures presented for future periods, New Era Helium advises that it is unable to provide reconciliations of such measures without unreasonable efforts. Accordingly, such measures should be considered in light of the fact that no GAAP measure of performance or liquidity is available as a point of comparison to such non - GAAP measures. (2) Financial forecast internally prepared by New Era Helium Management. The projections include expected revenue from contracted commitments and the sale of natural gas and natural gas liquids (NGLs). $25,267.7 $30,000 $25,000 $20,000 $15,000 $10,000 $5,000 $ - $(5,000) $(3,016.4) 2023E $(698.5) 2024E 2025E $932.1 $4,276.5 $34,467.2 $40,000 $35,000 $30,000 $25,000 $20,000 $15,000 $10,000 $5,000 $ - 2023E 2024E 2025E 1,162.0 3,236.7 14,336.3 0 5,000 10,000 15,000 20,000 2023E 2024E Adjusted Operating Netback (1)(2) ($000’s) 2025E

28 Conclusion STRATEGIC LOCALE Proximity to key infrastructure - 20 miles north of Roswell and within 550 miles of 6 out of 7 U.S. He Liquification plants. In close proximity to interstate pipelines and less than one mile from a major highway HELIUM PRODUCTION Producing helium TODAY (0.167 - 1.513 MOL% helium concentration) that can be scaled through workover improvements and/or new drills PLANT IN PROGRESS Helium Processing Plant construction underway (Q3 2023) ($3.5 million funded) with expected completion by late Q4 2024 OFFTAKE IN PLACE Two (2) 10 - year helium purchase ”take - or - pay” agreements executed to secure offtake for 32 MMCF p.a. plant throughput HELIUM RESERVES IN PLACE 137,000 gross acres (HBP) located in Southeastern New Mexico in the Permian Basin with approximately 2 BCF of gross proved and probable helium reserves in place

29 APPENDIX

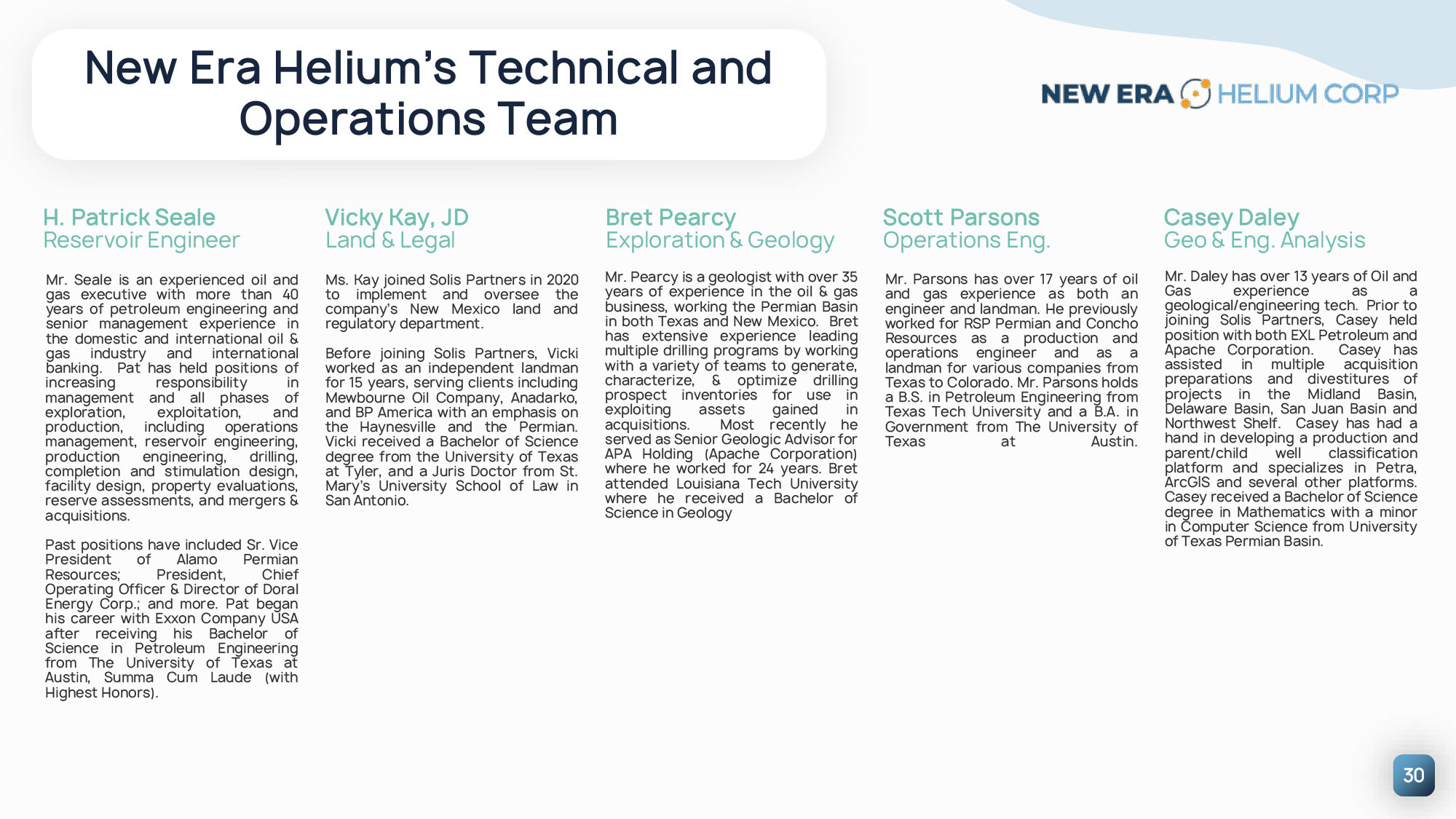

New Era Helium’s Technical and Operations Team H. Patrick Seale Reservoir Engineer Mr . Seale is an experienced oil and gas executive with more than 40 years of petroleum engineering and senior management experience in the domestic and international oil & gas industry and international banking . Pat has held positions of increasing responsibility in management and all phases of exploration, exploitation, and production, including operations management, reservoir engineering, production engineering, drilling, completion and stimulation design, facility design, property evaluations, reserve assessments, and mergers & acquisitions . Past positions have included Sr . Vice President of Alamo Permian Resources ; President, Chief Operating Officer & Director of Doral Energy Corp .; and more . Pat began his career with Exxon Company USA after receiving his Bachelor of Science in Petroleum Engineering from The University of Texas at Austin, Summa Cum Laude (with Highest Honors) . Vicky Kay, JD Land & Legal Ms . Kay joined Solis Partners in 2020 to implement and oversee the company’s New Mexico land and regulatory department . Before joining Solis Partners, Vicki worked as an independent landman for 15 years, serving clients including Mewbourne Oil Company, Anadarko, and BP America with an emphasis on the Haynesville and the Permian . Vicki received a Bachelor of Science degree from the University of Texas at Tyler, and a Juris Doctor from St . Mary’s University School of Law in San Antonio . Bret Pearcy Exploration & Geology Mr . Pearcy is a geologist with over 35 years of experience in the oil & gas business, working the Permian Basin in both Texas and New Mexico . Bret ha s extensive experience leading multiple drilling programs by working with a variety of teams to generate, characterize, & optimize drilling prospect inventories for use in exploiting assets gained in acquisitions . Most recently he served as Senior Geologic Advisor for APA Holding (Apache Corporation) where he worked for 24 years . Bret attended Louisiana Tech University where he received a Bachelor of Science in Geology Scott Parsons Operations Eng. Mr . Parsons has over 17 years of oil and gas experience as both an engineer and landman . He previously worked for RSP Permian and Concho Resources as a production and operations engineer and as a landman for various companies from Texas to Colorado . Mr . Parsons holds a B . S . in Petroleum Engineering from Texas Tech University and a B . A . in Government from The University of Texas at Austin . Casey Daley Geo & Eng. Analysis Mr. Daley has over 13 years of Oil and Gas experience as a geological/engineering tech. Prior to joining Solis Partners, Casey held position with both EXL Petroleum and Apache Corporation . Casey has assisted in multiple acquisition preparations and divestitures of projects in the Midland Basin, Delaware Basin, San Juan Basin and Northwest Shelf . Casey ha s had a hand in developing a production and parent/child well classification platform and specializes in Petra, ArcGIS and several other platforms . Casey received a Bachelor of Science degree in Mathematics with a minor in Computer Science from University of Texas Permian Basin . 30

31 Abo Structure Helium Heat Map Abo Gas Cum Map Key Maps

Appendix

MKM ENGINEERING

Oil and Gas Consulting Services

3905 Sagamore Hill Court

Plano, Texas 75025

November 6, 2023

Mr. E. Will Gray II

New Era Helium Corp.

4501 Santa Rosa Dr.

Midland, TX 79707

Dear Mr. Gray:

As requested, we are submitting our estimates of proved, probable, and possible reserves and our forecasts of the resulting economics attributable to the interests of Solis Partners, LLC (hereinafter referred to as “Solis”) and NEH Midstream, LLC (hereinafter referred to as “NEH”), as of July 1, 2023, in certain properties located in Chaves County, New Mexico and Howard County, Texas. We completed our evaluation on November 6, 2023. It is our understanding that the proved, probable, and possible reserves estimated in this report constitute 100% of all proved, probable and possible reserves owned by Solis Partners, LLC and NEH Midstream, LLC in the United States.

This report has been prepared for New Era Helium Corp.’s use in filing with the SEC; in our opinion the assumptions, data, methods, and procedures used in the preparation of this report are appropriate for such purpose. Composite proved reserve estimates and economic forecasts are summarized below:

| |

|

|

|

Proved |

|

|

Proved

Developed

Producing |

|

|

Proved

Non-Producing |

|

|

Proved

Undeveloped |

|

| Net Reserves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gas |

|

MMcf |

|

|

66,475.8 |

|

|

|

23,687.4 |

|

|

|

4,371.7 |

|

|

|

38,416.7 |

|

| Helium* |

|

MMcf |

|

|

483.6 |

|

|

|

0.0 |

|

|

|

0.0 |

|

|

|

483.6 |

|

| NGL |

|

MBbl |

|

|

4,766.0 |

|

|

|

0.0 |

|

|

|

0.0 |

|

|

|

4,766.0 |

|

| Oil |

|

MBbl |

|

|

46.2 |

|

|

|

3.3 |

|

|

|

42.9 |

|

|

|

0.0 |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gas |

|

M$ |

|

|

237,491.3 |

|

|

|

84,796.8 |

|

|

|

15,598.0 |

|

|

|

137,096.5 |

|

| Helium* |

|

M$ |

|

|

217,626.3 |

|

|

|

0.0 |

|

|

|

0.0 |

|

|

|

217,626.3 |

|

| NGL |

|

M$ |

|

|

157,882.0 |

|

|

|

0.0 |

|

|

|

0.0 |

|

|

|

157,882.0 |

|

| Oil |

|

M$ |

|

|

6,777.6 |

|

|

|

2,763.3 |

|

|

|

4,014.3 |

|

|

|

0.0 |

|

| Severance and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ad Valorem Taxes |

|

M$ |

|

|

52,617.6 |

|

|

|

6,126.6 |

|

|

|

1,902.4 |

|

|

|

44,588.6 |

|

| Operating Expenses |

|

M$ |

|

|

104,067.8 |

|

|

|

55,715.9 |

|

|

|

3,278.7 |

|

|

|

45,073.2 |

|

| Investments |

|

M$ |

|

|

90,177.0 |

|

|

|

0.0 |

|

|

|

8,000.0 |

|

|

|

82,177.0 |

|

| Operating Income (BFIT) |

|

M$ |

|

|

372,914.8 |

|

|

|

25,717.6 |

|

|

|

6,431.2 |

|

|

|

340,766.0 |

|

| Discounted @ 10% |

|

M$ |

|

|

91,700.4 |

|

|

|

11,716.3 |

|

|

|

-1,490.9 |

|

|

|

81,475.0 |

|

|

* |