false

0001355839

0001355839

2025-02-06

2025-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 6, 2025

| INTELLIGENT PROTECTION MANAGEMENT CORP. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-38717 |

|

20-3191847 |

| (State or other jurisdiction of |

|

(Commission File Number) |

|

(IRS Employer |

| incorporation) |

|

|

|

Identification No.) |

30 Jericho Executive Plaza, Suite 400E

Jericho, NY |

|

11753 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (212) 967-5120

(Former name

or former address, if changed since last report)

Not Applicable

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

|

IPM |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 7 - Regulation FD

Item 7.01 Regulation FD Disclosure.

Intelligent Protection Management

Corp. (the “Company”) is furnishing a copy of an investor presentation (the “Presentation”)

that the Company intends to use, in whole or in part, in one or more meetings with investors. A copy of the Presentation is furnished

as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information contained

in the Presentation is summary information that is intended to be considered in the context of the Company’s Securities and Exchange

Commission filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company

undertakes no duty or obligation to publicly update or revise the information contained in the Presentation, although it may do so from

time to time as its management believes is warranted.

The information in this Current

Report on Form 8-K is being furnished pursuant to Item 7.01 (including Exhibit 99.1) and shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation

language in such filing.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: February 6, 2025

| |

INTELLIGENT PROTECTION MANAGEMENT CORP. |

| |

|

|

| |

By: |

/s/ Jason Katz |

| |

|

Jason Katz |

| |

|

Chief Executive Officer |

2

Exhibit

99.1

Intelligent Protection Management Corp. A Managed Technology Solutions Provider Focused on Cybersecurity and Cloud Infrastructure 1 Investor Presentation February 2025 NASDAQ: IPM

2 Disclaimers This presentation is for discussion purposes only . Certain material is based upon third - party information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such . Certain statements in this presentation constitute “forward - looking statements” relating to Intelligent Protection Management Corp . (“IPM”, “we”, “our”, “us” or the “Company”) made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 that are based on current expectations, estimates, forecasts and assumptions and are subject to risks and uncertainties . Words such as “anticipate,” “assume,” “began,” “believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “would” and variations of such words and similar expressions are intended to identify such forward - looking statements . All forward - looking statements speak only as of the date on which they are made . Such forward - looking statements are subject to certain risks, uncertainties and assumptions relating to factors that could cause actual results to differ materially from those anticipated in such statements, including, without limitation, the following : • our ability to effectively integrate and manage the business of Newtek Technology Solutions, Inc . (“NTS”) or realize the expected benefits and synergies from our acquisition of NTS ; • our ability to achieve the anticipated operational and financial results following our acquisition of NTS ; • our ability to retain members of management and other key employees following our acquisition of NTS and the sale of our telecommunications services provider, “ Vumber ”, as well as our “Paltalk” and “Camfrog” applications and certain related assets and liabilities (the “Divestiture”) ; • our dependence on a small number of customers ; • our dependence on licensing arrangements in the operation of our business ; • the intense competition in the industry in which our business operates and our ability to effectively compete with existing competitors and new market entrants ; • our ability to consummate favorable acquisitions and effectively integrate any companies or properties that we acquire ; • the impact of any economic recession and the overall economic environment, including inflation, on our results of operations and our business ; • our ability to develop, establish and maintain strong brands ; • the possibility of interruptions in the operations of computer and communications hardware systems and infrastructure ; • the effect of security breaches, computer viruses and cybersecurity incidents ; • our ability to obtain additional capital or financing, when and if necessary, to execute our business plan, including through offerings of debt or equity or sale of any of our assets ; • the risk that we may face litigation resulting from the transmission of information through our information technology systems ; • the effects of current and future government regulation, including tax laws and laws and regulations regarding the use of the internet, privacy, cybersecurity and protection of user data ; • the impact of any claim that we have infringed on intellectual property rights of others ; and • our ability to protect our intellectual property rights . For a more detailed discussion of these and other factors that may affect our business, see our filings with the Securities and Exchange Commission (“SEC”), including the discussion under “Risk Factors” set forth in our latest Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q and our other filings with the SEC . We caution that the foregoing list of factors is not exclusive, and new factors may emerge, or changes to the foregoing factors may occur, that could impact our business . We do not undertake any obligation to update any forward - looking statement, whether written or oral, relating to the matters discussed in this presentation, except to the extent required by applicable securities laws .

3 Corporate Profile Intelligent Protection Management Corp. A managed technology solutions provider focused on cybersecurity and cloud infrastructure . Provides dedicated server hosting, cloud hosting, data storage, managed security, backup and disaster recovery, and other related services, including consulting and implementing technology solutions for enterprise and commercial clients across the United States . IPM sells and provides a range of IT - related services and goods, including the following : • Managed IT Security Services • Professional Services • Procurement Services • Secure Private Cloud Hosting • Managed Backup and Disaster Recovery • Web Hosting

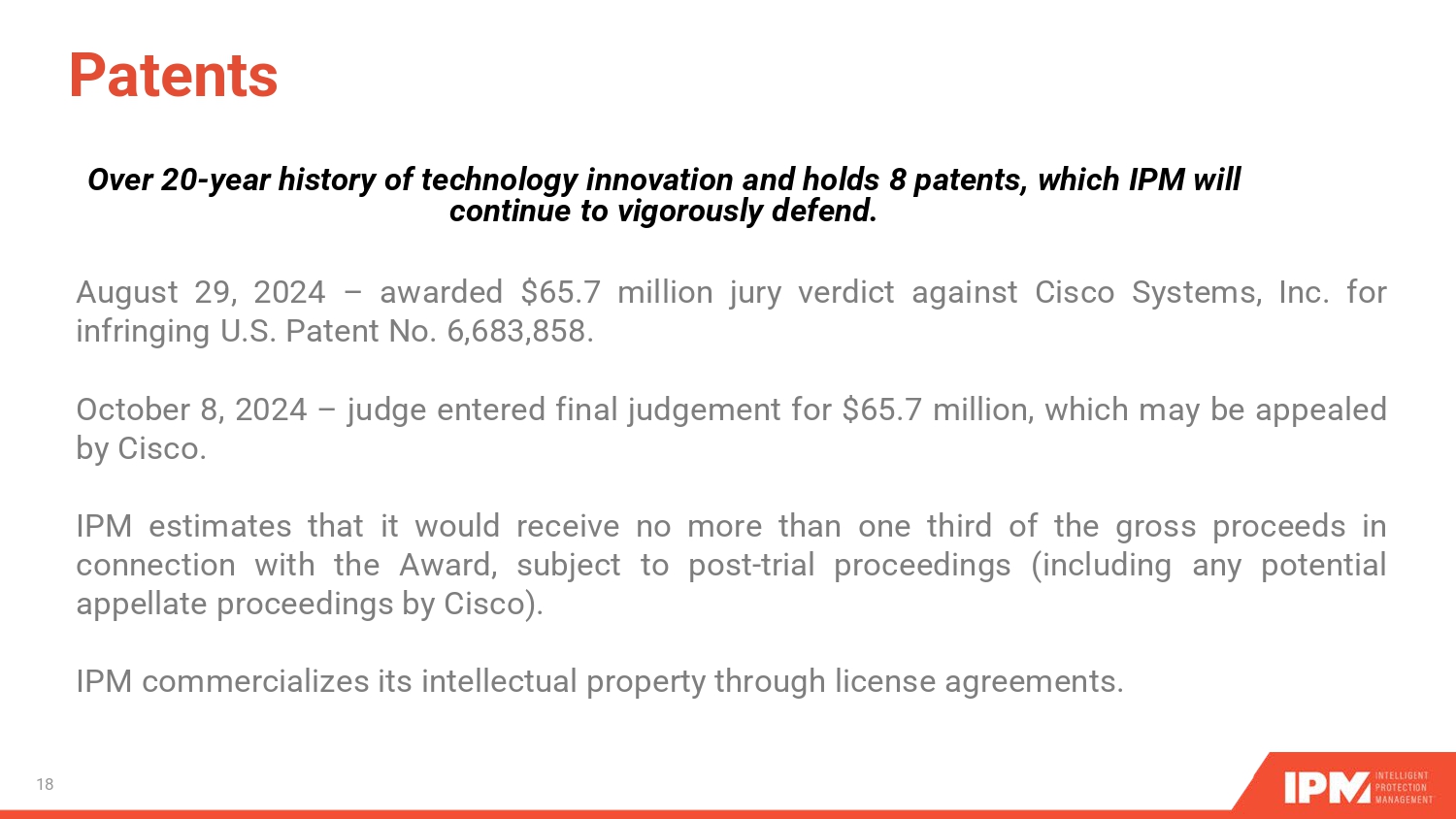

4 Historic Assets Patents IPM has an over 20 - year history of technology innovation and holds 8 patents, which it will continue to vigorously defend . IPM currently has patents licensed to Microsoft, Sony and Activision/Blizzard . August 29 , 2024 – awarded $ 65 . 7 million jury verdict (the “Award”) against Cisco Systems, Inc . (“Cisco”) for infringing U . S . Patent No . 6 , 683 , 858 ; judge entered final judgement for $ 65 . 7 million on October 8 , 2024 , which may be appealed by Cisco . The exact amount of the Award proceeds to be received by IPM (including any interest related thereto) will be determined based on a number of factors and will reflect the deduction of significant litigation - related expenses, including legal fees . Consequently, IPM estimates that it would receive no more than one third of the gross proceeds in connection with the Award, subject to post - trial proceedings (including any potential appellate proceedings by Cisco) . ManyCam ManyCam is a l ive streaming software and virtual camera with more than 1 million installs . Enables users to create virtual backgrounds and/or “masks” or other camera effects and deliver professional live videos on any streaming platform, video conferencing app or distance learning tool .

5 Seasoned Management Jason Katz, Chairman and Chief Executive Officer • Founder and CEO • Co - founder of MJ Capital, a money management firm • J.D. from NYU Law and B.A. from University of Pennsylvania Kara Jenny, Chief Financial Officer • Joined IPM in 2019 • Former CFO of Walker Innovation Inc. • Former CFO of Bluefly , Inc. • 8 years of public accounting experience, CPA, Member AICPA • B.S. in Accounting from Binghamton University School of Management Jared Mills , President • O ver 20 years of experience in managed IT services and global scale multi - site private cloud datacenter operations • Previous President, Chief Operating Officer and director of NTS • Previous Chief Technology Officer of NewtekOne, Inc. (“NewtekOne”) and Newtek Bank, National Association • Former President, Chief Operating Officer and director of Cloud Nine Solutions, Inc . Adam Zalko , Chief Operating Officer • Joined IPM in 2016 • Previously served as Senior Vice President and Vice President of Engineering • B.S. in Software Engineering from the Florida Institute of Technology

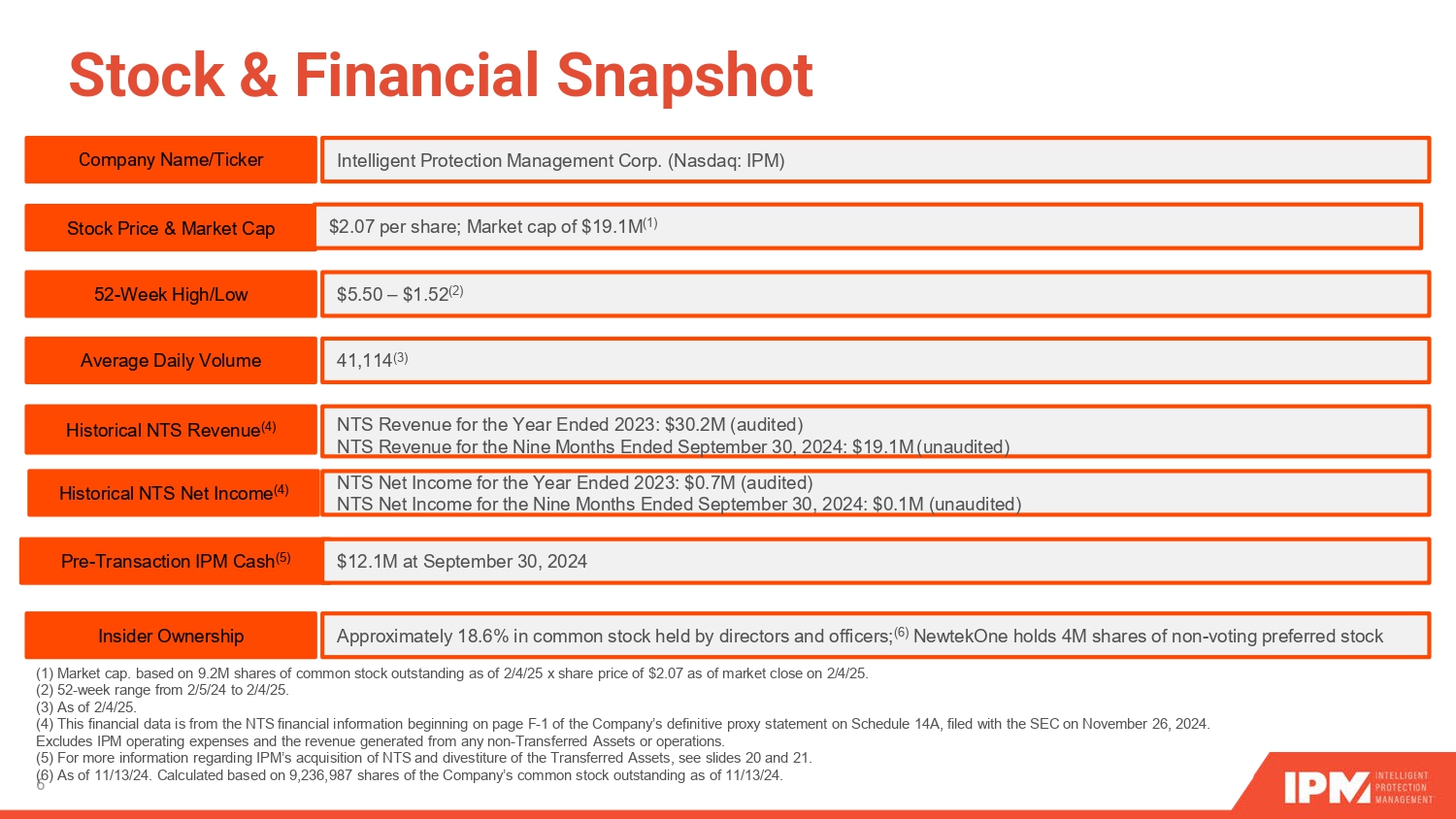

6 Stock & Financial Snapshot Company Name/Ticker Intelligent Protection Management Corp. (Nasdaq: IPM) Stock Price & Market Cap $2.07 per share; Market cap of $19.1M (1) 52 - Week High/Low $5.50 – $1.52 (2) Average Daily Volume 41,114 (3 ) Historical NTS Revenue (4) NTS Revenue for the Year Ended 2023: $30.2M (audited) NTS Revenue for the Nine Months Ended September 30, 2024: $19.1M (unaudited) Historical NTS Net Income (4) NTS Net Income for the Year Ended 2023: $0.7M (audited) NTS Net Income for the Nine Months Ended September 30, 2024: $0.1M (unaudited) Pre - Transaction IPM Cash (5) $12.1M at September 30, 2024 Insider Ownership Approximately 18.6% in common stock held by directors and officers; (6) NewtekOne holds 4M shares of non - voting preferred stock (1) Market cap. based on 9.2M shares of common stock outstanding as of 2/4/25 x share price of $2.07 as of market close on 2/ 4/2 5. (2) 52 - week range from 2/5/24 to 2/4/25. (3) As of 2/4/25. (4) This financial data is from the NTS financial information beginning on page F - 1 of the Company’s definitive proxy statement on Schedule 14A, filed with the SEC on November 26, 2024. Excludes IPM operating expenses and the revenue generated from any non - Transferred Assets or operations. (5) For more information regarding IPM’s acquisition of NTS and divestiture of the Transferred Assets, see slides 20 and 21. (6) As of 11/13/24. Calculated based on 9,236,987 shares of the Company’s common stock outstanding as of 11/13/24.

7 Investment Highlights Large and Growing Addressable Market with Favorable Potential Tailwinds Serving as an Essential Provider in Cybersecurity Several Paths for Growth Seasoned Management Team with Significant Industry and Pubco Experience Healthy Balance Sheet & Clean Capital Structure Patent Portfolio Provides Potential Monetary Windfalls 1 2 3 6 4 5 Multi - year Earn - out Potential in Connection with Divestiture 7

8 Intelligent Protection Management A comprehensive approach to cloud security, designed to ensure all cloud - based resources are secure, compliant, and resilient against threats. Intelligent Management Continuous monitoring of cloud environments with threat detection and automated responses. Proactive Risk Assessment Regular assessments and vulnerability scans to identify and mitigate threats while ensuring compliance . Managed Security Services 24/7 SOC support with managed detection, response, and expert firewall and management. Data Encryption & Privacy Date encryption, strict access controls, and compliance audits to protect privacy. Advanced Threat Protection Multi - layered defenses using threat intelligence and incident response to counter emerging threats. Resilience & Recovery Comprehensive disaster recovery, backup solutions, and continuity planning for maximum uptime.

Tailored IT Solutions, Backed by Decades of Experience 9 Deep Expertise, Proven Results Our team is composed of seasoned professionals with deep industry experience. We are problem solvers with a passion for leveraging technology to meet business goals. Whether it’s enhancing cybersecurity, optimizing IT systems, or developing tailored software, we provide forward - thinking solutions designed to meet the specific challenges businesses face today — and tomorrow. Proven experience that spans over two decades across diverse industries. Solutions customized to fit specific needs and objectives. End - to - end support from consultation to ongoing optimization.

Efficient Cloud Solutions Unlock the full potential of the cloud with seamless migration, expert design, and ongoing optimization to keep businesses ahead. Effective Data Security Protects critical assets with advanced threat detection, compliance - focused strategies, and 24/7 monitoring for peace of mind. Decades of Expertise Leverage 20+ years of IT innovation and success to solve complex challenges and deliver customized solutions with precision. Streamlined IT Transformation Provides tailored solutions and proactive guidance that simplify transformation and ensure rapid results. Technology Partner for Growth 10

We Serve Companies of Every Size From Small Business to Enterprise 11 11 We Serve Companies of Every Size From Small Business to Enterprise Small Businesses IPM supports small businesses with the end - to - end IT managed security and support they need to minimize overhead and focus on other business priorities without added staff or resources. Mid - Size Businesses IPM delivers cost - effective IT managed services and cloud hosting for the growing business, providing seamless scalability and enterprise - class security without added expense. Enterprise Businesses IPM offers comprehensive services for even the largest enterprises, solving complex challenges and offering deep expertise for critical infrastructure and projects.

12 IPM Solution Offerings Managed Security Services Simplify technology management with a predictable monthly fee, freeing resources for strategic projects and reducing costs. Backup & Disaster Recovery Protect critical data and ensure resilience with a fully - managed, cost - effective solution for seamless recovery. Secure Private & Hybrid Cloud Hosting Leverage cloud economies of scale with expert guidance from architecture to ongoing operations, ensuring compliance and security. Professional Consulting Services I mplement tailored IT strategies to streamline processes for our customers and increase the success rate, efficiency and value of your technology investments . Product Procurement Services Leverage our partner resources and buying power to optimize technology budgets, saving our customers time, money and resources.

Secures Business with Advanced Threat Protection Managed Security Services Proactive Threat Detection & Response ● Continuous monitoring and real - time detection of cyber threats. ● Rapid incident response to contain and mitigate risks. Vulnerability Management ● Regular vulnerability assessments to identify and remediate risks. ● Patch management to keep systems secure and up to date. Compliance Support ● Guidance to meet industry standards like GDPR, HIPAA, and PCI - DSS. ● Strategies to ensure regulatory compliance and mitigate risks. Incident Response & Recovery ● Comprehensive plans to handle breaches effectively. ● Seamless recovery to minimize downtime and ensure business continuity. Benefits ● Seamless integration with existing infrastructure without disrupting daily operations. ● Utilization of state - of - the - art security technologies and real - time threat intelligence. ● Scalable and flexible solutions that adapt as businesses grow or face new challenges. 13

Protects Data, Ensures Business Continuity Backup and Disaster Recovery Continuous Data Protection ● 24/7 monitoring ensures successful backups and immediate issue resolution, securing data at all times. Custom Disaster Recovery Plans ● Personalized strategies tailored to specific business needs, ensuring quick recovery and minimal disruption during incidents. Compliance Support ● Expert guidance to meet regulatory requirements, providing audit - ready documentation and processes. Rapid Recovery ● Advanced technology and dedicated teams guarantee swift data restoration, minimizing operational downtime. Benefits ● Customized solutions designed to match unique business continuity needs. ● Leverage cloud - based backups, encryption, and advanced recovery tools for maximum protection. ● Reduce complexity by integrating backups seamlessly into existing infrastructure. ● Ensures that businesses stay operational, even in the face of data loss or disaster. 14

Transforms Businesses with Secure, Scalable Solutions Secure Private & Hybrid Cloud Solutions Managed Private Cloud ● Customized environments offering full control and enhanced security, supported by proactive management. Hybrid Cloud Solutions ● Seamless integration of private and public clouds to optimize workload distribution and enhance flexibility. Cloud Migration Services ● Smooth transitions to the cloud, minimizing downtime and disruptions while leveraging modern architecture. 24/7 Monitoring & Support ● Continuous management with proactive issue resolution to ensure optimal performance. Backup & Disaster Recovery ● Data protection and rapid recovery solutions with industry - leading security protocols. State - of - the - Art Data Centers ● W ith capacity to grow. Benefits ● Ensures seamless operation between private and public environments for flexible workload management. ● Enhances efficiency by distributing workloads effectively, maximizing performance, and controlling costs. ● Adapts to a business’s changing demands without compromising security or performance. 15

No - Cost IT Assessment with Detailed Report Comprehensive Evaluation Gain insights into current IT infrastructure, pinpointing inefficiencies, vulnerabilities, and areas for improvement. Customized Recommendations Receive tailored strategies to optimize performance, enhance security, and reduce costs, aligned with business goals. Expert Guidance Leverage decades of IT expertise to understand how to future - proof technology investments and address critical challenges. Partner with IPM for a Stronger IT Infrastructure 16 Identify Gaps and Unlock Opportunities No Obligation Our assessment is entirely free with no strings attached. Proactive Solutions Identify potential risks before they become costly issues. Actionable Insights Get a clear roadmap to enhance IT performance and scalability. End - to - End Support Partner with a trusted provider to implement recommendations seamlessly. • • • •

17 IPM Growth Opportunities Refocused on Growth Following Merger with NTS NewtekOne Referrals Ripe Prospects in Cybersecurity M&A Opportunities to Scale

18 Patents Over 20 - year history of technology innovation and holds 8 patents, which IPM will continue to vigorously defend. August 29 , 2024 – awarded $ 65 . 7 million jury verdict against Cisco Systems, Inc . for infringing U . S . Patent No . 6 , 683 , 858 . October 8 , 2024 – judge entered final judgement for $ 65 . 7 million, which may be appealed by Cisco . IPM estimates that it would receive no more than one third of the gross proceeds in connection with the Award, subject to post - trial proceedings (including any potential appellate proceedings by Cisco) . IPM commercializes its intellectual property through license agreements .

19 ManyCam A l ive streaming software and virtual camera . Enables users to create virtual backgrounds and/or “masks” or other camera effects and deliver professional live videos on any streaming platform, video conferencing app or distance learning tool . A great addition to other videoconferencing applications like Zoom or Google Meet . More than 1 million downloads . Opportunity for growth with enterprise version .

20 Divestiture Transaction - Potential Earn - Out Payable to IPM Revenue Based Earn - Out from Divestiture of Paltalk, Camfrog and Vumber As a closing condition to the NTS acquisition, IPM completed the sale of its telecommunications services provider, “ Vumber ”, as well as its “Paltalk” and “Camfrog” applications and certain related assets and liabilities (the “Transferred Assets”) to Meteor Mobile Holdings, Inc . IPM is entitled to receive certain payments based on cash revenue attributable to the Transferred Assets . The cash payable to IPM for each Earn - Out Period is set forth below : • Earn - Out Period 1 – an amount equal to ( i ) for any revenue greater than or equal to $ 3 , 500 , 000 and less than $ 4 , 250 , 000 , the amount of such revenue multiplied by 0 . 30 , plus (ii) for any revenue greater than or equal to $ 4 , 250 , 000 , the amount of such revenue in excess of $ 4 , 250 , 000 multiplied by 0 . 40 ; and • Earn - Out Period 2 , Earn - Out Period 3 and Earn - Out Period 4 – an amount equal to ( i ) for any revenue greater than or equal to $ 7 , 000 , 000 and less than $ 8 , 500 , 000 , the amount of such revenue multiplied by 0 . 30 , plus (ii) for any revenue greater than or equal to $ 8 , 500 , 000 , the amount of such revenue in excess of $ 8 , 500 , 000 multiplied by 0 . 40 . The Earn - Out Periods are set forth below : • Earn - Out Period 1 = 7 / 1 / 25 – 12 / 31 / 25 • Earn - Out Period 2 = 1 / 1 / 26 – 12 / 31 / 26 • Earn - Out Period 3 = 1 / 1 / 27 – 12 / 31 / 27 • Earn - Out Period 4 = 1 / 1 / 28 – 12 / 31 / 28

21 NTS Acquisition - Potential Earn - Out Payable to NewtekOne Earn - Out payable to NewtekOne Based on Adjusted EBITDA In January 2025 , IPM (formerly Paltalk, Inc . ) completed the acquisition of NTS from NewtekOne through a two - step merger process . In connection with the closing of the acquisition, Paltalk, Inc . changed its name to “Intelligent Protection Management Corp . ” and began trading on Nasdaq under the ticker symbol “IPM . ” In connection with the NTS acquisition, IPM is required to pay NewtekOne up to $ 5 , 000 , 000 based on the achievement of certain cumulative average adjusted EBITDA thresholds (the “Earn - Out Amount”) . The Earn - Out Amount may be paid, at IPM’s sole discretion, in cash, in shares of IPM’s preferred stock or in a combination thereof . The Earn - Out Periods are set forth below : • Earn - Out Period 1 = 1 / 1 / 25 – 12 / 31 / 25 • Earn - Out Period 2 = 1 / 1 / 26 – 12 / 31 / 26

.com Thank You 30 Jericho Executive Plaza Suite 400E Jericho, NY 11753 Investor Relations: ClearThink Capital nyc@clearthink.capital P: 917 - 658 - 7878

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Paltalk (NASDAQ:PALT)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

Paltalk (NASDAQ:PALT)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025