UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July

GRUPO AEROPORTUARIO DEL CENTRO NORTE, S.A.B.

DE C.V.

(CENTRAL NORTH AIRPORT GROUP)

_________________________________________________________________

(Translation of Registrant’s Name Into

English)

México

_________________________________________________________________

(Jurisdiction of incorporation or organization)

Torre Latitud, L501, Piso 5

Av. Lázaro Cárdenas 2225

Col. Valle Oriente, San Pedro Garza García

Nuevo León, México

_________________________________________________________________

(Address of principal executive offices)

(Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Indicate by check mark whether the registrant

by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.)

(If “Yes” is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

OMA Announces Second Quarter 2022

Operating and Financial Results

Mexico City, Mexico, July 26, 2022—

Mexican airport operator Grupo Aeroportuario del Centro Norte, S.A.B. de C.V., known as OMA (NASDAQ: OMAB; BMV: OMA), today reported its

unaudited, consolidated financial and operating results for the second quarter 2022 (2Q22).

2Q22 Summary

| § | Passenger traffic increased 29.6% during 2Q22, as

compared to 2Q21, reaching 5.9 million passengers, and decreased 1.3% as compared to 2Q19. The airports

with the highest traffic growth compared to 2Q21 were Monterrey, Ciudad Juárez, Chihuahua, Culiacán, and Mazatlán.

|

| § | Adjusted EBITDA was

Ps.1,832 million, which compares to Ps.1,308 million in 2Q21, and was 27.1% higher than 2Q19. |

| § | Adjusted EBITDA margin reached

77.7%, compared to 74.7% in 2Q21 and 73.9% in 2Q19. |

| § | Capital investments and major maintenance works included

in the Master Development Plans (MDPs) plus strategic investments were Ps.784 million in the

quarter. |

OMA will

hold its 2Q22 earnings conference call on July 27, 2022 at 11:00 a.m. Eastern time, 10:00 a.m. Mexico City time.

Call +1-877-407-9208

toll-free from the U.S. or +1-201-493-6784 from outside the U.S. The conference ID is 13731402. The conference call will also be available

by webcast at http://ir.oma.aero/en/calendario-de-eventos.

2Q22 Operating Results

Operations, Passengers, and Cargo

The number of seats offered increased 28.4% compared

to 2Q21 and decreased 1.9%, compared to 2Q19.

During the quarter, 8 new routes, started operations.

Total passenger traffic reached 5.9 million

passengers, an increase of 29.6% as compared to 2Q21 and a decrease of 1.3% versus 2Q19. During the quarter, of total traffic, 89.1% was

domestic and 10.9% was international.

Domestic passenger traffic increased 34.5%,

compared to 2Q21, while international traffic decreased 0.4%. Compared to 2Q19, domestic passenger traffic and international passenger

traffic decreased 1.2% and 1.9%, respectively.

The airports with the largest passenger traffic recovery

in volume terms as compared to 2Q19, were:

§

Ciudad Juárez (+21.2%), on its Mexico City, Cancún and Guadalajara routes.

2

| § | Mazatlán (+27.2%), on its Tijuana, Phoenix and Chihuahua routes. |

| § | Reynosa (+9.5%), on its Mexico City and Cancún routes. |

| § | Zihuatanejo (+4.0%), on its Mexico City, Houston and Los Angeles routes. |

| § | Durango (+3.8%), on its Dallas, Mexico City and Tijuana routes. |

The airports with the largest passenger traffic growth

in volume terms as compared to 2Q21, were:

§

Monterrey (+32.2%), on its Mexico City, Guadalajara and Tijuana routes.

| § | Ciudad Juárez (+45.4%), on its Mexico City, Guadalajara and Monterrey routes. |

| § | Chihuahua (+35.4%), on its Mexico City and Monterrey routes. |

| § | Culiacán (+19.1%), on its Guadalajara, Mexico City and Tijuana routes. |

| § | Mazatlán (+24.8%), on its Tijuana, Mexico City and Monterrey routes. |

Commercial Operations

The commercial space occupancy rate in the passenger

terminals was 89.0% as of June 30, 2022.

Freight Logistics Services

| § | OMA Carga’s revenues increased by 42.8%, compared to 2Q21 due to higher handling, storage

and custody activity related to ground and air import cargo. Total tonnage handled was 11,592 metric tons, 19.9% higher than 2Q21. |

Hotel Services

| § | The NH Collection Terminal 2 Hotel had an 80.5% occupancy rate, compared to 55.8% in 2Q21, with

an 11.7% increase in the average room rate to Ps.2,293 per night. |

| § | Hilton Garden Inn had a 75.3% occupancy rate, compared to 45.8% in 2Q21, with a 15.8% increase

in the average room rate to Ps.2,161 per night. |

3

Industrial Services

| § | OMA VYNMSA Aero Industrial Park: Revenues reached Ps.17.8 million, an increase of 16.3% versus

2Q21. The increase is explained by a higher number of leased m2 as compared to 2Q21. |

Consolidated Financial Results

Revenues

Aeronautical revenues increased 33.2% mainly

due to an increase in passenger traffic, compared to 2Q21, as well as the increase in aeronautical tariffs.

Non-aeronautical revenues increased 40.2%.

Commercial revenues increased 48.5%. The line

items with the largest increases were:

| § | Parking, +53.5%, as a result of an increase in passenger traffic, as well as higher penetration

in the Chihuahua and Monterrey airports. |

| § | Restaurants, Retail and Car Rentals, +61.4%, +74.8% and +40.4%, respectively, as a result of an

increase in revenue share and the start of operations of new initiatives implemented. |

| § | VIP Lounges, +54.7%, as a result of the transition to a direct operation of the OMA Premium Lounges

and an increase in number of users of these lounges. |

4

Diversification revenues increased 43.4%,

mainly due to higher revenues from hotel services and OMA Carga.

Construction revenues represent the value

of improvements to concessioned assets. They are equal to construction costs and generate neither a gain nor a loss. Construction

revenues and costs are determined based on the advance in the execution of projects in accordance with the airports’ Master Development

Programs (MDP), and variations depend on the rate of project execution.

5

Costs and Operating Expenses

The sum of cost of airport services and general

and administrative expenses (G&A) increased 12.0%, mainly due to higher payroll costs as a result of changes in labor regulation

in Mexico applicable since 2Q21 and the incorporation of new business lines, such as the direct operation of the OMA Premium Lounges;

higher costs of minor maintenance and basic services due to the activity increase in all airports; and higher materials and supplies costs

as a result of the direct operation of the OMA Premium Lounges.

The major maintenance provision was Ps.298

million. The outstanding balance of the maintenance provision as of June 30, 2022 was Ps.1,966 million.

The airport concession tax was Ps.110 million

and the technical assistance fee was Ps.40 million.

Total operating costs and expenses increased

32.5%.

Operating Income and Adjusted EBITDA

Operating Income was Ps.1,402 million, with

an operating margin of 48.1%.

Adjusted EBITDA was Ps.1,832 million, with

a margin of 77.7%.

6

Financing Income and Net Income

Financing Expense was Ps.183 million, an increase

of 8.4%, mainly due to a higher interest expense as a result of additional debt issuance and the variation in the present value of the

major maintenance provision.

Consolidated net income in the quarter

was Ps.928 million, an increase of 49.8%.

Earnings per share, based on net income of

the controlling interest was Ps.2.39, and earnings per ADS was US$0.95. Each ADS represents eight Series B shares.

MDP and Strategic Investments

In 2Q22, capital investments and major maintenance

works in the MDPs and strategic investments totaled Ps.784 million, comprised of Ps.558 million in improvements to concessioned assets,

Ps.180 million in major maintenance, Ps.45 million in strategic investments, and Ps.1 million in other concepts.

7

The most important investment expenditures included:

Indebtedness

8

Derivatives

As of the date of this report, OMA has no financial

derivatives exposure.

Cash Flow Statement

During 2Q22, cash flows from operating activities

generated cash of Ps.1,076 million.

Investing activities used cash for Ps.595

million in the second quarter. Financing activities reflect mainly the payment of the first dividend installment of Ps.1,795 million,

resulting in a net cash outflow of Ps.1,993 million.

The net reduction in cash resulting from operating,

investing and financing activities in 2Q22 was Ps.1,512 million. This, combined with the positive effect of changes in the value of cash

of Ps.8 million, resulted in a Cash and Cash Equivalents balance as of June 30, 2022 of Ps.1,757 million.

Subsequent Events

OMA publishes

its first Green Bond Report. On July 1, 2022, OMA published its first Green Bond Report pursuant to

OMA’s Green Bond Framework. The Report provides information about allocation of proceeds and the impact of projects financed with

the Ps.1,000 million Green Bond issued on April 16, 2021.

OMA pays

the two installments of the dividend declared. Based on the resolutions adopted by its Annual General

Ordinary Shareholders’ Meeting, held on April 22, 2022, shareholders approved, among other matters, declaration and payment of a

cash dividend of Ps.2,300 million, to be paid in two installments: the first installment of Ps.1,800 million, or Ps.4.614064804 per share,

which was paid on May 24, 2022, and a second installment of Ps.500 million, or Ps. 1.281684668 per share, which was paid on July 25, 2022.

Inauguration

of Terminal A West Side Public Area. On June 24, 2022, OMA inaugurated the first phase of the Terminal

A expansion of the Monterrey International Airport. This first phase represents 15% of the total Terminal A expansion project and has

a total area of more than 10,000 m2.

9

10

11

12

13

14

15

Notes to the Financial Information

Financial statements are prepared in accordance with

International Financial Reporting Standards (“IFRS”), and presented in accordance with IAS 34 “Interim Financial Reporting.”

For more information, please refer to our Quarterly Financial Information submitted to the Mexican Stock Exchange (www.bmv.com.mx)

Unless stated otherwise, all comparisons of operating

or financial results are made with respect to the comparable prior of 2021. The exchange rates used to convert foreign currency amounts

were Ps.19.8157 as of June 30, 2021, Ps.20.4672 as of December 31, 2021 and Ps.20.1443 as of June 30, 2022.

Construction revenue, construction

cost: IFRIC 12 “Service Concession Arrangements” addresses how service concession operators should account for the obligations

they undertake and rights they receive in service concession arrangements. The concession contracts for each of OMA’s airport subsidiaries

establishes that the concessionaire is obligated to carry out improvements to the infrastructure transferred in exchange for the rights

over the concession granted by the Federal Government. The latter will receive all the assets at the end of the concession period. As

a result, the concessionaire should recognize, using the percentage of completion method, the revenues and costs associated with the improvements

to the concessioned assets. The amount of the revenues and costs so recognized should be the price that the concessionaire pays or would

pay in an arm’s length transaction for the execution of the works or the purchase of machinery and equipment, with no profit recognized

for the construction or improvement. The application of IFRIC 12 does not affect operating income, net income, or EBITDA, but does affect

calculations of margins based on total revenues.

Capital investments: includes

investments in fixed assets (including investments in land, machinery, and equipment) and improvements to concessioned properties under

the Master Development Plan (MDP) plus strategic investments.

Strategic Investments: Refers only to those

capital investments additional to the Master Development Program.

Passengers and Terminal passengers:

All references to passenger traffic volumes are to Terminal passengers, which includes passengers on the three types of aviation (commercial,

charter, and general aviation), and excludes passengers in transit.

Adjusted EBITDA and Adjusted

EBITDA margin: OMA defines Adjusted EBITDA as EBITDA less construction revenue plus construction expense and maintenance provision.

We calculate the Adjusted EBITDA margin as Adjusted EBITDA divided by the sum of aeronautical revenue and non-aeronautical revenue. Construction

revenue and construction cost do not affect cash flow generation and the maintenance provision corresponds to capital investments. OMA

defines EBITDA as net income minus net comprehensive financing income, taxes, and depreciation and amortization. Neither Adjusted EBITDA

nor EBITDA should be considered as an alternative to net income as an indicator of our operating performance, or as an alternative to

cash flow as an indicator of liquidity. It should be noted that neither Adjusted EBITDA nor EBITDA is defined under IFRS, and may be calculated

differently by different companies.

16

Analyst Coverage

In accordance with the requirements of the Mexican

Stock Exchange, the analysts covering OMA are:

This report may contain forward-looking information

and statements. Forward-looking statements are statements that are not historical facts. These statements are only predictions based on

our current information and expectations and projections about future events. Forward-looking statements may be identified by the words

“believe,” “expect,” “anticipate,” “target,” “estimate,” or similar expressions.

While OMA's management believes that the expectations reflected in such forward-looking statements are reasonable, investors are cautioned

that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict

and are generally beyond the control of OMA, that could cause actual results and developments to differ materially from those expressed

in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include, but are not limited

to, those discussed in our most recent annual report filed on Form 20-F under the caption “Risk Factors.” OMA undertakes no

obligation to update publicly its forward-looking statements, whether as a result of new information, future events, or otherwise.

About OMA

Grupo Aeroportuario del Centro Norte, S.A.B.

de C.V., known as OMA, operates 13 international airports in nine states of central and northern Mexico. OMA’s airports serve Monterrey,

Mexico’s third largest metropolitan area, the tourist destinations of Acapulco, Mazatlán, and Zihuatanejo, and nine other

regional centers and border cities. OMA also operates the NH Collection Hotel inside Terminal 2 of the Mexico City airport and the Hilton

Garden Inn at the Monterrey airport. OMA employs over 1,100 persons in order to offer passengers and clients airport and commercial services

in facilities that comply with all applicable international safety and security measures. OMA is listed on the Mexican Stock Exchange

(OMA) and on the NASDAQ Global Select Market (OMAB). For more information, visit:

| · | Webpage

http://ir.oma.aero |

| · | Twitter

http://twitter.com/OMAeropuertos |

| · | Facebook

https://www.facebook.com/OMAeropuertos |

17

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. |

| |

|

| By: |

/s/ Ruffo Pérez Pliego |

|

| |

Ruffo Pérez Pliego |

| |

Chief Financial Officer |

Dated July 26, 2022

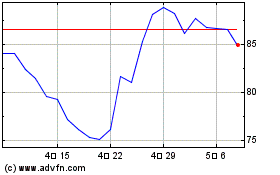

Grupo Aeroportuario del ... (NASDAQ:OMAB)

과거 데이터 주식 차트

부터 2월(2) 2025 으로 3월(3) 2025

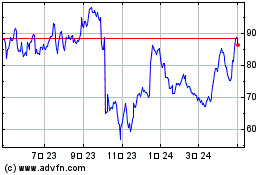

Grupo Aeroportuario del ... (NASDAQ:OMAB)

과거 데이터 주식 차트

부터 3월(3) 2024 으로 3월(3) 2025