Filed Pursuant to Rule

424(b)(3)

Registration No. 333-281964

PROSPECTUS

NewGenIvf Group

Limited

139,425,259 Class

A Ordinary Shares

This

prospectus relates to the resale by the selling shareholders identified in this prospectus

(“Selling Shareholders”) of up to 139,425,259 Class A Ordinary Shares, no par

value per share (“Ordinary Shares”), consisting of (i) 86,704,087 Ordinary Shares

issuable upon the conversion of (x) the senior convertible note (the “Initial Note”)

issued on August 12, 2024, (y) the senior convertible note (the “First Mandatory Additional

Note”) issued on August 28, 2024 and (y) the Additional Notes (as defined below), (ii)

22,085,003 Ordinary Shares issuable upon the conversion of the senior convertible notes (the

“Exchange Notes”, and together with the Initial Note, the First Mandatory Additional

Note and the Additional Notes, the “Notes”) exchanged on August 8, 2024, (iii)

19,871,935 Ordinary Shares that are issuable upon the exercise of Series A warrants to purchase

Ordinary Shares (the “Series A Warrants”), (iv) 180,722 Ordinary Shares that

are issuable upon the exercise of Series B warrants to purchase Ordinary Shares (the “Series

B Warrants”), (v) 3,253,012 Ordinary Shares that are issuable upon the exercise of

Series C warrants to purchase Ordinary Shares (the “Exchange Warrants” and together

with the Series A Warrants and the Series B Warrants, the “Warrants”) and (vi)

7,330,500 Ordinary Shares. The Notes and the Warrants were all issued in private placements

to certain Selling Shareholders, see “Item 7. Recent Sales of Unregistered Securities” on

page II-1 of this prospectus.

The

Selling Shareholders are identified in the table commencing on page 85. No Ordinary Shares

are being registered hereunder for sale by us. We will not receive any proceeds from the

sale of the Ordinary Shares by the Selling Shareholders, but will receive proceeds from the

exercise of the Warrants if the Warrants are exercised for cash, which proceeds will be used

for working capital and other general corporate purposes. All net proceeds from the sale

of the Ordinary Shares covered by this prospectus will go to the Selling Shareholders (see

“Use of Proceeds”). The Selling Shareholders are offering their securities

to further enhance liquidity in the public trading market for our equity securities in the

United States. Unlike an initial public offering, any sale by the Selling Shareholders of

the Ordinary Shares is not being underwritten by any investment bank. The Selling Shareholders

may sell all or a portion of the Ordinary Shares from time to time in market transactions

through any market on which our Ordinary Shares are then traded, in negotiated transactions

or otherwise, and at prices and on terms that will be determined by the then prevailing market

price or at negotiated prices directly or through a broker or brokers, who may act as agent

or as principal or by a combination of such methods of sale (see “Plan of Distribution”).

Our

Ordinary Shares currently trade on The Nasdaq Global Market under the symbol “NIVF.” The last reported closing price of our

Ordinary Shares on October 30, 2024 was $0.837. The Company’s common stock may be delisted by Nasdaq on November 20, 2024 for failing

to comply with the minimum market value of listed securities set forth in Nasdaq Listing Rule 5450(b)(2)(A). The Company’s common

stock may also be delisted by Nasdaq on November 20, 2024 for failing to comply with the minimum market value of publicly held shares

set forth in Nasdaq Listing Rule 5450(b)(2)(C). See “Prospectus Summary – Nasdaq Deficiency” and “Risk Factors”

regarding this possibility of delisting.

We

are not a “controlled company” as defined under the Listing Rules of The Nasdaq Stock Market LLC (“Nasdaq”),

but we qualify as a “foreign private issuer,” as defined in Rule 405 under the U.S. Securities Act of 1933, as amended, or

the Securities Act, and are eligible for reduced public company reporting requirements.

NewGenIvf

Group Limited (“NewGenIvf,” “Company,” “our,” “we,” or “us”) is a British

Virgin Islands holding company with our operations conducted through our subsidiaries in the Cayman Islands (our wholly-owned subsidiary,

NewGenIvf Limited) and in Asia (Hong Kong, Thailand, Kyrgyzstan, and the Kingdom of Cambodia). Under this holding company structure,

investors are purchasing equity interests in NewGenIvf, a British Virgin Islands holding company, and obtaining indirect ownership interests

in our Cayman Islands and Asian operating subsidiaries. Substantially all of NewGenIvf’s operations and assets are based in Thailand,

Cambodia and Kyrgyzstan. As a result, its businesses and operations are subject to the changing economic conditions prevailing from

time to time in such countries.

Investing

in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors”

starting on page 20 to read about the factors you should consider before buying the Ordinary Shares.

Neither

the Securities and Exchange Commission, or the SEC, nor any state or other foreign securities commission has approved nor disapproved

these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this

prospectus is November 8, 2024

TABLE OF CONTENTS

You

should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to

which we have referred you. Neither we nor any of the Selling Shareholders have authorized anyone to provide you with different information.

Neither we nor any of the Selling Shareholders are making an offer of these securities in any jurisdiction where the offer is not permitted.

You should not assume that the information in this prospectus or any applicable prospectus supplement is accurate as of any date other

than the date of the applicable document. Since the date of this prospectus, our business, financial condition, results of operations

and prospects may have changed.

For

investors outside of the United States: Neither we nor any of the Selling Shareholders have done anything that would permit this offering

or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United

States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of

this prospectus.

In

this prospectus, “we,” “us,” “our” and the “Company” refer to NewGenIvf Group Limited

and its wholly owned subsidiary, NewGenIvf Limited, a Cayman Islands company.

Our

reporting currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references in this prospectus

to “dollars” or “$” are to U.S. dollars.

This

prospectus includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent

industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports

generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy

or completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information

contained in such publications.

Our

consolidated financial statements are prepared and presented in accordance with accounting principles generally accepted in the United

States of America, or U.S. GAAP.

The

number of Ordinary Shares currently issued and outstanding was 10,149,386 as of September 4, 2024. No new shares are being issued by

the Company pursuant to this offering.

ABOUT

THIS PROSPECTUS

This

prospectus describes the general manner in which the Selling Shareholders identified in this prospectus may offer from time to time up

to 139,425,259 Ordinary Shares. If necessary, the specific manner in which the Ordinary Shares may be offered and sold will be described

in a supplement to this prospectus, which supplement may also add, update or change any of the information contained in this prospectus.

To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely

on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement

in another document having a later date—for example, any prospectus supplement—the statement in the document having the later

date modifies or supersedes the earlier statement.

GLOSSARY

OF DEFINED TERMS

In

this prospectus, unless otherwise indicated or the context otherwise requires, references to:

“ASCA”

means A SPAC I Acquisition Corp., a British Virgin Islands business company.

“A

SPAC I Mini Acquisition Corp.” means A SPAC I Mini Acquisition Corp., a British Virgin Islands business company.

“Business

Combination” means the transactions contemplated by the Merger Agreement, pursuant to which (i) ASCA reincorporated to the

British Virgin Islands by merging with and into the Company; and (ii) Merger Sub merged with and into Legacy NewGenIvf, resulting

in Legacy NewGenIvf being a wholly-owned subsidiary of the Company.

“BVI”

means British Virgin Islands.

“BVI

Act” means BVI Business Companies Act (As Revised).

“Class

A Ordinary Share” means Class A ordinary shares of the Company, no par value per share.

“Class

B Ordinary Share” means (x) the Company’s Class B ordinary shares with no par value per share, and (y) any shares into which

such ordinary shares shall have been changed or any shares resulting from a reclassification of such ordinary shares.

“Closing”

means the consummation of the Business Combination, which occurred on April 3, 2024.

“Company”

means NewGenIvf Group Limited, a British Virgin Islands business company, the surviving entity of the Business Combination.

“Legacy

NewGenIvf” means NewGenIvf Limited, a Cayman Islands exempted company, which became a wholly owned subsidiary of ASCA upon the

Closing.

“Merger

Agreement” means the Merger Agreement entered into on February 15, 2023, and as amended on June 12, 2023 and December 6, 2023,

between ASCA, A SPAC I Mini Acquisition Corp., Merger Sub, Legacy NewGenIvf, and certain shareholders of Legacy NewGenIvf, pursuant

to which the Reincorporation Merger and Acquisition Merger were consummated.

“Merger

Sub” means A SPAC I Mini Sub Acquisition Corp., a Cayman Islands exempted company and former wholly-owned subsidiary of A

SPAC I Mini Acquisition Corp.

“Memorandum

and Articles of Association” means the Company’s Amended and Restated Memorandum and Articles of Association, as and restated

on September 23, 2024.

“NewGenIvf”

means NewGenIvf Group Limited, a British Virgin Islands business company, the surviving entity of the Business Combination, unless the

context so requires.

“Ordinary

Shares” means the Class A Ordinary Shares.

“Preferred

Shares” means preferred shares of the Company, no par value per share.

“Reincorporation

Merger” means the first step of the Business Combination which occurred pursuant to the Merger Agreement, in which ASCA reincorporated

to the British Virgin Islands by merging with and into A SPAC I Mini Acquisition Corp.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should

consider before investing in our securities. Before you decide to invest in our securities, you should read the entire prospectus carefully,

including the “Risk Factors” section and the financial statements and related notes appearing at the end of this prospectus.

Unless

the context otherwise requires, all references in this Prospectus Summary to “NewGenIvf,” “we,” “our,”

and “us” refer to Legacy NewGenIvf and its subsidiaries as they existed prior to the Closing if described in relation to

a date prior to April 3, 2024. Any references to “NewGenIvf,” “we,” “our,” and “us” with

respect to the present time, a future time, or a date after April 3, 2024 refers to NewGenIvf, a British Virgin Islands company, and

its subsidiaries, whose existence continued after the Closing.

Overview

We

are an assisted reproductive services (“ARS”) provider in Asia-Pacific. Since the opening of our first clinic in Thailand

in 2014, we have established ourself as a long-standing ARS provider in this region. Our strategic presence in Thailand, Cambodia, and

Kyrgyzstan positions us to take advantage of opportunities across Asia-Pacific. According to China Insights Consultancy (“CIC”),

from 2014 to 2022, there was a rising number of women in the key ARS-targeted age group (ages 15 to 49) in Asia Pacific and a growing

trend towards later maternal age. The number of married women of reproductive age in Asia Pacific has risen from 816.4 million in

2014 to 833.2 million in 2022. Additionally, according to CIC, there was increasing social acceptance of ARS use in Asia Pacific

countries such as China, India, and Thailand during the same period. For example, the number of ARS users in China has risen from 136.8

thousand in 2017 to 184.9 thousand in 2022 approximately and that in Japan has risen from 98.0 thousand in 2017 to 128.5 thousand in

2022.

According

to CIC, the prevalence of infertility in Asia-Pacific developing countries is substantial. For example, the infertility rate in Thailand,

India and China was about 15.4%, 13.8% and 17.8%, respectively, in 2022. In India, the infertility rate in 2020 was approximately 13.1%,

representing an annual growth of 2.6%. The infertility rate in China was around 17.6% in 2020, representing an annual growth of 0.6%.

Infertility is increasingly gaining society’s attention as individuals are more openly discussing their struggles. Despite the

prevalence of infertility, access to treatment is often limited in the Asia Pacific region. According to CIC, financial challenges, costs

of treatment, and limited availability or capacity of fertility medical care are some of the main challenges in the fertility marketplace

in Asia-Pacific region. Religious, social and cultural roadblocks can also prevent hopeful couples from realizing their dream to have

children. We believe that we can help address some of these key challenges of Asia-Pacific fertility industry.

History and Development of the Company

Prior

to the Business Combination, on April 29, 2021, A SPAC I Acquisition Corp. (“ASCA”), was incorporated as a British Virgin

Islands business company, specifically a blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition,

share purchase, recapitalization, reorganization or similar business combination with one or more target businesses.

The Business

Combination

On

February 15, 2023, ASCA entered into the Merger Agreement (as amended on June 12, 2023 and December 6, 2023, the “Merger Agreement,”

and the transactions contemplated thereunder, the “Business Combination”) with A SPAC I Mini Acquisition Corp., Merger

Sub, NewGenIvf Limited, a Cayman Islands exempted company (“Legacy NewGenIvf”) and certain shareholders of Legacy NewGenIvf.

Pursuant to the Merger Agreement, the Business Combination was effected in two steps: (i) ASCA was reincorporated to the British

Virgin Islands by merging with and into A SPAC I Mini Acquisition Corp. (such transaction, the “Reincorporation Merger”);

and (ii) Merger Sub merged with and into Legacy NewGenIvf, resulting in Legacy NewGenIvf being a wholly-owned subsidiary of the

Company (such second step in isolation, the “Acquisition Merger”). The surviving entity of the Business Combination, together

with its subsidiaries is referred to in this prospectus as “NewGenIvf,” the “Company,” “we,” “our,”

or “us,” unless the context otherwise requires.

On

June 12, 2023, the parties to the Merger Agreement entered into the First Amendment to Merger Agreement (the “First Amendment”),

pursuant to which Legacy NewGenIvf agreed to provide non-interest bearing loans in an aggregate principal amount of up to $560,000 (the

“Loan”) to ASCA to fund any amount that would be required in order to further extend the period of time available for ASCA

to consummate a business combination and for ASCA’s working capital, payment of professional, administrative and operational fees

and expenses, and other purposes as mutually agreed by ASCA and Legacy NewGenIvf. Such loans were to become repayable upon the closing

of the Acquisition Merger. In addition, pursuant to the First Amendment, subject to receipt of at least $140,000 as part of the Loan

from NewGenIvf, ASCA agreed to waive its termination rights and the right to receive any break-up fee due to Legacy NewGenIvf’s

failure to deliver audited financial statements by no later than February 28, 2023.

On

December 6, 2023, the parties to the Merger Agreement entered into the Second Amendment to the Merger Agreement (the “Second Amendment”)

which amended and modified the Merger Agreement to, among other things, (i) reduce the size of NewGenIvf’s board of directors following

the consummation of the Business Combination to five (5) directors, two (2) of whom would be executive directors designated by NewGenIvf

and three (3) of whom will be designated by NewGenIvf to serve as independent directors in accordance with Nasdaq requirements, (ii)

provide for the conversion of NewGenIvf shares issued by NewGenIvf following the original date of the Merger Agreement into Class A Ordinary

Shares in connection with the Acquisition Merger, and (iii) remove the condition that ASCA have in excess of $5,000,000 in net tangible

assets immediately after the consummation of the Business Combination.

On

April 3, 2024, the Business Combination was consummated with the Company as the surviving entity.

NewGenIvf’s Business

With

a focus on providing fertility treatments to fulfil the dreams of building families, NewGenIvf mainly offers two services, namely: (i)

in vitro fertilization (“IVF”) treatment service, comprising traditional IVF and egg donation; and (ii) surrogacy and

ancillary caring services. Currently, we have three clinics: one clinic in Thailand, one clinic in Cambodia, and one clinic in Kyrgyzstan.

| |

● |

IVF treatment service: For the years ended December 31,

2023 and 2022, we generated approximately 78.3% and 47.4%, of its revenue from IVF treatments services. We primarily provide our

clients with conventional IVF/intracytoplasmic sperm injection (“ICSI”) and embryo transfer services. As technology has

progressively advanced, we have been able to, through technologies and facilities provided by MicroSort technology, help fulfill

the family-balancing dreams of its clients and avoiding certain gender-related hereditary diseases. IVF treatment involves the performance

of a series of medical treatment and procedures that are not separately distinct and only brings benefits to clients when embryo

is successfully implanted, therefore revenue from IVF treatment is recognized at a point in time when it is completed in clinic.

The completion of this treatment is evidenced by a written IVF report indicating successful embryo implantation. |

| |

● |

Surrogacy and ancillary caring services: We also generate revenue

from surrogacy services and related ancillary caring services in Kyrgyzstan. For the years ended December 31, 2023 and

2022, we generated approximately 21.7% and 52.6%, of our revenue from surrogacy and ancillary caring services. For surrogacy services,

NewGenIvf conducts implantation of embryos from biological parents in surrogate mothers. In addition, NewGenIvf provides a “success

guarantee” program for egg donation services in Cambodia and surrogacy services in Kyrgyzstan. Under this optional program,

patients pay additional fees of approximately 40% of the original price and can have repeated attempts of IVF cycles, egg donation

services and/or surrogacy services until the procedures are successful. The additional costs to NewGenIvf are generally limited and

amount to approximately 30% of the original costs because NewGenIvf’s clinics, together with the patients, can choose suitable

egg donors and surrogate mothers to limit the additional costs. During the pregnancy period, NewGenIvf provides ancillary caring

services including regular body check and provision of vitamins, supplements and medicines to surrogate mothers. Revenue from surrogacy

and ancillary caring services is recognized at a point in time when the surrogate mother gives birth. Surrogacy services provide

infertile couples with an alternative method of having children. |

For

the years ended December 31, 2023 and 2022, NewGenIvf’s revenue was US$5,136,153 and US$5,944,190, and its net income

was US$108,418 and US$135,847, respectively.

Market Opportunity

According

to CIC, NewGenIvf’s core market for fertility services is substantial and growing rapidly, driven by, among other things, societal

and cultural shifts, such as people starting families later in life and other health-related challenges which could impact couples’

and individuals’ ability to have children. In addition, NewGenIvf believes that continued overall de-stigmatization of infertility

will help drive better access to, and stronger demand for, fertility treatment services, thereby further enabling the expansion of NewGenIvf’s

addressable market. According to CIC, the market size of fertility treatments in Asia Pacific was increasing steadily and the potential

size of the Asia fertility market is expected to reach US$37.4 billion by 2030. NewGenIvf believes its market opportunity is substantial

and is continuing to grow as a result of the rising demand for fertility services, the lack of adequate offerings in the market and the

increasing awareness of the challenges of infertility.

Competitive Strengths

NewGenIvf

believes that the following competitive strengths have positioned it to meet growing opportunities in the fertility market across Asia-Pacific,

and have differentiated it from its competitors:

Broad-range

ARS Provider Offering Comprehensive Fertility Treatment Services

With

almost a decade of experience in the fertility market, NewGenIvf has built a reputation in the IVF industry in Asia-Pacific. NewGenIvf

has reinforced its long-standing position through expanding its service offerings and locations to address the evolving clients’

needs or requests.

NewGenIvf’s

comprehensive fertility treatment offerings in Thailand, Cambodia, and Kyrgyzstan, primarily including IVF, egg donation (in Cambodia)

and surrogacy services (in Kyrgyzstan), make it convenient for clients in Asia-Pacific market to have access to various fertility services

but with a relatively low cost, as compared with the US market. According to CIC, the average cost per IVF cycle in the US is around

US$12,000 (excluding medication), which is 65% higher than that of Asia-Pacific market. Meanwhile, the average cost per IVF cycle by

NewGenIvf is around US$7,000 (excluding medication). Each of NewGenIvf’s clinics in Thailand, Cambodia, and Kyrgyzstan has its

own specialty, and together, NewGenIvf is able to provide more flexibility and options to its patients. For example, NewGenIvf’s

Thailand clinic focus on IVF and related ancillary services including HIV sperm washing, egg freezing, and chromosome screening. The

clinic in Cambodia specializes in providing both IVF services and egg donation services. NewGenIvf opened the clinic in Kyrgyzstan in

2019, which broadened NewGenIvf’s services by being legally qualified/received approval letter from The Ministry of Health of Kyrgyzstan

to offer surrogacy services. As of December 31, 2023, NewGenIvf was the one of the few ARS providers in Kyrgyzstan and one of the few

companies in Kyrgyzstan that is licensed to offer surrogacy services in Kyrgyzstan.

NewGenIvf

attributes its track record of success to its experienced physicians and its ability to provide comprehensive ARS services, allowing

it to meet patients’ increasing demand for advanced, high-end, and sophisticated ARS, a higher standard and a wider range of advanced

services.

NewGenIvf

has extensive experience serving Asia-Pacific patients and a deep understanding of their general profiles. In particular, NewGenIvf has

personnel speaking multiple languages, including nurses, facilitators, and translators, who are familiar with the health condition and

culture of Asia-Pacific patients from different countries in the region. NewGenIvf believes that it is therefore well-positioned to benefit

from market growth driven by Asia-Pacific patients travelling to its clinics for treatment.

Attractive Market

with Significant Demand and Fast Growth

NewGenIvf

operates in the ARS market in Asia Pacific, positioning it to leverage on an attractive market with compelling underlying growth potential.

According to CIC, during the years ended December 31, 2021 and 2022, the ARS market in Asia Pacific has experienced growth

underpinned by long-term demographic and social trends. These trends include a rising demand for fertility services, the lack of adequate

offerings in the market and the increasing awareness of the challenges of infertility, according to CIC.

According

to CIC, the Asia Pacific ARS market is a large, multi-billion dollar industry growing at a strong pace of approximately 15% in 2022 as

increased awareness and acceptance of IVF and surrogacy services continue to drive demand. Additionally, according to CIC, the market

is underserved as a substantial percentage of patients in need of ARS treatments go untreated. The industry also remains constrained

in capacity, thereby creating challenges in providing access to ARS to the volume of patients in need. According to CIC, as of December 31,

2022, there were more than 213 million infertile couples in Asia Pacific. While there have been substantial increases in the use

of ARS, according to CIC, only approximately 1.47 million ARS cycles, including IVF, and other fertility treatments, were performed

in Asia Pacific in 2022. This amounts to less than 1.1% of the infertile couples in Asia Pacific being treated and only 0.7% having a

child though ARS in 2022, indicating significant unmet demand for ARS.

Asia-Pacific

fertility markets, in particular India and China, present a vast opportunity for ARS providers in the region. China’s ARS market

has been driven by an increasing rate of infertility, the implementation of the Three-Child Policy in May 2021, a decreasing number

of couples at childbearing age and increasing affordability and awareness of ARS, according to CIC. China’s ARS market size

in 2021 and 2022 was US$2,105 million and US$2,069 million, respectively, and is expected to further grow to US$2.3 billion

in 2023, according to CIC. India’s ARS market size increased from US$1.2 billion in 2021 to US$1.5 billion in 2022,

and is expected to grow further to US$1.6 billion in 2023, according to CIC. NewGenIvf believes that its existing market presence

and reputation in Thailand, Cambodia, and Kyrgyzstan well positions it to capitalize on the fast-growing Asia-Pacific fertility market.

According

to CIC, the significant entry barriers in Asia-Pacific ARS industry are expected to continue to constrain supply in the industry. The

industry is heavily regulated and a significant number of stringent requirements must be satisfied in order to obtain relevant licenses

to conduct IVF, egg donation and surrogacy procedures in the relevant countries. NewGenIvf believes that such barriers to entry can help

it maintain its market position in Asia Pacific as the fertility market in the region continues to expand.

Built

on years of experience, NewGenIvf has established a strong reputation in its industry, which in turn attracted potential business partners

to approach NewGenIvf to negotiate cooperations and referrals. Over the years, NewGenIvf sends representatives to medical expos mostly

held in the PRC to approach potential business partners and establish new partnerships by entering into agency agreements with each agent.

NewGenIvf has become a significant partner with approximately 90 fertility service agents in China as well as in India. Normally, each

agency agreement has a maximum term of one year, which is renewable upon mutual agreement. Agents typically market and promote NewGenIvf’s

services by word-to-mouth referrals and other measures and NewGenIvf pays the agents commission at a range of 10% to 25% of the treatment

fees upon the completion of client’s treatment. Normally, agents provide potential clients’ contact information to the sales

team of NewGenIvf, who then approach potential clients and provide consultation on services. Overall, approximately 50% of NewGenIvf’s

patients are referrals from agents, among which approximately 80% are referrals from China and the remaining 20% from India, whereas

the remaining 50% of NewGenIvf’s patients are patients who contact NewGenIvf directly through its websites from social media promotions.

With its partnerships in various countries, NewGenIvf believes it is able to better benefit from the growing market opportunities.

Exclusively Licensed Technology for

Family Planning and Access to Mature Fertility Technologies

NewGenIvf

believes that its licenses and/or access to mature technologies contribute to its ability to identify and tailor ARS services to individual

patient’s needs. These technologies include:

| |

● |

MicroSort Technology: NewGenIvf holds an exclusive license granted

by a division of the Genetics and IVF Institute, to use MicroSort technology in Thailand and Cambodia, which is a form of pre-conception

gender selection technology for humans. MicroSort technology aims to separate male sperm cells based on which gender chromosome they

contain, which results in separated semen samples that contain a higher percentage of sperm cells that carry the same gender chromosome.

The technology ultimately helps couples choose the gender of their future child by choosing semen samples that predominately contain

sperm with the X chromosome for a female or Y chromosome for a male. Traditionally and naturally, gender selection occurs after

conception, meaning after the eggs are fertilized. As a result, some fertilized eggs will go unused. However, with MicroSort technology,

NewGenIvf is able to increase the ratio of male or female embryos, based on the patient’s preference. Eggs are more likely

to be fertilized according to the preferences of the parents. Other improvements that MicroSort treatment could help achieve include

prevention of certain gender-related hereditary diseases. As of December 31, 2023, NewGenIvf was one of the only seven exclusive

license holders of MicroSort technology world-wide. |

| |

● |

Preimplantation Genetic Screening (“PGS”): PGS is

used in parallel with an IVF treatment cycle. PGS is the practice of determining the presence of aneuploidy (either too many or too

few chromosomes) in a developing embryo. PGS improves success rates of in vitro fertilization by ensuring the transfer of euploid

embryos that have a higher chance of implantation and resulting in a live birth. PGS has improved clinical outcomes for NewGenIvf

by achieving a higher implantation rate of 70.9% and reducing miscarriage rates by 26.6%. |

| |

● |

Next-Generation Sequencing (“NGS”): NGS is a high-throughput

technology for determining the sequence of deoxyribonucleic acid (“DNA”) or ribonucleic acid (“RNA”) to study

genetic variation associated with diseases or other biological phenomena. NGS determines the sequence of a sample all at once by

using parallel sequencing. Traditional Sanger sequencing determines the sequence of a sample one section at a time. Sequencing thousands

of gene fragments simultaneously with NGS reduces time and cost associated with sequencing and increases the coverage quality and

data output. |

| |

● |

Preimplantation Genetic Diagnosis (“PGD”): Similar

to PGS, PGD is also used in parallel with an IVF treatment cycle. But PGD is a process more enhanced than PGS since it scans for

individual genes. PGD is the practice of evaluating embryos for specific genetic abnormalities, such as sickle cell disease or cystic

fibrosis, where carrier status has been documented in each of the parents. By using this technique, physicians are able to check

the genes or chromosomes for a specific genetic condition. PGD can decrease the risk of miscarriage and this technology can help

women better achieve a healthy pregnancy. Individuals who suspect or know they carry genes for serious medical conditions may opt

to screen for healthy embryos ahead of time. |

Well Established Brand with Reliable

Reputation

The

founders of NewGenIvf entered the fertility market as agents in 2011 by introducing patients in need to a Thailand clinic for fertility

treatments. The founders of NewGenIvf started to operate their own clinic in Thailand in 2014 and subsequently added clinics in Cambodia

and Kyrgyzstan. Since then, NewGenIvf has attracted clients from countries throughout Asia-Pacific, including Mainland China, Hong Kong,

India, Thailand, Australia and Taiwan.

NewGenIvf

benefits from the favourable geographic locations of its clinics, especially its clinic in Thailand. Located in central Bangkok and situated

in one of the biggest shopping malls of the city, the clinic is located in close proximity to various transportation facilities and popular

tourist attractions, such as the Erawan Shrine. In this regard, NewGenIvf believes that its business has benefited from, and will continue

to benefit from, the convenience of its locations.

NewGenIvf

has developed a relatively replicable and scalable operating model that supports high productivity at its assisted reproductive medical

facilities in Asia. Under this model, NewGenIvf’s medical facilities have established standardized operating procedures to select

the treatment process according to each patient’s profile. NewGenIvf’s medical and operational personnel are organized into

specialized teams according to the different stages of the treatment process and different patient profiles. When patients are initially

admitted or would like to seek additional medical services later on, they are assigned to one of the optimal medical teams, which NewGenIvf

believes is better suited after taking into account the patient’s diagnosis and preferences. NewGenIvf believes that this model

allows each team to improve its efficiency and arrange suitable physicians for patients.

The

physicians of NewGenIvf have also developed and employed an operating model that seeks to increase the effectiveness of physicians by

utilizing standardized workflows and operating procedures with teams of supporting nurses and medical assistants. This helps to increase

the number of IVF treatment cycles that physicians can perform while providing treatment customized based on patient conditions.

With

its established client service history, accumulated experience as well as its continuous upgrades and development of treatment models,

NewGenIvf believes that it will be able to better monetize its brands through its business.

Experienced

Management Team

The

NewGenIvf management team has considerable experience in the ARS market and the broader healthcare industry. A considerable number of

NewGenIvf’s management are physicians or laboratory technicians who possess extensive experience in the ARS industry and are experts

in their respective fields. NewGenIvf’s Chief Executive Officer, Mr. Alfred Siu, has more than 13 years of experience

in the fertility service market. Dr. Wiphawee Luangtangvarodom had over 8 years of experience as an obstetrician and gynecologist.

NewGenIvf’s two lab supervisors, Ms. Anussara Phinyong, and Ms. Araya Boonchaisitthipong, each had over eight years of experience

in the embryologist field. These individuals have extensive experience in managing assisted reproductive medical facilities. NewGenIvf

is also led by other members of the professional management team, who are intimately involved in the operational and financial management

of NewGenIvf’s Group. Leveraging their experience, NewGenIvf believes that it is well positioned to expand its network and aims

to become a leader in the Asia Pacific ARS market.

Strategies

NewGenIvf’s

vision is to provide tailored ARS solutions to fulfil patients’ dreams of becoming a parent. To realize this vision, NewGenIvf

plans to adopt the following strategies:

Offer Broad

Fertility Services for Fertility Tourists across Asia Pacific

NewGenIvf

intends to provide broad fertility services for fertility tourists seeking high quality, cost effective and comprehensive fertility solutions.

According to CIC, the demand for fertility tourism is driven by a variety of factors including the prevalence of infertility, the introduction

of the Three-Child policy in China, the improved understanding of assisted reproductive technology and increased affordability of ARS. To

address these needs, NewGenIvf plans to offer its customers a “hassle-free”, seamless and integrated ARS and hospitality

arrangement experience. To complement its fertility services, NewGenIvf intends to integrate its offerings with additional services for

traveling patients, most of whom are first-time fertility tourists, such as translation service, hotel arrangement and airport pickup

services. NewGenIvf plans to enhance its customers’ experience by entering into exclusive cooperation arrangements with local premium

hospitality providers.

Furthermore,

NewGenIvf expects the easing of COVID-19 travel restrictions to contribute to an increase in tourists seeking fertility services. According

to CIC, the COVID-19 pandemic led to a delay in many patients’ plans for fertility treatments, with travel restrictions and border

closures impacting their ability to access care. On May 5, 2023, the WHO Director-General Dr. Tedros Adhanom Ghebreyesus announced

that COVID-19 no longer constituted a public health emergency of international concern. The pent-up demand for these services is expected

to be released with the lifting of the travel restrictions, leading to a surge in patients seeking fertility treatment. NewGenIvf’s

believes that its strategy of offering a comprehensive approach to fertility treatments will help it capture a share of the growing market

for fertility tourism in Asia Pacific.

Continue to Invest in Laboratories

and Facilities

NewGenIvf

believes laboratories and treatment facilities are critical to supporting its future research, development and clients experience. NewGenIvf

currently operates two laboratories that offer IVF services, one in Thailand and one in Cambodia, and plans to continue to scale up its

existing laboratories. NewGenIvf plans to continue to invest in upgrading its laboratories and facilities to complement its growth and

expansion, which it believes will help NewGenIvf maintain an edge over its competitors with regard to technology, operational efficiency,

scalability, and client experience.

NewGenIvf

intends to develop advanced facilities for its existing laboratories, which will be conducting research on ARS related basic science

and experiments relating to emerging technologies to improve ARS success rates and lower costs. NewGenIvf also plans to correlate its

data on patient treatment protocols to the embryo physiologic data and the pregnancy success rate-related data to identify better treatment

protocols to increase ARS success rates. NewGenIvf intends to continue to actively promote technological cooperation with tertiary institutions

to discover ways to improve its IVF success rates. Furthermore, NewGenIvf seeks to actively deploy the technology that it possesses to

expand the services it provides.

NewGenIvf

has accumulated experience in treating patients over 40 years old with premature ovarian failure and patients who have had recurrent

ARS implementation failure, by, for the example, injecting platelet rich plasma into the ovaries to stimulate and support growth of the

follicles. NewGenIvf is also implementing certain technological advancements relevant to the ARS industry, including microfluidics, automated

sperm analysers, time lapsed incubators, non-invasive preimplantation genetic testing (“PGT”) of cell-free DNA in spent media,

automated systems for oocyte/embryo vitrification to reduce reagent consumption and decrease labor intensity, mitochondria replacement

therapy to reconstruct oocytes by nuclear transfer of polar body genome from an MII oocyte into an enucleated donor MII cytoplasm, to

increase the number of oocytes available for the treatment of infertile women, preimplantation methylome screening. There are also breakthrough

developments in science including organ culture systems, induced pluripotent stem cells, embryonic stem cells, spermatogonial stem cells

for creation of functional gametes, but these techniques are not yet ready for human clinical trials.

NewGenIvf

also intends to develop clinically customised interior design concepts for its medical facilities, including improved service rooms,

consultation rooms, reception areas, nutrition food areas, and traditional Chinese medicine (such as acupuncture) facilities.

Increase Brand Awareness and Market

Share

NewGenIvf

intends to maintain and strengthen its brand awareness and market share in Asia Pacific. In order to expand its reach and increase patient

numbers, NewGenIvf plans to collaborate with local hospitals, companies, premium hospitality providers and other key players in the ARS

industry in Asia Pacific. Additionally, NewGenIvf intends to increase brand awareness through social media promotions and marketing initiatives,

and establishing its business development team with the goal of attracting new patients and partners across Asia Pacific. Meanwhile,

NewGenIvf intends to provide innovative treatment services to attract more clients. For example, NewGenIvf plans to introduce IVF mental

health services, which allows clients who fail in IVF treatments to access online consultation for further treatment plans such as egg

donation and surrogacy. These new treatments services aim to enable NewGenIvf to attract potential clients. By adopting a comprehensive

strategy to expand its market share, NewGenIvf aims to strengthen its reputation as a long-standing ARS provider and capture additional

market share of the growingly ARS market in Asia-Pacific.

Expand Service Reach Through Acquisitions

and Partnerships

Leveraging

its reputation and footprint in its current markets, NewGenIvf intends to expand its reach, services offering and client base through

strategic acquisitions and/or partnerships in Asia Pacific. Acquisitions of or by companies offering similar services could not only

allow NewGenIvf to diversify its client base, but also allow it to benefit from potential economies of scale and increasing efficiency

through consolidation. NewGenIvf could also leverage the acquired or acquiring company’s customer base, reputation and expertise

to further improve its offerings and operations. NewGenIvf intends to focus on ARS providers in Asia Pacific which possess all conventional

licenses and locally recognized brands. For the global market beyond Asia Pacific, NewGenIvf intends to expand its footprint through

partnerships with other IVF clinics.

In

addition, NewGenIvf plans to explore expanding its client base by offering its fertility services as part of corporate benefit programs

in Asia. NewGenIvf believes that there is potential in Asia in offering fertility treatments as a benefit for employees, particularly

in companies with a large number of female employees of childbearing age. By partnering with corporate clients to provide fertility benefits,

NewGenIvf can increase its market reach, enhance its brand reputation, and drive client growth. NewGenIvf’s broad range of fertility

services, including IVF and egg freezing, can help corporate partners differentiate their employee benefits in the competitive employment

landscape, which could make them more attractive to potential employees. Additionally, by offering these services, companies can help

address the growing concern of delayed childbearing, which is becoming more common among women according to CIC. NewGenIvf plans

to collaborate with potential corporate clients to develop customized fertility benefit programs that cater to their specific needs,

and to provide comprehensive support and counselling throughout the process.

Meanwhile,

NewGenIvf also intends to attract more clients by establishing its “home country gynecologist partnership program”. Under

the program, NewGenIvf may, subject to its discretion and screening process, offer treatment services to clients with reduced time requirements

to be spent overseas. Depending on local laws, the potential clients may be able to complete their treatments with gynecologists NewGenIvf

partners with, in their home countries.

NewGenIvf

had entered into a non-binding term sheet dated June 3, 2024 (the “Term Sheet”) with COVIRIX Medical Pty Ltd (“COVIRIX”)

for a proposed reverse merger (the “Proposed Transaction”). However, on September 21, 2024, COVIRIX withdrew from the Proposed

Transaction, as such the Proposed Transaction was terminated with no cost to the Company.

Business Model

With

a focus on providing fertility treatments to fulfil couples and individuals’ dreams of raising children, NewGenIvf offers mainly

two services, namely: (i) IVF treatment service, comprising traditional IVF and egg donation; and (ii) surrogacy and ancillary

caring services. The following table sets forth NewGenIvf’s revenue by service offerings and as a percentage of total revenue for

the periods indicated:

| | |

For

the Year ended December 31, | |

| | |

2023 | | |

2022 | |

| | |

US$ | | |

% | | |

US$ | | |

% | |

| IVF Treatment Service | |

| 4,021,696 | | |

| 78.3 | | |

| 2,819,163 | | |

| 47.4 | |

| Surrogacy

and Ancillary Caring Services | |

| 1,114,457 | | |

| 21.7 | | |

| 3,125,027 | | |

| 52.6 | |

| Total

Revenue | |

| 5,136,153 | | |

| 100.0 | | |

| 5,944,190 | | |

| 100.0 | |

IVF Treatment Service

NewGenIvf

primarily provides its clients with conventional IVF/ICSI and embryo transfer services. NewGenIvf is also able to, through MicroSort

technology, help fulfill the family-balancing dreams of its clients and avoiding certain gender-related hereditary diseases.

IVF

treatments that NewGenIvf provides address tubal factor, ovulatory dysfunction, diminished ovarian reserve, endometriosis, uterine factor,

male factor, unexplained infertility and other causes. IVF bypasses the function of the fallopian tube by achieving fertilization within

a laboratory environment. Ovarian hyper-stimulation is common with IVF treatments to recruit numerous follicles to increase the chances

for success. Follicles are retrieved trans-vaginally using a vaginal probe and ultrasound guidance. Anaesthesia is frequently used due

to the number of follicles retrieved and the resulting discomfort experienced by the patient. The eggs are identified in the follicular

fluid and combined with sperm and culture medium in culture dishes, which are placed in an incubator with a temperature and gas environment

designed to mimic the condition of the fallopian tubes. Once the embryos develop, typically over a 3-to-5-day period, they are transferred

to the uterine cavity. According to CIC, the average clinical pregnancy success rates, using 5-day incubation, averaged approximately

64.6% (with no PGT) for IVF, with live birth rate at approximately 28.7%.

As

a long-standing IVF treatments provider in Asia-Pacific, NewGenIvf had completed over 4,000 cycles of IVF treatments from 2014 to 2023.

For the years ended December 31, 2023 and 2022, the revenue from NewGenIvf’s IVF treatments was US$4,021,696 and US$2,819,163,

respectively, representing 78.3% and 47.4% of its total revenue in the corresponding periods.

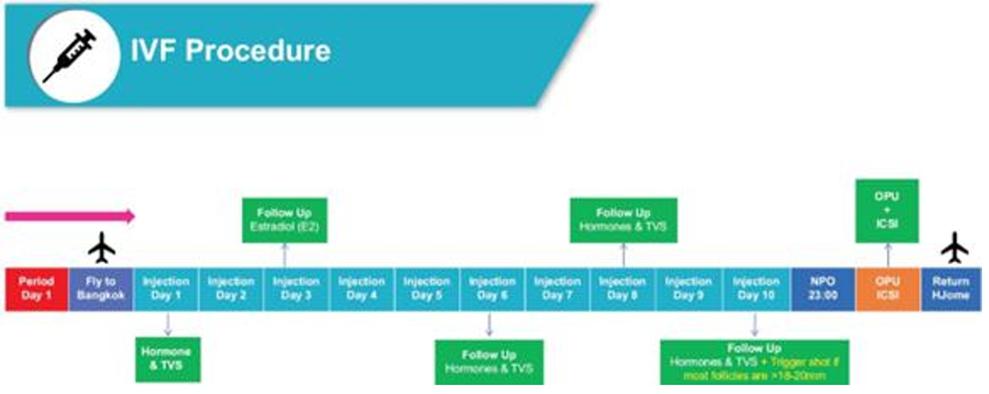

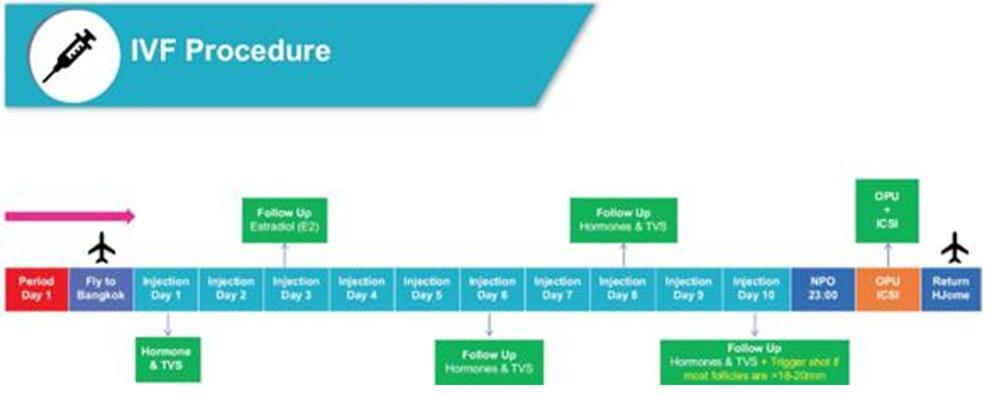

IVF Treatments Process

A

typical IVF treatment process mainly includes two stages, the pre-IVF treatment stage and the IVF treatment stage. During the IVF treatment

process, NewGenIvf also provides support services such as nutrition guidance and psychological counselling. The flow chart below shows

the stages involved in a typical IVF treatment process:

At

the pre-IVF treatment stage, clients attend an initial consultation, undergo pre-IVF tests, and undergo treatment for gynaecological

and andrological diseases, if needed. At the initial consultation, a physician reviews the clients’ detailed medical history to

collect more information relating to the potential cause of their infertility. The client then undergoes various pre-IVF tests, which

may include, among other things, blood pressure, hormone level, ultrasound, infectious disease screening, uterine evaluation and male

fertility test. The physician will then design treatment plans based on the client’s medical history and results of the tests.

If the client is satisfied with treatment plan and the test results are acceptable to the physician, the physician will prescribe medications

and start stimulation treatment.

The

first step of the cycle is to boost egg production through injecting synthetic hormones. Over about one week of ovarian stimulation,

clients are monitored on a regular basis with blood test and transvaginal ultrasound. If follicles have reached at least 10 mm in size,

an additional antagonist drug will be added into the daily injection schedule. This is used to prevent ovulation before ovum pickup time.

After another few days of ovarian simulation, if follicle growth is consistent and majority of follicles are around 16 mm to 17

mm, the final injection of a human chorionic gonadotropin will be administered. The trigger injection is the final step of the stimulation

process and is for the maturation of the eggs in the follicles before they are collected. The next major step is to retrieve the eggs

with a minor surgical procedure called Trans Vaginal Follicle Aspiration conducted under anaesthesia. At the same time the male partner

collects the sperms for fertilizing the eggs in the laboratory by a process known as intracytoplasmic sperm injection. The fertilized

embryos are cultured in the laboratory for two to six days. Embryos that grow well are biopsied and tested by PGT to detect potential

genetic diseases.

The

final step is to transfer the embryos into the uterus using a catheter. Within eight days after the embryo transfer, a blood test

can be conducted to detect whether the implantation was successful.

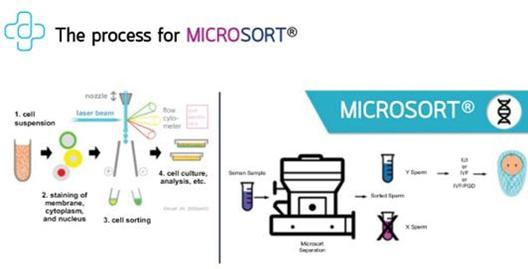

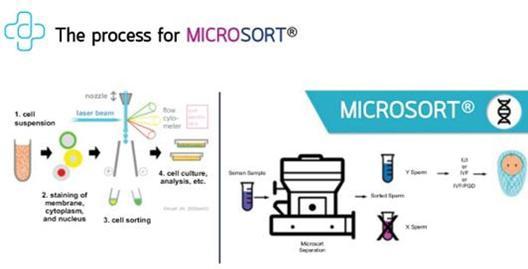

MicroSort Technology

MicroSort

technology is a preconception process developed by the Genetics and IVF Institute, Inc. that aims to improve the chances that the baby

to be conceived will be of the desired gender and prevents certain gender-related hereditary diseases.

Semen

samples usually contain equal amounts of sperm carrying the Y chromosome (which will produce a boy), and sperm carrying the X chromosome

(which will produce a girl). During the MicroSort process, the sperm sample is washed to remove seminal liquid and nonmotile cells. After

the washing, the sample is stained with a special fluorescent material that attaches to the DNA contained in the sperm. The stained sperm

cells are analyzed one by one by a flow cytometer, in which cells pass through a laser to make the stain attach to the DNA fluoresce.

The sperm containing the X chromosome (which have more DNA and therefore more stain) will shine brighter than the sperm containing

the Y chromosome. The flow cytometer uses a special software to identify X and Y chromosome sperm based on their fluorescence

signature. The sperm carrying the chromosome that will produce the desired gender are separated from the rest of the sample -resulting

in an enriched sperm sample ready for use.

NewGenIvf

holds an exclusive license granted by a division of the Genetics and IVF Institute, MicroSort International, to use the MicroSort technology

in Thailand and Cambodia. MicroSort licenses for NewGenIvf’s operation in Thailand and Cambodia are each provided under a lease

and service agreement. In April 2019, First Fertility PGS entered into a Lease and Services Agreement with MicroSort International to

use MicroSort equipment in Thailand and in March 2019, Phnom Penh Center entered into a Lease and Services Agreement with MicroSort International

to use MicroSort equipment in Cambodia (together, the “Lease and Services Agreements”). Pursuant to the Lease and Services

Agreements, First Fertility PGS and Phnom Penh Center each has the exclusive right to utilize the MicroSort equipment and to market and

sell MicroSort sperm sorting services in Thailand and Cambodia, respectively. MicroSort International is responsible for the maintenance

of MicroSort equipment and technical and engineering support. The term of each Lease and Service Agreements is initially from 2019 to

2024, which shall be automatically renewed for one year unless a written notice of at least 180 days prior to the intended termination

date is provided. The consideration under each of the Lease and Services Agreements is US$9,000 per month after six months from the effective

date of the agreements. MicroSort International was entitled to a down payment of US$15,000 per agreement and the aggregated amounts

received by it under the agreements was US$328,500. During the term of each lease and service agreement, MicroSort grants NewGenIvf the

exclusive right in that country to utilize the MicroSort equipment and market MicroSort services. The term of each lease and service

agreement is initially from 2019 to 2024, which shall be automatically renewed for one year unless a written notice at least 180 days

prior to the intended termination date is provided. The flow chart below shows the process involved in MicroSort:

Preimplantation Genetic Screening

PGS

is used in parallel with an IVF treatment cycle. PGS is the practice of determining the presence of aneuploidy (either too many or too

few chromosomes) in a developing embryo. PGS improves success rates of in vitro fertilization by ensuring the transfer of euploid embryos

that have a higher chance of implantation and resulting in a live birth. PGS has improved clinical outcomes for NewGenIvf by achieving

a higher implantation rate of 70.9% and reducing miscarriage rates by 26.6%.

Next-Generation

Sequencing

NGS

is a high-throughput technology for determining the sequence of deoxyribonucleic acid DNA or RNA to study genetic variation associated

with diseases or other biological phenomena. NGS determines the sequence of a sample all at once by using parallel sequencing. Traditional

Sanger sequencing determines the sequence of a sample one section at a time. Sequencing thousands of gene fragments simultaneously with

NGS reduces time and cost associated with sequencing and increases the coverage quality and data output.

Preimplantation Genetic Diagnosis

Similar

to PGS, PGD is also used in parallel with an IVF treatment cycle. But PGD is a more enhanced process than PGS since it scans for individual

genes. PGD is the practice of evaluating embryos for specific genetic abnormalities, such as sickle cell disease or cystic fibrosis,

where carrier status has been documented in each of the parents. By using this technique, physicians are able to check the genes or chromosomes

for a specific genetic condition. PGD can decrease the risk of miscarriage and this technology can help women achieve a healthy pregnancy.

Individuals who suspect or know they carry genes for serious medical conditions may opt to screen for healthy embryos ahead of time.

Surrogacy and Ancillary Caring

Services

NewGenIvf

also generated revenue from surrogacy services and related ancillary caring services in Kyrgyzstan. NewGenIvf conducts implantation of

embryos from biological parents in surrogate mothers. During the pregnancy period, NewGenIvf provides ancillary caring services including

regular body check and provision of vitamins, supplements and medicines to surrogate mothers. Revenue from surrogacy and ancillary caring

services is recognized when the surrogate mother gives birth. Surrogacy services provide infertile couples with an alternative method

of having children. In general, NewGenIvf provides certain discount to clients if they wish to pursue additional services such as egg

donation and surrogacy, after several cycles of IVF treatments failures due to medical reasons including, but not limited to, the poor

egg quality of aged female clients.

As

compared to other countries, Kyrgyzstan has the following features that allow NewGenIvf to operates its surrogacy services: (i) surrogacy

is legal and regulated, which means that there are less restrictions on either intended parents or surrogate mothers, and a parent-child

relationship can be requested before the child’s birth; and (ii) the costs of operation and surrogate mother is favourable,

given the cost of living in Kyrgyzstan is relatively low.

In

addition to the regular surrogacy services, NewGenIvf is also able to assist the clients with birth certificate applications and facilitate

the application of infants’ passports and visas as supplemental services.

For

the years ended December 31, 2023 and 2022, the revenue from NewGenIvf’s surrogacy and ancillary caring services was

US$1,114,457 and US$3,125,027, respectively, representing 21.7% and 52.6% of its total revenue in the corresponding periods.

The

flow chart below shows the stages involved in a typical surrogacy process:

In

Kyrgyzstan, NewGenIvf also provides ancillary fertility services when carrying out surrogacy services. These ancillary fertility services

include: (i) maternity caring service, and (ii) documentation service.

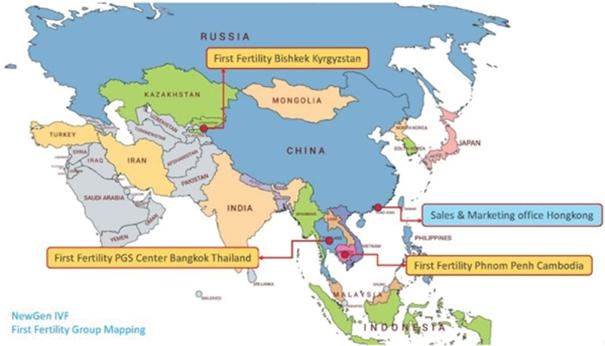

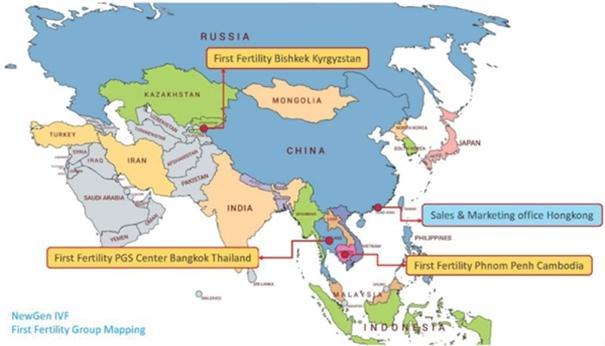

Network of Facilities

As

of December 31, 2023, NewGenIvf had one marketing and sales support office located in Hong Kong and three clinics located in Thailand,

in Cambodia, and in Kyrgyzstan, respectively. The integration of the medical facilities in Thailand help NewGenIvf provide a more seamless

one-stop experience to its clients. Set out below is an illustration of the locations of NewGenIvf’s clinics and marketing and

sales office:

The

following table sets forth the approximate aggregate average gross floor area (“G.F.A.”) of each of NewGenIvf’s

clinics that were under lease and actively used for client service as of December 31, 2023:

| | |

As

of

December 31,

2023 | |

| | |

(Square

Feet) | |

| Thailand | |

| |

First Fertility

PGS Center Co., Ltd.

(“First Fertility PGS Center”) | |

| 14,750 | |

| | |

| | |

| Cambodia | |

| | |

First Fertility Phnom Penh

Center

(“Phnom Penh Center”) | |

| 18,567 | |

| | |

| | |

| Kyrgyzstan | |

| | |

First Fertility Bishkek

Limited Liability Company

(“First Fertility Bishkek”) | |

| 2,368 | |

| | |

| | |

| Aggregate

G.F.A | |

| 35,685 | |

To

increase the scale of NewGenIvf’s operations, NewGenIvf expanded its Thailand fertility services by leasing a new property for

its second clinic Erawan Consultation Clinic in May 2023. Consisting of approximately 2,500 sq. ft., Erawan Consultation Clinic

is expected to open in 2024.

Currently,

IVF treatments are performed in its Thailand and Cambodia clinics, egg donation services are provided in its Cambodia clinic, and surrogacy

services are provided in its Kyrgyzstan clinic. The following table summarises the services available at NewGenIvf’s clinics:

| | |

IVF

Treatments | |

Surrogacy

Services |

| Thailand | |

| |

|

| First Fertility PGS Center | |

√ | |

× |

| | |

| |

|

| Cambodia | |

| |

|

| Phnom Penh Center | |

√ | |

× |

| | |

| |

|

| Kyrgyzstan | |

| |

|

| First Fertility Bishkek | |

× | |

√ |

The

following table sets forth a breakdown of revenue from services performed at NewGenIvf’s medical centers for the periods indicated:

| | |

For

the Year ended December 31, | |

| | |

2023 | | |

2022 | |

| | |

US$ | | |

% | | |

US$ | | |

% | |

| HK SAR | |

| 34,038 | | |

| 0.7 | | |

| — | | |

| — | |

| Thailand | |

| 1,356,903 | | |

| 26.4 | | |

| 505,609 | | |

| 8.5 | |

| Cambodia | |

| 621,619 | | |

| 12.1 | | |

| 377,608 | | |

| 6.4 | |

| Kyrgyzstan | |

| 3,123,593 | | |

| 60.8 | | |

| 5,060,973 | | |

| 85.1 | |

| Total

Revenue | |

| 5,136,153 | | |

| 100.0 | | |

| 5,944,190 | | |

| 100.0 | |

Thailand Clinic

As

of December 31, 2023, NewGenIvf had one clinic in Thailand. At the clinic in Thailand, NewGenIvf offers its clients customized fertility

treatment solutions including IVF/ICSI, embryo culture, hormonal blood tests, infectious diseases tests, chromosome screening by PGT,

hysteroscopy, sperm analysis, sorting, washing and freezing, and egg freezing. Its medical and operational personnel are organized into

specialized teams according to the different stages of the IVF treatment process and different patient profiles. When clients are admitted,

they are assigned to a team which NewGenIvf believes is better suited the clients after taking into account the clients’ diagnosis

and preferences. Furthermore, NewGenIvf also provides related value-added services such as nutrition guidance, psychological counselling,

acupuncture, and translation interpreters to supplement the IVF treatment. NewGenIvf prides itself on providing quality and customized

treatment to its clients on a day-to-day basis.

As

of December 31, 2023, the clinic in Thailand had six nurses, 8 full time lab physicians and embryologists, 14 administrative staff, totaling

28 staff members.

Cambodia Clinic

NewGenIvf

has one clinic, Phnom Penh Center, in Cambodia. Phnom Penh Center is staffed with one Cambodian physician, three embryologists, five

nurses and twelve other staff, and offers similar IVF treatments as in Thailand and egg donation services. Phnom Penh Center operates

under a license issued by Cambodia MOH for the Cambodian physician, who has entered into an agreement with Phnom Penh Center for the

exclusive use of such license.

After

eight years of development since its opening in 2015, Phnom Penh Center has become one of the long-standing ARS providers in Cambodia.

According to CIC, it was the first to use conventional IVF technology which led to a successful birth in 2016 in Cambodia. Since its

establishment, Phnom Penh Center achieved more than 1,600 IVF treatment cycles as of December 31, 2023. As of December 31, 2023, Phnom

Penh Center’s IVF philosophy concentrates on three key points in the treatment process: the mother’s wellbeing, the technology

used to assist mothers deliver a strong and healthy baby and the medical science used to ensure every chance of success for women in

various age spectrums.

Clinic in Kyrgyzstan

NewGenIvf

established First Fertility Bishkek in October 2019 in Kyrgyzstan for its surrogacy services, as Kyrgyzstan has supply of surrogate

candidates at a relatively low cost and a more friendly legal environment for surrogacy services. In 2020, First Fertility Bishkek obtained

the license to provide ARS and surrogacy services, becoming one of the few facilities licensed to offer ARS and one of the facilities

licensed to offer surrogacy services in Kyrgyzstan as of December 31, 2023, according to CIC. In addition, NewGenIvf also provide

related ancillary fertility services when carrying out surrogacy services. These ancillary fertility services include: (i) maternity

caring service, and (ii) documentation service.

Physicians

at First Fertility Bishkek have expertise in sourcing surrogate mothers, techniques of embryo transfers, prenatal care, baby delivery,

and postnatal care. First Fertility Bishkek also collaborates closely with Phnom Penh Center in arranging shipment of frozen embryos.

NewGenIvf hires local physicians and local staff. NewGenIvf also provides training for newly admitted Kyrgyzstan physicians and embryologists

in Thailand. Some personnel who had relevant experience in Kyrgyzstan had also been sent from Cambodia to Kyrgyzstan to help manage such

operations from time to time.

As

of December 31, 2023, First Fertility Bishkek had one full-time physician, one embryologist, two nurses, and ten other staff.

Professionals

Licensed Physicians

As

of December 31, 2023, NewGenIvf contracted with five licensed physicians, among which one was based in Cambodia and the other four were

based in Thailand. Most of NewGenIvf’s physicians had over 10 years of experience or above. The following table summarises

the number and types of such licensed physicians as of December 31, 2023.

| Country |

|

Licensed physician |

|

Licenses

and

Approvals |

|

Effective Period |

|

Issuing

Authority |

| Cambodia |

|

Mr. Keut Serey |

|

Decision on permission for beauty treatment operation |

|

December 14, 2022 – December 14, 2026 |

|

The Ministry of Health of Cambodia |

| Thailand |

|

Dr Patsama Vichinsartvichai |

|

Medical Facility Operating License number 288006 |

|

August 12, 2022 – December 31, 2023 |

|

The Ministry of Health of Thailand |

| |

|

|

|

Number 30920 Medical Practitioner License |

|

April 1, 2004 – Indefinite |

|

The Ministry of Health of Thailand |

| |

|

|

|

Number 26443/2556 Reproductive Medicine Diploma |

|

July 1, 2013 – Indefinite |

|

Medical Council of Thailand |

| |

|

|

|

Certificate number obscured OB-Gyn License |

|

October 13, 2010 – Indefinite |

|

Medical Council of Thailand |

| Thailand |

|

Dr Keatthisak Boonsimma |

|

Number 31801 Medical Practitioner License |

|

April 1, 2005 – Indefinite |

|

Royal Thai College of Obstetricians and Gynaecologists of Thailand |

| |

|

|

|

Number 22624/2554 OB-Gyn License |

|

July 1, 2014 – Indefinite |

|

Medical Council of Thailand |

| |

|

|

|

Number 40962/2563 Reproductive Medicine Diploma |

|

July 1, 2020 – Indefinite |

|

Medical Council of Thailand |

| Country |

|

Licensed physician |

|

Licenses and

Approvals |

|

Effective Period |

|

Issuing

Authority |

| Thailand |

|

Dr Seree Teerapong |

|

Number 15231/2564 Reproductive Medicine License |

|

July 1, 2021 – Indefinite |

|

Medical Council of Thailand |

| |

|

|

|

Number 4576/2533 OB-Gyn License |

|

July 12, 1990 – Indefinite |

|

Medical Council of Thailand |

| |

|

|

|

Number 11544 (replacement) Medical Practitioner License |

|

April 12, 1984 – Indefinite |

|

Medical Council of Thailand |

| Thailand |

|

Dr Wiphawee Luangtangvarodom |

|

Number 38347/2562 OB-Gyn License |

|

August 1, 2019 – Indefinite |

|

Medical Council of Thailand |

| |

|

|

|

Number 43217/2564 Reproductive Medicine License |

|

July 1, 2021 – Indefinite |

|

Medical Council of Thailand |

| |

|

|

|

Number 48510 Medical Practitioner License |

|

April 1, 2014 – Indefinite |

|

Medical Council of Thailand |

Agreements with Physicians

NewGenIvf

enters into independent physician agreements or employment contracts with its physicians. The terms and conditions and the format of

the agreements NewGenIvf enters into with each of its physicians vary, depending on the physician’s seniority and practise nature.

Customers

For

the years ended December 31, 2023 and 2022, the majority of NewGenIvf’s clients were from China (including mainland China

and Hong Kong). The number of Thai and Cambodian local patients generally increased in 2022 and 2023 compared with earlier years due

to the impact of COVID-19 on international travel. NewGenIvf enters into a service agreement with each of its customers that outline,

among other things, the scope of services, service fees, payment terms and rights, responsibilities and obligations of each party. Customers

are not entitled to enjoy the relevant services until outstanding amounts have been settled pursuant to the relevant contract. Sales

to individual consumers did not vary significantly and none of the customers contribute more than 10% of NewGenIvf’s revenue for

the years ended December 31, 2023 and 2022.

The

following table sets forth a breakdown of NewGenIvf’s total customers by major countries (determined by the passports they provided

to NewGenIvf for registration) and as a percentage of the total customers for the periods indicated(1):

| | |

For

the Year ended December 31, | |

| | |

2023 | | |

2022 | |

| | |

First

Fertility

PGS

Center | | |

Phnom

Penh

Center | | |

Total | | |

% | | |

First

Fertility

PGS

Center | | |

Phnom

Penh

Center | | |

Total | | |

% | |

| China(2) | |

| 34 | | |

| 87 | | |

| 121 | | |

| 42 | | |

| 66 | | |

| 117 | | |

| 183 | | |

| 72 | |

| India | |

| 16 | | |

| — | | |

| 16 | | |

| 6 | | |

| 16 | | |

| — | | |

| 16 | | |

| 6 | |

| Thailand | |

| 103 | | |

| — | | |

| 103 | | |

| 36 | | |

| 25 | | |

| 3 | | |

| 28 | | |

| 11 | |

| Cambodia | |

| — | | |

| 7 | | |

| 7 | | |

| 2 | | |

| — | | |

| 22 | | |

| 22 | | |

| 9 | |

| Others(3) | |

| 31 | | |

| 9 | | |

| 40 | | |

| 14 | | |

| — | | |

| 5 | | |

| 5 | | |

| 2 | |

| Total | |

| 184 | | |

| 103 | | |

| 287 | | |

| 100 | | |

| 107 | | |

| 147 | | |

| 254 | | |

| 100 | |

| (1) |

Customers of First Fertility Bishkek are the same customers of Phnom

Penh Center. |

| (2) |

Include customers from mainland China and Hong Kong. |

| (3) |

Include customers from Philippines, Singapore, USA, Korea, Nigeria

and UK. |

In

addition to significant customers using NewGenIvf’s IVF treatment services and surrogacy and ancillary caring services, NewGenIvf

also has customers who only use its relatively insignificant services, such as check-ups services, blood test services and other minor

services (the latter category of customers are referred to as “consultation customers”).

Sales and Marketing

For

the years ended December 31, 2023 and 2022, NewGenIvf promoted brand awareness through its sales teams and, in many cases,

through cooperating with third-party agencies and partners.

NewGenIvf’s

sales teams have broad experience in fertility services and are responsible for identifying potential clients and managing the overall

sales process. NewGenIvf’s sales team primarily relies on social media marketing, word-of-mouth referrals, recognition of its brand,

printed advertisements and marketing events. NewGenIvf spends marketing expenses on placing advertisements through popular social media

platforms, maintaining the official website of NewGenIvf and sending information through its official accounts on social media platforms.

Supply and Procurement

NewGenIvf’s

procurement is mainly for medications, laboratory media and reagents, laboratory consumables, and blood test reagents. As of December 31,

2023 and 2022, one and four suppliers individually contributed more than 10% of the Group’s trade payable, in aggregate accounting

for 30.6% and 69.8% of the Group’s trade payables, respectively. For the year ended December 31, 2023 and 2022, nil and two

vendors contributed more than 10% of total purchases of the Group, in aggregate accounting for nil and 55.3% of the Group’s total

purchases, respectively. NewGenIvf’s procurement team is experienced in selecting cost-effective supplies as well as selecting

reliable suppliers. NewGenIvf’s major suppliers are pharmaceutical companies.

Competition

NewGenIvf

believes that it is a long-standing provider of ARS in Asia Pacific that competes primarily based on the following competitive factors:

| ● | the

value and comprehensiveness of the solutions; |

| ● | treatment

that is effective and achieves desired outcomes; |

| ● | clients’

experience, including dedicated patient education, clinical guidance and emotional support;

and |

| ● | access

to a network of high-quality fertility specialists. |

NewGenIvf

competes primarily with other regional fertility service providers. While NewGenIvf does not believe any single competitor offers a comparably

robust and integrated fertility solution package as NewGenIvf in the regions that it operates, NewGenIvf’s competitors may compete

in a variety of ways, including by providing better services, having established local connections, fulfilling evolving client needs,

as well as conducting brand promotions and other marketing activities.

As

NewGenIvf may introduce new ancillary services and other companies may introduce similar fertility services as NewGenIvf’s, NewGenIvf

may become subject to additional competition.

Facilities

As

of December 31, 2023, in addition to its clinics, NewGenIvf leased one property in Hong Kong with an aggregate square footage of

approximately 8,000 for its administration support offices. NewGenIvf also operates its medical facilities as described above in “— Network

of Facilities” above. NewGenIvf believes that its existing facilities are suitable and adequate to meet its current needs.

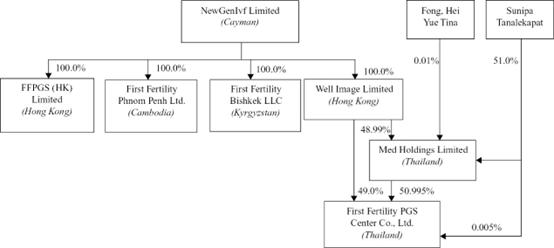

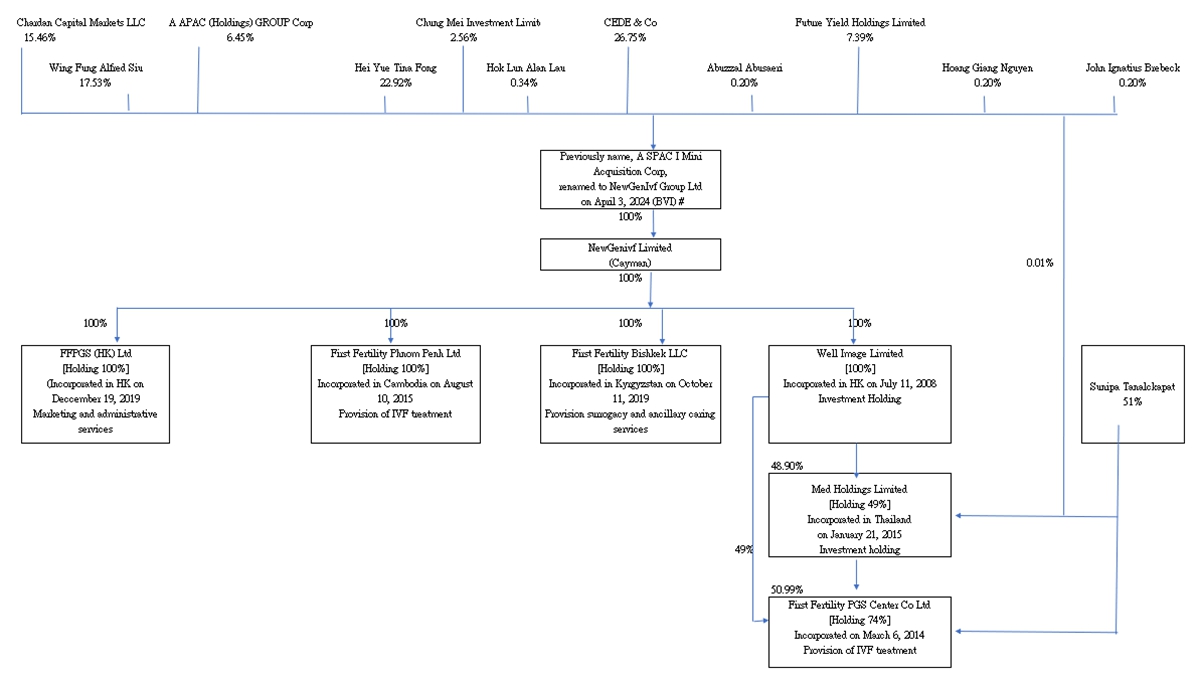

C. Organizational Structure

The

following is a list of our principal subsidiaries and consolidated affiliated entities as of the date of this prospectus:

| Name |

|

Place of Formation |

|

Relationship |

| |

|

|

|

|

| Legacy NewGenIvf |

|

Cayman Islands |

|

Wholly-owned subsidiary |

| |

|

|

|

|

| FFPGS (HK) Ltd |

|

Hong Kong |

|

Indirect subsidiary, wholly owned by Legacy NewGenIvf |

| |

|

|

|

|