false

0001830072

0001830072

2024-11-08

2024-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (date of earliest event reported):

November 8, 2024

iPower

Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40391 |

|

82-5144171 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

8798

9th Street

Rancho

Cucamonga, CA 91730

(Address Of Principal Executive Offices) (Zip Code)

(626)

863-7344

(Registrant’s Telephone Number, Including

Area Code)

___________________________

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock $0.001 per share |

|

IPW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On

November 8, 2024, iPower Inc., a Nevada corporation (the “Company”), entered into a third amendment (the “Third Amendment”)

to that certain credit agreement, initially entered into by and among the Company, its subsidiaries, E Marking Solution Inc. and Global

Product Marketing Inc.,, and JPMorgan Chase Bank, N.A., as administrative agent for the Lender and a lender (the “Administrative

Agent” or “Lender”), on November 12, 2021 (the “Credit Agreement”).

The

Third Amendment to the Credit Agreement amended, among other things, (i) the defined term “Aggregate Revolving Commitment”

to mean $15,000,000, and (ii) extended the maturity date to “November 8, 2027 or any earlier date on which the Revolving Commitments

are reduced to zero or otherwise terminated pursuant to the terms hereof.”

The

Third Amendment to the Credit Agreement also amended the defined term of “Applicable Rate,” “Payment Condition,”

and “Eligible Accounts,” as set forth under Section 1.01 of the Credit Agreement, and contained certain conditions precedent

to effectiveness, including, among others, that the Company has paid to the Administrative Agent (i) an amendment fee in an amount equal

to $37,500, to be distributed to the Lender and (ii) all other amounts required to be paid.

The

Third Amendment to the Credit Agreement also contains customary representations and governing law clauses. The foregoing description of

the Third Amendment to the Credit Agreement does not purport to be complete

and is qualified in its entirety by the terms and conditions of the Third Amendment to the Credit Agreement,

a copy of which is filed as Exhibit 10.1 hereto and incorporated by reference herein.

On

November 13, 2024, the Company issued a press release announcing that the execution of the Third Amendment to the Credit Agreement.

A copy of the press release is attached hereto as Exhibit 99.1.

| Item 9.01. |

Financial Statement and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

IPOWER, INC. |

| Dated: November 13, 2024 |

|

|

| |

By: |

/s/ Chenlong Tan |

| |

Name: |

Chenlong Tan |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

THIRD AMENDMENT TO CREDIT AGREEMENT

THIS THIRD AMENDMENT TO CREDIT

AGREEMENT (this “Amendment”), dated as of November 8, 2024 (“Third Amendment Date”), is entered

into by and among iPOWER INC., a Nevada corporation (the “Company” and together with any other Person that joins the

Credit Agreement (as hereinafter defined) as a Borrower in accordance with the terms thereof, are referred to hereinafter each individually

as a “Borrower”, and individually and collectively, jointly and severally, as the “Borrowers”),

the other Loan Parties party hereto, the Lenders described below, and JPMORGAN CHASE BANK, N.A., as administrative agent for the Lenders

(in such capacity, the “Administrative Agent”). Unless otherwise specified herein, capitalized terms used in this Amendment

shall have the meanings ascribed to them in the Credit Agreement as amended hereby.

A. WHEREAS,

the Borrowers, the other Loan Parties, certain financial institutions parties thereto (the “Lenders”) and the Administrative

Agent are parties to that certain Credit Agreement, dated as of November 12, 2021 (as so amended and as may be further amended, restated,

supplemented or otherwise modified from time to time, the “Credit Agreement”);

B. WHEREAS,

the Borrowers have requested that the Administrative Agent and the Lenders amend the Credit Agreement as set forth herein; and

C. WHEREAS,

on the terms and conditions set forth herein, the Administrative Agent and the Lenders have agreed to amend the Credit Agreement as set

forth herein.

NOW, THEREFORE, for and in

consideration of the premises and mutual agreements herein contained and for the purposes of setting forth the terms and conditions of

this Amendment and for other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto,

intending to be bound, hereby agree as follows:

1.

Amendments to Credit Agreement. Subject to the terms and conditions of this Amendment, the Credit Agreement is hereby amended

as follows:

(a)

Section 1.01 of the Credit Agreement is hereby amended by adding the following definition, in its appropriate alphabetical order,

to read as follows:

“Third Amendment

Effective Date” means November [__], 2024.

(b)

The defined term “Aggregate Revolving Commitment” set forth under Section 1.01 of the Credit Agreement is hereby

amended and restated in its entirety to read as follows:

“Aggregate

Revolving Commitment” means, at any time, the aggregate of the Revolving Commitments of all of the Lenders, as increased or

reduced from time to time pursuant to the terms and conditions hereof. As of the Third Amendment Effective Date, the Aggregate Revolving

Commitment is $15,000,000.

(c)

The table included in the defined term “Applicable Rate” set forth under Section 1.01 of the Credit

Agreement is hereby amended and restated in its entirety to read as follows:

Average Quarterly

Availability

|

Revolver

CB Floating R

ate Spread |

Revolver

REVSOFR30

Spread |

Revolver Term

Benchmark

Spread |

|

Category 1

³

20% of the Borrowing Base |

0.00% |

2.25% |

2.25% |

|

Category 2

< 20%

of the Borrowing Base |

0.25% |

2.50% |

2.50% |

(d)

Clause (e) of the defined term “Eligible Accounts” set forth under Section 1.01 of the Credit Agreement

is hereby amended and restated in its entirety to read as follows:

(e) which

is owing by an Account Debtor to the extent the aggregate amount of Accounts owing from such Account Debtor and its Affiliates to (i)

such Borrower exceeds 25% (or in the case of Amazon; (A) 90% for the 12-month period commencing on the date that is 18 months after the

Effective Date, (B) 80% for the period commencing on the date that is 30 months after the Effective Date through and including December

31, 2025, and (C) 75% thereafter commencing on January 1, 2026) of the aggregate amount of Eligible Accounts of such Borrower or (ii)

all Borrowers exceeds 25% (or in the case of Amazon (A) 90% for the 12-month period commencing on the date that is 18 months after the

Effective Date, (B) 80% for the period commencing on the date that is 30 months after the Effective Date through and including December

31, 2025, and (C) 75% thereafter commencing on January 1, 2026) of the aggregate amount of Eligible Accounts of all Borrowers;

(e)

The defined term “Maturity Date” set forth under Section 1.01 of the Credit Agreement is hereby amended

and restated in its entirety to read as follows:

“Maturity

Date” means November 8, 2027 or any earlier date on which the Revolving Commitments are reduced to zero or otherwise

terminated pursuant to the terms hereof.

(f)

Clause (c) of the defined term “Payment Condition” set forth under Section 1.01 of the Credit Agreement is

hereby amended and restated in its entirety to read as follows:

(c) with

respect to any Permitted Acquisition, immediately after giving effect to and at all times during the 30-day period immediately prior to

such Permitted Acquisition, the Borrowers shall have (i) Excess Availability calculated on a pro forma basis after giving effect to such

Permitted Acquisition of not less than the greater of (A) $4,000,000 or (B) an amount equal to 15% of the Revolving Commitment, and (ii)

a Fixed Charge Coverage Ratio for the trailing twelve months calculated on a pro forma basis after giving effect to such Permitted Acquisition

of not less than 1.15 to 1.00; provided, that, a Permitted Acquisition shall not be subject to the foregoing conditions so long

as (x) the aggregate amount of consideration paid in connection with such acquisition is less than $2,000,000 and (y) for any three-year

period, the aggregate amount of consideration paid for all such acquisitions described in the foregoing clause (x) is less than $5,000,000;

and

(g)

Clause (b) of Section 5.01 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

(b) concurrently

with the date of Borrower’s filing with the SEC, a copy of the Form 10-Q Quarterly Report for Borrower;

(h)

The Commitment Schedule of the Credit Agreement is hereby deleted and replaced with the Commitment Schedule attached hereto

as Annex 1.

2.

Conditions Precedent to Effectiveness. This Amendment shall become effective on the date (the “Amendment Effective

Date”) on which all of the following conditions are satisfied:

(a)

A fully-executed copy of this Amendment shall have been delivered to the Administrative Agent in form and substance satisfactory

to Administrative Agent;

(b)

the Borrowers shall have paid to the Administrative Agent (i) an amendment fee in an amount equal to Thirty-Seven Thousand Five

Hundred Dollars ($37,500), to be distributed to the Lenders on a pro rata basis and (ii) all other amounts required to be paid hereunder,

including, without limitation, those set forth in Section 3 hereto, in each case, on or before the Amendment Effective Date; and

(c)

the Administrative Agent shall have received such other agreements, instruments, documents and certificates as the Administrative

Agent may request, all in form and substance acceptable to the Administrative Agent.

3.

Fees and Expenses. Each Borrower agrees to pay on demand all costs and expenses of or incurred by the Administrative Agent,

including but not limited to, fees and disbursements of counsel to the Administrative Agent, in connection with the preparation, negotiation,

execution and delivery of this Amendment.

4.

Representations. Each Loan Party hereby represents and warrants to the Administrative Agent and the Lenders that: (a) it

has all necessary power and authority to execute and deliver this Amendment and perform its obligations hereunder, (b) no Default

or Event of Default exists both before and after giving effect to this Amendment, (c) this Amendment and the Loan Documents, as amended

hereby, constitute the legal, valid and binding obligations of each Loan Party and are enforceable against such Loan Party in accordance

with their terms, (d) all Liens created under the Loan Documents continue to be first-priority (subject only to Permitted Encumbrances)

perfected Liens, (e) all representations and warranties of the Loan Parties contained in the Credit Agreement, as amended hereby,

and all other Loan Documents are true and correct as though made on and as of the date hereof (except to the extent such representations

and warranties relate to an earlier date, in which case they are true and correct as of such date) and (f) the execution and delivery

of this Amendment will not contravene or result in a violation of any contract or agreement to which such Loan Party is a party.

5.

Ratification. Except as expressly modified in this Amendment, all of the terms, provisions and conditions of the Credit

Agreement, as heretofore amended, shall remain unchanged and in full force and effect. Except as herein specifically agreed, the Credit

Agreement and each other Loan Document are hereby ratified and confirmed and shall remain in full force and effect according to their

terms. Except as specifically set forth herein (including but not limited to Sections 2 and 3 hereunder), the execution, delivery and

effectiveness of this Amendment shall not operate as a waiver of any right, power, privilege or remedy of the Administrative Agent or

the Lenders under the Credit Agreement or any of the other Loan Documents, or constitute a waiver of any provision of the Credit Agreement

or any of the other Loan Documents. This Amendment shall not constitute a course of dealing with the Administrative Agent or the Lenders

at variance with the Credit Agreement or the other Loan Documents such as to require further notice by such Person to require strict compliance

with the terms of the Credit Agreement and the other Loan Documents in the future. Each Loan Party acknowledges and expressly agrees that

the Administrative Agent and each Lender reserves the right to, and does in fact, require strict compliance with all terms and provisions

of the Credit Agreement and the other Loan Documents. Each Loan Party hereby: (i) affirms that it is indebted to the Lenders under

the terms and conditions of the Credit Agreement and the other Loan Documents, each of which constitutes the valid and binding obligation

of the Loan Parties, enforceable in accordance with their respective terms, and that no offsets, expenses or counterclaims to its obligations

thereunder exist; and (ii) affirmatively waives any right to challenge the liens and security interests granted in favor of the Administrative

Agent under the Credit Agreement, the other Loan Documents or hereunder.

6.

Governing Law. This Amendment shall be governed by and construed in accordance with and governed by the laws of the State

of California.

7.

WAIVER OF JURY TRIAL. EACH PARTY HERETO HEREBY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT

MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AMENDMENT, THE CREDIT AGREEMENT,

ANY OTHER LOAN DOCUMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY (WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY). EACH

PARTY HERETO (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE,

THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND

THE OTHER PARTIES HERETO HAVE BEEN INDUCED TO ENTER INTO THIS AMENDMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS

IN THIS SECTION 7.

8.

JUDICIAL REFERENCE. IN THE EVENT ANY LEGAL PROCEEDING IS FILED IN A COURT OF THE STATE OF CALIFORNIA (THE “COURT”)

BY OR AGAINST THE LOAN PARTIES, THE ADMINISTRATIVE AGENT OR ANY OF THE LENDERS IN CONNECTION WITH ANY CONTROVERSY, DISPUTE OR CLAIM DIRECTLY

OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AMENDMENT, THE CREDIT AGREEMENT, THE OTHER LOAN DOCUMENTS OR THE TRANSACTIONS CONTEMPLATED

HEREBY OR THEREBY (WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY) (EACH, A “CLAIM”) AND THE WAIVER SET FORTH

IN SECTION 7 IS NOT ENFORCEABLE IN SUCH ACTION OR PROCEEDING, EACH LOAN PARTY, THE ADMINISTRATIVE AGENT AND EACH LENDER (BY THEIR

ACCEPTANCE HEREOF) AGREE AS FOLLOWS:

(a)

WITH THE EXCEPTION OF THE MATTERS SPECIFIED IN CLAUSE (B) BELOW, ANY CLAIM WILL BE DETERMINED BY A GENERAL REFERENCE PROCEEDING

IN ACCORDANCE WITH THE PROVISIONS OF CALIFORNIA CODE OF CIVIL PROCEDURE SECTIONS 638 THROUGH 645.2. EACH LOAN PARTY, THE ADMINISTRATIVE

AGENT AND EACH LENDER INTEND THIS GENERAL REFERENCE AGREEMENT TO BE SPECIFICALLY ENFORCEABLE IN ACCORDANCE WITH CALIFORNIA CODE OF CIVIL

PROCEDURE SECTION 638. EXCEPT AS OTHERWISE PROVIDED IN THIS AMENDMENT, THE CREDIT AGREEMENT AND THE OTHER LOAN DOCUMENTS, VENUE FOR THE

REFERENCE PROCEEDING WILL BE IN THE STATE OR FEDERAL COURT IN THE COUNTY OR DISTRICT WHERE VENUE IS OTHERWISE APPROPRIATE UNDER APPLICABLE

LAW.

(b)

THE FOLLOWING MATTERS SHALL NOT BE SUBJECT TO A GENERAL REFERENCE PROCEEDING: (A) NON-JUDICIAL FORECLOSURE OF ANY SECURITY

INTERESTS IN REAL OR PERSONAL PROPERTY; (B) EXERCISE OF SELF-HELP REMEDIES (INCLUDING, WITHOUT LIMITATION, SET-OFF); (C) APPOINTMENT

OF A RECEIVER; AND (D) TEMPORARY, PROVISIONAL OR ANCILLARY REMEDIES (INCLUDING, WITHOUT LIMITATION, WRITS OF ATTACHMENT, WRITS OF

POSSESSION, TEMPORARY RESTRAINING ORDERS OR PRELIMINARY INJUNCTIONS). NEITHER THIS AMENDMENT NOR THE CREDIT AGREEMENT LIMITS THE RIGHT

OF ANY LOAN PARTY, THE ADMINISTRATIVE AGENT OR ANY LENDER TO EXERCISE OR OPPOSE ANY OF THE RIGHTS AND REMEDIES DESCRIBED IN CLAUSES

(A) — (D) OF THIS SECTION AND ANY SUCH EXERCISE OR OPPOSITION DOES NOT WAIVE THE RIGHT OF ANY SUCH LOAN PARTY, THE ADMINISTRATIVE

AGENT OR SUCH LENDER TO A REFERENCE PROCEEDING PURSUANT TO THIS AMENDMENT OR THE CREDIT AGREEMENT.

(c)

UPON THE WRITTEN REQUEST OF THE LOAN PARTIES, THE ADMINISTRATIVE AGENT OR ANY LENDER, THE LOAN PARTIES, THE ADMINISTRATIVE AGENT

AND THE LENDERS SHALL SELECT A SINGLE REFEREE, WHO SHALL BE A RETIRED JUDGE OR JUSTICE. IF THE LOAN PARTIES, THE ADMINISTRATIVE AGENT

AND THE LENDERS DO NOT AGREE UPON A REFEREE WITHIN TEN (10) DAYS OF SUCH WRITTEN REQUEST, THEN, THE LOAN PARTIES, THE ADMINISTRATIVE AGENT

OR ANY LENDER, MAY REQUEST THE COURT TO APPOINT A REFEREE PURSUANT TO CALIFORNIA CODE OF CIVIL PROCEDURE SECTION 640(B).

(d)

EXCEPT AS EXPRESSLY SET FORTH IN THIS AMENDMENT OR THE CREDIT AGREEMENT, THE REFEREE SHALL DETERMINE THE MANNER IN WHICH THE REFERENCE

PROCEEDING IS CONDUCTED, INCLUDING THE TIME AND PLACE OF HEARINGS, THE ORDER OF PRESENTATION OF EVIDENCE, AND ALL OTHER QUESTIONS THAT

ARISE WITH RESPECT TO THE COURSE OF THE REFERENCE PROCEEDING. ALL PROCEEDINGS AND HEARINGS CONDUCTED BEFORE THE REFEREE, EXCEPT FOR TRIAL,

SHALL BE CONDUCTED WITHOUT A COURT REPORTER, EXCEPT WHEN THE LOAN PARTIES, THE ADMINISTRATIVE AGENT OR ANY LENDER SO REQUESTS, A COURT

REPORTER WILL BE USED AND THE REFEREE WILL BE PROVIDED A COURTESY COPY OF THE TRANSCRIPT. THE PARTY MAKING SUCH REQUEST SHALL HAVE THE

OBLIGATION TO ARRANGE FOR AND PAY COSTS OF THE COURT REPORTER, PROVIDED THAT SUCH COSTS, ALONG WITH THE REFEREE’S FEES, SHALL

ULTIMATELY BE BORNE BY THE PARTY WHO DOES NOT PREVAIL, AS DETERMINED BY THE REFEREE.

(e)

THE REFEREE MAY REQUIRE ONE OR MORE PREHEARING CONFERENCES. THE LOAN PARTIES, THE ADMINISTRATIVE AGENT AND THE LENDERS SHALL BE

ENTITLED TO DISCOVERY, AND THE REFEREE SHALL OVERSEE DISCOVERY IN ACCORDANCE WITH THE RULES OF DISCOVERY, AND MAY ENFORCE ALL DISCOVERY

ORDERS IN THE SAME MANNER AS ANY TRIAL COURT JUDGE IN PROCEEDINGS AT LAW IN THE STATE OF CALIFORNIA. THE REFEREE SHALL APPLY THE RULES

OF EVIDENCE APPLICABLE TO PROCEEDINGS AT LAW IN THE STATE OF CALIFORNIA AND SHALL DETERMINE ALL ISSUES IN ACCORDANCE WITH APPLICABLE STATE

AND FEDERAL LAW. THE REFEREE SHALL BE EMPOWERED TO ENTER EQUITABLE AS WELL AS LEGAL RELIEF AND RULE ON ANY MOTION WHICH WOULD BE AUTHORIZED

IN A TRIAL, INCLUDING, WITHOUT LIMITATION, MOTIONS FOR DEFAULT JUDGMENT OR SUMMARY JUDGMENT. THE REFEREE SHALL REPORT THE REFEREE’S

DECISION, WHICH REPORT SHALL ALSO INCLUDE FINDINGS OF FACT AND CONCLUSIONS OF LAW. THE REFEREE SHALL ISSUE A DECISION AND PURSUANT TO

CALIFORNIA CIVIL CODE OF CIVIL PROCEDURE, SECTION 644, THE REFEREE’S DECISION SHALL BE ENTERED BY THE COURT AS A JUDGMENT IN THE

SAME MANNER AS IF THE ACTION HAD BEEN TRIED BY THE COURT. THE FINAL JUDGMENT OR ORDER FROM ANY APPEALABLE DECISION OR ORDER ENTERED BY

THE REFEREE SHALL BE FULLY APPEALABLE AS IF IT HAS BEEN ENTERED BY THE COURT.

(f)

THE LOAN PARTIES, THE ADMINISTRATIVE AGENT AND THE LENDERS RECOGNIZE AND AGREE THAT ALL CLAIMS RESOLVED IN A GENERAL REFERENCE

PROCEEDING PURSUANT TO THIS SECTION 9 WILL BE DECIDED BY A REFEREE AND NOT BY A JURY. AFTER CONSULTING (OR HAVING HAD THE OPPORTUNITY

TO CONSULT) WITH COUNSEL OF THEIR OWN CHOICE, EACH PARTY HERETO KNOWINGLY AND VOLUNTARILY AND FOR THEIR MUTUAL BENEFIT AGREES THAT THIS

REFERENCE PROVISION SHALL APPLY TO ANY DISPUTE BETWEEN THEM THAT ARISES OUT OF OR IS RELATED TO THIS AGREEMENT OR THE OTHER LOAN DOCUMENTS.

9.

RELEASE. EACH LOAN PARTY ACKNOWLEDGES THAT THE ADMINISTRATIVE AGENT AND THE LENDERS WOULD NOT ENTER INTO THIS AMENDMENT

WITHOUT SUCH LOAN PARTY’S ASSURANCE HEREUNDER. EXCEPT FOR THE OBLIGATIONS ARISING HEREAFTER UNDER THIS AMENDMENT AND THE OTHER LOAN

DOCUMENTS, ON BEHALF OF ITSELF AND EACH OF ITS SUBSIDIARIES, EACH LOAN PARTY HEREBY ABSOLUTELY DISCHARGES AND RELEASES THE ADMINISTRATIVE

AGENT AND THE LENDERS, ANY PERSON THAT HAS OBTAINED ANY INTEREST FROM THE ADMINISTRATIVE AGENT AND THE LENDERS UNDER ANY LOAN DOCUMENT

AND EACH OF THE ADMINISTRATIVE AGENT’S AND THE LENDER’S FORMER AND PRESENT PARTNERS, STOCKHOLDERS, OFFICERS, DIRECTORS, EMPLOYEES,

SUCCESSORS, ASSIGNEES, AFFILIATES, AGENTS AND ATTORNEYS (COLLECTIVELY, THE “RELEASEES”) FROM ANY KNOWN OR UNKNOWN CLAIMS

WHICH ANY LOAN PARTY OR ANY OF ITS SUBSIDIARIES NOW HAS AS OF THE FIRST AMENDMENT DATE AGAINST THE ADMINISTRATIVE AGENT, ANY LENDER OR

ANY OTHER RELEASEE OF ANY NATURE ARISING OUT OF OR RELATED TO ANY BORROWER OR ANY OF ITS SUBSIDIARIES, ANY DEALINGS WITH SUCH LOAN PARTY

OR ANY OF ITS SUBSIDIARIES, ANY OF THE LOAN DOCUMENTS OR ANY TRANSACTIONS PURSUANT THERETO OR CONTEMPLATED THEREBY, THE COLLATERAL (OR

ANY OTHER COLLATERAL OF ANY PERSON THAT PREVIOUSLY SECURED OR NOW OR HEREAFTER SECURES ANY OF THE OBLIGATIONS), OR ANY NEGOTIATIONS FOR

ANY MODIFICATIONS TO OR FORBEARANCE OR CONCESSIONS WITH RESPECT TO ANY OF THE LOAN DOCUMENTS, IN EACH CASE INCLUDING ANY CLAIMS THAT SUCH

LOAN PARTY OR ANY OF ITS SUBSIDIARIES, SUCCESSORS, COUNSEL AND ADVISORS MAY IN THE FUTURE DISCOVER THEY WOULD HAVE NOW HAD AS OF THE FIRST

AMENDMENT DATE IF THEY HAD KNOWN FACTS NOT NOW KNOWN TO THEM, AND IN EACH CASE WHETHER FOUNDED IN CONTRACT, IN TORT OR PURSUANT TO ANY

OTHER THEORY OF LIABILITY.

10.

Miscellaneous.

(a)

Counterparts; Integration. This Amendment may be executed in counterparts (and by different

parties hereto on different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute

a single contract. This Amendment, the Credit Agreement, the other Loan Documents and any separate letter agreements with respect to fees

payable to the Administrative Agent constitute the entire contract among the parties relating to the subject matter hereof and thereof

and supersede any and all previous agreements and understandings, oral or written, relating to the subject matter hereof and thereof.

This Amendment shall become effective as provided in Section 2 hereof and when the Administrative Agent shall have received counterparts

hereof which, when taken together, bear the signatures of each of the other parties hereto, and thereafter shall be binding upon and inure

to the benefit of the parties hereto and their respective successors and assigns. Delivery of an executed counterpart of a signature page

of this Amendment by telecopy or other electronic transmission shall be effective as delivery of a manually executed counterpart of this

Amendment.

(b)

Entire Agreement. This Amendment and the other Loan Documents constitute the entire understanding of the parties hereto

and thereto with respect to the subject matter hereof and thereof and any prior agreements, whether written or oral, with respect thereto

are superseded hereby.

(c)

Severability of Provisions. Any provision of this Amendment held to be invalid, illegal or unenforceable in any jurisdiction

shall, as to such jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability without affecting the

validity, legality and enforceability of the remaining provisions hereof; and the invalidity of a particular provision in a particular

jurisdiction shall not invalidate such provision in any other jurisdiction.

(d)

Successors and Assigns. The provisions of this Amendment shall be binding upon and inure to the benefit of the parties hereto

and their respective successors and assigns permitted under the Credit Agreement.

(e)

Construction. The parties acknowledge and agree that this Amendment shall not be construed more favorably in favor of any

party hereto based upon which party drafted the same, it being acknowledged that all parties hereto contributed substantially to the negotiation

of this Amendment.

(f)

Incorporation. This Amendment shall form a part of the Credit Agreement, and all references to the Credit Agreement shall

mean that document as hereby modified. Upon the effectiveness of this Amendment, each reference in the Credit Agreement to “this

Agreement”, “hereunder”, “hereof”, “herein” or words of similar import shall mean and be a reference

to the Credit Agreement as amended hereby.

(g)

No Prejudice; No Impairment. This Amendment shall not prejudice, limit, restrict or impair any rights, privileges, powers

or remedies of the Administrative Agent or the Lenders under the Credit Agreement or any other Loan Documents as hereby amended. The Administrative

Agent and each Lender reserves, without limitation, all rights which the Administrative Agent and each Lender has now or in the future

against any guarantor or endorser of the Obligations.

[Signatures Immediately Follow]

IN WITNESS WHEREOF, the undersigned

have executed this Third Amendment to Credit Agreement as of the date first written above.

BORROWER:

IPOWER INC.,

a Nevada corporation

By: /s/ Kevin Vassily

Name: Kevin Vassily

Title: Chief Financial Officer

OTHER LOAN PARTIES:

E MARKETING SOLUTION INC,

a California corporation

By: /s/ Kevin Vassily

Name: Kevin Vassily

Title: Chief Financial Officer

GLOBAL PRODUCT MARKETING INC.,

a Nevada corporation

By: /s/ Kevin Vassily

Name: Kevin Vassily

Title: Chief Financial Officer

LENDERS:

JPMORGAN CHASE BANK, NATIONAL ASSOCIATION,

as Administrative

Agent, and a Lender

By: /s/ C. Hayes Blackwood

Name: C. Hayes Blackwood

Title: Authorized Officer

Annex 1

COMMITMENT SCHEDULE

|

Lender

|

Revolving Commitment |

|

JPMorgan Chase Bank, N.A.

|

$15,000,000 |

|

Total

|

$15,000,000 |

Exhibit 99.1

iPower

Renews Credit Facility with JPMorgan Chase

RANCHO CUCAMONGA,

CA, November 13, 2024 -- iPower Inc. (Nasdaq: IPW) (“iPower” or the “Company”), a tech and data-driven ecommerce

services provider and online retailer, today announced the renewal of its secured revolving credit facility with JPMorgan Chase, extending

the maturity by three years to November 2027.

The new facility has

a revolving commitment of $15.0 million, with an accordion feature to obtain additional lender commitments to increase the facility size

up to $40.0 million in the aggregate. Under the new agreement, the interest on borrowings will be based on SOFR plus 2.25% - 2.50%.

“We are pleased

to renew our credit facility with a leading institution like JPMorgan Chase, which underscores their confidence in our strategy and long-term

vision,” said Lawrence Tan, CEO of iPower. “This new facility is an essential component of our capital structure as it provides

us with the flexibility to fund our growth and advance our strategic initiatives. With a strengthened balance sheet, continued growth

in our SuperSuite supply chain business, and optimized cost structure, we believe we are well positioned to deliver on our goals ahead.”

About iPower Inc.

iPower Inc. is a tech and data-driven

online retailer, as well as a provider of value-added ecommerce services for third-party products and brands. iPower’s capabilities

include a full spectrum of online channels, robust fulfillment capacity, a network of warehouses serving the U.S., competitive

last mile delivery partners and a differentiated business intelligence platform. iPower believes that these capabilities will enable

it to efficiently move a diverse catalog of SKUs from its supply chain partners to end consumers every day, providing the best value

to customers in the U.S. and other countries. For more information, please visit iPower’s website

at www.meetipower.com.

Forward-Looking Statements

All statements other

than statements of historical fact in this press release are forward-looking statements. These forward-looking statements involve known

and unknown risks and uncertainties and are based on current expectations and projections about future events and financial trends that

iPower believes may affect its financial condition, results of operations, business strategy, and financial needs. Investors can identify

these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,”

“aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,”

“is/are likely to” or other similar expressions. iPower undertakes no obligation to update forward-looking statements to reflect

subsequent events or circumstances, or changes in its expectations, except as may be required by law. Although iPower believes that the

expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to

be correct, and iPower cautions investors that actual results may differ materially from the anticipated results and encourages investors

to review other factors that may affect its future results and performance in iPower’s Annual Report on Form 10-K, as filed with the SEC

on September 19, 2024, its Quarterly Reports on Form 10-Q, as filed with the SEC on November 15, 2023, February 14, 2024 and May 14, 2024,

and in its other SEC filings.

Investor Relations Contact

Sean Mansouri, CFA or Aaron D’Souza

Elevate IR

(720) 330-2829

IPW@elevate-ir.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

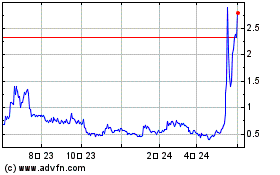

iPower (NASDAQ:IPW)

과거 데이터 주식 차트

부터 11월(11) 2024 으로 12월(12) 2024

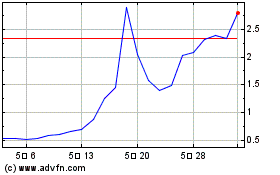

iPower (NASDAQ:IPW)

과거 데이터 주식 차트

부터 12월(12) 2023 으로 12월(12) 2024