SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

Form 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month

of June 2023

Commission File

Number: 001-39255

International

General Insurance Holdings Ltd.

(Translation

of Registrant’s name into English)

74 Abdel

Hamid Sharaf Street, P.O. Box 941428, Amman 11194, Jordan

(Address of principal

executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

INCORPORATION BY REFERENCE

This report on Form 6-K, including Exhibit 99.1

attached hereto, shall be deemed to be incorporated by reference into the registration statements on Form F-3 (File No. 333-254986) and

Form S-8 (File No. 333-238918) of International General Insurance Holdings Ltd. (including the prospectuses forming a part of such registration

statements) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports

subsequently filed or furnished.

EXHIBIT

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

INTERNATIONAL GENERAL INSURANCE HOLDINGS LTD. |

| |

|

|

|

| Date: June 30, 2023 |

By: |

/s/ Pervez Rizvi |

| |

|

Name: |

Pervez Rizvi |

| |

|

Title: |

Chief Financial Officer |

2

Exhibit 99.1

June 30, 2023

Dear Shareholder,

On behalf of the Board of Directors, it is my

pleasure to extend to you an invitation to attend the virtual 2023 Annual General Meeting of shareholders of International General Insurance

Holdings Ltd. (“IGI,” “we” or the “Company”). The 2023 Annual General Meeting will be held virtually

via live webcast on August 9, 2023, at 9:00 a.m. Eastern Daylight Time.

Due to the continued public health impact of the

coronavirus (COVID-19) and to support the health and well-being of our shareholders and their families, our Board of Directors has decided

to hold a virtual Annual General Meeting via live webcast.

The Notice of Annual General Meeting and Information

Circular describes the business to be transacted at the Annual General Meeting and provides other information concerning IGI. We

are holding the Annual General Meeting for the following purposes, which are more fully described in the attached Information Circular:

| 1. | To elect one Class III director nominated by our Board of Directors

to hold office until the 2026 Annual General Meeting or until his successor has been elected or appointed or his office is vacated in

accordance with the Amended and Restated Bye-laws of the Company; |

| 2. | To approve the re-appointment of Ernst & Young LLP, an independent registered public accounting

firm, to act as our independent auditor for the fiscal year ending December 31, 2023 and the authorization for our Board of Directors,

acting through our audit committee, to fix the remuneration of our independent auditor for the fiscal year ending December 31, 2023; |

| 3. | To receive the audited annual consolidated financial statements of the Company for the fiscal year ended

December 31, 2022, together with the notes thereto and the independent auditor’s report thereon; and |

| 4. | To transact such other business as may properly come before the meeting. |

The Board of Directors unanimously recommends

that shareholders vote “for” the above proposals nos. 1 and 2. Item nos. 3 and 4 do not require a vote of the shareholders.

Your vote is important. Whether or not you

plan to virtually attend the Annual General Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the

methods described in the Information Circular for the virtual Annual General Meeting. In order to ensure that your shares will be voted

in accordance with your wishes and that the presence of a quorum at the 2023 Annual General Meeting may be assured, please promptly complete,

sign, date and promptly submit your proxy card which will be available by requesting a paper copy of the proxy materials as provided in

the instructions set forth on the Notice of Annual General Meeting and Online Availability of Proxy Materials. The proxy card must be

properly dated, signed and submitted in order to be counted. You can submit your proxy to vote your shares via the Internet, by telephone,

via a mobile device or by mail as provided in the instructions set forth on the Notice of Annual General Meeting and Online Availability

of Proxy Materials or proxy card. If you decide to attend the meeting, you will be able to revoke your proxy and vote at the meeting.

Any signed proxy submitted and not completed will be voted by management in favor of all proposals presented in the Information Circular.

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE 2023 ANNUAL GENERAL MEETING TO BE HELD ON AUGUST 9, 2023. The Company’s proxy materials for the 2023

Annual General Meeting, including the Information Circular and 2022 Annual Report on Form 20-F, are available for view and to download

at https://www.cstproxy.com/igi/2023.

Sincerely,

| /s/ Wasef Jabsheh |

|

| WASEF JABSHEH |

|

| Chairman of the Board of Directors |

|

2023 ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE OF ANNUAL GENERAL MEETING AND INFORMATION

CIRCULAR

TABLE OF CONTENTS

| Notice of Annual General Meeting of Shareholders |

1 |

| |

|

| Questions and Answers about the Annual General Meeting |

3 |

| |

|

| Information Concerning Solicitation and Voting |

8 |

| |

|

| Principal Securityholders |

10 |

| |

|

| Proposal No. 1 Election of Director |

12 |

| |

|

| Information About the Director Nominee |

13 |

| |

|

| Information About Directors Continuing in Office |

14 |

| |

|

| Board Structure and Governance |

17 |

| |

|

| Proposal No. 2 Approval of the Re-appointment of Ernst & Young LLP |

20 |

| |

|

| Proposal No. 3 Presentation of IGI’s Financial Statements |

21 |

| |

|

| Nomination of Directors |

22 |

| |

|

| Other Matters |

23 |

INTERNATIONAL GENERAL INSURANCE HOLDINGS

LTD.

Notice of Annual

General Meeting of Shareholders

To our shareholders:

Notice is hereby given that the 2023 Annual General

Meeting of shareholders of International General Insurance Holdings Ltd. will be held virtually on Wednesday, August 9, 2023. The following

are details for the meeting:

| Time and Date |

|

Wednesday, August 9, 2023

9:00 a.m. Eastern Daylight Time |

| |

|

|

| Place |

|

Virtual meeting only

You may attend the Annual General Meeting and

vote your shares electronically during the meeting via live audio webcast by visiting https://www.cstproxy.com/igi/2023. You will

need the control number that is printed on your Notice of Annual General Meeting and Online Availability of Proxy Materials (“Proxy

Materials Notice”) or your proxy card to enter the Annual General Meeting. |

| |

|

|

| Items of Business |

|

(1) To

elect one Class III director to IGI’s Board of Directors for a term of three years.

(2) To

approve the re-appointment of Ernst & Young LLP, an independent registered public accounting firm, to act as our independent

auditor for the fiscal year ending December 31, 2023 and the authorization for our Board of Directors, acting through our audit committee,

to fix the remuneration of our independent auditor for the fiscal year ending December 31, 2023.

(3) To receive the audited annual consolidated financial statements of the Company for the fiscal year ended December 31,

2022, together with the notes thereto and the independent auditor’s report thereon.

(4) To

transact such other business as may properly come before the meeting. |

| |

|

|

| Adjournments and Postponements |

|

Any action on the items of business described above may be considered at the Annual General Meeting at the time and on the date specified above or at any time and date to which the Annual General Meeting may be properly adjourned or postponed. |

| |

|

|

| Record Date |

|

The record date for the Annual General Meeting is Friday, June 16, 2023. Only shareholders of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual General Meeting or any adjournment or postponement of the meeting. |

| |

|

|

| Voting |

|

Your vote is important. Whether or not you plan to virtually attend the Annual General Meeting, we urge you to vote and submit your proxy in advance of the meeting. In order to ensure that your shares will be voted in accordance with your wishes and that the presence of a quorum at the 2023 Annual General Meeting may be assured, please promptly complete, sign, date and promptly submit your proxy card which will be available by requesting a paper copy of the proxy materials as provided in the instructions set forth on the Proxy Materials Notice. The proxy card must be properly dated, signed and submitted in order to be counted. You can submit your proxy to vote your shares via the Internet, by telephone, via a mobile device or by mail as provided in the instructions set forth on the Proxy Materials Notice or proxy card. Following submission of your signed proxy, you may revoke your signed proxy at any time before it is voted by following the procedures specified in the Information Circular. |

By Order of the Board of Directors

| /s/ Rawan Alsulaiman |

|

| Rawan Alsulaiman |

|

| Chief Legal and Compliance Officer |

|

June 30, 2023

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE 2023 ANNUAL GENERAL MEETING TO BE HELD ON AUGUST 9, 2023. The Company’s proxy materials for the 2023

Annual General Meeting, including the Information Circular and 2022 Annual Report on Form 20-F, are available for view and to download

at https://www.cstproxy.com/igi/2023. A Proxy Materials Notice is being sent to eligible shareholders on or about June 30, 2023.

If you would like to receive a paper copy of

these documents, you must request one. There is no charge for such documents to be mailed to you. Please make your request for a paper

copy as instructed below on or before July 9, 2023 to facilitate a timely delivery. You may also request that you receive paper copies

of all future proxy materials from the Company.

REQUESTING A PAPER COPY OF THE PROXY MATERIALS

By telephone please call 1-888-266-6791, or

By logging on to https://www.cstproxy.com/igi/2023

or

By email at: proxy@continentalstock.com

Please include the company name and your control

number in the subject line.

Questions and Answers

about the Annual General Meeting

The following are some questions that you,

as a shareholder of International General Insurance Holdings Ltd. (“IGI,” “we” or the “Company”),

may have regarding the matters being considered at IGI’s 2023 Annual General Meeting and brief answers to those questions. You are

urged to carefully read this Information Circular in its entirety.

| Q: | Who is soliciting my vote? |

| A: | The board of directors of IGI (the “Board”) is soliciting proxies to vote common shares, par

value $0.01 per share (the “Common Shares”), at IGI’s Annual General Meeting of shareholders, which will take place

on Wednesday, August 9, 2023. In connection with this solicitation, we distributed a Proxy Materials Notice to registered holders of our

Common Shares on or about June 30, 2023. You may access the materials online by following the instructions in the Proxy Materials Notice. |

| Q: | What items of business will be voted on at the Annual General Meeting? |

| A: | The items of business scheduled to be voted on at the Annual General Meeting are: |

| ● | The election of one Class III director to IGI’s Board for a term of three years; |

| ● | The approval of the re-appointment of Ernst & Young LLP as our independent auditor for the fiscal

year ending December 31, 2023 and authorization for our Board to fix the independent auditor’s remuneration; and |

| ● | such other business as may properly come before the meeting. |

The audited financial statements of

the Company for the fiscal year ended December 31, 2022 will be presented to the Annual General Meeting but do not require a vote.

| Q: | How does the Board recommend that I vote? |

| A: | The Board recommends that you vote your shares “FOR” each of the proposals. |

| Q: | What shares can I vote? |

| A: | Each of IGI’s Common Shares issued and outstanding as of the close of business on June 16, 2023

(the “Record Date”) for the Annual General Meeting is entitled to be voted on all items being voted upon at the Annual General

Meeting. The record date for the Annual General Meeting is the date used to determine both the number of IGI’s Common Shares that

are entitled to be voted at the Annual General Meeting and the identity of the shareholders of record and beneficial owners

of those Common Shares who are entitled to vote those shares at the Annual General Meeting. On the Record Date for the Annual General

Meeting, we had 46,635,100 Common Shares issued and outstanding. This number includes both

(1) shares issued and outstanding as well as (2) contingent shares which have not yet vested but whose holders are entitled

to vote with respect to such contingent shares. |

You may vote all shares owned by you

as of the Record Date for the Annual General Meeting, including (1) shares held directly in your name as the shareholder of record,

and (2) shares held for you as the beneficial owner through a broker, trustee or other nominee such as a bank.

| Q: | What is the difference between holding shares as a shareholder of record and as a beneficial owner? |

| A: | Voting procedures vary between record holders of shares and beneficial owners of shares. |

Shareholder of Record

If your shares are registered directly

in your name with IGI’s transfer agent, Continental, you are considered, with respect to those shares, the shareholder of record,

and a Proxy Materials Notice is being sent directly to you by IGI. As the shareholder of record, you have the right to

grant your voting proxy directly to IGI management or to vote in person at the meeting. A proxy card will be available for your use by

requesting a copy of proxy materials.

Beneficial Owner

If your shares are held in a brokerage

account or by another nominee, you are considered the beneficial owner of shares held in street name and a Proxy Materials

Notice is being forwarded to you together with voting instructions. As the beneficial owner, you have the right to direct your broker,

trustee or nominee how to vote and are also invited to attend the Annual General Meeting.

Since a beneficial owner is not the

shareholder of record, you may not vote these shares at the virtual meeting unless you obtain a “legal proxy” from

the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting. Your broker, trustee or

nominee should have provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares.

| Q: | How can I attend the Annual General Meeting? |

| A: | You are entitled to attend the virtual Annual General Meeting only if you were an IGI shareholder as of

the close of business on June 16, 2023 or you hold a valid proxy for the Annual General Meeting. The Annual General Meeting will be held

on Wednesday, August 9, 2023 at 9:00 a.m. Eastern Daylight Time, in a virtual meeting format only via the Internet, with no physical in-person

meeting. You will be able to attend and participate in the virtual Annual General Meeting online by entering the unique control number

found on your Proxy Materials Notice or your proxy card at the meeting center at https://www.cstproxy.com/igi/2023, where you will

be able to listen to the Annual General Meeting live and vote. Information on how to vote virtually and enter your control number found

on your Proxy Materials Notice or your proxy card at the Annual General Meeting is discussed below. |

| Q: | How can I submit questions for the Annual General Meeting? |

| A: | Shareholders may submit questions until 9:00 p.m. Eastern Daylight Time on August 8, 2023 by emailing

Robin.Sidders@iginsure.com. Questions pertinent to meeting matters and that are submitted

in accordance with our Rules of Conduct for the Annual General Meeting (available on our website at www.iginsure.com)

will be answered after the meeting and posted to our website at www.iginsure.com. Questions

and answers may be grouped by topic and substantially similar questions may be grouped and answered once. In order to promote fairness,

efficient use of time and in order to ensure all shareholders are responded to, we will respond to up to two questions from a single shareholder. |

| Q: | What if during the check-in time or during the Annual General Meeting I have technical difficulties or

trouble accessing the virtual meeting website? |

| A: | Beginning 60 minutes prior to the start of and during the virtual Annual General Meeting, we will have

technicians ready to assist shareholders with any technical difficulties they may have accessing or hearing the virtual meeting. If you

encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support

number provided in our Rules of Conduct for the Annual General Meeting (available on our website at www.iginsure.com). |

| Q: | How can I vote my shares? |

| A: | For each of the proposals you may vote “For” or “Against” or abstain from voting. |

Shareholder of Record: Shares Registered in Your Name

If you are a shareholder of record as

of June 16, 2023, you may vote at the Annual General Meeting by proxy using your proxy card, over the telephone, through the Internet

or via a mobile device. Whether or not you plan to attend the virtual Annual General Meeting, we urge you to vote by proxy to ensure your

vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

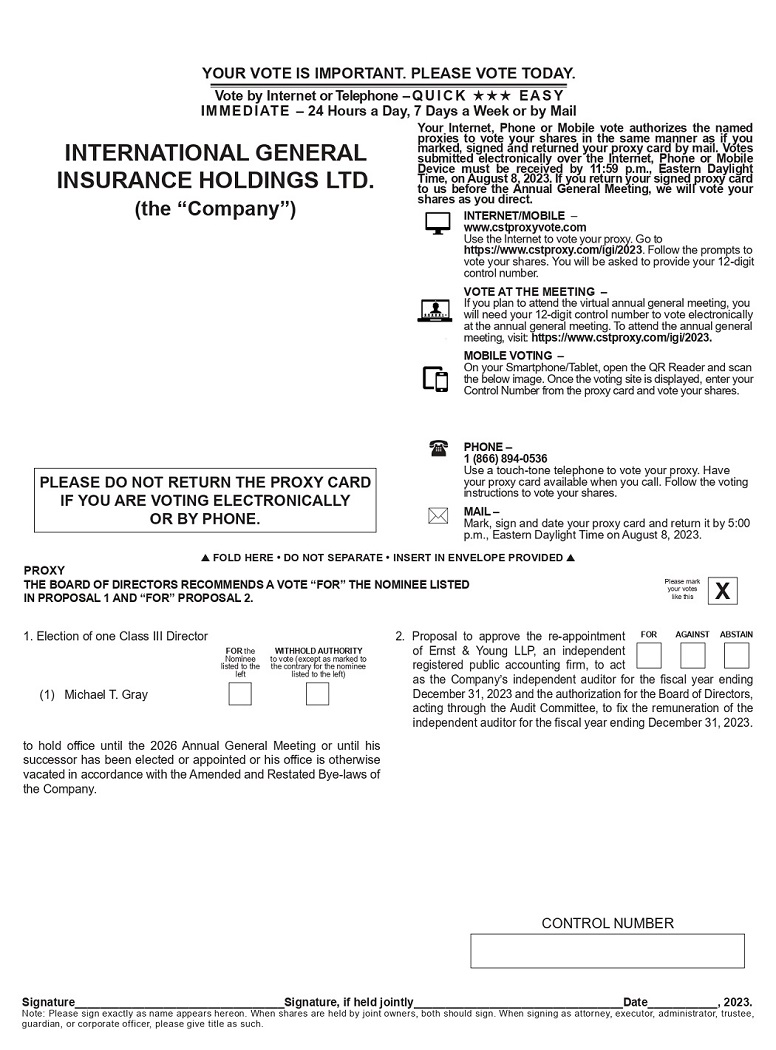

To vote using the proxy card, simply

complete, sign and date the proxy card and submit it promptly in accordance with the instructions therein. If you submit your signed proxy

card to us before the Annual General Meeting, we will vote your shares as you direct. Your proxy card must be received by 5:00 p.m., Eastern

Daylight Time on August 8, 2023.

To vote over the telephone, please dial

+1 866-894-0536 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the control number from

your Proxy Materials Notice or your proxy card. Your telephone vote must be received by 11:59 p.m., Eastern Daylight Time on August

8, 2023 to be counted.

To vote through the Internet during

the virtual Annual General Meeting, please visit https://www.cstproxy.com/igi/2023 and have available the control number included

on your Proxy Materials Notice or your proxy card.

To vote through the Internet before

the Annual General Meeting, go to https://www.cstproxy.com/igi/2023 to complete an electronic proxy card. You will be asked to

provide the control number from your Proxy Materials Notice or your proxy card. Your internet vote must be received by 11:59 p.m.,

Eastern Daylight Time on August 8, 2023 to be counted.

To vote via a mobile device, on your

smartphone/tablet, open the QR Reader and scan the image in the Proxy Materials Notice or the proxy card. Once the voting site is displayed,

enter the 12-digit control number included on your Proxy Materials Notice or your proxy card and vote your shares. Your mobile vote must

be received by 11:59 p.m., Eastern Daylight Time on August 8, 2023 to be counted.

Beneficial Owner: Shares Registered in the Name of

Broker or Bank

If you are a beneficial owner of shares

registered in the name of your broker, bank, or other agent, you should have received the Proxy Materials Notice from that organization

rather than from IGI. Simply follow the instructions in the Proxy Materials Notice to ensure that your vote is counted. Alternatively,

you may vote by telephone as instructed by your broker or bank.

| A: | You may change your vote at any time prior to the vote at the Annual General Meeting. If you are the shareholder

of record, you may change your vote by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) by providing

a written notice of revocation to IGI’s Chief Legal and Compliance Officer by mail, which must be received by 11:59 p.m. Eastern

Daylight Time on August 8, 2023 prior to your shares being voted in accordance with the earlier proxy, or by attending the Annual General

Meeting and voting. Virtual attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically

so request. For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your broker,

trustee or nominee, or, if you have obtained a legal proxy from your broker or nominee giving you the right to vote your shares, by attending

the meeting and voting. |

| Q: | Is my vote confidential? |

| A: | Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in

a manner that protects your voting privacy. Your vote will not be disclosed either within IGI or to third parties, except (1) as

necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote and (3) to

facilitate a successful proxy solicitation. Occasionally, shareholders provide written comments on their proxy card, which are then forwarded

to IGI management. |

| Q: | How many shares must be present or represented to conduct business at the Annual General Meeting? |

| A: | A quorum of shareholders is necessary to hold a valid meeting. A quorum will be present if two or more

shareholders holding at least a majority of the voting power of the issued and outstanding shares entitled to vote are present at the

meeting in person or represented by proxy. On the record date, there were 46,635,100 Common

Shares issued and outstanding and entitled to vote. Thus, Common Shares representing 23,317,551 votes must be present in person

or represented by proxy at the meeting to have a quorum. |

Your shares will be counted towards

the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if

you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement.

| A: | For each item of business, you may vote “FOR,” “AGAINST” or “ABSTAIN.”

If you “ABSTAIN,” your abstention is not considered a vote for the purposes of the proposals and therefore has no effect on

the adoption of any of the proposals. |

If you provide specific instructions

for a given item, your shares will be voted as you instruct on such item. If you sign your proxy card or voting instruction card without

giving specific instructions, your shares will be voted in accordance with the recommendations of the Board (“FOR” IGI’s

nominee to the Board, “FOR” the re-appointment of our independent auditor and authorization for the Board to fix their remuneration,

and in the discretion of the proxyholders on any other matters that properly come before the meeting).

If you hold shares beneficially in street

name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Generally, broker

non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions

are not given. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered

entitled to vote on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the meeting, assuming

that a quorum is obtained.

| Q: | What is the voting requirement to approve each of the proposals? |

| A: | Proposals 1 and 2 require the affirmative “FOR” vote of a majority of votes cast. |

| Q: | Is cumulative voting permitted for the election of directors? |

| A: | No. IGI does not allow you to cumulate your vote in the election of directors. For all matters proposed

for shareholder action at the Annual General Meeting, each Common Share issued and outstanding as of the close of business on the record

date is entitled to one vote. |

| Q: | What happens if additional matters are presented at the Annual General Meeting? |

| A: | Other than the items of business described in this Information Circular, we are not aware of any business

to be acted upon at the Annual General Meeting. If you grant a proxy, the persons named as proxyholders, Wasef Jabsheh, or failing him,

Walid Jabsheh, or failing him, Pervez Rizvi, each with the power to appoint his substitute, will have the discretion to vote your shares

on any additional matters properly presented for a vote at the meeting. If for any unforeseen reason any of our nominees are not available

as a candidate for director, the persons named as proxyholders will vote your proxy for such candidate or candidates as may be nominated

by the Board, unless the Board chooses to reduce the number of directors serving on the Board pursuant to the Amended and Restated Bye-laws. |

| Q: | Why did I receive a Proxy Materials Notice in the mail regarding notice of the Annual General Meeting

and the Internet availability of proxy materials instead of a full set of proxy materials? |

| A: | As permitted under Bermuda law and our Amended and Restated Bye-laws, we are able to provide information

to our shareholders by publication of an electronic record of such information on our website so long as the notice requirements in Bye-law

23 are met. We have provided notice to our shareholders of the Annual General Meeting and the availability of such related information

by mailing them the Proxy Materials Notice. This saves time and costs to the Company and is in line with our environmental commitments

to reduce wastage. |

If you would like

to receive a paper copy of the proxy materials, you must request one. There is no charge for such documents to be mailed to you. Please

make your request for a paper copy as instructed below on or before July 9, 2023 to facilitate a timely delivery. You may also request

that you receive paper copies of all future proxy materials from the Company.

By telephone please

call 1-888-266-6791, or

By logging on to https://www.cstproxy.com/igi/2023

or

By email at: proxy@continentalstock.com

Please include the

company name and your control number in the subject line. The Company shall provide paper copies of the requested documents to you within

seven days of receipt of your request.

| Q: | Who will bear the cost of soliciting votes for the Annual General Meeting? |

| A: | IGI is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing

and distributing the Proxy Materials Notice and soliciting votes. In addition to the mailing of the Proxy Materials Notice, the solicitation

of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will

not receive any additional compensation for such solicitation activities. Upon request, we will reimburse brokerage houses and other custodians,

nominees and fiduciaries for forwarding proxy and solicitation materials to shareholders. |

| Q: | Where can I find the voting results of the Annual General Meeting? |

| A: | We intend to publish final voting results in a report on Form 6-K filed with the U.S. Securities

and Exchange Commission (the “SEC”). |

| Q: | Where can I find additional information relating to the Annual General Meeting? |

| A: | Our Rules of Conduct for the Annual General Meeting are available on our website at www.iginsure.com. |

Information Concerning

Solicitation and Voting

General

IGI’s Board is soliciting proxies for use

at the Company’s Annual General Meeting of shareholders (the “Shareholders”) to be held virtually via live webcast on

August 9, 2023, at 9:00 a.m. Eastern Daylight Time or at any adjournment or postponement thereof (the “Annual General Meeting”),

for the purposes set forth herein and in the accompanying Notice of Meeting.

Voting Rights and Outstanding Shares

On June 16, 2023 (the “Record Date”),

the Company had issued and outstanding 46,635,100 Common Shares. Each Shareholder of record

at the close of business on the Record Date is entitled to one vote for each Common Share then held. Two or more persons present at the

start of the virtual Annual General Meeting and representing in person or by proxy in excess of 50% of the total voting rights of all

issued and outstanding shares of the Company shall form a quorum for the transaction of business at the 2023 Annual General Meeting.

The Common Shares represented by proxy will be

voted in accordance with the instructions given on the proxy if the proxy is properly executed and is received by the Company prior to

the close of voting at the Annual General Meeting or any adjournment or postponement thereof. Any signed proxies submitted without instructions

will be voted “FOR” the proposals set forth on the Notice of Meeting.

Methods of Voting

The procedures for voting differ depending on

whether or not you are a shareholder of record or a beneficial owner of the shares.

Shareholder of Record: Shares Registered in Your Name

If you are a shareholder of record as of June

16, 2023, you may vote by proxy online, over the telephone, through the Internet or via a mobile device. Whether or not you plan to attend

the virtual Annual General Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and

vote in person even if you have already voted by proxy.

In order to vote using the proxy card, simply

complete, sign and date the proxy card which will be available by requesting a paper copy of the proxy materials as provided in the instructions

set forth on the Proxy Materials Notice and submit the proxy card promptly in accordance with the instructions therein. If you submit

your signed proxy card to us before the Annual General Meeting, we will vote your shares as you direct. Your proxy card must be received

by 5:00 p.m., Eastern Daylight Time on August 8, 2023.

To vote over the telephone, please dial +1 866-894-0536

using a touch-tone phone and follow the recorded instructions. You will be asked to provide the control number from the Proxy Materials

Notice or the proxy card. Your telephone vote must be received by 11:59 p.m., Eastern Daylight Time on August 8, 2023 to be counted.

To vote through the Internet during the virtual

Annual General Meeting, please visit https://www.cstproxy.com/igi/2023 and have available the control number included in the Proxy

Materials Notice or the proxy card.

To vote through the Internet before the Annual

General Meeting, go to https://www.cstproxy.com/igi/2023 to complete an electronic proxy card. You will be asked to provide the

control number from the Proxy Materials Notice or the proxy card. Your internet vote must be received by 11:59 p.m., Eastern Daylight

Time on August 8, 2023 to be counted.

To vote via a mobile device, on your smartphone/tablet,

open the QR Reader and scan the image in the Proxy Materials Notice or the proxy card. Once the voting site is displayed, enter the 12-digit

control number included on your Proxy Materials Notice or your proxy card and vote your shares. Your mobile vote must be received by 11:59 p.m.,

Eastern Daylight Time on August 8, 2023 to be counted.

Beneficial Owner: Shares Registered in the Name of Broker or

Bank

If your shares are held in a brokerage account

or by another nominee, you are considered the beneficial owner of shares held in street name and these proxy materials are

being forwarded to you together with voting instructions. As the beneficial owner, you have the right to direct your broker, trustee or

nominee how to vote and are also invited to attend the Annual General Meeting.

Since a beneficial owner is not the shareholder

of record, you may not vote these shares at the virtual meeting unless you obtain a “legal proxy” from the broker, trustee

or nominee that holds your shares, giving you the right to vote the shares at the meeting. Your broker, trustee or nominee should have

provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares.

Revocability of Proxies

You may change your vote at any time prior to

the vote at the Annual General Meeting. If you are the shareholder of record, you may change your vote by granting a new proxy bearing

a later date (which automatically revokes the earlier proxy) by providing a written notice of revocation to IGI’s Chief Legal and

Compliance Officer by mail, which must be received by 11:59 p.m. Eastern Daylight Time on August 8, 2023 prior to your shares being

voted in accordance with the earlier proxy, or by attending the Annual General Meeting and voting. Virtual attendance at the meeting will

not cause your previously granted proxy to be revoked unless you specifically so request. For shares you hold beneficially in street name,

you may change your vote by submitting new voting instructions to your broker, trustee or nominee, or, if you have obtained a legal proxy

from your broker or nominee giving you the right to vote your shares, by attending the meeting and voting.

Solicitation

The cost of preparing and soliciting proxies will

be borne by the Company. Solicitation will be made primarily by mail and the Internet, but Shareholders may be solicited by telephone,

e-mail, or personal contact.

Electronic Delivery

For Shareholders who hold their shares through

a bank or brokerage account, instead of receiving future copies of the Proxy Materials Notice by mail, Shareholders can elect to receive

an e-mail that will contain the Proxy Materials Notice. Opting to receive your Proxy Materials Notice online will save the Company the

cost of producing and mailing the Proxy Materials Notice to your home or business.

2022 Annual Report

IGI’s 2022 Annual Report on Form 20-F,

which includes the audited consolidated financial statements for the year ended December 31, 2022, together with the notes thereto

and the independent auditor’s report thereon, can be accessed by following the instructions in the Proxy Materials Notice that was

mailed to shareholders on or about June 30, 2023 and under “SEC Filings” in the “Investors” section of our website

at www.iginsure.com. The Form 20-F is subject to review by the staff of the SEC, who may review the Form 20-F and issue comments

on the disclosures contained therein. Any comments from the SEC on the Form 20-F from time to time could be material. The Form 20-F

is also available at the website of the SEC at www.sec.gov. Shareholders may also request a free copy of our 2022 Annual Report

on Form 20-F from:

International General Insurance Holdings Ltd.

74 Abdel Hamid Sharaf Street,

P.O. Box 941428,

Amman 11194, Jordan

Attention: Investor Relations

Telephone: 44 (0) 2072 204937

Email: robin.sidders@iginsure.com

IGI will also furnish any exhibit to the Form 20-F,

if specifically requested.

Principal Securityholders

The following table sets forth information regarding

beneficial ownership of IGI’s Common Shares based on 46,635,100 Common Shares issued

and outstanding as of June 16, 2023, with respect to beneficial ownership of our shares by:

| ● | each person known by us to be the beneficial owner of more than 5% of our issued and outstanding Common

Shares; |

| ● | each of our executive officers and directors; and |

| ● | all our executive officers and directors as a group. |

The information provided in the table is based

on information filed with the SEC and information provided to IGI. In accordance with SEC rules, individuals and entities named below

are shown as having beneficial ownership over Common Shares they own or have the right to acquire within 60 days, as well as Common

Shares for which they have the right to vote or dispose of such Common Shares. Also in accordance with SEC rules, for purposes of calculating

percentages of beneficial ownership, Common Shares which a person has the right to acquire within 60 days are included both in that

person’s beneficial ownership as well as in the total number of Common Shares issued and outstanding used to calculate that person’s

percentage ownership but not for purposes of calculating the percentage for other persons.

Except as indicated by the footnotes below, we

believe that the persons named below have sole voting and dispositive power with respect to all Common Shares that they beneficially own.

The Common Shares owned by the persons named below have the same voting rights as the Common Shares owned by our other shareholders. We

believe that, as of June 16, 2023, our Common Shares are owned by 77 record holders.

Unless otherwise indicated, the business address

of each beneficial owner listed in the tables below is International General Insurance Holdings Ltd., 74 Abdel Hamid Sharaf Street, P.O. Box

941428, Amman 11194, Jordan.

Beneficial Ownership Table

| Name and Address of Beneficial Owner | |

Number of

Common Shares

Beneficially Owned | | |

Percentage

of Issued and

Outstanding

Common Shares(1) | |

| Directors and Executive Officers | |

| | |

| |

| Wasef Salim Jabsheh(2) | |

| 18,373,211 | | |

| 36.3 | % |

| Walid Wasef Jabsheh(3) | |

| 500,548 | | |

| * | |

| Hatem Wasef Jabsheh(4) | |

| 367,856 | | |

| * | |

| Pervez Rizvi(5) | |

| 75,000 | | |

| * | |

| Andreas Loucaides(6) | |

| 80,000 | | |

| * | |

| Michael T. Gray(7) | |

| 2,585,886 | | |

| 5.5 | % |

| Andrew J. Poole(8) | |

| 587,017 | | |

| 1.3 | % |

| David Anthony | |

| * | | |

| * | |

| David King | |

| * | | |

| * | |

| Wanda Mwaura | |

| * | | |

| * | |

| All directors and executive officers as a group (ten individuals) | |

| 22,569,518 | | |

| 44.6 | % |

| Five Percent or Greater Shareholders | |

| | | |

| | |

| Oman International Development & Investment Company SAOG(9) | |

| 9,575,138 | | |

| 20.5 | % |

| Royce & Associates, LP(10) | |

| 3,390,532 | | |

| 7.3 | % |

| Church Mutual Insurance Company(11) | |

| 3,300,000 | | |

| 7.1 | % |

| Weiss Multi-Strategy Advisers LLC(12) | |

| 3,241,571 | | |

| 7.0 | % |

| Argo Re Limited(13) | |

| 3,209,067 | | |

| 6.8 | % |

| (1) | Based on 46,635,100 common shares of the Company issued and outstanding

as of June 16, 2023. |

| (2) | Wasef Salim Jabsheh’s 18,373,211 common shares

beneficially owned includes 14,373,211 common shares and 4,000,000 warrants to acquire common shares. Mr. Jabsheh’s

14,373,211 common shares beneficially owned include 600,000 contingent unvested common shares that vest at $11.50 per share, 400,000

contingent unvested common shares that vest at $12.75 per share and 131,148 contingent unvested common shares that vest at $15.25

per share. Mr. Jabsheh has the right to vote and receive dividends with respect to these contingent unvested common shares. His

shares also include 273,457 restricted shares for which he has the right to vote, of which

44,064 shares vest on January 2, 2024, 49,792 shares vest on January 2, 2024, 43,269 shares vest on January 2, 2024, 49,793 shares

vest on January 2, 2025, 43,269 shares vest on January 2, 2025 and 43,270 shares vest on January 2, 2026. Mr. Jabsheh’s 4,000,000 warrants entitle him to

purchase 4,000,000 common shares at a price of $11.50 per share. 18,242,403 of Mr. Jabsheh’s shares are directly owned by W.

Jabsheh Investment Co. Ltd. Mr. Jabsheh is the sole director of W. Jabsheh Investment Co. Ltd. and may be deemed the beneficial

owner of all securities owned by W. Jabsheh Investment Co. Ltd. 130,808 of Mr. Jabsheh’s shares are owned by Mr. Jabsheh

directly. Wasef Jabsheh’s ownership does not include 1,141,529 common shares beneficially owned by his adult children, as

Mr. Jabsheh does not have the right to vote or dispose of such common shares and thus does not have beneficial ownership of

such common shares. Mr. Jabsheh is the Chairman of the Company. |

| (3) | Walid Wasef Jabsheh’s ownership includes 82,455 common

shares owned by his wife Zeina Salem Al Lozi, for which common shares he disclaims beneficial ownership, and 111,667 unvested restricted

shares, with respect to which he has voting rights. Mr. Jabsheh’s ownership does not include 640,981 common

shares beneficially owned by his brothers or 18,373,211 common shares beneficially owned by his father, as Mr. Jabsheh does not have

the right to vote or dispose of such common shares and thus does not have beneficial ownership of such common shares. Mr. Jabsheh

is currently the Chief Executive Officer of the Company and is the son of Wasef Jabsheh. |

| (4) | Hatem Wasef Jabsheh’s ownership includes 25,879

common shares owned by his wife Sarah Ann Bystrzycki, for which common shares he disclaims beneficial ownership, and 73,333 unvested

restricted shares, with respect to which he has voting rights. Mr. Jabsheh’s ownership

does not include 773,673 common shares beneficially owned by his brothers or 18,373,211 common

shares beneficially owned by his father, as Mr. Jabsheh does not have the right to vote or dispose of such common shares and thus

does not have beneficial ownership of such common shares. Mr. Jabsheh is currently the Chief Operating Officer of the Company and

is the son of Wasef Jabsheh. |

| (5) | Includes 43,333 unvested restricted shares, with respect to which

he has voting rights. |

| (6) | Includes 51,667 unvested restricted shares, with respect to which

he has voting rights. |

| (7) | Michael T. Gray’s beneficial ownership of 2,585,886 common

shares includes (1) 1,280,574 common shares owned by the Gray Insurance Company, of which Michael T. Gray is President, including

256,997 contingent unvested common shares that vest at $11.50, (2) 1,054,392 contingent unvested common shares owned by Mr. Gray,

including 263,499 common shares that vest at $11.50 per share, 122,032 common shares that vest at $12.75 per share, 417,396 common shares

that vest at $14.00 per share and 251,465 common shares that vest at $15.25 per share, with respect to which Mr. Gray has the right

to vote and receive dividends and (3) 105,741 unvested common shares owned by his wife Linda Gray, for which shares he disclaims

beneficial ownership, including 20,293 common shares that vest at $11.50 per share, 13,184 common shares that vest at $12.75 per share,

45,096 common shares that vest at $14.00 per share and 27,168 common shares that vest at $15.25 per share. Mr. Gray’s ownership

does not include 100,000 common shares owned by his adult son Joe Skuba. The business address of each of The Gray Insurance Company and

Michael T. Gray is 3601 N Interstate 10 Service Rd W Metairie, LA 70002. Mr. Gray was previously the Chairman and Chief

Executive Officer of Tiberius Acquisition Corp. (“Tiberius”) prior to the consummation of the business combination between

the Company and Tiberius and is currently a director of the Company. |

| (8) | The 587,017 common shares beneficially owned by Mr. Poole include

270,644 contingent unvested common shares, including 185,196 common shares that vest at $11.50 per share, 13,184 common shares that vest

at $12.75 per share, 45,096 common shares that vest at $14.00 per share and 27,168 common shares that vest at $15.25 per share. Mr. Poole

has the right to vote and receive dividends with respect to these contingent unvested common shares. Mr. Poole’s ownership

also includes 230,000 common shares owned by his son Torin Perry Poole, including 78,807 contingent unvested common shares that vest at

$11.50, for which common shares he disclaims beneficial ownership. The business address of Andrew Poole is 3601 N Interstate 10 Service

Rd W Metairie, LA 70002. Mr. Poole was previously the Chief Investment Officer of Tiberius prior to the consummation of the

business combination between the Company and Tiberius and is currently a director of the Company. |

| (9) | Based on a Schedule 13D/A filed with the SEC on March 2, 2023, the

business address of Ominvest is Madinat Al Erfaan, Muscat Hills, Block No 9993, Building No. 95, Seventh Floor, Sultanate of Oman. |

| (10) | According to a Schedule 13G filed with the SEC on January 31, 2023,

Royce & Associates, LP beneficially owned 3,390,532 common shares of the Company as of December 31, 2022. Royce & Associates,

LP’s shares are beneficially owned by one or more registered investment companies or other managed accounts that are investment

management clients of Royce & Associates, LP. The interest of one account, Royce Small-Cap Total Return Fund, an investment company

registered under the Investment Company Act of 1940 and managed by Royce & Associates, LP, amounted to 2,747,997 common shares. |

| (11) | The business address of Church Mutual Insurance Company is 3000

Schuster Lane, Merrill, WI 54452. |

| (12) | According to a Schedule 13G/A filed with the SEC on February 14,

2023, Weiss Multi-Strategy Advisers LLC held shared voting and dispositive power with George A. Weiss with regard to securities

of the Company. Such securities are owned by advisory clients of Weiss Multi-Strategy Advisers LLC and George Weiss is the managing

member of Weiss Multi-Strategy Advisers LLC. Weiss Multi-Strategy Advisers LLC and Mr. Weiss each disclaim beneficial

ownership of the common shares, except to the extent of their pecuniary interest therein. The business address of each of Weiss Multi-Strategy Advisors

LLC and Mr. Weiss is 320 Park Avenue, 20th Floor, New York, NY 10020. |

| (13) | According to a Schedule 13G/A filed with the SEC on February

13, 2023, Argo beneficially owned 2,709,067 common shares of the Company and 500,000 warrants. Argo’s 2,709,067 shares beneficially

owned include 39,200 contingent unvested common shares that vest at $12.75 per share. Argo Re Ltd. has the right to vote and receive dividends

with respect to these contingent unvested common shares. Argo’s 500,000 warrants entitle Argo to purchase 500,000 common shares

at a price of $11.50 per share. Argo Re Ltd. is a wholly owned subsidiary of Argo Group International Holdings, Ltd. The business address

of Argo Group International Holdings, Ltd. is 110 Pitts Bay Road, Pembroke HM 08, Bermuda. The business address of Argo Re Ltd. is 90

Pitts Bay Road, Pembroke HM 08, Bermuda. |

Proposal No. 1

Election of Director

IGI’s Board currently consists of seven

directors divided into three classes: Class I, Class II and Class III. The number of directors in each class is required

to be as nearly equal as possible. At the 2023 Annual General Meeting, shareholders are being asked to elect one Class III director (Michael

Gray) to serve for a three year term until the 2026 Annual General Meeting, or until his successors are elected, or until his office is

vacated in accordance with the Amended and Restated Bye-Laws.

Information regarding the business experience

of the nominee is provided below.

If you sign your proxy or voting instruction card

or otherwise submit a proxy but do not give instructions for the voting of directors, your shares will be voted “FOR” the

person recommended by the Board. If you wish to give specific instructions for the voting of directors, you may do so by indicating your

instructions on your proxy, proxy card or voting instruction card.

The person receiving the highest number of “FOR”

votes represented by IGI’s Common Shares, present in person or represented by proxy and entitled to be voted at the Annual General

Meeting will be elected.

The nominee was recommended by the Board, and

the Board expects that the nominee will be available to serve as director. If for any unforeseen reason the Board’s nominee is

not available as a candidate for director, the proxyholders, Wasef Jabsheh, or failing him, Walid Jabsheh, or failing him, Pervez Rizvi,

each with the power to appoint his substitute, will vote your proxy for such other candidate as may be nominated by the Board, unless

the Board chooses to reduce the number of directors serving on the Board pursuant to the Amended and Restated Bye-laws.

Information About

the Director Nominee

Class III Director (new term to expire in 2026)

Michael Gray

Director since 2020

Age 63

Independent Director |

Michael T. Gray has served as a Director since March 17, 2020. Mr. Gray has over 30 years of leadership experience in the insurance industry. He served on the board of Delwinds Insurance Acquisition Corp., a company formed for the purpose of effecting a business combination, which went public in December 2020 and closed its initial business combination with FOXO Technologies Inc. in September 2022. He served as the Executive Chairman and Chief Executive Officer of Tiberius from its inception until the closing of the business combination between IGI and Tiberius in March 2020. He is the principal executive and President of The Gray Insurance Company, a middle-market property and casualty insurance company. Mr. Gray became President of The Gray Insurance Company in 1996. In addition to his role at The Gray Insurance Company, Mr. Gray has served as Chairman of the board of the Louisiana Insurance Guaranty Association since 2008 (director since 1995), director of the American Property Casualty Insurance Association (APCI) since 2019 (and was director of the predecessor organizations American Insurance Association since 2011 and Property Casualty Insurers Association of America since 2010), director of the Tulane University Family Business Center Advisory Council since 2008 and, from 1999 to 2003, served on the board of directors of Argo Group International Holdings (NASDAQ: AGII), a global property and casualty, specialty insurance, and reinsurance products provider. Mr. Gray was the Chairman of the board of Family Security, a personal lines/homeowners insurance company, in which The Gray Insurance Company held an ownership interest from 2013 to 2015. This culminated in the sale of the company, which Mr. Gray led, to United Insurance Holding Corporation (NASDAQ: UIHC). The parent of The Gray Insurance Company, Gray & Company, has acquired or developed several businesses under Mr. Gray’s guidance, including surplus lines insurance and title insurance, casualty and surety insurance, oil production and exploration facilities, technology development and real estate. Mr. Gray holds a B.A. from Southern Methodist University and an MBA from Tulane University. Mr. Gray graduated from the Harvard Business School “Presidents Program in Leadership” in 2020. |

Information About

Directors Continuing in Office

Class I Directors (terms expire in 2024)

David King

Director since 2020

Age 77

Independent Director |

David King has served as a Director since March 17, 2020. Mr. King served as a Non-Executive Director on the board of our wholly-owned subsidiary, International General Insurance Holdings Limited, a company organized under the laws of the Dubai International Financial Centre (“IGI Dubai”), from November 2012 through 2020. He also served as Non-Executive Chairman and a member of the audit committee of International General Insurance Company (UK) Limited, our wholly-owned subsidiary, until March 17, 2022. He also serves as non-executive chairman of Forex Capital Markets Limited, where he has been a Non-Executive Director since August 2014 and is a member of its audit committee and nomination and remuneration committee. From 2010 to 2012, Mr. King was executive director of Middle East business development at China Construction Bank International. Prior to that, he was the director of finance and administration of the London Metal Exchange between 1987 and 1989, chief executive officer of The London Metal Exchange from 1989 to 2001, managing director and acting Chief Executive of the Dubai Financial Services Authority from 2003 to 2005 and managing director of global banking in the MENA division of HSBC Bank Middle East Limited from 2005 to 2008. David King is a fellow in the Association of Chartered Certified Accountants and holds a Master of Business Administration from Cranfield University. |

| |

|

David Anthony

Director since 2020

Age 69

Independent Director |

David Anthony has served as a Director since March 17, 2020. Mr. Anthony served as a Non-Executive director on the board of IGI Dubai from July 2018 through March 2020. Since June 2018, Mr. Anthony has been an independent insurance consultant. From March 1994 to June 2018, Mr. Anthony was a Director and Senior Analyst with S&P Global Ratings (formerly Standard & Poor’s), where he was an active lead rating analyst and a Chair of its Insurance Rating Committee. Before joining S&P Global Ratings, Mr. Anthony was Senior Relationship Manager and Vice President, European Insurance Banking Group, at Citi Bank N.A. London from June 1987 to April 1992, and Senior Insurance Analyst at Moody’s Investors Service, New York from April 1992 to March 1994. Mr. Anthony has more than 30 years of experience in the insurance and reinsurance industry, which has included senior, insurance-related positions at ratings agencies and with international banks. Throughout his career he has worked extensively in Europe, the Middle East, North Africa and the United States. Mr. Anthony holds a Master of Science degree in Economic History from the University of London. |

Class II Directors (terms expire in 2025)

Wanda Mwaura

Director since 2020

Age 50

Independent Director |

Wanda Mwaura has served as a Director since March 17, 2020. Ms. Mwaura has more than 27 years of financial services, reinsurance, and accounting and advisory experience. She began providing auditing and advisory services at Ernst & Young Ltd. in 1996, specializing in financial services with a focus in reinsurance. Ms. Mwaura was at Ernst & Young Ltd. from 1996 through 2013, including serving as a partner from 2005 to 2013. She later served as the Head of External Reporting and Accounting Policy at PartnerRe, a leading global reinsurer, from October 2013 to February 2017, and as External Reporting Director and Chief Accounting Officer at PartnerRe from February 2017 to July 2019 and, since August 2019, has been the sole proprietor of Consult.bm, a director and consulting services provider to various entities in Bermuda. Ms. Mwaura is the Executive Director of the Bermuda Public Accountability Board. In July 2022, she was also appointed non-executive director and a member of the audit committee of the board of directors of a London Stock Exchange listed entity, Gulf Keystone Petroleum Ltd. Ms. Mwaura holds a Bachelor of Commerce (Co-op) degree from Dalhousie University, is a certified public accountant (CPA) and is a member of CPA Bermuda. |

| |

|

Andrew Poole

Director since 2020

Age 42

Independent Director |

Andrew J. Poole has served as a Director since March 17, 2020. Mr. Poole has over 18 years of diversified investment experience. He served as Chief Executive Officer and Chairman of Delwinds Insurance Acquisition Corp., a blank check company which went public in December 2020 and consummated its initial business combination with FOXO Technologies Inc. in September 2022. He joined the board of FOXO Technologies Inc. in September 2022 and serves on its audit, compensation and nominating committees. Mr. Poole was the Chief Investment Officer of Tiberius, a blank check company which went public in March 2018 and which consummated its initial business combination with IGI in March 2020. Concurrently, from 2015 through December 2022, Mr. Poole was an investment consultant at The Gray Insurance Company. Mr. Poole’s most recent role prior to joining Tiberius and The Gray Insurance Company was as Partner and Portfolio Manager at Scoria Capital Partners, LP, a long/short equity hedge fund, where he managed a portion of the firm’s capital including insurance sector investments from 2013 to 2015. Prior to Scoria, Mr. Poole held various positions at Diamondback Capital Management from 2005 to 2012 (including Portfolio Manager from 2011 onwards) and SAC Capital from 2004 to 2005, both of which are multi-strategy multi-manager cross capital structure long/short hedge funds. Earlier, Mr. Poole started his career at Swiss Re (SIX: SREN) working in facultative property placements in 2003 and was on the Board of Family Security, a personal lines insurance company, from 2013 to 2015 prior to the sale of the company to United Insurance Holdings Corporation (Nasdaq: UIHC). Mr. Poole is a graduate of The George Washington University. |

Class III Directors (terms expire in 2026)

Wasef Jabsheh

Director since 2020

Age 80 |

Wasef Jabsheh has served as our Chairman of the Board since March 17, 2020, and served as our Chief Executive Officer from March 17, 2020 through June 30, 2023. Wasef Jabsheh founded IGI in 2001 and served as the Chief Executive Officer and Vice Chairman of IGI Dubai from 2011 until March 17, 2020. Wasef Jabsheh has specialized in marine and energy insurance for more than 50 years in various prominent roles with the Kuwait Insurance Co and with ADNIC (the Abu Dhabi National Insurance Company) from the mid-1970s to the late 1980s. In 1989, Mr. Jabsheh established Middle East Insurance Brokers and two years later founded International Marine & General Insurance Co. He also served as a member of the board of directors of HCC Insurance Holdings Inc. from 1994 until 1997. |

| |

|

Walid Jabsheh

Director since 2020

Age 47 |

Walid Jabsheh is to serve as our Chief Executive Officer from July 1, 2023 and has served as a Director since March 17, 2020. He was previously our President from March 17, 2020 through June 30, 2023. Walid Jabsheh joined IGI in 2002 and, prior to his current role at the Company, served as the President of IGI Dubai where he played a pivotal role in the growth and development of IGI Dubai. Walid Jabsheh began his career at Manulife Reinsurance in Toronto, Canada and later joined LDG Reinsurance Corporation, a subsidiary of Houston Casualty Co, in 1998 where he served as Senior Underwriter managing a $30 million book of treaty and facultative business. |

Board Structure

and Governance

Classification of Directors

Our Board is comprised of seven directors. Our

Amended and Restated Bye-laws provide that our Board is divided into three classes designated as Class I, Class II and Class III

with as nearly equal a number of directors in each group as possible. The Class I Directors were initially elected for a one-year

term of office, the Class II Directors were initially elected for a two year term of office and the Class III Directors were

initially elected for a three-year term of office. At each annual general meeting, successors to the class of directors whose term expires

at that annual general meeting shall be elected for a three-year term. A director will hold office until the annual general meeting for

the year in which his or her term expires, subject to his or her office being vacated in accordance with our Amended and Restated Bye-laws.

David Anthony and David King are currently serving

as Class I Directors with terms expiring at our 2024 Annual General Meeting, Wanda Mwaura and Andrew Poole are currently serving

as Class II Directors with terms expiring at our 2025 Annual General Meeting, and Wasef Jabsheh, Walid Jabsheh and Michael Gray are

currently serving as Class III Directors with terms expiring at our 2023 Annual General Meeting. The term of Michael Gray will expire

at the 2023 Annual General Meeting and our Board has nominated him for a new 3-year term which will expire at the 2026 Annual General

Meeting. In accordance with Bermuda law and our Amended and Restated Bye-laws, Wasef Jabsheh and Walid Jabsheh have been re-appointed

as Class III Directors with a 3-year term which will expire at the 2026 Annual General Meeting.

The directors are elected with a plurality of

the votes cast by the shareholders and there is no cumulative voting for elections of directors, provided that (1) for so long as

Wasef Jabsheh, his family and/or their affiliates own at least 10% of our issued and outstanding Common Shares and provided that Wasef

Jabsheh remains a shareholder, Wasef Jabsheh is entitled to appoint and classify two directors to the Board (such Wasef Jabsheh-appointed

directors, “Jabsheh Directors”), (2) for so long as Wasef Jabsheh, his family and/or their affiliates own at least 5%

of our issued and outstanding Common Shares and provided that Wasef Jabsheh remains a shareholder, Wasef Jabsheh is entitled to appoint

and classify one Jabsheh Director to the Board, and (3) the remaining directors are elected by the shareholders. The current Jabsheh

Directors are Wasef Jabsheh and Walid Jabsheh.

Board Independence

As a foreign private issuer, we are not required

to have a majority of independent directors. However, five out of seven members of our Board — David Anthony, Michael Gray, David

King, Wanda Mwaura and Andrew Poole — are “independent” directors under Nasdaq rules.

Committees of the Board of Directors

Our Board has established three standing committees:

the audit committee, the compensation committee and the nominating/governance committee. The membership of each of the committees as of

the date hereof, and the number of meetings of each committee held during 2022, are as follows:

| Name of Director | |

Audit | | |

Nominating/

Governance | | |

Compensation | |

| Non-Employee

Directors: | |

| | |

| | |

| |

| David Anthony | |

| X | | |

| | | |

| X | * |

| Michael T. Gray | |

| | | |

| X | | |

| | |

| David King | |

| X | | |

| X | * | |

| | |

| Wanda Mwaura | |

| X | * | |

| | | |

| | |

| Andrew J. Poole | |

| | | |

| | | |

| X | |

| | |

| | | |

| | | |

| | |

| Employee

Directors: | |

| | | |

| | | |

| | |

| Wasef Salim Jabsheh | |

| | | |

| | | |

| | |

| Walid Wasef Jabsheh | |

| | | |

| X | | |

| X | |

| Number

of Meetings in 2022 | |

| 6 | | |

| 4 | | |

| 5 | |

X = Committee Member

* = Committee Chair

Audit Committee

The members of IGI’s

audit committee are David Anthony, David King and Wanda Mwaura. Wanda Mwaura is the chair of the audit committee. The audit committee

must be composed exclusively of “independent directors,” as defined by the rules and regulations of the SEC. Each of

the members of our audit committee is independent under SEC and Nasdaq rules. Wanda Mwaura serves as the audit committee financial expert

(within the meaning of SEC regulations). The Company has adopted an audit committee charter which sets forth the requirements for audit

committee members and the responsibilities of the audit committee.

The audit committee is

responsible for the appointment, compensation, retention and oversight of the auditors, review of the results and scope of the audit and

other accounting related services and review of our accounting practices and systems of internal accounting and disclosure controls. The

audit committee pre-approves auditing services and permitted non-audit services to be performed for the Company by the independent

auditor. The audit committee also reviews the independence and quality control procedures of the auditors and the experience and qualifications

of the auditor’s senior personnel that are providing audit services to the Company. The audit committee’s duties include meeting

with management and the auditors in connection with the annual audit, overseeing the internal auditor or internal audit function, and

reviewing with management the risk assessment and risk management policies of the company and the voluntary earnings press releases.

The audit committee may

delegate to the chair of the audit committee, any of the members of the audit committee, or any subcommittee, the responsibility and authority

for any particular matter within its powers and authority. However, subcommittees do not have the authority to engage independent legal

counsel, accounting experts or other advisors unless expressly granted such authority by the audit committee.

Nominating/Governance Committee

As a foreign

private issuer, the Company is not required to have a nominating/governance committee or a nominating/governance committee composed entirely

of independent directors. However, IGI’s board of directors has a nominating/governance committee with a majority of independent

directors. The members of the nominating/governance committee are Walid Jabsheh, Michael Gray and David King. David King is the chair

of the nominating/governance committee. The nominating/governance committee is responsible for overseeing the selection of persons to

be nominated to serve on our board of directors, advising the board of directors and making recommendations regarding appropriate corporate

governance practices, and leading the board of directors in the annual performance evaluation of the board of directors and its committees.

Compensation Committee

As a foreign private

issuer, the Company is not required to have a compensation committee or a compensation committee consisting only of independent directors.

However, our board of directors has a compensation committee with a majority of independent directors. The members of the Compensation

Committee are Walid Jabsheh, David Anthony and Andrew Poole. David Anthony is the chair of the compensation committee.

The Company has adopted

a compensation committee charter which sets forth the requirements for compensation committee members and the responsibilities of the

compensation committee. The 2020 Omnibus Incentive Plan of the Company is administered by the full board of directors. The purpose of

the compensation committee is to review, evaluate and approve compensation paid to our officers and directors. The compensation committee

will review director compensation and make recommendations to the board of directors regarding the form and amount of director compensation.

Codes of Conduct

The Company has adopted

a Corporate Code of Business Conduct and Ethics applicable to all of its directors, officers and employees. The Code of Business Conduct

and Ethics covers, among other things, conflicts of interest, company books and records, use of company property, payments of gifts, corporate

opportunities, compliance, extension of credit to officers and directors, confidentiality and employee relations.

The Company has also

adopted a Financial Code of Ethics applicable to the Chief Executive Officer, Chief Financial Officer, Senior Vice President — Finance,

Controller and certain other officers performing similar functions. The Financial Code of Ethics provides that each officer must act ethically

with honesty and integrity (including ethical handling of conflicts of interest), provide full and accurate disclosure in SEC filings

and public communications, comply with applicable laws and regulations, act in good faith, responsibly, with due care, competence and

diligence, promote honest and ethical behavior by others, respect the confidentiality of information acquired in the course of employment,

responsibly use and maintain all assets and resources employed or entrusted to the officer, and

promptly internally report violations of this Financial Code to the designated Compliance Officer and in the case of the CFO and CEO,

to the Board of Directors and/or Audit Committee of the Board of Directors.

Approval of Certain Transactions

Our Amended and Restated

Bye-laws provide that the board of directors may approve the following transactions only if each Jabsheh Director then in office

votes in favor of such transactions:

| ● | sell or dispose of all or substantially all of the assets of

the Company and its subsidiaries on a consolidated basis; |

| ● | enter into any transaction in which one or more third parties

acquire or acquires 25% or more of the Company’s common shares; |

| ● | enter into any merger, consolidation, or amalgamation with an

aggregate value equal to or greater than $75 million (exclusive of inter-company transactions); |

| ● | alter the size of the board of directors; |

| ● | incur debt in an amount of $50 million (or other equivalent

currency) or more; and |

| ● | issue common shares (or securities convertible into common shares)

in an amount equal to or greater than 10% of the then issued and outstanding common shares of the Company. |

Board Leadership

Wasef Jabsheh serves

as the Executive Chairman of the Board. Mr. Jabsheh served as the Chairman and Chief Executive Officer from March 17, 2020 through June

30, 2023. On July 1, 2023, Wasef Jabsheh will step down from the role of the Chief Executive Officer and the Board has appointed Walid

Jabsheh, who previously served as the President, as the new Chief Executive Officer.

We believe that Wasef

Jabsheh’s continuing as the Executive Chairman of the Board is most appropriate for us at this time as it provides us with continued,

consistent and efficient leadership, both with respect to our strategy and the leadership of the Board. The appointment of Walid Jabsheh

as our new Chief Executive Officer, given his tenure and experience with the Company, provides us with continuity and a deep understanding

of our day-to-day operations and ensures the consistent implementation of our strategy.

We believe that the separation

of the roles of Chairman and Chief Executive Officer between Wasef Jabsheh and Walid Jabsheh, together with the significant responsibilities

of the Board’s independent directors, provides an appropriate balance between leadership and independent oversight.

Vote Required

Approval of the election of Michael Gray as a

Class III director requires an affirmative vote of a majority of the votes cast at the Annual General Meeting.

Our Board unanimously recommends a vote FOR

the approval of the election of Michael Gray as a Class III director as set forth in Proposal No. 1.

Proposal No. 2

Approval of the Re-appointment of Ernst & Young LLP

TO ACT AS OUR INDEPENDENT AUDITOR FOR THE

FISCAL YEAR ENDING DECEMBER 31, 2023

At the Annual General Meeting, shareholders will

be asked to approve the re-appointment of Ernst & Young LLP, an independent registered public accounting firm, to act as the

Company’s independent auditor for the fiscal year ending December 31, 2023 and the authorization for the Board, acting through

our audit committee, to fix the remuneration of the Company’s independent auditor for the fiscal year ending December 31, 2023.

Ernst & Young LLP has advised the Company

that the firm does not have any direct or indirect financial interest in the Company, nor has such firm had any such interest in connection

with the Company or its consolidated subsidiaries during the past three fiscal years other than in its capacity as the Company’s

independent auditor.

Principal Auditor Fees

Our principal accountant since October 28,

2019, the date of our incorporation, through December 31, 2022 and as of December 31, 2022 is Ernst & Young LLP. The

following table shows the fees IGI and our subsidiaries paid or accrued for audit and other services provided by Ernst & Young

LLP for 2021 and 2022.

| Fees (in thousands of U.S. dollars) | |

2021 | | |

2022 | |

| Audit Fees | |

$ | 1,527 | | |

$ | 1,639 | |

| Audit-Related Fees | |

| — | | |

| — | |

| Tax Fees | |

| 5 | | |

| 5 | |

| All Other Fees | |

| 69 | | |

| 69 | |

| Total | |

$ | 1,601 | | |

$ | 1,713 | |

The audit committee has the authority to pre-approve

audit-related and permitted non-audit services to be performed by our independent auditor and associated fees. Engagements for proposed

services either may be separately pre-approved by the audit committee or entered into pursuant to detailed pre-approval policies and procedures

established by the audit committee, as long as the audit committee is informed on a timely basis of any engagement entered into on that

basis. The audit committee separately pre-approved all engagements and fees paid to our principal accountants in 2021 and 2022.

Vote Required

Adoption of Proposal No. 2 requires the affirmative

vote of a majority of the votes cast at the Annual General Meeting.

Our Board unanimously recommends a vote FOR

the approval of the re-appointment of Ernst & Young LLP, an independent registered public accounting firm, to act as the Company’s

independent auditor for the fiscal year ending December 31, 2023 and the authorization for our Board, acting through our audit committee,

to fix the remuneration of the Company’s independent auditor for the fiscal year ending December 31, 2023 as set forth in

Proposal No. 2.

Proposal No. 3

Presentation of IGI’s Financial Statements

You can find the Company’s audited financial

statements for the year ended December 31, 2022, together with the notes thereto and the independent auditor’s report thereon

(the “2022 Financial Statements”), by following the instructions in the Proxy Materials Notice that was mailed to shareholders

on or about June 30, 2023 and under “SEC Filings” in the “Investors” section of our website at www.iginsure.com.

Nomination of Directors

The directors are elected by the shareholders,

except in the case of a casual vacancy, at an annual general meeting or at any special general meeting called for that purpose, subject

to the following provisions:

| (a) | for so long as Wasef Jabsheh, his family and/or their affiliates

own at least 10% of the issued and outstanding Common Shares and provided that Wasef Jabsheh is a shareholder, Mr. Jabsheh will be entitled

to appoint two (2) directors to the Board (each a “Jabsheh Director”) and to classify each Jabsheh Director as a Class I,

II or III Director as he sees fit; |

| (b) | for so long as Wasef Jabsheh, his family and/or their affiliates own at least 5% (and less than 10%) of

the issued and outstanding Common Shares and provided that Mr. Jabsheh is a shareholder, Mr. Jabsheh will be entitled to appoint one (1)

Jabsheh Director to the Board and to classify the Jabsheh Director as a Class I, II or III Director as he sees fit; and |

| (c) | all directors, except any Jabsheh Directors, shall be elected by the shareholders in accordance with Bye-law

36. |

Only persons who are proposed or nominated in