D. Boral Capital Served as Co-Manager to ImmunityBio, Inc. (Nasdaq: IBRX) in connection with its $100.0 Million Underwritten Public Offering

12 12월 2024 - 10:00PM

ImmunityBio, Inc. (NASDAQ: IBRX), a leading immunotherapy company,

today announced the pricing of its previously announced

underwritten public offering of an aggregate of 33,333,334 shares

of its common stock at a price to the public of $3.00 per share.

ImmunityBio has granted the underwriters a 30-day option to

purchase up to an additional 5,000,000 shares of its common stock

at the public offering price, less underwriting discounts and

commissions. All of the shares were sold by ImmunityBio. Before

deducting the underwriting discount and offering expenses payable

by ImmunityBio, ImmunityBio expects to receive gross proceeds of

approximately $100.0 million, assuming no exercise of the

underwriters’ option to purchase additional shares. The offering is

expected to close on or about December 12, 2024 subject to

satisfaction of customary closing conditions.

Jefferies and Piper Sandler are acting as joint book-running

managers and representatives of the underwriters for the offering.

BTIG and H.C. Wainwright & Co. are acting as co-lead managers

with D. Boral Capital acting as co-manager for the offering.

ImmunityBio currently intends to use the net proceeds from this

offering to progress its continued commercialization of

ANKTIVA® for the treatment of BCG-unresponsive non-muscle

invasive bladder cancer (“NMIBC”) with carcinoma in

situ (“CIS”) with or without papillary tumors, to fund its

trials in BCG-naïve NMIBC and non-small cell lung cancer (“NSCLC”),

toward further research and development, for working capital needs,

and for other general corporate purposes. A shelf registration

statement on Form S-3ASR relating to the common stock offered in

the public offering was filed with the Securities and Exchange

Commission (the “SEC”) on April 17, 2024 and became automatically

effective on April 17, 2024. The offering is being made only by

means of a prospectus supplement and accompanying prospectus that

form a part of the registration statement. A preliminary prospectus

supplement and accompanying prospectus relating to the offering was

filed with the SEC on December 10, 2024 and is available on the

SEC’s website at www.sec.gov. A final prospectus supplement

and accompanying prospectus relating to the offering will also be

filed with the SEC and will be available on the SEC’s website

at www.sec.gov. When available, copies of the final prospectus

supplement and the accompanying prospectus may also be obtained

from: Jefferies LLC, by mail at Attn: Equity Syndicate Prospectus

Department, 520 Madison Avenue, New York, New York 10022, by

telephone at (877) 821-7388 or by email

at Prospectus_Department@Jefferies.com, or Piper Sandler &

Co. by mail at Attention: Prospectus Department, 800 Nicollet Mall,

J12S03, Minneapolis, MN 55402 or by email

at prospectus@psc.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the securities being offered, nor

shall there be any sale of the securities being offered in any

state or other jurisdiction in which such offer, solicitation or

sale would be unlawful prior to the registration or qualification

under the securities laws of any such state or other jurisdiction.

The offering was made only by means of a prospectus supplement and

accompanying prospectus.

About ImmunityBio, Inc.

ImmunityBio is a vertically-integrated commercial stage

biotechnology company developing next-generation therapies that

bolster the natural immune system to defeat cancers and infectious

diseases. The Company’s range of immunotherapy platforms, alone and

together, act to drive an immune response with the goal of creating

durable immune memory generating safe protection against disease.

Designated an FDA Breakthrough Therapy, ANKTIVA® is the first

FDA-approved immunotherapy for non-muscle invasive bladder cancer

CIS that activates natural killer cells, T cells, and memory T

cells for a long-duration response. The Company is applying its

science and platforms to treating cancers, including the

development of potential cancer vaccines, as well as developing

immunotherapies and cell therapies that we believe sharply reduce

or eliminate the need for standard high-dose chemotherapy. These

platforms and their associated product candidates are designed to

be more effective, accessible, and easily administered than current

standards of care in oncology and infectious diseases.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements concerning expectations with respect to

the completion of the public offering, and the anticipated use of

the net proceeds from the offering. Risks and uncertainties related

to these endeavors include, but are not limited to, risks and

uncertainties associated with market conditions and the

satisfaction of customary closing conditions related to the public

offering. Forward-looking statements are neither forecasts,

promises nor guarantees, and are based on the current beliefs of

ImmunityBio’s management as well as assumptions made by and

information currently available to ImmunityBio. Such information

may be limited or incomplete, and ImmunityBio’s statements should

not be read to indicate that it has conducted a thorough inquiry

into, or review of, all potentially available relevant information.

Such statements reflect the current views of ImmunityBio with

respect to future events and are subject to known and unknown

risks, including business, regulatory, economic and competitive

risks, uncertainties, contingencies and assumptions about

ImmunityBio.

Investors should review the risks and uncertainties contained in

ImmunityBio’s filings with the SEC, including the Company’s

Quarterly Report on Form 10-Q for the quarter ended September 30,

2024, filed with the SEC on November 12, 2024, in the preliminary

prospectus supplement related to the public offering filed with the

SEC on December 10, 2024, and in the final prospectus supplement to

be filed with the SEC, as well as other risks set forth in the

Company’s other filings with the SEC. ImmunityBio cautions you that

the forward-looking information presented in this press release is

not a guarantee of future events, and that actual events may differ

materially from those described in or suggested by the

forward-looking information contained in this press release.

Statements in this presentation that are not statements of

historical fact are considered forward-looking statements, which

are usually identified by the use of words such as “anticipates,”

“believes,” “continues,” “goal,” “could,” “estimates,” “scheduled,”

“expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“indicate,” “projects,” “is,” “seeks,” “should,” “will,”

“strategy,” and variations of such words or similar expressions.

Any forward-looking information presented herein is made only as of

the date of this press release, and the Company does not undertake

any obligation to update or revise any forward-looking information

to reflect changes in assumptions, the occurrence of unanticipated

events, or otherwise, except to the extent required by law.

Contact Us:D. Boral Capital590 Madison Avenue,

39th FloorNew York, NY 10022Main Phone: +1 (212)

970-5150www.dboralcapital.cominfo@dboralcapital.com

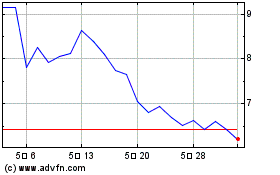

ImmunityBio (NASDAQ:IBRX)

과거 데이터 주식 차트

부터 12월(12) 2024 으로 1월(1) 2025

ImmunityBio (NASDAQ:IBRX)

과거 데이터 주식 차트

부터 1월(1) 2024 으로 1월(1) 2025