false

FY

0001883788

0001883788

2023-01-01

2023-12-31

0001883788

us-gaap:CommonClassAMember

2023-01-01

2023-12-31

0001883788

us-gaap:WarrantMember

2023-01-01

2023-12-31

0001883788

2023-06-30

0001883788

2024-04-26

0001883788

2023-12-31

0001883788

2022-12-31

0001883788

us-gaap:RelatedPartyMember

2023-12-31

0001883788

us-gaap:RelatedPartyMember

2022-12-31

0001883788

us-gaap:CommonClassAMember

2023-12-31

0001883788

us-gaap:CommonClassAMember

2022-12-31

0001883788

us-gaap:CommonClassBMember

2023-12-31

0001883788

us-gaap:CommonClassBMember

2022-12-31

0001883788

2022-01-01

2022-12-31

0001883788

us-gaap:CommonClassAMember

2022-01-01

2022-12-31

0001883788

DHAI:NonredeemableCommonStockMember

2023-01-01

2023-12-31

0001883788

DHAI:NonredeemableCommonStockMember

2022-01-01

2022-12-31

0001883788

DHAI:OrdinarySharesSubjectToPossibleRedemptionMember

us-gaap:CommonClassAMember

2022-12-31

0001883788

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2022-12-31

0001883788

us-gaap:CommonClassBMember

us-gaap:CommonStockMember

2022-12-31

0001883788

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001883788

us-gaap:RetainedEarningsMember

2022-12-31

0001883788

DHAI:OrdinarySharesSubjectToPossibleRedemptionMember

us-gaap:CommonClassAMember

2021-12-31

0001883788

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2021-12-31

0001883788

us-gaap:CommonClassBMember

us-gaap:CommonStockMember

2021-12-31

0001883788

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001883788

us-gaap:RetainedEarningsMember

2021-12-31

0001883788

2021-12-31

0001883788

DHAI:OrdinarySharesSubjectToPossibleRedemptionMember

us-gaap:CommonClassAMember

2023-01-01

2023-12-31

0001883788

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001883788

us-gaap:CommonClassBMember

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001883788

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001883788

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001883788

DHAI:OrdinarySharesSubjectToPossibleRedemptionMember

us-gaap:CommonClassAMember

2022-01-01

2022-12-31

0001883788

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001883788

us-gaap:CommonClassBMember

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001883788

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001883788

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001883788

DHAI:OrdinarySharesSubjectToPossibleRedemptionMember

us-gaap:CommonClassAMember

2023-12-31

0001883788

us-gaap:CommonClassAMember

us-gaap:CommonStockMember

2023-12-31

0001883788

us-gaap:CommonClassBMember

us-gaap:CommonStockMember

2023-12-31

0001883788

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001883788

us-gaap:RetainedEarningsMember

2023-12-31

0001883788

us-gaap:IPOMember

us-gaap:CommonClassAMember

2022-02-09

2022-02-09

0001883788

us-gaap:CommonClassAMember

us-gaap:OverAllotmentOptionMember

2022-02-09

2022-02-09

0001883788

us-gaap:CommonClassAMember

2022-02-09

0001883788

us-gaap:CommonClassAMember

2022-02-09

2022-02-09

0001883788

us-gaap:IPOMember

2022-02-09

2022-02-09

0001883788

2022-02-09

2022-02-09

0001883788

2022-02-09

0001883788

us-gaap:IPOMember

2022-02-09

0001883788

us-gaap:IPOMember

srt:MinimumMember

2022-02-09

2022-02-09

0001883788

us-gaap:IPOMember

srt:MaximumMember

2022-02-09

2022-02-09

0001883788

DHAI:AmendmentNoOneToInvestmentManagementTrustAgreementMember

2023-02-03

2023-02-03

0001883788

2023-07-27

2023-07-27

0001883788

DHAI:IfWeDoNotCompleteOurInitialBusinessCombinationMember

2023-01-01

2023-12-31

0001883788

DHAI:AbsentOurCompletingAnInitialBusinessCombinationMember

2023-01-01

2023-12-31

0001883788

2023-02-09

2023-02-09

0001883788

us-gaap:CommonClassAMember

2023-02-09

0001883788

us-gaap:CommonClassAMember

2023-07-28

2023-07-28

0001883788

2023-07-28

2023-07-28

0001883788

us-gaap:CommonClassAMember

2023-07-28

0001883788

us-gaap:IPOMember

DHAI:PrivatePlacementWarrantMember

2023-12-31

0001883788

us-gaap:WarrantMember

2023-01-01

2023-12-31

0001883788

DHAI:CommonClassASubjectToRedemptionMember

2023-01-01

2023-12-31

0001883788

DHAI:CommonClassASubjectToRedemptionMember

DHAI:PublicWarrantsMember

2023-01-01

2023-12-31

0001883788

DHAI:CommonClassASubjectToRedemptionMember

DHAI:PrivatePlacementWarrantsMember

2023-01-01

2023-12-31

0001883788

DHAI:CommonClassASubjectToRedemptionMember

2022-12-31

0001883788

DHAI:CommonClassASubjectToRedemptionMember

2023-12-31

0001883788

DHAI:RedeemableClassAOrdinarySharesMember

2023-01-01

2023-12-31

0001883788

DHAI:RedeemableClassAOrdinarySharesMember

2022-01-01

2022-12-31

0001883788

us-gaap:CommonClassAMember

us-gaap:OverAllotmentOptionMember

2022-02-09

0001883788

us-gaap:CommonClassAMember

DHAI:PrivatePlacementWarrantMember

2023-12-31

0001883788

us-gaap:CommonClassBMember

DHAI:FounderSharesMember

2021-08-07

2021-08-07

0001883788

us-gaap:CommonClassBMember

DHAI:FounderSharesMember

2021-08-07

0001883788

us-gaap:CommonClassAMember

2021-08-07

0001883788

us-gaap:CommonClassAMember

DHAI:SharePriceMoreThanOrEqualsToUsdTwelveMember

2021-08-07

2021-08-07

0001883788

DHAI:PromissoryNoteMember

2021-08-07

0001883788

DHAI:PromissoryNoteMember

2021-08-07

2021-08-07

0001883788

DHAI:PromissoryNoteMember

us-gaap:RelatedPartyMember

2021-08-07

0001883788

DHAI:PromissoryNoteMember

2023-12-31

0001883788

DHAI:PromissoryNoteMember

2022-12-31

0001883788

DHAI:FirstWorkingCapitalMember

2023-02-08

0001883788

DHAI:FirstExtensionNoteMember

2023-02-08

0001883788

DHAI:PromissoryNoteMember

2023-03-03

0001883788

DHAI:SecondExtensionNoteMember

2023-03-07

2023-03-07

0001883788

DHAI:SecondExtensionNoteMember

2023-04-06

2023-04-06

0001883788

DHAI:SecondExtensionNoteMember

2023-05-05

2023-05-05

0001883788

DHAI:SecondExtensionNoteMember

2023-06-02

2023-06-02

0001883788

DHAI:SecondExtensionNoteMember

2023-07-05

2023-07-05

0001883788

DHAI:SecondExtensionNoteMember

2023-01-01

2023-12-31

0001883788

DHAI:SecondWorkingCapitalMember

2023-04-06

0001883788

DHAI:ThirdWorkingCapitalMember

2023-05-02

0001883788

DHAI:FourthWorkingCapitalMember

2023-06-14

0001883788

DHAI:FifthWorkingCapitalMember

2023-07-10

0001883788

DHAI:FifthWorkingCapitalMember

2023-07-31

0001883788

DHAI:ThirdExtensionNoteMember

2023-07-31

2023-07-31

0001883788

DHAI:ThirdExtensionNoteMember

2023-09-01

2023-09-01

0001883788

DHAI:ThirdExtensionNoteMember

2023-10-02

2023-10-02

0001883788

DHAI:ThirdExtensionNoteMember

2023-12-05

2023-12-05

0001883788

DHAI:ThirdExtensionNoteMember

2023-11-02

2023-11-02

0001883788

DHAI:ThirdExtensionNoteMember

2023-01-01

2023-12-31

0001883788

DHAI:SixthWorkingCapitalMember

2023-09-01

0001883788

DHAI:SeventhWorkingCapitalMember

2023-10-24

0001883788

DHAI:EighthWorkingCapitalMember

2023-11-17

0001883788

DHAI:NinthWorkingCapitalMember

2023-11-21

0001883788

DHAI:TenthWorkingCapitalMember

2023-12-08

0001883788

DHAI:WorkingCapitalNotesMember

2023-12-31

0001883788

DHAI:SecondExtensionNoteMember

2023-12-31

0001883788

DHAI:WorkingCapitalAndSecondExtensionNoteMember

2023-12-31

0001883788

DHAI:WorkingCapitalLoanMember

2023-12-31

0001883788

us-gaap:RelatedPartyMember

2023-12-31

0001883788

us-gaap:RelatedPartyMember

2022-12-31

0001883788

DHAI:OfficeSpaceAdministrativeAndSupportServicesMember

2022-02-09

2022-02-09

0001883788

DHAI:AdministrativeSupportAgreementMember

2023-01-01

2023-12-31

0001883788

DHAI:AdministrativeSupportAgreementMember

2022-01-01

2022-12-31

0001883788

DHAI:FounderSharesMember

us-gaap:CommonClassAMember

2023-12-31

0001883788

DHAI:PublicWarrantsMember

2023-12-31

0001883788

DHAI:PrivatePlacementWarrantsMember

2023-12-31

0001883788

DHAI:PublicWarrantsMember

2023-01-01

2023-12-31

0001883788

DHAI:RedemptionOfWarrantsMember

DHAI:SharePriceEqualOrExceedsEighteenRupeesPerDollarMember

us-gaap:CommonClassAMember

2023-01-01

2023-12-31

0001883788

DHAI:RedemptionOfWarrantsMember

DHAI:SharePriceEqualOrExceedsEighteenRupeesPerDollarMember

us-gaap:CommonClassAMember

2023-12-31

0001883788

us-gaap:CommonClassAMember

DHAI:SharePriceEqualOrLessNinePointTwoRupeesPerDollarMember

2023-01-01

2023-12-31

0001883788

us-gaap:CommonClassAMember

DHAI:SharePriceEqualOrLessNinePointTwoRupeesPerDollarMember

2023-12-31

0001883788

DHAI:SharePriceEqualOrLessNinePointTwoRupeesPerDollarMember

2023-12-31

0001883788

DHAI:SharePriceEqualOrExceedsEighteenRupeesPerDollarMember

2023-12-31

0001883788

us-gaap:OverAllotmentOptionMember

DHAI:UnderwritingAgreementMember

2023-01-01

2023-12-31

0001883788

DHAI:UnderwritingAgreementMember

2023-01-01

2023-12-31

0001883788

DHAI:UnderwritingAgreementMember

2023-12-31

0001883788

us-gaap:IPOMember

2023-01-01

2023-12-31

0001883788

us-gaap:CommonClassAMember

2023-12-18

0001883788

us-gaap:CommonClassAMember

us-gaap:SubsequentEventMember

2024-02-07

0001883788

DHAI:PublicWarrantsMember

us-gaap:FairValueInputsLevel3Member

2021-12-31

0001883788

DHAI:PrivatePlacementWarrantsMember

us-gaap:FairValueInputsLevel3Member

2021-12-31

0001883788

us-gaap:FairValueInputsLevel3Member

DHAI:WarrantLiabilityMember

2021-12-31

0001883788

DHAI:PublicWarrantsMember

us-gaap:FairValueInputsLevel3Member

2022-01-01

2022-12-31

0001883788

DHAI:PrivatePlacementWarrantsMember

us-gaap:FairValueInputsLevel3Member

2022-01-01

2022-12-31

0001883788

DHAI:WarrantLiabilityMember

us-gaap:FairValueInputsLevel3Member

2022-01-01

2022-12-31

0001883788

DHAI:PublicWarrantsMember

us-gaap:FairValueInputsLevel3Member

DHAI:TrancheOneMember

2022-01-01

2022-12-31

0001883788

DHAI:PrivatePlacementWarrantsMember

us-gaap:FairValueInputsLevel3Member

DHAI:TrancheOneMember

2022-01-01

2022-12-31

0001883788

DHAI:WarrantLiabilityMember

us-gaap:FairValueInputsLevel3Member

DHAI:TrancheOneMember

2022-01-01

2022-12-31

0001883788

us-gaap:FairValueInputsLevel3Member

DHAI:PublicWarrantsMember

DHAI:TrancheTwoMember

2022-01-01

2022-12-31

0001883788

us-gaap:FairValueInputsLevel3Member

DHAI:PrivatePlacementWarrantsMember

DHAI:TrancheTwoMember

2022-01-01

2022-12-31

0001883788

us-gaap:FairValueInputsLevel3Member

DHAI:WarrantLiabilityMember

DHAI:TrancheTwoMember

2022-01-01

2022-12-31

0001883788

DHAI:PublicWarrantsMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001883788

DHAI:PrivatePlacementWarrantsMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001883788

us-gaap:FairValueInputsLevel3Member

DHAI:WarrantLiabilityMember

2022-12-31

0001883788

us-gaap:FairValueInputsLevel3Member

DHAI:PublicWarrantsMember

2023-01-01

2023-12-31

0001883788

us-gaap:FairValueInputsLevel3Member

DHAI:PrivatePlacementWarrantsMember

2023-01-01

2023-12-31

0001883788

us-gaap:FairValueInputsLevel3Member

DHAI:WarrantLiabilityMember

2023-01-01

2023-12-31

0001883788

DHAI:PublicWarrantsMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001883788

DHAI:PrivatePlacementWarrantsMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001883788

us-gaap:FairValueInputsLevel3Member

DHAI:WarrantLiabilityMember

2023-12-31

0001883788

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel1Member

2023-12-31

0001883788

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel2Member

2023-12-31

0001883788

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001883788

us-gaap:FairValueInputsLevel1Member

DHAI:PublicWarrantsMember

2023-12-31

0001883788

us-gaap:FairValueInputsLevel2Member

DHAI:PublicWarrantsMember

2023-12-31

0001883788

us-gaap:FairValueInputsLevel1Member

DHAI:PrivatePlacementWarrantsMember

2023-12-31

0001883788

us-gaap:FairValueInputsLevel2Member

DHAI:PrivatePlacementWarrantsMember

2023-12-31

0001883788

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001883788

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001883788

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001883788

us-gaap:FairValueInputsLevel1Member

DHAI:PublicWarrantsMember

2022-12-31

0001883788

us-gaap:FairValueInputsLevel2Member

DHAI:PublicWarrantsMember

2022-12-31

0001883788

us-gaap:FairValueInputsLevel1Member

DHAI:PrivatePlacementWarrantsMember

2022-12-31

0001883788

us-gaap:FairValueInputsLevel2Member

DHAI:PrivatePlacementWarrantsMember

2022-12-31

0001883788

DHAI:PublicWarrantsMember

2021-12-31

0001883788

DHAI:PrivatePlacementWarrantsMember

2021-12-31

0001883788

DHAI:DerivativeWarrantLiabilityMember

2021-12-31

0001883788

DHAI:PublicWarrantsMember

2022-01-01

2022-12-31

0001883788

DHAI:PrivatePlacementWarrantsMember

2022-01-01

2022-12-31

0001883788

DHAI:DerivativeWarrantLiabilityMember

2022-01-01

2022-12-31

0001883788

DHAI:PublicWarrantsMember

2022-12-31

0001883788

DHAI:PrivatePlacementWarrantsMember

2022-12-31

0001883788

DHAI:DerivativeWarrantLiabilityMember

2022-12-31

0001883788

DHAI:PrivatePlacementWarrantsMember

2023-01-01

2023-12-31

0001883788

DHAI:DerivativeWarrantLiabilityMember

2023-01-01

2023-12-31

0001883788

DHAI:DerivativeWarrantLiabilityMember

2023-12-31

0001883788

us-gaap:MeasurementInputSharePriceMember

DHAI:PrivatePlacementWarrantsMember

2022-02-09

0001883788

us-gaap:MeasurementInputExercisePriceMember

DHAI:PrivatePlacementWarrantsMember

2022-02-09

0001883788

us-gaap:MeasurementInputRiskFreeInterestRateMember

DHAI:PrivatePlacementWarrantsMember

2022-02-09

0001883788

us-gaap:MeasurementInputPriceVolatilityMember

DHAI:PrivatePlacementWarrantsMember

2022-02-09

0001883788

us-gaap:MeasurementInputExpectedTermMember

DHAI:PrivatePlacementWarrantsMember

2022-02-09

0001883788

DHAI:MeasurementInputProbabilityMember

DHAI:PrivatePlacementWarrantsMember

2022-02-09

0001883788

us-gaap:MeasurementInputExpectedDividendRateMember

DHAI:PrivatePlacementWarrantsMember

2022-02-09

0001883788

us-gaap:MeasurementInputSharePriceMember

DHAI:PublicWarrantsMember

2023-12-31

0001883788

us-gaap:MeasurementInputSharePriceMember

DHAI:PublicWarrantsMember

2022-12-31

0001883788

us-gaap:MeasurementInputExercisePriceMember

DHAI:PublicWarrantsMember

2023-12-31

0001883788

us-gaap:MeasurementInputExercisePriceMember

DHAI:PublicWarrantsMember

2022-12-31

0001883788

us-gaap:MeasurementInputRiskFreeInterestRateMember

DHAI:PublicWarrantsMember

2023-12-31

0001883788

us-gaap:MeasurementInputRiskFreeInterestRateMember

DHAI:PublicWarrantsMember

2022-12-31

0001883788

us-gaap:MeasurementInputPriceVolatilityMember

DHAI:PublicWarrantsMember

2023-12-31

0001883788

us-gaap:MeasurementInputPriceVolatilityMember

DHAI:PublicWarrantsMember

2022-12-31

0001883788

us-gaap:MeasurementInputExpectedTermMember

DHAI:PublicWarrantsMember

2023-12-31

0001883788

us-gaap:MeasurementInputExpectedTermMember

DHAI:PublicWarrantsMember

2022-12-31

0001883788

DHAI:MeasurementInputProbabilityMember

DHAI:PublicWarrantsMember

2023-12-31

0001883788

DHAI:MeasurementInputProbabilityMember

DHAI:PublicWarrantsMember

2022-12-31

0001883788

us-gaap:MeasurementInputExpectedDividendRateMember

DHAI:PublicWarrantsMember

2023-12-31

0001883788

us-gaap:MeasurementInputExpectedDividendRateMember

DHAI:PublicWarrantsMember

2022-12-31

0001883788

us-gaap:SubsequentEventMember

2024-01-04

0001883788

DHAI:WorkingCapitalNotesMember

us-gaap:SubsequentEventMember

2024-02-07

0001883788

DHAI:SecondExtensionNoteMember

us-gaap:SubsequentEventMember

2024-02-07

0001883788

DHAI:WorkingCapitalAndSecondExtensionNoteMember

us-gaap:SubsequentEventMember

2024-02-07

0001883788

us-gaap:SubsequentEventMember

DHAI:SubscriptionAgreementMember

2024-02-07

2024-02-09

0001883788

us-gaap:SubsequentEventMember

DHAI:SubscriptionAgreementMember

2024-02-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

| ☒ |

Annual

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For

the year ended December 31, 2023

| ☐ |

Transition

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For

the transition period from______to________

Commission

File Number: 001-41250

DIH

HOLDING US, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

98-1624542 |

(State

or Other Jurisdiction of

Incorporation) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

77

Accord Drive, Suite D-1

Norwell,

MA |

|

02061 |

| (Address

of principal executive offices) |

|

(zip

code) |

(877)

944-2000

(Issuer’s

Telephone Number, Including Area Code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| |

|

|

|

|

| Class

A Common Stock |

|

DHAI |

|

The

Nasdaq Stock Market LLC |

| Warrants |

|

DHAIW |

|

The

Nasdaq Stock Market LLC |

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934

during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirement for the past 90 days. Yes ☐ No ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☐ No ☒

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The

aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price

of the common stock of the Company on the Nasdaq Stock Market as of the last business day of the Registrant’s most recently completed

second fiscal quarter, June 30, 2023, was $63,434,566.

As

of April 26, 2024, there were 40,544,935 shares of Class A Common Stock issued and outstanding.

DIH

HOLDING US, INC.

FORM

10-K

TABLE

OF CONTENTS

BASIS

OF PRESENTATION

DIH Holding US, Inc. (“DIH”) (formerly known as Aurora Technology

Acquisition Corp. or “ATAK”) was a blank check company originally incorporated on August 6, 2021 as a Cayman Islands exempted

company for the purpose of effecting a merger, capital share exchange, asset acquisition, share purchase, recapitalization, reorganization,

or similar business combination with one or more businesses or entities. On February 7, 2022, the registration statement relating to an

initial public offering (“IPO”) was declared effective by the Securities and Exchange Commission (the “SEC”).

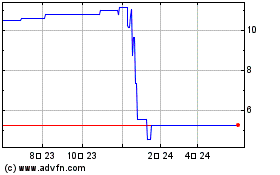

On February 9, 2022, ATAK consummated the IPO of 20,200,000 units at $10.00 per unit and the sale of 6,470,000 warrants at a price of

$1.00 per private warrant in a private placement to ATAC Sponsor LLC (the “Sponsor”) that closed simultaneously with the closing

of the IPO. The units were listed on the Nasdaq Global Market (“Nasdaq”). On February 26, 2023, ATAK entered into that certain

Business Combination Agreement (the “Business Combination Agreement”) by and between ATAK, Aurora Technology Merger Sub (“Merger

Sub”) and DIH Holding US, Inc., a Nevada corporation (“Legacy DIH”).

On February 7, 2024 (the “Closing Date”), ATAK, Legacy DIH

and Merger Sub consummated the transactions (collectively, the “Transaction”) contemplated by the Business Combination Agreement

by means of a domestication of ATAK from the Cayman Islands to Delaware and the subsequent merger of Merger Sub with and into Legacy DIH.

On

February 9, 2024, our shares of Class A common stock, par value $0.0001 (the “Common Stock”), and warrants to purchase

shares of Common Stock (the “Warrants”) began trading on Nasdaq Stock Market LLC (“Nasdaq”) under the

symbols, “DHAI” and “DHAIW,” respectively.

Unless otherwise indicated, the historical financial information included

in this Annual Report on Form 10-K (the “Annual Report”), including the audited financial statements and the notes thereto

in Part II. Item 8 and the information in Part II. Item 7. “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and Item 11. “Executive Compensation” is that of ATAK prior to the consummation of the Transactions.

The unaudited combined financial statements of Legacy DIH as of and for the nine months ended December 31, 2023 and 2022 will be included

in DIH’s Current Report on Form 8-K, which is anticipated to be filed with the SEC on or about April 29, 2024.

The Business Combination will be accounted for as a reverse recapitalization

in accordance with GAAP. Under this method of accounting, ATAK will be treated as the “acquired” company for financial reporting

purposes. Accordingly, the Business Combination will be treated as the equivalent of DIH issuing stock for the net assets of ATAK, accompanied

by a recapitalization. The net assets of DIH will be stated at historical cost, with no goodwill or other intangible assets recorded.

Operations prior to the Business Combination will be those of Legacy DIH.

Certain monetary amounts, percentages, and other figures included herein

have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables and charts may not be the arithmetic

aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when

aggregated may not be the arithmetic aggregation of the percentages that precede them.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements within the meaning of the Securities Act

of 1933, as amended, or the Securities Exchange Act of 1934, as amended, or the Private Securities Litigation Reform Act of 1995. Investors

are cautioned that such forward-looking statements are based on our management’s beliefs and assumptions and on information currently

available to our management and involve risks and uncertainties. Forward-looking statements include statements regarding our plans, strategies,

objectives, expectations and intentions, which are subject to change at any time at our discretion. Forward-looking statements include

our assessment, from time to time of our competitive position, the industry environment, potential growth opportunities, the effects

of regulation and events outside of our control, such as natural disasters, wars or health epidemics. Forward-looking statements include

all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,”

“could,” “estimates,” “expects,” “hopes,” “intends,” “may,” “plans,”

“potential,” “predicts,” “projects,” “should,” “will,” “would”

or similar expressions.

Forward-looking

statements are merely predictions and therefore inherently subject to uncertainties and other factors which could cause the actual results

to differ materially from the forward-looking statement. These uncertainties and other factors include, among other things:

| ● |

unexpected

technical and marketing difficulties inherent in major research and product development efforts; |

| |

|

| ● |

our

ability to remain a market innovator, to create new market opportunities, and/or to expand into new markets; |

| |

|

| ● |

the

potential need for changes in our long-term strategy in response to future developments; |

| |

|

| ● |

our

ability to attract and retain skilled employees; |

| |

|

| ● |

our

ability to raise sufficient capital to support our operations and fund our growth initiatives; |

| |

|

| ● |

unexpected

changes in significant operating expenses, including components and raw materials; |

| |

|

| ● |

any

disruptions or threatened disruptions to or relations with our resellers, suppliers, customers and employees, including shortages

in components for our products; |

| |

|

| ● |

changes

in the supply, demand and/or prices for our products; |

| |

|

| ● |

the

complexities and uncertainty of obtaining and conducting international business, including export compliance and other reporting

and compliance requirements; |

| |

|

| ● |

the

impact of potential security and cyber threats or the risk of unauthorized access to our, our customers’ and/or our suppliers’

information and systems; |

| |

|

| ● |

changes

in the regulatory environment and the consequences to our financial position, business and reputation that could result from failing

to comply with such regulatory requirements; |

| |

|

| ● |

our

ability to continue to successfully integrate acquired companies into our operations, including the ability to timely and sufficiently

integrate international operations into our ongoing business and compliance programs; |

| |

|

| ● |

failure

to develop new products or integrate new technology into current products; |

| |

|

| ● |

unfavorable

results in legal proceedings to which we may be subject; |

| |

|

| ● |

failure

to establish and maintain effective internal control over financial reporting; and |

| |

|

| ● |

general

economic and business conditions in the United States and elsewhere in the world, including the impact of inflation. |

You

should refer to Part I, Item 1A “Risk Factors” of this Annual Report on Form 10-K for a discussion of important factors that

may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of the

risks, uncertainties and assumptions described under “Risk Factors” and elsewhere, we cannot assure you that the forward-looking

statements in this Annual Report on Form 10-K will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate,

the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard

these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified

time frame or at all.

You

should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance, or events

and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly

any forward-looking statements for any reason after the date of this report to conform these statements to new information, actual results

or changes in our expectations, except as required by law.

The

forward-looking statements contained in this report are based on our current expectations and beliefs concerning future developments

and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated.

These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions

that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors.”

Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may

vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable

securities laws.

References

INTRODUCTORY

NOTE

References

to the “Company” refer to DIH Holding US, Inc., a Delaware corporation and its consolidated subsidiaries subsequent to the

Business Combination (defined below). References to “DIH” or “New DIH” are to ATAK post-closing of the Business

Combination.

References

to “management” or “management team” refer to the Company’s officers and directors and references to “Sponsor”

refer to ATAC Sponsor, LLC, a Delaware limited liability company.

Market

Data and Forecasts

Unless

otherwise indicated, information in this Annual Report concerning economic conditions, our industry, and our markets, including our general

expectations and competitive position, market opportunity and market size, is based on a variety of sources, including information from

independent industry analysts and publications, as well as our own estimates and research. Our estimates are derived from industry and

general publications, studies and surveys conducted by third-parties, as well as data from our own internal research. These publications,

studies and surveys generally indicate that their information has been obtained from sources believed to be reliable, although they do

not guarantee the accuracy or completeness of such information, and we have not independently verified industry data from such third-party

sources. While we believe our internal research is reliable and that our internal estimates are reasonable, such research has not been

verified by any independent source and our internal estimates are based on our good faith beliefs as of the respective dates of such

estimates. We are responsible for all of the disclosure in this Annual Report.

PART

I

ITEM

1. BUSINESS

Introduction

DIH

Holding US, Inc., a Delaware corporation ( “DIH”) (formerly known as Aurora Technology Acquisition Corp. “ATAK”)

was formed as a blank check company incorporated in the Cayman Islands on August 6, 2021 for the purpose of effecting a merger, capital

stock exchange, asset acquisition, stock purchase, reorganization or similar business combination. ATAK, Aurora Technology Merger Sub

Corp., a Nevada corporation and a direct, wholly-owned subsidiary of ATAK (“Merger Sub”), and DIH Holding US, Inc., a Nevada

corporation (“DIH (Nevada)”) entered into a Business Combination Agreement dated as of February 26, 2023 (as amended, supplemented

or otherwise modified from time to time, (the “Business Combination Agreement,” and the transactions contemplated thereby,

the “Business Combination”).

Following

the receipt of the required approval by ATAK’s and DIH (Nevada)’s shareholders and the fulfillment or waiver of other customary

closing conditions, the Business Combination closed on February 7, 2024, and the combined company was organized as a Delaware corporation.

In connection with the Closing, ATAK migrated and changed its domestication to become a Delaware corporation and changed its name to

“DIH Holding US, Inc.” For further information, see the section entitled “Corporate History” below.

DIH

is a global solution provider in blending innovative robotic and virtual reality (“VR”) technologies in the rehabilitation

market with clinical integration and insights. DIH stands for our vision to “Deliver Inspiration & Health” to improve

the functioning of millions of people with disabilities and functional impairments. DIH (Nevada) was built through the acquisitions of

global-leading niche technology providers including HOCOMA, a Switzerland-based global leader in robotics for rehabilitation, and MOTEK,

a Netherlands-based global leader in sophisticated VR-enabled movement platform powered by real-time integration, DIH is positioning

itself as a transformative total smart solutions provider and consolidator in a largely fragmented and manual-labor-driven industry.

DIH

offers innovative, robotic-enabled solutions in an augmented and interactive environment. These solutions deliver differentiated outcomes,

while also tracking patients’ progress and providing a network of collaboration and encouragement. DIH is dedicated to restoring

mobility and enhancing human performance through total solutions that enable transformation of rehabilitation care at our customers.

DIH currently has direct sales in the United States, Germany, Switzerland and Netherlands.

Industry

and Market Overview

Market

Opportunity

The

market for robotic devices for rehabilitation and human performance enhancement is rapidly growing. As populations age and the consequent

demand for healthcare services increases, we expect there will be a growing need for innovative solutions that can help individuals recover

from injuries and optimize their physical abilities. Additionally, there is a growing interest in the use of technology to enhance human

performance, whether in sports or in everyday life.

DIH’s

target market is composed of three major sub-markets:

| |

■ |

Advanced

Research Facilities (“ARFs”): which include advanced human performance labs or rehabilitation/biomedical research centers

at universities and academic hospitals); |

| |

■ |

Inpatient

rehabilitation facilities (“IRFs”) which include free standing rehabilitation hospitals and rehabilitation units in acute

care hospitals); |

| |

■ |

Outpatient

and inpatient rehabilitation facilities (“ORFs”) which include outpatient rehabilitation clinics, skilled nursing or

long-term care facilities). We are currently focused on the North American and European markets to accelerate market penetration,

while seeking early-stage opportunities in other international markets for future expansion |

For

the ARF (or Research Market), our products enable thought-provoking and sophisticated simulation and evaluation of human performance

in general, and dynamic gait and balance-focused movements research in specific, through our industry-leading interactive VR platform

empowered by human body modeling and visualization, with integration to advanced robotics and other smart system to expand imaginative

research interests. Most of the top 50 global leading research centers in human performance and rehabilitation have adopted our technologies

as the key base of their research exploration. We believe Motek is considered as the premier brand and global leader in the world’s

most advanced biomechanical lab for research and clinical treatment on human performance and movement disorders.

For

the IRFs (or Hospital Market) our products enable intensive, integral and interactive (“3i”) interventions that significantly

improve functional outcomes by utilizing established neural pathways and restoring patterns and agility through brain plasticity or neuro-musculoskeletal

interactions; powered by our most advanced rehabilitation robots, and further fueled by data integration and insights from integrated

and networked solutions. Most of the global top 500 leading IRFs have adopted our advanced robots as a backbone in their therapeutic

treatments to high acuity patients such as TBI, SCI, strokes, and other traumatically injured patients. Our Swiss engineered Hocoma robots

are well recognized by the industry and have the largest installed base. We believe there is vast growth potential in this core market

segment for us in the next 5-10 years by leveraging our leadership and expanding our market coverage.

For

the vast ORFs (or Clinical market), we enable modern specialty rehabilitation care models that differentiate and deliver high value with

better and consistent outcomes due to the 3i intervention approach empowered by our technology. By blending technology with innovative

care models, such modern specialty ORFs can deliver superior values to patients and their therapists by enabling one therapist to treat

multiple patients with better outcomes due to the intensive, interactive, and integral approach enabled by our smart solutions. By leveraging

the treatment protocol established by our advanced robots and movements platform, we are re-configuring our solutions through modularization

and further acquisitions to exploit this vast and diverse market.

Core

Product Overview

DIH

offers innovative, robotic-enabled devices in an augmented and interactive environment. These devices focus on restoring different functional

impairment issues, while using software thereby tracking patients’ progress and providing a network of collaboration and encouragement.

We

currently offer 17 robotic rehabilitation and VR-based movement systems within three major product categories through the hospital, clinical

and research markets. Our objective is to establish ourselves as a product and technology leader in each of the three categories, that

correspond to three key functional impact issues, i.e. 1) upper extremity devices for arm and hand functional improvement; 2) lower extremity

devices for gait and balance intervention; and 3) full body integrated intervention for strength and endurance enhancement. Through software

networks, we aim not only to maximize the benefits from each of the devices itself, but also to deliver multi-dimensional clinical, economic,

process and administrative benefits to therapists, patients and management by connecting and integrating these various devices into cohesive

and integrated caring processes and models, enabling transformative change in therapies and business models.

Upper

Extremity Product Categories

To

address differing clinical and economic needs, while providing consistent therapeutic interventions with similar treatment concepts and

protocols, we have developed three different device models, ArmeoPower, ArmeoSpring, and ArmeoSenso. All follow the same modular Armeo

Therapy Concept, that covers the “Continuum of Rehabilitation” with one software platform throughout the different stages

of rehabilitation; from the early stage where the patient is very weak and needs sophisticated power-assisted dynamic intervention to

help rewire the neural pattern in a safe environment which ArmeoPower provides, to self-initiated interactive ArmeoSpring which follows

a similar treatment protocol of ArmeoPower for patients who have gained certain muscle power and need to transition from controlled patterns

to an open environment. ArmeoSenso is for patients to apply what they learned from those self-initiated but still structurally controlled

movement patterns to completely open movement environments, further expanding the patient transfer skills. The economic costs of devices,

and the ratio of one therapist for multiple patients also improves dramatically, thus allowing service providers and health systems to

gain significant benefits of learning curves, i.e. the learning patient picks up from early acute expensive interventions, which will

be increasingly beneficial for later stages, generating a win-win, both economically and clinically.

ArmeoPower

is the backbone robot within our Upper Extremity portfolio; it has been specifically designed for arm and hand therapy in an early

stage of rehabilitation. It enables patients with even severe motor impairments to perform exercises with a high number of repetitions.

It assists the patient’s arm on an “as needed” basis to enable the patient to successfully reach the goal of the exercise.

The robotic arm assistance can be adapted to the individual’s needs and the changing abilities of each patient – from full

assistance for patients with very little activity to no assistance at all for more advanced patients. Such adjustable robotic assistance

while exercising, enables and motivates patients to actively participate in their training, while providing weight support to enable

extensive training. ArmeoPower supports 1D (joint-specific), 2D and 3D movements, with extensive game-emerged APF exercises simulating

tasks and activities essential for daily living, while enhancing strength and range of motion. Immediate performance feedback motivates

patients and helps to improve their motor abilities. It improves efficiency of the therapy session by reducing the therapist’s

physical effort and the need for continuous therapeutic guidance. Moreover, it enables therapists to make better use of their clinical

know-how and expertise, by focusing on the optimal exercise planning, instead of manually delivering many repetitions.

ArmeoPower

precisely records how patients perform during their therapy sessions. Standardized Assessment Tools evaluate a patient’s motor

functions such as joint range of motion and forces. The results can be used to analyze and document the patient’s state and therapy

progress. Results can then be shared with the patient and other clinicians. ManovoPower as an add-on module for ArmeoPower enables hand

opening and closing exercises.

ArmeoSpring

is targeted for less severe patients; it provides self-initiated repetitive arm and hand therapy in an extensive workspace. By providing

arm weight support, it encourages the patients to achieve a higher number of arm and hand movements based on specific therapy goals.

It also allows simultaneous arm and hand training in an extensive workspace. This enables patients to practice the movements important

for their therapy progress. ArmeoSpring also supports 1D (joint-specific), 2D and 3D movements. An extensive library of motivating game-like

APF exercises has been designed to train strength and range of motion needed for activities of daily living. Immediate performance feedback

motivates patients and helps to improve their motor abilities. The ArmeoSpring enables therapists to deliver higher training efficiency

(more hours per day) due to self-directed therapy. Furthermore, self-directed therapy enables patients to reach an even higher therapy

intensity through extra training during after-hours and weekends.

Lower

Extremity Product Categories

Similar

to the Armeo Therapy Concept for arm and hand, we have also developed 3+1 Robotics + VR devices to address the different clinical and

economic needs of patients across different stages of the patient journey, while providing consistent therapeutic interventions with

similar treatment concepts and protocols. The Erigo Robot is designed for patients right after ICU who have none or very weak muscle

power, with the goal to speed up the circulation and initiate early mobilization and prepare patients for intensive therapy, while preventing

or reducing secondary further impairment. LokoMat is designed to provide maximum intensive therapy to rewire the broken neuro pathway

to restricted functional capabilities through Neuroplasticity effect. Andago is designed to assist patients in walking in a real environment

to maximize patient transfer skills after the patient’s functional pattern has been rewired by LokoMat. C-Mill is designed to enhance

the patient’s adaptability, coordination and balancing skills in a challenging and integrative environment.

Erigo

is uniquely designed to provide therapy intervention to the most severe patient even at a high acute and critical post-ICU stage.

It uniquely combines gradual verticalization, leg mobilization, and intensive sensorimotor stimulation through cyclic leg loading.

The

main benefits include:

| |

■ |

Early

and safe mobilization even in acute care |

| |

■ |

Cardiovascular

stabilization |

| |

■ |

Improved

orthostatic tolerance using the Erigo functional stimulation. |

| |

■ |

Helping

to reduce patient’s length of stay, improving efficiency and outcome |

Lokomat

provides robot-assisted therapy that enables effective and intensive training to increase the strength of muscles and the range of

motion of joints in order to improve walking. The physiological movement of the lower extremities is ensured by the individually adjustable

patient interface. Additionally, the hip and knee joint angles can be adjusted during training to the patient’s specific needs.

During rehabilitation, patients need to be challenged. Therapists can help patients reach their goals by setting the training parameters

according to their performance. Lokomat motivates patients to reach their goals with various game-like exercises. This Augmented Performance

Feedback, or APF, maximizes the effect of Lokomat training. Lokomat allows therapists to focus on the patient and the actual therapy.

It enhances staff efficiency and safety, leading to higher training intensity, more treatments per therapist, and consistent, superior

patient care.

Lokomat

is available in two models, LokomatNanos and LokomatPro, and has other modules such as for pediatric use available. To date, we have

installed over 1,085 Lokomat systems in over 650 facilities worldwide.

Andago

is designed to assist patients in walking naturally which consequently triggers continuous physiological afferent input, due to its

built-in dynamic support. With its robotics smart control system, it enables patient to walk seamlessly and freely due to its robotic

system. Andago bridges the gap between treadmill-based gait training and free overground walking. No dedicated space is needed as it

can be used flexibly in different spaces. Its intuitive workflow allows for a quick and easy therapy start and simple integration into

clinical routine. The display of key training results and export of data via USB enables training progress documentation for clinical

decision-making and for health insurance providers. No infrastructure modification, meaning flexible use from room to room.

C-Mill

is a powerful tool that allows for more efficient rehabilitation. Besides objective assessment of balance and gait, the C-Mill provides

a safe and comfortable training environment using a treadmill, augmented reality and VR. Using our technology, patients are able to train

foot placement with the C-Mill, work through balance and dual-tasks with C-Mill VR or use C-Mill VR+ for early to late rehabilitation

with body weight support. It is a complete, advanced gait-lab and training center on a compact space.

CAREN,

“Computer Assisted Rehabilitation Environment”, is the most advanced and sophisticated VR-enabled real time movement platform,

that targets all aspects of balance and locomotion with visualization of full body participation empowered by Human Body Modeling. CAREN

provides researchers with the tools to efficiently study advanced human movement by collecting objective human performance data in real

time and functionally challenging environments. CAREN enables the most versatile human movement research as a result of its dual-belt

instrumented treadmill mounted on a 6 degree-of-freedom movable platform, motion capture system, immersive and interactive environments

and dedicated real-time and offline software packages; the CAREN is the most advanced system for your human movement research, training,

and assessment. We believe CAREN will enable pioneering research in many fields of application, such as: motor control and learning,

dual-tasking and feedback, balance assessment and therapy, gait analysis and adaptability, real-time human body modeling, virtual reality

and integrated smart systems like robot integration. We believe CAREN is considered as the world’s most advanced biomechanics lab.

GRAIL,

“Gait Real-time Analysis Interactive Lab”, the total package solution for gait analysis training and research, employs an

instrumented dual-belt treadmill and motion capture system combined with virtual reality and video cameras. GRAIL provides analysis and

therapy in challenging conditions to improve gait, while real-time feedback enables analysis and training during the same session.

Manufacturing

and Supply Chain

Our

manufacturing and supply chain strategy is founded on a commitment to blending Swiss quality mindset with Dutch agility, utilizing lean

manufacturing and supply chain practices, leveraging an the Oracle ERP system implemented, ensuring efficient order fulfillment to global

markets, and delivering exceptional value and commitment to our customers and patients.

Manufacturing

For

manufacturing we are building our devices in two plants. We manufacture the Lokomat, Andago, Erigo, Armeo Power, Armeo Spring and Armeo

Senso devices at Hocoma AG in Switzerland ) while our product line for hospitals and clinics, C-Mill, is manufactured at Motek Medical

B.V. in The Netherlands together with all research products (RYSEN, M-GAIT, GRAIL and CAREN).

For

the SafeGait 360 and Active product line that we acquired from Gorbel, those two products currently are only sold in the United States

and are manufactured through a contract manufacturing and development arrangement with Peko. We are in the process of establishing our

own manufacturing facility in Leeds, Alabama, and plan to start assembling those products ourselves from June 2023 rather than through

Peko.

Supply

Chain

For

standardized products (for hospitals and clinics) DIH conducts production planning based on the sales budget (yearly) and sales forecast

(quarterly). To have the correct alignment between all stakeholders, there is a monthly standard operating procedures (“S&OP”)

meeting in place. In this meeting, all relevant stakeholders are involved, such as planning, procurement, production, order fulfillment,

sales, finance, operational engineering, service and product management. Additionally, we have the inputs from regulatory and quality

as well. In the S&OP the forecast and the production/procurement planning for the quarters are set and the current fulfillment situation

is monitored.

Our

research products are generally fairly differentiated, which makes it difficult to manage supply chain dynamics far in advance. Many

of the parts are completely customized, and inputs are only known during the project phase when the order has been received. Basic parts

such as treadmills, drives and motors can be planned and procured accordingly. For these research projects, there is also an S&OP

in place limited to the research group.

DIH

has approximately 400 direct suppliers who deliver material and assemblies to the Hocoma and Motek facilities. The purchasing volume

is roughly $9 million, with approximately 9,700 purchase orders. We mainly purchase in the European Market, with focus on low-cost countries

in Eastern Europe. We have a few suppliers outside of the off-shore, and we are currently working on re-assessing suppliers on-shore.

Facilities

Our

executive offices are located at 77 Accord Drive, Suite D-1 Norwell, MA. We do not own any properties, instead we lease properties to

meet our needs. Currently, we have two main R&D and Operational campuses that we lease for Hocoma and Motek operation in Switzerland

and Netherlands. The Hocoma AG leased property is located at Industriestrasse 2 and 4a in 8604 Volketswil, The Motek Medical B.V. leased

property is located at Vleugelboot 14, Houten in The Netherlands.

Beside

those two main campuses, we also lease five commercial offices space at the following locations to house the regional Sales & Marketing,

Clinical Application & Training, Technical Services, Finance, Logistics, Administration and other local market support functions.

| |

■ |

DIH

Technology Inc. leased commercial office for American team at 77 Accord Park Dr., Suite D-1, Norwell, MA 02061, United States |

| |

■ |

DIH

Technology d.o.o leased commercial office for EMEA Indirect sales team at Letališka 29a, 1000 Ljubljana, Slovenia |

| |

■ |

DIH

GmbH leased commercial office for the Direct Sales team in DACH region, at Konrad-Adenauer Strasse 13, 50996 Köln, Germany |

| |

■ |

DIH

Pte Ltd leased commercial office for APAC team at 67 Ubi Avenue 1, #06-17 Starhub Green, Singapore 408942 |

| |

■ |

DIH

SpA leased commercial office for LATAM team at Pdte. Kennedy Lateral 5488, Oficina 1402; Vitacura, Santiago, Chile |

Employees

As of April 26, 2024, we employed 242 employees. We acknowledge that our

employees are the Company’s most valued asset and the driving force behind our success. For this reason, we aspire to be an employer

that is known for cultivating a positive and welcoming work environment and one that fosters growth, provides a safe place to work, supports

diversity and embraces inclusion. To support these objectives, our human resources programs are designed to develop talent to prepare

them for critical roles and leadership positions for the future; reward and support employees through competitive pay, benefit and perquisite

programs; enhance the Company’s culture through efforts aimed at making the workplace more engaging and inclusive; acquire talent

and facilitate internal talent mobility to create a high performing, diverse workforce; engage employees as brand ambassadors of the Company’s

products; and evolve and invest in technology, tools and resources to enable employees at work.

Diversity,

Equity, and Inclusion

We

are committed to fostering, cultivating and preserving a culture of diversity, equity and inclusion (DE&I). We recognize that a diverse,

extensive talent pool provides the best opportunity to acquire unique perspectives, experiences, ideas, and solutions to drive our business

forward. We believe that diverse teams solving complex problems leads to the best business results. We promote diversity by developing

policies, programs, and procedures that foster a work environment where differences are respected, and all employees are treated fairly.

Talent

Management

We

recognize the importance of attracting and retaining the best employees. Our continued success is not only contingent upon seeking out

the best possible candidates, but also retaining and developing the talent that lies within the organization. We strive to attract, develop,

and retain the best and brightest from all walks of life and backgrounds. Our goal is to offer opportunities for employees to improve

their skills to achieve their career goals.

Employee

Health and Safety

There

have been no OSHA recordable or lost time injuries in the United States and zero injuries at our other global sites.

Intellectual

Property

We

have over 20 different trademark families registered, including our most prominent product family names such as Lokomat, Armeo, Andago,

and RYSEN. These trademarks are registered in 18 strategically important countries, resulting in a total of 411 registrations. The earliest

registration was made in 2004, and the latest in 2020.

| Name/Description

of Patent |

|

Status |

|

Owned

or Licensed |

|

Type

of patent protection |

|

Expiration

Date |

|

Jurisdictions |

| US8834169/Method

and apparatus for automating arm and grasping movement training for rehabilitation of patients with motor impairment |

|

Issued |

|

Licensed |

|

Utility |

|

24.11.2030 |

|

US |

| |

|

|

|

|

|

|

|

|

|

|

| US8192331/Device

for adjusting the prestress of an elastic means around a predetermined tension or position |

|

Issued |

|

Owned |

|

Utility |

|

10.09.2028 |

|

US,

DE, FR, UK, IT, CH, CN, RU |

| |

|

|

|

|

|

|

|

|

|

|

| US9017271/System

for Arm therapy |

|

Issued |

|

Licensed |

|

Utility |

|

10.02.2031 |

|

US,

DE, FR |

| |

|

|

|

|

|

|

|

|

|

|

| US8924010

/Method to Control a Robot Device and Robot Device |

|

Issued |

|

Owned |

|

Utility |

|

06.10.2031 |

|

US,

DE, FR, NL, CH, UK |

| |

|

|

|

|

|

|

|

|

|

|

| US9987511/Gait

training apparatus |

|

Issued |

|

Owned |

|

Utility |

|

19.09.2034 |

|

US,

DE, FR, UK, IT, CH, CN, PL, KR |

| |

|

|

|

|

|

|

|

|

|

|

| EP3095430/Gait

training apparatus (Div) |

|

Issued |

|

Owned |

|

Utility |

|

09.11.2032 |

|

DE,

FR, UK, CH |

| |

|

|

|

|

|

|

|

|

|

|

| US10780009/Apparatus

for locomotion therapy |

|

Issued |

|

Owned |

|

Utility |

|

06.01.2037 |

|

US,

DE, FR, UK, CH, CN, RU |

| |

|

|

|

|

|

|

|

|

|

|

| EP3100707/Apparatus

for locomotion therapy (Div) |

|

Issued |

|

Owned |

|

Utility |

|

16.11.2032 |

|

DE,

FR, UK, IT, CH TR, PL, CN |

| |

|

|

|

|

|

|

|

|

|

|

| US9808668/Apparatus

for automated walking training |

|

Issued |

|

Owned |

|

Utility |

|

10.08.2034 |

|

US,

DE, FR, UK, IT, CH, CN, PL, TR, NL, FI, ES |

| |

|

|

|

|

|

|

|

|

|

|

| EP3035901/

Hand motion exercising device |

|

Issued |

|

Owned |

|

Utility |

|

14.08.2034 |

|

DE,

FR, UK, NL, SI, CH, CN |

| |

|

|

|

|

|

|

|

|

|

|

| US10349869/Method

and system for an assessment of a movement of a limb-related point in a predetermined 3D space |

|

Issued |

|

Owned |

|

Utility |

|

16.02.2036 |

|

US,

DE, FR, UK, CH, AU, IT, CN |

| |

|

|

|

|

|

|

|

|

|

|

| US10500122/Apparatus

for gait training |

|

Issued,

Pending

for KR |

|

Owned |

|

Utility |

|

20.08.2037 |

|

US,

DE, FR, UK, CH, CN, TR, NL, SE, ES, RU, KR |

| |

|

|

|

|

|

|

|

|

|

|

| US10925799/

Suspension device for balancing a weight |

|

Issued |

|

Owned |

|

Utility |

|

27.06.2037 |

|

US,

AU, CH, DE, FR, UK, IT, NL, PL, CN, KR |

| |

|

|

|

|

|

|

|

|

|

|

| US-20230039187-A1/Leg

Actuation Apparatus and Gait Rehabilitation Apparatus |

|

Pending |

|

Owned |

|

Utility |

|

|

|

US,

IN, CN, RU, EP, KR |

| |

|

|

|

|

|

|

|

|

|

|

| US-2023-0039187-A1/User

Attachment for Gait and Balance Rehabilitation Apparatus |

|

Pending |

|

Owned |

|

Utility |

|

|

|

US,

CN, EP, KR |

| |

|

|

|

|

|

|

|

|

|

|

| DM/091

450/Wheeled walking frame |

|

Issued |

|

Owned |

|

Design |

|

08.06.2041 |

|

CH,

EM, US, UK |

| |

|

|

|

|

|

|

|

|

|

|

| DM/221

948/ArmeoSpring Pro-Design |

|

Issued |

|

Owned |

|

Design |

|

01.07.2047 |

|

CH,

EM, US, UK |

Corporate

History

On

August 7, 2021, ATAK issued an aggregate of 5,750,000 Class B ordinary shares for an aggregate purchase price of $25,000, or approximately

$0.0043 per share, to ATAK’s Sponsor. We refer to the Class B ordinary shares purchased by our Sponsor as “founder shares.”

Due to the underwriters partial exercise of the over-allotment option, ATAK’s Sponsor forfeited 700,000 founder shares back to

ATAK.

On

February 9, 2022, ATAK consummated its initial public offering (the “Initial Public Offering” or “IPO”) of 20,200,000

of our units (the “Units”) which included 200,000 Units sold upon partial exercise of the underwriters’ over-allotment

option. Each Unit consists of one Class A ordinary share, one redeemable warrant entitling the holder to purchase one-half of one Class

A ordinary share at a purchase price of $11.50 per whole share (“Public Warrants”), and one right to acquire one-tenth (1/10)

of one Class A ordinary share (“Rights”). The Units were sold at a public offering price of $10.00 per Unit, generating gross

proceeds of $202,000,000.

Simultaneously

with the consummation of the IPO, ATAK consummated the private placement (“Private Placement”) of 6,470,000 warrants (the

“Private Warrants”), at a price of $1.00 per Private Warrant, generating gross proceeds of $6,470,000. The Private Warrants

were sold to ATAK’s Sponsor. The Private Warrants are identical to Public Warrants sold in the IPO as part of the Units, except

that the Private Warrants are non-redeemable and may be exercised on a cashless basis, in each case so long as they continue to be held

by our Sponsor or ATAK’s Sponsor’s permitted transferees.

Following

the closing of the IPO and the sale of the Private Warrants in the Private Placement, an aggregate amount of $204,020,000 was placed

in the trust account established in connection with the IPO.

On

March 17, 2022, ATAK announced that the holders of the Units may elect to separately trade the Class A ordinary shares, Public Warrants

and Rights included in the Units, commencing on March 21, 2022. Any Units not separated continued to trade on the Nasdaq under the symbol “ATAKU.” Any underlying Class A ordinary shares, Public Warrants and Rights that

were separated trade on the Nasdaq under the symbols “ATAK,” “ATAKW” and “ATAKR,” respectively. Following

the closing of the Business Combination, as of February 9, 2024, the Company’s Class A Ordinary Shares and Public Warrants trade

under the symbols “DHAI” and “DHAIW,” respectively.

Extension

of Combination Period

On

February 3, 2023, ATAK held an extraordinary general meeting of shareholders (the “Extraordinary General Meeting”), to approve

(i) a special resolution to amend ATAK’s amended and restated memorandum and articles of association (the “Articles”)

giving ATAK the right to extend the date by which it has to consummate a business combination (the “Combination Period”)

six (6) times for an additional one (1) month each time, from February 9, 2023 to August 9, 2023 (the “Extension Amendment”)

and (ii) the proposal to approve the Trust Amendment (as defined below). All proposals at the Extraordinary General Meeting were approved

by the shareholders of ATAK.

On

February 6, 2023, ATAK and Trustee entered into Amendment No. 1 to the Investment Management Trust Agreement, to allow ATAK to extend

the Combination Period six (6) times for an additional one (1) month each time from February 9, 2023 to August 9, 2023 by depositing

into the Trust Account for each one-month extension the lesser of: (x) $135,000 or (y) $0.045 per share multiplied by the number of public

shares then outstanding (the “Trust Amendment”). A copy of the Trust Amendment was attached to the Annual Report for the

fiscal year ended December 31, 2022 as Exhibit 10.1 and incorporated herein by reference. In addition, on February 6, 2023, ATAK adopted

the Extension Amendment, amending ATAK’s Articles.

In

connection with the vote to approve the Extension Amendment, the holders of 14,529,877 Class A ordinary shares elected to redeem their

shares for cash at a redemption price of approximately $10.2769 per share, for an aggregate redemption amount of approximately $149.3

million, leaving approximately $58.3 million in the trust account.

On

February 8, 2023, ATAK issued an unsecured promissory note (the “Extension Note”) in the amount of $135,000 to the Sponsor,

in exchange for the Sponsor depositing such amounts into ATAK’s trust account (the “Initial Extension Payment”) in

order to extend the Combination Period by one (1) month from February 9, 2023 to March 9, 2023. The Extension Note did not bear interest,

and matured (subject to the waiver against trust provisions) on August 31, 2023. In connection with the issuance of the Extension Note,

certain existing investors in the Sponsor received convertible notes issued by the Sponsor, whereby, at the election of the noteholders

and only if ATAK consummates the initial business combination, a noteholder may convert the principal outstanding under the respective

note into Class A ordinary shares of ATAK at a price of $10.00 per share. In addition, the Company issued an unsecured promissory note

(the “Working Capital Note”) in the amount of $90,000 to the Sponsor, in exchange for the Sponsor depositing such amounts

in ATAK’s working capital account, in order to provide ATAK with additional working capital. The Working Capital Note did not bear

interest, and matured (subject to the waiver against trust provisions) two (2) days following the date on which ATAK’s initial

business combination was consummated. The Extension Note and the Working Capital Note were issued pursuant to an exemption from registration

contained in Section 4(a)(2) of the Securities Act.

On

March 3, 2023, the Company issued an unsecured promissory note to the Sponsor, with a principal amount equal to $810,000 (the “Second

Extension Note” and, together with the Extension Note, the “Extension Notes”). The Second Extension Note bears no interest

and is repayable in full (subject to amendment or waiver) upon the earlier of (a) the date of the consummation of the Company’s

initial business combination, or (b) the date of the Company’s liquidation. Advances under the Second Extension Note are for the

purpose of making payments to extend the Combination Period (“Extension Payments”) and repaying the Sponsor or any other

person with respect to funds loaned to the Company for the purpose of paying Extension Payments, including the Initial Extension Payment.

On March 7, 2023, pursuant to the Second Extension Note, the Company delivered to the Sponsor a written request to draw down $135,000

for the second month of the Extension. Upon this written request, the Sponsor deposited $135,000 to the Company’s Trust Account

on March 8, 2023 in order to extend the Combination Period by one (1) month from March 9, 2023 to April 9, 2023. The Second Extension

Note was issued pursuant to an exemption from registration contained in Section 4(a)(2) of the Securities Act.

On

April 6, 2023, pursuant to the Second Extension Note, the Company delivered to the Sponsor a written request to draw down $135,000 for

the third month of the Extension. Upon this written request, the Sponsor deposited $135,000 to the Company’s Trust Account on April

6, 2023 in order to extend the Combination Period by one (1) month From April 9, 2023 to May 9, 2023. In addition, the Company issued

an unsecured promissory note (the “Second Working Capital Note” and, together with the Working Capital Note, the “Working

Capital Notes”) in the amount of $100,000 to the Sponsor, in exchange for the Sponsor depositing such amounts in the Company’s

working capital account, in order to provide the Company with additional working capital. The Second Working Capital Note does not bear

interest, and matures (subject to the waiver against trust provisions) upon the earlier of (i) two (2) days following the date on which

the Company’s initial business combination is consummated and (ii) the date of the liquidation of the Company. The Second Working

Capital Note was issued pursuant to an exemption from registration contained in Section 4(a)(2) of the Securities Act.

On May

2, 2023, the Company issued an unsecured promissory note (the “Third Working Capital Note and, together with the First Working Capital

Note and Second Working Capital Note, the “Working Capital Notes) in the amount of $100,000. The Third Working Capital Note does

not bear interest, and matures (subject to the waiver against trust provisions) upon the earlier of (i) two (2) days following the date

on which the Company’s initial business combination is consummated and (ii) the date of the liquidation of the Company. The Second

Working Capital Note was issued pursuant to an exemption from registration contained in Section 4(a)(2) of the Securities Act. Additionally,

on May 9, 2023, pursuant to the Second Extension Note, the Company delivered to the Sponsor a written request to draw down $135,000 for

the fourth month of the Extension. Upon this written request, the Sponsor deposited $135,000 to the Company’s Trust Account on May