- Proposed appointment of Jean-Gérard Galvez, Luc Demarre and

Caroline DeSurmont as directors

- Proposed financial delegations necessary for the Company's

development

- Proposed amendments to the bylaws, in particular to revise

the rules governing declarations of crossing statutory thresholds,

extend the terms of office of directors, and introduce double

voting rights

- Availability of preparatory documents for the General

Meeting

Regulatory News:

ABIONYX Pharma, (FR0012616852 - ABNX - eligible for PEA

PME), a new generation biotech company dedicated to the

discovery and development of innovative therapies based on the

world’s only natural recombinant apoA-I, today informs its

shareholders that its Combined General Meeting (Ordinary and

Extraordinary) will be held on November 28, 2024 at 2 pm at the

Company's head office at 33-43 avenue Georges Pompidou Bât. D -

31130 Balma, France, and presents the main resolutions proposed at

this Combined General Meeting to propose the appointment of three

new directors, to facilitate the Company's development and

shareholder loyalty and to take advantage of the opportunities

introduced by law no. 2024-537 of June 13, 2024, aimed at boosting

company financing and the attractiveness of France.

Proposed appointment of Jean-Gérard Galvez, Luc Demarre and

Caroline DeSurmont as directors

As announced by the Company in its press release dated

19/06/2024, it will be proposed at the next General Meeting that

you appoint Mr. Jean-Gérard Galvez as a director. The Board of

Directors specifies that Mr. Jean-Gérard Galvez, as Chairman of the

investment company ORSAY 53, does not qualify as an independent

member under the independence criteria of the Middlenext Code,

adopted by the Company as its corporate governance reference

code.

Aged 70, Mr. Galvez is an engineer from the École Nationale

Supérieure des Industries Chimiques, and holds a DEA in management

and an MBA from the Stanford Executive Program. After some fifteen

years with major groups (Dupont de Nemours, Control Data),

Jean-Gérard Galvez left Control Data's international operations in

1994 to become Chairman and CEO of ActivCard, a French Internet

security start-up. He expanded the company into the United States,

listing it on the Nasdaq in 2000 at a valuation of over $2 billion.

He managed the company until 2003. A private investor and Senior

Advisor to investment funds since 2004 (Natixis/Seventure Partners;

CVC Growth Partners; Téthys Invest), he has been a member of the

Board of Directors of a dozen listed and private companies,

including 6 terms as Chairman of the Board. He has led a large

number of fundraisings, participated in two IPO, and accompanied

several M&A operations in the software and healthcare sectors.

He is currently co-founder and director of Exotec (robotics), which

recently raised €300 million on a €2 billion valuation. He is also

the director of 3 other companies: MedSystem GMBH, Letsignit and

Polaris.

Following the Board meeting of November 6, 2024, it will also be

proposed at the next General Meeting to appoint Mr. Luc Demarre and

Mrs. Caroline DeSurmont as directors. The Board of Directors

specifies that Mrs. Caroline DeSurmont qualifies as an independent

member in terms of the independence criteria set out in the

Middlenext Code, adopted by the Company as its corporate governance

reference code. In this respect, it is specified that she has no

business relationship with the Group. However, Luc Demarre does not

qualify as an independent member under the aforementioned

independence criteria.

Aged 58, Luc Demarre is a recognized professional in the

financial sector, with 35 years' experience in investment banking.

Expert in mergers and acquisitions, Luc began his career in 1989 at

Banque Paribas, where he held the position of M&A analyst in

London. In 1991, he joined Deutsche Morgan Grenfell, where he spent

eight years as a senior M&A banker in London and Paris. In

1999, he joined Crédit Suisse First Boston (CSFB) as Head of

Investment Banking. His growing experience in this field led him in

2004 to co-found Bucéphale Finance, an independent company

specializing in financial advisory services for M&A,

restructuring and fundraising. He held the position of Managing

Director for over 15 years. In 2018, Luc co-founded a new

independent consulting firm in Paris specializing in M&A and

fundraising: ETXE Finance. In this capacity, he continues to advise

his clients, bringing a strategic vision and extensive operational

experience in complex financial transactions.

Senior Executive with over 25 years' experience in education,

biotechnology and industry, Caroline DeSurmont has a successful

track record in managing R&D and production programs, including

4 years of project management and over 20 years of regulatory

expertise. After Servier and Gencell/Serono, Caroline joined

Centelion, an Aventis legacy company, in January 2003 as Project

Director, before joining Sanofi's Regulatory Affairs group in

December 2004, where she held several positions of increasing

responsibility in regulatory development and transformation. For

the past 2 years, she has shifted her career towards corporate

governance, taking on the position of Corporate Secretary and

Secretary to the Board of Directors of Sanofi.

Caroline is Ph.D, Cardiovascular and Gene Therapy, has a degree

in Project Management / Management MBA at London Business School,

IMD Business School Lausane and an Executive MBA an Executive MBA

from Ecole Polythecnique.

If these proposed appointments were approved, the Board would

comprise four independent members and three women out of eight

members, in compliance with the applicable rules.

Proposed financial delegations required for the Company's

development

The Board of Directors wishes to have the necessary delegations

of authority to carry out, if it sees fit, any issues that may

prove necessary as part of the development of the Company's

activities. For this reason, a proposal will be made to the next

General Meeting to grant the Board a new authorization to issue

shares and/or securities giving access to the Company's capital,

without pre-emptive subscription rights for one or more named

persons, in order to benefit from this possibility introduced by

Act no. 2024-537 of June 13, 2024 aimed at increasing the financing

of businesses and the attractiveness of France. In view of the

inclusion of this resolution on the agenda, it will also be

proposed, in accordance with prevailing regulations, to approve a

delegation of authority to increase the Company's capital stock for

the benefit of members of a company savings plan.

Proposed amendments to the bylaws, in particular to revise

the rules governing declarations of ownership thresholds crossed,

extend the terms of office of directors and introduce double voting

rights

At the next Annual General Meeting, shareholders will be asked

to reduce from 2.5 to 1%, or any multiple thereof, the percentage

of share capital or voting rights that triggers the obligation to

notify the Company if these thresholds are exceeded or fallen

below, to extend the terms of office of directors and non-voting

directors from 3 to 4 years (it being specified that this amendment

would apply to current terms of office), and to specify certain

rules governing the convening and deliberations of the Board of

Directors (notably concerning the use of a means of

telecommunication at Board meetings and written consultation). It

will also be proposed to relax the rule concerning the Board's

determination of the term of office of the Chief Executive

Officer.

In addition, it will be proposed to introduce a double voting

right attached to fully paid-up shares that have been registered in

the name of the same shareholder for at least two years, it being

specified that for the calculation of this two-year period, account

will be taken of the period of registered shares prior to November

28, 2024.

Lastly, it will be proposed that the bylaws provide that the

Annual General Meeting may grant each shareholder the option of

receiving all or part of the dividend or interim dividend in cash

or in shares, in accordance with applicable laws and

regulations.

The preliminary notice of meeting was published in the Bulletin

des annonces légales obligatoires (BALO) on October 23, 2024

(https://www.journal-officiel.gouv.fr/pages/balo-annonce-unitaire/?q.id=id_annonce:202410232404171128),

in bulletin no. 128.

Shareholders' attention is drawn to the fact that the agenda and

the text of the draft resolutions published in the notice of

meeting published in BALO no. 128 of October 23, 2024, have been

supplemented by the Board of Directors on November 6, 2024, in

order to propose two new candidates for election to the Board of

Directors.

The notice of meeting will be published in the BALO on November

13, 2024.

It will also be sent to shareholders whose shares are held in

registered form and made available to institutions holding bearer

shares.

The documents and information relating to this General Meeting

will be, in accordance with applicable laws and regulations:

- posted on the ABIONYX Pharma website (abionyx.com) under the

heading “Investors/Shareholders Meeting/November 28, 2024 -

Combined Annual General Meeting”;

- made available to shareholders at the Company's registered

office at 33-43 avenue Georges Pompidou, Bât. D - 31130 Balma,

France.

In accordance with the applicable regulations:

- all holders of registered shares may, up to and including the

fifth day before the General Meeting, ask the Company to send them

the documents referred to in Articles R.225-81 and R.225-83 of the

French Commercial Code, by electronic means if expressly requested.

For holders of bearer shares, the exercise of this right is subject

to the provision of a certificate of participation in the bearer

share accounts held by the authorized intermediary;

- all shareholders may consult the documents referred to in

Articles L. 225-115 and R.225-83 of the French Commercial Code at

the Company's registered office.

Shareholders wishing to follow the Annual General Meeting but

unable to attend in person are invited to log on to the following

link:

https://app.livestorm.co/newcap-1/retransmission-en-direct-de-lassemblee-generale-mixte-dabionyx-le-28-novembre-2024?type=detailed

This live broadcast of the Annual General Meeting will not allow

remote voting or questions via the chat platform.

Further information on this General Meeting, and in particular

on shareholder voting procedures, is available at

www.abionyx.com.

About ABIONYX Pharma

ABIONYX Pharma is a new generation biotech company that aims to

contribute to health through innovative therapies in indications

where there is no effective or existing treatment, even the rarest

ones. Thanks to its partners in research, medicine,

biopharmaceuticals and shareholding, the company innovates on a

daily basis to propose drugs for the treatment of renal and

ophthalmological diseases, or new HDL vectors used for targeted

drug delivery.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106465742/en/

NewCap Investor relations Nicolas Fossiez Louis-Victor

Delouvrier abionyx@newcap.eu +33 (0)1 44 71 98 53

NewCap Media relations Arthur Rouillé abionyx@newcap.eu

+33 (0)1 44 71 00 15

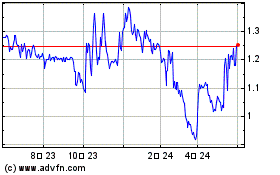

Abionyx Pharma (EU:ABNX)

과거 데이터 주식 차트

부터 1월(1) 2025 으로 2월(2) 2025

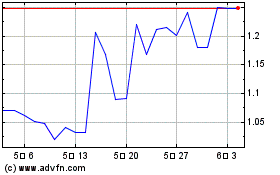

Abionyx Pharma (EU:ABNX)

과거 데이터 주식 차트

부터 2월(2) 2024 으로 2월(2) 2025