TIDMCORA

RNS Number : 9200Q

Cora Gold Limited

24 February 2023

Cora Gold Limited / EPIC: CORA.L / Market: AIM / Sector:

Mining

24 February 2023

Cora Gold Limited

('Cora' or 'the Company')

Fundraising: Update and Closing

Cora Gold Limited, the West African focused gold company, is

pleased to announce that, further to the announcement of 06

February 2023, it has conditionally raised US$19.843 million,

comprising both equity (the 'Equity Financing') and convertible

loan notes (the 'Convertible Financing') (together the

'Fundraising'), subject only to the passing of the resolutions to

be proposed at a General Meeting of the shareholders of the Company

on 28 February 2023.

The funds raised will be primarily used to commence development

of the Company's flagship Sanankoro Gold Project (the 'Project') in

southern Mali following the reported Optimised Project Economics

(announcement dated 21 November 2022), which highlighted strong

economic fundamentals.

Binding commitments have been received for aggregate investments

of US$19,843,169.26 pursuant to the Fundraising comprising

commitments to subscribe for:

-- 80,660,559 ordinary shares of no par value in the Company

('Ordinary Shares') at a price of US$0.0487 per share for total

gross proceeds of US$3,928,169.26 in respect of the Equity

Financing; and

-- convertible loan notes ('CLN') convertible into Ordinary

Shares for a total of US$15,915,000 in respect of the Convertible

Financing,

(together the 'Binding Commitments').

Bert Monro, Chief Executive Officer of Cora, commented, "I am

very pleased with the strong support received for this fundraising

from many of our existing shareholders as well as new investors.

Over the coming months we look forward to providing progress

updates on our flagship Sanankoro Gold Project."

Admission and Total Voting Rights

The Company has conditionally raised through the Equity

Financing a total of US$3,928,169.26, before expenses, through the

proposed issue of 80,660,559 new Ordinary Shares (the 'New Shares')

to certain existing shareholders and new investors.

The Fundraising is subject to Admission of the New Shares to

trading on the AIM Market of the London Stock Exchange

('Admission'). Application for Admission will be made after the

General Meeting of the shareholders of the Company on 28 February

2023. It is expected that Admission will become effective and

dealing in the New Shares will commence on or around 08 March 2023.

The New Shares will rank pari passu with the existing Ordinary

Shares.

Following Admission, the share capital of the Company will be

comprised of 370,217,718 Ordinary Shares. The above figure of

370,217,718 may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in Cora under the Financial Conduct

Authority's Disclosure and Transparency Rules.

Revised shareholdings following Admission

On Admission, the revised shareholdings of the following

directors, and current and new substantial shareholders will

be:

Current New Shares Shareholding Percentage

shareholding on Admission of enlarged

issued share

capital

----------------------------

Brookstone Business Inc 82,796,025 20,533,881 103,329,906 27.91%

-------------- ----------- -------------- --------------

Lord Farmer 42,537,183 26,694,045 69,231,228 18.70%

-------------- ----------- -------------- --------------

Paul Quirk 13,674,689 13,674,689

Non-Executive Director (a) - (a) 3.69%

-------------- ----------- -------------- --------------

First Island Trust Company

Ltd as Trustee of The

Marlborough Trust (b) - 12,320,328 12,320,328 3.33%

-------------- ----------- -------------- --------------

Robert Monro

Chief Executive Officer

& Director 2,028,896 206,000 2,234,896 0.60%

-------------- ----------- -------------- --------------

Edward Bowie

Non-Executive Director

(Independent) & Chair

of the Board of Directors 525,510 100,000 625,510 0.17%

-------------- ----------- -------------- --------------

Andrew Chubb

Non-Executive Director

(Independent) 539,526 - 539,526 0.15%

-------------- ----------- -------------- --------------

a held personally and through Key Ventures Holding Ltd which is

wholly owned and controlled by First Island Trust Company Ltd as

Trustee of The Sunnega Trust, being a discretionary trust of which

Paul Quirk is a potential beneficiary.

b The Marlborough Trust is a discretionary trust with a broad class of potential beneficiaries.

Market Abuse Regulation ('MAR') Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) No 596/2014 ('MAR'), which is part of

UK law by virtue of the European Union (Withdrawal) Act 2018, until

the release of this announcement.

* * ENDS * *

For further information, please visit http://www.coragold.com or

contact:

Bert Monro Cora Gold Limited info@coragold.com

Craig Banfield

Christopher Raggett finnCap Ltd

Charlie Beeson (Nomad & Joint Broker) +44 (0)20 7220 0500

-------------------------- ---------------------

Andy Thacker Turner Pope Investments

James Pope (Joint Broker) +44 (0)20 3657 0050

-------------------------- ---------------------

Susie Geliher St Brides Partners pr@coragold.com

Charlotte Page (Financial PR)

Isabelle Morris

-------------------------- ---------------------

Notes

Cora is a West African gold developer with three principal

de-risked project areas within two known gold belts in Mali and

Senegal covering c.900 sq km. Led by a team with a proven track

record in making multi-million ounce gold discoveries that have

been developed into operating mines, its primary focus is on

developing the Sanankoro Gold Project in the Yanfolila Gold Belt,

southern Mali, into an open pit oxide mine. Based on a gold price

of US$1,750/oz and a Maiden Probable Reserve of 422 koz at 1.3 g/t

Au the project has strong economic fundamentals, including 52% IRR,

US$234 million Free Cash Flow over life of mine and all-in

sustaining costs of US$997/oz.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPUBWPUPWPPW

(END) Dow Jones Newswires

February 24, 2023 02:00 ET (07:00 GMT)

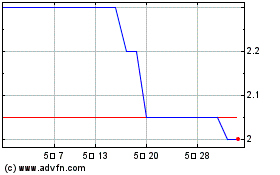

Cora Gold (LSE:CORA)

과거 데이터 주식 차트

부터 5월(5) 2024 으로 6월(6) 2024

Cora Gold (LSE:CORA)

과거 데이터 주식 차트

부터 6월(6) 2023 으로 6월(6) 2024