Osisko Gold Royalties Ltd (“

Osisko” or the

“

Corporation”) (TSX and NYSE: OR) is pleased to

announce the appointment of Mr. Jason Attew as President and

Chief Executive Officer, effective no later than January 2nd, 2024.

Mr. Attew will also join the Board of Directors of Osisko.

Mr. Attew is an accomplished mining executive

with almost 30 years' experience in the industry. He brings to

Osisko proven corporate leadership, a track record of successful

team building and deep mining industry connections, built upon a

background advising on some of the most transformational mergers

and acquisitions in the mining sector.

Mr. Attew’s appointment is the culmination of a

thorough search process conducted by Osisko’s Board under the

direction of a search committee of independent directors. After

considering a number of quality candidates, both external and

internal, Osisko’s Board unanimously concluded that Mr. Attew is

the ideal candidate to successfully lead Osisko going forward.

Osisko also announces that Mr. Norman MacDonald

has been appointed as Chair of the Board, effective immediately,

succeeding Mr. Sean Roosen. Mr. Roosen will continue as a director

with the title, “Chair Emeritus", to honour his legacy as founder

of Osisko and his continuing contributions to the Corporation. The

change reflects Mr. Roosen's desire to focus on his role as Chief

Executive Officer of Osisko Development Corp., while continuing to

contribute as a director of Osisko. Mr. Roosen was a founder of

Osisko Mining Corporation, where he was instrumental in the

discovery and development of the Canadian Malartic mine and also

led the efforts that resulted in the creation of the

Corporation.

“We are extremely pleased to have attracted a

new President and Chief Executive Officer of the caliber of Jason

Attew, and the entire Board looks forward to working with him over

the years ahead as we focus on a new and exciting stage of

long-term sustainable value creation,” said Mr. MacDonald, the

new Chair of the Board. “The Board also wishes to express its

sincere gratitude to Mr. Sean Roosen, who founded the

Corporation, and grew Osisko from a market capitalization of $400

million to $3.2 billion. We are grateful that Mr. Roosen will

continue as a director, allowing us to continue to benefit from his

knowledge, experience and connections while the Corporation moves

forward under the capable leadership of Mr. Attew. Lastly, I want

to thank Mr. Paul Martin for his leadership and steady hand as

our Interim Chief Executive Officer while we undertook our careful

CEO search process.”

Mr. Attew was most recently the President and

Chief Executive Officer of Liberty Gold Corp. Prior to that, he was

the President and Chief Executive Officer of Gold Standard Ventures

Corp until its acquisition by Orla Mining Ltd. Previously he served

as the Chief Financial Officer at Goldcorp Inc.

(“Goldcorp”) where, in addition to leading the

finance and investor relations operations, he was responsible for

Goldcorp’s corporate development and strategy culminating in the

US$32 billion merger with Newmont Mining Corporation. Mr. Attew has

extensive capital markets experience from his time in investment

banking with the BMO Global Metals and Mining Group where he was at

the forefront of structuring and raising significant growth capital

as well as advising on both formative and transformational mergers

and acquisitions for corporations that have become industry leaders

over the past two decades. He is also a director of Evolution

Mining Limited . Mr. Attew holds a Bachelor of Science (Hon)

from the University of British Columbia as well as a Masters of

Business Administration from Queen’s University.

In addition to being a director of Osisko since

June 2023, Mr. MacDonald is Partner, Natural Resources at Fort

Capital. He has over 25 years of experience working at natural

resource focused institutional investment firms, including over 10

years as a Senior Portfolio Manager at Invesco. Mr. MacDonald

began his investment career at Ontario Teachers’ Pension Plan

Board, where he worked for three years in progressive roles from

Research Assistant to Portfolio Manager. His next role was as a

Vice President and Partner at Beutel, Goodman & Co. Ltd. Prior

to joining Invesco, Mr. Macdonald was a Vice President and

Portfolio Manager at Salida Capital. Mr. MacDonald is

currently a director of Advantage Energy Ltd. and G Mining Ventures

Corp. Mr. MacDonald holds a Bachelor of Commerce Degree from the

University of Windsor and is a CFA Charterholder.

About Osisko Gold Royalties Ltd

Osisko Gold Royalties Ltd is an intermediate

precious metal royalty company which holds a North American focused

portfolio of over 180 royalties, streams and precious metal

offtakes. Osisko’s portfolio is anchored by its cornerstone asset,

a 5% net smelter return royalty on the Canadian Malartic mine, one

of Canada’s largest gold mines.

Osisko’s head office is located at 1100 Avenue

des Canadiens-de-Montréal, Suite 300, Montréal, Québec,

H3B 2S2.

For further information, please contact

Osisko Gold Royalties Ltd:

| Grant MoentingVice President,

Capital Markets Tel: (514) 940-0670 #116Mobile: (365) 275-1954

Email: gmoenting@osiskogr.com |

Heather TaylorVice President,

Sustainability & Communications Tel: (514) 940-0670 #105Email:

htaylor@osiskogr.com |

Forward-looking Statements

Certain statements contained in this press

release may be deemed "forward-looking statements" within the

meaning of the United States Private Securities Litigation Reform

Act of 1995 and “forward-looking information” within the meaning of

applicable Canadian securities legislation. All statements in this

press release, forward-looking statements are statements other than

statements of historical fact, that address, without limitation,

the effective date of Mr. Attew’s hiring, future events,

production estimates of Osisko’s assets (including increase of

production), timely developments of mining properties over which

Osisko has royalties, streams, offtakes and investments,

management’s expectations regarding Osisko’s growth, results of

operations, estimated future revenues, production costs, carrying

value of assets, ability to continue to pay dividend, requirements

for additional capital, business prospects and opportunities future

demand for and fluctuation of prices of commodities (including

outlook on gold, silver, diamonds, other commodities) currency

markets and general market conditions. In addition, statements and

estimates (including data in tables) relating to mineral reserves

and resources and gold equivalent ounces are forward-looking

statements, as they involve implied assessment, based on certain

estimates and assumptions, and no assurance can be given that the

estimates will be realized. Forward-looking statements are

statements that are not historical facts and are generally, but not

always, identified by the words "expects", "plans", "anticipates",

"believes", "intends", "estimates", "projects", "potential",

"scheduled" and similar expressions or variations (including

negative variations), or that events or conditions "will", "would",

"may", "could" or "should" occur. Forward-looking statements are

subject to known and unknown risks, uncertainties and other

factors, most of which are beyond the control of Osisko, and actual

results may accordingly differ materially from those in

forward-looking statements. Such risk factors include, without

limitation, (i) with respect to properties in which Osisko holds a

royalty, stream or other interest; risks related to: (a) the

operators of the properties, (b) timely development, permitting,

construction, commencement of production, ramp-up (including

operating and technical challenges), (c) differences in rate and

timing of production from resource estimates or production

forecasts by operators, (d) differences in conversion rate from

resources to reserves and ability to replace resources, (e) the

unfavorable outcome of any challenges or litigation relating title,

permit or license, (f) hazards and uncertainty associated with the

business of exploring, development and mining including, but not

limited to unusual or unexpected geological and metallurgical

conditions, slope failures or cave-ins, flooding and other natural

disasters or civil unrest or other uninsured risks; with respect to

external factors: (a) fluctuations in the prices of the commodities

that drive royalties, streams, offtakes and investments held by

Osisko, (b) fluctuations in the value of the Canadian dollar

relative to the U.S. dollar, (c) regulatory changes by national and

local governments, including permitting and licensing regimes and

taxation policies; regulations and political or economic

developments in any of the countries where properties in which

Osisko holds a royalty, stream or other interest are located or

through which they are held, (d) continued availability of capital

and financing and general economic, market or business conditions,

and (e) responses of relevant governments to the COVID-19 outbreak

and the effectiveness of such response and the potential impact of

COVID-19 on Osisko’s business, operations and financial condition;

with respect to internal factors: (a) business opportunities that

may or not become available to, or are pursued by Osisko or (b) the

integration of acquired assets. The forward-looking statements

contained in this press release are based upon assumptions

management believes to be reasonable, including, without

limitation: the absence of significant change in the Corporation’s

ongoing income and assets relating to determination of its Passive

Foreign Investment Company ("PFIC”) status; the absence of any

other factors that could cause actions, events or results to differ

from those anticipated, estimated or intended and, with respect to

properties in which Osisko holds a royalty, stream or other

interest, (i) the ongoing operation of the properties by the owners

or operators of such properties in a manner consistent with past

practice and with public disclosure (including forecast of

production), (ii) the accuracy of public statements and disclosures

made by the owners or operators of such underlying properties

(including expectations for the development of underlying

properties that are not yet in production), (iii) no adverse

development in respect of any significant property, (iv) that

statements and estimates relating to mineral reserves and resources

by owners and operators are accurate and (v) the implementation of

an adequate plan for integration of acquired assets.

For additional information on risks,

uncertainties and assumptions, please refer to the most recent

Annual Information Form of Osisko filed on SEDAR+ at

www.sedarplus.com and EDGAR at www.sec.gov which also provides

additional general assumptions in connection with these statements.

Osisko cautions that the foregoing list of risk and uncertainties

is not exhaustive. Investors and others should carefully consider

the above factors as well as the uncertainties they represent and

the risk they entail. Osisko believes that the assumptions

reflected in those forward-looking statements are reasonable, but

no assurance can be given that these expectations will prove to be

accurate as actual results and prospective events could materially

differ from those anticipated such the forward-looking statements

and such forward-looking statements included in this press release

are not guarantee of future performance and should not be unduly

relied upon. These statements speak only as of the date of this

press release. Osisko undertakes no obligation to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, other than as required

by applicable law.

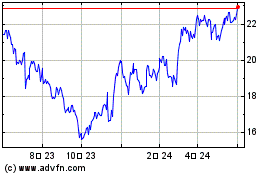

Osisko Gold Royalties (TSX:OR)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

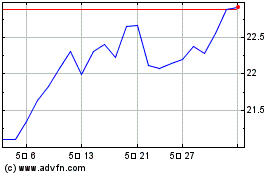

Osisko Gold Royalties (TSX:OR)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024