Argonaut Gold Inc. (TSX:AR) ("Argonaut Gold") and Prodigy Gold

Incorporated (TSX VENTURE:PDG) ("Prodigy ") are pleased to announce

that they have entered into an agreement (the "Arrangement

Agreement") pursuant to which Argonaut Gold has agreed to acquire

all of the issued and outstanding common shares of Prodigy by way

of a Plan of Arrangement (the "Arrangement"). The combined entity

will benefit from the strong operating experience and cash flow of

Argonaut Gold and its ability to successfully advance Prodigy's

Magino gold project, which has an indicated resource of more than 6

million ounces (223 million tonnes at 0.87 g/t using a cut-off

grade of 0.35 g/t).

Pursuant to the terms of the Arrangement announced today,

Prodigy shareholders will receive 0.1042 of an Argonaut Gold share

and C$0.00001 in cash per Prodigy share, representing C$1.08 per

share based on Argonaut Gold's 20-day volume-weighted average price

("VWAP") and a premium of 54% based on both companies' 20-day VWAPs

as at October 12, 2012, the last trading day prior to this

announcement. The transaction values Prodigy's equity at

approximately C$341 million on a fully diluted in-the-money basis

and implies an enterprise value of approximately C$277 million.

Pro forma the transaction, Argonaut Gold will be owned

approximately 78% by current Argonaut Gold shareholders and 22% by

current Prodigy shareholders (based on fully diluted in-the-money

shares outstanding). The terms of the transaction have been

unanimously approved by both companies' Boards of Directors, with

the commitment of votes from all directors and officers of Prodigy,

representing approximately 3.9% of Prodigy's shares, having been

secured.

Highlights of the Combined Entity:

-- Current production from two mines in Mexico and a strong pipeline of two

developments projects in Canada and Mexico, representing a diversified

asset portfolio in two premier jurisdictions for mine development and

operation

-- If both development projects are advanced to production, Argonaut Gold

is expected to enter the ranks of the intermediate producers and fulfill

its stated goal of 300,000 - 500,000 ounces of gold production per year

-- In excess of 12 million ounces of measured and indicated gold resource

including 1.2 million ounces of proven and probable gold reserve (fully

broken out by category and property as described below)

-- Strong balance sheet with no debt

-- Current and projected future cash flow generation expected to self-fund

future development, mitigating future financing risk

-- Strong management team and experienced Board of Directors with proven

development and operating track record

Pete Dougherty, President and CEO of Argonaut Gold said, "We are

very pleased to announce this transaction with Prodigy today.

Magino is a highly attractive asset which has shown continued

resource growth, and which we believe will provide a longer term

production opportunity for Argonaut Gold shareholders. The Magino

resource provides substantial flexibility for maximizing value

creation using a higher grade cut-off. We believe the project can

be "right-sized" for a company like Argonaut Gold to deliver the

best returns to our shareholders, while providing further upside

should the gold price maintain its strong performance. This

transaction is both highly attractive to Prodigy shareholders as

well as significantly accretive to Argonaut Gold shareholders on

all key financial and operational metrics."

Brian J. Maher, President and CEO of Prodigy said, "The

transaction announcement today is the culmination of the success we

have had growing and advancing the Magino project. We believe the

price offered by Argonaut Gold is highly attractive for our

shareholders, and that in addition to the premium our shareholders

receive today, our shareholders now have the opportunity to

participate in a company that has current production exposure and

can both finance and develop Magino."

Transaction Benefits for Argonaut Gold Shareholders

-- Magino represents a significant scale asset in the Argonaut Gold

portfolio, and has the potential to allow Argonaut Gold to achieve or

exceed its stated goal of 300,000 - 500,000 ounces of gold production

-- Magino is a multi-million ounce deposit which provides tremendous grade

flexibility when considering development alternatives while pursuing the

highest returns for Argonaut Gold shareholders

-- Timeline for Magino development provides for continued growth beyond

Argonaut Gold's existing organic growth projects with anticipated start-

up well timed after San Antonio is targeted to start production

-- Provides geopolitical and asset diversification, and entry into another

of the world's most supportive mining jurisdictions

-- Fairness opinion received from the financial advisor to Argonaut Gold

indicating that the transaction is fair from a financial point of view

to Argonaut Gold

-- Transaction significantly accretive to all of Argonaut Gold's per share

metrics, including net asset value per share, resources per share,

longer term cash flow per share, and longer term production per share

-- In addition to Magino, Argonaut Gold will gain exposure to Prodigy's

portfolio of other exploration stage assets

Transaction Benefits for Prodigy Shareholders

-- Significant premium of 54% to Prodigy shareholders based on both

companies' 20-day VWAPs as at October 12, 2012

-- All-share transaction provides Prodigy shareholders with exposure to

current production and cash flow in a strong gold price environment and

continuing exposure to the advancement of Magino as well as Argonaut

Gold's existing organic growth profile

-- Substantially decreases the financing risk for the project

-- Leverages Argonaut Gold's highly experienced and successful management

team

-- Argonaut Gold's shares provide improved trading liquidity for Prodigy

shareholders

-- Fairness opinion received from Prodigy's financial advisor indicating

that the transaction is fair, from a financial point of view, to Prodigy

shareholders

Arrangement Agreement Summary

The Arrangement includes, among other things, certain standard

conditions including receipt of approval of the shareholders of

Prodigy and Argonaut Gold by the affirmative vote of no less than

66 2/3% and 50.1% of the shares voted, respectively, and receipt of

court and stock exchange approvals. Special shareholder meetings

for each company to vote on the transaction are expected to be held

in December, 2012 with closing expected shortly thereafter.

The Arrangement Agreement is subject to customary

non-solicitation provisions, subject to Prodigy's right to consider

and accept superior proposals. In the event of a superior proposal,

Argonaut Gold will have a five business day right to match the

superior proposal. If the Arrangement is not completed as a result

of a superior proposal or in other certain specified circumstances,

a termination fee equal to C$10.25 million will be paid to Argonaut

Gold. The Arrangement Agreement also provides for reciprocal

expense reimbursement under certain specific circumstances. After

closing of the transaction, Prodigy will have the right to appoint

one Director to the Argonaut Gold Board of Directors.

The terms and conditions of the Arrangement will be disclosed in

more detail in the management information circulars which will be

filed and mailed to Argonaut Gold and Prodigy shareholders in

November 2012.

Advisors and Legal Counsel

BMO Capital Markets is acting as financial advisor and Fraser

Milner Casgrain LLP is acting as legal counsel to Argonaut Gold and

its Board of Directors. BMO Capital Markets has provided an opinion

that, based upon and subject to the assumptions, limitations, and

qualifications in such opinion, the consideration to be received by

Prodigy's shareholders is fair, from a financial point of view, to

Argonaut Gold.

National Bank Financial Inc. is acting as financial advisor and

DuMoulin Black LLP is acting as legal counsel to Prodigy. National

Bank Financial Inc. has provided an opinion that, based upon and

subject to the assumptions, limitations, and qualifications in such

opinion, the consideration to be received by Prodigy's shareholders

is fair, from a financial point of view, to Prodigy

shareholders.

Conference Call Details

Argonaut Gold and Prodigy will host a conference call to

investors and analysts to discuss the transaction on October 15,

2012 at 9:00 a.m. EDT (6:00 a.m. PDT).

You will be able to participate in this call using the following

details:

Conference Call Information:

Toll Free (North America) 1-877-440-9795

Toronto Local and International 1-416-340-8527

Webcast http://www.gowebcasting.com/3937

Conference Call Replay:

Toll Free Replay Call (North America) 1-800-408-3053

Replay Call 1-905-694-9451

Passcode 3150074

The conference call replay will be available from 12:00 p.m. ET

on October 15, 2012 until October 29, 2012. The webcast archive

will be available from 11:00 a.m. ET on October 15, 2012 for one

year.

About Argonaut Gold

Argonaut Gold is a Canadian gold company engaged in exploration,

mine development and production activities. Its primary assets are

the production-stage El Castillo Mine in the State of Durango,

Mexico, the La Colorada Mine in the State of Sonora, Mexico, the

advanced exploration stage San Antonio project in the State of Baja

California Sur, Mexico, and several exploration stage projects, all

of which are located in Mexico.

Creating Value Beyond Gold

Argonaut Gold Technical Information

----------------------------------------------------------------------------

Resource Tonnes Au Ounces Ag Ounces

Category Grade Grade

(g/t) (g/t)

----------------------------------------------------------------------------

Mineral

Reserves

----------------------------------------------------------------------------

Castillo -

Oxide Proven 84,470,000 0.36 994,000

----------------------------------------------------------------------------

Castillo -

Transition Proven 19,180,000 0.37 228,000

----------------------------------------------------------------------------

Sub Total

Proven -

Oxide &

Transition 104,650,000 0.36 1,222,000

----------------------------------------------------------------------------

Castillo -

Oxide Probable 772,000 0.33 8,000

----------------------------------------------------------------------------

Castillo -

Transition Probable 73,000 0.35 1,000

----------------------------------------------------------------------------

Sub Total

Probable -

Oxide &

Transition 844,000 0.33 9,000

----------------------------------------------------------------------------

Total Proven

and Probable

Reserves 105,495,000 0.36 1,231,000

----------------------------------------------------------------------------

Measured and

Indicated

Mineral

Resources

(Including

P&P

Reserves)

---------------------------------------------------------------

----------------------------------------------------------------------------

Castillo -

Oxide in Pit Measured 114,300,000 0.293 1,220,100

----------------------------------------------------------------------------

Castillo -

Oxide in Pit Indicated 4,900,000 0.293 45,700

----------------------------------------------------------------------------

Castillo -

Oxide in Pit M&I 119,200,000 0.331 1,268,000

----------------------------------------------------------------------------

Castillo -

Transition

in Pit Measured 44,600,000 0.295 423,200

----------------------------------------------------------------------------

Castillo -

Transition

in Pit Indicated 1,900,000 0.278 17,100

----------------------------------------------------------------------------

Castillo -

Transition

in Pit M&I 46,500,000 0.294 439,900

----------------------------------------------------------------------------

Total

Castillo

Oxide and

Transition

in Pit Measured 158,900,000 0.322 1,645,300

----------------------------------------------------------------------------

Total

Castillo

Oxide and

Transition

in Pit Indicated 6,800,000 0.289 62,900

----------------------------------------------------------------------------

Total

Castillo

Oxide and

Transition

in Pit M&I 165,700,000 0.32 1,704,700

----------------------------------------------------------------------------

Castillo

Sulphide

(Global) Measured 70,600 0.328 744,800

----------------------------------------------------------------------------

Castillo

Sulphide

(Global) Indicated 91,200 0.272 797,500

----------------------------------------------------------------------------

Total

Castillo

Sulphide

(Global) M&I 161,800,000 0.296 1,540,000

----------------------------------------------------------------------------

San Antonio,

Las Colinas

- Oxide &

Transition Indicated 1,910,000 0.62 38,000

----------------------------------------------------------------------------

San Antonio,

Las Colinas

- Sulphide Indicated 8,103 0.69 179,000

----------------------------------------------------------------------------

San Antonio,

Los Planes -

Oxide &

Transition Measured 12,351,000 0.76 303,000

----------------------------------------------------------------------------

San Antonio,

Los Planes -

Oxide &

Transition Indicated 8,408,000 0.67 181,000

----------------------------------------------------------------------------

San Antonio,

Los Planes -

Sulphide Measured 6,649,000 1.17 250

----------------------------------------------------------------------------

San Antonio,

Los Planes -

Sulphide Indicated 22,065,000 0.92 653,000

----------------------------------------------------------------------------

San Antonio,

Intermediate

- Oxide &

Transition Indicated 643,000 0.39 8,000

----------------------------------------------------------------------------

San Antonio,

Intermediate

- Sulphide Indicated 4,961,000 0.77 123,000

----------------------------------------------------------------------------

All San

Antonio

Deposits -

Oxide &

Transition M&I 23,312,000 0.71 530,000

----------------------------------------------------------------------------

All San

Antonio

Deposits -

Sulphide M&I 41,778,000 0.90 1,205,000

----------------------------------------------------------------------------

Total San

Antonio

Deposits -

Oxide /

Transition /

Sulphide M&I 65,089,000 0.83 1,735,000

----------------------------------------------------------------------------

La Colorada,

Gran Central

- La

Colorada Indicated 29,915,053 0.724 696,336 5.1 4,905,135

----------------------------------------------------------------------------

La Colorada,

Gran Central

- La

Colorada Inferred 2,500,000 1.204 95,149 8.4 661,000

----------------------------------------------------------------------------

La Colorada,

El Creston

Deposit Indicated 14,438,662 0.618 286,658 12.1 5,635,385

----------------------------------------------------------------------------

La Colorada,

El Creston

Deposit Inferred 2,199,713 0.88 62,703 13.3 943,734

----------------------------------------------------------------------------

La Colorada,

Veta Madre Indicated 2,900,000 0.491 46,261 3.3 307,155

----------------------------------------------------------------------------

La Colorada,

Veta Madre Inferred 8,799 0.665 200 2.4 700

----------------------------------------------------------------------------

La Colorada,

ROM Pad Indicated 2,700,000 0.429 38,000 36.5 3,200,000

----------------------------------------------------------------------------

Total La

Colorada

Deposits M&I 50,000,000 0.664 1,067,255 8.7 14,047,675

----------------------------------------------------------------------------

La Fortuna Measured 1,538,000 2.956

----------------------------------------------------------------------------

La Fortuna Indicated 3,287,000 1.533

----------------------------------------------------------------------------

Total La

Fortuna M&I 4,800,000 1.98 308,000

----------------------------------------------------------------------------

Inferred

Mineral

Resources

----------------------------------------------------------------------------

San Antonio Inferred 6,215,000 0.34 67,000

----------------------------------------------------------------------------

La Colorada Inferred 4,700,000 1.04 158,000 10.6 1,605,000

----------------------------------------------------------------------------

Total

Inferred

Resources 10,915,000 225,000 1,605,000

----------------------------------------------------------------------------

Total

Measured and

Indicated

Resources 447,389,000 6,354,955 14,047,675

----------------------------------------------------------------------------

The technical information contained in this document regarding

Argonaut Gold has been prepared under supervision of, and reviewed

and approved by Mr. Thomas H. Burkhart, Argonaut Gold's Vice

President of Exploration, and a qualified person as defined by

National Instrument 43-101 ("NI 43-101"). For further information

on Argonaut Gold's properties please see the reports as listed

below on Argonaut Gold's website or on www.sedar.com:

----------------------------------------------------------------------------

El Castillo NI 43-101 Technical Report on Resources and Reserves, Argonaut

Mine Gold Inc., El Castillo Mine, Durango State, Mexico dated

November 6, 2010

----------------------------------------------------------------------------

La Colorada NI 43-101 Preliminary Economic Assessment La Colorada Project,

Property Sonora, Mexico dated December 30, 2011

----------------------------------------------------------------------------

San Antonio Technical Report and Mineral Resource Estimate on the San

Gold Project Antonio Gold Project, Baja California Sur, Mexico dated June

30, 2011

----------------------------------------------------------------------------

La Fortuna La Fortuna, Durango, Mexico, Technical Report dated October

Property 21, 2008

----------------------------------------------------------------------------

(Argonaut Gold will shortly be filing its previously announced updated

preliminary economic assessment in relation to its San Antonio Gold

Project.)

The preliminary economic assessment is preliminary in nature,

includes inferred mineral resources that are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorizes as mineral

reserves, and that there is no certainty that the preliminary

economic assessment will be realized.

Mineral resources are not mineral reserves and do not have

demonstrated economic viability. There is no certainty that all or

any part of the mineral resource will be converted into mineral

reserves.

About Prodigy

Prodigy is currently evaluating the development of the Magino

mine gold project in Ontario as an open-pit mining opportunity with

the potential for deeper, higher grade gold production. The Magino

project contains Indicated gold resources of 6,250,990 ounces

grading 0.87 g/t gold (223.5 million tonnes), and 355,190 ounces of

Inferred gold resources grading 0.80 g/t gold (13.8 million tonnes)

at a cut-off grade of 0.35 g/t gold. For more information please

refer to the "Technical Report on the Magino Property, Wawa,

Ontario dated October 4, 2012 available on SEDAR or Prodigy's

website.

Mineral resources are not mineral reserves and do not have

demonstrated economic viability. There is no certainty that all or

any part of the mineral resource will be converted into mineral

reserves.

The technical information contained in this document regarding

Prodigy has been prepared under supervision of, and reviewed and

approved by Tom Pollock, P.Geo., Prodigy Gold's Vice President -

Exploration, who is a qualified person under the definitions

established by NI 43-101.

Forward-Looking Statements

This press release contains certain "forward-looking statements"

and "forward-looking information" under applicable Canadian

securities laws concerning the proposed transaction and the

business, operations and financial performance and condition of

each of Argonaut Gold Inc. ("Argonaut Gold") and Prodigy Gold

Incorporated ("Prodigy"). Forward-looking statements and

forward-looking information include, but are not limited to,

statements with respect to the Arrangement, development and

estimated production and mine life of the various mineral projects

of Argonaut Gold and Prodigy; synergies and financial impact of the

Arrangement; the benefits of the development potential of the

properties of Argonaut Gold and Prodigy; the future price of gold,

copper, and silver; the estimation of mineral reserves and

resources; the realization of mineral reserve estimates; the timing

and amount of estimated future production; costs of production;

success of exploration activities; and currency exchange rate

fluctuations. Except for statements of historical fact relating to

Argonaut Gold and Prodigy, certain information contained herein

constitutes forward-looking statements. Forward-looking statements

are frequently characterized by words such as "plan," "expect,"

"project," "intend," "believe," "anticipate", "estimate" and other

similar words, or statements that certain events or conditions

"may" or "will" occur. Forward-looking statements are based on the

opinions and estimates of management at the date the statements are

made, and are based on a number of assumptions and subject to a

variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those

projected in the forward-looking statements. Assumptions upon which

such forward-looking statements are based include that all required

third party, court, regulatory and governmental approvals to the

Arrangement will be obtained and all other conditions to completion

of the transaction will be satisfied or waived, that actual results

of exploration activities will be as expected, that proposed mine

plans and recoveries will be achieved, that capital costs and

sustaining costs will be as estimated, that the assumptions

underlying mineral resource estimates are valid, that Argonaut Gold

and Prodigy will not experience unforeseen accident, fire, ground

instability, flooding, labor disruption, equipment failure, or

adverse metallurgical or environmental events, and that supplies,

equipment, personnel, permits and other approvals required to

conduct planned activities will be available on reasonable terms.

Many of these assumptions are based on factors and events that are

not within the control of Argonaut Gold or Prodigy and there is no

assurance they will prove to be correct.

Factors that could cause actual results to vary materially from

results anticipated by such forward-looking statements include

non-completion of the Arrangement, changes in market conditions,

variations in ore grade or recovery rates, risks relating to

international operations, fluctuating metal prices and currency

exchange rates, changes in project parameters, the possibility of

project cost overruns or unanticipated costs and expenses, labour

disputes and other risks of the mining industry, failure of plant,

equipment or processes to operate as anticipated. Although Argonaut

Gold and Prodigy have each attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results

not to be anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Argonaut Gold

and Prodigy undertake no obligation to update forward-looking

statements if circumstances or management's estimates or opinions

should change except as required by applicable securities laws. The

reader is cautioned not to place undue reliance on forward-looking

statements. Statements concerning mineral reserve and resource

estimates may also be deemed to constitute forward-looking

statements to the extent they involve estimates of the

mineralization that will be encountered if the property is

developed. Comparative market information is as of a date prior to

the date of this document.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Contacts: Argonaut Gold Inc. Nichole Cowles Investor Relations

Manager (775) 284-4422 x 101nichole.cowles@argonautgold.com

www.argonautgold.com Contacts: Prodigy Gold Incorporated Brian J.

Maher President and Chief Executive Officer (604)

688-9006ir@prodigygold.com www.prodigygold.com

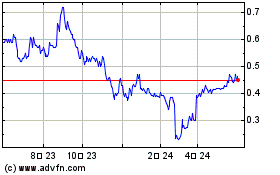

Argonaut Gold (TSX:AR)

과거 데이터 주식 차트

부터 6월(6) 2024 으로 7월(7) 2024

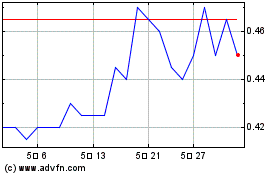

Argonaut Gold (TSX:AR)

과거 데이터 주식 차트

부터 7월(7) 2023 으로 7월(7) 2024