Argonaut Gold Inc. ("Argonaut" or the "Company") (TSX: AR), today

announced its full financial results for the 3rd quarter, ended on

September 30, 2010. The capital expansion program at El Castillo is

nearing completion, with the east side processing plant expected to

be operational by year end.

Third Quarter Highlights

-- 2010 Q3 compared to 2009 Q3

-- Total Tonnes mined up +83%

-- Ore Tonnes processed up +92%

-- Gold Production up +66%

-- Record ounces loaded on the pad (24,202 ounces)

-- $621 Cash cost per Oz. produced (El Castillo); $605 year to date

-- Revenue $9.8 million

-- Operating Income $3.2 million

-- Net Income $345,358

October Highlights

-- Over 1.5 million total tonnes moved in October 2010

-- Over 5,000 ounces of production in October 2010

-- Barren solution upgrade project completed

CAPEX Program Updates

West Side Improvements

-- Commissioned pad 7 and began loading ore in Q3

-- Barren solution volume capacity for the west carbon plant upgraded to

1000 cubic meters/hr of flow from 400 cubic meters per/hr of flow, more

than doubling the previous flow rate

East Side Additions

-- Stage 1, cell 1 was complete

-- Cell 2 and 3 of Stage 1 will be complete by year end

-- Barren and PLS ponds will be complete by year end

-- East Carbon plant will be commissioned by year end

CEO Commentary

Noting El Castillo's continuous improvements and increase in

production, Argonaut's President and CEO Peter Dougherty noted:

"The 3rd quarter marks the third consecutive quarter of

increased gold production at El Castillo (12,724 ounces). During

the 3rd quarter there were 24,202 ounces delivered to the pad. This

was a record month for ounces delivered to the pad at El Castillo.

Upgrades to the west side processing plant more than doubled the

previous flow rate.

The capital expansion program is scheduled for completion by

year end, which will include commissioning of the east side

processing plant. Combined, the two plants' facilities will provide

a processing capacity of over 1 million tonnes of ore per

month.

October demonstrated production abilities of operations at El

Castillo following the CAPEX improvements. October production was

over 5,000 ounces, with over 1.5 total tonnes mined. The

improvements made at the El Castillo mine were key to establishing

a 75,000 ounce run rate in 2011."

This press release should be read in conjunction with the

Company's unaudited consolidated interim financial statements for

the quarter-ended September 30, 2010 and associated Management's

Discussion and Analysis ("MD&A") which are available from the

Company's website www.argonautgoldinc.com, in the "Investors"

section under "Financial Filings", and under the Company's profile

on SEDAR at www.sedar.com.

Summary of Production Results:

Year over year, total tonnes mined increased by +83% for the

quarter. With a full quarter of utilizing a larger, more efficient

truck fleet at El Castillo, the rate of mining production exceeded

1.5 million tonnes per month. The total of ounces loaded to the

pads also increased. In the 3rd quarter 24,202 ounces were placed

on the pad, representing a 20% increase over 2nd quarter in

2010.

Gold production of 12,724 ounces in the third quarter of 2010

was a 66% increase compared to the third quarter of 2009.

The 3rd quarter strip ratio was slightly higher than previous

quarters. The Company chose to begin mining the $1,000 pit limit in

accordance with the arrival of the new larger capacity fleet. This

was done in anticipation of the new 43-101 technical report to be

completed and released in January 2011. The strip ratio is expected

to return to the range historically mined at El Castillo.

Key operational metrics and production statistics for the third

quarter of 2010 compared to 2009 are presented below:

Q3 2010 Q3 2009(i) 9 Months Ended

El Castillo Operating Statistics 9/30/2010 9/30/2009 9/30/2010 9/30/2009

---------- ---------- ---------- ----------

Total Tonnes mined 4,749,610 2,594,800 11,093,516 5,966,900

Tonnes Ore 2,013,668 1,051,300 5,197,406 2,477,800

ROM Tonnes Ore 1,675,504 782,900 4,237,532 1,809,000

(direct to leach pad)

Tonnes Crushed 369,275 268,300 954,559 668,800

Gold Grade (g/t) 0.37 0.42 0.37 0.48

Gold Loaded to Pad (oz) 24,202 14,100 60,744 37,851

Gold Produced (oz) 12,724 7,655 33,032 20,044

Gold Sales (oz) 7,994 7,311 26,779 19,436

(i)Note: Information obtained from Castle Gold Corporation press release

dated October 21, 2009 and Castle Gold Corporation 3rd quarter MD&A dated

November 25, 2009.

Financial Results - Third Quarter 2010

During the third quarter of 2010, revenue was $9.8 million

compared to $7.0 million for El Castillo in Q3 of 2009 as reported

by Castle Gold Corporation ("Castle Gold") for the El Castillo Mine

in its Management's Discussion and Analysis for the Quarter ended

September 30, 2009 posted on November 26, 2009 on www.sedar.com.

The increase in revenue is due to more gold ounces sold and higher

gold prices. During the third quarter of 2010, cost of sales and

depletion, depreciation and accretion expenses were $6.7 million.

Cash cost per gold ounce for units sold was $622. (Cash cost per

gold ounce for units sold is a non-GAAP measure and is cost of

sales less silver sales divided by gold ounces sold.) Income from

mining operations was $3.2 million and net income was $345,358.

Cash cost per ounce of gold produced was $621. (Cash cost per ounce

of gold produced is a non-GAAP measure and is mining and processing

cost over units produced.)

During the nine months ended September 30, 2010, revenue was

$31.7 million compared to $18.1 million for El Castillo as reported

by Castle Gold. The increase in revenue is due to 7,343 more gold

ounces sold and higher gold prices. During the first nine months of

2010, cost of sales & depletion, depreciation and accretion

expenses were $25.0 million. Cost of sales included 11,032 gold

ounces, of the 26,779 gold ounces sold, that were fair valued at

acquisition of Castle Gold at market price of gold less cost to

process units. The year-to-date cash cost per gold ounce for units

sold (a non-GAAP measure) was $809 which includes the above fair

value adjustment. During the first nine months of 2010, income from

mining operations was $6.6 million and net loss was $1.6 million.

During the first nine months of 2010, cash cost per ounce of gold

produced (a non-GAAP measure) was $605.

Looking Forward - 4th Quarter:

-- East side processing facility scheduled for year-end completion

-- Current production rate on target to achieve 47,000 ounces in 2010

-- Vote on proposed merger with Pediment Gold Corp

Cash Requirements:

The capital expansion program is anticipated to be funded by

operating cash flow and cash on hand.

Q3 2010 Financial Results Conference Call and Webcast:

Argonaut Gold will host a conference call on Monday, November

15th, 2010 at 9:30 am EST to discuss the third quarter 2010 results

and provide an update of the Company's operating, exploration, and

development activities.

Participants may join the conference call by dialing

1(877)240-9772 or 1(416)340-8530 for calls outside of Canada and

the United States. The pass code is 6778610 followed by the # key.

The conference call may also be accessed via webcast by visiting

the Company's website, www.argonautgoldinc.com.

A recorded playback of the conference call can be accessed after

the event until November 22, 2010 by dialing 1(800)408-3053 or

1(905)694-9451 for calls outside Canada and the United States. The

pass code for the conference call playback is 6778610 followed by

the # key.

About Argonaut

Argonaut is a Canadian gold company engaged in exploration, mine

development and production activities. Its primary assets being the

production-stage El Castillo Project and the exploration-stage La

Fortuna Project, both located in the State of Durango, Mexico.

Argonaut was created by former executive management team members of

Meridian Gold Inc. Creating the Next Quality Mid-Tier Gold Producer

in the Americas.

Cautionary Note Regarding Forward-looking Statements

This news release contains forward-looking statements that

involve risks and uncertainties that could cause results to differ

materially from management's current expectations. Actual results

may differ materially due to a number of factors. Except as

required by law, Argonaut Gold Inc. assumes no obligation to update

the forward-looking information contained in this news release.

Qualified Person

Preparation of this release was supervised by Thomas Burkhart,

Argonaut's Vice President of Exploration, and a Qualified Person

under NI 43-101. For additional information on El Castillo please

refer to the "Technical Report on the El Castillo Project in

Durango, Mexico" dated July 31, 2008 and available at Argonaut's

profile on www.sedar.com.

Contacts: Argonaut Gold Inc. Nichole Cowles Investor Relations

Manager (775) 284-4422 x 101 nichole.cowles@argonautgoldinc.com

www.argonautgoldinc.com

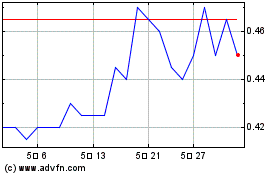

Argonaut Gold (TSX:AR)

과거 데이터 주식 차트

부터 6월(6) 2024 으로 7월(7) 2024

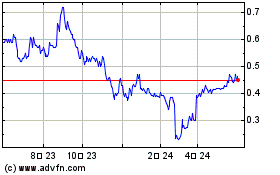

Argonaut Gold (TSX:AR)

과거 데이터 주식 차트

부터 7월(7) 2023 으로 7월(7) 2024