Argonaut Gold Ltd. (TSX: AR) today announced its financial results

for the 2nd quarter, ended on June 30, 2010. (All dollar amounts

expressed are in US dollars.) In addition, positive results from

the capital expansion program support our outlook for production

for the remainder of the year.

Second Quarter Highlights

-- 2010 Q2 compared to 2009 Q2

-- Total Tonnes mined up +85%

-- Ore tonnes processed up + 141%

-- Gold Production up +57%

-- $600 Cash cost per oz. produced

-- Revenue $12.5 million

-- Operating income $3.5 million

-- Net income $1.2 million

-- Cash flow from Operations $2.7 million

-- Amended loan agreement on $6.9 million of long-term debt to reduce the

interest rate from 12% to LIBOR plus 3%

-- Four 100 ton trucks and a 992 front loader belonging to the mining

contractor were delivered to the site and placed in production

July Highlights

-- 1.5 million total tonnes moved in July 2010

-- Over 4,500 ounces of production in July 2010

-- 13,000 meters of the Phase II drill program complete by the end of July

CAPEX Program Updates

West Side Improvements

-- Pad 7 is scheduled for 3rd quarter completion

-- New West Side Carbon Plant for gold recovery was completed and

commissioned in early July with a nominal flow of 740 cubic meters/hr,

approximately a 100% improvement to the existing carbon plant

-- New crushing circuit providing 250,000 tonnes per month (TPM) capacity

vs. 68,000 tonnes previously

East Side Additions

-- 5 million tonnes of heap leach pad capacity scheduled for 3rd quarter

completion

-- New East Side carbon plant with columns already in place is scheduled

for 3rd quarter completion and will be commissioned in the 4th quarter

after completion of processing ponds

El Castillo processing capacities will increase to 1 million ore

tonnes per month

CEO Commentary:

Pleased with progress made in the second quarter, Argonaut

Gold's President and CEO Pete Dougherty noted, "El Castillo's

growth is directly attributable to the extensive capital expansion

plans budgeted and implemented in 2010. Many of the capital

expansion initiatives scheduled have been completed ahead of

time.

July ramp up in production included 1.5 million total tonnes

moved, already achieving the September goal, due to the early

delivery of four new 100 ton trucks and a corresponding loader. El

Castillo production growth continued with July production of more

than 4,500 ounces of gold. In addition, with more than 20,000

ounces added on the pad during the 2nd quarter, production looks to

improve for the third consecutive quarter. This provides us with

strong support to achieve our projection of 47,000 ounces in

2010".

This press release should be read in conjunction with the

Company's unaudited consolidated interim financial statements for

the quarter-ended June 30, 2010 and associated Management's

Discussion and Analysis ("MD&A") which are available from the

Company's website www.argonautgoldinc.com, in the "Investors"

section under "Financial Filings", and on SEDAR www.sedar.com.

Summary of Production Results:

Year over year, total tonnes mined increased by 85% for the

quarter. The larger, more efficient truck fleet continued to

produce higher total tonnes mined. The 40 ton fleet is currently

being replaced by the mining contractor with a 100 ton mining fleet

and higher capacity loaders. Four trucks and a corresponding loader

have already arrived on site and were added into operation. 20,112

ounces were placed on the pad during the 2nd quarter of 2010

representing a 22% increase over 1st quarter 2010. In June, the

Company loaded 7,988 of the 20,112 ounces loaded on the pad for the

quarter.

A newly installed crushing circuit replaced equipment on the

west side in order to meet the 250,000 tonnes per month crushing

capacity for the west circuit at El Castillo. The downtime during

the replacement resulted in lower crushing totals for the second

quarter and impacted average grade.

Gold production of 10,066 ounces in the second quarter of 2010

was a 57% increase compared to the second quarter of 2009. Key

operational metrics and production statistics for the second

quarter of 2010 compared to 2009 are presented below in Table

1.

Table 1 - Summary of Q2 2010 Production Results

El Castillo Operating Q2 2010 Q2 2009 6 Months 6 Months

Statistics 6/30/2010 6/30/2009(i) 6/30/2010 6/30/2009(i)

------------ ----------- --------- -----------

Total Tonnes mined 3,450,572 1,862,200 6,343,906 3,372,100

Tonnes Ore 1,867,191 775,100 3,183,738 1,426,600

Tonnes Ore-direct to

leach pad 1,562,907 573,200 2,562,028 1,026,100

Tonnes Crushed 270,879 201,900 585,284 400,400

Gold Grade (grams/tonne) 0.34 0.47 0.36 0.52

Gold Ounces to Leach Pad

(ounces) 20,112 11,712 36,542 23,712

Gold Produced (ounces) 10,066 6,421 20,308 12,389

(i)Note: Information obtained from Castle Gold Corporation press release

dated August 26, 2009 and are prior to the acquisition of Castle Gold by

the Company.

Financial Results - Second Quarter 2010

During the second quarter of 2010, revenue was $12.5 million

compared to $5.9 million in Q2 of 2009 as reported by Castle Gold

Corporation ("Castle Gold") for the El Castillo Mine in its

Management's Discussion and Analysis for the Quarter ended June 30,

2009 posted on August 26th to Sedar.com. The increase in revenue is

due to 3,961 more gold ounces sold and higher gold prices. During

the second quarter of 2010, cost of sales was $7.4 million. Cost of

sales included 2,634 gold ounces, of the 10,387 gold ounces sold,

that were fair valued at acquisition of Castle Gold at market price

of gold less cost to process units. Cash cost per ounce of gold

produced was approximately $600. During the quarter, operating

income was $3.5 million and net income was $1.2 million.

During the six months ended June 30, 2010, revenue was $21.9

million compared to $11.1 million reported by Castle Gold. The

increase in revenue is due to 6,661 more gold ounces sold and

higher gold prices. During the first half of 2010, cost of sales

was $16.7 million. Cost of sales included 11,032 gold ounces, of

the 18,785 gold ounces sold, that were fair valued at acquisition

of Castle Gold at market price of gold less cost to process units.

During the first half of 2010, cash cost per ounce of gold produced

was approximately $594. During the first half of 2010, operating

income was $3.5 million and net loss was $1.9 million.

Looking Forward - 3rd Quarter Milestones:

-- Remaining nine 100 ton trucks scheduled for September delivery

-- East side processing facility scheduled for Q4 completion

-- Current production rate on target to achieve 47,000 ounces in 2010

Cash Requirements:

The cash balance as at June 30, 2010 was $27.6 million. Cash

flow from operating activities was $2.7 million in the second

quarter and $3.1 million in the first half of 2010. The 2010

capital expansion program is anticipated to be $15 - $20 million.

As at June 30, 2010, $12.7 million was recorded as capital

expenditures. The capital expansion program will be funded by cash

on hand and operating cash flow.

Q2 2010 Financial Results Conference Call and Webcast:

Argonaut Gold will host a conference call on Monday, August

16th, 2010 at 9:30 am EDT to discuss the second quarter 2010

results and provide an update of the Company's operating,

exploration, and development activities.

Participants may join the conference call by dialing

1(877)240-9772 or 1(416)340-8530 for calls outside of Canada and

the United States. The conference call may also be accessed via

webcast by visiting the Company's website,

www.argonautgoldinc.com.

A recorded playback of the conference call can be accessed after

the event until August 23, 2010 by dialing 1(800)408-3053 or

1(416)695-5800 for calls outside Canada and the United States. The

pass code for the conference call playback is 6778610 followed by

the # key.

About Argonaut Gold

Argonaut Gold is a Canadian gold company engaged in exploration,

mine development and production activities. Its primary assets

being the production-stage El Castillo Project and the

exploration-stage La Fortuna Project, both located in the State of

Durango, Mexico. Argonaut Gold is a new venture created by former

executive management team members of Meridian Gold Inc. Creating

the Next Quality Mid-Tier Gold Producer in the Americas.

Non-GAAP Measures

"Cash cost" is a non-GAAP measure calculated in accordance with

the Gold Institute Production Cost Standard and includes site costs

for all mining (excluding deferred stripping costs), processing

administration, royalties and production taxes but exclusive of

depletion, depreciation, reclamation, financing costs, capital

costs and exploration costs. Cash cost is presented as we believe

that it represents an industry standard of comparison.

"Cash cost per ounce" is a non-GAAP measure derived from the

cash cost of ounces produced divided by total ounces produced.

Cash cost per ounce is not a term defined under Canadian

generally accepted accounting principles, and does not have a

standard, agreed upon meaning. As such cash cost per ounce may not

be directly comparable to cash cost per ounce reported by similar

issuers.

Cautionary Language Regarding Forward-Looking Information

This news release contains certain forward-looking statements.

Forward-looking statements include but are not limited to those

with respect to the price of gold, the estimation of mineral

resources and reserves, the realization of mineral reserve

estimates, the timing and amount of estimated future production,

costs of production, capital expenditures, costs and timing of

development of new deposits, success of exploration activities,

permitting time lines, currency fluctuations, requirements for

additional capital, completion of capital projects, availability of

financing on acceptable terms, government regulation of mining

operations, environmental risks, unanticipated reclamation expenses

and title disputes or claims and limitations on insurance coverage.

In certain cases, forward- looking statements can be identified by

the use of words such as "goal", "targets", "objective", "plans",

"expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates", or

"does not anticipate", or "believes" or variations of such words

and phrases, or state that certain actions, events or results

"may", "could", "would", "might" or "will" be taken, occur or be

achieved. Forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of Argonaut Gold to be

materially different from any future results, performance or

achievement expressed or implied by the forward-looking statements.

Such risks and uncertainties include, among others, the actual

results of current exploration activities, conclusions of economic

evaluations, changes in project parameters, possible variations in

grade and ore densities or recovery rates, failure of plant,

equipment or processes to operate as anticipated, accidents, labour

disputes or other risks of the mining industry, delays in obtaining

government approvals or financing or in completion of development

or construction activities, risks relating to the integration of

acquisitions, to international operations, to the price of gold.

Although Argonaut Gold has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results

not to be as anticipated, estimated or intended.

It is important to note, that: (i) unless otherwise indicated,

forward-looking statements indicate the Company's expectations as

at the date of this news release; (ii) actual results may differ

materially from the Company's expectations if known and unknown

risks or uncertainties affect its business, or if estimates or

assumptions prove inaccurate; (iii) the Company cannot guarantee

that any forward-looking statement will materialize and,

accordingly, readers are cautioned not to place undue reliance on

these forward-looking statements; and (iv) the Company disclaims

any intention and assumes no obligation to update or revise any

forward-looking statement even if new information becomes

available, as a result of future events or for any other reason. In

making the forward-looking statements in this news release,

Argonaut Gold has made several material assumptions, including but

not limited to, the assumption that: (i) consistent supply of

sufficient inputs including power will be available to develop and

operate the project as planned; (ii) metal prices and exchange

rates experienced match those anticipated; (iii) mineral reserve

and resource estimates are accurate; (iv) the technology used to

develop and operate its project will and will continue to work

effectively; (vi) that labour and materials will be sufficiently

plentiful as to not impede the projects or add significantly to the

estimated cash costs of operations; and (vii) that the process and

plan expansion projects continue to be implemented

successfully.

Contacts: Argonaut Gold Ltd. Nichole Cowles Investor Relations

Manager (775) 284-4422 x 101 nichole.cowles@argonautgoldinc.com

www.argonautgoldinc.com

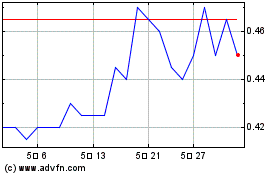

Argonaut Gold (TSX:AR)

과거 데이터 주식 차트

부터 6월(6) 2024 으로 7월(7) 2024

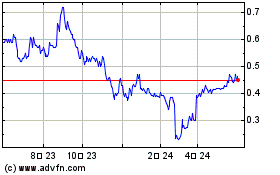

Argonaut Gold (TSX:AR)

과거 데이터 주식 차트

부터 7월(7) 2023 으로 7월(7) 2024