SiriusPoint Ltd. (“SiriusPoint” or the “Company”) (NYSE: SPNT)

announced today the results of the pricing of its previously

announced cash tender offer (the “Tender Offer”) for any and all of

its 4.600% Senior Notes due 2026 (the “2026 Notes”).

The Tender Offer and related consent solicitation

(the “Consent Solicitation”) were made pursuant to an Offer to

Purchase and Consent Solicitation Statement, dated March 21, 2024

(as may be amended or supplemented from time to time, the “Offer to

Purchase”).

The table below sets forth the Total Consideration

and summarizes certain pricing terms for the Tender Offer:

|

Title of Security |

|

CUSIP Number & ISIN (144A / Reg

S) |

|

Principal Amount Outstanding |

|

Reference Treasury

Security(1) |

|

Bloomberg Reference Page |

|

Reference Yield(1) |

|

Fixed Spread (bps) |

|

Early Tender Payment (per

$1,000) |

|

Total Consideration (per

$1,000)(2) |

|

4.600% Senior Notes due 2026 |

|

82968FAA2 / G8201FAA7 US82968FAA21 / USG8201FAA78 |

|

$400,000,000 |

|

1.875% UST due July 31, 2026 |

|

FIT5 |

|

4.618% |

|

+45 |

|

$50 |

|

$1,000.00 |

_________

(1) Calculated based on the bid-side

price of the Reference Treasury Security as quoted on the Bloomberg

Reference Page at 10:00 a.m., New York City time, on April 4,

2024.

(2) The total consideration offered

per $1,000 principal amount of 2026 Notes validly tendered and

accepted for purchase prior to the Early Expiration Time (as

defined below) pursuant to the Tender Offer (the “Total

Consideration”) was determined by the Dealer Managers (as defined

below) in the manner described in the Offer to Purchase and was

made equal to the greater of (x) the sum of the present value of

the remaining payments of principal and interest on the 2026 Notes

from the settlement date to (but excluding) August 1, 2026 (three

months prior to the maturity date of the 2026 Notes), at a discount

rate equal to the sum of the Fixed Spread plus the Reference Yield

and (y) $1,000.

The Total Consideration includes an early tender

payment of $50 for each $1,000 principal amount of 2026 Notes to

holders who validly tender 2026 Notes and deliver consents by a

deadline of 5:00 p.m., New York City time, on April 4,

2024, unless extended or earlier terminated by SiriusPoint (the

“Early Expiration Time”). The 2026 Notes tendered may be

withdrawn and consents for the Proposed Amendment delivered may be

revoked at any time prior to the Early Expiration Time, but not

thereafter, except as may be required by applicable law. Those who

validly tender 2026 Notes and deliver consents before the Early

Expiration Time will receive the Total Consideration for each

$1,000 principal amount of accepted 2026 Notes. Those who validly

tender 2026 Notes and deliver consents after the Early Expiration

Time will receive the Total Consideration, less $50, for each

$1,000 principal amount of accepted 2026 Notes. In each case,

holders of such accepted 2026 Notes will receive accrued and unpaid

interest to (but excluding) the settlement date. The Tender Offer

expires at 5:00 p.m., New York City time, on April 19, 2024,

unless extended or earlier terminated by SiriusPoint (the “Tender

Offer Expiration”).

SiriusPoint intends to initiate settlement for

Notes validly tendered by the Early Expiration Time on April 5,

2024. SiriusPoint’s obligation to accept for purchase, and to pay

for, 2026 Notes validly tendered and not validly withdrawn pursuant

to the Tender Offer and the Consent Solicitation is conditioned

upon the satisfaction or, when applicable, waiver of certain

conditions, which are more fully described in the Offer to

Purchase, including, among others, a financing condition requiring

the consummation of a notes offering described therein. In

addition, subject to applicable law, SiriusPoint has reserved the

right, in its sole discretion, to (i) extend, terminate or withdraw

the Tender Offer or the Consent Solicitation at any time or (ii)

otherwise amend the Tender Offer or the Consent Solicitation in any

respect at any time and from time to time. SiriusPoint has further

reserved the right, in its sole discretion, not to accept any

tenders of 2026 Notes or deliveries of consents with respect to the

2026 Notes.

BMO Capital Markets Corp., HSBC Securities (USA)

Inc., Jefferies LLC and J.P. Morgan Securities LLC have acted as

dealer managers for the Tender Offer and as solicitation agents for

the Consent Solicitation (the “Dealer Managers”). For questions

regarding the Tender Offer and the Consent Solicitation, the Dealer

Managers can be contacted as follows: BMO Capital Markets Corp. at

(833) 418-0762, HSBC Securities (USA) Inc. at (888) 472-2456,

Jefferies LLC at (877) 877-0696 and J.P. Morgan Securities LLC at

(866) 834-4666.

Copies of the Offer to Purchase have been made

available to holders of 2026 Notes from D.F. King & Co., Inc.,

the information agent and the tender agent for the Tender Offer and

the Consent Solicitation. Requests for copies of the Offer to

Purchase should be directed to D.F. King & Co., Inc. toll-free

at (866) 388-7535 or SPNT@dfking.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are subject to known

and unknown risks and uncertainties, many of which may be beyond

the Company’s control. The Company cautions you that the

forward-looking information presented in this press release is not

a guarantee of future events, and that actual events may differ

materially from those made in or suggested by the forward-looking

information contained in this press release. In addition,

forward-looking statements generally can be identified by the use

of forward-looking terminology such as “believes,” “intends,”

“seeks,” “anticipates,” “aims,” “plans,” “targets,” “estimates,”

“expects,” “assumes,” “continues,” “should,” “could,” “will,” “may”

and the negative of these or similar terms and phrases. Actual

events, results and outcomes may differ materially from the

Company’s expectations due to a variety of known and unknown risks,

uncertainties and other factors. Among the risks and uncertainties

that could cause actual results to differ from those described in

the forward-looking statements are the following: the Company’s

ability to execute on its strategic transformation, including

re-underwriting to reduce volatility and improving underwriting

performance, de-risking the Company’s investment portfolio, and

transforming the Company’s business; the impact of unpredictable

catastrophic events including uncertainties with respect to current

and future COVID-19 losses across many classes of insurance

business and the amount of insurance losses that may ultimately be

ceded to the reinsurance market, supply chain issues, labor

shortages and related increased costs, changing interest rates and

equity market volatility; inadequacy of loss and loss adjustment

expense reserves, the lack of available capital, and periods

characterized by excess underwriting capacity and unfavorable

premium rates; the performance of financial markets, impact of

inflation and interest rates, and foreign currency fluctuations;

the Company’s ability to compete successfully in the insurance and

reinsurance market and the effect of consolidation in the insurance

and reinsurance industry; technology breaches or failures,

including those resulting from a malicious cyber-attack on the

Company, the Company’s business partners or service providers; the

effects of global climate change, including increased severity and

frequency of weather-related natural disasters and catastrophes and

increased coastal flooding in many geographic areas; geopolitical

uncertainty, including the ongoing conflicts in Europe and the

Middle East; the Company’s ability to retain key senior management

and key employees; a downgrade or withdrawal of the Company’s

financial ratings; fluctuations in the Company’s results of

operations; legal restrictions on certain of SiriusPoint’s

insurance and reinsurance subsidiaries’ ability to pay dividends

and other distributions to SiriusPoint; the outcome of legal and

regulatory proceedings and regulatory constraints on the Company’s

business; reduced returns or losses in SiriusPoint’s investment

portfolio; the Company’s exposure or potential exposure to

corporate income tax in Bermuda and the E.U., U.S. federal income

and withholding taxes and the Company’s significant deferred tax

assets, which could become devalued if the Company does not

generate future taxable income or applicable corporate tax rates

are reduced; risks associated with delegating authority to third

party managing general agents; future strategic transactions such

as acquisitions, dispositions, investments, mergers or joint

ventures; SiriusPoint’s response to any acquisition proposal that

may be received from any party, including any actions that may be

considered by the Company’s Board of Directors or any committee

thereof; and other risks and factors listed under “Risk Factors” in

the Company’s most recent Annual Report on Form 10-K and other

subsequent periodic reports filed with the Securities and Exchange

Commission. All forward-looking statements speak only as of the

date made and the Company undertakes no obligation to update or

revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise.

About the Company

SiriusPoint is a global underwriter of insurance

and reinsurance providing solutions to clients and brokers around

the world. Bermuda-headquartered with offices in New York, London,

Stockholm and other locations, the Company is listed on the New

York Stock Exchange (SPNT). SiriusPoint has licenses to write

Property & Casualty and Accident & Health insurance and

reinsurance globally. SiriusPoint’s offering and distribution

capabilities are strengthened by a portfolio of strategic

partnerships with Managing General Agents and Program

Administrators within the Company’s Insurance & Services

segment.

SiriusPoint Contacts

Investor RelationsDhruv

Gahlaut, Head of Investor Relations and Chief Strategy

OfficerDhruv.gahlaut@siriuspt.com+44 7514 659 918

MediaSarah Hills,

Rein4ceSarah.hills@rein4ce.co.uk+ 44 7718882011

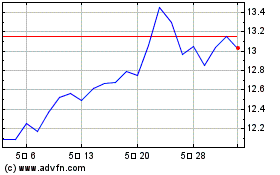

SiriusPoint (NYSE:SPNT)

과거 데이터 주식 차트

부터 11월(11) 2024 으로 12월(12) 2024

SiriusPoint (NYSE:SPNT)

과거 데이터 주식 차트

부터 12월(12) 2023 으로 12월(12) 2024