UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File

Number: 811-21326

Cohen & Steers REIT and Preferred and Income Fund, Inc.

(Exact name of registrant as specified

in charter)

280 Park Avenue, New York, NY 10017

(Address of principal executive

offices) (Zip code)

Dana A. DeVivo

Cohen & Steers Capital Management, Inc.

280 Park Avenue

New York, New York

10017

(Name and address of agent

for service)

Registrant’s telephone number, including area code: (212)

832-3232

Date of fiscal year

end: December 31

Date of reporting period: June 30,

2023

Item 1. Reports to Stockholders.

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

To Our Shareholders:

We would like to share with you our report for the six months ended June 30, 2023. The total returns for Cohen & Steers REIT and Preferred and Income Fund, Inc. (the Fund) and its comparative benchmarks were:

|

|

|

|

|

| |

|

Six Months Ended

June 30, 2023 |

|

| Cohen & Steers REIT and Preferred and Income Fund at Net Asset Value(a) |

|

|

3.55 |

% |

| Cohen & Steers REIT and Preferred and Income Fund at Market Value(a) |

|

|

–2.93 |

% |

| FTSE Nareit All Equity REITs

Index(b) |

|

|

2.97 |

% |

| ICE BofA Fixed Rate Preferred Securities Index(b) |

|

|

4.60 |

% |

| Blended Benchmark—50% FTSE Nareit All Equity REITs

Index/50% ICE BofA Fixed Rate Preferred Securities Index |

|

|

3.84 |

% |

| S&P 500

Index(b) |

|

|

16.89 |

% |

The performance data quoted represent past performance. Past performance is no guarantee of

future results. The investment return and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

Performance results reflect the effects of leverage, resulting from borrowings under a credit agreement. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. The Fund’s returns assume the reinvestment

of all dividends and distributions at prices obtained under the Fund’s dividend reinvestment plan. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. Performance

figures for periods shorter than one year are not annualized.

Managed Distribution Policy

The Fund, acting in accordance with an exemptive order received from the U.S. Securities and Exchange Commission (SEC) and with

approval of its Board of Directors (the Board), adopted a managed distribution policy under which the Fund intends to include long-term capital gains, where applicable, as part of the regular monthly cash distributions to its shareholders (the

Plan). The Plan gives the Fund greater flexibility to realize long-term capital gains and to distribute those gains on a regular monthly basis. In accordance with the Plan, the Fund currently distributes $0.136 per share on a monthly basis.

| (a) |

As a closed-end investment company, the price of the Fund’s exchange-traded shares will be set

by market forces and can deviate from the net asset value (NAV) per share of the Fund. |

| (b) |

The FTSE Nareit All Equity REITs Index contains all tax-qualified REITs with more than 50% of total

assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria. The ICE BofA Fixed Rate Preferred Securities Index tracks the performance of fixed-rate U.S. dollar-denominated

preferred securities issued in the U.S. domestic market. The S&P 500 Index is an unmanaged index of 500 large-capitalization stocks that is frequently used as a general measure of U.S. stock market performance. Benchmark returns are shown for

comparative purposes only and may not be representative of the Fund’s portfolio. |

1

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

The Fund may pay distributions in excess of the Fund’s investment company taxable income and net realized gains. This excess

would be a return of capital distributed from the Fund’s assets. Distributions of capital decrease the Fund’s total assets and, therefore, could have the effect of increasing the Fund’s expense ratio. In addition, in order to make

these distributions, the Fund may have to sell portfolio securities at a less than opportune time.

Shareholders should

not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the Fund’s Plan. The Fund’s total return based on NAV is presented in the table above as well as in the

Consolidated Financial Highlights table.

The Plan provides that the Board may amend or terminate the Plan at any time

without prior notice to Fund shareholders; however, at this time, there are no reasonably foreseeable circumstances that might cause the termination. The termination of the Plan could have the effect of creating a trading discount (if the

Fund’s stock is trading at or above NAV) or widening an existing trading discount.

Market Review

U.S. real estate securities modestly advanced in the six-month period ended June 30,

2023, although the group trailed broader equities by a wide margin. Notably, however, equity markets rose on the strength of just a few sectors, led by technology (which rallied sharply on optimism surrounding advancements in artificial

intelligence).

The U.S. economy decelerated in the first half of the year, although growth remained positive, and

worries about an impending recession receded. Major central banks continued to aggressively raise short-term lending rates to rein in inflation—in the steepest rate-hiking cycle in more than 40 years. However, with U.S. consumer prices trending

lower, the Federal Reserve appeared to be nearing a pause with its rate hikes.

Fund Performance

The Fund had a positive total return in the period based on NAV (it declined based on market price), but underperformed its blended

benchmark.

While REITs gained as a group in the period, there was a wide range of returns by property type. Health care

landlords outperformed broader REITs, with strength in certain senior housing companies. Senior housing employment showed signs of growth in the period, suggesting an optimistic outlook for staffing, which could lead to more moderate expense growth.

Stock selection in health care contributed positively to the Fund’s performance, led by an overweight in Welltower, which rallied amid a recovery in senior living occupancies.

Data center operators were a positive standout, benefiting from continued strength in cloud demand and the early innings of an

expected multiyear tailwind from artificial intelligence (AI). The Fund maintained an overweight in the data center sector during the period, which had a positive impact on relative performance.

Residential companies generally performed well, led by single-family homes landlords, which were supported by solid demand and

limited inventory. Apartment REITs gained on improving fundamentals as well as signs of early demand recovery on the West Coast. The manufactured home sector trailed as

2

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

home sales and transient revenues came in weaker than expected. The Fund’s overweight in single-family homes helped performance, although the

effect was countered by relatively unfavorable stock selection in the apartment and manufactured homes sectors.

Office

companies had a sizable decline, continuing to struggle with weak fundamentals and deteriorating access to capital. The Fund’s underweight in offices aided performance, as did stock selection in the sector.

In the infrastructure sector, which fell in the period, cell tower owners were hindered on a belief that wireless carrier capital

expenditure budgets likely peaked in 2022 and as lower forward earnings growth became more fully digested by the market. Our underweight in infrastructure REITs helped performance.

The self storage sector performed well, led by Life Storage, which received competing takeover bids. In April the company agreed to

be acquired by Extra Space Storage. Stock selection in the sector detracted from relative performance, as the Fund did not invest in Life Storage. Elsewhere of note, our underweight in timber REITs hindered performance, as they outperformed on

encouraging housing starts data, while stock selection in the industrials sector helped performance.

Preferred

securities had a gain in the period as measured by the preferreds component of the Fund’s blended benchmark, although they experienced significant volatility. In the U.S., the sudden collapse of Silicon Valley Bank (SVB) and Signature Bank in

March raised concerns about contagion risk.

Financial regulators took swift action to mitigate contagion risk within

the U.S. banking industry, including the Fed’s establishment of an emergency loan program, accepting as collateral U.S. Treasuries and certain other high-quality securities at their par value. In Europe, struggling Credit Suisse was acquired by

rival UBS in March. However, Credit Suisse was an outlier among European banks; other European banks do not face the same vulnerabilities as Credit Suisse. Security selection in banking detracted from the Fund’s performance, due in part to

having out-of-benchmark allocations to certain issues from Silicon Valley Bank and Credit Suisse that declined.

The insurance sector performed well during the period. Property & casualty insurance companies experienced significant

premium growth due to the recovering economy, while life insurers benefited from the declining impact of the Covid pandemic. The Fund’s security selection in insurance detracted from relative performance.

Utilities, a capital-intensive sector, benefited from declining long-term interest rates, strong earnings results, and increased

investor focus on balance sheet quality. Real estate also responded favorably to lower rates, as well as the improved economic outlook. The Fund’s security selection in utilities and real estate preferreds hindered relative performance.

Impact of Leverage on Fund Performance

The Fund employs leverage as part of a yield-enhancement strategy. Leverage, which can increase total return in rising markets

(just as it can have the opposite effect in declining markets), contributed significantly to the Fund’s performance for the six-month period ended June 30, 2023.

3

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

Impact of Derivatives on Fund Performance

The Fund used derivatives in the form of forward foreign currency exchange contracts for managing currency risk on certain Fund

positions denominated in foreign currencies. These instruments did not have a material effect on the Fund’s total return for the six-month period ended June 30, 2023.

The Fund used total return swaps with the intention of managing credit risk. These swaps did not have a material effect on the

Fund’s total return for the six-month period ended June 30, 2023.

The

Fund invested in European equity index options with the intention of managing volatility in certain European holdings. The equity index options did not have a material effect on the Fund’s total return for the six months ended June 30,

2023. The Fund also engaged in the buying and selling of single stock options with the intention of enhancing total returns and reducing overall volatility. These contracts did not have a material effect on the Fund’s total return for the

six-month period ended June 30, 2023.

In connection with its use of leverage, the Fund pays interest on a portion

of its borrowings based on a floating rate under the terms of its credit agreement. To reduce the impact that an increase in interest rates could have on the performance of the Fund with respect to these borrowings, the Fund used interest rate swaps

to exchange a portion of the floating rate for a fixed rate. The Fund’s use of these swaps contributed to the Fund’s total return for the six-month period ended June 30, 2023.

Sincerely,

|

|

|

|

|

|

|

|

| WILLIAM F. SCAPELL |

|

JASON YABLON |

| Portfolio Manager |

|

Portfolio Manager |

|

|

|

|

|

| ELAINE ZAHARIS-NIKAS

Portfolio Manager |

|

MATHEW KIRSCHNER

Portfolio Manager |

JERRY DOROST

Portfolio Manager

4

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

The views and opinions in the preceding commentary are subject to change without notice and are as of the date of the report.

There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not

intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about the Cohen & Steers family of mutual funds, visit cohenandsteers.com. Here you will

find fund net asset values, fund fact sheets and portfolio highlights, as well as educational resources and timely market updates.

Our website also provides comprehensive information about Cohen & Steers, including our

most recent press releases, profiles of our senior investment professionals and their investment approach to each asset class. The Cohen & Steers family of mutual funds specializes in liquid real assets, including real estate securities, listed

infrastructure and natural resource equities, as well as preferred securities and other income solutions.

5

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

Performance Review (Unaudited)

Average Annual Total Returns—For Periods Ended June 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

Since

Inception(a) |

|

|

Fund at NAV |

|

|

–1.36 |

% |

|

|

6.46 |

% |

|

|

8.79 |

% |

|

|

8.83 |

% |

|

Fund at Market Value |

|

|

1.00 |

% |

|

|

7.79 |

% |

|

|

9.07 |

% |

|

|

8.31 |

% |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The

investment return will vary and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance

results reflect the effect of leverage from utilization of borrowings under a credit agreement. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. The Fund’s returns assume the reinvestment of all

dividends and distributions at prices obtained under the Fund’s dividend reinvestment plan. The performance table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

| (a) |

Commencement of investment operations is June 27, 2003. |

6

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

Our Leverage Strategy

(Unaudited)

Our current leverage strategy utilizes borrowings up to the maximum

permitted by the Investment Company Act of 1940 to provide additional capital for the Fund, with an objective of increasing net income available for shareholders. As of June 30, 2023, leverage represented 32% of the Fund’s managed assets.

Through a combination of variable and fixed rate financing, the Fund has locked in interest rates on a

significant portion of this additional capital through 2027 (where we effectively reduce our variable rate obligation and lock in our fixed rate obligation over various terms). Locking in a significant portion of our leveraging costs is designed to

protect the dividend-paying ability of the Fund. The use of leverage increases the volatility of the Fund’s NAV in both up and down markets. However, we believe that locking in portions of the Fund’s leveraging costs for the various terms

partially protects the Fund’s expenses from an increase in short-term interest rates.

Leverage Facts(a)(b)

|

|

|

| Leverage (as a % of managed assets) |

|

32% |

| % Variable Rate Financing |

|

19% |

| Variable Rate |

|

6.0% |

| % Fixed Rate

Financing(c) |

|

81% |

| Weighted Average Rate on Fixed Financing |

|

1.8% |

| Weighted Average Term on Fixed Financing |

|

3.1 years |

The Fund seeks to enhance its dividend yield through leverage. The use of leverage

is a speculative technique and there are special risks and costs associated with leverage. The NAV of the Fund’s shares may be reduced by the issuance and ongoing costs of leverage. So long as the Fund is able to invest in securities that

produce an investment yield that is greater than the total cost of leverage, the leverage strategy will produce higher current net investment income for shareholders. On the other hand, to the extent that the total cost of leverage exceeds the

incremental income gained from employing such leverage, shareholders would realize lower net investment income. In addition to the impact on net income, the use of leverage will have an effect of magnifying capital appreciation or depreciation for

shareholders. Specifically, in an up market, leverage will typically generate greater capital appreciation than if the Fund were not employing leverage. Conversely, in down markets, the use of leverage will generally result in greater capital

depreciation than if the Fund had been unlevered. To the extent that the Fund is required or elects to reduce its leverage, the Fund may need to liquidate investments, including under adverse economic conditions which may result in capital losses

potentially reducing returns to shareholders. There can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

| (a) |

Data as of June 30, 2023. Information is subject to change. |

| (b) |

See Note 9 in Notes to Consolidated Financial Statements. |

| (c) |

Represents fixed payer interest rate swap contracts on variable rate borrowing.

|

7

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

June 30, 2023

Top Ten Holdings(a)

(Unaudited)

|

|

|

|

|

|

|

|

|

| Security |

|

Value |

|

|

% of

Managed

Assets |

|

|

|

|

| Prologis, Inc. |

|

$ |

74,705,583 |

|

|

|

5.3 |

|

| American Tower Corp. |

|

|

55,842,890 |

|

|

|

4.0 |

|

| Welltower, Inc. |

|

|

52,296,841 |

|

|

|

3.7 |

|

| Invitation Homes, Inc. |

|

|

43,427,626 |

|

|

|

3.1 |

|

| Digital Realty Trust, Inc. |

|

|

42,845,865 |

|

|

|

3.1 |

|

| Realty Income Corp. |

|

|

42,812,032 |

|

|

|

3.0 |

|

| Simon Property Group, Inc. |

|

|

38,766,405 |

|

|

|

2.8 |

|

| Equinix, Inc. |

|

|

31,525,363 |

|

|

|

2.2 |

|

| Mid-America Apartment Communities,

Inc. |

|

|

29,150,286 |

|

|

|

2.1 |

|

| Crown Castle, Inc. |

|

|

27,261,056 |

|

|

|

1.9 |

|

| (a) |

Top ten holdings (excluding short-term investments and derivative instruments) are determined on

the basis of the value of individual securities held. The Fund may also hold positions in other securities issued by the companies listed above. See the Consolidated Schedule of Investments for additional details on such other positions.

|

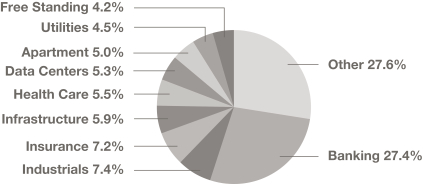

Sector Breakdown(b)

(Based on Managed Assets)

(Unaudited)

| (b) |

Excludes derivative instruments. |

8

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| COMMON STOCK—REAL

ESTATE |

|

|

70.2% |

|

|

|

|

|

|

|

|

|

| APARTMENT |

|

|

7.3% |

|

|

|

|

|

|

|

|

|

| Apartment Income REIT

Corp.(a)(b) |

|

|

|

157,962 |

|

|

$ |

5,700,848 |

|

| Camden Property

Trust(a)(b) |

|

|

|

129,141 |

|

|

|

14,059,581 |

|

| Mid-America Apartment Communities, Inc.(a)(b) |

|

|

|

191,955 |

|

|

|

29,150,286 |

|

| UDR,

Inc.(a)(b) |

|

|

|

481,228 |

|

|

|

20,673,555 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

69,584,270 |

|

|

|

|

|

|

|

| DATA CENTERS |

|

|

7.8% |

|

|

|

|

|

|

|

|

|

| Digital Realty Trust,

Inc.(a)(b) |

|

|

|

376,270 |

|

|

|

42,845,865 |

|

| Equinix,

Inc.(a)(b) |

|

|

|

40,214 |

|

|

|

31,525,363 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

74,371,228 |

|

|

|

|

|

|

|

| DIVERSIFIED |

|

|

0.7% |

|

|

|

|

|

|

|

|

|

| WP Carey, Inc. |

|

|

|

95,817 |

|

|

|

6,473,397 |

|

|

|

|

|

|

|

| FREE STANDING |

|

|

6.2% |

|

|

|

|

|

|

|

|

|

| NETSTREIT

Corp.(a)(b) |

|

|

|

249,581 |

|

|

|

4,460,012 |

|

| Realty Income

Corp.(a)(b) |

|

|

|

716,040 |

|

|

|

42,812,032 |

|

| Spirit Realty Capital,

Inc.(a)(b)(c) |

|

|

|

295,869 |

|

|

|

11,651,321 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

58,923,365 |

|

|

|

|

|

|

|

| HEALTH CARE |

|

|

8.1% |

|

|

|

|

|

|

|

|

|

| Healthcare Realty Trust, Inc., Class A(a)(b) |

|

|

|

1,098,232 |

|

|

|

20,712,656 |

|

| Medical Properties Trust, Inc. |

|

|

|

454,767 |

|

|

|

4,211,142 |

|

| Welltower,

Inc.(b) |

|

|

|

646,518 |

|

|

|

52,296,841 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

77,220,639 |

|

|

|

|

|

|

|

| HOTEL |

|

|

1.1% |

|

|

|

|

|

|

|

|

|

| Host Hotels & Resorts, Inc.(a)(b) |

|

|

|

600,246 |

|

|

|

10,102,140 |

|

|

|

|

|

|

|

| INDUSTRIALS |

|

|

10.5% |

|

|

|

|

|

|

|

|

|

| Americold Realty Trust,

Inc.(a)(b) |

|

|

|

583,096 |

|

|

|

18,834,001 |

|

| BG LLH, LLC (Lineage Logistics)(d)(k) |

|

|

|

61,115 |

|

|

|

6,553,919 |

|

| Prologis,

Inc.(b) |

|

|

|

609,195 |

|

|

|

74,705,583 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100,093,503 |

|

|

|

|

|

|

|

| INFRASTRUCTURE |

|

|

8.7% |

|

|

|

|

|

|

|

|

|

| American Tower

Corp.(a)(b) |

|

|

|

|

|

|

287,939 |

|

|

|

55,842,890 |

|

| Crown Castle,

Inc.(a)(b) |

|

|

|

239,258 |

|

|

|

27,261,056 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

83,103,946 |

|

|

|

|

|

|

|

See accompanying notes to the consolidated financial statements.

9

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| MANUFACTURED HOME |

|

|

2.1% |

|

|

|

|

|

|

|

|

|

| Sun Communities,

Inc.(a)(b) |

|

|

|

156,647 |

|

|

$

|

20,436,168 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OFFICE |

|

|

0.9% |

|

|

|

|

|

|

|

|

|

| Cousins Properties, Inc. |

|

|

|

|

|

|

201,339 |

|

|

|

4,590,529 |

|

| Highwoods Properties,

Inc.(b) |

|

|

|

|

|

|

188,322 |

|

|

|

4,502,779 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,093,308 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| REGIONAL MALL |

|

|

4.1% |

|

|

|

|

|

|

|

|

|

| Simon Property Group,

Inc.(a)(b)(c) |

|

|

|

335,698 |

|

|

|

38,766,405 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SELF STORAGE |

|

|

3.6% |

|

|

|

|

|

|

|

|

|

| Extra Space Storage,

Inc.(b) |

|

|

|

148,133 |

|

|

|

22,049,597 |

|

| Public Storage |

|

|

|

43,148 |

|

|

|

12,594,038 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34,643,635 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SHOPPING CENTERS |

|

|

1.9% |

|

|

|

|

|

|

|

|

|

| Kimco Realty

Corp.(b) |

|

|

|

904,912 |

|

|

|

17,844,865 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SINGLE FAMILY HOMES |

|

|

5.4% |

|

|

|

|

|

|

|

|

|

| American Homes 4 Rent, Class A |

|

|

|

227,301 |

|

|

|

8,057,821 |

|

| Invitation Homes,

Inc.(a)(b)(c) |

|

|

|

1,262,431 |

|

|

|

43,427,626 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51,485,447 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SPECIALTY |

|

|

1.4% |

|

|

|

|

|

|

|

|

|

| Iron Mountain, Inc. |

|

|

|

64,327 |

|

|

|

3,655,060 |

|

| Lamar Advertising Co., Class A |

|

|

|

33,466 |

|

|

|

3,321,501 |

|

| VICI Properties, Inc., Class A(a)(b) |

|

|

|

195,637 |

|

|

|

6,148,871 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,125,432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TIMBER |

|

|

0.4% |

|

|

|

|

|

|

|

|

|

| Weyerhaeuser

Co.(a)(b) |

|

|

|

117,855 |

|

|

|

3,949,321 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL COMMON

STOCK

(Identified cost—$528,217,702) |

|

|

|

|

|

|

|

669,217,069 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EXCHANGE-TRADED

FUNDS—PREFERRED |

|

|

0.2% |

|

|

|

|

|

|

|

|

|

| iShares Preferred & Income Securities ETF(b) |

|

|

|

68,892 |

|

|

|

2,130,830 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL EXCHANGE-TRADED

FUNDS

(Identified cost—$2,046,595) |

|

|

|

|

|

|

|

2,130,830 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PREFERRED

SECURITIES—EXCHANGE-TRADED |

|

|

12.2% |

|

|

|

|

|

|

|

|

|

| BANKING |

|

|

3.6% |

|

|

|

|

|

|

|

|

|

| Bank of America Corp., 6.00%, Series GG(b)(e) |

|

|

|

137,567 |

|

|

|

3,436,424 |

|

See accompanying notes to the consolidated financial statements.

10

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| Bank of America Corp., 5.875%, Series HH(e) |

|

|

|

141,663 |

|

|

$

|

3,494,826 |

|

| Bank of America Corp., 5.00%, Series LL(a)(b)(e) |

|

|

|

81,745 |

|

|

|

1,781,224 |

|

| Bank of America Corp., 4.25%, Series QQ(e) |

|

|

|

183,210 |

|

|

|

3,426,027 |

|

| Bank of America Corp., 4.75%, Series SS(e) |

|

|

|

16,348 |

|

|

|

336,278 |

|

| Dime Community Bancshares, Inc., 5.50%(e) |

|

|

|

38,941 |

|

|

|

637,075 |

|

| Federal Agricultural Mortgage Corp., 4.875%, Series G(b)(e) |

|

|

|

93,596 |

|

|

|

1,914,974 |

|

| KeyCorp., 6.20% to

12/15/27(b)(e)(f) |

|

|

|

43,521 |

|

|

|

830,381 |

|

| Regions Financial Corp., 6.375% to 9/15/24, Series B(b)(e)(f) |

|

|

|

1,146 |

|

|

|

26,163 |

|

| Regions Financial Corp., 5.70% to 5/15/29, Series C(b)(e)(f) |

|

|

|

72,265 |

|

|

|

1,477,819 |

|

| Texas Capital Bancshares, Inc., 5.75%, Series B(e) |

|

|

|

125,235 |

|

|

|

2,388,232 |

|

| Washington Federal, Inc., 4.875%, Series A(b)(e) |

|

|

|

48,643 |

|

|

|

724,781 |

|

| Wells Fargo & Co., 4.70%, Series AA(b)(e) |

|

|

|

139,460 |

|

|

|

2,571,642 |

|

| Wells Fargo & Co., 4.375%, Series CC(e) |

|

|

|

234,250 |

|

|

|

4,090,005 |

|

| Wells Fargo & Co., 4.25%, Series DD(b)(e) |

|

|

|

170,853 |

|

|

|

2,914,752 |

|

| Wells Fargo & Co., 5.85%, Series Q(b)(e)(g) |

|

|

|

30,000 |

|

|

|

750,300 |

|

| Wells Fargo & Co., 5.625%, Series Y(a)(b)(e) |

|

|

|

93,061 |

|

|

|

2,151,570 |

|

| Wells Fargo & Co., 4.75%, Series Z(a)(b)(e) |

|

|

|

72,101 |

|

|

|

1,372,803 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34,325,276 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BROKERAGE |

|

|

1.7% |

|

|

|

|

|

|

|

|

|

| Morgan Stanley, 6.875% to 1/15/24, Series F(a)(b)(e) |

|

|

|

25,704 |

|

|

|

650,825 |

|

| Morgan Stanley, 6.375% to 10/15/24, Series I(a)(b)(e) |

|

|

|

245,702 |

|

|

|

6,029,527 |

|

| Morgan Stanley, 5.85% to 4/15/27, Series K(b)(e) |

|

|

|

59,056 |

|

|

|

1,388,406 |

|

| Morgan Stanley, 4.25%, Series O(b)(e) |

|

|

|

259,556 |

|

|

|

4,827,742 |

|

| Morgan Stanley, 6.50%, Series P(b)(e) |

|

|

|

112,980 |

|

|

|

2,932,961 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,829,461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSUMER STAPLE PRODUCTS |

|

|

0.6% |

|

|

|

|

|

|

|

|

|

| CHS, Inc., 7.10% to 3/31/24, Series 2(b)(e)(f) |

|

|

|

110,595 |

|

|

|

2,801,372 |

|

| CHS, Inc., 6.75% to 9/30/24, Series 3(e)(f) |

|

|

|

102,892 |

|

|

|

2,598,023 |

|

| CHS, Inc., 7.50%, Series

4(b)(e) |

|

|

|

28,801 |

|

|

|

757,178 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,156,573 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCE |

|

|

0.1% |

|

|

|

|

|

|

|

|

|

| Brookfield Finance, Inc., 4.625%, due 10/16/80, Series 50 (Canada)(b) |

|

|

|

88,400 |

|

|

|

1,449,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the consolidated financial statements.

11

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| HOTEL |

|

|

0.2% |

|

|

|

|

|

|

|

|

|

| Pebblebrook Hotel Trust, 6.375%, Series G(b)(e) |

|

|

|

81,600 |

|

|

$

|

1,525,920 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INDUSTRIALS |

|

|

0.4% |

|

|

|

|

|

|

|

|

|

| LXP Industrial Trust, 6.50%, Series C ($50 Par Value)(b)(e) |

|

|

|

76,536 |

|

|

|

3,798,482 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INSURANCE |

|

|

2.6% |

|

|

|

|

|

|

|

|

|

| Allstate Corp./The, 7.375%, Series J(e) |

|

|

|

108,105 |

|

|

|

2,889,646 |

|

| Arch Capital Group Ltd., 4.55%, Series G(b)(e) |

|

|

|

67,650 |

|

|

|

1,289,409 |

|

| Assurant, Inc., 5.25%, due 1/15/61(b) |

|

|

|

31,954 |

|

|

|

602,652 |

|

| Athene Holding Ltd., 6.35% to 6/30/29, Series A(b)(e)(f) |

|

|

|

85,720 |

|

|

|

1,800,120 |

|

| Athene Holding Ltd., 5.625%, Series B(a)(b)(e) |

|

|

|

33,926 |

|

|

|

656,129 |

|

| Athene Holding Ltd., 4.875%, Series D(b)(e) |

|

|

|

85,266 |

|

|

|

1,389,836 |

|

| Athene Holding Ltd., 7.75% to 12/30/27, Series E(b)(e)(f) |

|

|

|

87,918 |

|

|

|

2,101,240 |

|

| Brighthouse Financial, Inc., 5.375%, Series C(b)(e) |

|

|

|

72,272 |

|

|

|

1,205,497 |

|

| Enstar Group Ltd., 7.00% to 9/1/28, Series D(b)(e)(f) |

|

|

|

63,422 |

|

|

|

1,446,656 |

|

| Equitable Holdings, Inc., 5.25%, Series A(b)(e) |

|

|

|

51,202 |

|

|

|

1,023,528 |

|

| Kemper Corp., 5.875% to 3/15/27, due 3/15/62(b)(f) |

|

|

|

35,230 |

|

|

|

616,525 |

|

| Lincoln National Corp., 9.00%, Series D(e) |

|

|

|

98,733 |

|

|

|

2,653,943 |

|

| MetLife, Inc., 5.625%, Series E(e) |

|

|

|

9,379 |

|

|

|

231,849 |

|

| MetLife, Inc., 4.75%, Series F(b)(e) |

|

|

|

67,121 |

|

|

|

1,422,965 |

|

| Prudential Financial, Inc., 5.95%, due 9/1/62(b) |

|

|

|

46,257 |

|

|

|

1,161,976 |

|

| Reinsurance Group of America, Inc., 7.125% to 10/15/27, due 10/15/52(b)(f) |

|

|

|

137,357 |

|

|

|

3,497,109 |

|

| RenaissanceRe Holdings Ltd., 4.20%, Series G (Bermuda)(a)(b)(e) |

|

|

|

39,843 |

|

|

|

713,190 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,702,270 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PIPELINES |

|

|

0.7% |

|

|

|

|

|

|

|

|

|

| Energy Transfer LP, 7.625% to 8/15/23, Series D(b)(e)(f) |

|

|

|

135,000 |

|

|

|

3,410,100 |

|

| Energy Transfer LP, 7.60% to 5/15/24, Series E(e)(f) |

|

|

|

119,381 |

|

|

|

2,910,509 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,320,609 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| REGIONAL MALL |

|

|

0.3% |

|

|

|

|

|

|

|

|

|

| Brookfield Property Partners LP, 5.75%, Series A(b)(e) |

|

|

|

104,400 |

|

|

|

1,435,500 |

|

| Brookfield Property Partners LP, 6.375%, Series A2(b)(e) |

|

|

|

92,000 |

|

|

|

1,252,120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,687,620 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TELECOMMUNICATION SERVICES |

|

|

0.8% |

|

|

|

|

|

|

|

|

|

| AT&T, Inc., 5.35%, due 11/1/66(b) |

|

|

|

29,063 |

|

|

|

697,512 |

|

See accompanying notes to the consolidated financial statements.

12

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| Telephone and Data Systems, Inc., 6.625%, Series UU(b)(e) |

|

|

|

41,584 |

|

|

$

|

627,918 |

|

| Telephone and Data Systems, Inc., 6.00%, Series VV(a)(b)(e) |

|

|

|

128,791 |

|

|

|

1,769,588 |

|

| United States Cellular Corp., 5.50%, due 3/1/70(b) |

|

|

|

127,486 |

|

|

|

1,861,296 |

|

| United States Cellular Corp., 5.50%, due 6/1/70(b) |

|

|

|

71,578 |

|

|

|

1,037,881 |

|

| United States Cellular Corp., 6.25%, due 9/1/69, Class C(a)(b) |

|

|

|

119,322 |

|

|

|

1,998,644 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,992,839 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| UTILITIES |

|

|

1.2% |

|

|

|

|

|

|

|

|

|

| Algonquin Power & Utilities Corp., 6.875% to 10/17/23, due 10/17/78

(Canada)(b)(f) |

|

|

|

74,199 |

|

|

|

1,886,139 |

|

| Algonquin Power & Utilities Corp., 6.20% to 7/1/24, due 7/1/79, Series

19-A (Canada)(b)(f) |

|

|

|

136,356 |

|

|

|

3,254,818 |

|

| BIP Bermuda Holdings I Ltd., 5.125% (Canada)(b)(e) |

|

|

|

14,141 |

|

|

|

246,053 |

|

| Brookfield BRP Holdings Canada, Inc., 4.625% (Canada)(b)(e) |

|

|

|

78,000 |

|

|

|

1,215,240 |

|

| Brookfield BRP Holdings Canada, Inc., 4.875% (Canada)(b)(e) |

|

|

|

60,941 |

|

|

|

1,020,152 |

|

| Brookfield Infrastructure Finance ULC, 5.00%, due 5/24/81 (Canada)(b) |

|

|

|

81,825 |

|

|

|

1,517,035 |

|

| Brookfield Infrastructure Partners LP, 5.125%, Series 13 (Canada)(b)(e) |

|

|

|

93,591 |

|

|

|

1,780,101 |

|

| NiSource, Inc., 6.50% to 3/15/24, Series B(b)(e)(f) |

|

|

|

26,433 |

|

|

|

665,847 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,585,385 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL PREFERRED

SECURITIES—EXCHANGE-TRADED

(Identified cost—$130,580,031) |

|

|

|

|

|

|

|

116,374,195 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount |

|

|

|

|

| PREFERRED

SECURITIES—OVER-THE-COUNTER |

|

|

59.4% |

|

|

|

|

|

|

|

|

|

| BANKING |

|

|

36.7% |

|

|

|

|

|

|

|

|

|

| Abanca Corp. Bancaria SA, 6.00% to 1/20/26 (Spain)(e)(f)(h)(i) |

|

|

$ |

1,800,000 |

|

|

|

1,701,356 |

|

| AIB Group PLC, 6.25% to 6/23/25 (Ireland)(e)(f)(h)(i) |

|

|

|

2,000,000 |

|

|

|

2,066,343 |

|

| Ally Financial, Inc., 4.70% to 5/15/28, Series C(b)(e)(f) |

|

|

|

3,437,000 |

|

|

|

2,225,458 |

|

| Banco Bilbao Vizcaya Argentaria SA, 6.50% to 3/5/25, Series 9

(Spain)(a)(b)(e)(f)(i) |

|

|

|

3,000,000 |

|

|

|

2,820,600 |

|

See accompanying notes to the consolidated financial statements.

13

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount |

|

|

Value |

|

| Banco BPM SpA, 7.00% to 4/12/27 (Italy)(e)(f)(h)(i) |

|

$

|

800,000 |

|

|

$

|

790,587 |

|

| Banco de Sabadell SA, 5.75% to 3/15/26 (Spain)(e)(f)(h)(i) |

|

|

800,000 |

|

|

|

736,888 |

|

| Banco de Sabadell SA, 9.375% to 7/18/28 (Spain)(e)(f)(h)(i) |

|

|

2,000,000 |

|

|

|

2,123,264 |

|

| Banco Mercantil del Norte SA/Grand Cayman, 6.625% to 1/24/32

(Mexico)(b)(e)(f)(i)(j) |

|

|

1,600,000 |

|

|

|

1,238,400 |

|

| Banco Santander SA, 4.75% to 11/12/26 (Spain)(b)(e)(f)(i) |

|

|

1,000,000 |

|

|

|

767,729 |

|

| Bank of America Corp., 5.875% to 3/15/28, Series FF(b)(e)(f) |

|

|

2,916,000 |

|

|

|

2,675,430 |

|

| Bank of America Corp., 6.10% to 3/17/25, Series AA(b)(e)(f) |

|

|

4,750,000 |

|

|

|

4,721,500 |

|

| Bank of America Corp., 6.125% to 4/27/27, Series TT(e)(f) |

|

|

3,760,000 |

|

|

|

3,683,484 |

|

| Bank of America Corp., 6.25% to 9/5/24, Series X(b)(e)(f) |

|

|

6,868,000 |

|

|

|

6,799,320 |

|

| Bank of America Corp., 6.30% to 3/10/26, Series DD(b)(e)(f) |

|

|

1,821,000 |

|

|

|

1,825,097 |

|

| Bank of America Corp., 6.50% to 10/23/24, Series Z(a)(b)(e)(f) |

|

|

5,363,000 |

|

|

|

5,361,498 |

|

| Bank of Ireland Group PLC, 6.00% to 9/1/25 (Ireland)(e)(f)(h)(i) |

|

|

1,600,000 |

|

|

|

1,656,512 |

|

| Bank of Ireland Group PLC, 7.50% to 5/19/25 (Ireland)(e)(f)(h)(i) |

|

|

3,800,000 |

|

|

|

4,074,805 |

|

| Bank of Nova Scotia/The, 4.90% to 6/4/25 (Canada)(b)(e)(f) |

|

|

2,040,000 |

|

|

|

1,931,003 |

|

| Bank of Nova Scotia/The, 8.625% to 10/27/27, due 10/27/82 (Canada)(f) |

|

|

3,000,000 |

|

|

|

3,126,415 |

|

| Barclays Bank PLC, 6.278% to 12/15/34, Series 1 (United Kingdom)(b)(e)(f) |

|

|

2,450,000 |

|

|

|

2,384,562 |

|

| Barclays PLC, 6.125% to 12/15/25 (United Kingdom)(b)(e)(f)(i) |

|

|

5,000,000 |

|

|

|

4,388,750 |

|

| Barclays PLC, 7.125% to 6/15/25 (United Kingdom)(e)(f)(i) |

|

|

1,100,000 |

|

|

|

1,270,501 |

|

| Barclays PLC, 8.00% to 6/15/24 (United Kingdom)(a)(b)(e)(f)(i) |

|

|

3,600,000 |

|

|

|

3,410,640 |

|

| Barclays PLC, 8.00% to 3/15/29 (United Kingdom)(e)(f)(i) |

|

|

7,800,000 |

|

|

|

6,988,020 |

|

| Barclays PLC, 8.875% to 9/15/27 (United Kingdom)(e)(f)(h)(i) |

|

|

3,500,000 |

|

|

|

4,102,644 |

|

| Barclays PLC, 9.25% to 9/15/28 (United Kingdom)(e)(f)(i) |

|

|

400,000 |

|

|

|

460,139 |

|

| BNP Paribas SA, 4.625% to 1/12/27 (France)(b)(e)(f)(i)(j) |

|

|

2,000,000 |

|

|

|

1,583,801 |

|

| BNP Paribas SA, 6.625% to 3/25/24 (France)(b)(e)(f)(i)(j) |

|

|

1,074,000 |

|

|

|

1,035,471 |

|

| BNP Paribas SA, 7.00% to 8/16/28 (France)(b)(e)(f)(i)(j) |

|

|

1,400,000 |

|

|

|

1,256,733 |

|

See accompanying notes to the consolidated financial statements.

14

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount |

|

|

Value |

|

| BNP Paribas SA, 7.375% to 8/19/25 (France)(b)(e)(f)(i)(j) |

|

$

|

1,700,000 |

|

|

$

|

1,652,524 |

|

| BNP Paribas SA, 7.375% to 6/11/30 (France)(e)(f)(h)(i) |

|

|

600,000 |

|

|

|

636,329 |

|

| BNP Paribas SA, 7.75% to 8/16/29 (France)(b)(e)(f)(i)(j) |

|

|

7,800,000 |

|

|

|

7,569,120 |

|

| BNP Paribas SA, 9.25% to 11/17/27 (France)(e)(f)(i)(j) |

|

|

4,400,000 |

|

|

|

4,545,696 |

|

| CaixaBank SA, 5.875% to 10/9/27 (Spain)(e)(f)(h)(i) |

|

|

600,000 |

|

|

|

587,429 |

|

| CaixaBank SA, 8.25% to 3/13/29 (Spain)(e)(f)(h)(i) |

|

|

2,600,000 |

|

|

|

2,743,141 |

|

| CaixaBank SA, 6.75% to 6/13/24 (Spain)(e)(f)(h)(i) |

|

|

600,000 |

|

|

|

635,531 |

|

| Charles Schwab Corp./The, 4.00% to 12/1/30, Series H(b)(e)(f) |

|

|

6,571,000 |

|

|

|

4,803,401 |

|

| Charles Schwab Corp./The, 4.00% to 6/1/26, Series I(a)(b)(e)(f) |

|

|

14,512,000 |

|

|

|

11,812,768 |

|

| Charles Schwab Corp./The, 5.375% to 6/1/25, Series G(b)(e)(f) |

|

|

5,483,000 |

|

|

|

5,267,628 |

|

| Citigroup Capital III, 7.625%, due 12/1/36 (TruPS)(b) |

|

|

4,700,000 |

|

|

|

4,885,499 |

|

| Citigroup, Inc., 3.875% to 2/18/26, Series X(a)(b)(e)(f) |

|

|

7,820,000 |

|

|

|

6,568,800 |

|

| Citigroup, Inc., 4.00% to 12/10/25, Series W(b)(e)(f) |

|

|

1,720,000 |

|

|

|

1,472,750 |

|

| Citigroup, Inc., 4.15% to 11/15/26, Series Y(b)(e)(f) |

|

|

1,256,000 |

|

|

|

1,013,592 |

|

| Citigroup, Inc., 5.00% to 9/12/24, Series U(b)(e)(f) |

|

|

3,324,000 |

|

|

|

3,111,065 |

|

| Citigroup, Inc., 5.95% to 5/15/25, Series P(a)(b)(e)(f) |

|

|

7,100,000 |

|

|

|

6,817,974 |

|

| Citigroup, Inc., 6.25% to 8/15/26, Series T(b)(e)(f) |

|

|

4,935,000 |

|

|

|

4,868,526 |

|

| Citigroup, Inc., 7.375% to 5/15/28, Series Z(e)(f) |

|

|

3,417,000 |

|

|

|

3,400,446 |

|

| Citizens Financial Group, Inc., 5.65% to 10/6/25, Series F(b)(e)(f) |

|

|

3,750,000 |

|

|

|

3,299,282 |

|

| CoBank ACB, 6.25% to 10/1/26, Series I(e)(f) |

|

|

4,334,000 |

|

|

|

4,072,270 |

|

| CoBank ACB, 6.45% to 10/1/27, Series K(e)(f) |

|

|

2,740,000 |

|

|

|

2,541,350 |

|

| Commerzbank AG, 7.00% to 4/9/25 (Germany)(e)(f)(h)(i) |

|

|

2,000,000 |

|

|

|

1,829,254 |

|

| Credit Agricole SA, 4.75% to 3/23/29 (France)(b)(e)(f)(i)(j) |

|

|

2,600,000 |

|

|

|

2,073,500 |

|

| Credit Agricole SA, 6.875% to 9/23/24 (France)(b)(e)(f)(i)(j) |

|

|

3,000,000 |

|

|

|

2,898,480 |

|

| Credit Agricole SA, 7.25% to 9/23/28, Series EMTN (France)(e)(f)(h)(i) |

|

|

1,300,000 |

|

|

|

1,413,638 |

|

| Credit Agricole SA, 8.125% to 12/23/25 (France)(b)(e)(f)(i)(j) |

|

|

2,500,000 |

|

|

|

2,514,062 |

|

| Credit Suisse Group AG, 5.25% to 2/11/27, Claim (Switzerland)(e)(f)(i)(j)(k)(l) |

|

|

1,200,000 |

|

|

|

50,796 |

|

| Credit Suisse Group AG, 6.375% to 8/21/26, Claim (Switzerland)(e)(f)(i)(j)(k)(l) |

|

|

1,200,000 |

|

|

|

50,796 |

|

| Credit Suisse Group AG, 7.25% to 9/12/25, Claim (Switzerland)(e)(f)(i)(j)(k)(l) |

|

|

1,600,000 |

|

|

|

67,728 |

|

See accompanying notes to the consolidated financial statements.

15

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount |

|

|

Value |

|

| Credit Suisse Group AG, 7.50% to 7/17/23, Claim (Switzerland)(e)(f)(i)(j)(k)(l) |

|

$

|

3,000,000 |

|

|

$

|

126,989 |

|

| Danske Bank A/S, 7.00% to 6/26/25 (Denmark)(e)(f)(h)(i) |

|

|

1,600,000 |

|

|

|

1,510,472 |

|

| Deutsche Bank AG/New York, 6.00% to 10/30/25, Series 2020 (Germany)(e)(f)(i) |

|

|

3,800,000 |

|

|

|

3,051,020 |

|

| Deutsche Bank AG/New York, 7.079% to 11/10/32, due 2/10/34 (Germany)(f) |

|

|

800,000 |

|

|

|

740,365 |

|

| Deutsche Bank AG/New York, 7.50% to 4/30/25 (Germany)(e)(f)(i) |

|

|

3,400,000 |

|

|

|

3,017,160 |

|

| Deutsche Bank AG/New York, 10.00% to 12/1/27 (Germany)(e)(f)(h)(i) |

|

|

2,800,000 |

|

|

|

3,036,283 |

|

| Discover Financial Services, 6.125% to 6/23/25, Series D(e)(f) |

|

|

790,000 |

|

|

|

754,795 |

|

| Dresdner Funding Trust I, 8.151%, due 6/30/31 (TruPS)(b)(j) |

|

|

1,235,906 |

|

|

|

1,321,956 |

|

| Farm Credit Bank of Texas, 5.70% to 9/15/25, Series 4(e)(f)(j) |

|

|

2,875,000 |

|

|

|

2,688,125 |

|

| Farm Credit Bank of Texas, 6.75% to 9/15/23(b)(e)(f)(j) |

|

|

18,000 |

† |

|

|

1,788,750 |

|

| First Horizon Bank, 6.061% (3 Month US LIBOR + 0.85%, Floor 3.75%)(b)(e)(g)(j) |

|

|

2,800 |

† |

|

|

1,791,104 |

|

| Goldman Sachs Group, Inc./The, 3.65% to 8/10/26, Series U(e)(f) |

|

|

3,544,000 |

|

|

|

2,748,372 |

|

| HSBC Capital Funding Dollar 1 LP, 10.176% to 6/30/30, Series 2 (United

Kingdom)(e)(f)(j) |

|

|

3,432,000 |

|

|

|

4,252,711 |

|

| HSBC Holdings PLC, 4.60% to 12/17/30 (United Kingdom)(e)(f)(i) |

|

|

600,000 |

|

|

|

458,250 |

|

| HSBC Holdings PLC, 6.375% to 3/30/25 (United Kingdom)(e)(f)(i) |

|

|

800,000 |

|

|

|

767,220 |

|

| HSBC Holdings PLC, 6.50% to 3/23/28 (United Kingdom)(a)(b)(e)(f)(i) |

|

|

1,700,000 |

|

|

|

1,535,503 |

|

| HSBC Holdings PLC, 8.00% to 3/7/28 (United Kingdom)(e)(f)(i) |

|

|

3,600,000 |

|

|

|

3,582,918 |

|

| HSBC Holdings PLC, 6.547% to 6/20/33, due 6/20/34 (United Kingdom)(f) |

|

|

1,400,000 |

|

|

|

1,395,423 |

|

| Huntington Bancshares, Inc./OH., 4.45% to 10/15/27, Series G(e)(f) |

|

|

3,543,000 |

|

|

|

2,886,287 |

|

| Huntington Bancshares, Inc./OH., 5.625% to 7/15/30, Series F(e)(f) |

|

|

4,061,000 |

|

|

|

3,649,263 |

|

See accompanying notes to the consolidated financial statements.

16

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount |

|

|

Value |

|

| ING Groep N.V., 4.25% to 5/16/31, Series NC10 (Netherlands)(b)(e)(f)(i) |

|

$

|

2,000,000 |

|

|

$

|

1,335,604 |

|

| ING Groep N.V., 4.875% to 5/16/29 (Netherlands)(e)(f)(h)(i) |

|

|

2,230,000 |

|

|

|

1,733,138 |

|

| ING Groep N.V., 5.75% to 11/16/26 (Netherlands)(b)(e)(f)(i) |

|

|

5,800,000 |

|

|

|

5,127,087 |

|

| ING Groep N.V., 6.50% to 4/16/25 (Netherlands)(b)(e)(f)(i) |

|

|

2,400,000 |

|

|

|

2,241,840 |

|

| ING Groep N.V., 7.50% to 5/16/28 (Netherlands)(e)(f)(h)(i) |

|

|

3,000,000 |

|

|

|

2,761,725 |

|

| Intesa Sanpaolo SpA, 5.875% to 9/1/31, Series EMTN (Italy)(e)(f)(h)(i) |

|

|

750,000 |

|

|

|

653,223 |

|

| Intesa Sanpaolo SpA, 7.70% to 9/17/25 (Italy)(b)(e)(f)(i)(j) |

|

|

4,400,000 |

|

|

|

4,141,500 |

|

| JPMorgan Chase & Co., 3.65% to 6/1/26, Series KK(e)(f) |

|

|

2,330,000 |

|

|

|

2,056,575 |

|

| JPMorgan Chase & Co., 4.60% to 2/1/25, Series HH(e)(f) |

|

|

377,000 |

|

|

|

352,495 |

|

| JPMorgan Chase & Co., 5.00% to 8/1/24, Series FF(b)(e)(f) |

|

|

1,204,000 |

|

|

|

1,176,910 |

|

| JPMorgan Chase & Co., 6.10% to 10/1/24, Series X(e)(f) |

|

|

5,330,000 |

|

|

|

5,321,072 |

|

| JPMorgan Chase & Co., 6.125% to 4/30/24, Series U(b)(e)(f) |

|

|

1,059,000 |

|

|

|

1,056,886 |

|

| JPMorgan Chase & Co., 6.75% to 2/1/24, Series S(a)(b)(e)(f) |

|

|

6,572,000 |

|

|

|

6,593,195 |

|

| Julius Baer Group Ltd., 6.875% to 6/9/27 (Switzerland)(e)(f)(h)(i) |

|

|

2,000,000 |

|

|

|

1,760,676 |

|

| Lloyds Banking Group PLC, 6.75% to 6/27/26 (United Kingdom)(b)(e)(f)(i) |

|

|

600,000 |

|

|

|

549,628 |

|

| Lloyds Banking Group PLC, 7.50% to 6/27/24 (United Kingdom)(a)(b)(e)(f)(i) |

|

|

3,666,000 |

|

|

|

3,505,246 |

|

| Lloyds Banking Group PLC, 7.50% to 9/27/25 (United Kingdom)(e)(f)(i) |

|

|

3,600,000 |

|

|

|

3,375,540 |

|

| Lloyds Banking Group PLC, 8.00% to 9/27/29 (United Kingdom)(e)(f)(i) |

|

|

4,500,000 |

|

|

|

4,122,675 |

|

| M&T Bank Corp., 5.125% to 11/1/26, Series F(b)(e)(f) |

|

|

1,682,000 |

|

|

|

1,334,006 |

|

| Nationwide Building Society, 5.75% to 6/20/27 (United Kingdom)(e)(f)(h)(i) |

|

|

1,000,000 |

|

|

|

1,090,612 |

|

| Natwest Group PLC, 4.60% to 6/28/31 (United Kingdom)(b)(e)(f)(i) |

|

|

1,000,000 |

|

|

|

695,000 |

|

| Natwest Group PLC, 6.00% to 12/29/25 (United Kingdom)(b)(e)(f)(i) |

|

|

5,800,000 |

|

|

|

5,379,500 |

|

| Natwest Group PLC, 8.00% to 8/10/25 (United Kingdom)(b)(e)(f)(i) |

|

|

4,700,000 |

|

|

|

4,579,351 |

|

| Nordea Bank Abp, 6.625% to 3/26/26 (Finland)(b)(e)(f)(i)(j) |

|

|

2,070,000 |

|

|

|

1,961,925 |

|

See accompanying notes to the consolidated financial statements.

17

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount |

|

|

Value |

|

| PNC Financial Services Group, Inc./The, 3.40% to 9/15/26, Series T(e)(f) |

|

$

|

742,000 |

|

|

$

|

549,080 |

|

| PNC Financial Services Group, Inc./The, 6.00% to 5/15/27, Series U(b)(e)(f) |

|

|

4,401,000 |

|

|

|

3,971,902 |

|

| PNC Financial Services Group, Inc./The, 6.20% to 9/15/27, Series V(b)(e)(f) |

|

|

3,973,000 |

|

|

|

3,713,364 |

|

| PNC Financial Services Group, Inc./The, 6.25% to 3/15/30, Series W(e)(f) |

|

|

3,840,000 |

|

|

|

3,456,960 |

|

| PNC Financial Services Group, Inc./The, 8.977% (3 Month US LIBOR + 3.678%)(b)(e)(g) |

|

|

1,973,000 |

|

|

|

1,977,386 |

|

| Regions Financial Corp., 5.75% to 6/15/25, Series D(e)(f) |

|

|

1,472,000 |

|

|

|

1,397,000 |

|

| Skandinaviska Enskilda Banken AB, 6.875% to 6/30/27 (Sweden)(e)(f)(h)(i) |

|

|

1,400,000 |

|

|

|

1,321,250 |

|

| Societe Generale SA, 5.375% to 11/18/30 (France)(b)(e)(f)(i)(j) |

|

|

3,400,000 |

|

|

|

2,531,229 |

|

| Societe Generale SA, 6.75% to 4/6/28 (France)(e)(f)(i)(j) |

|

|

3,600,000 |

|

|

|

2,926,281 |

|

| Societe Generale SA, 7.875% to 1/18/29, Series EMTN (France)(e)(f)(h)(i) |

|

|

1,300,000 |

|

|

|

1,360,577 |

|

| Societe Generale SA, 8.00% to 9/29/25 (France)(b)(e)(f)(i)(j) |

|

|

2,600,000 |

|

|

|

2,442,335 |

|

| Societe Generale SA, 9.375% to 11/22/27 (France)(e)(f)(i)(j) |

|

|

5,200,000 |

|

|

|

5,096,000 |

|

| Standard Chartered PLC, 7.75% to 8/15/27 (United Kingdom)(e)(f)(i)(j) |

|

|

1,000,000 |

|

|

|

992,760 |

|

| Toronto-Dominion Bank/The, 8.125% to 10/31/27, due 10/31/82 (Canada)(f) |

|

|

4,600,000 |

|

|

|

4,684,548 |

|

| Truist Financial Corp., 4.95% to 9/1/25, Series P(b)(e)(f) |

|

|

1,898,000 |

|

|

|

1,760,395 |

|

| Truist Financial Corp., 5.10% to 3/1/30, Series Q(b)(e)(f) |

|

|

3,030,000 |

|

|

|

2,636,100 |

|

| Truist Financial Corp., 5.125% to 12/15/27, Series M(a)(b)(e)(f) |

|

|

2,460,000 |

|

|

|

1,888,665 |

|

| UBS Group AG, 5.125% to 7/29/26 (Switzerland)(e)(f)(h)(i) |

|

|

1,800,000 |

|

|

|

1,572,280 |

|

| UBS Group AG, 6.875% to 8/7/25 (Switzerland)(e)(f)(h)(i) |

|

|

3,800,000 |

|

|

|

3,488,518 |

|

| UBS Group AG, 7.00% to 2/19/25 (Switzerland)(e)(f)(h)(i) |

|

|

1,000,000 |

|

|

|

954,153 |

|

| UBS Group AG, 4.375% to 2/10/31 (Switzerland)(e)(f)(i)(j) |

|

|

1,600,000 |

|

|

|

1,131,104 |

|

| UniCredit SpA, 8.00% to 6/3/24 (Italy)(e)(f)(h)(i) |

|

|

2,600,000 |

|

|

|

2,550,314 |

|

| US Bancorp, 3.70% to 1/15/27, Series N(b)(e)(f) |

|

|

2,305,000 |

|

|

|

1,715,842 |

|

| US Bancorp, 5.30% to 4/15/27, Series J(b)(e)(f) |

|

|

1,535,000 |

|

|

|

1,251,025 |

|

| Virgin Money UK PLC, 8.25% to 6/17/27 (United Kingdom)(e)(f)(h)(i) |

|

|

600,000 |

|

|

|

643,784 |

|

See accompanying notes to the consolidated financial statements.

18

COHEN

& STEERS REIT AND

PREFERRED AND INCOME FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2023 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount |

|

|

Value |

|

| Wells Fargo & Co., 3.90% to 3/15/26, Series BB(b)(e)(f) |

|

|

$

|

13,740,000 |

|

|

$

|

12,105,283 |

|

| Wells Fargo & Co., 5.875% to 6/15/25, Series U(b)(e)(g) |

|

|

|

4,026,000 |

|

|

|

3,955,135 |

|

| Wells Fargo & Co., 5.95%, due 12/15/36(a)(b) |

|

|

|

3,700,000 |

|

|

|

3,660,490 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

350,152,460 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BROKERAGE |

|

|

0.5% |

|

|

|

|

|

|

|

|

|

| Goldman Sachs Capital I, 6.345%, due 2/15/34 (TruPS) |

|

|

|

3,042,000 |

|

|

|

3,050,837 |

|

| Goldman Sachs Group, Inc./The, 5.50% to 8/10/24, Series Q(b)(e)(f) |

|

|

|

2,184,000 |

|

|

|

2,134,707 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,185,544 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSUMER STAPLE PRODUCTS |

|

|

1.0% |

|

|

|

|

|

|

|

|

|

| Dairy Farmers of America, Inc., 7.875%(b)(e)(j) |

|

|

|

82,000 |

† |

|

|

7,585,000 |

|

| Land O’ Lakes, Inc., 7.00%(b)(e)(j) |

|

|

|

1,650,000 |

|

|

|

1,356,745 |

|

| Land O’ Lakes, Inc., 7.25%(b)(e)(j) |

|

|

|

945,000 |

|

|

|

765,450 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,707,195 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ENERGY |

|

|

1.2% |

|

|

|

|

|

|

|

|

|

| BP Capital Markets PLC, 4.375% to 6/22/25 (United Kingdom)(b)(e)(f) |

|

|

|

2,000,000 |

|

|

|

1,923,500 |

|

| BP Capital Markets PLC, 4.875% to 3/22/30 (United Kingdom)(b)(e)(f) |

|

|

|

9,950,000 |

|

|

|

9,075,644 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,999,144 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCE |

|

|

0.5% |

|

|

|

|

|

|

|

|

|

| American Express Co., 3.55% to 9/15/26(b)(e)(f) |

|

|

|

1,895,000 |

|

|

|

1,577,588 |

|

| Apollo Management Holdings LP, 4.95% to 12/17/24, due 1/14/50(a)(b)(f)(j) |

|

|

|

1,424,000 |

|

|

|

1,193,217 |

|

| Ares Finance Co. III LLC, 4.125% to 6/30/26, due 6/30/51(b)(f)(j) |

|

|

|

2,365,000 |

|

|

|

1,729,524 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,500,329 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INSURANCE |

|

|

8.0% |

|

|

|

|

|

|

|

|

|

| Aegon NV, 5.50% to 4/11/28, due 4/11/48 (Netherlands)(b)(f) |

|

|

|

1,600,000 |

|

|

|

1,523,296 |

|

| Allianz SE, 3.50% to 11/17/25 (Germany)(b)(e)(f)(i)(j) |

|

|

|

1,400,000 |

|

|

|

1,159,165 |

|

| Allianz SE, 5.824%, due 7/25/53 (Germany)(f)(h) |

|

|

|

600,000 |

|

|

|