Reaffirms 2024 Full-Year Forecast for

Reported Diluted EPS of $5.89 to $6.01 and Adjusted Diluted EPS of

$6.33 to $6.45, Representing Currency-Neutral Growth of 11% to

13%

Regulatory News:

Philip Morris International Inc. (PMI) (NYSE: PM) Chief

Executive Officer, Jacek Olczak, will today participate in a

fireside chat session at the 2024 Barclays Global Consumer Staples

Conference.

The event will be webcast live in listen-only mode, beginning at

approximately 12:45 p.m. ET, at www.pmi.com/2024barclays and on the

PMI Investor Relations Mobile Application (www.pmi.com/irapp). An

archived copy of the webcast will be available until Friday,

October 4, 2024.

2024 Full-Year Forecast

PMI reaffirms its 2024 full-year reported diluted EPS forecast,

announced on July 23, 2024, of $5.89 to $6.01. Excluding a total

2024 adjustment of $0.44 per share and an unfavorable currency

impact, at then-prevailing exchange rates, of $0.34 per share, this

forecast represents a projected currency-neutral increase of 11% to

13% versus adjusted diluted EPS of $6.01 in 2023, as outlined in

the below table.

The assumptions underlying this forecast remain unchanged versus

those communicated by PMI in its earnings release of July 23,

2024.

Factors described in the Forward-Looking and Cautionary

Statements section of this release represent continuing risks to

these projections.

Full-Year

2024

Forecast

2023

Growth

Reported Diluted EPS

$5.89

-

$6.01

$5.02

Adjustments:

Asset impairment and exit costs

0.09

0.06

Termination of distribution arrangement in

the Middle East

—

0.04

Impairment of goodwill and other

intangibles

0.01

0.44

Amortization of intangibles(1)

0.43

0.25

Charges related to the war in Ukraine

—

0.03

Swedish Match AB acquisition accounting

related items

—

0.01

Income tax impact associated with Swedish

Match AB financing

0.09

(0.11)

South Korea indirect tax charge

—

0.11

Termination of agreement with Foundation

for a Smoke-Free World

—

0.07

Fair value adjustment for equity security

investments

(0.15)

(0.02)

Tax items

(0.03)

0.11

Total Adjustments

0.44

0.99

Adjusted Diluted EPS

$6.33

-

$6.45

$ 6.01

5.3%

-

7.3%

Less: Currency

(0.34)

Adjusted Diluted EPS, excluding

currency

$6.67

-

$6.79

$ 6.01

11.0%

-

13.0%

(1) See forecast assumptions in our Q2

2024 Earnings Release for details.

Philip Morris International: Delivering a Smoke-Free

Future

Philip Morris International (PMI) is a leading international

tobacco company, actively delivering a smoke-free future and

evolving its portfolio for the long term to include products

outside of the tobacco and nicotine sector. The company’s current

product portfolio primarily consists of cigarettes and smoke-free

products. Since 2008, PMI has invested over $12.5 billion to

develop, scientifically substantiate and commercialize innovative

smoke-free products for adults who would otherwise continue to

smoke, with the goal of completely ending the sale of cigarettes.

This includes the building of world-class scientific assessment

capabilities, notably in the areas of pre-clinical systems

toxicology, clinical and behavioral research, as well as

post-market studies. In 2022, PMI acquired Swedish Match – a leader

in oral nicotine delivery – creating a global smoke-free champion

led by the companies’ IQOS and ZYN brands. The U.S. Food and Drug

Administration has authorized versions of PMI’s IQOS devices and

consumables and Swedish Match’s General snus as Modified Risk

Tobacco Products and renewal applications for these products are

presently pending before the FDA. As of June 30, 2024, PMI's

smoke-free products were available for sale in 90 markets, and PMI

estimates that 36.5 million adults around the world use PMI's

smoke-free products. Smoke-free business accounted for

approximately 38% of PMI’s total first-half 2024 net revenues. With

a strong foundation and significant expertise in life sciences, PMI

announced in February 2021 its ambition to expand into wellness and

healthcare areas and, through its Vectura Fertin Pharma business,

aims to enhance life through the delivery of seamless health

experiences. "PMI" refers to Philip Morris International Inc. and

its subsidiaries. For more information, please visit www.pmi.com

and www.pmiscience.com.

Forward-Looking and Cautionary Statements

This press release contains projections of future results and

goals and other forward-looking statements, including statements

regarding expected financial or operational performance; capital

allocation plans; investment strategies; regulatory outcomes;

market expectations; and business plans and strategies. Achievement

of future results is subject to risks, uncertainties and inaccurate

assumptions. In the event that risks or uncertainties materialize,

or underlying assumptions prove inaccurate, actual results could

vary materially from those contained in such forward-looking

statements. Pursuant to the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, PMI is identifying

important factors that, individually or in the aggregate, could

cause actual results and outcomes to differ materially from those

contained in any forward-looking statements made by PMI.

PMI's business risks include: excise tax increases and

discriminatory tax structures; increasing marketing and regulatory

restrictions that could reduce our competitiveness, eliminate our

ability to communicate with adult consumers, or ban certain of our

products in certain markets or countries; health concerns relating

to the use of tobacco and other nicotine-containing products and

exposure to environmental tobacco smoke; litigation related to

tobacco and/or nicotine use and intellectual property; intense

competition; the effects of global and individual country economic,

regulatory and political developments, natural disasters and

conflicts; the impact and consequences of Russia's invasion of

Ukraine; changes in adult smoker behavior; the impact of natural

disasters and pandemics on PMI's business; lost revenues as a

result of counterfeiting, contraband and cross-border purchases;

governmental investigations; unfavorable currency exchange rates

and currency devaluations, and limitations on the ability to

repatriate funds; adverse changes in applicable corporate tax laws;

adverse changes in the cost, availability, and quality of tobacco

and other agricultural products and raw materials, as well as

components and materials for our electronic devices; and the

integrity of its information systems and effectiveness of its data

privacy policies. PMI's future profitability may also be adversely

affected should it be unsuccessful in its attempts to introduce,

commercialize, and grow smoke-free products or if regulation or

taxation do not differentiate between such products and cigarettes;

if it is unable to successfully introduce new products, promote

brand equity, enter new markets or improve its margins through

increased prices and productivity gains; if it is unable to expand

its brand portfolio internally or through acquisitions and the

development of strategic business relationships; if it is unable to

attract and retain the best global talent, including women or

diverse candidates; or if it is unable to successfully integrate

and realize the expected benefits from recent transactions and

acquisitions. Future results are also subject to the lower

predictability of our smoke-free products performance.

PMI is further subject to other risks detailed from time to time

in its publicly filed documents, including PMI's Annual Report on

Form 10-K for the fourth quarter and year ended December 31, 2023,

and the Quarterly Report on Form 10-Q for the second quarter ended

June 30, 2024. PMI cautions that the foregoing list of important

factors is not a complete discussion of all potential risks and

uncertainties. PMI does not undertake to update any forward-looking

statement that it may make from time to time, except in the normal

course of its public disclosure obligations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240902168270/en/

Philip Morris International Investor Relations: Stamford,

CT: +1 (203) 904 2410 Lausanne: +41 582 424 666 Email:

InvestorRelations@pmi.com Media: David Fraser Lausanne: +41 582 424

500 Email: David.Fraser@pmi.com

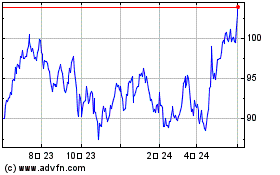

Philip Morris (NYSE:PM)

과거 데이터 주식 차트

부터 11월(11) 2024 으로 12월(12) 2024

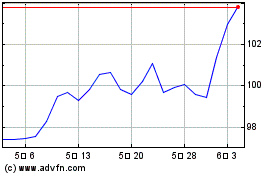

Philip Morris (NYSE:PM)

과거 데이터 주식 차트

부터 12월(12) 2023 으로 12월(12) 2024