false

0000093410

0000093410

2024-09-30

2024-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 30,

2024

| Chevron Corporation |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-00368 |

|

94-0890210 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

5001 Executive Parkway, Suite 200

San Ramon, CA |

|

94583 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| (925) 842-1000 |

| Registrant’s telephone number, including area code |

| |

|

N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common stock, par value $.75 per share |

|

CVX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As

previously disclosed, on October 22, 2023, Chevron Corporation (“Chevron”), Hess

Corporation (“Hess”) and Yankee Merger Sub Inc., a wholly owned subsidiary of Chevron (“Merger Sub”),

entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which, among other things and subject

to the terms and conditions therein, Merger Sub will be merged with and into Hess, with Hess surviving the merger as a direct, wholly

owned subsidiary of Chevron (such transaction, the “Merger”).

The

consummation of the Merger is subject to the satisfaction or waiver of certain closing conditions including, among other things, the expiration

or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR

Act”). As previously disclosed, on December 7, 2023, Chevron and Hess each received a request for additional information and

documentary material (the “Second Request”) from the U.S. Federal Trade Commission (“FTC”) in connection

with the FTC’s review of the transactions contemplated by the Merger Agreement. The effect of the Second Request was to extend the

waiting period under the HSR Act until 30 days after both Chevron and Hess certified substantial compliance with the Second Request. Following

Chevron’s and Hess’s certifications of substantial compliance, the waiting period under the HSR Act expired on July 1, 2024.

On

September 30, 2024, the FTC announced that a majority of the FTC Commissioners voted to accept a consent agreement among the FTC, Chevron and Hess (the

“Consent Agreement”), and on September 30, 2024, Chevron issued a press release announcing that the FTC’s

review of the Merger has been completed. A copy of the press release is included as Exhibit 99.1 to this current report on Form

8-K. Under the Consent Agreement, Chevron and Hess have agreed that John B. Hess will not be appointed to the Chevron Board of Directors

following consummation of the Merger. Mr. Hess will serve as an advisor and representative for Chevron on government relations and social

investments in Guyana, as well as on support for the Salk Institute’s Harnessing Plants Initiative.

Pursuant

to the regulations issued under the HSR Act, the parties have one year from the expiration of the waiting period to close the Merger.

Chevron and Hess will take appropriate steps in order to maintain HSR clearance for the Merger closing following satisfactory resolution

of the ongoing arbitration proceedings regarding preemptive rights in the Stabroek Block joint operating agreement, including

if necessary filing additional notifications under the HSR Act.

The

completion of the Merger remains subject to the Merger Agreement’s closing conditions, including the satisfactory resolution of

the Stabroek Block joint operating agreement arbitration.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 30,

2024

| |

CHEVRON CORPORATION

|

|

| |

By: |

/s/ Christine L. Cavallo |

|

| |

Name: |

Christine L. Cavallo |

|

| |

Title: |

Assistant Secretary |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

EXHIBIT 99.1

news release

Chevron-Hess merger clears

FTC antitrust review

San Ramon, California,

September 30, 2024 — Chevron Corporation

(NYSE: CVX) today announced the Federal Trade Commission (FTC) completed antitrust review of the company’s merger with Hess Corporation

(NYSE: HES), satisfying a key closing condition for the transaction.

“This

is an important step toward completing the merger, which will benefit our shareholders, the industry, and the country of Guyana, and add

world class assets to our already advantaged portfolio,” said Chevron Chairman and CEO Mike Wirth. “We look forward to completing

the transaction and welcoming Hess into our company.”

To facilitate

completion of the merger, Hess and Chevron have agreed that Hess CEO John Hess will not be appointed to the Chevron Board of Directors.

Instead, Mr. Hess will serve as an advisor to Chevron on government relations and social investments in Guyana as well as on support for

the Salk Institute’s Harnessing Plants Initiative.

“I

have the utmost respect for John, the company he has built, and the contributions he has made to our industry. It is unfortunate that

our Board of Directors will not get the benefit of his decades of global experience, but we look forward to drawing upon his knowledge,

relationships and experience in Guyana through his service as an advisor to Chevron,” added Mr. Wirth.

Completion

of the merger remains subject to other closing conditions, including the satisfactory resolution of ongoing arbitration proceedings regarding

preemptive rights in the Stabroek Block joint operating agreement. Chevron remains confident that the arbitration process will affirm

the company’s position. Hess shareholders approved the merger agreement in May 2024.

About Chevron

Chevron is one of the world’s leading integrated energy companies.

We believe affordable, reliable and ever-cleaner energy is essential to enabling human progress. Chevron produces crude oil and natural

gas; manufactures transportation fuels, lubricants, petrochemicals and additives; and develops technologies that enhance our business

and the industry. We aim to grow our oil and gas business, lower the carbon intensity of our operations and grow lower carbon businesses

in renewable fuels, carbon capture and offsets, hydrogen and other emerging technologies. More information about Chevron is available

at www.chevron.com.

NOTICE

As used in this news release, the term “Chevron”

and such terms as “the company,” “the corporation,” “our,” “we,” “us” and

“its” may refer to Chevron Corporation, one or more of its consolidated subsidiaries, or to all of them taken as a whole.

All of these terms are used for convenience only and are not intended as a precise description of any of the separate companies, each

of which manages its own affairs.

Please visit Chevron’s website and Investor

Relations page at www.chevron.com and www.chevron.com/investors, LinkedIn: www.linkedin.com/company/chevron, Twitter: @Chevron, Facebook:

www.facebook.com/chevron, and Instagram: www.instagram.com/chevron, where Chevron often discloses important information about the company,

its business, and its results of operations.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING

INFORMATION FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This news release contains forward-looking statements

relating to Chevron’s operations and lower carbon strategy that are based on management’s current expectations, estimates,

and projections about the petroleum, chemicals and other energy-related industries. Words or phrases such as “anticipates,”

“expects,” “intends,” “plans,” “targets,” “advances,” “commits,”

“drives,” “aims,” “forecasts,” “projects,” “believes,” “approaches,”

“seeks,” “schedules,” “estimates,” “positions,” “pursues,” “progress,”

“may,” “can,” “could,” “should,” “will,” “budgets,” “outlook,”

“trends,” “guidance,” “focus,” “on track,” “goals,” “objectives,”

“strategies,” “opportunities,” “poised,” “potential,” “ambitions,” “aspires”

and similar expressions, and variations or negatives of these words, are intended to identify such forward-looking statements, but not

all forward-looking statements include such words. These statements are not guarantees of future performance and are subject to numerous

risks, uncertainties and other factors, many of which are beyond the company’s control and are difficult to predict. Therefore,

actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader

should not place undue reliance on these forward-looking statements, which speak only as of the date of this news release. Unless legally

required, Chevron undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information,

future events or otherwise.

Among the important factors that could cause actual

results to differ materially from those in the forward-looking statements are: changing crude oil and natural gas prices and demand for

the company’s products, and production curtailments due to market conditions; crude oil production quotas or other actions that

might be imposed by the Organization of Petroleum Exporting Countries and other producing countries; technological advancements; changes

to government policies in the countries in which the company operates; public health crises, such as pandemics and epidemics, and any

related government policies and actions; disruptions in the company’s global supply chain, including supply chain constraints and

escalation of the cost of goods and services; changing economic, regulatory and political environments in the various countries in which

the company operates; general domestic and international economic, market and political conditions, including the military conflict between

Russia and Ukraine, the conflict in Israel and the global response to these hostilities; changing refining, marketing and chemicals margins;

actions of competitors or regulators; timing of exploration expenses; timing of crude oil liftings; the competitiveness of alternate-energy

sources or product substitutes; development of large carbon capture and offset markets; the results of operations and financial condition

of the company’s suppliers, vendors, partners and equity affiliates; the inability or failure of the company’s joint-venture

partners to fund their share of operations and development activities; the potential failure to achieve expected net production from existing

and future crude oil and natural gas development projects; potential delays in the development, construction or start-up of planned projects;

the potential disruption or interruption of the company’s operations due to war, accidents, political events, civil unrest, severe

weather, cyber threats, terrorist acts, or other natural or human causes beyond the company’s control; the potential liability for

remedial actions or assessments under existing or future environmental regulations and litigation; significant operational, investment

or product changes undertaken or required by existing or future environmental statutes and regulations, including international agreements

and national or regional legislation and regulatory measures related to greenhouse gas emissions and climate change; the potential liability

resulting from pending or future litigation; the risk that regulatory approvals with respect to the Hess Corporation (Hess) transaction

are not obtained or are obtained subject to conditions that are not anticipated by the company and Hess; potential delays in consummating

the Hess transaction, including as a result of regulatory proceedings or the ongoing arbitration proceedings regarding preemptive rights

in the Stabroek Block joint operating agreement; risks that such ongoing arbitration is not satisfactorily resolved and the potential

transaction fails to be consummated; uncertainties as to whether the potential transaction, if consummated, will achieve its anticipated

economic benefits, including as a result of regulatory proceedings and risks associated with third party contracts containing material

consent, anti-assignment, transfer or other provisions that may be related to the potential transaction that

are not waived or otherwise satisfactorily resolved;

the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement with Hess; risks

that the anticipated tax treatment of the potential transaction is not obtained; unforeseen or unknown liabilities or unexpected future

capital expenditures relating to Hess; potential litigation relating to the potential transaction that could be instituted against the

company or its respective directors; the possibility that the potential transaction may be more expensive to complete than anticipated,

including as a result of unexpected factors or events; the effect of the pendency or completion of the potential transaction on the company’s

business relationships and business generally; the company’s ability to integrate Hess’ operations in a successful manner

and in the expected time period; the possibility that any of the anticipated benefits and projected synergies of the potential transaction

will not be realized or will not be realized within the expected time period; the company’s future acquisitions or dispositions

of assets or shares or the delay or failure of such transactions to close based on required closing conditions; the potential for gains

and losses from asset dispositions or impairments; government mandated sales, divestitures, recapitalizations, taxes and tax audits, tariffs,

sanctions, changes in fiscal terms or restrictions on scope of company operations; foreign currency movements compared with the U.S. dollar;

higher inflation and related impacts; material reductions in corporate liquidity and access to debt markets; changes to the company’s

capital allocation strategies; the effects of changed accounting rules under generally accepted accounting principles promulgated by rule-setting

bodies; the company’s ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry;

and the factors set forth under the heading “Risk Factors” on pages 20 through 26 of the company’s 2023 Annual Report

on Form 10-K and in subsequent filings with the U.S. Securities and Exchange Commission. Other unpredictable or unknown factors not discussed

in this news release could also have material adverse effects on forward-looking statements.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

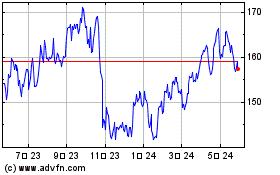

Chevron (NYSE:CVX)

과거 데이터 주식 차트

부터 11월(11) 2024 으로 12월(12) 2024

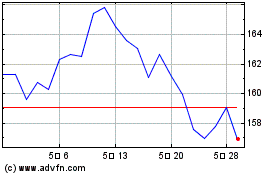

Chevron (NYSE:CVX)

과거 데이터 주식 차트

부터 12월(12) 2023 으로 12월(12) 2024