FALSE000186639000018663902023-06-282023-06-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

June 28, 2023

Date of Report (date of earliest event reported)

___________________________________

Babylon Holdings Limited

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Bailiwick of Jersey, Channel Islands (State or other jurisdiction of incorporation) | 001-40952 (Commission File Number) | 98-1638964 (IRS Employer Identification No.) |

2500 Bee Cave Road Building 1 - Suite 400 Austin, TX | | 78746 |

(Address of principal executive offices) | | (Zip Code) |

(512) 967-3787 |

(Registrant's telephone number, including area code) |

| Not Applicable |

(Former name or former address, if changed since last report) |

___________________________________Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A ordinary shares, par value $0.001056433113 per share | BBLN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On June 22, 2023, Babylon Holdings Limited (the “Company”) received a notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) indicating the Company is not in compliance with Section 802.01B and Section 802.01C of the NYSE Listed Company Manual because (i) the Company’s average total market capitalization over a consecutive 30 trading-day period was less than $50 million and, at the same time, its last reported shareholders’ equity was less than $50 million, and (ii) the average closing price of the Company’s Class A ordinary shares on the NYSE was less than $1.00 over a consecutive 30 trading-day period.

As previously disclosed in the Company’s Current Report on Form 8-K filed with the SEC on June 23, 2023, the Company has received a proposal from AlbaCore Capital LLP ("AlbaCore") and MindMaze Group SA ("MindMaze") pursuant to which core operating subsidiaries of the Company would be transferred to MindMaze (the “Proposed Transaction”). The closing of the Proposed Transaction is expected in July 2023 and is subject to agreed documentation, various conditions and appropriate approvals, if required. The Proposed Transaction will not provide for any payment to the Company’s Class A ordinary shareholders or other equity instrument holders, as AlbaCore will be exercising rights under its debt agreements with the Company to transition the go-forward business by transferring core operating subsidiaries of the Company to MindMaze.

In light of the expected closing of the Proposed Transaction in July 2023, the Company does not intend to undertake actions to cure the deficiencies described above and return to compliance with the NYSE continued listing standards, and has notified the NYSE of this decision. As a result, the Company expects the NYSE to immediately suspend its Class A ordinary shares from trading on the NYSE under the ticker symbol “BBLN”, and for the Class A ordinary shares to transition to trading on the over-the-counter market. In addition, the Company expects the NYSE to subsequently delist the Class A ordinary shares from the NYSE in accordance with its procedures. The Company will continue to comply with applicable Securities and Exchange Commission reporting requirements.

The Notice and the expected suspension of trading and subsequent delisting of the Class A ordinary shares from the NYSE do not affect the business operations of the Company and its subsidiaries, and will have no impact on the Proposed Transaction.

On June 28, 2023, the Company issued a press release regarding receipt of the Notice and its decision not to undertake actions to regain compliance with the NYSE continued listing standards. A copy of the press release is attached hereto as Exhibit 99.1.

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements generally relate to future events or our future financial or operating performance. When used in this Current Report on Form 8-K, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions, or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside of the Company’s management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. These risks, uncertainties, assumptions and other important factors include risks associated with the timing of any suspension of trading of or delisting of the Company's Class A ordinary shares by the NYSE and any resulting adverse consequences to the Company; the implementation of the transactions described the framework implementation agreement, dated May 10, 2023, between the Company and AlbaCore; the Company’s ability to execute definitive agreements for and close the Proposed Transaction on the terms and timeframe currently contemplated; and the Company's ability to enter into and consummate any other potential alternative transaction. Considering these risks, uncertainties and assumptions, the forward-looking statements regarding future events and circumstances discussed in this Current Report on Form 8-K may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements included in this Current Report on Form 8-K speak only as of the date hereof and, except as required by law, the Company undertakes no obligation to update publicly or privately any forward-looking statements, whether written or oral, for any reason after the date of this Current Report on Form 8-K to conform these statements to new information, actual results or to changes in its expectations.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 28, 2023

| | | | | |

| Babylon Holdings Limited |

| |

By: | /s/ David Humphreys |

Name: | David Humphreys |

Title: | Chief Financial Officer |

Babylon Proceeds With Previously Announced Transaction and Announces the Receipt of Continued Listing Standards Notice from NYSE and Upcoming Delisting

AUSTIN, TEXAS and LONDON – June 28, 2023 – Babylon Holdings Limited (the “Company” or “Babylon”) (NYSE:BBLN) previously announced in its June 23, 2023 press release that the Company has received a proposal from AlbaCore Capital LLP ("AlbaCore") and MindMaze Group SA ("MindMaze") pursuant to which core operating subsidiaries of the Company would be transferred to MindMaze (the “Proposed Transaction”). The closing of the Proposed Transaction is expected in July 2023 and is subject to agreed documentation, various conditions and appropriate approvals, if required. The Proposed Transaction will not provide for any payment to the Company’s Class A ordinary shareholders or other equity instrument holders, as AlbaCore will be exercising rights under its debt agreements with the Company to transition the go-forward business by transferring core operating subsidiaries of the Company to MindMaze.

The Company today announced that on June 22, 2023, the Company received a notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) indicating the Company is not in compliance with Section 802.01B and Section 802.01C of the NYSE Listed Company Manual because (i) the Company’s average total market capitalization over a consecutive 30 trading-day period was less than $50 million and, at the same time, its last reported shareholders’ equity was less than $50 million, and (ii) the average closing price of the Company’s Class A ordinary shares on the NYSE was less than $1.00 over a consecutive 30 trading-day period.

In light of the expected closing of the Proposed Transaction in July 2023, the Company does not intend to undertake actions to cure the deficiencies described above and return to compliance with the NYSE continued listing standards, and has notified the NYSE of this decision. As a result, the Company expects the NYSE to immediately suspend its Class A ordinary shares from trading on the NYSE under the ticker symbol “BBLN”, and for the Class A ordinary shares to transition to trading on the over-the-counter market. In addition, the Company expects the NYSE to subsequently delist the Class A ordinary shares from the NYSE in accordance with its procedures. The Company will continue to comply with applicable Securities and Exchange Commission (“SEC”) reporting requirements.

The Notice and the expected suspension of trading and subsequent delisting of the Class A ordinary shares from the NYSE do not affect the business operations of the Company and its subsidiaries, and will have no impact on the Proposed Transaction.

About Babylon

At Babylon, our mission is to make quality healthcare widely accessible and affordable. To this end we are building an integrated digital first primary care service that can manage population health at scale. Founded in 2013, we are reengineering how people engage with their care at every step of the healthcare continuum. Today, Babylon’s technology and clinical services support a global patient network across 15 countries, and our digital healthcare platform is capable of operating in 16 languages. Babylon is also working with governments, health providers, employers and insurers across the globe to provide them with a new digital-first platform that any partner can use to deliver high-quality healthcare with lower costs and better outcomes. For more information, please visit www.babylonhealth.com.

Forward-Looking Statements

This press release contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or our future financial or operating performance. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements include, without limitation, the timing of the expected suspension of trading and subsequent delisting of the Class A ordinary shares from the NYSE, information concerning Babylon’s ability to successfully implement the framework implementation agreement, dated May 10, 2023, between Babylon and AlbaCore (the “Framework Agreement”) and close the Proposed Transaction with AlbaCore and MindMaze on the terms or timeframe currently contemplated, possible or assumed future results of operations, business strategies, debt levels, competitive position, industry environment and potential growth opportunities.

These forward-looking statements are not guarantees of future performance, conditions, or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside of Babylon’s management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. These risks, uncertainties, assumptions and other important factors include, but are not limited to: the timing of

any suspension of trading of or delisting of our Class A ordinary shares by the NYSE, and any resulting adverse consequences to the Company; our ability to continue as a going concern over the next twelve months; risks associated with our debt financing agreements with AlbaCore, including the impact of the restrictive covenants on our operations; risks associated with the implementation of the proposed take private transaction pursuant to the Framework Agreement and our ability to enter into definitive agreements for and close the Potential Transaction with AlbaCore and MindMaze on the terms and timeframe currently contemplated; that we may require additional financing and our ability to obtain additional financing on favorable terms; our ability to timely identify and execute strategic alternatives on favorable terms, including restructuring, refinancing, an asset sale such as the proposed sale of the independent physician association (IPA) business, a take private transaction, and/or putting Babylon Holdings Limited into administration under UK law or obtaining relief under the U.S. Bankruptcy Code; risks and uncertainties associated with such administration or bankruptcy proceedings; the diversion of our senior management team’s attention from our business to pursuing strategic alternatives, include the Proposed Transaction with AlbaCore and MindMaze; the impact on our share price as a result of announcements related to the Potential Transaction, including the business combination with MindMaze; turnover in our senior management team and other key talent; our future financial and operating results, ability to generate profits in the future, and timeline to profitability for Babylon as a whole and in our lines of business; our ability to successfully execute our planned cost reduction actions and realize the expected cost savings; the growth of our business and organization; risks associated with impairment of goodwill and other intangible assets; our failure to compete successfully; our ability to renew contracts with existing customers, and risks of contract renewals at lower fee levels, or significant reductions in members, pricing or premiums under our contracts due to factors outside our control; our dependence on our relationships with physician-owned entities; our ability to maintain and expand a network of qualified providers; our ability to increase engagement of individual members or realize the member healthcare cost savings that we expect; a significant portion of our revenue comes from a limited number of customers; the uncertainty and potential inadequacy of our claims liability estimates for medical costs and expenses; risks associated with estimating the amount and timing of revenue recognized under our licensing agreements and value-based care agreements with health plans; risks associated with our physician partners’ failure to accurately, timely and sufficiently document their services; risks associated with inaccurate or unsupportable information regarding risk adjustment scores of members in records and submissions to health plans; risks associated with reduction of reimbursement rates paid by third-party payers or federal or state healthcare programs; risks associated with regulatory proposals directed at containing or lowering the cost of healthcare, including the ACO REACH model; immaturity and volatility of the market for telemedicine and our unproven digital-first approach; our ability to develop and release new solutions and services; difficulty in hiring and retaining talent to operate our business; risks associated with our international operations, economic uncertainty, or downturns; the impact of COVID-19 or any other pandemic, epidemic or outbreak of an infectious disease in the United States or worldwide on our business; risks associated with foreign currency exchange rate fluctuations and restrictions; and the other risks and uncertainties identified in Babylon’s Form 10-K filed with the SEC on March 16, 2023 and Form 10-Q filed with the SEC on May 10, 2023, and in other documents filed or to be filed by Babylon with the SEC and available at the SEC’s website at www.sec.gov.

Babylon cautions that the foregoing list of factors is not exclusive and cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Except as required by law, Babylon does not undertake any obligation to update or revise its forward-looking statements to reflect events or circumstances after the date of this press release.

Contacts:

Media

press@babylonhealth.com

Investors

investors@babylonhealth.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

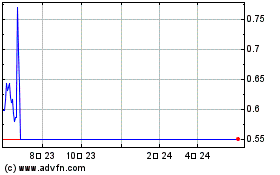

Babylon (NYSE:BBLN)

과거 데이터 주식 차트

부터 11월(11) 2024 으로 12월(12) 2024

Babylon (NYSE:BBLN)

과거 데이터 주식 차트

부터 12월(12) 2023 으로 12월(12) 2024