Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

HENNESSY ADVISORS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

NOTICE OF

2024 ANNUAL MEETING OF SHAREHOLDERS

and

PROXY STATEMENT

Hennessy Advisors, Inc.

7250 Redwood Boulevard, Suite 200

Novato, California 94945

800-966-4354

www.hennessyadvisors.com

In this proxy statement, the terms “Hennessy Advisors,” the “company,” “we,” “us,” and “our” refer to Hennessy Advisors, Inc.

This proxy statement and the enclosed proxy card are being first sent or made available to shareholders on December 20, 2023.

| Dear Hennessy Advisors Shareholder: |

December 2023 |

After a challenging and volatile 2022, the financial markets in 2023 have certainly recovered. Through November 30, 2023, the Dow Jones Industrial Average was up a solid 10.72% and the S&P 500® Index was up a robust 20.80%; however, a majority of the performance of the S&P 500® Index (72%) was provided by a relatively small number of mega-cap technology giants – Microsoft, Tesla, Facebook (Meta), Apple, Amazon, Netflix, Nvidia, and Google. To me, this dominance by so few stocks creates market opportunities for other large-, mid- and small-cap companies that exhibit strong fundamentals.

Interest rates and inflation controlled the market narrative in 2023, but businesses and individual balance sheets remained resilient. There is strength in household spending, employment remains strong (with the unemployment rate at 3.7%), inflation has calmed, and interest rates are finally showing signs of some flattening. After surviving a crisis early in the year, the banking sector has rebounded and shown signs of recovery, and it feels like volatility and market angst have subsided.

The stock market’s current stability and strong performance heading into 2024 may be overshadowed by global conflict and dysfunction in Washington, but I never bet against United States ingenuity. Our economy and our markets have overcome volatility, recessions, corrections, high interest rates, conflicts across the world, a pandemic, and other challenges, and we’ve persevered. I continue to believe in the strength and resilience of our country, our economy, our financial markets, and most of all, our people.

Financial Results

We began our current fiscal year with approximately $2.9 billion in assets under management, which has led to lower earnings throughout the year. However, our assets under management have held steady over the twelve months ended September 30, 2023, and ended the year up 5% at over $3.0 billion. We are further encouraged by several months of positive inflows into our funds toward the end of the fiscal year.

Although fully diluted earnings per share (EPS) declined to $0.63, our balance sheet continues to build. Our cash position net of debt increased 11% to over $20 million by September 30, 2023. We continue to hold $40.25 million of debt that is payable on December 31, 2026. The notes bear interest at 4.875% per annum, but the cash on-hand is currently earning more than 5% per annum of interest income in a money market fund. We are not only outearning the interest rate on our debt, but with gross cash on hand of over $60 million, we remain positive that there are tactical opportunities to be had and will continue to conscientiously seek such opportunities that may benefit our shareholders.

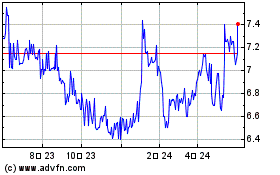

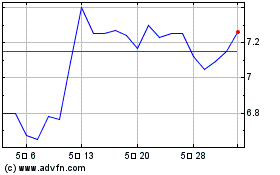

Hennessy Advisors, Inc. has been a public company since 2002 and has been listed on the Nasdaq for nearly a decade now. A key aspect of our commitment to our shareholders lies in our consistent dividend, which we have paid for the last 18 consecutive years. Based on a closing price of $6.57 per share on December 5, 2023, the $0.1375 quarterly dividend equates to an 8.4% yield on an annualized basis.

The Hennessy Funds

On April 26, 2023, we signed a definitive agreement with Community Capital Management, LLC related to the management of the CCM Core Impact Equity Fund and the CCM Small/Mid-Cap Impact Value Fund. On November 10, 2023, we completed the acquisition of assets related to the management of the CCM Small/Mid-Cap Impact Value Fund. As a result, the CCM Small/Mid-Cap Impact Value Fund was reorganized into Hennessy Stance ESG ETF (NYSE: STNC). The acquisition represented approximately $12 million in assets.

The Special Meeting of shareholders of the CCM Core Impact Equity Fund (approximately $56 million in assets as of December 8, 2023) has been adjourned to January 31, 2024. Pending shareholder approval, the CCM Core Impact Equity Fund will also be reorganized into the Hennessy Stance ESG ETF.

Against a backdrop of positive equity performance, 14 of the 17 Hennessy Funds posted positive returns for the one-year period ended September 30, 2023. The longer-term performance numbers remain strong, with 13 of the Hennessy Funds posting positive returns for the three-year and five-year periods ended September 30, 2023, and all 14 Hennessy Funds with at least 10 years of operating history posting positive returns for the 10-year period ended September 30, 2023.

The Future

We are dedicated to growing our funds by pursuing smart investing, targeted distribution, and successful marketing. Meanwhile, we continue our exhaustive search for our next acquisition, partnership, or other beneficial opportunity for the benefit of our shareholders. We are fortunate to have a team of employees who have shown dedication to their work product, and that is what we believe is of utmost importance to our company. The consistency we have worked to create has paved the way for continued success, and we are excited to find out what great things our team can do next.

Our incredible team of employees, coupled with a truly supportive and hardworking Board of Directors, are all continuing to work for you – our shareholders. On behalf of Hennessy Advisors, thank you for your continued investment, and we look forward to a promising year ahead.

If you have any questions or would like to speak with us directly, please don’t hesitate to call us at (800) 966-4354.

Sincerely,

Neil J. Hennessy

Chairman and CEO

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

Date and Time

Thursday, February 8, 2024

6:30 p.m. Pacific time

(business casual recommended)

|

Place

StoneTree Golf Club

9 StoneTree Lane

Novato, California 94945

|

Record Date

December 11, 2023

|

DEAR SHAREHOLDER:

The annual meeting of shareholders will be held for the following purposes:

| |

1.

|

to elect all director nominees named in the proxy statement;

|

| |

2.

|

to approve the Hennessy Advisors, Inc. 2024 Omnibus Incentive Plan;

|

| |

3.

|

to ratify the selection of Marcum LLP as our independent registered public accounting firm for fiscal year 2024; and

|

| |

4.

|

to transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

|

Our board of directors recommends a vote “FOR” proposals 1, 2, and 3.

Your vote is important, and we encourage you to vote promptly whether or not you plan to attend the annual meeting. You may vote now by internet, phone, or mail.

| |

By Order of the Board of Directors,

Teresa M. Nilsen

President, Chief Operating Officer, and Secretary

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on February 8, 2024. The notice, proxy statement, annual report, and form of proxy are available at www.hennessyadvisors.com/proxy.

TABLE OF CONTENTS

Page

HENNESSY ADVISORS, INC.

7250 Redwood Boulevard, Suite 200

Novato, California 94945

PROXY STATEMENT FOR ANNUAL MEETING OF

SHAREHOLDERS TO BE HELD ON FEBRUARY 8, 2024

This proxy statement and the enclosed proxy card are being first sent to shareholders of Hennessy Advisors on or about December 20, 2023, in connection with the solicitation by our board of directors of proxies to be used at the 2024 annual meeting of shareholders. The annual meeting will be held on Thursday, February 8, 2024, at 6:30 p.m. Pacific time, at StoneTree Golf Club, 9 StoneTree Lane, Novato, California 94945 (business casual recommended).

The board of directors has designated Neil J. Hennessy and Teresa M. Nilsen as proxy agents to vote the shares of common stock solicited on its behalf.

VOTING INFORMATION

Each share of our common stock has one vote on each matter to come before the meeting. As of December 11, 2023, we had outstanding and entitled to vote 7,673,869 shares of common stock. Only shareholders of record (which means shares are owned in your name in an account with our transfer agent, Computershare) as of the close of business on December 11, 2023, are entitled to vote at the annual meeting. If you are a beneficial owner of shares of our common stock, meaning your shares are held in street name in an account with a broker, which may include a bank or other nominee acting as custodian on your behalf, you may instruct your broker how to vote your shares.

A quorum is required to hold a valid meeting. Holders of a majority of our outstanding common stock must be present in person or represented by proxy to constitute a quorum at the annual meeting. Abstentions and “broker non-votes” (explained below) are counted as present for purposes of determining quorum.

Whether you hold shares directly as a shareholder of record or beneficially in street name, you may vote your shares without attending the annual meeting in any of the following three ways:

| |

●

|

Internet. If you are a shareholder of record, you may vote online by visiting www.Investorvote.com/HNNA and following the instructions on the website. If you are a beneficial owner, the availability and method of online voting depends on the voting procedures of your broker.

|

| |

●

|

Phone. If you are a shareholder of record, you may vote by phone by calling the toll‑free number found on your proxy card. If you are a beneficial owner, the availability and method of phone voting depends on the voting procedures of your broker.

|

| |

●

|

Mail. If you are a shareholder of record, you may vote by mail by filling out the proxy card and returning it in the envelope provided. If you are a beneficial owner, the availability and method of mail voting depends on the voting procedures of your broker.

|

You may also vote in person at the annual meeting, although we encourage you to vote your shares now even if you plan to attend the annual meeting. If you are a beneficial owner and want to vote your shares in person at the annual meeting, you must obtain a legal proxy and bring it to the annual meeting. A legal proxy is a written document that authorizes you to vote your shares held in street name in connection with the annual meeting. Please contact your broker for instructions regarding obtaining a legal proxy because your broker will not automatically supply one to you.

For shareholders of record, if you choose to vote by internet, phone, or mail, then the proxy agents will vote your shares at the annual meeting in accordance with your specific voting instructions (unless your proxy is mutilated or otherwise received in such form or at such time as to render it not votable). If you submit a proxy but do not provide specific voting instructions, then the proxy agents will vote your shares in the manner recommended by the board on each proposal described in this proxy statement.

For beneficial owners, your broker must vote your shares in accordance with the specific voting instructions your broker receives from you, which may include voting by internet, phone, or mail as permitted by your broker. If you do not provide your broker with instructions on how to vote your shares, your broker will have discretionary authority to vote on your behalf on any “routine” proposals.” However, your broker may not vote your shares with respect to “non-routine” proposals unless it receives specific instructions from you. A “broker non-vote” occurs when a broker does not vote on a particular proposal because the broker does not have discretionary voting authority for that particular proposal and has not received specific instructions from the beneficial owner or otherwise does not vote. Proposals 1 and 2 – the election of directors and approval of the Hennessy Advisors, Inc. 2024 Omnibus Incentive Plan – are non‑routine matters for which brokers do not have discretionary voting authority. If you are a beneficial owner and do not instruct your broker how to vote with respect to these two non‑routine proposals, your broker will not vote with respect to such proposals. Proposal 3 – the ratification of the selection of Marcum LLP as the company’s independent registered public accounting firm for fiscal year 2024 – is a routine matter on which brokers have discretionary voting authority.

If you are a shareholder of record, you may change your vote or revoke your proxy at any time before the annual meeting by giving written notice to our corporate secretary, submitting a later‑dated proxy, or attending the annual meeting and voting in person. If you are a beneficial owner, then you may change your vote by following the instructions provided by your broker.

Shown below is a list of the matters to be considered at the annual meeting and the vote required for election or approval, as the case may be.

|

Matter

|

|

Required Vote for

Election or Approval

|

|

Impact of Abstentions or Broker Non‑Votes

|

|

Proposal 1: Election of directors

|

|

Plurality of votes cast

|

|

Abstentions and broker non‑votes are not counted as votes for or against and do not affect the outcome.

|

|

Proposal 2: Approval of the Hennessy Advisors, Inc. 2024 Omnibus Incentive Plan

|

|

Affirmative vote of the majority of the shares represented at the meeting and entitled to vote

|

|

Abstentions have the same effect as votes against. Broker non-votes are not counted as votes for or against and will not affect the outcome.

|

|

Proposal 3: Ratification of the selection of the independent registered public accounting firm

|

|

Affirmative vote of the majority of the shares represented at the meeting and entitled to vote

|

|

Abstentions have the same effect as votes against. We do not expect any broker non‑votes because brokers have discretion to vote uninstructed shares on this proposal. In any event, broker non‑votes do not affect the outcome.

|

We encourage you to vote your shares now regardless of whether you plan to attend the annual meeting.

PROPOSAL 1:

ELECTION OF DIRECTORS

The board of directors recommends a vote “FOR” the election of each nominee listed below.

At the annual meeting, eight directors will be elected to serve for one-year terms or until their respective successors are elected and qualified. At the recommendation of the nominating committee, our board of directors has nominated each of our eight current directors to stand for reelection.

Each director nominee is presently available for election and has consented to being named in this proxy statement and to serve as a director if elected. In the unanticipated event that any director nominee becomes unavailable, the proxy agents may, in their discretion, vote for a substitute.

The following biographies describe the experience, qualifications, attributes, and skills of the director nominees that led the board and the nominating committee to conclude that he or she should serve as a director. In addition, we also believe that all of our director nominees have a reputation for integrity, honesty, and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to the company and our board.

Neil J. Hennessy (age 67) has served as chairman of the board and chief executive officer of Hennessy Advisors since 1989 and served as president of Hennessy Advisors from 1989 to January 2018. Mr. Hennessy also serves as chairman of the board, chief market strategist, president, and portfolio manager of Hennessy Funds Trust (the trust for our investment funds). He previously served as the chief investment officer of Hennessy Funds Trust from 1996 until 2021. Mr. Hennessy started his financial career in 1979 as a broker at Paine Webber. He subsequently moved to Hambrecht & Quist and later returned to Paine Webber. From 1987 to 1990, Mr. Hennessy served as a nominated member of the National Association of Securities Dealers, Inc.’s District 1 Business Conduct Committee. From January 1993 to January 1995, Mr. Hennessy served his elected term as chairman of the District 1 Business Conduct Committee. Mr. Hennessy earned a bachelor of business administration from the University of San Diego. Mr. Hennessy has amassed considerable business acumen in his career. Since founding the company in 1989, he has successfully navigated the company through many economic cycles. His significant experience in managing the company enables him to provide the board with invaluable knowledge and guidance. Mr. Hennessy is the brother of Dr. Brian A. Hennessy.

Teresa M. Nilsen (age 57) has served as president of Hennessy Advisors since January 2018, as chief operating officer since October 2010, and as a director and secretary since 1989. From 1989 until January 2018, Ms. Nilsen served as executive vice president and chief financial officer of Hennessy Advisors. Ms. Nilsen is also executive vice president and treasurer of our investment funds. Ms. Nilsen has worked in the securities industry since 1987, and she earned a bachelor of arts in economics from the University of California, Davis. Ms. Nilsen contributes invaluable long‑term knowledge of the Company’s business and operations. Her additional qualifications to serve on our board include her significant financial management, operational, and leadership experience gained during her extensive career in the securities industry.

Henry Hansel (age 75) has served as a director of Hennessy Advisors since 2001. He has been president of The Hansel Auto Group, which includes nine automobile dealerships, since 1982. Mr. Hansel served as a director of the Bank of Petaluma from its organization in 1987 until it was sold in 2002. Mr. Hansel earned a bachelor of science in economics from the University of Santa Clara. Mr. Hansel’s experience with running a large and economically cyclical business provides him with excellent financial statement and operational knowledge. His corporate business experience, combined with his attentive and thorough service as a director over the years, allows him to provide the board with valuable recommendations and ideas.

Brian A. Hennessy (age 70) has served as a director of Hennessy Advisors since 1989 and as a director of our investment funds from 1996 to 2001. Dr. Hennessy, now retired, was a self‑employed dentist for over 20 years. Dr. Hennessy earned a bachelor of science in biology from the University of San Francisco and a D.D.S. from the University of the Pacific. Dr. Hennessy’s qualifications to serve on our board include his considerable experience as a business owner. His many years running his own practice allowed him to navigate many business-related issues, making him a valuable source of knowledge to us. This, combined with his prior service as a director of our investment funds, has provided him with a solid understanding of the company and the industry in which it operates. Dr. Hennessy is the brother of our chairman of the board, Neil J. Hennessy.

Lydia Knight-O’Riordan (age 59) has served as a director of Hennessy Advisors since 2021. Ms. Knight-O’Riordan worked for Hathaway Dinwiddie Construction Co. from 1988 until her retirement in 2023. During her career, she served as a manager in the Cost Management and Project Management division, as well as an Assistant Project Manager and Project Accountant prior to her manager role. Ms. Knight‑O’Riordan is a member of the Middletown Rancheria of Pomo Indians of California and was appointed to the tribe’s Economic Committee in 2020 after having previously served two terms as Treasurer. She also serves as a board member of the Santa Venetia Swim Club. Ms. Knight‑O’Riordan’s extensive leadership and management experience has given her in‑depth knowledge of the business world and enables her to provide the board with valuable insight.

Kiera Newton (age 46) has served as a director of Hennessy Advisors since 2022. Ms. Newton has worked as a Forensic Accountant for Gursey | Schneider LLP since January 2020. Prior to that, she was an Assurance Manager at Marcum LLP from 2013 through November 2019, where she was involved in numerous private and public company reviews and audits and supervised the work of others on the audit team. Ms. Newton earned a bachelor of science in Accounting from Saint Mary’s College of California. Her extensive accounting and auditing experience enables her to lead and guide our audit committee.

Susan W. Pomilia (age 57) has served as a director of Hennessy Advisors since 2014. Ms. Pomilia has worked in the mortgage industry for over 30 years. From 1985 to 2007, Ms. Pomilia worked for Residential Mortgage Capital, d/b/a First Security Loan, where she opened branches in Larkspur and Mill Valley. From 2007 to 2017, she worked with RPM Mortgage and grew her business to include branches in Mill Valley, Napa, and Petaluma. Because of her constant pursuit of better products and service, she aligned her team with Supreme Lending in November 2017. Ms. Pomilia’s experience managing dozens of employees and multiple branches provides her with excellent insight and business perception. This, combined with her exceptional service as the president of Cruisin’ with Susan, a non-profit organization, treasurer of NorthBay California Association of Mortgage Professionals, and vice president of Pomilia Financial, Inc., provides her with tremendous understanding of business in general and the financial industry specifically.

Thomas L. Seavey (age 77) has served as a director of Hennessy Advisors since 2001. For the majority of Mr. Seavey’s business career he has been involved in the sales and marketing of athletic and leisure products, as well as working with professional athletes. During the 1980s and 1990s, Mr. Seavey worked for Nike as the vice president of sales, as well as for International Management Group (IMG) as a vice president. During this time, he also formed his own company, Seavey Corp., now ALPS Group, which sells sport and leisure products. Mr. Seavey formally managed ALPS Group for over a decade. He is no longer involved in the day-to-day operations of ALPS Group, but continues as an advisor and president. Mr. Seavey earned a bachelor of arts in English and history from Western Michigan University. Mr. Seavey’s experience working for a large corporation, where he led worldwide marketing campaigns, provided him vast knowledge of the business world. His experience has sharpened his financial and operational knowledge, and he brings these assets to our board of directors in a relatable, effective way. This, combined with his diligent and focused service as a director of our company over the years, has provided him with an excellent understanding of the company and the industry in which it operates, making him a valuable resource to our board.

CORPORATE GOVERNANCE

Director Attendance

Our board held five regular meetings during fiscal year 2023. All directors attended at least 75% of all meetings of the board and board committees on which they served during fiscal year 2023.

Directors are encouraged to attend the annual meetings of shareholders. Seven of our eight directors attended the 2023 annual meeting of shareholders.

Director Independence

The board determined that Henry Hansel, Lydia Knight‑O’Riordan, Kiera Newton, Susan W. Pomilia, and Thomas L. Seavey are independent under Nasdaq rules. The Nasdaq rules include several objective tests and one subjective test for determining who is an independent director. The subjective test requires that the board affirmatively determine, after reviewing all relevant information, that a director does not have any relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The board has not established categorical standards or guidelines to make this subjective determination, but instead considers all relevant facts and circumstances.

Henry Hansel, Lydia Knight‑O’Riordan, Kiera Newton, Susan W. Pomilia, and Thomas L. Seavey all qualified as independent under the objective tests. The board then reviewed and discussed additional information provided by the directors and the company with regard to any transactions, relationships, or arrangements that each such director had with the company during the three years prior to the independence determination. Matters reviewed included commercial and charitable transactions, relationships, and arrangements, and the board deemed none of such matters to be material. Based on this review, the board made a subjective determination that no relationships exist that impair the independence of such directors.

Board Diversity

The following matrix details the diversity of the board of directors as of the date of this proxy statement:

|

Board Size:

|

|

Total Number of Directors

|

8

|

|

Gender:

|

Male

|

Female

|

Non-Binary

|

Gender Undisclosed

|

|

Number of Directors Based on Gender Identity

|

4

|

4

|

0

|

0

|

|

Number of Directors Who Identify in Any of the Categories Below:

|

|

|

|

|

|

African American or Black

|

0

|

1

|

0

|

0

|

|

Alaskan Native or Native American

|

0

|

1

|

0

|

0

|

|

Asian

|

0

|

0

|

0

|

0

|

|

Hispanic or Latino

|

0

|

0

|

0

|

0

|

|

Native Hawaiian or Pacific Islander

|

0

|

0

|

0

|

0

|

|

White

|

4

|

2

|

0

|

0

|

|

Two or More Races or Ethnicities

|

0

|

0

|

0

|

0

|

|

LGBTQ+

|

0

|

0

|

0

|

0

|

|

Undisclosed

|

0

|

0

|

0

|

0

|

Board Committees

The board of directors has established an audit committee, a compensation committee, and a nominating committee. Members of these committees are elected annually, generally in the winter. Each committee has a written charter that is approved by the board and reviewed for adequacy on an annual basis. Committee charters are available on our website at www.hennessyadvisors.com.

Audit Committee. The audit committee comprises Kiera Newton (Chair), Henry Hansel, and Thomas L. Seavey, all of whom are considered independent under Nasdaq rules. The audit committee met four times during fiscal year 2023. The principal responsibilities and functions of the audit committee include reviewing our internal controls and the integrity of our financial reporting, approving the employment and compensation of and overseeing our independent auditor, and reviewing the quarterly reviews and annual audit with the auditor.

Our board has determined that Kiera Newton, who has served as Chair of our audit committee since 2022, is an audit committee financial expert, as defined in the rules and regulations of the Securities and Exchange Commission (the “SEC”), and is considered independent under SEC and Nasdaq rules. Our board based its determination on the fact that Ms. Newton has extensive experience evaluating financial statements prepared in accordance with generally accepted accounting principles and has also acquired an understanding of internal controls, procedures for financial reporting, and audit committee functions as a Certified Public Accountant with seven years of experience in public accounting. Ms. Newton worked as an Audit Associate for Ernst & Young from 2012 to 2013 and subsequently as an Assurance Manager for Marcum LLP from 2013 through 2019.

Compensation Committee. During fiscal year 2023, the compensation committee comprised Thomas L. Seavey (Chair) and Susan W. Pomilia, both of whom are considered independent under Nasdaq rules. The compensation committee met two times during fiscal year 2023. Effective December 6, 2023, the compensation committee comprises Thomas L. Seavey (Chair), Susan W. Pomilia, and Kiera Newton. This committee has the responsibility of approving the compensation arrangements for our executive officers, including annual equity awards, which were approved on September 18, 2023, with a grant date of September 18, 2023, and annual cash bonuses, which were approved on September 18, 2023. It also recommends to the board of directors whether to adopt any compensation plans in which our officers and directors are eligible to participate and makes grants of employee stock options and other stock awards under our incentive plan. Our executive officers do not determine their own compensation. However, the president, after consultation with the company’s other executive officers, recommends to the compensation committee (1) the amount of base salary, cash bonus, company 401(k) contribution, and equity compensation for Ms. Kathryn R. Fahy, our chief financial officer, and Mr. Steadman, our executive vice president, (2) the amount of the chief executive officer’s company 401(k) contribution and equity compensation, and (3) the amount of her own company 401(k) contribution and equity compensation, in each case based on salary surveys and the experience and performance of our executive officers. The compensation committee does not have any arrangements with compensation consultants. As a small company, our compensation committee relies on its business judgment in making compensation decisions for our executive officers. The compensation committee is also responsible for reviewing and approving all related party transactions.

Nominating Committee. During fiscal year 2023, the nominating committee comprised Susan W. Pomilia (Chair), Henry Hansel, and Thomas L. Seavey. The nominating committee met once during fiscal year 2023. Effective December 6, 2023, the nominating committee comprises Susan W. Pomilia (Chair), Henry Hansel, Lydia Knight‑O’Riordan, and Thomas L. Seavey. The principal responsibilities and functions of the nominating committee include making recommendations for director nominees to the full board of directors for the next annual meeting of shareholders and making recommendations for committee assignments and committee chair designations.

Qualifications for consideration as a director nominee vary according to the particular areas of expertise sought to complement the existing board composition. However, in making its nominations, the nominating committee considers, among other things, an individual’s business experience, industry experience, financial background, breadth of knowledge about issues affecting the company, time available for meetings and consultation regarding company matters, and other particular skills and experience. In considering the diversity of a candidate, the committee considers a variety of factors including, but not limited to, age, gender, and ethnicity. We do not currently employ an executive search firm or retain any other third party to locate qualified candidates for director positions, although we may do so in the future if the nominating committee deems it appropriate. Shareholders may recommend a potential director nominee by following the procedures described below in “Deadlines for Submissions of Proxy Proposals, Proposals for Director Nominations or Other Business, and Recommendations for Potential Director Nominees.”

Leadership Structure

Neil J. Hennessy serves as both our chief executive officer and chairman of the board, which the board believes is the most appropriate and effective leadership structure for the board and the company at this time. Mr. Hennessy brings over 30 years of strategic leadership experience and an unparalleled knowledge of the company’s business, operations, and risks to his role as chairman. This depth of knowledge enables Mr. Hennessy to effectively set appropriate board agendas and ensure appropriate processes and relationships are established between management and the board as our board works together to oversee our management and affairs. The board has not appointed a lead independent director.

Board Role in Risk Oversight

The board, together with the audit committee, oversees both the investment risk and operational risk components of our risk management framework and is responsible for helping to ensure that our risks are managed in a sound manner. The directors oversee an enterprise-wide approach to risk management designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. It is a fundamental aspect of risk management not only to understand the risks a company faces and the steps management is taking to manage those risks, but also to evaluate the appropriate risk level for the company. The involvement of the full board in setting our business strategy is a key part of the directors’ assessment of management’s appetite for risk and a determination of what constitutes an appropriate risk level. The board has determined that its risk oversight is appropriate for the company.

The board has adopted a Code of Ethics for Hennessy Funds Trust and Hennessy Advisors that applies to our directors and employees, the full text of which is available at www.hennessyadvisors.com. Each director and employee annually confirms in writing that he or she has reviewed and will fully comply with the Code of Ethics.

Hedging Transactions

We have not adopted any practice or policy regarding the ability of our directors or employees (including our executive officers), or any of their designees, to engage in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our common stock.

Clawback Policy

During 2023, we adopted a compensation recovery policy designed to comply with the mandatory compensation “clawback” requirements under Nasdaq rules that became effective as of October 2, 2023. Under the policy, in the event of certain accounting restatements, we will be required to recover erroneously received incentive‑based compensation from our executive officers representing the excess of the amount actually received over the amount that would have been received had the financial statements been correct in the first instance. The compensation committee has discretion to make certain exceptions to the clawback requirements (when permitted by Nasdaq rules) and ultimately determine whether any adjustment will be made.

Insider Trading Policy

Our Code of Ethics prohibits us and our directors, officers, and employees from trading on the basis of material non‑public information or communicating material non‑public information to others in violation of applicable law. The Code of Ethics also establishes quarterly quiet periods during which our directors, officers, and employees may not trade in the company’s securities.

Related Party Transactions

During fiscal years 2023 and 2022, there were no related party transactions of more than $120,000, except as described below.

Alan J. Hennessy, son of Neil J. Hennessy, is employed by the company and serves as vice president of corporate development and operations of our investment funds. In fiscal year 2023, he earned a total of $291,913 from the company, consisting of base salary, cash bonus, and a grant of restricted stock units at a grant date stock price of $6.79 per share. In fiscal year 2022, he earned a total of $282,250 from the company, consisting of base salary, cash bonus, and a grant of restricted stock units at a grant date stock price of $9.00 per share. All restricted stock units vest at a rate of 25% per year over four years. In addition, in both fiscal years he received other benefits on the same terms available to all other employees of the company, including eligibility for awards of restricted stock units. His compensation is commensurate with his peers’ compensation.

DIRECTOR COMPENSATION

The following table sets forth compensation received by each non‑management director in fiscal year 2023. Non-management directors received $12,000 per board meeting and $1,500 per committee meeting, and committee chairs received $2,000 per committee meeting. In addition to the fees received for board and committee service, the compensation committee determines the amount of restricted stock units, if any, to award to each non‑management director on an annual basis.

|

Name(1)

|

|

Fees Earned or

Paid in Cash

($)

|

|

|

Stock Awards(2)

($)

|

|

|

Total

($)

|

|

|

Henry Hansel

|

|

|

67,500 |

|

|

|

38,024 |

|

|

|

105,524 |

|

|

Brian A. Hennessy

|

|

|

60,000 |

|

|

|

38,024 |

|

|

|

98,024 |

|

|

Lydia Knight-O'Riordan

|

|

|

60,000 |

|

|

|

38,024 |

|

|

|

98,024 |

|

|

Kiera Newton

|

|

|

54,000 |

|

|

|

38,024 |

|

|

|

92,024 |

|

|

Daniel G. Libarle

|

|

|

45,500 |

|

|

|

19,012 |

|

|

|

64,512 |

|

|

Rodger Offenbach

|

|

|

43,500 |

|

|

|

19,012 |

|

|

|

62,512 |

|

|

Susan W. Pomilia

|

|

|

65,000 |

|

|

|

38,024 |

|

|

|

103,024 |

|

|

Thomas L. Seavey

|

|

|

71,500 |

|

|

|

38,024 |

|

|

|

109,524 |

|

| |

(1)

|

Ms. Newton was appointed to the Board effective December 8, 2022.

|

| |

|

|

| |

|

Messrs. Libarle and Offenbach transitioned to serve on our Advisory Committee effective December 8, 2022.

|

| |

|

|

| |

(2)

|

The amounts in this column include the aggregate grant date fair value, computed in accordance with FASB ASC Topic 718 – Stock Compensation. Stock awards are grants of restricted stock units with no exercise price. The units vest at a rate of 25% per year on the first four anniversaries of the grant date. Restricted stock units do not earn dividends or dividend equivalents. The value of restricted stock units granted is calculated as the number of units granted times the fair market value of our common stock on the grant date, which was $6.79 on the grant date of September 18, 2023. Ms. Knight‑O’Riordan and Ms. Newton held 8,975 and 7,287.5 non‑vested restricted stock units, respectively, as of September 30, 2023. Mr. Libarle and Mr. Offenbach each held 10,112.5 non‑vested restricted stock units as of September 30, 2023. Each other non‑management director held 12,912.5 non‑vested restricted stock units as of September 30, 2023.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows information relating to the beneficial ownership as of November 30, 2023, of (1) each person known to us to be the beneficial owner of more than 5% of our common stock, (2) each director, (3) each executive officer named in the summary compensation table elsewhere in this proxy statement, and (4) all directors and executive officers as a group. Except as otherwise indicated, the shareholders listed exercise sole voting and dispositive power over the shares. The mailing address for all individuals listed in the following table is c/o Hennessy Advisors, Inc., 7250 Redwood Boulevard, Suite 200, Novato, California 94945.

|

Name

|

|

|

Number of

Shares Owned

|

|

|

Percent

of Class

|

|

Additional Information

|

|

Neil J. Hennessy

|

|

|

|

2,046,550 |

|

|

|

26.7 |

% |

Includes (A) 2,016,429 shares held jointly with his spouse, over which Mr. Hennessy has shared voting and dispositive power, (B) 5,062 shares held in his IRA, over which Mr. Hennessy has sole voting and dispositive power, and (C) 25,059 shares held solely by his spouse.

|

|

Teresa M. Nilsen

|

|

|

|

122,884 |

|

|

|

1.6 |

% |

Includes (A) 98,081 shares held jointly with her spouse, over which Ms. Nilsen has shared voting and dispositive power, (B) 23,285 shares held by Ms. Nilsen and by her spouse as custodian for their children, over which Ms. Nilsen has shared voting and dispositive power, and (C) 1,518 shares held solely by her spouse.

|

|

Kathryn R. Fahy

|

|

|

|

47,983 |

|

|

|

* |

|

None.

|

|

Daniel B. Steadman

|

|

|

|

32,128 |

|

|

|

* |

|

Includes (A) 29,378 shares held jointly with his spouse, over which Mr. Steadman has shared voting and dispositive power, (B) 1,500 shares held in his IRA, over which Mr. Steadman has sole voting and dispositive power, and (C) 1,250 shares held solely by his child.

|

|

Henry Hansel

|

|

|

|

196,013 |

|

|

|

2.6 |

% |

None.

|

|

Brian A. Hennessy

|

|

|

|

274,778 |

|

|

|

3.6 |

% |

Includes (A) 236,852 shares held jointly with his spouse, over which Mr. Hennessy has shared voting and dispositive power, (B) 18,963 shares held in his IRA, over which Mr. Hennessy has sole voting and dispositive power, and (C) 18,963 shares held solely by his spouse.

|

|

Lydia Knight‑O’Riordan

|

|

|

|

1,125 |

|

|

|

* |

|

None.

|

|

Kiera Newton

|

|

|

|

562 |

|

|

|

* |

|

None.

|

|

Susan W. Pomilia

|

|

|

|

103,644 |

|

|

|

1.4 |

% |

Includes (A) 36,025 shares held jointly with her spouse, over which Ms. Pomilia has shared voting and dispositive power, and (B) 67,619 shares held solely by her spouse.

|

|

Thomas L. Seavey

|

|

|

|

71,917 |

|

|

|

* |

|

None.

|

|

All directors and executive officers (10 individuals)

|

|

|

|

2,897,584 |

|

|

|

37.8 |

% |

None.

|

| * |

Less than one percent of our common stock.

|

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires our executive officers, directors, and 10% shareholders to file reports with the SEC setting forth their holdings of, and transactions in, our common stock. Based solely on a review of copies of such reports and representations from these reporting persons, we believe all required reports were filed on a timely basis during fiscal year 2023 except for two Form 4 filings for Ms. Pomilia related to a series of sales transactions over eight calendar days that were filed late due to an administrative error.

EXECUTIVE OFFICERS

Our executive officers are listed below.

|

Neil J. Hennessy

|

Chief Executive Officer and Chairman of the Board of Directors

|

|

Teresa M. Nilsen

|

President, Chief Operating Officer, and Secretary

|

|

Kathryn R. Fahy

|

Chief Financial Officer and Senior Vice President

|

|

Daniel B. Steadman

|

Executive Vice President

|

Biographical information for Ms. Fahy and Mr. Steadman is set forth below. Biographical information for Mr. Hennessy and Ms. Nilsen may be found under the heading “Election of Directors.”

Kathryn R. Fahy (age 43) has served as the chief financial officer and as a senior vice president of Hennessy Advisors since January 2018. From January 2006 until January 2018, Ms. Fahy served as the controller of Hennessy Advisors, and from March 2015 until January 2018, she also served as director of finance of Hennessy Advisors. She is also vice president, assistant secretary, and assistant treasurer of our investment funds. Ms. Fahy began her career in accounting in 2002. Before joining the company in 2006, she worked as a public accountant for Deloitte & Touche, and as a senior internal auditor for Knight Ridder, Inc. Ms. Fahy holds a bachelor of arts in international economics with a minor in accounting from the University of California, Los Angeles, and is a Certified Public Accountant.

Daniel B. Steadman (age 67) has served as an executive vice president of Hennessy Advisors since 2000. He previously served as the chief compliance officer from 2010 until January 2018 and as a director from 2000 through December 2022. Mr. Steadman is also executive vice president and secretary of our investment funds. Mr. Steadman has been in the banking and financial services industry since 1974, serving as vice president of WestAmerica Bank from 1995 through 2000, vice president of Novato National Bank from its organization in 1984 through 1995, assistant vice president and branch manager of Bank of Marin from 1980 through 1984, and banking services officer of Wells Fargo Bank from 1974 through 1980.

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Overview

The goal of our compensation program is the same as our broader company‑wide goal, which is to create long‑term value for our shareholders. In an effort to achieve this goal, we have designed and implemented our compensation program to (1) encourage our executive officers to remain with us for long and productive careers and (2) align the interests of our executive officers with the interests of our shareholders. We believe that most of our compensation elements fulfill both of these objectives simultaneously. The principal elements of our compensation program are salary, bonus, equity awards, company 401(k) contributions, severance payments, and payments in the event of a change of control.

Compensation Objectives

Retention. Given our small number of high‑level executives, all of our executive officers are essential to our success. Our executive officers are experienced in the investment fund industry and are presented with other professional opportunities in the industry from time to time, including opportunities at potentially higher compensation levels. We believe it is critical to our success that turnover among our executive officers remains low and that our executive officers remain driven to achieve their individual and company-wide goals. Key elements of our compensation program that are designed to maximize executive officer retention include:

| |

●

|

equity awards that vest over a four-year period;

|

| |

●

|

competitive base salaries;

|

| |

●

|

company 401(k) contributions; and

|

| |

●

|

severance or change of control agreements.

|

Alignment. We seek to align the interests of our executive officers with the interests of our shareholders. Key elements of our compensation program that are designed to do so include:

| |

●

|

cash bonuses based on individual and company-wide performance; and

|

| |

●

|

equity awards, which link a significant portion of compensation to shareholder value because the total value of those awards corresponds to stock price appreciation and provide an added incentive for our executive officers to focus on long‑term performance and profitability.

|

Say-on-Pay and Say-on-Frequency

An advisory say-on-pay vote relating to the compensation of our executive officers occurred at the 2023 annual meeting of shareholders. Shareholders indicated strong support of our compensation programs for our executive officers, with approximately 94% of votes cast in favor. In light of this strong support, which we believe demonstrates our shareholders’ satisfaction with the alignment of our executive officers’ compensation with the company’s performance, the compensation committee maintained substantially the same compensation approach for fiscal year 2023. In addition, because a substantial majority of the votes cast on our say‑on‑frequency proposal at the 2020 annual meeting of shareholders were in favor of having a say-on-pay vote every three years, we will hold our next say-on-pay vote at the 2026 annual meeting of shareholders. We will hold our next say-on-frequency vote at the same meeting.

Process for Determining Compensation of Our Executive Officers

The compensation committee is responsible for establishing and administering our policies governing executive officer compensation. Mr. Hennessy and Ms. Nilsen each receive a minimum salary and a formulaic quarterly cash bonus pursuant to their respective employment agreements. They are each eligible to receive a salary increase at the start of every calendar year. Any such increase is at the discretion of the board based on the recommendation of the compensation committee. For the remaining elements of compensation for Mr. Hennessy and Ms. Nilsen and for all elements of compensation for Ms. Fahy and Mr. Steadman, Ms. Nilsen recommends compensation amounts to the compensation committee after consulting with the company’s other executive officers. Ms. Nilsen recommends the amount of cash bonuses and equity compensation for Ms. Fahy and Mr. Steadman for the current fiscal year, company 401(k) contributions for all executive officers for the current fiscal year, and the future base salary amounts for all executive officers. The compensation committee then decides whether to approve or adjust Ms. Nilsen’s recommendations.

Ms. Nilsen’s recommendations are based on her experience, the performance of our executive officers, and third‑party salary survey data from McLagan. McLagan has an extensive database that includes compensation data from most investment management companies, including private companies for which information is not otherwise generally available. McLagan aggregates and summarizes the compensation data by position without disclosing specific information for any particular company. We compare our executive positions to what we determine to be positions of similar scope and complexity that are included in the McLagan data. We believe this comparative data is useful and appropriate in establishing competitive compensation levels for our executive officers.

The compensation committee does not have any arrangements with compensation consultants. In recognition of the fact that we are a smaller company, our compensation committee relies on its business judgment in making compensation decisions for our executive officers. With respect to each area in which our executive officers are evaluated, the compensation committee compares the company’s performance and each executive officer’s performance against targeted performance for the year and then evaluates whether individual and company-wide objectives set during the prior year’s review were achieved. Specific factors affecting compensation decisions for executive officers include, but are not limited to, the following:

| |

●

|

key financial measurements, such as annual net income and year‑end cash balance;

|

| |

●

|

preparing and effectively executing short‑term and long‑term strategic plans for the company;

|

| |

●

|

building banking relationships;

|

| |

●

|

improving and expanding the distribution, marketing, public relations, and sales programs for our funds;

|

| |

●

|

effectively leading and managing the company’s employees, multiple offices, and several sub‑advisors;

|

| |

●

|

maintaining compliance with applicable regulatory requirements; and

|

| |

●

|

providing administrative services, shareholder services, and investment advisory services to the Hennessy Funds family of funds (currently 17 funds) and their parent company, Hennessy Funds Trust.

|

Elements of Our Compensation Program

Base Salaries. Base salaries are used to provide a fixed amount of compensation for an executive officer’s regular work. According to the most recent McLagan salary survey, the base salaries for our executive officers are in the bottom half of financial services companies participating in the survey. Base salaries for executive officers are reviewed annually and may be adjusted from time to time by the compensation committee.

Bonuses. Mr. Hennessy and Ms. Nilsen each receive a quarterly incentive-based bonus (a “Quarterly Bonus”) pursuant to employment agreements we entered into with them. Each Quarterly Bonus is calculated based on the company’s pre-tax profits for each fiscal quarter, as computed for financial reporting purposes in accordance with accounting principles generally accepted in the United States of America, except that pre-tax profit is computed without regard to (1) bonuses payable to employees (including related payroll tax expenses) for the fiscal year, (2) depreciation expense, (3) amortization expense, (4) compensation expense related to restricted stock units (or other stock‑based compensation expense), and (5) asset impairment charges (such amount, “Adjusted Quarterly Pre-Tax Profit”). Mr. Hennessy and Ms. Nilsen each receive a Quarterly Bonus equal to 6.5% and 3.5%, respectively, of Adjusted Quarterly Pre-Tax Profit. With respect to any fiscal quarter in which they earn Quarterly Bonuses, Mr. Hennessy and Ms. Nilsen receive 50% of their respective Quarterly Bonuses within 75 days following the end of such fiscal quarter and the remaining 50% is held in a reserve account. If Adjusted Quarterly Pre-Tax Profit is negative (reflecting a quarterly pre-tax loss) during any fiscal quarter in such fiscal year, the reserve accounts are reduced by an amount equal to such quarterly pre-tax loss multiplied by the same percentage amount used to determine Mr. Hennessy’s and Ms. Nilsen’s Quarterly Bonuses, respectively. If there is a positive balance in the reserve accounts at the end of the fiscal year, the amount in each reserve account is paid to Mr. Hennessy and Ms. Nilsen, respectively, within 75 days. If there is a negative balance in the reserve accounts at the end of the fiscal year, the negative reserve amounts are canceled and are not carried forward into the next fiscal year. More information regarding Mr. Hennessy’s and Ms. Nilsen’s employment agreements are described below under “Potential Payments upon Termination or Change of Control.”

The cash bonus amounts for Mr. Steadman and Ms. Fahy are approved by the compensation committee and paid out of a general bonus pool for all employees other than Mr. Hennessy and Ms. Nilsen. The total bonus pool generally is set as a percentage of pre-tax profits, but the executive officers have discretion to adjust the bonus pool up or down based on business circumstances. Our executive officers determine the percentage amount to be accrued in the bonus pool each year and review that percentage amount quarterly based on the current performance of the company. Bonuses paid out of the bonus pool are discretionary, but are based in part on individual performance. Each year, our executive officers set company‑wide objectives that are then presented to the board. They also set individual performance objectives for each employee that are based on customer focus, teamwork, ethics, work product and quality, and attitude. For fiscal year 2023, company‑wide objectives included effectively managing cash and equity, maintaining profitability, pursuing strategic business opportunities, building banking relationships, improving and expanding our distribution, marketing, public relations, and sales programs, strengthening our networking and business relationships, effectively managing our relationships with our sub-advisors and satellite offices, and maintaining our compliance program. Because the bonus accrual is based primarily on a percentage of pre-tax profits, bonuses automatically are aligned with the company’s performance.

Equity Awards. We believe that the use of equity awards helps us to maintain a strong association between the compensation of our executive officers and the long‑term interests of our shareholders. Furthermore, we believe that restricted stock units are the most effective equity compensation tool for a company of our size because restricted stock units provide the same type of equity-based value to executive officers as stock options, but with less dilution to earnings per share for an equivalent grant date fair value. All of our restricted stock unit awards vest over four-year periods, which we believe provide added incentive to our executive officers to focus on long‑term performance and profitability and encourage executive retention. Following its annual performance review of our executive officers, the compensation committee determines the amount of restricted stock units, if any, to award to our executive officers and sets the aggregate amount of restricted stock units, if any, to be awarded to employees on a subjective basis based on our budget for future years and the number of shares available for issuance under the company’s omnibus incentive plan.

Company 401(k) Contributions. We use 401(k) contributions as a means of compensating and retaining our executive officers while also instilling in them the idea that retirement planning is essential. The company 401(k) contribution is optional from year to year and is awarded to our executive officers on the same basis that it is awarded to all employees. It is not based on performance or goal achievement. The percentage level of the contribution is subjective and is determined by our executive officers annually for all employees. The compensation committee approves the percentage level of contribution with respect to our executive officers.

Severance or Change of Control Agreements. Mr. Hennessy’s and Ms. Nilsen’s employment agreements provide for certain payments upon the occurrence of specified events, including (i) if Mr. Hennessy’s or Ms. Nilsen’s employment is terminated, respectively, or (ii) if an acquiror of all or substantially all of the company’s assets does not assume Mr. Hennessy’s or Ms. Nilsen’s employment agreement, respectively. We believe that the rights to these payments provide job security for Mr. Hennessy and Ms. Nilsen and allow them to focus on the performance of our company.

We have also entered into bonus agreements with Ms. Nilsen and Mr. Steadman that provide for payments in the event of a change of control with or without termination. The change of control payments are intended to allow Ms. Nilsen and Mr. Steadman to remain focused on their performance, our best interests, and the best interests of our shareholders if a change of control is anticipated or occurs, as well as to ensure a smooth transition in the event of a change of control. Upon a change of control, Ms. Nilsen would not receive a bonus pursuant to both her employment agreement and bonus agreement upon a change of control; instead, she would receive the higher of the two payments.

In addition, the restricted stock unit award agreements between the company and each executive officer provide that all restricted stock units held by an executive officer immediately vest in full (i) if the executive officer’s employment terminates as a result of death, disability, or retirement at a time when the company would not be able to terminate the executive officer for cause or (ii) upon a change of control of the company.

More information regarding these agreements is included below under “Potential Payments upon Termination or Change of Control.”

Nonqualified Deferred Compensation Benefits. We do not offer a nonqualified deferred compensation plan to any of our employees.

Pension Benefits. We do not sponsor any pension plans.

Other Compensation. Benefits and perquisites provided to our executive officers are generally the same as those offered to all employees, except that we pay for a car allowance, premiums on life insurance, and premiums on disability insurance for Neil J. Hennessy pursuant to the terms of his employment agreement. We also pay for fitness club memberships for Ms. Nilsen and Ms. Fahy. Finally, we make charitable contributions on behalf of each of our executive officers and cover expenses related to required travel by their spouses, as applicable.

Other Policies. In 2023, we adopted a compensation recovery policy to comply with recently adopted SEC rules and Nasdaq listing standards. Under the policy, if we are required to prepare an accounting restatement due to material noncompliance with any financial reporting requirement, then, unless an exception applies, we will seek to recover the excess of the amount of incentive-based compensation any executive officer received during the preceding three fiscal years over the amount the executive officer would have received based on the restated numbers, determined on a pre-tax basis.

Tax Treatment. Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), generally limits our income tax deduction for compensation paid in any taxable year to our executive officers that exceeds $1,000,000. The compensation committee considers the impact of Section 162(m) when determining base salary, cash bonuses, equity awards, and other compensation for our executive officers, but tax deductibility is only one of several factors considered by the compensation committee in the design and implementation of our compensation program. Therefore, the compensation committee may approve compensation that exceeds $1,000,000 to ensure competitive compensation levels and structures for our executive officers.

EXECUTIVE COMPENSATION

Summary Compensation Table for Fiscal Years 2023 and 2022 (1)

|

Name and Principal Position

|

|

Fiscal

Year

|

|

Salary

($)

|

|

|

Stock

Awards(2)

($)

|

|

|

Non-Equity

Incentive Plan

Compensation

($)

|

|

|

All Other

Compensation(4)

($)

|

|

|

Total

($)

|

|

|

Neil J. Hennessy

|

|

2023

|

|

|

350,000 |

|

|

|

133,763 |

|

|

|

683,683 |

(3) |

|

|

72,403 |

|

|

|

1,239,849 |

|

|

CEO

|

|

2022

|

|

|

350,000 |

|

|

|

141,750 |

|

|

|

790,887 |

|

|

|

86,990 |

|

|

|

1,369,627 |

|

|

Teresa M. Nilsen

|

|

2023

|

|

|

325,000 |

|

|

|

133,763 |

|

|

|

368,138 |

(3) |

|

|

25,402 |

|

|

|

852,303 |

|

|

President and COO

|

|

2022

|

|

|

325,000 |

|

|

|

141,750 |

|

|

|

425,862 |

|

|

|

26,628 |

|

|

|

919,240 |

|

|

Kathryn R. Fahy

|

|

2023

|

|

|

250,000 |

|

|

|

84,875 |

|

|

|

200,000 |

|

|

|

17,160 |

|

|

|

552,035 |

|

|

CFO and Senior Vice President

|

|

2022

|

|

|

250,000 |

|

|

|

90,000 |

|

|

|

170,000 |

|

|

|

18,547 |

|

|

|

528,547 |

|

|

Daniel B. Steadman

|

|

2023

|

|

|

250,000 |

|

|

|

63,826 |

|

|

|

25,000 |

|

|

|

15,928 |

|

|

|

354,754 |

|

|

Executive Vice President

|

|

2022

|

|

|

250,000 |

|

|

|

67,500 |

|

|

|

100,000 |

|

|

|

18,831 |

|

|

|

436,331 |

|

|

(1)

|

As a smaller reporting company for purposes of the SEC’s disclosure rules, we are subject to scaled disclosure requirements under which reduced disclosure of executive compensation is permitted. We include only two fiscal years of compensation information in the Summary Compensation Table for our named executive officers, rather than three, pursuant to such scaled disclosure rules.

|

|

(2)

|

The amounts in this column include the aggregate grant date fair value, computed in accordance with FASB ASC Topic 718 – Stock Compensation. Stock awards are grants of restricted stock units with no exercise price. The units vest at a rate of 25% per year on the first four anniversaries of the grant date. Restricted stock units do not earn dividends or dividend equivalents. The value of restricted stock units for a particular fiscal year is calculated as the number of units granted during such fiscal year times the fair market value of our common stock on the grant date. The fair market value of our common stock was $6.79 and $9.00 on the grant date for fiscal year 2023 (September 18, 2023) and the grant date for fiscal year 2022 (September 18, 2022), respectively.

|

|

(3)

|

For fiscal year 2023, Mr. Hennessy and Ms. Nilsen each received an incentive-based bonus in the amount of 6.5% and 3.5%, respectively, of our Adjusted Quarterly Pre‑Tax Profit. The Adjusted Quarterly Pre-Tax Profit for fiscal year 2023 was calculated as income before tax of $6,600,650 plus bonuses of $2,639,821 (Mr. Hennessy’s and Ms. Nilsen’s bonus accruals and the bonus accrual for other employees), payroll tax accruals of $39,677, depreciation and amortization expense of 229,862 and compensation expense related to restricted stock units of $1,008,203, for a total pre-tax profit of $10,518,212. A discussion of the terms of Mr. Hennessy’s and Ms. Nilsen’s employment agreements begins on page 17.

|

|

(4)

|

All other compensation for fiscal year 2023 for Mr. Hennessy includes premiums on life insurance ($52,475), a charitable contribution made on his behalf, miscellaneous expenses related to required travel by his spouse, and a profit‑sharing contribution to his 401(k) plan. All other compensation for fiscal year 2023 for each of Ms. Nilsen, Ms. Fahy, and Mr. Steadman includes a fitness club membership (for each of Ms. Nilsen and Ms. Fahy only), a charitable contribution made on his or her behalf, miscellaneous expenses related to required travel by his or her spouse, as applicable, and a profit‑sharing contribution to his or her 401(k) plan.

|

Outstanding Equity Awards at Fiscal Year End 2023

| |

|

|

|

Stock Awards (1)

|

|

|

Name

|

|

Grant Date

|

|

Number of Shares

or Units of Stock

That Have Not

Vested

|

|

|

Market Value of

Shares or Units of

Stock That Have

Not Vested

($)

|

|

|

Neil J. Hennessy

|

|

9/18/2020

|

|

|

3,937.5 |

|

|

|

26,224 |

|

| |

|

9/18/2021

|

|

|

7,875.0 |

|

|

|

52,448 |

|

| |

|

9/18/2022

|

|

|

11,812.5 |

|

|

|

78,671 |

|

| |

|

9/18/2023

|

|

|

19,700.0 |

|

|

|

131,202 |

|

|

Teresa M. Nilsen

|

|

9/18/2020

|

|

|

3,937.5 |

|

|

|

26,224 |

|

| |

|

9/18/2021

|

|

|

7,875.0 |

|

|

|

52,448 |

|

| |

|

9/18/2022

|

|

|

11,812.5 |

|

|

|

78,671 |

|

| |

|

9/18/2023

|

|

|

19,700.0 |

|

|

|

131,202 |

|

|

Kathryn R. Fahy

|

|

9/18/2020

|

|

|

2,500.0 |

|

|

|

16,650 |

|

| |

|

9/18/2021

|

|

|

5,000.0 |

|

|

|

33,300 |

|

| |

|

9/18/2022

|

|

|

7,500.0 |

|

|

|

49,950 |

|

| |

|

9/18/2023

|

|

|

12,500.0 |

|

|

|

83,250 |

|

|

Daniel B. Steadman

|

|

9/18/2020

|

|

|

1,875.0 |

|

|

|

12,488 |

|

| |

|

9/18/2021

|

|

|

3,750.0 |

|

|

|

24,975 |

|

| |

|

9/18/2022

|

|

|

5,625.0 |

|

|

|

37,463 |

|

| |

|

9/18/2023

|

|

|

9,400.0 |

|

|

|

62,604 |

|

|

(1)

|

Stock awards are grants of restricted stock units with no exercise price. The units vest at a rate of 25% per year on the first four anniversaries of the grant date. Restricted stock units do not earn dividends or dividend equivalents. The market value of restricted stock units that have not vested is calculated as the number of unvested units times the fair market value of $6.66 per share on September 30, 2023. The actual value realized by the executive officer will depend on the market value of our common stock on the date the awards vest.

|

Potential Payments upon Termination or Change of Control

Under the terms of the restricted stock unit award agreements between the company and each executive officer, the employment agreements with Mr. Hennessy and Ms. Nilsen, and the bonus agreements with Ms. Nilsen and Mr. Steadman, our executive officers are entitled to certain compensation in the event of a termination of employment or a change of control of the company. The material terms of each such agreement are discussed below.

Neil J. Hennessy

Employment Agreement

We have had an employment agreement with Mr. Hennessy since the time of our initial public offering, and such employment agreement has been amended and amended and restated several times. The employment agreement provides for automatic one‑year renewals on each January 26 unless either party gives written notice to the other at least 60 days prior to the expiration of the then‑current term.

Under the terms of his employment agreement, Mr. Hennessy is entitled to (1) an annual base salary of $350,000, which amount may be increased in the board’s sole discretion at the start of each calendar year, (2) Quarterly Bonuses of 6.5% of Adjusted Quarterly Pre-Tax Profit, and (3) participate in our benefit plans. In the event that (A) Mr. Hennessy’s employment is terminated by the company without cause or (B) Mr. Hennessy terminates his employment with the company for good reason, Mr. Hennessy is entitled to receive severance payable in 24 equal monthly installments (except to the extent payment is required to be delayed pursuant to Section 409A of the Code) equal to the sum of (i) (x) one year’s full base salary and an average annual bonus for the three most recent fiscal years prior to the termination of employment multiplied by (y) two and (ii) a pro‑rated Quarterly Bonus for the quarter in which the termination occurs. In addition, under the foregoing circumstances, Mr. Hennessy is also entitled to receive payment of any previously earned and deferred Quarterly Bonus in the reserve account following the end of the fiscal year in which his employment terminates. In the event Mr. Hennessy is terminated for cause or terminates his employment with the company without good reason, no severance is payable.

If the employment agreement terminates as a result of death or disability, Mr. Hennessy is entitled to all bonuses earned or accrued as of the date of his termination. Furthermore, in the case of disability, Mr. Hennessy is also entitled to continue receiving his base salary and benefits for three months or until the date he begins receiving benefits under a disability plan or policy, whichever is soonest.

In the event of a sale, transfer, or other disposition of all or substantially all of our assets or business, whether by merger, consolidation, or otherwise, we may assign the employment agreement and its rights, provided that the successor assumes all of our obligations under the employment agreement.

If any payment or benefit under the employment agreement and any other agreement, plan, or arrangement would constitute an excess parachute payment under Section 280G of the Code, then Mr. Hennessy would receive either the full amount of such payments and benefits or a lesser amount such that no portion of the payments and benefits would be subject to the excise tax, whichever would result in a greater after‑tax benefit to Mr. Hennessy.

The employment agreement defines the terms listed below as follows:

| |

●

|

Cause exists if Mr. Hennessy:

|

| |

●

|

is convicted of, or enters a plea of nolo contendere to, a felony (other than a traffic‑related offense) under any state, federal, or local law or any felony involving the company, where conviction includes any final disposition of the charge that does not result in the charges being completely dismissed or Mr. Hennessy’s being completely acquitted;

|

| |

●

|

materially breaches (1) the employment agreement or (2) the company’s policies and procedures, which breach is not cured, if capable of being cured, after written notice within 30 days of the date notice of such breach is received by Mr. Hennessy; or

|

| |

●

|

engages in willful or gross misconduct or willful or gross negligence in performing his duties, or fraud, misappropriation, or embezzlement.

|

| |

●

|

the assignment to Mr. Hennessy of duties materially inconsistent with his position, authority, duties, or responsibilities as of the date of the employment agreement; or

|

| |

●

|

any action or omission that results in a material diminution of the position, authority, duties, or responsibilities of Mr. Hennessy as of the date of the employment agreement;

|

| |

●

|

a material reduction in Mr. Hennessy’s annual base salary (other than a reduction that applies generally to the Company’s senior management);

|

| |

●

|

the relocation, without Mr. Hennessy’s prior written consent, of his principal place of employment to a location more than 50 miles away (measured in the shortest driving distance) from his principal place of employment on the date of the employment agreement; or

|

| |

●

|

the failure by the Company to have an acquirer of all or substantially all of the Company’s assets assume Mr. Hennessy’s employment agreement;

|