Amended Current Report Filing (8-k/a)

25 5월 2023 - 6:16AM

Edgar (US Regulatory)

0001857855

true

--12-31

0001857855

2023-05-08

2023-05-08

0001857855

FNVT:UnitsEachConsistingOfOneClassOrdinaryShareAndThreequartersOfOneRedeemableWarrantMember

2023-05-08

2023-05-08

0001857855

FNVT:ClassOrdinarySharesParValue0.0001PerShareMember

2023-05-08

2023-05-08

0001857855

FNVT:RedeemableWarrantsEachWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2023-05-08

2023-05-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

Amendment

No. 1

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d)

of

The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 8, 2023

FINNOVATE

ACQUISITION CORP.

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

001-41012 |

|

N/A |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

The

White House,

20

Genesis Close, George Town

Grand

Cayman, Cayman Islands |

|

KY1

1208 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

++86

131-2230-7009

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencements

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units, each consisting of

one Class A ordinary share and three-quarters of one redeemable warrant |

|

FNVTU |

|

The Nasdaq Stock Market

LLC |

| |

|

|

|

|

| Class A ordinary shares,

par value $0.0001 per share |

|

FNVT |

|

The Nasdaq Stock Market

LLC |

| |

|

|

|

|

| Redeemable warrants, each

warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

FNVTW |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Explanatory

Note

On

May 12, 2023, Finnovate Acquisition Corp. filed a Current Report on Form 8-K (the “Original Form 8-K”) with the

Securities and Exchange Commission. This amendment to Form 8-K supplements the Original Form 8-K to include disclosure that

approximately $132.6 million was removed from the Trust Account to pay holders that redeemed their shares in connection with the

Extension. Except as described above, all other information in the Original Form 8-K remains unchanged.

Item

2.01 Completion of Acquisition or Disposition of Assets.

As

previously announced in the Current Report on Form 8-K filed by Finnovate Acquisition Corp. (the “Company”) with the Securities

and Exchange Commission on May 3, 2023, on April 27, 2023, the Company entered into an agreement (the “Investment Agreement”)

with Finnovate Sponsor LP (the “Sponsor”) and Sunorange Limited (the “Investor”), pursuant to which Investor

and its designees shall acquire partnership interests in the Sponsor and Class B ordinary shares directly held by certain Company directors,

which combined interests will entitle Investor to receive, in the aggregate, 3,557,813 Class B ordinary shares and 6,160,000 private

placement warrants (collectively, the “Insider Securities”), and the Company shall introduce a change in management and the

board as follows: (i) Calvin Kung shall replace David Gershon as Chairman of the Board of Directors (the “Board”) and Chief

Executive Officer and Wang (Tommy) Chiu Wong shall replace Ron Golan as Chief Financial Officer and director of the Board, effective

upon closing of the Investment (as defined herein); (ii) Jonathan Ophir and Uri Chaitchik shall tender their resignations as Chief Investment

Officer and Senior Consultant, respectively, effective upon closing of the Investment; and (iii) Mitch Garber, Gustavo Schwed and Nadav

Zohar shall tender their resignations as directors, to be effective upon expiration of all applicable waiting periods under Section 14(f)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 14f-1 thereunder (such period of time being

referred to herein as the “Waiting Period”), and whose vacancies shall be filled by individuals to be designated by the Investor

and effective upon expiration of the Waiting Period (such new officers and directors collectively referred to herein as the “New

Management”). Investor’s acquisition of interests in the Insider Securities, the change to New Management, and other transactions

contemplated by the Investment Agreement are hereinafter referred to as the “Investment.”

On

May 8, 2023, the Company completed the closing of the Investment (the “Closing”) after the Company’s shareholders approved

of certain proposals discussed below, and after certain closing conditions were met, including but not limited to: (i) a minimum of $30

million remaining in the Company’s trust account (the “Trust Account”) after accounting for all redemptions in connection

with the Extension Meeting; (ii) the Company obtaining or extending a D&O insurance policy on terms satisfactory to the parties,

(iii) the conversion of Class B ordinary shares into Class A ordinary shares as needed to retain shareholders and meet continued listing

requirements of Nasdaq in the event that the Articles Extension Proposal is approved; (iv) the amendment of the Sponsor’s existing

limited partnership agreement; (v) the transfer of 61,875 Class B ordinary shares from certain Company directors to the Investor or its

designees; and (vi) the cancellation of an outstanding $550,000 loan from the Sponsor and the reduction of certain advisory fees to be

due upon the closing of an initial business combination.

In

connection with the Closing, on May 8, 2023, the Investor caused $300,000 to be deposited into the Trust Account to support the first

three months of the Articles Extension from May 9, 2023 through August 8, 2023. The Investor has agreed to deposit into the Trust Account

an additional $100,000 for each successive month, or portion thereof, that is needed by the Company to complete an initial business combination

until May 8, 2024.

Item

3.02 Unregistered Sales of Equity Securities.

On

May 8, 2023, the Company issued an aggregate of 4,237,499 (the “Sponsor Shares”) of the Company’s Class A ordinary

shares, par value $0.0001 per share (“Class A Ordinary Shares”) to Finnovate Sponsor, LP, the sponsor of the Company and

the holder of the Company’s Class B ordinary shares (the “Sponsor”), par value $0.0001 per share (“Class B Ordinary

Shares”) upon the conversion of an equal number of shares of Class B Ordinary Shares (the “Sponsor Conversion”).

On

May 8, 2023, the Company issued an aggregate of 75,000 Class A Ordinary Shares (together with the Sponsor Shares, the “Converted

Class A Ordinary Shares”) to Mitch Garber, Nadav Zohar and Gustavo Schwed (collectively, the “Directors”) and the holders

of the Company’s 75,000 Class B Ordinary Shares upon the conversion of an equal number of shares of Class B Ordinary Shares (together

with the Sponsor Conversion, the “Conversion”). On the same day, in connection with the closing of the Investment, the Converted

Class A Ordinary Shares held by the Directors were transferred to designees of the Investor.

The

Converted Class A Ordinary Shares issued in connection with the Conversion are subject to the same restrictions as applied to the Class

B Ordinary Shares before the Conversion, including, among other things, certain transfer restrictions, waiver of redemption rights and

the obligation to vote in favor of an initial business combination as described in the prospectus for our initial public offering. Following

the Conversion, there are 9,085,831 Class A Ordinary Shares issued and outstanding and one Class B Ordinary Shares issued and outstanding.

As a result of the Conversion, the Sponsor and certain designees of the Investor hold, in the aggregate, approximately 47.4% of the Company’s

Class A Ordinary Shares that are outstanding.

The

issuance of the Converted Class A Ordinary Shares upon the Conversion has not been registered under the Securities Act of 1933, as amended,

in reliance on the exemption from registration provided by Section 3(a)(9) thereof.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Effective

upon the Closing, Calvin Kung was appointed Chief Executive Officer of the Company and Chairman of the Board.

Effective

upon the Closing, Wang (Tommy) Chiu Wong was appointed Chief Financial Officer of the Company and as a director of the Board.

Calvin

Kung, 38, recently served as a senior director at GDS Holdings Limited, a developer and operator of high-performance data centers

in mainland China and Hong Kong from June 2020 to March 2023. During his tenure at GDS, Mr. Kung coordinated its secondary listing on

the Hong Kong Stock Exchange, and the release of its sustainability strategy and inaugural ESG report. He assisted with other projects

at GDS across operations, finance, legal and investor relations. From February 2017 to June 2020, Mr. Kung was director at RADII, a media

and entertainment platform. Prior to joining RADII, Mr. Kung worked as a corporate attorney in Beijing and New York with a focus on capital

markets. He began his career in credit research at Goldman Sachs & Co. in New York. Mr. Kung received a bachelor’s degree from

Duke University and Juris Doctor from Northwestern University. We believe he is well qualified to serve on our Board due to his extensive

industry, investment research, financial market and related experience.

Wang

(Tommy) Chiu Wong, 49, is a seasoned finance and investment professional with more than 20 years of experience. Since November 2012,

Mr. Wong has worked at Yitian Group in various roles, and most recently as a vice president with responsibility for urban renewal projects.

During his tenure, Mr. Wong led negotiations with numerous stakeholders and overseen various managerial finance and property management

functions. From August 2004 to October 2012, he worked at Safe Chemical, a Hong Kong-based chemicals company, as general manager. Mr.

Wong was also a business development manager at iiLcorp Limited, a communications firm from January 2003 to August 2004. Mr. Wong received

his Bachelor of Science degree from the Chinese University of Hong Kong and was a visiting student at the University California, Los

Angeles. He received a Master of Public Affairs from Indiana University with a concentration in Information Systems and Public Finance.

We believe he is well qualified to serve as our Chief Financial Officer due to his extensive managerial finance related experience.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The

disclosure contained in Item 5.07 of this Current Report on Form 8-K is incorporated by reference in this Item 5.03.

Item

5.07 Submission of Matters to a Vote of Security Holders.

On

May 8, 2023, the Company held an extraordinary general meeting of shareholders (the “Extension Meeting”) to amend

the Company’s amended and restated memorandum and articles of association (the “Charter Amendment”) to: (i)

extend the date by which the Company has to consummate a Business Combination from May 8, 2023 to May 8, 2024 (the “Articles

Extension Proposal”) and (ii) amend the Company’s amended and restated memorandum and articles of association entitle

holders of Class B Ordinary Shares to convert such shares into Class A Ordinary Shares prior to the closing of a business combination

at the election of the holder (the “Conversion Amendment Proposal”). The proposal to adjourn the Extension Meeting

to a later date was not presented because there were enough votes to approve each of the foregoing proposals.

There

were 21,712,500 ordinary shares of the Company issued and outstanding on April 14, 2023, the record date for the Extension Meeting. At

the Extension Meeting, there were 14,402,264 ordinary shares present in person or by proxy, representing approximately 66.33% of the

total ordinary shares outstanding as of the record date, which constituted a quorum.

The

final voting results for the Articles Extension Proposal were as follows:

| For |

|

Against |

|

Abstain |

| 14,780,469 |

|

301,669 |

|

63,205 |

The

final voting results for the Conversion Amendment Proposal were as follows:

| For |

|

Against |

|

Abstentions |

| 15,065,518 |

|

16,620 |

|

63,205 |

Shareholders

holding 12,626,668 Class A Ordinary Shares exercised their right to redeem such shares for a pro rata portion of the funds in the Company’s

Trust Account. As a result, approximately $132.6 million (approximately $10.50 per share) was removed from the Trust Account to pay such

holders.

A

form of the Charter Amendment, effective as of May 8, 2023, is attached as Exhibit 3.1 hereto and is incorporated by reference. The Company

will file the Charter Amendment with the Cayman Islands Registrar of Companies.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits. The following exhibits are filed with this Current Report on Form 8-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Finnovate Acquisition Corp. |

| |

|

|

| Date:

May 24, 2023 |

By: |

/s/ Calvin

Kung |

| |

Name: |

Calvin Kung |

| |

Title: |

Chairman and Chief Executive Officer |

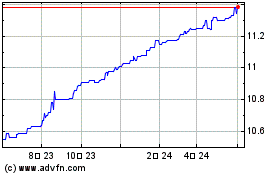

Finnovate Acquisition (NASDAQ:FNVT)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

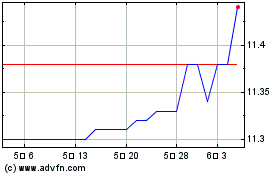

Finnovate Acquisition (NASDAQ:FNVT)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024