Shares of LDK Solar and Energy Conversion Devices Look to Rebound as Solar Demand Stays Strong

26 1월 2012 - 10:20PM

Marketwired

Solar stocks have been on an impressive run with the Guggenheim

Solar ETF, which consists of approximately 25 stocks selected based

on the relative importance of solar power within the Company's

business model, up roughly 19 percent in the month of January.

Aaron Chew, a Maxim Group LLC analyst in New York recently told

Bloomberg that China's plan to double capacity this year is helping

to drive demand for solar panels, and boost shares throughout the

industry. Five Star Equities examines the outlook for companies in

the solar industry and provides equity research on LDK Solar Co.

Inc. (NYSE: LDK) and Energy Conversion Devices Inc. (NASDAQ: ENER).

Access to the full company reports can be found at:

www.fivestarequities.com/LDK

www.fivestarequities.com/ENER

Despite weak stock performances by several alternative energy

firms, 2011 was a strong year for the renewable energy industry.

Investments in renewable energy rose five percent from 2010 to $260

billion. According to data from to Bloomberg New Energy Finance,

solar led all alternative energy investments, and for the first

time since 2008, the US took back its leading position over China.

Investments in solar surged 36 percent to $136.6 billion last

year.

Five Star Equities releases regular market updates on the solar

industry so investors can stay ahead of the crowd and make the best

investment decisions to maximize their returns. Take a few minutes

to register with us free at www.fivestarequities.com and get

exclusive access to our numerous stock reports and industry

newsletters.

While solar stocks kicked off the year on the upswing, recent

announcements out of Germany took some wind out of the industry's

sails. Last week Germany, the largest market for panels, said it

will make quicker cuts to subsidized rates and phase out support

for the industry by 2017. As reported in Bloomberg, German

Environment Minister Norbert Roettgen said last week that he

planned to reduce feed-in tariffs providing above-market prices for

solar power every month instead of twice a year as he does now. He

said he's working to curb an "unacceptable" surge in installations

last year.

Meanwhile, Economy Minister Philipp Roesler said spiraling costs

linked to solar subsidies are a threat to the economy. Roettgen

indicated concern that the funds are benefiting Chinese companies.

"The increase in installations in the past few years has gone far

beyond what we had targeted in our legislation," Roettgen said.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.fivestarequities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

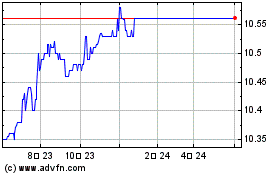

Accretion Acquisition (NASDAQ:ENER)

과거 데이터 주식 차트

부터 4월(4) 2024 으로 5월(5) 2024

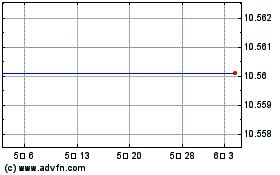

Accretion Acquisition (NASDAQ:ENER)

과거 데이터 주식 차트

부터 5월(5) 2023 으로 5월(5) 2024