- Amended tender offer statement by Issuer (SC TO-I/A)

13 11월 2009 - 1:07AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

AMENDMENT

NO. 4 to

SCHEDULE

TO-I

(Rule

13e-4)

TENDER

OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF

THE SECURITIES EXCHANGE ACT OF 1934

ENERGY

CONVERSION DEVICES, INC.

(Name of

Subject Company (Issuer))

ENERGY

CONVERSION DEVICES, INC.

(Names of

Filing Person (Offeror))

Restricted

Stock Units

Convertible

into Common Stock, $0.01 Par Value per Share

(Title of

Class of Securities)

292659109

(CUSIP

Number of Class of Securities)

(Underlying

Class)

Jay

Knoll

Energy

Conversion Devices, Inc.

2956

Waterview Drive

Rochester

Hills, MI 48309-3484

(248)

293-0440

Copy

to:

W.

Andrew Jack

Covington

& Burling LLP

1201

Pennsylvania Avenue

Washington,

DC 20004-2401

(202)

662-5232

(Name,

address and telephone number of person authorized to

receive

notices and communications on behalf of filing persons)

CALCULATION

OF FILING FEE

|

Transaction Valuation*

|

|

Amount of Filing Fee**

|

|

|

$

|

1,181,483.16

|

|

$

|

65.93

|

|

*

Calculated solely for purposes of determining the filing fee. This amount

assumes that RSUs convertible into 97,724 shares of common stock of Energy

Conversion Devices, Inc. at $12.09 per share, the average of the high

and low sales prices for October 13, 2009, as reported on the NASDAQ Global

Select Market, will be issued in exchange for currently outstanding RSUs

pursuant to this offer.

** Previously

paid. The amount of the filing fee, calculated in accordance with

Rule 0-11(b)(2) of the Securities Exchange Act of 1934, as amended, equals

$55.80 per million dollars of the value of the transaction.

|

o

|

Check

the box if any part of the fee is offset as provided by Rule 0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid.

Identify the previous filing by registration statement number, or the Form

or Schedule and the date of its

filing.

|

Amount

Previously Paid:

Form or

Registration No.:

Filing

Party:

Date

Filed:

|

o

|

Check

the box if the filing relates solely to preliminary communications made

before the commencement of a tender

offer.

|

Check the

appropriate boxes below to designate any transactions to which the statement

relates:

|

o

|

third-party

tender offer subject to Rule 14d-1.

|

|

x

|

issuer

tender-offer subject to Rule 13e-4.

|

|

o

|

going

private transaction subject to Rule

13e-3.

|

|

o

|

amendment

to Schedule 13D under Rule 13d-2.

|

Check the

following box if the filing is a final amendment reporting the results of the

tender offer:

o

SCHEDULE

TO

This

Amendment No. 4 (this “Amendment No. 4”) amends and supplements the Tender Offer

Statement on Schedule TO (“Schedule TO”) filed with the Securities and Exchange

Commission on October 14, 2009, relating to an offer by Energy Conversion

Devices, Inc. (the “Company”) to its employees, subject to specified conditions,

to exchange certain Restricted Stock Units subject to the achievement of

performance goals for fiscal 2012 (the “2012 RSUs") and granted to employees of

the Company under the 2006 Stock Incentive Plan (the "plan"), convertible into

shares of the Company's common stock, $0.01 par value (the "Common

Stock").

This

Amendment No. 4 is filed to report the final results of the tender offer,

which the Company disclosed in a press release dated November 11,

2009.

The

Schedule TO is amended by the information contained in this Amendment No.

4. Only those items amended are reported herein. Except as specifically provided

herein, this Amendment No. 4 does not modify any of the information previously

reported in the Schedule TO. The information in the Offer to Exchange and

the Letter of Transmittal is incorporated by reference herein.

|

Item

11.

|

|

Additional

Information.

|

Item 11

of the Schedule TO is hereby amended and supplemented by adding the

following:

On

November 11, 2009, the Company issued a press release announcing the final

results of the tender offer, which expired at 12:00 midnight, EST, on

November 10, 2009. A copy of the press release is filed as Exhibit

(a)(7) to this Schedule TO and is incorporated herein by reference.

ITEM

12. EXHIBITS

|

(a)(1)

|

Offer

to Exchange dated October 14, 2009.*

|

|

|

|

|

(a)(1)(i)

|

Supplement

to Offer to Exchange, dated November 4, 2009 *

|

|

|

|

|

(a)(2)

|

Form

of Election Concerning Exchange of Restricted Stock Units.

*

|

|

|

|

|

(a)(3)

|

Form

of Letter to Energy Conversion Devices, Inc. Restricted Stock Unit

Holders. *

|

|

|

|

|

(a)(4)

|

Form

of Letter to Tendering Restricted Stock Unit Holders. *

|

|

|

|

|

(a)(5)

|

Energy

Conversion Devices, Inc. Annual Report on Form 10-K for the year ended

June 30, 2009, filed with the Securities and Exchange Commission and

incorporated herein by reference. *

|

|

|

|

|

(a)(6)

|

Employee

Presentation Materials*

|

|

(a)(7)

|

Press

Release, dated November 11, 2009, filed herewith

|

|

|

|

|

(b)

|

Not

applicable. *

|

|

|

|

|

(d)

|

Energy

Conversion Devices, Inc. 2006 Stock Incentive Plan, as amended, filed as

Exhibit A to the Company’s Proxy Statement dated October 13, 2006 and

Amendment 1 to the 2006 Stock Incentive Plan, filed with the SEC on Form

10-Q for the quarter ended September 30, 2008 and incorporated herein by

reference. *

|

|

|

|

|

*

|

Previously

filed.

|

SIGNATURE

After due

inquiry and to the best of my knowledge and belief, I certify that the

information set forth in this statement is true, complete and

correct.

|

Date:

November 12, 2009

|

|

|

|

|

|

|

Energy

Conversion Devices, Inc.

|

|

|

|

|

|

By: /s/ Jay B.

Knoll

|

|

|

Jay

B. Knoll

|

|

|

Executive

Vice President, General Counsel

|

|

|

and

Chief Administrative

Officer

|

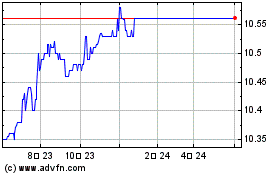

Accretion Acquisition (NASDAQ:ENER)

과거 데이터 주식 차트

부터 6월(6) 2024 으로 7월(7) 2024

Accretion Acquisition (NASDAQ:ENER)

과거 데이터 주식 차트

부터 7월(7) 2023 으로 7월(7) 2024