The information

contained in this preliminary prospectus supplement is not

complete and may be changed. This preliminary prospectus

supplement and the accompanying prospectus are not an offer to

sell these securities and are not soliciting an offer to buy

these securities in any state where the offer or sale is not

permitted.

|

CALCULATION

OF REGISTRATION FEE CHART

|

|

|

|

|

|

|

|

|

|

|

|

Amount to be

|

|

|

|

|

|

|

|

Registered/Maximum

|

|

|

|

|

|

|

|

Offering Price per

|

|

|

|

|

|

|

|

Unit/Maximum

|

|

|

|

Title of Each Class of

|

|

|

Aggregate Offering

|

|

|

Amount of

|

|

Securities to be Registered

|

|

|

Price

|

|

|

Registration Fee

|

|

Convertible Notes due 2013

|

|

|

$258,750,000

|

|

|

$10,168.88(1)

|

|

Common stock, par value $0.01 per share

|

|

|

(2)

|

|

|

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

The filing fee of $10,168.88 is calculated in accordance with

Rule 457(o) and Rule 457(r) of the Securities Act of

1933, as amended (the “Securities Act”) and relates to

the registration statement on

Form S-3

(File No.

333-131886)

filed by Energy Conversion Devices, Inc.

|

|

|

|

(2)

|

|

There are also being registered hereby an indeterminate number

of shares of common stock into which the notes may be converted.

Pursuant to Rule 457(i), no separate registration fee is payable

where securities and securities into which conversion is offered

are registered at the same time and no additional consideration

is payable upon conversion.

|

Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-131886

SUBJECT TO COMPLETION, DATED

JUNE 12, 2008

PRELIMINARY PROSPECTUS

SUPPLEMENT TO PROSPECTUS DATED FEBRUARY 15, 2006

Energy Conversion Devices,

Inc.

$225,000,000

% Convertible

Senior Notes due 2013

We are offering $225,000,000 aggregate principal amount of

our % Convertible Senior Notes

due 2013, or the “notes.” The notes will bear interest

at a rate of % per year. Interest

on the notes will be payable semi-annually in arrears on June 15

and December 15 of each year, beginning December 15, 2008. The

notes will mature on June 15, 2013.

Holders may convert their notes, at their option, under certain

circumstances described herein prior to the close of business on

the business day immediately preceding the maturity date. Upon

conversion, we will deliver cash and a number of shares of our

common stock determined as described in this prospectus

supplement. The conversion rate for the notes will

be shares of our

common stock per $1,000 principal amount of notes, equivalent to

a conversion price of approximately

$ per share of our common stock.

The conversion rate will be subject to adjustment in certain

events as described in this prospectus supplement, including

following certain corporate transactions.

If we undergo a fundamental change, as defined in this

prospectus supplement, holders may require us to purchase all or

a portion of their notes for cash at a price equal to 100% of

the principal amount of the notes to be purchased plus any

accrued and unpaid interest.

The notes will be senior unsecured obligations, will rank equal

in right of payment with any of our other existing and future

senior unsecured debt, and will rank senior to all of our debt

that is subordinated to the notes. The notes will be effectively

subordinated to any of our secured indebtedness to the extent of

the assets securing such indebtedness. The notes also will be

structurally subordinated to any existing and future

indebtedness and other liabilities and commitments (including

trade payables and lease obligations) of our subsidiaries.

For a more detailed description of the notes, see

“Description of the Notes” beginning on

page S-40.

Concurrently with this offering of notes, we are offering, by

means of a separate prospectus supplement and accompanying

prospectus, 4,708,500 shares of our common stock,

3,438,500 of which are being borrowed by an affiliate of

Credit Suisse Securities (USA) LLC, a managing underwriter in

this offering, and 1,270,000 of which are being

underwritten by the underwriters of this offering and offered to

the public at a price of $ per

share. We refer to the portion of the common stock offering for

which we will receive cash proceeds as the “underwritten

equity offering” and the shares sold in the underwritten

equity offering as the “underwritten shares.” We

estimate that the net proceeds from the sale of the underwritten

shares, after deducting estimated underwriting discounts and

commissions and estimated offering expenses payable by us, will

be approximately $ million,

assuming the underwriters’ over-allotment option in that

offering is not exercised. We refer to the borrowed shares

portion of the common stock offering as the “borrowed

shares.” We will not receive any proceeds from the

borrowing of the borrowed shares by the affiliate of Credit

Suisse Securities (USA) LLC, but we will receive from that

affiliate a nominal lending fee for the use of those shares. See

“Description of the Share Lending Agreement” and

“Underwriting.” This affiliate has agreed to use the

borrowed shares to facilitate the establishment by investors in

the notes, and certain other of our securities, of hedge

positions in such securities. Up

to of the borrowed

shares may be used to facilitate such transactions on a delayed

basis at any time prior to the termination of the agreement

relating to the borrowed shares.

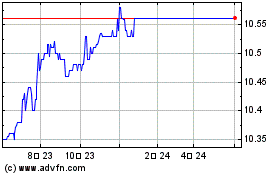

Our common stock is listed on the Nasdaq Global Select Market

under the symbol “ENER.” On June 11, 2008, the

last reported sale price of our common stock on the Nasdaq

Global Select Market was $64.24 per share.

We do not intend to apply for listing of the notes on any

securities exchange or for inclusion of the notes in any

automated quotation system.

Investing in the notes involves

risks. See “Risk Factors” on

page S-12

of this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underwriting

|

|

|

|

|

|

|

|

Discounts and

|

|

|

|

|

|

Price to

Public

(1)

|

|

Commissions

|

|

Proceeds to

ECD

(1)

|

|

Per note

|

|

|

100

|

%

|

|

|

|

%

|

|

|

|

%

|

|

Total

|

|

$

|

225,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Plus accrued interest, if any, from

June , 2008, if settlement occurs after that

date.

|

The underwriters have a

30-day

option to purchase a maximum of $33,750,000 additional principal

amount of the notes solely to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these

securities or determined if this prospectus supplement or the

related prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

Delivery of the notes will be made in book-entry form on or

about June , 2008.

|

|

|

|

CREDIT

SUISSE

|

UBS INVESTMENT BANK

|

JPMORGAN

|

|

|

|

DEUTSCHE

BANK SECURITIES

|

LAZARD CAPITAL MARKETS

|

June , 2008

|

Energy Conversion Devices, Inc.

®

Building-integrated and commercial rooftop photovoltaics

|

TABLE OF

CONTENTS

|

|

|

|

|

|

|

Prospectus Supplement

|

|

Page

|

|

|

|

|

|

|

S-ii

|

|

|

|

|

|

S-iii

|

|

|

|

|

|

S-1

|

|

|

|

|

|

S-12

|

|

|

|

|

|

S-32

|

|

|

|

|

|

S-33

|

|

|

|

|

|

S-34

|

|

|

|

|

|

S-35

|

|

|

|

|

|

S-36

|

|

|

|

|

|

S-40

|

|

|

|

|

|

S-63

|

|

|

|

|

|

S-66

|

|

|

|

|

|

S-68

|

|

|

|

|

|

S-69

|

|

|

|

|

|

S-74

|

|

|

|

|

|

S-78

|

|

|

|

|

|

S-79

|

|

|

|

|

|

S-79

|

|

|

|

|

|

S-79

|

|

|

|

|

|

|

|

|

Prospectus

|

|

Page

|

|

|

|

|

|

|

1

|

|

|

|

|

|

1

|

|

|

|

|

|

2

|

|

|

|

|

|

2

|

|

|

|

|

|

12

|

|

|

|

|

|

12

|

|

|

|

|

|

12

|

|

|

|

|

|

12

|

|

|

|

|

|

13

|

|

|

|

|

|

13

|

|

|

|

|

|

13

|

|

About

This Prospectus Supplement

This document is in two parts. The first part is this prospectus

supplement, which describes the specific terms of this offering,

risks related to an investment in the notes and a discussion of

risks our business faces. The second part, the accompanying

prospectus, gives more general information, some of which may

not apply to this offering. If any statement in this prospectus

supplement varies between this prospectus supplement and the

accompanying prospectus, you should rely only on the information

contained or incorporated by reference in this prospectus

supplement.

You should rely only on the information contained or

incorporated by reference in this prospectus supplement, the

accompanying prospectus and any free writing prospectus prepared

by or on behalf of us. We have not, and the underwriters have

not, authorized any other person to provide you with different

information. If anyone provides you with different or

inconsistent information, you should not rely on it. We are not,

and the underwriters are not, making an offer to sell these

securities in any jurisdiction where the offer or sale is not

permitted.

You should assume that the information appearing in this

prospectus supplement, the accompanying prospectus and the

documents incorporated by reference is accurate only as of the

respective dates of those documents in which the information is

contained. Our business, financial condition, results of

operations and prospects may have changed since any of those

respective dates. You should read this entire prospectus

supplement, as well as the accompanying prospectus and the

documents incorporated by reference that are described under

“Where You Can Find More Information” in this

prospectus supplement and the accompanying prospectus before

making your investment decision. Unless otherwise indicated

herein, the information in this prospectus supplement assumes no

exercise of the underwriters’ option to purchase additional

notes described herein.

In this prospectus supplement, we rely on and refer to

information regarding the market in which we operate and compete

and other related markets. We obtained this information from

various third-party sources, including industry publications,

surveys and forecasts that we believe to be reasonable. We also

make statements in this prospectus supplement regarding the

performance, characteristics or properties of our products.

Unless indicated otherwise, these statements are based on our

own studies, internal data and information obtained from our

customers.

S-ii

Cautionary

Note Regarding Forward-Looking Statements

This prospectus supplement includes “forward-looking

statements” that involve risks and uncertainties. These

forward-looking statements are made pursuant to safe harbor

provisions of the Private Securities Litigation Reform Act of

1995. Forward-looking statements include statements concerning

our plans, objectives, goals, strategies, future events, future

sales or performance, capital expenditures, financing needs,

plans or intentions relating to acquisitions, business trends

and other information that is not historical information. When

used in this prospectus, the words “estimates,”

“expects,” “anticipates,”

“projects,” “plans,” “intends,”

“believes,” “forecasts,”

“foresees,” “likely,” “may,”

“should,” “goal,” “target” and

variations of such words or similar expressions are intended to

identify forward-looking statements. All forward-looking

statements are based upon information available to us on the

date of this prospectus supplement.

These forward-looking statements are subject to risks,

uncertainties and other factors, many of which are outside of

our control, that could cause actual results to differ

materially from the results discussed in the forward-looking

statements, including, among other things, the matters discussed

in this prospectus supplement in the section captioned

“Risk Factors.” Factors you should consider that could

cause these differences are:

|

|

|

|

|

|

•

|

the worldwide demand for electricity and the market for

renewable energy, including solar energy;

|

|

|

|

|

•

|

the ability or inability of conventional fossil fuel-based

generation technologies to meet the worldwide demand for

electricity;

|

|

|

|

|

•

|

government subsidies and policies supporting renewable energy,

including solar energy;

|

|

|

|

|

•

|

our expenses, sources of sales and international sales and

operations;

|

|

|

|

|

•

|

future pricing of, and demand for, our solar laminates;

|

|

|

|

|

•

|

the performance, features and benefits of our solar laminates

and plans for the enhancement of solar laminates;

|

|

|

|

|

•

|

the supply and price of components and raw materials;

|

|

|

|

|

•

|

our ability to expand our manufacturing capacity in a timely and

cost-effective manner;

|

|

|

|

|

•

|

our ability to retain our current key executives, integrate new

key executives and attract and retain other skilled managerial,

engineering and sales marketing personnel;

|

|

|

|

|

•

|

the viability of our intellectual property and our continued

investment in research and development;

|

|

|

|

|

•

|

payments and other obligations resulting from the unfavorable

resolution of legal proceedings;

|

|

|

|

|

•

|

changes in, or the failure to comply with, government

regulations and environmental, health and safety requirements;

|

|

|

|

|

•

|

interest rate fluctuations and both our and our end-users’

ability to secure financing on commercially reasonable terms or

at all; and

|

|

|

|

|

•

|

general economic and business conditions, including those

influenced by international and geopolitical events such as the

war in Iraq and any future terrorist attacks.

|

There may be other factors that could cause our actual results

to differ materially from the results referred to in the

forward-looking statements. We undertake no obligation to

publicly update or revise forward-looking statements to reflect

events or circumstances after the date made or to reflect the

occurrence of unanticipated events, except as required by law.

S-iii

Prospectus

Supplement Summary

This summary highlights information contained elsewhere in

this prospectus supplement, the accompanying prospectus and the

documents incorporated by reference. This summary does not

contain all of the information that you may consider to be

important in deciding whether to invest in our notes. You should

read this entire prospectus supplement, the accompanying

prospectus and the documents incorporated by reference

carefully, including the “Risk Factors” section

beginning on

page S-12

of this prospectus supplement, as well as our consolidated

financial statements and the related notes incorporated by

reference.

Unless otherwise specified or unless the context requires

otherwise, all references in this prospectus supplement to

“ECD,” “we,” “us,” “our”

or similar references mean Energy Conversion Devices, Inc. and

its subsidiaries.

Our

Company

We design, manufacture and sell photovoltaic (“PV”)

products, commonly referred to as solar cells, solar modules or

solar laminates, that provide clean, renewable energy by

converting sunlight into electricity. Our solar laminates have

unique characteristics that differentiate them from conventional

crystalline solar modules, including physical flexibility, low

weight, high durability and ease of installation. These

characteristics make our products particularly suitable for

rooftop applications, which is our target market. We manufacture

our solar laminates using a proprietary process and technology

that we developed through nearly 30 years of research.

Demand for our solar laminates, which we market under the brand

name

UNI-SOLAR

®

,

currently exceeds our ability to manufacture these products, and

we believe this trend will continue for some time. To meet the

increasing demand for our products, we are actively expanding

our production capacity and have embarked on an expansion plan

to reach 1 GW of annual production capacity by 2012. Solar

laminate sales represent more than 90% of our revenues. We also

receive fees and royalties from licensees of our nickel metal

hydride (“NiMH”) battery technology and sell high

performance nickel hydroxide used in NiMH batteries.

We appointed a new President and Chief Executive Officer in

September of 2007, who is leading a new management team, all of

whom have been appointed since June 2006, including our Chief

Financial Officer, Vice President of Operations, Senior Vice

President and Chief Administration Officer, Vice President of

Strategic Marketing, Vice President of Systems Engineering and

Vice President of Global Sales. Over the past several months,

this new leadership team has implemented a series of strategic

initiatives designed to strengthen our competitive position and

improve our financial performance, including:

|

|

|

|

|

|

•

|

Focusing our efforts on expanding our solar

business.

We have made a strategic decision to

focus our business on the production and sale of our solar

laminates. We believe this concentration will enable us to

capitalize on global PV market growth opportunities and position

us for increased profitability.

|

|

|

|

|

•

|

Implementing best practices to improve ramp times, increase

production yields and lower costs.

We have

developed and implemented techniques to reduce our “ramp

time.” The phrase “ramp time” refers to the

amount of time it takes to bring a new production line to

“nameplate capacity,” which is the amount of annual

production of solar laminates measured in watts that a plant

initially is designed to produce. Shorter ramp times reduce our

costs and enable us to accelerate the availability of our

finished products for sale. We have also developed and

implemented improved manufacturing practices in our facilities

that are resulting in higher production yields and lower

production costs, thereby increasing our gross margins.

|

|

|

|

|

•

|

Restructuring our operations to reduce costs related to

non-solar related activities and streamlining our organization

and reporting structure.

In April 2007, we began

implementing a restructuring plan to reduce costs in our

non-manufacturing activities. This plan includes the elimination

of over 100 employees and other changes, which we expect to

result in approximately $23.0 million of annualized cost

savings (as implemented through June 30, 2008). We expect

to realize further savings primarily through facility

rationalization programs related to non-manufacturing

activities. In June 2007, we also realigned our organizational

structure into two segments and began a process of consolidating

support functions within our businesses. These actions have

streamlined our decision-making processes and reduced our costs.

|

S-1

|

|

|

|

|

|

•

|

Reviewing strategic alternatives with respect to our non-core

businesses.

In connection with concentrating our

efforts on our solar business, we are performing ongoing reviews

of our other business activities. These reviews are designed to

identify activities where we can realize greater value for our

stockholders through a variety of mechanisms, including

potential exits of these activities. For example, in May 2008,

we announced that we were engaged in discussions to sell our

ownership interest in Cobasys LLC (“Cobasys”), a joint

venture with Chevron Technology Ventures, LLC (“CTV”)

that manufactures hybrid vehicle batteries and battery systems.

|

Our

Market Opportunity

Solar power technology has been used to generate electricity in

space program applications for several decades and in commercial

applications over the last 30 years. Increasingly,

government incentive programs are accelerating the adoption of

solar power. According to Solarbuzz, a research and consulting

firm, the global PV market grew to an estimated 2,826 MW in

2007, as measured by total PV modules delivered to installation

sites during that year, representing a compound annual growth

rate of 47.4% since 2003. Solarbuzz estimates that PV industry

revenues were approximately $17.2 billion in 2007 and

projects under one of its forecast scenarios that the global PV

market and PV industry revenues will reach 9,917 MW and

$39.5 billion, respectively, in 2012.

Today, the cost per kilowatt hour for solar power is higher than

electricity delivered through the power grid. However, the cost

for electricity delivered through the power grid has been

increasing steadily while the cost of solar power has been

decreasing. Some industry and government publications have

indicated that the cost of solar power may become as economical

as electricity delivered through the power grid by 2015.

Thin-film technologies, such as our solar laminates, are being

developed as a means of substantially reducing the cost of PV

systems as they are cheaper to manufacture than traditional PV

systems due to their reduced material, energy, handling and

capital costs. Growth in thin-film demand is expected to be

driven by rising conversion efficiency and increased demand for

building-integrated photovoltaics (“BIPV”), such as

grid-connected roof-mounted PV systems. According to one of

Solarbuzz’s forecast scenarios, grid-connected roof-mounted

PV systems are expected to grow from approximately 56% of the

total PV market in 2007 to 66% of the market by 2012. Within the

overall roof-mounted market, many commercial buildings can be

powered by less than 5

watts/ft

2

.

We believe the installed solar capacity on commercial rooftops

could reach 5 GW by 2012.

Our

Competitive Strengths

We have several competitive strengths, including:

|

|

|

|

|

|

•

|

Our products are well-suited for rooftop applications and

possess several unique attributes.

Our PV

laminates possess several unique attributes that make them ideal

for both rooftop and building integrated applications, including:

|

|

|

|

|

|

|

•

|

Ability to be integrated with roofing materials and to

qualify for special BIPV incentives.

Unlike

conventional solar modules, our products are physically

flexible, do not require a metal frame and can be integrated

directly with roofing materials during production to create a

seamless appearance. France and Italy, which are among the most

significant markets for solar products, have recently instituted

higher incentives for BIPV than for ground mount installations.

These governments typically define BIPV products as those that

represent an essential component of the roofing materials

themselves. We believe our PV laminates are one of only a few

products available today that qualify as BIPV under this

definition.

|

|

|

|

|

•

|

Low weight.

Our PV laminates weigh less than

one pound per square foot. This compares with between two and

five pounds per square foot for conventional solar modules. The

relatively low weight of our products allows them to be used on

most rooftops without the need for reinforcement which can add

significant cost to the installation.

|

|

|

|

|

•

|

Superior resistance to wind lift.

Our PV

laminates have a low profile and are bonded to, or integrated

with, the roof as opposed to being mounted on a raised support

structure like many conventional solar modules. This gives our

products superior resistance to wind lift, which can loosen and

even dislodge conventional solar modules in storm prone areas.

|

S-2

|

|

|

|

|

|

•

|

No roof penetration.

Our PV laminates are

bonded to roofing materials during production or to existing

roof surfaces by their adhesive backing and do not require

penetrating the roof with bolts or other fasteners like many

conventional solar modules. We believe that end-users prefer

systems that do not result in roof penetrations as such

installations may lead to leaks, damages to the structural

integrity of the roof or invalidation of the roof

manufacturer’s warranty.

|

|

|

|

|

•

|

High durability and impact resistance.

Our PV

laminates are flexible and can be walked on or dropped with

minimal risk of damaging the product. Dropping a conventional

solar module, which generally is enclosed in glass, can often

destroy the entire product.

|

|

|

|

|

•

|

Ease of installation.

Our PV laminates can be

shipped in rolls directly to the installation site in addition

to being integrated with the roofing materials. Installers

remove a release paper from the back of our products as they

unfurl the roll on the roof. The release paper reveals an

adhesive backing that allows the product to be bonded directly

to the roof. We believe the installation process for our

products is significantly less time consuming than the

installation process for conventional glass-based solar modules,

which typically involves building a support structure and

mounting each module individually. This simplified installation

process results in cost savings to our customers.

|

|

|

|

|

|

|

•

|

Effective research and development activities supporting

innovation in our solar business

. Our research

and development group is a leader in the development of

thin-film solar technology and has been recognized for achieving

high efficiency solar cells using this technology. For example,

we developed the first commercial flexible PV product. We

continue to develop new innovative technologies to reduce

production cost, improve light-to-electricity conversion

efficiency, and identify new commercial applications for our

products.

|

|

|

|

|

•

|

Our products do not use polysilicon, which is currently in

short supply

. Conventional solar modules are made

from crystalline silicon wafers. These wafers are made from

polysilicon, which is also used to produce semiconductor chips.

Rising demand for solar modules has led to a significant

increase in the price of polysilicon. From December 2004 to the

second half of 2007, the average spot price of polysilicon

increased from $32 per kilogram to nearly $400 per kilogram and

several polysilicon manufacturers have reported that their

capacity is sold out for the next two to three years. Our

production process uses silane gas to deposit a thin film of

amorphous silicon on a sheet of stainless steel. Silane gas is

widely available and we have agreements in place with multiple

suppliers. We believe that our use of silane gas as opposed to

polysilicon allows us to control our material costs and deliver

our product more reliably than our competitors who manufacture

conventional solar modules based on crystalline silicon.

|

|

|

|

|

•

|

Our roll-to-roll manufacturing process and equipment are

proprietary.

Most conventional crystalline solar

modules are produced using well-known processes and widely

available equipment. We believe the availability of conventional

crystalline technology has contributed to the proliferation of a

large number of solar companies that produce similar products.

We design, develop and manufacture our automated production

equipment based on proprietary process technologies, including

vacuum deposition of amorphous silicon and large-scale,

roll-to-roll

manufacturing processes. We believe that our access to these

technologies poses a significant barrier to entry for

competitors who may seek to produce products similar to our own.

|

|

|

|

|

•

|

Our products generate more electricity in real world

conditions than many competing products, resulting in higher

returns on investment for our customers.

Solar

modules are typically priced by their rated power output

measured in watt peak determined in standard test conditions,

and most solar module manufacturers sell their products for a

similar price per watt. We believe our solar laminates generate

electricity earlier in the day and later into the evening and

perform better in diffuse light and at high temperatures than

conventional crystalline products. Our internal studies (based

on prevailing European climate conditions) have shown that our

solar laminates produce 8-20% more kilowatt hours of electricity

per rated kilowatt of power output on an annual basis than

similarly priced conventional solar modules. Higher

kilowatt-hours

per rated kilowatt of output increases our customers’

return on investment, which we believe should result in greater

demand for our products relative to conventional solar modules

over time.

|

S-3

|

|

|

|

|

|

•

|

We have developed multiple sales channels for our solar

laminates.

Most conventional solar modules are

distributed through a relatively small number of specialty PV

distributors and installers. We sell our solar laminates through

this channel as well as through commercial roofing companies and

building contractors, which we believe gives us greater access

to end-users in our target markets.

|

|

|

|

|

•

|

Our management team has significant experience scaling and

optimizing manufacturing operations.

Our current

management team possesses significant manufacturing expertise,

which we believe will become increasingly critical to our

success as we continue to grow and improve the productivity and

efficiency of our operations. Our President and Chief Executive

Officer has held a variety of positions in manufacturing

environments over a

15-year

period in which he has demonstrated the ability to improve

profitability, lead team-building and reorganization efforts and

integrate businesses of a global scale. Our Vice President of

Operations has held progressive manufacturing leadership roles

within the automotive industry for more than 21 years. Our

second tier of operations management also possesses many years

of relevant manufacturing experience and its members have been

integrated in the development and implementation of our current

growth and efficiency programs. We believe our current team has

the necessary skills and experience to successfully scale and

optimize our business as we move forward. For more information

about our directors, executive officers and key employees,

please see “Management,” beginning on page S-36.

|

Our

Strategy

Our key strategies include:

|

|

|

|

|

|

•

|

Focus on customers where our products have a competitive

advantage, particularly within the BIPV

market.

The physical flexibility, durability and

lightweight nature of our solar laminates makes them an

attractive value proposition for the BIPV market, particularly

commercial rooftop applications, where our solar laminates can

be integrated with roofing materials and other building

products. Our solar laminates produce over 5.8

watts/ft

2

,

whereas many commercial buildings can be powered by less than

5 watts/ft

2

,

which represents a significant market opportunity for us.

Additionally, the BIPV market is attractive due to the

favorable incentives offered by France and Italy, two of the

largest solar markets, for BIPV products. Since BIPV products

are integrated into the buildings that ultimately consume the

power produced, they do not take the land space or use the

transmission infrastructure required by other solar products.

France and Italy are rewarding this factor in the form of higher

incentives. We believe the BIPV market, including commercial

roof top applications, represents the most attractive

opportunity for our solar laminates and we believe we will

continue to increase our sales within this market.

|

|

|

|

|

•

|

Expand our manufacturing capacity to meet growing

demand

. We have embarked on an expansion plan to

reach 1 GW of nameplate capacity by 2012. We believe this

expansion is necessary to meet the rapidly growing demand for

our products. We currently have agreements in place to sell 94%

and 48% of our FY 2009 and FY 2010, respectively,

forecasted production volumes, each of which exceeds our current

nameplate capacity, and we have agreements totaling

approximately 600 MW through 2013. We currently operate two

manufacturing lines in Auburn Hills, Michigan totaling

58 MW of nameplate capacity and are ramping up production

at two new manufacturing lines in Greenville, Michigan with

additional nameplate capacity of 60 MW. We expect these new

lines to be operating at nameplate capacity by December 2008. We

also are installing two additional manufacturing lines at a

second location in Greenville, Michigan that will bring our

nameplate capacity to 178 MW. We expect these lines to be

operating at nameplate capacity before the end of FY 2009. We

will continue our manufacturing expansion to 300 MW of

nameplate capacity and then to 1 GW of nameplate capacity by

carefully evaluating sites globally based on analysis of

proximity to end markets, local cost-structure (including

incentives) and access to an appropriately skilled workforce. As

we plan for capacity expansion, we believe that our

differentiated technology and processes can be replicated

successfully.

|

|

|

|

|

•

|

Increase the percentage of our sales from “take or

pay” agreements.

Historically we entered

into long-term supply agreements with our customers that did not

include minimum purchase requirements. These orders were

completed on a current basis through purchase orders issued by

the customers as they required our PV laminates. In order to

increase visibility and certainty, and to plan our operations

accordingly, we

|

S-4

|

|

|

|

|

|

|

have recently focused our efforts on long-term “take or

pay” agreements that require the customer to purchase a

specified minimum amount of our products. We have and will

continue to increase the percentage of our products that are

sold under take or pay agreements as we continue to pursue our

strategy of demand-driven expansion.

|

|

|

|

|

|

|

•

|

Reduce the cost and increase conversion efficiency of our

products.

Although significant progress has been

made to date in reducing the cost and increasing the conversion

efficiency of our products, we continue to believe that

additional cost improvements and higher efficiency can be

achieved through:

|

|

|

|

|

|

|

•

|

Lowering raw material costs.

We already have

qualified suppliers, and are in the process of qualifying

additional suppliers, for certain commodity materials such as

stainless steel, grid wire and polymers. We will continue to

transition our supply chain to include multiple suppliers. We

believe that using a broader pool of suppliers will help lower

costs by mitigating the impact of an increase of prices by our

suppliers and possibly creating more competition among such

suppliers. As we significantly increase our volume, we should

also benefit from more competitive pricing which will help us

reduce our cost per watt.

|

|

|

|

|

•

|

Increasing manufacturing throughput and

yield.

We are continually improving the

manufacturing process to increase the productivity and

efficiency of our machines. We will continue to implement

manufacturing best practices to increase manufacturing

throughput and yield, which will enable us to achieve scale

benefits.

|

|

|

|

|

•

|

Increasing the conversion efficiency of our laminate

products.

We are continually improving the

conversion efficiency of our solar laminates. Higher conversion

efficiency allows the same amount of power to be produced with

less material, which translates into lower costs and higher

margins for our product. We will continue to review our product

designs and manufacturing processes to identify opportunities to

improve the conversion efficiency of our solar laminates.

|

|

|

|

|

|

|

•

|

Increase our sales presence in key solar

markets.

We have identified several markets where

we believe there are significant growth opportunities for our

solar laminates, including France, Spain, Italy and South Korea.

In several of these target countries, government incentives

favoring BIPV continue to drive the increased adoption of solar

power generated by BIPV systems. We are in the process of

establishing relationships with appropriate channel partners and

deploying additional sales resources to exploit these

opportunities.

|

|

|

|

|

•

|

Continue to improve our financial

performance.

We have historically generated

operating losses. However, our business achieved operating

profitability during our third fiscal quarter ended

March 31, 2008. This profitability delivered by our new

management team resulted from adoption of a focused product

strategy, growth in our manufacturing capacity, continued

technological advancements, cost cutting and sourcing

initiatives and a focus on manufacturing efficiency. We will

continue implementing cost saving initiatives and executing the

programs we have started, with a long range goal of raising our

gross margin to in excess of 40%.

|

|

|

|

|

•

|

Continue to innovate, and realize value from our technology

portfolio.

While our innovation and technological

advancement in solar power is most prominent, we also have

developed proprietary technologies outside of our core solar

business that we believe have substantial value. These include

technologies for NiMH batteries, solid hydrogen storage, metal

hydride fuel cells, biofuel reformation and phase-change random

access memory. We are currently reviewing strategic alternatives

to determine the best way to maximize value for each of these

technologies. We have in the past licensed several of our

technologies to third parties under royalty bearing agreements.

We have also partnered with third parties to commercialize

certain other technologies. We expect to consider licenses,

joint ventures and sales as means to realize value from our

technology portfolio in the future.

|

Description

of Concurrent Offering

Concurrently with this offering, we are offering an aggregate of

4,708,500 shares of our common stock by means of a separate

prospectus supplement for an aggregate purchase price of

$ million.

S-5

1,270,000 of the shares being offered by that prospectus

supplement are being underwritten by the underwriters of this

offering and are being offered to the public at a price of

$ per share. We refer to this

portion of the concurrent offering as the “underwritten

equity offering.” We have also granted a

30-day

option to the underwriters of the underwritten equity offering

to purchase up to an additional 190,500 shares of our

common stock.

The remaining shares of common stock being offered by that

prospectus supplement and accompanying prospectus are shares

that we will loan to an affiliate of Credit Suisse Securities

(USA) LLC, a managing underwriter in this offering, pursuant to

a share lending agreement among us, Credit Suisse Securities

(USA) LLC and such affiliate. These shares are referred to in

this prospectus supplement as the “borrowed shares.”

Under the share lending agreement, the affiliate of Credit

Suisse Securities (USA) LLC has agreed to use such borrowed

shares to facilitate transactions by which investors in the

notes offered hereby and, with our consent, other securities

that we may issue in the future, will hedge their respective

investments through short sales or privately negotiated

transactions and will be entitled to sell such shares pursuant

to our registration statement.

This affiliate of Credit Suisse Securities (USA) LLC will

receive all of the proceeds from the sale of the borrowed shares

pursuant to the share lending agreement and we will not receive

any of those proceeds, but we will receive a nominal lending fee

for the use of those shares from that affiliate. See

“Description of the Share Lending Agreement.” Because

the shares borrowed pursuant to that agreement must be returned

to us, we believe that under U.S. GAAP the borrowed shares

will not be considered outstanding for the purpose of computing

and reporting our earnings per share.

The delivery of shares of common stock being offered pursuant to

the share lending agreement is contingent on the closing of this

offering. We expect that delivery of the shares of our common

stock in that portion of the common stock offering will be made

concurrently with the closing of this offering.

Recent

Developments

On June 6, 2008 we reached a settlement agreement with

International Acquisitions Services, Inc. (“IAS”),

Innovative Transportation Systems AG (“ITS”) and

Neville Chamberlain (together with IAS and ITS, the

“InnoVan Plaintiffs”). The settlement agreement

resolves a lawsuit instituted by the InnoVan Plaintiffs where

they claimed, among other things, that we made fraudulent

statements relating to the supply of battery products by Cobasys

to ITS, an entity created to manufacture and sell an electric

delivery vehicle known as the InnoVan. The net costs to us of

the litigation and settlement, including attorneys’ fees

and after certain third party reimbursements, is estimated to be

approximately $500,000.

Our

Corporate Information

We incorporated in the State of Delaware in 1964. Our principal

executive offices are located at 2956 Waterview Drive, Rochester

Hills, Michigan 48309. Our telephone number is

(248) 293-0440.

We maintain an Internet website at www.ovonic.com. We have not

incorporated by reference into this prospectus supplement the

information in, or that can be accessed through, our website,

and you should not consider it to be a part of this prospectus

supplement or the accompanying prospectus.

S-6

The

Offering

The following summary contains basic information about this

offering and the notes and is not intended to be complete. It

does not contain all of the information that may be important to

you. For a more complete understanding of all of the terms and

provisions of the notes, please refer to the section of this

prospectus supplement entitled “Description of the

Notes.”

|

|

|

|

|

Issuer

|

|

Energy Conversion Devices, Inc., a Delaware corporation.

|

|

|

|

Securities

|

|

$225,000,000 aggregate principal amount

of % Convertible Senior Notes

due 2013, or the “notes.” We have also granted the

underwriters a

30-day

option to purchase a maximum of $33,750,000 additional principal

amount of the notes solely to cover over-allotments, if any.

|

|

|

|

Maturity

|

|

The notes will mature on June 15, 2013, subject to earlier

repurchase or conversion.

|

|

|

|

Interest

|

|

% per year on the principal amount

from June , 2008, payable semi-annually in arrears on

June 15 and December 15 of each year, beginning December 15,

2008.

|

|

|

|

Conversion Rights

|

|

Under the circumstances discussed below, you will be able to

surrender your notes for conversion, in whole or in part, into

cash and, if applicable, shares of our common stock at any time

prior to the close of business (

i.e.

5:00 p.m. New York City time) on the business day

immediately preceding June 15, 2013, unless the notes have been

previously repurchased. Prior to March 15, 2013, you may,

subject to your compliance with the procedures described under

“Description of the Notes — Conversion

Rights,” convert your notes only in the following

circumstances:

|

|

|

|

|

|

• at any time during any calendar quarter commencing

after June 30, 2008, if the last reported sale price of our

common stock for at least 20 trading days during the period of

30 consecutive trading days ending on the last trading day of

the immediately preceding calendar quarter (subject to

adjustment in certain circumstances as described under

“Description of the Notes — Conversion

Rights — Conversion Upon Satisfaction of Common Stock

Price Condition”) is greater than 130% of the conversion

price on such last trading day;

|

|

|

|

|

|

• during the five

business-day

period following any ten consecutive

trading-day

period (after a qualifying request for determination) in which

the trading price for the notes was less than 97% of the product

of the last reported sale price of our common stock and the

conversion rate on such day;

|

|

|

|

|

|

• upon the occurrence of specified corporate

transactions described under “Description of the

Notes — Conversion Rights — Conversion Upon

Specified Corporate Transactions.”

|

|

|

|

|

|

On or after March 15, 2013, notes may be converted until

the close of business on the business day preceding maturity

without regard to the foregoing conditions.

|

|

|

|

|

|

The

“conversion price”

is a dollar amount

(initially, approximately $ )

determined by dividing $1,000 by the conversion rate.

|

S-7

|

|

|

|

|

|

|

The

“conversion rate”

is

initially shares

of our common stock, subject to adjustment as described under

“Description of the Notes — Conversion Rate

Adjustments.”

|

|

|

|

Conversion Payment

|

|

Subject to certain exceptions, we will deliver to holders in

respect of each $1,000 principal amount of notes surrendered for

conversion a

“settlement amount”

equal to the

sum of the daily settlement amounts for each of the 20

consecutive trading days during the applicable cash settlement

averaging period.

|

|

|

|

|

|

The

“daily settlement amount

,” for each of the

20 consecutive trading days during a cash settlement averaging

period, shall consist of:

|

|

|

|

|

|

• cash equal to $50 or, if less, the daily conversion

value; and

|

|

|

|

|

|

• to the extent the daily conversion value exceeds

$50, a number of shares equal to (A) the difference between

the daily conversion value and $50, divided by (B) the

applicable stock price (as defined under “Description of

the Notes — Conversion Rights —

General”) of our common stock for such day.

|

|

|

|

|

|

The

“daily conversion value”

means, for each of

the 20 consecutive trading days during a cash settlement

averaging period, 1/20th of the product of (1) the

conversion rate and (2) the applicable stock price of our

common stock on such day.

|

|

|

|

|

|

The

“cash settlement averaging period”

with

respect to any note being converted means the 20 consecutive

trading-day

period beginning on and including the second trading day after a

conversion date (as defined under “Description of the

Notes — Conversion Rights — Conversion

Procedures”), except that with respect to any conversion

date that is on or after the 24th scheduled trading day

immediately preceding the maturity date, the cash settlement

averaging period means the 20 consecutive trading days beginning

on and including the 22nd scheduled trading day prior to the

maturity date.

|

|

|

|

|

|

You will not receive any additional cash payment, including any

accrued but unpaid interest, upon conversion of a note except in

circumstances described in “Description of the

Notes — Interest.” Instead, interest will be

deemed paid by the shares of common stock delivered to you upon

conversion of a note.

|

|

|

|

Increase of Conversion Rate upon Certain Fundamental Changes

|

|

If a make-whole fundamental change (as defined under

“Description of the Notes — Conversion

Rights — Increase of Conversion Rate Upon Conversion

Upon Make-Whole Fundamental Change”) occurs, we may be

required in certain circumstances to increase the conversion

rate for any notes converted in connection with such fundamental

change. A description of how the conversion rate will be

increased and a table showing the increase in conversion rate

that would apply at various stock prices and effective dates of

the fundamental change are set forth under “Description of

the Notes — Conversion Rights — Increase of

Conversion Rate Upon Conversion Upon Make-Whole Fundamental

Change.”

|

|

|

|

Sinking Fund

|

|

None.

|

S-8

|

|

|

|

|

Repurchase of Notes upon a Fundamental Change

|

|

If we undergo a fundamental change (as defined under

“Description of the Notes — Fundamental Change

Permits Holders to Require Us to Purchase Notes”), you will

have the option to require us to purchase all or any portion of

your notes for cash. The fundamental change purchase price will

be 100% of the principal amount of the notes to be purchased

plus any accrued and unpaid interest to, but excluding, the

fundamental change repurchase date.

|

|

|

|

Ranking

|

|

The notes will rank equally in right of payment with all our

existing and future unsecured senior debt and senior in right of

payment to any of our debt that is subordinated to the notes.

The indenture pursuant to which the notes are issued does not

limit the amount of debt that we or our subsidiaries may incur.

The notes will be effectively subordinated to any of our secured

indebtedness to the extent of the value of the assets securing

such indebtedness. The notes will also be structurally

subordinated to any existing and future indebtedness and other

liabilities and commitments (including trade payables and lease

obligations) of our subsidiaries.

|

|

|

|

Use of Proceeds

|

|

We intend to use the net proceeds from the offering for

expansion of our production capacity in connection with the 1 GW

plan and for general corporate purposes.

|

|

|

|

|

|

See “Use of Proceeds.”

|

|

|

|

Concurrent Offering

|

|

Concurrently with this offering, we are offering an aggregate of

4,708,500 shares of our common stock by means of a separate

prospectus supplement. 1,270,000 of the shares being offered by

that prospectus supplement are being underwritten by the

underwriters of this offering and are being offered to the

public at a price of $ per share.

We have also granted a

30-day

option to the underwriters of the underwritten equity offering

to purchase up to an additional 190,500 shares of our

common stock. The remaining shares of common stock being offered

by that prospectus supplement and accompanying prospectus are

shares that we will loan to an affiliate of Credit Suisse

Securities (USA) LLC, a managing underwriter in this offering,

pursuant to a share lending agreement among us, Credit Suisse

Securities (USA) LLC and such affiliate, and also are offered to

the public at a price of $ per

share. Under the share lending agreement, the affiliate of

Credit Suisse Securities (USA) LLC has agreed to use the

borrowed shares to facilitate transactions by which investors in

the notes offered hereby and, with our consent, other securities

that we may issue in the future, will hedge their respective

investments through short sales or privately negotiated

transactions, and such affiliate will be entitled to sell such

shares pursuant to our registration statement. Up

to of the borrowed shares may be

used to facilitate such transactions on a delayed basis at any

time prior to the termination of the agreement.

|

|

|

|

|

|

This affiliate of Credit Suisse Securities (USA) LLC will

receive all of the proceeds from the sale of the borrowed shares

pursuant to the share lending agreement and we will not receive

any of those proceeds, but we will receive a nominal lending fee

for the use of those shares from that affiliate. See

“Description of the Share Lending Agreement.”

|

S-9

|

|

|

|

|

|

|

Because the shares borrowed must be returned to us prior to

June 15, 2013, we believe that under U.S. GAAP the borrowed

shares will not be considered outstanding for the purpose of

computing and reporting our earnings per share.

|

|

|

|

|

|

For a discussion of the potential impact of any market or other

activity by the share borrower in connection with the share

lending agreement, see “Risk Factors — Risks

Relating to the Common Stock — The effect of the

concurrent issuance of our shares of common stock, which

issuance is being made to facilitate sales of our common stock

in short sale transactions by purchasers of certain of our

securities, may be to lower the market price of our common

stock.”

|

|

|

|

|

|

The delivery of shares of common stock being offered pursuant to

the share lending agreement is contingent on the closing of this

offering. We expect that delivery of the shares of our common

stock in the common stock offering will be made concurrently

with the closing of this offering.

|

|

|

|

Trustee and Paying Agent

|

|

The Bank of New York Trust Company, N.A.

|

|

|

|

Governing Law

|

|

The indenture and the notes provide that they will be governed

by, and construed in accordance with, the laws of the State of

New York.

|

|

|

|

Book-Entry Form

|

|

The notes will be issued in book-entry form and will be

represented by permanent global certificates deposited with, or

on behalf of, The Depository Trust Company, which we refer

to as “DTC,” and registered in the name of a nominee

of DTC. Beneficial interests in any of the notes will be shown

on, and transfers will be effected only through, records

maintained by DTC or its nominee and any such interest may not

be exchanged for certificated securities, except in limited

circumstances.

|

|

|

|

Absence of a Public Market for the Notes

|

|

The notes are new securities, and there is currently no

established market for the notes. The underwriters have advised

us that they currently intend to make a market in the notes.

However, they are not obligated to do so, and may discontinue

any market making with respect to the notes without notice. We

do not intend to apply for a listing of the notes on any

national securities exchange or any automated dealer quotation

system. Accordingly, we cannot assure you as to the development

or liquidity of any market for the notes.

|

|

|

|

Nasdaq Symbol for Our Common Stock

|

|

Our common stock is listed on the Nasdaq Global Select Market

under the symbol “ENER.”

|

|

|

|

Material U.S. Federal Income Tax Considerations

|

|

Holders are urged to consult their own tax advisors with respect

to the federal, state, local and foreign tax consequences of

purchasing, owning and disposing of the notes and the common

stock issuable upon conversion of the notes. See “Material

U.S. Federal Income Tax Considerations.”

|

|

|

|

Risk Factors

|

|

Investment in the notes involves risk. You should carefully

consider the information under the section titled “Risk

Factors” and all other information included in this

prospectus supplement, the accompanying prospectus and the

documents incorporated by reference before investing in the

notes.

|

S-10

Summary

Historical Consolidated Financial Data

The following summary consolidated financial information as of

and for the three years ended June 30, 2007, is derived

from our audited financial statements. The summary consolidated

financial information as of and for the nine months ended

March 31, 2008, and March 31, 2007 is derived from our

unaudited financial statements. Such financial information is

only a summary and should be read in conjunction with our

audited and unaudited financial statements, including the notes

thereto, and the “Management’s Discussion and Analysis

of Financial Condition and Results of Operations”

incorporated by reference in this prospectus supplement. Figures

in the table below are in thousands, except share and per share

data.

Consolidated

Statements of Operations Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended March 31,

|

|

|

|

Year Ended June 30,

|

|

|

|

|

2008

|

|

|

2007

|

|

|

|

2007

|

|

|

2006

|

|

|

2005

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales

|

|

$

|

159,391

|

|

|

$

|

64,731

|

|

|

|

$

|

96,014

|

|

|

$

|

84,431

|

|

|

$

|

51,944

|

|

|

Revenues from product development agreements

|

|

|

8,490

|

|

|

|

8,750

|

|

|

|

|

11,934

|

|

|

|

10,046

|

|

|

|

17,653

|

|

|

Other revenues

|

|

|

5,592

|

|

|

|

4,078

|

|

|

|

|

5,619

|

|

|

|

7,942

|

|

|

|

86,973

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL REVENUES

|

|

|

173,473

|

|

|

|

77,559

|

|

|

|

|

113,567

|

|

|

|

102,419

|

|

|

|

156,570

|

|

|

EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales

|

|

|

122,109

|

|

|

|

54,122

|

|

|

|

|

81,241

|

|

|

|

67,271

|

|

|

|

51,409

|

|

|

Cost of revenues from product development agreements

|

|

|

5,391

|

|

|

|

5,726

|

|

|

|

|

7,684

|

|

|

|

7,710

|

|

|

|

14,012

|

|

|

Product development and research

|

|

|

7,699

|

|

|

|

15,338

|

|

|

|

|

19,745

|

|

|

|

19,909

|

|

|

|

16,529

|

|

|

Operating, selling, general and administrative (net)

|

|

|

35,730

|

|

|

|

24,611

|

|

|

|

|

35,179

|

|

|

|

31,535

|

|

|

|

28,652

|

|

|

Restructuring charges

|

|

|

7,457

|

|

|

|

—

|

|

|

|

|

5,385

|

|

|

|

—

|

|

|

|

—

|

|

|

Other

|

|

|

6,925

|

|

|

|

3,961

|

|

|

|

|

6,835

|

|

|

|

3,215

|

|

|

|

2,585

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL EXPENSES

|

|

|

185,311

|

|

|

|

103,758

|

|

|

|

|

156,069

|

|

|

|

129,640

|

|

|

|

113,187

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME (LOSS) FROM OPERATIONS

|

|

|

(11,838

|

)

|

|

|

(26,199

|

)

|

|

|

|

(42,502

|

)

|

|

|

(27,221

|

)

|

|

|

43,383

|

|

|

Interest income (expense)

|

|

|

5,971

|

|

|

|

14,374

|

|

|

|

|

17,540

|

|

|

|

8,474

|

|

|

|

624

|

|

|

Other non-operating income (expense)

|

|

|

(57

|

)

|

|

|

(261

|

)

|

|

|

|

(269

|

)

|

|

|

(163

|

)

|

|

|

6,280

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) BEFORE INCOME TAXES

|

|

|

(5,924

|

)

|

|

|

(12,086

|

)

|

|

|

|

(25,231

|

)

|

|

|

(18,910

|

)

|

|

|

50,287

|

|

|

Income taxes

|

|

|

95

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

—

|

|

|

|

825

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE

EXTRAORDINARY ITEM

|

|

$

|

(6,019

|

)

|

|

$

|

(12,086

|

)

|

|

|

$

|

(25,231

|

)

|

|

$

|

(18,910

|

)

|

|

$

|

49,462

|

|

|

Discontinued operations

|

|

|

—

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

314

|

|

|

|

(1,393

|

)

|

|

Extraordinary item

|

|

|

—

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

—

|

|

|

|

2,263

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS)

|

|

$

|

(6,019

|

)

|

|

$

|

(12,086

|

)

|

|

|

$

|

(25,231

|

)

|

|

$

|

(18,596

|

)

|

|

$

|

50,332

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income (loss) per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations

|

|

$

|

(0.15

|

)

|

|

$

|

(0.31

|

)

|

|

|

$

|

(0.64

|

)

|

|

$

|

(0.58

|

)

|

|

$

|

1.80

|

|

|

Discontinued operations

|

|

|

—

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

0.01

|

|

|

|

(0.05

|

)

|

|

Extraordinary item

|

|

|

—

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

—

|

|

|

|

0.08

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

(0.15

|

)

|

|

$

|

(0.31

|

)

|

|

|

$

|

(0.64

|

)

|

|

$

|

(0.57

|

)

|

|

$

|

1.83

|

|

|

Diluted net income (loss) per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations

|

|

$

|

(0.15

|

)

|

|

$

|

(0.31

|

)

|

|

|

$

|

(0.64

|

)

|

|

$

|

(0.58

|

)

|

|

$

|

1.67

|

|

|

Discontinued operations

|

|

|

—

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

0.01

|

|

|

|

(0.05

|

)

|

|

Extraordinary item

|

|

|

—

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

—

|

|

|

|

0.08

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

(0.15

|

)

|

|

$

|

(0.31

|

)

|

|

|

$

|

(0.64

|

)

|

|

$

|

(0.57

|

)

|

|

$

|

1.70

|

|

|

Weighted average shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|